How Credible Is the 25-Year Photovoltaic (PV) Performance Warranty?—A Techno-Financial Evaluation and Implications for the Sustainable Development of the PV Industry

Abstract

:1. Introduction

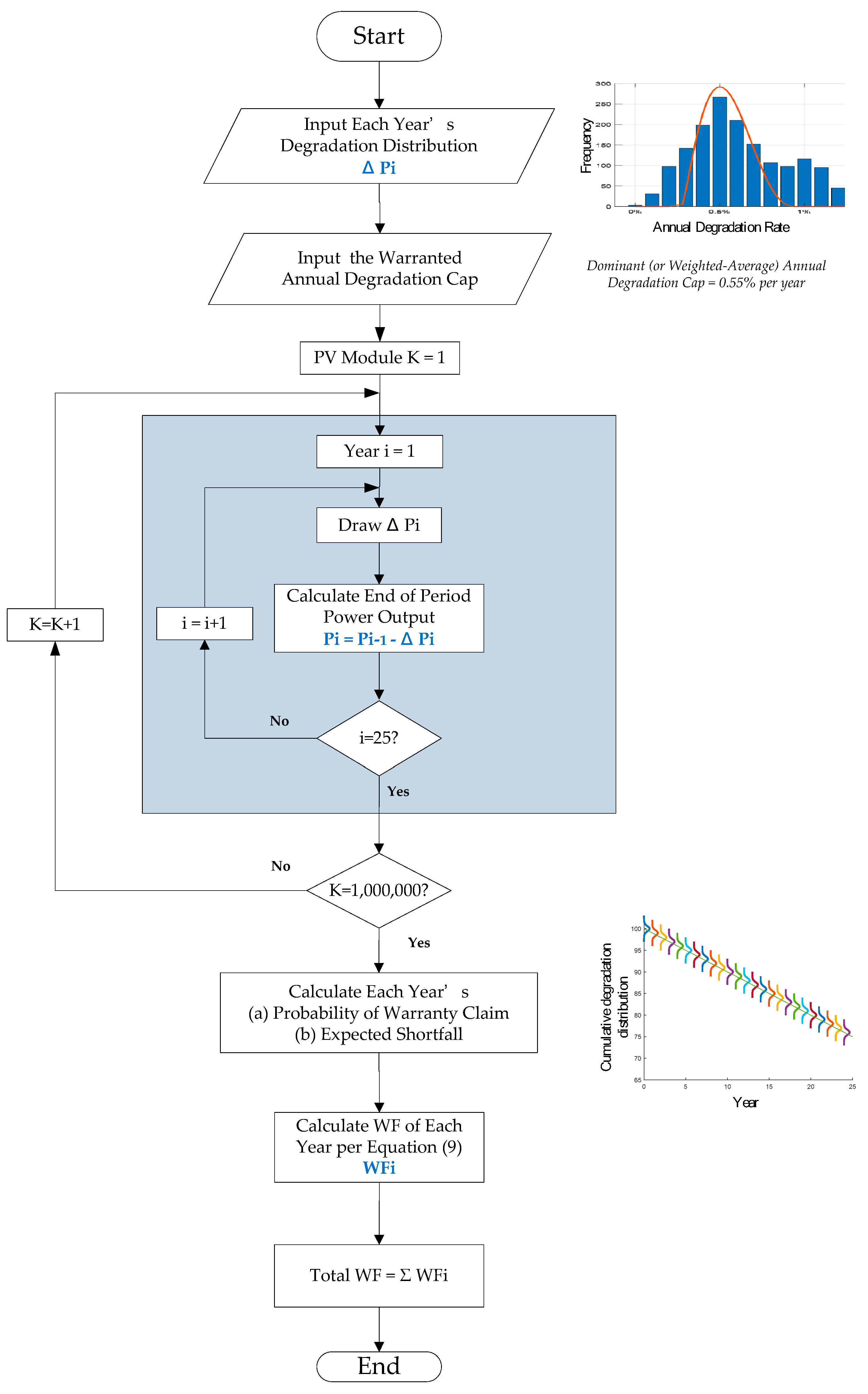

- Develop a new method using Monte Carlo simulation and expected shortfall (ES) to estimate, in monetary terms, the necessary WF for 25-year PV performance warranty considering annual degradation cap.

- Adopt the benchmark degradation profile as the basis for WF estimation to avoid selection bias and also to provide stability for the estimation over time, given the portfolio nature of the benchmark degradation profile.

- The methodology proposed is in line with international accounting principles and therefore provides a transparent and fair basis for comparison among the PV manufacturers.

- Provide a visualization summary of the top 6 PV manufacturer’s warranty terms and their WF versus respective revenue and profit ratio based on extensive public domain data research.

- Base-case and sensitivity analysis simulations to demonstrate the benchmark WF requirement and key drivers of the WF.

2. Materials and Methods

2.1. Review of The Traditional WF Estimation Method

- WF = warranty fund

- w = warranty period

- t = failure time

- f(t) = probability distribution function of failure time

- F(t) = cumulative distribution function of failure time

- E(t) = expected value of the failure time

- h(t) = failure rate

- f(t) = probability distribution function of failure time

- F(t) = cumulative distribution function of failure time

- R(t) = survival function = 1 − F(t)

- λ = distribution rate and 1/λ = MTTF

2.2. Unique Aspects of PV Performance WF Estimation

- DR = degradation rate

- Pnominal = nominal or rated output of the PV module

- Pactual = actual module output measured under standard testing condition (STC)

- Each year’s degradation rates are considered independent random variables: Once a PV module is manufactured and installed in the field, environmental stress (weather) is the biggest influencing factor of each year’s degradation rate, assuming maintenance work is done in accordance with manufacturer recommendations. Since the weather is basically independent each year, the degradation rate each year can be considered as independent random variables. That is, if the degradation rate for years 1–3 are ΔP1, ΔP2, ΔP3, respectively, then ΔP1, ΔP2, ΔP3 are considered as independent random variables in this study. The cumulative degradation of each year is the sum of the current and all prior-year degradations. For example, the cumulative degradation for year 2 is ΔP1 + ΔP2, and for year 3 it is ΔP1 + ΔP2 + ΔP3.

- The values of each year’s degradation rate are sampled from the benchmark degradation distribution that is representative of a portfolio of technologies: As each manufacturer has many products which continue evolving, the degradation rate should be sampled from a common benchmark degradation distribution that is representative of a portfolio of technologies. Unless the manufacturer can demonstrate that its degradation pattern is significantly better than the benchmark profile, the common benchmark degradation distribution should be used as the basis of the WF estimation. This will avoid selection bias and ensure stability of the WF estimate over time.

2.3. Benchmark Degradation Distribution

2.4. Probability of Warranty Claim and Expected Shortfall (ES)

- WF = warranty fund requirement

- 0.2266 = probability that degradation exceeds the cutoff threshold

- 0.67% = average level of degradation, given that the degradation exceeds the cutoff threshold

- 0.55% = the cut-off threshold or the guaranteed degradation cap of that particular year

2.5. Monte Carlo Simulation

3. Results

3.1. Baseline Case

3.2. Sensitivity Analysis

- Changes in the median degradation value have the largest impact on WF: If the company-wide median degradation rate can be reduced by 10% (from 0.5% to 0.45%, holding other conditions constant, including the annual degradation cap), the company-wide WF can be significantly reduced from 1.302% to 0.412%. On the contrary, if the company-wide median degradation rate increases by 10% (from 0.5% to 0.55%), the required WF almost doubles and becomes 2.555%. The reduction in PV module median degradation value often represents an upgrade in PV technology or manufacturing technique. If such an upgrade only applies to a particular product line, the adjustment of median degradation value should only be made on a pro-rata basis. For example, if a company has cumulatively sold 100 GW of PV modules and only 15% of the modules represents new technology with a lower median degradation rate of 0.45%, then the appropriate median degradation rate to be applied for the simulation should be 85% * 0.5% + 15% * 0.45% = 0.4925%.

- Changes in maximum degradation value have the 2nd largest impact on WF: If the company-wide maximum degradation rate decreases by 10% (from 0.95% to 0.855%), the company-wide WF can be reduced by half to 0.615%. On the other hand, an increase of the maximum degradation value by 10% would result in a 60% increase in WF. Unlike the changes in the median degradation rate, the changes in maximum degradation rate are an increase in the “spread” of degradation and are often a result of quality control issue or application environment issue. For example, if the products of a manufacturer are mostly sold to extremely hot and humid environments with freezing temperatures in the evening, the manufacturer should consider using a higher maximum degradation value for the simulation.

- Changes in the minimum degradation value have the least impact on WF: For +/−10% changes in company-wide minimum degradation rate, the company-wide WF changes approximately +/−5.5%.

3.3. Reduction in the Degradation Allowance

4. Discussion

- Avoid selection bias—Most PV manufacturers have many different products with different technologies. The same product model can be manufactured using different bill of materials (BOM) or different tool settings over time. The application environments for each sales contract can also be very different. Unless the manufacturer can demonstrate that its degradation pattern is significantly better than the benchmark profile, the benchmark degradation distribution should represent a best estimate of the actual degradation profile on a company-wide basis. This would avoid selection bias and also provide a common measurement basis for all PV manufacturers.

- Ensure stability of the WF reserve estimate over time—The benchmark degradation profile was based on nearly 2000 cases published in the literature over the past 4 decades. In this study the advances in technology and manufacturing have also been taken into consideration by capping the maximum degradation based on latest field measurement data. WF reserve estimates based on the benchmark degradation profile will therefore be more stable over time.

- Updateable based on latest field data—International Accounting Standard (IAS) 37 requires that the warranty fund provision “be measured at probability-weighted expected value and be updated annually to reflect the current best estimate”. If the latest field measurement data suggests or the manufacturers can demonstrate that the actual degradation profile has improved (or deteriorated), the benchmark degradation profile can be updated to reflect the current best estimate of the WF reserve. However, to ensure stability of the WF reserve, it is important that the key drivers behind the improvement (or deterioration) be clearly analyzed when updating the benchmark degradation profile. The key drivers should also preferably be confirmed by accelerated aging test such as those per IEC 63209 [56,57].

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Masson, G.; de l’Epine, M.; Kaizuka, I.; Jäger-Waldau, A. Snapshot of Global PV Markets 2023; IEA: Paris, France, 2023. [Google Scholar]

- Weaver, J.F. New Solar Installations to Hit 413 GW This Year, Says BloombergNEF. Available online: https://www.pv-magazine.com/2023/11/29/new-solar-installations-to-hit-413-gw-this-year-says-bloombergnef/ (accessed on 25 March 2024).

- International Technology Roadmap for Photovoltaic (ITRPV), 10th ed.; Verband Deutscher Maschinen- und Anlagenbau: Frankfurt, Germany, 2019.

- International Technology Roadmap for Photovoltaic (ITRPV), 11th ed.; Verband Deutscher Maschinen- und Anlagenbau: Frankfurt, Germany, 2020.

- Fraunhofer Institute for Solar Energy Systems. ISE Photovoltaic Report; Fraunhofer Institute for Solar Energy Systems: Freiburg, Germany, 2023. [Google Scholar]

- Zuboy, J.; Springer, M.; Palmiotti, E.; Barnes, T.; Karas, J.; Smith, B.; Woodhouse, M. Technology Scouting Report: Reliability Implications of Recent PV Module Technology Trends; U.S. Department of Energy: Washington, DC, USA, 2022.

- Papargyri, L.; Theristis, M.; Kubicek, B.; Krametz, T.; Mayr, C.; Papanastasiou, P.; Georghiou, G.E. Modelling and Experimental Investigations of Microcracks in Crystalline Silicon Photovoltaics: A Review. Renew. Energy 2020, 145, 2387–2408. [Google Scholar] [CrossRef]

- Zuboy, J.; Springer, M.; Palmiotti, E.C.; Karas, J.; Barnes, T.M. Getting Ahead of the Curve: Assessment of New Photovoltaic Module Reliability Risks Associated With Projected Technological Changes. IEEE J. Photovolt. 2023, 14, 4–22. [Google Scholar] [CrossRef]

- Jordan, D.C.; Anderson, K.; Perry, K.; Muller, M.; Deceglie, M.; White, R.; Deline, C. Photovoltaic Fleet Degradation Insights. Prog. Photovolt. Res. Appl. 2022, 30, 1166–1175. [Google Scholar] [CrossRef]

- Bolinger, M.; Gorman, W.; Millstein, D. System-Level Performance and Degradation of 21 GWDC of Utility-Scale PV Plants in the United States. J. Renew. Sustain. Energy 2020, 12, 043501. [Google Scholar] [CrossRef]

- Jordan, D.C.; Marion, B.; Deline, C.; Barnes, T.; Bolinger, M. PV Field Reliability Status—Analysis of 100,000 Solar Systems. Prog. Photovolt. Res. Appl. 2020, 28, 739–754. [Google Scholar] [CrossRef]

- Atsu, D.; Seres, I.; Aghaei, M.; Farkas, I. Analysis of Long-Term Performance and Reliability of PV Modules under Tropical Climatic Conditions in Sub-Saharan. Renew. Energy 2020, 162, 285–295. [Google Scholar] [CrossRef]

- Da Fonseca, J.E.F.; de Oliveira, F.S.; Massen Prieb, C.W.; Krenzinger, A. Degradation Analysis of a Photovoltaic Generator after Operating for 15 Years in Southern Brazil. Sol. Energy 2020, 196, 196–206. [Google Scholar] [CrossRef]

- Lillo-Sánchez, L.; López-Lara, G.; Vera-Medina, J.; Pérez-Aparicio, E.; Lillo-Bravo, I. Degradation Analysis of Photovoltaic Modules after Operating for 22 Years. A Case Study with Comparisons. Sol. Energy 2021, 222, 84–94. [Google Scholar] [CrossRef]

- Dhimish, M. Performance Ratio and Degradation Rate Analysis of 10-Year Field Exposed Residential Photovoltaic Installations in the UK and Ireland. Clean Technol. Environ. Policy 2020, 2, 170–183. [Google Scholar] [CrossRef]

- Solar (Photovoltaic) Panel Prices. Available online: https://ourworldindata.org/grapher/solar-pv-prices (accessed on 18 March 2024).

- Fokuhl, E.; Philipp, D.; Mülhöfer, G.; Gebhardt, P. LID and LETID Evolution of PV Modules during Outdoor Operation and Indoor Tests. EPJ Photovolt. 2021, 12, 9. [Google Scholar] [CrossRef]

- Lindroos, J.; Savin, H. Review of Light-Induced Degradation in Crystalline Silicon Solar Cells. Sol. Energy Mater. Sol. Cells 2016, 147, 115–126. [Google Scholar] [CrossRef]

- Kontges, M.; Kurz, S.; Packard, C.; Jahn, U.; Berger, K.A.; Kato, K.; Friesen, T.; Liu, H.; Van Iseghem, M. Review of Failures of Photovoltaic Modules; IEA PVPS: Paris, France, 2014. [Google Scholar]

- Law, A.M.; Jones, L.O.; Walls, J.M. The Performance and Durability of Anti-Reflection Coatings for Solar Module Cover Glass—A Review. Sol. Energy 2023, 261, 85–95. [Google Scholar] [CrossRef]

- Bossens, M. Unveiling Potential-Induced Degradation (PID): Causes, Detection, and Effective Mitigation for PV Modules. Available online: https://www.sitemark.com/blog/unveiling-potential-induced-degradation-pid-causes-detection-and-effective-mitigation-for-pv-modules/ (accessed on 26 April 2024).

- Wohlgemuth, J.H. Photovoltaic Module Reliability; Wiley: Hoboken, NJ, USA, 2020; ISBN 9781119458999. [Google Scholar]

- TamizhMani, G.; Kuitche, J. Accelerated Lifetime Testing of Photovoltaic Modules; Solar America Board for Codes and Standards: Torrance, CA, USA, 2013. [Google Scholar]

- Jordan, D.C.; Kurtz, S.R. Photovoltaic Degradation Rates—An Analytical Review. Prog. Photovoltaics Res. Appl. 2013, 21, 12–29. [Google Scholar] [CrossRef]

- Jordan, D.C.; Kurtz, S.R.; VanSant, K.; Newmiller, J. Compendium of Photovoltaic Degradation Rates. Prog. Photovolt. Res. Appl. 2016, 24, 978–989. [Google Scholar] [CrossRef]

- Alimi, O.A.; Meyer, E.L.; Olayiwola, O.I. Solar Photovoltaic Modules’ Performance Reliability and Degradation Analysis—A Review. Energies 2022, 15, 5964. [Google Scholar] [CrossRef]

- Ishii, T.; Masuda, A. Annual Degradation Rates of Recent Crystalline Silicon Photovoltaic Modules. Prog. Photovoltaics Res. Appl. 2017, 25, 953–967. [Google Scholar] [CrossRef]

- Kim, J.; Rabelo, M.; Padi, S.P.; Yousuf, H.; Cho, E.-C.; Yi, J. A Review of the Degradation of Photovoltaic Modules for Life Expectancy. Energies 2021, 14, 4278. [Google Scholar] [CrossRef]

- Denz, J.; Hepp, J.; Buerhop, C.; Doll, B.; Hauch, J.; Brabec, C.J.; Peters, I.M. Defects and Performance of Si PV Modules in the Field—An Analysis. Energy Environ. Sci. 2022, 15, 2180–2199. [Google Scholar] [CrossRef]

- Lindig, S.; Ascencio-Vásquez, J.; Leloux, J.; Moser, D.; Reinders, A. Performance Analysis and Degradation of a Large Fleet of PV Systems. IEEE J. Photovolt. 2021, 11, 1312–1318. [Google Scholar] [CrossRef]

- Jordan, D.C.; Silverman, T.J.; Sekulic, B.; Kurtz, S.R. PV Degradation Curves: Non-linearities and Failure Modes. Prog. Photovolt. Res. Appl. 2017, 25, 583–591. [Google Scholar] [CrossRef]

- Prieto-Castrillo, F.; Núñez, N.; Vázquez, M. Warranty Assessment of Photovoltaic Modules Based on a Degradation Probabilistic Model. Prog. Photovolt. Res. Appl. 2020, 28, 1308–1321. [Google Scholar] [CrossRef]

- Vázquez, M.; Rey-Stolle, I. Photovoltaic Module Reliability Model Based on Field Degradation Studies. Prog. Photovolt. Res. Appl. 2008, 16, 419–433. [Google Scholar] [CrossRef]

- Darling, S.B.; You, F.; Veselka, T.; Velosa, A. Assumptions and the Levelized Cost of Energy for Photovoltaics. Energy Environ. Sci. 2011, 4, 3133–3139. [Google Scholar] [CrossRef]

- Kneifel, J.D.; Webb, D.; O’Rear, E.G. Energy and Economic Implications of Solar Photovoltaic Performance Degradation; National Institute of Standards and Technology: Gaithersburg, MD, USA, 2016.

- Santos, B. Top PV Module Manufacturers by Shipment Volume in 2022. Available online: https://www.pv-magazine.com/2023/04/13/top-pv-module-manufacturers-by-shipment-volume-in-2022/ (accessed on 21 April 2023).

- IEC 61215-1: 2021; Terrestrial Photovoltaic (PV) Modules—Design Qualification and Type Approval—Part. 1: Test. Requirements. IEC: Geneva, Switzerland, 2021.

- Karatas, E.; Gottschalg, R. Predicting Warranty Risk of PV Modules. IEEE J. Photovolt. 2023, 13, 945–950. [Google Scholar] [CrossRef]

- Cohen, D.; Darrough, M.N.; Huang, R.; Zach, T. Warranty Reserve: Contingent Liability, Information Signal, or Earnings Management Tool? Account. Rev. 2011, 86, 569–604. [Google Scholar] [CrossRef]

- International Energy Agency. Special Report on Solar PV Global Supply Chains; IEA: Paris, France, 2022. [Google Scholar]

- O’Connor, P.P.; Kleyner, A. Practical Reliability Engineering, 5th ed.; Wiley: Hoboken, NJ, USA, 2012; ISBN 9780470979815. [Google Scholar]

- IAS 37—Provisions, Contingent Liabilities and Contingent Assets. Available online: https://www.iasplus.com/en/standards/ias/ias37 (accessed on 22 April 2023).

- Kuitche, J.M. Statistical Approach to Solar Photovoltaic Module Lifetime Prediction. Ph.D. Thesis, Arizona State University, Tempe, AZ, USA, 2014. [Google Scholar]

- Kurtz, S.; Wohlgemuth, J.; Kempe, M.; Bosco, N.; Hacke, P.; Jordan, D.; Miller, D.C.; Silverman, T.J.; Phillips, N.; Earnest, T.; et al. Photovoltaic Module Qualification Plus Testing; NREL: Golden, CO, USA, 2013. [Google Scholar]

- Solar Bankability Consortium. Technical Bankability Guidelines: Recommendations to Enhance Technical Quality of Existing and New PV Investments; Solar Bankability EU: Andalucía, Spain, 2017. [Google Scholar]

- Sauer, T.C. Solar Investment Risk Mitigation—Are We All on the Same Page? EPJ Photovolt. 2019, 10, 7. [Google Scholar] [CrossRef]

- Moser, D.; Lindig, S.; Richter, M.; Ascencio-Vásquez, J.; Horvath, I.; Müller, B.; Green, M.; Vedde, J.; Herz, M.; Herteleer, B.; et al. Bengt Stridh Uncertainties in Yield Assessments and PV LCOE 2020. Available online: https://iea-pvps.org/key-topics/uncertainties-yield-assessments/ (accessed on 25 March 2024).

- Jahn, U.; Herz, M.; Moser, D.; Belluardo, G.; Richter, M. Managing Technical Risks in PV Investments: How to Quantify the Impact of Risk Mitigation Measures for Different PV Project Phases? Prog. Photovolt. Res. Appl. 2018, 26, 597–607. [Google Scholar] [CrossRef]

- Blischke, W.R.; Prabhakar Murthy, D.N. (Eds.) Warranty Cost Analysis; CRC Press: Boca Raton, FL, USA, 1993. [Google Scholar]

- Yoe, C. Principles of Risk Analysis: Decision Making Under Uncertainty, 2nd ed.; CRC Press: Boca Raton, FL, USA, 2019; ISBN 9781138478206. [Google Scholar]

- LONGi Limited Warranty for LONGi PV Modules HE Single Glass Series 2022. Available online: https://static.longi.com/Limited_Warranty_for_LON_Gi_PV_Modules_HE_Single_Glass_Series_20220530_7d6b6431b8.pdf (accessed on 25 March 2024).

- Alexander, C. Market Risk Analysis, Value at Risk Models; Wiley: Hoboken, NJ, USA, 2009; Volume IV, ISBN 9780470997888. [Google Scholar]

- Parodi, P. Pricing in General Insurance; Chapman and Hall/CRC: Boca Raton, FL, USA, 2014; ISBN 9781466581449. [Google Scholar]

- Average Auction Prices for Solar PV by Region and Commissioning Date, 2016–2022. Available online: https://www.iea.org/data-and-statistics/charts/average-auction-prices-for-solar-pv-by-region-and-commissioning-date-2016-2022 (accessed on 27 January 2023).

- Santos, B. PV Payback Times Hit Average of 20 Years in 2022, Says SolarPower Europe. Available online: https://www.pv-magazine.com/2023/03/31/pv-payback-times-hit-average-of-20-years-in-2022-says-solarpower-europe/ (accessed on 24 April 2023).

- IEC TS 63209-1:2021; Photovoltaic Modules—Extended-Stress Testing—Part. 1: Modules. IEC: Geneva, Switzerland, 2021.

- IEC TS 63209-2:2022; Photovoltaic Modules—Extended-Stress Testing—Part. 2: Polymeric Component Materials. IEC: Geneva, Switzerland, 2022.

| Degradation and Failure Mode | Common Cause of Failure | Degradation Impacts over 25 Years |

|---|---|---|

| Light induced degradation (LID) | Increased minority-carrier recombination, Boron-oxygen defect | 1.1~1.5% [17,18] |

| Glass anti-reflection degradation | Durability issue of the anti-reflection coating | <3~4% [19,20] |

| EVA discoloring | EVA additive issue, UV exposure at high temperature | <10% [19] |

| Potential induced degradation (PID) | Sodium ion flow through front glass and shunt the solar cells | Up to 30% [21] |

| Delamination | Contamination, lamination process issue, environmental factors | <4% [19] |

| Corrosion of cell metallization | Moisture ingress following delamination | >5% [22] |

| Broken cell, snail trails | Thinner cells, poor handling of module, silver acetate | ~10% [19,22] |

| Broken string interconnect | Thermal expansion stress, stiffer ribbon, flexing due to wind | ~10% [22] |

| Broken glass/loose frame | High impact, hot spot, improper handling, misuse of support | Up to 100% |

| Junction box failure | Material defect, condensation of water within the box, detachment | Up to 100% |

| Connector failure | Insufficient current rating, water ingress, UV induced degradation | Up to 100% |

| Product | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | Remarks |

|---|---|---|---|---|---|---|---|

| Longi Hi-MO1 | 0.55% | 0.55% | 0.55% | 0.55% | 0.55% | 25Y | |

| Trina TSM-DE18M(II) | 0.55% | 0.55% | 0.55% | 0.55% | 25Y | ||

| Trina TSM-DEG18MC.20(II) | 0.45% | 0.45% | 0.45% | 0.45% | 30Y, Bifacial | ||

| Jinko Cheetah | 0.70% | 0.60% | 0.60% | 0.60% | 0.60% | 0.60% | 25Y |

| Jinko Tiger N | 0.40% | 0.40% | 0.40% | 0.40% | 30Y | ||

| Jinko Tiger Pro | 0.45% | 0.45% | 0.45% | 0.45% | 30Y, Bifacial | ||

| JA Solar JAM60S20 | 0.60% | 0.55% | 0.60% | 0.55% | 0.55% | 25Y | |

| JA SolarJAM72D40 | 0.50% | 0.45% | 0.45% | 0.40% | 0.40% | 30Y, Bifacial | |

| Canadian Solar KU Series | 0.55% | 0.55% | 0.55% | 0.55% | 25Y | ||

| Canadian Solar CS1HA-MS | 0.70% | 0.60% | 0.60% | 25Y | |||

| Risen Energy RSM40-8-xxxMB | 0.55% | 0.55% | 0.55% | 25Y | |||

| Risen Energy RSM40-8-xxxN | 0.40% | 0.40% | 0.40% | 25Y | |||

| Risen Energy RSM72-6-xxxM | 0.60% | 0.60% | 0.60% | 0.60% | 0.60% | 25Y | |

| Average | 0.700% | 0.575% | 0.523% | 0.513% | 0.504% | 0.504% |

| Rank | Company | 2020 Revenue (‘000 $) | 2021 Revenue (‘000 $) | 2022 Revenue (‘000 $) | 2020 New WF (‘000 $/%*) | 2021 New WF (‘000 $/%*) | 2022 New WF (‘000 $/%*) | Total WF Ratio | Lever-age Ratio |

|---|---|---|---|---|---|---|---|---|---|

| 1 | LONGi | 8,003,399 | 11,866,899 | 18,914,679 | 53,998 (0.67%) | 81,152 (0.68%) | 116,748 (0.62%) | 0.74% | 1.24 |

| 2 | Trina Solar | 4,313,486 | 6,522,051 | 12,470,937 | 5857 (0.14%) | −386 (−0.01%) | 26,214 (0.21%) | 0.62% | 2.12 |

| 3 | Jinko Solar | 4,935,419 | 5,948,624 | 12,122,592 | 34,923 (0.71%) | 17,061 (0.29%) | 93,970 (0.78%) | 0.88% | 2.96 |

| 4 | JA Solar | 3,789,812 | 6,055,976 | 10,702,258 | 14,488 (0.38%) | 22,160 (0.37%) | 51,028 (0.48%) | 0.71% | 1.40 |

| 5 | Canadian Solar | 3,476,495 | 5,277,169 | 7,468,610 | −18,146 (−0.52%) | 7414 (0.14%) | 31,531 (0.42%) | 0.39% | 0.45 |

| 6 | Risen Energy | 2,355,351 | 2,761,103 | 4,308,610 | −554 (−0.02%) | −930 (−0.03%) | −143 (−0.00%) | 0.00% | 2.68 |

| Changes | WF Estimate after Changes in Median (Most Likely) Degradation Value | WF Estimate after Changes in Maximum Degradation Value | WF Estimate after Changes in Minimum Degradation Value |

| −10% | 0.412% | 0.615% | 1.230% |

| +10% | 2.555% | 2.085% | 1.374% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hsi, P.-H.; Shieh, J.C.P. How Credible Is the 25-Year Photovoltaic (PV) Performance Warranty?—A Techno-Financial Evaluation and Implications for the Sustainable Development of the PV Industry. Sustainability 2024, 16, 3880. https://doi.org/10.3390/su16093880

Hsi P-H, Shieh JCP. How Credible Is the 25-Year Photovoltaic (PV) Performance Warranty?—A Techno-Financial Evaluation and Implications for the Sustainable Development of the PV Industry. Sustainability. 2024; 16(9):3880. https://doi.org/10.3390/su16093880

Chicago/Turabian StyleHsi, Pao-Hsiang, and Joseph C. P. Shieh. 2024. "How Credible Is the 25-Year Photovoltaic (PV) Performance Warranty?—A Techno-Financial Evaluation and Implications for the Sustainable Development of the PV Industry" Sustainability 16, no. 9: 3880. https://doi.org/10.3390/su16093880