Statistical Properties of the Foreign Exchange Network at Different Time Scales: Evidence from Detrended Cross-Correlation Coefficient and Minimum Spanning Tree

Abstract

:1. Introduction

2. Data and Methodology

2.1. Data Set

| Continent | Currency | Symbol | Continent | Currency | Symbol |

|---|---|---|---|---|---|

| Africa | Egyptian Pound | EGP | Europe | Romanian New Leo | RON |

| South Africa Rand | ZAR | Russian Rubles | RUB | ||

| Asia | Chinese Renminbi | CNY | Swedish Krona | SEK | |

| Indian Rupee | INR | Swiss Franc | CHF | ||

| Indonesian Rupiah | IDR | Turkish New Lira | TRY | ||

| Japanese Yen | JPY | Latin America | Argentinian Peso | ARS | |

| Malaysian Ringgit | MYR | Brazilian Real | BRL | ||

| Pakistani Rupee | PKR | Chilean Pesos | CLP | ||

| Philippines Peso | PHP | Colombian Peso | COP | ||

| Singapore Dollar | SGD | Panamanian Balboas | PAB | ||

| South Korean Won | KRW | Peruvian New Sole | PEN | ||

| Sri Lankan Rupee | LKR | Mexican Peso | MXN | ||

| Taiwan Dollar | TWD | Venezuelan Bolívar Fuerte | VEF | ||

| Thai Baht | THB | Middle East | Israeli New Shekel | ILS | |

| Vietnamese Dong | VND | Jordanian Dinar | JOD | ||

| Vietnamese Dong | British Pound | GBP | Kuwaiti Dinar | KWD | |

| Czech Koruna | CZK | Saudi Arabian Riyal | SAR | ||

| European Euros | EUR | United Arab Emirates Dirham | AED | ||

| Hungarian Forint | HUF | North America | Canadian Dollar | CAD | |

| Icelandic Krona | ISK | US Dollar | USD | ||

| Norwegian Krone | NOK | Pacific Ocean | Australian Dollar | AUD | |

| Polish Zloty | PLN | New Zealand Dollar | NZD |

2.2. Methodology

3. Empirical Results and Analysis

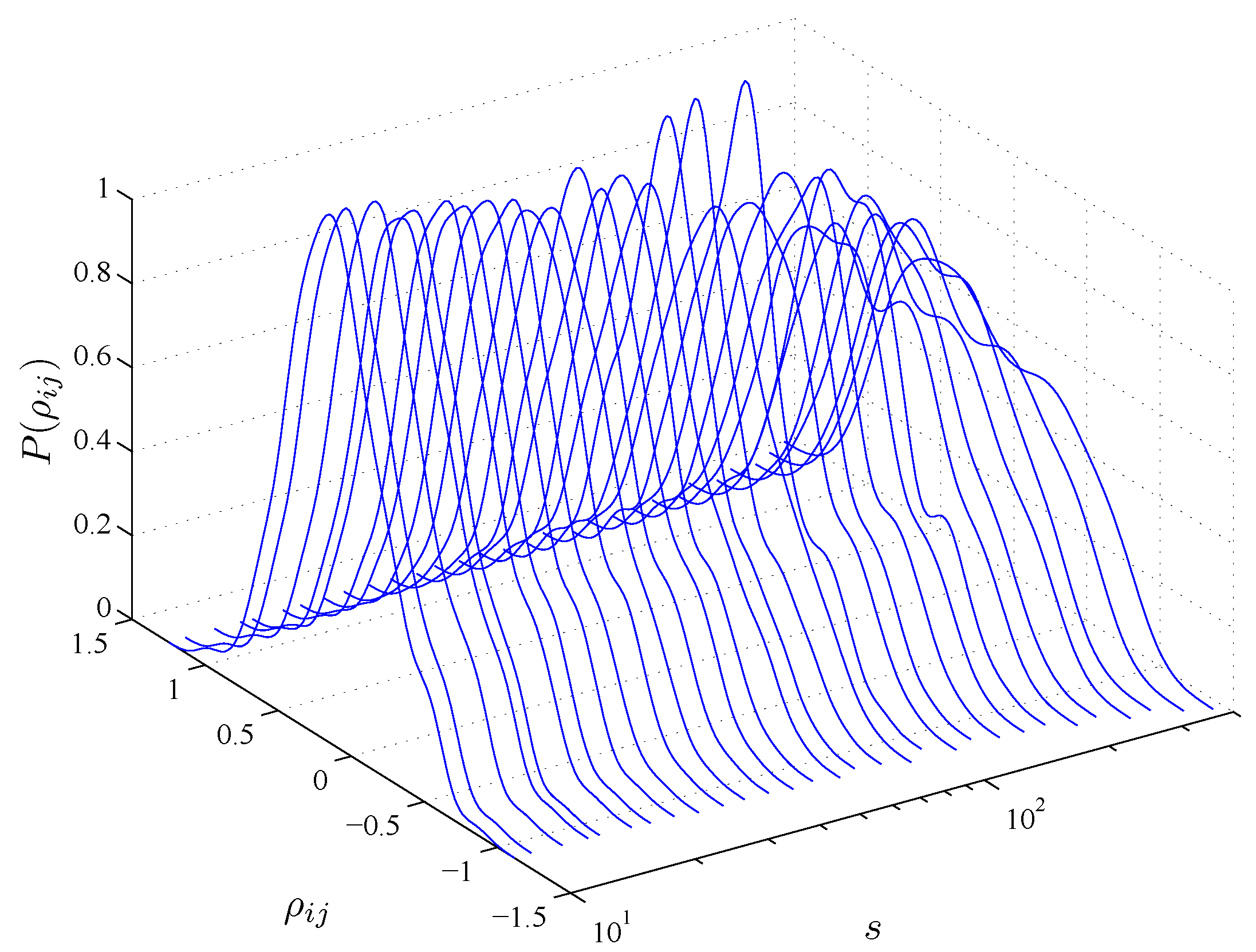

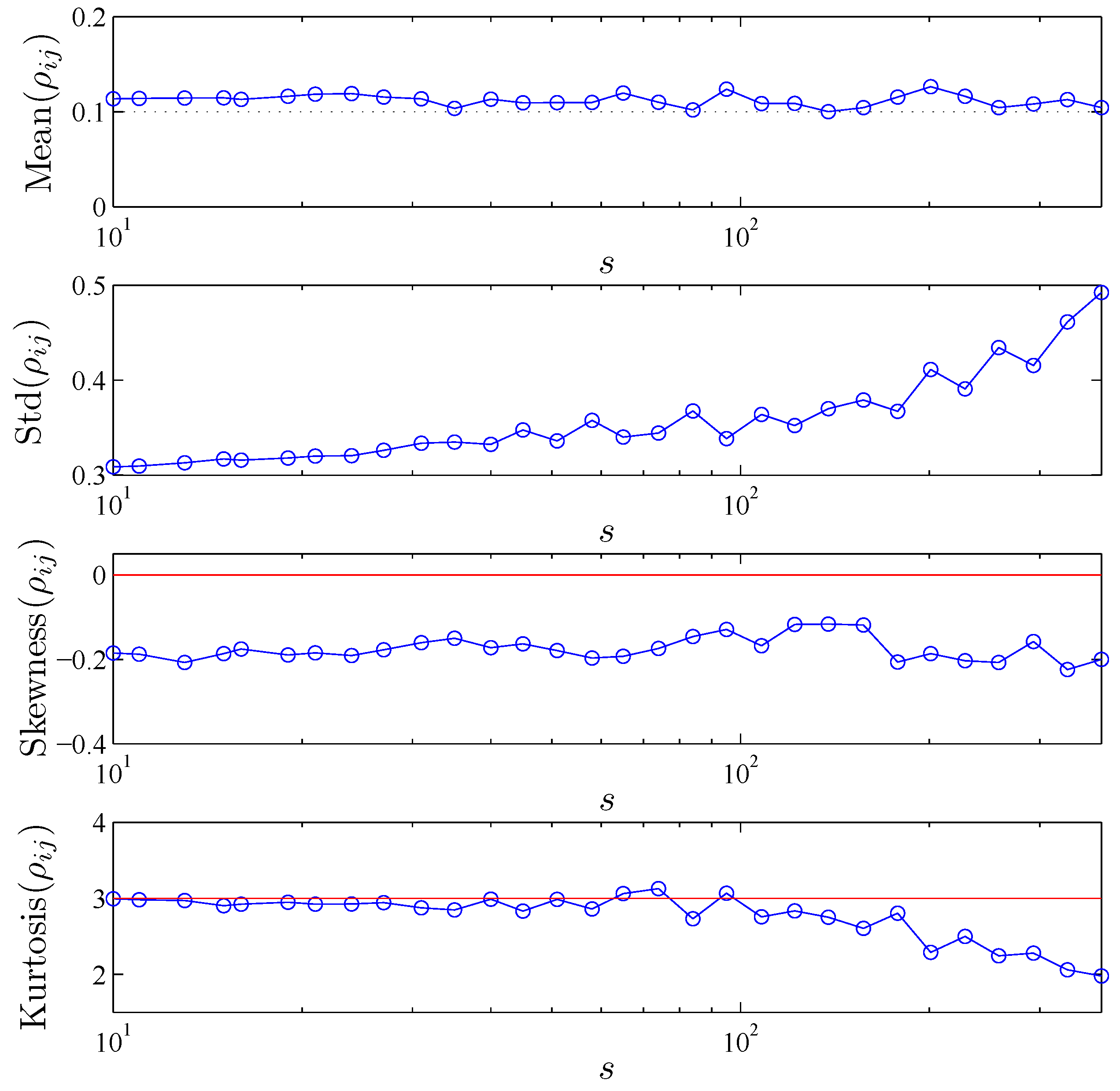

3.1. Statistics of Cross-Correlation Coefficients

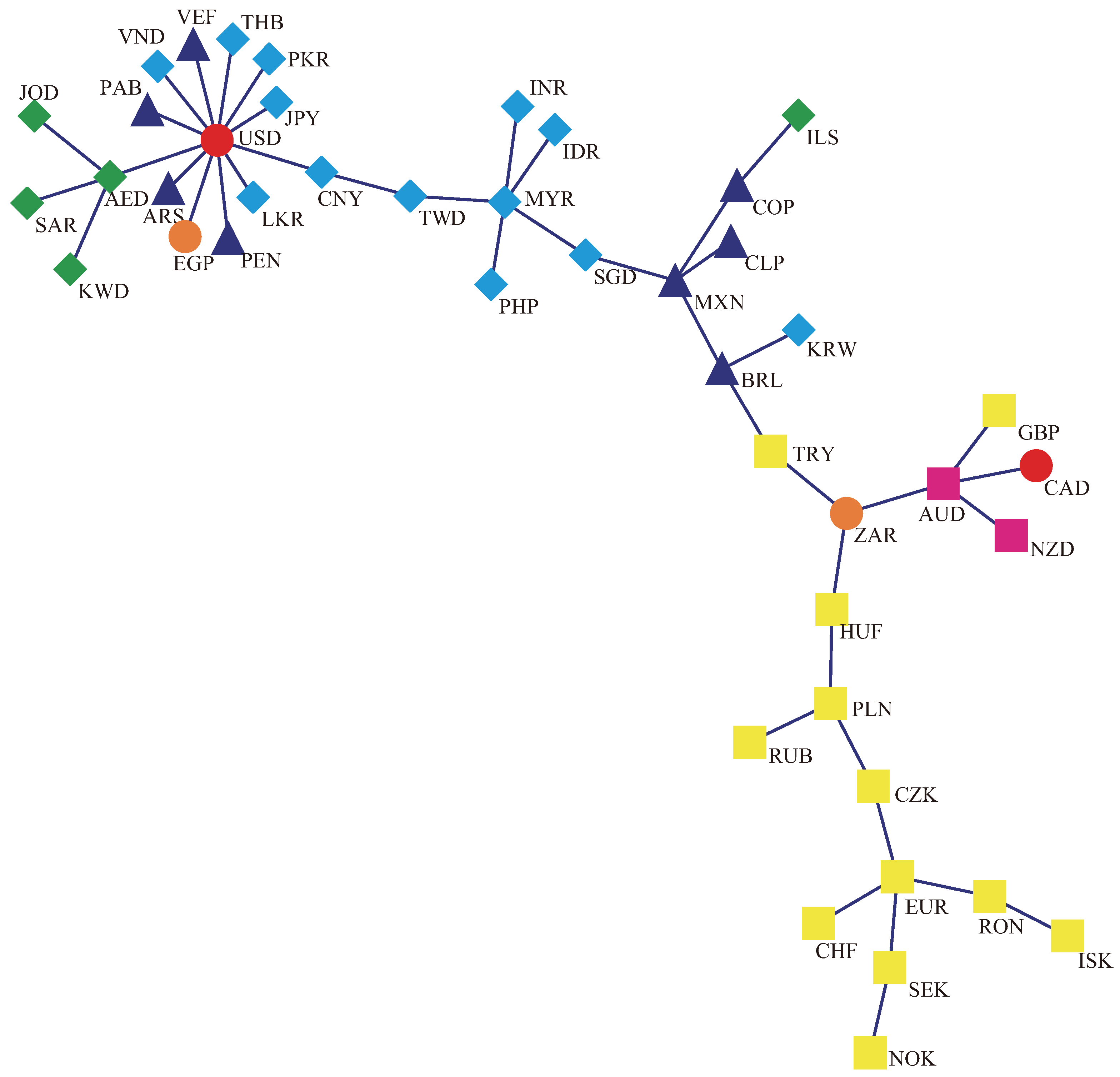

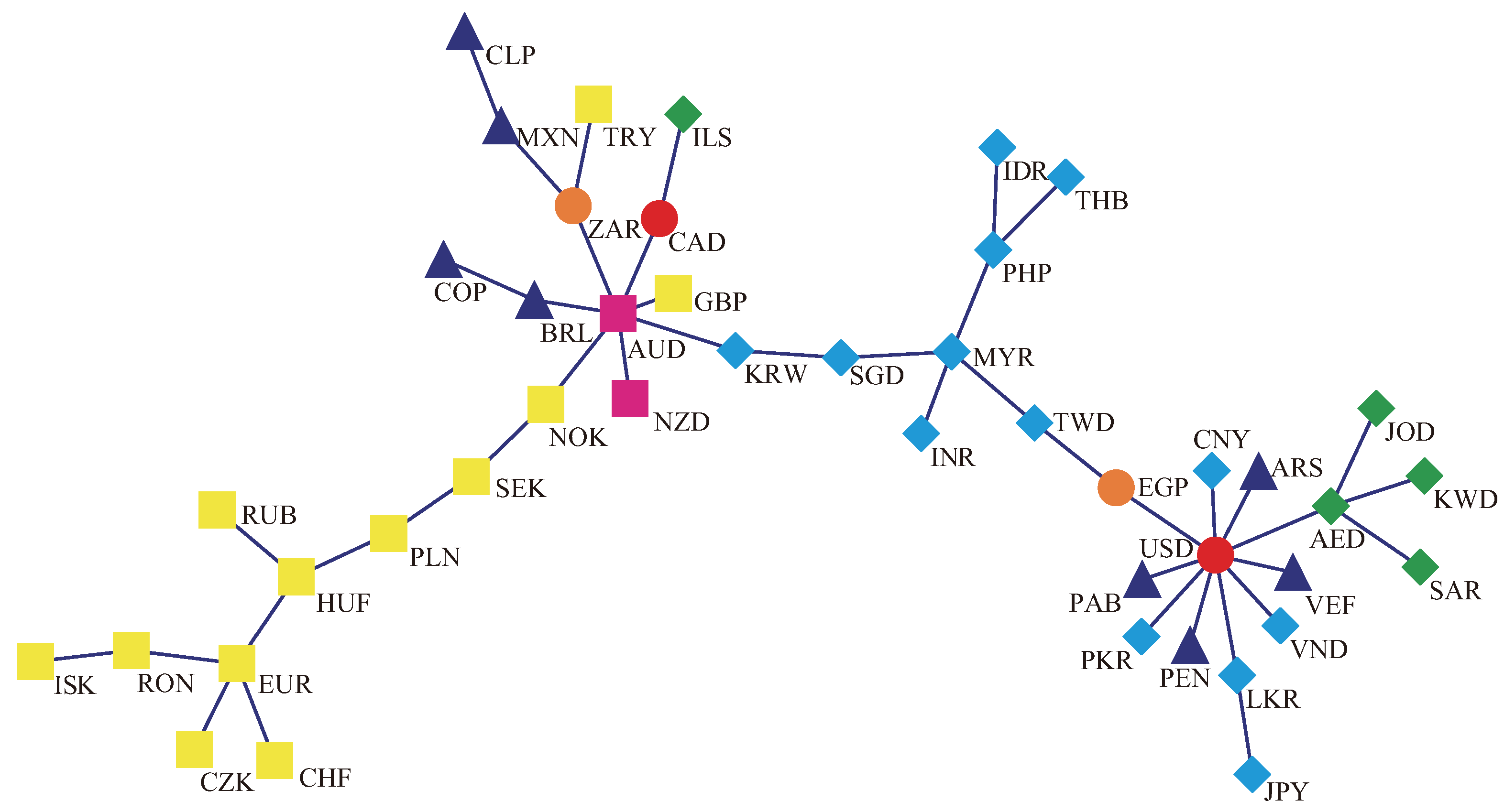

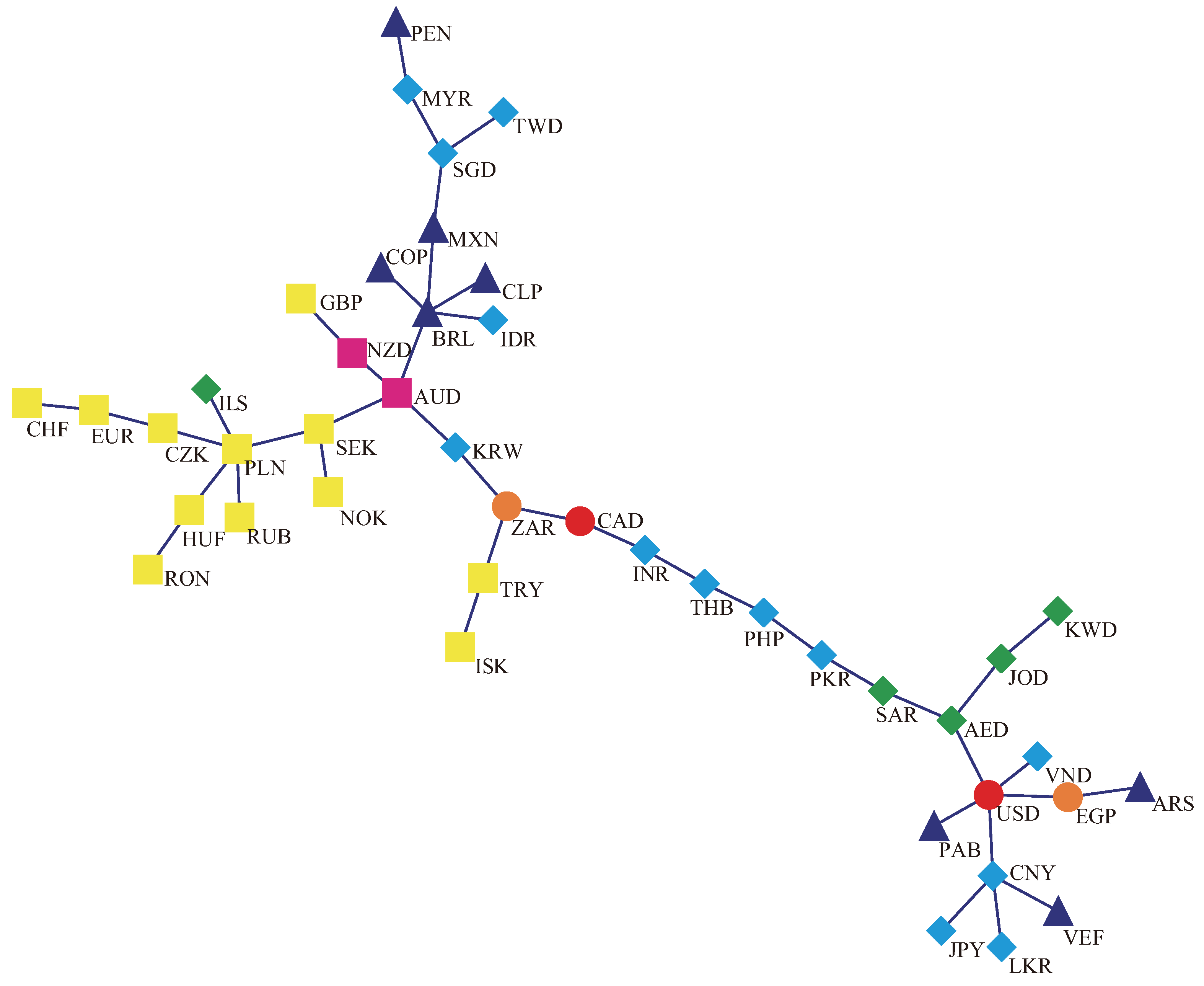

3.2. MST Results

- (1)

- The international cluster with USD as its center becomes smaller than those of the former two scales, and only five currencies directly link to USD.

- (2)

- The Asia cluster splits into two small clusters: one is the linear-linked group in the MST, which is composed of INR, THB, PHP, and PKR, and the other is the triangle-linked group, which is composed of SGD, TWD, and MYR.

- (3)

- Compared with Figure 4, the Latin America cluster has appeared again but with BRL as its center.

- (4)

- Although the European cluster still exists in the MST, the center is changed to PLN.

- (5)

- The Commonwealth cluster is separated into two units by KRW but the five currencies (i.e., GBP, NZD, AUD, ZAR, and CAD) are still on a line.

- (1)

- Both the international cluster and the European cluster exist in the MSTs for three different time scales, which confirms that USD and EUR are the predominant currencies in the FX market and suggests that the currencies can be clustered by the geographical criterion or the trade criterion.

- (2)

- Another stable cluster in the three MSTs is the Middle East cluster with AED as its center, which consists of AED, JOD, SAR, and KWD. Three countries of them are the members of the Organization of the Petroleum Exporting Countries (OPEC), which causes their currencies to have a strong relationship with USD because the U.S. is the largest importer and consumer of oil in the world at present and USD is the main currency of payment.

- (3)

- The Asia and Latin America clusters are not stable, which indicates that countries in these areas need more cooperation such as in the fields of trade, policy, economy, and currency.

- (4)

- An interesting finding is that the Commonwealth cluster appears in our study. This phenomenon suggests that the shared values and the shared trade links of the Commonwealth of Nations are beneficial to the formation of the monetary cluster.

- (5)

- Five currencies (i.e., CNY, PAB, VND, AED, and EGP) always connect to USD as their center. There are two possible origins to explain the connections: on the one hand, the country is one of the main trading partners of America or the opposite, such as China; on the other hand, the currency may be pegged to USD, such as PAB.

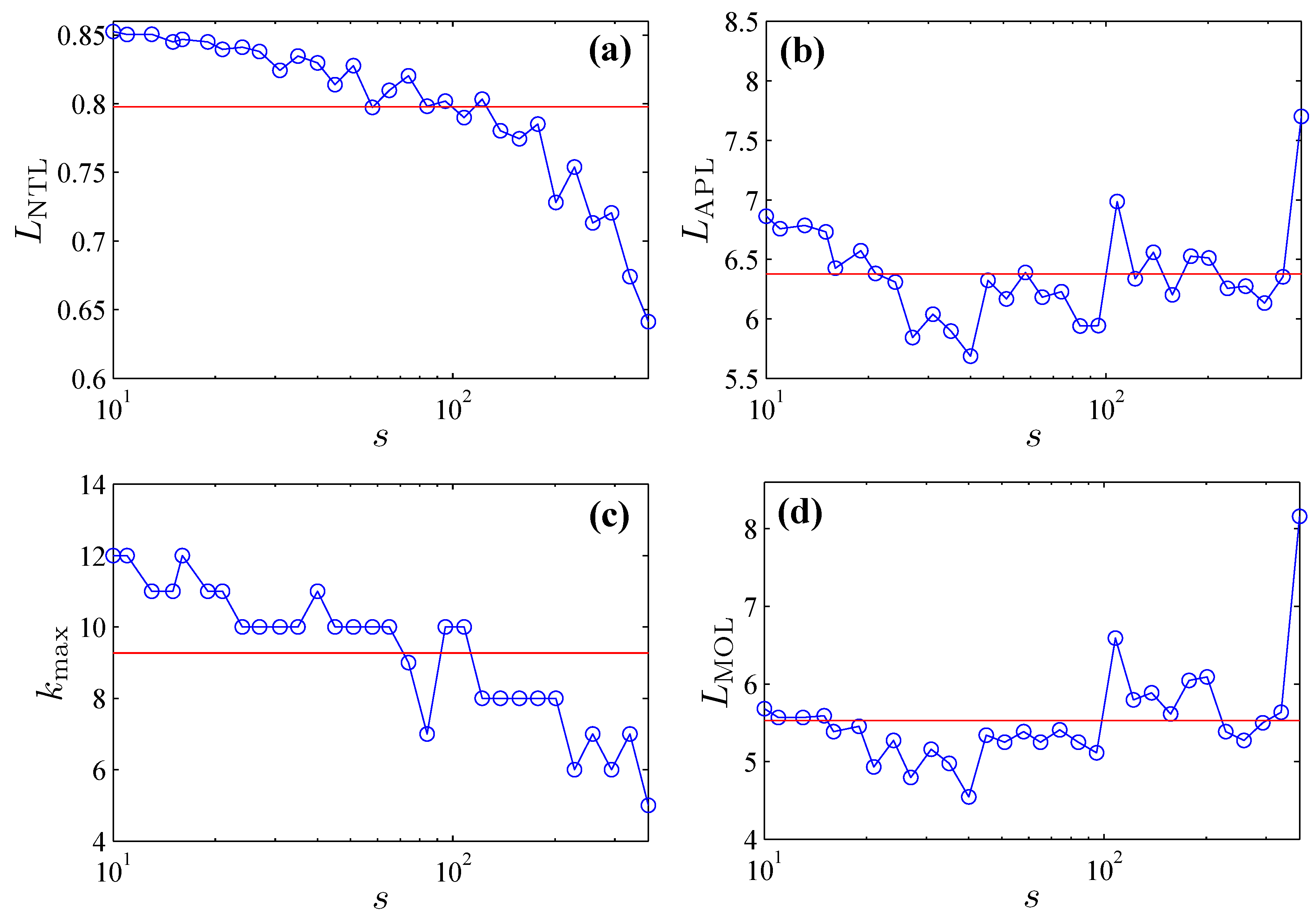

3.3. Statistical Properties of MSTs at Different Time Scales

3.3.1. Four Evaluation Criteria

3.3.2. Distribution of Vertex Degrees

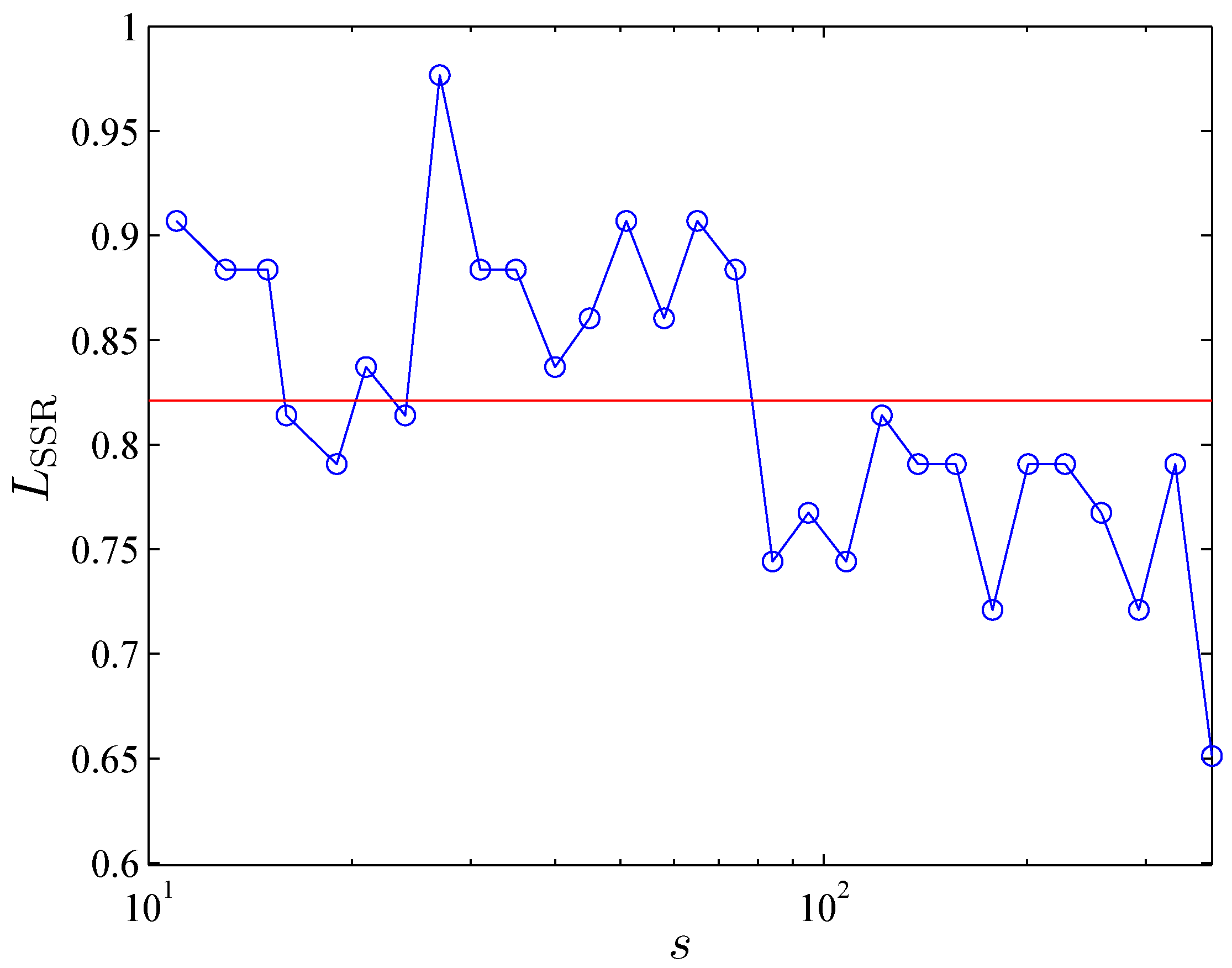

3.3.3. Single-Step Survival Ratio

4. Conclusions

- (1)

- Based on the analysis of statistical properties of cross-correlation coefficients, we find that the cross-correlation coefficients of the FX market in the period of 2007–2012 are fat-tailed.

- (2)

- From the three MSTs in Section 3.2, we draw some conclusions. For instance, USD and EUR are confirmed as the predominant world currencies in the three MSTs. The Asian cluster and the Latin America cluster are not stable while the Middle East cluster is very stable in the MSTs. It is interesting to note that the Commonwealth cluster is found in the MSTs.

- (3)

- By analyzing the four evaluation criteria, we find that the MSTs of the FX market present diverse topological and statistical properties at different time scales.

- (4)

- The scale-free (or power-law) behavior is also found in the FX network at most of time scales.

- (5)

- Through quantifying the single-step survival ratio of the MSTs at different time scales, we conclude that a great majority of links in the FX network survive from one time scale to the next.

- (1)

- (2)

- Our analysis based on the two methods of DCCA coefficient and MST can be employed to analyze the statistical properties of other financial markets at different time scales, such as stock markets and commodity markets.

- (3)

- The DCCA coefficient method also can be combined with other correlation network-based approaches to study the topology of the networks at different time scales, such as PMFG, and correlation threshold methods.

Acknowledgements

References

- Mantegna, R.N.; Stanley, H.E. An Introduction to Econophysics: Correlations and Complexity in Finance; Cambridge University Press: Cambridge, UK, 2000. [Google Scholar]

- Kwapień, J.; Drożdż, S. Physical approach to complex systems. Phys. Rep. 2012, 515, 115–226. [Google Scholar] [CrossRef]

- Wang, G.J.; Xie, C. Cross-correlations between WTI crude oil market and US stock market: A perspective from econophysics. Acta Phys. Pol. B 2012, 43, 2021–2036. [Google Scholar] [CrossRef]

- Wang, G.J.; Xie, C. Cross-correlations between Renminbi and four major currencies in the Renminbi currency basket. Physica A 2013, 392, 1418–1428. [Google Scholar] [CrossRef]

- Kenett, D.Y.; Raddant, M.; Lux, T.; Ben-Jacob, E. Evolvement of uniformity and volatility in the stressed global financial village. PLoS One 2012, 7, e31144. [Google Scholar] [CrossRef] [PubMed]

- Siqueira, E.L., Jr.; Stošić, T.; Bejan, L.; Stošić, B. Correlations and cross-correlations in the Brazilian agrarian commodities and stocks. Physica A 2010, 389, 2739–2743. [Google Scholar] [CrossRef]

- Wang, G.J.; Xie, C. Cross-correlations between the CSI 300 spot and futures markets. Nonlinear Dyn. 2013. [Google Scholar] [CrossRef]

- Kenett, D.Y.; Shapira, Y.; Madi, A.; Bransburg-Zabary, S.; Gur-Gershgoren, G.; Ben-Jacob, E. Dynamics of stock market correlations. Czech AUCO Econ. Rev. 2010, 4, 330–340. [Google Scholar]

- Kenett, D.Y.; Preis, T.; Gur-Gershgoren, G.; Ben-Jacob, E. Quantifying meta-correlations in financial markets. Europhys. Lett. 2012, 99, 38001. [Google Scholar] [CrossRef]

- Mantegna, R.N. Hierarchical structure in financial markets. Eur. Phys. J. B 1999, 11, 193–197. [Google Scholar] [CrossRef]

- Tumminello, M.; Aste, T.; di Matteo, T.; Mantegna, R.N. A tool for filtering information in complex systems. Proc. Natl. Acad. Sci. USA 2005, 102, 10421–10426. [Google Scholar] [CrossRef] [PubMed]

- Boginski, V.; Butenko, S.; Pardalos, P.M. Statistical analysis of financial networks. Comput. Stat. Data Anal. 2005, 48, 431–443. [Google Scholar] [CrossRef]

- Huang, W.Q.; Zhuang, X.T.; Yao, S. A network analysis of the Chinese stock market. Physica A 2009, 388, 2956–2964. [Google Scholar] [CrossRef]

- Onnela, J.P.; Kaski, K.; Kertész, J. Clustering and information in correlation based financial networks. Eur. Phys. J. B 2004, 38, 353–362. [Google Scholar] [CrossRef]

- Sandoval Junior, L.; Franca, I.D.P. Correlation of financial markets in times of crisis. Physica A 2012, 391, 187–208. [Google Scholar] [CrossRef]

- Plerou, V.; Gopikrishnan, P.; Rosenow, B.; Amaral, L.A.N.; Guhr, T.; Stanley, H.E. Random matrix approach to cross correlations in financial data. Phys. Rev. E 2002, 65, 066126. [Google Scholar] [CrossRef] [PubMed]

- Laloux, L.; Cizeau, P.; Bouchaud, J.P.; Potters, M. Noise dressing of financial correlation matrices. Phys. Rev. Lett. 1999, 83, 1467–1470. [Google Scholar] [CrossRef]

- Plerou, V.; Gopikrishnan, P.; Rosenow, B.; Amaral, L.A.N.; Stanley, H.E. Universal and nonuniversal properties of cross correlations in financial time series. Phys. Rev. Lett. 1999, 83, 1471–1474. [Google Scholar] [CrossRef]

- Podobnik, B.; Wang, D.; Horvatic, D.; Grosse, I.; Stanley, H.E. Time-lag cross-correlations in collective phenomena. Europhys. Lett. 2010, 90, 68001. [Google Scholar] [CrossRef]

- Podobnik, B.; Stanley, H.E. Detrended cross-correlation analysis: A new method for analyzing two nonstationary time series. Phys. Rev. Lett. 2008, 100, 084102. [Google Scholar] [CrossRef] [PubMed]

- Zhou, W.X. Multifractal detrended cross-correlation analysis for two nonstationary signals. Phys. Rev. E 2008, 77, 066211. [Google Scholar] [CrossRef] [PubMed]

- Horvatic, D.; Stanley, H.E.; Podobnik, B. Detrended cross-correlation analysis for non-stationary time series with periodic trends. Europhys. Lett. 2011, 94, 18007. [Google Scholar] [CrossRef]

- Wang, G.J.; Xie, C.; Han, F.; Sun, B. Similarity measure and topology evolution of foreign exchange markets using dynamic time warping method: Evidence from minimal spanning tree. Physica A 2012, 391, 4136–4146. [Google Scholar] [CrossRef]

- Onnela, J.P.; Chakraborti, A.; Kaski, K.; Kertiész, J. Dynamic asset trees and portfolio analysis. Eur. Phys. J. B 2002, 30, 285–288. [Google Scholar] [CrossRef]

- Onnela, J.P.; Chakraborti, A.; Kaski, K.; Kertesz, J.; Kanto, A. Dynamics of market correlations: Taxonomy and portfolio analysis. Phys. Rev. E 2003, 68, 056110. [Google Scholar] [CrossRef] [PubMed]

- Jiang, Z.Q.; Zhou, W.X. Complex stock trading network among investors. Physica A 2010, 389, 4929–4941. [Google Scholar] [CrossRef]

- Tabak, B.M.; Serra, T.R.; Cajueiro, D.O. Topological properties of stock market networks: The case of Brazil. Physica A 2010, 389, 3240–3249. [Google Scholar] [CrossRef]

- Tumminello, M.; Lillo, F.; Mantegna, R.N. Correlation, hierarchies, and networks in financial markets. J. Econ. Behav. Organ. 2010, 75, 40–58. [Google Scholar] [CrossRef]

- Aste, T.; Shaw, W.; di Matteo, T. Correlation structure and dynamics in volatile markets. New J. Phys. 2010, 12, 085009. [Google Scholar] [CrossRef]

- Di Matteo, T.; Pozzi, F.; Aste, T. The use of dynamical networks to detect the hierarchical organization of financial market sectors. Eur. Phys. J. B 2010, 73, 3–11. [Google Scholar] [CrossRef]

- Gao, Y.C.; Wei, Z.W.; Wang, B.H. Dynamic evolution of financial network and its relation to economic crises. Int. J. Mod. Phys. C 2013, 24, 1350005. [Google Scholar] [CrossRef]

- Yang, C.; Shen, Y.; Xia, B. Evolution of Shanghai stock market based on maximal spanning trees. Mod. Phys. Lett. B 2013, 27, 1350022. [Google Scholar] [CrossRef]

- Kenett, D.Y.; Tumminello, M.; Madi, A.; Gur-Gershgoren, G.; Mantegna, R.N.; Ben-Jacob, E. Dominating clasp of the financial sector revealed by partial correlation analysis of the stock market. PLoS One 2010, 5, e15032. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Kenett, D.Y.; Preis, T.; Gur-Gershgoren, G.; Ben-Jacob, E. Dependency network and node influence: Application to the study of financial markets. Int. J. Bifurcat. Chaos. 2012, 22, 1250181. [Google Scholar] [CrossRef]

- Sieczka, P.; Hołyst, J.A. Correlations in commodity markets. Physica A 2009, 388, 1621–1630. [Google Scholar] [CrossRef]

- McDonald, M.; Suleman, O.; Williams, S.; Howison, S.; Johnson, N.F. Detecting a currency’s dominance or dependence using foreign exchange network trees. Phys. Rev. E 2005, 72, 046106. [Google Scholar] [CrossRef] [PubMed]

- Mizuno, T.; Takayasu, H.; Takayasu, M. Correlation networks among currencies. Physica A 2006, 364, 336–342. [Google Scholar] [CrossRef]

- Naylor, M.J.; Rose, L.C.; Moyle, B.J. Topology of foreign exchange markets using hierarchical structure methods. Physica A 2007, 382, 199–208. [Google Scholar] [CrossRef]

- Kwapień, J.; Gworek, S.; Drożdż, S. Structure and evolution of the foreign exchange networks. Acta Phys. Pol. B 2009, 40, 175–194. [Google Scholar]

- Kwapień, J.; Gworek, S.; Drożdż, S.; Górski, A. Analysis of a network structure of the foreign currency exchange market. J. Econ. Interact. Coord. 2009, 4, 55–72. [Google Scholar] [CrossRef]

- Gworek, S.; Kwapień, J.; Drożdż, S. Sign and amplitude representation of the forex networks. Acta Phys. Pol. A 2010, 117, 681–687. [Google Scholar]

- Keskin, M.; Deviren, B.; Kocakaplan, Y. Topology of the correlation networks among major currencies using hierarchical structure methods. Physica A 2011, 390, 719–730. [Google Scholar] [CrossRef]

- Jang, W.; Lee, J.; Chang, W. Currency crises and the evolution of foreign exchange market: Evidence from minimum spanning tree. Physica A 2011, 390, 707–718. [Google Scholar] [CrossRef]

- Górski, A.Z.; Drożdż, S.; Kwapień, J. Scale free effects in world currency exchange network. Eur. Phys. J. B 2008, 66, 91–96. [Google Scholar] [CrossRef]

- Gu, R.; Shao, Y.; Wang, Q. Is the efficiency of stock market correlated with multifractality? An evidence from the Shanghai stock market. Physica A 2013, 392, 361–370. [Google Scholar] [CrossRef]

- Mantegna, R.N.; Stanley, H.E. Scaling behaviour in the dynamics of an economic index. Nature 1995, 376, 46–46. [Google Scholar] [CrossRef]

- Drożdż, S.; Kwapień, J.; Oświȩcimka, P.; Rafał, R. The foreign exchange market: Return distributions, multifractality, anomalous multifractality and the Epps effect. New J. Phys. 2010, 12, 105003. [Google Scholar] [CrossRef]

- Zebende, G.F. DCCA cross-correlation coefficient: Quantifying level of cross-correlation. Physica A 2011, 390, 614–618. [Google Scholar] [CrossRef]

- Peng, C.K.; Buldyrev, S.V.; Havlin, S.; Simons, M.; Stanley, H.E.; Goldberger, A.L. Mosaic organization of DNA nucleotides. Phys. Rev. E 1994, 49, 1685–1689. [Google Scholar] [CrossRef]

- Vassoler, R.T.; Zebende, G.F. DCCA cross-correlation coefficient apply in time series of air temperature and air relative humidity. Physica A 2012, 391, 2438–2443. [Google Scholar] [CrossRef]

- Zebende, G.F.; da Silva, M.F.; Machado Filho, A. DCCA cross-correlation coefficient differentiation: Theoretical and practical approaches. Physica A 2013, 392, 1756–1761. [Google Scholar] [CrossRef]

- Cao, G.; Xu, L.; Cao, J. Multifractal detrended cross-correlations between the Chinese exchange market and stock market. Physica A 2012, 391, 4855–4866. [Google Scholar] [CrossRef]

- Podobnik, B.; Jiang, Z.Q.; Zhou, W.X.; Stanley, H.E. Statistical tests for power-law cross-correlated processes. Phys. Rev. E 2011, 84, 066118. [Google Scholar] [CrossRef] [PubMed]

- Wang, G.J.; Xie, C.; Chen, S.; Yang, J.J.; Yang, M.Y. Random matrix theory analysis of cross-correlations in the U.S. stock market: Evidence from Pearson correlation coefficient and detrended cross-correlation coefficient. Physica A 2013. [Google Scholar] [CrossRef]

- Pacific Exchange Rate Service. Available online: http://fx.sauder.ubc.ca/data.html (accessed on 6 May 2013).

- Wang, Y.; Wei, Y.; Wu, C. Cross-correlations between Chinese A-share and B-share markets. Physica A 2010, 389, 5468–5478. [Google Scholar] [CrossRef]

- Kantelhardt, J.W.; Zschiegner, S.A.; Koscielny-Bunde, E.; Havlin, S.; Bunde, A.; Stanley, H.E. Multifractal detrended fluctuation analysis of nonstationary time series. Physica A 2002, 316, 87–114. [Google Scholar] [CrossRef]

- Kruskal, J.B., Jr. On the shortest spanning subtree of a graph and the traveling salesman problem. Proc. Am. Math. Soc. 1956, 7, 48–50. [Google Scholar] [CrossRef]

- Djauhari, M.A.; Gan, S.L. Minimal spanning tree problem in stock networks analysis: An efficient algorithm. Physica A 2013, 392, 2226–2234. [Google Scholar] [CrossRef]

- Vandewalle, N.; Brisbois, F.; Tordoir, X. Non-random topology of stock markets. Quant. Econom. 2001, 1, 372–374. [Google Scholar] [CrossRef]

- Clauset, A.; Shalizi, C.R.; Newman, M.E.J. Power-law distributions in empirical data. SIAM Rev. 2009, 51, 661–703. [Google Scholar] [CrossRef]

© 2013 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/3.0/).

Share and Cite

Wang, G.-J.; Xie, C.; Chen, Y.-J.; Chen, S. Statistical Properties of the Foreign Exchange Network at Different Time Scales: Evidence from Detrended Cross-Correlation Coefficient and Minimum Spanning Tree. Entropy 2013, 15, 1643-1662. https://doi.org/10.3390/e15051643

Wang G-J, Xie C, Chen Y-J, Chen S. Statistical Properties of the Foreign Exchange Network at Different Time Scales: Evidence from Detrended Cross-Correlation Coefficient and Minimum Spanning Tree. Entropy. 2013; 15(5):1643-1662. https://doi.org/10.3390/e15051643

Chicago/Turabian StyleWang, Gang-Jin, Chi Xie, Yi-Jun Chen, and Shou Chen. 2013. "Statistical Properties of the Foreign Exchange Network at Different Time Scales: Evidence from Detrended Cross-Correlation Coefficient and Minimum Spanning Tree" Entropy 15, no. 5: 1643-1662. https://doi.org/10.3390/e15051643