A New Stochastic Dominance Degree Based on Almost Stochastic Dominance and Its Application in Decision Making

Abstract

:1. Introduction

2. Stochastic Dominance and Almost Stochastic Dominance

2.1. Stochastic Dominance

- is the set of increasing utility functions (rational investors). is equivalent to for all .

- is the set of increasing and concave utility functions (risk averters). is equivalent to and for all .

- is the set of increasing and convex utility functions (risk seekers). is equivalent to and for all .

- is the set of all S-shaped utility functions as suggested by Prospect Theory (prospect investors). is equivalent to for all , and for all , and for all . This means risk seeking for losses and risk aversion for gains.

- (1)

- if and only if

- (i)

- for all with strict inequality for some , or

- (ii)

- for all with strict inequality for some ;

- (2)

- if and only if

- (i)

- for all with strict inequality for some , or

- (ii)

- for all with strict inequality for some ;

- (3)

- if and only if

- (i)

- for all with strict inequality for some , or

- (ii)

- for all with strict inequality for some ;

- (4)

- if and only if

- (i)

- for all with strict inequality for some , or

- (ii)

- for all and with strict inequality for some and .

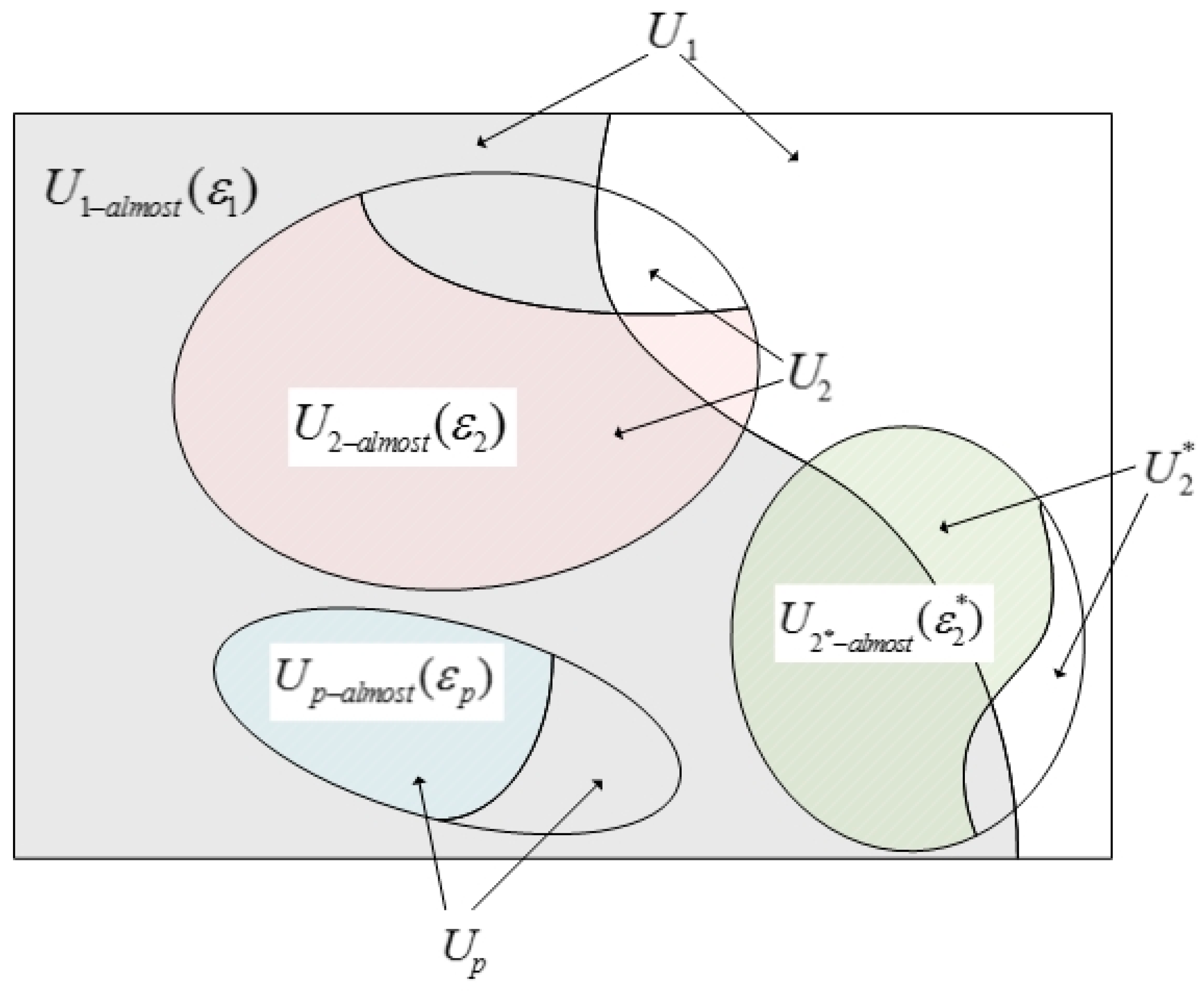

2.2. Almost Stochastic Dominance

- (i)

- for all , or

- (ii)

- ;

- (i)

- for all , or

- (ii)

- and ;

- (i)

- for all , or

- (ii)

- and ;

- (i)

- for all , or

- (ii)

- , and ;

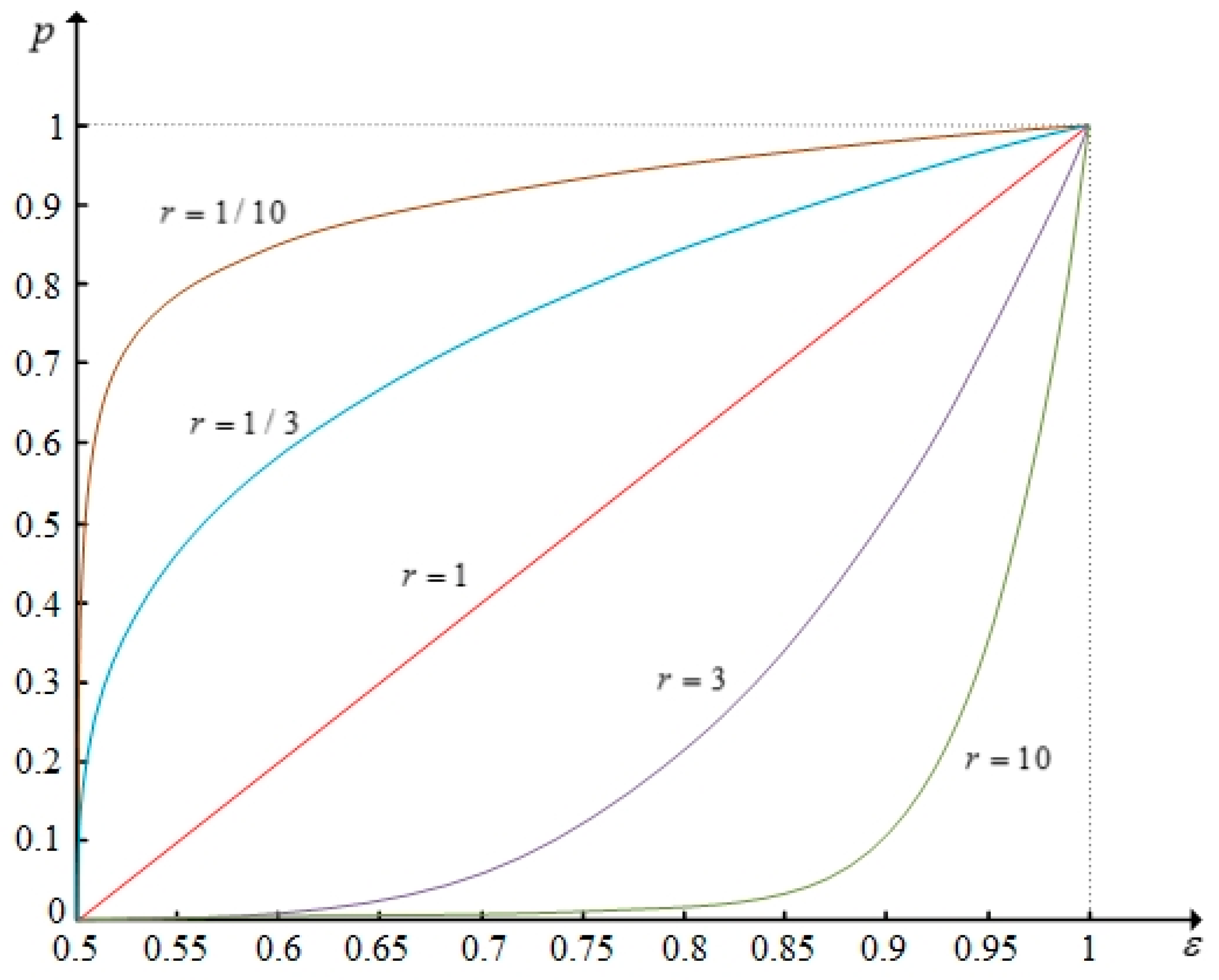

3. Stochastic Dominance Degree

- (a)

- , if ;

- (b)

- .

- (a)

- , if ;

- (b)

- .

4. A Method for Stochastic MCDM

- Step 1.

- Identify the SD or ASD relation for pairwise comparisons of alternatives with respect to each attribute, and then calculate the SDD that an alternative dominates another by Definition 7, set up SDD matrix for each attribute, where denote the SDD of alternative dominates with respect to the attribute .

- Step 2.

- According to SDD matrix , calculate relative dominant degree on each attribute with a PROMETHEE-II based method. Then construct relative dominant degree matrix .

- Step 3.

- Normalize the relative dominant degree matrix into .For benefit-type criteria:For cost-type criteria:

- Step 4.

- Calculate overall dominant degree matrix by Equation (5).

- Step 5.

- Determine the ranking result of alternatives according to , .

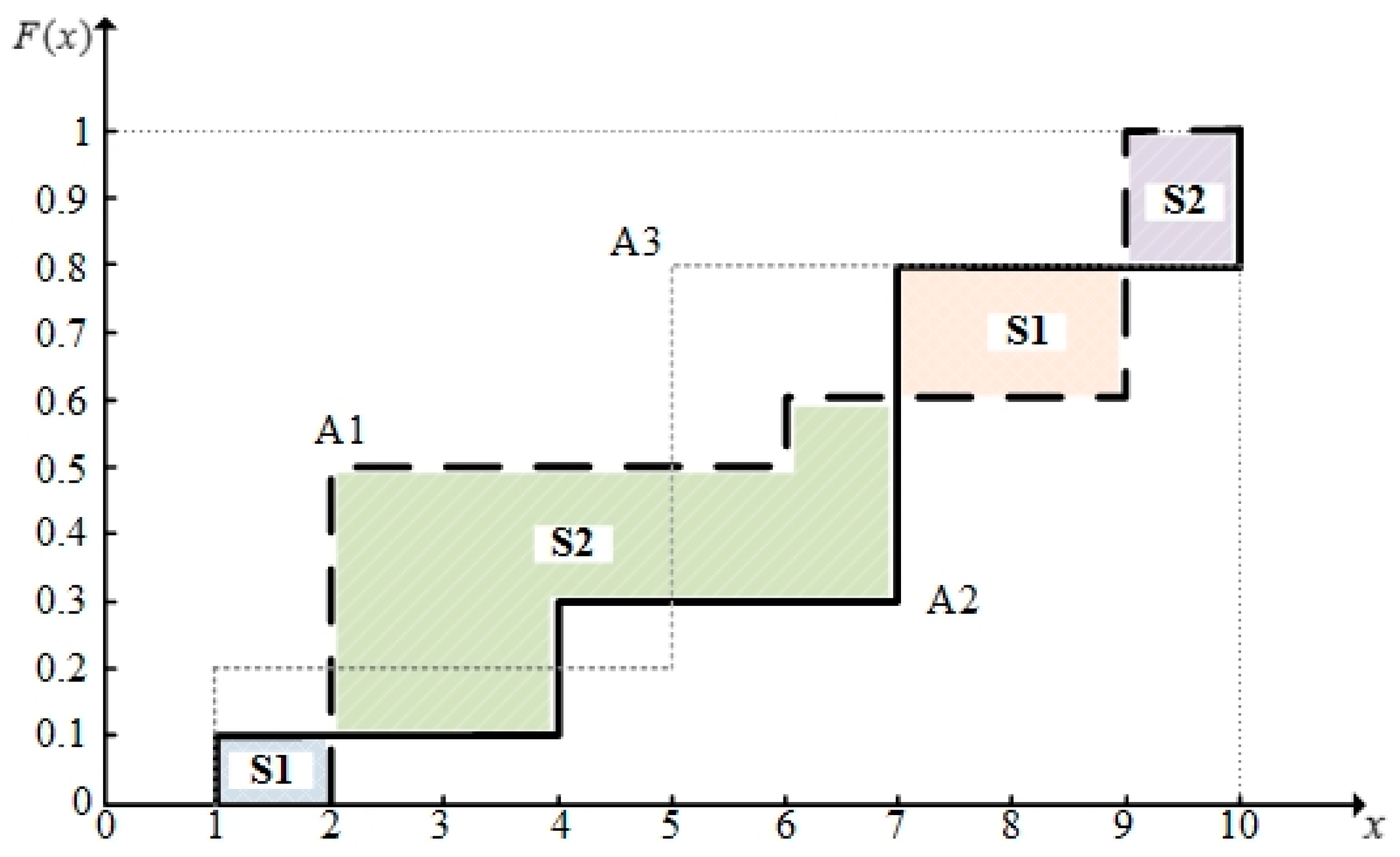

5. A Numerical Example

5.1. Illustrative Applications

5.2. Comparative Analysis and Discussion

6. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Yager, R.R.; Alajlan, N. Probability weighted means as surrogates for stochastic dominance in decision making. Knowl. Based Syst. 2014, 66, 92–98. [Google Scholar] [CrossRef]

- Montes, I.; Miranda, E.; Montes, S. Decision making with imprecise probabilities and utilities by means of statistical preference and stochastic dominance. Eur. J. Oper. Res. 2014, 234, 209–220. [Google Scholar] [CrossRef]

- Wu, Y.; Xu, C.; Xu, H. Optimal site selection of tidal power plants using a novel method: A case in China. Energies 2016, 9, 832. [Google Scholar] [CrossRef]

- Wu, Y.; Xu, H.; Xu, C.; Xiao, X. An almost stochastic dominance based method for stochastic multiple attributes decision making. Intell. Decis.Technol. 2017, 11, 1–13. [Google Scholar] [CrossRef]

- Graves, S.B.; Ringuest, J.L. Probabilistic dominance criteria for comparing uncertain alternatives: A tutorial. Omega 2009, 37, 346–357. [Google Scholar] [CrossRef]

- Hodder, J.E.; Jackwerth, J.C.; Kolokolova, O. Improved Portfolio Choice Using Second Order Stochastic Dominance; Social Science Electronic Publishing: Rochester, NY, USA, 2014. [Google Scholar]

- Zagst, R.; Kraus, J. Stochastic dominance of portfolio insurance strategies. Ann. Oper. Res. 2011, 185, 75–103. [Google Scholar] [CrossRef]

- Montes, I.; Miranda, E.; Montes, S. Stochastic dominance with imprecise information. Comput. Stat. Data Anal. 2014, 71, 868–886. [Google Scholar] [CrossRef]

- Stoyanov, S.V.; Rachev, S.T.; Fabozzi, F.J. Metrization of stochastic dominance rules. Int. J. Theor. Appl. Finance 2012, 15, 203–256. [Google Scholar] [CrossRef]

- Wu, Y.; Xu, H.; Xu, C.; Chen, K. Uncertain multi-attributes decision making method based on interval number with probability distribution weighted operators and stochastic dominance degree. Knowl. Based Syst. 2016, 113, 199–209. [Google Scholar] [CrossRef]

- Leshno, M.; Levy, H. Preferred by “all” and preferred by “most” decision makers: Almost stochastic dominance. Manag. Sci. 2002, 48, 1074–1085. [Google Scholar] [CrossRef]

- Nowak, M. Preference and veto thresholds in multicriteria analysis based on stochastic dominance. Eur. J. Oper. Res. 2004, 158, 339–350. [Google Scholar] [CrossRef]

- Shu, M.H.; Wu, H.C. Supplier evaluation and selection based on stochastic dominance: A quality-based approach. Commun. Stat. Theory Methods 2014, 43, 2907–2922. [Google Scholar] [CrossRef]

- Post, T. Critical Values for Almost Stochastic Dominance Based on Relative Risk Aversion; Social Science Electronic Publishing: Rochester, NY, USA, 2015. [Google Scholar]

- Post, T.; Potì, V. Portfolio analysis using stochastic dominance, relative entropy, and empirical likelihood. Manag. Sci. 2017, 63, 153–165. [Google Scholar] [CrossRef]

- Linton, O.; Maasoumi, E.; Whang, Y.J. Consistent testing for stochastic dominance under general sampling schemes. Rev. Econ. Stud. 2005, 72, 735–765. [Google Scholar] [CrossRef]

- Zhang, Y.; Fan, Z.P.; Liu, Y. A method based on stochastic dominance degrees for stochastic multiple criteria decision making. Comput. Ind. Eng. 2010, 58, 544–552. [Google Scholar] [CrossRef]

- Liu, Y.; Fan, Z.P.; Zhang, Y. A method for stochastic multiple criteria decision making based on dominance degrees. Inf. Sci. 2011, 181, 4139–4153. [Google Scholar] [CrossRef]

- Tan, C.; Ip, W.H.; Chen, X. Stochastic multiple criteria decision making with aspiration level based on prospect stochastic dominance. Knowl. Based Syst. 2014, 70, 231–241. [Google Scholar] [CrossRef]

- Levy, H. Stochastic dominance: Investment decision making under uncertainty. In Studies in Risk and Uncertainty; Springer: Berlin/Heidelberg, Germany, 2006; pp. 757–776. [Google Scholar]

- Tzeng, L.Y.; Shih, P.T. Revisiting almost second-degree stochastic dominance. Manag. Sci. 2013, 59, 1250–1254. [Google Scholar] [CrossRef]

- Levy, H.; Wiener, Z. Stochastic dominance and prospect dominance with subjective weighting functions. J. Risk Uncertain. 1998, 16, 147–163. [Google Scholar] [CrossRef]

- Nowak, M. Aspiration level approach in stochastic mcdm problems. Eur. J. Oper. Res. 2007, 177, 1626–1640. [Google Scholar] [CrossRef]

- Blavatskyy, P.R. Probabilistic Choice and Stochastic Dominance; Springer: Berlin/Heidelberg, Germany, 2012; pp. 59–83. [Google Scholar]

- Huang, R.J.; Tsetlin, I.; Tzeng, L.Y.; Winkler, R.L. Generalized Almost Stochastic Dominance; Institute for Operations Research and the Management Sciences (INFORMS): Catonsville, MD, USA, 2015; Volume 63. [Google Scholar]

- Hwang, C.-L.; Lin, M.-J. Group Decision Making under Multiple Criteria: Methods and Applications; Springer Science & Business Media: Berlin, Germany, 2012; Volume 281. [Google Scholar]

- Guo, X.; Zhu, X.; Wong, W.-K.; Zhu, L. A note on almost stochastic dominance. Econ. Lett. 2013, 121, 252–256. [Google Scholar] [CrossRef] [Green Version]

- Jalao, E.R.; Wu, T.; Dan, S. A stochastic ahp decision making methodology for imprecise preferences. Inf. Sci. 2014, 270, 192–203. [Google Scholar] [CrossRef]

- Martel, J.-M.; Zaras, K. Stochastic dominance in multicriterion analysis under risk. Theory Decis. 1995, 39, 31–49. [Google Scholar] [CrossRef]

| Scores | Alternatives | ||

|---|---|---|---|

| A1 | A2 | A3 | |

| 1 | - | 1/10 | 2/10 |

| 2 | 5/10 | - | - |

| 3 | - | - | - |

| 4 | - | 2/10 | - |

| 5 | - | - | 6/10 |

| 6 | 1/10 | - | - |

| 7 | - | 5/10 | - |

| 8 | - | - | - |

| 9 | 4/10 | - | - |

| 10 | - | 2/10 | 2/10 |

| A1 & A2 | −0.773 | −0.991 | −0.968 | −1.2 |

| A1 & A3 | 0.5 | −0.828 | 0.828 | 0 |

| A2 & A3 | 0.929 | 1 | 1 | 1.2 |

| Criteria | Scores | Alternatives | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| A1 | A2 | A3 | A4 | A5 | A6 | A7 | A8 | A9 | A10 | ||

| C1 | 1 | 0 | 0 | 0 | 1/7 | 0 | 1/7 | 1/7 | 1/7 | 0 | 0 |

| 2 | 3/7 | 1/7 | 0 | 0 | 0 | 0 | 0 | 2/7 | 0 | 1/7 | |

| 3 | 1/7 | 0 | 0 | 0 | 1/7 | 0 | 0 | 2/7 | 0 | 2/7 | |

| 4 | 0 | 2/7 | 0 | 0 | 0 | 0 | 0 | 1/7 | 0 | 2/7 | |

| 5 | 2/7 | 1/7 | 3/7 | 1/7 | 0 | 0 | 3/7 | 1/7 | 2/7 | 1/7 | |

| 6 | 0 | 2/7 | 1/7 | 0 | 2/7 | 0 | 1/7 | 0 | 1/7 | 0 | |

| 7 | 1/7 | 0 | 1/7 | 0 | 2/7 | 1/7 | 0 | 0 | 3/7 | 1/7 | |

| 8 | 0 | 1/7 | 2/7 | 1/7 | 0 | 3/7 | 1/7 | 0 | 1/7 | 0 | |

| 9 | 0 | 0 | 0 | 4/7 | 2/7 | 0 | 0 | 0 | 0 | 0 | |

| 10 | 0 | 0 | 0 | 0 | 0 | 2/7 | 1/7 | 0 | 0 | 0 | |

| C2 | 1 | 0 | 1/7 | 1/7 | 0 | 0 | 0 | 1/7 | 3/7 | 0 | 0 |

| 2 | 2/7 | 0 | 0 | 0 | 0 | 0 | 3/7 | 3/7 | 0 | 1/7 | |

| 3 | 1/7 | 0 | 0 | 1/7 | 0 | 4/7 | 1/7 | 0 | 1/7 | 0 | |

| 4 | 0 | 0 | 0 | 1/7 | 0 | 0 | 0 | 1/7 | 1/7 | 0 | |

| 5 | 2/7 | 0 | 0 | 0 | 1/7 | 0 | 1/7 | 0 | 0 | 0 | |

| 6 | 0 | 1/7 | 1/7 | 1/7 | 2/7 | 0 | 1/7 | 0 | 1/7 | 0 | |

| 7 | 0 | 1/7 | 0 | 0 | 1/7 | 1/7 | 0 | 0 | 4/7 | 2/7 | |

| 8 | 1/7 | 1/7 | 2/7 | 3/7 | 2/7 | 2/7 | 0 | 0 | 0 | 3/7 | |

| 9 | 1/7 | 3/7 | 1/7 | 1/7 | 1/7 | 0 | 0 | 0 | 0 | 0 | |

| 10 | 0 | 0 | 2/7 | 0 | 0 | 0 | 0 | 0 | 0 | 1/7 | |

| C3 | 1 | 0 | 0 | 1/7 | 0 | 1/7 | 0 | 0 | 2/7 | 0 | 1/7 |

| 2 | 0 | 0 | 0 | 0 | 0 | 0 | 3/7 | 1/7 | 0 | 2/7 | |

| 3 | 1/7 | 0 | 0 | 1/7 | 0 | 0 | 1/7 | 4/7 | 1/7 | 0 | |

| 4 | 3/7 | 0 | 0 | 0 | 0 | 1/7 | 1/7 | 0 | 2/7 | 0 | |

| 5 | 0 | 1/7 | 0 | 0 | 0 | 1/7 | 2/7 | 0 | 2/7 | 0 | |

| 6 | 1/7 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 2/7 | |

| 7 | 0 | 1/7 | 0 | 1/7 | 0 | 0 | 0 | 0 | 2/7 | 2/7 | |

| 8 | 1/7 | 2/7 | 0 | 2/7 | 3/7 | 2/7 | 0 | 0 | 0 | 0 | |

| 9 | 1/7 | 3/7 | 2/7 | 1/7 | 1/7 | 1/7 | 0 | 0 | 0 | 0 | |

| 10 | 0 | 0 | 4/7 | 2/7 | 2/7 | 2/7 | 0 | 0 | 0 | 0 | |

| C4 | 1 | 0 | 1/7 | 0 | 1/7 | 0 | 0 | 0 | 2/7 | 0 | 0 |

| 2 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1/7 | 0 | |

| 3 | 3/7 | 0 | 0 | 0 | 0 | 0 | 1/7 | 0 | 0 | 0 | |

| 4 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1/7 | 1/7 | 0 | |

| 5 | 2/7 | 0 | 0 | 0 | 0 | 1/7 | 1/7 | 2/7 | 0 | 0 | |

| 6 | 0 | 0 | 0 | 0 | 1/7 | 1/7 | 0 | 1/7 | 3/7 | 3/7 | |

| 7 | 0 | 0 | 1/7 | 0 | 1/7 | 1/7 | 0 | 0 | 0 | 1/7 | |

| 8 | 1/7 | 2/7 | 4/7 | 0 | 3/7 | 2/7 | 3/7 | 1/7 | 1/7 | 1/7 | |

| 9 | 0 | 2/7 | 0 | 1/7 | 1/7 | 1/7 | 1/7 | 0 | 0 | 1/7 | |

| 10 | 1/7 | 2/7 | 2/7 | 5/7 | 1/7 | 1/7 | 1/7 | 0 | 1/7 | 1/7 | |

| Methods | Rank | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | |

| First degree, second degree and second degree inverse SDD | ||||||||||

| Prospect SDD | ||||||||||

| Zaras and Martel’s | ||||||||||

| Nowak’s | ||||||||||

| Liu and Fan’s | ||||||||||

| Rank and Final Score | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | |

| 1/10 | 0.977 | 0.907 | 0.894 | 0.876 | 0.716 | 0.708 | 0.625 | 0.481 | 0.277 | 0 |

| 1/3 | 0.980 | 0.917 | 0.904 | 0.882 | 0.728 | 0.715 | 0.633 | 0.490 | 0.282 | 0 |

| 1 | 0.984 | 0.937 | 0.924 | 0.893 | 0.753 | 0.729 | 0.653 | 0.512 | 0.292 | 0 |

| 3 | 0.985 | 0.963 | 0.958 | 0.910 | 0.801 | 0.750 | 0.694 | 0.554 | 0.311 | 0 |

| 10 | 0.956 | 0.953 | 0.946 | 0.896 | 0.830 | 0.743 | 0.728 | 0.600 | 0.332 | 0 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wu, Y.; Sun, X.; Xu, H.; Xu, C.; Xu, R. A New Stochastic Dominance Degree Based on Almost Stochastic Dominance and Its Application in Decision Making. Entropy 2017, 19, 606. https://doi.org/10.3390/e19110606

Wu Y, Sun X, Xu H, Xu C, Xu R. A New Stochastic Dominance Degree Based on Almost Stochastic Dominance and Its Application in Decision Making. Entropy. 2017; 19(11):606. https://doi.org/10.3390/e19110606

Chicago/Turabian StyleWu, Yunna, Xiaokun Sun, Hu Xu, Chuanbo Xu, and Ruhang Xu. 2017. "A New Stochastic Dominance Degree Based on Almost Stochastic Dominance and Its Application in Decision Making" Entropy 19, no. 11: 606. https://doi.org/10.3390/e19110606