An Approach to the Evaluation of the Quality of Accounting Information Based on Relative Entropy in Fuzzy Linguistic Environments

Abstract

:1. Introduction

2. Related Works

2.1. 2-Tuple Linguistic Model

- (1)

- If then is bigger than ;

- (2)

- If then

- (a)

- if then is bigger than ;

- (b)

- if then is equal to ;

- (c)

- if then is smaller r than .

2.2. Relative Entropy

3. Construction of Evaluation Attributes of Accounting Information Quality

3.1. Evaluation Attributes of Accounting Information Content

3.1.1. Reliability

3.1.2. Correlation

3.1.3. Constraints

3.1.4. Third Party Opinion

3.2. Evaluation Attributes of Accounting Information Environment

3.2.1. Internal Environment

3.2.2. External Environment

4. Method to Deal with the Linguistic Evaluation Information Based on Relative Entropy in the Fuzzy Linguistic Environment

- (a)

- If , it means that the individual evaluator opinion is more important;

- (b)

- If , it means that the similarity of the evaluator group opinion is more important;

- (c)

- If , it means that the individual evaluator opinion is as important as the similarity of the evaluator group opinion.

5. Application of the Accounting Information Quality Evaluation

5.1. Calculate the Evaluation Results

- (1)

- : (poor), : (medium), : (good);

- (2)

- : (poorer), : (poor), : (medium), : (good), : (better);

- (3)

- : (awful), : (poorest), : (poorer), : (poor), : (medium), : (good), : (better), : (best), : (excellent).

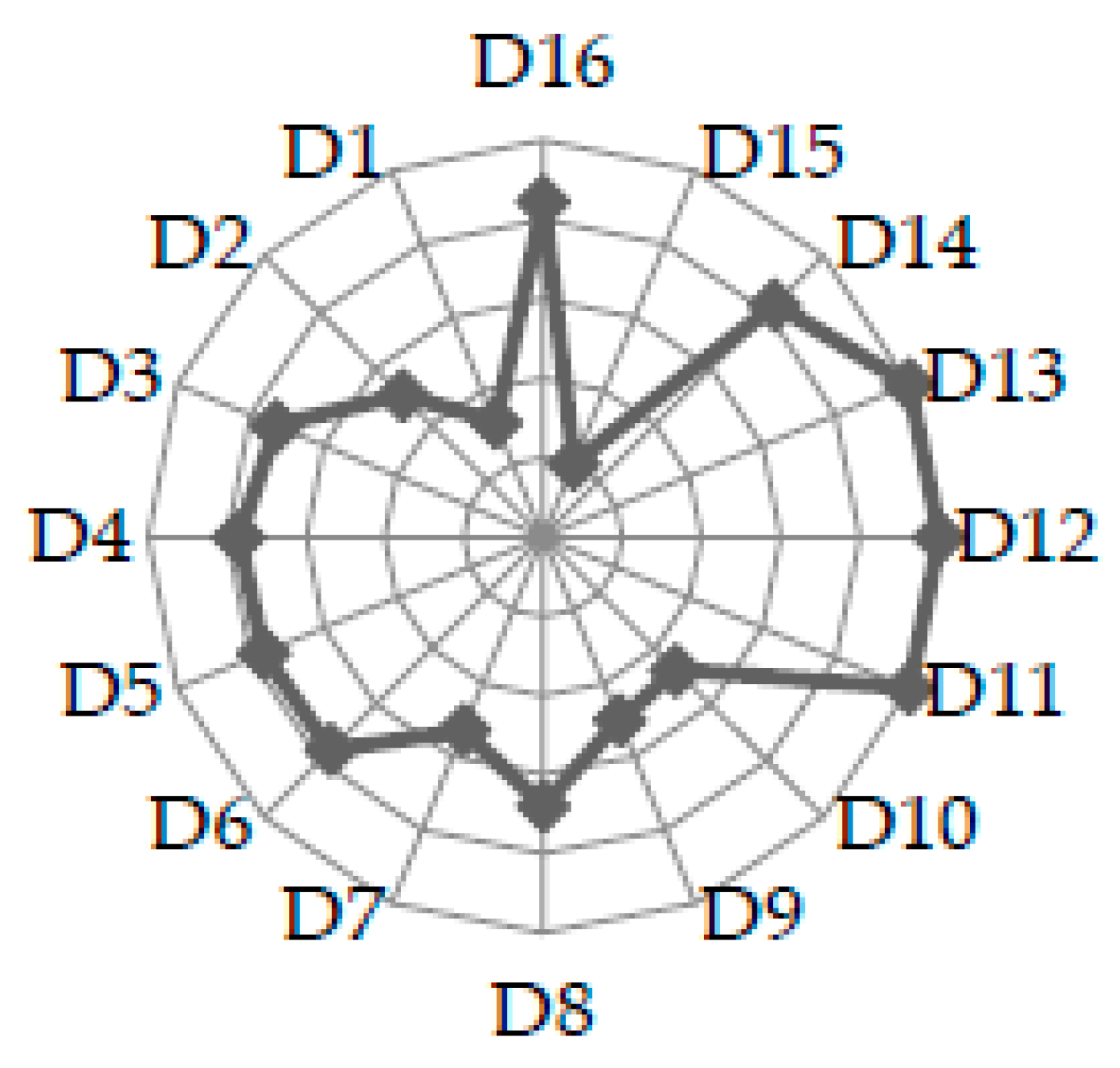

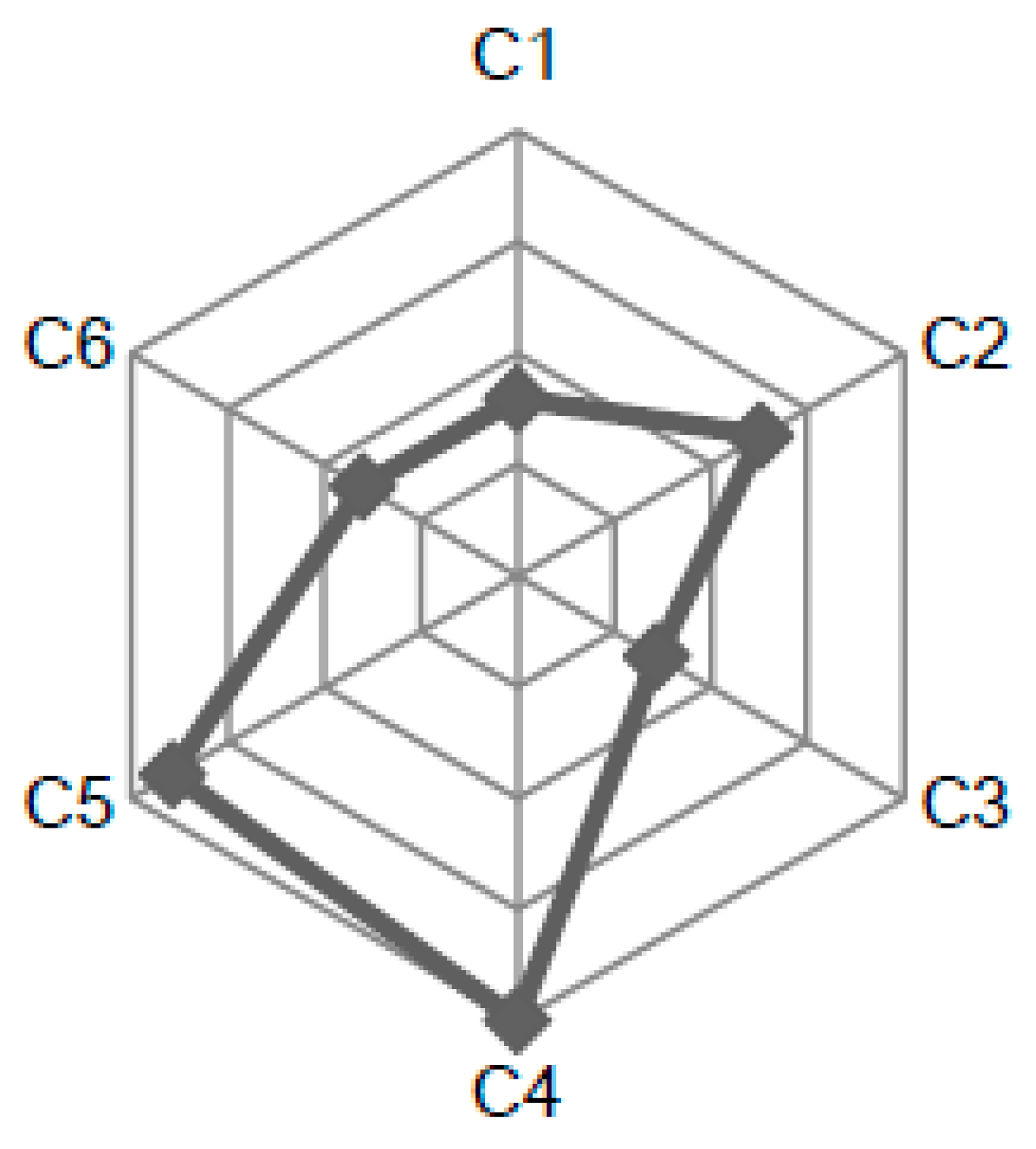

5.2. Analyze the Evaluation Results

6. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Sun, G.G.; Yang, J.F.; Zheng, W.J. Financial Report Quality Assessment: Theoretical Framework, Key Concepts and Operational Mechanism. Account. Res. 2013, 3, 27–35. [Google Scholar]

- Xu, H.; Xiao, N.; Cai, M.R. The Quality of Accounting Information in Evaluation Index System. Res. Econ. Manag. 2012, 11, 122–128. [Google Scholar]

- Wu, M.T.; Liu, Y.; Shi, Y. Ealuation of Enterprises’ Accounting Information Quality based on Projection Pursuit Model. J. Liaoning Technol. Univ. 2012, 4, 383–385. [Google Scholar]

- Zheng, R.Z.; Lin, Z.A. On the Construction of Accounting Information Quality Evaluation Index System—Based on Government Supervision. Commun. Financ. Account. 2008, 8, 26–27. [Google Scholar]

- Bai, P. A Study on the Measurement System of the Accounting Information Quality in the Perspective of Investor Protection. Ph.D. Thesis, Huazhong University of Science and Technology, Wuhan, China, 2012. [Google Scholar]

- Wang, X.J.; Wan, Y.H. The Construction of Enterprise Accounting Information Quality Evaluation Index System under Large Data—Based on Fuzzy Comprehensive Evaluation Method. Financ. Account. Mon. 2015, 14, 74–77. [Google Scholar]

- Li, L.Q.; Shi, P. The Index System of the Enterprise’s Accounting Information Quantity and It’s Comprehensive Evaluation. J. Taiyuan Univ. Technol. 2005, 3, 52–56. [Google Scholar]

- Zang, X.Q.; Zhang, X.X. Research on Fuzzy Comprehensive Evaluation of Accounting Information Quality of Listed Companies. Stat. Decis. 2008, 23, 173–175. [Google Scholar]

- Chen, S.M. Aggregating Fuzzy Opinions in the Group Decision-making Environment. Cybern. Syst. 1998, 29, 363–376. [Google Scholar] [CrossRef]

- Chen, X.; Yang, X. Multiple Attributive Group Decision Making Method based on Triangular Fuzzy Numbers. Syst. Eng. Electron. 2008, 30, 278–282. [Google Scholar]

- Herrera, F.; Martínez, L. A 2-tuple fuzzy linguistic representation model for computing with words. IEEE Trans. Fuzzy Syst. 2000, 8, 746–752. [Google Scholar]

- Liu, Y. Method for 2-tuple Linguistic Dynamic Multiple Attribute Decision Making with Entropy Weight. J. Intell. Fuzzy Syst. 2014, 27, 1803–1810. [Google Scholar]

- Yong-Jie, X.; Chen, X. Model for Evaluating the Virtual Enterprise’s Risk with 2-tuple Linguistic Information. J. Intell. Fuzzy Syst. 2016, 31, 193–200. [Google Scholar]

- Xiong, S.H.; Chen, Z.S.; Li, Y.L. On Extending Power-Geometric Operators to Interval-Valued Hesitant Fuzzy Sets and Their Applications to Group Decision Making. Int. J. Inf. Technol. Decis. Mak. 2016, 15, 1055–1114. [Google Scholar] [CrossRef]

- Edmundas, K.Z.; Valentinas, P. Integrated Determination of Objective Criteria Weights in MCDM. Int. J. Inf. Technol. Decis. Mak. 2016, 15, 267–283. [Google Scholar]

- Dutta, B.; Guha, D. Partitioned Bonferroni Mean based on Linguistic 2-tuple for Dealing with Multi-attribute Group Decision Making. Appl. Soft Comput. 2015, 37, 166–179. [Google Scholar] [CrossRef]

- Estrella, F.J.; Espinilla, M.; Herrera, F. Flintstones: A fuzzy linguistic decision tools enhancement suite based on the 2-tuple linguistic Model and Extensions. Inf. Sci. 2014, 280, 152–170. [Google Scholar] [CrossRef]

- Tan, M.; Shi, Y.; Yang, J.C. Decision Making Method of Multi-Granularity Uncertain Language Group Based on Similarity. Comput. Sci. 2016, 3, 262–265. [Google Scholar]

- Zhang, Z.; Guo, C.H. A Multi-granularity Uncertain Linguistic Group Decision-making Method based on Relative Entropy. Dalian Univ. Technol. 2012, 6, 921–927. [Google Scholar]

- Xu, Z.; Wang, H. Managing Multi-granularity Linguistic Information in Qualitative Group Decision Making: An Overview. Granul. Comput. 2016, 1, 21–35. [Google Scholar] [CrossRef]

- Morente-Molinera, J.A.; Pérez, I.J.; Ureña, M.R. On Multi-granular Fuzzy Linguistic Modeling in Group Decision Making Problems: A Systematic Review and Future Trends. Knowl.-Based Syst. 2015, 74, 49–60. [Google Scholar] [CrossRef]

- Li, M.; Jin, L.; Wang, J.; Ding, D.; Liu, O.; Li, M. A new MCDM method combining QFD with TOPSIS for knowledge management system selection from the user’s perspective in intuitionistic fuzzy environment. Appl. Soft Comput. 2014, 21, 28–37. [Google Scholar] [CrossRef]

- Herrera, F.; Martínez, L. An Approach for Combining Linguistic and Numerical Information based on 2-tuple Fuzzy Linguistic Representation Model in Decision-making. Int. J. Uncertain. Fuzziness Knowl.-Based Syst. 2000, 8, 539–562. [Google Scholar] [CrossRef]

- Herrera, F.; Martínez, L.; Sanchez, P.J. Managing Non-homogeneous Information in Group Decision Making. Eur. J. Oper. Res. 2005, 166, 115–132. [Google Scholar] [CrossRef]

- Herrera, F.; Martinez, L. A Model based on Linguistic 2-tuples for Dealing with Multi-granularity Hierarchical Linguistic Contexts in Multi-expert Decision-making. IEEE Trans. Syst. Man Cybern. Part B Cybern. 2001, 31, 227–234. [Google Scholar] [CrossRef] [PubMed]

- Zhang, Z.; Guo, C. A Method for Multi-granularity Uncertain Linguistic Group Decision Making with Incomplete Weight Information. Knowl.-Based Syst. 2012, 111–119. [Google Scholar] [CrossRef]

- Jiang, Y.; Fan, Z.; Ma, J. A Method for Group Decision Making with Multi-granularity Linguistic Assessment Information. Inf. Sci. 2008, 178, 1098–1109. [Google Scholar] [CrossRef]

- Clausius, R. Ueber verschiedene für die Anwendung bequeme Formen der Hauptgleichungen der mechanischen Wrmetheorie. Ann. Phys. 1865, 125, 353–400. [Google Scholar] [CrossRef]

- Ellis, R.S. The Theory of Large Deviations: From Boltzmann’s 1877 Calculation to Equilibrium Macrostates in 2D Turbulence. Phys. D Nonlinear Phenom. 1999, 133, 106–136. [Google Scholar] [CrossRef]

- Shannon, C.E. A Mathematical Theory of Communication. Bell Syst. Tech. J. 1948, 27, 379–423. [Google Scholar] [CrossRef]

- Kullback, S.; Leibler, R.A. On Information and Sufficiency. Ann. Math. Stat. 1951, 22, 79–86. [Google Scholar] [CrossRef]

- Zhu, H.; Fu, Z.Z.; Li, Z.M. A New Image Thresholding Method Based on Relative Entropy. In Proceedings of the IEEE 2002 International Conference on Communications, Circuits, Systems and West Sino Expositions, Chengdu, China, 29 June–1 July 2002; pp. 634–638. [Google Scholar]

- Kleeman, R. Measuring Dynamical Prediction Utility Using Relative Entropy. J. Atmos. Sci. 2002, 59, 2057–2072. [Google Scholar] [CrossRef]

- Vedral, V. The Role of Relative Entropy in Quantum Information Theory. Rev. Mod. Phys. 2001, 74, 197–234. [Google Scholar] [CrossRef]

- Financial Accounting Standards Board (FASB). Concepts Statements No. 2, Qualitative Characteristics of Accounting Information; Financial Accounting Standards Board: Norwalk, CT, USA, 1980. [Google Scholar]

- Joyce, E.J.; Libby, R.; Sunder, S. Using the FASB’s Qualitative Characteristics in Accounting Policy Choices. J. Account. Res. 1982, 20, 654–675. [Google Scholar] [CrossRef]

- Accounting Principles Board (APB). Statement No. 4; Accounting Principles Board: Norwalk, CT, USA, 1970; pp. 85–105. [Google Scholar]

- International Accounting Standards Committee (IASC). Framework for the Preparation and Presentation of Financial Statements; International Accounting Standards Committe: London, UK, 1989. [Google Scholar]

- American Institute of Certified Public Accountants (AICPA). Improving Business Reporting—A Customer Focus; American Institute of Certified Public Accountants: Durham, NC, USA, 1994; pp. 20–25. [Google Scholar]

- Accounting Standards Board (ASB). Statement of Principles for Financial Reporting; Accounting Standards Board: London, UK, 1999. [Google Scholar]

- Maltby, J. The Origins of Prudence in Accounting. Crit. Perspect. Account. 2000, 11, 51–70. [Google Scholar] [CrossRef]

- Jonas, G.J.; Blanchet, J. Assessing Quality of Financial Reporting. Account. Horiz. 2008, 14, 353–363. [Google Scholar] [CrossRef]

- Ge, J.S.; Chen, S.D. Study on Assessment of the Quality of Financial Reporting. Account. Res. 2001, 11, 9–18. [Google Scholar]

- Wolk, H.I.; Dodd, J.L.; Rozycki, J.J. Accounting Theory: Conceptual Issues in a Political and Economic Environment. Accountancy 2004, 40, 2515–2522. [Google Scholar]

- Whittred, G.P.; Zimmer, I.R. Timeliness of Financial Reporting and Financial Distress. Account. Rev. 1984, 59, 287–295. [Google Scholar]

- Reed, P. The Trueblood Report: An Analyst’s View. Financ. Anal. J. 2005, 31, 32–41. [Google Scholar]

- International Accounting Standards Board (IASB). The Conceptual Framework for Financial Reporting; International Accounting Standards Board: London, UK, 2010. [Google Scholar]

- Financial Accounting Standards Board (FASB). Preliminary Views: Conceptual Framework for Financial Reporting: Objective of Financial Reporting and Qualitative Characteristics of Decision-Useful Financial Reporting Information; Financial Accounting Standards Board: Norwalk, CT, USA, 2006. [Google Scholar]

- International Accounting Standards Board/ Financial Accounting Standards (IASB/FASB). Exposure Draft (ED). The Objective of Financial Reporting and Qualitative Characteristics and Constraints of Decision-Useful Financial Reporting Information; International Accounting Standards Board: London, UK, 2008. [Google Scholar]

- Karjalainen, J. Audit Quality and Cost of Debt Capital for Private Firms: Evidence from Finland. Int. J. Audit. 2011, 15, 88–108. [Google Scholar] [CrossRef]

- Francis, J.; Schipper, K. Have Financial Statements Lost Their Relevance. J. Account. Res. 1999, 37, 319–352. [Google Scholar] [CrossRef]

- Committee of Sponsoring Organizations (COSO). Internal Control-Integrated Framework. 2013. Available online: https://www.coso.org/Documents/990025P-Executive-Summary-final-may20.pdf (accessed on 23 March 2017).

- Bhojraj, S.; Sengupta, P. Effect of Corporate Governance on Bond Ratings and Yields: The Role of Institutional Investors and the Outside Directors. J. Bus. 2003, 76, 455–475. [Google Scholar] [CrossRef]

- Chow, C. The Demand for External Auditing: Size, Debt and Ownership Influence. Account. Rev. 1982, 57, 272–291. [Google Scholar]

| First Level | Second Level | Third Level | Attributes Description | Type |

|---|---|---|---|---|

| Accounting Information Content Evaluation | Correlation | Predictive value | The information is helpful for investors to predict the possibility that the event will happen or not in the future | Linguistic |

| Confirmatory value | The information can help investors to understand the impact of past management decisions on the company’s current financial situation | Linguistic | ||

| Betimes | Provide information in a timely manner | Linguistic | ||

| Reliability | Integrity | The information shows all the truth, no omission | Linguistic | |

| Neutrality | The information conveys the fact in an unbiased way | Linguistic | ||

| No error | The information is consistent with the facts | Linguistic | ||

| Verifiability | A third party with sufficient knowledge to use the same data can get similar results | Linguistic | ||

| Prudence | Not over-estimating earnings, not underestimating losses | Linguistic | ||

| Constraints | Importance | The existence of the information will affect the investor’s decision-making | Linguistic | |

| Cost-benefit principle | The cost of providing accounting information should not be greater than the benefits it generates | Linguistic | ||

| Third Party Opinion | Type of audit opinion | The type of audit opinion represents the extent to which the certified public accountants guarantee the quality of accounting information of the company | Numeric | |

| Compliance | The government examines the financial reports of the Company in form and content | Numeric | ||

| Information generation environment evaluation | Internal environment | Internal Control | The company has formed a good control environment, established a smooth information channel of communication, and control activities have been implemented and supervision | Numeric |

| Corporate Governance | The company set up a scientific governance institution, the formation of good governance environment and the management layer has played a role | Linguistic | ||

| External environment | External Auditor | The qualifications of the auditors, the quality of the auditors, and the rotation of the accounting firm. | Numeric | |

| External supervision | The soundness of laws and regulations, and the intensity of law enforcement by regulatory agencies | Linguistic |

| 3 Granularity Set Transform into 9 Granularity Set | |||||||

| Before transformation | () | () | () | ||||

| After transformation | () | () | () | ||||

| 5 Granularity Set Transform into 9 Granularity Set | |||||||

| Before transformation | () | () | () | () | () | ||

| After transformation | () | () | () | () | () | ||

| Second Level Attributes | Evaluation Value | Importance of Attributes | Third Level Attributes | Evaluation Value | Importance of Attributes |

|---|---|---|---|---|---|

| Correlation | (, −0.41) | (, −0.46) | Predictive value | (, −0.43) | (, 0.45) |

| Determined value | (, −0.48) | (, −0.38) | |||

| Betimes | (, −0.35) | (, −0.45) | |||

| Reliability | (, −49) | (, −0.44) | Integrity | (, −0.15) | (, −0.18) |

| Neutrality | (, −0.17) | (, 0.36) | |||

| No error | (, −0.20) | (, −0.36) | |||

| Verifiability | (, −0.35) | (, 0.44) | |||

| Prudence | (, 0.39) | (, −0.48) | |||

| Constraints | (, 0.44) | (, −0.47) | Importance | (, −0.49) | (, −0.32) |

| Cost-benefit principle | (, 0.37) | (, 0.38) | |||

| Third Party Opinion | (, 0) | (, −0.26) | Type of audit opinion | (, 0) | (, −0.25) |

| Compliance | (, 0) | (, −0.27) | |||

| Internal environment | (, −0.42) | (, −0.47) | Internal Control | (, 0) | (, −0.42) |

| Corporate Governance | (, 0.14) | (, 0.49) | |||

| External environment | (, −0.40) | (, −0.50) | External Auditor | (, 0) | (, −0.48) |

| External supervision | (, 0.23) | (, 0.48) |

| First Level Attributes | Evaluation Value | Importance of Attributes |

|---|---|---|

| Information Content Evaluation | (, 0.41) | (, −0.41) |

| Information generation environment | (, −41) | (, −0.48) |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, M.; Ning, X.; Li, M.; Xu, Y. An Approach to the Evaluation of the Quality of Accounting Information Based on Relative Entropy in Fuzzy Linguistic Environments. Entropy 2017, 19, 152. https://doi.org/10.3390/e19040152

Li M, Ning X, Li M, Xu Y. An Approach to the Evaluation of the Quality of Accounting Information Based on Relative Entropy in Fuzzy Linguistic Environments. Entropy. 2017; 19(4):152. https://doi.org/10.3390/e19040152

Chicago/Turabian StyleLi, Ming, Xiaoli Ning, Mingzhu Li, and Yingcheng Xu. 2017. "An Approach to the Evaluation of the Quality of Accounting Information Based on Relative Entropy in Fuzzy Linguistic Environments" Entropy 19, no. 4: 152. https://doi.org/10.3390/e19040152