Coordinating Leader-Follower Supply Chain with Sustainable Green Technology Innovation on Their Fairness Concerns

Abstract

:1. Introduction

2. Literature Review

3. Problem Formulation

3.1. Assumption and Notation

- When there is no sustainable green technology innovation effort provided by the manufacturer and only the supplier plunges sustainable green technology innovation effort into the firm’s R&D activities, then the market demand function is .

- When there is no sustainable green technology innovation effort provided by the supplier and only the manufacturer plunges sustainable green technology innovation effort into the firm’s R&D activities, then the market demand function is .

- A1:

- All members of the supply chain are rational and pursue profit maximization and utility maximization.

- A2:

- The supplier and the manufacturer of the supply chain are running under symmetric information in their sustainable green technology innovation efforts.

- A3:

- , where the unit retailing price p is greater than the unit wholesale price w, and the unit wholesale price w is no less than the unit cost c.

- A4:

- Without the fairness concerns, when the sustainable green technology innovation efforts provided by the supplier, the manufacturer and both of them, the following assumptions hold.

- .

- , or we assume .

- .

- A5:

- With the fairness concerns, when the sustainable green technology innovation efforts provided by the supplier, the manufacturer and both of them, the following assumptions hold.

- .

- .

3.2. Benchmarking Sustainable Green Technology Innovation Effort Model without Fairness Concerns

3.2.1. SGTIE Only by the Supplier

3.2.2. SGTIE Only by the Manufacturer

3.2.3. SGTIE by Both the Supplier and the Manufacturer

3.2.4. SGTIE Effects on the Members

4. The Decisions with Fairness Concerns

4.1. The Supplier Concerns about Fairness

4.2. The Manufacturer Concerns about Fairness

5. Numerical Analysis

6. Conclusions

Further Research

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A. Proofs under Stackelberg Game without Fairness Concerns

Appendix B. Proofs under Stackelberg Game with Fairness Concerns

References

- Carter, C.R.; Rogers, D.S. A framework of sustainable supply chain management: Moving toward new theory. Int. J. Phys. Distrib. Logist. Manag. 2008, 38, 360–387. [Google Scholar] [CrossRef]

- European Commission. Eco-Innovation: When Business Meets the Environment. Available online: http://ec.europa.eu/environment/eco-innovation/ (accessed on 12 September 2017).

- Schuetze, C.F. Sustainable Innovation: The Vegan Shoe. Available online: https://rendezvous.blogs.nytimes.com/2012/09/10/sustainable-innovation-the-vegan-shoe/ (accessed on 12 September 2017).

- Direction, S. The innovation high ground: Winning tomorrow’s customers using sustainability-driven innovation. Strateg. Dir. 2006, 22, 35–37. [Google Scholar]

- Aminoff, A.; Kettunen, O. Sustainable Supply Chain Management in a Circular Economy—Towards Supply Circles. In Sustainable Design and Manufacturing 2016; Springer: Zürich, Switzerland, 2016; pp. 61–72. [Google Scholar]

- Tunn, V.; Dekoninck, E. How Does Sustainability Help or Hinder Innovation? A Study of Successful Companies Founded on Sustainability Principles. In Sustainable Design and Manufacturing 2016; Springer: Zürich, Switzerland, 2016; pp. 73–83. [Google Scholar]

- Li, Q.; Shen, B. Sustainable Design Operations in the Supply Chain: Non-Profit Manufacturer vs. For-Profit Manufacturer. Sustainability 2016, 8, 639. [Google Scholar] [CrossRef]

- Barbosa-Póvoa, A.P. Optimising Sustainable Supply Chains: A Summarised View of Current and Future Perspectives. In Optimization and Decision Support Systems for Supply Chains; Springer: Zürich, Switzerland, 2017; pp. 1–11. [Google Scholar]

- Roos, G. Business Model Innovation to Create and Capture Resource Value in Future Circular Material Chains. Resources 2014, 3, 248–274. [Google Scholar] [CrossRef]

- Behnam, S.; Cagliano, R. Be Sustainable to Be Innovative: An Analysis of Their Mutual Reinforcement. Sustainability 2017, 9, 17. [Google Scholar] [CrossRef]

- Foxon, T.; Pearson, P. Overcoming barriers to innovation and diffusion of cleaner technologies: Some features of a sustainable innovation policy regime. J. Clean. Prod. 2008, 16, S148–S161. [Google Scholar] [CrossRef]

- Zijm, H.; Klumpp, M.; Clausen, U.; Hompel, M. Logistics and Supply Chain Innovation: Bridging the Gap between Theory and Practice; Springer: Zürich, Switzerland, 2016. [Google Scholar]

- Pagell, M.; Wu, Z. Business implications of sustainability practices in supply chains. In Sustainable Supply Chains; Springer: Zürich, Switzerland, 2017; pp. 339–353. [Google Scholar]

- Wang, Y. China’s Sustainable Development in the Shifting Global Context. Sustain. Dev. 2012, 26, 183–190. [Google Scholar]

- Boons, F.; Montalvo, C.; Quist, J.; Wagner, M. Sustainable innovation, business models and economic performance: An overview. J. Clean. Prod. 2013, 45, 1–8. [Google Scholar] [CrossRef]

- Boons, F.; Lüdeke-Freund, F. Business models for sustainable innovation: State-of-the-art and steps towards a research agenda. J. Clean. Prod. 2013, 45, 9–19. [Google Scholar] [CrossRef]

- Cortes, A. A Triple Bottom Line Approach for Measuring Supply Chains Sustainability Using Data Envelopment Analysis. Eur. J. Sustain. Dev. 2017, 6, 119–128. [Google Scholar]

- De Medeiros, J.F.; Ribeiro, J.L.D.; Cortimiglia, M.N. Success factors for environmentally sustainable product innovation: A systematic literature review. J. Clean. Prod. 2014, 65, 76–86. [Google Scholar] [CrossRef]

- Bitzer, V.; Hamann, R. The business of social and environmental innovation. In The Business of Social and Environmental Innovation; Springer: Zürich, Switzerland, 2015; pp. 3–24. [Google Scholar]

- Haitao Cui, T.; Raju, J.S.; Zhang, Z.J. Fairness and channel coordination. Manag. Sci. 2007, 53, 1303–1314. [Google Scholar] [CrossRef]

- Katok, E.; Pavlov, V. Fairness in supply chain contracts: A laboratory study. J. Oper. Manag. 2013, 31, 129–137. [Google Scholar] [CrossRef]

- Katok, E.; Olsen, T.; Pavlov, V. Wholesale pricing under mild and privately known concerns for fairness. Prod. Oper. Manag. 2014, 23, 285–302. [Google Scholar] [CrossRef]

- Niu, B.; Cui, Q.; Zhang, J. Impact of channel power and fairness concern on supplier’s market entry decision. J. Oper. Rese. Soc. 2017, 1–12. [Google Scholar] [CrossRef]

- Fehr, E.; Schmidt, K.M. A theory of fairness, competition, and cooperation. Q. J. Econ. 1999, 114, 817–868. [Google Scholar] [CrossRef]

- Caliskan-Demirag, O.; Chen, Y.F.; Li, J. Channel coordination under fairness concerns and nonlinear demand. Eur. J. Oper. Res. 2010, 207, 1321–1326. [Google Scholar] [CrossRef]

- Du, S.; Nie, T.; Chu, C.; Yu, Y. Newsvendor model for a dyadic supply chain with Nash bargaining fairness concerns. Int. J. Prod. Res. 2014, 52, 5070–5085. [Google Scholar] [CrossRef]

- Li, Q.H.; Li, B. Dual-channel supply chain equilibrium problems regarding retail services and fairness concerns. Appl. Math. Model. 2016, 40, 7349–7367. [Google Scholar] [CrossRef]

- Liu, W.; Wang, S.; Zhu, D.; Wang, D.; Shen, X. Order allocation of logistics service supply chain with fairness concern and demand updating: Model analysis and empirical examination. Ann. Oper. Res. 2017, 1–37. [Google Scholar] [CrossRef]

- Chen, J.; Zhou, Y.W.; Zhong, Y. A pricing/ordering model for a dyadic supply chain with buyback guarantee financing and fairness concerns. Int. J. Prod. Res. 2017, 55, 5287–5304. [Google Scholar] [CrossRef]

- Kim, K.T.; Lee, J.S.; Lee, S.Y. The effects of supply chain fairness and the buyer’s power sources on the innovation performance of the supplier: A mediating role of social capital accumulation. J. Bus. Ind. Mark. 2017, 32, 987–997. [Google Scholar] [CrossRef]

- Li, T.; Xie, J.; Zhao, X.; Tang, J. On supplier encroachment with retailer’s fairness concerns. Comput. Ind. Eng. 2016, 98, 499–512. [Google Scholar] [CrossRef]

- Pu, X.; Gong, L.; Han, G. A feasible incentive contract between a manufacturer and his fairness-sensitive retailer engaged in strategic marketing efforts. J. Intell. Manuf. 2016, 1–14. [Google Scholar] [CrossRef]

- Nie, T.; Du, S. Dual-fairness supply chain with quantity discount contracts. Eur. J. Oper. Res. 2017, 258, 491–500. [Google Scholar] [CrossRef]

- Qin, F.; Mai, F.; Fry, M.J.; Raturi, A.S. Supply-chain performance anomalies: Fairness concerns under private cost information. Eur. J. Oper. Res. 2016, 252, 170–182. [Google Scholar] [CrossRef]

- Mussa, M.; Rosen, S. Monopoly and product quality. J. Econ. Theory 1978, 18, 301–317. [Google Scholar] [CrossRef]

| Only Supplier | Only Manufacturer | Both of Them | |

|---|---|---|---|

| N/A | |||

| N/A | |||

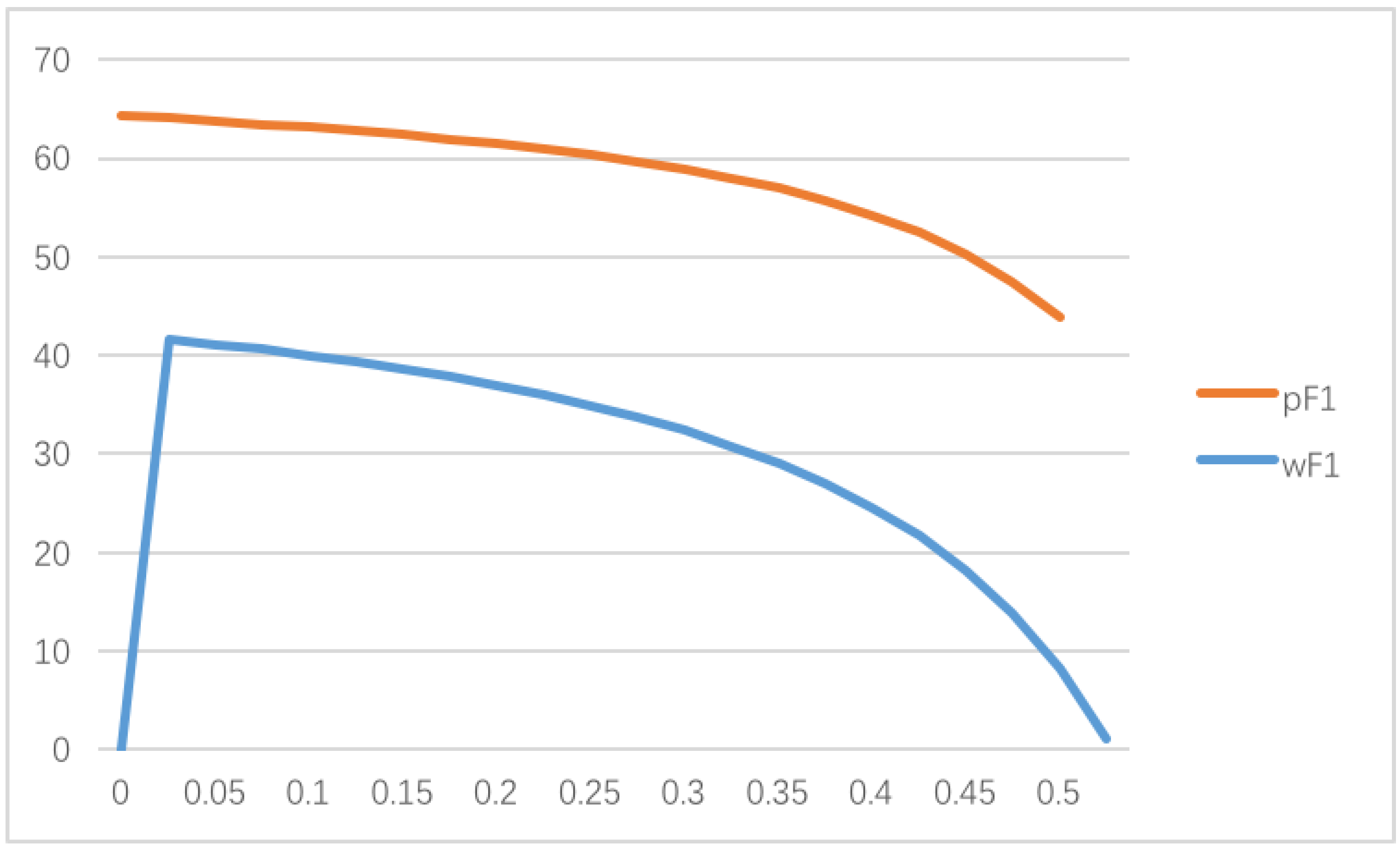

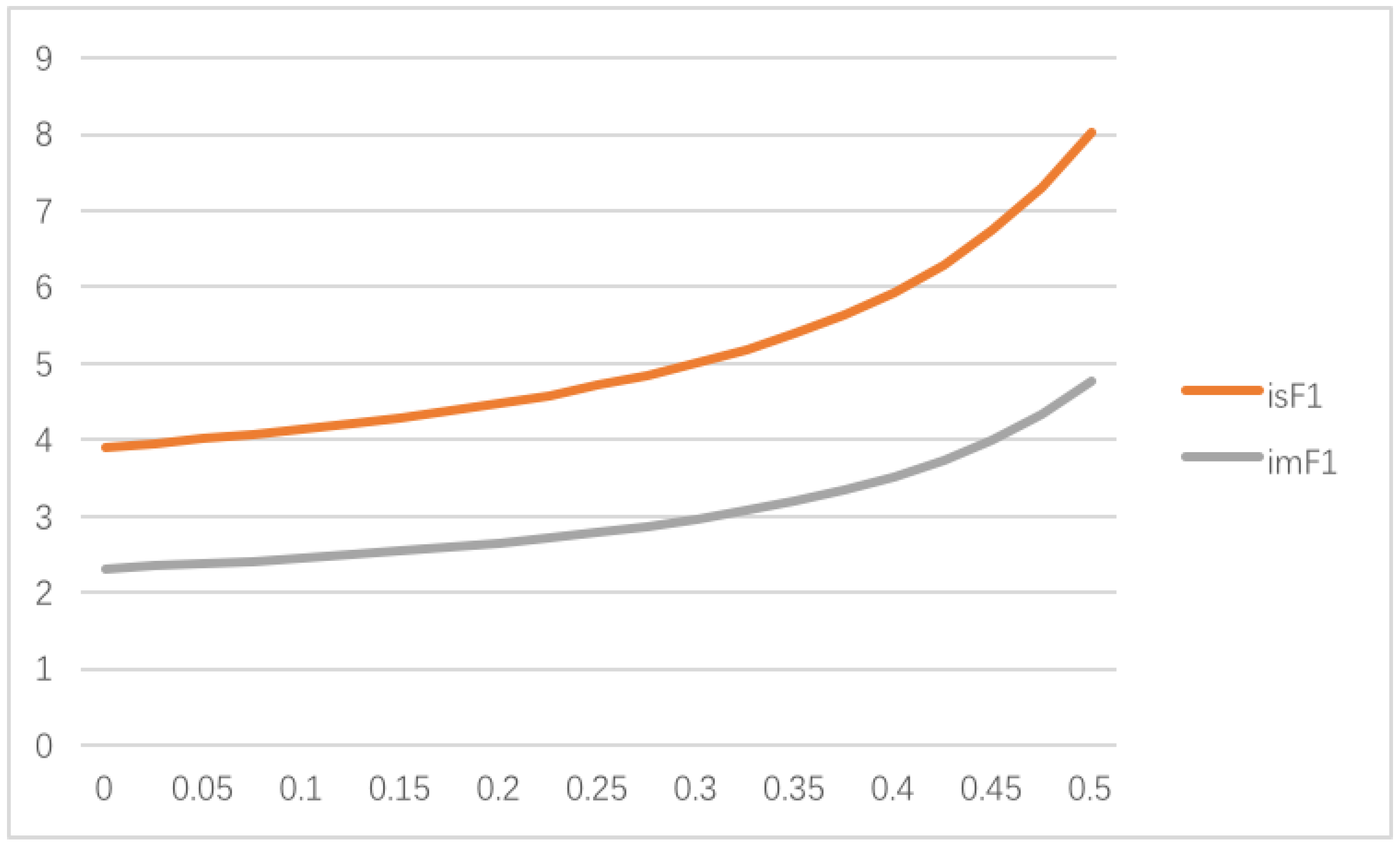

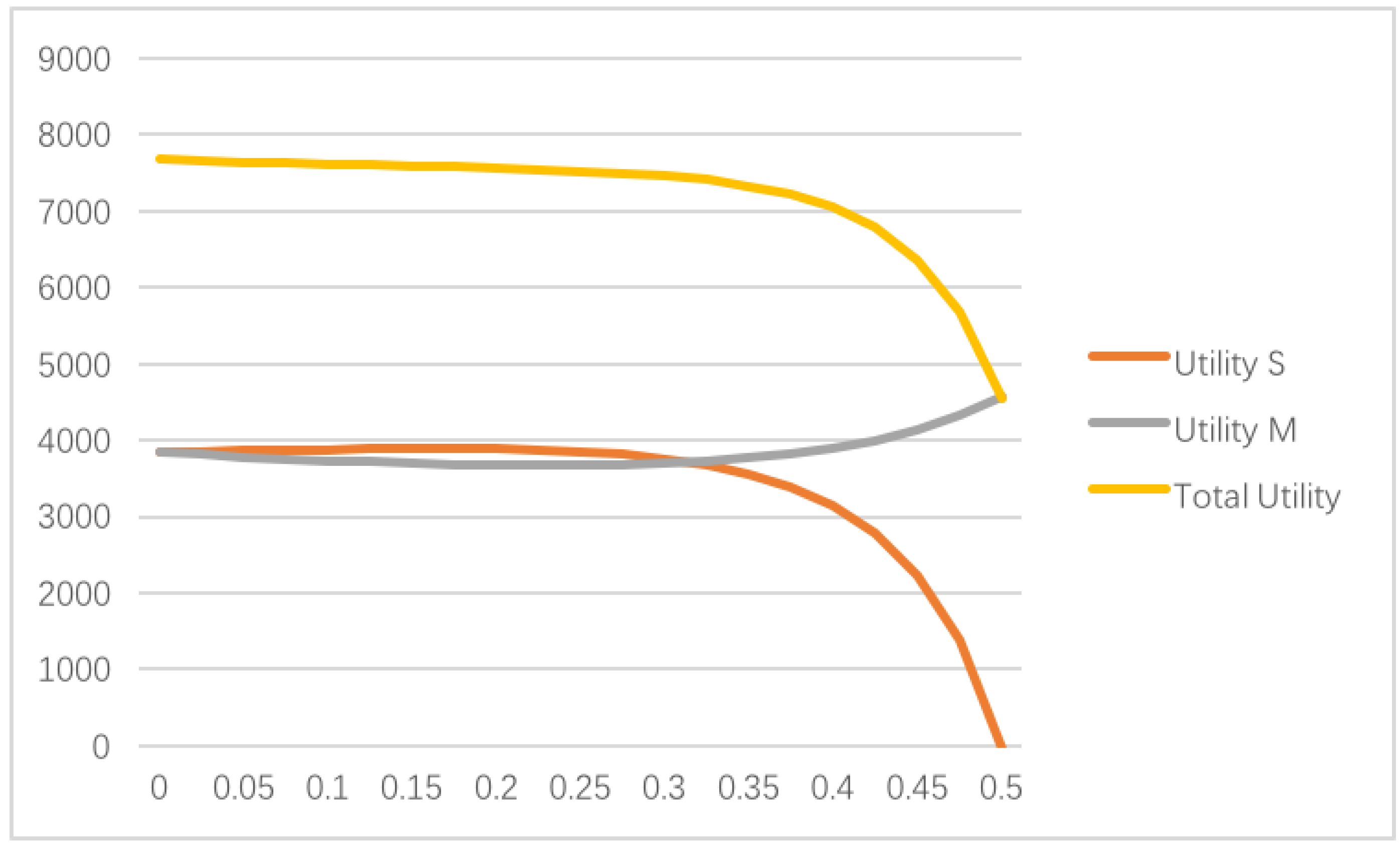

| Demand | Profit S | Profit (Utility) M | Utility S | |||||

|---|---|---|---|---|---|---|---|---|

| 0.00 | 64.34 | 41.67 | 3.90 | 3.90 | 36,254.64 | 1,474,462.59 | 821,860.18 | 821,860.18 |

| 0.025 | 64.08 | 41.16 | 3.95 | 3.95 | 37,242.18 | 1,495,530.07 | 853,728.54 | 837,683.50 |

| 0.05 | 63.80 | 40.60 | 4.01 | 4.01 | 38,226.27 | 1,513,841.89 | 886,817.29 | 855,466.06 |

| 0.075 | 63.50 | 40.00 | 4.07 | 4.07 | 39,207.35 | 1,529,086.14 | 921,300.61 | 875,716.69 |

| 0.10 | 63.17 | 39.34 | 4.14 | 4.14 | 40,185.81 | 1,540,888.09 | 957,380.67 | 899,029.93 |

| 0.125 | 62.81 | 38.63 | 4.21 | 4.21 | 41,161.97 | 1,548,797.05 | 995,294.93 | 926,107.17 |

| 0.15 | 62.41 | 37.84 | 4.29 | 4.29 | 42,136.09 | 1,552,268.86 | 1,035,325.19 | 957,783.64 |

| 0.175 | 61.97 | 36.97 | 4.38 | 4.38 | 43,108.41 | 1,550,642.86 | 1,077,809.48 | 995,063.64 |

| 0.20 | 61.49 | 36.01 | 4.48 | 4.48 | 44,079.13 | 1,543,111.01 | 1,123,157.71 | 1,039,167.04 |

| 0.225 | 60.95 | 34.93 | 4.58 | 4.58 | 45,048.43 | 1,528,676.20 | 1,171,872.54 | 1,091,591.71 |

| 0.25 | 60.34 | 33.73 | 4.71 | 4.71 | 46,016.46 | 1,506,095.27 | 1,224,577.99 | 1,154,198.66 |

| 0.275 | 59.66 | 32.37 | 4.85 | 4.85 | 46,983.36 | 1,473,799.59 | 1,282,058.97 | 1,229,330.31 |

| 0.30 | 58.88 | 30.82 | 5.00 | 5.00 | 47,949.27 | 1,429,782.48 | 1,345,317.40 | 1,319,977.87 |

| 0.325 | 57.98 | 29.04 | 5.18 | 5.18 | 48,914.30 | 1,371,436.28 | 1,415,653.22 | 1,430,023.72 |

| 0.35 | 56.94 | 26.97 | 5.39 | 5.39 | 49,878.56 | 1,295,310.32 | 1,494,784.78 | 1,564,600.85 |

| 0.375 | 55.71 | 24.54 | 5.64 | 5.64 | 50,842.18 | 1,196,741.64 | 1,585,032.40 | 1,730,641.43 |

| 0.40 | 54.26 | 21.64 | 5.94 | 5.94 | 51,805.28 | 1,069,272.60 | 1,689,607.75 | 1,937,741.81 |

| 0.425 | 52.49 | 18.13 | 6.29 | 6.29 | 52,767.99 | 903,696.85 | 1,813,088.05 | 2,199,579.31 |

| 0.45 | 50.30 | 13.78 | 6.74 | 6.74 | 53,730.48 | 686,424.05 | 1,962,228.57 | 2,536,340.60 |

| 0.475 | 47.51 | 8.25 | 7.30 | 7.30 | 54,692.97 | 396,519.22 | 2,147,433.85 | 2,979,118.31 |

| 0.50 | 43.86 | 1.00 | 8.04 | 8.04 | 55,655.78 | −32.30 | 2,385,607.35 | 3,578,427.17 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Du, B.; Liu, Q.; Li, G. Coordinating Leader-Follower Supply Chain with Sustainable Green Technology Innovation on Their Fairness Concerns. Int. J. Environ. Res. Public Health 2017, 14, 1357. https://doi.org/10.3390/ijerph14111357

Du B, Liu Q, Li G. Coordinating Leader-Follower Supply Chain with Sustainable Green Technology Innovation on Their Fairness Concerns. International Journal of Environmental Research and Public Health. 2017; 14(11):1357. https://doi.org/10.3390/ijerph14111357

Chicago/Turabian StyleDu, Bisheng, Qing Liu, and Guiping Li. 2017. "Coordinating Leader-Follower Supply Chain with Sustainable Green Technology Innovation on Their Fairness Concerns" International Journal of Environmental Research and Public Health 14, no. 11: 1357. https://doi.org/10.3390/ijerph14111357