Exploring Impacts of Taxes and Hospitality Bans on Cigarette Prices and Smoking Prevalence Using a Large Dataset of Cigarette Prices at Stores 2001–2011, USA

Abstract

:1. Introduction

2. Materials and Methods

2.1. Data

2.1.1. Cigarette Prices

2.1.2. Cigarette Taxes

2.1.3. Smoking Bans

2.1.4. Smoking Prevalence

2.1.5. Temporal Aggregation

2.1.6. Census Data and Linking Stores to Census Data

2.1.7. Region and Urbanicity

2.1.8. Additional Variables: Store Type and State Funding for Tobacco Control Programs

2.2. Statistical Methods

3.Results

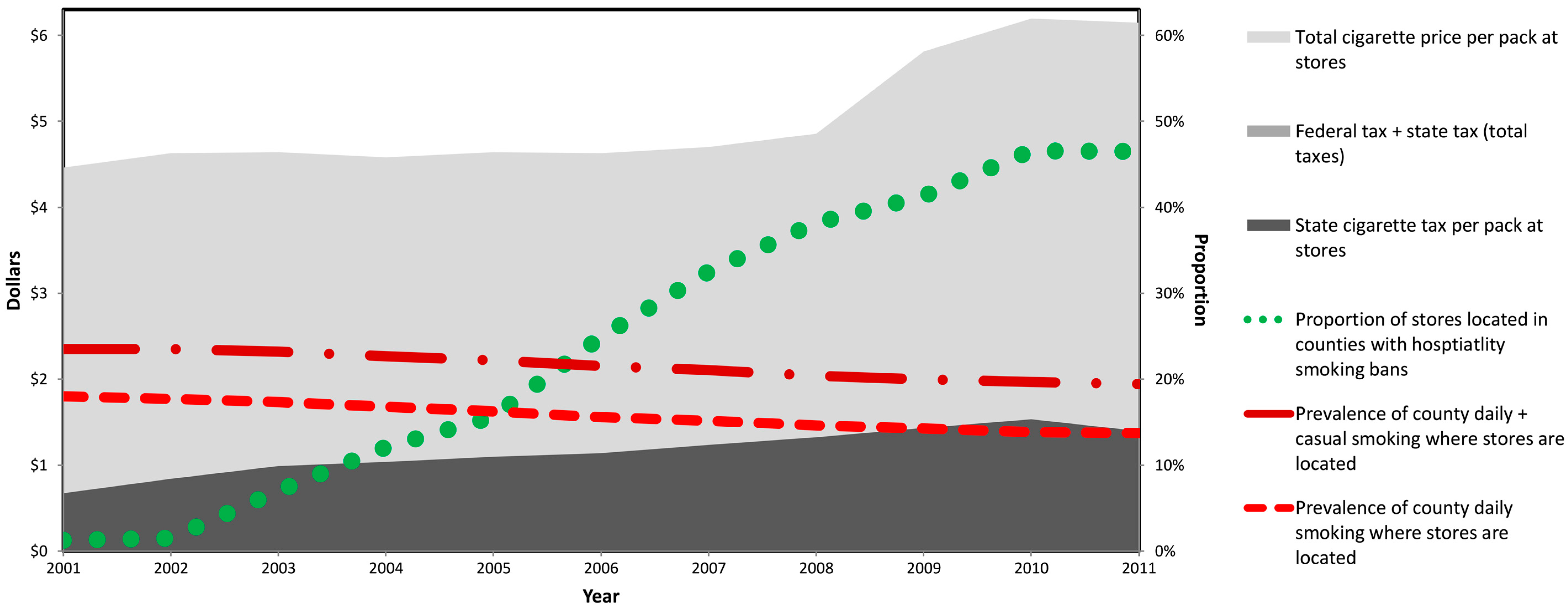

3.1. Descriptives

3.2. Regression Models

3.2.1. Price Outcome

3.2.2. Smoking Outcome

4. Discussion

4.1. Main Finding of This Study

4.2. What Is Already Known on This Subject and What This Study Adds

4.3. Limitations

5. Conclusions

Supplementary Materials

Acknowledgments

Author Contributions

Conflicts of Interest

References

- CDC. Trends in Current Cigarette Smoking among High School Students and Adults, United States, 1965–2014, National Health Interview Survey, 1965–2014. Available online: https://www.cdc.gov/tobacco/data_statistics/tables/trends/cig_smoking/ (accessed on 4 February 2017).

- Chaloupka, F.J.; Yurekli, A.; Fong, G.T. Tobacco taxes as a tobacco control strategy. Tob. Control 2012, 21, 172–180. [Google Scholar] [CrossRef] [PubMed]

- HHS. The Health Consequences of Smoking—50 Years of Progress. A Report of the Surgeon General; U.S. Department of Health and Human Services, Centers for Disease Control and Prevention, National Center for Chronic Disease Prevention and Health Promotion, Office on Smoking and Health: Atlanta, GA, USA, 2014.

- Hanson, A.; Sullivan, R. The incidence of tobacco taxation: Evidence from geographic micro-level data. Nat. Tax J. 2009, 62, 677–698. [Google Scholar] [CrossRef]

- Harding, M.; Leibtag, E.; Lovenheim, M.F. The heterogeneous geographic and socioeconomic incidence of cigarette taxes: Evidence from Nielsen Homescan Data. Am. Econ. J. Econ. Policy 2012, 4, 169–198. [Google Scholar] [CrossRef]

- Brock, B.; Choi, K.; Boyle, R.G.; Moilanen, M.; Schillo, B.A. Tobacco product prices before and after a statewide tobacco tax increase. Tob. Control 2016, 25, 166–173. [Google Scholar] [CrossRef] [PubMed]

- Espinosa, J.; Evans, W.N. Excise taxes, tax incidence, and the flight to quality: Evidence from scanner data. Public Financ. Rev. 2012, 41, 147–176. [Google Scholar] [CrossRef]

- DeCicca, P.; Kenkel, D.; Liu, F. Excise tax avoidance: The case of state cigarette taxes. J. Health Econ. 2013, 32, 1130–1141. [Google Scholar] [CrossRef] [PubMed]

- Keeler, T.E.; Hu, T.W.; Barnett, P.G.; Manning, W.G.; Sung, H.Y. Do cigarette producers price-discriminate by state? An empirical analysis of local cigarette pricing and taxation. J. Health Econ. 1996, 15, 499–512. [Google Scholar] [CrossRef]

- Sullivan, R.S.; Dutkowsky, D.H. The effect of cigarette taxation on prices an empirical analysis using local-level data. Public Financ. Rev. 2012, 40, 687–711. [Google Scholar] [CrossRef]

- Xu, X.; Malarcher, A.; O‘Halloran, A.; Kruger, J. Does every U.S. smoker bear the same cigarette tax? Addiction 2014, 109, 1741–1749. [Google Scholar] [CrossRef] [PubMed]

- Bader, P.; Boisclair, D.; Ferrence, R. Effects of tobacco taxation and pricing on smoking behavior in high risk populations: A knowledge synthesis. Int. J. Environ. Res. Public Health 2011, 8, 4118–4139. [Google Scholar] [CrossRef] [PubMed]

- Fichtenberg, C.M.; Glantz, S.A. Effect of smoke-free workplaces on smoking behaviour: Systematic review. BMJ 2002, 325, 188. [Google Scholar] [CrossRef] [PubMed]

- Coady, M.H.; Jasek, J.; Davis, K.; Kerker, B.; Kilgore, E.A.; Perl, S.B. Changes in smoking prevalence and number of cigarettes smoked per day following the implementation of a comprehensive tobacco control plan in New York city. J. Urban Health 2012, 89, 802–808. [Google Scholar] [CrossRef] [PubMed]

- Hahn, E.J.; Rayens, M.K.; Butler, K.M.; Zhang, M.; Durbin, E.; Steinke, D. Smoke-free laws and adult smoking prevalence. Prev. Med. 2008, 47, 206–209. [Google Scholar] [CrossRef] [PubMed]

- Kilgore, E.A.; Mandel-Ricci, J.; Johns, M.; Coady, M.H.; Perl, S.B.; Goodman, A.; Kansagra, S.M. Making it harder to smoke and easier to quit: The effect of 10 years of tobacco control in New York city. Am. J. Public Health 2014, 104, e5–e8. [Google Scholar] [CrossRef] [PubMed]

- Messer, K.; Pierce, J.P.; Zhu, S.H.; Hartman, A.M.; Al-Delaimy, W.K.; Trinidad, D.R.; Gilpin, E.A. The California Tobacco Control Program‘s effect on adult smokers: (1) Smoking cessation. Tob. Control 2007, 16, 85–90. [Google Scholar] [CrossRef] [PubMed]

- Bronnenberg, B.J.; Kruger, M.W.; Mela, C.F. Database paper—The IRI marketing data set. Mark. Sci. 2008, 27, 745–748. [Google Scholar] [CrossRef]

- IRI 2013 Market and Region Profiles. Available online: http://www.infores.com/public/mrp/default.htm (accessed on 1 January 2015).

- CSP. Tobacco Sales from Year-End 2015. Available online: http://www.cspdailynews.com/category-data/cmh/tobacco/tobacco-cigarettes-2016 (accessed on 4 February 2017).

- Sharma, A.; Fix, B.V.; Delnevo, C.; Cummings, K.M.; O’Connor, R.J. Trends in market share of leading cigarette brands in the USA: National Survey on Drug Use and Health 2002–2013. BMJ Open 2016, 6, e008813. [Google Scholar] [CrossRef] [PubMed]

- Orzechowski, W.; Walker, R.C. The Tax Burden on Tobacco: Historical Compilation; Orzechowski and Walker Inc.: Arlington, VA, USA, 2014; Available online: http://old.taxadmin.org/fta/tobacco/papers/tax_burden_2014.pdf (accessed on 17 March 2017).

- American Nonsmokers’ Rights Foundation (ANRF). Chronological Table of U.S. Population Protected by 100% Smokefree State or Local Laws 1990–2015; American Nonsmokers’ Rights Foundation: Berkeley, CA, USA, 2015; Available online: http://www.no-smoke.org/pdf/EffectivePopulationList.pdf (accessed on 17 March 2017).

- Census Standard Hierarchy of Census Geographic Entities. Available online: http://www2.census.gov/geo/pdfs/reference/geodiagram.pdf (accessed on 2 January 2017).

- Farrelly, M.C.; Evans, W.N.; Sfekas, A.E. The impact of workplace smoking bans: Results from a National Survey. Tob. Control 1999, 8, 272–277. [Google Scholar] [CrossRef] [PubMed]

- Dwyer-Lindgren, L.; Mokdad, A.H.; Srebotnjak, T.; Flaxman, A.D.; Hansen, G.M.; Murray, C.J. Cigarette smoking prevalence in U.S. counties: 1996–2012. Popul. Health Metr. 2014, 12, 5. [Google Scholar] [CrossRef] [PubMed]

- Pierannunzi, C.; Hu, S.S.; Balluz, L. A systematic review of publications assessing reliability and validity of the Behavioral Risk Factor Surveillance System (BRFSS), 2004–2011. BMC Med. Res. Methodol. 2013, 13, 49. [Google Scholar] [CrossRef] [PubMed]

- Chiou, L.; Muehlegger, E. Consumer response to cigarette excise tax changes. Nat. Tax J. 2014, 67, 621–650. [Google Scholar] [CrossRef]

- Bureau of Labor Statistics Consumer Price Index. Available online: http://www.bls.gov/cpi/cpi_dr.htm (accessed on 9 July 2015).

- Census. The 2005–2009 American Community Survey 5-Year Summary File Technical Documentation; Bureau of the Census: Washington, DC, USA, 2011. [Google Scholar]

- Mariolis, P.; Rock, V.; Asman, K. Tobacco Use Among Adults—United States, 2005; Center for Disease Control: Atlanta, GA, USA, 2005. [Google Scholar]

- Roux, A.V.D.; Merkin, S.S.; Arnett, D.; Chambless, L.; Massing, M.; Nieto, F.J.; Sorlie, P.; Szklo, M.; Tyroler, H.A.; Watson, R.L. Neighborhood of residence and incidence of coronary heart disease. N. Engl. J. Med. 2001, 345, 99–106. [Google Scholar] [CrossRef] [PubMed]

- Census Geographic Terms and Concepts: Census Divisions and Census Regions. Available online: https://www.census.gov/geo/reference/gtc/gtc_census_divreg.html (accessed on 2 January 2017).

- USDA—ERS 2013 Urban Influence Codes. Available online: http://www.ers.usda.gov/data-products/urban-influence-codes/documentation.aspx#.UYKQ2kpZRvY (accessed on 7 January 2017).

- Bridging the GAp/ImpacTeen Project. University of Illinois—Chicago State Tobacco Activities Tracking and Evaluation System. Funding Data, Appropriations (1991–2014). Available online: https://chronicdata.cdc.gov/Funding/University-of-Illinois-at-Chicago-Health-Policy-Ce/vw7y-v3uk (accessed on 10 January 2017).

- Decicca, P.; Kenkel, D.; Mathios, A.; Shin, Y.J.; Lim, J.Y. Youth smoking, cigarette prices, and anti-smoking sentiment. Health Econ. 2008, 17, 733–749. [Google Scholar] [CrossRef] [PubMed]

- Merlo, J.; Yang, M.; Chaix, B.; Lynch, J.; Råstam, L. A brief conceptual tutorial on multilevel analysis in social epidemiology: Investigating contextual phenomena in different groups of people. J. Epidemiol. Community Health 2005, 59, 729–736. [Google Scholar] [CrossRef] [PubMed]

- Jamison, N.; Tynan, M.; MacNeil, A. Federal and State Cigarette Excise Taxes—United States, 1995–2009; Centers for Disease Control and Prevention: Atlanta, GA, USA, 2009.

- CDC. BRFSS Prevalence & Trends Data. Available online: https://www.cdc.gov/brfss/brfssprevalence/ (accessed on 19 November 2016).

- Jamal, A.; Homa, D.M.; O‘Connor, E.; Babb, S.D.; Caraballo, R.S.; Singh, T.; Hu, S.S.; King, B.A. Current cigarette smoking among adults—United States, 2005–2014 (NHIS). MMWR—Morb. Mortal. Wkly. Rep. 2015, 64, 1233–1240. Available online: https://www.cdc.gov/mmwr/preview/mmwrhtml/mm6444a2.htm (accessed on 4 February 2017). [Google Scholar]

- Townsend, J.; Roderick, P.; Cooper, J. Cigarette smoking by socioeconomic group, sex, and age: Effects of price, income, and health publicity. BMJ 1994, 309, 923–927. [Google Scholar] [CrossRef] [PubMed]

- Yurekli, A.A.; Zhang, P. The impact of clean indoor-air laws and cigarette smuggling on demand for cigarettes: An empirical model. Health Econ. 2000, 9, 159–170. [Google Scholar] [CrossRef]

- Jiang, N.; Lee, Y.O.; Ling, P.M. Young adult social smokers: Their co-use of tobacco and alcohol, tobacco-related attitudes, and quitting efforts. Prev. Med. 2014, 69, 166–171. [Google Scholar] [CrossRef] [PubMed]

- Schane, R.E.; Glantz, S.A.; Ling, P.M. Nondaily and social smoking: An increasingly prevalent pattern. Arch. Intern. Med. 2009, 169, 1742–1744. [Google Scholar] [CrossRef] [PubMed]

- Guindon, G.E.; Driezen, P.; Chaloupka, F.J.; Fong, G.T. Cigarette tax avoidance and evasion: Findings from the International Tobacco Control Policy Evaluation (ITC) Project. Tob. Control 2014, 23, i13–i22. [Google Scholar] [CrossRef] [PubMed]

- Stehr, M. Cigarette tax avoidance and evasion. J. Health Econ. 2005, 24, 277–297. [Google Scholar] [CrossRef] [PubMed]

- Levy, D.T.; Romano, E.; Mumford, E. The relationship of smoking cessation to sociodemographic characteristics, smoking intensity, and tobacco control policies. Nicotine Tob. Res. 2005, 7, 387–396. [Google Scholar] [CrossRef] [PubMed]

- Franz, G.A. Price effects on the smoking behaviour of adult age groups. Public Health 2008, 122, 1343–1348. [Google Scholar] [CrossRef] [PubMed]

- Zablocki, R.W.; Edland, S.D.; Myers, M.G.; Strong, D.R.; Hofstetter, C.R.; Al-Delaimy, W.K. Smoking ban policies and their influence on smoking behaviors among current California smokers: A Population-Based Study. Prev. Med. 2014, 59, 73–78. [Google Scholar] [CrossRef] [PubMed]

| Variable | Number of Stores | Cigarette Prices | State Cigarette Taxes | Hospitality Smoking Bans | Daily Smoking Prevalence | Casual Smoking Prevalence | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean | STD | Mean | STD | Mean % | STD | Mean % | STD | Mean % | STD | ||

| Overall (2001–2011) | 2973 | $4.96 | $0.90 | $1.06 | $0.69 | 21.4 | 34.2 | 16.1 | 3.9 | 5.8 | 0.8 |

| Region | |||||||||||

| Northeast | 707 | $5.64 | $0.91 | $1.81 | $0.57 | 43.9 | 41.1 | 16.1 | 3.2 | 5.6 | 0.6 |

| Midwest | 547 | $4.70 | $0.64 | $1.01 | $0.54 | 21.4 | 29.9 | 18.2 | 3.6 | 5.9 | 0.8 |

| South | 1032 | $4.38 | $0.68 | $0.50 | $0.44 | 5.0 | 18.0 | 17.1 | 4.0 | 6.0 | 0.8 |

| West | 687 | $5.35 | $0.70 | $1.17 | $0.40 | 22.8 | 34.7 | 13.0 | 2.7 | 5.6 | 0.8 |

| Urban classification (county level variable) | |||||||||||

| Large metro (pop. ≥ 1 million) | 1948 | $5.11 | $0.90 | $1.16 | $0.68 | 23.5 | 35.5 | 14.8 | 3.5 | 5.8 | 0.8 |

| Small metro (pop. < 1 million) | 859 | $4.72 | $0.86 | $0.90 | $0.69 | 17.7 | 31.4 | 18.3 | 3.3 | 5.8 | 0.7 |

| Micropolitan (pop. 10 k–50 k) | 128 | $4.54 | $0.72 | $0.82 | $0.57 | 15.3 | 30.3 | 20.3 | 3.0 | 5.9 | 1.0 |

| Noncore areas (pop < 10 k) | 38 | $4.33 | $0.75 | $0.66 | $0.66 | 14.6 | 32.5 | 21.0 | 2.8 | 5.9 | 0.9 |

| Area-level socio-economic index * | |||||||||||

| lowest tertile (0.2–<35) | 991 | $4.73 | $0.85 | $0.92 | $0.66 | 15.4 | 30.4 | 16.7 | 4.1 | 5.7 | 0.8 |

| middle tertile (35–<62) | 991 | $5.03 | $0.90 | $1.10 | $0.70 | 22.5 | 34.5 | 16.6 | 3.9 | 5.8 | 0.8 |

| highest tertile (62–100) | 991 | $5.14 | $0.92 | $1.17 | $0.70 | 26.3 | 36.6 | 15.1 | 3.5 | 5.8 | 0.8 |

| Area-level non-Hispanic white *,† | |||||||||||

| lowest tertile (2.6%–<72%) | 991 | $4.88 | $0.89 | $0.92 | $0.66 | 15.9 | 31.9 | 18.0 | 4.0 | 6.0 | 0.8 |

| middle tertile (72%–<87%) | 991 | $4.98 | $0.91 | $1.04 | $0.69 | 20.9 | 33.6 | 16.3 | 3.6 | 5.7 | 0.8 |

| highest tertile (87%–100%) | 991 | $5.04 | $0.90 | $1.22 | $0.70 | 27.3 | 36.0 | 14.1 | 3.2 | 5.7 | 0.8 |

| Explanatory Variable | Labels and Category | Model 1.1 Base Adjustment † | Model 1.2 Base † Model Plus State Tax | Model 1.3 Base † Model Plus Hospitality Smoking Ban | Model 1.4 Base † Model Plus State Tax, Hospitality Smoking Bans, SES Index, Race | Model 1.5 Base † Model Plus State Tax, Hospitality Smoking Bans, SES Index, Race, Interaction Tax × Ban | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Est. | p-Value | Est. | p-Value | Est. | p-Value | Est. | p-Value | Est. | p-Value | |||||

| Region | North East | 0.290 | 0.1481 | −0.307 | 0.0007 | 0.226 | 0.2176 | −0.302 | 0.0006 | −0.302 | 0.0006 | |||

| Midwest | −0.634 | 0.0013 | −0.426 | <0.0001 | −0.612 | 0.0007 | −0.419 | <0.0001 | −0.418 | <0.0001 | ||||

| South | −0.835 | <0.0001 | −0.304 | 0.0003 | −0.770 | <0.0001 | −0.279 | 0.0007 | −0.304 | 0.0002 | ||||

| West | Ref | Ref | Ref | Ref | Ref | |||||||||

| Urbanicity ‡ | Small metro | −0.109 | 0.0011 | −0.096 | 0.0024 | −0.110 | 0.0009 | −0.081 | 0.0106 | −0.080 | 0.0108 | |||

| Micropolitan | −0.220 | <0.0001 | −0.189 | <0.0001 | −0.216 | <0.0001 | −0.148 | 0.0017 | −0.150 | 0.0015 | ||||

| Noncore | −0.240 | 0.0008 | −0.244 | 0.0004 | −0.241 | 0.0008 | −0.191 | 0.0053 | −0.195 | 0.0043 | ||||

| Large metro | Ref | Ref | Ref | Ref | Ref | |||||||||

| State tax | State cigarette tax, per pack | 0.912 | <0.0001 | 0.895 | <0.0001 | 0.852 | <0.0001 | |||||||

| Ban | Hospitality (restaurant and bar) indoor smoking ban | 0.313 | <0.0001 | 0.089 | <0.0001 | −0.070 | 0.0650 | |||||||

| Interaction | Tax × Ban | 0.096 | <0.0001 | |||||||||||

| Area-level § | Socio-economic index | 0.002 | <0.0001 | 0.002 | <0.0001 | |||||||||

| Race non-Hispanic white | 0.000 | 0.7 | 0.000 | 0.7 | ||||||||||

| Intraclass correlation coefficients * | ||||||||||||||

| Both state and county | 0.30 | 0.16 | 0.27 | 0.15 | 0.15 | |||||||||

| Explanatory Variable | Label of Variable | Model 2.1 Base Adjustment † | Model 2.2 Base † Adjustment, Cigarette Price, State Tax, Hospitality Bans | Model 2.3 Base † Adjustment, SES Index, Race, Cigarette Price, State Tax, Hospitality Bans, Interaction Tax × Bans | |||

|---|---|---|---|---|---|---|---|

| Est. | p-Value | Est. | p-Value | Est. | p-Value | ||

| A. Daily smoking prevalence | |||||||

| County cigarette price (after adjustment for taxes) | 0.010 | 0.621 | 0.022 | 0.269 | 0.015 | 0.46 | |

| State tax | State cigarette tax, per pack | −0.433 | <0.001 | −0.440 | <0.001 | −0.282 | <0.001 |

| Ban | Hospitality (restaurant and bar) indoor smoking ban | −0.123 | 0.003 | 0.311 | <0.001 | ||

| Interaction | Ban × state tax | −0.247 | <0.001 | ||||

| B. Non-daily (casual) smoking prevalence | |||||||

| County cigarette price (after adjustment for taxes) | 0.039 | 0.002 | 0.041 | 0.001 | 0.041 | 0.001 | |

| State tax | State cigarette tax, per pack | −0.124 | <0.001 | −0.096 | <0.001 | −0.092 | <0.001 |

| Ban | Hospitality (restaurant and bar) indoor smoking ban | −0.182 | <0.001 | −0.18 | 0.001 | ||

| Interaction | Ban × state tax | −0.003 | 0.918 | ||||

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license ( http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ballester, L.S.; Auchincloss, A.H.; Robinson, L.F.; Mayne, S.L. Exploring Impacts of Taxes and Hospitality Bans on Cigarette Prices and Smoking Prevalence Using a Large Dataset of Cigarette Prices at Stores 2001–2011, USA. Int. J. Environ. Res. Public Health 2017, 14, 318. https://doi.org/10.3390/ijerph14030318

Ballester LS, Auchincloss AH, Robinson LF, Mayne SL. Exploring Impacts of Taxes and Hospitality Bans on Cigarette Prices and Smoking Prevalence Using a Large Dataset of Cigarette Prices at Stores 2001–2011, USA. International Journal of Environmental Research and Public Health. 2017; 14(3):318. https://doi.org/10.3390/ijerph14030318

Chicago/Turabian StyleBallester, Lance S., Amy H. Auchincloss, Lucy F. Robinson, and Stephanie L. Mayne. 2017. "Exploring Impacts of Taxes and Hospitality Bans on Cigarette Prices and Smoking Prevalence Using a Large Dataset of Cigarette Prices at Stores 2001–2011, USA" International Journal of Environmental Research and Public Health 14, no. 3: 318. https://doi.org/10.3390/ijerph14030318