Pharmaceutical Industry in Vietnam: Sluggish Sector in a Growing Market

Abstract

:1. Introduction

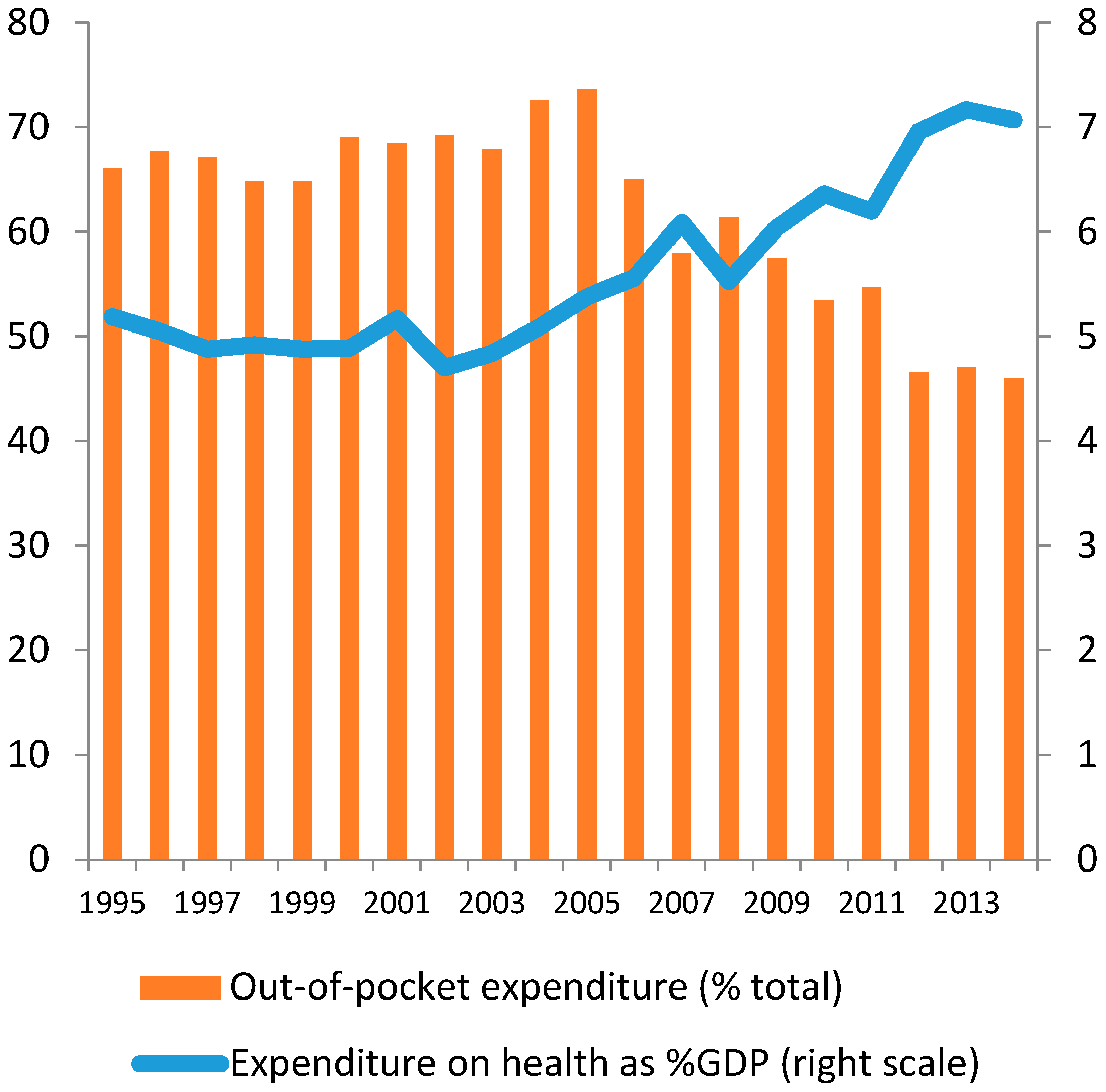

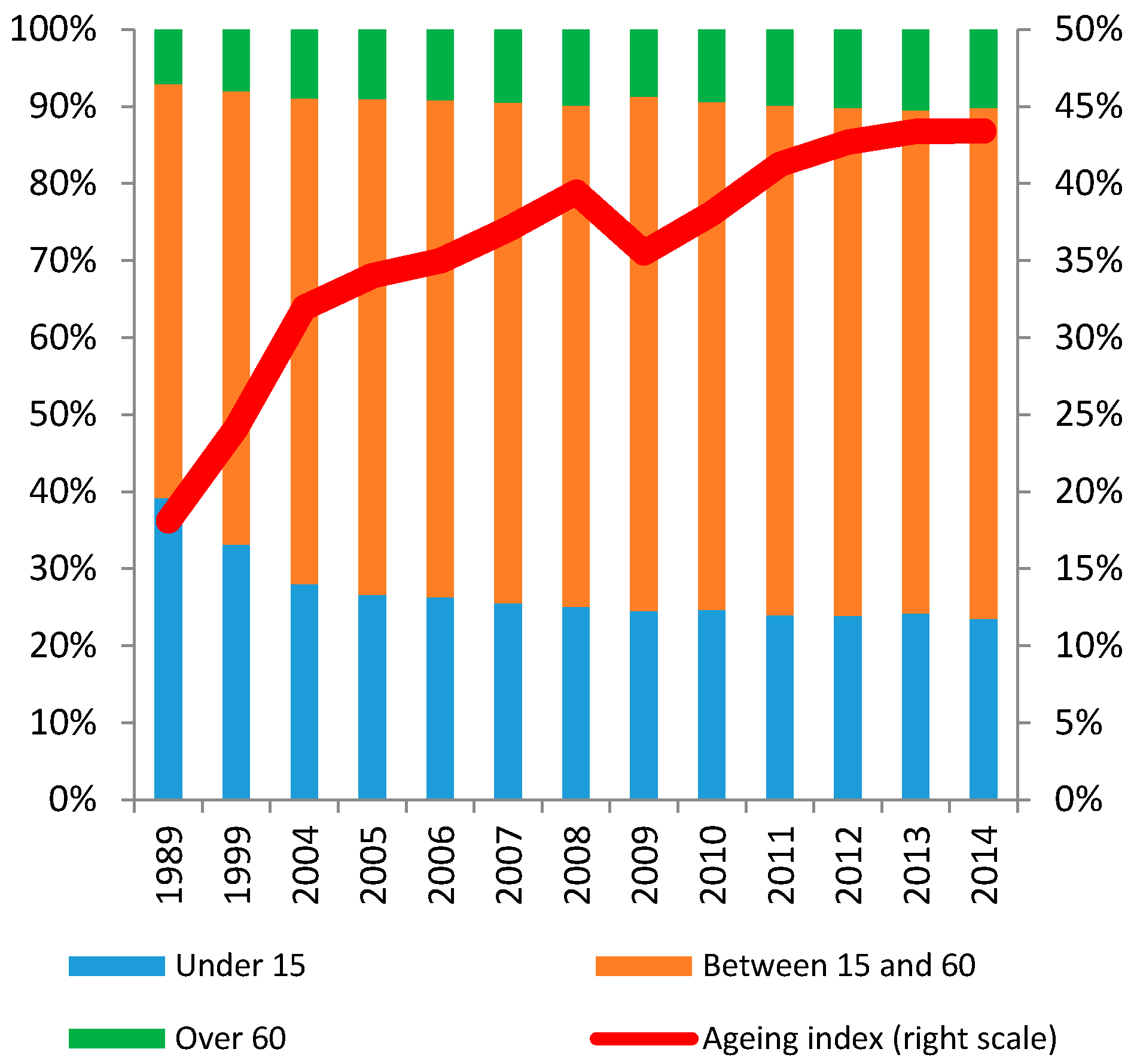

2. The Development of the Health Care Market

3. Evolution of Pharmaceutical Industry

3.1. Overview of the Industry

3.1.1. State of Development of the Domestic Production

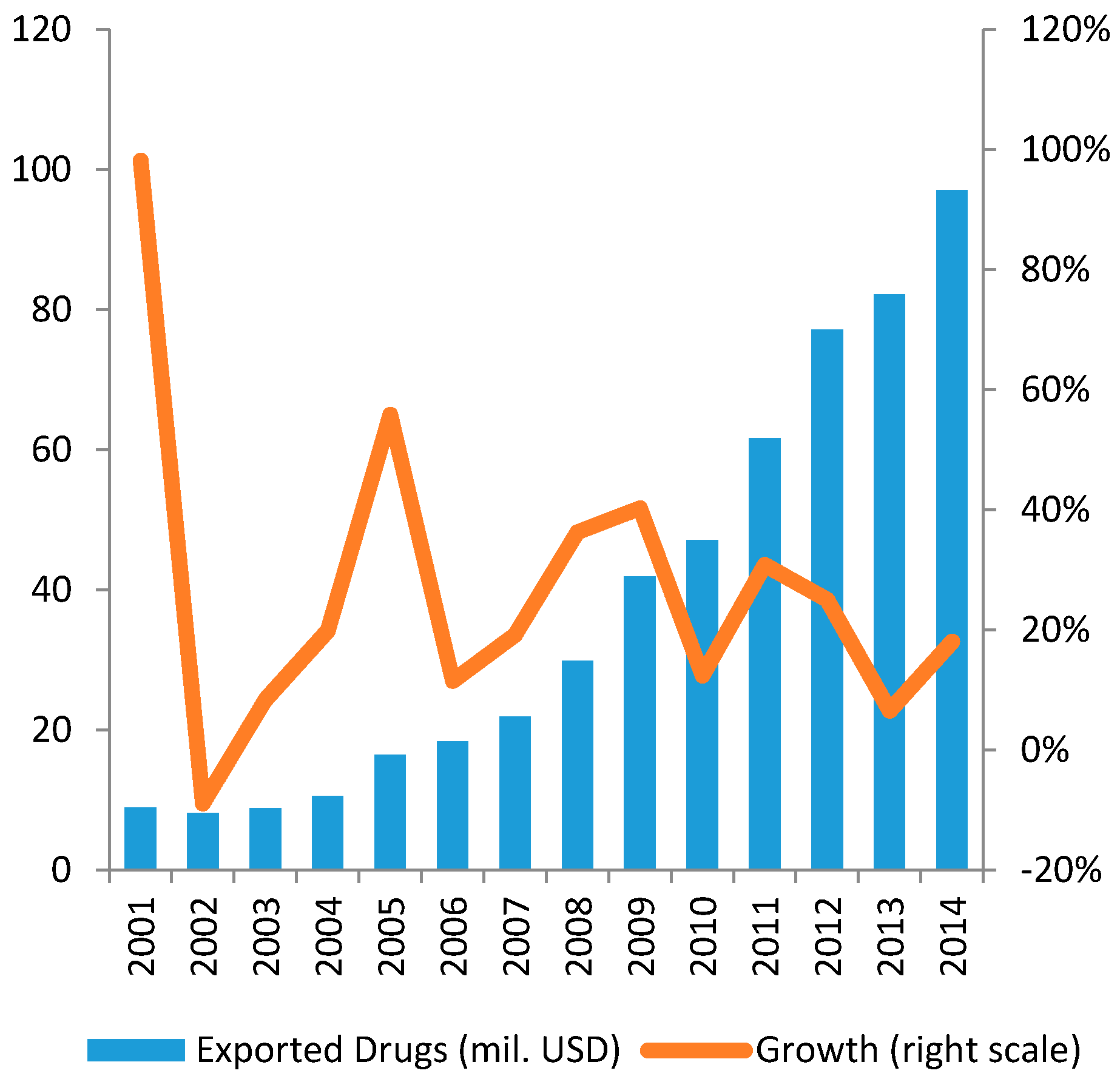

3.1.2. Imports and Exports

3.1.3. Agents, Dynamics and Governance in the Vietnamese Pharmaceutical Sector

3.2. The Evolution of Government Policies in the Pharmaceutical Industry

3.2.1. Transition Period (1990–2005)

3.2.2. Integration Period (2005–2017)

3.2.3. New Expansion Period (2017–Onward)

- State policies on pharmacy and pharmaceutical industry development;

- Pharmacy practice

- Clinical pharmacy; and

- Management of drug prices

4. Analysis of Major Challenges in the Vietnamese Pharmaceutical Industry

4.1. No Long Term Strategy

4.2. Low Value Added Production

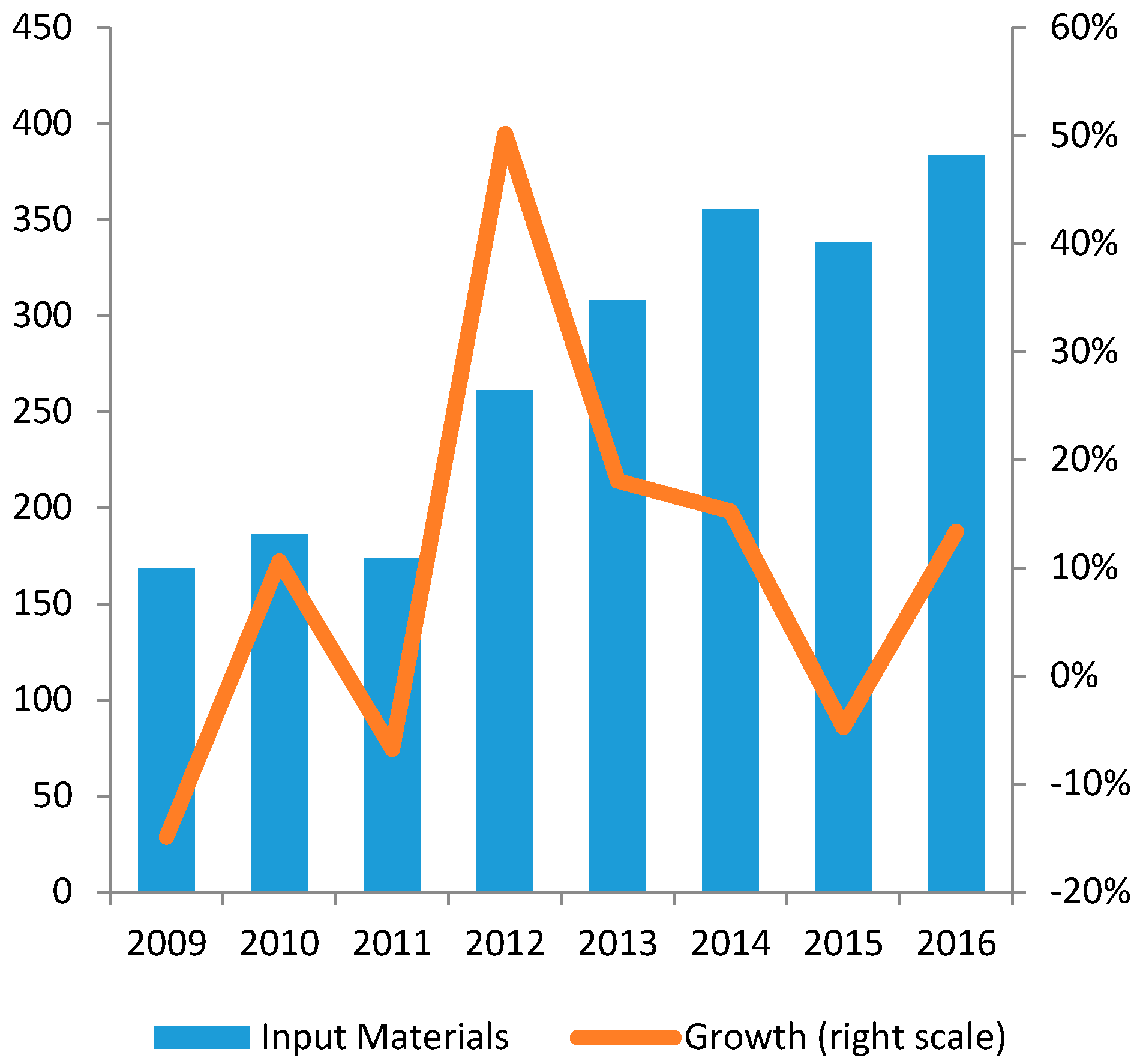

4.3. Dependence of External Material Inputs

4.4. Distorted Distribution Network

4.5. Price Distortion

4.6. Ineffective Quality Control and Supervision

5. Conclusions

Author Contributions

Conflicts of Interest

References

- Le, V.T. Vietnam’s Pharma Market Booms Amid Short Supply; VNExpress Business: Hanoi, Vietnam, 2016. [Google Scholar]

- Business Monitor International. Vietnam Pharmaceutical and Healthcare Report; Bill Thompson: London, UK, 2017. [Google Scholar]

- Hoang, H.T. Pharmaceutical Sector Report; FPT Securities: Hanoi, Vietnam, 2014. [Google Scholar]

- Italian Trade Agency. Brief Sector Note on Pharmaceutical Industry in Vietnam; Italian Trade Agency: Mayfair, UK, 2014.

- World Bank. Vietnam 2035: Toward Prosperity, Creativity, Equity, and Democracy; World Bank and Ministry of Planning and Investment: Washington, DC, USA, 2016. [Google Scholar]

- United Nations Commodity Trade Statistics. Available online: https://comtrade.un.org/data/ (accessed on 29 August 2017).

- Dinh, H.T.; Mishra, D.; Le, D.B.; Pham, M.D.; Pham, T.T.H. Light Manufacturing in Vietnam: Creating Jobs and Prosperity in a Middle-Income Economy; World Bank Publications: Washington, DC, USA, 2014. [Google Scholar]

- Ladinsky, J.; Nguyen, H.; Volk, N. Changes in the health care system of vietnam in response to the emerging market economy. J. Public Health Policy 2000, 21, 82–98. [Google Scholar] [CrossRef] [PubMed]

- Simonet, D. The Vietnamese pharmaceutical market: An assessment and analysis. Cahiers D’études Recherche Francophone/Santé 2001, 11, 155–160. [Google Scholar]

- Simonet, D. The Vietnamese pharmaceutical market: A comparison of foreign entry strategies. Int. J. Bus. Emerg. Mark. 2008, 1, 61. [Google Scholar] [CrossRef]

- Wrona, T.; Trapczynski, P. Re-explaining international entry modes—Interaction and moderating effects on entry modes of pharmaceutical companies into transition economies. Eur. Manag. J. 2012, 30, 295–315. [Google Scholar] [CrossRef]

- Nguyen, A.T.; Roughead, E.E. Pharmaceutical pricing policies in Vietnam. In Pharmaceutical Prices in the 21st Century, 1st ed.; Babar, Z.-U.-D., Ed.; Springer: Berlin, Germany, 2014; pp. 321–342. [Google Scholar]

- Business Monitor International. Vietnam Pharmaceutical and Healthcare Report Q3-2009; Bill Thompson: London, UK, 2009. [Google Scholar]

- Nguyen, A.T.; Vitry, A.; Roughead, E.E. Pharmaceutical policies in Vietnam. In Pharmaceutical Policy in Countries with Developing Healthcare Systems, 1st ed.; Babar, Z.-U.-D., Ed.; ADIS, Springer International Publishing AG: Cham, Switzerland, 2017; p. 430. [Google Scholar]

- Vu, T.H. Possibility to bring about Economic Benefits of Evfta and Implications for Vietnamese Enterprises. In Proceedings of the International Conference on “ Emerging Challenges: Managing to Success ”, Hanoi, Vietnam, 12 November 2015. [Google Scholar]

- Vu, T.H. Assessing potential impacts of the evfta on Vietnam’s pharmaceutical imports from the EU: An application of smart analysis. Springerplus 2016, 5, 1503. [Google Scholar] [CrossRef] [PubMed]

- Opportunities in Vietnams Healthcare Sector. Available online: http://www.business-sweden.se/contentassets/75fbed36e1eb48d59a339d763e9fa696/opportunies-in-vietnams-healthcare-sector.pdf (accessed on 24 August 2017).

- EU-Vietnam Business Network. Vietnam: Healthcare 2016; EU-Vietnam Business Network: Ho Chi Minh, Vietnam, 2016. [Google Scholar]

- General Statistics Office. Statistics for Pharmaceutical Industry; General Statistics Office: Hanoi, Vietnam, 2017.

- Ministry of Health. Strengthening Primary Health Care at the Grassroots towards Universal Health Coverage; Ministry of Health: Hanoi, Vietnam, 2016.

- Jan-Willem, E. China and the New Harbingers of Change in Healthcare; Slideshare: San Francisco, CA, USA, 2011. [Google Scholar]

- General Statistics Office. Vietnam National Accounts Database; General Statistics Office: Hanoi, Vietnam, 2017.

- Bennett, S.; Quick, J.D.; Vela’squesz, G. Public Private Roles in the Pharmaceutical Sector. Implications for Equitable Access and Rational Drug Use. In Health Economics and Drugs; World Health Organization: Geheva, Switzerland, 1997. [Google Scholar]

- Mayer, J. Towards more Balanced Growth Strategies in Developing Countries: Issues Related to Market Size, Trade Balances and Purchasing Power; United Nations Conference on Trade and Development (UNCTAD): Geneva, Switzerland, 2013. [Google Scholar]

- World Bank. World Development Indicators; World Bank: Washington, DC, USA, 2017. [Google Scholar]

- World Bank. East Asia’s Changing Urban Landscape: Measuring a Decade of Spatial Growth; World Bank: Washington, DC, USA, 2015. [Google Scholar]

- General Statistics Office and United Nations Population Fund. Vietnam Population Projection 2014–2049; General Statistics Office and United Nations Population Fund: Hanoi, Vietnam, 2016.

- Yuanjia, H.; Geng, F.; Ying, B.; Yitao, W. The Chinese pharmaceutical market: Perspectives of the health consumer. J. Med. Mark. 2007, 7, 295–300. [Google Scholar] [CrossRef]

- Zhu, X.; Cai, Q.; Wang, J.; Liu, Y. Determinants of medical and health care expenditure growth for urban residents in China: A systematic review article. Iran J. Public Health 2014, 43, 1597–1604. [Google Scholar] [PubMed]

- Solidance. Beyond Hanoi and Ho Chi Minh City—Emerging Opportunities in Vietnam’s Healthcare Landscape; Solidance: Ho Chi Minh, Vietnam, 2015. [Google Scholar]

- Montgomery, M.R.; Ezeh, A.C. The health of urban populations in developing countries: An overview. In Handbook of Urban Health: Populations, Methods and Practice; Galea, S., Vlahov, D., Eds.; Springer: New York, NY, USA, 2005. [Google Scholar]

- United Nations Population Division. World Population Prospects 2015 Revision; United Nations Population Division: New York, NY, USA, 2015. [Google Scholar]

- World Bank. Taking Stock, July 2016: An Update on Vietnam’s Recent Economic Developments; World Bank: Washington, DC, USA, 2016. [Google Scholar]

- Ministry of Health. Strengthening Prevention and Control of Non-Communicable Disease; Ministry of Health: Hanoi, Vietnam, 2015.

- Ministry of Health. Health Financing in Vietnam; Ministry of Health: Hanoi, Vietnam, 2008.

- Government of Vietnam. Law on Health Insurance No. 25/2008/qh12 Passed by the National Assembly on 14 November 2008, Effective from 1 July 2009; Government of Vietnam: Hanoi, Vietnam, 2008.

- Somanathan, A.; Tandon, A.; Dao, H.L.; Hurt, K.; Fuenzalida, H. Moving toward Universal Coverage of Social Health Insurance in Vietnam: Assessment and Options; Human Development: Washington, DC, USA, 2014. [Google Scholar]

- Schulz Noack Bärwinke. Guide for the Health Care Market in Vietnam; Schulz Noack Bärwinke: Hanoi, Vietnam, 2016. [Google Scholar]

- Ministry of Health. General Report of 2016 and Direction, Solutions for 2017; Ministry of Health: Hanoi, Vietnam, 2017.

- Government of Vietnam. Resolution No. 37-CP of the Government on Strategic Orientations for Public Health Care and Protection in the 1996–2000 Period and National Drug Policy; Government of Vietnam: Hanoi, Vietnam, 1996.

- Larsson, M. Antibiotic Use and Resistance, Assessing and Improving Utilisation and Provision of Antibiotics and Other Drugs in Vietnam; Sciences Karolinska Institutet: Stockholm, Sweden, 2003. [Google Scholar]

- Witter, S. ‘Doi moi’ and health: The effect of economic reforms on the health system in Vietnam. Int. J. Health Plan. Manag. 1996, 11, 159–172. [Google Scholar] [CrossRef]

- Sepehri, A.; Moshiri, S.; Simpson, W.; Sarma, S. Taking account of context: How important are household characteristics in explaining adult health-seeking behaviour? The case of Vietnam. Health Policy Plan. 2008, 23, 397–407. [Google Scholar] [CrossRef] [PubMed]

- Nguyen, A.T.; Knight, R.; Mant, A.; Cao, Q.M.; Brooks, G. Medicine pricing policies: Lessons from Vietnam. Southern Med. Rev. 2010, 3, 12–19. [Google Scholar]

- Government of Vietnam. Law on Pharmacy No. 34/2005/qh11 Passed by the National Assembly on 14 June 2005, Effective from 1 October 2005; Government of Vietnam: Hanoi, Vietnam, 2005.

- ViettinBank Securities Company. Pharmaceutical Industry Report; ViettinBank Securities Company: Hanoi, Vietnam, 2015. [Google Scholar]

- Ministry of Health MoH. Five-Year Health Sector Plan 2011–2015; Ministry of Health: Hanoi, Vietnam, 2010.

- Government of Vietnam. Law on Pharmacy no. 105/2016/qh13 Passed by the National Assembly on 6 April 2016, Effective from 1 January 2017; Government of Vietnam: Hanoi, Vietnam, 2016.

- Le, V.T. Vietnam Pharmaceutical 2011–2020: Drugs & Cosmetics Review; VNExpress Business: Hanoi, Vietnam, 2011. [Google Scholar]

- Ministry of Health. Plan: For People’s Health Protection, Care and Promotion 2016–2020; Ministry of Health: Hanoi, Vietnam, 2016.

| Forms of Establishment | 2010 | 2011 | 2012 | 2013 | 2014 |

|---|---|---|---|---|---|

| Drug manufacturers achieving GMP * | 101 | 109 | 119 | 123 | 131 |

| Manufacturers of vaccines and biologicals achieving GMP | 4 | 4 | 4 | 4 | 4 |

| Manufacturers of finished herbal products achieving GMP | 0 | n/a | n/a | n/a | 24 ** |

| Units meeting GLP * | 104 | 113 | 124 | 130 | 141 |

| Importer-exporters achieving GSP * | 0 | n/a | n/a | n/a | 174 |

| Drug storage facilities meeting GSP | 0 | n/a | n/a | n/a | 3 |

| Drug-wholesalers achieving GDP * | 0 | n/a | n/a | n/a | 1900 |

| Retail drug outlet | 43,629 | 39,172 | 39,124 | 42,262 | n/a |

| Company | Revenue Growth (2009–2013) (%) | Profit Growth (2009–2013) (%) | Total Turnover 2013 (mil. USD) |

|---|---|---|---|

| Hau Giang Pharmacy | 19.2 | 13.1 | 168 |

| Traphaco | 22.5 | 35.3 | 80 |

| Domesco | 7.6 | 8.9 | 68 |

| IMEXPHARM | 6.3 | −2 | 40 |

| OPC | 11 | 3.3 | 27 |

| Cuu Long Pharmacy | 4 | −14.4 | 32 |

| SPM | 14.7 | −27.2 | 21 |

| Pharmedic | 16.5 | 23.9 | 17 |

| Phong Phu Pharmacy | 19.3 | n.a. | 5 |

| Year | Number of Samples Taken for Quality Assurance | Number of Samples Failed the Quality Tests | Percentage of Drugs Failed the Quality Test |

|---|---|---|---|

| 2010 | 32,313 | 1008 | 3.12 |

| 2011 | 33,508 | 950 | 2.81 |

| 2012 | 32,949 | 1008 | 3.09 |

| 2013 | 39,482 | 948 | 2.54 |

| 2014 | 40,711 | 967 | 2.38 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Angelino, A.; Khanh, D.T.; An Ha, N.; Pham, T. Pharmaceutical Industry in Vietnam: Sluggish Sector in a Growing Market. Int. J. Environ. Res. Public Health 2017, 14, 976. https://doi.org/10.3390/ijerph14090976

Angelino A, Khanh DT, An Ha N, Pham T. Pharmaceutical Industry in Vietnam: Sluggish Sector in a Growing Market. International Journal of Environmental Research and Public Health. 2017; 14(9):976. https://doi.org/10.3390/ijerph14090976

Chicago/Turabian StyleAngelino, Antonio, Do Ta Khanh, Nguyen An Ha, and Tuan Pham. 2017. "Pharmaceutical Industry in Vietnam: Sluggish Sector in a Growing Market" International Journal of Environmental Research and Public Health 14, no. 9: 976. https://doi.org/10.3390/ijerph14090976