Demand Response Unit Commitment Problem Solution for Maximizing Generating Companies’ Profit

Abstract

:1. Introduction

2. Demand Response Unit Commitment Problem Formulation

2.1. Mathematical Modelling of DRUC

2.2. Traditional Unit Commitment Constraints

2.2.1. Equality Constraint

2.2.2. Inequality Constraint

2.2.3. Ramp up Rate

2.2.4. Ramp down Rate

2.2.5. Minimum up Time

2.2.6. Minimum down Time

2.2.7. Reserve Constraints

2.2.8. Spinning Reserve

2.2.9. Startup Cost of Units

2.3. Demand Response Unit Commitment Constraints

2.3.1. Equality Constraint

2.3.2. Minimum up Time

2.3.3. Minimum down Time

2.3.4. Ramp up Rate

2.3.5. Ramp down Rate

3. Cat Swarm Optimization (CSO)

3.1. Seeking Mode

- (a)

- Seeking Memory Pool (SMP): number of copies of a cat produced.

- (b)

- Seeking Range of selected Dimension (SRD): difference between the new and old in the dimension selected for mutation.

- (c)

- Counts of Dimensions to Change (CDC): number of dimensions to be mutated.

- (d)

- Mixture Ratio (MR): to state that most of the time spent by the cats is resting and observing.

- (1)

- Randomly select MR fraction of population as seeking cats: rest of them as tracing cats.

- (2)

- SMP copies of the ith seeking cat is created.

- (3)

- Update the position of each copy based on CDC by randomly adding or subtracting SRD fraction.

- (4)

- Evaluate error fitness values of copies.

- (5)

- Best candidate is picked from all copies and placed at ith seeking cat.

- (6)

- Repeat Step 2 until all seeking cats are involved.

3.2. Tracing Mode

- Step 1:

- Create N number of population.

- Step 2:

- Initialize time t = 0 and i = 0.

- Step 3:

- Find the overall cost and revenue for TUC and DRSP from the data provided using iterations and store the values and evaluate the profit for TUC and DRSP using the formula Pf = Rv − Tcost.

- Step 4:

- Check if all units are over and whether the cat is in seeking mode based on MR value

- Step 5:

- If yes, Seeking Mode.Create SMP copies and update position based on CDC, then take best value from SMP copies.

- Step 6:

- If no, then Tracing mode.Update position and velocity by using the equations:And save the highest profit unit.

- Step 7:

- Check if all cats are updated, if yes, then proceed or else go back to Step 4.

- Step 8:

- Check if maximum iteration is over, if yes, then stop and display the result, else go back to Step 2.

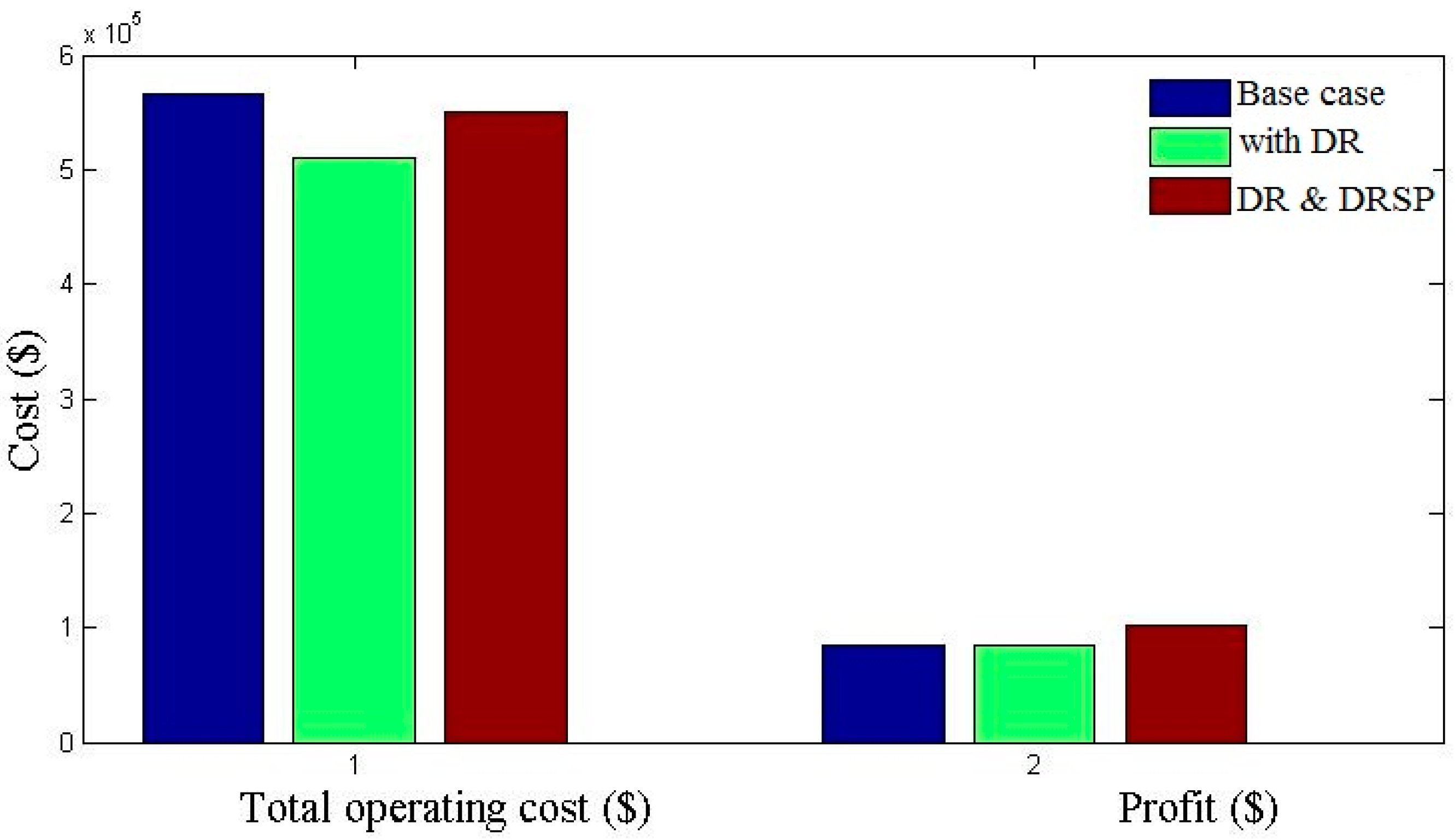

4. Result and Discussion

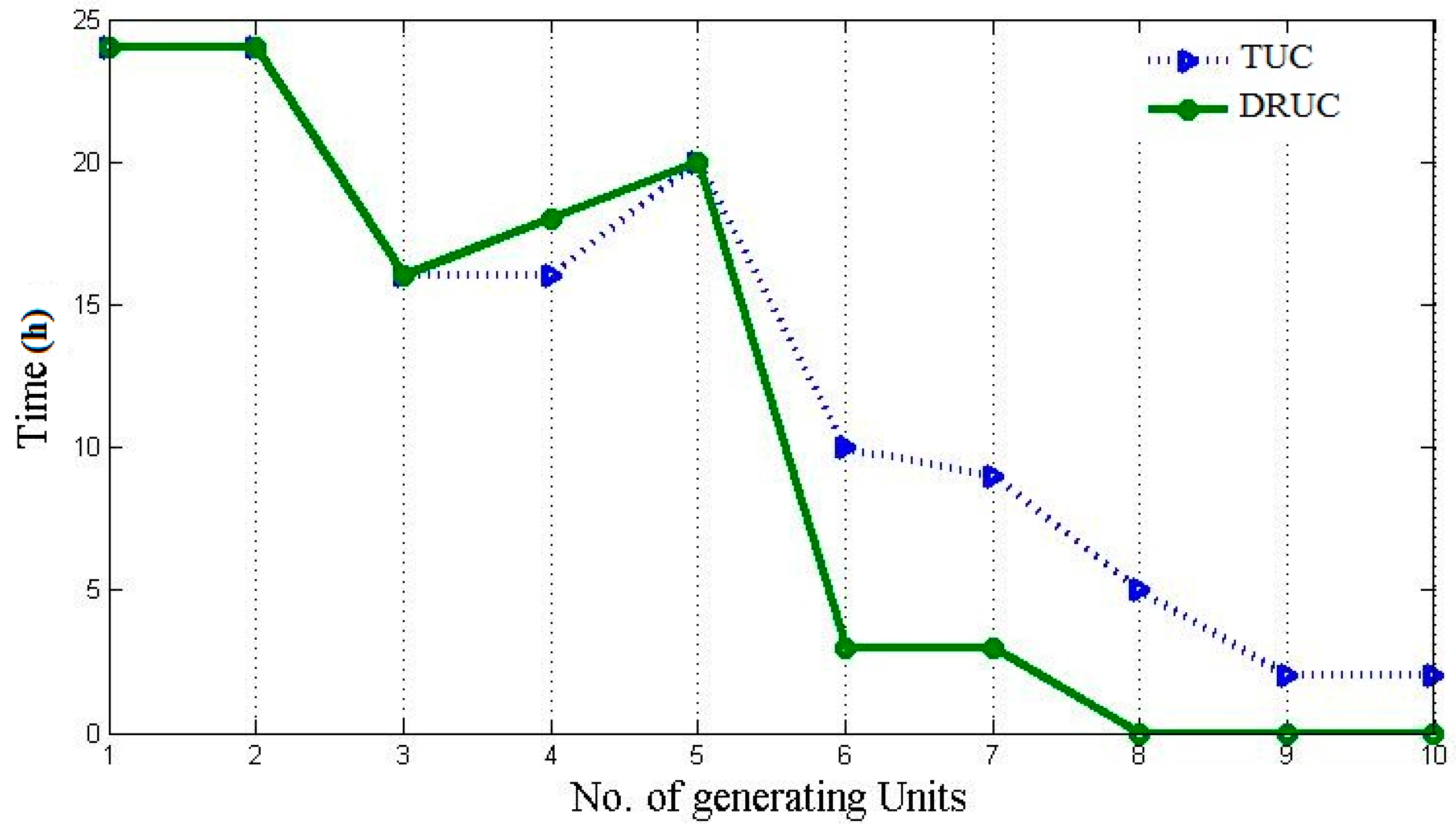

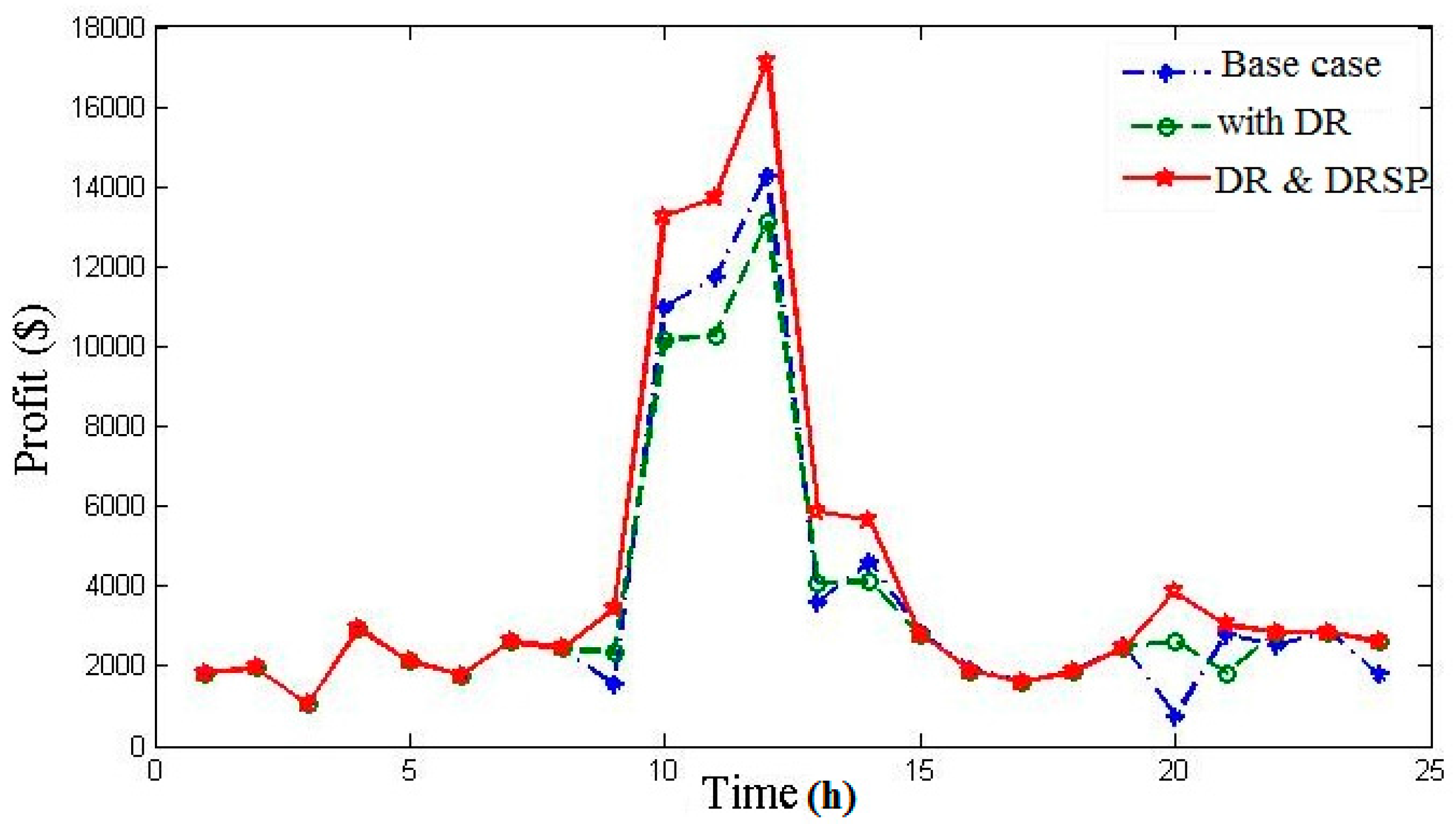

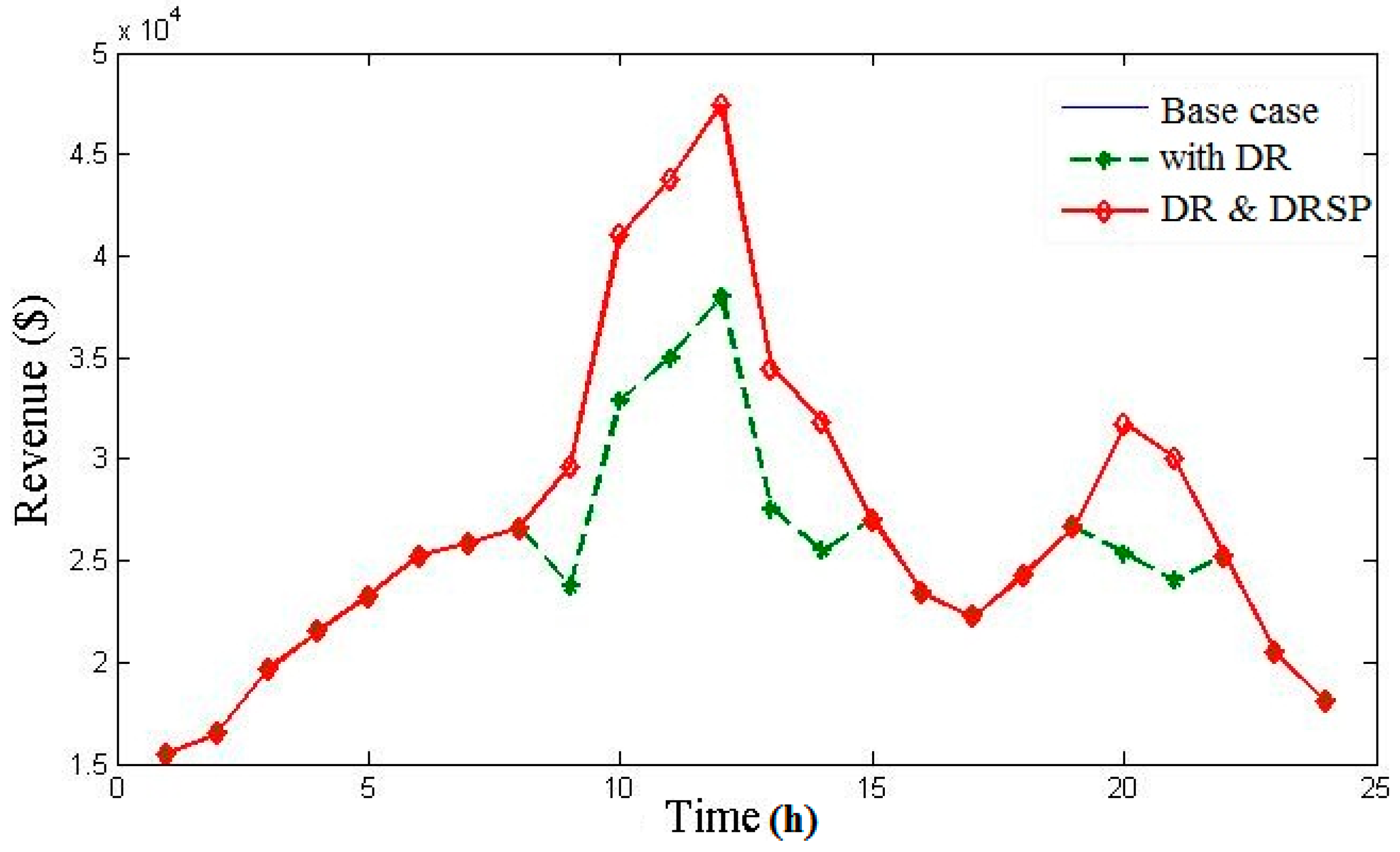

5. Simulation Results

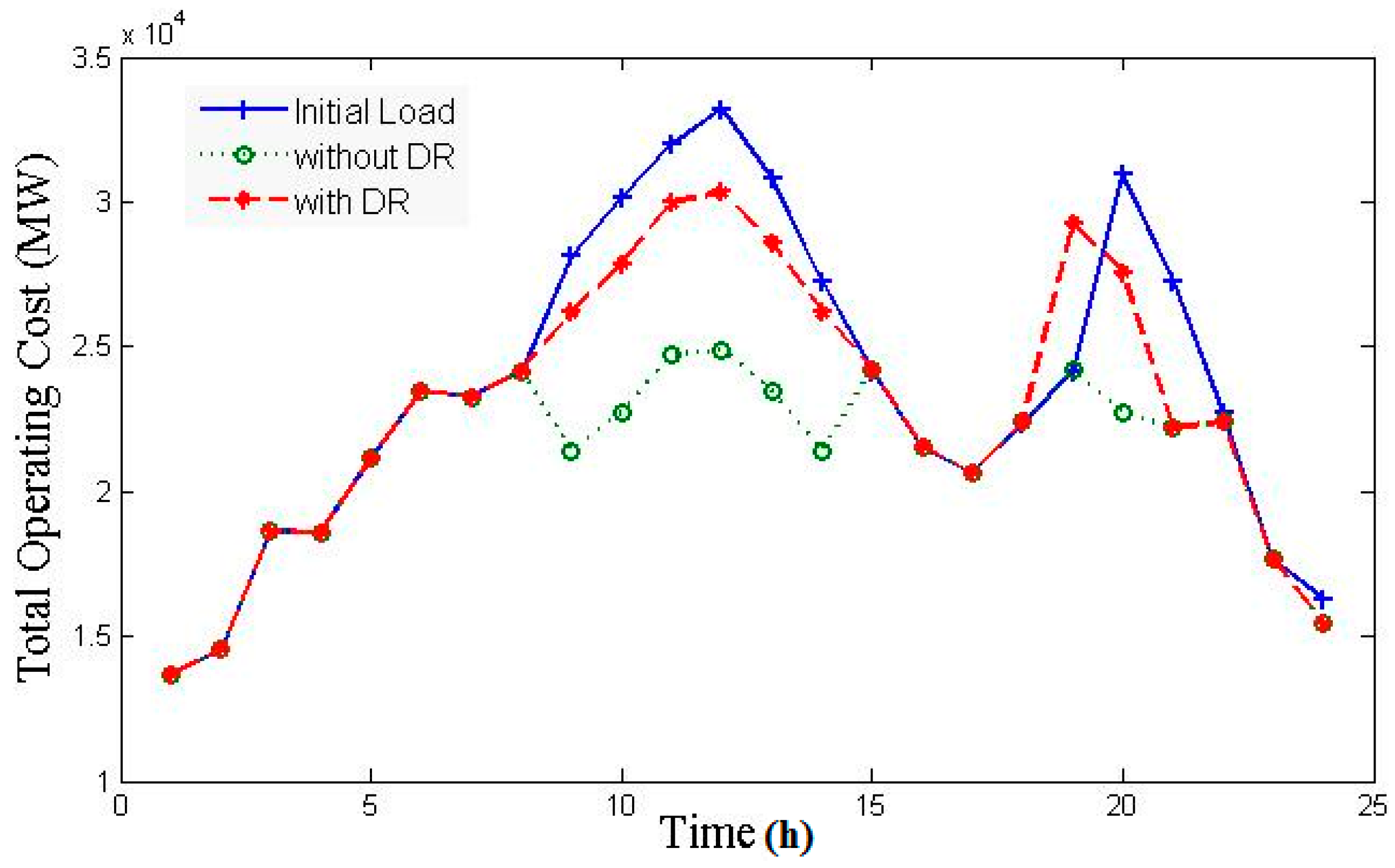

5.1. Case 1: Base Case

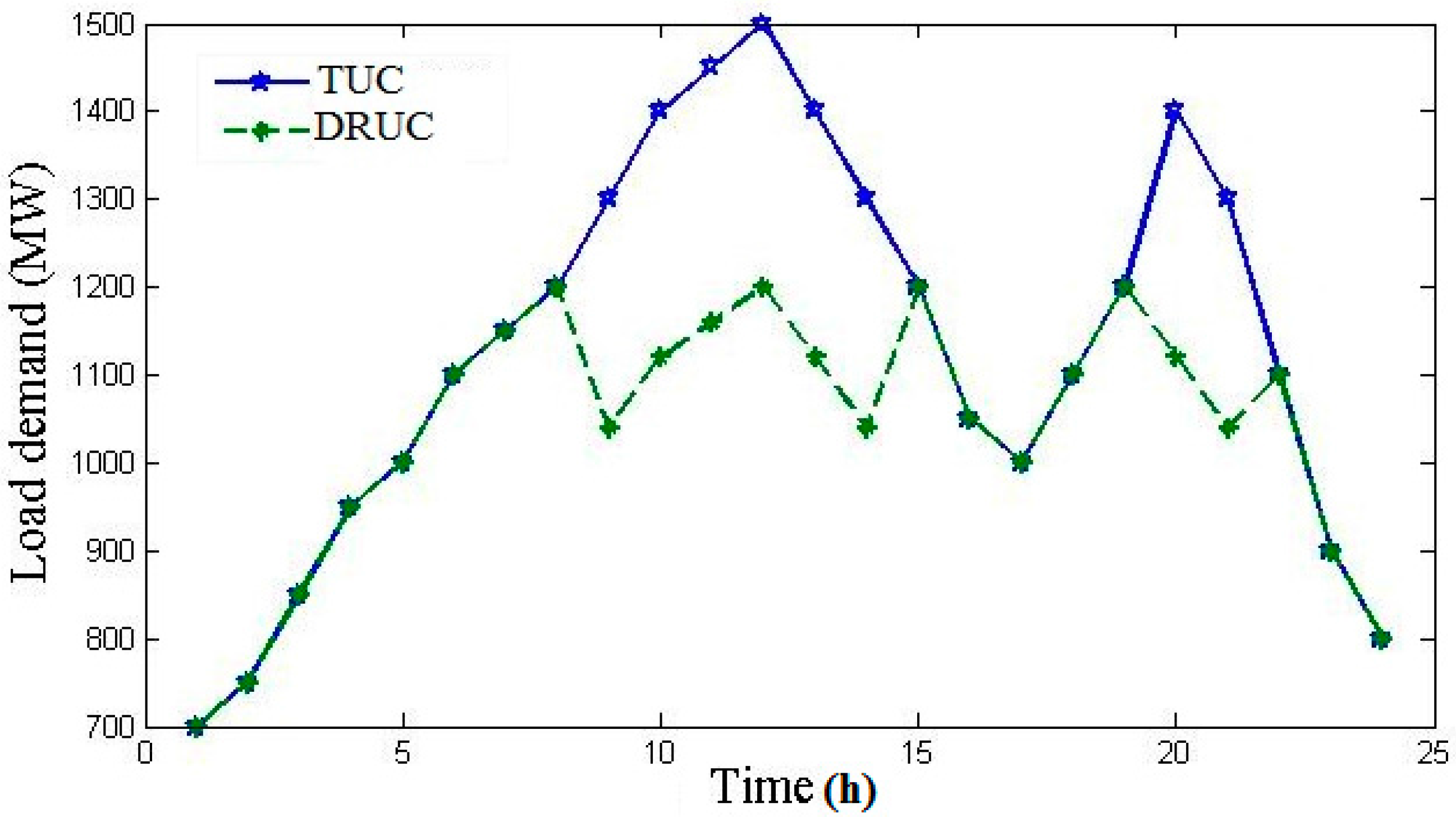

5.2. Case 2: Base Case Established Using DR

6. Conclusions

Author Contributions

Conflicts of Interest

Nomenclature

| Constants | |

| N | Total number of units |

| Ψ | Unit commitment time step (60 min) |

| T | Dispatch period in hours |

| dN | Total number of DRSP units |

| Θdi, δdi, φdi | Supply curve coefficients of DRSP generating units |

| θmdi, δmdi, φmdi | Customer’s supply curve cost coefficients |

| ai, bi, ci | Supply curve coefficients of IEEE 10 generating units |

| μdi | Customer willingness coefficient |

| Ramp up rate of unit i | |

| Ramp down rate of unit i | |

| Minimum up time limit of unit i | |

| Minimum down time limit of unit i | |

| Hot start cost of unit i | |

| Cold start cost of unit i | |

| Cold start hour of unit i | |

| Variables | |

| i | Index of generator unit |

| di | Index of DRSP generator unit |

| PR | Total profit of the GENCO’s and DRSP combined |

| TRV | Total revenue calculated from GENCO’s and DRSP |

| TOcost | Total operating cost of GENCO’s and DRSP combined |

| Fuel cost of generator unit | |

| Fuel cost of DRSP generating unit | |

| DRprice | Demand response clearing price |

| DRSP generator output per hour | |

| Total profit of DRSP | |

| DRreq | Required power output from DRSP generating units |

| Power generator output of ith unit at tth hour | |

| DRSP output of dith unit at tth hour | |

| Unit status of ith unit at tth hour | |

| Total power demand at hour t | |

| Minimum generation output power of ith unit | |

| Minimum generation output power of ith unit at tth hour | |

| Maximum generation output power of ith unit | |

| Maximum generation output power of ith unit at tth hour | |

| Power generated in the previous hour | |

| ONi | Number of hours the unit was committed |

| OFFi | Number of hours the unit was not committed |

| Reserve generation of unit i at tth hour | |

| Spinning reserve of unit i | |

| Forecasted spot price of unit i | |

| Forecasted spot price of DRSP generating units di | |

| Startup cost of unit i | |

References

- Muzhikyan, A.; Farid, A.M.; Youcef-Toumi, K. Relative merits of load following reserves & energy storage market integration towards power system imbalances. Int. J. Electr. Power Energy Syst. 2016, 74, 222–229. [Google Scholar]

- Paterakis, N.G.; Erdinç, O.; Catalão, J.P. An overview of Demand Response: Key-elements and international experience. Renew. Sustain. Energy Rev. 2017, 69, 871–891. [Google Scholar] [CrossRef]

- Kyoho, R.; Goya, T.; Mengyan, W.; Senjyu, T.; Yona, A.; Funabashi, T.; Kim, C.H. Thermal unit commitment with demand response to optimize battery storage capacity. In Proceedings of the 2013 IEEE 10th International Conference on Power Electronics and Drive Systems (PEDS), Kitakyushu, Japan, 22–25 April 2013; pp. 1207–1212. [Google Scholar]

- Federal Energy Regulatory Commission (FERC). Federal Energy Regulatory Commission Report to Congress: Implementation Proposal for the National Action Plan on Demand Response; FERC: Washington, DC, USA, 2011.

- Federal Energy Regulatory Commission (FERC). News Release: FERC Approves Market-Based Demand Response Compensation Rule; FERC: Washington, DC, USA, 2011.

- Benefits of Demand Response in Electricity Markets and Recommendations for Achieving Them United States DOE Report to the Congress; U.S. Department of Energy: Washington, DC, USA, 2006.

- Abdollahi, A.; Moghaddam, M.P.; Rashidinejad, M.; Sheikh-El-Eslami, M.K. Investigation of economic & environmental—Driven demand response measures incorporating UC. IEEE Trans. Smart Grid 2012, 3, 12–25. [Google Scholar]

- Rastegar, M.; Fotuhi-Firuzabad, M.; Choi, J. Investigating the impacts of different price-based demand response programs on home load management. J. Electr. Eng. Technol. 2014, 9, 1125–1131. [Google Scholar] [CrossRef]

- Pierluigi, S. Demand response and smart grids—A survey. Renew. Sustain. Energy Rev. 2014, 30, 461–478. [Google Scholar]

- Howlader, H.O.R.; Matayoshi, H.; Senjyu, T. Distributed generation integrated with thermal unit commitment considering demand response for energy storage optimization of smart grid. Renew. Energy 2016, 99, 107–117. [Google Scholar] [CrossRef]

- Babar, M.; Tp, I.A.; Alammar, E.A. The consumer rationality assumption in incentive based demand response program via reduction bidding. J. Electr. Eng. Technol. 2015, 10, 64–74. [Google Scholar] [CrossRef]

- Ghazvini, M.A.F.; Soares, J.; Horta, N.; Neves, R.; Castro, R.; Vale, Z. A multi-objective model for scheduling of short-term incentive-based demand response programs offered by electricity retailers. Appl. Energy 2015, 151, 102–118. [Google Scholar] [CrossRef]

- Aalami, H.A.; Parsa Moghaddam, M.; Yousefi, G.R. Demand response modeling considering interruptible/curtailable loads and capacity market programs. Appl. Energy 2010, 80, 426–435. [Google Scholar] [CrossRef]

- Motalleb, M.; Thornton, M.; Reihani, E.; Ghorbani, R. A nascent market for contingency reserve services using demand response. Appl. Energy 2016, 179, 985–995. [Google Scholar] [CrossRef]

- Motalleb, M.; Thornton, M.; Reihani, E.; Ghorbani, R. Providing frequency regulation reserve services using demand response scheduling. Energy Convers. Manag. 2016, 124, 439–452. [Google Scholar] [CrossRef]

- Zhang, X.; Hug, G.; Kolter, Z.; Harjunkoski, I. Industrial demand response by steel plants with spinning reserve provision. N. Am. Power Symp. (NAPS) 2015, 1–6. [Google Scholar] [CrossRef]

- How Smart Is the Smart Grid; NPR: Washington, DC, USA, 2010.

- The Power to Choose—Enhancing Demand Response in Liberalised Electricity Markets Findings of IEA Demand Response Project, Presentation. 2003. Available online: http://www.schneider-electric.us/documents/solutions1/demand-response-solutions/powertochoose_2003.pdf (accessed on 21 September 2017).

- Electric Power Supply Association. Demand Response Compensation in Organized Wholesale Energy Markets; Docket No. RM10-17-000, Request for Clarification or, in the Alternative, Request for Rehearing of the Public Utilities Commission of the State of California; Electric Power Supply Association: Washington, DC, USA, 2011. [Google Scholar]

- Grunewald, P.; Torriti, J. Demand response from the non-domestic sector: Early UK experiences and future opportunities. Energy Policy 2013, 61, 423–429. [Google Scholar] [CrossRef]

- Zhou, S.; Shu, Z.; Gao, Y.; Gooi, H.B.; Chen, S.; Tan, K. Demand response program in Singapore’s wholesale electricity market. Electr. Power Syst. Res. 2017, 142, 279–289. [Google Scholar] [CrossRef]

- Klobasa, M. Analysis of demand response and wind integration in Germany’s electricity market. IET Renew. Power Gener. 2010, 4, 55–63. [Google Scholar] [CrossRef]

- Arasteh, H.R.; Moghaddam, M.P.; Sheikh-El-Eslami, M.K.; Abdollahi, A. Integrating commercial demand response resources with unit commitment. Electr. Power Energy Syst. 2013, 51, 153–161. [Google Scholar] [CrossRef]

- Zhang, N.; Hu, Z.; Han, X.; Zhang, J.; Zhou, Y. A fuzzy chance-constrained program for unit commitment problem considering demand response, electric vehicle and wind power. Electr. Power Energy Syst. 2015, 65, 201–209. [Google Scholar] [CrossRef]

- Kiran, B.D.H.; Kumari, M.S. Demand response and pumped hydro storage scheduling for balancing wind power uncertainties: A probabilistic unit commitment approach. Electr. Power Energy Syst. 2016, 81, 114–122. [Google Scholar] [CrossRef]

- Aghajani, G.R.; Shayanfar, H.A.; Shayeghi, H. Presenting a multi-objective generation scheduling model for pricing demand response rate in micro-grid energy management. Energy Convers. Manag. 2015, 106, 308–321. [Google Scholar] [CrossRef]

- Kwag, H.G.; Kim, J.O. Optimal combined scheduling of generation and demand response with demand resource constraints. Appl. Energy 2012, 96, 161–170. [Google Scholar] [CrossRef]

- Dietrich, K.; Latorre, J.M.; Olmos, L.; Ramos, A. Demand response in an isolated system with high wind integration. IEEE Trans. Power Syst. 2012, 27, 20–29. [Google Scholar] [CrossRef]

- Ikeda, Y.; Ikegami, T.; Kataoka, K.; Ogimoto, K. A unit commitment model with demand response for the integration of renewable energies. In Proceedings of the 2012 IEEE Power and Energy Society General Meeting, San Diego, CA, USA, 22–26 July 2012. [Google Scholar]

- Chaoyue, Z.; Jianhui, W.; Watson, J.P.; Yongpei, G. Multi-stage robust unit commitment considering wind and demand response uncertainties. Power Syst. IEEE Trans. 2013, 28, 2708–2717. [Google Scholar]

- Reddy, K.S.; Panwar, L.K.; Kumar, R.; Panigrahi, B.K. Binary fireworks algorithm for profit based unit commitment (PBUC) problem. Electr. Power Energy Syst. 2016, 83, 270–282. [Google Scholar] [CrossRef]

- Govardhan, M.; Master, F.; Roy, R. Economic analysis of different demand response programs on unit commitment. In Proceedings of the 2014 IEEE Region 10 Conference—TENCON 2014, Bangkok, Thailand, 22–25 October 2014; pp. 1–6. [Google Scholar]

- Han, X.; You, S.; Bindner, H. Critical kick-back mitigation through improved design of demand response. Appl. Therm. Eng. 2017, 114, 1507–1514. [Google Scholar] [CrossRef]

- Wang, Q.; Wang, J.; Guan, Y. Stochastic unit commitment with uncertain demand response. IEEE Trans. Power Syst. 2013, 28, 562–563. [Google Scholar] [CrossRef]

- Liu, G.; Tomsovic, K. Robust unit commitment considering uncertain demand response. Electr. Power Syst. Res. 2015, 119, 126–137. [Google Scholar] [CrossRef]

- Magnago, F.H.; Alemany, J.; Lin, J. Impact of demand response resources on unit commitment and dispatch in a day-ahead electricity market. Electr. Power Energy Syst. 2015, 68, 142–149. [Google Scholar] [CrossRef]

- Morales-España, G.; Ramírez-Elizondo, L.; Hobbs, B.F. Hidden power system inflexibilities imposed by traditional unit commitment formulations. Appl. Energy 2017, 191, 223–238. [Google Scholar] [CrossRef]

- Reddy, G.V.S.; Ganesh, V.; Rao, C.S. Implementation of clustering based unit commitment employing imperialistic competition algorithm. Electr. Power Energy Syst. 2016, 82, 621–628. [Google Scholar] [CrossRef]

- Venkatesan, K.; Selvakumar, G.; Rajan, C. EP based PSO method for solving multi area unit commitment problem with import and export constraints. J. Electr. Eng. Technol. 2014, 9, 415–422. [Google Scholar] [CrossRef]

- Sahraei-Ardakani, M.; Rahimi-Kian, A. A dynamic replicator model of the players’ bids in an oligopolistic electricity market. Electr. Power Syst. Res. 2009, 79, 781–788. [Google Scholar] [CrossRef]

- Saha, S.K.; Ghoshal, S.P.; Kar, R.; Mandal, D. Cat Swarm Optimization algorithm for optimal linear phase FIR filter design. ISA Trans. 2013, 52, 781–794. [Google Scholar] [CrossRef] [PubMed]

- Chu, S.-C.; Tsai, P.; Pan, J.-S. Cat Swarm Optimization; Springer-Verlag: Berlin/Heidelberg, Germany, 2006. [Google Scholar]

- Panda, G.; Pradhan, P.M.; Majhi, B. IIR system identification using Cat Swarm Optimization. Expert Syst. Appl. 2011, 38, 12671–12683. [Google Scholar] [CrossRef]

- Chu, S.-C.; Tsai, F.-W. Computational Intelligence based on the behavior of Cats. Int. J. Innov. Comput. Inf. Control 2007, 3, 163–173. [Google Scholar]

- Kazarlis, S.A.; Bakirtzis, A.G.; Petridis, V. A genetic algorithm solution to the unit commitment problem. IEEE Trans. Power Syst. 1996, 11, 83–92. [Google Scholar] [CrossRef]

- Damousis, I.G.; Bakirtzis, A.G.; Dokopoulos, P.S. A solution to the unit-commitment problem using integer-coded genetic algorithm. IEEE Trans. Power Syst. 2004, 19, 1165–1172. [Google Scholar] [CrossRef]

- Eslamian, M.; Hosseinian, S.H.; Vahidi, B. Bacterial foraging-based solution to the unit-commitment problem. IEEE Trans. Power Syst. 2009, 24, 1478–1488. [Google Scholar] [CrossRef]

- Hadji, M.M.; Vahidi, B. A solution to the unit commitment problem using imperialistic competition algorithm. IEEE Trans. Power Syst. 2012, 27, 117–124. [Google Scholar] [CrossRef]

| Unit No. | ai | bi | ci |

|---|---|---|---|

| U-1 | 1000 | 16.19 | 0.00048 |

| U-2 | 970 | 17.26 | 0.00031 |

| U-3 | 700 | 16.6 | 0.002 |

| U-4 | 680 | 16.5 | 0.00211 |

| U-5 | 450 | 19.7 | 0.00398 |

| U-6 | 370 | 22.26 | 0.00712 |

| U-7 | 480 | 27.74 | 0.00079 |

| U-8 | 660 | 25.92 | 0.00413 |

| U-9 | 665 | 27.27 | 0.0022 |

| U-10 | 670 | 27.799 | 0.00173 |

| Unit No. | (MW) | (MW) | (h) | (h) | ($) | ($) | (h) | (h) |

|---|---|---|---|---|---|---|---|---|

| U-1 | 455 | 150 | 8 | 8 | 4500 | 9000 | 5 | 8 |

| U-2 | 455 | 150 | 8 | 8 | 5000 | 10,000 | 5 | 8 |

| U-3 | 130 | 20 | 5 | 5 | 550 | 1100 | 4 | −5 |

| U-4 | 130 | 20 | 5 | 5 | 560 | 1120 | 4 | −5 |

| U-5 | 162 | 25 | 6 | 6 | 900 | 1800 | 4 | −6 |

| U-6 | 80 | 20 | 3 | 3 | 170 | 340 | 2 | −3 |

| U-7 | 85 | 25 | 3 | 3 | 260 | 520 | 2 | −3 |

| U-8 | 55 | 10 | 1 | 1 | 30 | 60 | 0 | −1 |

| U-9 | 55 | 10 | 1 | 1 | 30 | 60 | 0 | −1 |

| U-10 | 55 | 10 | 1 | 1 | 30 | 60 | 0 | −1 |

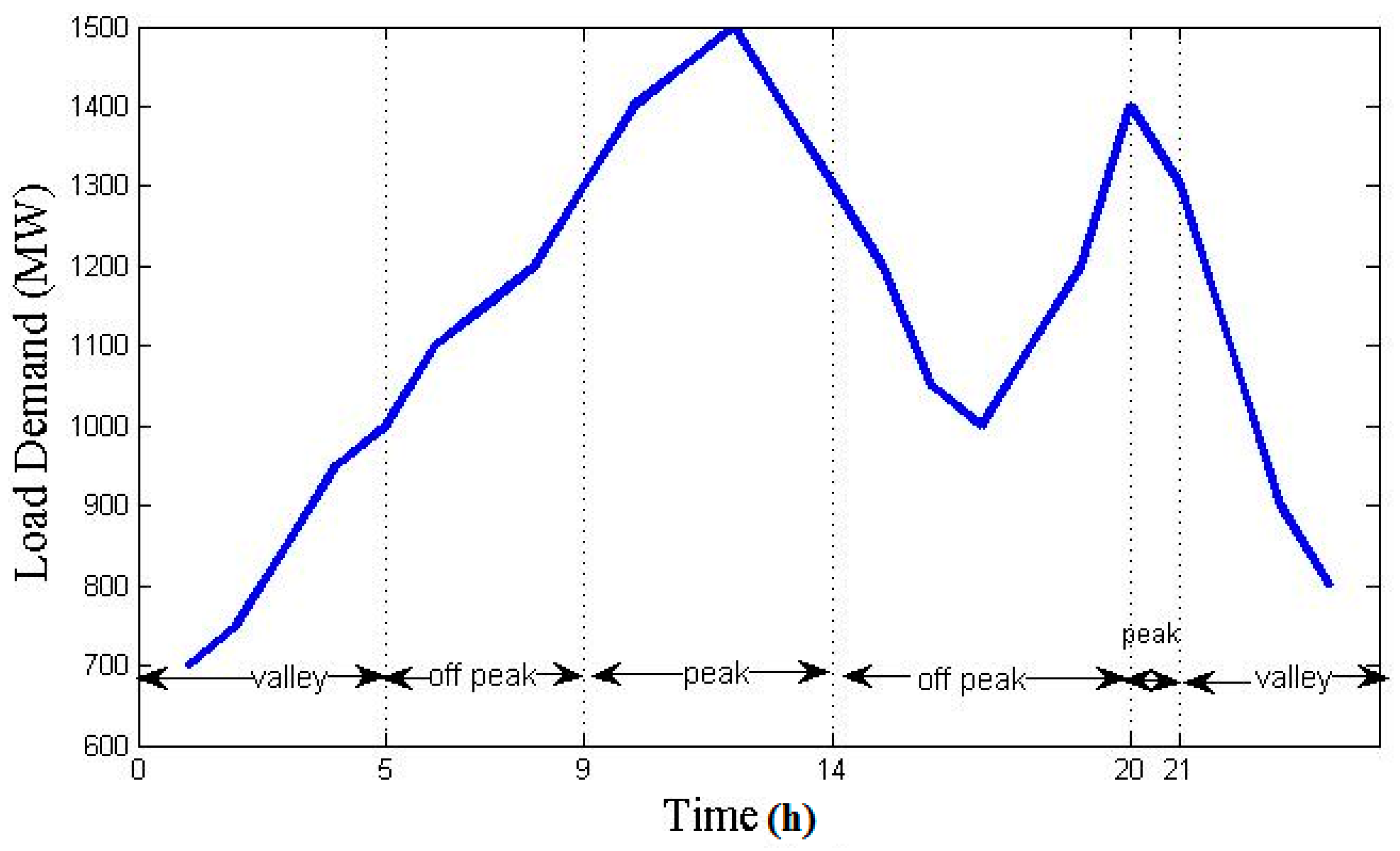

| Time (h) | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| Load Demand (MW) | 700 | 750 | 850 | 950 | 1000 | 1100 | 1150 | 1200 | 1300 | 1400 | 1450 | 1500 |

| Time (h) | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 |

| Load Demand (MW) | 1400 | 1300 | 1200 | 1050 | 1000 | 1100 | 1200 | 1400 | 1300 | 1100 | 900 | 800 |

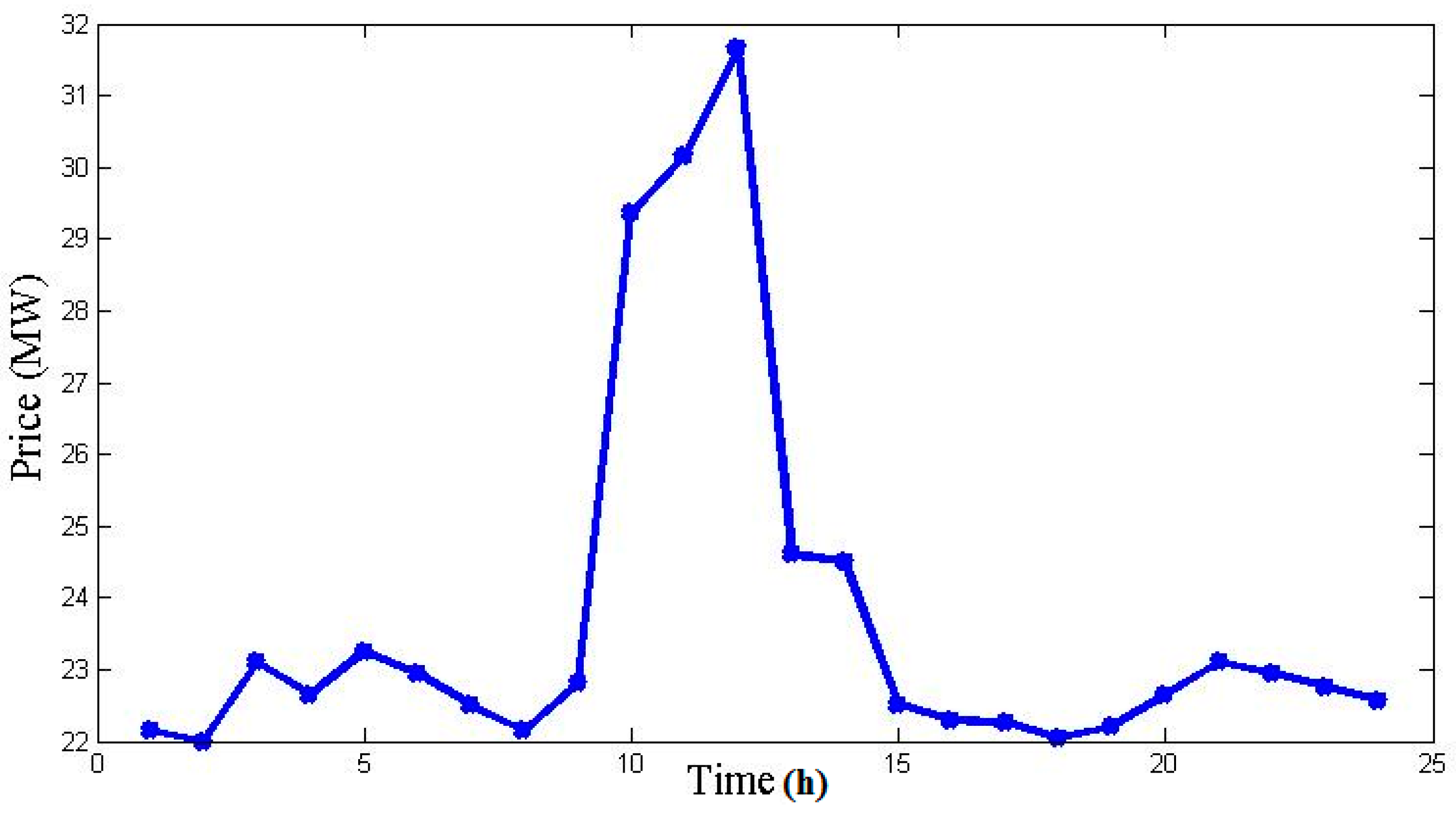

| Time (h) | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| Price ($) | 22.15 | 22 | 23.1 | 22.65 | 23.25 | 22.95 | 22.5 | 22.15 | 22.8 | 29.35 | 30.15 | 31.65 |

| Time (h) | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 |

| Price ($) | 24.6 | 24.5 | 22.5 | 22.3 | 22.25 | 22.05 | 22.2 | 22.65 | 23.1 | 22.95 | 22.75 | 22.55 |

| - | |||

|---|---|---|---|

| DRSP1 | 0.07 | 70 | 240 |

| DRSP2 | 0.095 | 100 | 200 |

| DRSP3 | 0.09 | 85 | 220 |

| DRSP4 | 0.09 | 110 | 200 |

| DRSP5 | 0.08 | 105 | 220 |

| DRSP6 | 0.075 | 120 | 190 |

| Hour | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | Reserve (MW) | ($) | SC ($) | TOcost ($) | ($) | PR ($) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 455 | 245 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 210 | 13,683.13 | 0 | 13,683.13 | 15,505 | 1821.87 |

| 2 | 455 | 295 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 160 | 14,554.50 | 0 | 14,554.50 | 16,500 | 1945.50 |

| 3 | 455 | 370 | 0 | 0 | 25 | 0 | 0 | 0 | 0 | 0 | 222 | 16,809.45 | 900 | 17,709.45 | 19,635 | 1925.55 |

| 4 | 455 | 455 | 0 | 0 | 40 | 0 | 0 | 0 | 0 | 0 | 122 | 18,597.67 | 0 | 18,597.67 | 21,517.5 | 2919.83 |

| 5 | 455 | 390 | 0 | 130 | 25 | 0 | 0 | 0 | 0 | 0 | 202 | 20,020.02 | 560 | 20,580.02 | 23,250 | 2669.98 |

| 6 | 455 | 360 | 130 | 130 | 25 | 0 | 0 | 0 | 0 | 0 | 232 | 22,387.04 | 1100 | 23,487.04 | 25,245 | 1757.96 |

| 7 | 455 | 410 | 130 | 130 | 25 | 0 | 0 | 0 | 0 | 0 | 182 | 23,261.98 | 0 | 23,261.98 | 25,875 | 2613.02 |

| 8 | 455 | 455 | 130 | 130 | 30 | 0 | 0 | 0 | 0 | 0 | 132 | 24,150.34 | 0 | 24,150.34 | 26,580 | 2429.66 |

| 9 | 455 | 455 | 130 | 130 | 85 | 20 | 25 | 0 | 0 | 0 | 197 | 27,251.06 | 860 | 28,111.06 | 29,640 | 1528.94 |

| 10 | 455 | 455 | 130 | 130 | 162 | 33 | 25 | 10 | 0 | 0 | 152 | 30,057.55 | 60 | 30,117.55 | 41,090 | 10,972.45 |

| 11 | 455 | 455 | 130 | 130 | 162 | 73 | 25 | 10 | 10 | 0 | 157 | 31,916.06 | 60 | 31,976.06 | 43,717.5 | 11,741.44 |

| 12 | 455 | 455 | 130 | 130 | 162 | 80 | 25 | 43 | 10 | 10 | 162 | 33,890.16 | 60 | 33,950.16 | 47,475 | 13,524.84 |

| 13 | 455 | 455 | 130 | 130 | 162 | 33 | 25 | 10 | 0 | 0 | 152 | 30,057.55 | 0 | 30,057.55 | 34,440 | 4382.45 |

| 14 | 455 | 455 | 130 | 130 | 85 | 20 | 25 | 0 | 0 | 0 | 197 | 27,251.06 | 0 | 27,251.06 | 31,850 | 4598.94 |

| 15 | 455 | 455 | 130 | 130 | 30 | 0 | 0 | 0 | 0 | 0 | 132 | 24,150.34 | 0 | 24,150.34 | 27,000 | 2849.66 |

| 16 | 455 | 310 | 130 | 130 | 25 | 0 | 0 | 0 | 0 | 0 | 282 | 21,513.66 | 0 | 21,513.66 | 23,415 | 1901.34 |

| 17 | 455 | 260 | 130 | 130 | 25 | 0 | 0 | 0 | 0 | 0 | 332 | 20,641.82 | 0 | 20,641.82 | 22,250 | 1608.18 |

| 18 | 455 | 360 | 130 | 130 | 25 | 0 | 0 | 0 | 0 | 0 | 232 | 22,387.04 | 0 | 22,387.04 | 24,255 | 1867.96 |

| 19 | 455 | 455 | 130 | 130 | 30 | 0 | 0 | 0 | 0 | 0 | 132 | 24,150.34 | 0 | 24,150.34 | 26,640 | 2489.66 |

| 20 | 455 | 455 | 130 | 130 | 162 | 33 | 25 | 10 | 0 | 0 | 152 | 30,057.55 | 490 | 30,547.55 | 31,710 | 1162.45 |

| 21 | 455 | 455 | 130 | 130 | 85 | 20 | 25 | 0 | 0 | 0 | 197 | 27,251.06 | 0 | 27,251.06 | 30,030 | 2778.94 |

| 22 | 455 | 455 | 0 | 0 | 145 | 20 | 25 | 0 | 0 | 0 | 137 | 22,735.52 | 0 | 22,735.52 | 25,245 | 2509.48 |

| 23 | 455 | 425 | 0 | 0 | 0 | 20 | 0 | 0 | 0 | 0 | 90 | 17,645.36 | 0 | 17,645.36 | 20,475 | 2829.64 |

| 24 | 455 | 345 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 110 | 15,427.42 | 0 | 15,427.42 | 18,040 | 2612.58 |

| TOTAL COST ($) | 55,9847.7 | 4090 | 563,937.7 | 651,380 | 87,442.31 | |||||||||||

| Hour | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | Reserve (MW) | ($) | SC ($) | TOcost ($) | ($) | PR ($) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 455 | 245 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 210 | 13,683.13 | 0 | 13,683.13 | 15,505 | 1821.87 |

| 2 | 455 | 295 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 160 | 14,554.49 | 0 | 14,554.5 | 16,500 | 1945.5 |

| 3 | 455 | 370 | 0 | 0 | 25 | 0 | 0 | 0 | 0 | 0 | 222 | 16,809.45 | 900 | 17,709.45 | 19,635 | 1925.55 |

| 4 | 455 | 455 | 0 | 0 | 40 | 0 | 0 | 0 | 0 | 0 | 122 | 18,597.67 | 0 | 18,597.67 | 21,517.5 | 2919.83 |

| 5 | 455 | 390 | 0 | 130 | 25 | 0 | 0 | 0 | 0 | 0 | 202 | 20,020.02 | 560 | 20,580.02 | 23,250 | 2669.98 |

| 6 | 455 | 360 | 130 | 130 | 25 | 0 | 0 | 0 | 0 | 0 | 232 | 22,387.04 | 1100 | 23,487.04 | 25,245 | 1757.95 |

| 7 | 455 | 410 | 130 | 130 | 25 | 0 | 0 | 0 | 0 | 0 | 182 | 23,261.98 | 0 | 23,261.98 | 25,875 | 2613.02 |

| 8 | 455 | 455 | 130 | 130 | 30 | 0 | 0 | 0 | 0 | 0 | 132 | 24,150.34 | 0 | 24,150.34 | 26,580 | 2429.66 |

| 9 | 405 | 360 | 130 | 120 | 25 | 0 | 0 | 0 | 0 | 0 | 292 | 21,386.63 | 0 | 21,386.63 | 23,712 | 2325.37 |

| 10 | 455 | 380 | 130 | 130 | 25 | 0 | 0 | 0 | 0 | 0 | 212 | 22,736.83 | 0 | 22,736.83 | 32,872 | 10,135.17 |

| 11 | 455 | 395 | 130 | 130 | 25 | 0 | 25 | 0 | 0 | 0 | 257 | 24,173.33 | 520 | 24,693.33 | 34,974 | 10,280.67 |

| 12 | 455 | 435 | 130 | 130 | 25 | 0 | 25 | 0 | 0 | 0 | 217 | 24,874.02 | 0 | 24,874.02 | 37,980 | 13,105.98 |

| 13 | 455 | 355 | 130 | 130 | 25 | 0 | 25 | 0 | 0 | 0 | 297 | 23,473.63 | 0 | 23,473.63 | 27,552 | 4078.37 |

| 14 | 410 | 355 | 130 | 120 | 25 | 0 | 0 | 0 | 0 | 0 | 292 | 21,382.13 | 0 | 21,382.13 | 25,480 | 4097.87 |

| 15 | 455 | 435 | 130 | 130 | 50 | 0 | 0 | 0 | 0 | 0 | 132 | 24,199.99 | 0 | 24,199.99 | 27,000 | 2800.01 |

| 16 | 415 | 350 | 130 | 130 | 25 | 0 | 0 | 0 | 0 | 0 | 282 | 21,547.94 | 0 | 21,547.94 | 23,415 | 1867.06 |

| 17 | 455 | 260 | 130 | 130 | 25 | 0 | 0 | 0 | 0 | 0 | 332 | 20,641.82 | 0 | 20,641.82 | 22,250 | 1608.18 |

| 18 | 455 | 350 | 130 | 130 | 35 | 0 | 0 | 0 | 0 | 0 | 232 | 22,411.63 | 0 | 22,411.63 | 24,255 | 1843.37 |

| 19 | 455 | 445 | 130 | 130 | 40 | 0 | 0 | 0 | 0 | 0 | 132 | 24,174.74 | 0 | 24,174.74 | 26,640 | 2465.26 |

| 20 | 455 | 380 | 130 | 130 | 25 | 0 | 0 | 0 | 0 | 0 | 212 | 22,736.83 | 0 | 22,736.83 | 25,368 | 2631.17 |

| 21 | 415 | 360 | 110 | 110 | 25 | 20 | 0 | 0 | 0 | 0 | 372 | 21,859.06 | 340 | 22,199.06 | 24,024 | 1824.94 |

| 22 | 455 | 445 | 0 | 120 | 35 | 45 | 0 | 0 | 0 | 0 | 182 | 22,398.79 | 0 | 22,398.79 | 25,245 | 2846.21 |

| 23 | 455 | 425 | 0 | 0 | 0 | 20 | 0 | 0 | 0 | 0 | 90 | 17,645.36 | 0 | 17,645.36 | 20,475 | 2829.64 |

| 24 | 455 | 345 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 110 | 15,427.42 | 0 | 15,427.42 | 18,040 | 2612.58 |

| TOTAL COST ($) | 504,534.29 | 3420 | 507,954.3 | 593,389.5 | 85,435.21 | |||||||||||

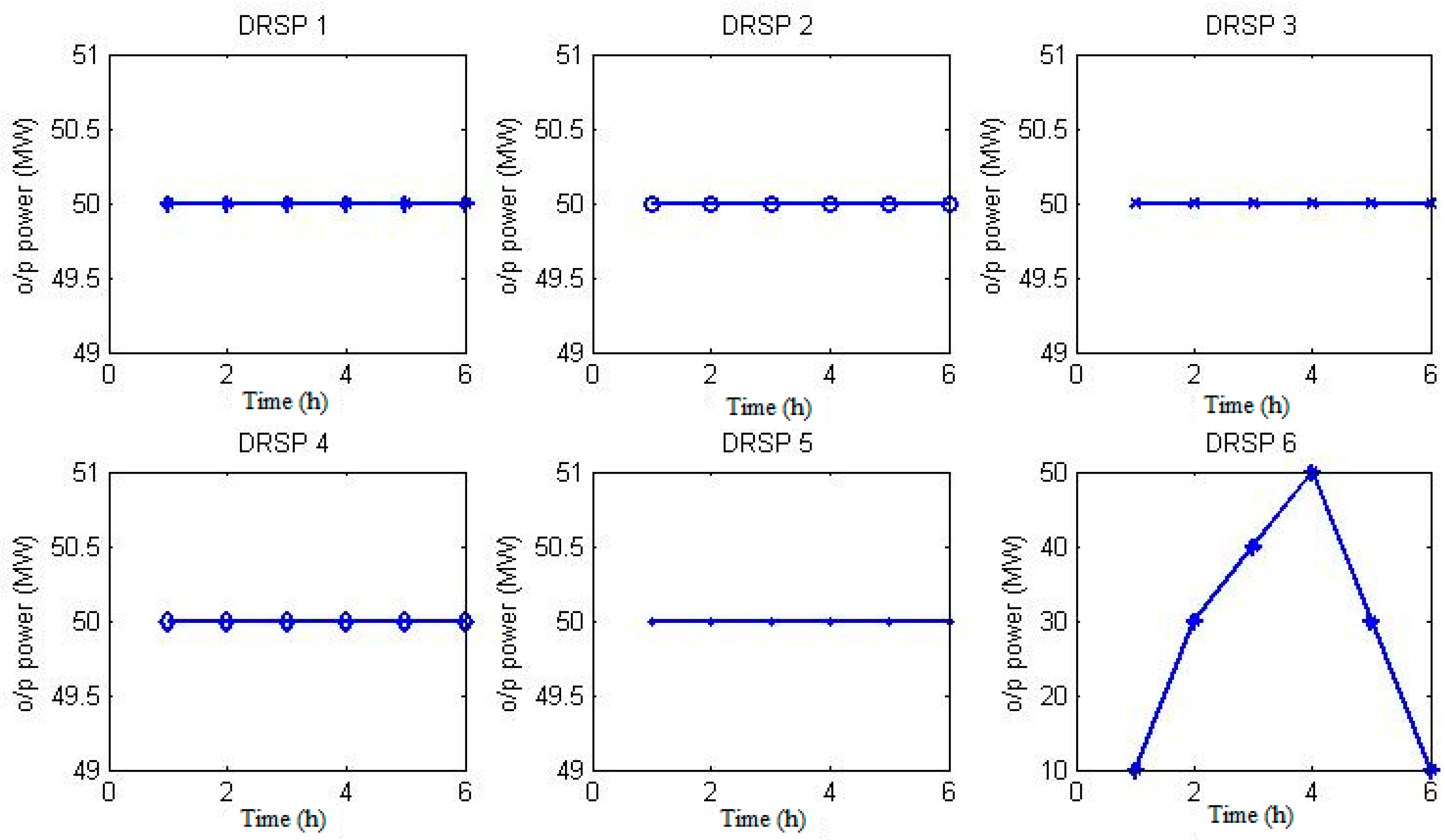

| Hour | DRSP 1 | DRSP 2 | DRSP 3 | DRSP 4 | DRSP 5 | DRSP 6 | Reserve (MW) | ($) | ($) | |

|---|---|---|---|---|---|---|---|---|---|---|

| 9 | 50 | 50 | 50 | 50 | 50 | 10 | 40 | 4810 | 5928 | 1118 |

| 10 | 50 | 50 | 50 | 50 | 50 | 30 | 20 | 5110 | 8218 | 3108 |

| 11 | 50 | 50 | 50 | 50 | 50 | 40 | 10 | 5282.5 | 8743.5 | 3461 |

| 12 | 50 | 50 | 50 | 50 | 50 | 50 | 0 | 5470 | 9495 | 4025 |

| 13 | 50 | 50 | 50 | 50 | 50 | 30 | 20 | 5110 | 6888 | 1778 |

| 14 | 50 | 50 | 50 | 50 | 50 | 10 | 40 | 4810 | 6370 | 1560 |

| 20 | 50 | 50 | 50 | 50 | 50 | 30 | 20 | 5110 | 6342 | 1232 |

| 21 | 50 | 50 | 50 | 50 | 50 | 10 | 40 | 4810 | 6006 | 1196 |

| TOTAL COST ($) | 40,512.5 | 57,990.5 | 17,478 | |||||||

| - | ($) | SC ($) | TOcost ($) | ($) | PR ($) | % Rise |

|---|---|---|---|---|---|---|

| TUC (LR) [45] | - | - | 565,825 | 651,380 | 85,555 | 13.13 |

| TUC (BCGA) [46] | - | - | 567,367 | 651,380 | 84,013 | 12.89 |

| TUC (ICGA) [46] | - | - | 566,404 | 651,380 | 84,976 | 13.05 |

| TUC (BFA) [47] | - | - | 565,872 | 651,380 | 85,508 | 13.13 |

| TUC (ICA) [48] | - | - | 563,938 | 651,380 | 87,442 | 13.42 |

| TUC (CSO) | 559,847.7 | 4090 | 563,937.7 | 651,380 | 87,442.31 | 13.42 |

| DRUC | 504,534.3 | 3420 | 507,954.3 | 593,389.5 | 85,435.21 | 14.40 |

| DRSP | - | - | 40,512.5 | 57,990.5 | 17,478 | 30.14 |

| DRUC + DRSP | - | - | 548,466.8 | 651,380 | 102,913.2 | 15.80 |

| % Difference | Total cost variation = 2.74% | Total profit variation = 2.37% | ||||

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Selvakumar, K.; Vijayakumar, K.; Boopathi, C.S. Demand Response Unit Commitment Problem Solution for Maximizing Generating Companies’ Profit. Energies 2017, 10, 1465. https://doi.org/10.3390/en10101465

Selvakumar K, Vijayakumar K, Boopathi CS. Demand Response Unit Commitment Problem Solution for Maximizing Generating Companies’ Profit. Energies. 2017; 10(10):1465. https://doi.org/10.3390/en10101465

Chicago/Turabian StyleSelvakumar, K., K. Vijayakumar, and C. S. Boopathi. 2017. "Demand Response Unit Commitment Problem Solution for Maximizing Generating Companies’ Profit" Energies 10, no. 10: 1465. https://doi.org/10.3390/en10101465