Modeling of Electricity Demand for Azerbaijan: Time-Varying Coefficient Cointegration Approach

Abstract

:1. Introduction

2. Literature Review

2.1. Previous Studies Investigating Electricity Demand in Azerbaijan

2.2. Previous Studies Using Time-Varying Methods

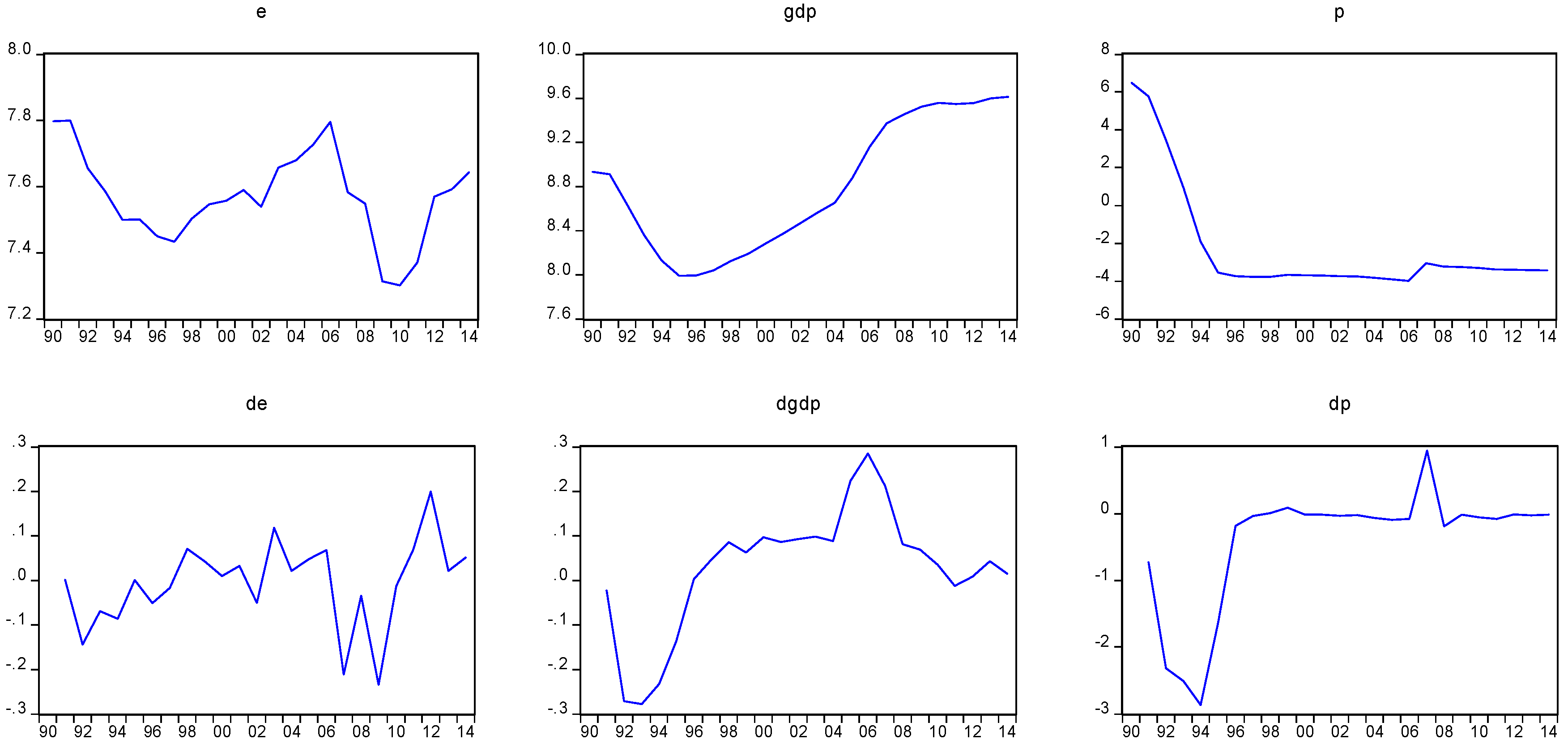

3. Data

4. Econometric Methodology

4.1. Unit Root Tests

4.2. Time-Varying Coefficient Cointegration Approach

5. Empirical Estimation and Discussion

5.1. Empirical Estimation

5.1.1. Unit Root Test Results

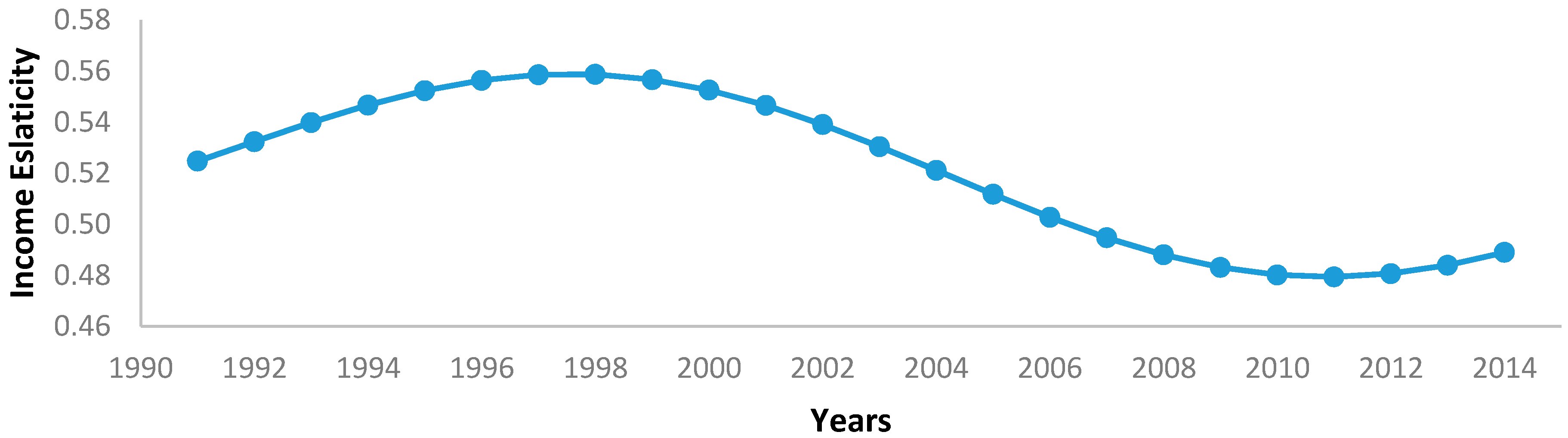

5.1.2. TVC Estimation Results

5.2. Discussion of the Estimation Results

6. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Bentzen, J.; Engsted, T. Short-and long-run elasticities in energy demand: A cointegration approach. Energy Econ. 1993, 15, 9–16. [Google Scholar] [CrossRef]

- Reiss, P.; White, M. Household electricity demand, revisited. Rev. Econ. Stud. 2005, 72, 853–858. [Google Scholar] [CrossRef]

- Karimu, A.; Brännlund, R. Functional form and aggregate energy demand elasticities: A nonparametric panel approach for 17 OECD countries. Energy Econ. 2013, 36, 19–27. [Google Scholar] [CrossRef]

- Horowitz, M.J. Changes in electricity demand in the United States from the 1970s to 2003. Energy J. 2007, 28, 93–119. [Google Scholar] [CrossRef]

- Labandeira, X.; Labeaga, J.M.; Lopez-Otero, X. Estimation of elasticity price of electricity with incomplete information. Energy Econ. 2012, 34, 627–633. [Google Scholar] [CrossRef]

- Krishnamurthy, C.K.B.; Kriström, B. A cross-country analysis of residential electricity demand in 11 OECD-countries. Resour. Energy Econ. 2015, 39, 68–88. [Google Scholar] [CrossRef]

- Prosser, R.D. Demand elasticities in OECD: Dynamical aspects. Energy Econ. 1985, 7, 9–12. [Google Scholar] [CrossRef]

- Fell, H.; Li, S.; Paul, A. A new look at residential electricity demand using household expenditure data. Int. J. Ind. Organ. 2014, 33, 37–47. [Google Scholar] [CrossRef]

- Sun, Y.; Yu, Y. Revisiting the residential electricity demand in the United States: A dynamic partial adjustment modelling approach. Soc. Sci. J. 2017, 54, 295–304. [Google Scholar] [CrossRef]

- Flaig, G. Household production and the short- and long-run demand for electricity. Energy Econ. 1990, 12, 116–121. [Google Scholar] [CrossRef]

- Narayan, P.K.; Smyth, R. The residential demand for electricity in Australia: An application of the bounds testing approach to cointegration. Energy Policy 2005, 33, 467–474. [Google Scholar] [CrossRef]

- Arisoy, I.; Ozturk, I. Estimating industrial and residential electricity demand in Turkey: A time varying parameter approach. Energy 2014, 66, 959–964. [Google Scholar] [CrossRef]

- Salisu, A.A.; Ayinde, T.O. Modeling energy demand: Some emerging issues. Renew. Sustain. Energy Rev. 2016, 54, 1470–1480. [Google Scholar] [CrossRef]

- Haas, R.; Schipper, L. Residential energy demand in OECD-countries and the role of irreversible efficiency improvements. Energy Econ. 1998, 20, 421–442. [Google Scholar] [CrossRef]

- Chang, Y.; Martinez-Chombo, E. Electricity Demand Analysis Using Cointegration and Error-Correction Models with Time Varying Parameters: The Mexican Case; Working Paper 2003-08; Department of Economics, Rice University: Houston, TX, USA, 2003. [Google Scholar]

- Terasvirta, T.; Anderson, H.M. Characterizing nonlinearities in business cycles using smooth transition autoregressive models. J. Appl. Econ. 1992, 7, S119–S136. [Google Scholar] [CrossRef]

- Dargay, J.M. Are Price and Income Elasticities of Demand Constant? Working Paper 16; Oxford Institute for Energy Studies: Oxford, UK, 1992. [Google Scholar]

- Stock, J.H.; Watson, M.W. Evidence on structural instability in macroeconomic time series relations. J. Bus. Econ. Stat. 1996, 14, 11–30. [Google Scholar]

- Phillips, P.C.B. Trending time series and macroeconomic activity: Some present and future challenges. J. Econ. 2001, 100, 21–27. [Google Scholar] [CrossRef]

- Lucas, R.R. Econometric policy evaluation: A critique. Carnegie-Rochester Conf. Ser. Public Policy 1976, 1, 19–46. [Google Scholar] [CrossRef]

- Park, J.Y.; Hahn, S.B. Cointegrating regressions with time varying coefficients. Econ. Theory 1999, 15, 664–703. [Google Scholar] [CrossRef]

- Chang, Y.; Kim, C.K.; Miller, J.I.; Park, J.Y.; Park, S. Time-varying Long-run Income and Output Elasticities of Electricity Demand with an Application to Korea. Energy Econ. 2014, 46, 334–347. [Google Scholar] [CrossRef]

- Hasanov, F.J.; Hunt, L.C.; Mikayilov, C.I. Modeling and Forecasting Electricity Demand in Azerbaijan Using Cointegration Techniques. Energies 2016, 9, 1045. [Google Scholar] [CrossRef]

- Hasanov, F.; Hasanli, K. Why had the Money Market Approach been irrelevant in explaining inflation in Azerbaijan during the rapid economic growth period? Middle East. Financ. Econ. 2011, 10, 1–11. [Google Scholar]

- World Bank. Word Development Indicators. Available online: http://www.worldbank.org (accessed on 21 September 2017).

- Vidadili, N.; Suleymanov, E.; Bulut, C.; Mahmudlu, C. Transition to renewable energy and sustainable energy development in Azerbaijan. Renew. Sustain. Energy Rev. 2017, 80, 1153–1161. [Google Scholar] [CrossRef]

- Hasanov, F.J.; Mikayilov, J.I. The impact of age groups on consumption of residential electricity in Azerbaijan. Communist Post-Communist Stud. 2017, in press. [Google Scholar] [CrossRef]

- Dietz, T.; Rosa, E.A. Rethinking the environmental impacts of population, affluence, and technology. Hum. Ecol. Rev. 1994, 1, 277–300. [Google Scholar]

- Dietz, T.; Rosa, E.A. Effects of population and affluence on CO2 emissions. Proc. Natl. Acad. Sci. USA 1997, 94, 175–179. [Google Scholar] [CrossRef] [PubMed]

- Bildirici, M.E.; Kayikci, F. Economic growth and electricity consumption in former Soviet Republics. Energy Econ. 2012, 34, 747–753. [Google Scholar] [CrossRef]

- Klytchnikova, I. Methodology and Estimation of the Welfare Impact of Energy Reforms on Households in Azerbaijan. Ph.D. Thesis, University of Maryland, College Park, MD, USA, 2006. [Google Scholar]

- Azerenerji Joint Stock Company (AJSC). Electricity Forecast Report; Azerenerji: Baku, Azerbaijan, 2009. [Google Scholar]

- Azerenerji Joint Stock Company (AJSC). Electricity Forecast Report; Azerenerji: Baku, Azerbaijan, 2013. [Google Scholar]

- Japan International Cooperation Agency (JICA); Tokyo Electric Power Services Co. (TEPSCO). Study for Electric Power Sector in Azerbaijan; JICA: Tokyo, Japan; TEPSCO: Tokyo, Japan, 2013. [Google Scholar]

- Fichtner. Update of the Power Sector Master Plan of Azerbaijan 2013–2025; Fichtner: Stuttgart, Germany, 2013. [Google Scholar]

- Mercados. Azerenerji Generation and Transmission Master Plan 2010–2025; Fichtner: Stuttgart, Germany, 2010. [Google Scholar]

- Inglesi-Lotz, R. The evolution of price elasticity of electricity demand in South Africa: A Kalman filter application. Energy Policy 2011, 39, 3690–3696. [Google Scholar] [CrossRef]

- Adom, P.K. Time-varying analysis of aggregate electricity demand in Ghana: A rolling analysis. OPEC Energy Rev. 2013, 37, 63–80. [Google Scholar] [CrossRef]

- Chang, H.; Hsing, Y. The demand for residential electricity: New evidence on time-varying elasticities. Appl. Econ. 1991, 23, 1251–1256. [Google Scholar] [CrossRef]

- Engle, R.F.; Granger, C.J. Co-integration and Error Correction: Representation, Estimation and Testing. Econometrica 1987, 55, 251–276. [Google Scholar] [CrossRef]

- International Energy Agency. Energy Statistics. Available online: www.iea.org (accessed on 10 May 2016).

- State Agency of Statistics of Azerbaijan. Available online: http://www.astat.org (accessed on 6 July 2016).

- Dickey, D.; Fuller, W. Likelihood Ratio Statistics for Autoregressive Time Series with a Unit Root. Econometrica 1981, 49, 1057–1072. [Google Scholar] [CrossRef]

- Phillips, P.B.; Perron, P. Testing for Unit Roots in Time Series Regression. Biometrika 1988, 75, 335–346. [Google Scholar] [CrossRef]

- Silk, J.; Joutz, F. Short and long-run elasticities in US residential electricity demand: A co-integration approach. Energy Econ. 1997, 19, 493–513. [Google Scholar] [CrossRef]

- Park, J.Y. Canonical Cointegrating Regressions. Econometrica 1992, 60, 119–143. [Google Scholar] [CrossRef]

- Park, J.Y. Testing for unit roots and cointegration by variable addition. In Advances in Econometrics; Rhodes, G.F., Fomby, T.B., Eds.; JAI Press: Greenwich, UK, 1990; pp. 107–133. [Google Scholar]

- MacKinnon, J. Critical Values for Cointegration Test. In Long-Run Economic Relationships; Engle, R., Granger, C., Eds.; Oxford University Press: Oxford, UK, 1991. [Google Scholar]

- Zivot, E.; Andrews, D. Further evidence of great crash, the oil price shock and unit root hypothesis. J. Bus. Econ. Stat. 1992, 10, 251–270. [Google Scholar]

- Johansen, S. Statistical analysis of cointegration vectors. J. Econ. Dyn. Control 1988, 12, 231–254. [Google Scholar] [CrossRef]

- Johansen, S.; Juselius, K. Maximum likelihood estimation and inference on cointegration with applications to the demand for money. Oxf. Bull. Econ. Stat. 1990, 52, 169–210. [Google Scholar] [CrossRef]

- Pesaran, H.M.; Shin, Y. An Autoregressive Distributed Lag Modeling Approach to Cointegration Analysis. In Econometrics and Economic Theory in the 20th Century: The Ragnar Frisch Centennial Symposium; Strom, S., Ed.; Cambridge University Press: Cambridge, UK, 1999. [Google Scholar]

- Opitz, P.; Kharazyan, A.; Pasoyan, A.; Gurbanov, M.; Margvelashvili, M. Sustainable Energy Pathways in the South Caucasus: Opportunities for Development and Political Choices; South Caucasus Regional Office of the Heinrich Boell Foundation: Tbilisi, Georgia, 2015. [Google Scholar]

- Chang, Y.; Choi, Y.; Kim, C.S.; Miller, J.I.; Park, J.Y. Disentangling temporal patterns in elasticities: A functional coefficient panel analysis of electricity demand. Energy Econ. 2016, 60, 232–243. [Google Scholar] [CrossRef]

| Variable | The ADF Test | The PP Test | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Test Value | C | t | None | k | Test Value | C | t | None | |

| e | −3.787 ** | x | 2 | −2.446 | x | ||||

| p | −7.794 *** | x | 1 | −2.990 | x | ||||

| gdp | −6.379 *** | x | 1 | −2.736 | x | ||||

| e | −3.846 *** | x | 0 | −3.909 *** | x | ||||

| p | −1.581 | x | 0 | −1.644 * | x | ||||

| gdp | −3.436 ** | x | 1 | −1.567 | |||||

| Test for Joint Significance of Time-Varying Coefficients | Variable Addition Test | ||||||

|---|---|---|---|---|---|---|---|

| Test statistics | 1% CV | 5% CV | 10% CV | Test statistics | 1% CV | 5% CV | 10% CV |

| 44.43 | 15.09 | 11.07 | 9.24 | 59.89 | 13.18 | 9.49 | 7.78 |

| Statistics | Coefficient | Parameters of the Time-Varying Income Coefficient | ||||

|---|---|---|---|---|---|---|

| Heading | τ | β | λ0 | λ1: | λ2: | λ3: |

| estimates | 3.088 | −0.013 | 0.537 | −0.065 | −0.006 | 0.032 |

| t-values | 2.828 | −0.457 | 4.224 | −1.765 | −0.590 | 2.587 |

| p-values | 0.011 | 0.653 | 0.000 | 0.096 | 0.563 | 0.019 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mikayilov, J.I.; Hasanov, F.J.; Bollino, C.A.; Mahmudlu, C. Modeling of Electricity Demand for Azerbaijan: Time-Varying Coefficient Cointegration Approach. Energies 2017, 10, 1918. https://doi.org/10.3390/en10111918

Mikayilov JI, Hasanov FJ, Bollino CA, Mahmudlu C. Modeling of Electricity Demand for Azerbaijan: Time-Varying Coefficient Cointegration Approach. Energies. 2017; 10(11):1918. https://doi.org/10.3390/en10111918

Chicago/Turabian StyleMikayilov, Jeyhun I., Fakhri J. Hasanov, Carlo A. Bollino, and Ceyhun Mahmudlu. 2017. "Modeling of Electricity Demand for Azerbaijan: Time-Varying Coefficient Cointegration Approach" Energies 10, no. 11: 1918. https://doi.org/10.3390/en10111918