2.1. Aggregate Production Functions (APFs)

APFs seek to describe economic output via factors of production, such as capital, labor, and energy. The origins of APFs can be traced to von Thünen in the 1840s [

17,

18], and the meaningfulness of models built using APFs has been debated nearly as long. Mishra [

18] provides an excellent history of production functions and a detailed discussion of the key controversies surrounding their use. Brockway et al. [

19] is a “sister” paper to this and provides a general, non-empirical discussion of the landscape around CES APFs, summarizing several notable critics and their arguments [

5,

6,

20,

21,

22] and providing guidance for the application of the CES APF to economic growth modeling. Recent application of cointegration analysis by Santos et al. [

23] suggests that APFs can provide statistically significant long-run relationships among economic output, capital, labor, and energy, thereby avoiding the critique of APFs in Felipe and Fisher [

7]. The issues swirling around APFs are sometimes acknowledged by practitioners. For example, Miller [

24] (p. 10) reviewed different APFs for use in the US Congressional Budget Office (CBO) model, and suggested that “even if our [CBO model] is misspecified and the parameters are in fact statistical artefacts, they may still be useful for forecasting purposes”. Our approach is (a) to acknowledge the widespread usage of APFs despite the various concerns and (b) to demonstrate empirically the effects of APF modeling choices through to policy.

We apply and evaluate APFs at the national level, although APFs can be used at the sectoral level, too. Many of the issues discussed here arise from the statistical estimation of APF parameters, and those issues will pertain to both national and sectoral levels.

Historically, the most common mainstream APF has been the Cobb-Douglas (C-D) function:

where economic output (

y) is written as a function of the traditional factors of production capital (

k) and labor (

l). Greek letters in this and other APFs represent unknown parameters that must be estimated. When referring to parameter estimates, we add the Latin circumflex (e.g.,

).

In the C-D APF, the parameters

θ,

, and

are, respectively, a scale parameter and output elasticities for capital and labor. Output elasticity is defined as the normalized partial derivative of economic output with respect to a factor of production,

. The constraint

is often applied to impose constant returns to scale. (Under constant returns to scale, economic output increases by the same proportion as all inputs increase, all other things being equal. For increasing returns to scale,

and output increases by a greater proportion than all inputs. For decreasing returns to scale,

.) The term

is known as the Solow residual, here represented as an exponential with growth rate

λ. (The Solow residual is a representation of exogenous factors that influence economic growth, and, as such, represents that part of economic growth not explained by endogenous factors of production. In the case of Equation (

1), the endogenous factors of production are

k and

l. The Solow residual is often attributed to “technology”. In Equation (

1), the Solow residual multiplies all endogenous factors of production and is sometimes called “total factor productivity”.) Solow’s study [

8] of the US economy using Equation (

1) “was a landmark in the development of growth accounting” [

25] and started a burgeoning literature on the topic.

Equation (

1) can be generalized in a natural way to include additional factors of production (e.g., energy,

e):

Disadvantages of the C-D APF are (a) output elasticities (

α) that are constant through time and (b) elasticities of substitution (

σ) that are fixed at 1. The Hicks elasticity of substitution between factors of production

and

is defined as

and quantifies the ease with which

and

can substitute for each other in an economy. (See Sorrell [

26], Equation 24.)

indicates that

and

are perfect complements.

indicates that

and

are perfect substitutes. (See Sorrell [

26] for discussion of and taxonomy for various elasticities of substitution.) The Constant Elasticity of Substitution (CES) APF [

27] generalizes Equation (

1) and addresses these drawbacks:

In Equation (

3),

provides weighting for the factors of production, and the elasticity of substitution is easily accessible from model parameters:

. Equation (

3) assumes Hicks-neutral technical change (

augments all factors of production), because, as Henningsen and Henningsen [

28] (p. 25) note, a consensus approach to non-neutral technical change (wherein each factor of production has its own

A) has not yet emerged. (See Frieling and Madlener [

29] for an example of factor-specific technical change.) If

(

), the CES APF (Equation (

3)) simplifies to the C-D APF (Equation (

1)).

Generalization to three factors of production can be accomplished by nesting two factors of production (

and

) against the third (

):

where

,

, and

are permutations of the factors of production

k,

l, and

e.

Table 1 shows three of six nesting structures for Equation (

4). The other three nesting structures [

,

, and

] produce identical fits to historical data. Note that Equation (

3) is a degenerate form of Equation (

4) with

,

,

, and

ρ undetermined.

Because output elasticity (

Section 3.2) is unlikely to be constant over time and because the substitutability and complementarity of factors of production may vary from one economy to the next and from factor to factor within an economy, the CES APF is potentially better suited to describe economic output than the C-D APF. However, the increased suitability of the CES APF comes at a cost: with more parameters and a non-linear structure (in logarithmic space), the CES APF is more demanding than the C-D APF in terms of fitting technique, computational resources, and economic interpretation. The C-D APF (Equation (

1)) has three free parameters (

θ,

λ,

, with

for constant returns to scale), and the CES APF (Equation (

3)) has four free parameters (

θ,

λ,

,

).

Brockway et al. [

19] found that the two most common APFs are C-D (Equation (

1)) and CES (Equation (

3)), with the more flexible CES function overtaking Cobb-Douglas recently [

12,

24,

30,

31,

32]. (Brockway et al. [

19] suggest several reasons for the change: (a) critique of the C-D APF [

7]; (b) empirical studies suggesting CES APFs give improved results versus the C-D APF [

33]; (c) interest in elasticity of substitution (

) which cannot be assessed by C-D APFs which assume

[

34]; (d) increasing use of the CES APF in government economic models [

10,

35]; and (e) increasing computing capability to estimate parameters of CES APFs [

28].) Other functions are also in use and worth noting here, including the translog production function [

36,

37] and cost functions that use factor prices as inputs instead of aggregated production factors [

38]. Notably, the CES APF is cited more than twice as often as the translog APF over the last five decades ([

19] (

Figure 1)). Trade-offs exist: Kander and Stern [

39] (p. 58) considered both CES and translog functions, deciding “that it was better to model some of the main features more reliably or believably [via CES] than to attempt to model many features of the data less reliably [via translog]”. We focus on CES-based APFs, because they are more prevalent in the theory-to-policy process than alternatives (e.g., the translog APF) and because they are amenable to empirical applications (unlike cost functions which require price data that can be difficult to obtain.) Indeed, our focus on CES-based APFs reflects the practical reality that CES APFs and their estimated parameters are in widespread use today and thus play a crucial role in important economic models [

24,

40] and resulting energy and economic policies [

16,

41]. (Elasticities of substitution (

σ) are especially important. See

Section 5.3 for further discussion.)

2.3. Modeling Choices

Our critical evaluation of the theory-to-policy process and the role of APFs therein focuses on four modeling choices. The first three choices are interrelated and can be illustrated by considering the role of energy in economic growth.

Many integrated climate-change/economic models and many ecological/biophysical economics models assume energy is a factor of production, although most mainstream economic growth models typically devalue or altogether ignore energy as a factor of production. Standard economic theory distinguishes between primary factors of production (those that facilitate production but neither become part of the product nor experience significant transformation as a result of the production process) and intermediate factors of production (those created during and used up entirely in production processes). Capital and labor are considered primary factors of production, while energy is considered an intermediate factor that can be “produced” by some combination of capital investment and labor (with technology). Thus, under standard economic theory, economic growth is essentially independent of energy consumption [

51].

The mainstream economic approach is formalized in a cost share theorem leading to a Cost Share Principle (CSP). (We differente theorem from principle as follows: theorems have specific if/then structures, while principles are assertions that can be applied to analyses.) The cost share theorem states that if (a) an homogeneous APF of degree one correctly models the effects of some factors of production on economic output; (b) there is perfect competition; and (c) the economy is at equilibrium with no surplus or scarce resources, then the following Cost Share Principle applies: output elasticity is equal to cost share for each factor of production. (A function is homogenous of degree one if . The C-D APF under constant returns to scale is one such function.)

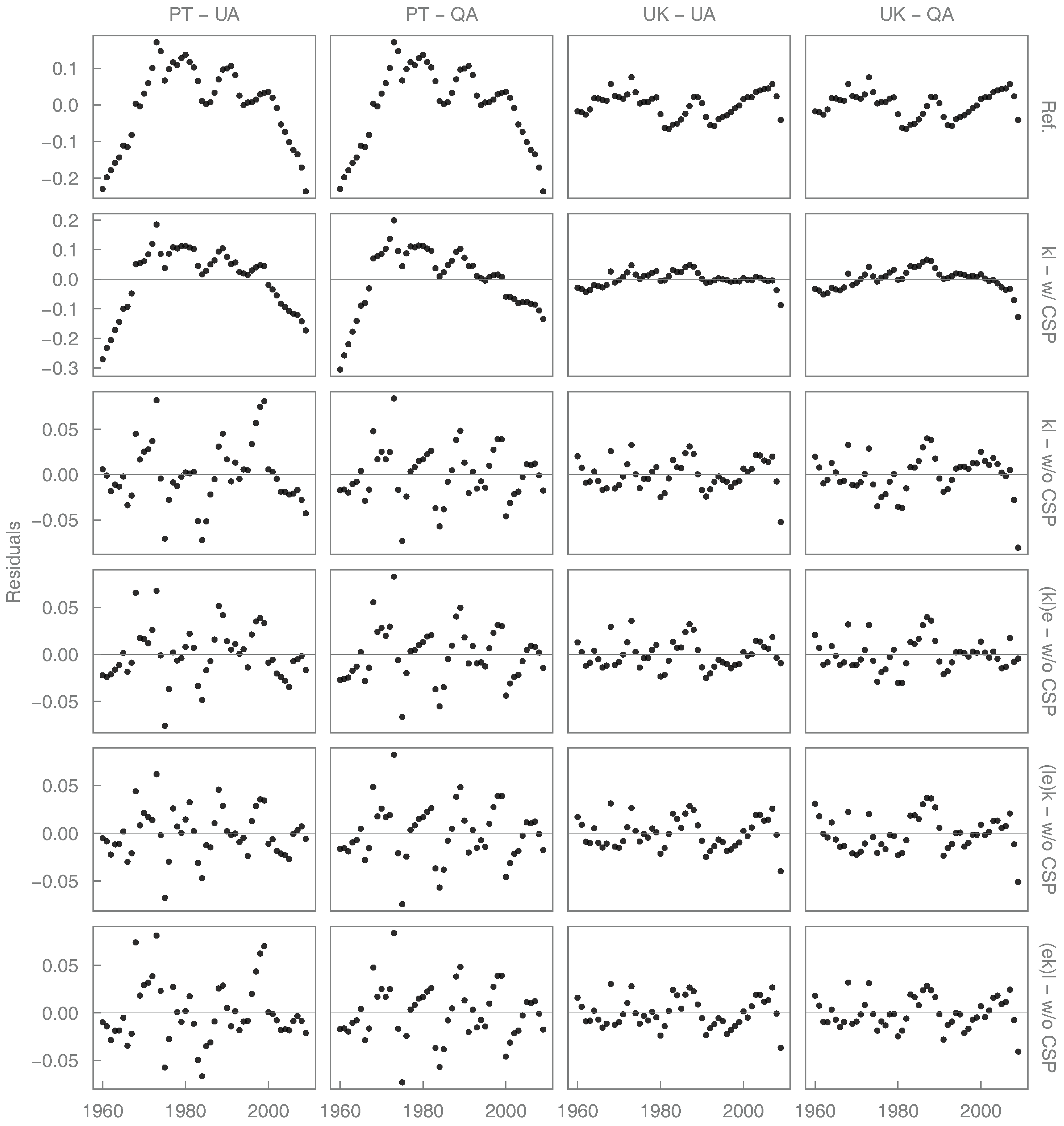

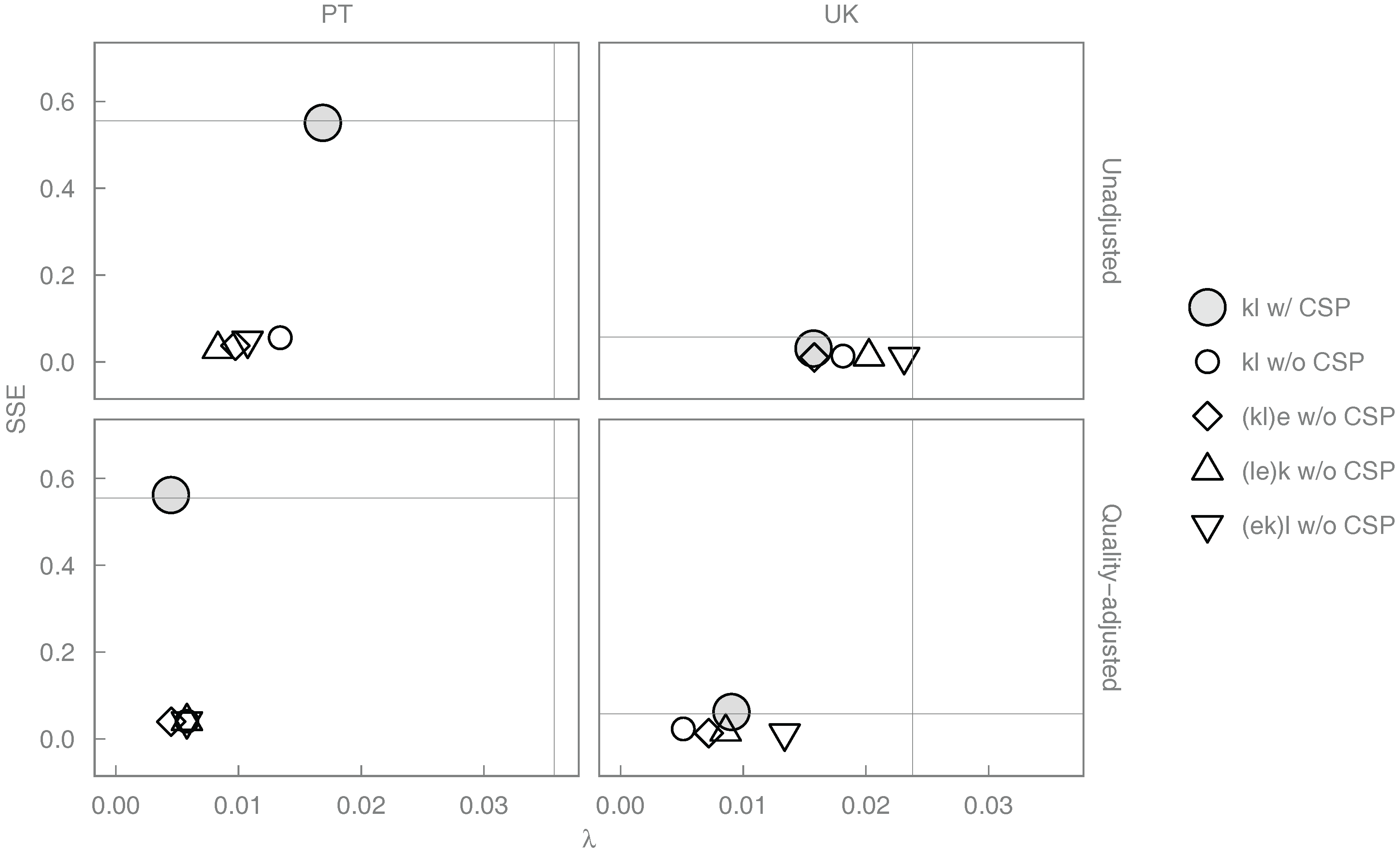

Historically, a stylized fact observed across countries verifies stable long-run cost shares for factors of production, with labor receiving approximately 70% of total income and capital the remaining 30%. This is true for both Portugal and the UK over the time period covered by this study. (See

Figure 2.) Typically, payments to energy are less than 10% of GDP [

52]. Because direct payments to energy are much smaller than payments to capital or labor, energy is attributed (by the CSP) a correspondingly small output elasticity. These assumptions and observations naturally lead to mainstream modeling approaches in which choices are made to exclude energy as a factor of production, favor the Cobb-Douglas APF (which is homogenous and of degree one), and adhere to the CSP.

However, there may be good reasons to reject the a-priori imposition of each of those choices. And recent literature questions whether the assumptions leading to the CSP are tenable. Two examples are relevant.

First are examples of studies that have adopted alternatives to the assumptions of mainstream economics. Because it is considered to be an intermediate input, the cost of energy is seen as a payment to the owners of primary factors of production for the services provided either directly or embodied in the intermediate factors of production [

53]. The use of “Gross-output” APFs [

54] allows intermediate factors of production (such as energy) to drive economic growth. Gross output measures of economic output differ from value-added measures of output by including energy as a regular factor of production alongside capital and labor. Although gross output approaches provide a more-complete picture of production processes, and therefore have intuitive appeal, they impose greater demands on data availability. A second alternative to the assumptions of mainstream economics are biophysical growth models [

55] that assume energy is the only primary factor of production. (In such models, capital and labor are treated as flows of capital consumption and labor services, computed in terms of the embodied energy use associated with them). From this biophysical point of view, it is argued that energy has a small cost share not because it is relatively less important than either capital or labor as a factor of production; rather energy has a small cost share because it has been abundant and cheap thanks to the free work of the biosphere and geosphere.

Second, according to Kümmel [

56,

57,

58] and others, the CSP is valid only for equilibrium economies comprised solely of profit-maximizing firms in the absence of technological constraints—conditions that are seldom, if ever, present. It might seem absurd that mainstream economics employs the CSP, which is based on assumptions that have never been true, are not now true, and never will be true, but such “ideal” cases are common in many fields. For example, a Carnot heat engine has never, does not, and will never exist, but it is useful as an “ideal” machine against which all real machines are compared. The CSP and models that follow from it play a similar role in economics. (See Acemoglu [

59] for a neoclassical derivation of the CSP. See Kümmel et al. [

57] for a derivation involving shadow prices and for an excellent discussion of issues surrounding the CSP.)

These examples show that one need not follow the mainstream approach of employing the CSP to obtain constant output elasticities and exclude energy as a factor of production. A different approach to determining output elasticities should be pursued: they cannot be equated to cost shares a-priori. A standard technique, if one rejects the CSP, is to estimate economic growth model parameters (including output elasticities) by fitting models to historical data.

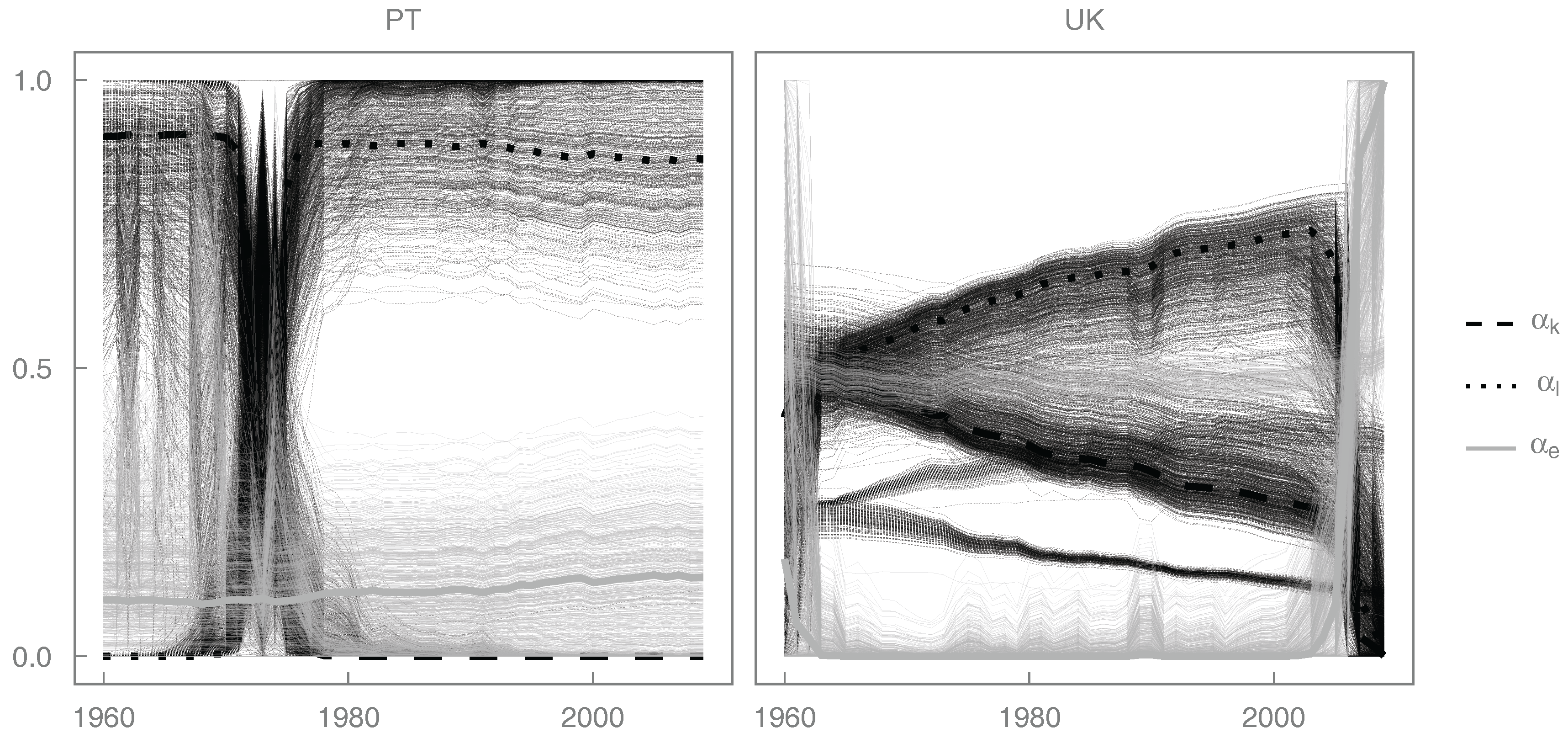

If we want to preserve the choice to reject the CSP, justification for assuming that output elasticities are constant with respect to time (as in the C-D APF) is removed. Indeed, in real economies output elasticities may change as the structure of the economy evolves and as technological constraints on production ebb and flow. Because output elasticities are constant with respect to time in the C-D APF (Equations (

1) and (

2)), rejecting the CSP leads away from Cobb-Douglas models. A common APF that provides time-varying output elasticities is the CES production function (Equations (

3) and (

4)), the focus of this study.

When generalizing the two-factor CES production function to include a third factor of production (e.g., energy in Equation (

4)), the question arises as to where it feeds into the economic system [

60]. There is no a-priori mathematical justification to prefer one nesting structure over another (see

Table 1), and the appropriate choice of nesting structure is an unsettled issue in both the theoretical and empirical literature [

61]. When adding a third factor of production, the

nesting structure is used broadly, probably following the traditional “value-added approach”, whereby capital and labor are incorporated first to form a composite input that is secondarily combined with energy [

62]. But the

nesting structure has appeared in various models, reflecting an assumption that capital and energy are combined first [

63]. And Shen and Whalley [

34] argue that the

nesting structure is appropriate for China.

The choice of the grouped factors of production raises the issue of “separability”, the requirement that the substitution elasticity between paired inputs remains the same, regardless of whether an additional (third) factor of production has been added [

64]. Moreover, the cross-elasticities between the nested factors of production and the third factor of production must be equal (e.g., the elasticities between

k and

e and between

l and

e in the

nesting structure). Typically, separability is merely assumed rather than tested.

Furthermore, in our experience, parameter estimates may differ substantially depending on the nesting structure employed. Unfortunately, few studies methodically assess the effect of nesting structure. (Kemfert [

65], Van der Werf [

16], and Shen and Whalley [

34] provide exceptions.) In the literature, nesting structure is often decided a-priori, either without comment or based on commitments made in Step 1 (Select a theoretical framework).

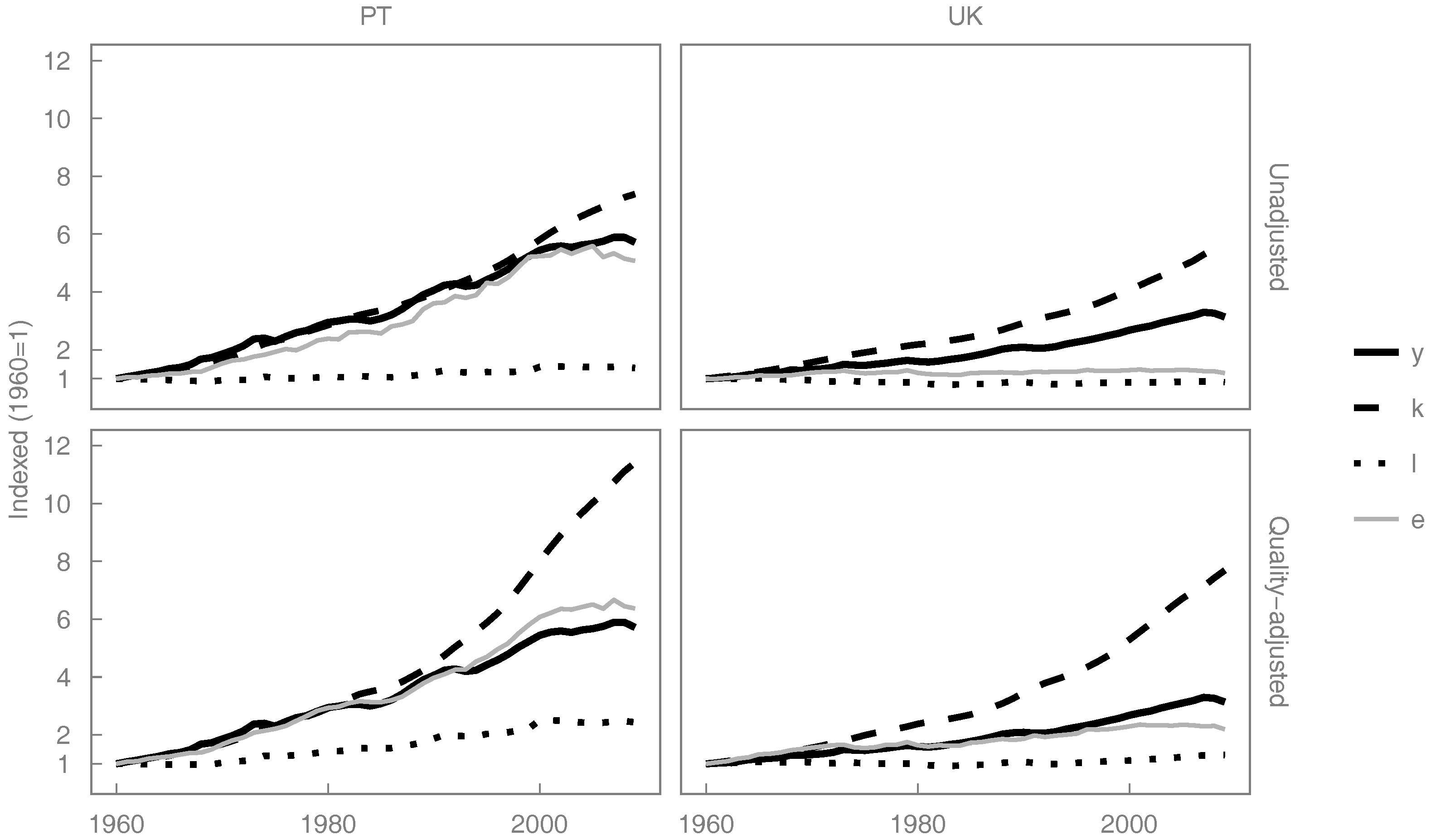

To clarify the above issues and facilitate comparisons among various modeling approaches, we consider three distinct modeling choices: (1) whether (or not) to include energy as a factor of production; (2) whether (or not) to assume the CSP; and (3) which APF to use. We note that CES nesting structure is an aspect of the third modeling choice.

A fourth modeling choice is largely orthogonal to the above considerations and comprises choices relating to the methods used to quantify the factors of production. Most empirical studies of economic growth quantify capital and labor by unadjusted values such as monetary value for capital and work hours for labor [

49,

66,

67]. However, not all capital and labor are equally productive: different capital assets provide different services to economic production, and skilled workers are more productive than unskilled ones. In the relevant literature, there are studies that consider quality-adjusted capital (measuring the productive effect of capital stocks as capital services) and quality-adjusted labor (e.g., adjusting work hours by educational indexes), with the latter [

68,

69] being more common than the former [

70,

71]. Indeed, accounting for capital services is a newer field of study, and Inklaar [

72] suggests significant measurement issues remain, such as the choice of the rates of return. Work continues in academia [

73] and in government [

74] to develop consistent datasets of capital services.

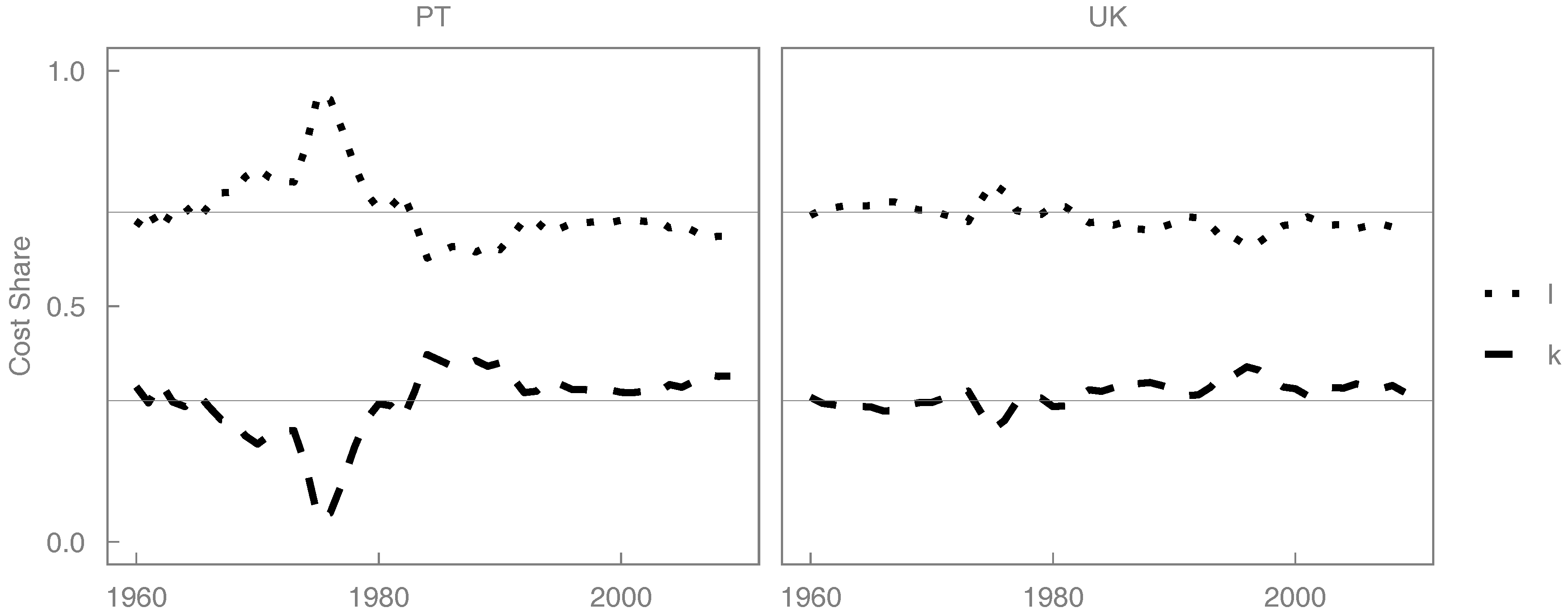

Energy, too, has unadjusted and quality-adjusted quantifications. Unadjusted energy is quantified by the thermal equivalent of primary (extracted) energy: the quantity of heat that could be produced from a primary energy carrier. Energy can be quality adjusted on an economic or a physical basis, as discussed by Cleveland et al. [

75] and Stern [

76], among others. The economic approach commonly involves a price-based Divisia index to allocate greater weight to those energy carriers (such as electricity) that have a higher cost per unit of unadjusted (thermal) energy (in units of $/GJ). In contrast, physical approaches are based on physical attributes of energy only and are founded on the laws of thermodynamics. In our case, we adopt a physical approach with exergy as the quantification for quality-adjusted energy. The second law of thermodynamics quantifies (via the concept of entropy) the observation that work can be completely converted into heat, but the converse is not true. Exergy, based on the second law, is a measure of energy that describes its ability to do physical work. Thermodynamically, exergy is defined as the maximum possible work that could be done by a system as it comes to equilibrium with its surroundings. Quantifying all forms of energy as exergy changes the numerical relationship between work and heat, thereby accounting for energy’s quality. Our approach has two beneficial characteristics: (1) it avoids mixing economic and physical attributes of energy and (2) it obeys the first and second laws of thermodynamics (by virtue of the exergy quantification).

Our approach to quality-adjusting energy is based on the work of Ayres and Warr [

51,

77,

78,

79] who argue that the energy factor of production should be quantified as exergy at its point of use in an economy (useful exergy) as opposed to the point of extraction from the biosphere (primary exergy) or at the point when it is sold to final consumers (final exergy), because useful exergy is closer to productive processes and, therefore, more closely correlated to economic activity. From a thermodynamic point of view, measuring energy input to the economy as useful exergy makes sense: it takes

physical work at the point of energy dissipation into heat to extract and transform raw materials, fabricate goods and generate services, distribute products, and consume and dispose goods and services in a real economy. Useful exergy can be seen as a quality-adjusted measure of energy, similar to service-adjusted capital and education-adjusted labor. Quality-adjusting (or not) all factors of production (capital, labor, and energy) is our fourth modeling choice.

There are other possible modeling choices in addition to the four discussed above, fitting technique and quantification of economic output among them. However, for this paper, we use a single, rigorous fitting technique in all modeling approaches (see

Section 3.3), and we quantify economic output by GDP only. Although the four modeling choices for this paper do not comprise the full set of modeling choices, they provide a sufficiently wide space within which to explore the effect on policy of decisions made throughout the theory-to-policy process.

We thus arrive at our starting point. Fitting APFs to historical data is at the core of an important theory-to-policy process, with the energy-augmented CES production function increasing in popularity. However, few studies critically evaluate, let alone articulate, the theory-to-policy process or examine the impacts of the modeling choices discussed above through to policy. So the time is right for a thorough, detailed, and rigorous evaluation of the theory-to-policy process and the effects of upstream modeling choices on energy and economic policymaking, with particular attention paid to the role of the CES production function.

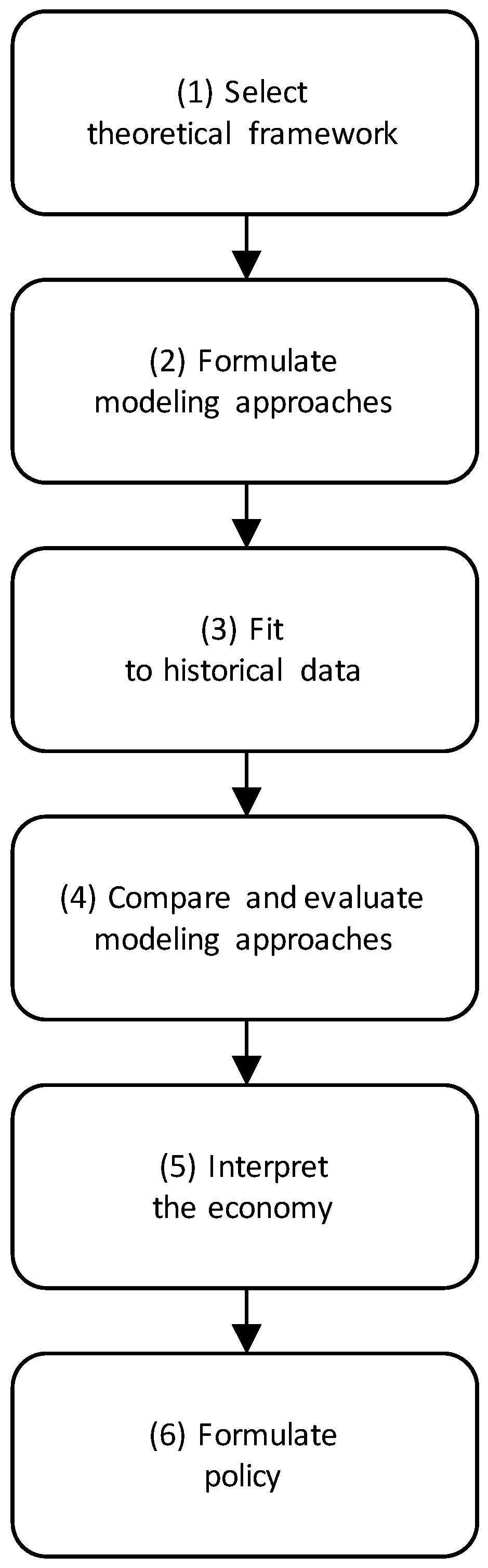

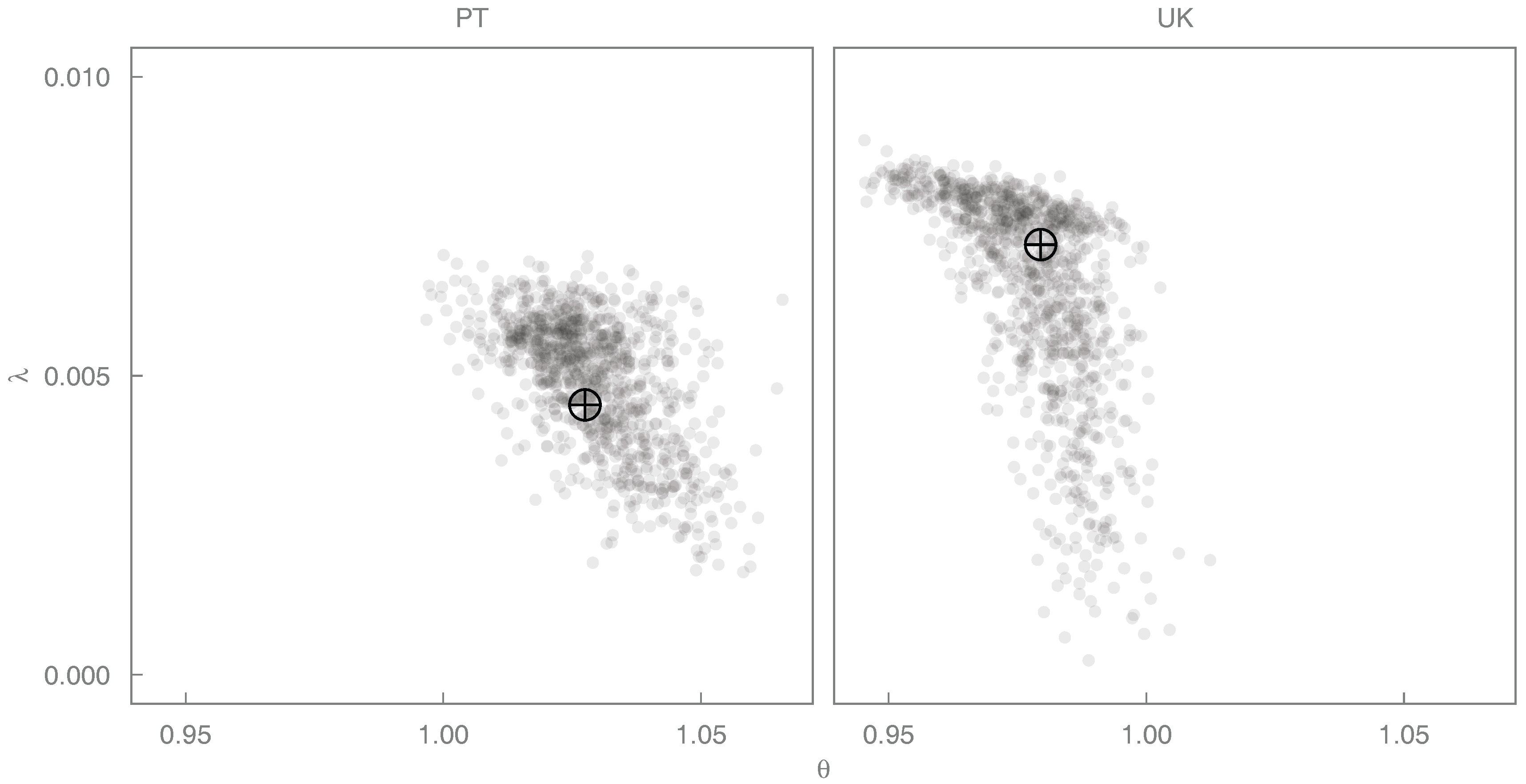

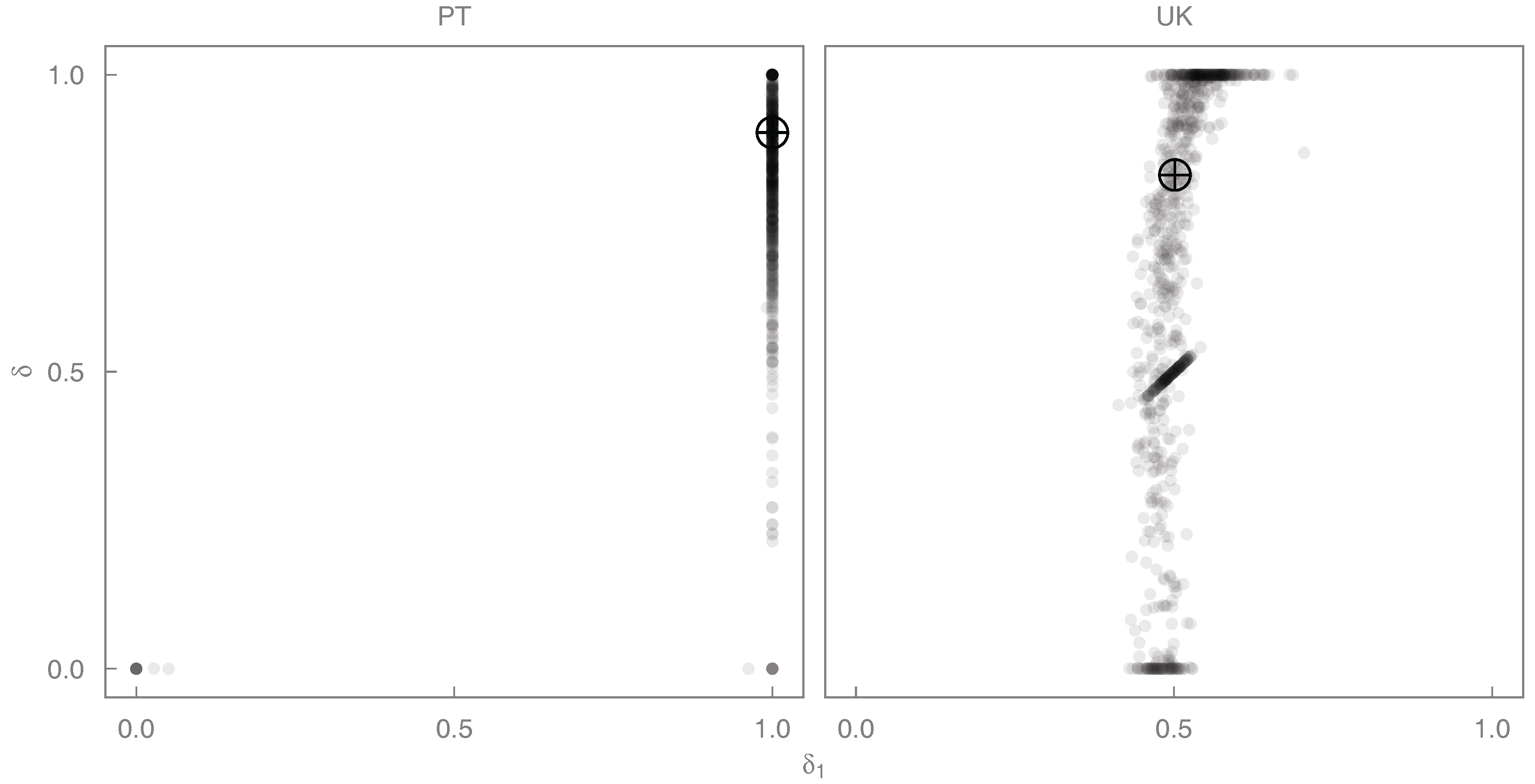

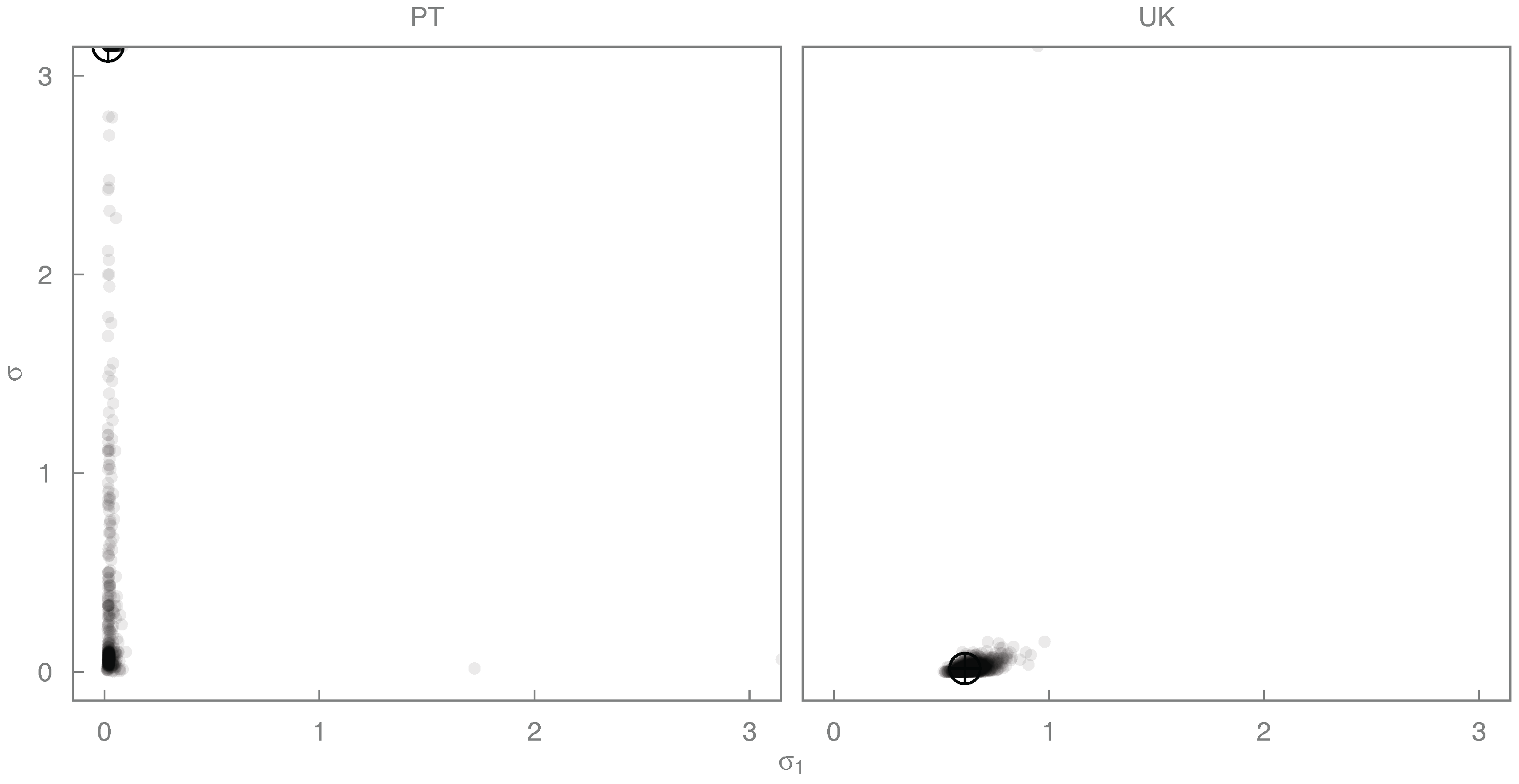

The remainder of this paper performs this evaluation by investigating the effects on policymaking of four modeling choices: (a) including (or not) energy as a factor of production; (b) rejecting (or not) the cost-share principle (CSP); (c) CES nesting structure; and (d) quality-adjusting (or not) the factors of production. We utilize historical data for Portugal and the UK for the time period 1960–2009. Furthermore, we perform bootstrap resampling on one CES production function to give an indication of the precision with which CES parameters can be estimated. We know of no previous studies that perform a similarly comprehensive, quantitative, and rigorous evaluation of the theory-to-policy process and the role of APFs therein.

) for both Portugal and the UK.

) for both Portugal and the UK.