Pareto-Efficient Capacity Planning for Residential Photovoltaic Generation and Energy Storage with Demand-Side Load Management

Abstract

:1. Introduction

2. System Model

2.1. Smart Grid Model

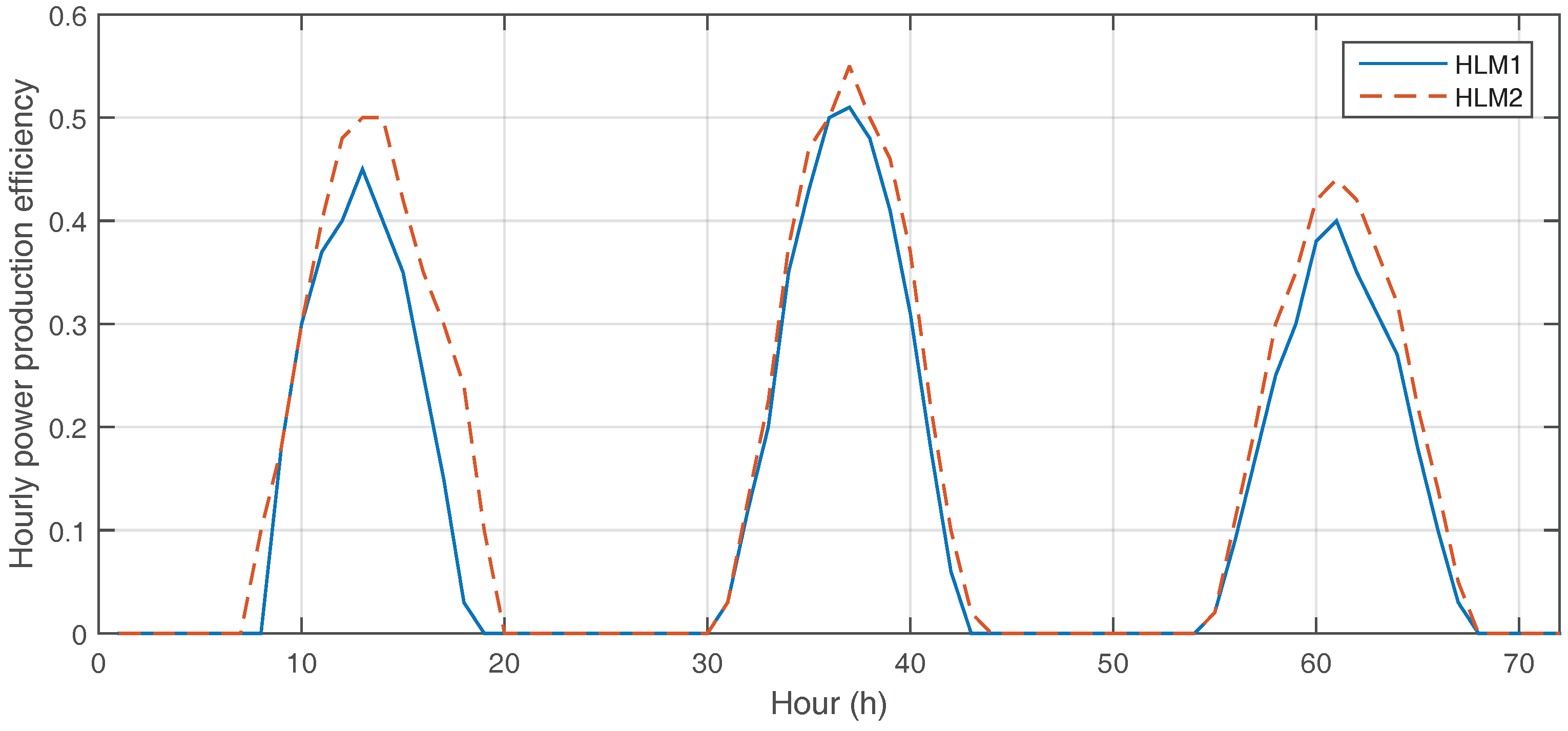

2.2. Photovoltaic Generation Model

2.3. Energy Storage Model

2.4. Residential Load Control by HLM Module

3. Capacity Planning Problem

3.1. Multi-Objective Formulation

3.2. Pareto-Optimal Solution

3.3. Game-Theoretic Approach

4. Numerical Results

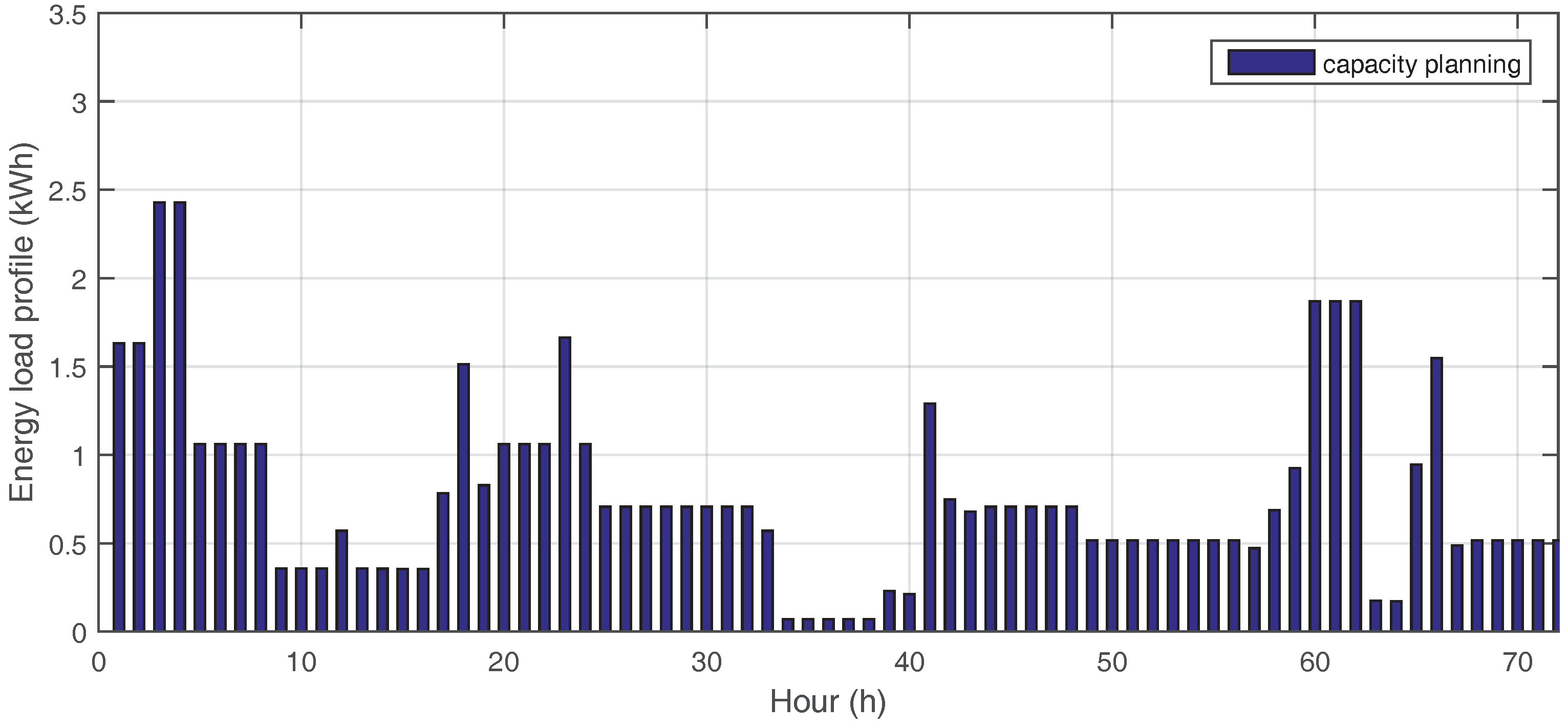

4.1. Simulation Setup

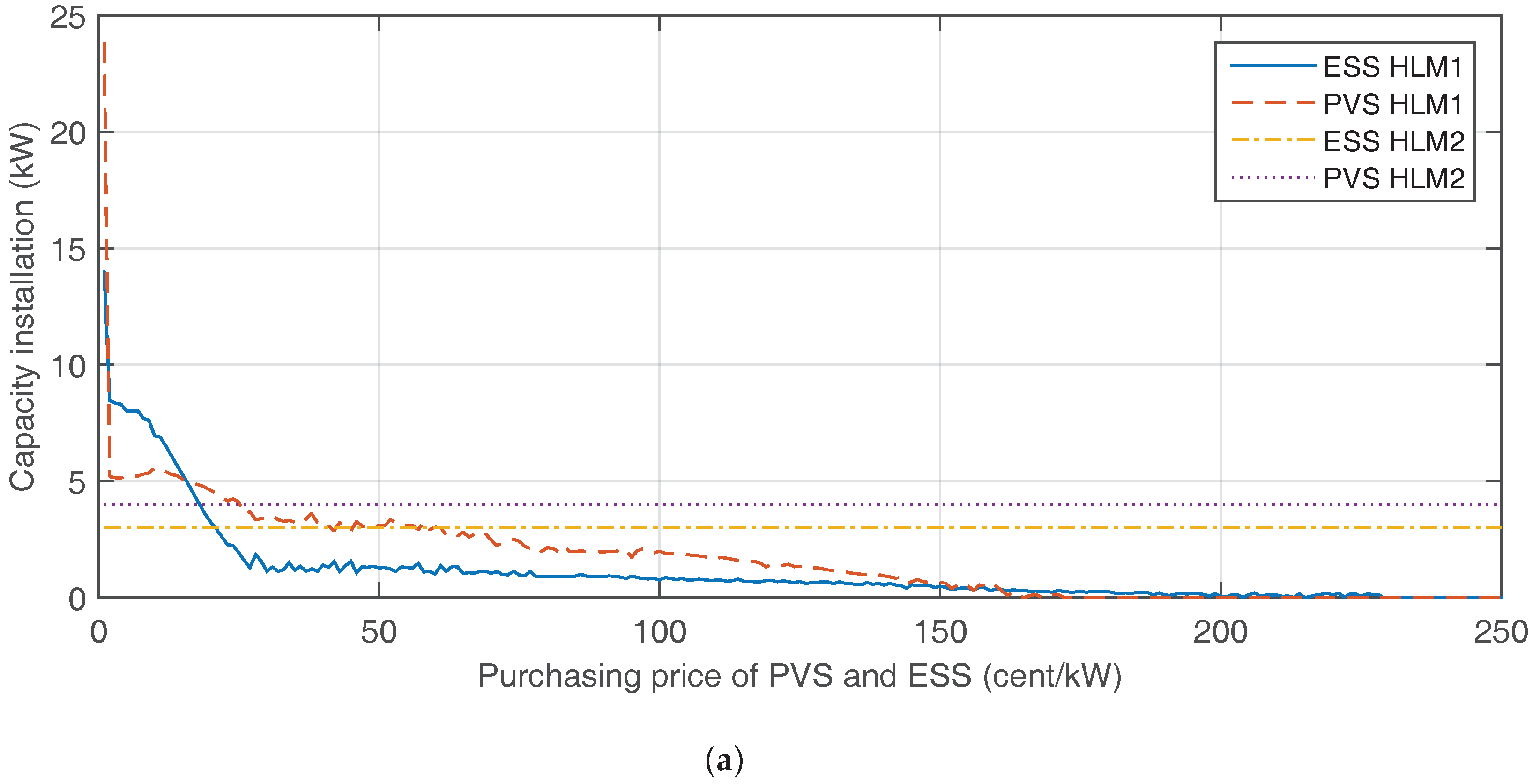

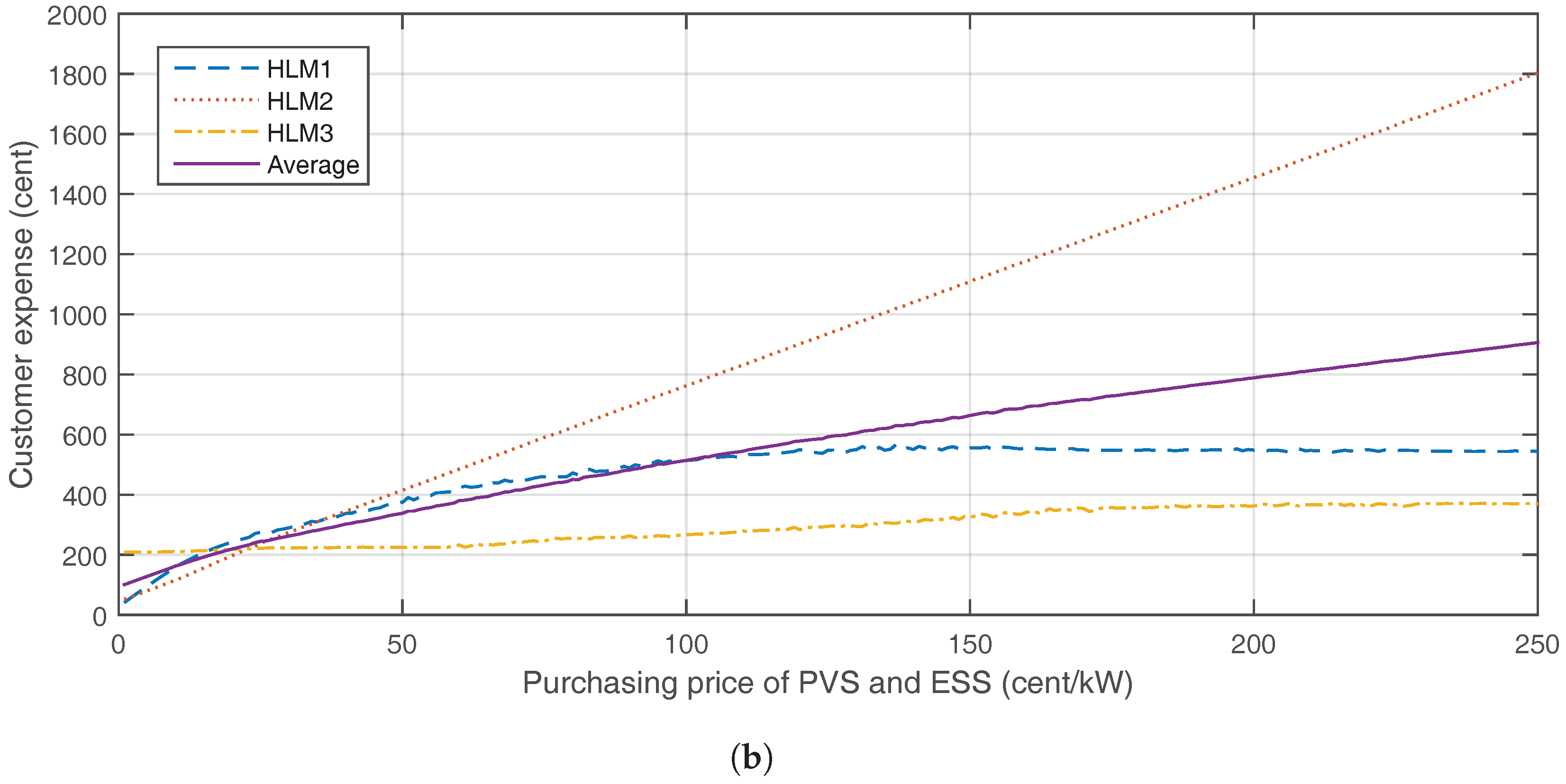

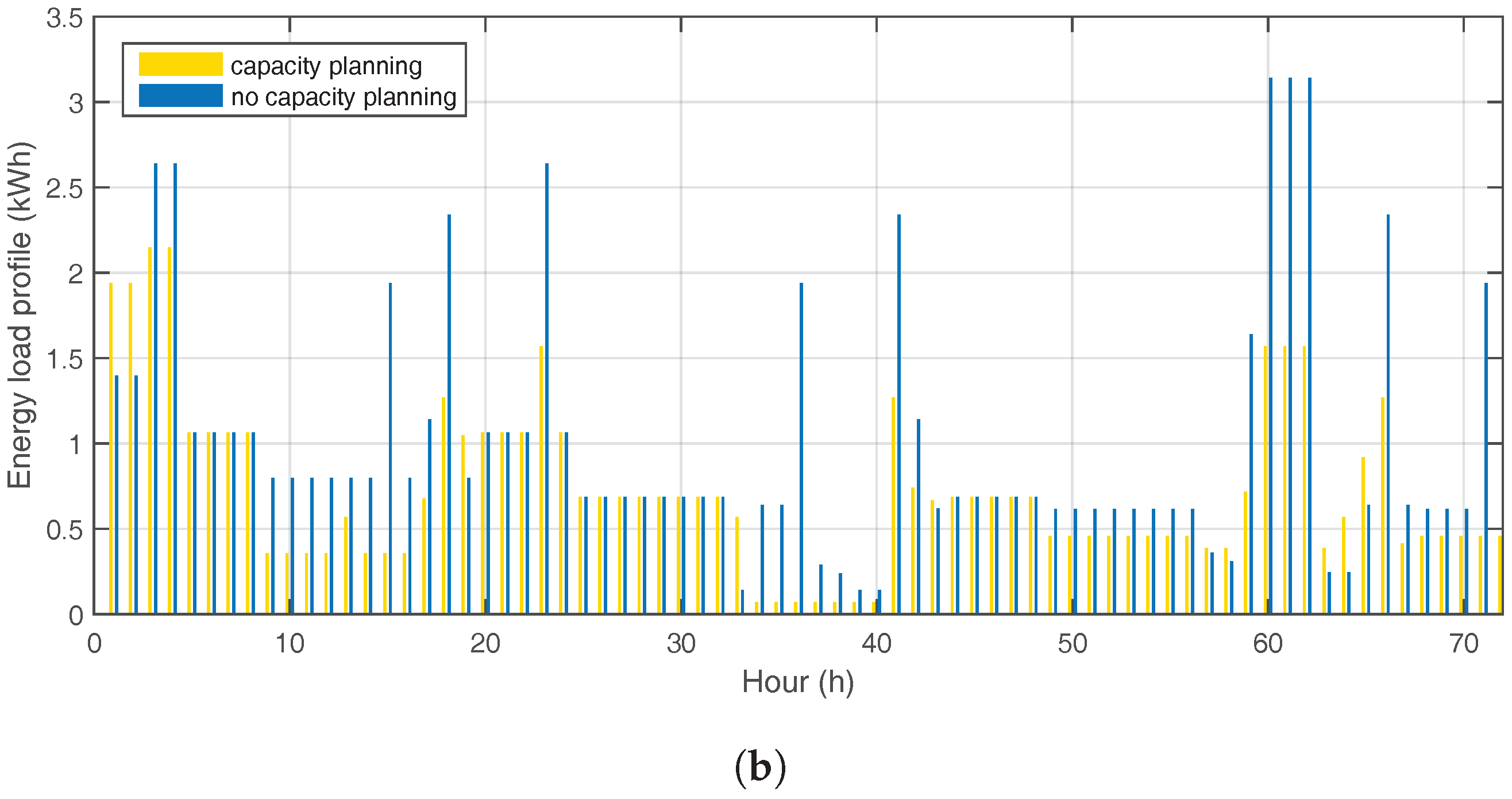

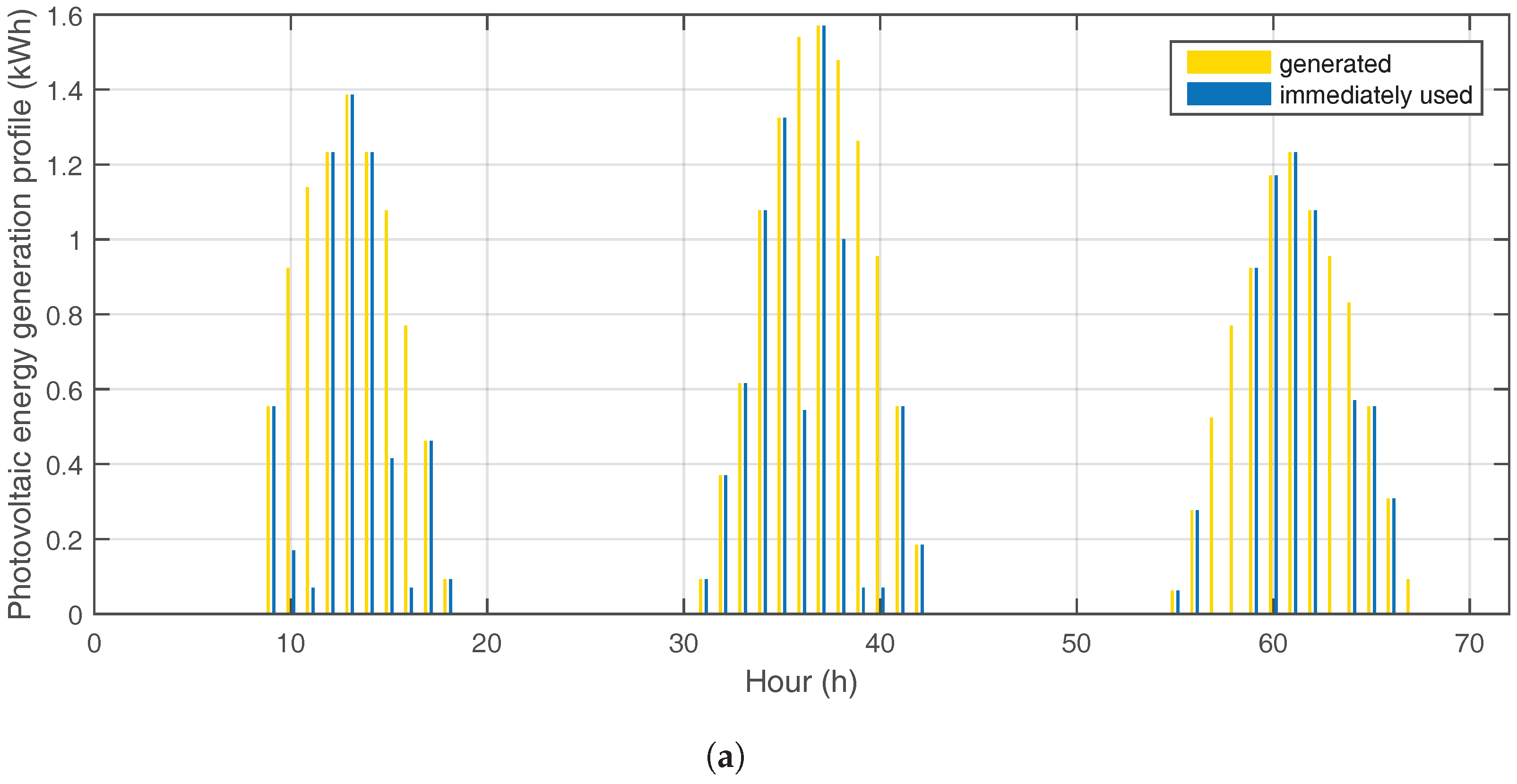

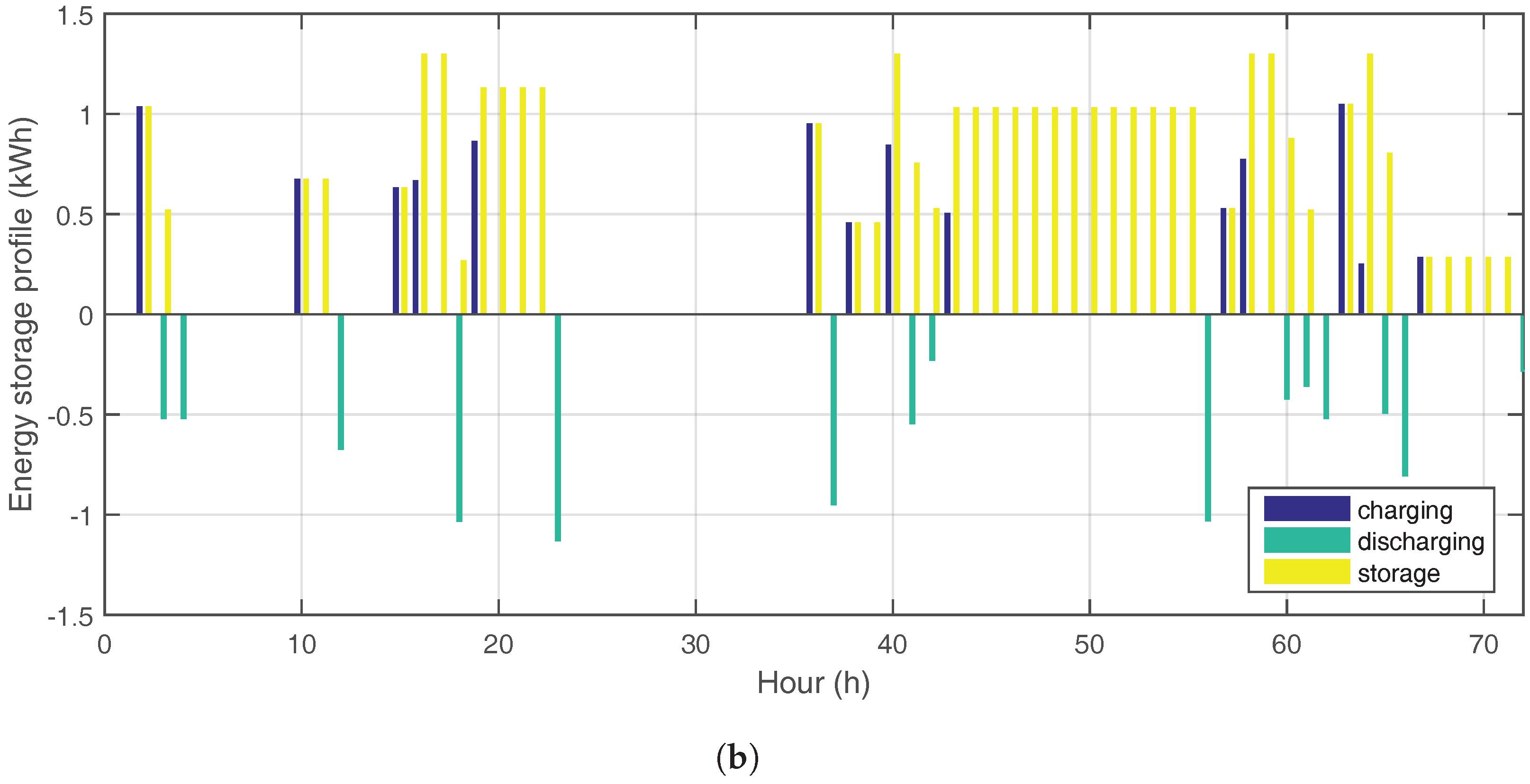

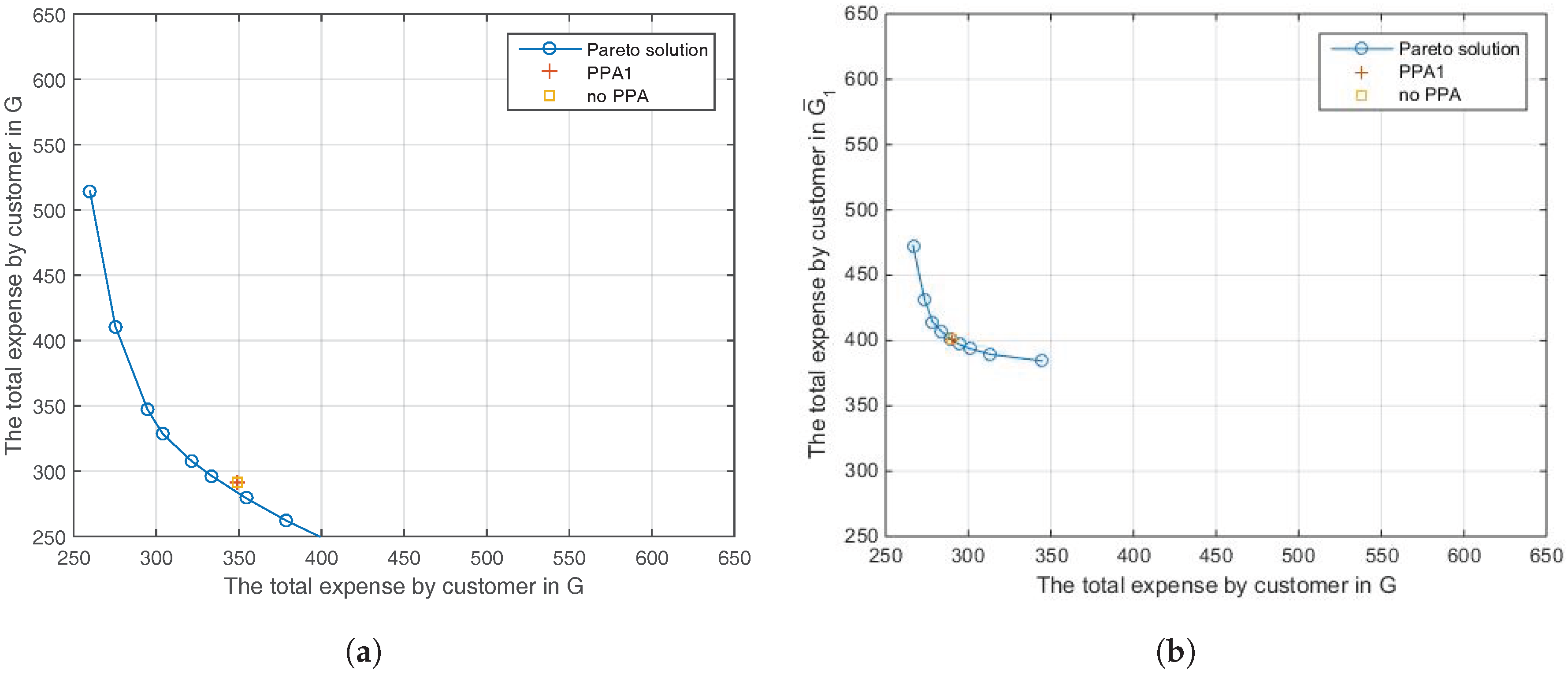

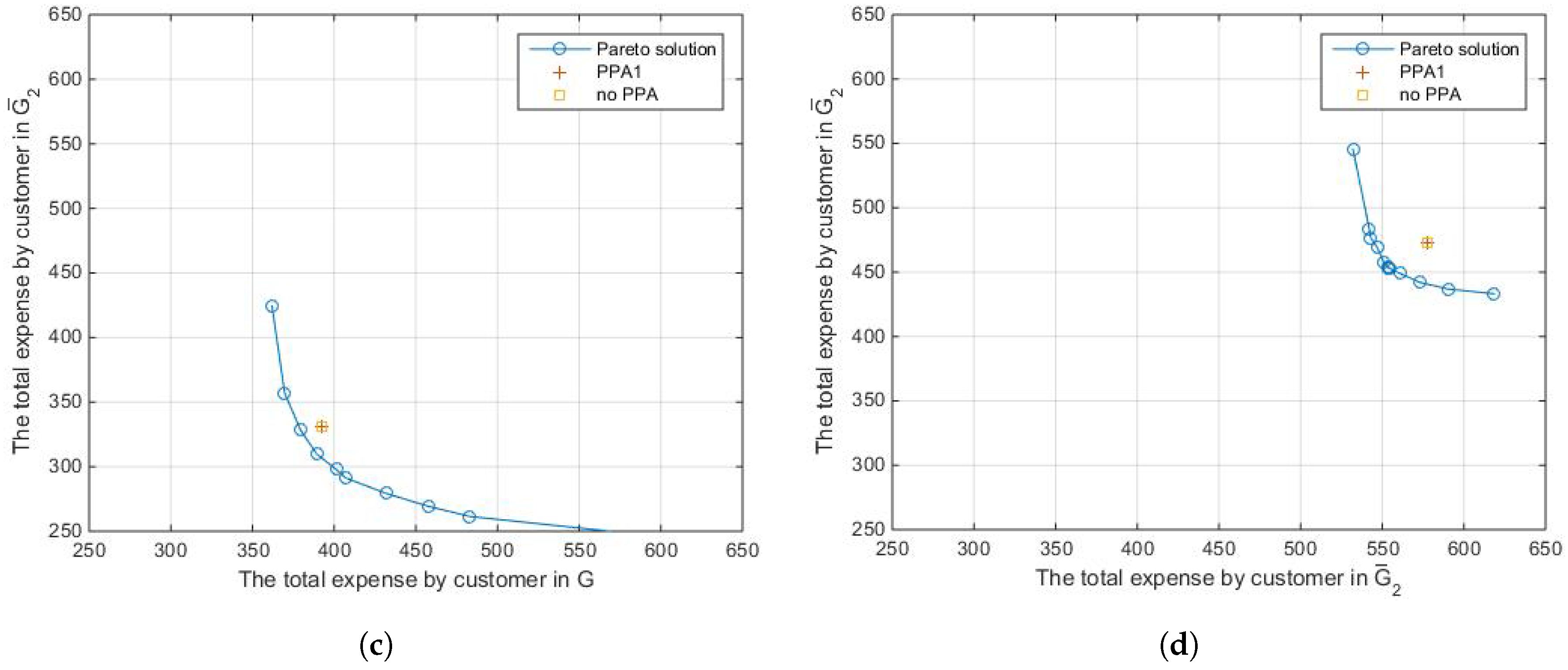

4.2. Pareto-Efficient Planning

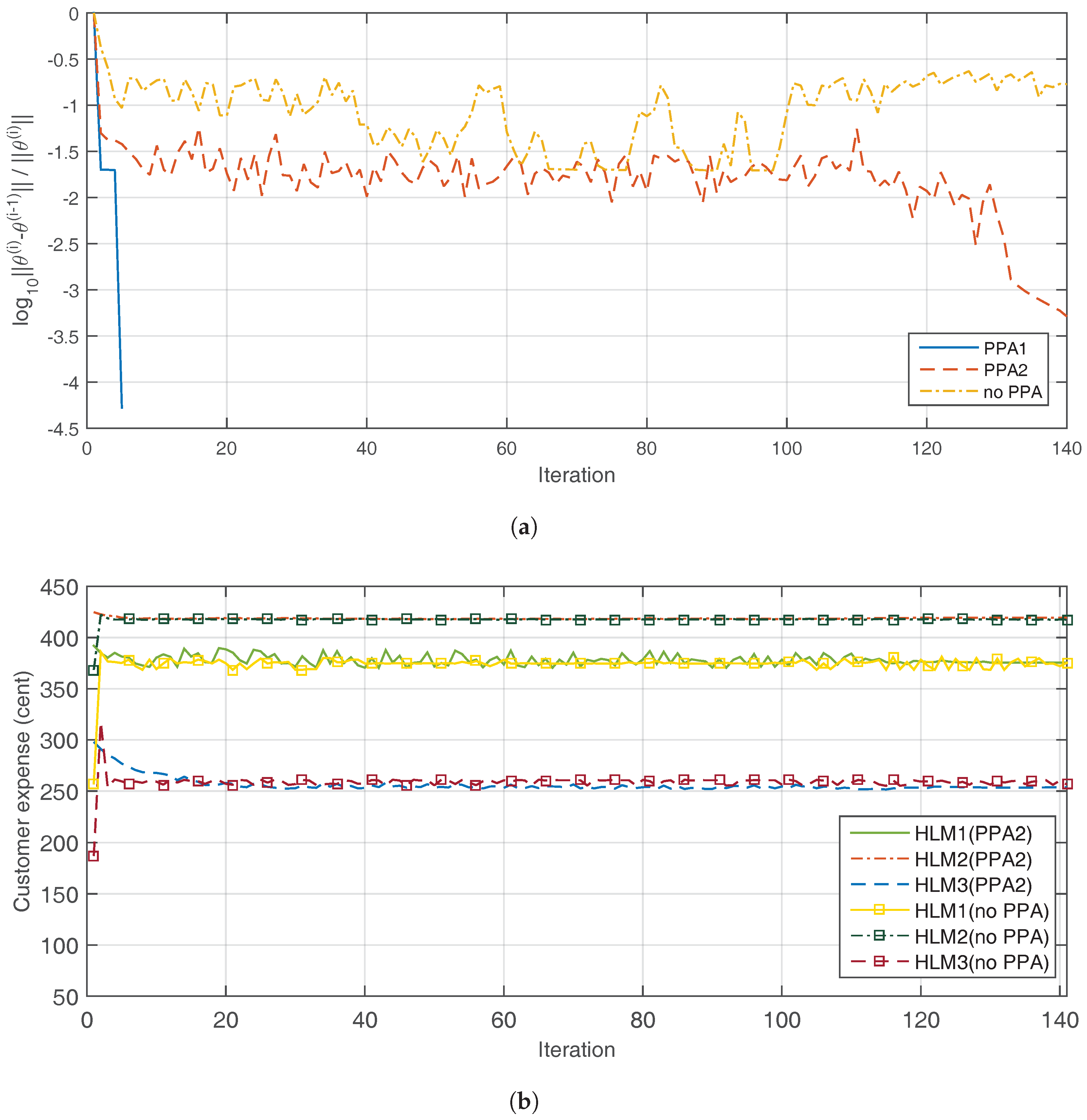

4.3. Game-Theoretic Planning

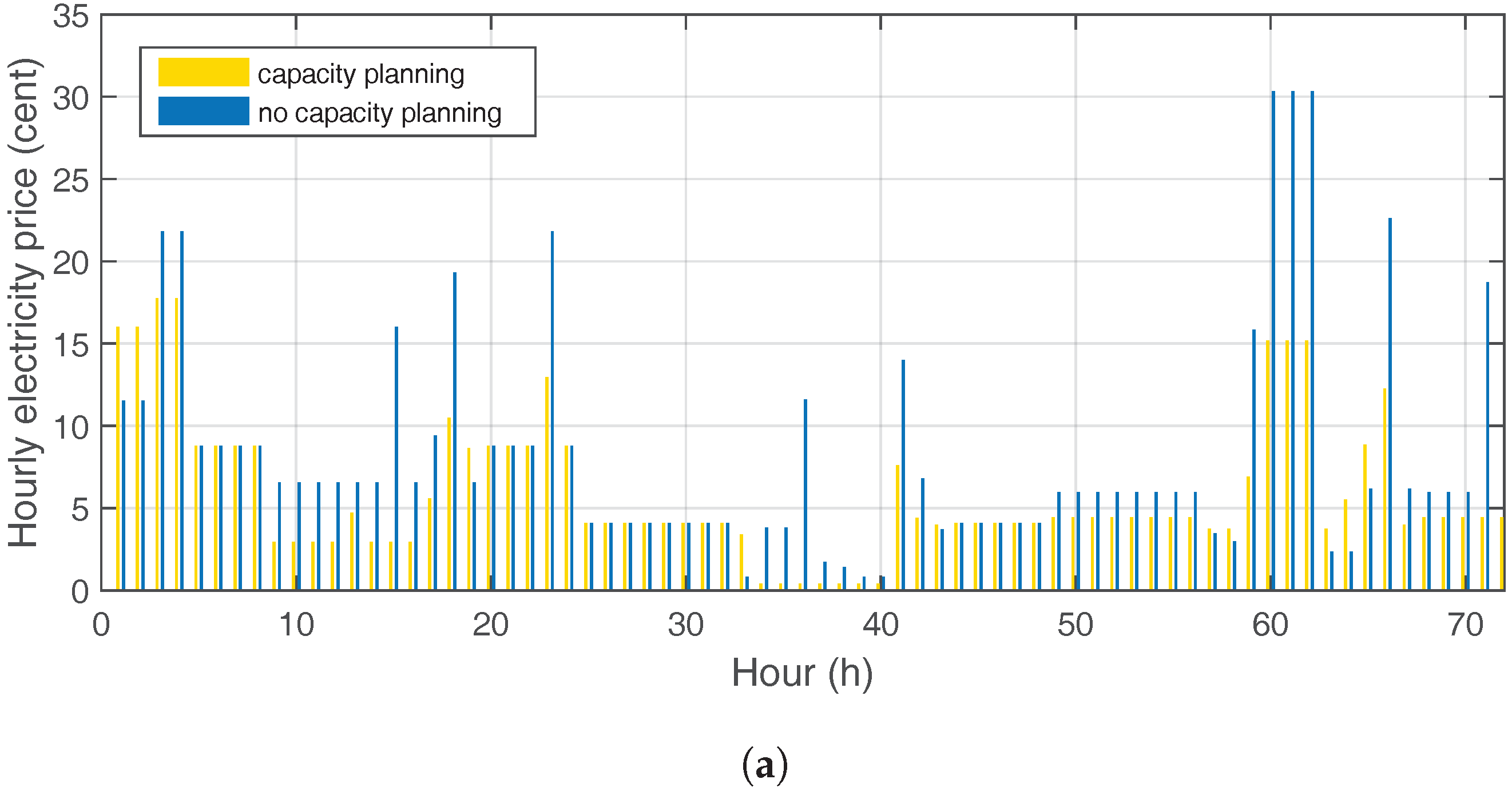

4.4. Pareto Solution vs. Game-Theoretic Solution

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

Abbreviations

| SM | Smart meter |

| HLM | Home load management |

| HA | Home appliance |

| PVS | Photovoltaic generation |

| ESS | Energy storage system |

| NTS | Non time-shiftable |

| PS | Power-shiftable |

| TS | Time-shiftable |

| PPA | Proximal point algorithm |

References

- Technology Roadmap: Smart Grids. Available online: https://www.iea.org/publications/freepublications/publication/TechnologyRoadmapSolarPhotovoltaicEnergy_2014edition.pdf (accessed on 6 February 2017).

- Smart Grids: From innovation to Deployment, European Commission; Tech Report; The Commission to the European Parliament, the Council, the European Economic and Social Committee, and the Committee of the Regions: Brussels, Belgium, 12 April 2011.

- Masters, G.M. Renewable and Efficient Electric Power Systems; Wiley: Hoboken, NJ, USA, 2004. [Google Scholar]

- Reducing Electricity Consumption in Houses, Ontario Home Builders’ Assoc.; Energy Conservation Committee Report and Recommendations: Toronto, ON, Canada, 21 April 2006.

- Olivares, D.E.; Merhrizi-Sani, A.; Etemadi, A.H.; Canizares, C.A.; Iravani, R.; Kazerani, M.; Hajimiragha, A.H.; Gomis-Bellmunt, O.; Saeedifard, M.; Palma-Behnke, R.; et al. Trends in microgrid control. IEEE Trans. Smart Grid 2014, 5, 1905–1919. [Google Scholar] [CrossRef]

- Safdarian, A.; Fotuhi-Firuzabad, M.; Lehtonen, M. Optimal residential load management in smart grids: A decentralized framework. IEEE Trans. Smart Grid 2016, 7, 1836–1845. [Google Scholar] [CrossRef]

- Moradzadeh, B.; Tomsovic, K. Two-stage residential energy management considering network operational constraints. IEEE Trans. Smart Grid 2013, 4, 2339–2346. [Google Scholar] [CrossRef]

- Guo, Y.; Pan, M.; Fang, Y.; Khargonekar, P.P. Decentralized coordination of energy utilization for residential households in the smart grid. IEEE Trans. Smart Grid 2013, 4, 1341–1350. [Google Scholar] [CrossRef]

- Atzeni, I.; Ordóñez, L.G.; Scutari, G.; Palomar, D.P.; Fonollosa, J.R. Demand-side management via distributed energy generation and storage optimization. IEEE Trans. Smart Grid 2013, 4, 866–876. [Google Scholar] [CrossRef]

- Zhu, Z.; Chin, W.H. An integer linear programming based optimization for home demand-side management in smart grid. In Proceedings of the 2012 IEEE PES, Innovative Smart Grid Technologies (ISGT), Washington, DC, USA, 16–20 January 2012; pp. 1–5. [Google Scholar]

- Liu, R. An algorithmic game approach for demand side management in smart grid with distributed renewable power generation and storage. Energies 2016, 9, 654. [Google Scholar] [CrossRef]

- Diaf, S.; Notton, G.; Belhamel, M.; Haddadi, M.; Louche, A. Design and techno-economical optimization for hybrid PV/wind system under various meteorological conditions. Appl. Energy 2008, 85, 968–987. [Google Scholar] [CrossRef]

- Koutroulis, E.; Kolokotsa, D.; Potirakis, A.; Kalaitzakis, K. Methodology for optimal sizing of stand-alone photovoltaic/wind-generator systems using genetic algorithms. Sol. Energy 2006, 80, 1072–1088. [Google Scholar] [CrossRef]

- Yang, H.; Zhou, W.; Lu, L.; Fang, Z. Optimal sizing method for stand-alone hybrid solar/wind system with LPSP technology by using genetic algorithm. Sol. Energy 2008, 82, 354–367. [Google Scholar] [CrossRef]

- Dufo-Lopez, R.; Bernal-Agustin, J.L. Design and control strategies of PV-Diesel systems using genetic algorithms. Sol. Energy 2005, 79, 33–46. [Google Scholar] [CrossRef]

- Dufo-Lopez, R.; Bernal-Agustin, J.L.; Yusta-Loyo, J.M.; Domínguez-Navarro, J.A.; Ramírez-Rosado, I.J.; Lujano, J.; Aso, I. Multi-objective optimization minimizing cost and life cycle emissions of stand-alone PV/wind/diesel systems with batteries storage. Appl. Energy 2011, 88, 4033–4041. [Google Scholar] [CrossRef]

- Chen, H.-C. Optimum capacity determination of stand-alone hybrid generation system considering cost and reliability. Appl. Energy 2013, 103, 155–164. [Google Scholar] [CrossRef]

- Zhao, B.; Zhang, X.; Li, P.; Wang, K.; Xue, M.; Wang, C. Optimal sizing, operating strategy and operational experience of a stand-alone microgrid on Dongfushan Island. Appl. Energy 2014, 113, 1656–1666. [Google Scholar] [CrossRef]

- Perera, A.T.D.; Attalage, R.A.; Perera, K.K.C.K.; Dassanayake, V.P.C. A hybrid tool to combine multi-objective optimization and multi-criterion decision making in designing standalone hybrid energy systems. Appl. Energy 2013, 107, 412–425. [Google Scholar] [CrossRef]

- Nosrat, A.; Pearce, J.M. Dispatch strategy and model for hybrid photovoltaic and trigeneration power systems. Appl. Energy 2011, 88, 3270–3276. [Google Scholar] [CrossRef]

- Rubio-Maya, C.; Uche-Marcuello, J.; Martínez-Gracia, A.; Bayod-Rújula, A.A. Design optimization of a polygeneration plant fuelled by natural gas and renewable energy sources. Appl. Energy 2011, 88, 449–457. [Google Scholar] [CrossRef]

- Wang, J.; Zhai, Z.; Jing, Y.; Zhang, C. Particle swarm optimization for redundant building cooling heating and power system. Appl. Energy 2010, 87, 3668–3679. [Google Scholar] [CrossRef]

- Ko, M.J.; Kim, Y.S.; Chung, M.H.; Jeon, H.C. Multi-objective optimization design for a hybrid energy system using the genetic algorithm. Energies 2015, 8, 2924–2949. [Google Scholar] [CrossRef]

- Hernandez-Aramburo, C.A.; Green, T.C.; Mugniot, N. Fuel consumption minimization of a microgrid. IEEE Trans. Ind. Appl. 2005, 41, 673–681. [Google Scholar] [CrossRef]

- Varaiya, P.P.; Wu, F.F.; Bialek, J.W. Smart operation of smart grid: Risk-limiting dispatch. IEEE Proc. 2011, 99, 40–57. [Google Scholar] [CrossRef]

- Ontario Bill 150, Green Energy and Green Economy Act, 2009. Available online: http://www.ontla.on.ca/web/bills/bills_detail.do?BillID=2145 (accessed on 6 February 2017).

- Recent Facts about Photovoltaics in Germany. Available online: https://www.ise.fraunhofer.de/content/dam/ise/en/documents/publications/studies/recent-facts-about-photovoltaics-in-germany.pdf (accessed on 6 February 2017).

- Mohsenian-Rad, A.-H.; Wong, V.W.S.; Jatskevich, J.; Schober, R.; Leon-Garcia, A. Autonomous demand-side management based on game-theoretic energy consumption scheduling for the future smart grid. IEEE Trans. Smart Grid 2010, 1, 320–331. [Google Scholar] [CrossRef]

- Rockafellar, R.T. Monotone operators and the proximal point algorithm. SIAM J. Control Optim. 1976, 14, 877–898. [Google Scholar]

- Bracale, A.; Pierluigi, C.; Guido, C.; Anna, R.D.F.; Gabriella, F. A Bayesian method for short-term probabilistic forecasting of photovoltaic generation in smart grid operation and control. Energies 2013, 6, 733–747. [Google Scholar] [CrossRef]

- Duffie, J.A.; Beckman, W.A. Solar Engineering of Thermal Processes; John Wiley & Sons: Hoboken, NJ, USA, 2013. [Google Scholar]

- Pareto, V. Cours d’ Economie Politique, Rouge, Lausanne, 1897. Reprinted as the First Volume of Oeuvres Completes; Droz: Geneva, Switzerland, 1964. [Google Scholar]

- Chankong, V.; Haimes, Y.Y. Multiobjective Decision Making: Theory and Methodology; Courier Dover Publications: Mineola, NY, USA, 2008. [Google Scholar]

- Parikh, N.; Boyd, S. Proximal algorithms. Found. Trends Optim. 2014, 1, 127–239. [Google Scholar] [CrossRef]

| Type | Symbol | Definition |

|---|---|---|

| Sets | set of customers in the power system | |

| set of customers that are willing to install PVS and ESS at their home | ||

| set of customers that are already equipped with PVS and ESS | ||

| set of customers that currently do not consider PVS and ESS | ||

| set of household appliances at customer n | ||

| Parameters | daily price profile at hour h. | |

| unit cost of installing PVS by customer n | ||

| unit cost of installing ESS by customer n | ||

| r | market rate of interest per day | |

| hourly power production efficiency of PVS installed by customer n | ||

| PV capacity installed by customer n at hour h | ||

| ES capacity installed by customer n at hour h | ||

| leakage rate of ES installed by customer n | ||

| charging efficiency of ES installed by customer n | ||

| discharging efficiency of installed by customer n | ||

| daily electricity requirement of appliance a at customer n | ||

| fixed energy requirement of appliance a at customer n | ||

| standby power of appliance a at customer n | ||

| maximum working power of appliance a at customer n | ||

| fixed energy consumption pattern of appliance a at customer n | ||

| matrix of standby power of appliance a at customer n | ||

| matrix of maximum working power of appliance a at customer n | ||

| Variables | energy load profile by customer n at hour h | |

| electricity requirement due to charging ESS by customer n at hour h | ||

| PV energy generation profile by customer n at hour h | ||

| energy generated by PV at hour h and immediately used at that time slot in customer n | ||

| energy storage profile of customer n at hour h | ||

| energy charging profile of customer n at hour h | ||

| energy discharging profile of customer n at hour h | ||

| PV capacity installed by customer n | ||

| ES capacity installed by customer n | ||

| energy consumption scheduling of appliance a in customer n at hour h | ||

| binary variable indicating switch control for the time-shiftable appliances |

| Notation | Constraint | Index Set | |

|---|---|---|---|

| . | a ∈ | ||

| . | |||

| , = 0 or 1. | |||

| . | n ∈ | ||

| 0. | |||

| n | |||

| n | |||

| Step 0. | Set and an initial reference solution |

| Find any initial feasible starting point . Set and . | |

| Step 1. | For , each customer computes such that |

| subject to the constraints in (22). | |

| Step 2. | If a Nash equilibrium is reached, go to Step 3. Otherwise, update and go to Step 1. |

| Step 3. | If , then terminate. |

| Otherwise, update for , and . And go to Step 1. |

| Appliance | HLM1 | HLM2 | HLM3 | ||||

|---|---|---|---|---|---|---|---|

| Class | Type | Consumption Requirement | Time Period | Consumption Requirement | Time Period | Consumption Requirement | Time Period |

| NTS | Hob and oven | 1.0(H) | 17–18 | 1.0(H) | 17–18 | 1.2(H) | 18 |

| Heater | 1.0(H) | 3–4, 23 | 1.0(H) | 3–4, 23 | 1.5(H) | 3–4, 23 | |

| Fridge and freezer | 0.07(H) | 24 h | 0.07(H) | 24 h | 0.07(H) | 24 h | |

| Air conditioner | 1.5(H) | 11–14 | 1.55(H) | 11–14 | 1.5(H) | 12–14 | |

| PS | Water boiler | 0–1.2, 2(D) | 24 h | 0–1.5, 2(D) | 24 h | 0–1.2,2(D) | 24 h |

| Electric fan | 0–0.07, 0.7(D) | 24 h | 0–0.07, 0.8(D) | 24 h | 0–0.07, 0.8(D) | 24 h | |

| Electric vehicle | 0–3.5(D) | 20–8 | 0–2.3(D) | 20–8 | - | - | |

| TS | Washing machine | 0.5(H) | 1 h /day | 0.5(H) | 1 h/day | 0.5(H) | 1 h/day |

| TV | 0.1, 0.15(H) | 2 h/day | 0.1, 0.15(H) | 2 h/day | - | - | |

| Dishwasher | 1.8(H) | 1 h/day | - | - | - | - | |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jung, S.; Kim, D. Pareto-Efficient Capacity Planning for Residential Photovoltaic Generation and Energy Storage with Demand-Side Load Management. Energies 2017, 10, 426. https://doi.org/10.3390/en10040426

Jung S, Kim D. Pareto-Efficient Capacity Planning for Residential Photovoltaic Generation and Energy Storage with Demand-Side Load Management. Energies. 2017; 10(4):426. https://doi.org/10.3390/en10040426

Chicago/Turabian StyleJung, Somi, and Dongwoo Kim. 2017. "Pareto-Efficient Capacity Planning for Residential Photovoltaic Generation and Energy Storage with Demand-Side Load Management" Energies 10, no. 4: 426. https://doi.org/10.3390/en10040426