A Game Theoretical Approach Based Bidding Strategy Optimization for Power Producers in Power Markets with Renewable Electricity

Abstract

:1. Introduction

2. Problem Formulation

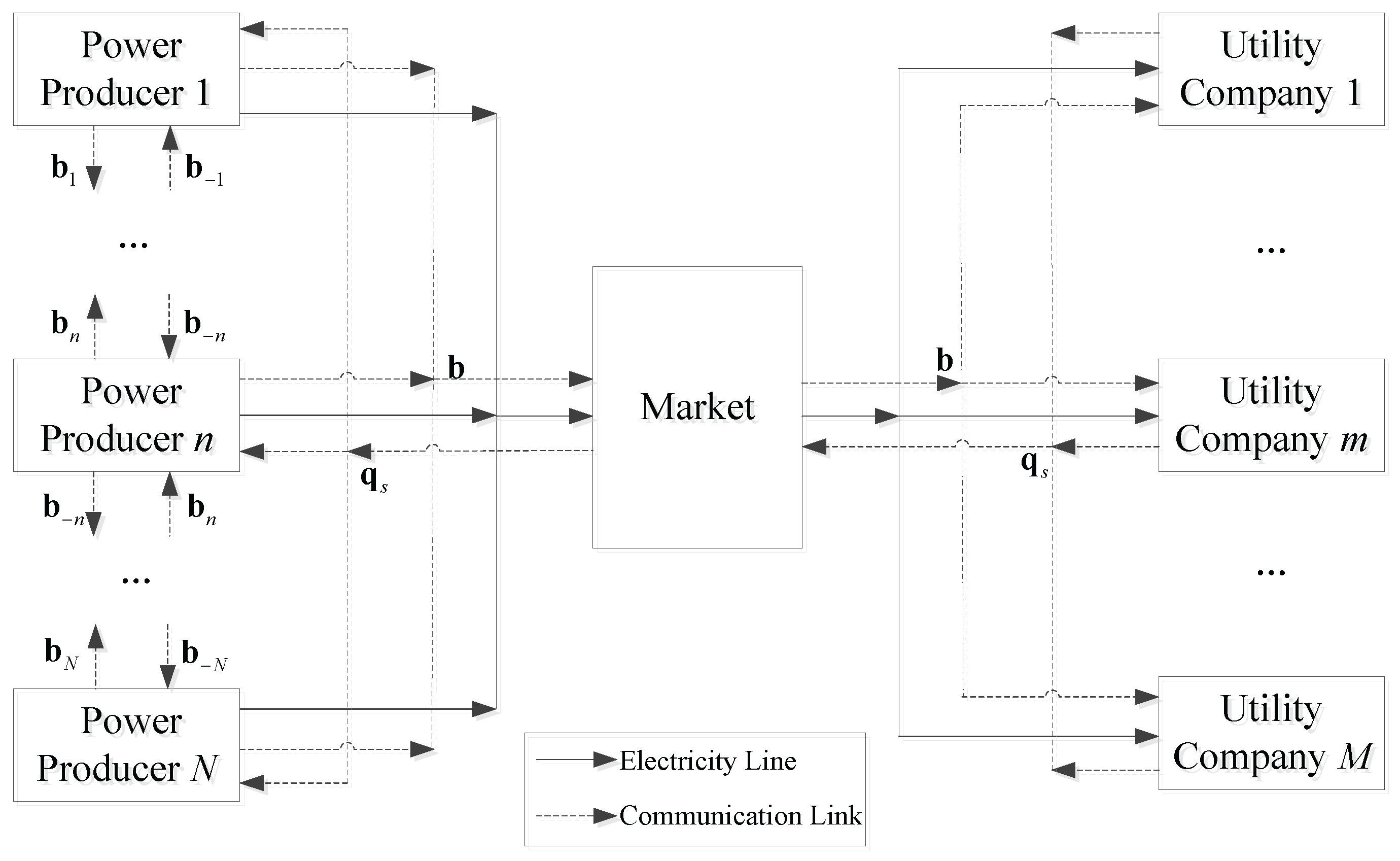

2.1. Market Framework

2.2. Cost Model

2.3. Bidding Model

3. Profit Model

3.1. Day-Ahead Market

3.2. Intraday Market

4. Methodology Based on the Non-Cooperative Game

4.1. Bilevel Optimization

4.1.1. Utility Company Side

4.1.2. Power Producer Side

4.2. Non-Cooperative Game Theoretic Optimization Approach and Algorithm

| Algorithm 1: Executed by each power producer at each time slot . |

| Initializing bidding strategy and profit of power producer n, and choose repeat Solve the optimization problem (30) according to bidding strategies of all power produces, and get the power generation dispatch policy Calculate profit according to power generation dispatch policy Solve the optimization problem (34), and obtain profit and bidding strategy if then end if until is satisfied. |

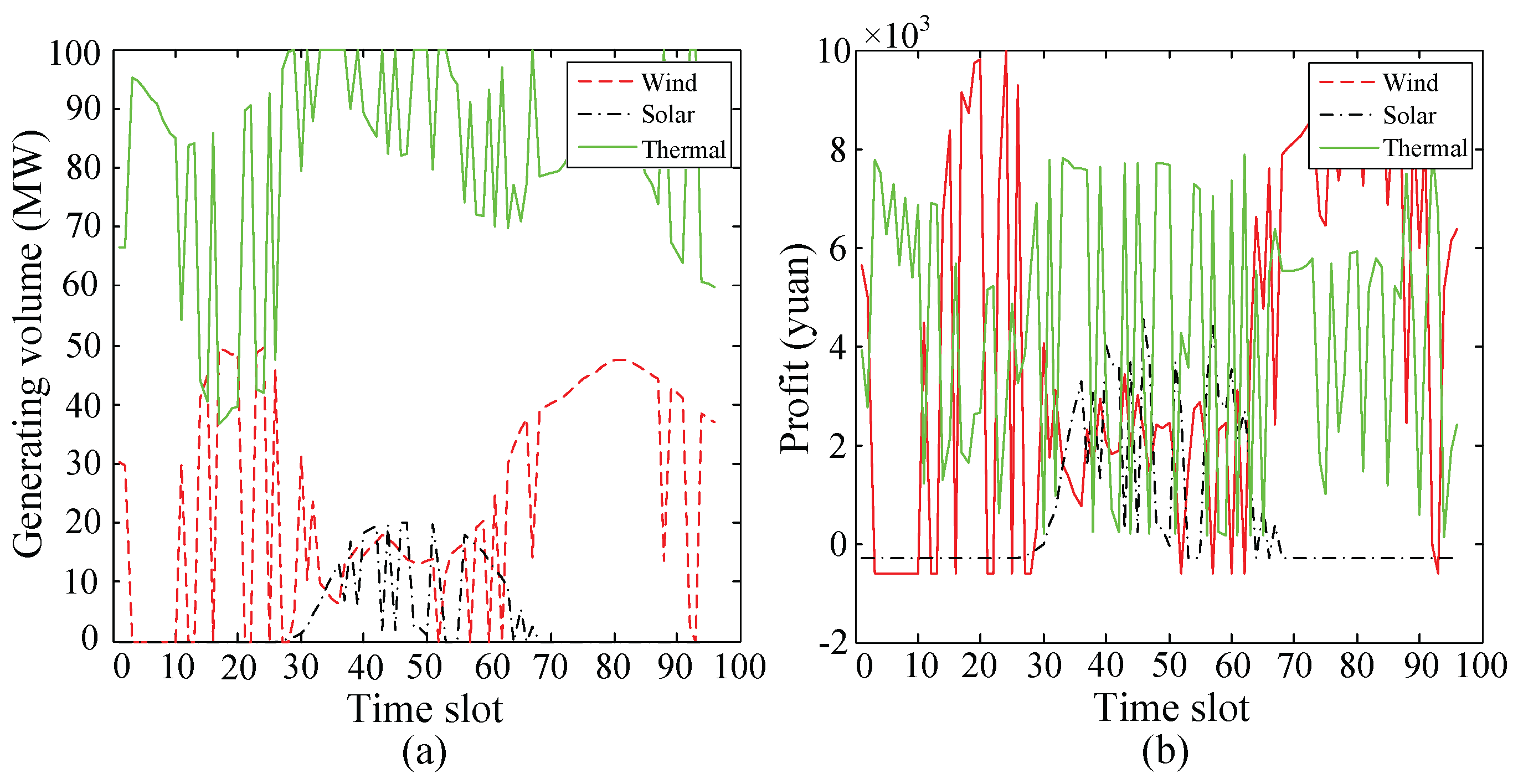

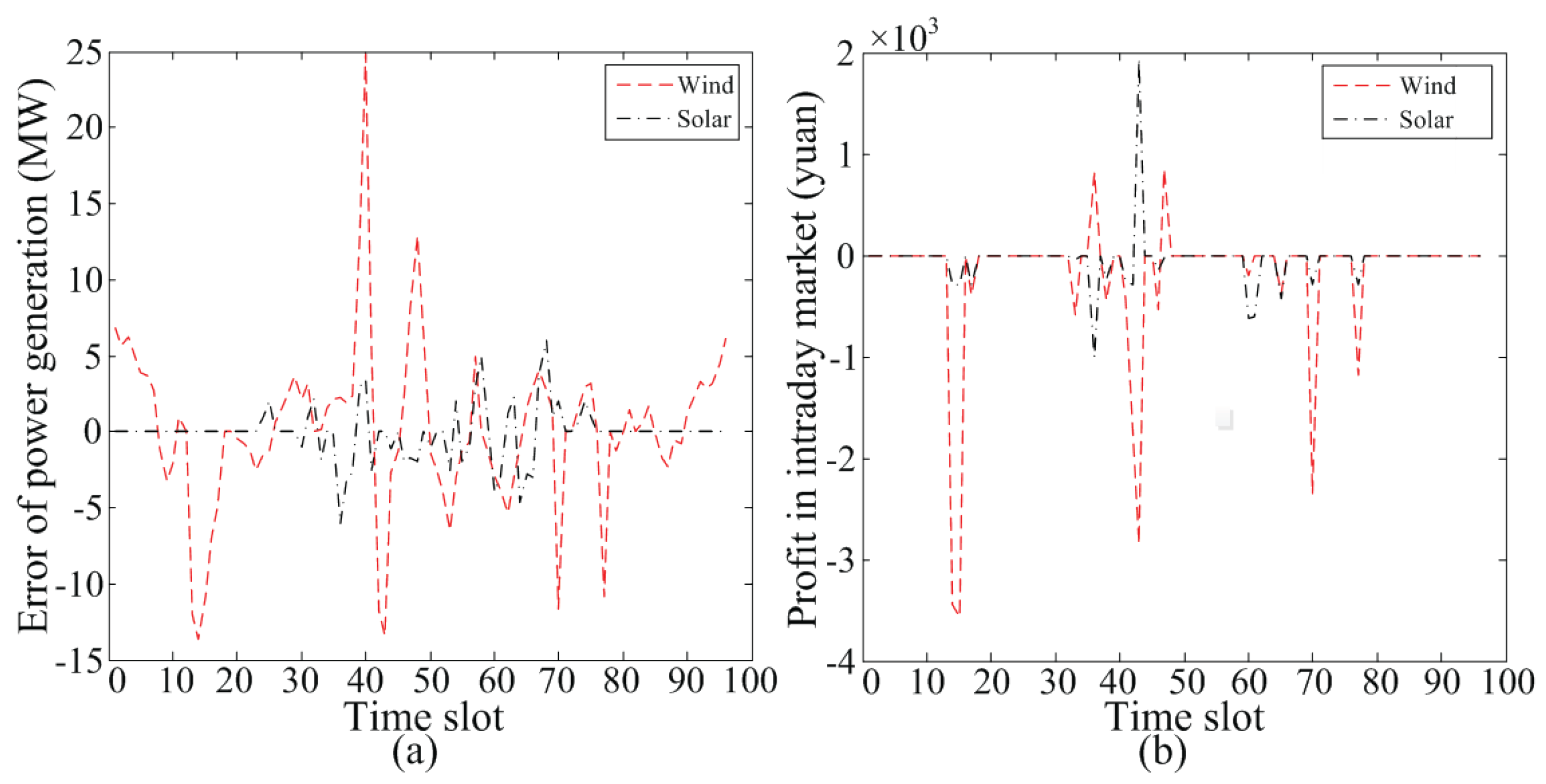

5. Numerical Results

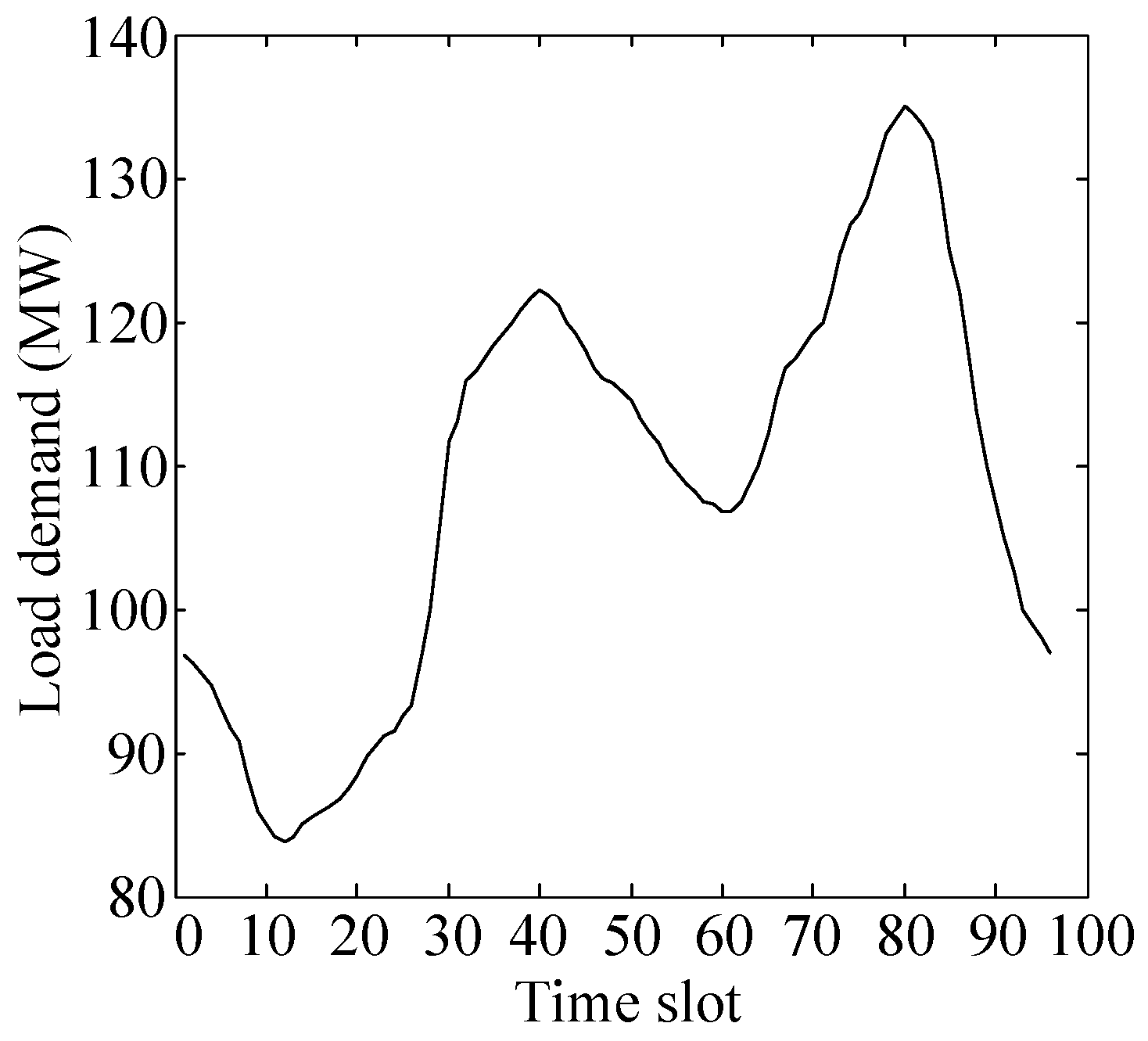

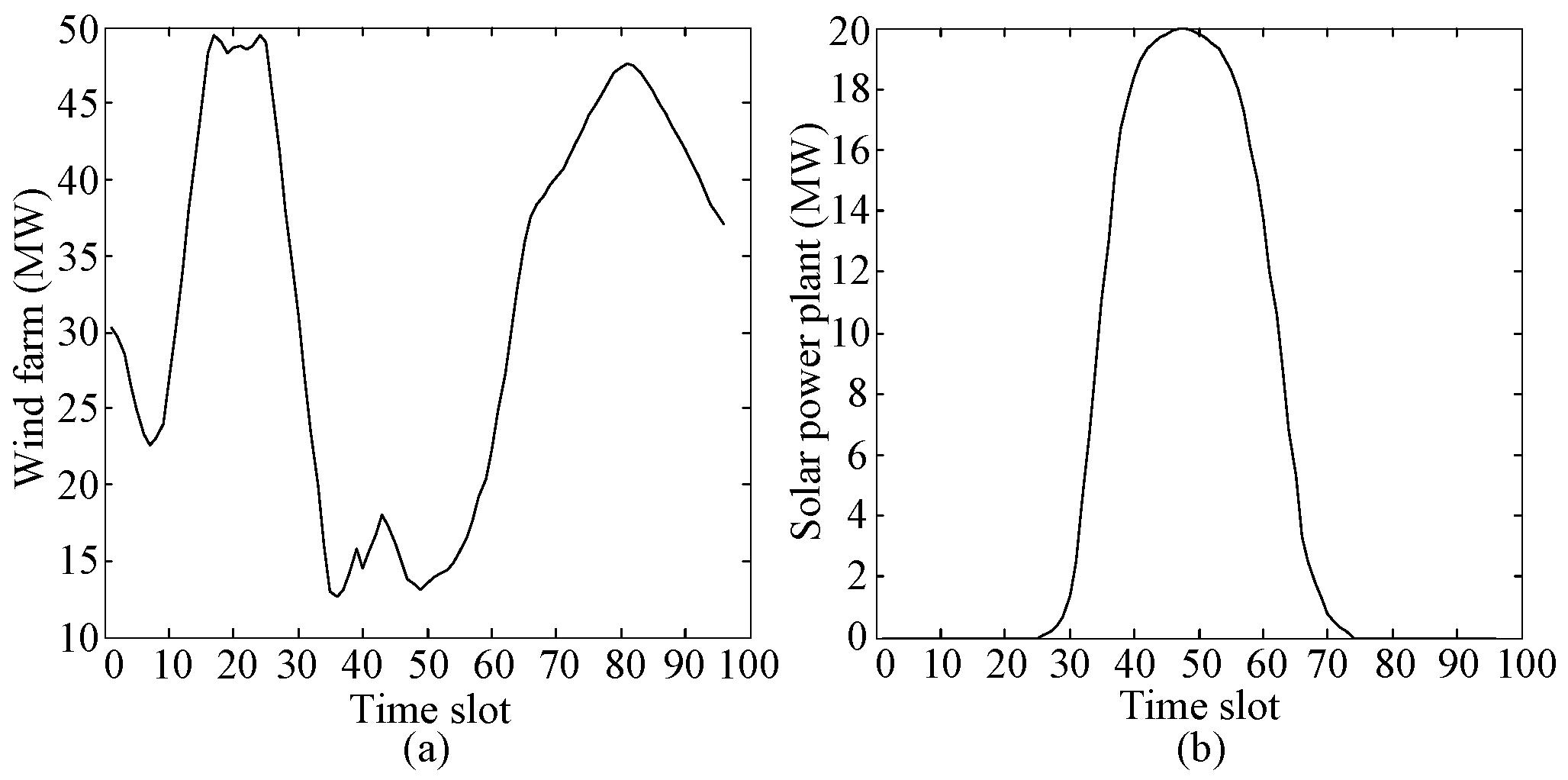

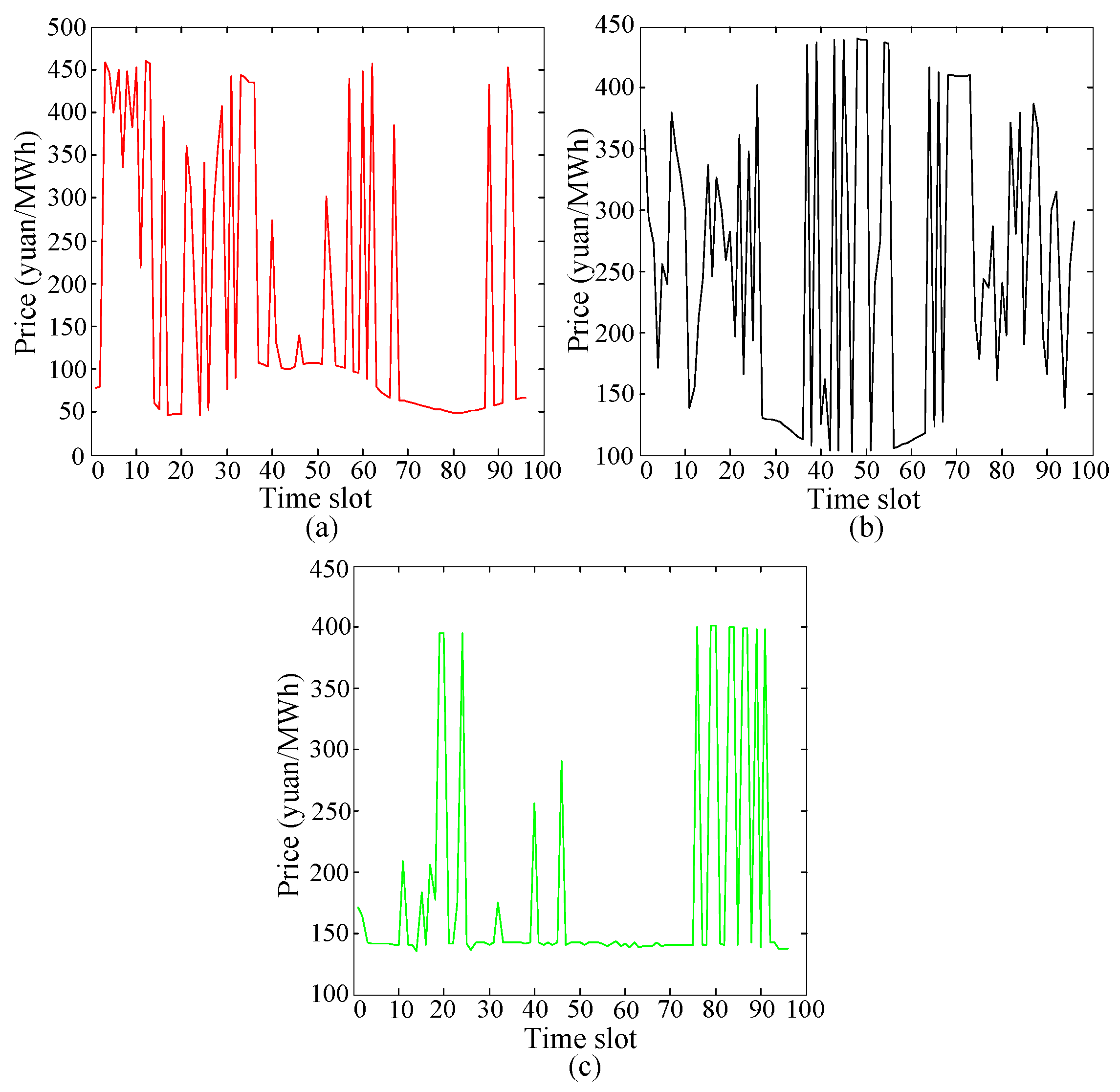

5.1. Simulations

5.2. Discussions

6. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Gountis, V.P.; Bakirtzis, A.G. Bidding strategies for electricity producers in a competitive electricity marketplace. IEEE Trans. Power Syst. 2004, 19, 356–365. [Google Scholar] [CrossRef]

- Woo, C.K.; Lloyd, D.; Tishler, A. Electricity market reform failures: UK, Norway, Alberta and California. Energy Policy 2003, 31, 1103–1115. [Google Scholar] [CrossRef]

- Sharma, K.C.; Bhakar, R.; Tiwari, H.P. Strategic bidding for wind power producers in electricity markets. Energy Convers. Manag. 2014, 86, 259–267. [Google Scholar] [CrossRef]

- Morales, J.M.; Conejo, A.J.; Perez-Ruiz, J. Short-term trading for a wind power producer. IEEE Trans. Power Syst. 2010, 25, 554–564. [Google Scholar] [CrossRef]

- Fampa, M.; Barroso, L.A.; Candal, D.; Simonetti, L. Bilevel optimization applied to strategic pricing in competitive electricity markets. Comput. Optim. Appl. 2008, 39, 121–142. [Google Scholar] [CrossRef]

- Zhang, G.; Zhang, G.; Gao, Y.; Lu, J. Competitive strategic bidding optimization in electricity markets using bi-level programming and swarm technique. IEEE Trans. Ind. Electron. 2011, 58, 2138–2146. [Google Scholar] [CrossRef]

- Pang, J.S.; Fukushima, M. Quasi-variational inequalities, generalized Nash equilibria, and multi-leader- follower games. Comput. Manag. Sci. 2005, 2, 21–56. [Google Scholar] [CrossRef]

- Bathurst, G.N.; Weatherill, J.; Strbac, G. Trading wind generation in short term energy markets. IEEE Trans. Power Syst. 2002, 17, 782–789. [Google Scholar] [CrossRef]

- Matevosyan, J.; Soder, L. Minimization of imbalance cost trading wind power on the short-term power market. IEEE Trans. Power Syst. 2006, 21, 1396–1404. [Google Scholar] [CrossRef]

- Pinson, P.; Chevallier, C.; Kariniotakis, G.N. Trading wind generation from short-term probabilistic forecasts of wind power. IEEE Trans. Power Syst. 2007, 22, 1148–1156. [Google Scholar] [CrossRef]

- Bridier, L.; David, M.; Lauret, P. Optimal design of a storage system coupled with intermittent renewables. Renew. Energy 2014, 67, 2–9. [Google Scholar] [CrossRef]

- Ghaffari, R.; Venkatesh, B. Options based reserve procurement strategy for wind generators—Using binomial trees. IEEE Trans. Power Syst. 2013, 28, 1063–1072. [Google Scholar] [CrossRef]

- Abreu, L.V.; Khodayar, M.E.; Shahidehpour, M.; Wu, L. Risk-constrained coordination of cascaded hydro units with variable wind power generation. IEEE Trans. Sustain. Energy 2012, 3, 359–368. [Google Scholar] [CrossRef]

- Dai, T.; Qiao, W. Trading wind power in a competitive electricity market using stochastic programing and game theory. IEEE Trans. Sustain. Energy 2013, 4, 805–815. [Google Scholar]

- Zugno, M.; Morales, J.M.; Pinson, P.; Madsen, H. Pool strategy of a price-maker wind power producer. IEEE Trans. Power Syst. 2013, 28, 3440–3450. [Google Scholar] [CrossRef]

- Baringo, L.; Conejo, A.J. Strategic offering for a wind power producer. IEEE Trans. Power Syst. 2013, 28, 4645–4654. [Google Scholar] [CrossRef]

- Dai, T.; Qiao, W. Optimal bidding strategy of a strategic wind power producer in the short-term market. IEEE Trans. Sustain. Energy 2015, 6, 707–719. [Google Scholar] [CrossRef]

- Kazempour, S.J.; Zareipour, H. Equilibria in an oligopolistic market with wind power production. IEEE Trans. Power Syst. 2014, 29, 686–697. [Google Scholar] [CrossRef]

- Dai, T.; Qiao, W. Finding equilibria in the pool-based electricity market with strategic wind power producers and network constraints. IEEE Trans. Power Syst. 2017, 32, 389–399. [Google Scholar] [CrossRef]

- Kristiansen, T. A time series spot price forecast model for the Nord Pool market. Int. J. Electr. Power Energy Syst. 2014, 61, 20–26. [Google Scholar] [CrossRef]

- Skajaa, A.; Edlund, K.; Morales, J.M. Intraday trading of wind energy. IEEE Trans. Power Syst. 2015, 30, 3181–3189. [Google Scholar] [CrossRef]

- Fang, X.; Li, F.; Wei, Y.; Azim, R.; Xu, Y. Reactive power planning under high penetration of wind energy using Benders decomposition. IET Gener., Transm. Distrib. 2015, 9, 1835–1844. [Google Scholar] [CrossRef]

- Zhang, H.; Gao, F.; Wu, J.; Liu, K.; Zhai, Q. A stochastic Cournot bidding model for wind power producers. In Proceedings of the IEEE International Conference on Automation and Logistics, Chongqing, China, 15–18 August 2011; pp. 319–324. [Google Scholar]

- Sharma, K.C.; Bhakar, R.; Padhy, N.P. Stochastic cournot model for wind power trading in electricity markets. In Proceedings of the Power and Energy Society General Meeting, National Harbor, MD, USA, 27–31 July 2014; pp. 1–5. [Google Scholar]

- Zhao, Z.Y.; Li, Z.W.; Yao, X. Study on cost price of wind power electricity based on the certified emission reduction income. Renew. Energy Resour. 2014, 32, 662–667. (In Chinese) [Google Scholar]

- Gan, L.; Eskeland, G.S.; Kolshus, H.H. Green electricity market development: Lessons from Europe and the US. Energy Policy 2007, 35, 144–155. [Google Scholar] [CrossRef]

- Sorknaes, P.; Andersen, A.N.; Tang, J.; Strom, S. Market integration of wind power in electricity system balancing. Energy Strategy Rev. 2013, 1, 174–180. [Google Scholar] [CrossRef]

- Robinson, M. Role of balancing markets in wind integration. In Proceedings of the IEEE PES Power Systems Conference and Exposition, Atlanta, GA, USA, 29 October–1 November 2006; pp. 232–233. [Google Scholar]

- Hu, X.; Ralph, D. Using EPECs to model bi-level games in restructured electricity markets with locational prices. Oper. Res. 2007, 55, 809–827. [Google Scholar] [CrossRef]

- Ghotbi, E.; Dhingra, A.K. A bi-level game theoretic approach to optimum design of flywheels. Eng. Optim. 2012, 44, 1337–1350. [Google Scholar] [CrossRef]

- Haghighat, H.; Seifi, H.; Kian, A.R. Gaming analysis in joint energy and spinning reserve markets. IEEE Trans. Power Syst. 2007, 22, 2074–2085. [Google Scholar] [CrossRef]

- Song, H.; Liu, C.C.; Lawarree, J. Nash equilibrium bidding strategies in a bilateral electricity market. IEEE Trans. Power Syst. 2002, 17, 73–79. [Google Scholar] [CrossRef]

- Wu, H.; Shahidehpour, M.; Alabdulwahab, A.; Abusorrah, A. A game theoretic approach to risk-based optimal bidding strategies for electric vehicle aggregators in electricity markets with variable wind energy resources. IEEE Trans. Sustain. Energy 2016, 7, 374–385. [Google Scholar] [CrossRef]

- Hobbs, B.F.; Metzler, C.B.; Pang, J.S. Strategic gaming analysis for electric power systems: An MPEC approach. IEEE Trans. Power Syst. 2000, 15, 638–645. [Google Scholar] [CrossRef]

- Leyffer, S.; Munson, T. Solving multi-leader-common-follower games. Optim. Methods Softw. 2010, 25, 601–623. [Google Scholar] [CrossRef]

| Power Plants | Installed Capacity (MW) | (Yuan/MWh2) | (Yuan/MWh) | (Yuan) | Minimum Output (MW) |

|---|---|---|---|---|---|

| Wind farm | 49.5 | 0 | 0.018 | 2490 | 0 |

| Solar power plant | 20 | 0 | 0.023 | 1187 | 0 |

| Thermal power plant | 100 | 0.063 | 125.3 | 0 | 20 |

| Power Plant | (Yuan) | (Yuan) | (Yuan/MWh) | (Yuan/MWh) |

|---|---|---|---|---|

| Wind farm | 130 | 460 | 215 | −1.6945 |

| Solar power plant | 130 | 510 | 420 | −1.35468 |

| Thermal power plant | 130 | 390 | 0 | 0.126 |

| (Yuan/MWh) | (Yuan/MWh) | (t/MWh) | ||

|---|---|---|---|---|

| 190 | 190 | 0 | 1.3 | 1.1 |

| Power Plant | Profit ( Yuan) | Trading Generating Volume (MWh) | Maximum Generating Volume (MWh) |

|---|---|---|---|

| Wind farm | 37.91 | 563.73 | 773.37 |

| Solar power plant | 5.35 | 88.83 | 136.1 |

| Thermal power plant | 42.09 | 1956.93 | 2400 |

| Power Plant | Profit ( Yuan) | Total Profit ( Yuan) |

|---|---|---|

| Wind farm | −2.65 | 35.26 |

| Solar power plant | −0.61 | 4.74 |

| Thermal power plant | 0.14 | 42.23 |

| Power Plant | Profit in Reserve Market ( Yuan) | ( Yuan) |

|---|---|---|

| Wind farm | −5.03 | 2.38 |

| Solar power plant | −1.53 | 0.92 |

| Thermal power plant | 0 | 0.14 |

| Power Plant | No Game | With Game | |

|---|---|---|---|

| Wind farm | 37.29 | 37.91 | 0.62 |

| Solar power plant | 5.28 | 5.35 | 0.07 |

| Thermal power plant | 42.02 | 42.09 | 0.07 |

| All power plants | 84.59 | 85.35 | 0.76 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tang, Y.; Ling, J.; Ma, T.; Chen, N.; Liu, X.; Gao, B. A Game Theoretical Approach Based Bidding Strategy Optimization for Power Producers in Power Markets with Renewable Electricity. Energies 2017, 10, 627. https://doi.org/10.3390/en10050627

Tang Y, Ling J, Ma T, Chen N, Liu X, Gao B. A Game Theoretical Approach Based Bidding Strategy Optimization for Power Producers in Power Markets with Renewable Electricity. Energies. 2017; 10(5):627. https://doi.org/10.3390/en10050627

Chicago/Turabian StyleTang, Yi, Jing Ling, Tingting Ma, Ning Chen, Xiaofeng Liu, and Bingtuan Gao. 2017. "A Game Theoretical Approach Based Bidding Strategy Optimization for Power Producers in Power Markets with Renewable Electricity" Energies 10, no. 5: 627. https://doi.org/10.3390/en10050627