An Optimization Framework for Investment Evaluation of Complex Renewable Energy Systems

Abstract

:1. Introduction and Motivation

Contribution and Paper Outline

2. Literature Review

3. Problem Definition

3.1. Problem Notation: Parameters and Variables

3.1.1. Sets

- set of candidate locations where generation plants can be located.

- set of candidate locations where substations or line junctures can be located.

- set of selling points, i.e., sub-stations of the existing power grid where energy is associated with a spot price.

- set of potential lines connecting generation locations from with locations in (i.e., ).

- set of lines connecting locations from with both, other elements from and selling points from O (i.e., ).

3.1.2. Generation Parameters

- maximum generation capacity to be installed, at a single location (MWp).

- available radiation for a given generation location and a given hour t (MW/m).

- nominal power of a PV module under standard test conditions (STC) (MWp/m) of a photovoltaic (PV) module with a surface of a (m)). Hence, a PV generation plant will be comprised by a group (of say Q) of these modules, and its capacity will be given by (MWp).

- performance of the inverter that is planned to be used in the installed PV plants.

- loss factor of the PV modules due to the presence of dust.

- fixed cost of installing a PV power plant (USD).

- variable cost of installing a PV power plant (USD/MW).

- variable cost of installing a sub-station (USD/MW).

- variable cost of ESS installation (USD/MWh).

- sale price in node o at period t (USD/MW).

3.1.3. Transmission Parameters

- transmission loss factor associated with direct current (DC).

- transmission loss factor associated with alternate current (AC).

- maximum extension of a single line segment due regulations (km).

- distance between point i and point j (km).

- loss factor associated with power transmission.

- fixed installation cost of installing one kilometer of transmission line (USD/km).

- variable installation cost of installing, per MW, one kilometer of transmission line (USD/MW/km).

3.1.4. Energy Storage Parameters

- ESS’ charge efficiency.

- ESS’ discharge efficiency.

- minimum level of the state of charge that must be preserved in the ESS.

- maximum ESS’ charge power flow (MW).

- maximum ESS’ discharge power flow (MW).

- maximum storage capacity (MWh).

- variable cost of ESS installation (USD/MWh).

3.1.5. Problem Variables

- binary variable, so that if a generator (i.e., a PV plant) is installed at location , and otherwise.

- installed fraction of of installed generator at a given ().

- installed nominal power (PV) at a given . ().

- generated power from the generator located at in period t.

- dispatched power from the generator located at in period t.

- spilled power in the generator located at in period t.

- binary variable so that if a substation is installed at location , and otherwise.

- capacity of installed substation, at a given .

- binary variable, so that if a line between i and j is built (), and otherwise.

- binary variable, so that if a line between j and k is built (), and otherwise.

- capacity of installed transmission line, between i and j ().

- capacity of installed transmission line, between j and k is built ().

- power flow on line in period t.

- non-transmitted power through the line in period t.

- power losses at line in period t.

- power flow on in period t.

- non-transmitted power through the line in period t.

- power losses on in period t.

- capacity of the ESS installed at .

- installed portion of of installed ESS at ().

- charge status, in period t, of the ESS located at i.

- charging flow, in period t, at the ESS located at i.

- discharging flow, in period t, at the ESS located at i.

- binary variable, so that , if the ESS in i is discharged in period t, and , otherwise.

3.2. An MILP for the GTSELSP

3.2.1. Generation

3.2.2. Transmission Topology

3.2.3. Energy Storage Systems

3.2.4. Power Balance

3.2.5. Transmission and Substation Capacities

3.2.6. Losses and Boundary Conditions

3.2.7. The GTSELSP

4. Results and Discussion

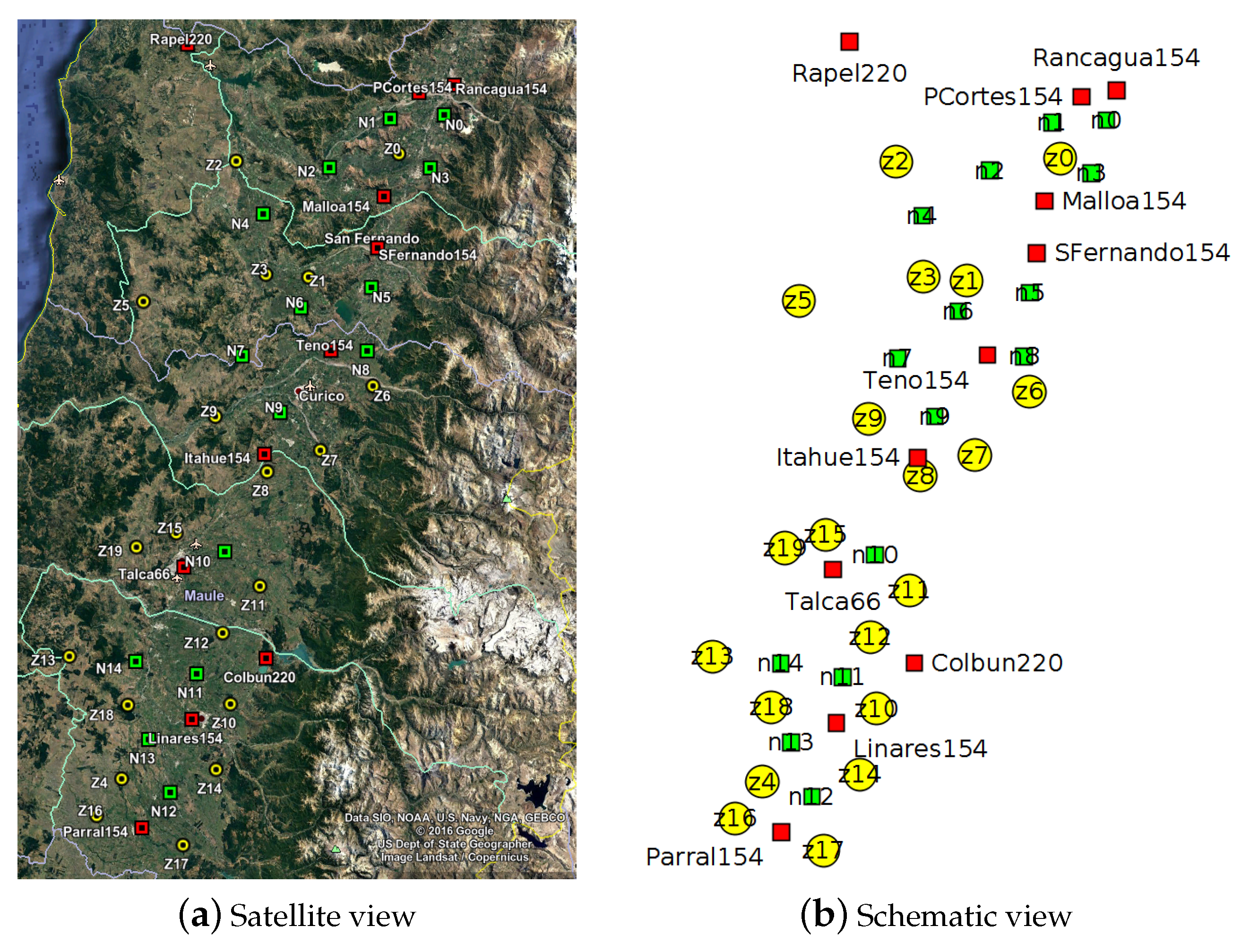

4.1. Case Study: Chilean Central Region

4.2. Estimation and Model Parameters

4.2.1. Solar Radiation Potential

4.2.2. Generation and Transmission Technological Parameters

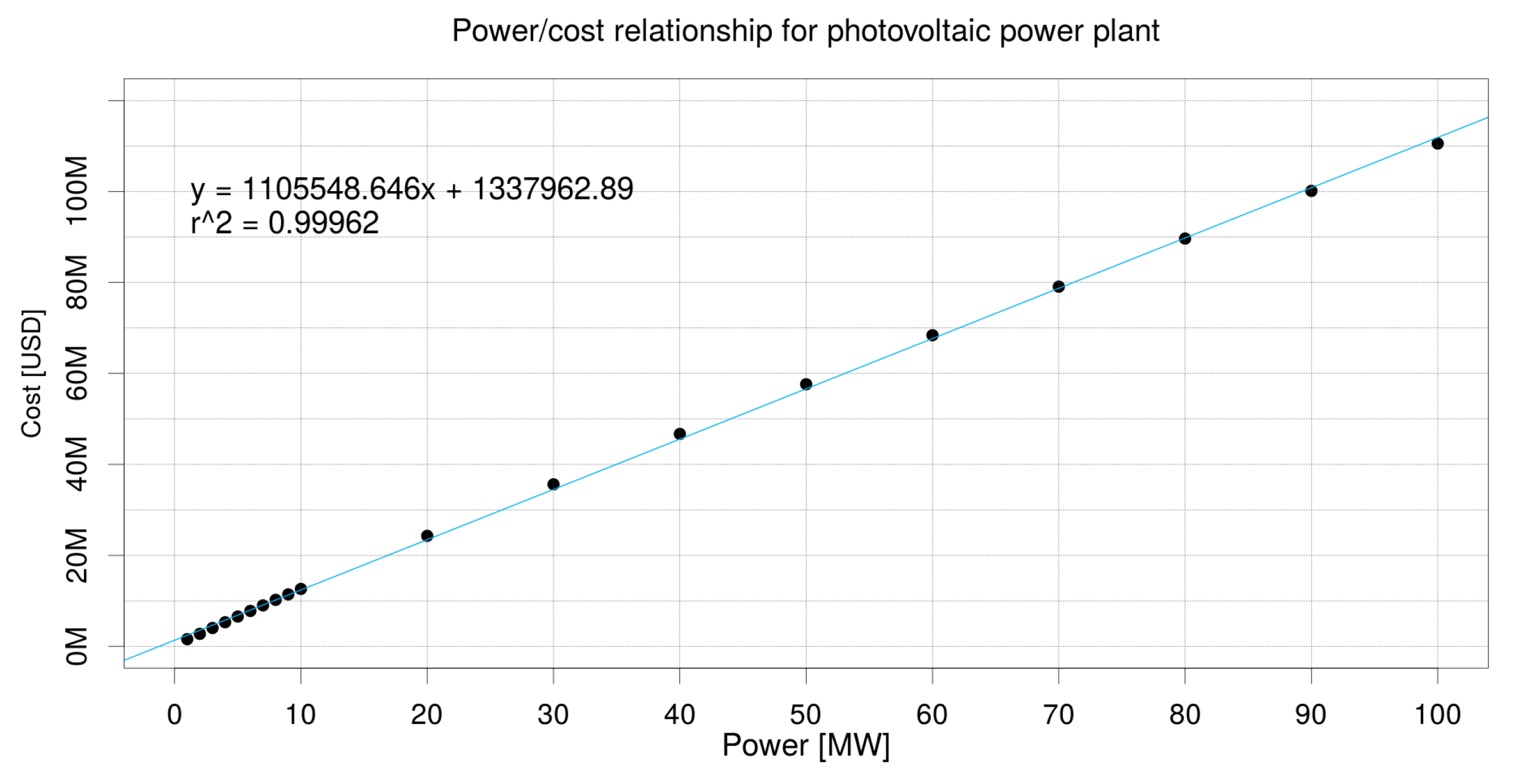

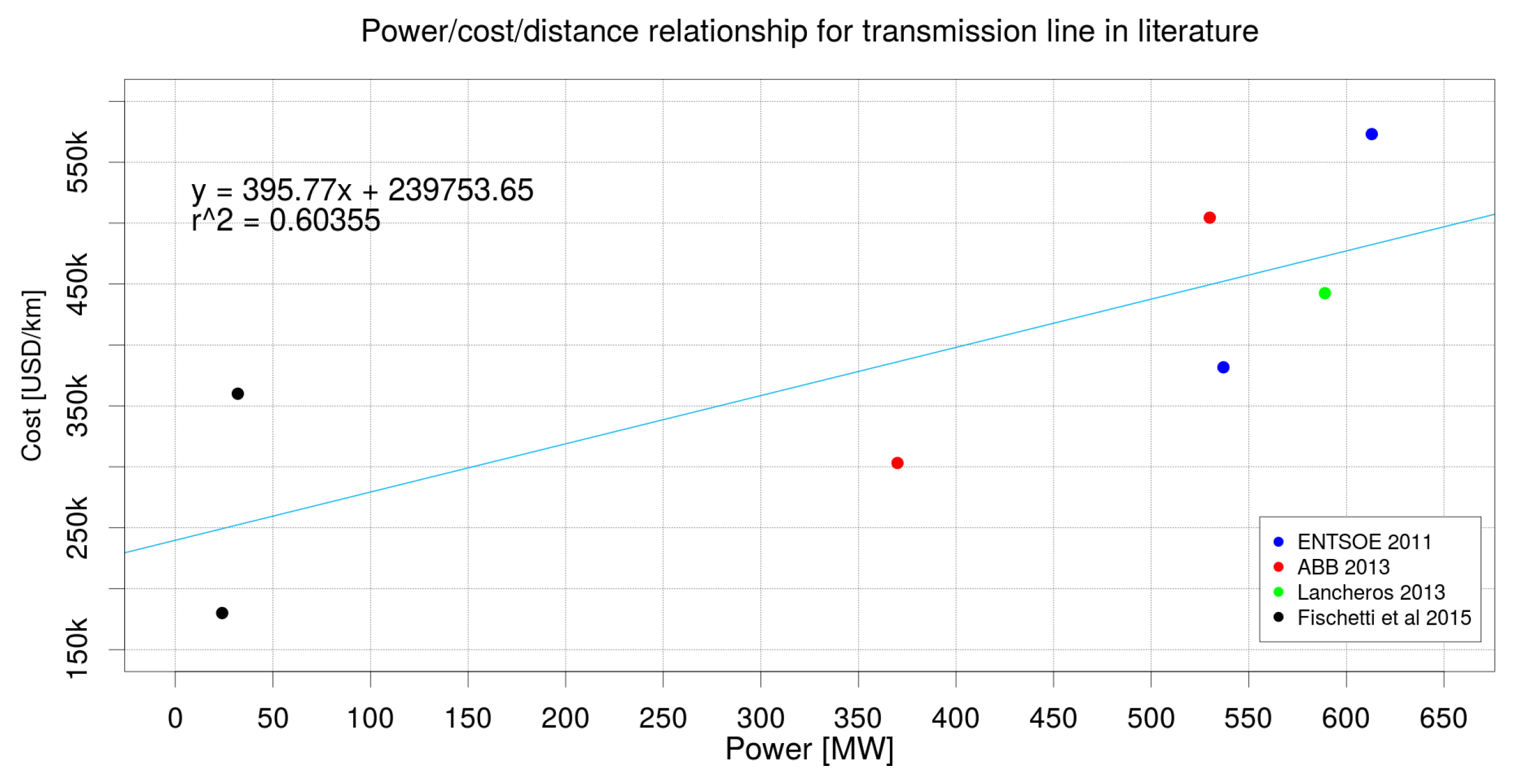

4.2.3. Generation and Transmission Construction Costs

4.2.4. Energy Storage Parameters

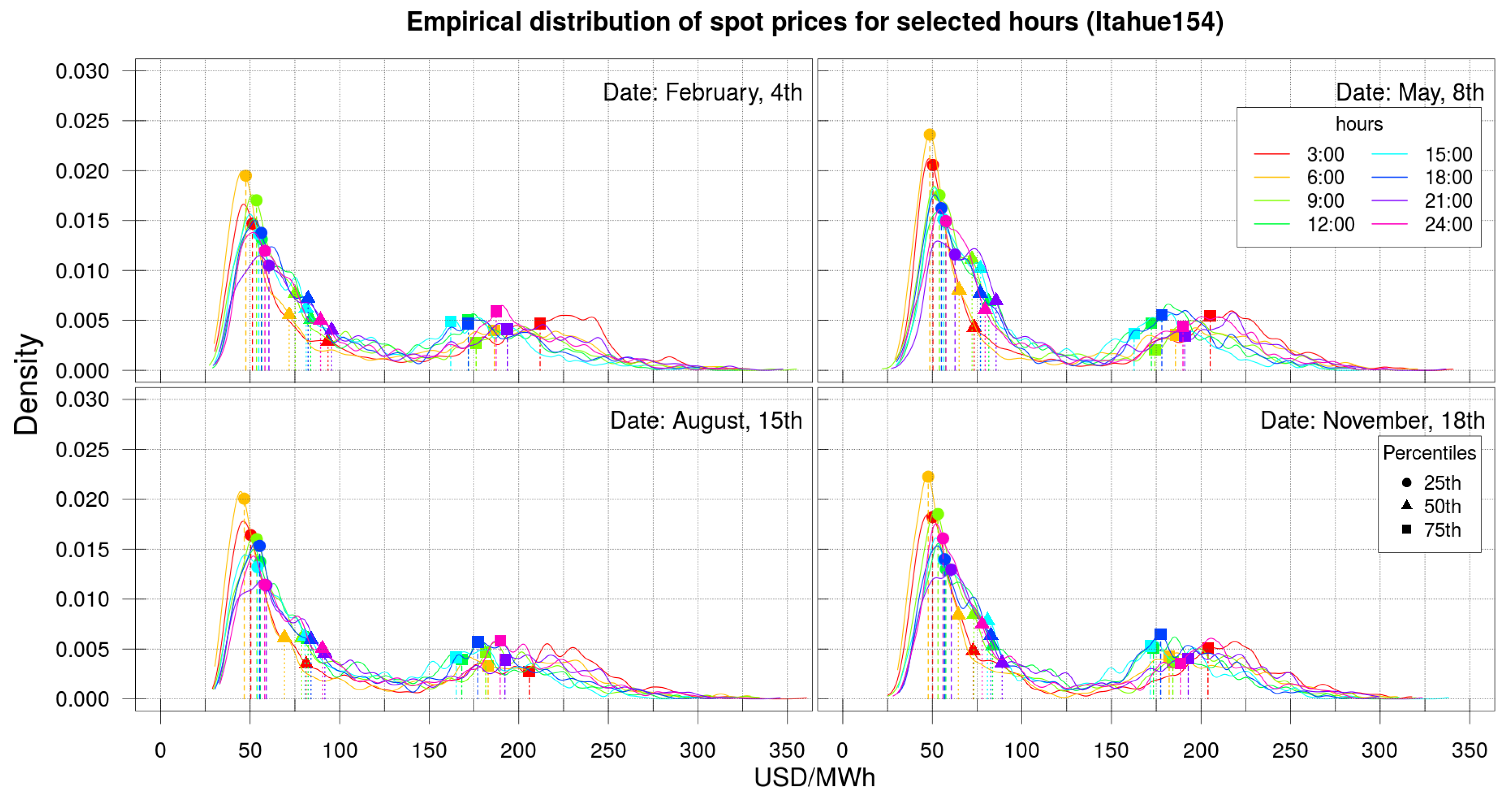

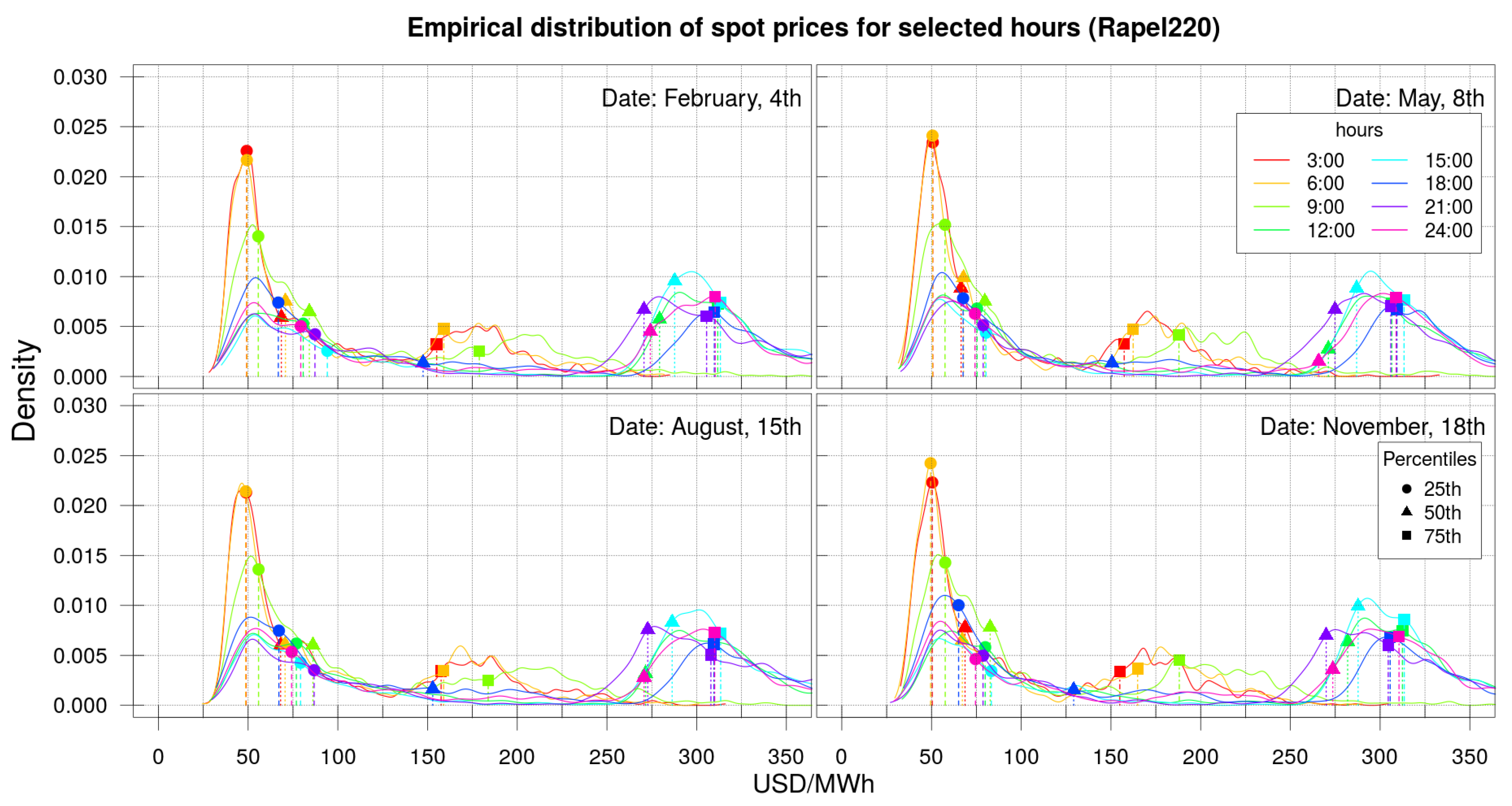

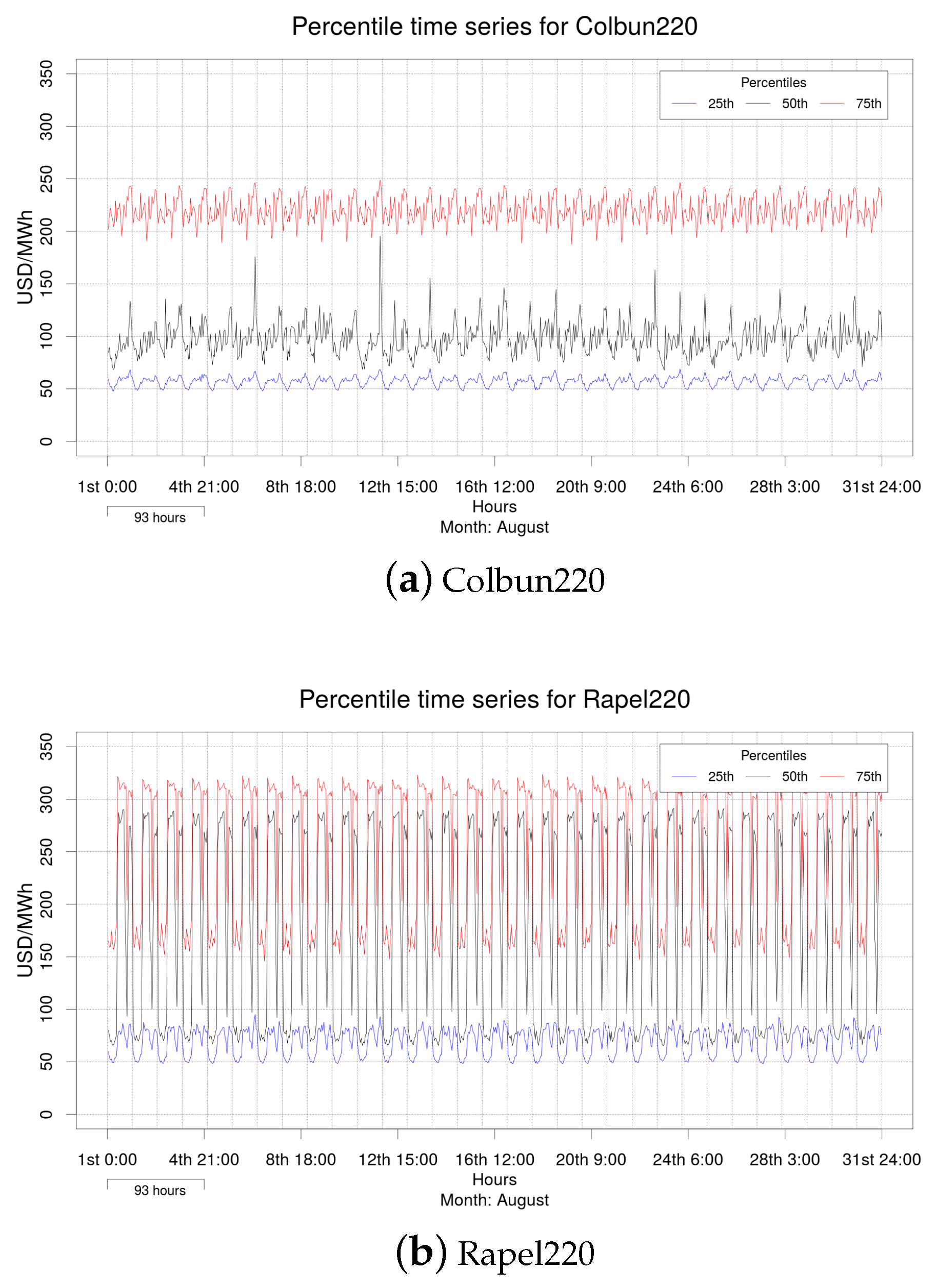

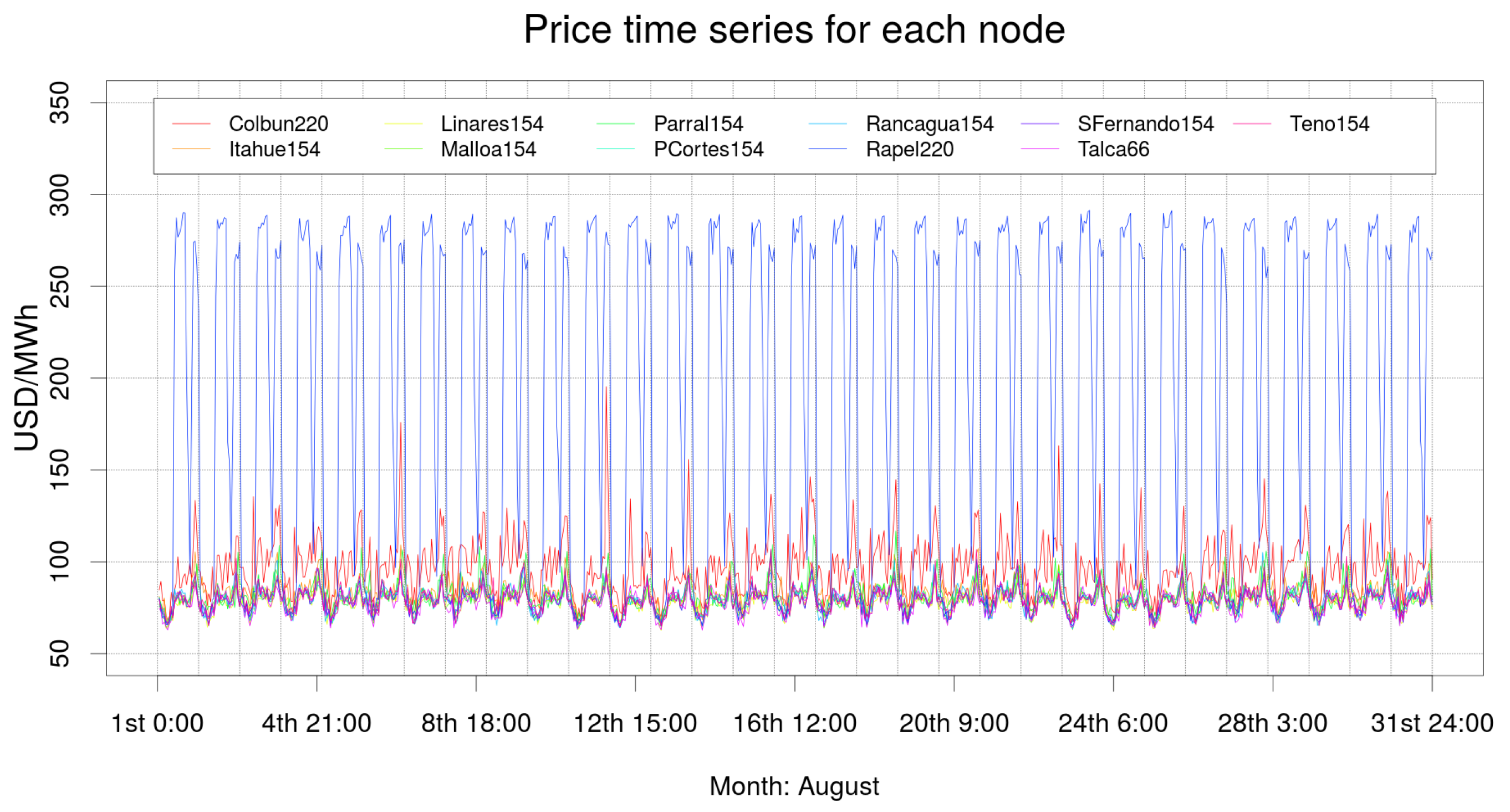

4.2.5. Modeling and Estimation of Spot Prices

4.3. Discussion and Results Analysis

4.3.1. Experimental Setting

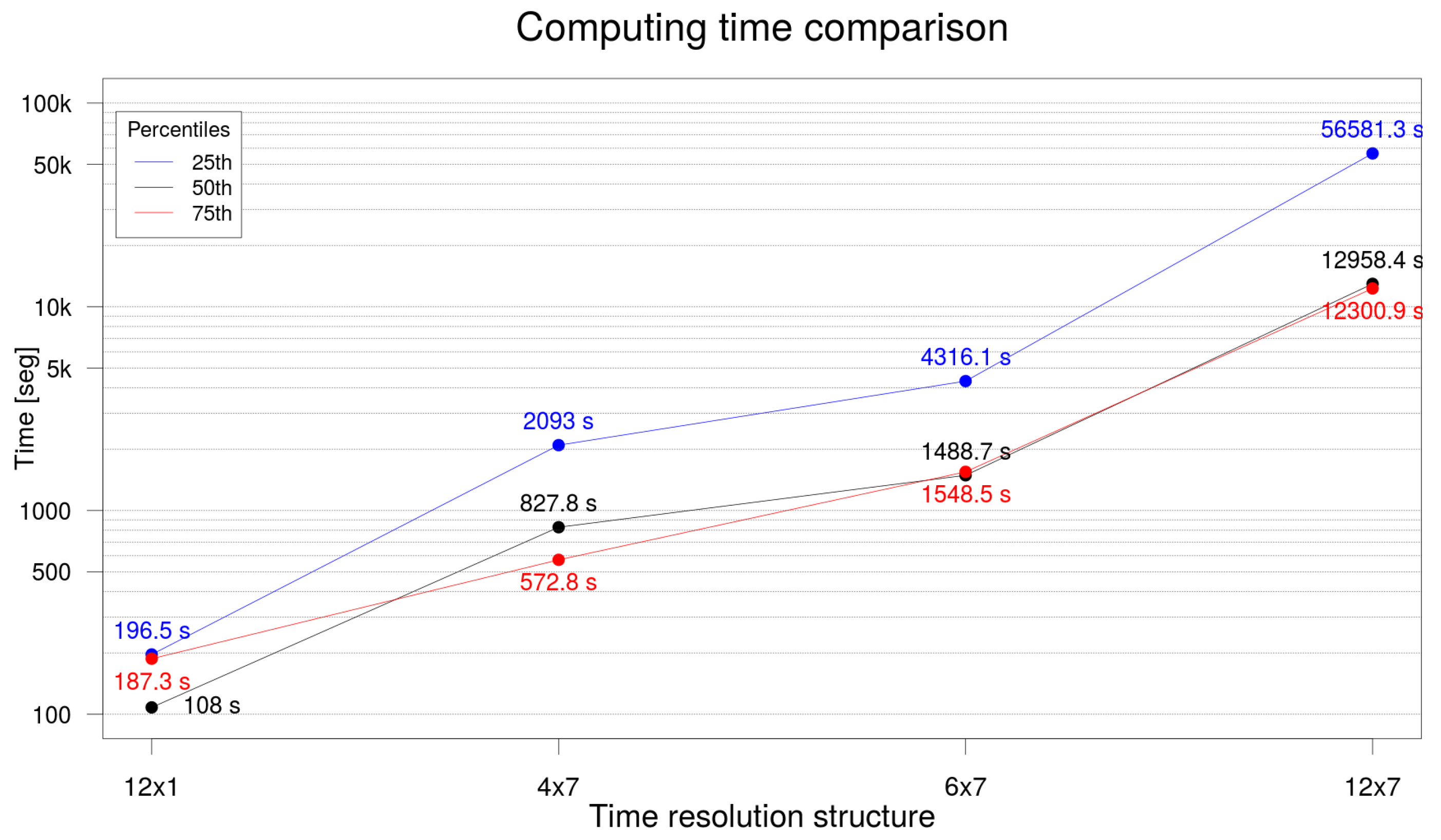

4.3.2. Time Resolution

- ‘12 × 1’: One year is characterized by 12 days, so that each day encodes one month. Since every day is comprised of 24 h, this setting yields .

- ‘4 × 7’: One year is characterized by four weeks, so that each week encodes three months. In this case, we have .

- ‘6 × 7’: One year is characterized by six weeks, so that each week encodes two months. In this case, we have .

- ‘12 × 7’: One year is characterized by 12 weeks, so that each week encodes one month. In this case, we have .

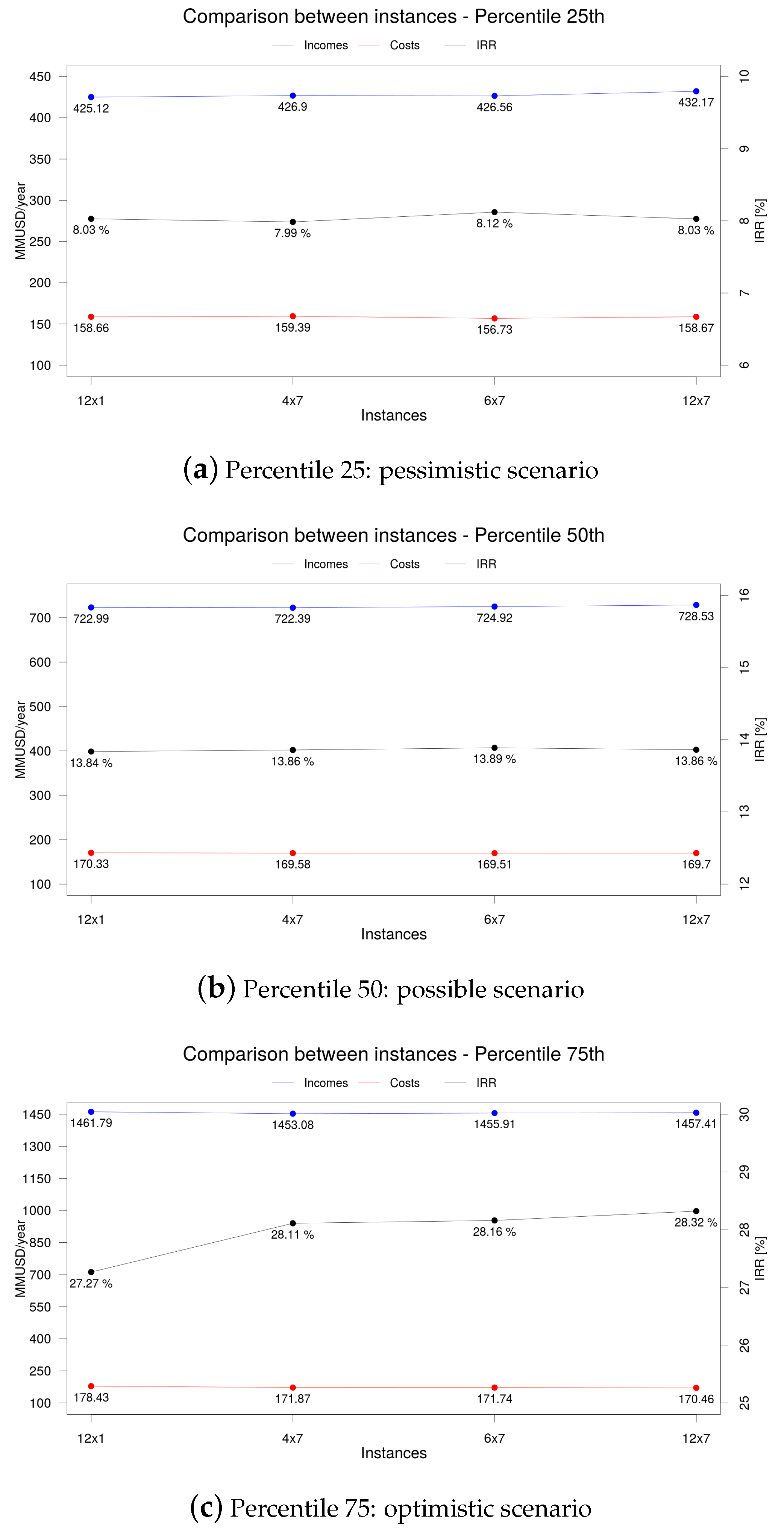

4.3.3. Spot Price Scenarios

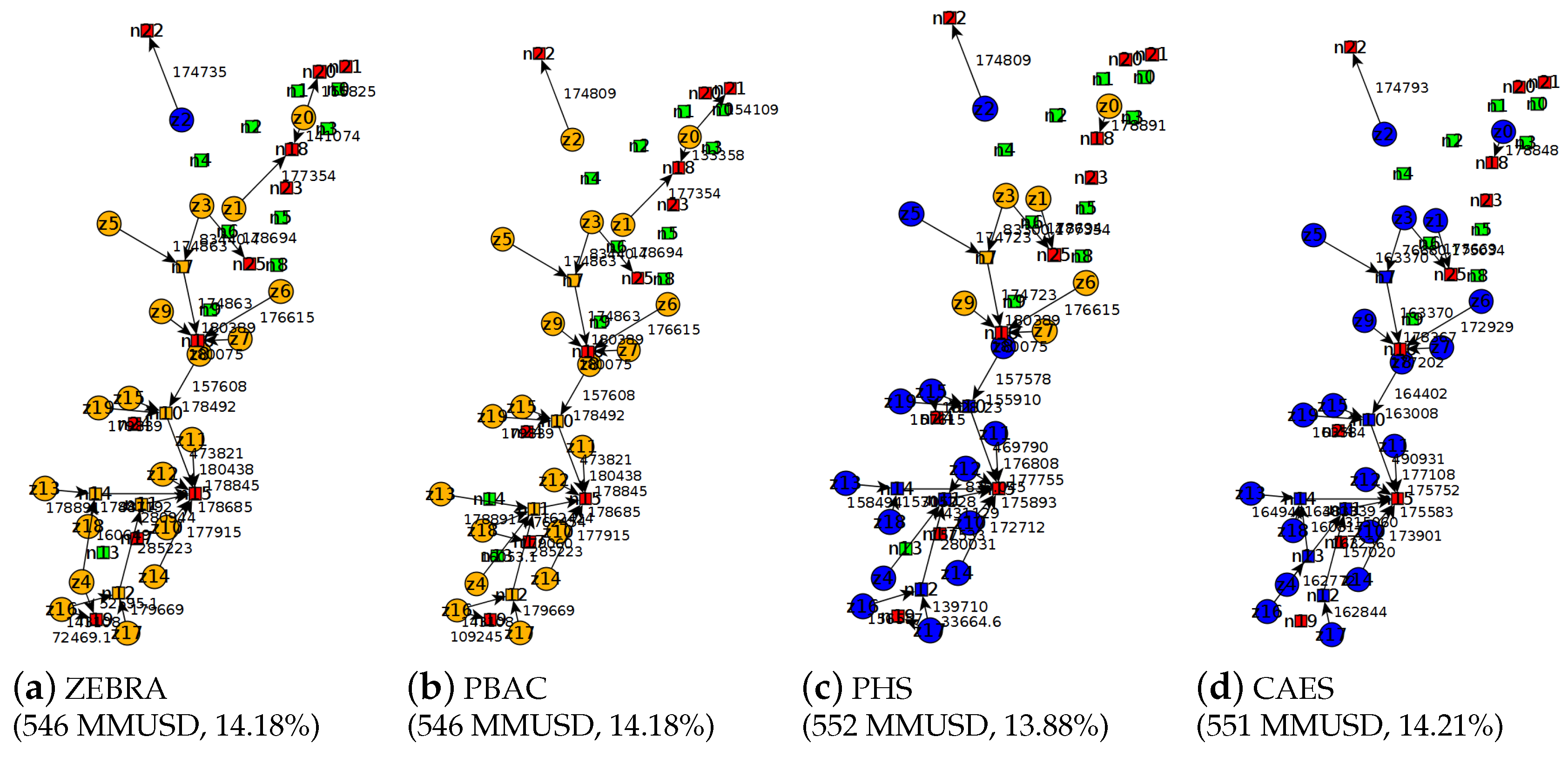

- The solution obtained for P25 (with a total investment of 4702 MMUSD) is comprised by 20 generation points (orange and blue circles), where an ESS facility is installed in only one of them (blue circle); these generation points inject the generated power through nine existing substations (red squares) and require one additional intermediate substation (orange square).

- The solution obtained for P50 (with a total investment of 5085 MMUSD) is comprised by 20 generation points, where ESS facilities are installed in 14 of them; these generation points inject the generated power through six existing substations and require five additional intermediate substations, and ESS facilities are installed in four of them (blue squares).

- The solution obtained for P75 (with a total investment of 5152 MMUSD) is comprised by 20 generation points, where ESS facilities are installed in 14 of them; these generation points inject the generated power through six existing substations and require eight additional intermediate substations, and ESS facilities are installed in four of them.

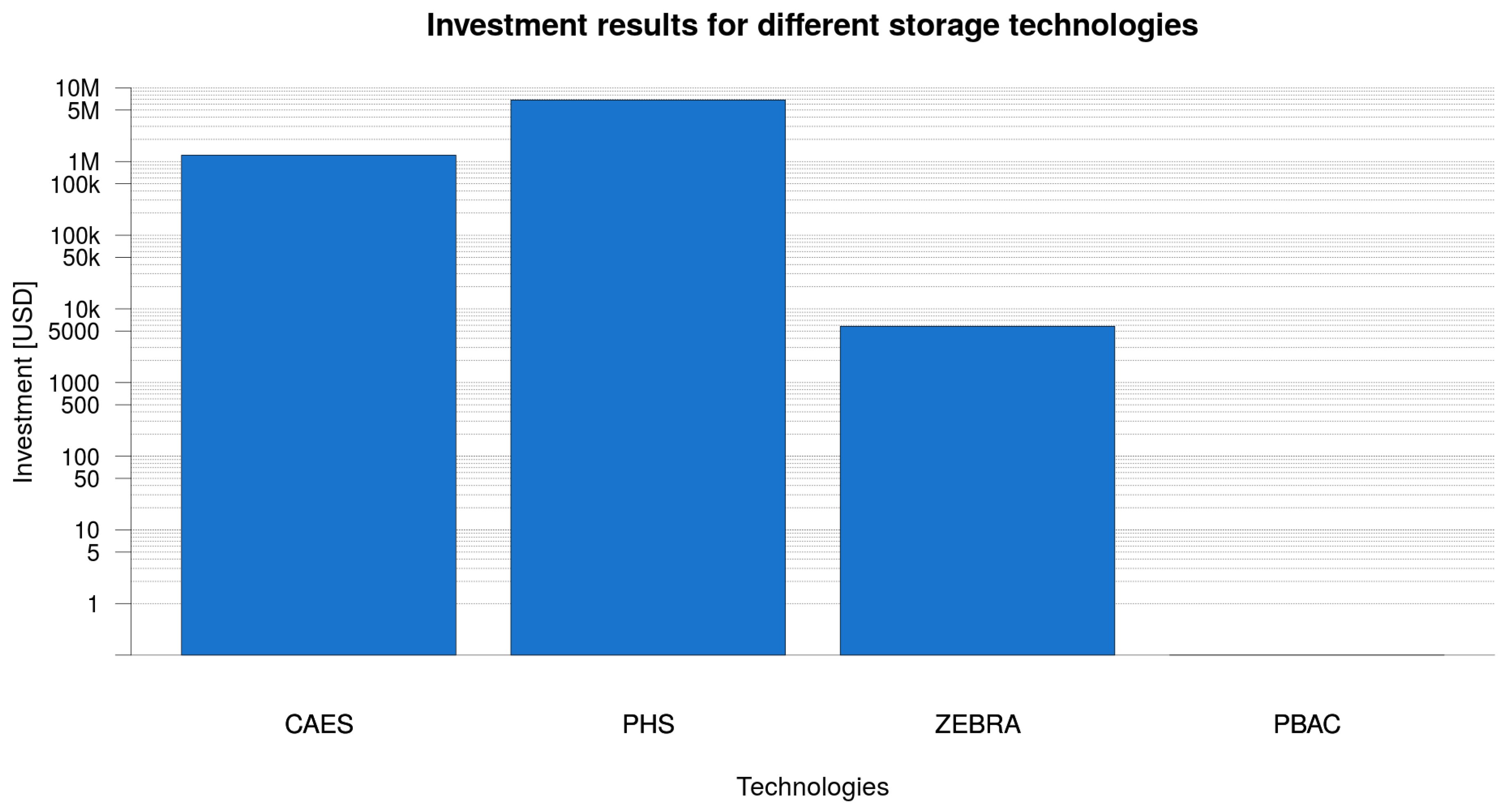

4.3.4. Storage Technology

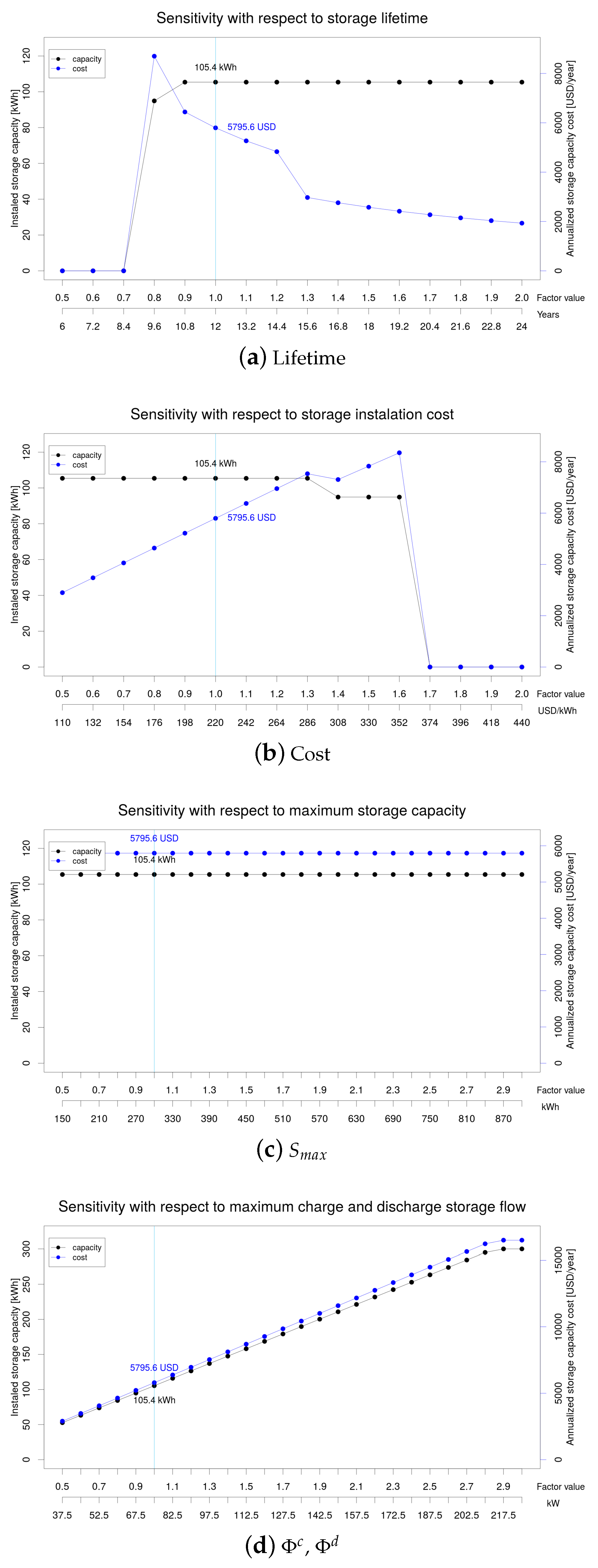

4.3.5. Sensitivity Analysis on Storage Parameters

5. Conclusions and Future Work

Acknowledgments

Author Contributions

Conflicts of Interest

References

- International Energy Agency (IEA). Key World Energy Statistics 2015; Technical Report; International Energy Agency: Vienna, Austria, 2015. [Google Scholar]

- Carlyle, R. How big are the currently known oil reserves and what are the chances of finding new ones?—Forbes. Available online: http://www.forbes.com/sites/quora/2013/03/27/how-big-are-the-currently-known-oil-reserves-and-what-are-the-chances-of-finding-new-ones/ (accessed on 21 July 2016).

- Tully, A. How long will world’s oil reserves last? 53 Years, Says BP. Available online: http://www.csmonitor.com/Environment/Energy-Voices/2014/0714/How-long-will-world-s-oil-reserves-last-53-years-says-BP (accessed on 21 July 2016).

- Petroleum, B.B. Oil Reserves | About BP | BP Global. Available online: http://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy/oil/oil-reserves.html (accessed on 21 July 2016).

- Roboam, X. (Ed.) Integrated Design by Optimization of Electrical Energy Systems; Wiley-ISTE: Hoboken, NJ, USA, 2012. [Google Scholar]

- Suazo-Martínez, C.; Pereira-Bonvallet, E.; Palma-Behnke, R. A simulation framework for optimal energy storage sizing. Energies 2014, 7, 3033–3055. [Google Scholar] [CrossRef]

- Kim, J.; Powell, W. Optimal energy commitments with storage and intermittent supply. Oper. Res. 2011, 59, 1347–1360. [Google Scholar] [CrossRef]

- Koltsaklis, N.; Georgiadis, M. A multi-period, multi-regional generation expansion planning model incorporating unit commitment constraints. Appl. Energy 2015, 158, 310–331. [Google Scholar] [CrossRef]

- Jiang, R.; Wang, J.; Guan, Y. Robust unit commitment with wind power and pumped storage hydro. IEEE Trans. Power Syst. 2012, 27, 800–810. [Google Scholar] [CrossRef]

- Dehghan, S.; Amjady, N. Robust transmission and energy storage expansion planning in wind farm-integrated power systems considering transmission switching. IEEE Trans. Sustain. Energy 2016, 7, 765–774. [Google Scholar] [CrossRef]

- MacRae, C.; Ozlen, M.; Ernst, A.; Behrens, S. Locating and sizing energy storage systems for distribution feeder expansion planning. In Proceedings of the TENCON 2015—2015 IEEE Region 10 Conference, Macao, China, 1–4 November 2015; pp. 1–6. [Google Scholar]

- Bradbury, K.; Pratson, L.; Patiño-Echeverri, D. Economic viability of energy storage systems based on price arbitrage potential in real-time US electricity markets. Appl. Energy 2014, 114, 512–519. [Google Scholar] [CrossRef]

- Berrada, A.; Loudiyi, K. Operation, sizing, and economic evaluation of storage for solar and wind power plants. Renew. Sustain. Energy Rev. 2016, 59, 1117–1129. [Google Scholar] [CrossRef]

- Xiong, P.; Singh, C. Optimal planning of storage in power systems integrated with wind power generation. IEEE Trans. Sustain. Energy 2016, 7, 232–240. [Google Scholar] [CrossRef]

- Rahmann, C.; Palma-Behnke, R. Optimal allocation of wind turbines by considering transmission security constraints and power system stability. Energies 2013, 6, 294–311. [Google Scholar] [CrossRef]

- Jakus, D.; Krstulovic, J.; Vasilj, J. Algorithm for optimal wind power plant capacity allocation in areas with limited transmission capacity. Int. Trans. Electr. Energy Syst. 2014, 24, 1505–1520. [Google Scholar] [CrossRef]

- Qi, W.; Liang, Y.; Shen, Z. Joint planning of energy storage and transmission for wind energy generation. Oper. Res. 2015, 63, 1280–1293. [Google Scholar] [CrossRef]

- Ghofrani, M.; Arabali, A.; Etezadi-Amoli, M.; Fadali, M. A framework for optimal placement of energy storage units within a power system with high wind penetration. IEEE Trans. Sustain. Energy 2013, 4, 434–442. [Google Scholar] [CrossRef]

- Oh, H. Optimal planning to include storage devices in power systems. IEEE Trans. Power Syst. 2011, 26, 1118–1128. [Google Scholar] [CrossRef]

- Jabr, R.; Džafić, I.; Pal, B. Robust optimization of storage investment on transmission networks. IEEE Trans. Power Syst. 2015, 30, 531–539. [Google Scholar] [CrossRef]

- Wang, H.; Huang, J. Hybrid renewable energy investment in microgrid. In Proceedings of the 2014 IEEE International Conference on Smart Grid Communications, Venice, Italy, 3–6 November 2014; pp. 602–607. [Google Scholar]

- Wang, H.; Huang, J. Joint investment and operation of microgrid. IEEE Trans. Smart Grid 2017, 8, 833–845. [Google Scholar] [CrossRef]

- Wang, H.; Huang, J. Cooperative planning of renewable generations for interconnected microgrids. IEEE Trans. Smart Grid 2016, 7, 2486–2496. [Google Scholar] [CrossRef]

- Ciabattoni, L.; Ferracuti, F.; Grisostomi, M.; Ippoliti, G.; Longhi, S. Fuzzy logic based economical analysis of photovoltaic energy management. Neurocomputing 2015, 170, 296–305. [Google Scholar] [CrossRef]

- Ministerio de Energía de Chile. Explorador de Energía Solar. 2011. Available online: http://walker.dgf.uchile.cl/Explorador/Solar3/ (accessed on 03 May 2016). (In Spanish).

- Fuentes-Ryks, R.; Wander, C. Technical Information. Personal communication, Vivest Energías Renovables S.A.. 2016. [Google Scholar]

- Coordinador Eléctrico Nacional. Información Técnica Centrales SING. 2016. Available online: http://cdec2.cdec-sing.cl/pls/portal/cdec.pck_web_coord_elec.sp_pagina?p_id=5187 (accessed on 20 May 2016). (In Spanish).

- Dirección de Planificación y Desarrollo CDEC-SIC. Determinación de Puntos de Conexión STT. Technical Report. Coordinador Eléctrico Nacional: Santiago, Chile, 2015. Available online: https://sic.coordinadorelectrico.cl/wp-content/uploads/2015/07/Determinación-de-puntos-de-conexión-STT.pdf(accessed on 4 May 2016). (In Spanish)

- ABB AB. It’s Time to Connect-HVDC Light©, 7th ed.; Grid Systems-NVDC: Ludvika, Sweden, 2013. [Google Scholar]

- European Network of Transmission System Operators for Electricity. Offshore Transmission Technology; Technical Report Prepared by the Regional Group North Sea for the NSCOGI; ENTSOE: Brussels, Belgium, 2011. [Google Scholar]

- Lancheros, C. Transmission Systems for Offshore Wind Farms: A Technical, Enviromental and Economic Assessment. Master’s Thesis, Hamburg University of Technology, Hamburg, Germany, 2013. [Google Scholar]

- Fischetti, M.; Leth, J.; Borchersen, A. A Mixed-Integer Linear Programming approach to wind farm layout and inter-array cable routing. In Proceedings of the 2015 American Control Conference (ACC), Chicago, IL, USA, 1–3 July 2015; pp. 5907–5912. [Google Scholar]

- Van Eeckhout, B.; Van Hertem, D.; Reza, M.; Srivastava, K.; Belmans, R. Economic comparison of VSC, HVDC and HVAC as transmission system for a 300 MW offshore wind farm. Eur. Trans. Electr. Power 2010, 20, 661–671. [Google Scholar] [CrossRef]

- Chen, H.; Cong, T.; Yang, W.; Tan, C.; Li, Y.; Ding, Y. Progress in electrical energy storage system: A critical review. Prog. Nat. Sci. 2009, 19, 291–312. [Google Scholar] [CrossRef]

- Cho, J.; Jeong, S.; Kim, Y. Commercial and research battery technologies for electrical energy storage applications. Prog. Energy Combust. Sci. 2015, 48, 84–101. [Google Scholar] [CrossRef]

- Coordinador Eléctrico Nacional. Programación Semanal CDEC SIC. 2016. Available online: https://sic.coordinadorelectrico.cl/informes-y-documentos/fichas/operacion-programada-2/ (accessed on 3 May 2016).

- Pascual, L.; Romo, J.; Ruiz, E. Bootstrap predictive inference for ARIMA processes. J. Time Ser. Anal. 2004, 25, 449–465. [Google Scholar] [CrossRef] [Green Version]

- Pascual, L.; Romo, J.; Ruiz, E. Bootstrap prediction intervals for power-transformed time series. Int. J. Forecast. 2005, 21, 219–235. [Google Scholar] [CrossRef] [Green Version]

| Reference | Storage | Generation | Transmission | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Capacity | Location | Others | Capacity | Location | Others | Layout | Capacity | Flow | |

| [6] | ✓ | ||||||||

| [7] | Op. | Op. | |||||||

| [8] | Op. | ||||||||

| [9] | Op. | ||||||||

| [10] | ✓ | ✓ | Op. | ✓ | |||||

| [11] | ✓ | ✓ | Op. | ✓ | |||||

| [12] | ✓ | Tech. | |||||||

| [13] | ✓ | Op. and Tech. | |||||||

| [14] | ✓ | ✓ | Op. | ||||||

| [15] | ✓ | Tech. | |||||||

| [16] | ✓ | ✓ | ✓ | ✓ | |||||

| [17] | ✓ | ✓ | ✓ | ✓ | |||||

| [18] | ✓ | ✓ | |||||||

| [19] | ✓ | Op. | ✓ | ||||||

| [20] | ✓ | ✓ | ✓ | ||||||

| [21] | ✓ | Op. and Tech. | |||||||

| [22] | ✓ | Op. | ✓ | Op. and Tech. | |||||

| [23] | Op. | ✓ | ✓ | Op. and Tech. | |||||

| our work | ✓ | ✓ | Op. and Tech. | ✓ | ✓ | Connect. | ✓ | ✓ | ✓ |

| (MWh) | , (%) | , (MW) | (%) | Cost (USD/MWh) | Lifetime (Years) | Reference | |

|---|---|---|---|---|---|---|---|

| ZEBRA | 0.3 | 94.9 | 0.075 | 25 | 220,000 | 12 | [34] |

| PBAC | 20 | 86.6 | 5 | 40 | 450,000 | 10 | [26,34,35] |

| PHS | 200 | 92.0 | 50 | 10 | 200,000 | 30 | [34] |

| CAES | 200 | 89.0 | 25 | 10 | 50,000 | 30 | [34] |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Olave-Rojas, D.; Álvarez-Miranda, E.; Rodríguez, A.; Tenreiro, C. An Optimization Framework for Investment Evaluation of Complex Renewable Energy Systems. Energies 2017, 10, 1062. https://doi.org/10.3390/en10071062

Olave-Rojas D, Álvarez-Miranda E, Rodríguez A, Tenreiro C. An Optimization Framework for Investment Evaluation of Complex Renewable Energy Systems. Energies. 2017; 10(7):1062. https://doi.org/10.3390/en10071062

Chicago/Turabian StyleOlave-Rojas, David, Eduardo Álvarez-Miranda, Alejandro Rodríguez, and Claudio Tenreiro. 2017. "An Optimization Framework for Investment Evaluation of Complex Renewable Energy Systems" Energies 10, no. 7: 1062. https://doi.org/10.3390/en10071062