Impact Analysis of Demand Response Intensity and Energy Storage Size on Operation of Networked Microgrids

Abstract

:1. Introduction

- In contrast to the existing literature, where sizing/siting of BESS and integration of DR programs are focused, the impact of change in BESS size and DR intensity on the operation of microgrids is considered in this study.

- Robust optimization is used and worst-case scenarios of renewables, loads, and price signals are considered for analyzing the impact of BESS size and DR intensity on the operation of microgrids.

- Finally, integration of favorable DR program and/or BESS units for different microgrid networks with diverse objectives is suggested by using simulation results.

2. Demand Response and Energy Storage for Networked Microgrids

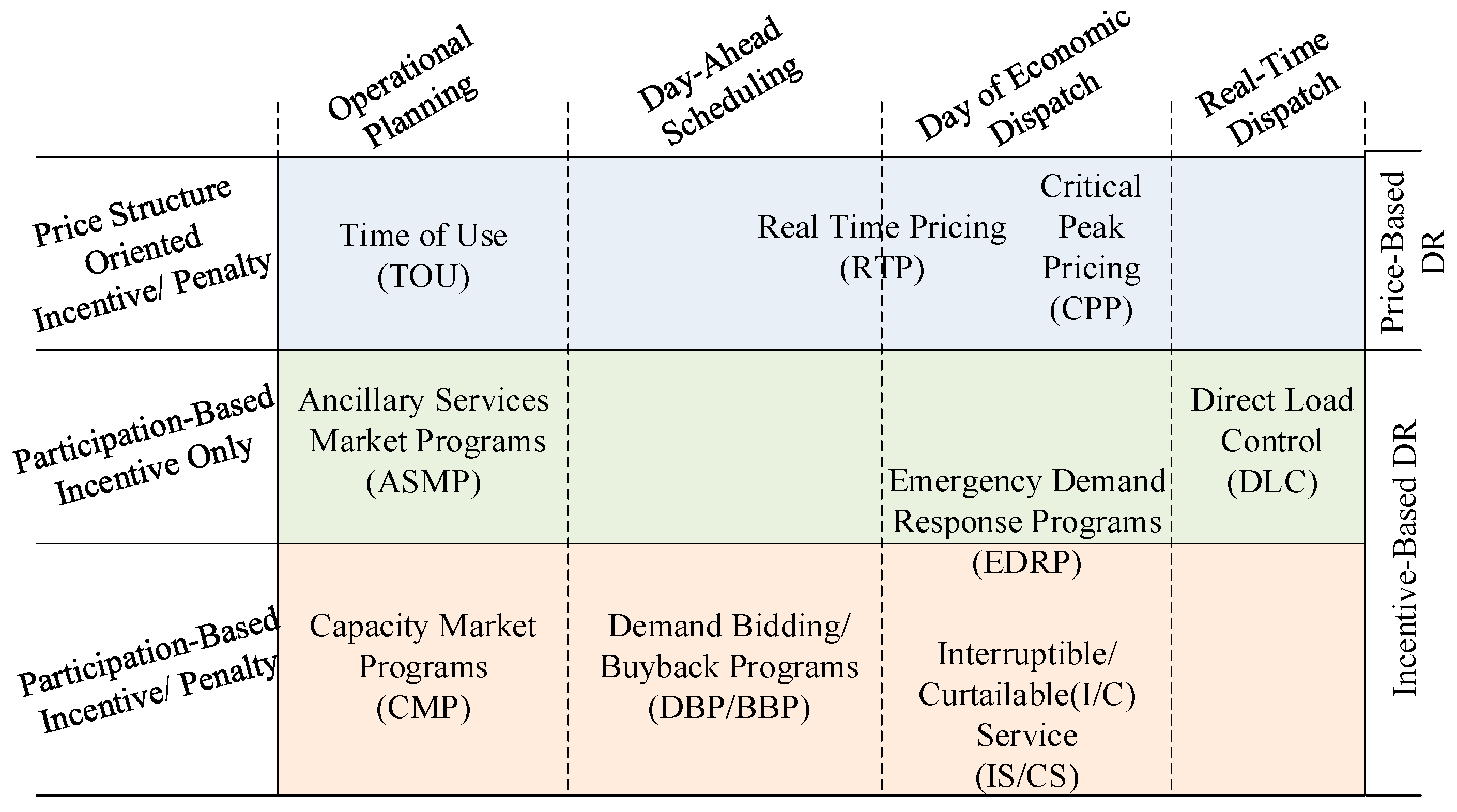

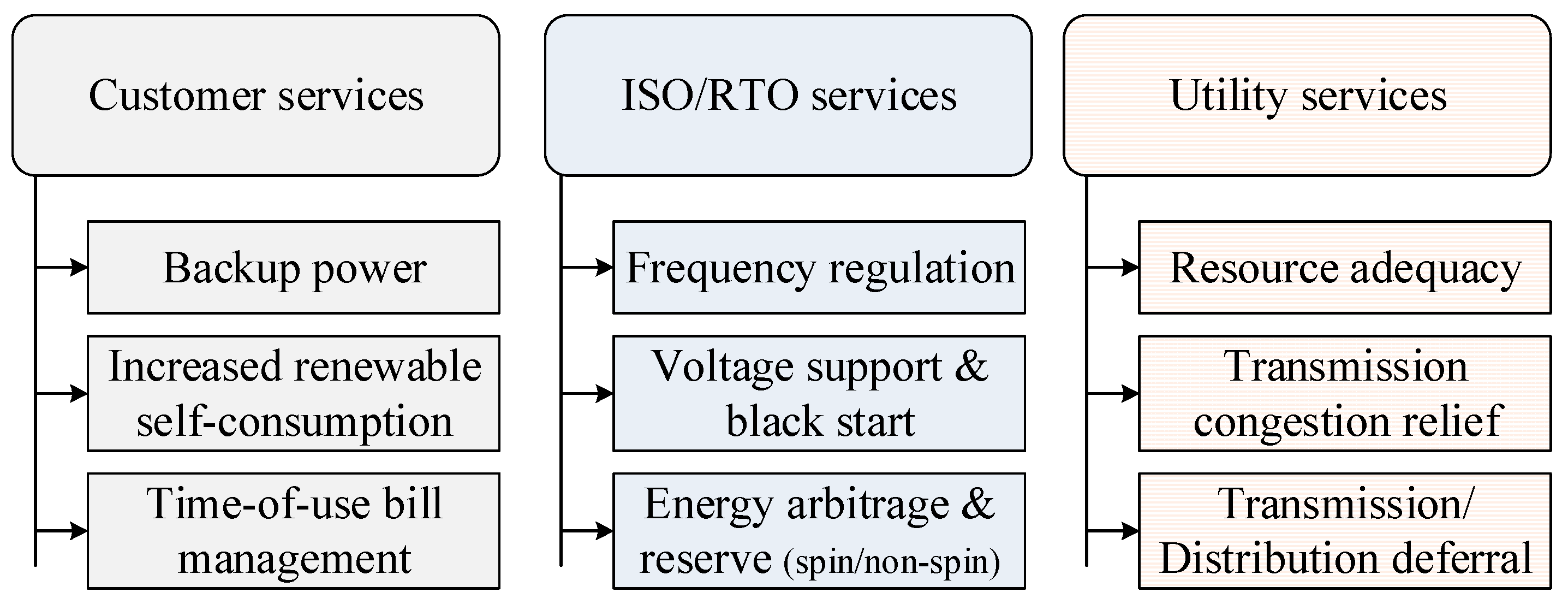

2.1. Demand Response (DR) Programs and Battery Energy Storage System (BESS)

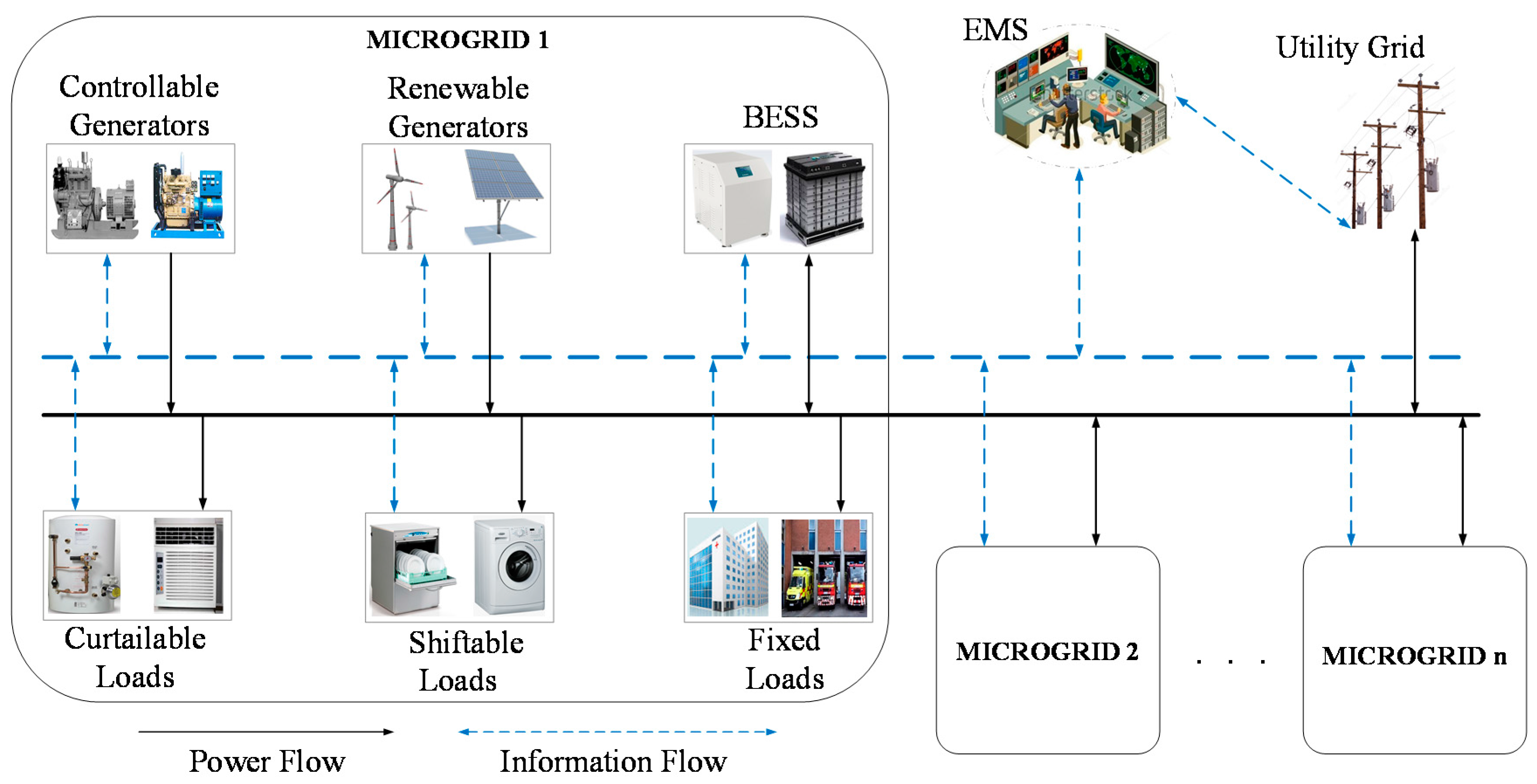

2.2. System Configuration

- Fixed Loads: These loads are considered the most critical as they can be neither curtailed nor shifted. These loads cannot participate in any DR program and need to be served by the microgrid.

- Controllable Loads: These loads are considered less critical than fixed loads and are divided into shiftable loads and curtailable loads. Only controllable loads can participate in different DR programs offered by the utilities or RTOs/ISOs.

- Shiftable Loads: These loads are a sub-category of controllable loads, which can be shifted from one time interval to another time interval but cannot be curtailed, i.e., can participate in price-based DR programs only.

- Curtailable Loads: These loads are also a sub-category of controllable loads, which can be curtailed when the market price is very high or system stability is jeopardized, i.e., can participate in incentive-based DR programs.

3. Problem Formulation

3.1. Deterministic Model

3.1.1. Objective Function

3.1.2. Load Balancing Constraints

3.1.3. Constraints for Controllable Generators

3.1.4. Energy Trading Constraints

3.1.5. Battery Constraints

3.1.6. Demand Response Constraints

3.2. Uncertainty Modeling of Renewables and Loads

3.2.1. Uncertain Variables and Uncertainty Bounds

3.2.2. Worst-Case Identification and Problem Transformation

3.2.3. Trackable Robust Load Balancing

3.3. Uncertainty Modeling of Buying and Selling Prices

3.3.1. Uncertain Variables and Uncertainty Bounds

3.3.2. Robust Counterpart and Dual Problem

3.4. Final Tractable Robust Counterpart

4. Numerical Simulations

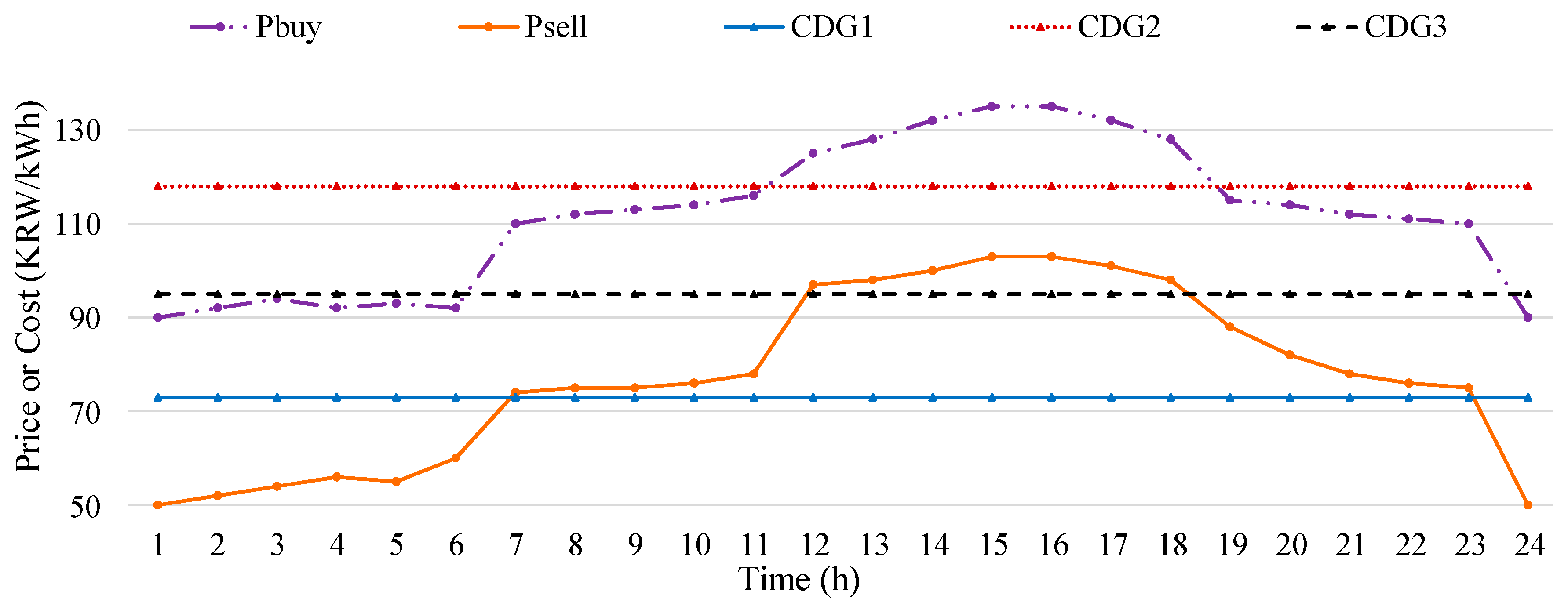

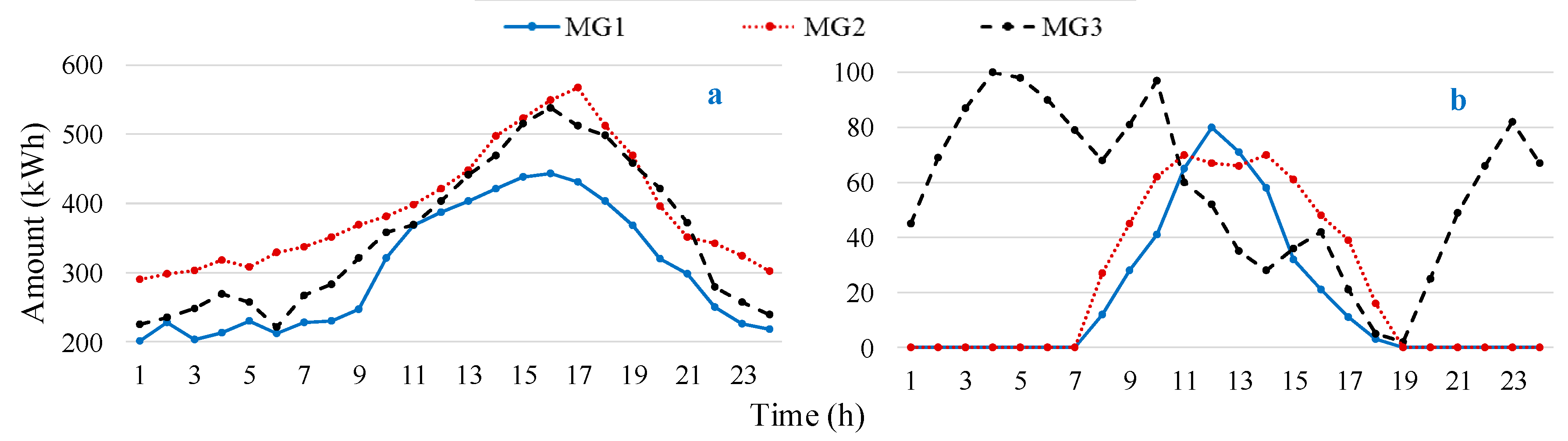

4.1. Input Data

- It is assumed that each microgrid contains at least one BESS unit and has both shiftable and curtailable loads, i.e., controllable loads.

- A community EMS (CEMS) is assumed to be responsible for the operation of the entire multi-microgrid network.

- Each microgrid (MG) is assumed to have a BESS unit with a maximum capacity of 250 kWh.

- The maximum intensity of price-based DR programs and incentive-based DR programs is assumed to be 25% and 15% of the forecasted load, respectively, at each time interval.

- Incentive-based DR programs are assumed to be triggered in only peak-price intervals, i.e., 12 to 18 in this study.

- The uncertainty bounds for load, market price signals, and renewables are taken as ±10%, ±15%, and ±20%, respectively.

4.2. Impact Analysis of DR Intensity

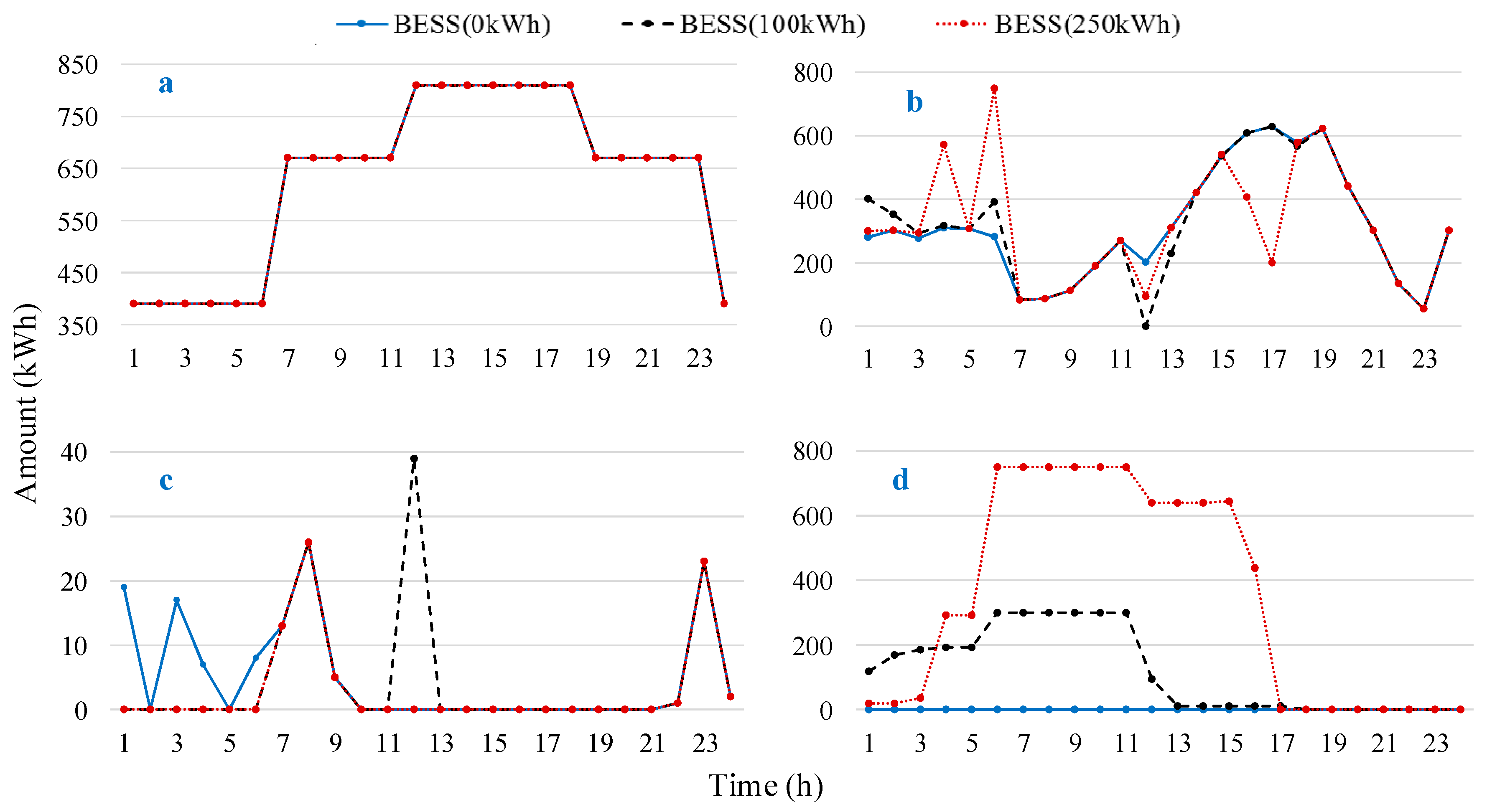

4.3. Impact Analysis of BESS Size

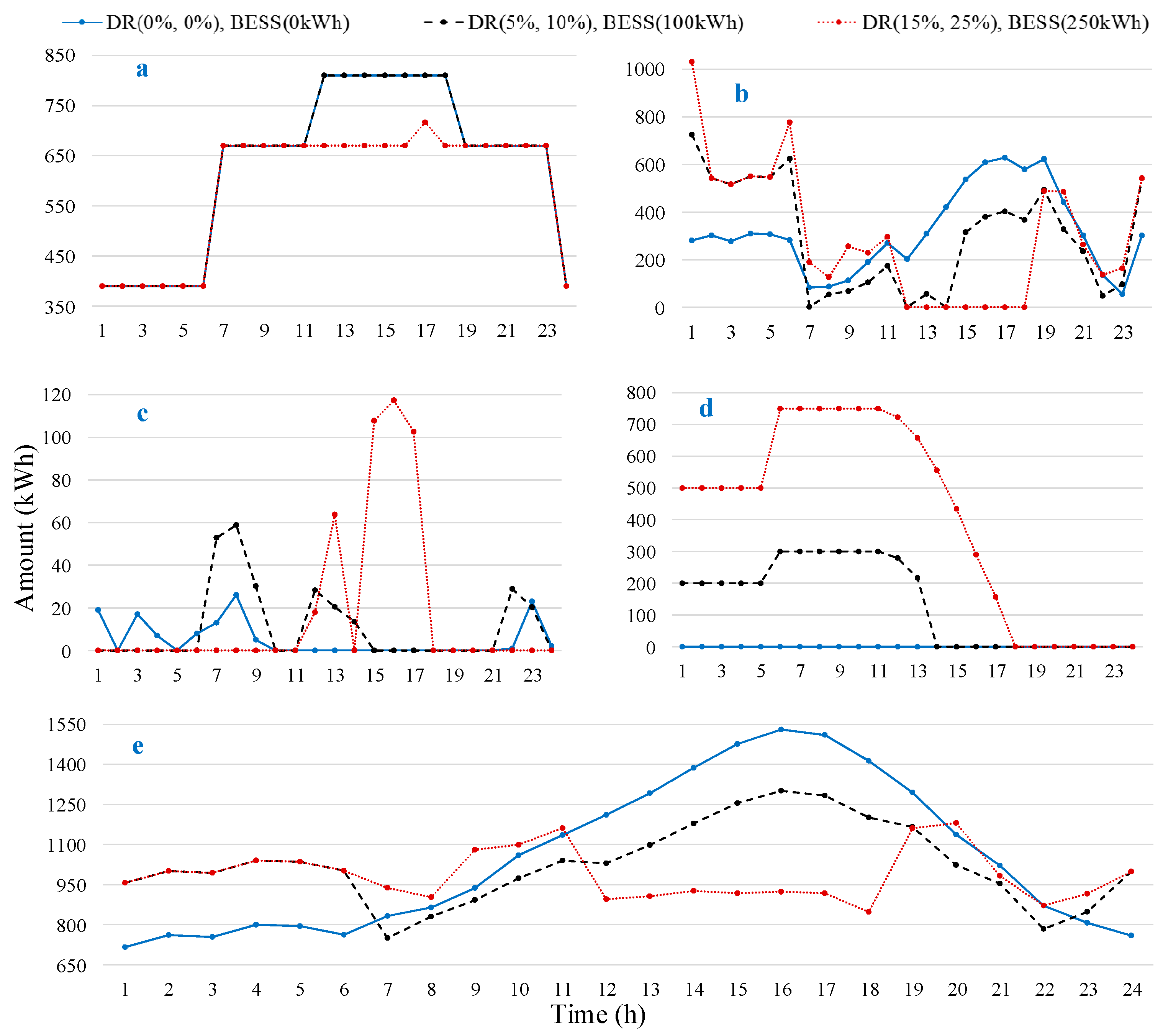

4.4. Impact Analysis of Both DR Intensity and BESS Size

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

Nomenclature

| Identifiers and Binary Variables | |

| Index of time, running from 1 to . | |

| Index of microgrids, running from 1 to and 1 to , respectively. | |

| Index of dispatchable generators, running from 1 to . | |

| Commitment status identifier of dispatchable generator of at . | |

| Start-up and shut-down identifiers of dispatchable generator of at . | |

| , | Identifier for charging and discharging of BESS in . |

| Identifier for load shifting allowance in . | |

| Variables and Constants | |

| Generation cost of dispatchable unit of. | |

| Amount of power generated by dispatchable unit of. | |

| , | Incentive for load curtailment and amount of load curtailed in . |

| Start-up cost of dispatchable unit of. | |

| Shut-down cost of dispatchable unit of. | |

| , | Price for buying and selling power from the utility grid. |

| , | Amount of power bought from and sold to the utility grid by. |

| Amount of fixed and adjusted electric load of . | |

| Amount of curtailable and shiftable electric load of . | |

| Amount of load shifted from in microgrid m. | |

| , | Amount of electrical energy charged/discharged to/from BESS of . |

| , | Amount of power sent by/received from. |

| Forecasted power of RDG unit of. | |

| Capacity of line connecting mth MG with utility grid and nth MG, respectively. | |

| (t) | Amount of power received by mth MG from nth MG at. |

| (t) | Amount of power sent by mth MG to nth MG at |

| , | Surplus and deficit amount of power in. |

| Capacity and SOC of BEES in | |

| Charging and discharging loss of BESS in | |

| , | Maximum load allowed to shift to interval t and allowed to shift from t in MG m. |

| , | Bounded load and associated uncertainty bound in MG m at t |

| Bounded RDG output power and associated uncertainty bound in | |

| , | Upper and lower bounds of load in. |

| , | Upper and lower bounds of RDG output power in. |

| Scaled deviations for load of. | |

| Scaled deviations for WT power output of. | |

| , | Budget of uncertainty and uncertainty adjustment factor of. |

| , | Dual variables for load and RDG unit of. |

| , | Bounded buying price and associated uncertainty bound in at t |

| , | Bounded selling price and associated uncertainty bound in |

| , | Upper and lower bounds of buying price. |

| , | Upper and lower bounds of selling price. |

| Dual variables for buying price at . | |

| Dual variables for selling price at. | |

| , | Budget of uncertainty for buying and selling price. |

References

- Kim, H.M.; Lim, Y.; Kinoshita, T. An intelligent multiagent system for autonomous microgrid operation. Energies 2012, 5, 3347–3362. [Google Scholar] [CrossRef]

- Nguyen, D.T.; Le, L.B. Optimal energy management for cooperative microgrids with renewable energy resources. In Proceedings of the IEEE International Conference on Smart Grid Communications (Smart Grid Comm), Vancouver, BC, Canada, 21–24 October 2013; pp. 678–683. [Google Scholar]

- Farzan, F.; Vaghefi, S.A.; Mahani, K.; Jafari, M.A.; Gong, J. Operational planning for multi-building portfolio in an uncertain energy market. Energy Build. 2015, 103, 271–283. [Google Scholar] [CrossRef]

- Zhang, Y.; Gatsis, N.; Giannakis, G.B. Robust energy management for microgrids with high-penetration renewables. IEEE Trans. Sustain. Energy 2013, 4, 944–953. [Google Scholar] [CrossRef]

- Battistelli, C.; Baringo, L.; Conejo, A.J. Optimal energy management of small electric energy systems including V2G facilities and renewable energy sources. Electr. Power Syst. Res. 2012, 92, 50–59. [Google Scholar] [CrossRef]

- Hussain, A.; Bui, V.H.; Kim, H.M.; Im, Y.H.; Lee, J.Y. Optimal operation of tri-generation microgrids considering demand uncertainties. Int. J. Smart Home 2016, 10, 131–144. [Google Scholar] [CrossRef]

- Jian, L.; Xue, H.; Xu, G.; Zhu, X.; Zhao, D.; Shao, Z.Y. Regulated charging of plug-in hybrid electric vehicles for minimizing load variance in household smart microgrid. IEEE Trans. Ind. Electr. 2013, 60, 3218–3226. [Google Scholar] [CrossRef]

- Hussain, A.; Bui, V.H.; Kim, H.M. Robust optimization-based scheduling of multi-microgrids considering uncertainties. Energies 2016, 9, 278–298. [Google Scholar] [CrossRef]

- Xiang, Y.; Liu, J.; Liu, Y. Robust energy management of microgrid with uncertain renewable generation and load. IEEE Trans. Smart Grid 2016, 7, 1034–1043. [Google Scholar] [CrossRef]

- Hussain, A.; Bui, V.H.; Kim, H.M. Impact quantification of demand response uncertainty on unit commitment of microgrids. In Proceedings of the IEEE International Conference on Frontiers of Information Technology (FIT), Islamabad, Pakistan, 19–21 December 2016; pp. 274–279. [Google Scholar]

- Kwag, H.G.; Kim, J.O. Reliability modeling of demand response considering uncertainty of customer behavior. Appl. Energy 2014, 122, 24–33. [Google Scholar] [CrossRef]

- Soroudi, A. Possibilistic-scenario model for DG impact assessment on distribution networks in an uncertain environment. IEEE Trans. Power Syst. 2012, 27, 1283–1293. [Google Scholar] [CrossRef]

- Bertsimas, D.; Sim, M. The price of robustness. Oper. Res. 2004, 52, 35–53. [Google Scholar] [CrossRef]

- Hussain, A.; Bui, V.H.; Kim, H.M. Fuzzy logic-based operation of battery energy storage systems (BESSs) for enhancing the resiliency of hybrid microgrids. Energies 2017, 10, 271–290. [Google Scholar] [CrossRef]

- Hussain, A.; Arif, S.M.; Aslam, M.; Shah, S.D.A. Optimal siting and sizing of tri-generation equipment for developing an autonomous community microgrid considering uncertainties. Sustain. Cities Soc. 2017, 32, 318–330. [Google Scholar] [CrossRef]

- Hosseinimehr, T.; Ghosh, A.; Shahnia, F. Cooperative control of battery energy storage systems in microgrids. Int. J. Elect. Power Energy Syst. 2017, 87, 109–120. [Google Scholar] [CrossRef]

- Tan, X.; Li, Q.; Wang, H. Advances and trends of energy storage technology in Microgrid. Int. J. Elect. Power Energy Syst. 2013, 44, 179–191. [Google Scholar] [CrossRef]

- Kerdphol, T.; Qudaih, Y.; Mitani, Y. Optimum battery energy storage system using PSO considering dynamic demand response for microgrids. Int. J. Elect. Power Energy Syst. 2016, 83, 58–66. [Google Scholar] [CrossRef]

- Chen, S.X.; Gooi, H.B.; Wang, M. Sizing of energy storage for microgrids. IEEE Trans. Smart Grid 2012, 3, 142–151. [Google Scholar] [CrossRef]

- Zhou, N.; Liu, N.; Zhang, J.; Lei, J. Multi-objective optimal sizing for battery storage of PV-based microgrid with demand response. Energies 2016, 9, 591. [Google Scholar] [CrossRef]

- Khatibzadeh, A.; Besmi, M.; Mahabadi, A.; Reza Haghifam, M. Multi-agent-based controller for voltage enhancement in AC/DC hybrid microgrid using energy storages. Energies 2017, 10, 169. [Google Scholar] [CrossRef]

- Nguyen, T.A.; Crow, M.L. Stochastic optimization of renewable-based microgrid operation incorporating battery operating cost. IEEE Trans. Power Syst. 2016, 31, 2289–2296. [Google Scholar] [CrossRef]

- Mazidi, M.; Zakariazadeh, A.; Jadid, S.; Siano, P. Integrated scheduling of renewable generation and demand response programs in a microgrid. Energy Convers. Manag. 2014, 86, 1118–1127. [Google Scholar] [CrossRef]

- Nwulu, N.I.; Xia, X. Optimal dispatch for a microgrid incorporating renewables and demand response. Renew. Energy 2017, 101, 16–28. [Google Scholar] [CrossRef]

- Karapetyan, A.; Khonji, M.; Chau, C.K.; Elbassioni, K.; Zeineldin, H. Efficient algorithm for scalable event-based demand response management in microgrids. IEEE Trans. Smart Grid 2017. [Google Scholar] [CrossRef]

- Pourmousavi, S.A.; Nehrir, M.H. Real-time central demand response for primary frequency regulation in microgrids. IEEE Trans. Smart Grid 2012, 3, 1988–1996. [Google Scholar] [CrossRef]

- Cha, H.J.; Won, D.J.; Kim, S.H.; Chung, I.Y.; Han, B.M. Multi-agent system-based microgrid operation strategy for demand response. Energies 2015, 8, 14272–14286. [Google Scholar] [CrossRef]

- Hussain, A.; Bui, V.H.; Lee, B.H.; Kim, H.M. Impact analysis of demand response and energy storage in microgrids. In Proceedings of the Korea Institute of Electrical Engineers, Summer Conference, Pyeongchang-gun, South Korea, 4–6 July 2016; pp. 458–460. [Google Scholar]

- US DoE, Benefits of Demand Response in Electricity Markets and Recommendations for Achieving Them, Report to the US Congress. 2006. Available online: http://eetd.idi.gov.

- Garrett, F.; James, M.; Jesse, M.; Hervé, T. The Economics of Battery Energy Storage. 2015. Available online: http://www.rmi.org/ELECTRICITY_BATTERY_VALUE (accessed on 17 May 2017).

- Bui, V.H.; Hussain, A.; Kim, H.M. A multiagent-based hierarchical energy management strategy for multi-microgrids considering adjustable power and demand response. IEEE Trans. Smart Grid 2016, pp. [Google Scholar] [CrossRef]

- Wang, Y.; Shiwen, M.; Nelms, R.M. On hierarchical power scheduling for the macrogrid and cooperative microgrids. IEEE Trans. Ind. Inf. 2015, 11, 1574–1584. [Google Scholar] [CrossRef]

- Bertsimas, D.; Sim, M. Robust discrete optimization and network flows. Math. Program. 2003, 98, 49–71. [Google Scholar] [CrossRef]

| Major Consideration(s) | Optimization Method | Ref. |

|---|---|---|

| Uncertainties in renewable energy sources | Robust optimization | [ 4,5] |

| Uncertainties in forecasted load values | [ 6] | |

| Using electrical vehicles | [ 7] | |

| Uncertainties in both renewables and forecasted loads | Robust optimization | [ 8,9] |

| Uncertainties in demand response | [ 10] | |

| Multi-stage modeling | [ 11] | |

| Impact of distributed generators on uncertainty | Stochastic optimization | [ 12] |

| Operation of BESS for improving resilience | Fuzzy logic | [ 14] |

| Optimal siting and sizing of BESS | Particle swarm optimization | [ 18] |

| Cost-benefit analysis | [ 19] | |

| Multi-objective model for maximum photovoltaic consumptive rate and net profit | Non-dominated sorting genetic algorithm II | [ 20] |

| Modeling for using BESS as a dispatchable generators | Stochastic optimization | [ 22] |

| DR for compensating forecasting errors | [ 23] | |

| Incentive-based DR programs | Sensitivity analysis | [ 24] |

| Event-based DR management in microgrids | A greedy approach | [ 25] |

| DR for frequency regulation and load minimization | Multi-agent system | [ 26] |

| Impact of DR on industrial loads | [ 27] |

| Parameter | Price-Based DR (%) | Incentive-Based DR (%) | BESS Capacity (kW) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| MG1 | MG2 | MG3 | MG1 | MG2 | MG3 | MG1 | MG2 | MG3 | |

| Minimum | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Maximum | 25 | 25 | 25 | 15 | 15 | 15 | 250 | 250 | 250 |

| Parameter | Renewable Power (%) | Load (%) | Market Price Signals (%) | |||||

|---|---|---|---|---|---|---|---|---|

| MG1 | MG2 | MG3 | MG1 | MG2 | MG3 | Buying price | Selling Price | |

| Upper bound | 20 | 20 | 20 | 10 | 10 | 10 | 15 | 15 |

| Lower bound | –20 | –20 | –20 | –10 | –10 | –10 | –15 | –15 |

| Parameter | CDG Generation (kW) | Line Capacity (kW) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| MG1 | MG2 | MG3 | MG1 ↔ MG2 | MG1 ↔ MG3 | MG2 ↔ MG3 | MG1 ↔ UG | MG2 ↔ UG | MG3 ↔ UG | |

| Minimum | 0 | 170 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Maximum | 220 | 310 | 280 | 400 | 400 | 400 | 600 | 600 | 600 |

| DR Intensity (%) | Internal Power Transfer (kW) | External Power Trading (kW) | Operation Cost (KRW) | Decrease (%) | |

|---|---|---|---|---|---|

| Price-Based | Incentive-Based | ||||

| 0 | 0 | 121 | 7648 | 2,279,910.0000 | 0.00 |

| 0.05 | 0.03 | 172.8 | 7353.43 | 2,240,424.0000 | 1.73 |

| 0.1 | 0.06 | 199.8 | 7157.05 | 2,209,872.0000 | 3.07 |

| 0.15 | 0.09 | 0.04 | 6900.31 | 2,201,409.5600 | 3.44 |

| 0.2 | 0.12 | 0 | 6675.3 | 2,195,181.2800 | 3.72 |

| 0.25 | 0.15 | 45.65 | 6426.4 | 2,192,273.0000 | 3.84 |

| BESS Size (kW) | Internal Power Transfer (kW) | External Power Trading (kW) | Operation Cost (KRW) | Decrease (%) |

|---|---|---|---|---|

| 0 | 121 | 7648 | 2,279,910.0000 | 0.00 |

| 50 | 121 | 7654.0604 | 2,273,044.8320 | 0.30 |

| 100 | 109 | 7660.1228 | 2,266,179.8240 | 0.60 |

| 150 | 114.003 | 7667.33799 | 2,259,464.7887 | 0.90 |

| 200 | 73.003 | 7672.246 | 2,252,449.6800 | 1.20 |

| 250 | 70.003 | 7678.471 | 2,245,605.9300 | 1.50 |

| DR Intensity (%) | BESS Size (kW) | Internal Power Transfer (kW) | External Power Trading (kW) | Operation Cost (KRW) | Decrease (%) | |

|---|---|---|---|---|---|---|

| Price-Based | Incentive-Based | |||||

| 0 | 0 | 0 | 121 | 7648 | 2,279,910.0000 | 0.00 |

| 0.05 | 0.03 | 50 | 179.84 | 7359.49 | 2,233,558.8000 | 2.03 |

| 0.1 | 0.06 | 100 | 253.551 | 7169.9853 | 2,196,247.4590 | 3.67 |

| 0.15 | 0.09 | 150 | 130.023 | 6919.7064 | 2,180,947.5760 | 4.34 |

| 0.2 | 0.12 | 200 | 56.535 | 6754.116 | 2,168,375.8000 | 4.89 |

| 0.25 | 0.15 | 250 | 409.65 | 7138.906 | 2,166,133.8800 | 4.99 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hussain, A.; Bui, V.-H.; Kim, H.-M. Impact Analysis of Demand Response Intensity and Energy Storage Size on Operation of Networked Microgrids. Energies 2017, 10, 882. https://doi.org/10.3390/en10070882

Hussain A, Bui V-H, Kim H-M. Impact Analysis of Demand Response Intensity and Energy Storage Size on Operation of Networked Microgrids. Energies. 2017; 10(7):882. https://doi.org/10.3390/en10070882

Chicago/Turabian StyleHussain, Akhtar, Van-Hai Bui, and Hak-Man Kim. 2017. "Impact Analysis of Demand Response Intensity and Energy Storage Size on Operation of Networked Microgrids" Energies 10, no. 7: 882. https://doi.org/10.3390/en10070882