1. Introduction

Smart grid is an intelligent power system that integrates advanced control, communications, demand response, storage, and sensing technologies into the power grid. A smart metering system is crucial in order to provide management capabilities and obtain metering data with additional information [

1]. Additionally, demand forecasting as a forecast technology plays an important role in the smart grid and the energy generation process [

2]. In the smart grid, demand-side management (DSM) is an effective technology to keep the energy real-time balance in the deregulated electricity market. It is widely accepted that demand response can transform the traditional power grid into a more reliably and economically operated smart grid [

3,

4,

5,

6]. An overview for various types of DSM is given in [

7]. Demand response can motivate consumers to shift their loads from on-peak to off-peak periods. To reduce the peak load of a smart distribution network feeder, a self-decision method for load management is proposed in [

8]. In general, the demand response programs include two categories: incentive-based programs and price-based programs [

9]. The incentive-based programs include the direct load control, the emergency demand response, and the ancillary services market. For the price-based program, there are two types of consumers: pricing-taking (PT) consumers [

10] and price-anticipating (PA) consumers [

11,

12,

13]. The utility companies can adjust the power consumption of customers by pricing strategy, such as time of use (TOU), critical peak pricing (CPP), and real-time pricing (RTP) that can match the supply with demand [

14,

15,

16]. Generally, the regulation service is defined by the North American Electric Reliability Council (NERC) as the provision of generation and load response capability, which responds to automatic control signals issued by the system operator updated every four seconds [

17].

Recently, different pricing-based demand response programs were developed based on game theory and kinds of optimization methods. For example, the authors analyzed the cooperation between the small-scale electricity suppliers (SESs) and end-users (EUs) based on the coalitional game in [

18,

19,

20]. Solving potential games with dynamical constraint, and improving the Pareto efficiency with punishment mechanism were developed in [

21,

22]. The Stackelberg game was developed to formulate the energy trading between the consumers and multiple utility companies who aim to maximize their own profits from the energy exchange between the plug-in electric vehicles (PEVs) and the smart grid [

23,

24,

25]. The authors in [

26,

27] developed a load curtailment strategy and analyzed the energy consumption control in the smart grid based on the noncooperative game and aggregate game theory. The dual decomposition method was developed to achieve the social welfare maximization by optimizing the individual utilities of the consumers [

28,

29,

30]. Distributed power control algorithms with a linear pricing function and a nonlinear pricing function were developed to achieve the balance between supply and demand for demand response [

31,

32]. The authors use the Nash bargaining theory to study the financial bilateral contract negotiation process between a generation company and a load-serving entity in a wholesale electric power market [

33]. Nash bargaining was developed in the demand response and microgrid to derive the optimal solutions for the load reduction and maximize the social welfare [

34,

35]. To minimize the emission by optimizing the total power generation, an economic dispatch algorithm for congestion management in power system is proposed in [

36]. In [

37], the author proposed a novel unsymmetrical faults analysis method for microgrid distribution systems. This method can achieve the advantages of reducing computation time, increasing convergence robustness and improving accuracy for unsymmetrical faults analysis. The computation time of the algorithm is important to the power system; thus, we take into account the computation time of the proposed algorithm in the paper. To achieve a fast and stable response for real power control, a dynamic operation and control strategy for a microgrid hybrid power system under different load conditions with disturbances was proposed in [

38]. In [

39], the authors proposed a novel intelligent damping controller (NIDC) for the static synchronous compensator (STATCOM) to reduce the power fluctuations, voltage support and damping in a hybrid power multi-system. To mitigate the voltage imbalance and deviation, the authors in [

40] developed a modified bird-mating optimization approach to enhance the phase-connection adjustment of distribution transformers, and ensure a satisfactory supplying power. The differences between our work and the above work are shown in

Table 1.

On the whole, the above work didn’t consider the unfavorable disturbances on the power system when the consumers participate in the demand response to keep the energy real-time balance. Moreover, the wholesale price bargaining between the the utility company and generation company is neglected. Therefore, a systematic study with an effective approach is important to match supply with demand; thereby, it motivates the study in this paper.

In this paper, based on the consumers’ utility maximization, we establish a price regulation model with price feedback in the electricity retail markets, and use the iterative algorithm to solve the optimal retail price and the consumer’s optimal power consumption. Then, we formulate the wholesale price negotiation problem by the bargaining framework between the multiple utility companies and the generation company. The utility companies and generation company negotiate the wholesale price to maximize their revenues. We prove that the interaction between the utility companies and generation company is a bargaining problem. Furthermore, the input-to-state stability condition with additive electricity measurement disturbance and price disturbance is given. We have three contributions in this work:

We formulate a wholesale price negotiation problem between the multiple utility companies and the generation company. Then, we prove that the wholesale price negotiation is a bargaining problem and the Raiffa–Kalai–Smorodinsky bargaining solution (RBS) was utilized to achieve the optimal solution.

We establish a price regulation model with price feedback in the electricity retail markets based on the consumers’ utility maximization and the negotiated wholesale price.

The iterative algorithm is used to search for the optimal retail price and the power consumption. Moreover, we prove that the power management system is input-to-state stability under additive electricity measurement disturbance and price disturbance.

The rest of the paper is organized as follows. Some preliminaries are given in

Section 2. In

Section 3, the electricity market model is established and the problem is formulated. In

Section 4, the wholesale price negotiation between the generation company and multiple utility companies is developed; then, the Raiffa–Kalai–Smorodinsky bargaining solution (RBS) is utilized to achieve the optimal outcome. In

Section 5, the power management system with additive disturbances is developed. The input-to-state stability of the power management system is proved. System implementation is described in

Section 6. Numerical results are given in

Section 7, and conclusions are summarised in

Section 8.

3. System Model and Problem Formulation

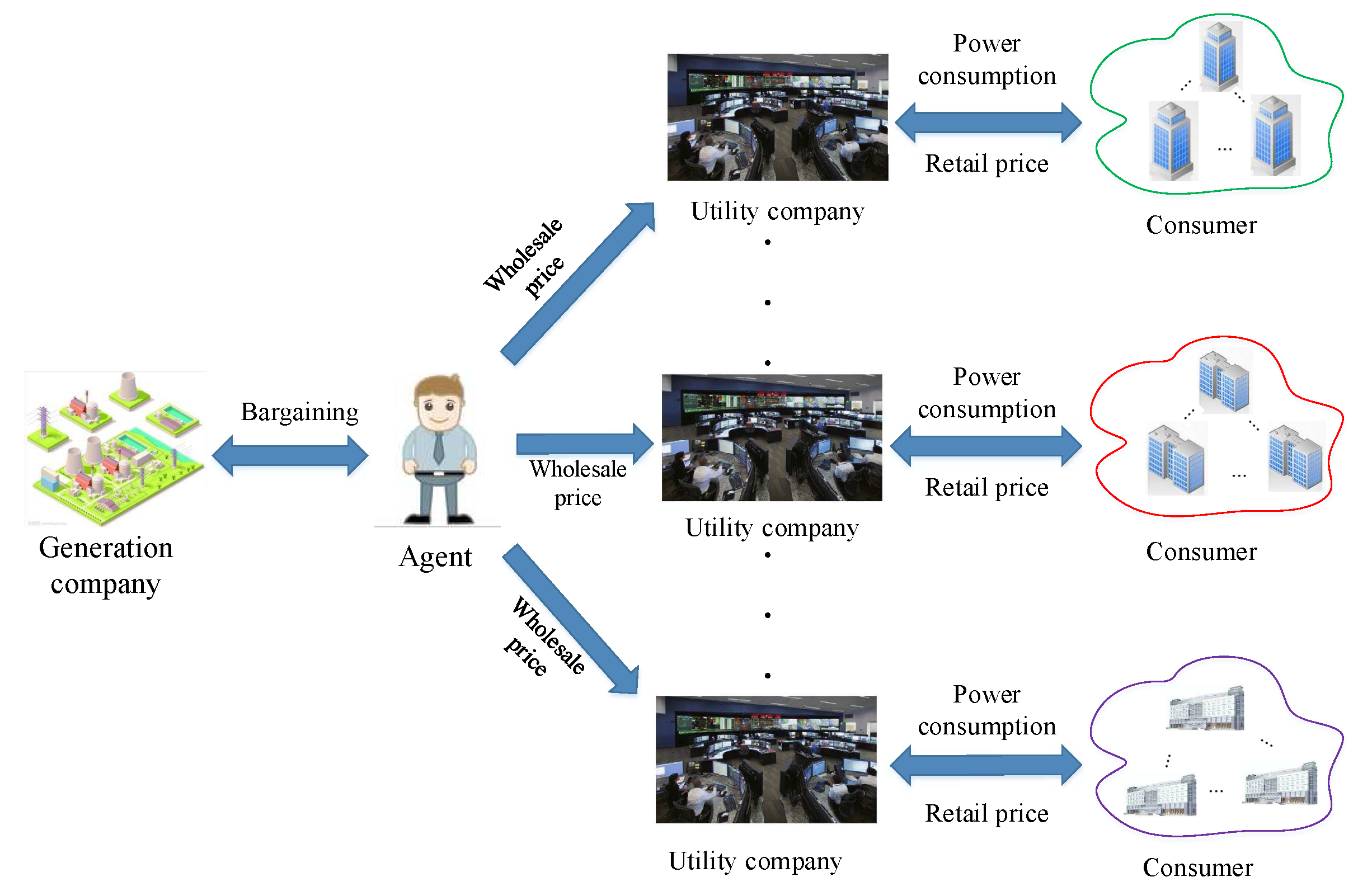

We consider an electricity system composed of one generation company, one agent, multiple utility companies, and consumers, as shown in

Figure 1.

The agent negotiates with the generation company on wholesale price instead of the multiple utility companies. Additionally, the operation cycle of the power system is divided into several time slots. In each time slot, the utility company decides the electricity price and announces it to the consumers. Then, the consumers manage their power consumption according to the announced price. We employ the utility functions to characterize the profits of the customers, where

denotes the utility of consumer

i, and

is the power consumption of the consumer

i. Thus, the maximization of the social welfare can be formulated as the following optimization problem:

where

w is the wholesale price, and

Q denotes the total power supply of the utility companies. The constraint indicates that the total power consumption should match with the power supply. The optimization problem is a convex optimization problem and can be solved by the following primal-dual algorithm:

and:

where

and

z are the control gain,

p is the price of the utility company, and

denotes the set of power consumption of all the customers.

4. Bargaining Model and Solution

The agent representing the multiple utility companies negotiates with the generation company on the wholesale price

w, and then announces the wholesale price to each utility company to maximize the efficiency of the electricity market. It can be formulated as a bargaining problem between the agent and the generation company according to Definition 1. The agent’s utility function can be regarded as the total utility function of the utility companies, which is denoted as:

denotes the power supply of the utility company

j. The profit of the generation company can be denoted as:

where

,

is the cost of the generation.

Next, we prove that the negotiation between the agent and generation company is a bargaining problem. The set of feasible profit is defined as:

where

is the minimum wholesale price and

is the maximum wholesale price.

It is easy to see that the set

T is a closed subset of

from the profit functions of the utility company and generation company, i.e., Equations (

7) and (

8). Assume any two elements

and

:

and:

Next, we construct the weighted summation of the two elements, i.e.,

where

. Comparing Equations (

10) and (

12), we define:

It can be proved that

and

; then, we have:

Meanwhile, it can be proved that

and

; then, we have:

Therefore, we can conclude that

T is closed and convex on

, and the negotiation between the agent and the generation company is a bargaining problem. The cooperative strategy based on RBS can be denoted as:

where

and:

Next, we can obtain the globally optimal solution:

where

is the abscissa axis of symmetry.

5. Power Management System with Additive Disturbances

In reality, the utility company set the optimal retail price according to Equation (

6) based on the wholesale price, and the consumers determine the optimal power consumption according to Equation (

5). It is dependent on the two-way communications between the utility company and the customers. It is necessary to study the impact of disturbances on the power management system because of the errors in the power measurements and the price. As shown in

Figure 2,

and

denote the additive disturbances on the price and the total power consumption, respectively. Then, the power management algorithm with disturbances is denoted as:

and:

Next, we study the input-to-state stability of the power management system with additive disturbances and denote as p for short. Before the proof, we first give the following lemma:

Lemma 1. (input-to-state Stability [43]) Support that satisfieswhere denotes the upper Dini derivative, α is a positive constant, and . Then, Then, we obtain the following theorem:

Theorem 1. The power management algorithm is input-to-state stable when the utility function satisfies , yieldswhere , ,

,

, z is a positive constant,

,

,

,

,

,

,

.

Proof. Consider the Lyapunov candidate function:

where

, take the derivation respect to

V, we have:

where

,

,

.

Adding and subtracting

from the right-hand side of Equation (

26), we obtain

Setting

, we obtain:

which, from Lemma 1, implies that:

The inequality (

24) is proved. ☐

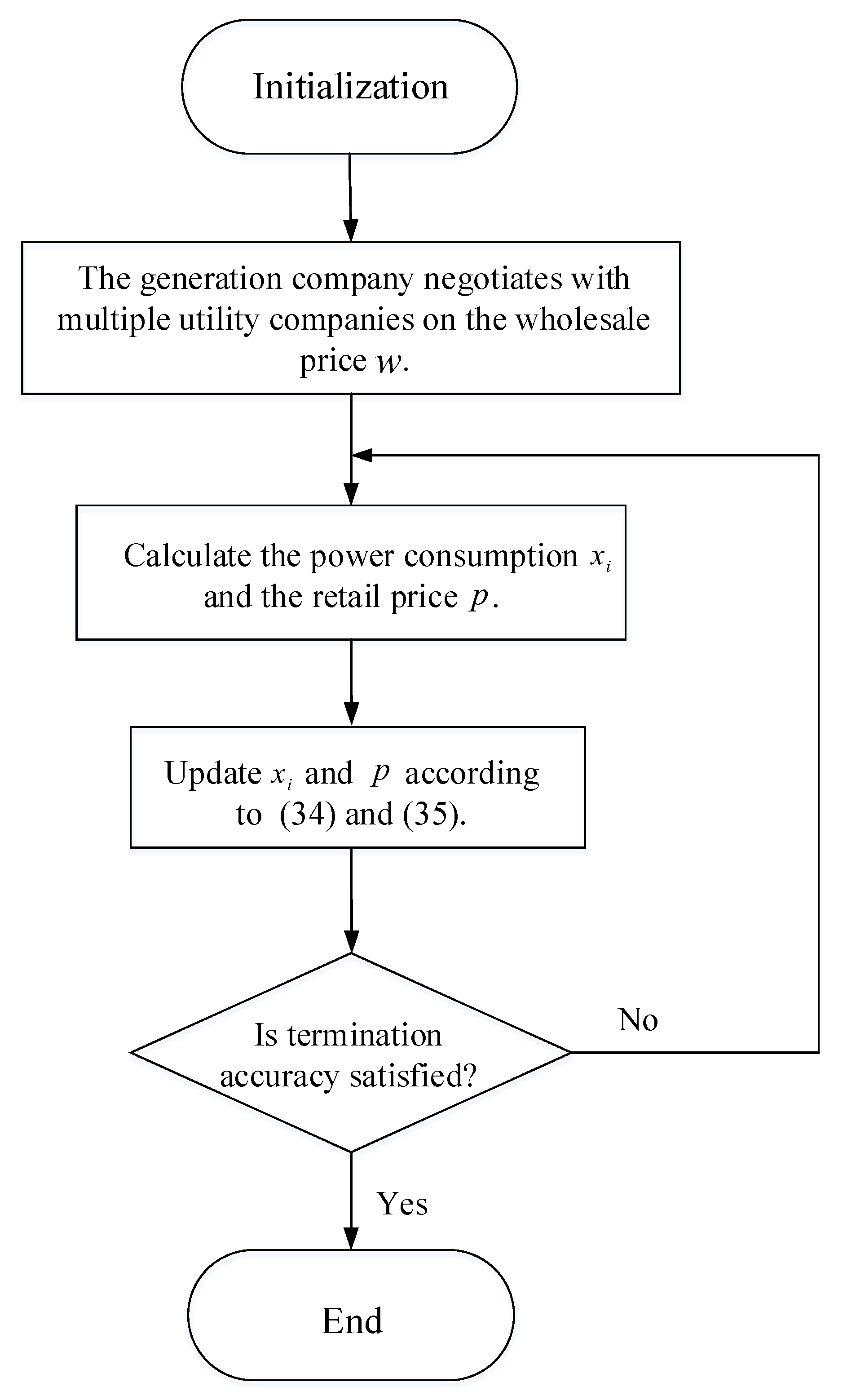

6. System Implementation

The system implementation is shown in

Figure 3, and the process is shown as below.

Generation company: the generation company produces the electric energy and then sells it to the utility companies at a wholesale price to maximize its profits.

Agent: the agent represents the multiple utility companies and then bargains the wholesale price with the generation company to maximize the efficiency of the electricity market.

Utility company: the utility company receives the wholesale price announced by the agent and then sets the optimal retail price. Furthermore, the optimal retail price is sent to the consumers through the bidirectional communication link.

Consumer: the consumers accept the optimal retail price sent by the utility company through the smart meters and then determine the optimal power consumption to maximize their utilities. Then, the consumers send the optimal power consumption to the utility company.

7. Numerical Results

In this section, we consider a smart power system consisting of one generation company (GC), one agent and multiple utility companies (UC). Moreover, each utility company services for several consumers. The utility company decides the electricity price and announces it to the consumers. Then, the consumers manage their power consumption according to the announced price. We employ the utility functions to characterize the profits of consumers. A quadratic utility function with decreasing marginal benefit is defined as:

where

is the power consumption of consumer

,

denotes the willingness to increase the power consumption, and

denotes the maximum demand of consumer

i. The power management algorithm with disturbance is denoted as:

and:

The discrete-time power management algorithm with disturbance is denoted as:

The flowchart of the pricing regulation strategy is given in

Figure 4.

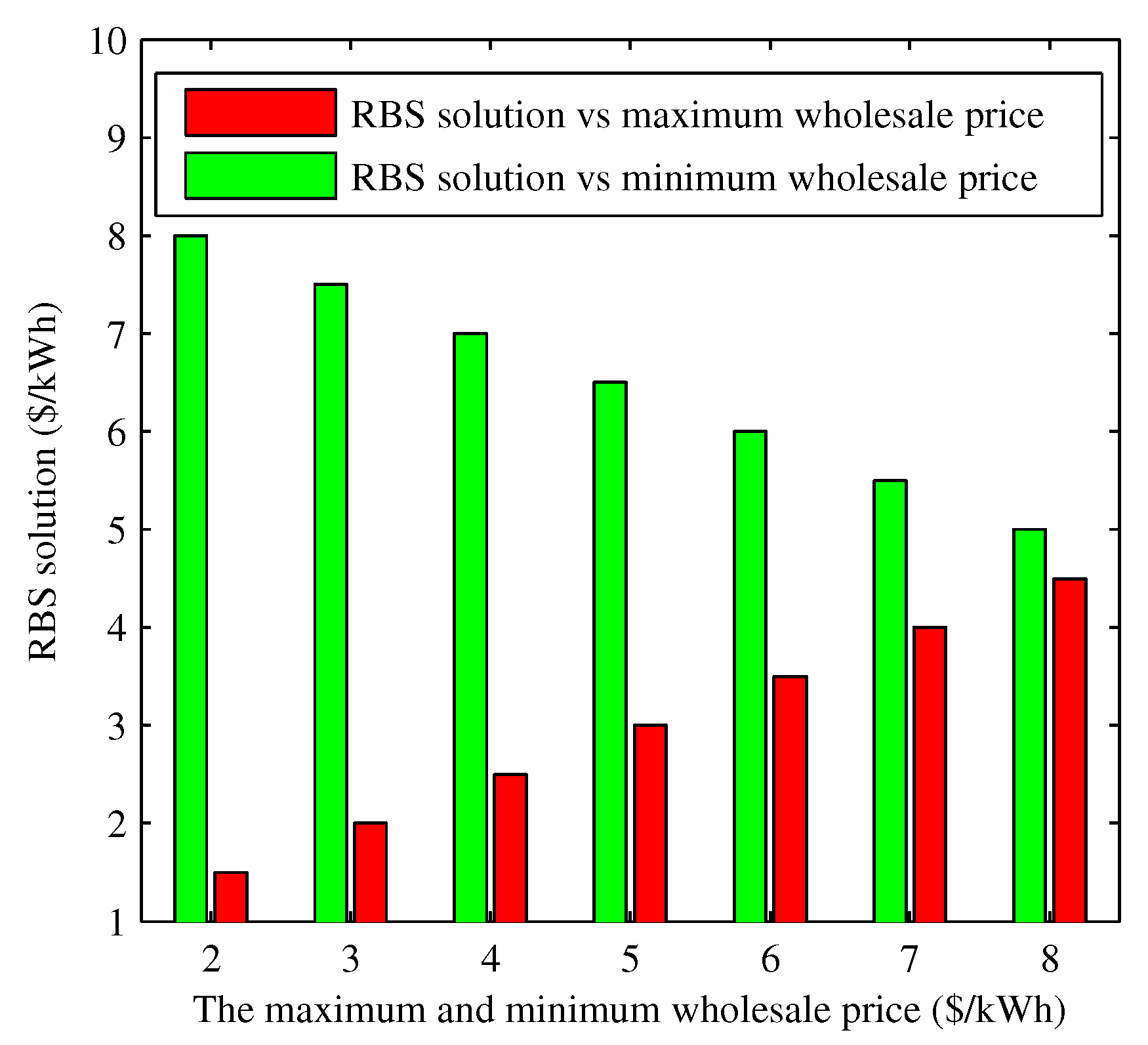

Assuming that the wholesale price is set in

, the generation and agent negotiate on the wholesale price based on Equation (

19), and the RBS solution is

. Moreover, the influence of the maximum wholesale price

and minimum wholesale price

on the RBS solution are shown in

Figure 5, where

is changed from 2 to 8 when

is fixed (green bar) and

is changed from 2 to 8 when

is fixed (red bar). For convenience, we select 1000 consumers from one utility company. Each consumer’s willingness parameter

is randomly selected from [

22,

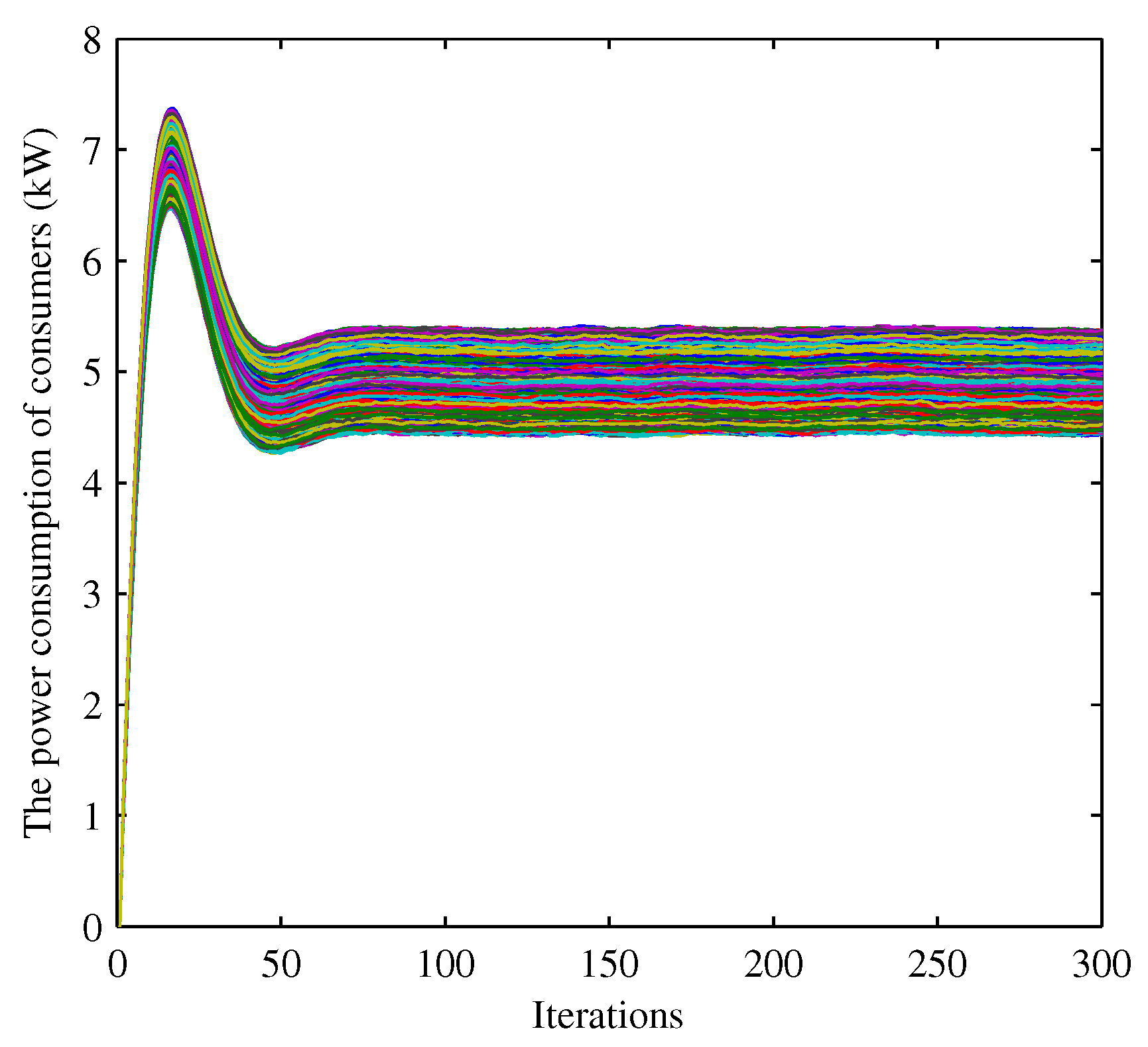

28], and the power supply Q is varying from 5 kW to 12 kW.

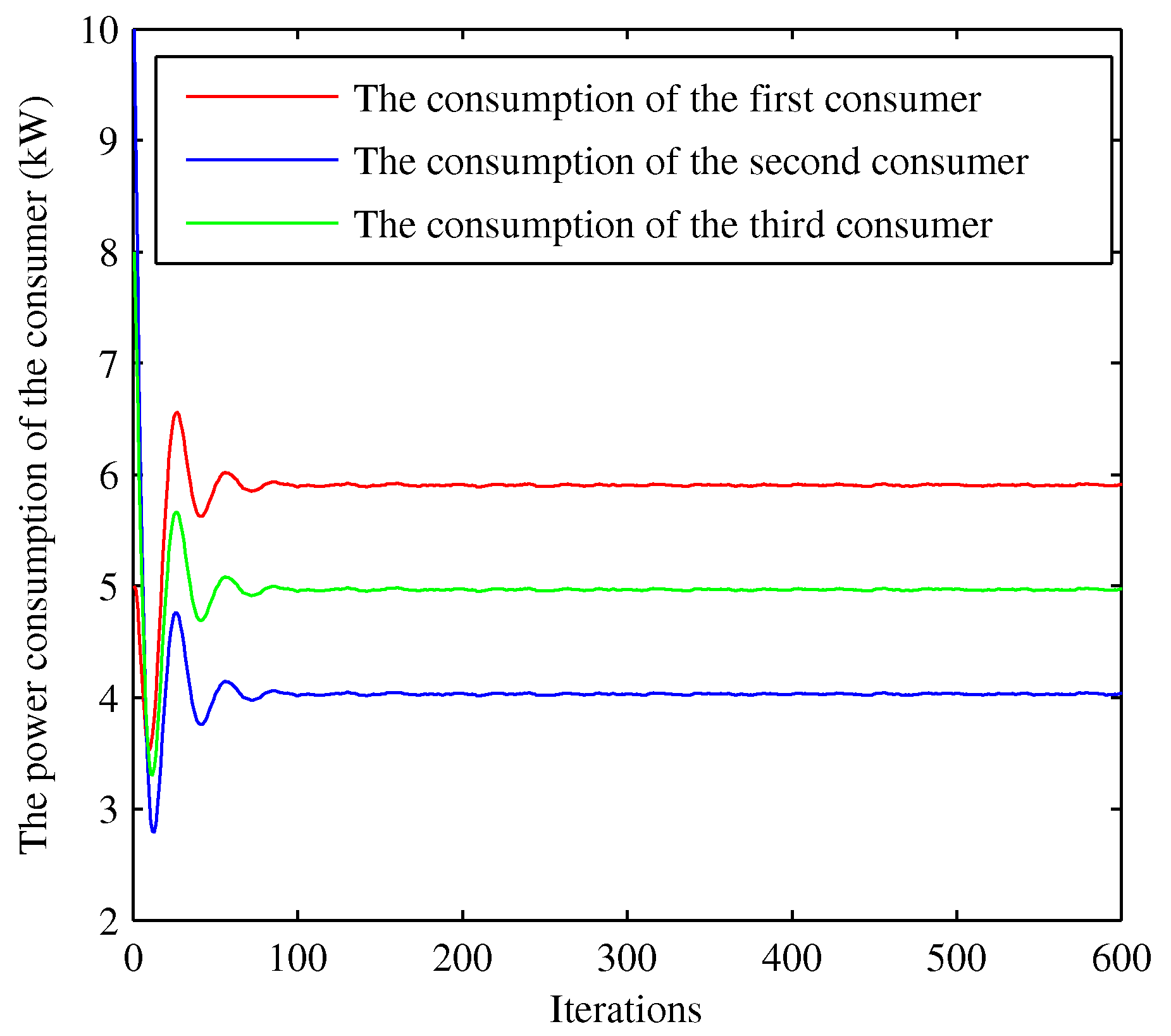

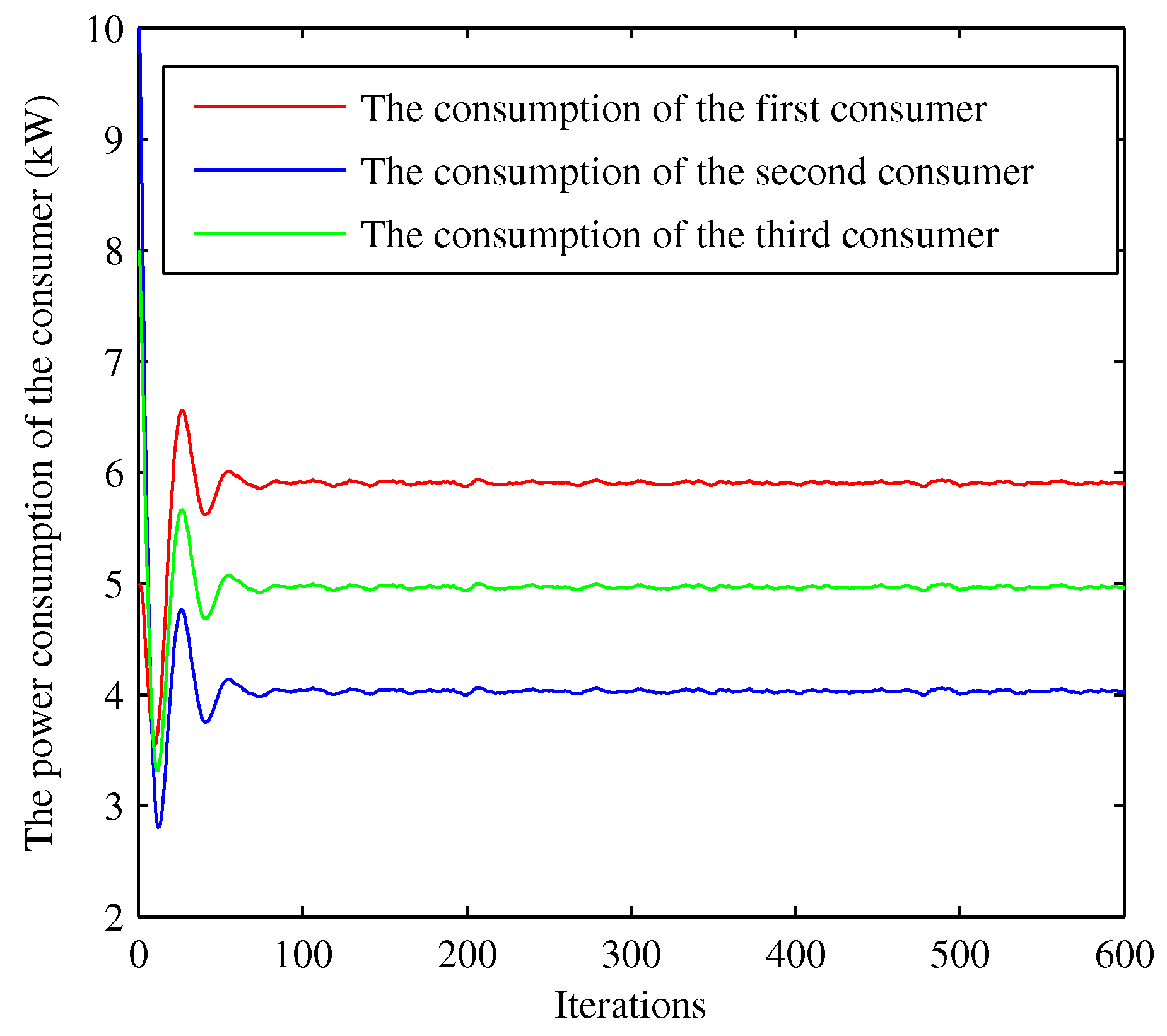

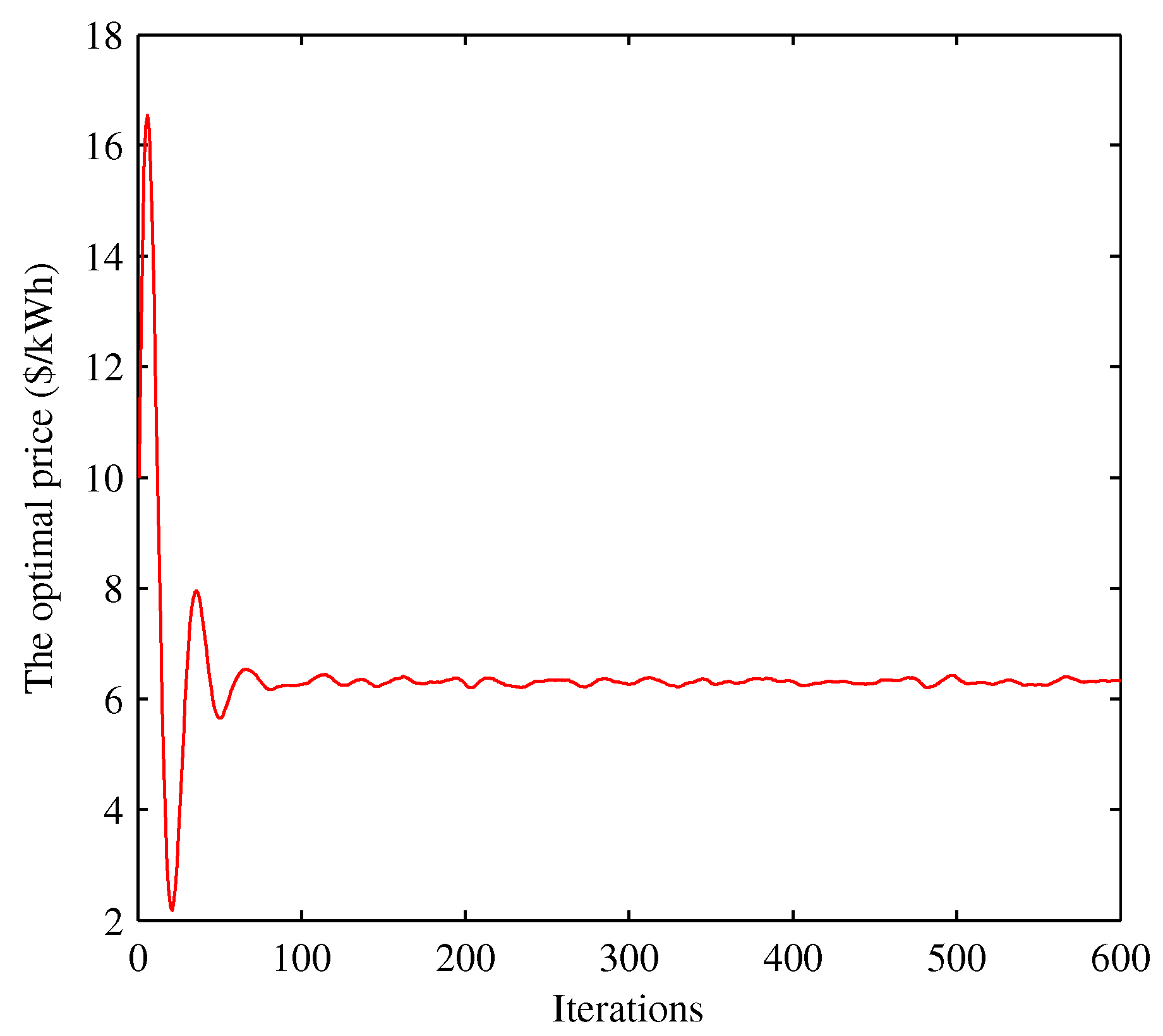

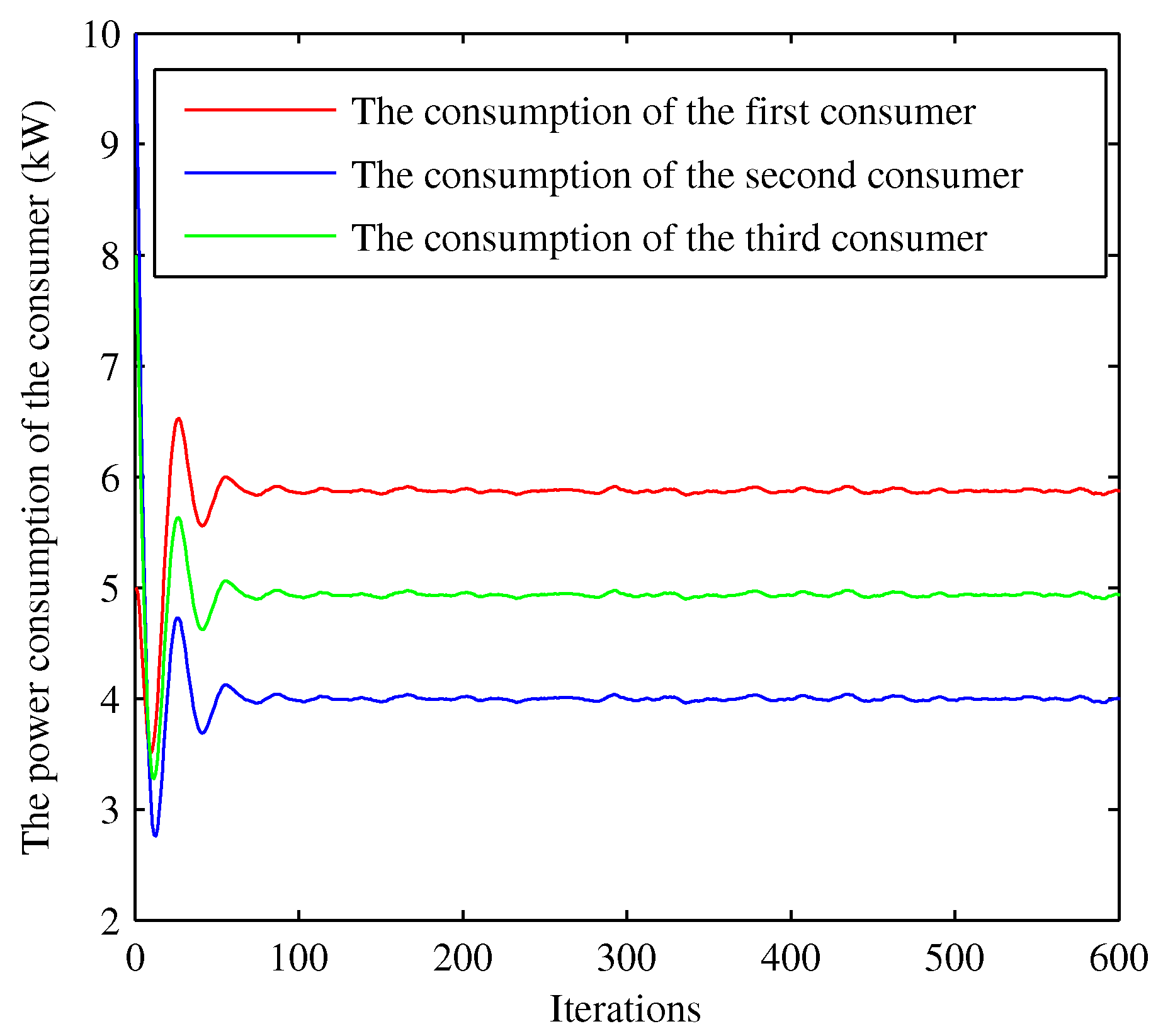

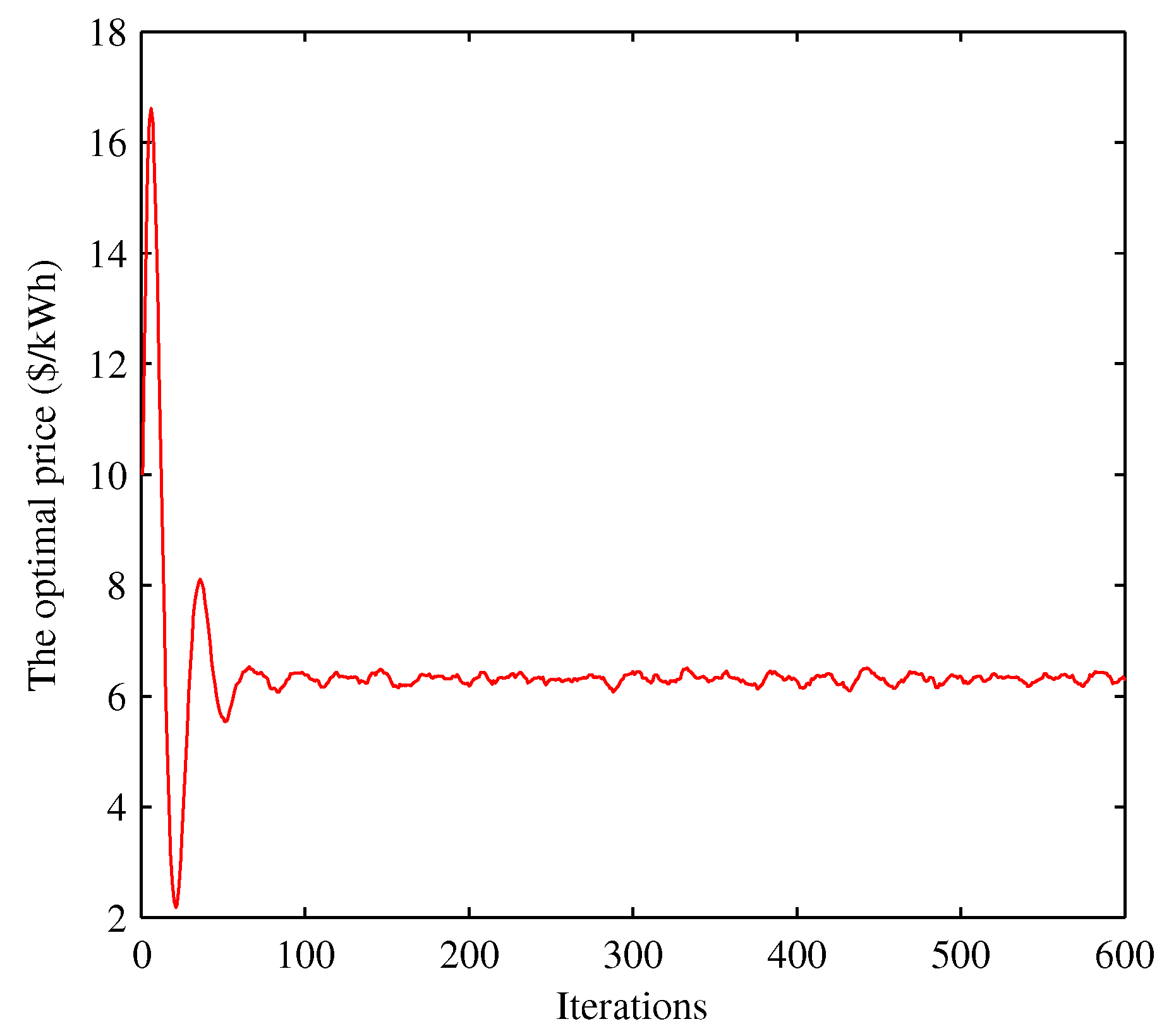

Figure 6 shows the convergence of 1000 consumer’s power consumption bounded by 4.456 kWh and 5.379 kWh. Next, we focus on studying the disturbance impact on the system; for convenience, we select three consumers from the 1000 consumers to analyze the disturbance influence on the system. The parameters of the system are given in

Table 2. The changes of the power consumption and the retail price versus the iterations of the algorithm are shown in

Figure 7,

Figure 8,

Figure 9,

Figure 10,

Figure 11 and

Figure 12, respectively. In the simulations, we mainly focus on the influence of the communication disturbances

and

on the power control algorithm. We take three different parameter values in

Table 3, where

and

follow normal distribution. From

Figure 7 and

Figure 9, we observe that the fluctuations of the power consumption will increase with the variance of

. Furthermore, it is shown that the fluctuations of the retail price will increase greatly with the variance of

from

Figure 8 and

Figure 12. In general, the power system has a good robustness for the additive disturbances, and the errors can be bounded by 1%, 2% and 6% under Case I, Case II and Case III, respectively. From the simulation results, we can observe that the power control algorithm has a fast convergence speed. In the first 100 iterations, the fluctuations are large, and the convergence rate slows down after 100 iterations. The optimal consumption and optimal retail price are given in

Table 4. The proposed algorithm can calculate the optimal power consumption and retail price with short time as shown in

Table 5, which was conducted in MATLAB R2010b (MathWorks, Natick, MA, USA) with a 3.60 GHz CPU and 4.0 GB of RAM.

8. Conclusions

In this paper, we propose an economic dispatch strategy for the electricity system. We formulate a wholesale price negotiation problem between the generation company and multiple utility companies. Then, we prove that the negotiation problem between the generation company and multiple utility companies is a bargaining problem. Next, the RBS is utilized to achieve the optimal bargaining outcome. In the simulation, we find that the RBS solution is increasing with the maximum wholesale price when the minimum wholesale price is fixed. Meanwhile, when the maximum wholesale price is fixed, the RBS solution is decreasing with the minimum wholesale price. Moreover, based on the consumers’ utility maximization and the negotiated wholesale price, we establish a utility function model of utility company with price feedback in the electricity retail markets, and then use the iterative algorithm to obtain the optimal retail price and the optimal power consumption. Additionally, we prove that the algorithm is input-to-state stable and give the input-to-state stability condition under the additive power measurement disturbance and price disturbance. In this work, the proposed algorithm can converge to the optimal value within 100 steps, and the errors can be bounded by 1%, 2% and 6% under Case I, Case II and Case III, respectively. In the future, an interesting topic is to consider the incomplete information game between the utility company and the consumers. The consumers determine the optimal power consumption and the utility company sets the optimal retail price to maximize their own profits, respectively. Then, the Markov game and robust game are promising methods to deal with this problem.