The Next-Generation U.S. Retail Electricity Market with Customers and Prosumers—A Bibliographical Survey

Abstract

:1. Introduction

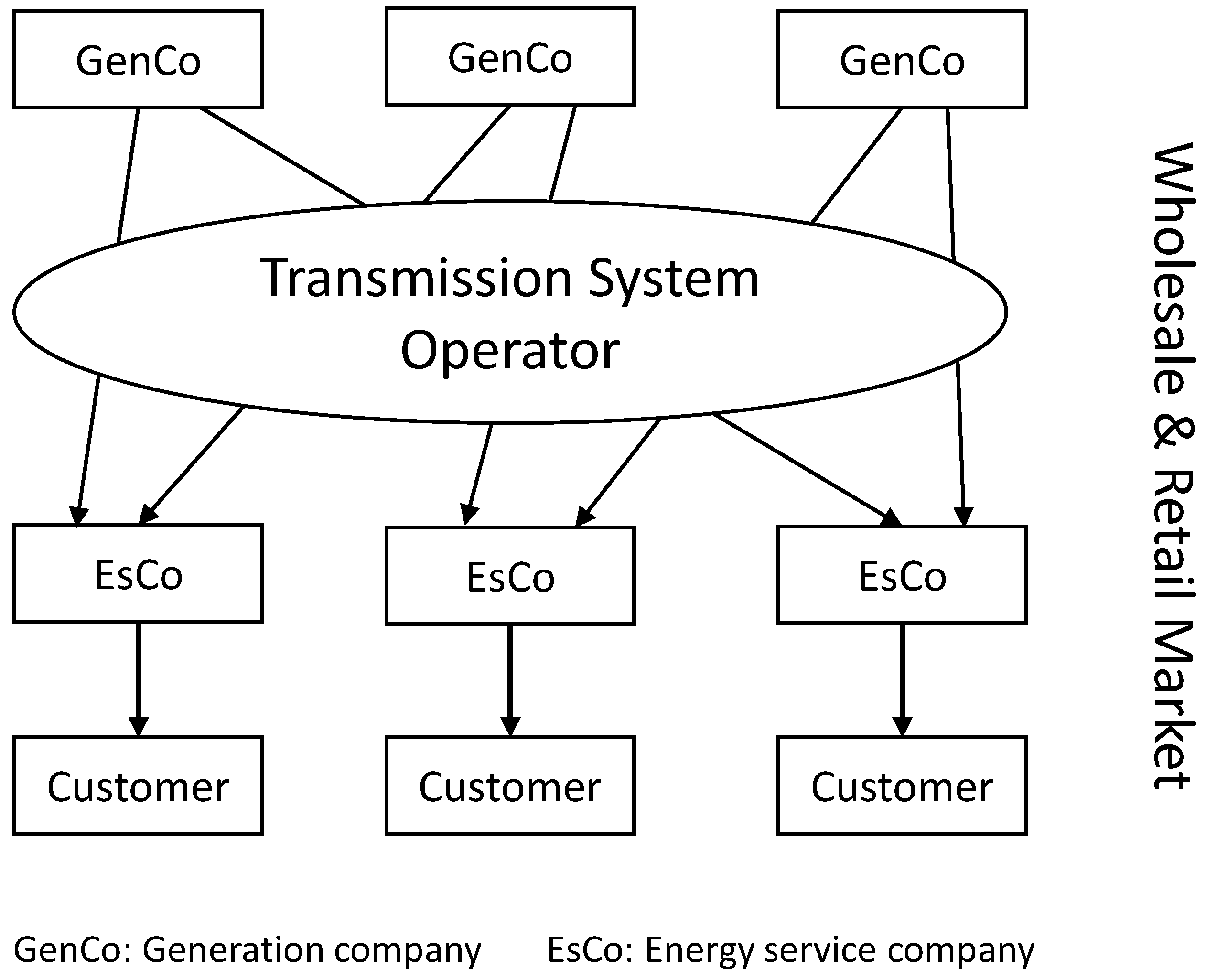

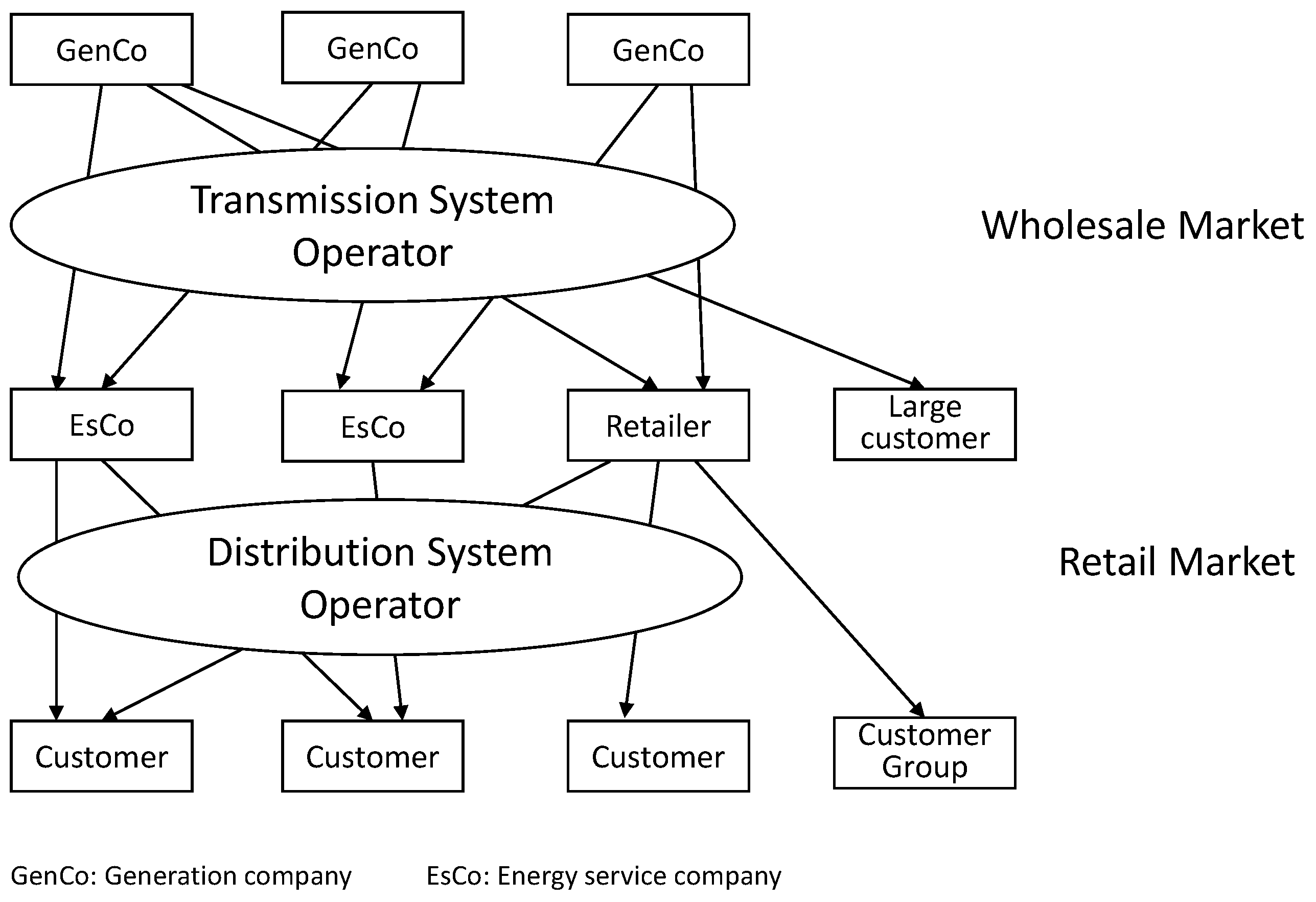

2. Retail Electricity Market with Pure Consumers

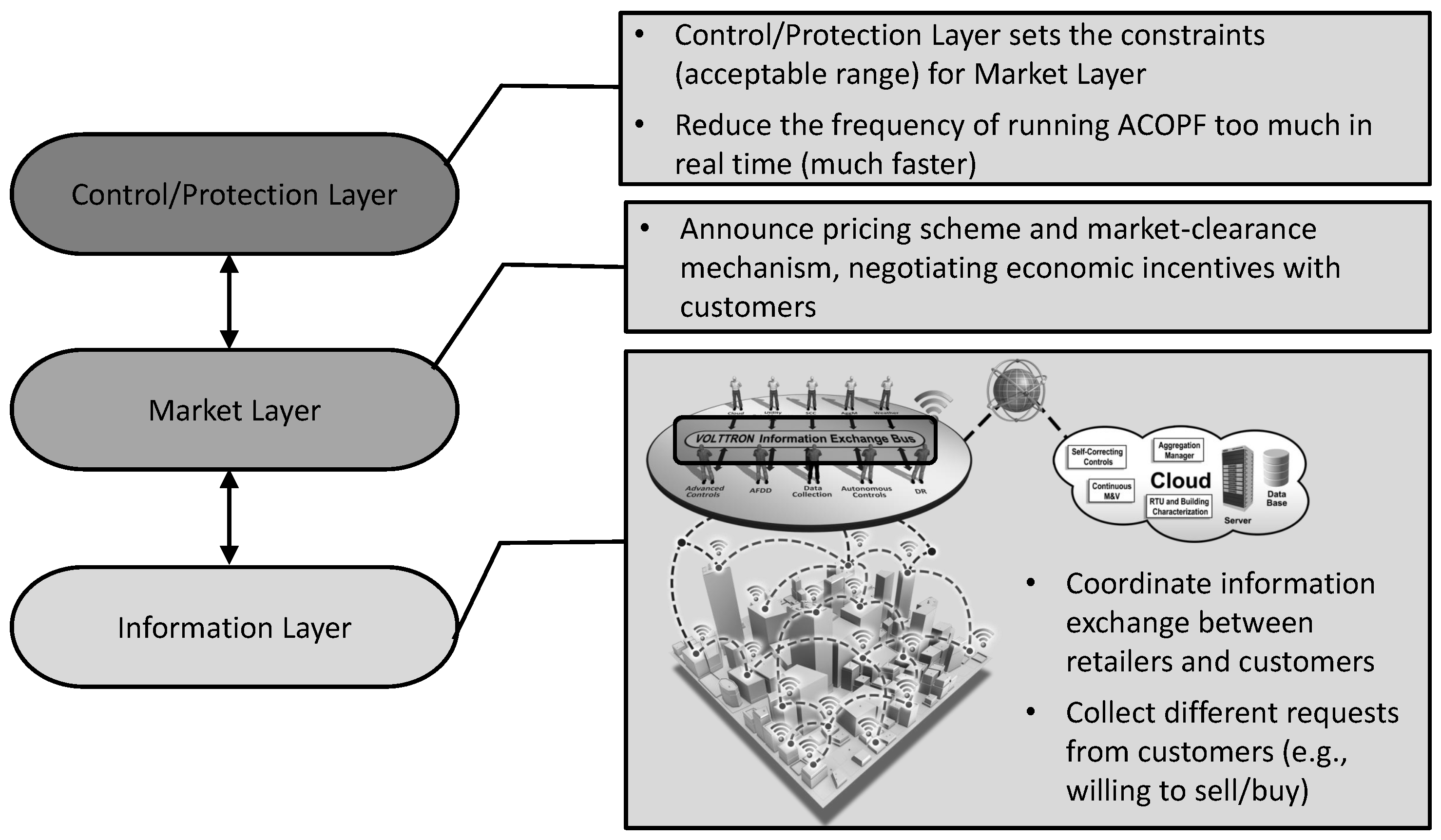

2.1. DSO with Distribution Level Pricing

2.2. Decision Making of Retailers

2.3. Price Scheme and Demand Response

2.4. Transactive Energy and Transactive Control

3. Retail Electricity Market with Prosumers

3.1. Prosumer Grid Integration

3.2. Inter-Network Trading with Peer-To-Peer Models

3.3. Indirect Customer-To-Customer Trading

3.4. Prosumer Community Groups

4. Methodology

4.1. Optimization, Distributed Optimization and Blockchain

4.2. Game Theoretic Method and Prospect Theory

4.3. Agent-Based Simulation

4.4. Machine Learning Techniques

5. Discussion and Policy Issues

6. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- The Public Utility Regulatory Policies Act. Smithsonian Museum of American History. Available online: http://americanhistory.si.edu/powering/past/history4.htm (accessed on 21 August 2017).

- Yan, Y.; Qian, Y.; Sharif, H.; Tipper, D. A survey on smart grid communication infrastructures: Motivations, requirements and challenges. IEEE Commun. Surv. Tutor. 2013, 15, 5–20. [Google Scholar] [CrossRef] [Green Version]

- Prabavathi, M.; Gnanadass, R. Energy bidding strategies for restructured electricity market. Int. J. Electr. Power Energy Syst. 2015, 64, 956–966. [Google Scholar] [CrossRef]

- Hogan, W.W. Financial transmission rights: point-to point formulations. In Financial Transmission Rights; Springer: Berlin, Germnay, 2013; pp. 1–48. [Google Scholar]

- Zhou, K.; Yang, S.; Shao, Z. Energy internet: The business perspective. Appl. Energy 2016, 178, 212–222. [Google Scholar] [CrossRef]

- Abe, R.; Taoka, H.; McQuilkin, D. Digital grid: Communicative electrical grids of the future. IEEE Trans. Smart Grid 2011, 2, 399–410. [Google Scholar] [CrossRef]

- Rudnick, H. Chile: Pioneer in deregulation of the electric power sector. IEEE Power Eng. Rev. 1994, 14, 28–30. [Google Scholar] [CrossRef]

- Richard, G. Electricity liberalisation in Europe—How competitive will it be? Energy Policy 2006, 16, 2532–2541. [Google Scholar]

- Xu, S.; Chen, W. The reform of electricity power sector in the PR of China. Energy Policy 2006, 16, 2455–2465. [Google Scholar] [CrossRef]

- Wang, N.; Mogi, G. Deregulation, market competition, and innovation of utilities: Evidence from Japanese electric sector. Energy Policy 2017, 111, 403–413. [Google Scholar] [CrossRef]

- Gonzalez, W. Restructured States, Retail Competition, and Market-Based Generation Rates. Smart Rate Design for a Smart Future 2015. Available online: https://www.raponline.org/wp-content/uploads/2016/05/appendix-c-smart-rate-design-2015-aug-31.pdf (accessed on 12 September 2017).

- Kirschen, D.S. Demand-Side View of Electricity Markets. IEEE Trans. Power Syst. 2003, 18, 520–527. [Google Scholar] [CrossRef]

- Deng, R.; Yang, Z.; Chow, M.Y.; Chen, J. A Survey on Demand Response in Smart Grids: Mathematical Models and Approaches. IEEE Trans. Ind. Inform. 2015, 11, 570–582. [Google Scholar] [CrossRef]

- Saad, W.; Glass, A.L.; Mandayam, N.B.; Poor, H.V. Toward a Consumer-Centric Grid: A Behavioral Perspective. Proc. IEEE 2016, 104, 865–882. [Google Scholar] [CrossRef]

- Su, W. The Role of Customers in the US Electricity Market: Past, Present and Future. Electr. J. 2014, 27, 112–125. [Google Scholar]

- Yang, J.; Zhao, J.; Luo, F.; Wen, F.; Dong, Z.Y. Decision-Making for Electricity Retailers: A Brief Survey. IEEE Trans. Smart Grid 2017. [Google Scholar] [CrossRef]

- Chen, T.; Pourbabak, H.; Liang, Z.; Su, W. An Integrated eVoucher Mechanism for Flexible Loads in Real-Time Retail Electricity Market. IEEE Access 2017, 5, 2101–2110. [Google Scholar] [CrossRef]

- Chen, T.; Pourbabak, H.; Su, W. A Game Theoretic Approach to Analyze the Dynamic Interactions of Multiple Residential Prosumers Considering Power Flow Constraints. In Proceedings of the 2016 IEEE Power & Energy Society General Meeting, Boston, MA, USA, 17–21 July 2016. [Google Scholar]

- Xu, Z.; Callaway, D.S.; Hu, Z.; Song, Y. Hierarchical Coordination of Heterogeneous Flexible Loads. IEEE Trans. Smart Grid 2016, 31, 4206–4216. [Google Scholar] [CrossRef]

- Callaway, D.S.; Hiskens, I.A. Achieving controllability of electric loads. Proc. IEEE 2011, 99, 184–199. [Google Scholar] [CrossRef]

- Su, W.; Chow, M.Y. Performance evaluation of an EDA-based large-scale plug-in hybrid electric vehicle charging algorithm. IEEE Trans. Smart Grid 2012, 3, 308–315. [Google Scholar] [CrossRef]

- Kok, K.; Widergren, S. A society of devices: Integrating intelligent distributed resources with transactive energy. IEEE Power Energy Mag. 2016, 14, 34–45. [Google Scholar] [CrossRef]

- Liu, Z.; Wu, Q.; Huang, S.; Zhao, H. Transactive Energy: A Review of State of The Art and Implementation. In Proceedings of the 12th IEEE Power and Energy Society PowerTech Conference, Manchester, UK, 18–22 June 2017. [Google Scholar]

- Hao, H.; Corbin, C.D.; Kalsi, K.; Pratt, R.G. Transactive control of commercial buildings for demand response. IEEE Trans. Power Syst. 2017, 32, 774–783. [Google Scholar] [CrossRef]

- Liu, N.; Yu, X.; Wang, C.; Li, C.; Ma, L.; Lei, J. An energy sharing model with price-based demand response for microgrids of peer-to-peer prosumers. IEEE Trans. Power Syst. 2017, 32, 3569–3583. [Google Scholar] [CrossRef]

- Apostolopoulou, D.; Bahramirad, S.; Khodaei, A. The interface of power: Moving toward distribution system operators. IEEE Power Energy Mag. 2016, 14, 46–51. [Google Scholar] [CrossRef]

- Zheng, T.; Litvinov, E. On ex post pricing in the real-time electricity market. IEEE Trans. Power Syst. 2011, 26, 153–164. [Google Scholar] [CrossRef]

- Li, F.; Bo, R. DCOPF-based LMP simulation: Algorithm, comparison with ACOPF, and sensitivity. IEEE Trans. Power Syst. 2007, 22, 1475–1485. [Google Scholar] [CrossRef]

- Caramanis, M.; Ntakou, E.; Hogan, W.W.; Chakrabortty, A.; Schoene, J. Co-optimization of power and reserves in dynamic T&D power markets with nondispatchable renewable generation and distributed energy resources. Proc. IEEE 2016, 104, 807–836. [Google Scholar]

- Li, R.; Wu, Q.; Oren, S.S. Distribution locational marginal pricing for optimal electric vehicle charging management. IEEE Trans. Power Syst. 2014, 29, 203–211. [Google Scholar] [CrossRef]

- Yang, R.; Zhang, Y. Three-Phase AC Optimal Power Flow Based Distribution Locational Marginal Price: Preprint; Technical Report; National Renewable Energy Laboratory (NREL): Golden, CO, USA, 2017.

- Conejo, A.J.; Carrión, M.; Morales, J.M. Decision Making under Uncertainty in Electricity Markets; Springer: Berlin, Germany, 2010. [Google Scholar]

- Kong, W.; Dong, Z.Y.; Hill, D.J.; Luo, F.; Xu, Y. Short-Term Residential Load Forecasting based on Resident Behaviour Learning. IEEE Trans. Power Syst. 2017. [Google Scholar] [CrossRef]

- Stephen, B.; Tang, X.; Harvey, P.R.; Galloway, S.; Jennett, K.I. Incorporating practice theory in sub-profile models for short term aggregated residential load forecasting. IEEE Trans. Smart Grid 2017, 8, 1591–1598. [Google Scholar] [CrossRef]

- De la Nieta, A.A.S.; González, V.; Contreras, J. Portfolio Decision of Short-Term Electricity Forecasted Prices through Stochastic Programming. Energies 2016, 9, 1069. [Google Scholar] [CrossRef]

- Calvo-Silvosa, A.; Antelo, S.I.; Soares, I.; deLlano-Paz, F. Energy planning and modern portfolio theory: A review. Renew. Sustain. Energy Rev. 2017, 77, 636–651. [Google Scholar]

- Song, M.; Amelin, M. Purchase bidding strategy for a retailer with flexible demands in day-ahead electricity market. IEEE Trans. Power Syst. 2017, 32, 1839–1850. [Google Scholar] [CrossRef]

- Hatami, A.; Seifi, H.; Sheikh-El-Eslami, M.K. A stochastic-based decision-making framework for an electricity retailer: time-of-use pricing and electricity portfolio optimization. IEEE Trans. Power Syst. 2011, 26, 1808–1816. [Google Scholar] [CrossRef]

- Rockafellar, R.T.; Uryasev, S. Conditional value-at-risk for general loss distributions. J. Bank. Financ. 2002, 26, 1443–1471. [Google Scholar] [CrossRef]

- Nezamoddini, N.; Wang, Y. Real-time electricity pricing for industrial customers: Survey and case studies in the United States. Appl. Energy 2017, 195, 1023–1037. [Google Scholar] [CrossRef]

- Gyamfi, S.; Krumdieck, S.; Urmee, T. Residential peak electricity demand response—Highlights of some behavioral issues. Renew. Sustain. Energy Rev. 2013, 25, 71–77. [Google Scholar] [CrossRef]

- Hogan, W.W. Time-of-Use Rates and Real-Time Prices. 2014. Available online: http://www.hks.harvard.edu/fs/whogan/Hogan_TOU_RTP_Newark_082314.pdf (accessed on 11 September 2017).

- Celebi, E.; Fuller, J.D. Time-of-use pricing in electricity markets under different market structures. IEEE Trans. Power Syst. 2012, 27, 1170–1181. [Google Scholar] [CrossRef]

- Robu, V.; Vinyals, M.; Rogers, A.; Jennings, N. Efficient Buyer Groups with Prediction-of-Use Electricity Tariffs. IEEE Trans. Smart Grid 2017. [Google Scholar] [CrossRef]

- Zhong, H.; Xie, L.; Xia, Q. Coupon incentive-based demand response: Theory and case study. IEEE Trans. Power Syst. 2013, 28, 1266–1276. [Google Scholar] [CrossRef]

- Xia, B.; Ming, H.; Lee, K.Y.; Li, Y.; Zhou, Y.; Bansal, S.; Shakkottai, S.; Xie, L. EnergyCoupon: A Case Study on Incentive-based Demand Response in Smart Grid. In Proceedings of the Eighth International Conference on Future Energy Systems, Hong Kong, China, 16–19 May 2017; pp. 80–90. [Google Scholar]

- Behrangrad, M. A review of demand side management business models in the electricity market. Renew. Sustain. Energy Rev. 2015, 47, 270–283. [Google Scholar] [CrossRef]

- Melton, R.B. Gridwise Transactive Energy Framework (Draft Version); Technical Report; Pacific Northwest National Laboratory (PNNL): Richland, WA, USA, 2013.

- Masiello, R. Transactive Energy: The Hot Topic in the Industry [Guest Editorial]. IEEE Power Energy Mag. 2016, 14, 14–16. [Google Scholar] [CrossRef]

- Rahimi, F.A.; Ipakchi, A. Transactive energy techniques: Closing the gap between wholesale and retail markets. Electr. J. 2012, 25, 29–35. [Google Scholar] [CrossRef]

- Behboodi, S.; Chassin, D.P.; Djilali, N.; Crawford, C. Transactive control of fast-acting demand response based on thermostatic loads in real-time retail electricity markets. Appl. Energy 2017, 210, 1310–1320. [Google Scholar] [CrossRef]

- Parag, Y.; Sovacool, B.K. Electricity market design for the prosumer era. Nat. Energy 2016, 1, 16032. [Google Scholar] [CrossRef]

- Bompard, E.F.; Han, B. Market-based control in emerging distribution system operation. IEEE Trans. Power Deliv. 2013, 28, 2373–2382. [Google Scholar] [CrossRef]

- Calvillo, C.; Sánchez-Miralles, A.; Villar, J.; Martín, F. Optimal planning and operation of aggregated distributed energy resources with market participation. Appl. Energy 2016, 182, 340–357. [Google Scholar] [CrossRef]

- Clausen, A.; Umair, A.; Demazeau, Y.; Jørgensen, B.N. Agent-Based Integration of Complex and Heterogeneous Distributed Energy Resources in Virtual Power Plants. In Proceedings of the International Conference on Practical Applications of Agents and Multi-Agent Systems, Porto, Portugal, 21–23 June 2017; pp. 43–55. [Google Scholar]

- Rodríguez-Molina, J.; Martínez-Núñez, M.; Martínez, J.F.; Pérez-Aguiar, W. Business models in the smart grid: challenges, opportunities and proposals for prosumer profitability. Energies 2014, 7, 6142–6171. [Google Scholar] [CrossRef]

- Sikdar, S.; Rudie, K. Microgrid level competitive market using dynamic matching. In Proceedings of the Electrical Power & Energy Conference (EPEC), Halifax, NS, Canada, 21–23 August 2013; pp. 1–6. [Google Scholar]

- Lee, J.; Guo, J.; Choi, J.K.; Zukerman, M. Distributed energy trading in microgrids: A game-theoretic model and its equilibrium analysis. IEEE Trans. Ind. Electron. 2015, 62, 3524–3533. [Google Scholar] [CrossRef]

- Mihaylov, M.; Jurado, S.; Avellana, N.; Razo-Zapata, I.; Van Moffaert, K.; Arco, L.; Bezunartea, M.; Grau, I.; Cañadas, A.; Nowé, A. Scanergy: A scalable and modular system for energy trading between prosumers. In Proceedings of the 2015 International Conference on Autonomous Agents and Multiagent Systems, Istanbul, Turkey, 4–8 May 2015; pp. 1917–1918. [Google Scholar]

- Mihaylov, M.; Jurado, S.; Avellana, N.; Van Moffaert, K.; de Abril, I.M.; Nowé, A. NRGcoin: Virtual currency for trading of renewable energy in smart grids. In Proceedings of the 49th North American Power Symposium, Morgantown, WV, USA, 17–19 September 2017; pp. 1–6. [Google Scholar]

- Pecan Street Inc. Real Energy. Real Customers. In Real Time. Available online: http://www.pecanstreet.org/energy/ (accessed on 24 October 2017).

- Chen, T.; Chen, Y.S.; Su, W. An Innovative Localized Retail Electricity Market based on Energy Broker and Search Theory. In Proceedings of the 2014 11th International Conference on the European Energy Market (EEM), Krakow, Poland, 28–30 May 2014; pp. 1–6. [Google Scholar]

- Albrecht, J. The 2011 Nobel Memorial Prize in Search Theory; Department of Economics, Georgetown University: Washington, DC, USA, 2011. [Google Scholar]

- Kim, B.; Zhang, Y.; der Schaar, M.; Lee, J. Dynamic Pricing and Energy Consumption Scheduling With Reinforcement Learning. IEEE Trans. Smart Grid 2016, 5, 2187–2198. [Google Scholar] [CrossRef]

- Luo, J.; Su, W.; Huang, A.Q. Bit-Energy: An Innovative Bitcoin-style Distributed Transactional Model for a Competitive Electricity Market. In Proceedings of the 2017 IEEE Power and Energy Society General Meeting, Chicago, IL, USA, 16–20 July 2017. [Google Scholar]

- Cai, Y.; Huang, T.; Bompard, E.; Cao, Y.; Li, Y. Self-sustainable community of electricity prosumers in the emerging distribution system. IEEE Trans. Smart Grid 2016, 8, 2207–2216. [Google Scholar] [CrossRef]

- Rathnayaka, A.D.; Potdar, V.M.; Kuruppu, S.J. An innovative approach to manage prosumers in Smart Grid. In Proceedings of the 2011 World Congress on Sustainable Technologies (WCST), London, UK, 7–10 November 2011; pp. 141–146. [Google Scholar]

- Tushar, W.; Chai, B.; Yuen, C.; Smith, D.B.; Wood, K.L.; Yang, Z.; Poor, H.V. Three-party energy management with distributed energy resources in smart grid. IEEE Trans. Ind. Electron. 2015, 62, 2487–2498. [Google Scholar] [CrossRef]

- Pourbabak, H.; Luo, J.; Chen, T.; Su, W. A Novel Consensus-based Distributed Algorithm for Economic Dispatch Based on Local Estimation of Power Mismatch. IEEE Trans. Smart Grid 2017. [Google Scholar] [CrossRef]

- Swan, M. Blockchain: Blueprint for a New Economy; O’Reilly Media, Inc.: Sebastopol, CA, USA, 2015. [Google Scholar]

- Munsing, E.; Mather, J.; Moura, S. Blockchains for Decentralized Optimization of Energy Resources in Microgrid Networks. In Proceedings of the 2017 IEEE Conference on Control Technology and Applications (CCTA), Mauna Lani, HI, USA, 27–30 August 2017. [Google Scholar]

- Danzi, P.; Angjelichinoski, M.; Stefanović, Č.; Popovski, P. Distributed Proportional-Fairness Control in MicroGrids via Blockchain Smart Contracts. arXiv, 2017; arXiv:1705.01453. [Google Scholar]

- Wang, H.; Huang, J. Incentivizing energy trading for interconnected microgrids. IEEE Trans. Smart Grid 2016. [Google Scholar] [CrossRef]

- Zhang, N.; Yan, Y.; Su, W. A game-theoretic economic operation of residential distribution system with high participation of distributed electricity prosumers. Appl. Energy 2015, 154, 471–479. [Google Scholar] [CrossRef]

- El Rahi, G.; Etesami, S.R.; Saad, W.; Mandayam, N.; Poor, H.V. Managing Price Uncertainty in Prosumer-Centric Energy Trading: A Prospect-Theoretic Stackelberg Game Approach. IEEE Trans. Smart Grid 2017. [Google Scholar] [CrossRef]

- Li, Y.; Yang, L. Prospect theory, the disposition effect, and asset prices. J. Financ. Econ. 2013, 107, 715–739. [Google Scholar] [CrossRef]

- Zhou, Z.; Chan, W.K.V.; Chow, J.H. Agent-based simulation of electricity markets: A survey of tools. Artif. Intell. Rev. 2007, 28, 305–342. [Google Scholar] [CrossRef]

- Kahn, K. An Introduction to Agent-Based Modeling. Phys. Today 2015, 68, 55. [Google Scholar] [CrossRef]

- Dehghanpour, K.; Nehrir, M.H.; Sheppard, J.W.; Kelly, N.C. Agent-Based Modeling in Electrical Energy Markets Using Dynamic Bayesian Networks. IEEE Trans. Power Syst. 2016, 31, 4744–4754. [Google Scholar] [CrossRef]

- Krishnamurthy, D.; Li, W.; Tesfatsion, L. An 8-zone test system based on ISO New England data: Development and application. IEEE Trans. Power Syst. 2016, 31, 234–246. [Google Scholar] [CrossRef]

- Ketter, W.; Collins, J.; Weerdt, M.D. The 2016 Power Trading Agent Competition. 2016. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2714236 (accessed on 14 September 2017).

- Dehghanpour, K.; Nehrir, H.; Sheppard, J.; Kelly, N. Agent-based modeling of retail electrical energy markets with demand response. IEEE Trans. Smart Grid 2016. [Google Scholar] [CrossRef]

- Yadack, M.; Vermeulen, B.; Pyka, A. Competition in the German market for retail electricity: An agent-based simulation. In Innovation Networks for Regional Development; Springer: Berlin, Germnay, 2017; pp. 255–272. [Google Scholar]

- Yu, Y.; Liu, G.; Zhu, W.; Wang, F.; Shu, B.; Zhang, K.; Astier, N.; Rajagopal, R. Good Consumer or Bad Consumer: Economic Information Revealed from Demand Profiles. IEEE Trans. Smart Grid 2017. [Google Scholar] [CrossRef]

- Wang, Y.; Chen, Q.; Kang, C.; Xia, Q. Clustering of Electricity Consumption Behavior Dynamics toward Big Data Applications. IEEE Trans. Smart Grid 2016, 7, 2437–2447. [Google Scholar] [CrossRef]

- Chen, T.; Mutanen, A.; Järventausta, P.; Koivisto, H. Change detection of electric customer behavior based on AMR measurements. In Proceedings of the 2015 IEEE Eindhoven PowerTech, Eindhoven, The Netherlands, 29 June–2 July 2015; pp. 1–6. [Google Scholar]

- Luo, F.; Ranzi, G.; Wang, X.; Dong, Z.Y. Social Information Filtering Based Electricity Retail Plan Recommender System for Smart Grid End Users. IEEE Trans. Smart Grid 2017. [Google Scholar] [CrossRef]

- Sutton, R.S.; Barto, A.G. Reinforcement Learning: An Introduction; MIT Press: Cambridge, UK, 1998. [Google Scholar]

- De Somer, O.; Soares, A.; Kuijpers, T.; Vossen, K.; Vanthournout, K.; Spiessens, F. Using Reinforcement Learning for Demand Response of Domestic Hot Water Buffers: a Real-Life Demonstration. arXiv, 2017; arXiv:1703.05486. [Google Scholar]

- Mnih, V.; Kavukcuoglu, K.; Silver, D.; Rusu, A.A.; Veness, J.; Bellemare, M.G.; Graves, A.; Riedmiller, M.; Fidjeland, A.K.; Ostrovski, G.; et al. Human-level control through deep reinforcement learning. Nature 2015, 518, 529–533. [Google Scholar] [CrossRef] [PubMed]

- Hirth, L.; Ueckerdt, F. Redistribution effects of energy and climate policy: The electricity market. Energy Policy 2013, 62, 934–947. [Google Scholar] [CrossRef]

- Newbery, D.M. Towards a green energy economy? The EU Energy Union’s transition to a low-carbon zero subsidy electricity system—Lessons from the UK’s Electricity Market Reform. Appl. Energy 2016, 179, 1321–1330. [Google Scholar] [CrossRef]

- Salies, E.; Price, C.W. Charges, costs and market power: the deregulated UK electricity retail market. Energy J. 2004, 25, 19–35. [Google Scholar] [CrossRef]

- Defeuilley, C. Retail competition in electricity markets. Energy Policy 2009, 37, 377–386. [Google Scholar] [CrossRef]

| Solution Methods | Advantage | Disadvantage | Prosumer Easily Considered | Computational Complexity |

|---|---|---|---|---|

| (Distributed) optimization | Accurate analytical solution result with clear interpretation; Easily consider power flow constraint and network operation conditions; Deterministic conclusion; | Hard to describe every trading features in constraints; Central or regional controllers are needed; Usually need high computational resources; | Yes | Medium |

| Game theoretic method | Intuitive description about different market participants; Suitable for distributed control; Good economic interpretation; | Convergence is not guaranteed and hard to find the equilibrium point; Limited to stylized trading situations involving few actors; | No | High |

| Agent-based modeling | Highly adaptive to market and trading environment; Heterogeneity of different types of market participants; Easily incorporate social abilities to exchange information; | Most neglect transmission/distribution grid constraints; Results are mostly non-deterministic with poor interpretation; Not reliable due to external conditions and for policy makers; | Yes | Low |

| Machine learning techniques | Very autonomous decision-making process; Insensitive to market structure and large data sources; | Data-driven and need realistic experiments; Usually need high computational resources; | Yes | Medium |

| Year | Effect |

|---|---|

| 1935 | Congress passes the Public Utility Holding Company Act of 1935 (PUHCA) to require the breakup and the stringent federal oversight of large utility holding companies. |

| 1978 | Congress passed the Public Utility Regulatory Policies Act (PURPA) which initiated the first step toward deregulation and competition by opening power markets to non-utility electricity producers. |

| 1992 | Congress passed the Energy Policy Act of 1992 (EPACT), which promoted greater competition in the bulk power market. The Act chipped away at utilities’ monopolies. |

| 1996 | FERC implemented the intent of the Act in 1996 with Orders 888 and 889, with the stated objective to ‘‘remove impediments to competition in wholesale trade and to bring more efficient, lower cost power to the nation’s electricity customers.’’ |

| 2005 | Congress passed the Energy Policy Act of 2005, a major energy law to repeal PUHCA and decrease limitations on utility companies’ ability to merge or be owned by financial holding/non-utility companies. |

| 2007 | FERC issued Order 890, reforming the open-access regulations for electricity transmission, in order to strengthen non-discrimination services. |

| 2008 | FERC issued Order 719 to improve the competitiveness of the wholesale electricity markets in various ways, and to enhance the role of RTOs. |

| 2012 | FERC issued Order 768 to facilitate price transparency in markets for the sale and strengthen the Commission’s ability monitor its retail markets for anti-competitive and manipulative behavior. |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, T.; Alsafasfeh, Q.; Pourbabak, H.; Su, W. The Next-Generation U.S. Retail Electricity Market with Customers and Prosumers—A Bibliographical Survey. Energies 2018, 11, 8. https://doi.org/10.3390/en11010008

Chen T, Alsafasfeh Q, Pourbabak H, Su W. The Next-Generation U.S. Retail Electricity Market with Customers and Prosumers—A Bibliographical Survey. Energies. 2018; 11(1):8. https://doi.org/10.3390/en11010008

Chicago/Turabian StyleChen, Tao, Qais Alsafasfeh, Hajir Pourbabak, and Wencong Su. 2018. "The Next-Generation U.S. Retail Electricity Market with Customers and Prosumers—A Bibliographical Survey" Energies 11, no. 1: 8. https://doi.org/10.3390/en11010008