1. Introduction

Policy responses to climate change are transforming energy networks with the rise in distributed renewable energy generation. In Australia, policy measures to incentivize the take-up of residential photovoltaics (PV) coincided with a time of network driven electricity price rises, with average household bills increasing by two-thirds from 2007 to 2013 [

1]. This has spurred one of the highest rates of solar penetration in the world with over 1.79 million, or 17% of, households installing PV. Nationally, households have installed 5.3 GW of PV generation, as of December 2016, which is forecast to rise to 12.55 GW by 2037 [

2]. In many regions, over 40% of residential dwellings have PV installed [

3].

This extent of PV adoption has challenged the operational and planning processes of distribution network service providers (DNSP) due to both the change in household demand profiles and voltage regulation issues during high generation periods.

The impact of PV generation on reducing household energy demand, combined with an increase in appliance and building efficiencies, has let to flat or declining annual aggregate volumes of energy served since 2009 [

2]. Compounding the issue of declining or static energy volumes is the continued growth of system peak demand, particularly in New South Wales (NSW) and Queensland, reaching a record in Queensland of 9357 MW in January 2017 [

4].

To date, energy volumes served have been the primary basis for the recovery of network costs by DNSPs. With distribution costs in Australia accounting for 37% of the retail bill, and transmission a further 8% [

2]. The current 2014-19 Australian Energy Regulator (AER) determination of

$6576.4 M (regulated five-year spending plan) for the NSW DNSP Ausgrid, considered in this study, represents cost recovery of 48.7% capital expenditure (capex), 30.3% operational expenditure (opex), and 21% regulated return including the return of capital (depreciation) and return on capital [

5]. Further, under all current DNSP determinations in the National Energy Market (NEM) total approved distribution spending is

$36,637 M of which

$19,301 M is capex [

6]. This is illustrative of the high proportion of capex value that could be accessed by displacing traditional network spending, or diverting to householders in the form of incentives to drive a rapid transformation of electricity networks.

Changing load conditions and a lack of policy certainty regarding carbon reduction strategies have found existing network cost recovery methods slow to adapt [

7]. One effect of the reduction in energy served has been to exacerbate network driven price rises as the costs of the network are recovered on a smaller base. This effect has been referred to as the network ‘death-spiral’ [

8], where high network prices resulting from network investment have incentivized households to install PV to manage their energy use. This in turn, by shrinking the base, results in further price increases and so on, raising the threat of leaving DNSPs with stranded assets in the absence of more efficient pricing strategies. This also presents social equity issues for those unable to afford the upfront investment in renewable generation to manage their price exposure.

The intermittency of PV generation has also posed network management challenges to DNSPs. The variability of PV generation is most felt in its impact on forecasting, frequency, and voltage variation. Studies have shown that LV networks can reach up to 20–30% penetration before there are significant network voltage quality issues [

9,

10,

11].

The rapid technological advancement of battery energy storage systems (BESS) [

12,

13], has presented an opportunity to address the technical and economic challenges in transitioning to higher levels of distributed generation (DG) in electricity networks [

14,

15,

16]. BESS can be used to meet demand through stored energy as well as managing PV generation intermittency and maintaining network voltage and frequency within allowable limits [

17,

18,

19]. Further, BESS can be used to improve the efficiency of the network by displacing peak demand driven network spending [

20,

21,

22].

If the rate of BESS adoption follows a similar pattern to that of PV, accelerated by continued reductions in capital costs, it will change the characteristics of the network itself [

23]. Indeed in 2017 as a greater range of residential battery products came to market there was a more than doubling of installed PV and BESS systems as shown in

Table 1.

Households combining PV and BESS have moved into the realm of the ‘prosumer’ where they gain the ability to both produce energy and manage their energy use [

1,

25,

26]. This will upturn the current ‘price-taker’ relationship between households and DNSPs, and how this is managed in terms of collaboration in reaching greater levels of network efficiency and renewable generation will be crucial in transitioning energy networks to a low-carbon future.

Combined with advanced metering the rise of the ‘prosumer’ will enable greater freedom for households to aggregate into ‘smart grids’ or other arrangements of aggregation which provides further options for greater network efficiencies through the pooling of generation and storage both within and across regions [

27,

28].

Traditional approaches of volume-based cost recovery are becoming increasingly inefficient, hence innovative approaches to cost recovery, whilst encouraging innovation and network efficiency, are required. Studies have shown that the development of new network pricing methods are hampered by the lack of information to form truly cost-reflective pricing [

7,

29,

30]. Building on their work, a thorough evaluation of the economic drivers of all network participants must be undertaken to provide the optimum balance between the objectives of increasing network efficiency and the decarbonizing of energy systems.

Prior research into the economics of DG at the household level, and increasingly the addition of BESS, primarily has focused on the private costs to investors and the gains arising through self-consumption, peak shaving, and energy export [

31,

32]. The price of peak energy under time of use (ToU) was an important factor in determining value, however, BESS costs were still found to be the primary determinant of profitability in South African pricing conditions [

33]. Similarly, a publication found that with domestic BESS prices in 2014, under German electricity pricing conditions, that the gains from incorporating BESS with PV justified the investment in BESS [

34]. Further a study analyzing a university building in Bologna, Italy, found that the incorporation of BESS and PV resulted in savings of 24.5% on grid electricity prices [

35]. In Australia a paper found that there was high probability of economic gains based on BESS costs of

$500/kWh, 14 kWh sized battery with 75% efficiency [

36]. However, a more recent paper from Italy found that the economics of PV and BESS are justified only when there is a significant increase in self-consumption [

37]. A recent paper compared residential business cases against that of a large-scale project with consideration of gravity storage as an option, it found that in residential cases batteries were uneconomical [

38]. However, the authors did not ascribe any value from the deferment of network upgrades to actions taken by households.

Where the economic perspective of DNSPs has been evaluated, whether in evaluating microgrids [

39,

40] or mitigating forecasting uncertainty as in [

19], the most commonly identified benefit is deferring network spending [

41,

42], and to a lesser extent the provision of ancillary services as the primary network benefits. The deferral of network spending has through various studies has ranged from AUD

$1200 [

43] per kVA displaced, to

$1500 AUD/kVa in 2009

$ [

41], a more recent figure of

$810 per kVa (2012 AUD

$) has been obtained from the AEMC Power of Choice report for the Ausgrid Network area [

44]. However, in these studies into benefits of DG they have not considered residential renewable energy and storage as the source of supply.

To date, despite the wealth of papers analyzing household economics of photovoltaics and storage, there are few studies that seek to provide an integrated household and network economics impact model. In the literature there is clearly a divide between the household sector perspective and that of the network operators. The predominant network impact considered has been voltage and frequency stability arising from a surplus of household PV generation. This is an important consideration; however, it is the view of the authors that this leaves much of the changing nature of energy systems and the impact of prosumers underexamined.

Without a clear understanding of the full range of impacts on network capital spending, customer reliability and the reduction of losses there is a significant gap in the ability to evaluate the impact of household energy investment decisions. Given the high proportion of network costs in energy prices, a clear view of the potential network benefits arising from private household energy investments will allow the identification of network spending efficiencies and inform the scope for, and incentivization of, greater levels of household renewable generation. Such an understanding will assist in addressing the resistance of network operators to further incorporation of DG. Whether based on risk aversion or industry culture, in cases of push-back on the spread of DG as explored in a paper by Simpson [

45], through increasing of cost and complexity of connection agreements, a clear understanding of wider economic benefits can help address this resistance.

In order to provide this novel perspective, the purpose of this research is to develop a probabilistic techno-economic model that integrates a highly-granular household energy system model combined with an economic analysis of network sector impacts. Stochasticity in input variables will be addressed by using a Monte Carlo (MC) simulation. MC modelling combined with Life Cycle Cost (LCC) is a common methodology for incorporating uncertainty across a range of scenarios by random sampling using probability distributions [

46,

47,

48].

This paper is organized as follows,

Section 2 presents the methods used to perform the simulations and economic analysis,

Section 3 presents the results of the modelling, and

Section 4 presents the conclusions of the analyses.

4. Conclusions

This paper presents a model for a broader economic examination of the benefit or cost of investment decisions taken by households in terms of their impact on the capital planning of LV networks. This study contributes to the literature in several ways. Firstly, it bridges the gap between the household and network operator perspective in evaluating the wider impact of household investment decisions. Second, by evaluating the effect on customer reliability and reduced losses in addition to deferred network augmentation it demonstrates that DG and storage presents a powerful tool for improving the efficiency of networks. Prosumers have shown that they will invest in energy infrastructure and it is both a challenge and an opportunity for network operators to develop new ways to manage and plan networks collaboratively. Third, it presents a method for evaluating the scope for incentives for the household adoption of DG and storage to be funded by displacing network spending.

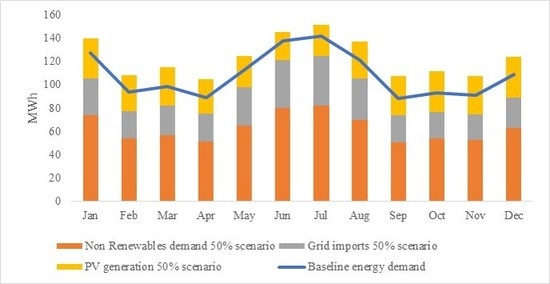

The results of the modelling show that where the private investment case does not support the installation of PV and BESS that the system benefits can outweigh these private losses. This has significant implications for determining policy support levels for the adoption of residential batteries. Further, that the modelling results show that when penetration levels approach 50% households installing PV and BESS in an area it can redefine area maximum demand. Given the residential contribution to maximum demand in Australia this indicates that residential batteries represent a significant opportunity to increase the efficiency of networks both in capital and utilization rates. To fully access the potential benefits on offer the transition to a network of prosumers will require new pricing structures and collaborative relationships between network operators and prosumers.

Specifically, this study aims to serve as analytical support to academics and policy makers in informing strategies for the contribution of retrofitting of existing housing stock with distributed generation and storage to the decarbonization of energy systems. With PV installed in over 17% of Australian households, how best to adapt existing control and pricing structures in response will have a significant impact on future adaptation strategies world-wide.

Further research will seek to integrate a detailed power flow model of the LV network to determine the impact of household investment decisions on network operations through the simulation of voltage and frequency maintenance requirements, thereby enhancing the analytical capabilities regarding network spending impacts as well as the increased capacity for the incorporation of higher levels of PV generation.