1. Introduction

The overall Pan-European political goals of decarbonising the power sector have already resulted in substantial growth of generation from renewable energy sources (RES) in Europe. In Germany the share of electric power from RES during the first part of 2017 reached 35% of the total generation mix [

1], while in Denmark wind power already accounted for 42% of all electricity generated in 2016 and is expected to cover 48% in 2020 [

2]. This process has been reinforced by massive subsidies, channelized via various support schemes as feed-in tariffs, feed-in premiums, quota obligation systems and combinations of these approaches, which are the most commonly applied. Other instruments such as quota systems with tradable green certificates and priority dispatch for RES are also applied in several European countries (for detailed descriptions see [

3]). Apart from their positive effects, i.e., increasing the share of RES in the European generation mix, these support schemes combined with some inherited properties of variable renewable energy have also caused several interrelated challenges for the European power sector on the market level (for a complete overview see [

3]) as well as the system level. Among latter the following may be mentioned:

Local grids cannot maintain normal

n − 1 security (transmission systems shall be designed to maintain a

n − 1 security criterion, meaning that the system is in a secure state with all transmission facilities in service and in a satisfactory state under credible contingent events.

n − 1 is a common security standard in many countries. The single contingencies to be considered under an

n − 1 criterion are: loss of a single transmission circuit, loss of a single generator, loss of a high-voltage, direct current

(HVDC) pole, loss of a single bus section, loss of an interconnecting transformer, loss of a single shunt connected reactive component) if local generation exceeds local demand and if separation of generation and consumption is insufficient. Restoration after fault has become more complicated and more time consuming (the case of Western Denmark with its high share of wind power [

4]).

Security analysis has become less accurate due to missing information on local generation and the unpredictable nature of wind and solar power.

Traditional under-frequency load shedding schemes will disconnect both load and generation.

Growing share of RES, following decommissioning of the nuclear generation and reduced operational time for thermal power plants will lead to declining of system inertia and accordingly system’s stability [

5].

These challenges have raised the necessity of reconsidering the existing power system architecture. Several initiatives have been working in this direction during the recent years. Depending upon the time horizon and the scope, the ambitions may vary from rather evolutionary, which require minor changes in the system’s architecture, to very radical approaches:

The FP7 project EcoGrid EU (2011–2015) worked on development and testing of new market concept allowing to improve the balancing mechanisms by introducing a 5 min real-time price response that will provide additional regulation power from smaller customers directly to Transmission System Operators (TSOs) [

6].

Moving in the same direction, the H2020 project SmartNet (2015–2018) attempts to rethink the system architecture and corresponding market arrangements. This will improve TSO-DSO interaction the acquisition of ancillary services (reserve and balancing, voltage balancing control, congestion management) from subjects located in the distribution segment (flexible load and distributed generation) [

7].

More radical approaches are attempting to redesign the overall system architecture, especially aiming for division of the power system into separated grid areas with various level of autonomy:

The concept developed by the Danish Cell Project led by Energinet.dk looked at dividing the power system into virtual fully autonomous grid areas in terms of control, so-called cells. The cell concept could be realized through the development and implementation of an advanced monitoring and control system capable of monitoring the state of the cell and—in extreme situations—taking control of its individual units such as circuit breakers, transformers, wind turbines and combined heat and power (CHP) plants [

8].

Division of the grid into semi-autonomous units is studied by H2020 project Fractal Grid [

9] and recently started C/sells project [

10].

Among the most recent initiatives one can mention FP7 ELECTRA IRP [

11], which addresses the issue of deployment of RES connected to the network at all voltage levels as well as establishes and validates proofs of concepts that utilize flexibility from across traditional boundaries in a holistic manner.

In particular, the FP7 ELECTRA IRP [

11,

12] observes that beyond 2020 the European power sector will undergo significant developments. Electricity production will shift from traditional fossil fuel-based units to units using intermittent RES. Electricity producing units will be connected both to transmission and distribution networks. A wave of electrification of transport and space heating sectors will rise and strengthen towards 2050, resulting in increasing demand for electricity. Electricity storage technologies will become cost-effective solutions for the provision of balancing services. Extensive amounts of flexible loads having fast activation and short ramping times will be available at all voltage levels. Therefore, the demand for activation of balancing capacities to correct the imbalances caused by forecast errors of intermittent RES and flexible loads will increase. The present power system balancing paradigm will need to be transformed from generation following load to load following generation. The location of imbalance-causing problems, which require activation of balancing capacity and resources, will move from transmission to distribution network level.

For that reason, ELECTRA proposes a new cell-based decentralized control framework named Web-of-Cells. In this view the power system is split into control cells. An ELECTRA Cell is a portion of the power grid able to maintain an agreed power exchange at its boundaries by using the internal flexibility of any type available from flexible generators/loads and/or storage systems. The total amount of internal flexibility in each Cell shall be at least enough to compensate the Cell generation and load uncertainties in normal operation.

In short, the solution is starting from the current control area (Transmission System Operator-based (TSO-based)) balancing approach and applying it at any voltage level/power size with enhanced control through concurrent service deployment and greater autonomy and collaboration at local levels.

An ELECTRA Cell has several specific characteristics [

12,

13]:

local problems are usually solved within a Cell where local observables are used to decide on local corrective actions to handle local issues;

communication and computational complexities are minimised;

local grid conditions are explicitly taken into consideration when deciding what kind of resources are used;

provision of a distributed bottom-up approach for the restoring of the system balance;

focus more on balance restoration—and thereby restoring frequency as well—rather than the current traditional sequence of frequency containment followed by frequency restoration.

the total amount of internal flexibility in each Cell is at least enough to compensate the Cell generation and load uncertainties in normal operation.

For a detailed description of rules, which define the Cell, see [

12]. Moreover, some key roles—Cell operator (CO), balance service providers (BSPs), balance responsible parties (BRPs) and load and generation forecaster (LGF)—are identified for the future electricity market design within the ELECTRA.

In addition, an advanced Web-of-Cells control scheme is developed within the ELECTRA [

12,

13]. It is characterized by six high-level functionalities—balance restoration control (BRC), adaptive frequency containment control (aFCC), inertia response power control (IRPC), balance steering control (BSC), primary voltage control (PVC) and post-primary voltage control (PPVC)—and the following fundamental characteristics [

12]:

solve local problems locally;

responsibilisation with local neighbour-to-neighbour collaboration;

ensuring that only local reserves providing resources will be used whose activation does not cause local grid problems.

The above shortly presented Web-of-Cells architecture shall require reconsidering presently existing electricity market design for the procurement of system balancing products. The aim of this article is to demonstrate a high-level market design for the economically efficient procurement of system balancing products within a new architecture called Web-of Cells.

To implement the aim, the following tasks are set:

to develop the concept of the market design for the procurement of system balancing products by identifying the most crucial structural elements of market design;

to determine the assessment criteria of economically efficient market design;

to assess the alternative solutions of market design elements by considering their advantages and disadvantages and against the assessment criteria;

to prepare a market design for the procurement of system balancing products within the Web-of-Cells architecture.

There is a large volume of literature [

14,

15,

16,

17,

18,

19,

20,

21,

22,

23,

24,

25,

26,

27] that discusses the design of balancing markets in the presence of intermittent RES. The novelty of this article beyond the prevailing literature is that it proposes harmonized and unified rules for trading standardized system balancing products intra- and inter-Cell between the identified types of the market participants in an organized market to implement the merit order collection (MOC) and merit order decision (MOD) functions of Web-of-Cells architecture. The market for system balancing products is designed in accordance with the general principles of a competitive market, the principles of a wholesale electricity market and the principles of the market for ancillary services. In addition, the market for system balancing products is developed in accordance to the assessment criteria of “economic efficiency” and in line with the requirements tackling the issue of climate change.

A critical review of scientific publications, research projects, energy market monitoring reports and European Union-wide Directives and following Regulations is done. This allowed identifying the alternatives of market design elements, perceiving the structure of existing European electricity market, its strong sides, which should be respected within the Web-of-Cells architecture, and weak aspects of market design, which should be transformed in a way to implement the MOC and MOD functions of the Web-of-Cells architecture. Comparative analysis method is the secondary method applied to understand the advantages and disadvantages of collected market design elements. Assessment of market design elements as a tertiary method is used to rank the market design elements based on the economic efficiency criteria, to identify the key market design elements (the best alternative from the entire set of possible options) and finally take a decision regarding the particular option of market design element, which well fits to the Web-of-Cells market design.

The remainder of the article is organized as follows: in

Section 2, the concept of market design for the procurement of system balancing products is developed based on results of literature analysis. In

Section 3, market participants and their roles within the Web-of-Cells architecture are identified.

Section 4 and

Section 5 discuss peculiarities of marketplaces and auctions possibly available for a new power grid structure, respectively.

Section 7 analyses options of market design elements to improve operational efficiency. Options of market design elements to enhance price efficiency and utilization efficiency are discussed in

Section 8 and

Section 9, respectively. The concluding remarks are drawn in the final section.

2. Concept of Market Design

2.1. Theoretical Background

There is no single and universal definition of the market design [

28,

29,

30,

31,

32]. Definitions significantly depend on, and they are related to the practical policy goals for achievement of which market design is developed, peculiarities of economic sector or country under consideration, aspects of market design discussed, analysis method applied, assessment criteria used or scientist’s insights and penetration glance into the issue.

Considering to a great variety of factors, which disclose an array of research issues the market design covers, the market design for the procurement of system balancing products under the Web-of-Cell architecture is developed considering three concepts, which are market and its roles, designing and market design. The interrelation between them is given in

Figure 1 and discussion is provided below.

The primary role (objective) of the electricity market is to establish competitive situations, particularly, preventing the creation or the strengthening of market power or prohibiting the abuse of a position of substantial market power (monopolization) [

33].

Competitive situations are established by implementing the competitive electricity market. In [

34], five core attributes of a competitive market are segregated. These are ease of market entry and exit, the absence of significant monopoly power, transparency, the absence of market externalities and achievement of public policy goals, such as ensure a reliable supply of electricity, increased production of electricity from RES. The list of attributes of a competitive market could be expanded by including trade in standardized products, which are perfect substitutes for each other [

35], great variety of market participants [

36], etc. Violation of any attribute of a competitive market hinder the market to achieve both its primary and secondary roles, which are as follows [

14,

15,

37]:

to promote economic efficiency and lower delivered product costs;

to foster liquidity. Liquidity seems to be very important, especially for bilateral markets. However, the article does not consider liquidity for the time being, since the concept is very new, but this will be studied further in the subsequent activities;

to avoid undue barriers to entry for new BSPs;

to increase the choices to market participants;

to assure level playing field to all the BSPs;

to be transparent;

to be flexible;

to fit for future;

to be consumer-oriented, etc.

Within the Web-of-Cells architecture, the market means an auction-based exchange where system balancing products are traded between the market participants, who are the BSPs and the COs (their description and responsibilities in the market are defined in

Section 3). This keeps the primary and secondary roles for a well-functioning market for system balancing products. However, this article concentrates on the role of the market to be economically efficient.

Within the Web-of-Cells architecture, the concept of the market presented above is expanded by adding supplementary structural components, called market elements. It is known that at the procurement side of the market for system balancing products attention should paid at balancing service classes, reserve requirements, control system, timing of the markets, activation strategy, bid requirements, program time unit, scope of balance responsibility, gate closure times (GCT), types of balances, closed/opened portfolio positions [

16], types of market participants, contracting approach, contract duration, scoring rule, dispatch criteria and cost allocation [

17], transaction mechanisms and payments to the BSPs, response time and duration period [

18], structure for bids and payments [

19], types of procurement and remuneration methods, price caps [

19,

20], types of auction [

21], number of markets, pricing rule, number of bid submissions, scarcity pricing and cascading procurement [

22], approach towards markets organization [

23] and other. However, with the purpose to establish an economically efficient market design, the following market design elements are considered [

16,

24,

25,

26,

38,

39]: system balancing product resolution in time, bid time unit, frequency of bidding, frequency of clearance, establishment of Merit Order list, distance to real time of the auction, procurement scheme, remuneration scheme and pricing mechanism.

2.2. Concept of Market Design

By combining the concepts of market and design into a single new concept, the market design is defined as a solution of the process of designing market elements requested within a market, which meets the objectives held for the market [

40]. The concept of proposed market design encompasses the institution established for the system balancing products trading, interacting market participants and a set of market design elements.

2.3. Market Design Assessment Criteria

Market design (more precisely separate its elements) is assessed against the following economic efficiency criteria [

16]:

Operational efficiency is economic efficiency of handling the transactions related to the administrative process in the market for system balancing products, including of energy schedule and system balancing product bid submission and balance settlement.

Price efficiency involves the cost-reflectivity of system balancing product prices paid to the BSPs. The premise that prices are efficient, to the extent that they already factor in or discount all available information.

Utilization efficiency is defined as the economic efficiency of the utilization of available balancing resources, i.e., the degree to which the least and cheapest balancing resources are used to maintain the system balance.

Utilization, price and operational efficiencies are also criteria against which market elements are assessed. The market elements in relation to the criterion of economic efficiency are summarized in

Figure 2.

3. Roles and Responsibilities in the Market for System Balancing Products

Several key roles are foreseen at the procurement side of the market for system balancing products developed within the Web-of-Cells architecture.

The balance service provider (BSP) is a market participant who is responsible for the provision of system balancing products to the CO if it is in a contract agreement with the CO. In accordance to existing practice and the “Winter package”, the list of system balancing products provided by the BSPs is limited to balancing capacity and balancing energy. Within the Web-of-Cells architecture, the BSP has a responsibility to trade in inertia capacity, inertia, balancing energy and balancing capacity for upward or downward regulation.

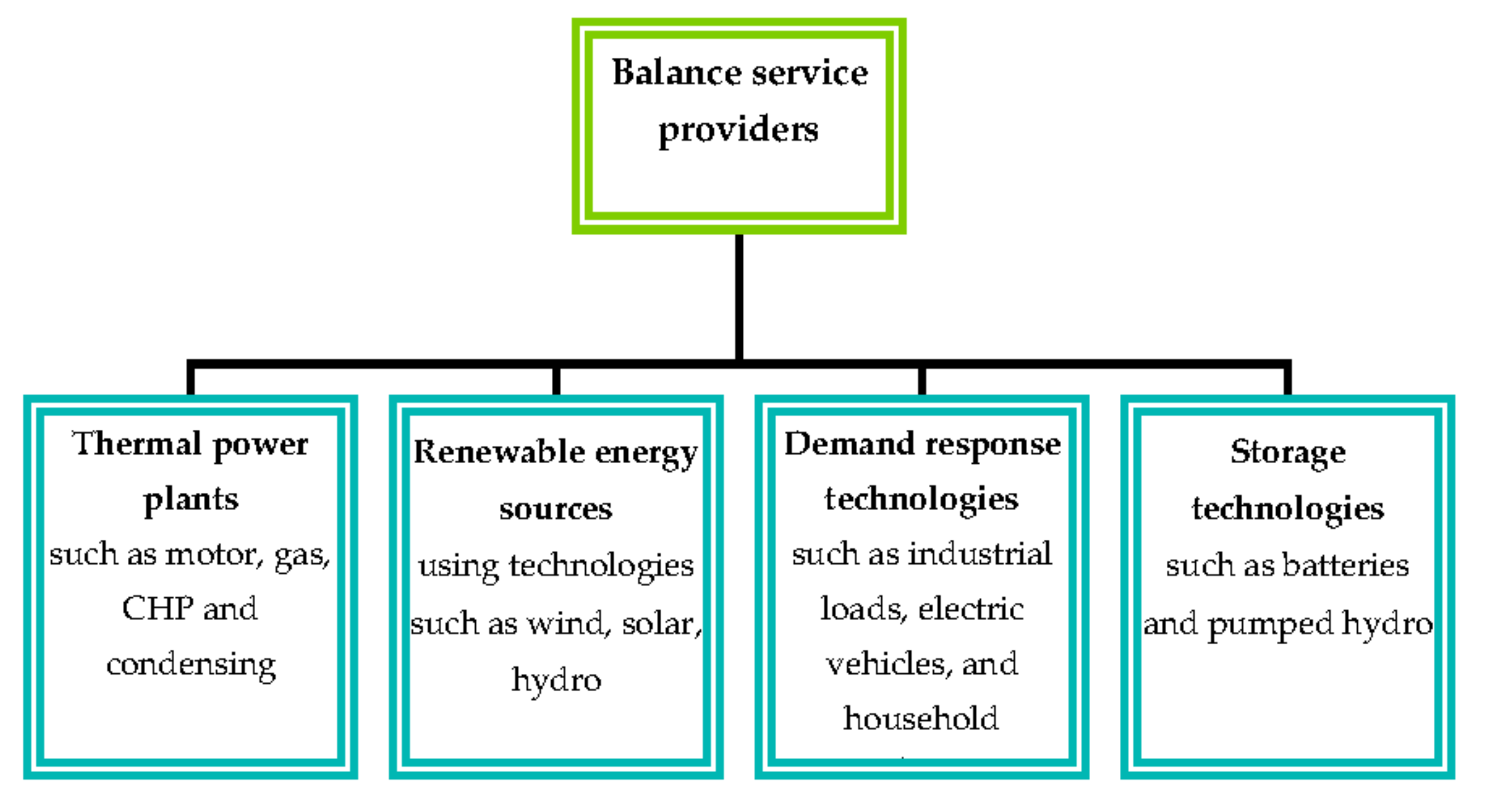

Within the Web-of-Cells architecture various types of BSPs take part in the market for system balancing products. A detail list of the BSPs in the framework of the Web-of-Cells architecture is given in

Figure 3.

As the share of intermittent RES significantly increases in future, additional flexibility will become a valuable source to balance real-time generation and consumption. The CO will have to rely on flexible BSPs who could tailor (adapt) their generation and consumption by either producing and consuming above or below their set schedule with the aim to solve the imbalance in the Cell. Thus, in addition to presently acting BSPs, who are centralized gas-fired or hydropower plants, new BSPs will be requested and, indeed, available. They will be found at the distribution level. RES, demand response and storage technologies will be available new BSPs in future. Moreover, seeking to increase the size of the BSPs, an aggregation is believed to be of critical importance. Thus, the aggregators as a separate type of the BSPs will be requested under the Web-of-Cells architecture.

The responsibilities of the BSP in the market are in line with the requirements determined in [

26], however, responsibilities are expanded to new types of system balancing products developed within the Web-of-Cells architecture. Therefore:

the BSP qualifies for providing bids for inertia capacity, inertia, balancing energy or balancing capacity which are procured and activated by the CO;

each BSP participating in the procurement process for inertia capacity submits and has the right to update its inertia capacity bids before the GCT of the bidding process;

each BSP participating in the procurement process for balancing capacity submits and has the right to update its balancing capacity bids before the GCT of the bidding process;

each BSP with a contract for inertia capacity submits to its CO the inertia bids corresponding to the volume, products, and other requirements set out in the inertia capacity contract;

each BSP with a contract for balancing capacity submits to its CO the balancing energy bids corresponding to the volume, products, and other requirements set out in the balancing capacity contract.

The Cell operator (CO) (TSO/DSO) within the Web-of-Cells architecture is a market participant procuring system balancing products from the BSPs to balance electricity consumption and production in real time. The CO decides on the demanded volume of system balancing products considering to load and generation forecasts provided by Load and Generation Forecaster (LGF) and energy schedules provided by the Balance Responsible Parties (BRPs).

The CO is responsible for the performance of the Cell operation, maintenance and development to ensure electricity supply in a safe, efficient and reliable manner too. More precisely, it is responsible for the secure operation of the Cell, measurement of electricity demand on high voltage (HV), medium voltage (MW) or low voltage (LV) grid, maintenance of HV, MV or LV grid and procurement of the system balancing products for its Cell (based on [

41]), which demand arises due to the occurrence of the following events [

20]:

unexpected RES generation variations;

unexpected consumption variations;

unplanned outages of generation and consumption capacity and grid elements;

if discrepancies between the duration of day-ahead/intraday markets periods and real-time settlement periods exists;

discretization of continuous time in discrete market periods.

Presently, the TSOs are responsible for the preparation of market regulations to the BSPs on the procedure for the procurement of system balancing products. In the Web-of-Cell architecture, this task is under the responsibility of COs, who prepare uniform and harmonized rules for the procurement of system balancing products. The rules are applied to all market participants. For a detailed description of other non-market related responsibilities of the CO, see in [

12].

The load and generation forecaster (LGF). Nowadays the TSOs calculate day-ahead, week-ahead, month-ahead and year-ahead forecasts of total load, estimate of the total scheduled generation (MW) and forecast wind and solar power generation (MW) per bidding zone, per each market time unit of the following day [

39,

42]. Generation units and DSOs located within a TSO’s control area provide the TSO with all important information necessary to calculate the load and generation forecasts. This information is used by the TSO to determine volume of system balancing products required to balance electricity consumption and production in real time. In the Web-of-Cells architecture, generation and load forecasts are made by two types of entities. These are the large-scale BRPs, receiving all necessary information from their large-scale generating and load units, and the Aggregator, collecting all important information for this task from the small-scale BRPs who themselves are supplied with data by small-scale generating and load units. The LGF is responsible for provision of load and generation forecasts to the CO.

4. Description of System Balancing Products

A variety of system balancing products, which are procured by the CO and supplied by the BSPs to assure the balance between electricity production and consumption in real time, is suggested within the Web-of-Cells architecture. They differ in functions, technical characteristics, procurement schemes and other requirements.

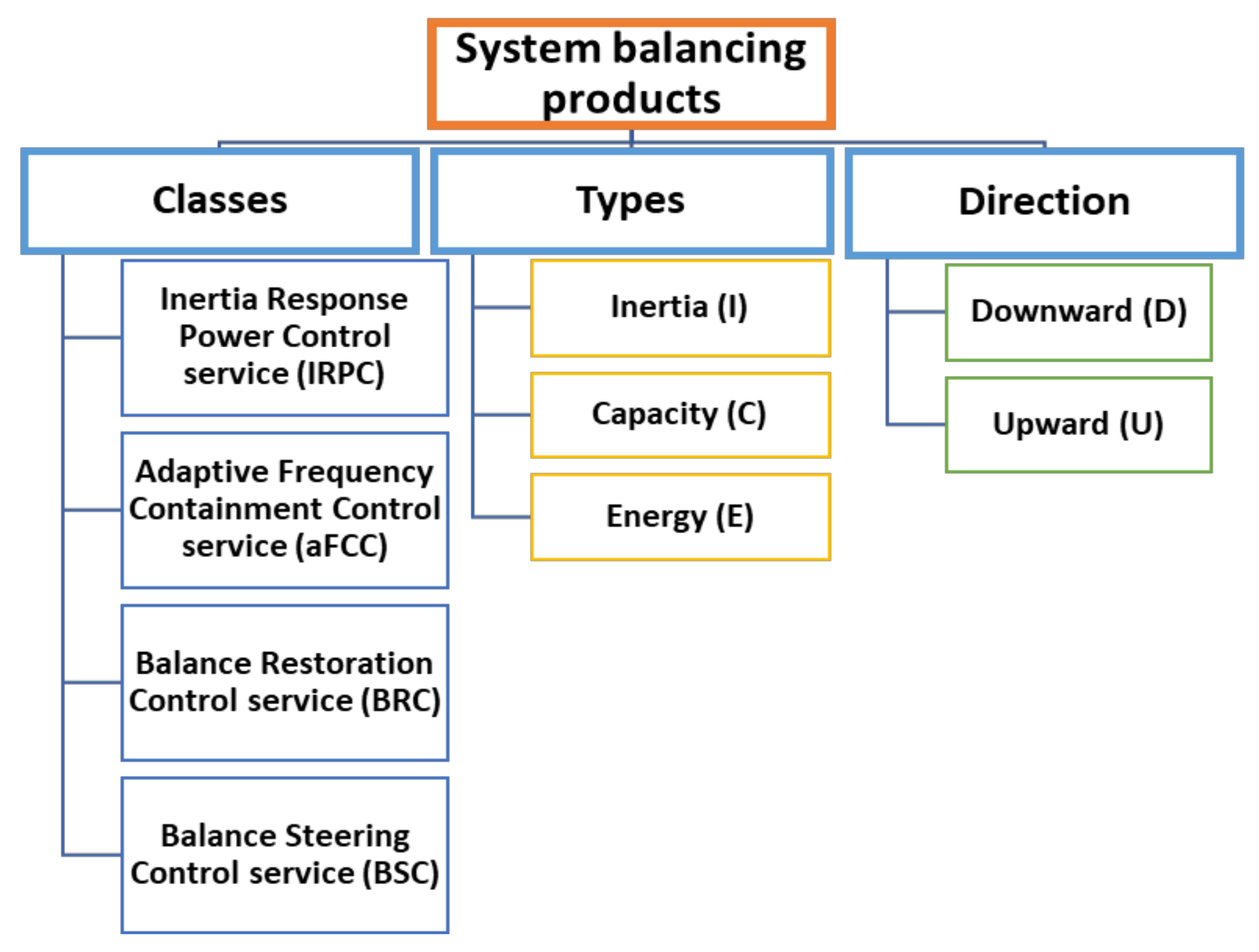

In

Figure 4, the list of system balancing products traded within the Web-of-Cells architecture is presented by categorizing them into classes, directions and types.

In the framework of the Web-of-Cells, four classes of system balancing products in separate sub-markets are traded with the purpose to keep the system frequency target value within the certain limits [

43]:

Inertia response power control (IRPC) service where each unit, involved in inertia control, automatically changes its level of inertia power response (synthetic inertia) depending on certain predefined characteristics. Reacts to frequency changes over time.

Adaptive frequency containment control (aFCC) service will not be fundamentally changed compared to today’s schemes, except that the resources providing containment reserves will be different: generating units (in the broadest sense) as well as loads and storage distributed across the power grid (within each Cell). Reacts to deviations of the absolute frequency value so as to contain any change and stabilize frequency to a steady-state value.

Balance restoration control (BRC) service initiates the restoration of the Cell balance and load flows based on local information. It is assumed that (almost) all prosumers, that are connected through public communication infrastructure, will be able to offer fast BRC capacity, e.g., through their flexible loads, and possibly local storage. Reacts to absolute frequency deviations in conjunction with the tie line deviations from the scheduled interchanges so as to restore both quantities to their initial values.

Balance steering control (BSC) service will replace the BRC in a more economic manner if this can be done safely or adjust the balance set points. It can as well have pro-active activation based on prognoses. This control deploys resources not only within the Cell but also from neighboring Cells. Regulates power balance within a Cell in order to replace the BRC reserves or mitigate potential imbalances in a cost-effective manner.

The system balancing products are standard. The minimum requirements are set for them (

Table 1).

Based on today’s operation a clear direct link between the quality of system balancing products and their price is established, showing that the quality of system balancing products is hierarchical in nature. Therefore, the primary control service is a higher quality-balancing product than the secondary control service, which in turn is a higher quality-balancing product than the tertiary control service. Thus, it is reasonable that higher quality balancing products are priced at higher prices. In the Web-of-Cells architecture, the relationship between the quality of system balancing products and their price could be kept too (

Figure 5), however, there are some differences.

The IRPC service is the most difficult service, thus, it is expected that it will be the most expensive. The cost (price)—quality of the aFCC and BRC services should not vary, since the type and mechanisms of resources providing these two services are very similar and, if anything, the BRC service could be even more expensive because it is more crucial as a service. The BSC service is not anymore tertiary, hence cheaper, reserves. The BSC involves the change of tie-lines set points only and that is not based on reserves. This means that the commodity here is rather different that the other three services. In any case, the cost are expected to be higher than the BRC’s because otherwise, the COs would always tend to modify their set-points and that should be done only in exceptional cases.

The direction of the system balancing products corresponds to upward and downward regulation. Upward regulation means an increase in generation (or decrease in consumption) and down regulation means a decrease in generation (or increase in consumption). Upward regulation is provided by units that are more expensive than the marginal unit of the day-ahead or intraday markets, meaning that the system balancing product of upward regulation is traded at higher price than the day-ahead price. For downward regulation those units that already received payments from the day-ahead and/or intraday markets can save the fuel costs by decreasing generation. Splitting the market for procurement of system balancing products into the sub-markets of “upward” and “downward” and do not setting/keeping the requirement for bid symmetricity creates preconditions and lead to increasing number of the BSPs in the corresponding sub-market. For example, loads are more familiar and capable of reducing load than increasing it. Therefore, if symmetric bids are not required, the available balancing capacity could be better used.

Three types of system balancing products are traded. They are inertia, balancing energy and capacity necessary for balancing and inertia. Balancing energy means energy used by the CO to perform balancing and provided by the BSPs. Balancing capacity means a volume of reserve capacity that the BSP has agreed to hold and in respect to which the BSP has agreed to submit bids for a corresponding volume of balancing energy to the CO for the duration of the contract. In line with the determination of balancing capacity and balancing energy, the capacity necessary for provision of inertia and inertia are determined, respectively.

Separate sub-markets are established to trade a particular class, direction and type of system balancing product. Coding of system balancing products is established to increase the transparency and operational efficiency of the market and with the purpose of quickly directing the BSP and the COs to the appropriate sub-market. The following structure of coding is applied: C-D-T: YMD_H_Q, where C—class, D—direction abnd T—type of the system balancing product and Y, M, D, H, Q—year, month, day, hour and quarter hour of system balancing product delivery. Thus, under the coding aFCC-U-C: 20171026_15_00 the upward regulation (U) balancing capacity (C) for the provision of adaptive frequency containment control (aFCC) service is traded, when the system balancing product has to be delivered on 26 October 2017 at 3 pm.

5. A Marketplace

The Web-of-Cells architecture keeps an idea that all system balancing products, which are needed to operate the Cells are procured in a marketplace. Three types of marketplaces are considered. They are exchange, organized over-the-counter (oOTC) and bilateral over-the-counter (bOTC) [

45].

Exchange as a type of organized market is needed. The Web-of-Cells architecture prefers the exchange because of the reasons discussed in [

46], the most important of which are the pursuit of transparency, confidentiality, anonymity and publicity. In the exchange, only standard balancing products are traded meaning that contracts are uniform regarding their structure and form. This enables the CO to compare identical system balancing products and activate the most cost-efficient solution. Standardized system balancing products support the integration of RES&DR&Storage technologies into the market. Due date, place of delivery, the time in which the deliveries take place and the conditions for clearing and settlement are standardized too. The set of rules such as the conditions to be admitted to trade on the exchange are made public and are the same for every BSP. Prices and revenues are made public too and this allow the BSPs evaluating the position of their bids on an initial Merit Order list relative to bids from other BSPs. The participation is voluntary and non-discriminatory. Trading partners do not have to be found and the counterparty risk is minimized. Since the trading process is anonymous, the BSPs can keep their strategy in secret. Also, the process to offer flexibility in the market is easy with a low entry barrier.

All the COs and the BSPs use a common platform for trading system balancing products, however, they are not pooling the bids and offers into a single integrated market for system balancing products, except in case of trading the BSC service, when every bid and offer available to one of the Cell is available to other Cells. This comes from the feature of the Web-of-Cells architecture that, basically, local problems should be solved locally and only in case there is a shortage in inertia, balancing capacity and balancing energy, they are procured from the neighboring Cell by procuring the BSC service.

6. An auction

6.1. General Issues

Auction as an instrument promoting competition in procurement of system balancing products is applied within the Web-of-Cells architecture. In addition, within the Web-of-Cells architecture it is used as a mechanism to coordinate efficient production. Moreover, it is chosen as an institution determining the price and conducting the trade in the exchange. It is worth mentioning that within the Web-of-Cells architecture an auction serves as the economic (market) mechanism used to allocate the system balancing products in economically efficient way. The main arguments for the choice of the auction are derived from the following advantages of the auction to be fair, open, transparent, objective, non-discriminatory, and timely process, which well corresponds the determined roles of the market for the procurement of system balancing products to be market facilitating. The trade in system balancing products in the auction is organized in Cell- and inter-Cell levels. The IRPC, aFCC and BRC services are traded within a particular Cell, but the BSC service is traded between the Cells, i.e., the COs organize a common auction to trade in the BSC service.

6.2. Types of Auctions

6.2.1. Closed-Type vs. Opened-Type Auction

In relation to the extent to which information about orders submitted to the auction are provided, closed-type auctions instead of opened- ones are established. In a closed (sealed-bid)-type auction, the BSPs, who are the auction participants during the bidding process, privately submit their bids and offers to the CO, who is the auctioneer, and the CO keeps this information private, such that there is no sharing of bidding information amongst the BSPs. The BSPs are informed whether they won or lost. It is expected that limiting the provision of information works as a constraint on exercising market power and thereby increasing prices of system balancing products.

6.2.2. Uniform Auction vs. Discriminatory Auction

Two types of closed-type auctions differing in bidding formats and pricing mechanisms are considered within the Web-of-Cells architecture. They are uniform and discriminatory auctions. The results of scientific investigations regarding the type of the auction, which is superior another, are controversial and comparison of the auctions is complex, since it depends on the objective of the auction (

Table 2) [

47]. Thus, there is no unanimous opinion, which type of the auction should be selected.

However, based on the observations provided in [

47] that aim at maximizing revenue, increasing the number of bidders, strengthening the role of the market and selling at the market price, the priority should be given to the uniform auction. In [

48], it is supposed that uniform auction is relevant because of its simplicity and effectiveness when responding to the main questions, such as who should receive system balancing products, who should supply them and at what price system balancing products should be traded. Moreover, when the market is competitive the uniform auction has two features, such as short-run and long-run efficiency [

48]. In addition, consumers and BSPs are much better off with uniform auction than with other alternatives and the main argument against uniform auction is political but not economical [

48]. Research findings of [

49] suggest that discriminatory auction may lead to inefficient production. The [

50] concludes that discriminatory auctions could reduce volatility, but at the expense of higher average prices. Findings of [

51] suggest that switching to a discriminatory auction will not necessarily result in greater competition or lower prices. Considering to advantages of uniform auction and disadvantages of discriminatory auction, the authors of the article have good motives to select the uniform auction design to trade in system balancing products within the Web-of-Cells architecture.

The peculiarities of the uniform auction are as follows: the uniform auction design is selected when at least the one CO and many competing BSPs participate in the market for system balancing product, which has to allocate multiple units of system balancing product. Subject to the uniform auction, the CO collects all the bids and offers from the bidders (BSPs), creates an initial Merit Order list for the system balancing product, and match it with the requested volume of system balancing product. The CO establishes the market-clearing price (MCP) by matching supply and demand of system balancing product. Win the bidders (BSPs) whose bids, or sections of their bids, offered lower price than the MCP. All winners (BSPs) receive the same price, independently on their financial offers. The advantage of a uniform auction is that it is fair and attracts the participation of small bidders. Since this is a closed-type auction, no information is published before the clearing takes place. It is expected that under the Web-of-Cells architecture the level of competition is achieved high in the market and many small-scale BSPs participate here. Therefore, this type of auction is selected.

6.2.3. One-Sided vs. Two-Sided Auction

In relation to types of market participants involved in the auction both one-sided and two-sided auction designs are relevant for the Web-of-Cells architecture.

The need for one-sided auction comes from the “local problems should be solved locally” feature of the Web-of-Cells architecture. This feature leads to the establishment of a monopsonistic market structure (one-sided), where the CO is a single buyer of the system balancing products and there are many local small-scale BSPs supplying the system balancing products. The peculiarity of the one-sided auction is that only the BSPs bid (peer of price and volume) in the auction and form the price-responsive supply curve of the particular system balancing product. The nature of demand, for establishment of which the CO is responsible, is price-non-responsive. The CO determines the demanded volume of system balancing product but no price is established at which the CO would prefer to procure the system balancing product. The CO is not allowed to bid price because it is a single buyer and can dampen the price, which then could be too low for the BSPs to participate in the market. One-sided auction is established to trade in the IRPC, aFCC and BRC services.

Principally, the two-sided auction design features a number of the COs and the BSPs from different Cells and enables the active participation of supply and demand sides to compete on a level-playing-field basis, where both the BSPs and the COs are allowed to bid. It enables forming the aggregated price-responsive demand curve too, when the COs bid both quantity and price in the auction and in such a way show their preferences. The two-sided auction is established for trading in the BSC service, since cross-Cell trade in the BSC service is allowed and more than one buyer exists. The advantage of the two-sided auction over the one-sided auction is that the former ensures lower transaction cost for the BSPs and the COs. Thus, operational efficiency improves. It helps to control market power, increase price and utilization efficiencies and enhance the social welfare of the market through the establishment of the competitive situations in the market too.

6.3. Consistency of Auctioning

Depending on the consistency of the auctions held during the time, two categories of auctioning (sequential and simultaneous auctioning) are considered for the Web-of-Cells architecture. Based on their peculiarities, the Web-of-Cells architecture develops an idea of the hybrid auctioning, which combines the features of both sequential, which is applied in European countries, and simultaneous, widely used in USA, auctioning.

The hybrid auctioning takes into account the approach of the sequential auction that market for electricity (day-ahead and intraday) products and market for system balancing products are cleared sequentially meaning that the market for balancing energy is cleared after the clearance of day-ahead and intraday electricity markets. Winners in the sequential auctioning are chosen easy by selecting the lowest price-offering participants for each product separately. This type of auctioning is selected as a core auctioning mechanism because of its practical use in European countries. The transformation of electricity markets auctioning to simultaneous auctions shall mean significantly increased cost. Subject to the simultaneous auctioning, the products to bidders are allocated along with the minimization of joint bid cost of providing energy and balancing services. In this approach, it is hard to justify the schedule and pricing of the product.

The Web-of-Cells architecture improves the sequential market mechanism by adding the cascading procurement principle applied in the simultaneous auctions. In result, the system balancing products are procured by the CO in a way that total cost of providing system balancing services products is reduced. That is, the reduction of total cost of system balancing products achieved through the application of the cascading procurement principle, which is described in a more detail in

Section 9.2.

7. Analysis of Market Design Variables for Improvement of Operational Efficiency

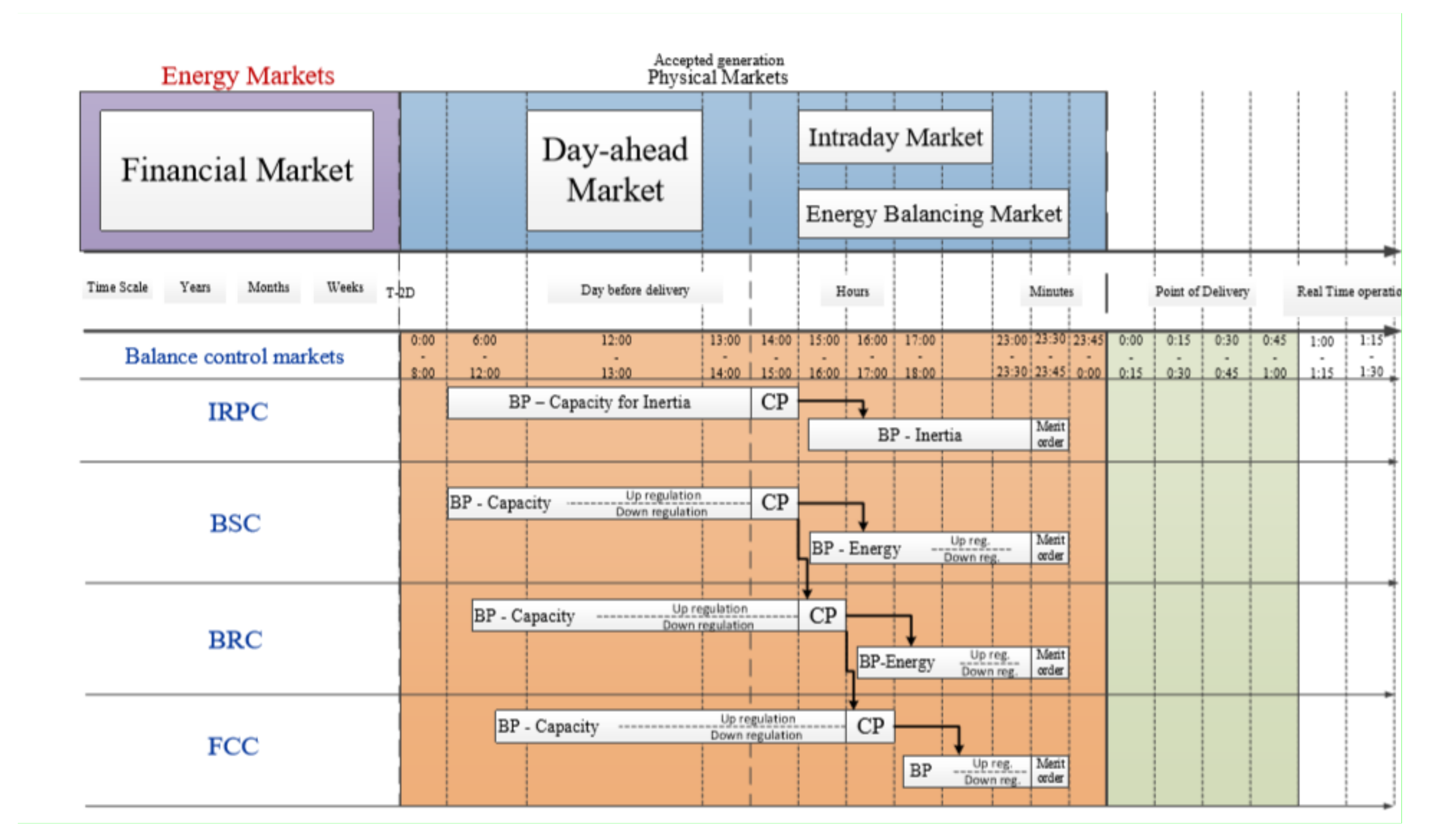

7.1. Timing of the Market for System Balancing Products

The Web-of-Cells architecture proposes a novel approach towards an organization of timing of the market for system balancing products. The approach is based on the finding of the solutions to reduce the costs of system balancing products provision (see in detail

Section 7.2), the rolling schedule of bidding, clearance and the Merit Order list establishment (see in detail

Section 7.4), the transparency of rules how the market for system balancing products is organized and the non-discrimination of system balancing products provision against the time criteria. The composition and alignment in point of timing of the market for system balancing products is provided in

Figure 6.

The market for system balancing products is organized in a way that initially, the BSPs decide on in which sub-market—inertia capacity or balancing capacity—they will take part in. Those BSPs who decide to participate in the sub-market for inertia capacity and whose bids are accepted, are not allowed participating in other sub-markets, except for inertia. The same is valid for the BSPs who bid balancing capacity. Those BSPs who decide to participate in the sub-market for balancing capacity for a particular service (either this is the BSC, BRC or aFCC service), and whose bids are accepted are not allowed participating in other sub-markets, except in the sub-market for balancing energy for this particular service.

The Web-of-Cells architecture assumes that the sub-markets for balancing capacity for the BSC, BRC and aFCC services are organized in a sequential manner. After the sub-market for balancing capacity for the BSC service is cleared, the sub-market for balancing capacity for the BRC service is cleared and later on the sub-market for balancing capacity for the aFCC service is cleared. Such a layout of the system balancing products in time is recommended for several reasons, including to reduce the costs of the system balancing products provision and to limit a “price reversal” effect of lower-quality balancing capacity to be priced at a higher price. Aiming at implementation of aforementioned recommendations, the cascading procurement principle is implemented (see the arrows connecting separate sub-markets for balancing capacity). Therefore, higher-quality balancing capacity is cleared one hour earlier than lower-quality balancing capacity. This hour is required both to move the rejected by the market higher-quality balancing capacity bids (the bids submitted but not accepted by the sub-market) to the sub-market for lower-quality balancing capacity, if they correspond to technical requirements held for the system balancing product of this sub-market and clearing the sub-market. The sub-market for upward and downward regulations are organized in parallel, i.e., they have the same timing.

The sub-markets for inertia capacity and balancing capacity are organized earlier than the sub-markets for inertia and balancing energy, since inertia and balancing energy bids are submitted to the market by the BSPs who won capacity auction and thus have an obligation to keep the capacity for the particular hours in real time. Thus, clear interrelationships of the timing of the sub-markets for inertia capacity and inertia, balancing capacity and balancing energy are established.

Considering to the criteria of transparency and non-discrimination, the length of bidding and clearance processes as well as the length of the Merit Order list establishment is based on the following time-related principles:

the BSP submits bids for inertia capacity and balancing capacity during 8 h;

the clearance process takes 1 h;

if inertia capacity or balancing capacity bids are accepted, the inertia and balancing energy bids are submitted during 6.5–8.5 h depending on the service for the provision of which the inertia capacity and balancing capacity is reserved, respectively;

the Merit Order list for inertia and balancing energy provision is established during 15 min and 15 min before real time.

7.2. System Balancing Product Resolution in Time

In Europe, both short- and long-term markets for the provision of system balancing products are established. The products (balancing capacity and balancing energy) for primary control are acquired by entering into hourly, daily, weekly, monthly or annually contracts. The system balancing products for secondary and tertiary controls are purchased in the long-term markets by entering into contracts, the duration of which varies from week to year or more [

30]. Certainly, in some countries both short- and long-term markets for the provision of secondary and tertiary services are established. The “Winter Package” sets that the contracting period should have a maximum of one day.

Considering to the experience of European TSOs and suggestions provided in the “Winter Package”, short and long contracting (procurement cycles) is considered within the Web-of-Cells architecture. Shorter procurement cycles allow new entrants and BSPs with a small portfolio of either generation units and/or schedulable load to participate in the market for system balancing products. The BSPs owning RES units prefer short procurement cycle because RES capacity can be used only for a limited time, for example, 3500 h a year whereas traditional fossil fuel-based power plants can run for much longer period. Therefore, if a system balancing product’s resolution (in time) is set long, the BSPs owning RES units will not be technically capable to provide the required capacity. Thus, utilization efficiency of available resources reduces. Since an entry barrier for intermittent low marginal cost technologies is created, the price efficiency reduces too, because these RES technologies do not take part in the market and do not form prices. Thus, prices are tended to be high reflecting marginal cost of traditional production technologies. The BSPs operating peak/marginal plants as well some large consumers are interested in longer procurement cycles to guarantee fixed revenues [

27].

The system balancing product resolution (in time) as a market element is essential for the BSPs under the Web-of-Cells architecture, especially for the demand response, RES and storage technologies. The market element’s relevance for the BSPs who aggregate consumption units or electric vehicles is highly dependent on the habits of consumers. The amount of reserve they are able to provide is variable and it will be precluded from a market where the time is too long. Demand response providers are smaller than traditional generators and may be limited in the contiguous period in which they deliver the system balancing product. With the aim to increase the number of demand response related participants and competition between the BSPs, shorter balancing product resolution (in time) should be set. However, short system balancing product resolution (establishment of short-term markets) alone could be too volatile and risky to support procurement of the products. Thus, long system balancing product resolution (long-term contracts) could be considered as an alternative too. It is justified for the purpose to protect investments. Moreover, long-term markets could give the BSPs the opportunity to better control risks by fixing the contracted volume and price for long-term. However, from the point of view of Web-of-Cells architecture and the European Commission’s approach to long-term contracts [

52], longer system balancing product resolution (in time) potentially comes with some drawbacks, for example:

it reduces competition in future bidding processes since the COs who are beneficiaries holding long-term contracts will effectively be out of the market for the duration of the contract;

it transfers risks to the BSPs (both the risk that prices of balancing products will rise in future and capacity prices fall, and—as more contracts are signed—the risk that contracted capacity will not be required in future).

it increases the costs of any future market design transition (operational efficiency reduces), since long-term contracts would in principle need to be honored if in future a new market design will be adopted.

Considering advantages and disadvantages of different length of the system balancing product resolution, the results of EcoGrid EU project (in the EcoGrid EU project a 5 min resolution was initially used, but the overall conclusion was that 15 min would be enough and serve the purpose), EU practice, and requirements set in “Winter Package” for future power systems, the Web-of-Cells architecture establishes the short-term market for system balancing products.

7.3. Bid Time Unit

Within the Web-of-Cells architecture, the bid time unit (BTU) is closely linked to the energy schedule time unit (STU), which divides responsibility between the CO and the BRPs, and imbalance settlement period (ISP), the period for which imbalance of the BRP is calculated. The recommendation to link BTU to STU and ISP comes from the need to harmonize time units to increase operational and price efficiencies. The explanation of how different types of time units are interrelated is derived from the analysis of the following chain of events—information (in terms of prices of the system balancing products) received from a particular BTU is used to price an imbalance of a particular ISP, which is established taking into account energy schedules from a particular STU. Thus, if time units of BTU, STU and ISP are not equalized and harmonized the operational efficiency and price efficiency reduces. Operational efficiency reduces because additional tasks should be performed by the market participants to normalize the results of transactions exercised in one type of time unit (for example, in the BTU) in a way that they could be available for use in other types of time unit (for example, in the ISP). The comparability of information received from time units of different length is complicated. Moreover, more time, qualified personnel and physical infrastructure is required, which increases cost and reduces price efficiency.

The Web-of Cell architecture considers short and long BTU&STU&ISP. Short BTU&STU&ISP is selected of 15 min and long BTU&STU&ISP—of 60 min. It is expected that a short BTU&STU&ISP provides the BRP with a stronger incentive to balance the available energy portfolio than a long BTU&STU&ISP because more accurate information is available on short terms, and deviations from the scheduled energy will be smaller. Thus, balance planning accuracy shall increase. This shall lead to smaller energy imbalances at the Cell level. Thereby, the CO will activate less balancing energy bids, as demand for balancing energy will be lower. Indeed, reduced demand for the balancing energy will lower imbalance price, which in turn will diminish incentives for the BRPs to balance their energy portfolios, as imbalance cost could be smaller than cost if the balancing efforts were placed. However, short BTU&STU&ISP shall raise the transaction cost because energy schedules and balancing energy bids shall be submitted and imbalance shall be calculated frequently. Within a short BTU&STU&ISP, the reduced demand for balancing energy will influence the improvement of criteria of the availability of balancing resources in a way the BSPs will have more opportunities to provide balancing energy, even if they have abundant commitments in the intraday electricity market. Subject to the abundant commitments in the intraday market and long BTU&STU&ISP the BSP may be technically incapable to provide balancing energy for BTU&STU&ISP of 60 min. If only few BSPs are capable to provide balancing energy, they can start using power in the market and offer balancing energy at price not reflecting actual cost. Thus, price efficiency shall reduce. Within the framework of the Web-of-Cells architecture, the BTU&STU&ISP is set of 15 min.

7.4. Time Horizon (Frequency) of Bidding, Clearance and Establishment of Merit Order List

The time horizon of the system balancing products’ bidding, clearance and the Merit Order list establishment is short in the Web-of-Cells architecture. This means that bidding and clearance processes as well as the establishment of the Merit Order list for the particular system balancing product is performed hourly instead of daily, quarter-annually, semi-annually or annually and on the rolling schedule.

Short time horizon means that the BSP has a right to take part in 24 auctions per day for the particular system balancing product selling if the CO organizes the auctions. The auction can be held 24 times a day for each coming hour of the day. The BSPs and the CO submit bids for each hour, which inter alia is divided into quarters. These quarters are known as the market time units (MTU). Thus, totally 96 MTU are foreseen per day. Bids that are submitted for a particular MTU can be changed until the clearance process of inertia capacity or balancing capacity starts or the Merit Order list for inertia or balancing energy is established. The rolling schedule means that the proposed timing of the sub-market for system balancing product (see

Figure 6) moves forward in a way that the Merit Order lists for the MTUs of the particular hour are established 15 min before the real time.

Short time horizon has sense in terms of improved utilization and price efficiency. For instance, if the sub-market for system balancing capacity is cleared yearly, then only those BSPs who have balancing resources, which are available across the whole year, could offer balancing resources. Indeed, this is an entry barrier for many RES&DER BSPs since they are intermittent and cannot offer capacity for the whole year. Thus, efficiency of RES&DER utilization reduces. Because of limited supply, the price efficiency reduces too [

16].

7.5. The Distance to Real Time of the Auction

The general existing practice in Europe is that the TSOs organize auctions or enter into the agreement for the procurement of the balancing capacity for the delivery of the primary control services day- or week-ahead from real time while agreements for the provision of services for the secondary and tertiary control are signed from day- to year-ahead from real time. Long distance to real time is favorable to the TSOs since it reduces the uncertainty of balancing capacity availability. However, the uncertainty increases the risk premium added on the top of balancing capacity procurement price. Therefore, balancing capacity procurement price can be high. During the long time many events (including new lower cost balancing capacity BSPs could appear) could happen. Their impact will not be reflected into the price of balancing capacity agreed in advance. Thus, the real value of the balancing capacity will be rarely reflected in the procurement price. Seeking to avoid such situations, the distance to real time of the auction should be reduced.

The general practice is that the distance to real time of the auction/agreement is linked to the system balancing product resolution (in time). It is well known that long-term contracts are agreed in advance from real time and they are effective far ahead from real time. Indeed, this proclaims that market is “locked” for new BSPs even for several years forward because old annual contracts are valid and additional contracts for the following years have been already agreed. Thus, new BSPs have not even possibility to enter the market until the old contracts expire. And this is a serious barrier, which hinder and inhibits competition in the market. Therefore, the price of balancing capacity will not reflect its true value and the price efficiency will reduce.

What could happen if the existing practice was hold for future? Let’s consider the case of the aggregator. Long distance to real time of auction will induce uncertainty on decision making. If the procurement of balancing capacity was made long before the real time, the aggregator would made particular assumptions on the amount of reserve it could provide. For instance, if the procurement of balancing capacity was made one year in advance, the aggregator would submit the bid on the number of units at the time of the bid, and it would not be able to take into account all the potential new aggregated units. Thus, in real time, the utilization efficiency would reduce, since additional balancing capacities would not be requested and accepted by the market.

Thus, for the future market design the distance to real time is reviewed and shortened, as it is proposed in the “Winter Package”. The Web-of-Cells architecture proposes to solve the issue of risk premium, reflection of the real value in the price of the system balancing products, reduction in price efficiency and utilization efficiency by organizing auctions day ahead from real time and on rolling schedule.

8. Analysis of Market Design Elements for Improvement of Price Efficiency

8.1. Procurement Scheme

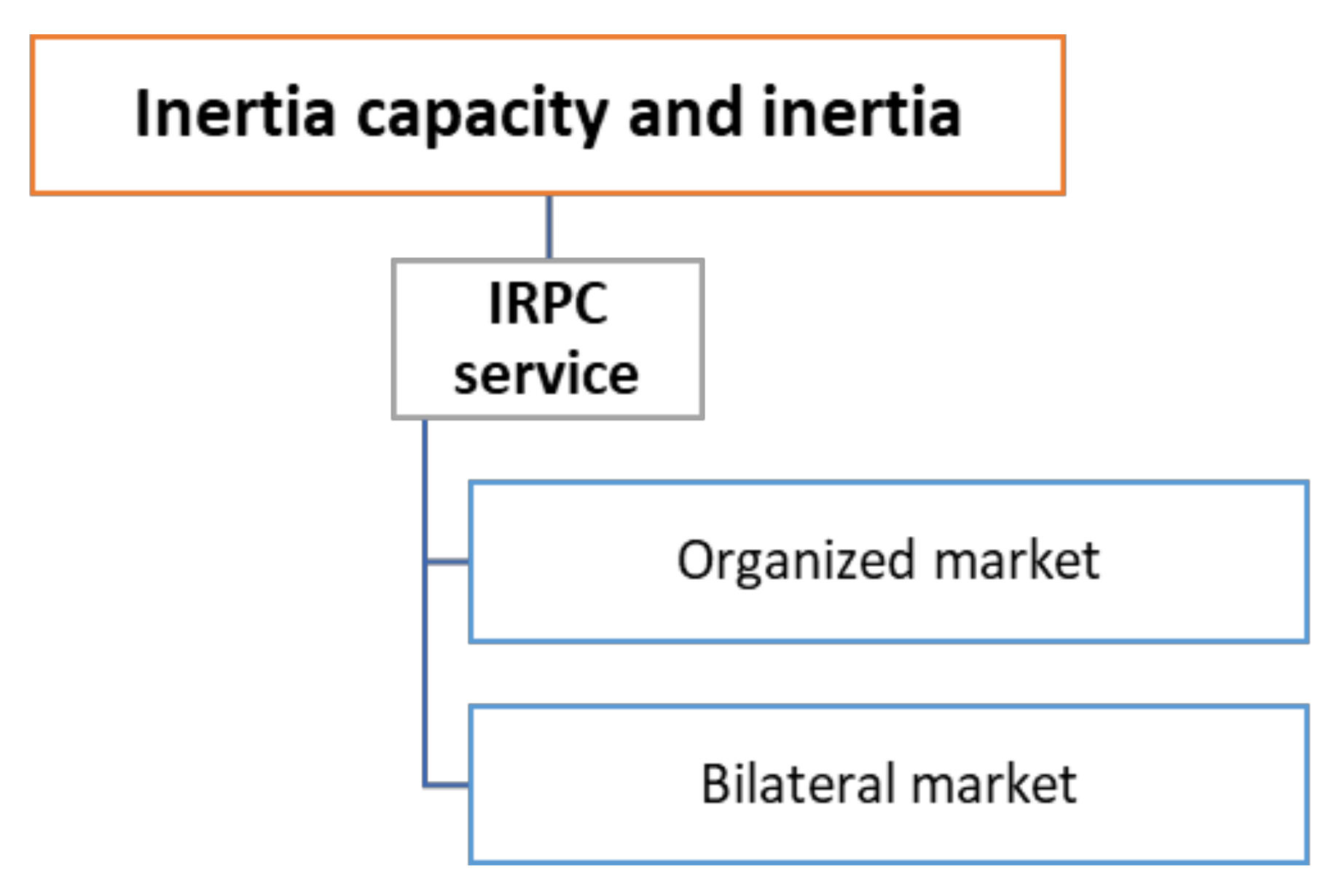

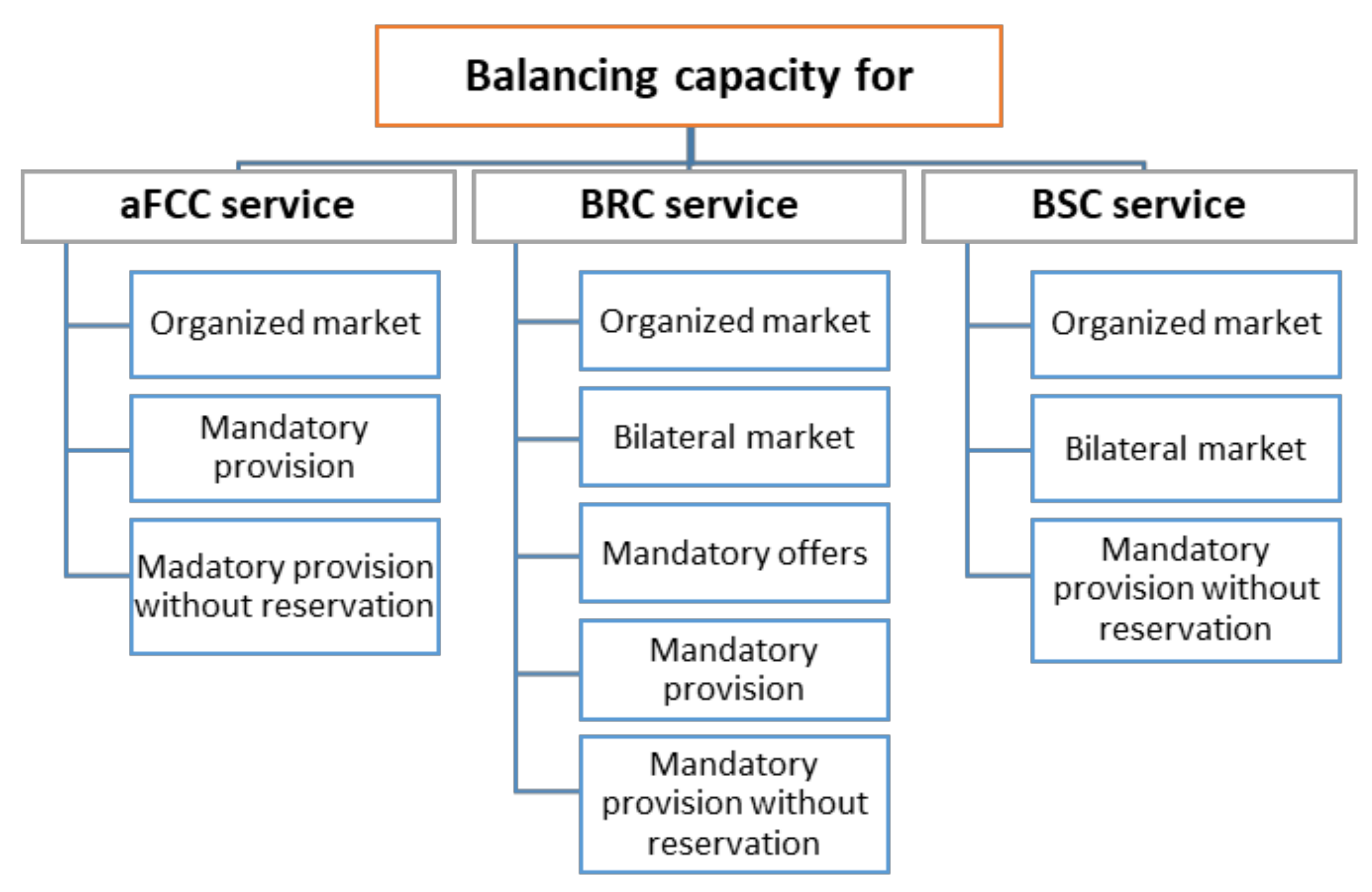

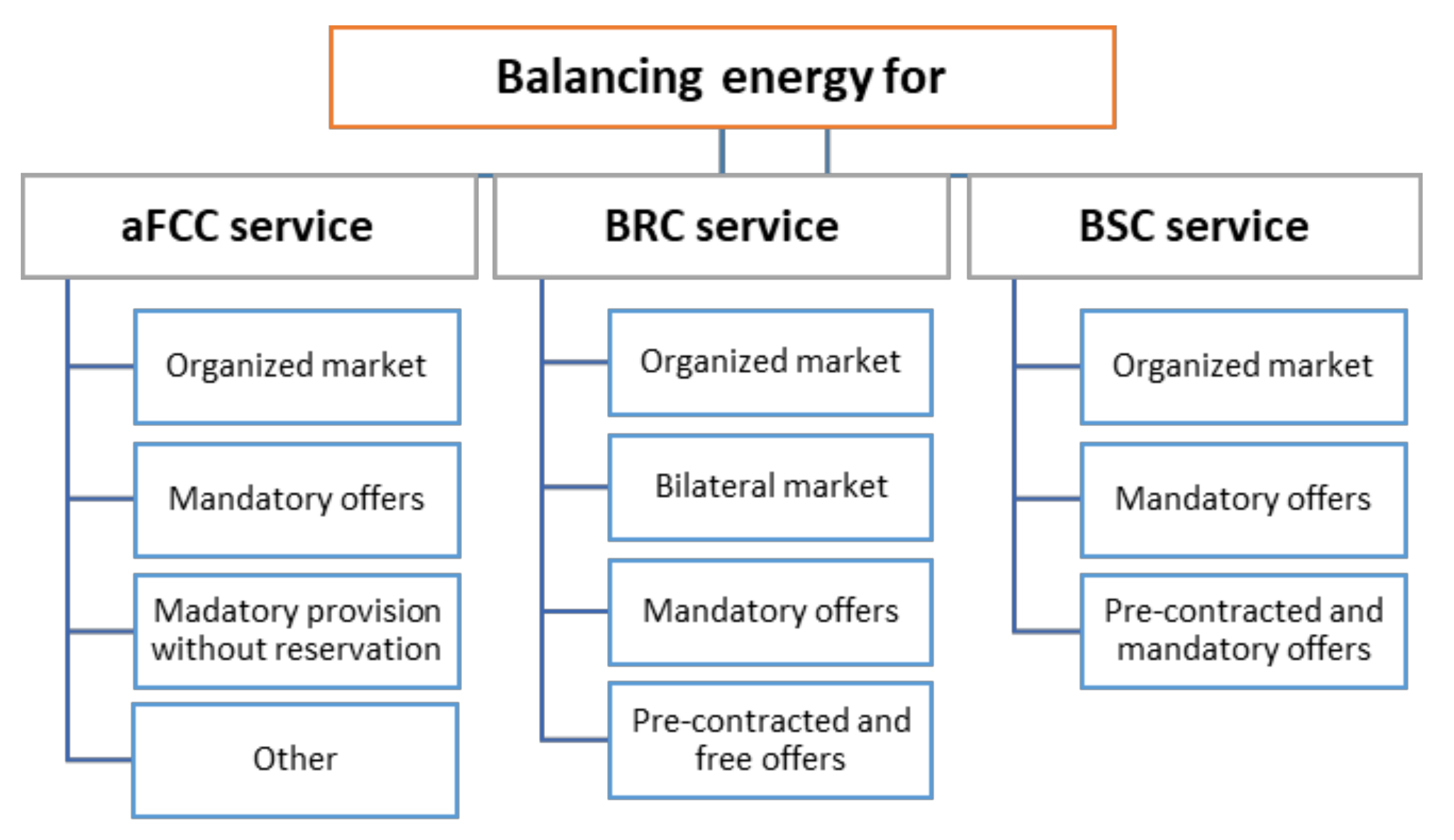

Within the Web-of-Cells architecture, several types of schemes for the procurement of inertia capacity, inertia, balancing capacity and balancing energy are considered (

Figure 7,

Figure 8 and

Figure 9, respectively).

Organized and bilateral markets are recognized as two main market arrangements for the procurement of the system balancing products within the Web-of-Cells architecture, although alternative procurement schemes (mandatory offers, etc.) are considered too. However, alternative procurement schemes are not discussed in this article as they are usually country-specific.

The peculiarity of the procurement scheme in the organized market is that there is no contract or obligation for the BSPs to offer capacity for inertia, inertia, balancing capacity or balancing energy in the market; the BSPs voluntarily participate here and bid a price, at which they wish to sell, and volume. This is a centralized market, where the CO utilizes a merit order to dispatch the generators and loads in a least cost way. Besides, standardized products with a short duration are exchanged here. The organized market model enhances transparency and fosters competition. The drawback of the market model is high data management costs and availability to facilitate the exercise of market power by some BSPs.

If the BSPs and the CO are allowed negotiating a contract regarding the offered system balancing product (its quantity and quality) and its price, bilateral market is established. Negotiations (through the customization) provide a flexible way to determine prices, quality of the system balancing product, financing terms and other, but they are costly (high transaction cost) and time consuming.

The CO and the BSPs may want customized contracts that offer flexibility because there are many uncertain factors that have an influence on predictions of electricity consumption, production and price in the future. The flexibility enables them to make adjustments more easily and at lower cost when the factors become better recognized. The economists argue that this type of market arrangements is decisive to the functioning of electricity markets, because they provide parties with price stability and certainty necessary to perform long-term planning and to make rational and socially optimal investments. Bilateral markets are valuable since they protect the BSPs and the COs against price uncertainty and make revenue and payment streams more predictable. As a result, investment decisions are facilitated. Within the Web-of Cells architecture they could be used to provide location-based services where there are potentially insufficient volumes of competition. The bilateral market is a decentralized market, where the CO is constrained in scheduling by negotiated contract price and volume. The advantage of the bilateral market model against the compulsory provision is the fact that the CO procurers only the amount it needs and deals only with the cheapest BSPs. However, the bilateral market model has drawbacks, which are discussed in [

19].

Taking into account the advantages and disadvantages of the markets for procurement of system balancing products, as well as the requirements established in the “Winter Package” (particularly, that “the procurement processes … are transparent while at the same time confidential …”, “… the procurement … is organized in such a way as to be non-discriminatory between the market participants …” and “… procurement … is market-based …” [

26]) the Web-of-Cells architecture accepts organized market for the system balancing products’ procurement processes.

8.2. Remuneration Scheme

The Web-of-Cells architecture considers that the system balancing products are procured on commercial basis and the BSPs are remunerated for the provision of them. The COs can apply different remuneration mechanisms (

Figure 10).

In case of aFCC, BRC and BSC services, the COs pay the BSPs for balancing capacity availability (i.e., for holding balancing capacity) and for its utilization (i.e., for the delivery of balancing energy) (

Figure 10):

the availability payment is made to the BSP in return for the balancing capacity being made available to the CO during the MTU. The availability payment is equal to the price (EUR/MW) at which all the BSPs are paid for holding balancing capacity for the MTU;

later, when balancing capacity is called upon, in addition to the availability payment the CO pays a utilization price (EUR/MWh) for balancing electricity delivery. The utilization price may be noticeably different from the price the BSP asked for the activation of balancing capacity. The utilization price therefore reflects the prevailing market price at the time of use.

In case of IRPC service the BSPs are remunerated for availability of inertia providing capacity (EUR/(MW × s)) and for its utilization (delivery of inertia) (EUR/kg × m2).

9. Analysis of Market Design Elements for Improvement of Utilization Efficiency

9.1. Pricing Mechanisms for the System Balancing Products

The Web-of-Cells architecture considers both market-based pricing mechanisms and pricing exercised by the regulating authority or the CO. By definition, the regulated price is set by the regulating authority or the CO and is the same for all the BSPs. The use of regulated price is related to the mandatory provision of the services by a few BSPs (often large producers) since there is no information to choose the BSPs based on their cost [

30]. As it is argued in [

30], even if the rules allow for new entrants, such as aggregators to propose system balancing products, the selection of the capacity will be made by an administrative rule, which would not allow new participants competing effectively with incumbent market participants. Thus, this form of pricing should be or is used, when market power is an issue in the market. However, a regulated price is not a desirable choice since it reflects very imperfectly the actual cost of providing the balancing service, especially, if cost changes in time and circumstances [

19]. This means that regulated price does not take into account the market value of electricity generation [

30]. With a fixed guaranteed and unchanging price, a generator can receive cross-subsidies [

30].

The Web-of-Cells architecture considers two alternative market-based pricing rules to the regulated price. In particular, it considers uniform and pay-as-bid pricing rules.

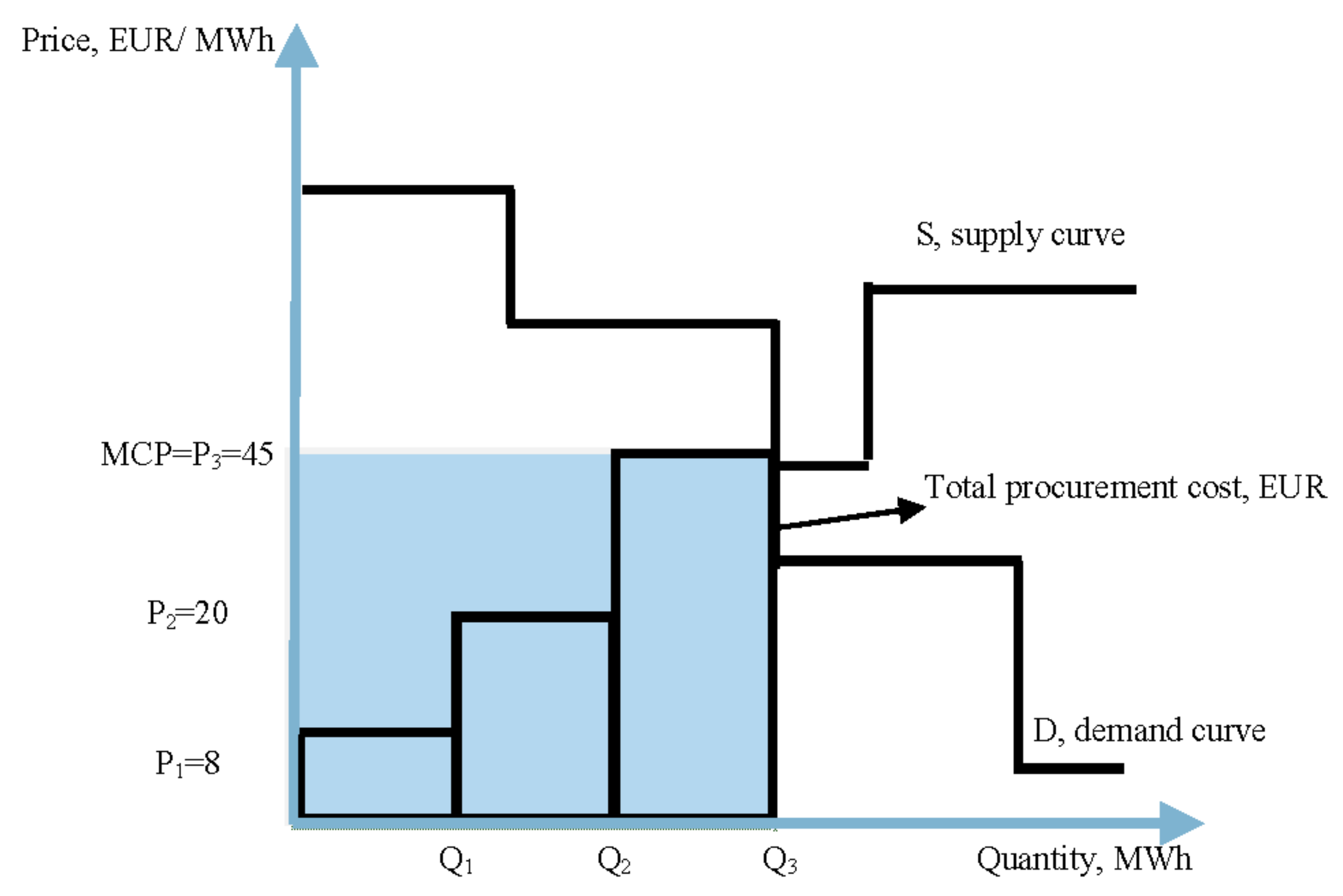

Under the uniform pricing rule all market participants with accepted bids are paid a uniform (single) price, which is the market-clearing price (MCP), regardless of their bids. The MCP is determined as the offer price of the highest accepted offer in the market, as it is shown in

Figure 11.

The uniform pricing rule is beneficial to apply because the MCP aligns the actions of the BSPs and COs with maximizing the gains from the trade. The reason for the application of the uniform pricing rule to determine the price in the market for system balancing products is twofold [

48]:

the incentive to provide for efficient dispatch. The uniform pricing rule means that the BSPs offer the system balancing products at prices closely reflecting their marginal costs. This results in operationally efficient dispatch meaning that demand is supplied by the lowest cost resources and technologies, which are owned by the BSPs;

the optimal investment means that generation technologies are built in necessary places at required time with the investment risks borne by the investors but not the tariff payers.

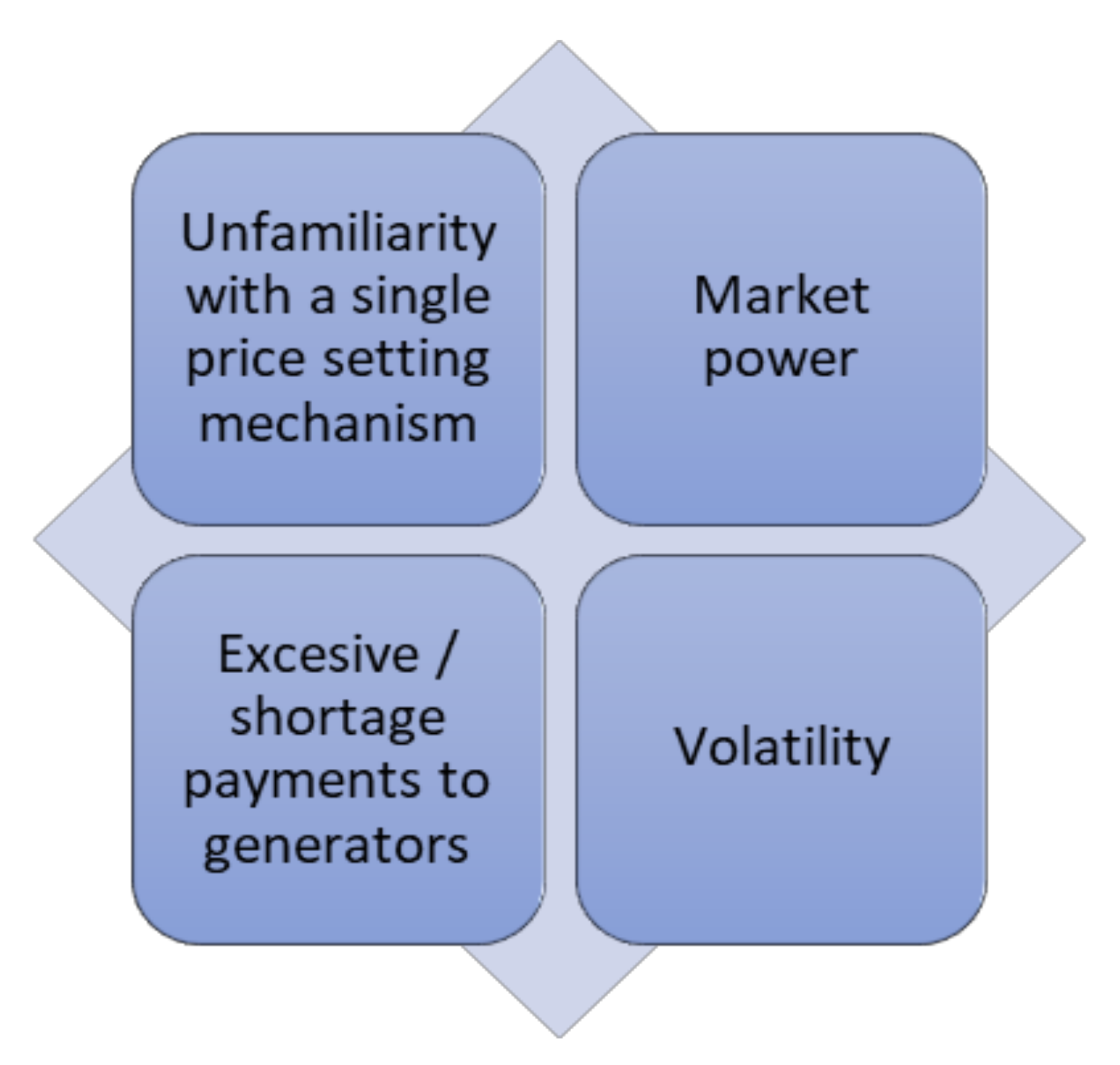

In [

48], four principal criticisms against the application of the uniform pricing rule to set the MCP (

Figure 12) are discussed.

In [

48], it is argued that the critique of employing the unified pricing rule in electricity market includes a reference to the thoughtful unfamiliarity with the price setting process and application possibilities. However, critics do not notice that the pricing mechanism is successfully implemented in other commodity markets. Nowadays, considering to its wide application in all timeframes of electricity market, the argument is not significantly relevant, but it should be taken into account when introducing uniform pricing in newly developed markets, including market for system balancing products. The potential exercise of market power is an issue too, but if market power is an issue under the uniform pricing rule, it could be also an issue under an alternative pricing rule, i.e., pay-as bid. In [

48], it is argued that the shift from a uniform pricing rule does not curb the exercise of market power. A number of measures available to mitigate market power that is consistent with the uniform pricing rule could be used. Since the MCP could set by the expensive offers (for instance of gas-based generators), there is a criticism about the excessive level of payment to baseload resources such as coal and nuclear generators—particularly to owners of old assets those construction cost was lower than presently new construction cost. This means that BSPs owning old baseload generation units receives high operational profit. However, the excessive payments to the BSPs is reduced by allowing of varies technologies, including RES having low marginal cost participating in the market. The current practice shows that subject to the uniform pricing rule and high shares of RES-E in the market, electricity prices are low or even negative [

53]. The generation side is threatened by closure of conventional power plants that are presently experiencing decreasing profitability due to low electricity prices and limited number of operating hours [

54,

55]. However, changes in pricing rule aimed at reducing or increasing profitability to the generating assets are unfair [

48]. It would signal to the investors in generating assets that they are exposed [

48]. Volatility of prices caused by the unified pricing rule is an issue too [

48] but forward contracts could be applied to hedge against price variability and reduce exposure to volatility.

Under the pay-as-bid pricing rule (it is commonly applied at the Nordic regulating power market for so-called “special regulation” e.g., resolving congestions, where location of the resource is important), the prices are set based on a first-come, first-served principle, where best prices, which are the lowest selling prices offered by the BSPs, come first.

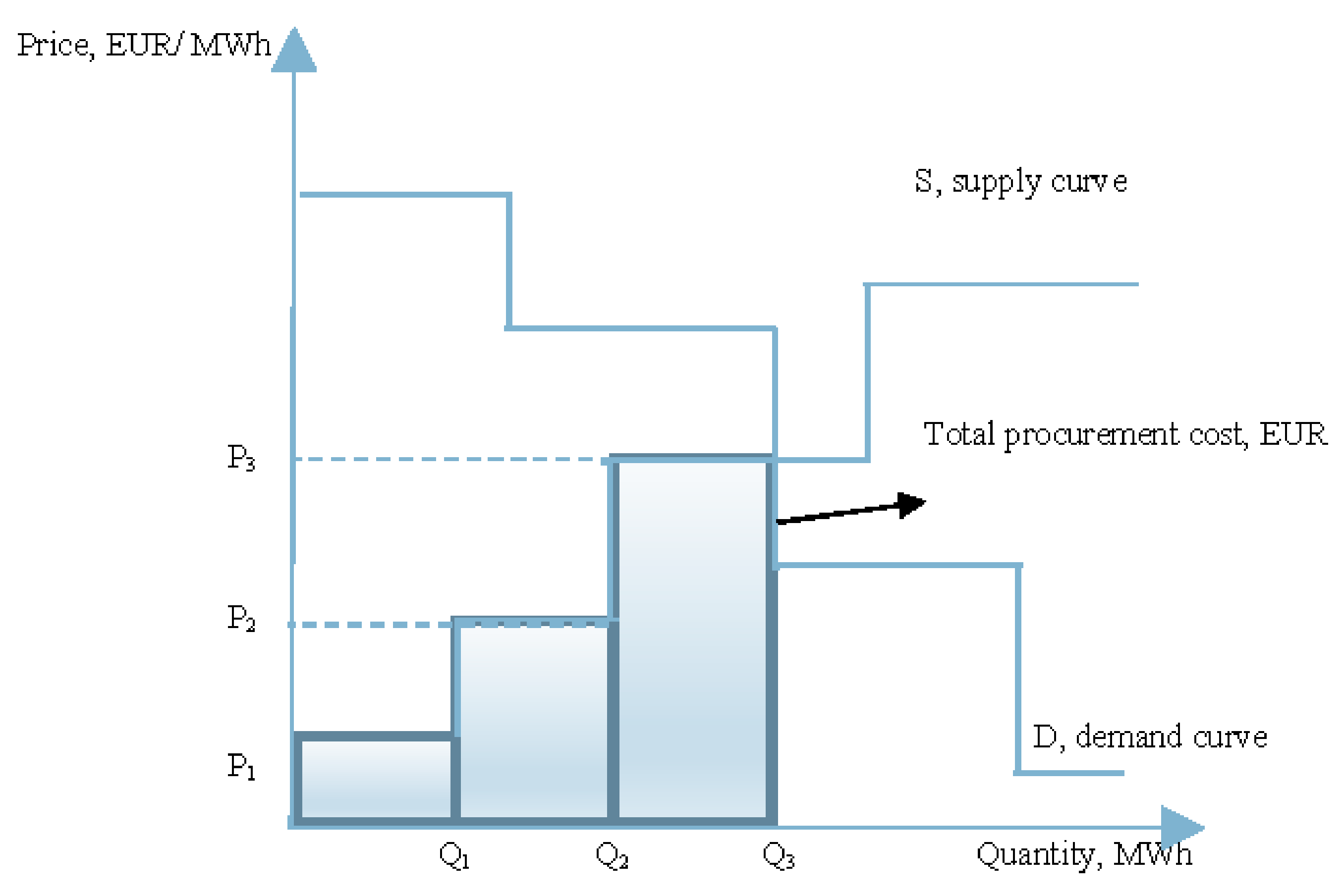

Figure 13 illustrates price setting and total procurement cost of the pay-as-bid pricing rule.

As it is seen from

Figure 13, under the pay-as-bid pricing rule, the BSPs with the accepted bids are paid according to their bids, i.e., prices

P1,

P2 and

P3, respectively. No single MCP is established.

Total procurement cost (TPC) is the sum of individual procurement cost, as it is expressed by Equation (1):

where:

n—is the identification BSP;

Pn—price of accepted bid of the

n-th BSP;

Qn—volume of accepted bid of the

n-th BSP.

Thus, total procurement cost, which are defined as the payment by the CO as a representative of demand side, typically involves the demand paying a price that is equal to the BSPs weighted-average price. Using the BSPs-weighted average price ensures that the total payment by the CO equals total paid to the BSPs.

The pay-as-bid pricing rule is typically used as a measure tackling the issues of the unifom pricing. The pay-as-bid pricing rule used for continuous trading meaning that BSPs and COs submit supply and demand bids to a central platform (exchange) and matching bids are continuously cleared on an individual basis. The continuous trading order book is visible to all market participants and contains all submitted bids that have not cleared yet. The BSPs can cancel submitted and not-cleared bids at any time. Continuous trading bids are matched based on price-time priority: orders are matched in sequence of the attractiveness of their price. If offers have identical prices, the time of submission is the decisive factor. It implies that BSPs have to anticipate the clearing price and accordingly mark up their bids. There is no empirical or experimental evidence that pay-as-bid or other alternatives would reduce prices significantly compared to a single market-clearing price design. In fact, some evidence suggests that pay-as-bid would increase prices compared to explicitly setting the single MCP. Moreover, pay-as-bid pricing rule has some significant drawbacks [

48,

51]:

When bidding truthfully, non-marginal BSPs may receive smaller remuneration for the system balancing products they supply compared to the BSPs paid at uniform pricing rule. In this case, the CO meets more favorable prices compared to a uniform pricing rule, however, is at risk of losing the opportunity to match bids if it waits too long. Thus, continuous trading with a pay-as-bid pricing rule may incentivize market participants do not bid truthfully. Thus, incorrect demand and supply signals could happen;

A market based on continuous trading with a pay-as-bid pricing rule includes a certain first-come-first serve characteristic, as matching bids are immediately cleared, which may not lead to a welfare maximization and an optimal allocation of balancing resources;

An important question regarding the organization of continuous trading with a pay-as-bid pricing rule that is not answered yet includes the optimal number of auctions and their timing, taking into account the impact on liquidity;

Inefficient dispatch. Under the pay-as-bid pricing rule, a profit maximizing offer involves prediction of the MCP. When uncertainties exist, the forecast is inaccurate and different BSPs will forecast different values of the price. Since the CO uses offers to decide on the dispatch, this means that occasionally a high marginal cost BSPs with a lower offer will be dispatched instead of low marginal cost BSP submitting higher offer, i.e., the efforts to maximize profits will result in inadequate dispatch decision. Inefficient dispatch wastes costly resources and is undesirable;

Another inefficiency of pay-as-bid pricing rule is the cost of forecasting market prices that it will impose on all BSPs and COs. Under the uniform pricing rule, the BSPs are motivated to bid at marginal cost, which are available to them. If the method is changed to pay-as-bid pricing rule, uncertainty about market price calculation and large cost to forecast it are introduced. Moreover, small companies achieve much higher cost per unit of output, although they put as much efforts to forecast price as large ones.

Bias against the small BSPs. The basic argument against pay-as-bid pricing rule is that the bsps suffer relatively higher costs in the assessment required to form their offers for pay-as-bid pricing rule than assessment required for offers for uniform pricing rule. Under the pay-as-bid pricing rule, the MCP is forecasted instead of offering a price reflecting the marginal cost. This requires knowledge about the market and more investment in market analysis and data gathering are required. Large BSPs could spread the associated cost across a greater amount of output while this is not possible by small BSPs who as a result may lose their competitive position. From this perspective, pay-as-bid pricing rule is more favorable to large BSPs. A pay-as bid pricing rule make it relatively harder for new entry by small BSPs than entry under the uniform pricing rule.

Difficulties with market monitoring. The aim of market monitoring is to assess if prices are not competitive. The assessment is done considering the offers. Under a pay-as-bid pricing rule, competitive offers involve markup above the marginal cost. There is no easy to assess if or not such offers are exploiting market power, i.e., market power monitoring becomes impossible under the pay-as-bid pricing rule. Under the uniform pricing rule there is a particular test to monitor market power. This is an assessment whether offers track marginal cost.

Investment. Under the pay-as-bid pricing rule the prices paid to the bsps would be driven towards recovery of operating cost only. This would fail to provide enough remuneration to cover investment cost. Owners of generating assets will find themselves going bankrupt and no new investment will be available. Thus, pay-as-bid impede capacity expansion, which alongside with a demand-side response is a measure for a better performance of the market. The pay-as-bid impede new entry, which is a measure of mitigating market power.

Tend to weaken the competition in generation that is the remedy against of monopoly power, which may cause the steady price increase at times of peak demand.

Pricing mechanism for the Web-of-Cells architecture is chosen in a way that selected pricing mechanism performed three important functions [

56]:

Signaling, meaning that changes in prices provide information both to the CO and the BSPs about changes in the market conditions, prices reflect scarcities and surpluses,

Transmission of preferences meaning that through the choices the CO send information to the BSPs about the changing nature of needs;

Rationing meaning that when there is a shortage of balancing product, its price will rise and deter some CO from buying the balancing product.

The “Winter Package” foresees that the uniform pricing rule as an advanced method of pricing should be applied for the pricing balancing energy instead of pay-as-bid. Considering to results of analysis of advantages and disadvantages of different pricing mechanism and in accordance to the proposal of “Winter Package”, that prices should be formed based on demand and supply and price signals should drive the market to react to shifting energy demands and fluctuating renewable energy generation, the Web-of-Cells architecture suggests that all system balancing products are priced by a uniform pricing rule.

9.2. Cascading Procurement