7.2. Calculation Results and Analysis

Consider the carbon trading (i.e., the economic costs objective function is Equation (21)). The carbon trading penalty price

KLt is 60

$/t; the margin of the carbon emission rights that can be purchased

ρ is 0.4; the confidence level

α is 0.85; the carbon trading price

KCt is 20

$/t.

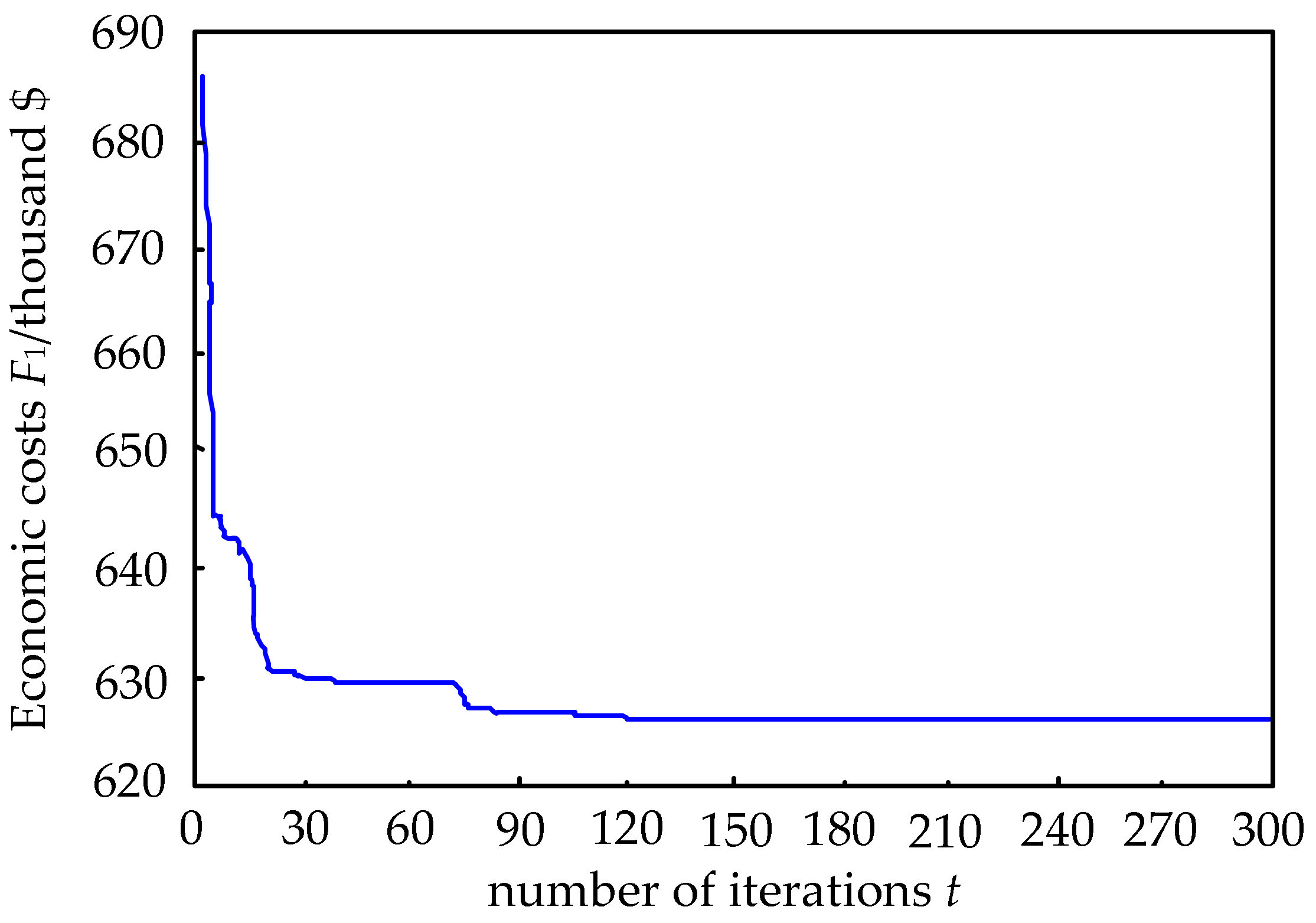

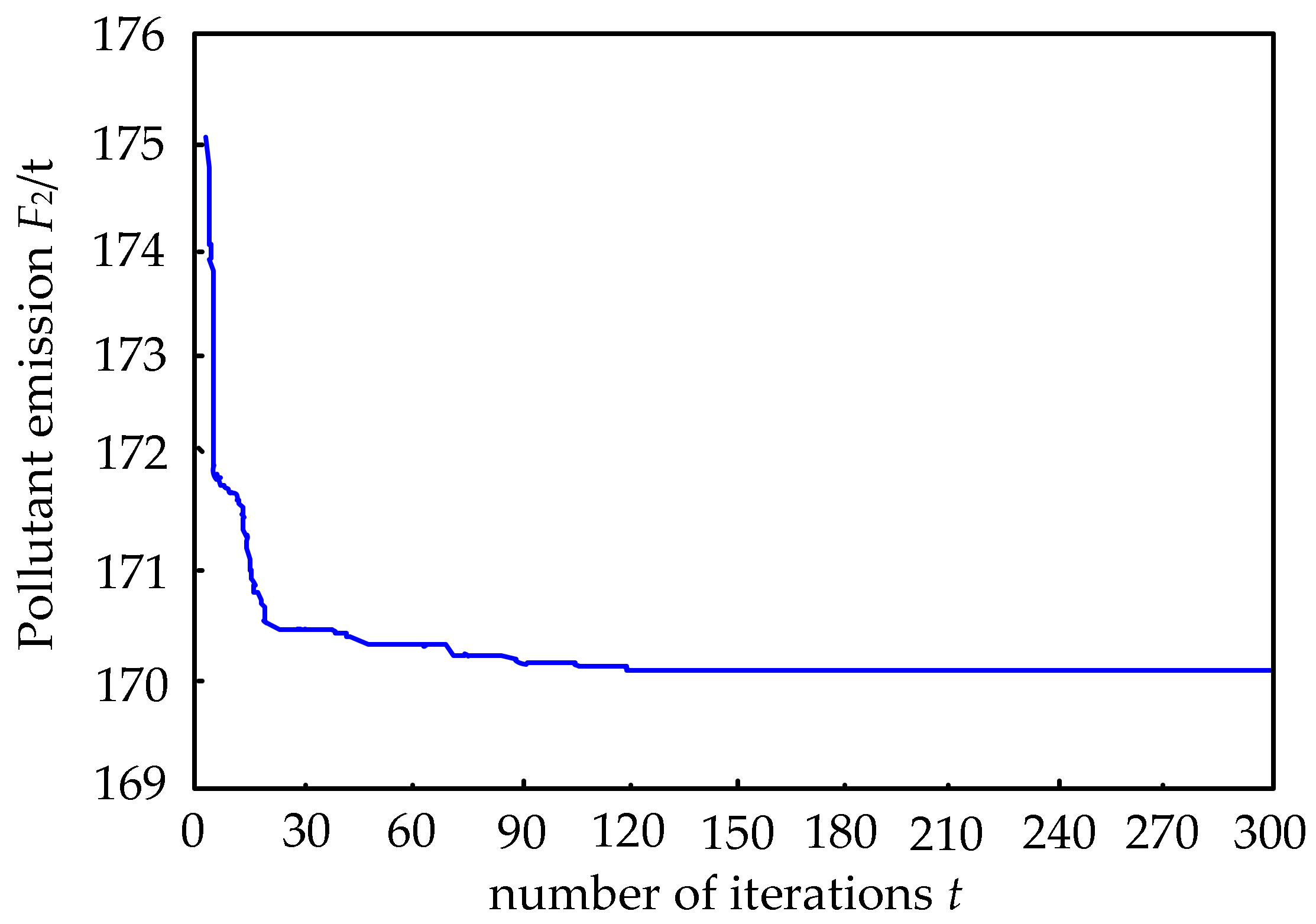

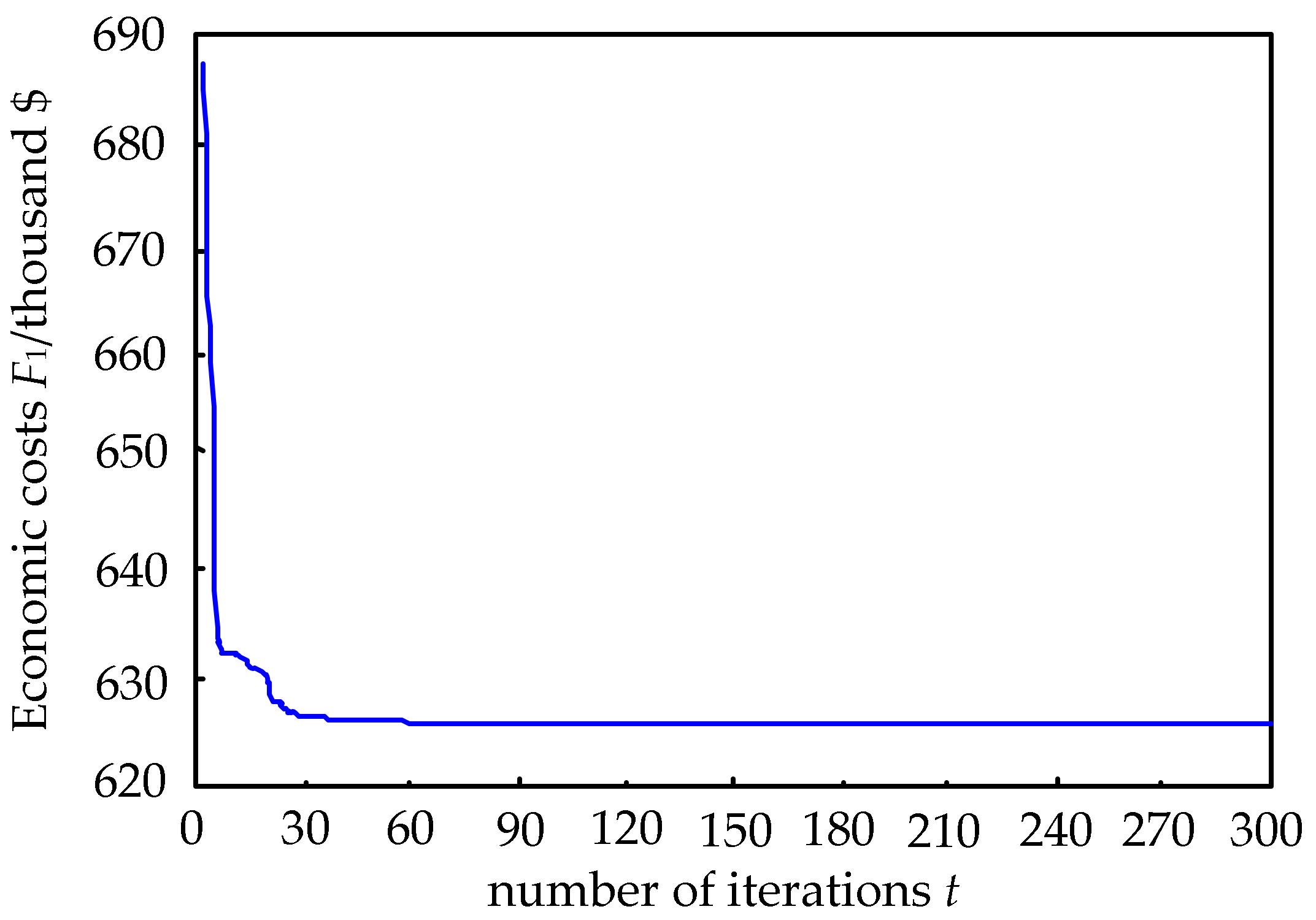

Figure 3 and

Figure 4 show the change curves of the economic costs and pollutant emissions with the number of iterations under the SPSO algorithm, respectively.

Figure 5 and

Figure 6 show the change curves of the economic costs and pollutant emissions with the number of iterations under the improved SPSO algorithm, respectively.

Table 5 shows the final economic costs and pollutant emissions under the SPSO and improved SPSO algorithms.

It can be seen from

Figure 3 and

Figure 4 that the economic costs and the pollutant emissions are minimized when the number of iterations reaches 90 times under the SPSO algorithm.

Figure 5 and

Figure 6 show that when the improved SPSO algorithm is used, the convergence speed is improved, and the minimum values have been reached when the number of iterations is 30. It is proven that the improved SPSO algorithm can improve the optimization speed.

It can be seen from

Table 5 that the economic cost is 626.194 thousand dollars and the pollutant emission is 170.037 tons under the improved SPSO algorithm. Its optimal dispatch results are reduced compared with the dispatch results of the SPSO algorithm. It is proven that the improved SPSO algorithm can improve the accuracy of optimization.

Consider the carbon trading (i.e., the economic costs objective function is Equation (21)). The carbon trading penalty price

KLt is 60

$/t; the margin of the carbon emission rights that can be purchased

ρ is 0.4; the confidence level

α is 0.85.

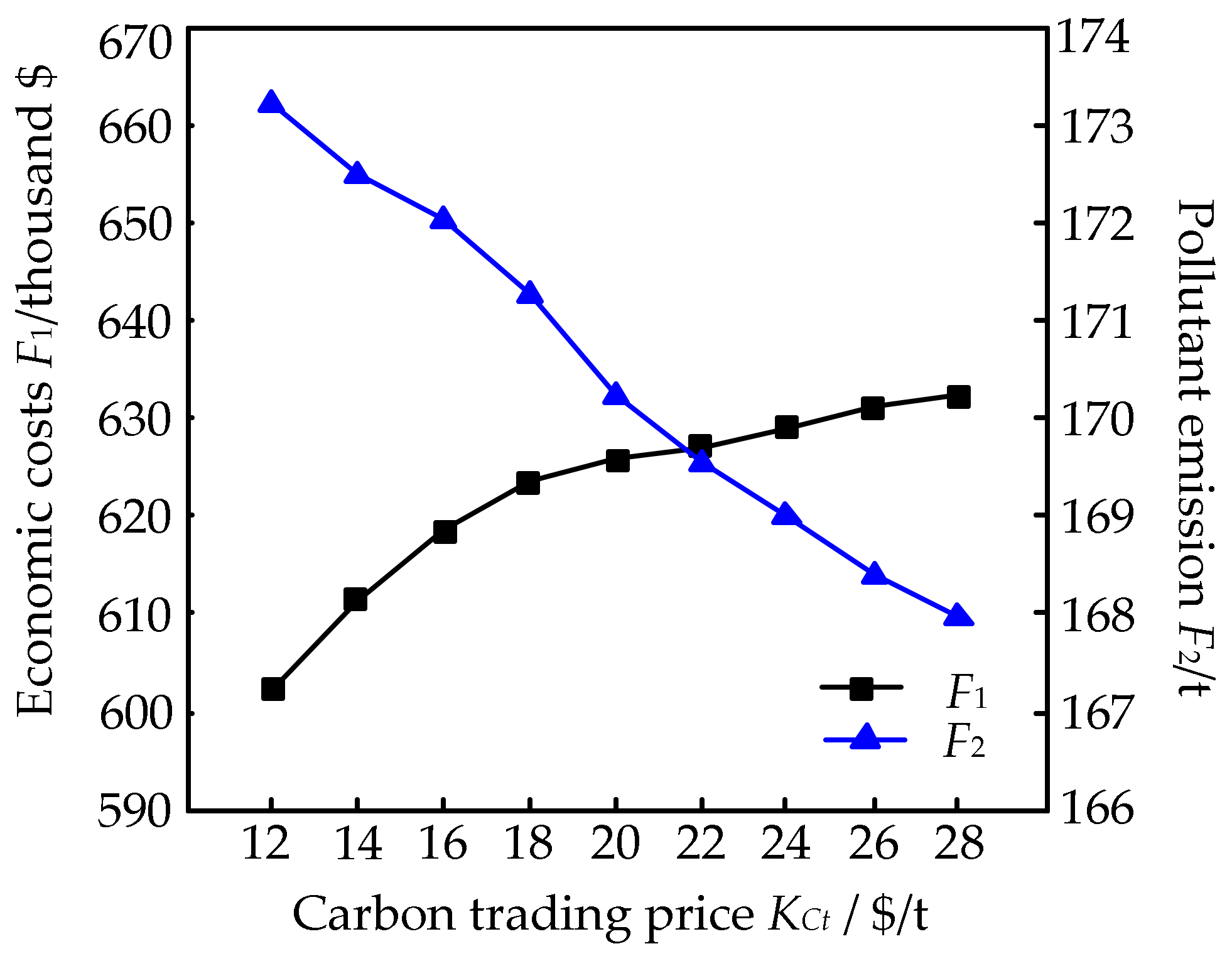

Figure 7 shows the change curve of total economic costs

F1 and system pollutant emission

F2 with the change of carbon trading price

KCt.

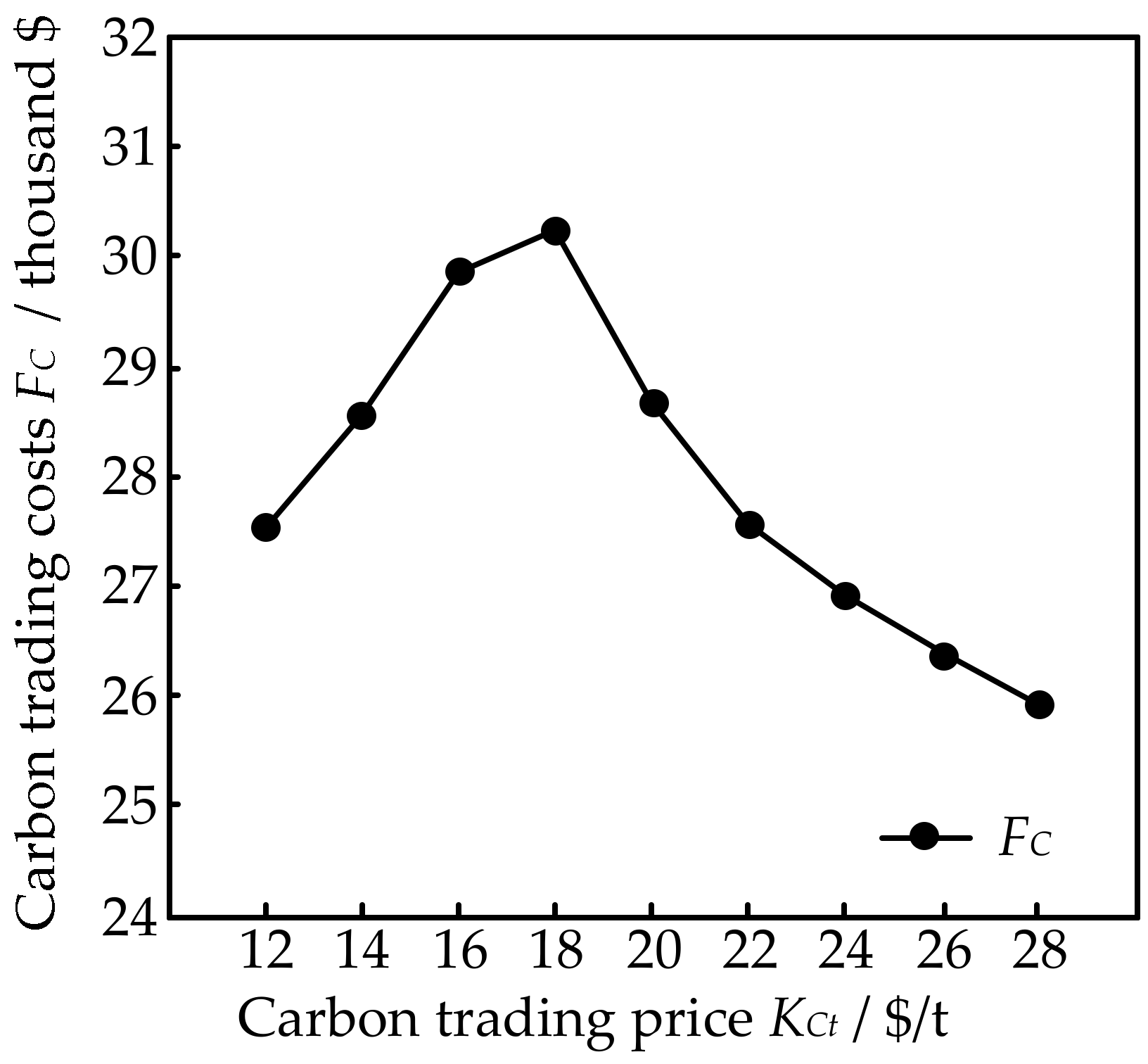

Figure 8 shows the change curve of carbon trading costs

FC with the change of carbon trading price

KCt.

It can be seen from

Figure 7 that with the increase of the carbon trading price

KCt, the low-carbon scheduling target weight increases, and low emission units and wind turbines gradually gain advantages. Low-emission units and wind turbines’ generating costs are higher, so the total economic costs of the system

F1 will increase accordingly. With the increase of the carbon trading price, the increase of the output of the wind turbines makes the output of the thermal power units decrease, so the pollutant emissions of the system

F2 will decrease accordingly.

It can be seen from

Figure 8 that when the carbon trading price

KCt is low, the system of carbon emissions

Eqt is greater than the amount of the carbon emission rights quota

Eqt. Therefore, it is necessary to purchase carbon emission rights, which results in a certain carbon trading cost

FC. With the increase of carbon trading price, the output of wind turbines will increase by a small margin, and the cost of carbon emission rights purchased will increase, so the carbon trading costs will increase. When the carbon trading price reaches 18

$/t, the carbon trading costs reach the peak value, which is 30.372 thousand dollars. As the carbon trading price continues to increase, the output of wind turbines will gradually increase, and the system carbon emissions will decrease, so the carbon trading costs decrease. Therefore, the carbon trading costs increase first and then decrease.

Consider the green certificate trading (i.e., the economic costs objective function is Equation (22)). The green certificate trading price

KRt is 3

$/copy; the green certificate trading penalty price

KHt is 9

$/copy; the confidence level

α is 0.85.

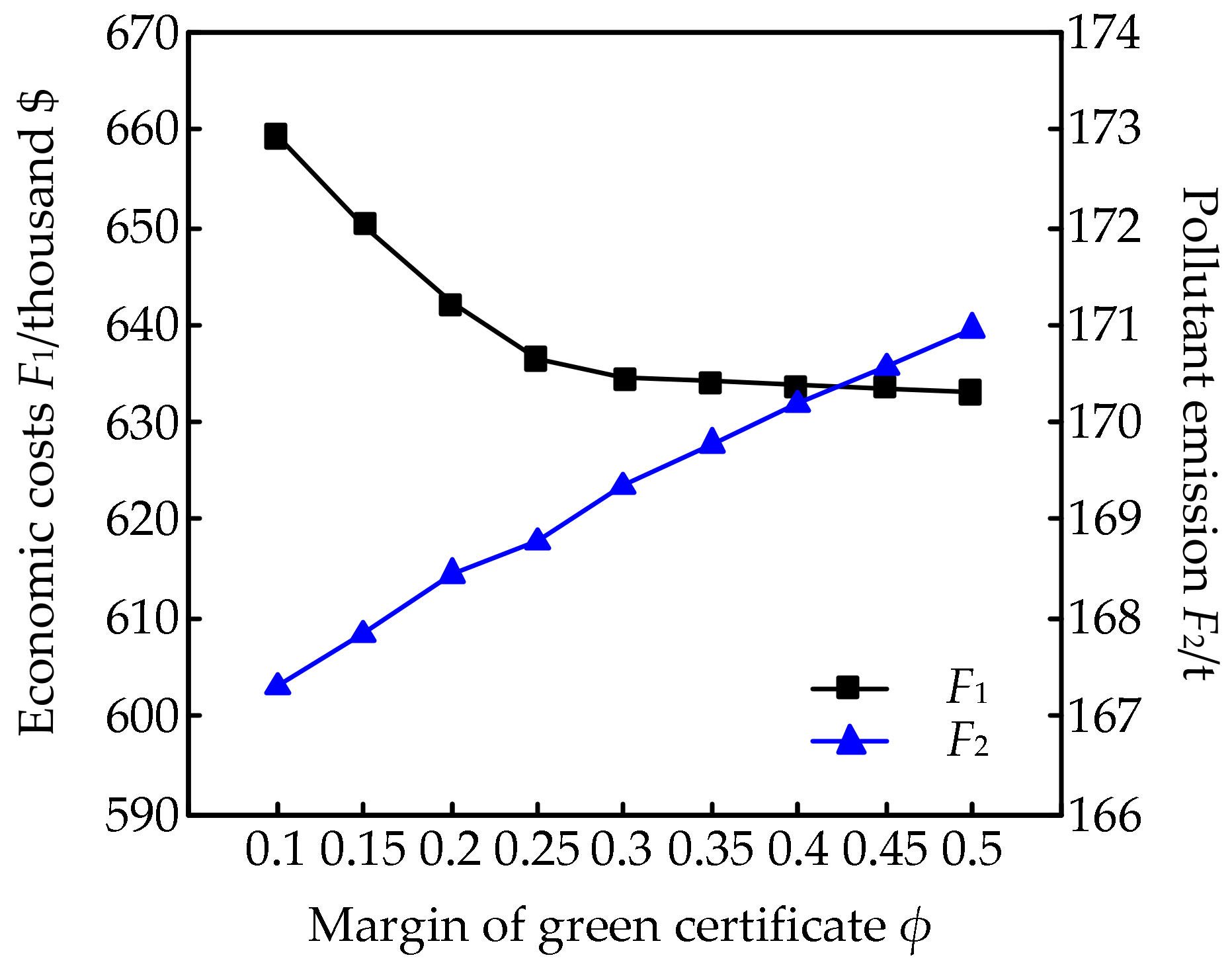

Figure 9 shows the change curve of total economic costs

F1 and system pollutant emissions

F2 with the change of the purchase margin of the green certificate

ϕ.

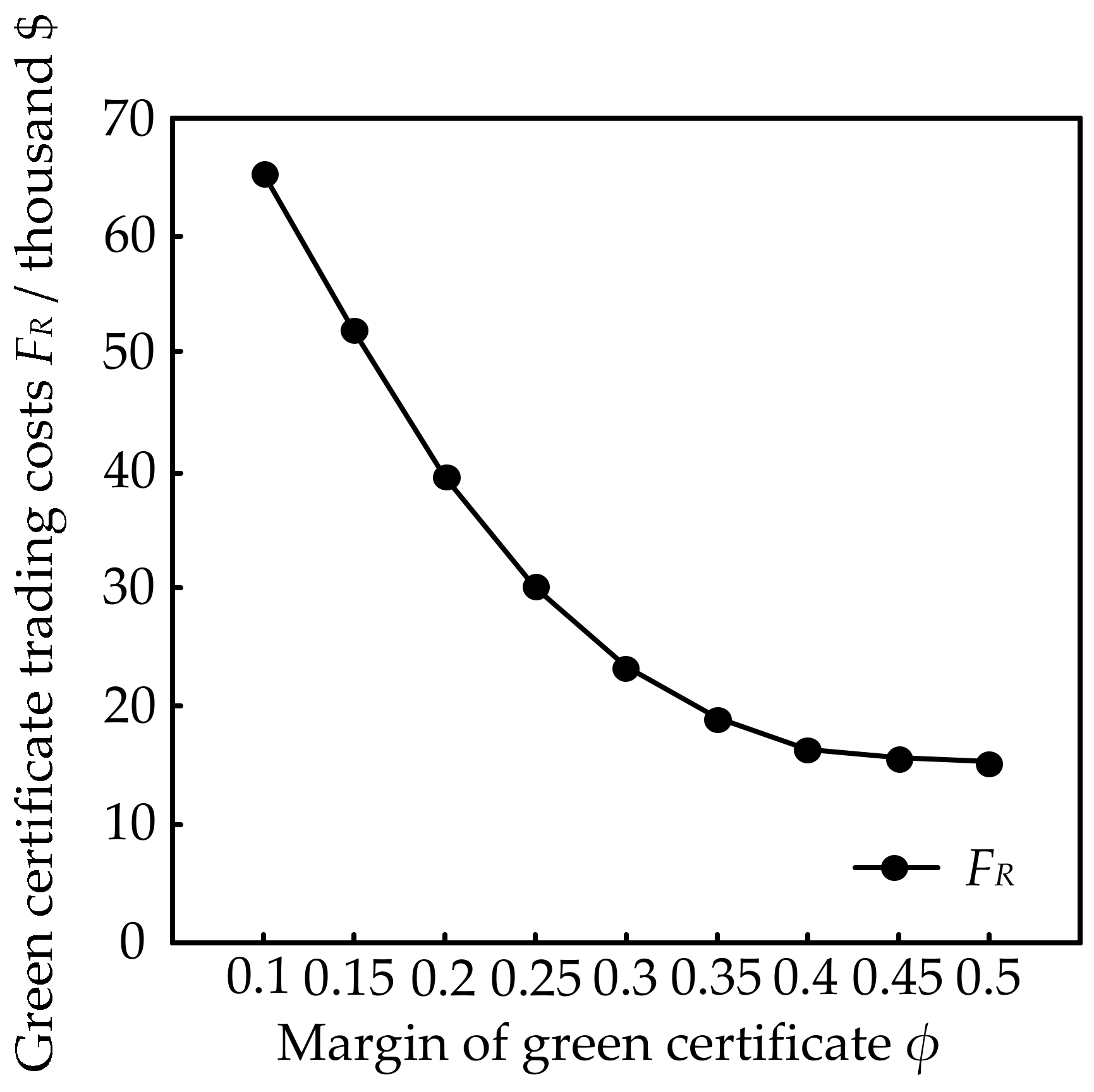

Figure 10 shows the change curve of green certificate trading costs

FR with the change of the purchase margin of the green certificate

ϕ.

It can be seen from

Figure 9 that with the increase of the purchase margin of the green certificate

ϕ, the system can purchase more green certificates, so we can reduce the output of high cost low emission units and wind turbines. The total economic costs of the system

F1 will decrease accordingly. With the increase of the purchase margin of the green certificate, the decrease of the output of the wind turbines makes the output of the thermal power units increase, so the pollutant emissions of the system

F2 will increase accordingly. It can be seen from

Figure 7 and

Figure 9 that the total economic costs of the system and the emissions of pollutants are restricted by each other, and the relationship between them is negatively related.

It can be seen from

Figure 10 that when the green certificate purchase margin

ϕ is small, fewer green certificates are purchased, and the cost of green certificate trading

FR is the sum of green certificate purchase cost and penalty cost. As the margin of purchase increases, the cost of the green certificate purchased increases, and the cost of the penalty decreases. Because the price of the penalty is higher than the price of green certificate purchased, the trading cost of green certificates is decreasing. As the margin continues to increase, the penalty cost continues to decrease to zero, where the amount of green certificate exchanged

Rpt is less than the amount of green certificate quota

Rqt, but the amount of green certificate vacancies does not exceed the amount of green certificate that can be purchased

RLt, so one only needs to pay the purchase cost of green certificate vacancies. Taking into account that the purchased green certificates can be re-sold, the green certificate trading costs

FR have one a small change.

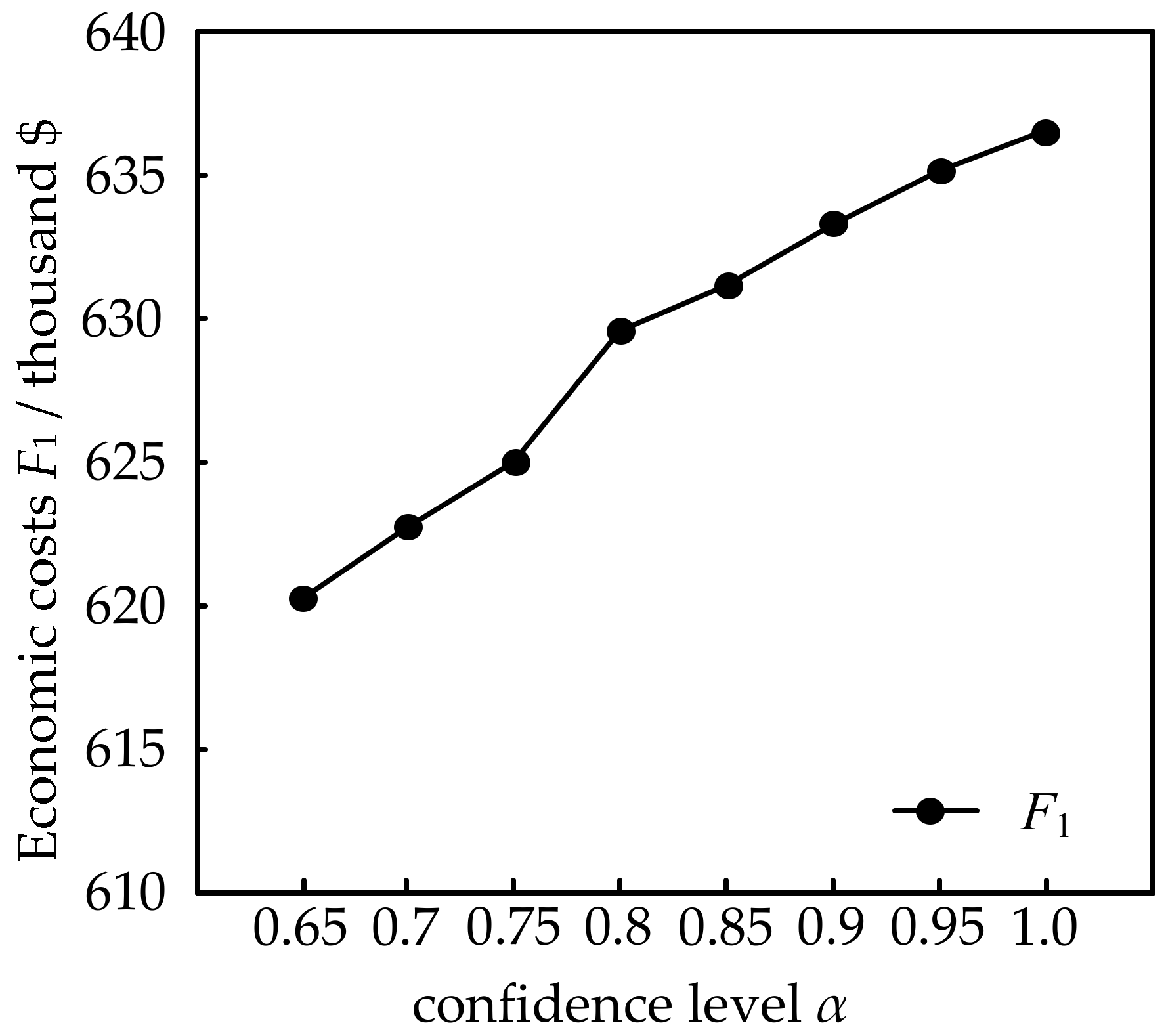

Consider the green certificate trading (i.e., the economic cost objective function is Equation (22)). The green certificate trading price

KRt is 3

$/copy; the green certificate trading penalty price

KHt is 9

$/copy; the green certificate purchase margin

ϕ is 0.4.

Figure 11 shows the change curve of total economic cost

F1 with the change of confidence level

α.

It can be seen from

Figure 11 that when the confidence level α is low, the total economic cost of the system

F1 is small, that is to say, high risk brings high returns. With the increase of the confidence level

α, the total economic cost of the system

F1 is increasing gradually, that is to say, high reliability requires a high cost of investment. The confidence level reflects the decision maker’s grasp of risk, and the risk originates from the fuzziness of load and the output of the wind turbine. In the actual decision making, according to the data analysis of the output of the wind turbine and the load, the unit combination scheme that can accept the above risk and achieve the maximum economic return can be selected.

Consider the green certificate trading (i.e., the economic cost objective function is Equation (22)). The green certificate trading price

KRt is 3

$/copy; the green certificate trading penalty price

KHt is 9

$/copy; the green certificate purchase margin

ϕ is 0.4; the confidence level

α is 0.85. We take the multi-objective economic scheduling in this paper as Model 1. Take the single-objective economic scheduling that only takes the minimum total economic costs of the system

F1 as the scheduling goal as Model 2. Take the single-objective economic scheduling that only takes the minimum pollutant emissions of the system

F2 as the scheduling goal as Model 3.

Table 6 lists the scheduling results in the different models.

It can be seen form

Table 6 that under Model 3, only taking the minimum pollutant emissions of the system

F2 as the scheduling goal, wind turbines have a priority to generate electricity relative to thermal power units, making the system’s pollutant emissions the smallest. However, due to the high cost of wind power generation, the economic costs of the system are the highest among the three models. Under Model 2, only taking the minimum economic costs of the system

F1 as the scheduling goal, thermal power units have a priority to generate electricity relative to wind turbines, making the system’s economic costs the smallest. However, because the thermal power units discharge pollutants while generating electricity, the pollutant emissions of the system are the highest among the three models. The scheduling results of Model 1 are between those of Model 2 and Model 3. This model ensures the system’s scheduling economy, while reducing the amount of pollutant emissions of the system, which is good for environmental protection.