Forecasting Electricity Demand in Thailand with an Artificial Neural Network Approach

Abstract

:1. Introduction

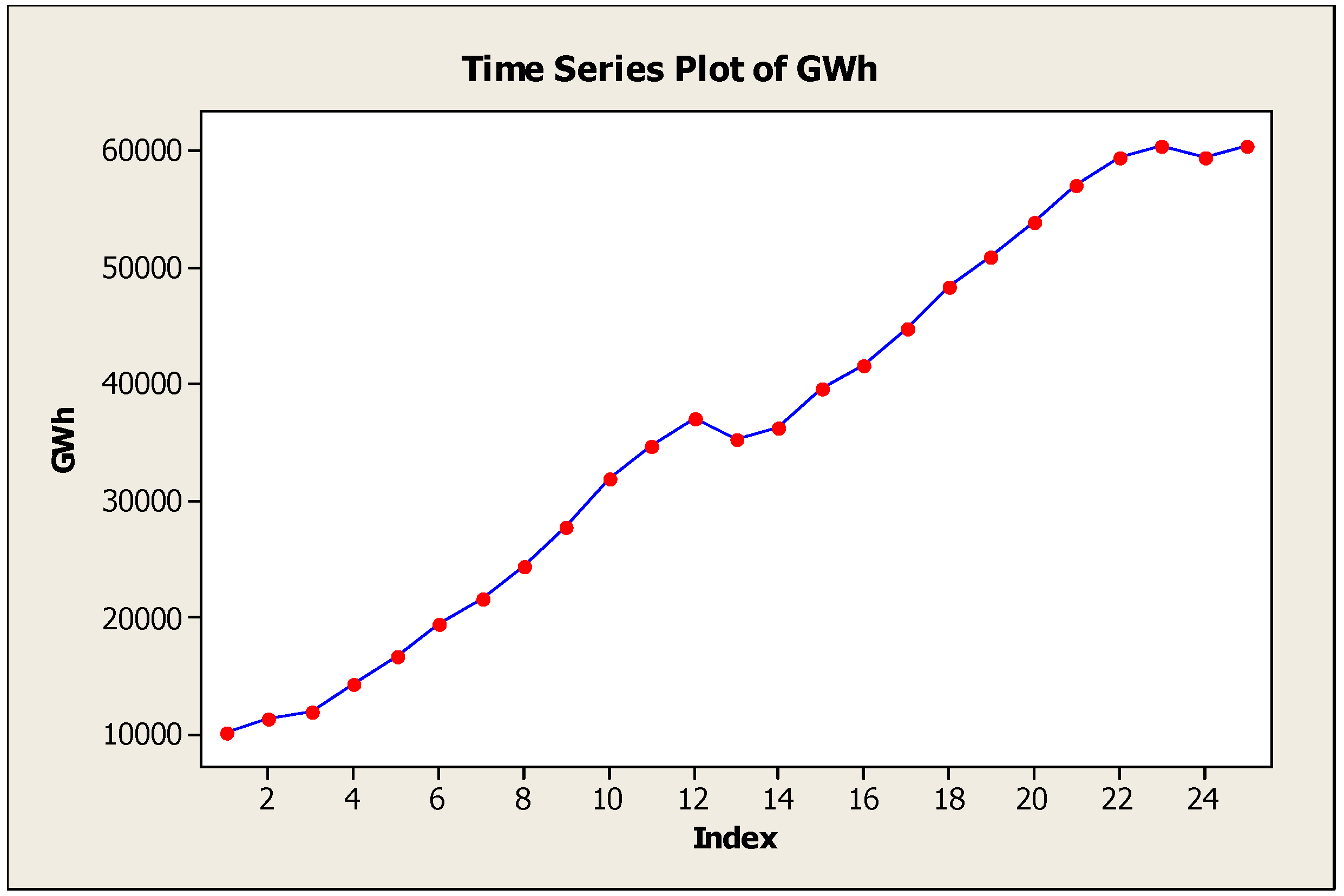

2. Historical Data

| Year | Population | GDP | SET Index | Export (million baht) | Electricity Consumption (GWh) |

|---|---|---|---|---|---|

| 1986 | 52511000 | 1257177 | 207.2 | 364017.25 | 10162.7 |

| 1987 | 53427000 | 1376847 | 284.94 | 455991.43 | 11319.4 |

| 1988 | 54326000 | 1559804 | 386.73 | 462426.83 | 11942.38 |

| 1989 | 55214000 | 1749952 | 879.19 | 562426.76 | 14328.1 |

| 1990 | 55839000 | 1945372 | 612.86 | 683946.13 | 16717.23 |

| 1991 | 56574000 | 2111862 | 711.36 | 725448.79 | 19406.02 |

| 1992 | 57294000 | 2282572 | 893.42 | 824643.29 | 21641.01 |

| 1993 | 58010000 | 2470908 | 1682.85 | 940862.59 | 24321.28 |

| 1994 | 58713000 | 2692973 | 1360.09 | 1137601.65 | 27758.43 |

| 1995 | 59401000 | 2941736 | 1280.81 | 1153489 | 31870.37 |

| 1996 | 60003000 | 3115338 | 831.57 | 1153894.61 | 34607.29 |

| 1997 | 60602000 | 3072615 | 372.69 | 1492331.29 | 36981.24 |

| 1998 | 61201000 | 2749684 | 355.81 | 1854500.09 | 35154.99 |

| 1999 | 61806000 | 2871980 | 481.92 | 1871544.78 | 36275.13 |

| 2000 | 62236000 | 3008401 | 269.19 | 2378191.26 | 39546.26 |

| 2001 | 62836000 | 3073601 | 303.85 | 2454987.54 | 41658.51 |

| 2002 | 63419000 | 3237042 | 356.48 | 2506442.96 | 44805.66 |

| 2003 | 63982000 | 3468166 | 772.15 | 2857191.85 | 48293.79 |

| 2004 | 64531000 | 3688189 | 668.1 | 3361360.69 | 50810.54 |

| 2005 | 65099000 | 3858019 | 713.73 | 3897247.1 | 53894.12 |

| 2006 | 65574000 | 4054504 | 679.84 | 4305406.71 | 56994.75 |

| 2007 | 66041000 | 4259026 | 858.1 | 4691207.01 | 59436.12 |

| 2008 | 66482000 | 4364833 | 449.96 | 5149902.76 | 60266.29 |

| 2009 | 66903000 | 4263139 | 734.54 | 4619810.05 | 59401.92 |

| 2010 | 67209942.8 | 4595809 | 1032.76 | 5476766.65 | 60315.04 |

3. Data Analysis

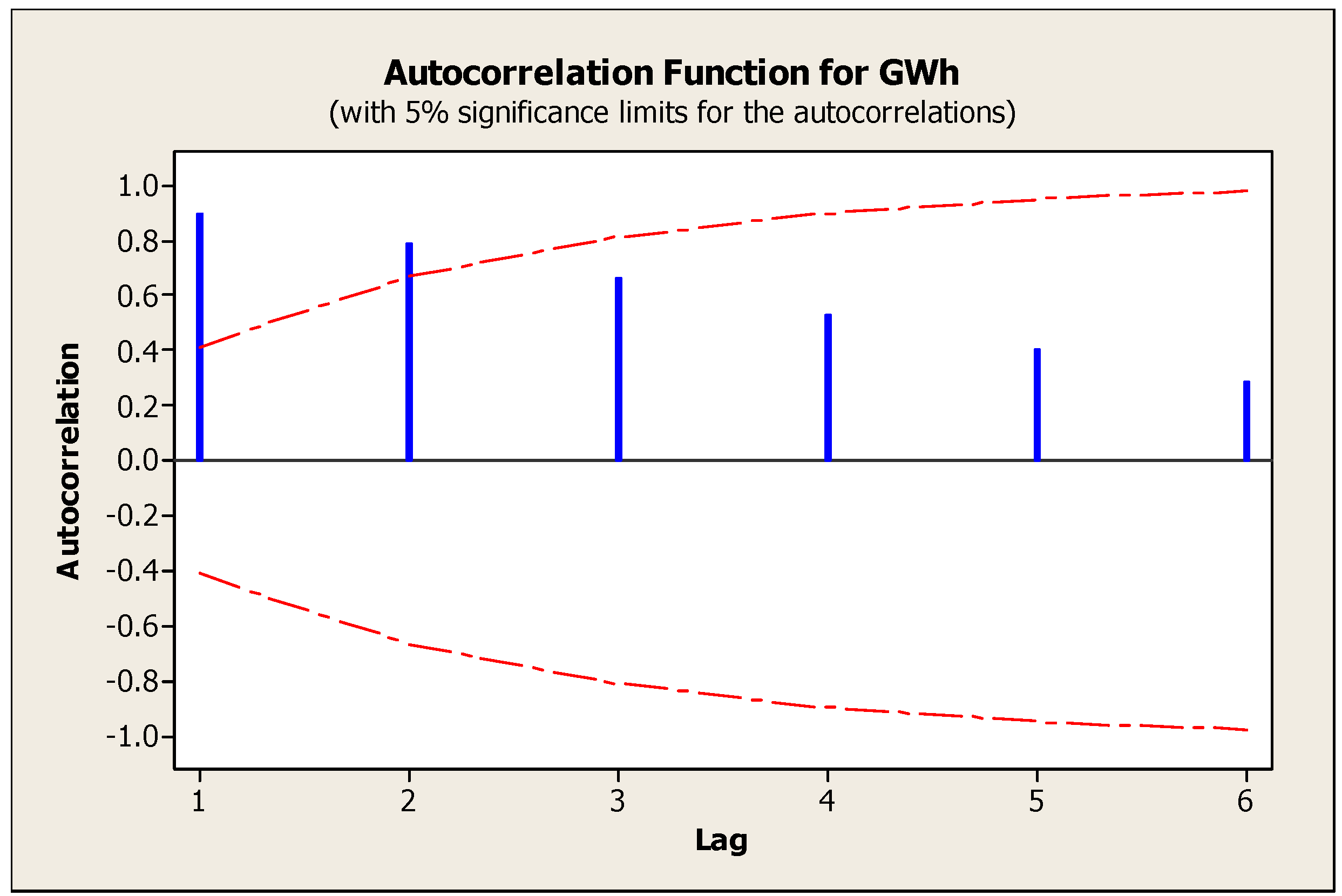

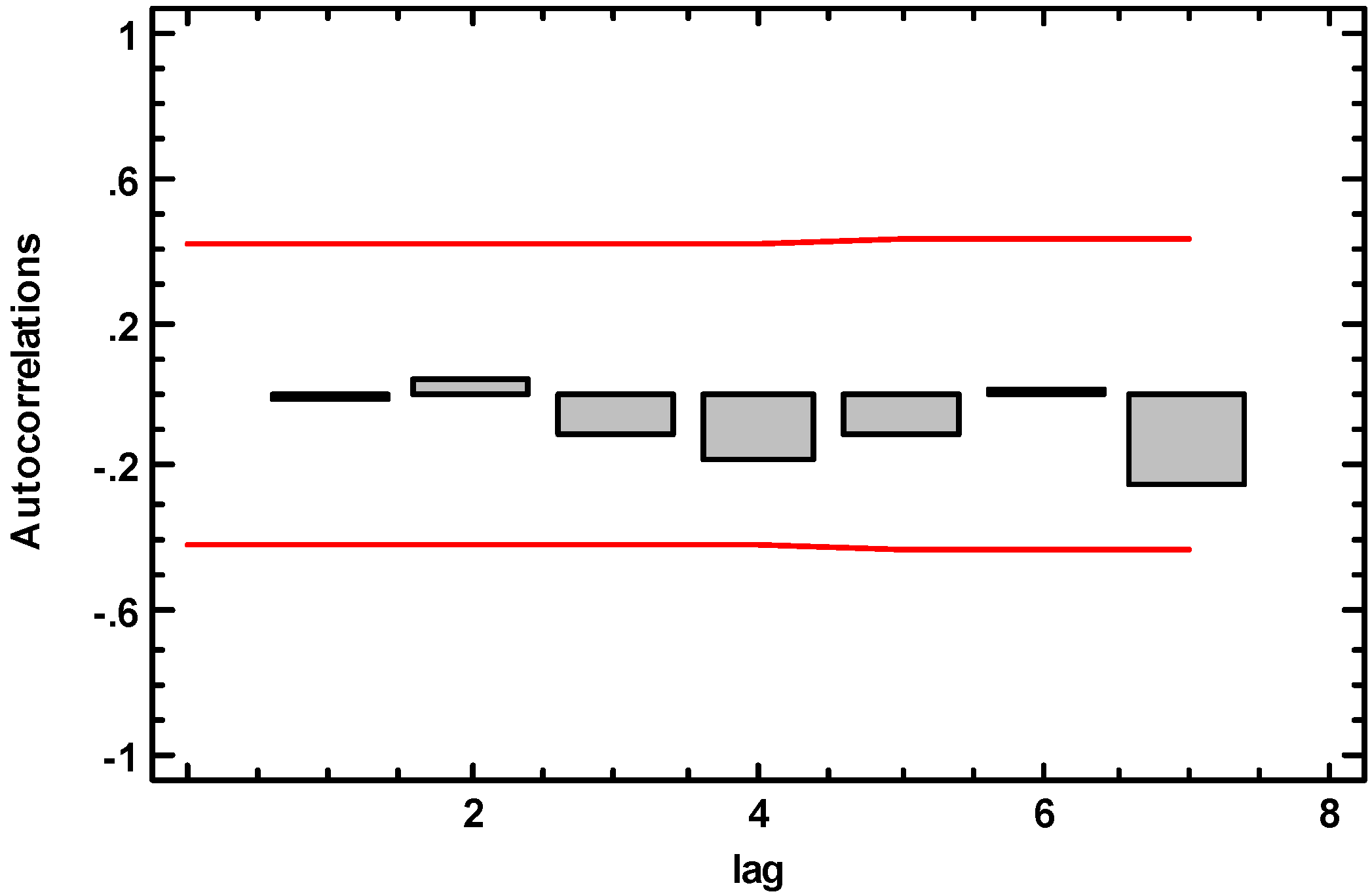

3.1. ARIMA Model

| Model | MAPE |

|---|---|

| ARIMA (0,2,2) | 2.80981 |

| ARIMA (1,2,1) | 3.02891 |

| ARIMA (1,1,0) | 3.34578 |

| ARIMA (0,2,0) | 3.30197 |

where

where  and

and  . Let

. Let  . The amount of p and q as well as β1 in the ARIMA (p, 0, q) model:

. The amount of p and q as well as β1 in the ARIMA (p, 0, q) model:  were calculated by a Box Jenkins method and AIC criterion where

were calculated by a Box Jenkins method and AIC criterion where  . Afterwards, let

. Afterwards, let  ,

,  and

and  , the parameter of ARIMA (0,d,0) model:

, the parameter of ARIMA (0,d,0) model:  was estimated by applying the log Gaussian likelihood function as:

was estimated by applying the log Gaussian likelihood function as:  where R = Covariance matrix of

where R = Covariance matrix of  . The ARIMA (0,2,2) model coefficients are given in Table 3.

. The ARIMA (0,2,2) model coefficients are given in Table 3.| Parameter | Estimate |

|---|---|

| MA(1) | 0.434155 |

| MA(2) | 0.488944 |

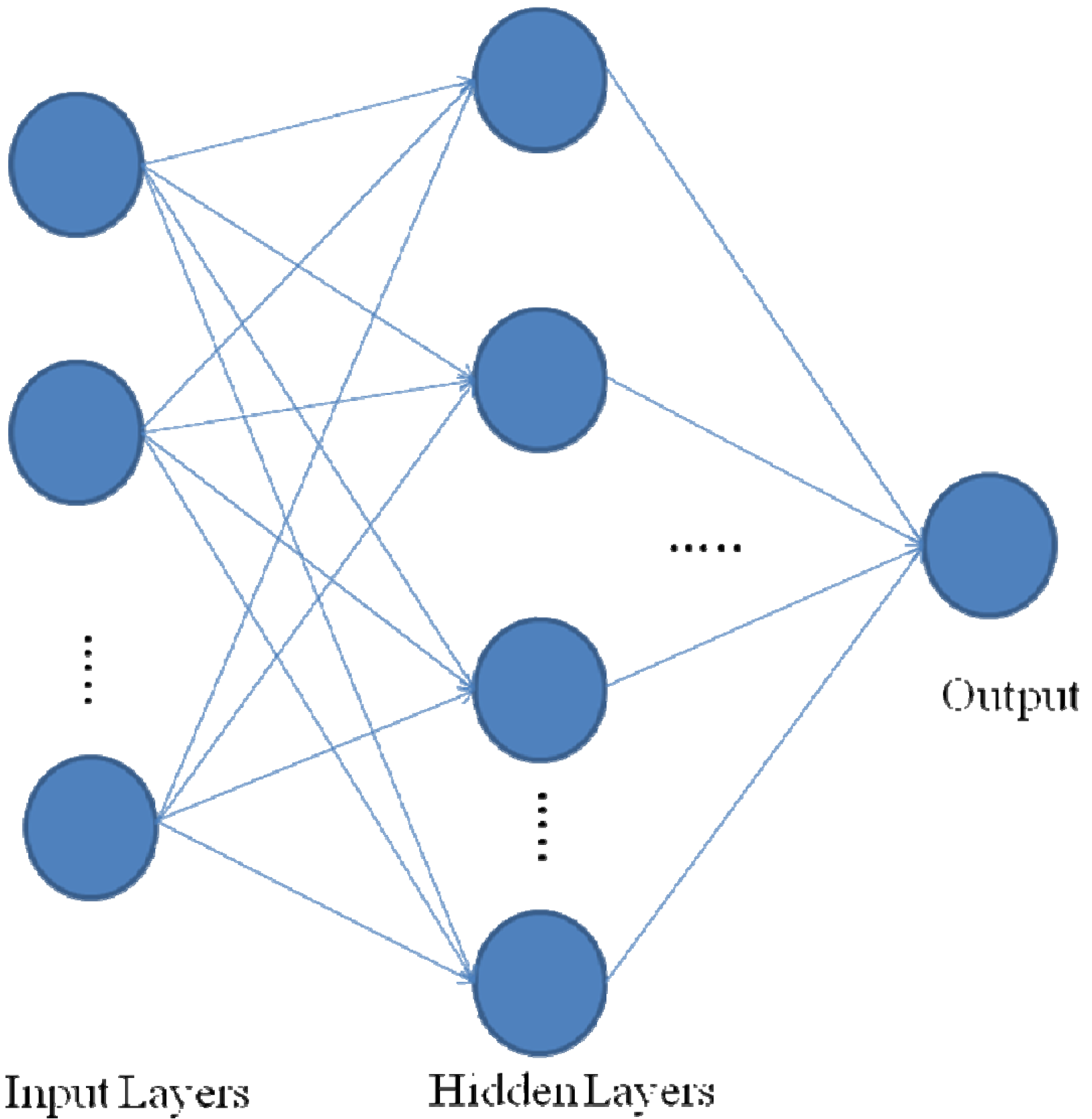

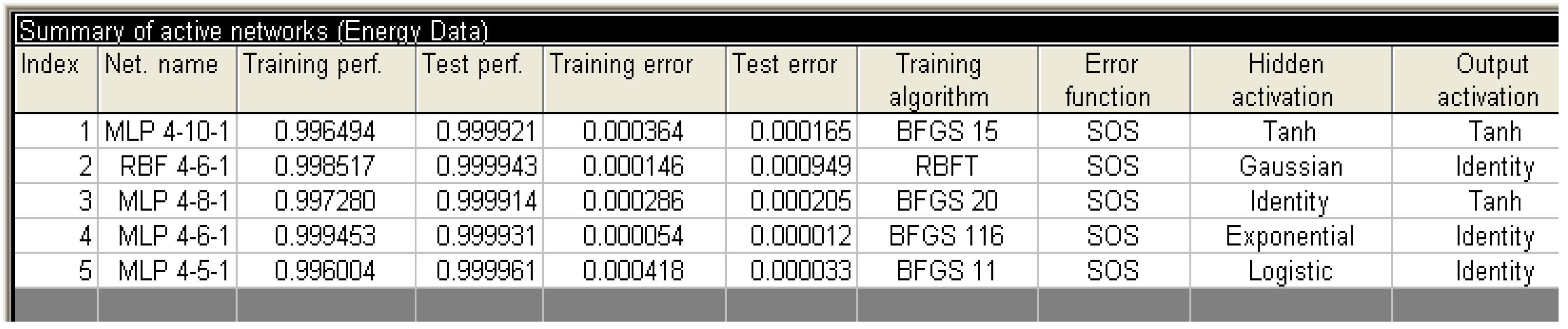

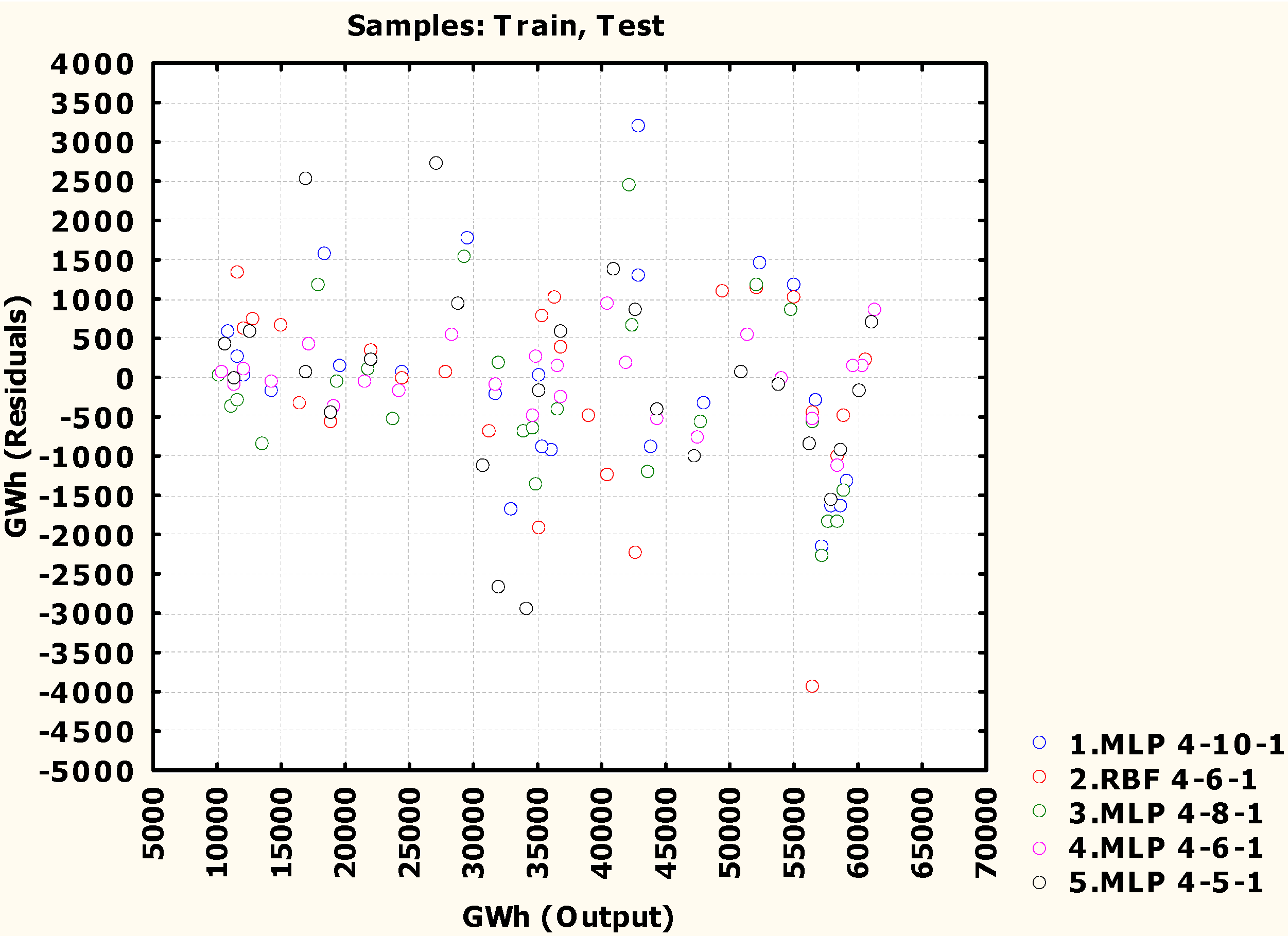

3.2. Artificial Neural Network

| Model | MAPE |

|---|---|

| MLP (4,10,1) | 2.770 |

| RBF (4,6,1) | 3.033 |

| MLP (4,8,1) | 2.598 |

| MLP (4,6,1) | 0.996 |

| MLP (4,5,1) | 3.2938 |

3.3. Multiple Linear Regression

4. Results

| Model | MAPE |

|---|---|

| ARIMA (0,2,2) | 2.80981 |

| MLP (4,6,1) | 0.996 |

| MLR | 3.2604527 |

| Pairs of Methods | p-value |

|---|---|

| ANN-MLR | 0.819095 |

| ANN-ARIMA | 0.784289 |

| Pairs of Methods | p-value |

|---|---|

| ANN-MLR | 0.785697 |

| ANN-ARIMA | 0.927594 |

5. Discussion

6. Conclusions

References

- Box, G.E.P.; Jenkins, G.M. Time Series Analysis: Forecasting and Control; Holden-Day: San Francisco, CA, USA, 1970; pp. 5–10. [Google Scholar]

- Montgomery, D.C.; Keats, J.B.; Runger, G.C.; Messina, W.S. Integrating statistical process control and engineering process control. J. Qual. Technol. 1994, 26, 79–87. [Google Scholar]

- Box, G.E.P.; Luceno, A. Statistical Control by Monitoring and Feedback Adjustment; John Wiley & Sons: New York, NY, USA, 1997. [Google Scholar]

- Ediger, V.S.; Akar, S. ARIMA forecasting of primary energy demand by fuel in Turkey. Energy Policy 2007, 35, 1701–1708. [Google Scholar] [CrossRef]

- Abdel-Aal, R.E.; Al-Garni, A.Z. Forecasting monthly electric energy consumption in eastern saudi arabia using univariate time-series analysis. Energy 1997, 22, 1059–1069. [Google Scholar] [CrossRef]

- Zhou, P.; Ang, B.W.; Poh, K.L. A trigonometry grey prediction approach to forecasting electricity demand. Energy 2006, 31, 2839–2847. [Google Scholar] [CrossRef]

- Cho, M.Y.; Hwang, J.C.; Chen, C.S. Customer Short Term Load Forecasting by Using ARIMA Transfer Function Model. In Proceedings of the International Conference on Energy Management and Power Delivery, EMPD’95, Singapore, 20–23 November 1995; pp. 317–322.

- Hsu, C.-C.; Chen, C.-Y. Regional load forecasting in Taiwan-applications of artificial neural networks. Energy Convers. Manag. 2003, 44, 1941–1949. [Google Scholar] [CrossRef]

- Catalao, J.P.S.; Mariano, S.J.P.S.; Mendes, V.M.F.; Ferreira, L.A.F.M. Short-term electricity prices forecasting in a competitive market: A neural network approach. Electr. Power Syst. Res. 2007, 77, 1297–1304. [Google Scholar] [CrossRef]

- Bakirtzis, A.G.; Petridis, V.; Klartzis, S.J.; Alexladis, M.C. A neural network short term load forecasting model for the greek power system. IEEE Trans. Power Syst. 1996, 11, 858–863. [Google Scholar] [CrossRef]

- Mohamed, Z.; Bodger, P. Forecasting electricity consumption in New Zealand using economic and demographic variables. Energy 2005, 30, 1833–1843. [Google Scholar] [CrossRef]

- Azadeh, A.; Ghaderi, S.F.; Tarverdian, S.; Saberi, M. Intergraion of artificial neural networks and genetic algorithm to predict electrical energy consumption. Appl. Math. Comput. 2007, 186, 1731–1741. [Google Scholar] [CrossRef]

- Azadeh, A.; Ghaderi, S.F.; Sohrabkhani, S. A simulated-based neural network algorithm for forecasting electrical energy consumption in Iran. Energy Policy 2008, 36, 2637–2644. [Google Scholar] [CrossRef]

- Hong, W.-C. Electric load forecasting by support vector model. Appl. Math. Model. 2009, 33, 2444–2454. [Google Scholar] [CrossRef]

- Ekonomou, L. Greek long-term energy consumption prediction using artificial neural networks. Energy 2010, 35, 512–517. [Google Scholar] [CrossRef]

- Pappas, S.S.; Ekonomou, L.; Karamousantas, D.C.; Chatzarakis, G.E.; Katsikas, S.K.; Liatsis, P. Electricity demand loads modeling using autoregressive moving average (ARIMA) models. Energy 2008, 33, 1353–1360. [Google Scholar] [CrossRef]

© 2011 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/3.0/).

Share and Cite

Kandananond, K. Forecasting Electricity Demand in Thailand with an Artificial Neural Network Approach. Energies 2011, 4, 1246-1257. https://doi.org/10.3390/en4081246

Kandananond K. Forecasting Electricity Demand in Thailand with an Artificial Neural Network Approach. Energies. 2011; 4(8):1246-1257. https://doi.org/10.3390/en4081246

Chicago/Turabian StyleKandananond, Karin. 2011. "Forecasting Electricity Demand in Thailand with an Artificial Neural Network Approach" Energies 4, no. 8: 1246-1257. https://doi.org/10.3390/en4081246