The Potential of a Surfactant/Polymer Flood in a Middle Eastern Reservoir

Abstract

:1. Introduction

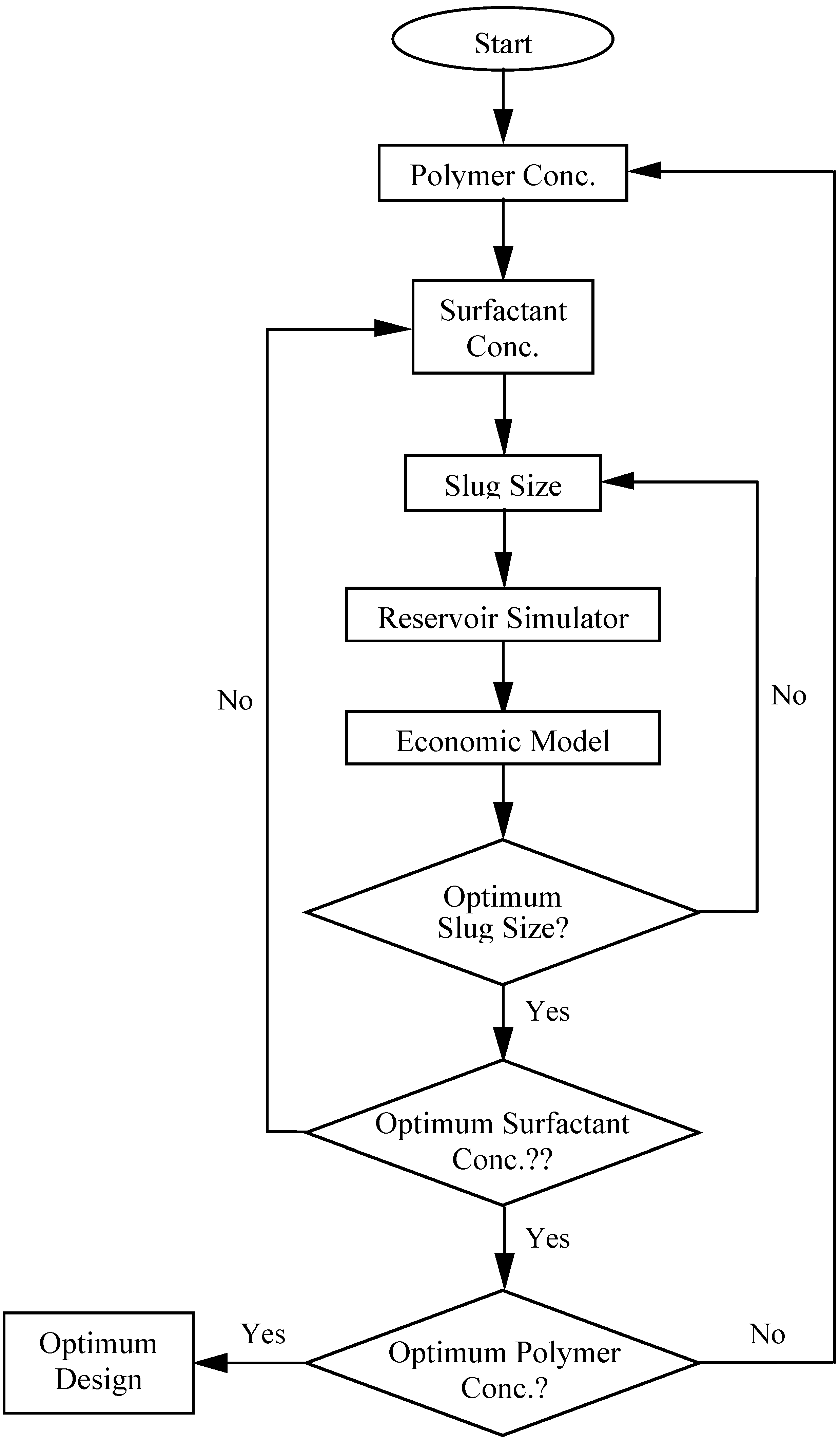

2. Optimization Methodology

3. Economic Model

4. Reservoir Management Strategies

4.1. EOR Selection

| Depth | 3800 ft |

|---|---|

| Temperature | 145 °F |

| Rock type | Sandstone |

| Formation thickness | 150 ft |

| Porosity | 17% |

| Permeability | 300 md |

| API gravity | 31° API |

| High percentage of light -intermediates | |

| Oil viscosity | 3.7 cp |

| Clays | little amount |

| Formation water | 9000 ppm chlorides |

| <200 ppm divalent ions | |

| Acid number | 0.1 mg KOH/g of oil |

4.2. Sector Model and EOR Process Optimization

| Oil Price | $60.00/bbl |

| Operating Cost | $0.30/bbl |

| Startup Cost | $85,000 |

| Surfactant Price | $1.85/lb |

| Polymer Price | $3.20/lb |

| Royalty | 11% |

| Taxes | 30% |

| Inflation Rate | 3% |

| Real Discount Rate | 10% |

| Run # | Chemical Slug (PV) | Surfactant Conc. (vol.%) | Poylmer Conc. (ppm) | Chemical Cost ($/bbl) | NPV (Million $) | IRR (%) | Economic Limit (years) |

|---|---|---|---|---|---|---|---|

| 1 | 0.75 | 0.05 | 800 | 4.42 | 285 | 44.20 | 9 |

| 2 | 1.00 | 0.05 | 800 | 4.61 | 293 | 45.01 | 10 |

| 3 | 1.50 | 0.05 | 800 | 4.85 | 297 | 46.04 | 12 |

| 4 | 2.0 | 0.05 | 800 | 4.91 | 294 | 46.12 | 11 |

| 5 | 0.50 | 0.10 | 800 | 5.11 | 278 | 45.01 | 10 |

| 6 | 1.00 | 0.10 | 800 | 5.32 | 283 | 43.22 | 11 |

| 7 | 1.50 | 0.10 | 800 | 5.58 | 292 | 44.21 | 12 |

| 8 | 1.75 | 0.10 | 800 | 5.75 | 291 | 44.35 | 13 |

| 9 | 0.30 | 0.15 | 800 | 6.26 | 252 | 32.75 | 11 |

| 10 | 0.60 | 0.15 | 800 | 6.46 | 311 | 33.45 | 10 |

| 11 | 1.50 | 0.15 | 800 | 7.31 | 332 | 34.12 | 13 |

| 12 | 0.25 | 0.25 | 800 | 7.15 | 201 | 20.88 | 11 |

| 13 | 0.50 | 0.25 | 800 | 7.41 | 231 | 19.35 | 12 |

| 14 | 0.75 | 0.25 | 800 | 7.81 | 270 | 20.34 | 15 |

| 15 | 1.25 | 0.25 | 800 | 8.50 | 262 | 24.15 | 12 |

| 16 | 0.20 | 0.40 | 800 | 8.05 | 179 | 12.65 | 10 |

| 17 | 0.40 | 0.40 | 800 | 8.43 | 229 | 13.92 | 11 |

| 18 | 0.70 | 0.40 | 800 | 9.02 | 241 | 7.11 | 12 |

| 19 | 1.00 | 0.40 | 800 | 9.48 | 211 | 2.54 | 13 |

| 20 | 0.10 | 0.50 | 800 | 7.95 | 101 | 8.10 | 11 |

| 21 | 0.20 | 0.50 | 800 | 8.72 | 150 | 7.02 | 13 |

| 22 | 0.40 | 0.50 | 800 | 9.53 | 122 | 4.65 | 15 |

| 23 | 0.80 | 0.50 | 800 | 11.50 | 2 | 1.06 | 16 |

| Optimum Design | |||||||

| 24 | 1.20 | 0.15 | 2800 | 6.90 | 340 | 35.21 | 14 |

5. Conclusions

- The study suggested that, on the basis of its characteristics, the reservoir is most suited for a surfactant/polymer flood.

- Based on sensitivity analysis and application of a discounted-cash-flow method to optimize the net present value of surfactant/polymer flood, the most economical design was achieved with a surfactant concentration of 0.15 vol.%, a chemical slug size of 1.20 PV, and a polymer concentration of 2800 ppm.

- The use of high concentration of polymer and low concentration of surfactant are beneficial for this reservoir.

Acknowledgment

References

- Gharbi, R. An expert system for selecting and designing EOR processes. J. Petrol. Sci. Eng. 2000, 27, 33–47. [Google Scholar] [CrossRef]

- Taber, J.J.; Martin, F.D.; Seright, R.S. EOR screening criteria revisited—Part 2: Applications and impact of oil prices. SPE Reserv. Eng. 1997, 12, 199–206. [Google Scholar] [CrossRef]

- Taber, J.J.; Martin, F.D.; Seright, R.S. EOR screening criteria revisited—Part 1: Introduction to screening criteria and enhanced recovery field projects. SPE Reserv. Eng. 1997, 12, 189–198. [Google Scholar] [CrossRef]

- Trujillo, M.; Mercado, D.; Maya, G.; Castro, R.; Soto, C.; Pérez, H.; Gómez, V. Selection Methodology for Screening Evaluation of Enhanced-Oil-Recovery Methods. In Presented at the SPE Latin American and Caribbean Petroleum Engineering Conference, Lima, Peru, 1–3 December 2010. SPE 139222.

- Aladasani, A.; Bai, B. Recent Developments and Updated Screening Criteria of Enhanced Oil Recovery Techniques. In Presented at the SPE International Oil and Gas Conference and Exhibition, Beijing, China, 8–10 June 2010. SPE 130726.

- Yee, H.V.; Kechut, N.I.; Wan Razak, N. Enhanced-Oil-Recovery Potential of Heavy-Oil Fields in Africa. In Presented at the SPE International Oil Conference and Exhibition, Veracruz, Mexico, 27–30 June 2007. SPE 108513.

- Resnyanskiy, P.; Babadagli, T. Development of marginal/mature oil fields: A case study of the sinclair field. J. Can. Petrol. Technol. 2010, 49, 29–35. [Google Scholar] [CrossRef]

- Nguyen, N.T.B.; Dang, C.T.Q.; Chung, W.B.; Phung, T.H.; Lee, H.Y. Integrating geological characterization and historical production analysis to optimize field management of lower miocene reservoir in White Tiger Field, Vietnam. J. Can. Petrol. Technol. 2010, 49, 8–18. [Google Scholar] [CrossRef]

- Shahid, M.; Altaf, B.; Tanvir, M.Z.; Memon, A.A. Implementation of Surface Operating Conditions in Subsurface Reservoir Simulation Model using Eclipse Simulator—A Case Study of Mari Gas Field—Pakistan. In Presented at the SPE/PAPG Annual Technical Conference, Islamabad, Pakistan, 10–11 November 2010. SPE 142844.

- Larijani, G.R.; Gallivan, J.D.; Pepelyaev, R.V. Can Simulation Models Help in Oil and Gas Field Management? An Assessment Methodology for Reservoir Modeling. In Presented at the SPE Russian Oil and Gas Conference and Exhibition, Moscow, Russia, 26–28 October 2010. SPE 136318.

- Urdaneta, M.C.; Angel, F.J.; Askoul, Y.E.; Guevara, J.; González, E.R. Simulation of a Complex Fluvial-Deltaic Reservoir to Identify Opportunities to Improve Oil Recovery in a Mature Oil Field: A Case History. In Presented at the SPE Russian Oil and Gas Conference and Exhibition, Moscow, Russia, 26–28 October 2010. SPE 134209.

- Legrand, N.; de Kok, J.; Neff, P.; Clemens, T. Recovery Mechanisms and Oil Recovery from a Tight, Fractured Basement Reservoir, Yemen. In Presented at the SPE Annual Technical Conference and Exhibition, Florence, Italy, 20–22 September 2010. SPE 133086.

- Gharbi, R.; Garrouch, A. The performance of miscible EOR displacements in geostatistically generated permeable media using horizontal wells. J. Porous Media 2001, 4, 113–126. [Google Scholar] [CrossRef]

- Dakhlia, H.; Wu, W.J.; Lim, M.T.; Delshad, M.; Pope, G.A.; Sepehrnoori, K. Simulation of Surfactant Flooding using Horizontal Wells. In Presented at the Petroleum Society of CIM 46th Annual Technical Meeting, Banff, Alberta, Canada, 14–17 May 1995.

- Gharbi, R.; Peters, E.J.; Garrouch, A. Effect of heterogeneity on the performance of immiscible displacement with horizontal wells. In J. Petrol. Sci. Eng.; 1997; Volume 18, pp. 35–47. [Google Scholar] [CrossRef]

- Dougherty, E.L.; Sarkar, J. Current Investment Practices and Procedures: Results of a Survey of U.S. Oil and Gas Producers and Petroleum Consultants. In Presented at the SPE Hydrocarbon Economics and Evaluation Symposium, Dallas, TX, USA, 29–30 March 1993. SPE 25824.

- Allen, F.H.; Seba, R.D. Economics of Worldwide Petroleum Production; Oil & Gas Consultants International: Tulsa, OK, USA, 1993; pp. 10–55. [Google Scholar]

- Bradley, M.E.; Wood, A.R.O. Forecasting oilfield economic performance. J. Petrol. Technol. 1994, 11, 9–65. [Google Scholar]

- Saad, N. Field Scale Simulation of Chemical Flooding. Ph.D. Dissertation, The University of Texas at Austin, Austin, TX, USA, 1989; pp. 15–211. [Google Scholar]

© 2012 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gharbi, R.; Alajmi, A.; Algharaib, M. The Potential of a Surfactant/Polymer Flood in a Middle Eastern Reservoir. Energies 2012, 5, 58-70. https://doi.org/10.3390/en5010058

Gharbi R, Alajmi A, Algharaib M. The Potential of a Surfactant/Polymer Flood in a Middle Eastern Reservoir. Energies. 2012; 5(1):58-70. https://doi.org/10.3390/en5010058

Chicago/Turabian StyleGharbi, Ridha, Abdullah Alajmi, and Meshal Algharaib. 2012. "The Potential of a Surfactant/Polymer Flood in a Middle Eastern Reservoir" Energies 5, no. 1: 58-70. https://doi.org/10.3390/en5010058