1. Introduction

There are two main transaction modes in a deregulated electric power industry, namely, competitive bidding and bilateral contract. Competitive biddings are used in the energy, spot, firm-transmission-right and ancillary service markets while bilateral contract is adopted outside the competitive market for any two individual entities, buyer and seller [

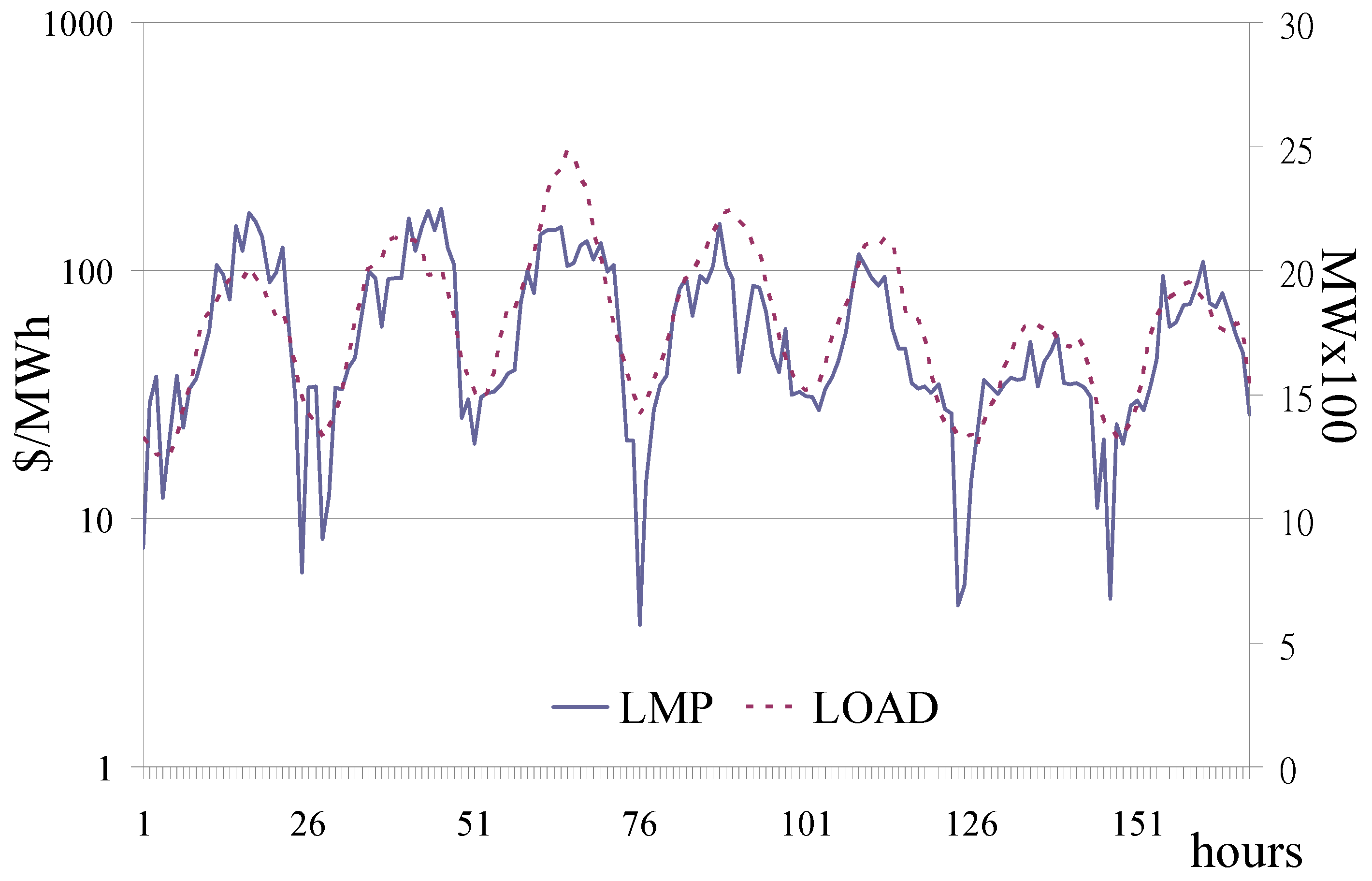

1,

2]. For either transaction mode, the electricity price information serves as an essential signal for all entities to adjust their offers/bids and/or contract prices. In particular, locational marginal pricing (LMP) is one of the most popular modes for pricing electricity in a deregulated electricity market. LMPs can reflect the electricity value at a node and may be discriminated at different nodes in a power network [

3]. LMPs provide information that is helpful to market participants in developing their bidding strategies. It is also a vital indicator for the Security Coordinator to mitigate transmission congestion [

4]. LMPs reveal important information for both the spot market and entities with bilateral contracts.

Past studies have investigated short-term System Marginal Price (SMP) forecasting [

5,

6]. Because the SMP is irrelevant to transmission constraints, forecasting LMPs subject to transmission constraints is more difficult than forecasting Market Clear Prices (MCPs). Current methods for short-term LMP forecasting can be classified at least into three groups: hour-ahead, day-ahead and week-ahead forecastings.

The recurrent neural network integrated with fuzzy-c-means was proposed for hour-ahead LMP forecasting in [

7]. Linguistic descriptions in the PJM market were transformed into fuzzy membership functions associated with the recurrent neural network for forecasting volatile hour-ahead LMP variations when contingency occurs [

8]. This paper investigates the more difficult problem related to the day-ahead price forecasting, which may be applied to the day-ahead market and will be discussed in the next paragraph.

In recent years, Contreras

et al. [

9] used the ARIMA model and Nogales

et al. [

10] used the dynamic regression approach and transfer function approach to predict the next-day (day-ahead) electricity prices. However, there is no discussion on extracting the market features for usage of these approaches in [

9,

10]. Li

et al. [

11] integrated the fuzzy inference system with least-squares estimation to conduct the day-ahead electricity price forecasting. The “week day”, “yesterday price” and “local demand” were considered in the 18 antecedent (premise or condition) parts of the fuzzy rules in [

11]. Giving the membership functions of these three linguistic variables is quite heuristic. Moreover, the “local demand” for the fuzzy rules is not a forecasted but an actual value, which is generally not available in the day-ahead market. Amjady and Keynia [

12] combined a mutual information technique (MIT) with the cascaded neuro-evolutionary algorithm (NEA) for the day-ahead electricity price forecasting. In [

12], 14 features in the market were selected by MIT for 24 feedforward neural networks trained by the NEA. No reasonable explanation was found for these 14 features. Moreover, many (24) neural networks make the method impractical for industrial application. Garcia

et al. [

13] presented an approach to predicting next-day electricity prices using the Generalized Autoregressive Conditional Heteroskedastic (GARCH) methodology, which is an extended auto-regressive integrated moving average (ARIMA). Amjady [

14] presented a fuzzy neural network with an inter-layer and feedforward architecture using a new hypercubic training mechanism. The proposed method predicted hourly market-clearing prices for the day-ahead electricity markets. Again, there is no discussion on extracting the market features for usage of the GARCH in [

13,

14]. Coelho and Santos [

15] proposed a nonlinear forecasting model based on radial basis function neural networks (RBF-NNs) with Gaussian activation functions. Partial autocorrelation functions (PACF), which relies on the mutual linear dependency among studied parameters, was used to identify the market features. However, the relation among power market features is very nonlinear.

The problem of week-ahead price forecasting is generally easier than that of day-ahead price forecasting because the price pattern of a day is similar to that of its corresponding week-ahead day. Catalao

et al. [

16] proposed a wavelet-based Sugeno type fuzzy inference system to predict the electricity price in the electricity market of mainland Spain. However, the selection of numbers of membership functions in [

16] is a trade-off between refining and sparseness. Che and Wang [

17] presented a method based on support vector regression and ARIMA modeling; however, only the MCPs of California electricity market were used to examine the accuracy of the proposed method. The method has not been applied to forecasting LMPs, whose pattern is more nonlinear than MCPs’.

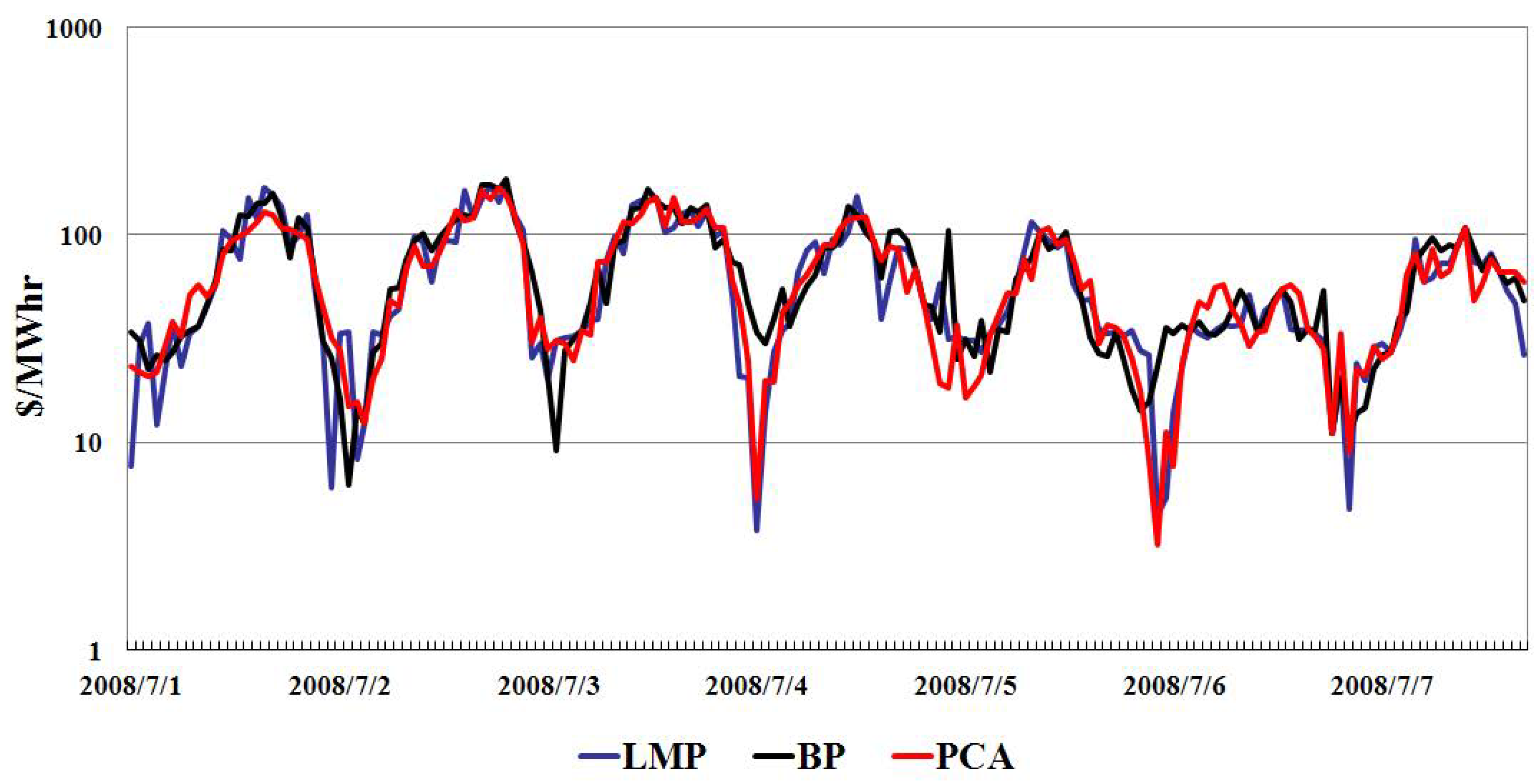

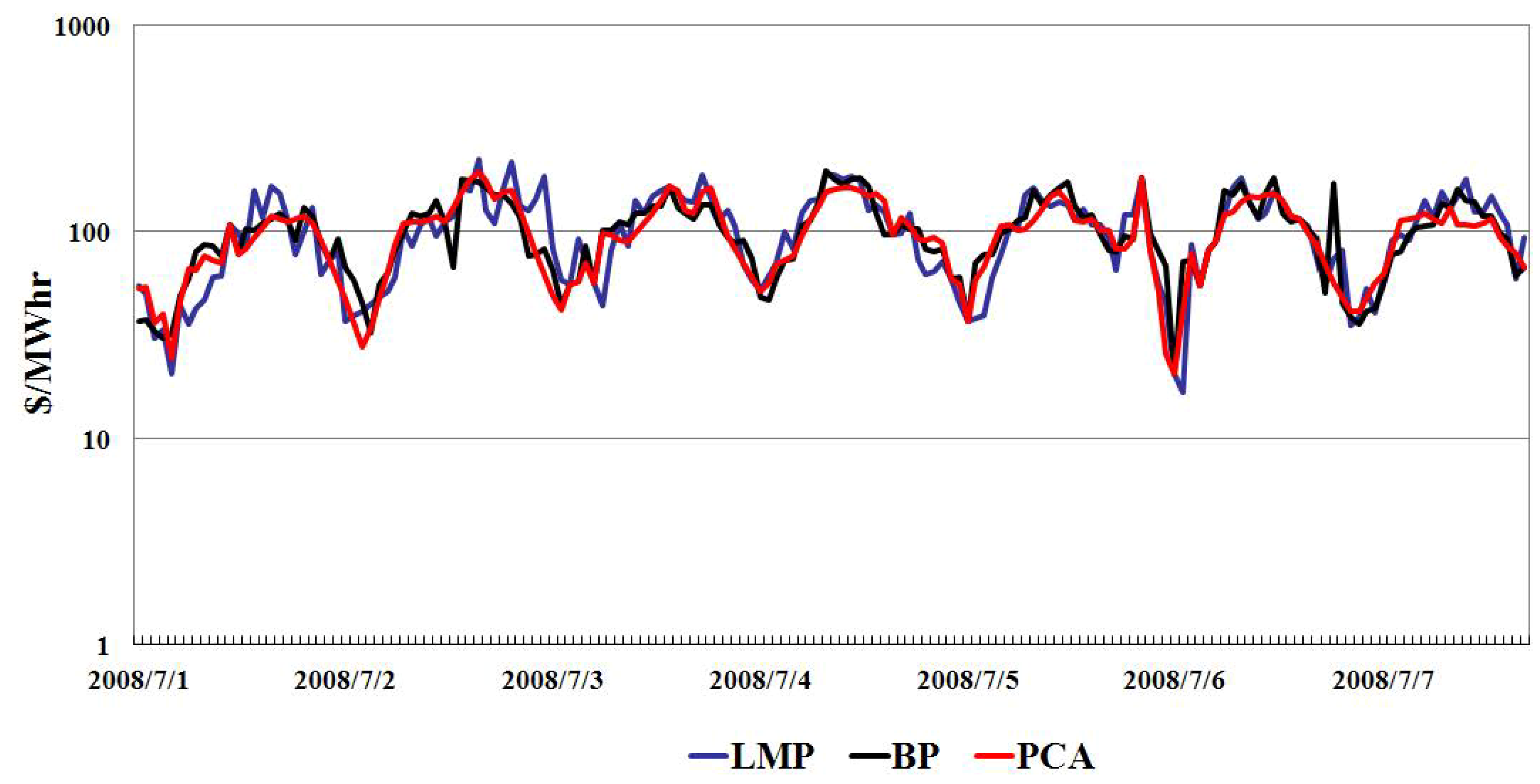

Because LMPs vary dramatically, it is difficult to analyze the related data with traditional techniques (e.g., regression analysis). Like other forecasting problems [

18,

19,

20], the LMP forecasting needs feature extraction incorporating a powerful approach. As described above, the neural network is suitable for nonstationary time-series prediction, providing satisfactory results. In this paper, a principal component analysis (PCA) neural network cascaded with the multi-layer-feedforward (MLF) neural network is proposed for day-ahead LMP forecasting. The PCA neural network is used to extract essential features in the electricity market. It also helps reduce high-dimensional data into low-dimensional ones, which serve as inputs for the MLF neural network.

The rest of this paper is organized as follows: the PJM real-time market data will be described in

Section 2. The proposed PCA neural network cascaded with the MLF neural network for forecasting day-ahead LMPs will be given in

Section 3. Simulation results obtained using the PJM data are presented in

Section 4. Concluding remarks are provided in

Section 5.

3. The Proposed Method

The hybrid PCA neural network is developed by combining the unsupervised PCA and supervised MLF neural networks to conduct day-ahead LMP forecasting. The PCA neural network is employed to extract essential features in the electricity market. The PCA neural network can also reduce high-dimensional data into low-dimensional ones, which serve as inputs of the MLF neural network to reduce the training CPU time.

3.1. Principal Component Analysis Neural Network

The purpose of the PCA neural network is to find a set of P orthonormal vectors (OVs) in a Q-dimensional space (Q ≥ P), such that these OVs will account for as much variance of the input data as possible. OVs are actually P eigenvectors associated with the P largest eigenvalues of the E(), where x denotes the Q-dimensional input column vector, i.e., x = (x1 x2 … xQ)t. The direction of the q-th principal component will be along the q-th eigenvector, q = 1, 2, .., Q.

Let symbol

t be the training index. This paper used Sanger’s method [

21] to update the weightings between the neurons of the PCA network as follows:

where

is a parameter of learning rate and

is the output. Equation (1) is employed to train a neural network consisting of P linear neurons so as to find the first P principal components. More specifically, Generalized Hebbian Algorithm was able to make

p = 1, 2, …, P, converge to the first P principal component directions, in sequential order:

where

vi is a normalized eigenvector associated with the

i-th largest eigenvalue of the correlation matrix. It was shown that if

pj = 1, 2, …,

p − 1 have converged to

pj = 1, 2, …,

p − 1, respectively, then the maximal eigenvalue

and the corresponding normalized eigenvector

of the correlation matrix of

xp,

i.e., C

p ≡

E(

), are exactly the

p-th eigenvalue and the

p-th normalized eigenvector

of the correlation matrix of

x,

i.e., C ≡

E(

), respectively. Consequently, neuron

p can find the

p-th normalized eigenvector of C. Detailed explanations can be found in [

21].

It was shown that should be smaller than the reciprocal largest eigenvalue of E(xxt) to ensure the convergence of training a PCA neural network. When the training process is convergent, , p = 1, 2, …, P, converges to the p-th eigenvector of E(xxt).

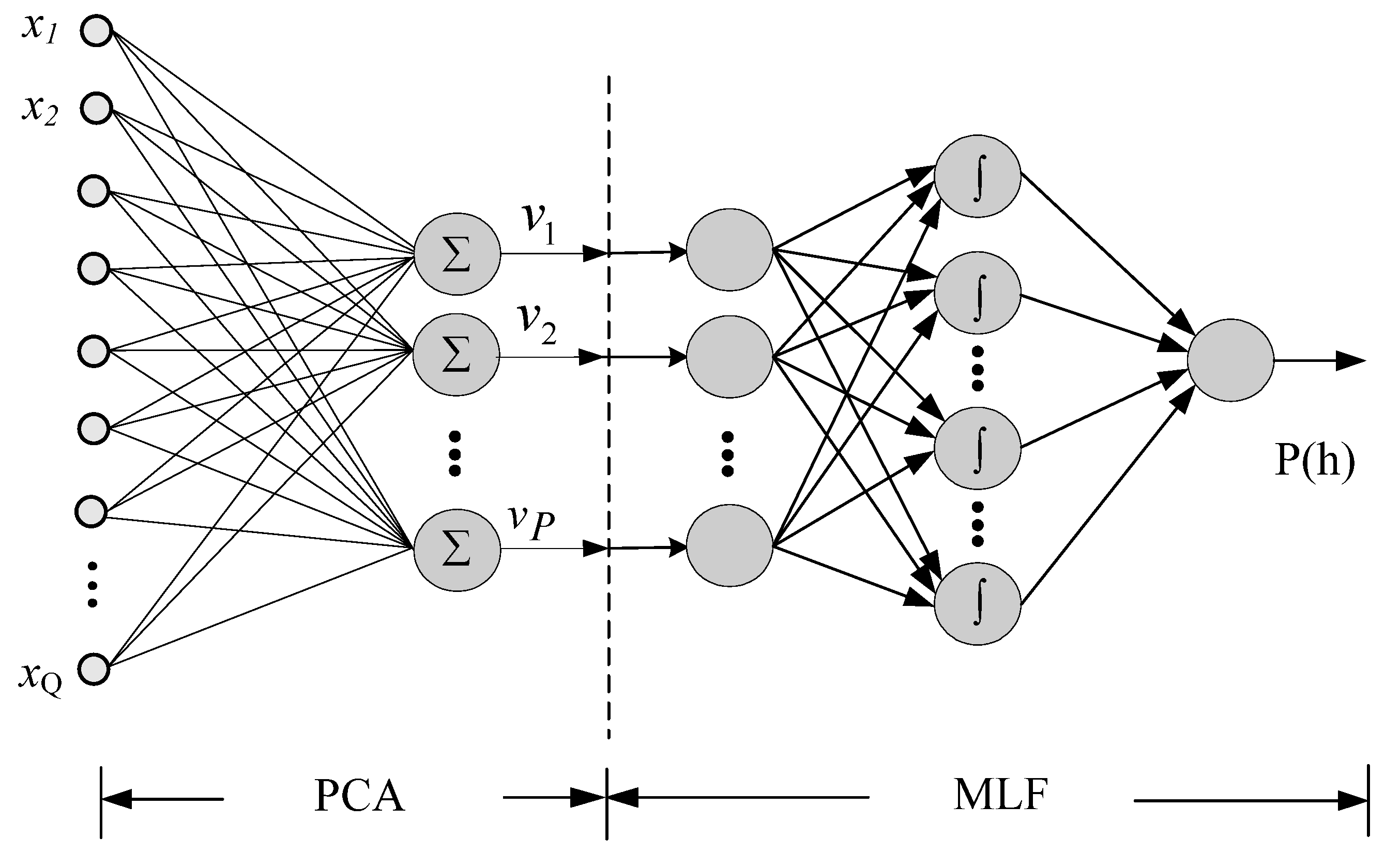

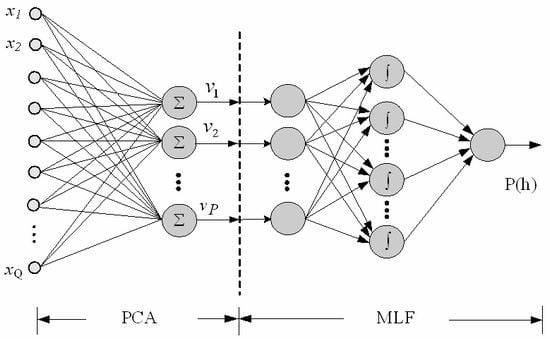

Figure 3 shows the configuration of the hybrid PCA neural network: The left part of

Figure 3 is the unsupervised PCA neural network while the right part is the supervised MLF neural network. Because the training time of unsupervised PCA neural network is trivial while that of supervised MLF is considerable, PCA neural network is adopted to reduce both the dimension of training data and the training time for the cascaded MLF network trained by the back-propagation algorithm, which is well known and ignored here.

In the proposed hybrid PCA, the new hidden layer consists of 20 neurons. The number (p) of orthonormal vectors is 24 or 48, depending on the numbers of inputs. After training the unsupervised PCA, the supervised MLF is trained, using the frozen weights of the unsupervised PCA. The training sets are identical for both unsupervised and supervised NNs.

Figure 3.

The proposed hybrid PCA neural network.

Figure 3.

The proposed hybrid PCA neural network.

3.3. Moving Data Windows for Forecasting

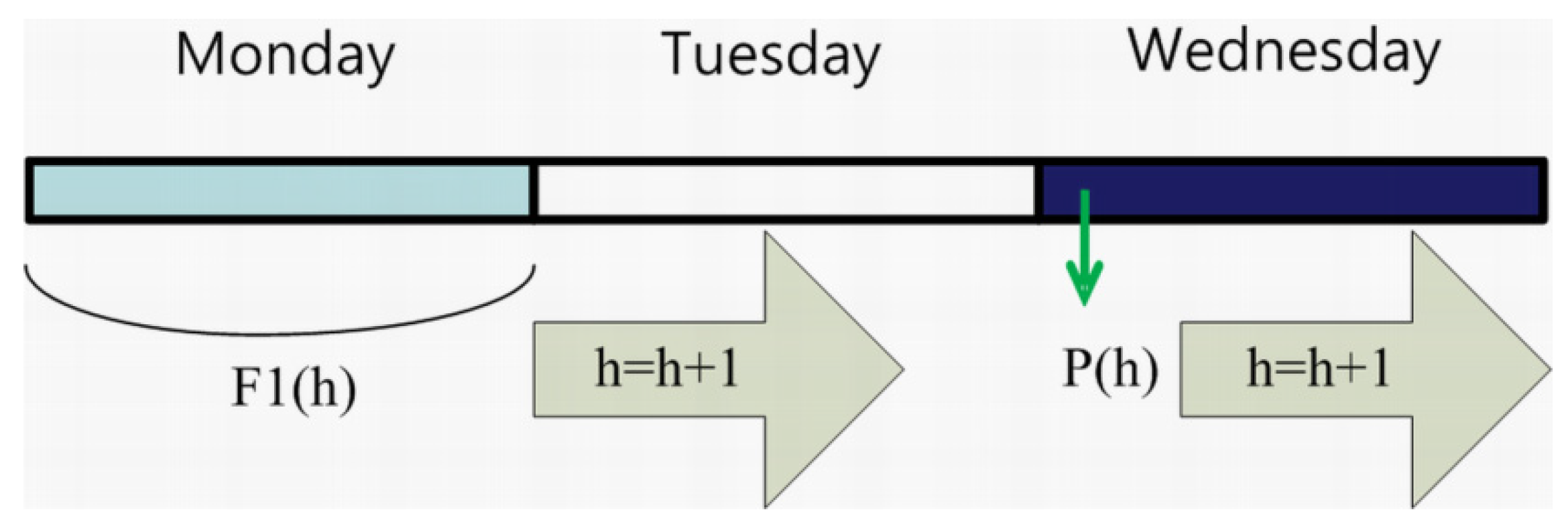

P(h) at the output layer is paired with F1(h), F2(h), F3(h) or F4(h). More specifically, assume that F1(h) is considered and the 24 LMPs on Wednesday (next day) are forecasted.

Figure 4 illustrates the moving data window corresponding to the forecasted LMP. Hence, the paired training data are as follows: (F1(h), P(h)), (F1(h + 1), P(h + 1)), …, (F1(h + 23), P(h + 23)). In

Figure 4, the first data set involves only Monday and Wednesday. The last 23 data on Monday and the first data on Tuesday will be paired with P(h + 1) for the second data set. Restated, forecasting 24 LMPs on Wednesday will be completed at 23:00 p.m. on Tuesday.

When the proposed hybrid PCA neural network is used in the day-ahead market or in the testing stage, the input data for the past day (e.g., Monday in

Figure 4) and this day (e.g., Tuesday in

Figure 4) are known and output (forecasted) data for the next day (e.g., Wednesday in

Figure 4) is unknown.

Figure 4.

Moving data window (F1(h)) corresponding to forecasted P(h).

Figure 4.

Moving data window (F1(h)) corresponding to forecasted P(h).

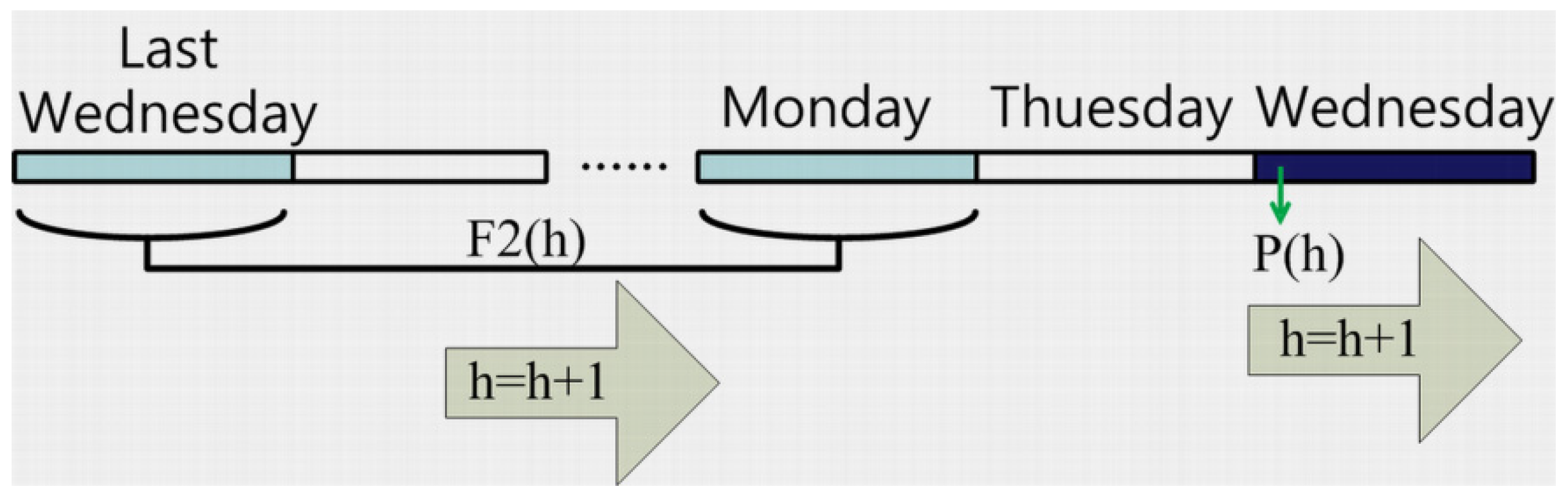

Assume that this day is Tuesday and LMPs on Wednesday are to be forecasted.

Figure 5 shows the moving data window for F2(h) paired with P(h). The paired training data are as follows: (F2(h), P(h)), (F2(h + 1), P(h + 1)), …, (F2(h + 23), P(h + 23)). As shown in

Figure 5, the first data set involves only the last Wednesday, Monday and Wednesday. The time index h will be increased by one at a time until h + 23. Restated, forecasting 24 LMPs on Wednesday will be completed at 23:00 p.m. on Tuesday.

Figure 5.

Moving data window (F2(h)) corresponding to forecasted P(h).

Figure 5.

Moving data window (F2(h)) corresponding to forecasted P(h).

3.4. Numbers of Neurons in Different Layers

The numbers of input, output, second, and fourth layers are discussed as follows:

- (1)

The numbers of input neurons for the hybrid PCA neural networks are 48, 96, 49 and 97 for F1(h), F2(h), F3(h) and F4(h), respectively. That is, subscript Q in

Figure 3 can be 48, 96, 49 or 97.

- (2)

The number of neurons in the MLF output layer is one (i.e., P(h)), regardless of F1(h), F2(h), F3(h) and F4(h) being considered.

- (3)

Because the purpose of the PCA neural network is to find a set of P orthonormal vectors (OVs) in a Q-dimensional space, P is expected to be smaller than the corresponding number of inputs. It is intuitive to consider P in

Figure 3 to be 24 for the studied problem with Q = 48 or 49 because there are 24 hours in a day. Similarly, P = 48 while Q = 96 or 97.

- (4)

The common number of neurons for the fourth (hidden) layer is (P + number of output neurons)/2 or (P × number of output neurons)0.5. The simulation results show no significant difference between these two alternatives.