ARAAC: A Rational Allocation Approach in Cloud Data Center Networks

Abstract

:1. Introduction and Problem Statement

- Allocating the network resources on the basis of the market clearing price may help the cloud-DCN provider avoid losses, however, it can never achieve profit maximization. Indeed, knowing that the offered bid prices will not be considered for the charging issues, bidders will always tend to offer high bid prices simply to win the auction. Then all those who win the auction pay the same price defined by that market clearing price.

- The absence of a competition environment in such an allocation scenario can motivate exaggeration actions. Bidders with no incentives to truthfully reveal their true needs and real resource requirements, may tend to exaggerate their needs and ask for more resources. Living with such huge growth in the global network traffic, exaggerated actions may impose real waste for the available cloud resources.

- Cutting portions from the requested network resources contradicts the tenants’ satisfaction goals. In truth, those bidders who receive only portions of what they have asked for may not be satisfied as this may affect their QoS requirements.

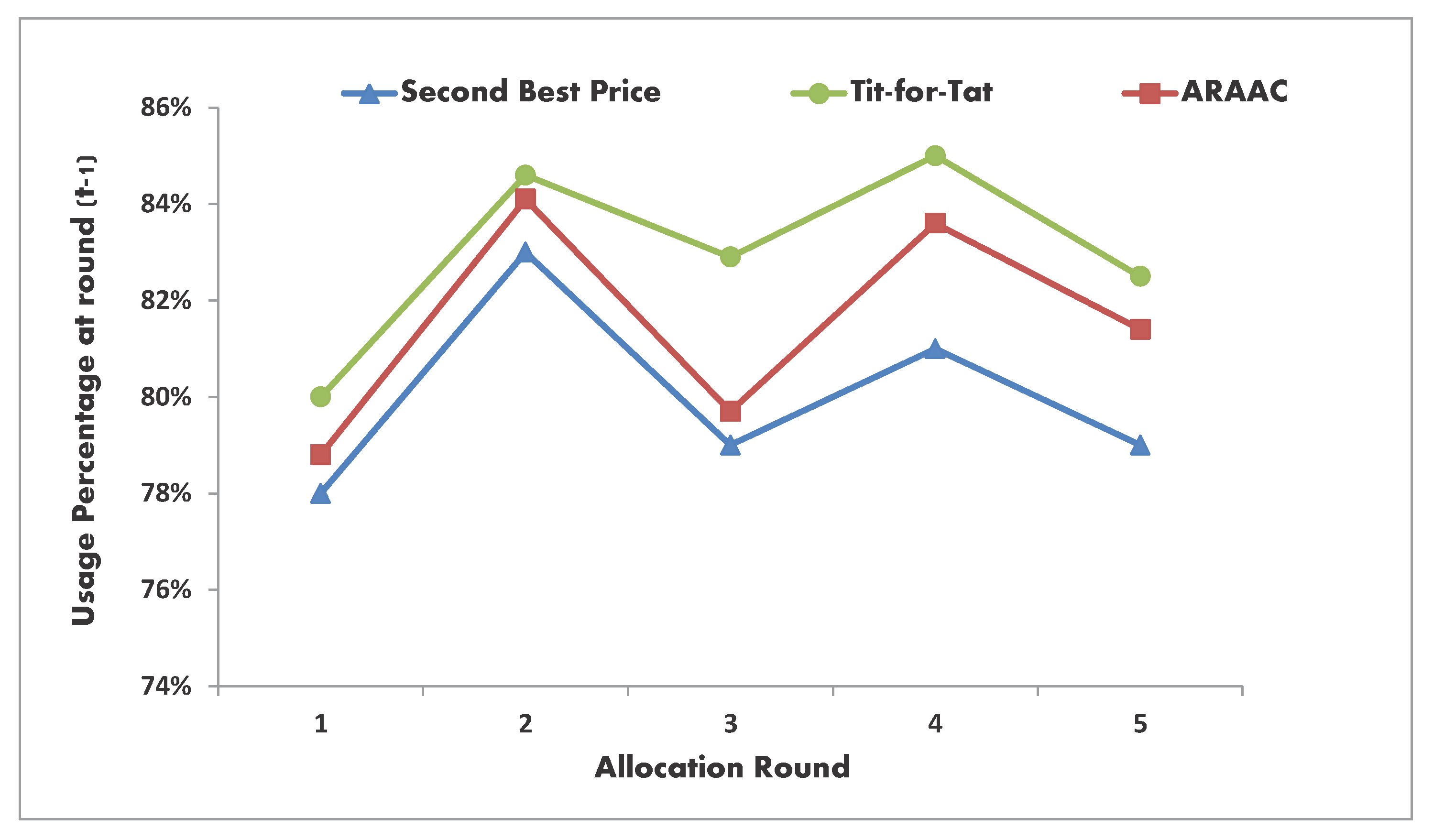

- ARAAC provides for strategy-proofness [5] and an incentive-compatible [6] solution that encourages truthful reveals for the required cloud-DCN resources, thus leading to high utilization rates. This comes through the competition environment enforced throughout the SBP [7] and the behavior-based reputation mechanisms.

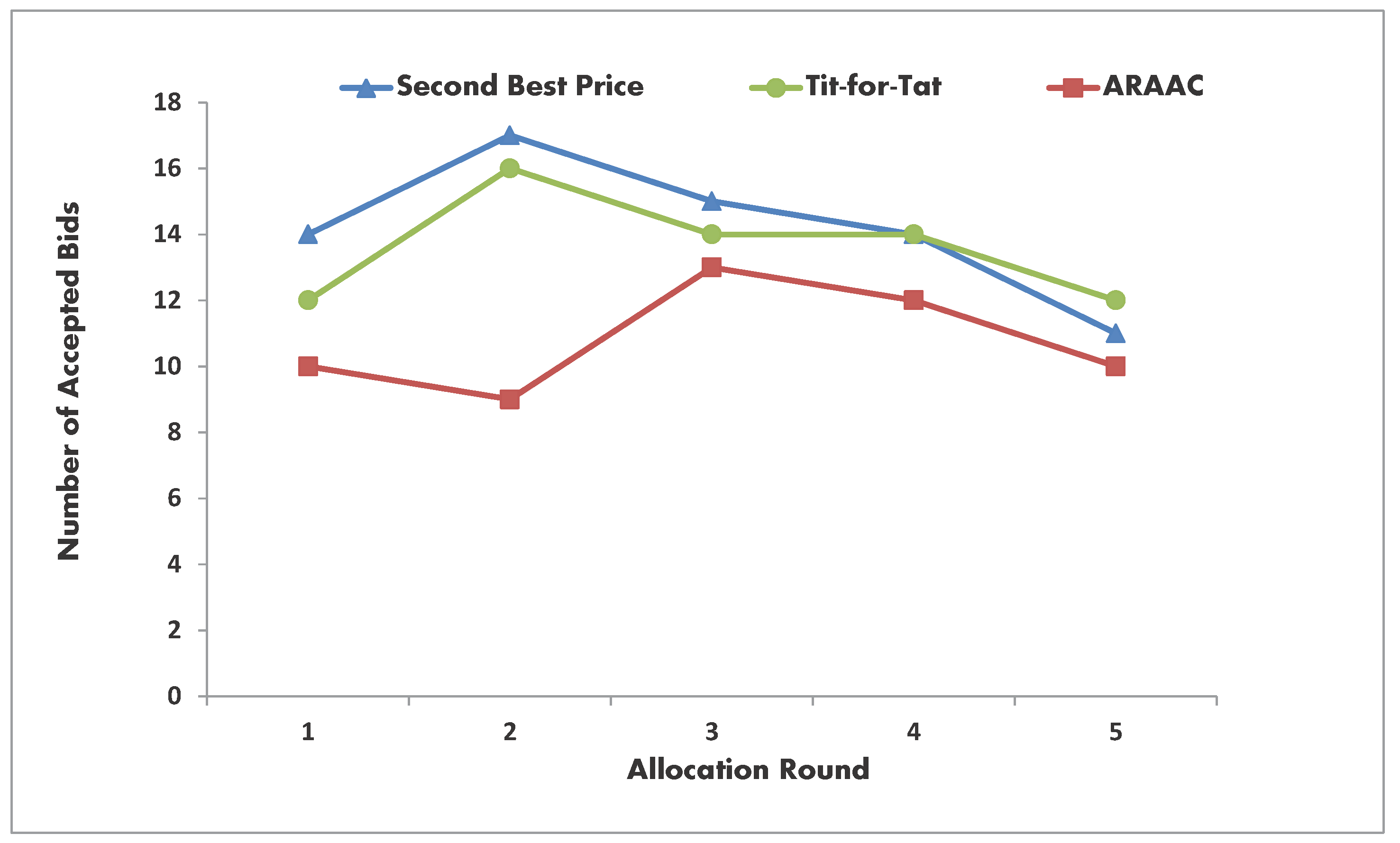

- ARAAC allows for a fair allocation model that motivates the tenants’ positive behaviour, while it does not affect their required service levels. Fairness comes from the fact that ARRAC allocates the resources to those bidders with positive behavior and competing offered prices.

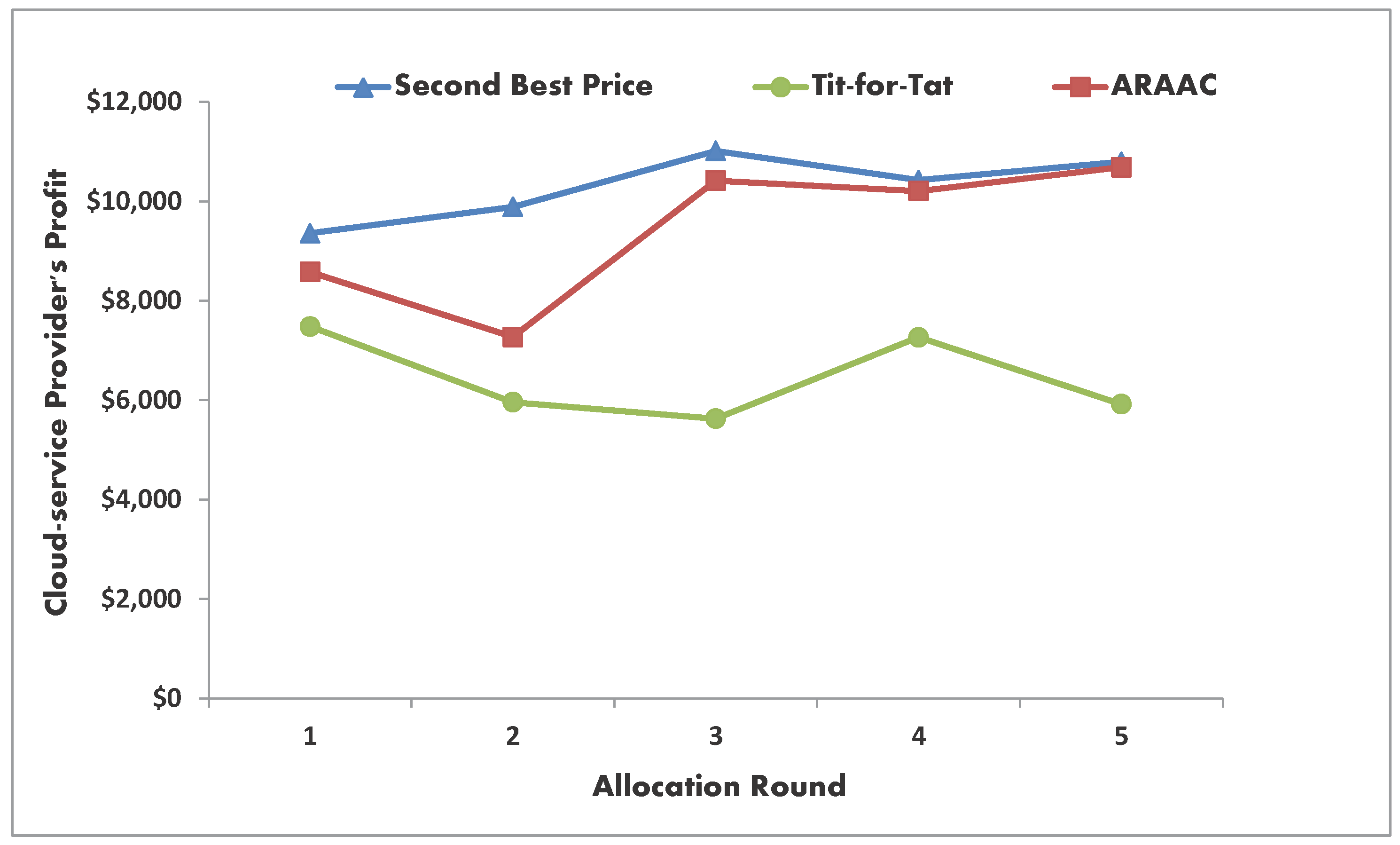

- ARAAC motivates reasonable bid prices that maximizes the cloud-DCN providers profits while not being a greedy allocation approach [8]. ARAAC chooses the winning bidders not only through their offered bid prices, but according to their usages’ behavior.

2. ARAAC: A Rational Allocation Approach in Cloud-Service Networks

2.1. Definitions and Mathematical Modeling

- Definition 1: (Provider’s Utility.) The utility of the cloud-DCN provider in such a game is represented in the charges collected from the cooperative tenants nominated for allocation. In ARAAC, this is calculated as shown in Equation (1), which adds the different charges collected per accepted request i, ∀i∈N:where refers to the requested resource units by bidder i, and is the price-unit chosen by the pricing policy of the cloud-DCN provider. This function is bounded by the following constraints:Behavior-Based Threshold:For each bidder i, an identification reference is used to link i to a database that collects information related to the bidder’s previous history, in regard to its resource utilization behavior throughout a certain time window predefined by the market providers. For bidder i to be listed among the candidates for allocation, its behavior score needs to pass the behavioral threshold value . At each auction round t, the threshold value may be revised by the providers according to the market state. The formulation of this constraint is given by:Leasing Price-unit Threshold:For each bidder i, to be considered for allocation among the set of candidates, its offered price-unit needs to be higher than or at least equal a predefined price-unit threshold . The process of defining such threshold follows the providers’ profit objectives and market state at the allocation period t. With such threshold, ARAAC allows to maintain the providers’ profit objectives and avoids losses. Such constraint is given by:Resource Availability:To control the allocation decision, those bidders who satisfy the aforementioned two constraints are sorted in N according to their offered price-units . After having the bidders sorted, and according to their required resource units , for each bidder i, the provider checks if it has sufficient resource capacities for allocation in accordance to the residual resources after previous allocations. At each auction round t, the cloud-DCN provider defines the portion of the resources available for allocation . Hence, each candidate bidder i needs to pass the following:Those bidders who pass the aforementioned three constraints are stored in the candidate list C, and thus are charged for their granted services according to the pricing policy set by the cloud-DCN providers. In ARAAC, the model chooses the SBP policy to set the charges for its service tenants.

- Definition 2: (Tenants’ Utility.) The utility of the service-tenants (i.e., the bidders) in the allocation game is represented by the gain a tenant can collect from participating in the auction. Being a candidate for allocation, and besides the service granted by the allocation itself, the financial-utility is calculated in Equation (5) below as the difference between the sum of the offered price unit and the charged price for the required service resource units . Intuitively, the objective for each tenant i is to maximize the value of given below:The calculation of the tenants’ utility is also bounded by the constraint discussed next:Partial Allocation is Not Accepted:To ease the presentation of such constraint, we define as a set of entities referred to by where . It is worth to highlighting that allocation in this work is for service instances, and such instances require various types of network and computing resources. This includes resources such as bandwidth, switching capacities, memory space, and CPU cycles. Hence, the allocation of is met only when all the j entities are granted, otherwise the allocation is not considered. Such constraint is described by:

- Definition 3: (Incentive Compatible Approach). The proposal of ARAAC provides an incentive compatible [6] approach that motivates the rational service-tenants to reveal their truthful valuation of the required services (i.e., resource units). Indeed, bids with low price units may be excluded from the auction, as they do not satisfy a predefined price-unit threshold , while others with reasonable offered price units are rewarded by having the required resources allocated, and only pay the next highest price (i.e., the SBP in row). This allows for positive utilities. Moreover, ARAAC also motivates efficient resource utilization. True, bidders with bad utilization behavior records may find themselves deprived of being candidates for allocation in this round and others, regardless of their offered prices units.

- Definition 4: (Individual Rationality [10]). ARAAC can be considered as an approach that provides for rational allocation. Regardless of the offered price-units, it excludes those bidders with low reputation records, and instead, it allows others with potentially lower offered prices for allocation, as they have attained certain levels of reputation. Accordingly, we can clearly state that ARAAC maximizes the providers’ profits while not being greedy. Indeed, among the bids with high offered price units, only those with acceptable reputation records remain; others are excluded regardless of their offered bids.

2.2. ARAAC’s Allocation Algorithm

2.3. Benchmark Mechanisms

2.3.1. SBP: Second Best Price

2.3.2. Tit-for-Tat & Second-Best Price

3. Simulation Results

3.1. Service and Tenant Instances

3.2. Discussion

4. Related Work

5. Conclusions

Author Contributions

Conflicts of Interest

References

- Duan, Q. Modeling and Delay Analysis for Converged Network-Cloud Service Provisioning Systems. In Proceedings of the IEEE International Conference on Computing, Networking, and Communications (ICNC’13), San Diego, CA, USA, 28–31 January 2013. [Google Scholar]

- Duan, Q. Cloud Service Performance Evaluation: Status, Challenges, and Opportunities—A Survey from the System Modeling Perspective. J. Digit. Commun. Netw. 2017, 32, 101–111. [Google Scholar] [CrossRef]

- Luong, N.C.; Wang, P.; Niyato, D.; Yonggang, W.; Han, Z. Resource Management in Cloud Networking Using Economic Analysis and Pricing Models: A Survey. IEEE Commun. Surv. Tutor. 2017, 19, 954–1001. [Google Scholar] [CrossRef]

- Wee, K.T.; Dinil, M.D.; Mohan, G. Uniform Price Auction for Allocation of Dynamic Cloud Bandwidth. In Proceedings of the 2014 IEEE International Conference on Communications (ICC), Sydney, NSW, Australia, 10–14 June 2014. [Google Scholar]

- Marian, M.; Yong, M.T. Strategy-Proof Dynamic Resource Pricing of Multiple Resource Types on Federated Clouds. In Algorithms and Architectures for Parallel Processing (ICA3PP) 2010; Hsu, C.H., Yang, L.T., Park, J.H., Yeo, S.S., Eds.; Springer: Berlin/Heidelberg, Germany, 2010; pp. 337–350. ISBN 978-3-642-13119-6. [Google Scholar]

- Robert, J.M.; Otrok, H.; Quttoum, A.N.; Boukhris, R. A distributed resource management model for Virtual Private Networks: Tit-for-Tat strategies. J. Comput. Netw. 2012, 56, 927–939. [Google Scholar] [CrossRef]

- Alvin, E.R.; Axel, O. Last-Minute Bidding and the Rules for Ending Second-Price Auctions: Evidence from eBay and Amazon Auctions on the Internet. Am. Econ. Rev. 2002, 92, 1093–1103. [Google Scholar]

- Wee, K.T.; Dinil, M.D.; Mohan, G. Near-Optimal Dynamic Spectrum Allocation in Cellular Networks. In Proceedings of the 3rd IEEE Symposium on New Frontiers in Dynamic Spectrum Access Networks, DySPAN 2008, Chicago, IL, USA, 14–17 October 2008. [Google Scholar]

- Hai-Ya, S.; Wan-Liang, W.; Ngai-Ming, K.; Sheng-Yong, C. Game Theory for Wireless Sensor Networks: A Survey. J. Sens. 2012, 12, 9055–9097. [Google Scholar] [CrossRef]

- Roger, B.M. Game Theory: Analysis of Conflict; Harvard University Press: Cambridge, MA, USA, 1991; ISBN 9780674728615 0674728610. [Google Scholar]

- Robert, M.A. The Evolution of Cooperation: Revised Edition; Basic Books: New York, NY, USA, 2006; ISBN 0-465-02122-0. [Google Scholar]

- Yang, G.; Zhenzhe, Z.; Fan, W.; Xiaofeng, G.; Guihai, C. SOAR: Strategy-proof auction mechanisms for distributed cloud bandwidth reservation. In Proceedings of the 2014 IEEE International Conference on Communication Systems (ICCS), Macau, China, 19–21 November 2014. [Google Scholar]

- Quttoum, A.N.; Otrok, H.; Dzion, Z. ARMM: An Autonomic Resource Management Model for Virtual Private Networks. In Proceedings of the 2010 IEEE International Conference on Consumer Communications and Networking Conference (CCNC), Las Vegas, NV, USA, 12–15 January 2010. [Google Scholar]

- SHI, W.; Wu, C.; Li, Z. A Shapley-value Mechanism for Bandwidth On Demand between Datacenters. IEEE Trans. Cloud Comput. 2015. [Google Scholar] [CrossRef]

- Jinwu, G.; Xiangfeng, Y.; Di, L. Uncertain Shapley value of coalitional game with application to supply chain alliance. J. Sens. 2017, 56, 551–556. [Google Scholar] [CrossRef]

- Ilan, K.; Kjell, G.N. Underpricing and Market Power in Uniform Price Auctions; Oxford Academic: Oxford, UK, 2003; pp. 849–877. [Google Scholar]

- Kabir, M.E.; Mahmood, A.N.; Mustafa, A.K.; Wang, H. Micoraggregation Sorting Framework for K-Anonymity Statistical Disclosure Control in Cloud Computing. IEEE Trans. Cloud Comput. 2015. [Google Scholar] [CrossRef]

- Wang, H.; Yi, H.; Bertino, E.; Sun, L. Protecting Outsourced Data in Cloud Computing Through Access Management. Concurr. Comput. Pract. Exp. 2014, 137–153. [Google Scholar] [CrossRef]

- Jian, G.; Fangming, L.; Dan, Z.; John, C.S.L.; Hai, J. A cooperative game based allocation for sharing data center networks. In Proceedings of the IEEE 2013 INFOCOM Conference, Turin, Italy, 14–19 April 2013. [Google Scholar]

- Jian, G.; Fangming, L.; Haowen, T.; Yingnan, L.; Hai, J.; John, C.; Lui, S. Falloc: Fair network bandwidth allocation in IaaS datacenters via a bargaining game approach. In Proceedings of the 21st Internation IEEE Conference on Network Protocols (ICNP), Goettingen, Germany, 7–10 October 2013. [Google Scholar]

| Allocation Algorithm: Selecting the Candidate Service Tenants for Allocation |

|---|

| 1: Input: Vector of offered bids N, ∀ i ∈ N, collect (, , ); |

| 2: Output: Vector of candidate tenants for allocation C; |

| 3: for all i ∈ N; |

| 4: find the value , then |

| 5: sort them accordingly in N as > > > ... > > ; |

| 6: update N; |

| 7: end |

| 8: for all i ∈ N; |

| 9: find the reputation record associated with the id , then |

| 10: exclude all those who have < ; |

| 11: update N; |

| 12: end |

| 13: for all i ∈ N; |

| 14: if < , exclude from N; |

| 15: else keep in N; |

| 16: end |

| 17: for all i ∈ N; |

| 18: find bidder , where () and (); |

| 19: move bidders from i → to a new vector C; |

| 20: end |

| 21: for each i ∈ C; |

| 22: choose as a cost-unit; |

| 23: choose as a cost-unit for bidder ; |

| 24: end |

| Tit-for-Tat’s Algorithm: Selecting the Candidate Service Tenants for Allocation |

|---|

| 1: Input: Vector of offered bids N, ∀ i ∈ N, collect (, , ); |

| 2: Output: Vector of candidate tenants for allocation C; |

| 3: for all i ∈ N; |

| 4: find the value , then |

| 5: sort them accordingly in N as > > > ... > > ; |

| 6: update N; |

| 7: end |

| 8: for all i ∈ N; |

| 9: find the reputation score associated with the id , then |

| 10: exclude all those who have = 0; |

| 11: update N; |

| 12: end |

| 13: for all i ∈ N; |

| 14: find bidder , where () and (); |

| 15: move bidders from i → to a new vector C; |

| 16: end |

| 17: for eachi ∈ C; |

| 18: choose as a cost-unit; |

| 19: end |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Quttoum, A.N.; Alsarhan, A.; Moh’d, A. ARAAC: A Rational Allocation Approach in Cloud Data Center Networks. Future Internet 2017, 9, 50. https://doi.org/10.3390/fi9030050

Quttoum AN, Alsarhan A, Moh’d A. ARAAC: A Rational Allocation Approach in Cloud Data Center Networks. Future Internet. 2017; 9(3):50. https://doi.org/10.3390/fi9030050

Chicago/Turabian StyleQuttoum, Ahmad Nahar, Ayoub Alsarhan, and Abidalrahman Moh’d. 2017. "ARAAC: A Rational Allocation Approach in Cloud Data Center Networks" Future Internet 9, no. 3: 50. https://doi.org/10.3390/fi9030050