To License or Not to License Remanufacturing Business?

Abstract

:1. Introduction

- (1)

- Is it optimal for OEMs to license remanufacturing? And is it optimal for IRs to accept the licensing? Under what conditions will they cooperate with each other?

- (2)

- What are the optimal decisions of OEMs and IRs when they cooperate with each other or choose not to?

2. Literature Review

3. Model Description and Notations

4. Analysis and Results

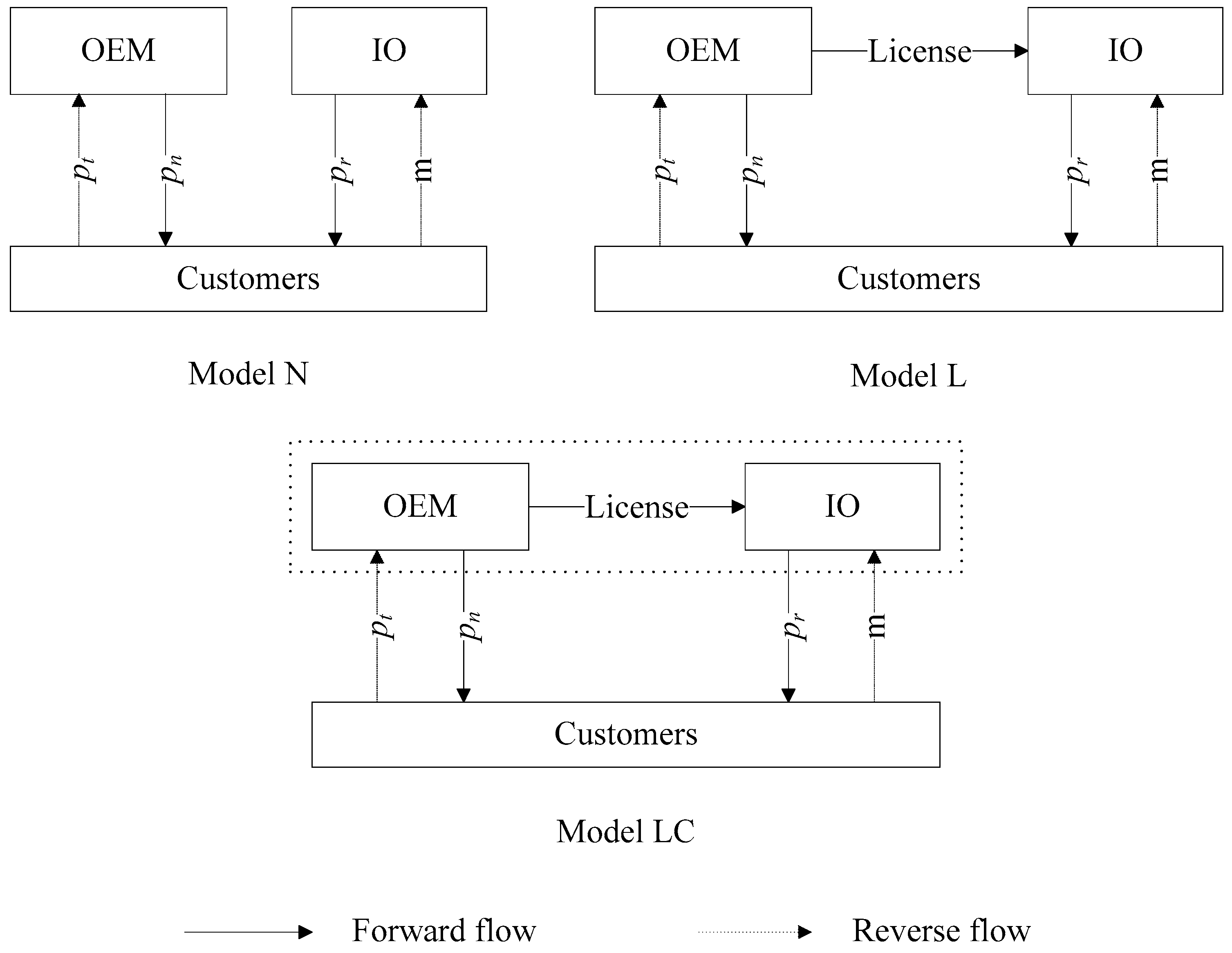

4.1. CLSC Models with Licensed and Unlicensed Remanufacturing

4.1.1. Model N

- (1)

- The IR will engage in remanufacturing on condition that . Therefore, the IR achieves a higher cost saving from remanufacturing and a lower production cost facilitates remanufacturing. The demand for remanufactured products is equal to the collected quantity of used products under the conditions , , and . The IR will neither collect superfluous used products nor produce surplus remanufactured products because of the low unit net value of reclaiming used products and high remanufacturing cost.

- (2)

- The demand for remanufactured products is smaller than the collected quantity of used products under the condition . It indicates that the collected quantity of used products is larger than the demand for remanufactured products because reclaiming used products is beneficial.

- (3)

- The IR will not engage in remanufacturing under the condition . Similarly, a lower cost saving from remanufacturing and a higher production cost impair the implementation of remanufacturing. This suggests that the IR will continue collecting used products but will quit remanufacturing because the unit net value of reclaiming used products is too large.

4.1.2. Model L

4.1.3. Model LC

4.2. Model Comparison

4.2.1. Comparison of Model N and Model L

- (i)

- The optimal prices in unlicensed and licensed remanufacturing scenarios have the following respective relationships: , while under the condition and under the condition .

- (ii)

- The optimal quantities have the following relationships: , while under the condition .

- (i)

- The optimal prices in unlicensed and licensed remanufacturing scenarios are constrained as follows: , while under the condition .

- (ii)

- The optimal quantities are constrained as follows: , while under the condition .

- (i)

- The optimal prices in unlicensed and licensed remanufacturing scenarios have the following relationships: .

- (ii)

- The optimal quantities have the following relationships: . Accordingly, .

4.2.2. Comparison of Model L and Model LC

- (i)

- The optimal prices have the following relationships: , , under the condition , and under the condition .

- (ii)

- The optimal quantities have the following relationships: while , and under the condition .

- (iii)

- The OEM’s profit has the following relationships: if , for , then ; if , for or , then ; if , for , then . The IR’s profit has the following relationship: under the condition . Where and .

- (i)

- The optimal prices are constrained as follows: , while , , under the condition .

- (ii)

- The optimal quantities are constrained as follows: , , while , under the condition .

- (iii)

- The OEM’s profit has the following relationship: if , for , then ; if , for or , then ; if , for , then . The IR’s profit has the following relationship: if , for , then ; if , for or , then ; if , for , then . Where , and .

- (i)

- The optimal prices have the following relationships: .

- (ii)

- The optimal quantities have the following relationships: , , and . Accordingly, .

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A

Appendix A.1. Proof of Proposition 1

Appendix A.2. Proof of Proposition 2

Appendix A.3. Proof of Proposition 3

Appendix A.4. Proof of Proposition 4

Appendix A.5. Proof of Proposition 5

Appendix A.6. Proof of Proposition 6

Appendix A.7. Proof of Proposition 7

Appendix A.8. Proof of Proposition 8

Appendix A.9. Proof of Proposition 9

References

- Bazan, E.; Jaber, M.Y.; Zanoni, S. A review of mathematical inventory models for reverse logistics and the future of its modeling: An environmental perspective. Appl. Math. Model. 2016, 40, 4151–4178. [Google Scholar] [CrossRef]

- Ferrer, G.; Swaminathan, J.M. Managing new and remanufactured products. Manag. Sci. 2006, 52, 15–26. [Google Scholar] [CrossRef] [Green Version]

- Geyer, R.; Van Wassenhove, L.N.; Atasu, A. The impact of limited component durability and finite life cycles on remanufacturing profit. Manag. Sci. 2007, 53, 88–100. [Google Scholar] [CrossRef]

- Ayres, R.; Ferrer, G.; Van Leynseele, T. Eco-efficiency, asset recovery and remanufacturing. Eur. Manag. J. 1997, 15, 557–574. [Google Scholar] [CrossRef]

- Ferguson, M.E. Strategic issues in closed-loop supply chains with remanufacturing. In Closed-Loop Supply Chains: New Developments to Improve the Sustainability of Business Practices; Ferguson, M.E., Souza, G.C., Eds.; Auerbach Publications: Boca Raton, FL, USA, 2010; pp. 9–21. [Google Scholar]

- Hauser, W.M.; Lund, R.T. Remanufacturing, Operating Practices and Strategies: Perspectives on the Management of Remanufacturing Businesses in the United States; Research Report; Boston University: Boston, MA, USA, 2008. [Google Scholar]

- Cat Reman. Available online: https://www.caterpillar.com/en/company/brands/cat-reman.html (accessed on 30 November 2017).

- Stealth Champion of Automatic Gearbox Remanufacturing: Shanghai Xin Fumei. Available online: http://www.xfm960.cn/about/?64.html (accessed on 29 November 2017).

- Liu, H.; Lei, M.; Huang, T.; Leong, G.K. Refurbishing authorization strategy in the secondary market for electrical and electronic products. Int. J. Prod. Econ. 2018, 195, 198–209. [Google Scholar] [CrossRef]

- Atasu, A.; Sarvary, M.; Van Wassenhove, L.N. Remanufacturing as a marketing strategy. Manag. Sci. 2008, 54, 1731–1746. [Google Scholar] [CrossRef]

- Debo, L.G.; Toktay, L.B.; Van Wassenhove, L.N. Market segmentation and product technology selection for remanufacturable products. Manag. Sci. 2005, 51, 1193–1205. [Google Scholar] [CrossRef]

- Heese, H.S.; Cattani, K.; Ferrer, G.; Gilland, W.; Roth, A.V. Competitive advantage through take-back of used products. Eur. J. Oper. Res. 2005, 164, 143–157. [Google Scholar] [CrossRef]

- Wu, C.H. OEM product design in a price competition with remanufactured product. Omega 2013, 41, 287–298. [Google Scholar] [CrossRef]

- Orsdemir, A.; Kemahlıoglu-Ziya, E.; Parlakturk, A.K. Competitive quality choice and remanufacturing. Prod. Oper. Manag. 2014, 23, 48–64. [Google Scholar] [CrossRef]

- Majumder, P.; Groenevelt, H. Competition in remanufacturing. Prod. Oper. Manag. 2001, 10, 125–141. [Google Scholar] [CrossRef]

- Ferguson, M.E.; Toktay, L.B. The effect of competition on recovery strategies. Prod. Oper. Manag. 2006, 15, 351–368. [Google Scholar] [CrossRef]

- Agrawal, V.; Atasu, A.; Van Ittersum, K. Remanufacturing, third-party competition, and consumers’ perceived value of new products. Manag. Sci. 2015, 61, 60–72. [Google Scholar] [CrossRef]

- Wu, X.; Zhou, Y. Does the entry of third-party remanufacturers always hurt original equipment manufacturers? Decis. Sci. 2016, 47, 762–780. [Google Scholar] [CrossRef]

- Wei, S.; Tang, O.; Sundin, E. Core (product) acquisition management for remanufacturing: A review. J. Remanuf. 2015, 5, 1–27. [Google Scholar] [CrossRef]

- Gönsch, J. Buying used products for remanufacturing: Negotiating or posted pricing. J. Bus. Econ. 2014, 84, 715–747. [Google Scholar] [CrossRef]

- Kleber, R.; Zanoni, S.; Zavanella, L. On how buyback and remanufacturing strategies affect the profitability of spare parts supply chains. Int. J. Prod. Econ. 2011, 133, 135–142. [Google Scholar] [CrossRef]

- Ma, Z.J.; Zhou, Q.; Dai, Y.; Sheu, J.B. Optimal pricing decisions under the coexistence of “trade old for new” and “trade old for remanufactured” programs. Transp. Res. Part E 2017, 106, 337–352. [Google Scholar] [CrossRef]

- Klemperer, P. Markets with consumer switching costs. Q. J. Econ. 1987, 102, 375–394. [Google Scholar] [CrossRef]

- Klemperer, P. Welfare Effects of Entry into Markets with Switching Costs. J. Ind. Econ. 1988, 37, 159–165. [Google Scholar] [CrossRef]

- Levinthal, D.A.; Purohit, D. Durable goods and product obsolescence. Mark. Sci. 1989, 8, 35–56. [Google Scholar] [CrossRef]

- Ackere, A.V.; Reyniers, D.J. A rationale for trade-ins. J. Econ. Bus. 1993, 45, 1–16. [Google Scholar] [CrossRef]

- Ackere, A.V.; Reyniers, D.J. Trade-ins and introductory offers in a monopoly. RAND J. Econ. 1995, 26, 58–74. [Google Scholar] [CrossRef]

- Ray, S.; Boyaci, T.; Aras, N. Optimal prices and trade-in rebates for durable, remanufacturable products. Manuf. Serv. Oper. Manag. 2005, 7, 208–228. [Google Scholar] [CrossRef]

- Okada, E.M. Trade-ins, mental accounting, and product replacement decisions. J. Consum. Res. 2001, 27, 433–446. [Google Scholar] [CrossRef]

- Rao, R.S. Understanding the role of trade-ins in durable goods markets: Theory and evidence. Mark. Sci. 2009, 28, 950–967. [Google Scholar] [CrossRef]

- Agrawal, V.V.; Ferguson, M.; Souza, G.C. Trade-in rebates for price discrimination and product recovery. IEEE Trans. Eng. Manag. 2016, 63, 326–339. [Google Scholar] [CrossRef]

- Kaufmann, P.J.; Dant, R.P. The pricing of franchise rights. J. Retail. 2002, 77, 537–545. [Google Scholar] [CrossRef]

- Shane, S.; Shankar, V.; Aravindakshan, A. The effects of new franchisor partnering strategies on franchise system size. Manag. Sci. 2006, 52, 773–787. [Google Scholar] [CrossRef]

- Lal, R. Improving channel coordination through franchising. Mark. Sci. 1990, 9, 299–318. [Google Scholar] [CrossRef]

- Subramanian, R.; Subramanyam, R. Key Factors in the Market for Remanufactured Products. Manuf. Serv. Oper. Manag. 2012, 14, 315–326. [Google Scholar] [CrossRef]

- Zhu, X.; Wang, M.; Chen, G.; Chen, X. The effect of implementing trade-in strategy on duopoly competition. Eur. J. Oper. Res. 2016, 248, 856–868. [Google Scholar] [CrossRef]

- Yin, R.; Tang, C.S. Optimal temporal customer purchasing decisions under trade-in programs with up-front fees. Decis. Sci. 2014, 45, 373–400. [Google Scholar] [CrossRef]

- Chiang, W.Y.K.; Chhajed, D.; Hess, J.D. Direct marketing, indirect profits: A strategic analysis of dual-channel supply-chain design. Manag. Sci. 2003, 49. [Google Scholar] [CrossRef]

- Souza, G.C. Closed-loop supply chains: A critical review, and future research. Decis. Sci. 2013, 44, 7–38. [Google Scholar] [CrossRef]

- Guide, V.D.R.; Wassenhove, L.N. Managing product returns for remanufacturing. Prod. Oper. Manag. 2001, 10, 142–155. [Google Scholar] [CrossRef]

- Guide, V.D.R. Production planning and control for remanufacturing: Industry practice and research needs. J. Oper. Manag. 2000, 18, 467–483. [Google Scholar] [CrossRef]

| Notations | Definitions |

|---|---|

| Parameters | |

| Total demand for new products | |

| Total demand for remanufactured products | |

| Total demand of trade-in consumers | |

| Total demand of direct-collection consumers | |

| Fraction rate of consumer valuation on remanufactured products, | |

| Durability parameter of new products, | |

| Average increment of consumer’s valuation of licensed remanufactured products | |

| Segment size of customers who hold used products | |

| Unit production cost of new products | |

| Unit cost saving from remanufacturing used products in unlicensed and licensed scenarios respectively () | |

| Unit royalty fee paid by the IR to the OEM for the production and sales of remanufactured products | |

| Unit net value of reclaiming used products for the OEM and the IR respectively, and | |

| Decision Variables | |

| Unit price of new products | |

| Unit price of remanufactured products | |

| OEM’s unit trade-in rebate | |

| IR’s unit acquisition price of used products |

| Optimal Solutions | Scenario 1: | Scenario 2: | Scenario 3: |

|---|---|---|---|

| , , | , | , | |

| Optimal Solutions | Scenario 1: | Scenario 2: | Scenario 3: |

|---|---|---|---|

| , , | , | , | |

| Optimal Solutions | Scenario 1: | Scenario 2: | Scenario 3: |

|---|---|---|---|

| , , | , | , | |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ma, Z.-J.; Zhou, Q.; Dai, Y.; Guan, G.-F. To License or Not to License Remanufacturing Business? Sustainability 2018, 10, 347. https://doi.org/10.3390/su10020347

Ma Z-J, Zhou Q, Dai Y, Guan G-F. To License or Not to License Remanufacturing Business? Sustainability. 2018; 10(2):347. https://doi.org/10.3390/su10020347

Chicago/Turabian StyleMa, Zu-Jun, Qin Zhou, Ying Dai, and Gao-Feng Guan. 2018. "To License or Not to License Remanufacturing Business?" Sustainability 10, no. 2: 347. https://doi.org/10.3390/su10020347