Manufacturing Decisions and Government Subsidies for Electric Vehicles in China: A Maximal Social Welfare Perspective

Abstract

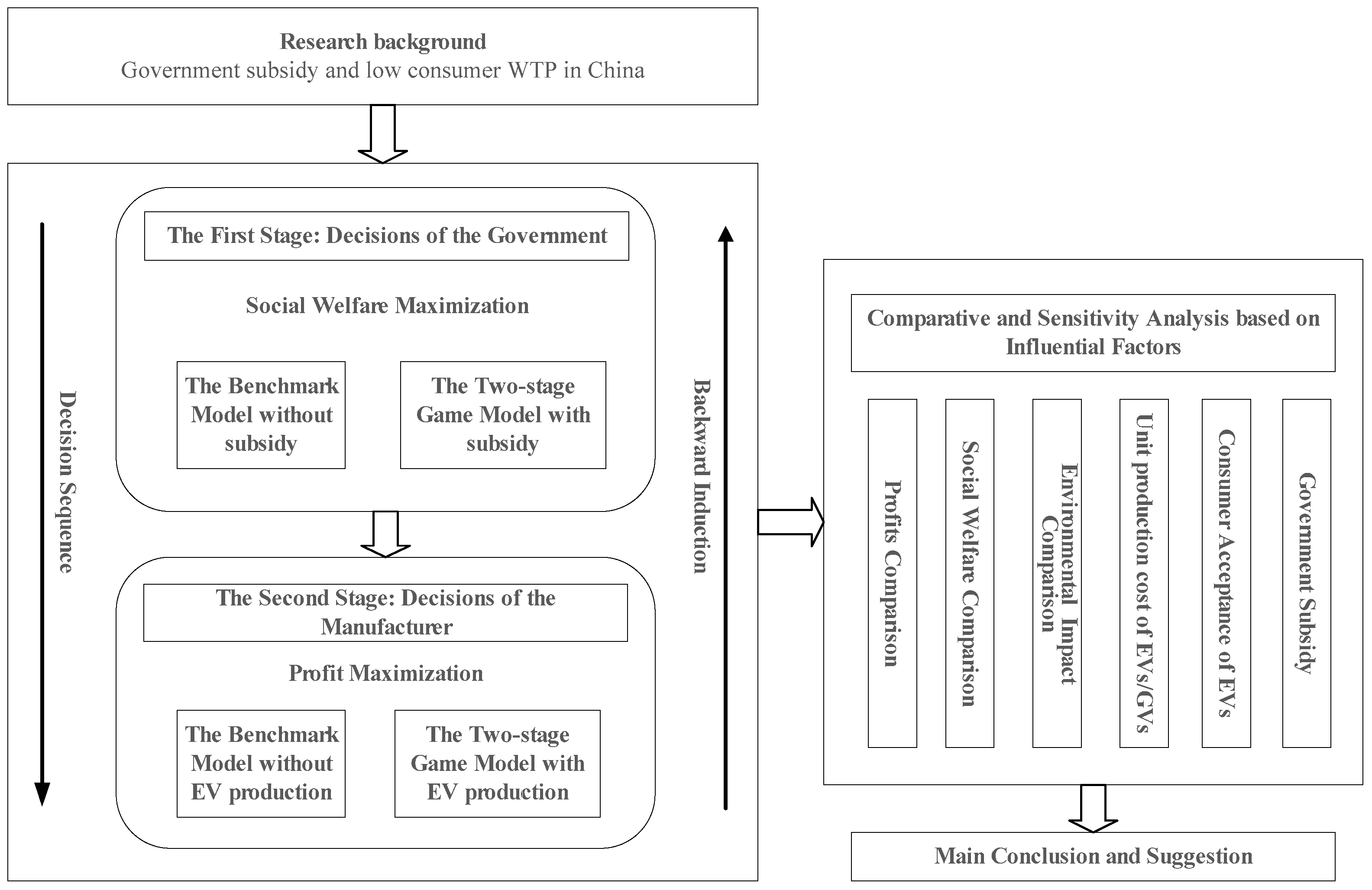

:1. Introduction

- How effective is the government subsidy for EV consumers to transfer internal and external savings to the auto industry?

- What are the impacts of EV manufacturing-related factors on the economics of EV production (i.e., production quantities and prices of GVs and EVs) under the government subsidy?

- Under the government subsidy, what is the degree of the cannibalization from EV production? How does the cannibalization influence the overall economic and environmental performances?

- What is the optimal subsidy to realize the maximization of social welfare which EV production offers? If the optimal subsidy does not exist, is there a feasible range of subsidies that we can explore?

2. Literature Review

- Social performance: concerning consumers’ willingness to pay (WTP) for EVs. Specifically, these papers aim to explore the factors influencing the consumer’s acceptance of EVs or maximize consumers’ utility under three possible scenarios (i.e., high, uncertain or low WTP).

- Regarding the papers on the evaluation of EV environmental performance, even though the authors consider some specific indexes (e.g., emissions, energy efficiency) for measuring performance, few papers present a set of indexes integrating economic efficiency; none of the above-mentioned papers in this area incorporate social indexes into the measuring framework. Due to a different research focus, our paper reduces the complicated environmental impact to a simple exogenous variable to examine its influence on the optimal EV production decision.

- Concerning the papers that are dealing with the EV economic performance, many papers have incorporated the government subsidy into the EV production strategy and consumers’ purchasing decision. Few papers have explored the environmental impact and the heterogeneity in consumers’ attitudes toward EVs and GVs, which are both considered in our paper.

- As far as the literature on the EV social performance, the majority of papers conduct empirical studies on customers’ acceptance and EV market penetration rates, and seldom include automakers’ actions and government policy. Our paper involves mathematical modelling of integration of all the above elements.

- As for the three papers considering three performances, the authors have explored the effects of the different government incentive schemes, and examined the environmental, economic, and social performances of EV production. Unlike these three studies, we have made the following innovations: first, our model investigates whether EV production must be added to GV production, rather than whether it must replace GV production. Second, we consider a utility model which allows us to capture the customers’ low WTP for EVs. This attitude reflects the general reality of China more closely than the high or uncertain WTP presented in these three papers. Third, a critical component of our model is the issue of demand cannibalization, which may result in auto manufacturers’ output reductions, which are inconsistent with the government’s initial expectation. Therefore, the EV production decision aiming at realizing the triple win (the economic, social, and environmental benefits) of EV production should involve the degree of cannibalization.

- The environmental, economic, and social gains of EV production must be questioned based on not only on the choice of EV production, but also on the degree of cannibalization.

- The literature on EV performances has been classified on the basis of methodology followed in conducting the research, as follows: survey (including secondary data analysis), case studies approach, mathematical modeling, and literature review. We build a model as a multi-stage Stackelberg game between a government policymaker who aims at the social welfare maximization and an auto manufacturer who pursues the profit maximization because the policymaker firstly determines the per unit subsidy, then the auto manufacturer decide the optimal retailer price, which is analogous to Stackelberg market competition. Thus, we contextualized the EV study to develop the Stackelberg model to optimize the environmental, economic, and social performance of the system.

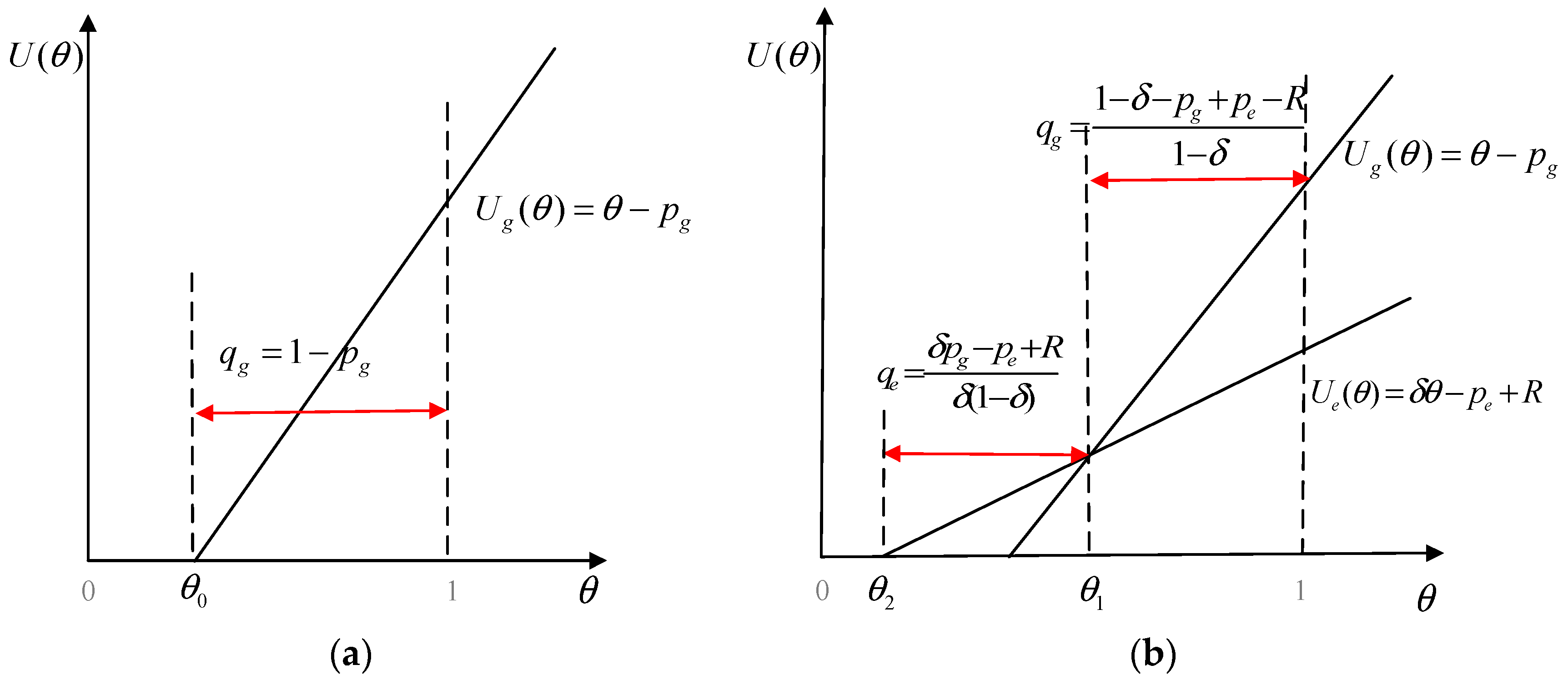

3. Problem Definition and Assumptions

4. The Second Stage: Decisions of the Manufacturer

4.1. The Benchmark Model (Marked as Model B)

4.2. The Two-Stage Game Model (Marked as Model T)

4.3. The Decision Analysis

5. The First Stage: Decisions of the Government

- (i)

- The government sets the feasible optimal subsidy , then is obtained and holds;

- (ii)

- The government sets the feasible optimal subsidy , then is obtained.

6. Numerical Example

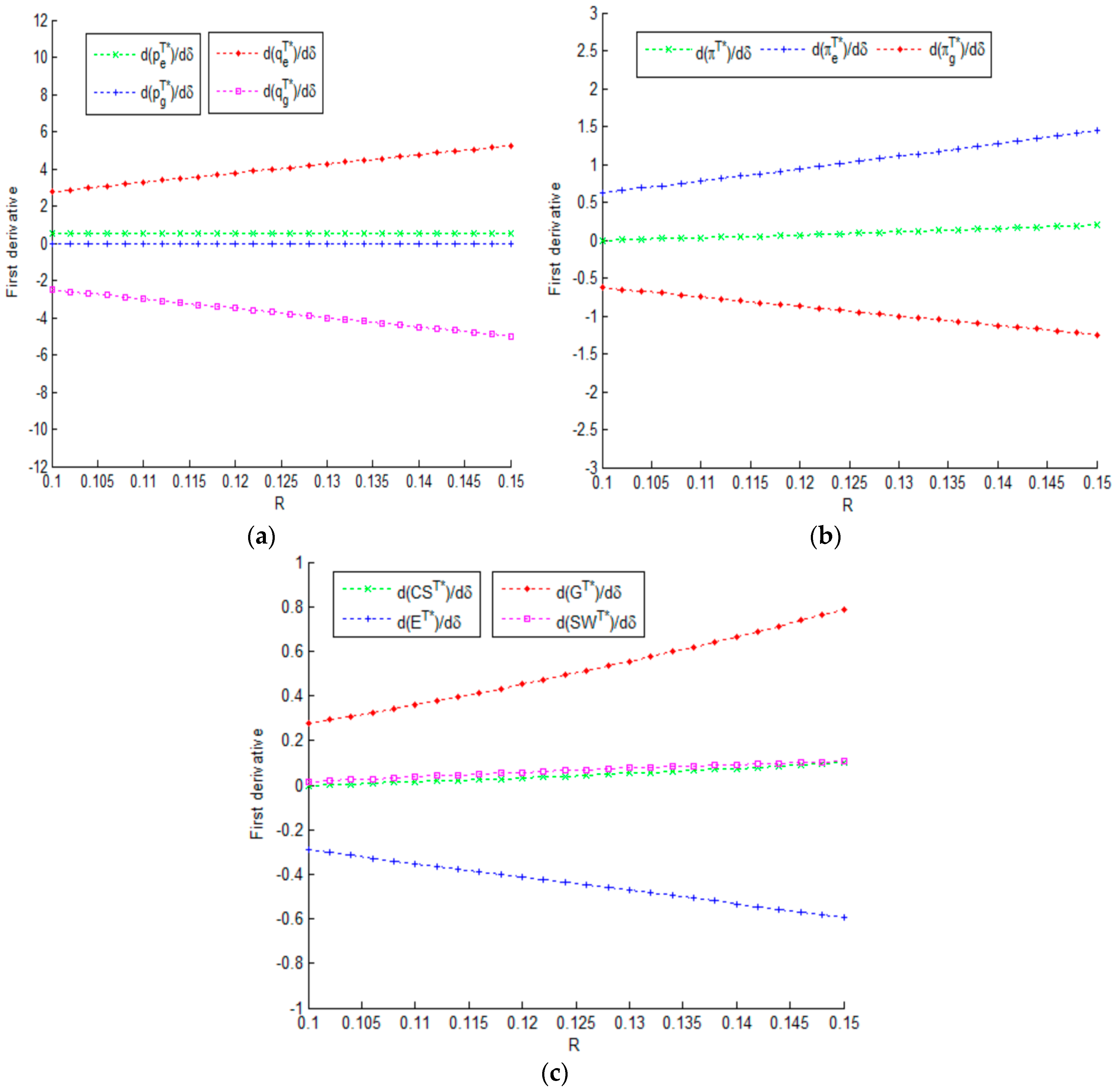

6.1. Sensitivities on the Consumer Acceptance Change with

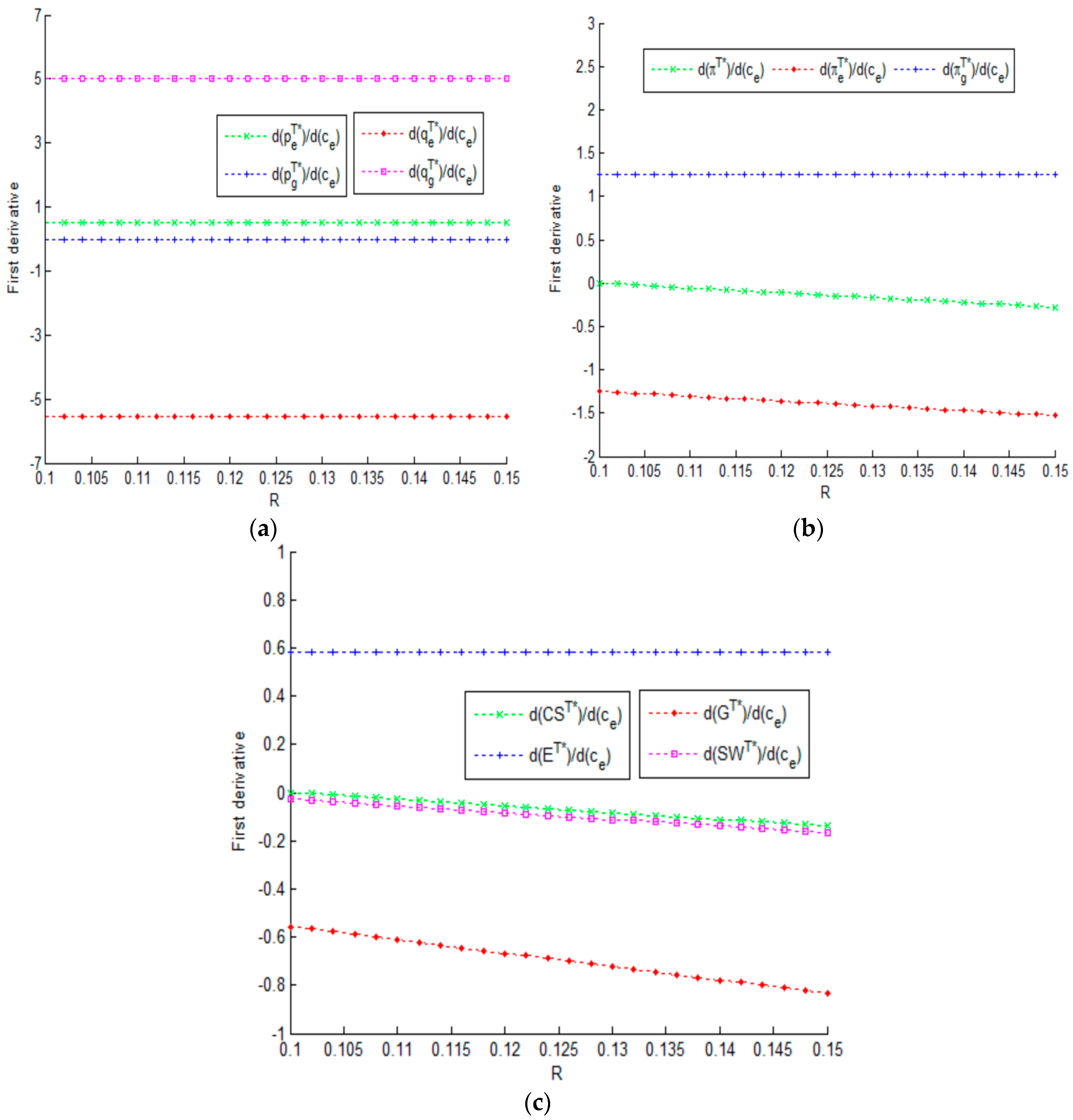

6.2. Sensitivities on the Production Cost of EVs Change with

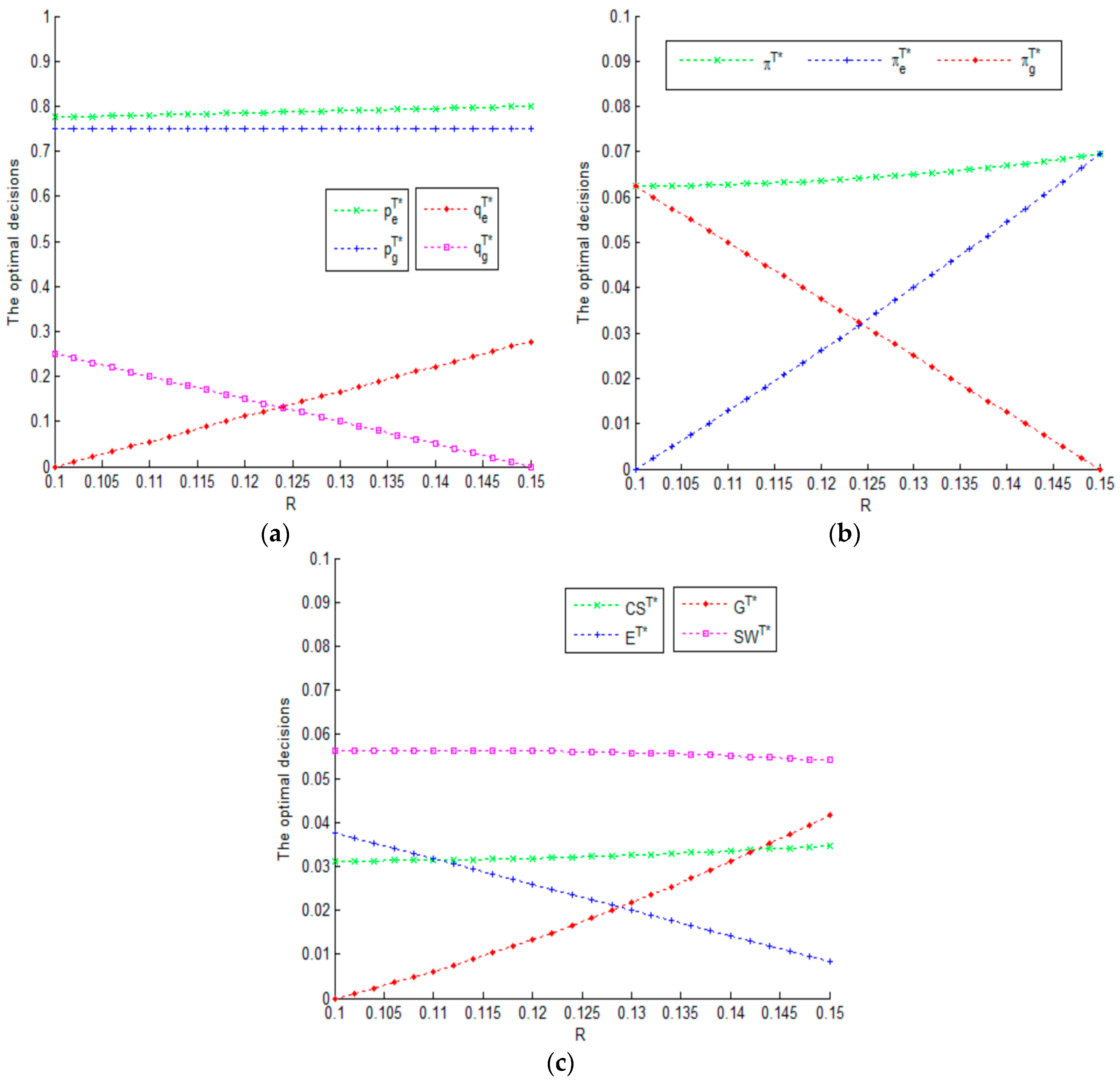

6.3. Sensitivities on the Government Subsidy

7. Conclusions

- Well-intentioned incentive policies to reduce auto products’ environmental impact and produce profitable revenue for manufacturers may lead to adverse effects if not implemented effectively.

- Government of China should focus on strengthening public awareness of protecting the environment and promote the development and application of new green technologies.

- Government should establish collaborative relationships with auto manufacturers and consumers since that the adoption and diffusion of EV can be understood and conducted smoothly.

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A. Calculations of the Optimal Decisions in Model B

Appendix B. Calculations of the Optimal Decisions in Model T

Appendix C. Proof of Proposition 1

Appendix D. Proof of Corollary 1

Appendix E. Proof of Proposition 2

Appendix F. Proof of Proposition 3

Appendix G. Proof of Proposition 4

Appendix H. Proof of Proposition 5

Appendix I. Proof of Proposition 6

Appendix J. Proof of Proposition 7

References

- Wang, K.; Zhao, Y.; Cheng, Y.; Choi, T.-M. Cooperation or competition? Channel choice for a remanufacturing fashion supply chain with government subsidy. Sustainability 2014, 6, 7292–7310. [Google Scholar] [CrossRef]

- Egbue, O.; Long, S. Barriers to widespread adoption of electric vehicles: An analysis of consumer attitudes and perceptions. Energy Policy 2012, 48, 717–729. [Google Scholar] [CrossRef]

- Romm, J. The car and fuel of the future. Energy Policy 2006, 34, 2609–2614. [Google Scholar] [CrossRef]

- Graham-Rowe, E.; Gardner, B.; Abraham, C.; Skippon, S.; Dittmar, H.; Hutchins, R.; Stannard, J. Mainstream consumers driving plug-in battery-electric and plug-in hybrid electric cars: A qualitative analysis of responses and evaluations. Transp. Res. Part A Policy Pract. 2012, 46, 140–153. [Google Scholar] [CrossRef]

- Gu, H.; Liu, Z.; Qing, Q. Optimal electric vehicle production strategy under subsidy and battery recycling. Energy Policy 2017, 109, 579–589. [Google Scholar] [CrossRef]

- Consumer Acceptance of Electric Vehicles in the US. Available online: https://www.epa.gov/sites/production/files-/2014-09/documents/kodjak121312.pdf (accessed on 15 October 2017).

- Wang, S.; Li, J.; Zhao, D. The impact of policy measures on consumer intention to adopt electric vehicles: Evidence from China. Transp. Res. Part A Policy Pract. 2017, 105, 14–26. [Google Scholar] [CrossRef]

- Zhang, X.; Wang, K.; Hao, Y.; Fan, J.-L.; Wei, Y.-M. The impact of government policy on preference for NEVs: The evidence from China. Energy Policy 2013, 61, 382–393. [Google Scholar] [CrossRef]

- Li, W.; Long, R.; Chen, H. Consumers’ evaluation of national new energy vehicle policy in China: An analysis based on a four paradigm model. Energy Policy 2016, 99, 33–41. [Google Scholar] [CrossRef]

- Li, S.; Liu, Y.; Wang, J. Factors Affecting the Electric Vehicle Demonstration: 14 International Cities/Regions Cases. In Proceedings of the 2015 International Conference on Logistics, Informatics and Service Sciences (LISS), Barcelona, Spain, 27–29 July 2015; IEEE: Piscataway, NJ, USA, 2015; pp. 1–7. [Google Scholar]

- Yenipazarli, A. Managing new and remanufactured products to mitigate environmental damage under emissions regulation. Eur. J. Oper. Res. 2016, 249, 117–130. [Google Scholar] [CrossRef]

- Lin, B.; Wu, W. Why people want to buy electric vehicle: An empirical study in first-tier cities of China. Energy Policy 2018, 112, 233–241. [Google Scholar] [CrossRef]

- China Automobile Industry Yearbook. Available online: http://www.auto-stats.org.cn/default.asp (accessed on 30 October 2017).

- Wang, N.; Pan, H.; Zheng, W. Assessment of the incentives on electric vehicle promotion in China. Transp. Res. Part A Policy Pract. 2017, 101, 177–189. [Google Scholar] [CrossRef]

- Zhang, G.; Xu, Y.; Zhang, J. Consumer-oriented policy towards diffusion of electric vehicles: City-level evidence from China. Sustainability 2016, 8, 1343. [Google Scholar] [CrossRef]

- Rajeev, A.; Pati, R.K.; Padhi, S.S.; Govindan, K. Evolution of sustainability in supply chain management: A literature review. J. Clean. Prod. 2017, 162, 299–314. [Google Scholar] [CrossRef]

- Centobelli, P.; Cerchione, R.; Esposito, E. Developing the WH2 framework for environmental sustainability in logistics service providers: A taxonomy of green initiatives. J. Clean. Prod. 2017, 165, 1063–1077. [Google Scholar] [CrossRef]

- Centobelli, P.; Cerchione, R.; Esposito, E. Environmental Sustainability and Energy-Efficient Supply Chain Management: A Review of Research Trends and Proposed Guidelines. Energies 2018, 11, 275. [Google Scholar] [CrossRef]

- Centobelli, P.; Cerchione, R.; Esposito, E. Environmental sustainability in the service industry of transportation and logistics service providers: Systematic literature review and research directions. Transp. Res. Part D Transp. Environ. 2017, 53, 454–470. [Google Scholar] [CrossRef]

- Correia, E.; Carvalho, H.; Azevedo, S.G.; Govindan, K. Maturity models in supply chain sustainability: A systematic literature review. Sustainability 2017, 9, 64. [Google Scholar] [CrossRef]

- Rolim, C.C.; Gonçalves, G.N.; Farias, T.L.; Rodrigues, Ó. Impacts of electric vehicle adoption on driver behavior and environmental performance. Procedia-Soc. Behav. Sci. 2012, 54, 706–715. [Google Scholar] [CrossRef]

- Hawkins, T.R.; Gausen, O.M.; Strømman, A.H. Environmental impacts of hybrid and electric vehicles—A review. Int. J. LCA 2012, 17, 997–1014. [Google Scholar] [CrossRef]

- Hawkins, T.R.; Singh, B.; Majeau-Bettez, G.; Strømman, A.H. Comparative environmental life cycle assessment of conventional and electric vehicles. J. Ind. Ecol. 2013, 17, 53–64. [Google Scholar] [CrossRef]

- He, L.-Y.; Chen, Y. Thou shalt drive electric and hybrid vehicles: Scenario analysis on energy saving and emission mitigation for road transportation sector in China. Transp. Policy 2013, 25, 30–40. [Google Scholar] [CrossRef]

- Garcia, R.; Freire, F. A review of fleet-based life-cycle approaches focusing on energy and environmental impacts of vehicles. Renew. Sustain. Energy Rev. 2017, 79, 935–945. [Google Scholar] [CrossRef]

- Ma, Y.; Ke, R.-Y.; Han, R.; Tang, B.-J. The analysis of the battery electric vehicle’s potentiality of environmental effect: A case study of Beijing from 2016 to 2020. J. Clean. Prod. 2017, 145, 395–406. [Google Scholar] [CrossRef]

- Faria, R.; Marques, P.; Moura, P.; Freire, F.; Delgado, J.; de Almeida, A.T. Impact of the electricity mix and use profile in the life-cycle assessment of electric vehicles. Renew. Sustain. Energy Rev. 2013, 24, 271–287. [Google Scholar] [CrossRef]

- Chatzikomis, C.; Spentzas, K.; Mamalis, A. Environmental and economic effects of widespread introduction of electric vehicles in Greece. Eur. Transp. Res. Rev. 2014, 6, 365–376. [Google Scholar] [CrossRef]

- Shafiei, E.; Leaver, J.; Davidsdottir, B. Cost-effectiveness analysis of inducing green vehicles to achieve deep reductions in greenhouse gas emissions in New Zealand. J. Clean. Prod. 2017, 150, 339–351. [Google Scholar] [CrossRef]

- Fernández, R.Á. A more realistic approach to electric vehicle contribution to greenhouse gas emissions in the city. J. Clean. Prod. 2018, 172, 949–959. [Google Scholar] [CrossRef]

- Sgouridis, S.; Helmers, E.; Al Hadhrami, M. Light-duty electric vehicles in the gulf? Techno-economic assessment and policy implications. Int. J. Sustain. Transp. 2018, 12, 92–106. [Google Scholar] [CrossRef]

- Kiani, A. Electric vehicle market penetration impact on transport-energy-greenhouse gas emissions nexus: A case study of United Arab Emirates. J. Clean. Prod. 2017, 168, 386–398. [Google Scholar] [CrossRef]

- Braun, A.; Rid, W. Assessing driving pattern factors for the specific energy use of electric vehicles: A factor analysis approach from case study data of the Mitsubishi i–MiEV minicar. Transp. Res. Part D Transp. Environ. 2018, 58, 225–238. [Google Scholar] [CrossRef]

- Yang, J.; Dong, J.; Lin, Z.; Hu, L. Predicting market potential and environmental benefits of deploying electric taxis in Nanjing, China. Transp. Res. Part D Transp. Environ. 2016, 49, 68–81. [Google Scholar] [CrossRef]

- Hao, H.; Cheng, X.; Liu, Z.; Zhao, F. Electric vehicles for greenhouse gas reduction in China: A cost-effectiveness analysis. Transp. Res. Part D Transp. Environ. 2017, 56, 68–84. [Google Scholar] [CrossRef]

- Wu, Y.; Zhang, L. Can the development of electric vehicles reduce the emission of air pollutants and greenhouse gases in developing countries? Transp. Res. Part D Transp. Environ. 2017, 51, 129–145. [Google Scholar] [CrossRef]

- Jochem, P.; Doll, C.; Fichtner, W. External costs of electric vehicles. Transp. Res. Part D Transp. Environ. 2016, 42, 60–76. [Google Scholar] [CrossRef]

- Bauer, G. The impact of battery electric vehicles on vehicle purchase and driving behavior in Norway. Transp. Res. Part D Transp. Environ. 2018, 58, 239–258. [Google Scholar] [CrossRef]

- Sierzchula, W.; Bakker, S.; Maat, K.; van Wee, B. The influence of financial incentives and other socio-economic factors on electric vehicle adoption. Energy Policy 2014, 68, 183–194. [Google Scholar] [CrossRef]

- Turrentine, T.S.; Kurani, K.S. Car buyers and fuel economy? Energy Policy 2007, 35, 1213–1223. [Google Scholar] [CrossRef]

- Lutsey, N.; Searle, S.; Chambliss, S.; Bandivadekar, A. Assessment of Leading Electric Vehicle Promotion Activities in United States Cities; International Council on Clean Transportation: Washington, DC, USA, 2015; Available online: https://www.theicct.org/sites/default/files/publications/ICCT_EV-promotion-US-ities_20150729.pdf (accessed on 30 October 2017).

- Bjerkan, K.Y.; Nørbech, T.E.; Nordtømme, M.E. Incentives for promoting battery electric vehicle (BEV) adoption in Norway. Transp. Res. Part D Transp. Environ. 2016, 43, 169–180. [Google Scholar] [CrossRef]

- Olson, E.L. Lead market learning in the development and diffusion of electric vehicles. J. Clean. Prod. 2018, 172, 3279–3288. [Google Scholar] [CrossRef]

- Kontou, E.; Yin, Y.; Lin, Z.; He, F. Socially optimal replacement of conventional with electric vehicles for the US household fleet. Int. J. Sustain. Transp. 2017, 11, 749–763. [Google Scholar] [CrossRef]

- Wang, N.; Yan, R. Research on Consumers’ Use Willingness and Opinions of Electric Vehicle Sharing: An Empirical Study in Shanghai. Sustainability 2016, 8, 7. [Google Scholar] [CrossRef]

- Wang, Z.; Zhao, C.; Yin, J.; Zhang, B. Purchasing intentions of Chinese citizens on new energy vehicles: How should one respond to current preferential policy? J. Clean. Prod. 2017, 161, 1000–1010. [Google Scholar] [CrossRef]

- Diamond, D. The impact of government incentives for hybrid-electric vehicles: Evidence from US states. Energy Policy 2009, 37, 972–983. [Google Scholar] [CrossRef]

- Wang, F.-P.; Yu, J.-L.; Yang, P.; Miao, L.-X.; Ye, B. Analysis of the Barriers to Widespread Adoption of Electric Vehicles in Shenzhen China. Sustainability 2017, 9, 522. [Google Scholar] [CrossRef]

- He, H.; Fan, J.; Li, Y.; Li, J. When to switch to a hybrid electric vehicle: A replacement optimisation decision. J. Clean. Prod. 2017, 148, 295–303. [Google Scholar] [CrossRef]

- Kieckhäfer, K.; Wachter, K.; Spengler, T.S. Analyzing manufacturers’ impact on green products’ market diffusion–the case of electric vehicles. J. Clean. Prod. 2017, 162, S11–S25. [Google Scholar] [CrossRef]

- Zhang, X. Reference-dependent electric vehicle production strategy considering subsidies and consumer trade-offs. Energy Policy 2014, 67, 422–430. [Google Scholar] [CrossRef]

- Chocteau, V.; Drake, D.; Kleindorfer, P.R.; Orsato, R.; Roset, A. Collaborative Innovation for Sustainable Fleet Operations: The Electric Vehicle Adoption Decision; INSEAD: Fontainebleau, France, 2011. [Google Scholar]

- Junquera, B.; Moreno, B.; Álvarez, R. Analyzing consumer attitudes towards electric vehicle purchasing intentions in Spain: Technological limitations and vehicle confidence. Technol. Forecast. Soc. 2016, 109, 6–14. [Google Scholar] [CrossRef]

- Struben, J.; Sterman, J.D. Transition challenges for alternative fuel vehicle and transportation systems. Environ. Plan. B Plan. Des. 2008, 35, 1070–1097. [Google Scholar] [CrossRef]

- Ferguson, M.; Mohamed, M.; Higgins, C.D.; Abotalebi, E.; Kanaroglou, P. How open are Canadian households to electric vehicles? A national latent class choice analysis with willingness-to-pay and metropolitan characterization. Transp. Res. Part D Transp. Environ. 2018, 58, 208–224. [Google Scholar] [CrossRef]

- Smith, B.; Olaru, D.; Jabeen, F.; Greaves, S. Electric vehicles adoption: Environmental enthusiast bias in discrete choice models. Transp. Res. Part D Transp. Environ. 2017, 51, 290–303. [Google Scholar] [CrossRef]

- Degirmenci, K.; Breitner, M.H. Consumer purchase intentions for electric vehicles: Is green more important than price and range? Transp. Res. Part D Transp. Environ. 2017, 51, 250–260. [Google Scholar] [CrossRef]

- Pettifor, H.; Wilson, C.; McCollum, D.; Edelenbosch, O. Modelling social influence and cultural variation in global low-carbon vehicle transitions. Glob. Environ. Chang. 2017, 47, 76–87. [Google Scholar] [CrossRef]

- She, Z.-Y.; Sun, Q.; Ma, J.-J.; Xie, B.-C. What are the barriers to widespread adoption of battery electric vehicles? A survey of public perception in Tianjin, China. Transp. Policy 2017, 56, 29–40. [Google Scholar] [CrossRef]

- Eppstein, M.J.; Grover, D.K.; Marshall, J.S.; Rizzo, D.M. An agent-based model to study market penetration of plug-in hybrid electric vehicles. Energy Policy 2011, 39, 3789–3802. [Google Scholar] [CrossRef]

- Letmathe, P.; Suares, M. A consumer-oriented total cost of ownership model for different vehicle types in Germany. Transp. Res. Part D Transp. Environ. 2017, 57, 314–335. [Google Scholar] [CrossRef]

- Wu, G.; Inderbitzin, A.; Bening, C. Total cost of ownership of electric vehicles compared to conventional vehicles: A probabilistic analysis and projection across market segments. Energy Policy 2015, 80, 196–214. [Google Scholar] [CrossRef]

- Dimitropoulos, A.; Rietveld, P.; Van Ommeren, J.N. Consumer valuation of changes in driving range: A meta-analysis. Transp. Res. Part A Policy Pract. 2013, 55, 27–45. [Google Scholar] [CrossRef]

- Franke, T.; Günther, M.; Trantow, M.; Krems, J.F. Does this range suit me? Range satisfaction of battery electric vehicle users. Appl. Ergon. 2017, 65, 191–199. [Google Scholar] [CrossRef] [PubMed]

- Li, Q.; Long, R.; Chen, H.; Geng, J. Low Purchase Willingness for Battery Electric Vehicles: Analysis and Simulation Based on the Fault Tree Model. Sustainability 2017, 9, 809. [Google Scholar]

- Qian, L.; Yin, J. Linking Chinese cultural values and the adoption of electric vehicles: The mediating role of ethical evaluation. Transp. Res. Part D Transp. Environ. 2017, 56, 175–188. [Google Scholar] [CrossRef]

- Al-Alawi, B.M.; Bradley, T.H. Review of hybrid, plug-in hybrid, and electric vehicle market modeling studies. Renew. Sustain. Energy Rev. 2013, 21, 190–203. [Google Scholar] [CrossRef]

- Huang, J.; Leng, M.; Liang, L.; Liu, J. Promoting electric automobiles: Supply chain analysis under a government’s subsidy incentive scheme. IIE Trans. 2013, 45, 826–844. [Google Scholar] [CrossRef]

- Luo, C.; Leng, M.; Huang, J.; Liang, L. Supply chain analysis under a price-discount incentive scheme for electric vehicles. Eur. J. Oper. Res. 2014, 235, 329–333. [Google Scholar] [CrossRef] [Green Version]

- Shao, L.; Yang, J.; Zhang, M. Subsidy scheme or price discount scheme? Mass adoption of electric vehicles under different market structures. Eur. J. Oper. Res. 2017, 262, 1181–1195. [Google Scholar] [CrossRef]

- Liu, Z.; Tang, J.; Li, B.-Y.; Wang, Z. Trade-off between remanufacturing and recycling of WEEE and the environmental implication under the Chinese Fund Policy. J. Clean. Prod. 2017, 167, 97–109. [Google Scholar] [CrossRef]

- Cowan, R.; Hultén, S. Escaping lock-in: The case of the electric vehicle. Technol. Forecast. Soc. 1996, 53, 61–79. [Google Scholar] [CrossRef]

- Nykvist, B.; Nilsson, M. Rapidly falling costs of battery packs for electric vehicles. Nat. Clim. Chang. 2015, 5, 329–332. [Google Scholar] [CrossRef]

- Agrawal, V.V.; Ferguson, M.; Toktay, L.B.; Thomas, V.M. Is leasing greener than selling? Manag. Sci. 2012, 58, 523–533. [Google Scholar] [CrossRef]

- Mussa, M.; Rosen, S. Monopoly and product quality. J. Econ. Theory 1978, 18, 301–317. [Google Scholar] [CrossRef]

- Örsdemir, A.; Kemahlıoğlu-Ziya, E.; Parlaktürk, A.K. Competitive quality choice and remanufacturing. Prod. Oper. Manag. 2014, 23, 48–64. [Google Scholar] [CrossRef]

- MacKay, D. Sustainable Energy-without the Hot Air; UIT Cambridge: Cambridge, UK, 2008. [Google Scholar]

| 100 km ≤ R < 150 km | 150 km ≤ R < 250 km | R ≥ 250 km | |||||

|---|---|---|---|---|---|---|---|

| 2016 | 2017 | 2016 | 2017 | 2016 | 2017 | ||

| Central government subsidy (yuan) | 25,000 | 20,000 | 45,000 | 36,000 | 55,000 | 44,000 | |

| Beijing | Local subsidy (yuan) | 25,000 | 10,000 | 45,000 | 18,000 | 55,000 | 22,000 |

| Total subsidy (yuan) | 50,000 | 30,000 | 90,000 | 54,000 | 110,000 | 66,000 | |

| Shanghai | Local subsidy (yuan) | 10,000 | 10,000 | 30,000 | 18,000 | 30,000 | 22,000 |

| Total subsidy (yuan) | 35,000 | 30,000 | 75,000 | 54,000 | 85,000 | 66,000 | |

| Guangzhou | Local subsidy (yuan) | 25,000 | 10,000 | 45,000 | 18,000 | 55,000 | 22,000 |

| Total subsidy (yuan) | 50,000 | 30,000 | 90,000 | 54,000 | 110,000 | 66,000 | |

| Shenzhen | Local subsidy (yuan) | 35,000 | 10,000 | 50,000 | 18,000 | 60,000 | 22,000 |

| Total subsidy (yuan) | 60,000 | 30,000 | 95,000 | 54,000 | 115,000 | 66,000 | |

| Authors, Year | (The Triple Bottom Line) TBL | Methodology | |||

|---|---|---|---|---|---|

| Environmental Performance | Economic Performance | Social Performance(WTP) | |||

| High or Uncertain | Low (China) | ||||

| Rolim et al., 2012 [21] | ● | Case study | |||

| Hawkins et al., 2012 [22] | ● | Literature review | |||

| Hawkins et al., 2013 [23] | ● | Life cycle assessment | |||

| He and Chen, 2013 [24] | ● | Long-rang energy alternative Planning | |||

| Garcia and Freire, 2017 [25] | ● | Literature review | |||

| Ma et al., 2016 [26] | ● | Case study | |||

| Faria et al., 2013 [27] | ● | ● | Life cycle assessment | ||

| Chatzikomis et al., 2014 [28] | ● | ● | Life cycle assessment | ||

| Shafiei et al., 2017 [29] | ● | Simulation-based comparative analysis | |||

| Fernández, 2018 [30] | ● | A new approach | |||

| Sgouridis et al., 2018 [31] | ● | ● | A diffusion model | ||

| Kiani, 2017 [32] | ● | ● | Long range energy alternative planning | ||

| Braun and Rid, 2018 [33] | ● | A factor analysis approach | |||

| Yang et al., 2016 [34] | ● | ● | Simulation-optimization model | ||

| Hao et al., 2017 [35] | ● | ● | Life cycle assessment | ||

| Wu and Zhang, 2017 [36] | ● | Life cycle assessment | |||

| Jochem et al., 2016 [37] | ● | Empirical study | |||

| Bauer, 2018 [38] | ● | Logistic and linear regression | |||

| Sierzchula et al., 2012 [39] | ● | ● | Linear regression analysis | ||

| Turrentine and Kurani, 2007 [40] | ● | ● | Interview and data analysis | ||

| Lutsey et al., 2015 [41] | ● | Statistical analysis | |||

| Bjerkan et al., 2016 [42] | ● | Interview and data analysis | |||

| Olson, 2018 [43] | ● | Consumer survey | |||

| Kontou et al., 2017 [44] | ● | Non-linear programming | |||

| Zhang, Xu and Zhang [15] | ● | ● | Empirical study | ||

| Wang and Yan, 2015 [45] | ● | ● | Empirical study | ||

| Wang et al., 2017 [46] | ● | Structural equation model | |||

| Diamond, 2008 [47] | ● | Cross-sectional analysis | |||

| Zhang et al., 2013 [8] | ● | ● | Questionnaire survey | ||

| Wang et al., 2017 [48] | ● | ● | Statistical model | ||

| He et al., 2017 [49] | ● | ● | Empirical study | ||

| Kieckhäfer et al., 2017 [50] | ● | System dynamics model | |||

| Zhang, 2014 [51] | ● | Newsvendor model | |||

| Gu et al., 2017 [5] | ● | Newsvendor model | |||

| Chocteau et al., 2011 [52] | ● | Cooperative game | |||

| Junquera et al., 2016 [53] | ● | Consumers survey and regression analysis | |||

| Struben and Sterman, 2008 [54] | ● | ● | Dynamic model | ||

| Ferguson et al., 2018 [55] | ● | Consumer survey | |||

| Smith et al., 2017 [56] | ● | Consumer survey | |||

| Degirmenci and Breitner, 2017 [57] | ● | Consumer survey | |||

| Pettifor et al., 2017 [58] | ● | Empirical study | |||

| She et al., 2017 [59] | ● | Questionnaire survey | |||

| Eppstein et al., 2011 [60] | ● | Agent-based modeling | |||

| Letmathe and Suares, 2017 [61] | ● | consumer-oriented total cost of ownership model | |||

| Wu et al., 2015 [62] | ● | Probabilistic analysis | |||

| Dimitropoulos et al., 2013 [63] | ● | Meta-analysis | |||

| Franke et al., 2017 [64] | ● | Contrast and regression analysis | |||

| Li et al., 2017 [65] | ● | Fault tree analysis method | |||

| Qian and Yin, 2017 [66] | ● | Consumer survey | |||

| Al-Alawi and Bradley, 2013 [67] | ● | Literature review | |||

| Huang et al., 2012 [68] | ● | ● | ● | Generalized Nash Bargaining | |

| Luo et al., 2013 [69] | ● | ● | ● | Generalized Nash Bargaining | |

| Shao et al., 2017 [70] | ● | ● | ● | Stackelberg game | |

| This paper | ● | ● | ● | Stackelberg game | |

| Symbol | Definition |

|---|---|

| The consumer’s willingness to pay (WTP) for GVs | |

| The consumer’s acceptance of EVs, where | |

| / | Unit production cost of GVs/EVs |

| / | Per-unit environmental impact of GVs/EVs |

| / | The quantity of GVs/EVs |

| / | The utility from purchasing GVs/EVs |

| The total government expenditure | |

| The consumer surplus | |

| The social welfare | |

| The profit of the vehicle manufacturer | |

| The total environmental impact | |

| Decision variables | |

| Subsidy given by the government to EV buyers and | |

| / | Unit retail price of GVs/EVs set by the manufacturer |

| Superscripts | |

| The benchmark model | |

| The two-stage game model |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zheng, X.; Lin, H.; Liu, Z.; Li, D.; Llopis-Albert, C.; Zeng, S. Manufacturing Decisions and Government Subsidies for Electric Vehicles in China: A Maximal Social Welfare Perspective. Sustainability 2018, 10, 672. https://doi.org/10.3390/su10030672

Zheng X, Lin H, Liu Z, Li D, Llopis-Albert C, Zeng S. Manufacturing Decisions and Government Subsidies for Electric Vehicles in China: A Maximal Social Welfare Perspective. Sustainability. 2018; 10(3):672. https://doi.org/10.3390/su10030672

Chicago/Turabian StyleZheng, Xiaoxue, Haiyan Lin, Zhi Liu, Dengfeng Li, Carlos Llopis-Albert, and Shouzhen Zeng. 2018. "Manufacturing Decisions and Government Subsidies for Electric Vehicles in China: A Maximal Social Welfare Perspective" Sustainability 10, no. 3: 672. https://doi.org/10.3390/su10030672