Energy-Saving Potential and an Economic Feasibility Analysis for an Arctic Route between Shanghai and Rotterdam: Case Study from China’s Largest Container Sea Freight Operator

Abstract

:1. Introduction

- (1)

- Oil prices lower than in the previous several decades (summer intermediate fuel oil (IF0380) costs only of about 266 USD/ton), which is not even included in the lowest price ranges of previous studies;

- (2)

- Declining Russian NSR tariff because of the Russian ambition to attract traffic and to stimulate regional port activities;

- (3)

- The impact of emission control areas (ECAs), where stringent regulations could be established to mitigate the impact of pollution along the route, which may require much cleaner energy, thus impacting costs not tapped in previous models;

- (4)

- The difference in capital costs between a rented and a self-owned vessel, which could impact a sensitivity analysis. Specifically, a self-owned ship has smaller capital costs, giving the shipping companies potential leverage in response to the other changing cost factors.

2. Literature Review

3. Methods

4. Results and Discussion

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Holland, C. Arctic Exploration and Development, c. 500 BC to 1915: An Encyclopedia; Garland Publishing: New York, NY, USA, 1993; ISBN 978-0824076481. [Google Scholar]

- German Ships Blaze Arctic Trail. Available online: http://news.bbc.co.uk/2/hi/europe/8251914.stm (accessed on 20 January 2018).

- Rogers, T.S.; Walsh, J.E.; Rupp, T.S.; Brigham, L.W.; Sfraga, M. Future Arctic marine access: Analysis and evaluation of observations, models, and projections of sea ice. Cryosphere 2013, 7, 321–332. [Google Scholar] [CrossRef]

- Bekkers, E.; Francois, J.F.; Rojas-Romagosa, H. Melting ice caps and the economic impact of opening the Northern Sea Route. Econ. J. 2016. [Google Scholar] [CrossRef]

- Haas, C.; Howell, S.E.L. Ice thickness in the Northwest Passage. Geophys. Res. Lett. 2015, 42, 7673–7680. [Google Scholar] [CrossRef]

- Eguíluz, V.M.; Fernández-Gracia, J.; Irigoien, X.; Duarte, C.M. A quantitative assessment of Arctic shipping in 2010–2014. Sci. Rep. 2016, 6. [Google Scholar] [CrossRef] [PubMed]

- Pizzolato, L.; Howell, S.E.L.; Dawson, J.; Laliberté, F.; Copland, L. The influence of declining sea ice on shipping activity in the Canadian Arctic. Geophys. Res. Lett. 2016, 43. [Google Scholar] [CrossRef]

- Young, O.R. Arctic governance—Pathways to the future. Arct. Rev. Law Politics 2010, 1, 164–185. [Google Scholar]

- ARCTIS, Russian Federation Policy for the Arctic to 2020. Available online: http://www.arctis-search.com/Russian+Federation+Policy+for+the+Arctic+to+2020 (accessed on 4 March 2018).

- Ministry of Energy of the Russian Federation 2010. Available online: http://www.energystrategy.ru/projects/docs/ES-2030 (Eng).pdf (accessed on 4 March 2018).

- Buixadé Farré, A.; Stephenson, S.R.; Chen, L.; Czub, M.; Dai, Y.; Demchev, D.; Efimov, Y.; Graczyk, P.; Grythe, H.; Keil, K.; et al. Commercial Arctic shipping through the Northeast Passage: Routes, resources, governance, technology, and infrastructure. Polar Geogr. 2014, 37, 298–324. [Google Scholar] [CrossRef]

- Stephens, P. Now China Starts to Make the Rules. Financial Times. 28 May 2015. Available online: https://www.ft.com/content/9dafcb30-0395-11e5-a70f-00144feabdc0 (accessed on 20 January 2018).

- Lanteigne, M. China’s maritime security and the “Malacca Dilemma”. Asian Secur. 2008, 4, 143–161. [Google Scholar] [CrossRef]

- Alphaliner. Alphaliner TOP 100. 2018. Available online: https://alphaliner.axsmarine.com/PublicTop100/ (accessed on 4 March 2018).

- Staalesen, A. COSCO Sends Five Vessels through Northern Sea Route. The Independent Barents Observer. 2016. Available online: https://thebarentsobserver.com/en/arctic-industry-and-energy/2016/10/cosco-sends-five-vessels-through-northern-sea-route (accessed on 20 January 2018).

- Beveridge, L.; Fournier, M.; Lasserre, F.; Huang, L.; Têtu, P.L. Interest of Asian shipping companies in navigating the Arctic. Polar Sci. 2016, 10, 404–414. [Google Scholar] [CrossRef]

- Arpiainen, M.; Killi, R. Arctic Shuttle Container Link from Alaska US and Europe, Report K-63; Aker Arctic Technology: Helsinki, Finland, 2006. [Google Scholar]

- Liu, M.; Kronbak, J. The potential economic viability of using the Northern Sea Route (NSR) as an alternative route between Asia and Europe. J. Transp. Geogr. 2010, 18, 434–444. [Google Scholar] [CrossRef]

- Schøyen, H.; Bråthen, S. The Northern Sea Route versus the Suez Canal: Cases from bulk shipping. J. Transp. Geogr. 2011, 19, 977–983. [Google Scholar] [CrossRef]

- Lasserre, F. Case studies of shipping along Arctic routes. Analysis and profitability perspectives for the container sector. Transp. Res. Part A Policy Pract. 2014, 66, 144–161. [Google Scholar] [CrossRef]

- Wang, N.; Yan, B.; Wu, N.; Zhao, W.J. Comments on “Case studies of shipping along Arctic routes. Analysis and profitability perspectives for the container sector” [Transp. Res. Part A: Policy Pract. 66 (2014) 144–161]. Transp. Res. Part A Policy Pract. 2016, 94, 699–702. [Google Scholar] [CrossRef]

- Lasserre, F. “Case studies of shipping along Arctic routes. Analysis and profitability perspectives for the container sector” [Transport. Res. Part A Pol. Pract. 66 (2014) 144–161]: A rejoinder. Transp. Res. Part A Policy Pract. 2016, 94, 703–704. [Google Scholar] [CrossRef]

- Cariou, P.; Faury, O. Relevance of the Northern Sea Route (NSR) for bulk shipping. Transp. Res. Part A Policy Pract. 2015, 78, 337–346. [Google Scholar]

- Faury, O.; Cariou, P. The Northern Sea Route competitiveness for oil tankers. Transp. Res. Part A Policy Pract. 2016, 94, 461–469. [Google Scholar] [CrossRef]

- Li, Z. Analysis of China’s strategy on Arctic Route. China Soft Sci. 2009, 1, 1–7. (In Chinese) [Google Scholar]

- Li, Z.; You, X.; Wang, W.; Ding, C. Economic Analysis of the Container Shipping on the Arctic Northeast Route. J. Jimei Univ. 2015, 1, 34–40. (In Chinese) [Google Scholar]

- Zhang, X.; Shou, J.; Zhou, H. Studies on North Pole Maritime Shipping Commodity Types and Related Economy Scale. Chin. J. Polar Res. 2013, 25, 66–74. [Google Scholar]

- Stopford, M. Maritime Economics 3e; Routledge: London, UK, 2009. [Google Scholar]

- Melia, N.; Haines, K.; Hawkins, E. Sea ice decline and 21st century trans-Arctic shipping routes. Geophys. Res. Lett. 2016, 43, 9720–9728. [Google Scholar] [CrossRef]

- Anderson, P. The Mariner’s Guide to Marine Insurance; Nautical Institute: London, UK, 1999. [Google Scholar]

- Puttevils, J.; Deloof, M. Marketing and Pricing Risk in Marine Insurance in Sixteenth-Century Antwerp. J. Econ. Hist. 2017, 77, 796–837. [Google Scholar] [CrossRef]

- Yao, Z.; Ng, S.H.; Lee, L.H. A study on bunker fuel management for the shipping liner services. Comput. Oper. Res. 2012, 39, 1160–1172. [Google Scholar] [CrossRef]

- Wan, Z.; el Makhloufi, A.; Chen, Y.; Tang, J. Decarbonizing the international shipping industry: Solutions and policy recommendations. Mar. Pollut. Bull. 2018, 126, 428–435. [Google Scholar] [CrossRef] [PubMed]

- Woo, J.K.; Moon, D.S. The effects of slow steaming on the environmental performance in liner shipping. Marit. Policy Manag. 2014, 41, 176–191. [Google Scholar] [CrossRef]

- Lindstad, H.; Sandaas, I.; Strømman, A.H. Assessment of cost as a function of abatement options in maritime emission control areas. Transp. Res. Part D Transp. Environ. 2015, 38, 41–48. [Google Scholar] [CrossRef]

- Wan, Z.; Zhu, M.; Chen, S.; Sperling, D. Pollution: Three steps to a green shipping industry. Nature 2016, 530, 275–277. [Google Scholar] [CrossRef] [PubMed]

- Comer, B.; Olmer, N.; Mao, X.; Roy, B.; Rutherford, D. Prevalence of Heavy Fuel Oil and Black Carbon in Arctic Shipping, 2015 to 2025. International Council on Clean Transportation. 2017. Available online: https://www.theicct.org/sites/default/files/publications/HFO-Arctic_ICCT_Report_01052017_vF.pdf (accessed on 20 January 2018).

- Yumashev, D.; van Hussen, K.; Gille, J.; Whiteman, G. Towards a balanced view of Arctic shipping: Estimating economic impacts of emissions from increased traffic on the Northern Sea Route. Clim. Chang. 2017, 143, 143–155. [Google Scholar] [CrossRef]

- Smith, K.R.; Jerrett, M.; Anderson, H.R.; Burnett, R.T.; Stone, V.; Derwent, R.; Atkinson, R.W.; Cohen, A.; Shonkoff, S.B.; Krewski, D.; et al. Public health benefits of strategies to reduce greenhouse-gas emissions: Health implications of short-lived greenhouse pollutants. Lancet 2009, 374, 2091–2103. [Google Scholar] [CrossRef]

- Sofiev, M.; Winebrake, J.J.; Johansson, L.; Carr, E.W.; Prank, M.; Soares, J.; Vira, J.; Kouznetsov, R.; Jalkanen, J.P.; Corbett, J.J. Cleaner fuels for ships provide public health benefits with climate tradeoffs. Nat. Commun. 2018, 9. [Google Scholar] [CrossRef] [PubMed]

- Gritsenko, D.; Kiiski, T. A review of Russian ice-breaking tariff policy on the northern sea route 1991–2014. Polar Rec. 2016, 52, 144–158. [Google Scholar] [CrossRef]

- Sinha, U.K.; Bekkevold, J.I. Arctic: Commerce, Governance and Policy; Routledge: London, UK, 2017; ISBN 978-1-13-885599-1. [Google Scholar]

- Pettersen, J.B.; Song, X. Life Cycle Impact Assessment in the Arctic: Challenges and Research Needs. Sustainability 2017, 9, 1605. [Google Scholar] [CrossRef]

- Sarrabezoles, A.; Lasserre, F.; Hagouagn’rin, Z. Arctic shipping insurance: Towards a harmonisation of practices and costs? Polar Rec. 2016, 52, 393–398. [Google Scholar] [CrossRef]

- Kiiski, T.; Solakivi, T.; Töyli, J.; Ojala, L. Long-term dynamics of shipping and icebreaker capacity along the Northern Sea Route. Marit. Econ. Logist. 2016. [Google Scholar] [CrossRef]

- Grubb, M.; Neuhoff, K. Allocation and competitiveness in the EU emissions trading scheme: Policy overview. Clim. Policy 2016, 6, 7–30. [Google Scholar] [CrossRef]

- Armstrong, V.N. Vessel optimisation for low carbon shipping. Ocean Eng. 2013, 73, 195–207. [Google Scholar] [CrossRef]

| Sailing Parameters | NSR | Suez | Remarks | ||

|---|---|---|---|---|---|

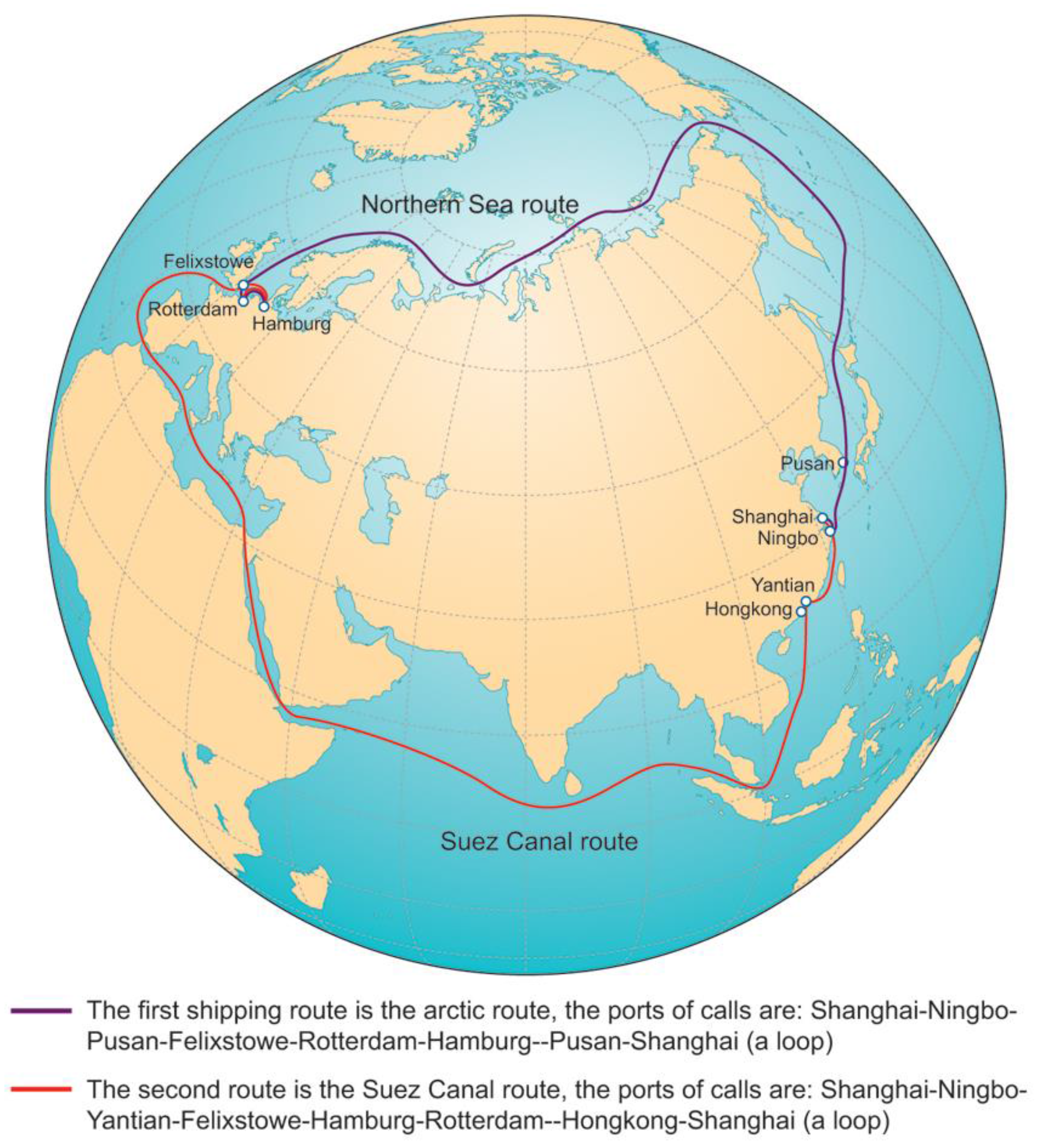

| Distance per loop/n mile | 16,968.3 | 22,156 | Calculation using ”McDistance” software | ||

| Operational time/days | 147 | 151 | From June 1 to October 31 (153 days) Maintenance and repair time (days): NSR: 6, SCR: 2 | ||

| Load factor (eastbound) | 0.55 | 0.60 | SCR: Three year third-quarter average (2015–2017) Data source: www.clarksons.net/portal; NSR: see the main paper | ||

| Load factor (westbound) | 0.84 | 0.89 | |||

| TEU transported, one-way eastbound | 2799 | 3078 | |||

| TEU transported, one-way westbound | 4275 | 4536 | |||

| Sailing time (normal sea conditions)/days | 21.04 | 41.91 | 20 kn | ||

| Sailing time (ECA)/days | 4.39 | 4.25 | ECA data: “McDistance” | ||

| Sailing time (ice area)/days | 14.17 | 0 | 14 kn between Cape Zhelaniya and Cape Dezhnev, about 2380 nm each way | ||

| Delay at the Suez Canal/days | 0 | 4 | Industrial average, 1–2 days delay for one passage during summer | ||

| Number of intermediate ports | 6 | 6 | NSR: Shanghai-Ningbo-Pusan-Felixstowe-Rotterdam-Hamburg-Pusan-Shanghai. SCR: Shanghai-Ningbo-Yantian-Felixstowe-Hamburg-Rotterdam-Hong Kong-Shanghai | ||

| Stop at port/days, per loop | 10 | 10 | COSCO: one day at each Asian port; two days at each European port | ||

| Total voyage time per loop/days | 49.6 | 60.16 | |||

| Number of loops | 3 | 2.5 | |||

| Total TEU transported | 21,222 | 19,764 | |||

| Cost analysis (five months) | |||||

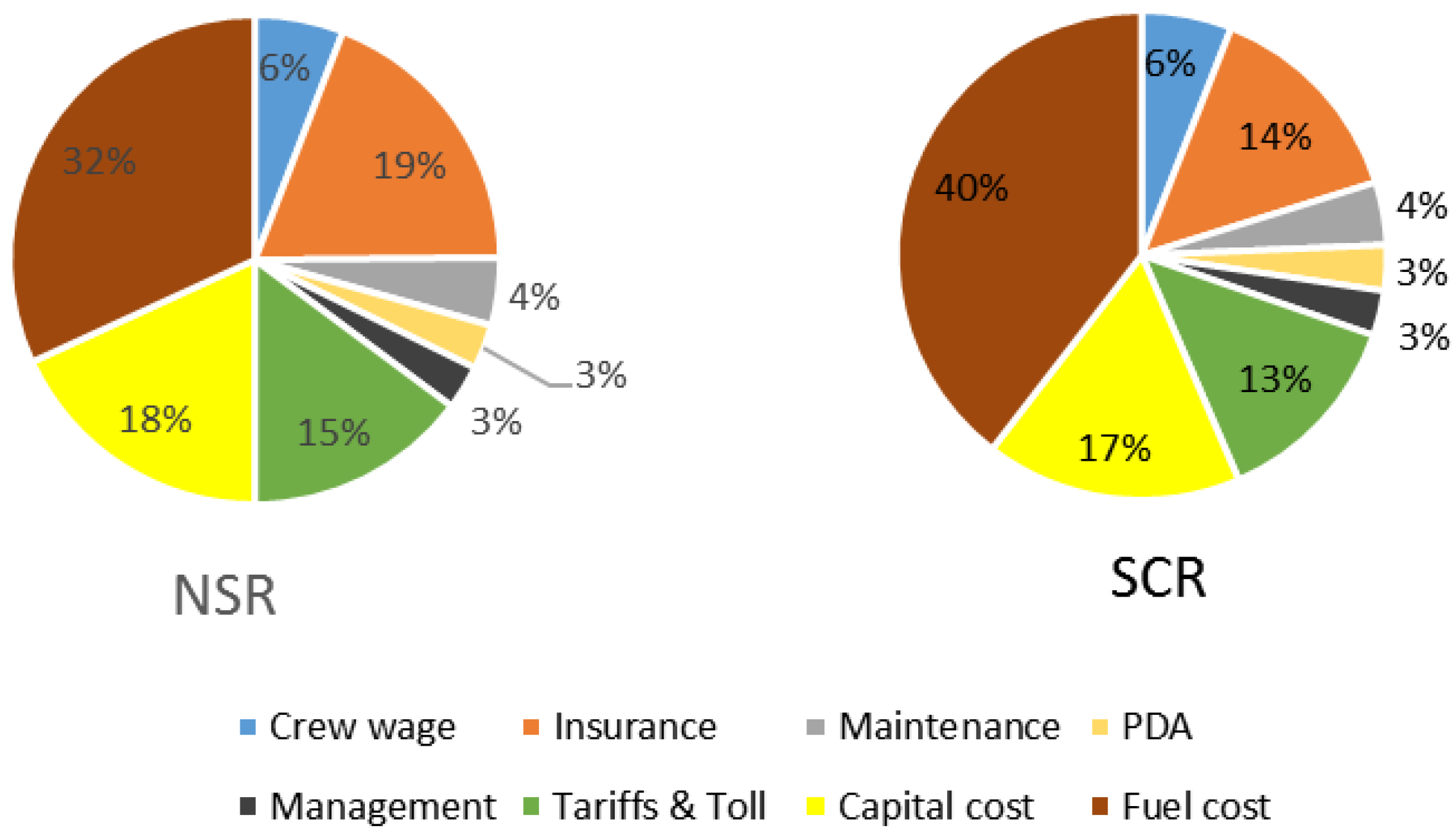

| Crew wage/,000 USD | 621.50 | 565.00 | SCR: 20 crew, $113,000 per month (COSCO); NSR: +10% | ||

| Insurance (H&M, P&I)/,000 USD | 2022.75 | 1348.5 | SCR: H&M rate: 1.4%, P&I rate: 1.7% (COSCO); NSR: +50% | ||

| Maintenance/,000 USD | 474.79 | 395.66 | SCR data from COSCO estimates; NSR: +20% | ||

| Port Disbursement Account (PDA)/,000 USD | 315 | 285 | COSCO: Average $15,000/port, cargo movement and handling not included | ||

| Management/,000 USD | 310.75 | 282.50 | COSCO: Generally half of the crew wage. NSR: +10% | ||

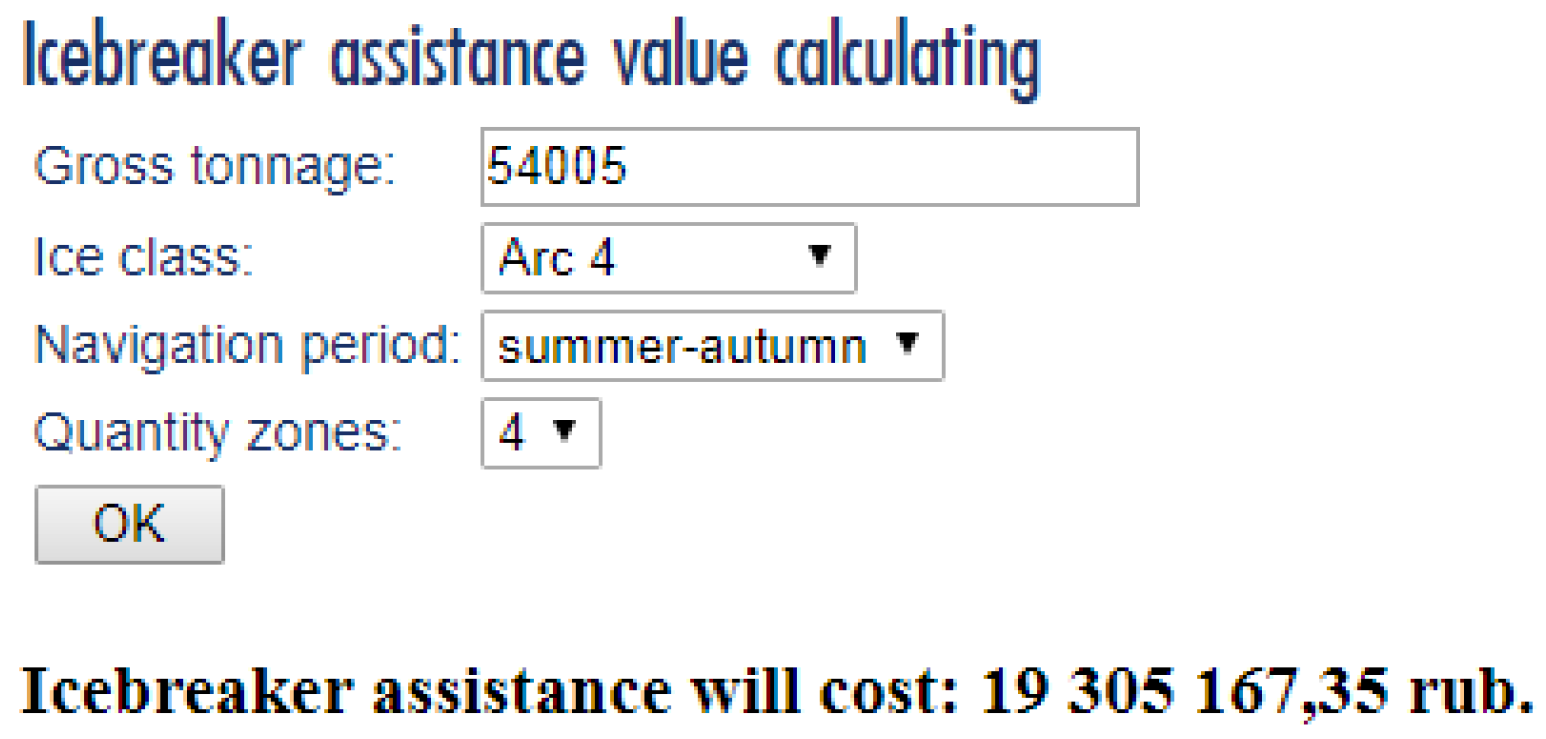

| Tariffs and Tolls/,000 USD | 1575.30 | 1254.84 | NSR: 19.3 million rubles/transit with a 20% discount, 1 rub = $0.017 (www.nsra.ru) Suez Canal: $250,968.85/transit (www.suezcanal.gov.eg) | ||

| Fuel consumption rate t/day (main engine) | 118.8/48.6 | 110/45 | Main engine: 45 t/d at 14 kn, 110 t/d at 20 kn +8% for ice-class ship. Auxiliary engine: 10 t/d at port Average price for the last three years (Rotterdam), every June to October, from 2015 to 2017 IFO380 = $266.46/t,MGO = $449.52/t. Data: www.clarksons.net/portal. | ||

| Fuel consumption rate t/day (auxiliary) | 10 | 10 | |||

| Fuel price USD/t (IFO380) | 266.46 | 266.46 | |||

| Fuel price USD/t (MGO) | 449.52 | 449.52 | |||

| Capital cost/,000 USD | Hired | 1927.8 | 1606.5 | Hire fee: Drewry Container Forecaster Quarter 3, 2017 Self-owned: 43.5 million USD for new building, 7.06 million USD for scrapping, 24-years straight-line depreciation (COSCO); NSR: +20% for ice-class ships. | |

| Owned | 783.68 | 632.64 | |||

| Fuel consumption per loop/t (IFO380) | I | 3188.45 | 4610.40 | ||

| II | 2499.95 | ||||

| Fuel consumption per loop/t (MGO) | I | 621.61 | 607.02 | ||

| II | 1310.11 | ||||

| Fuel cost/,000 USD | I | 3387.05 | 3753.38 | NSR: 1129.02/1255.06 thousand USD per loop | |

| II | 3765.17 | SCR: 1501.35 thousand USD per loop | |||

| Total cost/,000 USD | Hired | I | 10,634.95 | 9491.38 | NSR: 3544.98/3671.02 thousand USD per loop |

| II | 11,013.06 | SCR: 3796.55 thousand USD per loop | |||

| Owned | I | 9490.93 | 8517.52 | NSR: 3163.64/3289.68 thousand USD per loop | |

| II | 9869.04 | SCR: 3407.01 thousand USD per loop | |||

| Unit cost (USD/TEU) | Hired | I | 501.13 | 480.24 | |

| II | 518.95 | ||||

| Owned | I | 447.22 | 430.96 | ||

| II | 465.04 | ||||

| Revenue analysis | |||||

| Freight rate per TEU/USD | 921.7 | Shanghai Shipping Exchange for AEX route: $921.7/TEU (Q1–Q3 average, 2017) | |||

| Total Revenue/,000 USD | 19,560.32 | 18,216.48 | |||

| Total Profit/,000 USD | Hired | I | 8925.37 | 8725.09 | |

| II | 8547.26 | ||||

| Owned | I | 10,069.39 | 9698.95 | ||

| II | 9691.28 | ||||

| Profit per TEU/USD | Hired | I | 420.57 | 441.46 | |

| II | 402.75 | ||||

| Owned | I | 474.48 | 490.74 | ||

| II | 456.66 | ||||

| Sensitivity Analysis | Differential (USD, 000) | −50% | −40% | −30% | −20% | −10% | 0% | 10% | 20% | 30% | 40% | 50% |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Hired | Fuel Cost | 17.11 | 53.74 | 90.37 | 127.01 | 163.64 | 200.27 | 236.90 | 273.54 | 310.17 | 346.80 | 383.44 |

| NSR Tariff | 987.92 | 830.39 | 672.86 | 515.33 | 357.80 | 200.27 | 42.74 | −114.79 | −272.32 | −429.85 | −587.38 | |

| Insurance | 1211.65 | 1009.37 | 807.10 | 604.82 | 402.55 | 200.27 | −2.00 | −204.28 | −406.55 | −608.83 | −811.10 | |

| Load Factor | −9577.12 | −7622.20 | −5664.51 | −3709.58 | −1751.89 | 200.27 | 2157.96 | 3999.52 | - | - | - | |

| Self-owned | Fuel cost | 187.27 | 223.90 | 260.53 | 297.17 | 333.80 | 370.43 | 407.06 | 443.70 | 480.33 | 516.96 | 553.60 |

| NSR Tariff | 1158.08 | 1000.55 | 843.02 | 685.49 | 527.96 | 370.43 | 212.90 | 55.37 | −102.16 | −259.69 | −417.22 | |

| Insurance | 1381.81 | 1179.53 | 977.26 | 774.98 | 572.71 | 370.43 | 168.16 | −34.12 | −236.39 | −438.67 | −640.94 | |

| Load Factor | −9406.96 | −7452.04 | −5494.35 | −3539.42 | −1581.73 | 370.43 | 2328.12 | 4169.68 | - | - | - |

| Emissions | NSR | Suez | Emission Factor Value |

|---|---|---|---|

| CO2 | 119,936.81 | 163,688.25 | 77,400 kg/TJ for IFO380 and MGO |

| CH4 | 4.65 | 6.34 | 3 kg/TJ for IFO380 and MGO |

| N2O | 0.93 | 1.27 | 0.6 kg/TJ for IFO380 and MGO |

| NOx | 301.64 | 413.26 | 79.3 kg/T for IFO380, 78.5 kg/T for MGO |

| CO | 28.19 | 38.61 | 7.4 kg/T for IFO380 and MGO |

| SOx | 76.20 | 104.35 | 20 kg/T for IFO380 and MGO |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wan, Z.; Ge, J.; Chen, J. Energy-Saving Potential and an Economic Feasibility Analysis for an Arctic Route between Shanghai and Rotterdam: Case Study from China’s Largest Container Sea Freight Operator. Sustainability 2018, 10, 921. https://doi.org/10.3390/su10040921

Wan Z, Ge J, Chen J. Energy-Saving Potential and an Economic Feasibility Analysis for an Arctic Route between Shanghai and Rotterdam: Case Study from China’s Largest Container Sea Freight Operator. Sustainability. 2018; 10(4):921. https://doi.org/10.3390/su10040921

Chicago/Turabian StyleWan, Zheng, Jiawei Ge, and Jihong Chen. 2018. "Energy-Saving Potential and an Economic Feasibility Analysis for an Arctic Route between Shanghai and Rotterdam: Case Study from China’s Largest Container Sea Freight Operator" Sustainability 10, no. 4: 921. https://doi.org/10.3390/su10040921