Impact of Land Input on Economic Growth at Different Stages of Development in Chinese Cities and Regions

Abstract

:1. Introduction

2. Previous Literature

3. Methodology and Data

3.1. Methodology

3.1.1. Theil Statistics

3.1.2. Economic Model

3.2. Data

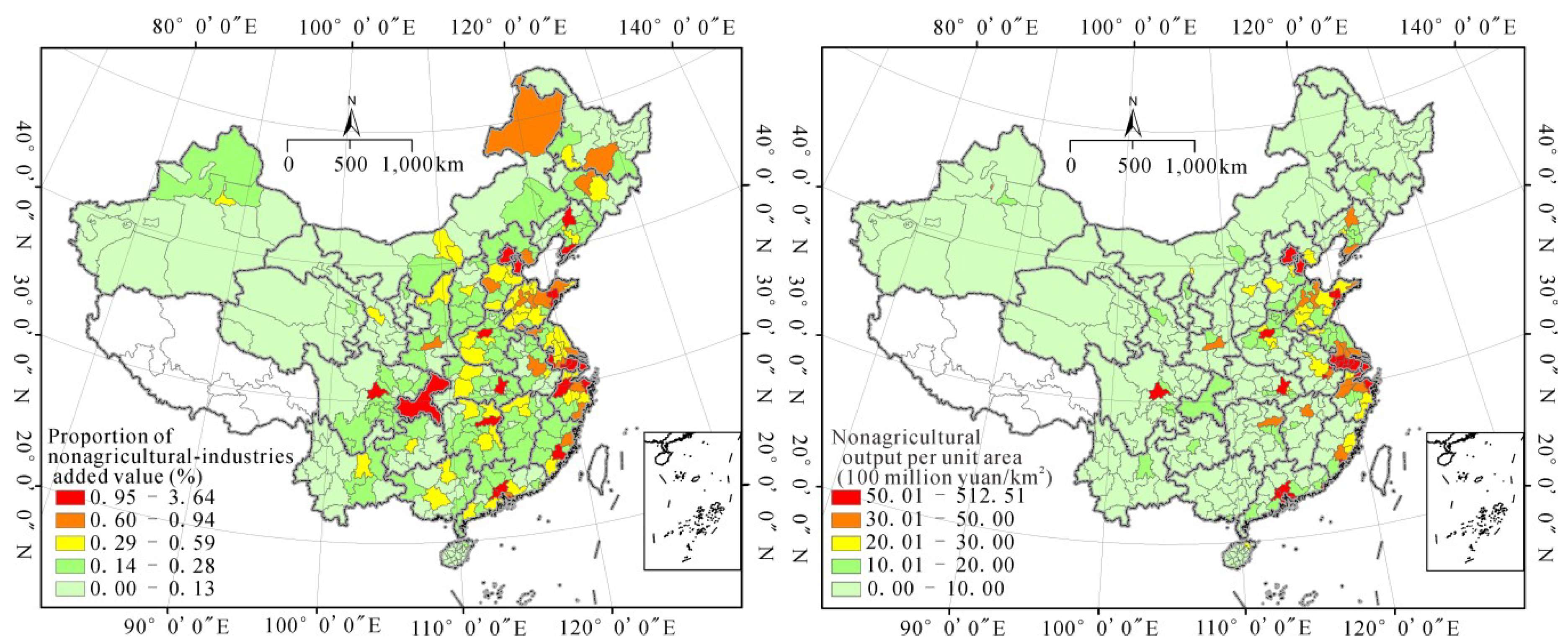

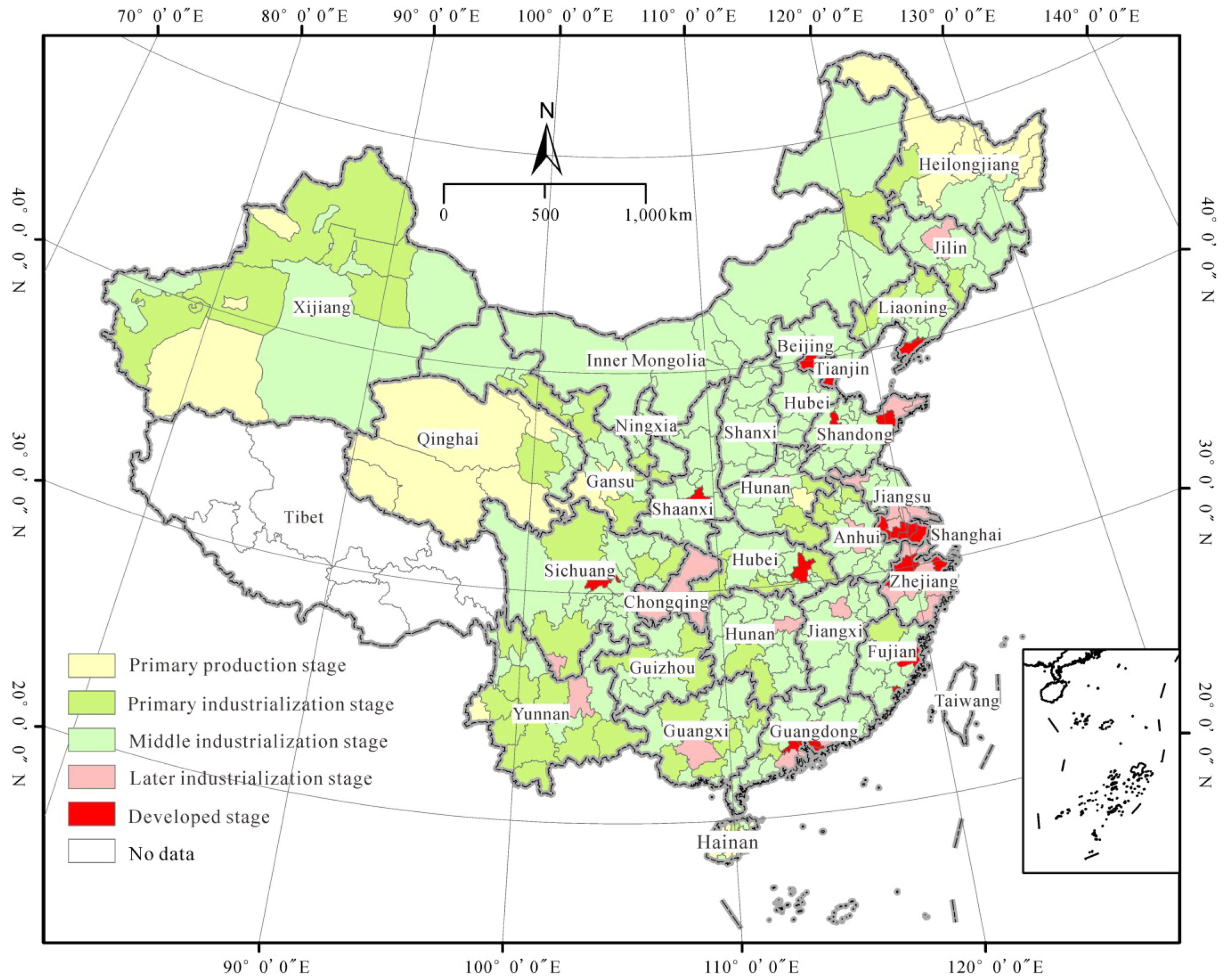

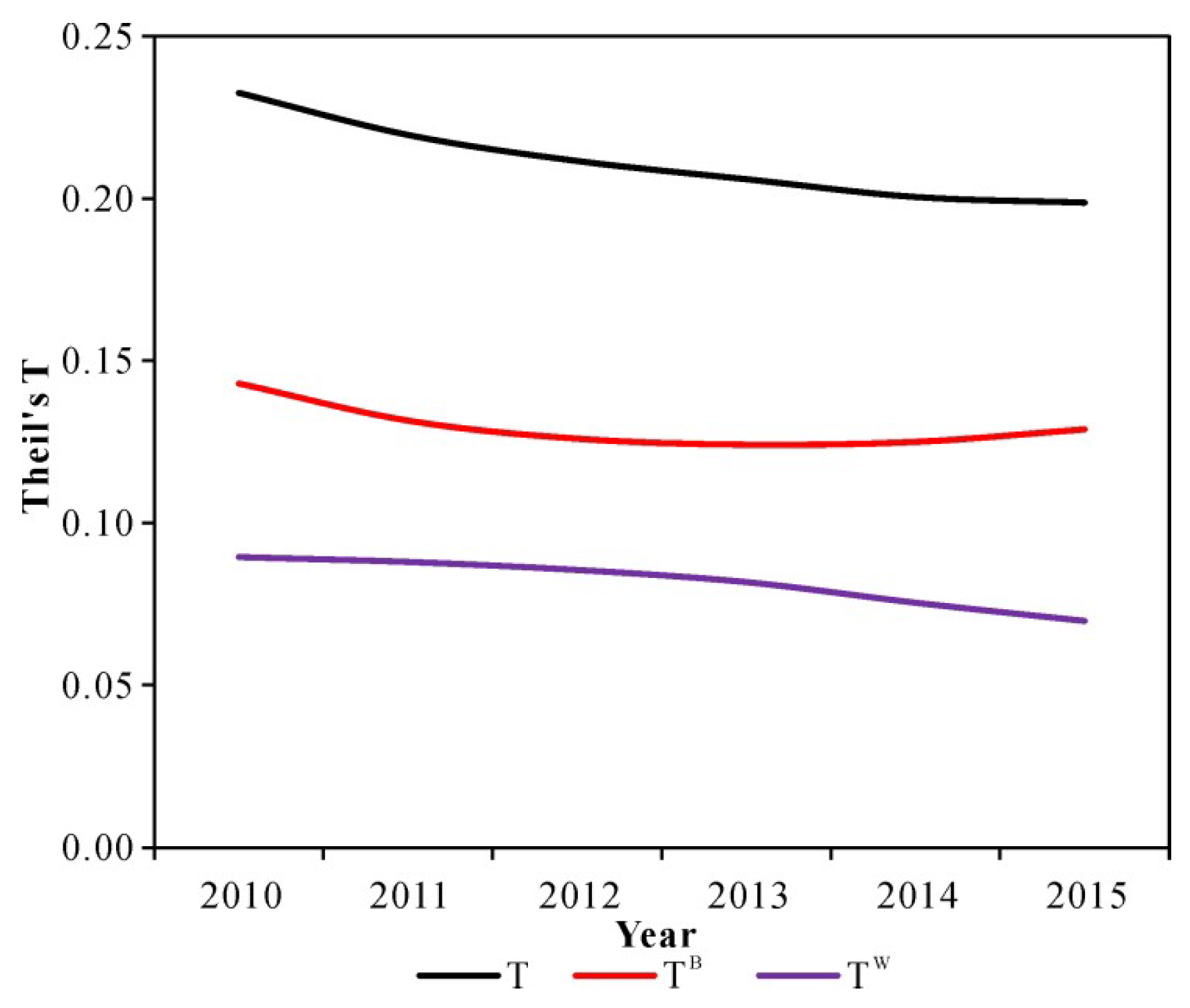

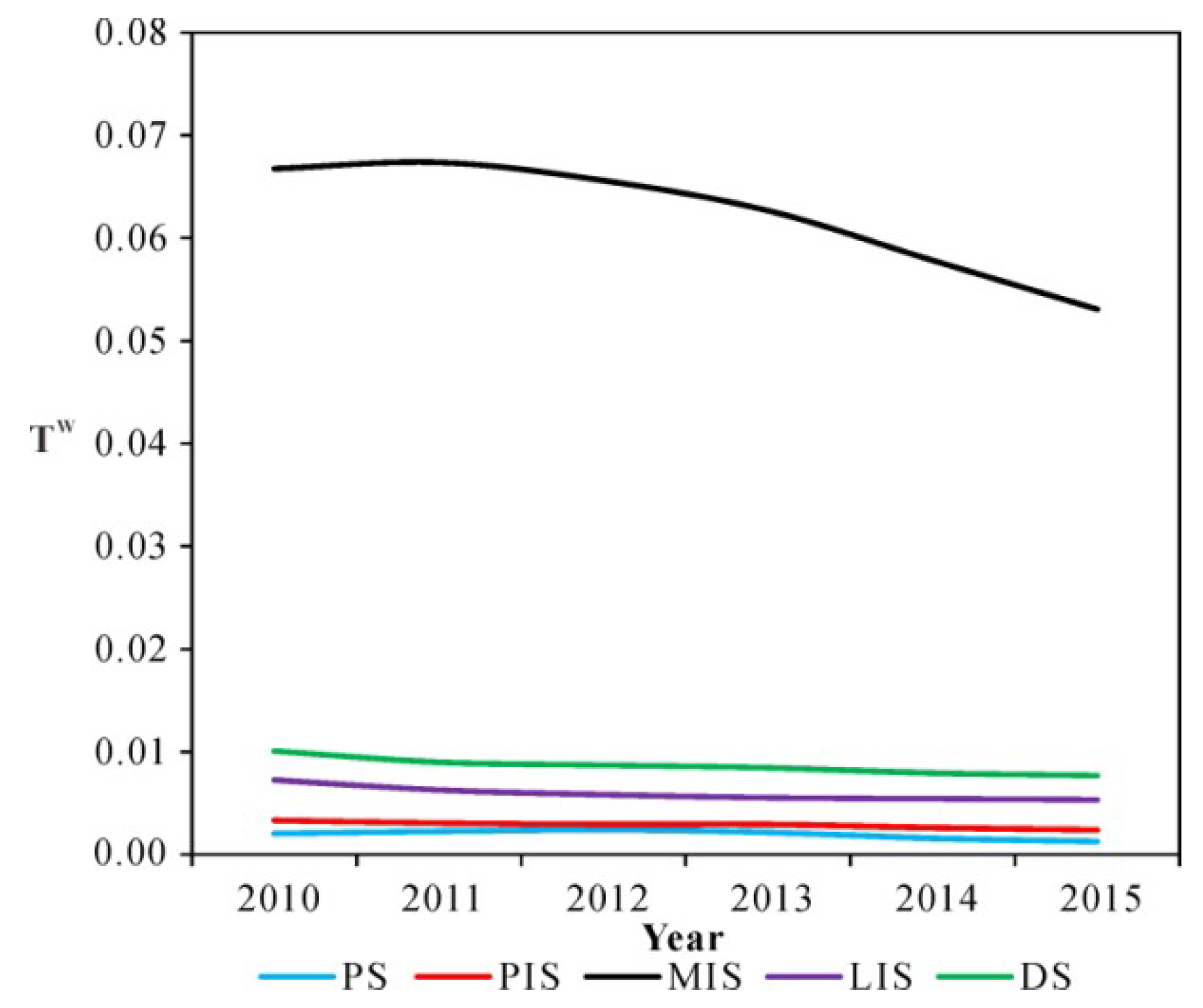

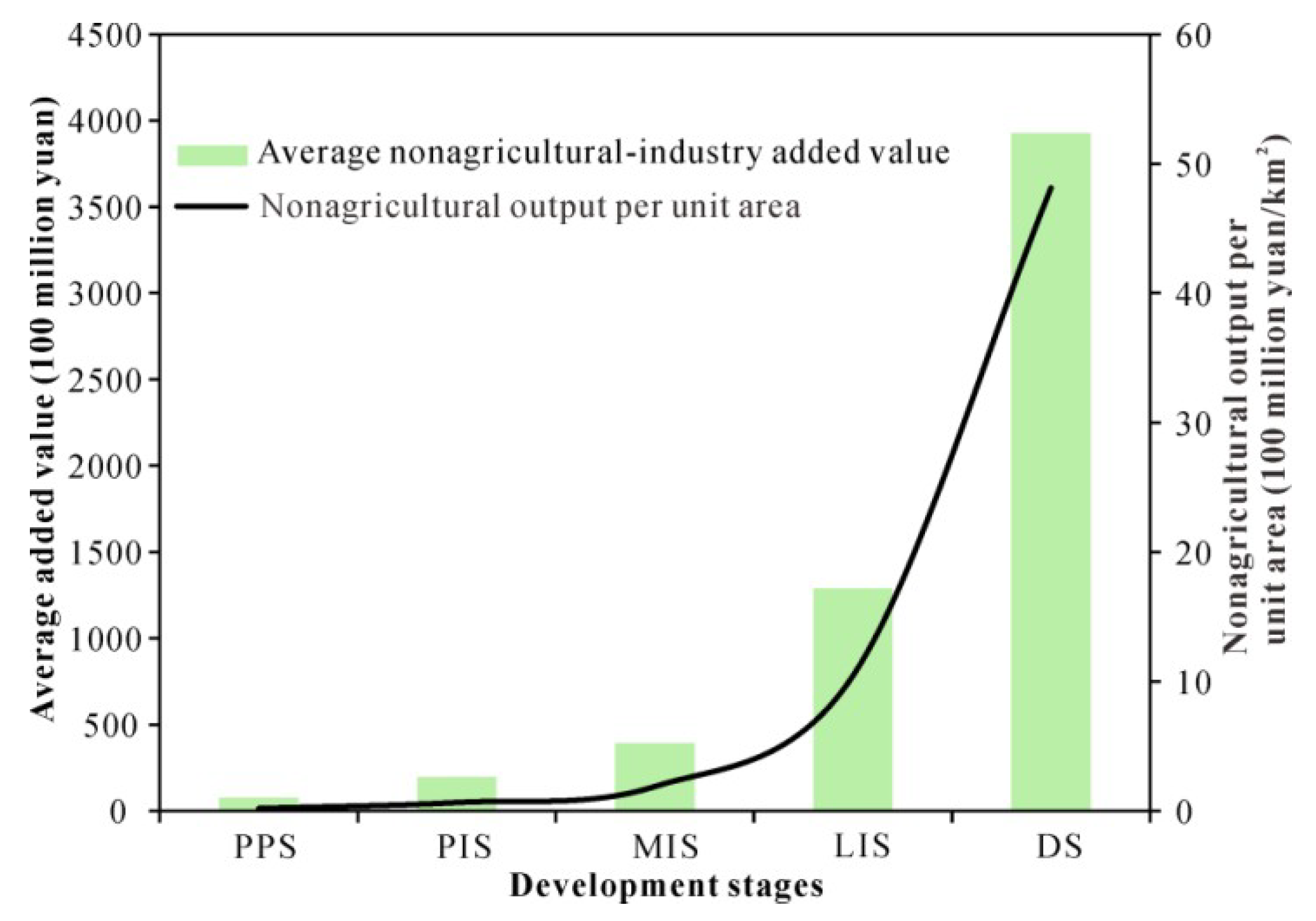

4. Economic Growth of Cities and Regions at Different Stages of Development

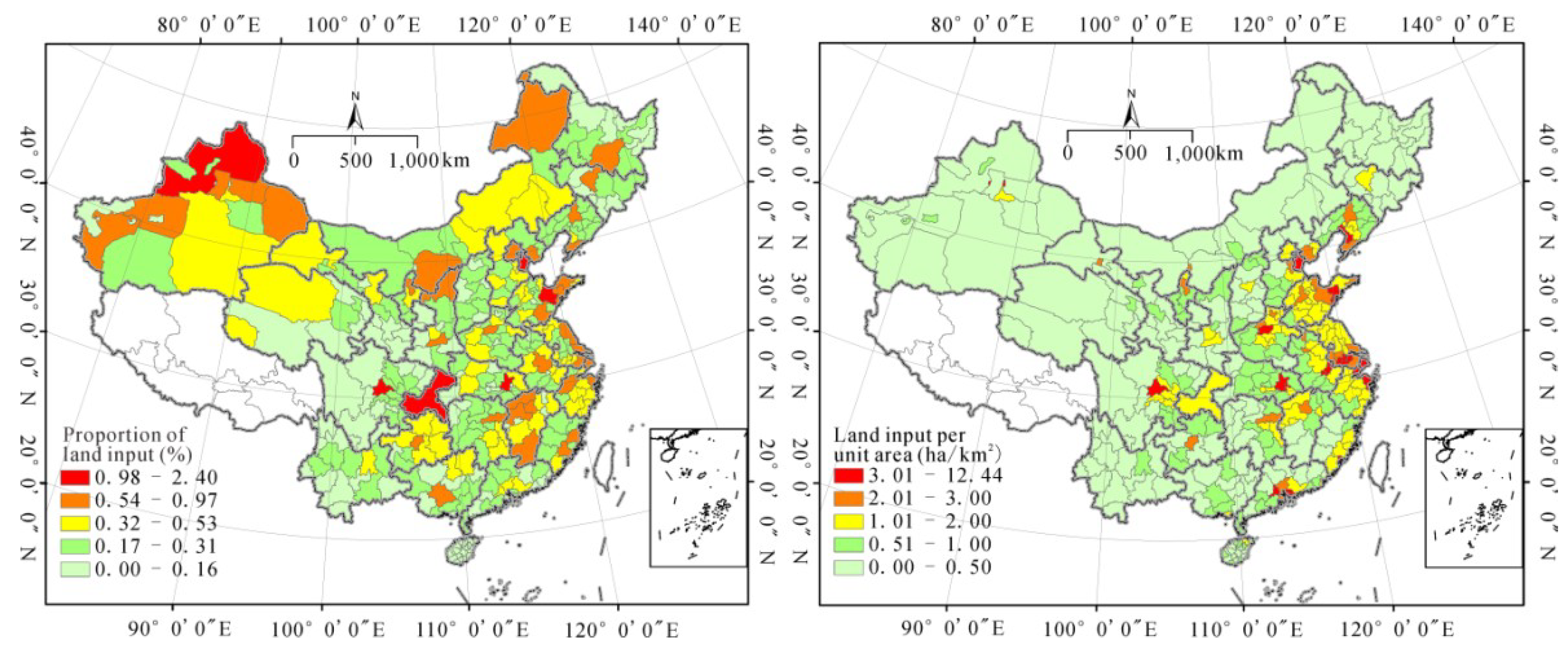

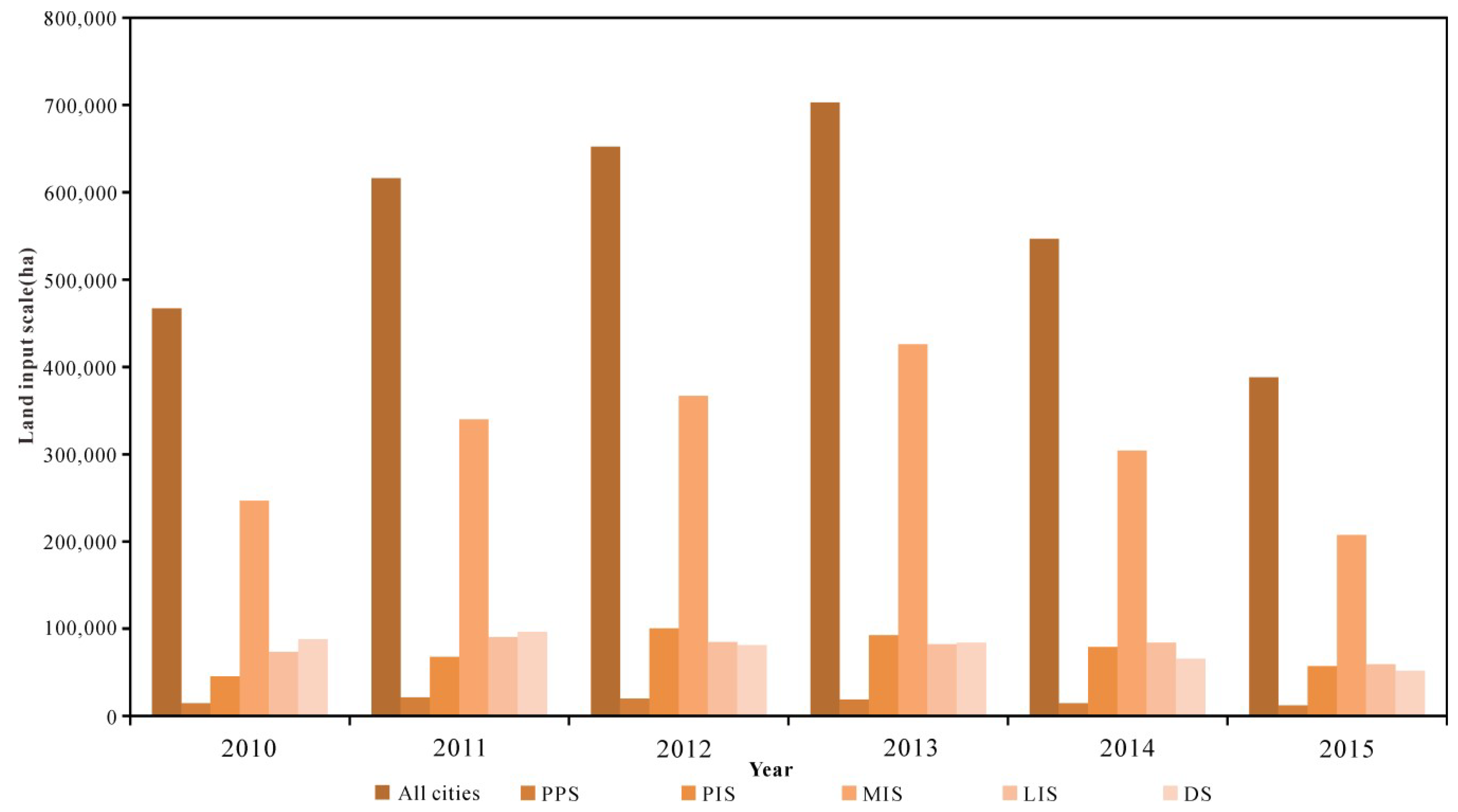

5. Land Input of Cities and Regions at Different Stages of Development

6. Impact of Land Input of Cities and Regions on Economic Growth at Different Stages of Development

7. Conclusions and Policy Implications

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

| City/Region | Area (10,000 km2) | Size (10,000 Persons) | Density (Person/km2) | Proportion (%) | City/Region | Area (10,000 km2) | Size (10,000 Persons) | Density (Person/km2) | Proportion (%) |

|---|---|---|---|---|---|---|---|---|---|

| Aba | 8.11 | 93.01 | 11.47 | 0.07 | Luoyang | 1.44 | 674.30 | 466.95 | 0.49 |

| Akesu | 11.74 | 260.34 | 22.17 | 0.19 | Luzhou | 1.22 | 432.50 | 355.33 | 0.31 |

| Alaer | 0.59 | 21.92 | 36.85 | 0.02 | Lvliang | 2.00 | 383.22 | 191.62 | 0.28 |

| Alashan | 22.44 | 24.35 | 1.09 | 0.02 | Maanshan | 0.16 | 226.22 | 1413.98 | 0.16 |

| Ankang | 2.25 | 265.00 | 117.96 | 0.19 | Maoming | 1.24 | 608.08 | 488.73 | 0.44 |

| Anqing | 1.57 | 540.73 | 345.05 | 0.39 | Meishan | 0.74 | 300.13 | 407.23 | 0.22 |

| Anshan | 0.88 | 347.10 | 394.46 | 0.25 | Meizhou | 1.66 | 434.08 | 261.65 | 0.32 |

| Anshun | 0.94 | 231.35 | 245.08 | 0.17 | Mianyang | 2.00 | 477.19 | 238.81 | 0.35 |

| Anyang | 0.70 | 511.70 | 731.17 | 0.37 | Mudangjiang | 3.61 | 262.04 | 72.65 | 0.19 |

| Baicheng | 2.38 | 196.67 | 82.65 | 0.14 | Nanchang | 0.77 | 530.29 | 687.22 | 0.39 |

| Baise | 3.83 | 359.67 | 93.87 | 0.26 | Nanchong | 1.23 | 636.40 | 517.53 | 0.46 |

| Baisha | 0.25 | 17.10 | 69.01 | 0.01 | Nanjing | 0.67 | 823.59 | 1227.90 | 0.60 |

| Baishan | 1.61 | 125.37 | 77.76 | 0.09 | Nanning | 2.40 | 698.61 | 291.21 | 0.51 |

| Baiyin | 1.94 | 173.69 | 89.56 | 0.13 | Nanping | 2.67 | 266.76 | 100.05 | 0.19 |

| Baoding | 2.09 | 1155.24 | 552.18 | 0.84 | Nantong | 0.82 | 730.00 | 893.08 | 0.53 |

| Baoji | 1.77 | 376.33 | 212.65 | 0.27 | Nanyang | 2.64 | 1002.12 | 379.88 | 0.73 |

| Baoshan | 2.06 | 258.10 | 125.13 | 0.19 | Neijiang | 0.55 | 373.97 | 684.89 | 0.27 |

| Baoting | 0.13 | 15.02 | 112.77 | 0.01 | Ningbo | 0.83 | 782.50 | 945.06 | 0.57 |

| Baotou | 2.58 | 282.93 | 109.80 | 0.21 | Ningde | 1.32 | 287.00 | 217.95 | 0.21 |

| Bayanzhuoe | 5.98 | 167.73 | 28.06 | 0.12 | Nujiang | 1.40 | 54.20 | 38.78 | 0.04 |

| Bayinguole | 44.45 | 146.32 | 3.29 | 0.11 | Ordos | 8.09 | 204.51 | 25.29 | 0.15 |

| Bazhong | 1.19 | 332.86 | 279.79 | 0.24 | Panjin | 0.28 | 126.70 | 451.35 | 0.09 |

| Beihai | 0.36 | 162.57 | 454.84 | 0.12 | Panzhihua | 0.75 | 123.81 | 166.15 | 0.09 |

| Beijing | 1.53 | 2170.50 | 1421.65 | 1.58 | Pingdingshan | 0.76 | 496.34 | 652.22 | 0.36 |

| Bengbu | 0.56 | 329.14 | 589.81 | 0.24 | Pingliang | 1.05 | 209.80 | 200.13 | 0.15 |

| Benxi | 0.76 | 151.60 | 199.22 | 0.11 | Pingxiang | 0.41 | 190.11 | 467.86 | 0.14 |

| Bijie | 2.72 | 660.61 | 242.47 | 0.48 | Puer | 4.73 | 260.50 | 55.06 | 0.19 |

| Binzhou | 0.81 | 385.90 | 477.80 | 0.28 | Putian | 0.43 | 287.00 | 675.25 | 0.21 |

| Boer | 2.36 | 49.74 | 21.10 | 0.04 | Puyang | 0.37 | 361.00 | 970.72 | 0.26 |

| Bozhou | 0.86 | 504.69 | 585.67 | 0.37 | Qiandongnan | 3.12 | 350.48 | 112.36 | 0.25 |

| Cangzhou | 1.30 | 744.30 | 574.64 | 0.54 | Qianjiang | 0.20 | 95.80 | 478.89 | 0.07 |

| Chande | 1.88 | 584.39 | 311.09 | 0.43 | Qiannan | 2.74 | 325.22 | 118.60 | 0.24 |

| Changchun | 1.88 | 779.30 | 414.75 | 0.57 | Qianxinan | 1.84 | 284.26 | 154.39 | 0.21 |

| Changji | 6.98 | 142.02 | 20.36 | 0.10 | Qingdao | 1.03 | 909.70 | 886.92 | 0.66 |

| Changjiang | 0.17 | 22.92 | 135.76 | 0.02 | Qingyang | 2.58 | 223.05 | 86.52 | 0.16 |

| Changsha | 1.17 | 743.18 | 635.05 | 0.54 | Qingyuan | 2.00 | 383.45 | 191.48 | 0.28 |

| Changzhi | 1.31 | 342.04 | 261.85 | 0.25 | Qinhuangdao | 0.71 | 307.32 | 434.37 | 0.22 |

| Changzhou | 0.43 | 470.14 | 1087.60 | 0.34 | Qinzhou | 1.16 | 320.93 | 276.46 | 0.23 |

| Chaozhou | 0.33 | 272.87 | 835.07 | 0.20 | Qionghai | 0.20 | 50.25 | 252.05 | 0.04 |

| Chengde | 3.68 | 353.01 | 96.02 | 0.26 | Qiongzhong | 0.28 | 17.72 | 62.24 | 0.01 |

| Chengdu | 1.20 | 1465.80 | 1220.61 | 1.07 | Qiqihaer | 3.90 | 549.39 | 140.79 | 0.40 |

| Chengmai | 0.24 | 48.39 | 204.73 | 0.04 | Qitaihe | 0.55 | 91.27 | 165.15 | 0.07 |

| Chenzhou | 2.04 | 473.02 | 231.79 | 0.34 | Quanzhou | 1.15 | 851.00 | 737.02 | 0.62 |

| Chifeng | 8.06 | 429.95 | 53.34 | 0.31 | Qujing | 3.00 | 604.70 | 201.55 | 0.44 |

| Chizhou | 0.84 | 143.63 | 171.46 | 0.10 | Quzhou | 0.93 | 213.30 | 229.91 | 0.16 |

| Chongqing | 8.11 | 3016.55 | 371.75 | 2.19 | Rizhao | 0.49 | 288.00 | 589.98 | 0.21 |

| Chongzuo | 1.90 | 205.45 | 107.90 | 0.15 | Sanmenxia | 0.95 | 225.31 | 238.32 | 0.16 |

| Chuxiong | 3.03 | 273.30 | 90.22 | 0.20 | Sanming | 2.37 | 253.00 | 106.79 | 0.18 |

| Chuzhou | 1.34 | 401.71 | 299.55 | 0.29 | Sanya | 0.23 | 74.89 | 323.05 | 0.05 |

| Dali | 2.96 | 354.40 | 119.90 | 0.26 | Shanghai | 0.62 | 2415.27 | 3924.80 | 1.76 |

| Dalian | 1.14 | 593.90 | 520.08 | 0.43 | Shangluo | 1.89 | 235.74 | 124.73 | 0.17 |

| Dandong | 1.31 | 238.80 | 182.31 | 0.17 | Shangqiu | 1.01 | 727.39 | 721.29 | 0.53 |

| Danzhou | 0.34 | 97.77 | 285.92 | 0.07 | Shangrao | 2.28 | 671.51 | 293.96 | 0.49 |

| Daqing | 1.92 | 277.48 | 144.50 | 0.20 | Shantou | 0.23 | 555.21 | 2462.22 | 0.40 |

| Datong | 1.33 | 340.64 | 256.77 | 0.25 | Shanwei | 0.53 | 302.16 | 571.09 | 0.22 |

| Daxingan | 5.94 | 47.24 | 7.95 | 0.03 | Shaoguan | 1.93 | 293.15 | 151.50 | 0.21 |

| Dazhou | 1.63 | 556.76 | 340.71 | 0.41 | Shaoxin | 0.81 | 496.80 | 614.12 | 0.36 |

| Dehong | 1.21 | 127.90 | 105.27 | 0.09 | Shaoyang | 2.11 | 726.17 | 343.55 | 0.53 |

| Deyang | 0.60 | 351.30 | 589.84 | 0.26 | Shennongjia | 0.32 | 7.68 | 24.09 | 0.01 |

| Dezhou | 1.02 | 574.23 | 562.90 | 0.42 | Shenyang | 1.19 | 730.60 | 615.57 | 0.53 |

| Dingan | 0.14 | 29.14 | 211.66 | 0.02 | Shenzhen | 0.21 | 1137.87 | 5375.70 | 0.83 |

| Dingxi | 1.89 | 277.83 | 146.83 | 0.20 | Shihezi | 0.05 | 65.18 | 1442.39 | 0.05 |

| Diqing | 2.41 | 40.80 | 16.93 | 0.03 | Shijiazhuang | 1.34 | 1070.16 | 799.09 | 0.78 |

| Dongfang | 0.25 | 42.01 | 168.33 | 0.03 | Shiyan | 2.33 | 338.30 | 144.97 | 0.25 |

| Dongguan | 0.24 | 825.41 | 3427.65 | 0.60 | Shizuishan | 0.36 | 78.80 | 218.08 | 0.06 |

| Dongying | 0.59 | 211.06 | 359.23 | 0.15 | Shuangyashan | 1.98 | 147.43 | 74.31 | 0.11 |

| Enshi | 2.46 | 332.70 | 135.16 | 0.24 | Shuozhou | 1.03 | 176.22 | 171.69 | 0.13 |

| Ezhou | 0.15 | 105.95 | 721.55 | 0.08 | Siping | 1.35 | 326.41 | 241.17 | 0.24 |

| Fangcheng | 0.65 | 91.84 | 141.37 | 0.07 | Songyuan | 1.96 | 278.07 | 142.13 | 0.20 |

| Foshan | 0.41 | 743.06 | 1798.33 | 0.54 | Suihua | 3.15 | 548.51 | 174.12 | 0.40 |

| Fushun | 1.05 | 216.60 | 205.36 | 0.16 | Suining | 0.53 | 329.00 | 620.88 | 0.24 |

| Fuxin | 1.00 | 190.20 | 190.29 | 0.14 | Suizhou | 0.93 | 219.08 | 236.71 | 0.16 |

| Fuyang | 1.01 | 790.15 | 783.29 | 0.57 | Suqian | 0.88 | 485.38 | 552.00 | 0.35 |

| Fuyun | 0.81 | 246.05 | 303.56 | 0.18 | Suzhou3 | 0.95 | 554.12 | 581.86 | 0.40 |

| Fuzhou1 | 1.87 | 399.28 | 213.56 | 0.29 | Suzhou4 | 0.80 | 1061.60 | 1334.78 | 0.77 |

| Fuzhou2 | 1.22 | 750.00 | 615.10 | 0.55 | Taian | 0.74 | 560.08 | 752.24 | 0.41 |

| Gannan | 3.52 | 70.50 | 20.05 | 0.05 | Taiyuan | 0.67 | 431.87 | 647.71 | 0.31 |

| Ganzhou | 4.12 | 854.71 | 207.28 | 0.62 | Taizhou5 | 0.93 | 610.40 | 656.67 | 0.44 |

| Ganzi | 14.51 | 116.49 | 8.03 | 0.08 | Taizhou6 | 0.56 | 464.16 | 829.16 | 0.34 |

| Gouluo | 7.48 | 19.43 | 2.60 | 0.01 | Tangshan | 1.19 | 780.12 | 656.84 | 0.57 |

| Guangan | 0.63 | 324.66 | 516.61 | 0.24 | Tian | 1.09 | 1546.95 | 1415.19 | 1.13 |

| Guangyuan | 1.57 | 263.00 | 167.57 | 0.19 | Tianmen | 0.29 | 129.20 | 449.68 | 0.09 |

| Guangzhou | 0.80 | 1350.11 | 1693.44 | 0.98 | Tianshui | 1.32 | 331.17 | 250.31 | 0.24 |

| Guigang | 1.16 | 429.37 | 369.92 | 0.31 | Tieling | 1.21 | 299.00 | 246.84 | 0.22 |

| Guilin | 2.86 | 496.16 | 173.75 | 0.36 | Tongchuan | 0.37 | 84.62 | 228.09 | 0.06 |

| Guiyang | 0.80 | 462.18 | 580.74 | 0.34 | Tonghua | 1.46 | 221.10 | 151.63 | 0.16 |

| Guyuan | 0.95 | 131.59 | 138.17 | 0.10 | Tongliao | 5.47 | 312.08 | 57.09 | 0.23 |

| Haerbin | 4.85 | 961.37 | 198.29 | 0.70 | Tonglin | 0.11 | 73.98 | 675.64 | 0.05 |

| Haibei | 3.31 | 30.06 | 9.08 | 0.02 | Tongren | 1.81 | 312.24 | 172.48 | 0.23 |

| Haidong | 1.23 | 174.40 | 141.32 | 0.13 | Tulufan | 6.38 | 66.33 | 10.39 | 0.05 |

| Haikou | 0.24 | 222.30 | 932.17 | 0.16 | Tumukesu | 0.22 | 17.59 | 78.68 | 0.01 |

| Hainan | 4.10 | 47.81 | 11.67 | 0.03 | Tunchang | 0.14 | 26.36 | 184.12 | 0.02 |

| Haixi | 30.94 | 41.67 | 1.35 | 0.03 | Wanning | 0.21 | 56.47 | 265.57 | 0.04 |

| Hami | 12.71 | 62.54 | 4.92 | 0.05 | Weifang | 1.49 | 927.72 | 622.49 | 0.67 |

| Handan | 1.17 | 943.30 | 807.12 | 0.69 | Weihai | 0.51 | 281.28 | 547.31 | 0.20 |

| Hangzhou | 1.68 | 901.80 | 536.22 | 0.66 | Weinan | 1.23 | 535.99 | 435.62 | 0.39 |

| Hanzhong | 2.63 | 343.81 | 130.94 | 0.25 | Wenchang | 0.28 | 55.49 | 199.99 | 0.04 |

| Hebi | 0.22 | 165.10 | 760.18 | 0.12 | Wenshan | 3.33 | 360.70 | 108.20 | 0.26 |

| Hechi | 3.44 | 347.68 | 101.07 | 0.25 | Wenzhou | 1.12 | 927.90 | 824.87 | 0.68 |

| Hefei | 1.65 | 778.95 | 471.49 | 0.57 | Wuhai | 0.16 | 55.58 | 341.42 | 0.04 |

| Hegang | 1.34 | 105.61 | 78.78 | 0.08 | Wuhan | 0.87 | 1060.77 | 1224.15 | 0.77 |

| Heihe | 6.27 | 167.94 | 26.80 | 0.12 | Wuhu | 0.33 | 365.45 | 1107.67 | 0.27 |

| Hengshui | 0.82 | 443.54 | 543.59 | 0.32 | Wujiaqu | 0.09 | 9.37 | 103.39 | 0.01 |

| Hengyang | 1.54 | 733.75 | 476.03 | 0.53 | Wulanchabu | 5.11 | 211.13 | 41.32 | 0.15 |

| Hetian | 23.58 | 221.67 | 9.40 | 0.16 | Wulumuqi | 0.95 | 270.89 | 285.00 | 0.20 |

| Heyuan | 1.64 | 307.35 | 187.39 | 0.22 | Wuwei | 3.12 | 182.73 | 58.54 | 0.13 |

| Heze | 1.19 | 850.03 | 713.88 | 0.62 | Wuxi | 0.46 | 651.10 | 1421.79 | 0.47 |

| Hezhou | 1.22 | 202.59 | 165.89 | 0.15 | Wuzhishan | 0.14 | 10.56 | 74.68 | 0.01 |

| Honghe | 3.55 | 465.00 | 130.85 | 0.34 | Wuzhong | 1.50 | 137.32 | 91.36 | 0.10 |

| Huaian | 0.90 | 487.20 | 541.10 | 0.35 | Wuzhou | 1.37 | 299.94 | 218.23 | 0.22 |

| Huaibei | 0.26 | 217.88 | 836.30 | 0.16 | Xiamen | 0.19 | 386.00 | 2084.46 | 0.28 |

| Huaihua | 2.80 | 490.16 | 175.18 | 0.36 | Xian | 0.98 | 870.56 | 884.00 | 0.63 |

| Huainan | 0.20 | 239.35 | 1197.70 | 0.17 | Xiangtan | 0.50 | 282.37 | 565.73 | 0.21 |

| Huanggang | 1.73 | 629.10 | 363.28 | 0.46 | Xiangxi | 1.58 | 263.45 | 166.97 | 0.19 |

| Huangnan | 1.73 | 27.89 | 16.11 | 0.02 | Xiangyang | 1.89 | 561.40 | 297.30 | 0.41 |

| Huangshan | 0.97 | 137.37 | 142.05 | 0.10 | Xianning | 1.00 | 250.70 | 251.29 | 0.18 |

| Huangshi | 0.43 | 245.80 | 575.93 | 0.18 | Xiantao | 0.25 | 119.18 | 475.77 | 0.09 |

| Huhehaote | 1.58 | 305.96 | 193.69 | 0.22 | Xianyang | 1.00 | 517.58 | 516.25 | 0.38 |

| Huizhou | 1.23 | 475.55 | 386.18 | 0.35 | Xiaogan | 0.90 | 487.80 | 542.23 | 0.35 |

| Huludao | 0.91 | 278.60 | 307.32 | 0.20 | Xinan | 4.93 | 159.91 | 32.42 | 0.12 |

| Hulunbeier | 23.58 | 252.65 | 10.71 | 0.18 | Xingtai | 1.18 | 729.44 | 615.70 | 0.53 |

| Huzhou | 0.59 | 295.00 | 502.88 | 0.21 | Xining | 0.71 | 205.02 | 287.55 | 0.15 |

| Jiamusi | 2.99 | 237.55 | 79.45 | 0.17 | Xinlinguole | 18.51 | 99.16 | 5.36 | 0.07 |

| Jian | 2.55 | 489.90 | 192.09 | 0.36 | Xinxiang | 0.82 | 572.10 | 700.42 | 0.42 |

| Jiangmen | 0.96 | 451.95 | 469.50 | 0.33 | Xinyang | 1.84 | 613.65 | 333.69 | 0.45 |

| Jiaozuo | 0.40 | 353.40 | 884.93 | 0.26 | Xinyu | 0.32 | 116.67 | 360.38 | 0.08 |

| Jiaxing | 0.40 | 458.50 | 1148.17 | 0.33 | Xinzhou | 2.36 | 314.13 | 133.29 | 0.23 |

| Jiayuguan | 0.22 | 24.39 | 112.79 | 0.02 | Sipsongpanna | 2.15 | 116.40 | 54.26 | 0.08 |

| Jieyang | 0.58 | 605.89 | 1050.87 | 0.44 | Xuancheng | 1.20 | 259.24 | 216.39 | 0.19 |

| Jilin | 2.59 | 426.24 | 164.30 | 0.31 | Xuchang | 0.50 | 434.15 | 868.96 | 0.32 |

| Jinan | 0.75 | 713.20 | 950.19 | 0.52 | Xuzhou | 1.08 | 866.90 | 803.15 | 0.63 |

| Jinchang | 0.70 | 47.05 | 67.62 | 0.03 | Yaan | 1.51 | 154.68 | 102.18 | 0.11 |

| Jincheng | 0.90 | 231.50 | 256.64 | 0.17 | Yanan | 3.50 | 223.13 | 63.80 | 0.16 |

| Jingdezhen | 0.53 | 164.05 | 310.29 | 0.12 | Yanbian | 4.03 | 216.63 | 53.75 | 0.16 |

| Jingmen | 1.22 | 289.63 | 236.95 | 0.21 | Yancheng | 1.46 | 722.85 | 494.93 | 0.53 |

| Jingzhou | 1.39 | 574.90 | 412.17 | 0.42 | Yangjiang | 0.88 | 251.12 | 286.08 | 0.18 |

| Jinhua | 1.11 | 545.40 | 493.02 | 0.40 | Yangquan | 0.42 | 139.83 | 329.17 | 0.10 |

| Jining | 1.11 | 829.92 | 745.97 | 0.60 | Yangzhou | 0.66 | 448.36 | 677.59 | 0.33 |

| Jinzhong | 1.55 | 333.57 | 215.21 | 0.24 | Yantai | 1.30 | 701.41 | 537.71 | 0.51 |

| Jinzhou | 0.87 | 303.90 | 350.24 | 0.22 | Yibin | 1.34 | 449.00 | 335.79 | 0.33 |

| Jiujiang | 1.89 | 482.58 | 254.94 | 0.35 | Yichang | 2.11 | 411.50 | 194.71 | 0.30 |

| Jiuquan | 13.59 | 111.54 | 8.21 | 0.08 | Yichun7 | 1.95 | 551.20 | 283.35 | 0.40 |

| Jixi | 2.02 | 181.17 | 89.60 | 0.13 | Yichun8 | 3.03 | 121.19 | 39.97 | 0.09 |

| Jiyuan | 0.19 | 72.90 | 377.96 | 0.05 | Yili | 24.98 | 484.74 | 19.40 | 0.35 |

| Kaifeng | 0.58 | 454.26 | 787.64 | 0.33 | Yinchuang | 0.69 | 216.41 | 311.89 | 0.16 |

| Kashi | 10.49 | 438.20 | 41.77 | 0.32 | Yingtan | 0.36 | 115.33 | 319.98 | 0.08 |

| Kelamayi | 0.67 | 30.14 | 45.07 | 0.02 | Yinkou | 0.51 | 232.00 | 453.98 | 0.17 |

| Kezilesu | 6.48 | 61.66 | 9.52 | 0.04 | Yiyang | 1.19 | 441.02 | 369.17 | 0.32 |

| Kunming | 2.15 | 667.70 | 310.14 | 0.49 | Yongzhou | 2.33 | 542.97 | 233.12 | 0.39 |

| Laibin | 1.46 | 218.20 | 149.54 | 0.16 | Yueyang | 1.56 | 562.92 | 360.37 | 0.41 |

| Laiwu | 0.20 | 135.16 | 672.30 | 0.10 | Yulin9 | 4.15 | 340.11 | 81.86 | 0.25 |

| Langfang | 0.59 | 456.32 | 773.63 | 0.33 | Yulin10 | 1.37 | 570.72 | 416.39 | 0.42 |

| Lanzhou | 1.22 | 369.31 | 302.64 | 0.27 | Yuncheng | 1.38 | 527.53 | 382.90 | 0.38 |

| Ledong | 0.32 | 47.30 | 149.72 | 0.03 | Yushu | 19.06 | 41.45 | 2.17 | 0.03 |

| Leshan | 1.31 | 326.05 | 249.54 | 0.24 | Yuxi | 1.55 | 236.20 | 152.86 | 0.17 |

| Liangshan | 6.11 | 465.50 | 76.24 | 0.34 | Zaoqing | 1.62 | 405.96 | 250.12 | 0.30 |

| Lianyungang | 0.73 | 447.37 | 614.87 | 0.33 | Zaozhuang | 0.43 | 387.80 | 907.35 | 0.28 |

| Liaocheng | 0.83 | 597.06 | 721.59 | 0.43 | Zhangjiajie | 0.95 | 152.40 | 159.67 | 0.11 |

| Chaoyang | 1.93 | 336.90 | 174.61 | 0.25 | Zhangjiakou | 3.46 | 442.17 | 127.79 | 0.32 |

| Liaoyang | 0.46 | 179.40 | 388.84 | 0.13 | Zhangye | 3.61 | 121.98 | 33.75 | 0.09 |

| Liaoyuan | 0.48 | 120.80 | 252.70 | 0.09 | Zhangzhou | 1.39 | 500.00 | 360.99 | 0.36 |

| Lijiang | 2.11 | 128.00 | 60.54 | 0.09 | Zhanjiang | 1.36 | 724.14 | 531.74 | 0.53 |

| Lincang | 2.50 | 250.90 | 100.36 | 0.18 | Zhaotong | 2.28 | 543.00 | 237.82 | 0.40 |

| Linfen | 1.94 | 443.57 | 228.70 | 0.32 | Zhenjiang | 0.36 | 317.65 | 893.20 | 0.23 |

| Lingao | 0.15 | 44.29 | 294.24 | 0.03 | Zhenzhou | 0.70 | 956.90 | 1367.21 | 0.70 |

| Lingshui | 0.14 | 32.78 | 230.08 | 0.02 | Zhongshan | 0.19 | 320.96 | 1698.42 | 0.23 |

| Linxia | 0.77 | 201.21 | 260.68 | 0.15 | Zhongwei | 1.27 | 114.16 | 89.86 | 0.08 |

| Linyi | 1.61 | 1031.16 | 639.74 | 0.75 | Zhoukou | 1.14 | 900.45 | 792.31 | 0.66 |

| Lishui | 1.73 | 213.90 | 123.87 | 0.16 | Zhoushan | 0.06 | 115.20 | 2042.85 | 0.08 |

| Liupanshui | 0.99 | 288.99 | 290.86 | 0.21 | Zhuhai | 0.18 | 163.41 | 932.80 | 0.12 |

| Liuzhou | 1.92 | 392.27 | 204.84 | 0.29 | Zhumadian | 1.47 | 695.55 | 471.95 | 0.51 |

| Longnan | 2.73 | 259.09 | 94.86 | 0.19 | Zhuzhou | 1.18 | 400.05 | 337.92 | 0.29 |

| Longyan | 2.02 | 261.00 | 129.43 | 0.19 | Zibo | 0.58 | 464.20 | 802.29 | 0.34 |

| Loudi | 0.82 | 387.18 | 472.73 | 0.28 | Zigong | 0.44 | 277.02 | 625.25 | 0.20 |

| Luan | 1.85 | 576.67 | 311.12 | 0.42 | Ziyang | 0.79 | 356.90 | 452.43 | 0.26 |

| Luohe | 0.25 | 262.50 | 1048.88 | 0.19 | Zunyi | 3.14 | 619.21 | 196.93 | 0.45 |

References

- Liu, T.; Cao, G.Z.; Yan, Y.; Wang, R.Y. Urban land marketization in China: Central policy, local initiative, and market mechanism. Land Use Policy 2016, 57, 265–276. [Google Scholar] [CrossRef]

- National Bureau of Statistics of China. China Statistical Yearbook 2017; China Statistics Press: Beijing, China, 2017; pp. 805–836. (In Chinese) [Google Scholar]

- National Bureau of Statistics of China. China Statistical Yearbook 2012; China Statistics Press: Beijing, China, 2012; pp. 99–121. (In Chinese) [Google Scholar]

- Deng, X.Z.; Huang, J.K.; Rozelle, S.; Uchida, E. Economic growth and the expansion of urban land in China. Urban Stud. 2010, 47, 813–843. [Google Scholar] [CrossRef]

- Ding, C.R.; Lichtenberg, E. Land and urban economic growth in China. J. Reg. Sci. 2011, 51, 299–317. [Google Scholar] [CrossRef]

- Tian, L.; Ma, W. Government intervention in city development of China: A tool of land supply. Land Use Policy 2009, 26, 599–609. [Google Scholar] [CrossRef]

- Tan, S.K.; Rao, Y.X.; Zhu, X.B. Study on the influence of land investment on regional economic growth. China Popul. Resour. Environ. 2012, 22, 61–67. (In Chinese) [Google Scholar]

- Xu, J.; Yeh, A.G.O.; Wu, F.L. Land commodification: New land development and politics in China since the late 1990s. Int. J. Urban Reg. Res. 2009, 33, 890–913. [Google Scholar] [CrossRef]

- Tao, R.; Su, F.B.; Liu, M.X.; Cao, G.Z. Land leasing and local public finance in China’s regional development: Evidence from prefecture-level cities. Urban Stud. 2010, 47, 2217–2236. [Google Scholar] [CrossRef]

- Liu, T.; Lin, G.C.S. New geography of land commodification in Chinese cities: Uneven landscape of urban land development under market reforms and globalization. Appl. Geogr. 2014, 51, 118–130. [Google Scholar] [CrossRef]

- He, C.F.; Huang, Z.J.; Wang, R. Land use change and economic growth in urban China: A structural equation analysis. Urban Stud. 2014, 51, 2880–2898. [Google Scholar] [CrossRef]

- Huang, Z.J.; He, C.F.; Zhu, S.J. Do China’s economic development zones improve land use efficiency? The effects of selection, factor accumulation and agglomeration. Landsc. Urban Plan. 2017, 162, 145–156. [Google Scholar] [CrossRef]

- Xu, G.L.; Huang, X.J.; Zhong, T.Y.; Chen, Y.; Wu, C.Y.; Jin, Y.Z. Assessment on the effect of city arable land protection under the implementation of China’s National General Land Use Plan (2006–2020). Habitat Int. 2015, 49, 466–473. [Google Scholar] [CrossRef]

- Bai, Z.G.; Dent, D.L.; Olsson, L.; Schaepman, M.E. Proxy global assessment of land degradation. Soil Use Manag. 2008, 24, 223–234. [Google Scholar] [CrossRef] [Green Version]

- Liu, X.P.; Ou, J.P.; Wang, S.J.; Li, X.; Yan, Y.C.; Jiao, L.M.; Liu, Y.L. Estimating spatiotemporal variations of city-level energy-related CO2 emissions: An improved disaggregating model based on vegetation adjusted nighttime light data. J. Clean. Prod. 2018, 177, 101–114. [Google Scholar] [CrossRef]

- Lin, G.C.S.; Ho, S.P.S. China’s land resources and land-use change: Insights from the 1996 land survey. Land Use Policy 2003, 20, 87–107. [Google Scholar] [CrossRef]

- Ho, P. Who owns China’s land? Policies, property rights and deliberate institutional ambiguity. China Q. 2001, 166, 394–421. [Google Scholar] [CrossRef]

- Van der Veen, A.; Otter, H.S. Land use changes in regional economic theory. Environ. Model. Assess. 2001, 6, 145–150. [Google Scholar] [CrossRef]

- Nichols, D.A. Land and economic growth. Am. Econ. Rev. 1970, 60, 332–340. [Google Scholar]

- Sachs, J.D.; Warner, A.M. The curse of natural resources. Eur. Econ. Rev. 2001, 45, 827–838. [Google Scholar] [CrossRef]

- Huang, Z.H.; Du, X.J. Strategic interaction in local governments’ industrial land supply: Evidence from China. Urban Stud. 2017, 54, 1328–1346. [Google Scholar] [CrossRef]

- Ding, C.R.; Niu, Y.; Lichtenberg, E. Spending preferences of local officials with off-budget land revenues of Chinese cities. China Econ. Rev. 2014, 31, 265–276. [Google Scholar] [CrossRef]

- Jiang, M.; Xin, L.J.; Li, X.B.; Tan, M.H. Spatiotemporal variation of China’s state-owned construction land supply from 2003 to 2014. Sustainability 2016, 8, 1137. [Google Scholar] [CrossRef]

- Ping, Y.C. Explaining land use change in a Guangdong county: The supply side of the story. China Q. 2011, 207, 626–648. [Google Scholar] [CrossRef]

- Wang, D.; Zhang, L.; Zhang, Z.; Zhao, Z. Urban infrastructure financing in reform-era China. Urban Stud. 2011, 48, 2975–2998. [Google Scholar] [CrossRef]

- Zhan, J.V. Strategy for fiscal survival? Analysis of local extra-budgetary finance in China. J. Contemp. China 2012, 22, 185–203. [Google Scholar] [CrossRef]

- Li, J. Land sale venue and economic growth path: Evidence from China’s urban land market. Habitat Int. 2014, 41, 307–313. [Google Scholar] [CrossRef]

- Fan, X.W.; Zheng, D.; Shi, M.J. How does land development promote China’s urban economic growth? The mediating effect of public infrastructure. Sustainability 2016, 8, 279. [Google Scholar] [CrossRef]

- He, C.F.; Zhou, Y.; Huang, Z.J. Fiscal decentralization, political centralization, and land urbanization in China. Urban Geogr. 2016, 37, 436–457. [Google Scholar] [CrossRef]

- Wu, Q.; Li, Y.L.; Yan, S.Q. The incentives of China’s urban land finance. Land Use Policy 2015, 42, 432–442. [Google Scholar] [CrossRef]

- Wei, Y.D. Zone fever, project fever: Economic transition, development policy, and urban expansion in China. Geogr. Rev. 2015, 105, 156–177. [Google Scholar] [CrossRef]

- Zhou, T.; Zhao, R.; Zhou, Y. Factors influencing land development and redevelopment during China’s rapid urbanization: Evidence from Haikou city, 2003–2016. Sustainability 2017, 9, 2011. [Google Scholar] [CrossRef]

- Thun, E. Keeping up with the Jones’: Decentralization, policy imitation and industrial development in China. World Dev. 2004, 32, 1289–1308. [Google Scholar] [CrossRef]

- Ping, Y.C. Pseudo-urbanization? Competitive government behavior and urban sprawl in China. J. Contemp. China 2012, 21, 281–298. [Google Scholar] [CrossRef]

- Ye, J.P.; Ma, C.F.; Zhang, Q.H. Contribution of land to the economic growth of China: Based on spatial panel data model. Financ. Trade Econ. 2011, 4, 111–116. (In Chinese) [Google Scholar]

- Long, F.J.; Guo, M. Research on the impact of land supply on urban growth in China. Urban Stud. 2009, 16, 83–87. (In Chinese) [Google Scholar]

- Romer, P. Increasing returns and long-run growth. J. Polit. Econ. 1986, 94, 1002–1037. [Google Scholar] [CrossRef]

- Lucas, R.E. Making a miracle. Econometrica 1993, 61, 251–272. [Google Scholar] [CrossRef]

- Skonhoft, A.; Solem, H. Economic growth and land-use changes: The declining amount of wilderness land in Norway. Ecol. Econ. 2001, 37, 289–301. [Google Scholar] [CrossRef]

- Li, M.Y.; Hu, Z.Z. Empirical study on contribution rate of land to economic growth in Shanghai. Soft Sci. 2005, 19, 21–23. (In Chinese) [Google Scholar]

- Wang, J.K.; Gu, G.F. Study on contribution of land element to urban economic growth in China. China Popul. Resour. Environ. 2015, 25, 10–17. (In Chinese) [Google Scholar]

- Theil, H. Economics and Information Theory; North-Holland Publishing Company: Amsterdam, The Netherlands, 1967; pp. 90–135. [Google Scholar]

- Zhang, W.J.; Bao, S.M. Created unequal: China’s regional pay inequality and its relationship with mega-trend urbanization. Appl. Geogr. 2015, 61, 81–93. [Google Scholar] [CrossRef]

- Conceição, P.; Galbraith, J.K. Constructing long and dense time-series of inequality using the Theil Index. East. Econ. J. 2000, 26, 61–74. [Google Scholar] [CrossRef]

- Li, X.J.; Li, G.P.; Zeng, G.; Tan, C.L.; Zhang, W.Z. Economic Geography; Higher Education Press: Beijing, China, 2006; pp. 76–78. (In Chinese) [Google Scholar]

- Cobb, C.W.; Douglas, P.H. A theory of production. Am. Econ. Rev. 1928, 18, 139–165. [Google Scholar]

- Zhang, J.; Wu, G.Y.; Zhang, J.P. The estimation of China’s provincial capital stock: 1952–2000. Econ. Res. J. 2004, 10, 35–44. (In Chinese) [Google Scholar]

- Chen, L.; Li, X.; Yao, Y.; Chen, D.S. Effects of population agglomeration on urban economic growth in China. Acta Geogr. Sin. 2018, 73, 1107–1120. (In Chinese) [Google Scholar]

- Chenery, H.; Robinson, S.; Syrquin, M. Industrialization and Growth: A Comparative Study; Oxford University Press: New York, NY, USA, 1986; pp. 37–84. [Google Scholar]

- Qi, Y.J.; Yang, Y.; Jin, F.J. China’s economic development stage and its patio-temporal evolution: A prefectural-level analysis. J. Geogr. Sci. 2013, 23, 297–314. [Google Scholar] [CrossRef]

- Ba, T.E. Problems in the implementation of general land use planning in Erdos City. Inn. Mong. For. Investig. Des. 2015, 38, 113–134. (In Chinese) [Google Scholar]

- National Bureau of Statistics of China. China Statistical Yearbook 2014; China Statistics Press: Beijing, China, 2014; pp. 99–121. (In Chinese) [Google Scholar]

- Main Data Bulletin of Erdos’s Sixth National Census 2010. Available online: http://www.360doc.com/content/11/0601/10/983667_120899944.shtml (accessed on 21 May 2018).

- Main Data Bulletin of Shanghai’s Sixth National Census 2010. Available online: http://www.stats.gov.cn/tjsj/tjgb/rkpcgb/dfrkpcgb/201202/t20120228_30403.html (accessed on 21 May 2018).

- Main Data Bulletin of Shenzhen’s Sixth National Census 2010. Available online: https://max.book118.com/html/2017/0415/100480075.shtm (accessed on 21 May 2018).

- Efficient Land Use and Land Development Intensity Control in Pearl River Delta. Available online: http://www.xinhuanet.com/finance/2015-02/03/c_127453300.htm (accessed on 23 May 2018).

- Bureau of Statistics of Guangdong. Guangdong Province Statistical Yearbook 2016; China Statistics Press: Beijing, China, 2016; pp. 329–400. (In Chinese) [Google Scholar]

- Accelerateing the Construction of a Modern Industrial System Led by Innovation. Available online: http://sz.people.com.cn/n2/2018/0417/c202846-31469287.html (accessed on 23 May 2018).

- World Economic Forum (WEF). The Global Competitiveness Report 2016–2017; World Economic Forum (WEF) Publication: Geneva, Switzerland, 2016; pp. 35–38. [Google Scholar]

- Jiang, H.; Qu, F.T. Contribution and response of constructed land expansion to economic growth at different development stages: A case study for Jiangsu. China Popul. Resour. Environ. 2009, 19, 70–75. (In Chinese) [Google Scholar]

- Ding, C.R. Urban Spatial Planning: Theory, Method and Practice; Higher Education Press: Beijing, China, 2007; pp. 135–141. (In Chinese) [Google Scholar]

| Model 1 | Model 2 | Model 3 | |

|---|---|---|---|

| Land Input | 0.8850 *** (51.8910) | 0.3027 *** (20.8830) | 0.0921 *** (8.3833) |

| Labor Force Scale | 0.8050 *** (58.4550) | 0.2563 *** (17.1387) | |

| Capital Stock | 0.7567 *** (47.6492) | ||

| Chis | 2612.9 *** | 139.51 *** | 2416.5 *** |

| F | 2692.63 *** | 5239.64 *** | 8017.68 *** |

| N | 2112 | 2112 | 2112 |

| R2 | 0.5612 | 0.8328 | 0.9196 |

| Model 4 (PPS) | Model 5 (PIS) | Model 6 (MIS) | Model 7 (LIS) | Model 8 (DS) | |

|---|---|---|---|---|---|

| Land Input | 0.1483 *** (5.986) | 0.0930 *** (5.2675) | 0.1086 *** (7.3096) | −0.0675 ** (−2.0374) | −0.0930 ** (−2.3843) |

| Labor Force Scale | 0.1067 * (1.9312) | 0.3397 *** (11.9650) | 0.2429 *** (14.1087) | 0.4634 *** (13.5288) | 0.7739 *** (16.6434) |

| Capital Stock | 0.7237 *** (12.1130) | 0.5084 *** (15.6691) | 0.6547 *** (32.4825) | 0.5099 *** (12.7760) | 0.4004 *** (7.0232) |

| Chis | 1540.4 *** | 288.63 *** | 5035.9 *** | 373.1 *** | 58.359 *** |

| F | 564.767 *** | 1273.18 *** | 1969.59 *** | 661.309 *** | 277.152 *** |

| N | 192 | 342 | 1290 | 162 | 126 |

| R2 | 0.9025 | 0.9198 | 0.8218 | 0.9284 | 0.8766 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jin, W.; Zhou, C.; Luo, L. Impact of Land Input on Economic Growth at Different Stages of Development in Chinese Cities and Regions. Sustainability 2018, 10, 2847. https://doi.org/10.3390/su10082847

Jin W, Zhou C, Luo L. Impact of Land Input on Economic Growth at Different Stages of Development in Chinese Cities and Regions. Sustainability. 2018; 10(8):2847. https://doi.org/10.3390/su10082847

Chicago/Turabian StyleJin, Wanfu, Chunshan Zhou, and Lijia Luo. 2018. "Impact of Land Input on Economic Growth at Different Stages of Development in Chinese Cities and Regions" Sustainability 10, no. 8: 2847. https://doi.org/10.3390/su10082847