Why Does Environmental Policy in Representative Democracies Tend to Be Inadequate? A Preliminary Public Choice Analysis

Abstract

:1. Introduction

“A survey of 40 leading US economists in 1998 found that that there is little agreement among them as to which of thirteen national tax and regulatory reforms are desirable public policies, with the exception that all support a proposed 25¢ per gallon fuel tax increase.”[1]

2. Choosing an Instrument: Market-Based versus Command-and-Control

2.1. Permits

2.2. Environmental Taxes

| Study | Region | Emissions change | Employment effect |

|---|---|---|---|

| (% vs. BAU) | (% vs. BAU) | ||

| Köppl et al. (1995) | Austria | –7 | 0,4 |

| Capros et al. (1998) | European Union | –18 | 0,4 |

| Bayar (1998) | European Union | –16 | 1,3 |

| Ellingsen et al. (2000) | European Union | –14 | 1 |

| Bosello and Carraro (2001) | European Union | –14 | 1,3 |

| Hayden (1999) | European Union | –11,5 | 0,1 |

| Barker and Rosendahl (2000) | European Union | –11,5 | 1,1 |

| Barker (1998) | European Union | –10 | 1,2 |

| Welsch (1996) | European Union | –6,5 | 1,7 |

| Capros et al. (1996) | European Union | –5 | 0,2 |

| Bossier and Brechet (1995) | European Union | –4,4 | 0,6 |

| Koschel (2001) | European Union | 5 | 0,6 |

| Welsch (1998) | European Union | 8,5 | 5,4 |

| Buttermann and Hillebrand (1996) | Germany | –17,1 | –0,7 |

| DIW (1994) | Germany | –17,1 | 1,1 |

| Meyer et al. (1997) | Germany | –17 | 3,3 |

| Meyer (2001) | Germany | –16,9 | 1,6 |

| Schmidt and Koschel (1999) | Germany | –15,5 | 0,6 |

| Conrad and Löschel (2002) | Germany | –13,7 | 0,4 |

| Schön et al. (1995) | Germany | –5 | 0 |

| Braun and Kitterer (2000) | Germany | –3 | 1,7 |

| Stephan et al. (2003) | Germany | –2 | –0,6 |

| Meyer zu Himmern (1997) | Switzerland | –15,4 | 0,1 |

| Mauch et al. (1996) | Switzerland | –6,1 | 0,3 |

2.3. Permits, Taxes and Command-and-Control Measures

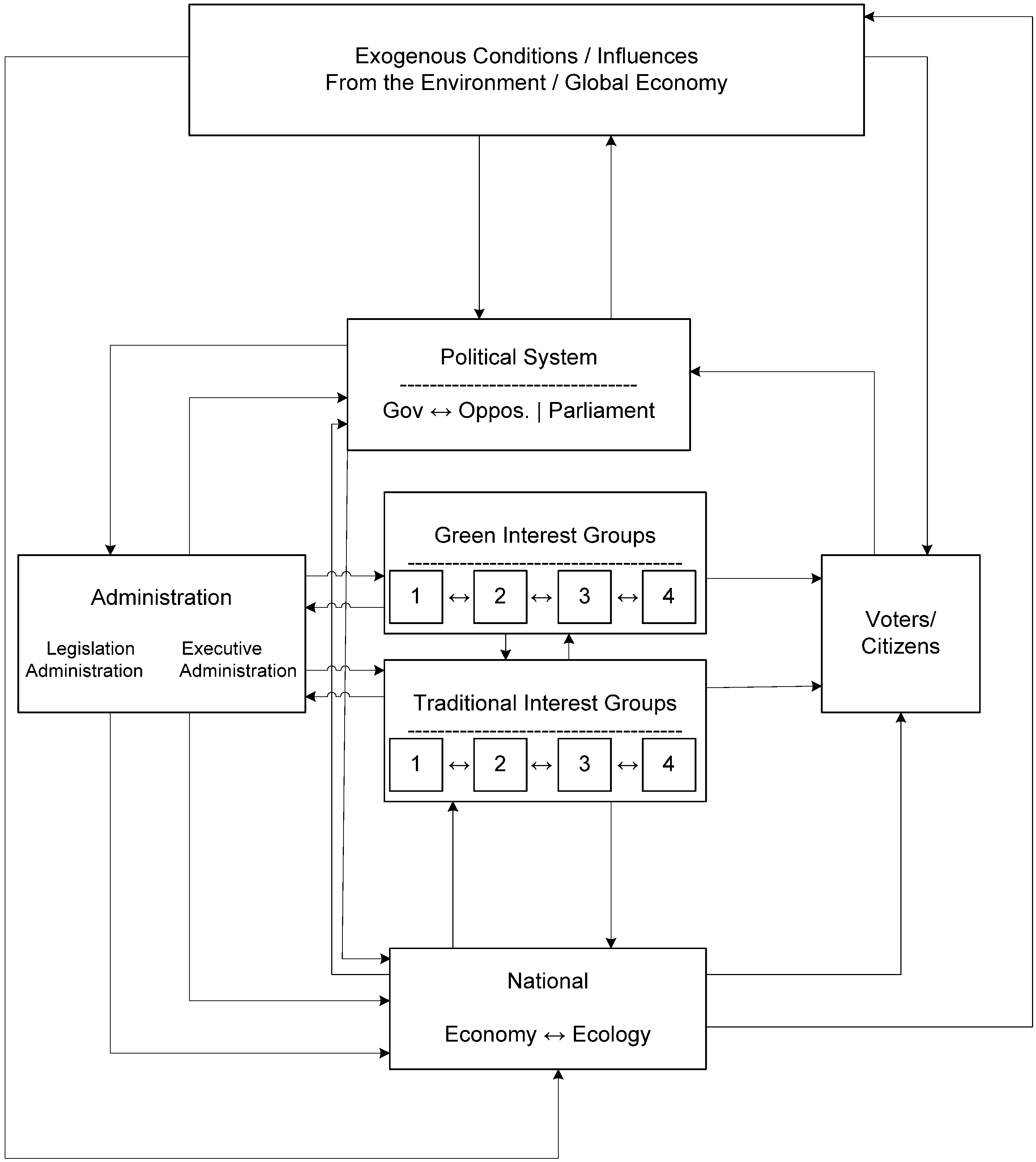

3. The Public Choice Approach to Environmental Policy

3.1. The Voters

| In your opinion, which of the following do you consider to be the most serious problem currently facing the world as a whole? Firstly? Any others?—% EU | ||||

|---|---|---|---|---|

| Rank | Problems | 2008 | 2009 | %-change |

| 1 | Poverty, lack of food and drinking water | 67% | 66% | –1% |

| 2 | A major global economic downturn | 24% | 52% | 117% |

| 3 | Climate change | 62% | 50% | –19% |

| 4 | International terrorism | 53% | 42% | –21% |

| 5 | Armed conflicts | 38% | 39% | 3% |

| What do you think are the two most important issues facing (OUR COUNTRY) at the moment? | ||

|---|---|---|

| Rank | Issues | Answers in %* |

| 1 | Unemployment | 51% |

| 2 | Economic Situation | 40% |

| 3 | Crime | 19% |

| 4 | Rising prices/inflation | 19% |

| 5 | Healthcare system | 14% |

| 6 | Immigration | 9% |

| 7 | Pensions | 9% |

| 8 | Taxation | 8% |

| 9 | The educational system | 7% |

| 10 | Housing | 5% |

| 11 | Terrorism | 4% |

| 12 | The environment | 4% |

| 13 | Energy | 3% |

| 14 | Defense/foreign affairs | 2% |

| Source | Electricity tax | District heating | Oil tax | Gasoline/transport fuels |

|---|---|---|---|---|

| [48] | –1.8 | –1.83 | –1.58 | |

| [49] | –0.6 to –1.0 | |||

| [50] | –0.32 to –0.75 | |||

| [51] | –0.34 to –0.84 |

3.2. The Politicians

3.3. The Affected Producers and Interest Groups

- -

- service functions, i.e., the provision of specific (and often exclusive) services for their members

- -

- lobbying functions, i.e., attempts to influence decision-making processes from outside

- -

- decision-making functions, i.e., attempts to influence decisions from within

- -

- implementation functions, i.e., participation in policy implementation

3.4. The Public Bureaucracy

4. Concluding Remarks

- (1)

- While, in the past, command-and-control instruments successfully reduced tangible environmental pollution (mostly in local areas) and improved the overall environmental quality in Western democracies, the more threatening, but much less tangible global pollution arising from CO2 emissions, obviously cannot be controlled with command-and-control measures. Furthermore, economic theory shows the superiority of market-based instruments over command-and-control measures in terms of efficiency. Still, experience so far with market-based instruments is sobering, as regards both their frequency of use and their design and effects. The EU-ETS suffers from conceptual weaknesses, as not only was grandfathering chosen as the allocation method instead of auctions, but it also seems to have led to an over-allocation of tradable permits and to windfall profits. The environmental taxes imposed in several European countries on fossil energy and CO2 emissions are used more to finance public spending and less as instruments in fighting climate change or reducing environmental pollution.

- (2)

- On the other hand, both political rhetoric and public discussion point strongly to the need to fight climate change, and to the economic superiority of tradable permit systems or taxes over command-and-control instruments. And the general public, the voters, attach great importance to environmental quality—an empirical fact repeatedly verified in the studies we reviewed. The growing body of literature about what influences happiness also shows the high positive correlation between individual happiness and environmental quality. In addition, the more tangible willingness-to-pay studies confirm these findings and show that parents have a higher willingness to pay for CO2 emission reductions, which may be an argument in favor of a non-zero social discount rate. The value that voters place on the environment surely is high, but we also mentioned that in terms of everyday life, in which one’s job, income and security situation have more weight than less tangible aspects, like CO2 emissions, people’s environmental morale or intrinsic motivation may not be high enough for them to actively vote for the environment. Furthermore, the costs of fighting climate change are imposed on today’s voters immediately, while it is future generations that will benefit from this effort. While, as described above, altruistic behavior can surely be ascribed to part of society, it may be less prevalent for environmental policy measures in society as a whole.

- (3)

- With a look at the affected producers and interest groups, we conclude that, all in all, traditional (industrial) interest groups have every advantage over green interest groups: their group’s size is in their favor and their financial backing is considerable. Both aspects work against the green interest groups, who suffer from the simple fact that they represent the general public, so group size is an issue and financing themselves is much more difficult (not least due to free-rider behavior).

- (4)

- Considering the public administration, we conclude that administrators exhibit budget-maximizing behavior which makes command-and-control measures more attractive to them, because monitoring these is resource-intensive. Furthermore, they are in favor of command-and-control instruments over market-based instruments for several other reasons: command-and-control mechanisms exhibit high costs, there they have an information advantage because they profit from expert knowledge within the authority compared to the government; the authority simply knows what to do, which may not be the case with a new instrument; and the public authority is needed for command-and-control mechanisms, but may be much less needed if a command-and-control mechanism is replaced by market-based instruments such as an environmental tax. We conclude that the regulated industries and public authorities are the two groups who have the strongest reasons to favor command-and-control policies. Also, both parties have the political power and resources to influence the design of environmental policy, which we consider the main answer to the question posed in the title of our paper.

References and Notes

- Wachs, M. A Dozen Reasons for Raising Gasoline Taxes; Research Report UCB-ITS-RR-2003-1; Institute of Transportation Studies, University of California (Berkeley): Berkeley, CA, USA, 2003. [Google Scholar]

- Unalan, D.; Cowell, R.J. Europeanization, strategic environmental assessment and the impacts on environmental governance. Environ. Policy Gov. 2009, 19, 32–43. [Google Scholar] [CrossRef]

- IPCC. Climate Change 2007: Working Group I: The Physical Science; Cambridge University Press: Cambridge, MA, USA, 2007. [Google Scholar]

- Europe‘s Climate Change Opportunity: 20-20 by 2020. Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions; COM (2008) 30 final; European Commission: Brussels, Belgium, 2008.

- Newig, J.; Fritsch, O. Environmental governance: Participatory, multi-level-and effective? Environ. Policy Gov. 2009, 19, 197–214. [Google Scholar] [CrossRef]

- Endres, A.; Ohl, C. Kyoto, Europe?—An economic evaluation of the European emission trading directive. J. Law Econ. 2005, 19, 17–39. [Google Scholar] [CrossRef]

- Bailey, I.; Rupp, S. Geography and climate policy: A comparative assessment of new environmental policy instruments in the UK and Germany. Geoforum 2005, 36, 387–401. [Google Scholar] [CrossRef]

- Schepelmann, P.; Stock, M.; Koska, T.; Schüle, R.; Reutter, O. A Green New Deal for Europe—Towards Green Modernization in the Face of Crisis; Wuppertal Institute for Climate, Environment and Energy: Wuppertal, Germany, 2009. [Google Scholar]

- Sandoff, A.; Schaad, G. Does EU ETS lead to emission reductions through trade? The case of the Swedish emissions trading sector participants. Energ. Policy 2009, 37, 3967–3977. [Google Scholar] [CrossRef]

- Svendsen, G.T.; Daugbjerg, C.; Hjollund, L.; Pedersen, A.B. Consumers, industrialists and the political economy of green taxation: CO2 taxation in OECD. Energ. Policy 2001, 29, 489–497. [Google Scholar] [CrossRef]

- Schneider, F.; Volkert, J. No chance for incentive oriented environmental policies in representative democracies? A public choice analysis. Ecol. Econ. 1999, 31, 123–138. [Google Scholar] [CrossRef]

- Kirchgässner, G.; Schneider, F. On the Political Economy of Environmental Policy; CESifo Working Papers, NO 741; CESifo Group: Munich, Germany, 2002. [Google Scholar]

- Anthoff, D.; Hahn, R. Government failure and market failure: On the inefficiency of environmental and energy policy. Oxf. Rev. Econ. Policy 2010, 26, 197–224. [Google Scholar] [CrossRef]

- Schneider, F.; Weck-Hannemann, H. Why is economic theory ignored in environmental policy practice. Appl. Res. Environ. Econ. 2005, 31, 257–275. [Google Scholar]

- Smith, S.; Vos, H.B. Evaluating Economic Instruments for Environmental Policy; OECD Publishing: Paris, France, 1997. [Google Scholar]

- Stavins, R.N. Experience with marked-based environmental policy instruments. In Handbook of Environmental Economics—Volume 1 Environmental Degradation and Institutional Responses; Mäler, K.-G., Vincent, J.R., Eds.; Elsevier: Amsterdam, The Netherlands, 2003. [Google Scholar]

- Santos, R.; Antunes, P.; Baptista, G.; Mateus, P.; Madruga, L. Stakeholder participation in the design of environmental policy mixes. Ecol. Econ. 2006, 60, 100–110. [Google Scholar] [CrossRef]

- Dresner, S.; Dunne, L.; Clinch, P.; Beuermann, C. Social and political responses to ecological tax reform in Europe: An introduction to the special issue. Energ. Policy 2006, 34, 895–904. [Google Scholar] [CrossRef]

- Frey, B.S.; Stutzer, A. Environmental Morale and Motivation; CREMA Working Paper Series 2006-17; Center for Research in Economics, Management and the Arts: Basel, Switzerland, 2007. [Google Scholar]

- Goers, S.R.; Wagner, A.F.; Wegmayr, J. New and old market-based instruments for climate change policy. Environ. Econ. Policy Stud. 2010, 12, 1–30. [Google Scholar] [CrossRef] [Green Version]

- Anger, N.; Böhringer, C.; Oberndorfer, U. Public Interest vs. Interest Groups: Allowance Allocation in the EU Emission Trading Scheme; Discussion Paper No. 08-023; Centre for European Economic Research: Mannheim, Germany, 2008. [Google Scholar]

- Goeree, J.K.; Holt, C.A.; Palmer, K.; Shobe, W.; Burtraw, D. An Experimental Study of Auctions versus Grandfathering to Assign Pollution Permits; Discussion Paper; Resources for the Future: Washington, DC, USA, 2009; Volume RFF DP 09-39. [Google Scholar]

- Benz, E.; Löschel, A.; Sturm, B. Auctioning of CO2 Emission Allowances in Phase 3 of the EU Emissions Trading Scheme; Discussion Paper No. 08-081; Centre for European Economic Research: Mannheim, Germany, 2008. [Google Scholar]

- Ellerman, A.D.; Joskow, P.L. The European Union’s Emissions Trading System in Perspective; Prepared for Pew Center on Global Climate Change; Massachusetts Institute of Technology: Cambridge, MA, USA, 2008. [Google Scholar]

- Convery, F.J. Reflections—The emerging literature on emissions trading in Europe. Rev. Environ. Econ. Policy 2009, 3, 121–137. [Google Scholar]

- Agnolucci, P. The effect of the German and British environmental taxation reforms: A simple assessment. Energ. Policy 2009, 37, 3043–3051. [Google Scholar] [CrossRef]

- Patuelli, R.; Nijkamp, P.; Pels, E. Environmental tax reform and the double dividend: A meta-analytical performance assessment. Ecol. Econ. 2005, 55, 564–583. [Google Scholar] [CrossRef]

- Anger, N.; Böhringer, C.; Löschel, A. Paying the piper and calling the tune? A meta-regression analysis of the double-dividend hypothesis. Ecol .Econ. 2010, 69, 1495–1502. [Google Scholar] [CrossRef]

- Ciocirlan, C.E.; Yandle, B. The political economy of green taxation in OECD countries. Eur. J. Law Econ. 2003, 15, 203–218. [Google Scholar] [CrossRef]

- Felder, S.; Schleiniger, R. Environmental tax reform: Efficiency and political feasibility. Ecol. Econ. 2002, 42, 107–116. [Google Scholar] [CrossRef]

- Oates, W.E.; Portney, P.R. The political economy of environmental policy. In Environmental Degradation and Institutional Responses; Mäler, K.-G., Vincent, J.R., Eds.; Elsevier: Amsterdam, The Netherlands, 2003; Volume 1, pp. 325–354. [Google Scholar]

- Stavins, R.; Keohane, N.; Revesz, R. The Positive Political Economy of Instrument Choice in Environmental Policy; Discussion Papers 97-25; Resources for the Future: Washington, DC, USA, 1997. [Google Scholar]

- Lai, Y.-B. Auctions or grandfathering: The political theory of tradable emission permits. Public Choice 2008, 136, 181–200. [Google Scholar] [CrossRef]

- Llewellyn, J. The political economy of national climate change mitigation policies. OECD Working paper ECO/CPE/WP1(2010)18; OECD: Paris, France, 2010. [Google Scholar]

- Rondinelli, D.A.; Berry, M.A. Corporate environmental management and public policy: Bridging the gap. Am. Behav. Sci. 2000, 44, 168–187. [Google Scholar] [CrossRef]

- Wüstenhagen, R.; Bilharz, M. Green energy market development in Germany: Effective public policy and emerging customer demand. Energ. Policy 2006, 34, 1681–1696. [Google Scholar] [CrossRef]

- Attitudes of European Citizens towards the Environment; Report Special Eurobarometer 247, 2008; European Commission: Brussels, Belgium, 2008.

- Europeans’ Attitudes towards Climate Change; Report Special Eurobarometer 313, 2009; European Commission: Brussels, Belgium, 2009.

- Eurobarometer 72, Public Opinion in the European Union; Report No.72, 2009; European Commission: Brussels, Belgium, 2009.

- Welsch, H. Environment and happiness: Valuation of air pollution using life satisfaction data. Ecol. Econ. 2006, 58, 801–813. [Google Scholar] [CrossRef]

- Welsch, H. Implications of happiness research for environmental economics. Ecol. Econ. 2009, 68, 2735–2742. [Google Scholar] [CrossRef]

- Halla, M.; Schneider, F.; Wagner, A. Satisfaction with Democracy and Collective Action Problems: The Case of the Environment; Working Paper No. 0808; Department of Economics, Johannes Kepler University: Linz, Austria, 2008. [Google Scholar]

- Layton, D.F.; Levine, R. How much does the far future matter? A hierarchical Bayesian analysis of the public’s willingness to mitigate ecological impacts of climate change. J. Am. Stat. Assoc. 2003, 98, 533–544. [Google Scholar] [CrossRef]

- Deroubaix, J.-F.; Leveque, F. The rise and fall of French ecological tax reform: Social acceptability versus political feasibility in the energy tax implementation process. Energ. Policy 2004, 34, 940–949. [Google Scholar] [CrossRef]

- Clinch, J.; Dunne, L. Environmental tax reform: An assessment of social responses in Ireland. Energ. Policy 2006, 34, 950–959. [Google Scholar] [CrossRef]

- Beuermann, C.; Santarius, T. Ecological tax reform in Germany: Handling two hot potatoes at the same time. Energ. Policy 2006, 34, 917–929. [Google Scholar] [CrossRef]

- Klok, J.; Larsen, A.; Dahl, A.; Hansen, K. Ecological tax reform in Denmark: History and social acceptability. Energ. Policy 2006, 34, 905–916. [Google Scholar] [CrossRef]

- Owens, S.; Driffill, L. How to change attitudes and behaviours in the context of energy. Energ. Policy 2008, 36, 4412–4418. [Google Scholar] [CrossRef]

- Ghalwash, T. Energy taxes as a signaling device: An empirical analysis of consumer preferences. Energ. Policy 2005, 35, 29–38. [Google Scholar] [CrossRef]

- Graham, D.J.; Glaister, S. Decomposing the determinants of road traffic demand. Appl. Econ. 2005, 37, 19–28. [Google Scholar] [CrossRef]

- Romero-Jordán, D.; del Ríob, P.; Jorge-Garcíac, M.; Burguillod, M. Price and income elasticities of demand for passenger transport fuels in Spain. Implications for public policies. Energ. Policy 2010, 38, 3898–3909. [Google Scholar] [CrossRef]

- Brons, M.; Nijkamp, P.; Pels, E.; Rietveld, P. A meta-analysis of the price elasticity of gasoline demand. A SUR approach. Energ. Econ. 2008, 30, 2105–2122. [Google Scholar] [CrossRef]

- Feld, L.; Frey, B. Trust breeds trust: How Taxpayers are treated. Econ. Govern. 2002, 3, 87–99. [Google Scholar] [CrossRef]

- Brännlund, R.; Persson, L. Tax or No Tax? Preferences for Climate Policy Attributes; Working Paper No. 2010:4; Centre for Environmental and Resource Economics, Umeå University: Umeå, Sweden, 2010. [Google Scholar]

- Thalmann, P. The public acceptance of green taxes: 2 million voters express their opinion. Public Choice 2004, 119, 179–217. [Google Scholar] [CrossRef]

- Bornstein, N.; Lanz, B. Voting on the environment: Price or ideology? Evidence from Swiss referendums. Ecol. Econ. 2008, 67, 430–440. [Google Scholar] [CrossRef]

- Van der Bergh, J.C. Safe climate policy is affordable—12 reasons. Climatic Chang 2010, 101, 339–385. [Google Scholar] [CrossRef]

- Howarth, R.B. Intertemporal social choice and climate stabilization. Int. J. Environ. Pollut. 2001, 15, 386–403. [Google Scholar]

- Ackerman, F.; DeCanio, S.J.; Howarth, R.B.; Sheeran, K. Limitations of integrated assessment models of climate change. Climatic Chang 2009, 95, 297–315. [Google Scholar] [CrossRef]

- Mueller, D.C. Public Choice III; Cambridge University Press: Cambridge, MA, USA, 2003. [Google Scholar]

- Maux, B.L. Governmental behavior in representative democracy: A synthesis of the theoretical literature. Public Choice 2009, 141, 447–465. [Google Scholar] [CrossRef]

- Böhringer, C.; Vogt, C. The dismantling of a breakthrough: The Kyoto Protocol as symbolic policy. Eur. J. Polit. Econ. 2004, 20, 597–617. [Google Scholar] [CrossRef]

- Weck-Hannemann, H. Environmental politics. In Readings in Public Choice and Constitutional Political Economy; Rowley, C.K., Schneider, F.G., Eds.; Springer: Berlin, Germany, 2008. [Google Scholar]

- List, J.A.; Sturm, D.M. How elections matter: Theory and evidence from environmental policy. Q. J. Econ. 2006, 121, 1249–1281. [Google Scholar]

- Franzese, R.J. Electoral and partisan cycles in economic policies and outcomes. Annu. Rev. Polit. Sci. 2002, 5, 369–421. [Google Scholar] [CrossRef]

- Tellier, G. Public expenditures in Canadian provinces: An empirical study of politico-economic interactions. Public Choice 2006, 126, 367–385. [Google Scholar] [CrossRef]

- Frey, B.S.; Schneider, F. A politico-economic model of the United Kingdom. Econ. J. 1978, 88, 243–253. [Google Scholar] [CrossRef]

- Oberholzer-Gee, F.; Weck-Hannemann, H. Pricing road use: Politico-economic and fairness considerations. Transp. Res. Part D Trans. Environ. 2002, 7, 357–371. [Google Scholar] [CrossRef]

- Lehmann, W. Lobbying in the European Union: Current Rules and Practices; Working Paper, Constitutional Affairs Series, AFCO 104 EN; European Parliament: Luxembourg, 2003. [Google Scholar]

- Coen, D. Lobbying in the European Union; Working Paper, PE 393. 226; European Parliament: Brussels, Belgium, 2007. [Google Scholar]

- Eising, R. Institutional context, organizational resources and strategic choices. Eur. Union Polit. 2007, 8, 329–362. [Google Scholar] [CrossRef]

- Becker, G. A theory of competition among pressure groups for political influence. Q. J. Econ. 1983, 98, 371–400. [Google Scholar] [CrossRef]

- Brandt, U.S.; Svendsen, G.T. Rent-seeking and Grandfathering: The Case of GHG Trade in the EU; Working Paper 35/02; Department of Environmental and Business Economics, University of Southern Denmark: Odense, Denmark, 2002. [Google Scholar]

- Svendsen, G.T. Lobbyism and CO2 Trade in the EU. In Presented at the 10th Symposium of The Egon-Sohmen-Foundation, Dresden, Germany, 2002; Working Papers 02-16; Department of Economics, Aarhus School of Business, University of Aarhus: Aarhus, Denmark, 2002. [Google Scholar]

- Markussen, P.; Svendsen, G.T.; Vesterdal, M. The Political Economy of a Tradeable GHG Permit Market in the European Union; Aarhus School of Business, University of Aarhus: Aarhus, Denmark, 1998. [Google Scholar]

- Brandt, U.S.; Svendsen, G.T. The Political Economy of Climate Change Policy in the EU: Auction and Grandfathering; Department of Environmental and Business Economics, University of Southern Denmark: Esbjerg, Denmark, 2003. [Google Scholar]

- Anger, N.; Böhringer, C.; Lange, A. Differention of Green Taxes: A Political-Economy Analysis for Germany; Discussion Paper No. 06-003, 2006; Centre for European Economic Research: Mannheim, Germany, 2006. [Google Scholar]

- Aidt, T. Green taxes: Refunding rules and lobbying. J. Environ. Econ. Manage. 2010, 60, 31–43. [Google Scholar] [CrossRef]

- Gullberg, A.T. Lobbying friends and foes in climate policy: The case of business and environmental interest groups in the Eruropean Union. Energ. Policy 2008, 36, 2964–2972. [Google Scholar] [CrossRef]

- Markussen, P.; Svendsen, G.T. Industry lobbying and the political economy of GHG trade in the European Union. Energ. Policy 2005, 33, 245–255. [Google Scholar] [CrossRef]

- Niskanen, W. Bureaucracy and Representative Government; Aldine-Atherton: Chicago, IL, USA, 1971. [Google Scholar]

- Chang, C.; Turnbull, G.K. Bureaucratic behavior in the local public sector: A revealed preference approach. Public Choice 2002, 113, 191–209. [Google Scholar] [CrossRef]

- Stavins, R.N. Market-based Environmental Policies: What Can We Learn from U.S. Experience (and Related Research)? Discussion Paper 03-43; Resources for the Future: Washington, DC, USA, 2003. [Google Scholar]

- Betz, R. Emissions trading to combat climate change: The impact of scheme design on transaction costs. Available online: http://www.ceem.unsw.edu.au/content/documents/betz-paper_AARES.pdf (accessed on 1 October 2010).

- McCann, L.; Colby, B.; Easter, K.W.; Kasterine, A.; Kuperan, K. Transaction cost measurement for evaluating environmental policies. Ecol. Econ. 2005, 52, 527–542. Available online: http://www.sciencedirect.com/science/article/B6VDY-4FD79R6-2/2/8ac68e4d3833a50eef81b6e0bfed89a1 (accessed on 1 October 2010). [Google Scholar] [CrossRef]

© 2010 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license ( http://creativecommons.org/licenses/by/3.0/).

Share and Cite

Kollmann, A.; Schneider, F. Why Does Environmental Policy in Representative Democracies Tend to Be Inadequate? A Preliminary Public Choice Analysis. Sustainability 2010, 2, 3710-3734. https://doi.org/10.3390/su2123710

Kollmann A, Schneider F. Why Does Environmental Policy in Representative Democracies Tend to Be Inadequate? A Preliminary Public Choice Analysis. Sustainability. 2010; 2(12):3710-3734. https://doi.org/10.3390/su2123710

Chicago/Turabian StyleKollmann, Andrea, and Friedrich Schneider. 2010. "Why Does Environmental Policy in Representative Democracies Tend to Be Inadequate? A Preliminary Public Choice Analysis" Sustainability 2, no. 12: 3710-3734. https://doi.org/10.3390/su2123710