1. Introduction

Risk governance denotes both the institutional structure and the policy process that guide and restrain collective activities of a group, society or international community to regulate, reduce or control risk problems [

1]. Institutions of risk handling include risk assessment institutions such as an earthquake research institute, private and public risk management institutions such as an office for establishing building codes, political regulatory agencies, such as ministries for urban development, and monitoring institutions such as environmental air quality laboratories. We can observe that the contemporary handling of collectively relevant risk problems has been shifted from traditional state-centric approaches with hierarchically organized governmental agencies as the dominant locus of power to multi-level systems, in which the political authority for handling risk problems is distributed to separately constituted public bodies with overlapping jurisdictions that do not match the traditional hierarchical order [

2,

3]. This implicates an increasingly multilayered and diversified socio-political landscape in which a multitude of actors, their perceptions and evaluations draw on a diversity of knowledge and evidence claims, value commitments and political interests in order to influence processes of risk analysis, decision-making and risk management [

4]. Institutional diversity can offer considerable advantages when complex, uncertain and ambiguous risk problems need to be addressed because, first, risk problems with different scopes can be managed at different levels, second, an inherent degree of overlap and redundancy makes non-hierarchical adaptive and integrative risk governance systems more resilient and therefore less vulnerable, and third, the larger number of actors facilitates experimentation and learning [

5]. Disadvantages refer to the possible commodification of risk, the fragmentation of the risk governance process, costly collective risk decision-making and the potential loss of democratic accountability [

6].

Thus, understanding the dynamics, structures and functionality of risk governance processes requires a general and comprehensive conceptualization of procedural mechanisms and structural configurations. The classic model of risk analysis consisting of three components: risk assessment, management and communication [

7] proves to be too narrowly focused on regulatory bodies as to be capable of covering the variety of actors and processes in governing risk. Therefore it is necessary to enrich the classic model by adding two additional steps called risk evaluation and pre-estimation [

8]. These steps will be explained later in the paper. Furthermore, risk governance incorporates expert, stakeholder and public involvement as a core feature in the stage of communication and deliberation. In spite of new attempts to develop new models and frameworks of risk governance, there is still a need for a descriptively accurate, analytically rich and normatively convincing framework of risk governance.

Based on our previous work on risk governance and risk evaluation [

1,

5,

9,

10,

11,

12] we will explain our recent normative-analytical model of a risk governance process that incorporates the diversity of actors, addresses the institutional means to process diverse input and discusses the theoretical prospects and implications for adaptive and integrative capacity (first published in: [

9]). We will, address major functions of the risk governance process: pre-estimation, interdisciplinary risk estimation (including scientific risk assessment and concern assessment), risk characterization and risk evaluation as well as risk management including decision-making and implementation. Furthermore, we will explicate the design of an effective and fair institutional arrangement including four different forms of public and stakeholder involvement in order to cope with the challenges raised by the three risk characteristics. We will apply these insights to urban planning at the end of this article and show the relationship to sustainability.

2. Three Characteristics of Risk Knowledge

Adaptive and integrative governance on risk is supposed to address challenges raised by three risk characteristics that result from a lack of knowledge and/or competing knowledge claims about the risk problem. Transboundary and collectively relevant risk problems such as global environmental threats (climate change, loss of biological diversity, chemical pollution,

etc.), new and/or large-scale technologies (nanotechnology, biotechnology, offshore oil production,

etc.), food security or pandemics are all characterized by limited and sometimes controversial knowledge with respect to their risk properties and their implications [

13]. (The three characteristics are complexity, scientific uncertainty and socio-political ambiguity [

9,

10,

11,

14]).

2.1. Complexity

Complexity refers to the difficulty of identifying and quantifying causal links between a multitude of potential candidates and specific adverse effects [

15,

16,

17]. A crucial aspect in this respect concerns the applicability of probabilistic risk assessment techniques. If the chain of events between a cause and an effect follows a linear relationship (as for example in car accidents, or in an overdose of pharmaceutical products), simple statistical models are sufficient to calculate the probabilities of harm. Such simple relationships may still be associated with high uncertainty, for example, if only few data are available or the effect is stochastic by its own nature. Sophisticated models of probabilistic inferences are required if the relationship between cause and effects becomes more complex [

18]. The nature of this difficulty may be traced back to interactive effects among these candidates (synergisms and antagonisms, positive and negative feedback loops), long delay periods between cause and effect, inter-individual variation, intervening variables, and others. It is precisely these complexities that make sophisticated scientific investigations necessary since the dose-effect relationship is neither obvious nor directly observable. Nonlinear response functions may also result from feedback loops that constitute a complex web of intervening variables. Complexity requires therefore sensitivity to non-linear transitions as well as to scale (on different levels). It also needs to take into account a multitude of exposure pathways and the composite effects of other agents that are present in the exposure situation. Examples of highly complex risk include sophisticated chemical facilities, synergistic effects of potentially toxic substances, failure risk of large interconnected infrastructures and risks of critical loads to sensitive ecosystems.

2.2. Scientific Uncertainty

Scientific uncertainty relates to the limitedness or even absence of scientific knowledge (data, information) that makes it difficult to exactly assess the probability and possible outcomes of undesired effects [

19,

20,

21,

22]. It most often results from an incomplete or inadequate reduction of complexity in modeling cause-effect chains [

23]. Whether the world is inherently uncertain is a philosophical question that is not pursued here. It is essential to acknowledge in the context of risk assessment that human knowledge is always incomplete and selective, and, thus, contingent upon uncertain assumptions, assertions and predictions [

24,

25,

26]. It is obvious that the modeled probability distributions within a numerical relational system can only represent an approximation of the empirical relational system that helps elucidate and predict uncertain events. It therefore seems prudent to include additional aspects of uncertainty [

27]. Although there is no consensus in the literature on the best means of disaggregating uncertainties, the following categories appear to be an appropriate means of distinguishing between the key components of uncertainty:

Variability refers to different vulnerability of targets such as the divergence of individual responses to identical stimuli among individual targets within a relevant population such as humans, animals, plants, landscapes, etc.;

Inferential effects relate to systematic and random errors in modeling including problems of extrapolating or deducing inferences from small statistical samples, from animal data or experimental data onto humans or from large doses to small doses, etc. All of these are usually expressed through statistical confidence intervals;

Indeterminacy results from genuine stochastic relationship between cause and effects, apparently non-causal or non-cyclical random events, or badly understood non-linear, chaotic relationships;

System boundaries allude to uncertainties stemming from restricted models and the need for focusing on a limited amount of variables and parameters;

Ignorancemeans the lack of knowledge about the probability of occurrence of a damaging event and about its possible consequences.

The first two components of uncertainty qualify as statistically quantifiable uncertainty and, therefore, can be reduced by improving existing knowledge, applying standard statistical instruments such as Monte Carlo simulation,

i.e., finding appropriate solutions by generating sequences of random numbers [

28]. The last three components represent genuine uncertainty components and can be characterized, to some extent, by using scientific approaches, but cannot be completely resolved. The validity of the end results is questionable and, for risk management purposes, additional information is needed, such as a subjective confidence level in risk estimates, potential alternative pathways of cause-effect relationships, ranges of reasonable estimates, maximum loss scenarios and others. Examples of high uncertainty include many natural disasters, such as earthquakes, possible health effects of mass pollutants below the threshold of statistical significance, acts of violence—such as terrorism and sabotage—and long-term effects of introducing genetically modified species into the natural environment.

2.3. Socio-Political Ambiguity

While more and better data and information may reduce scientific uncertainty, more knowledge does not necessarily reduce ambiguity. Ambiguity thus indicates a situation of ambivalence in which different and sometimes divergent streams of thinking and interpretation about the same risk phenomena and their circumstances are apparent [

29,

30]. We distinguish between interpretative and normative ambiguity, which both relate to divergent or contested perspectives on the justification, severity or wider “meanings” associated with a given threat [

31,

32].

Interpretative ambiguity denotes the variability of (legitimate) interpretations based on identical observations or data assessments results, e.g., an adverse or non-adverse effect. Variability of interpretation, however, is not restricted to expert dissent. Laypeople’s perception of risk often differs from expert judgments because it is related to qualitative risk characteristics such as familiarity, personal or institutional control, assignment of blame, and others. Moreover, in contemporary pluralist societies diversity of risk perspectives within and between social groups is generally fostered by divergent value preferences, variations in interests and very few, if any, universally applicable moral principles; all the more, if risk problems are complex and uncertain. In the context of urban planning, interpretative ambiguity may be linked to understanding residents’ needs and preferences in a plural residential area or reconciling different aesthetic requirements for buildings.

That leads us to the aspect of normative ambiguity. It elludes to different concepts of what can be regarded as tolerable referring e.g., to ethics, quality of life parameters, distribution of risks and benefits, etc. A condition of ambiguity emerges where the problem lies in agreeing on the appropriate values, priorities, assumptions, or boundaries to be applied to the definition of possible outcomes. Examples for high interpretative ambiguity include low dose radiation (ionizing and non-ionizing), low concentrations of genotoxic substances, food supplements and hormone treatment of cattle. Normative ambiguities can be associated, for example, with passive smoking, nuclear power, pre-natal genetic screening and genetically modified food. With respect to urban planning, examples include the drafting of building codes, the division in residential, commercial and recreational districts and the level of protection against natural hazards.

Most risks are characterized by a mixture of complexity, uncertainty and ambiguity. Passive smoking may be a good example of low complexity and uncertainty, but high ambiguity. Nuclear energy may be a good candidate for high complexity and high ambiguity, but relatively little uncertainty. The use of microchips in human brains could be cited as an example for high complexity, uncertainty and ambiguity.

3. Adaptive and Integrative Capacity of Risk Governance

The ability of risk governance institutions to cope with complex, uncertain and ambiguous consequences and implications has become a central concern to scientists and practitioners alike. We understand adaptive and integrative governance on risk broadly as the ability of politics and society to collectively design and implement a systematic approach to organizational and policy learning in institutional settings that are conducive to resolving cognitive, evaluative and normative problems and conflicts of risks (To the definition and understanding of adaptive capacity, see [

33,

34,

35,

36,

37,

38]. The main purpose of adaptive management is to cope with external demands from the various environments to which the system is associated. For example, in urban planning one needs to include an energy infrastructure that has the potential to cope with supply shortages or unexpected growth of the population.

It is a dynamic governance process of continuous and gradual learning and adjustment that permits a prudent handling of complexity, scientific uncertainty and/or socio-political ambiguity. Adaptive and integrative capacity in risk governance processes encompasses a broad array of structural and procedural means and mechanisms by which politics and society can handle collectively relevant risk problems. In practical terms, adaptive and integrative capacity is the ability to design and incorporate the necessary steps in a risk governance process that allow risk managers to reduce, mitigate or control the occurrence of harmful outcomes resulting from collectively relevant risk problems in an effective, efficient and fair manner [

39]. The adaptive and integrative quality of the process requires the capacity to learn from previous and similar risk handling experiences to cope with current risk problems and apply these lessons to cope with future potential risk problems and surprises.

For this reason, we propose a comprehensive risk governance model with adaptive and integrative capacity that addresses four core functions:

Systematically and consistently complementing the relevant risk handling functions in a risk governance cycle;

Coping with vulnerabilities evoked by generic challenges of different orders of uncertainty;

Providing adaptability and flexibility in risk governance institutions in response to actual outcome or expected consequences which may moderate the estimates about the risk; and

Enhancing the resilience of the risk governance system by enhancing the capacity to retain the basic functions and structures of risk handling and to absorb disturbance in the risk handling components.

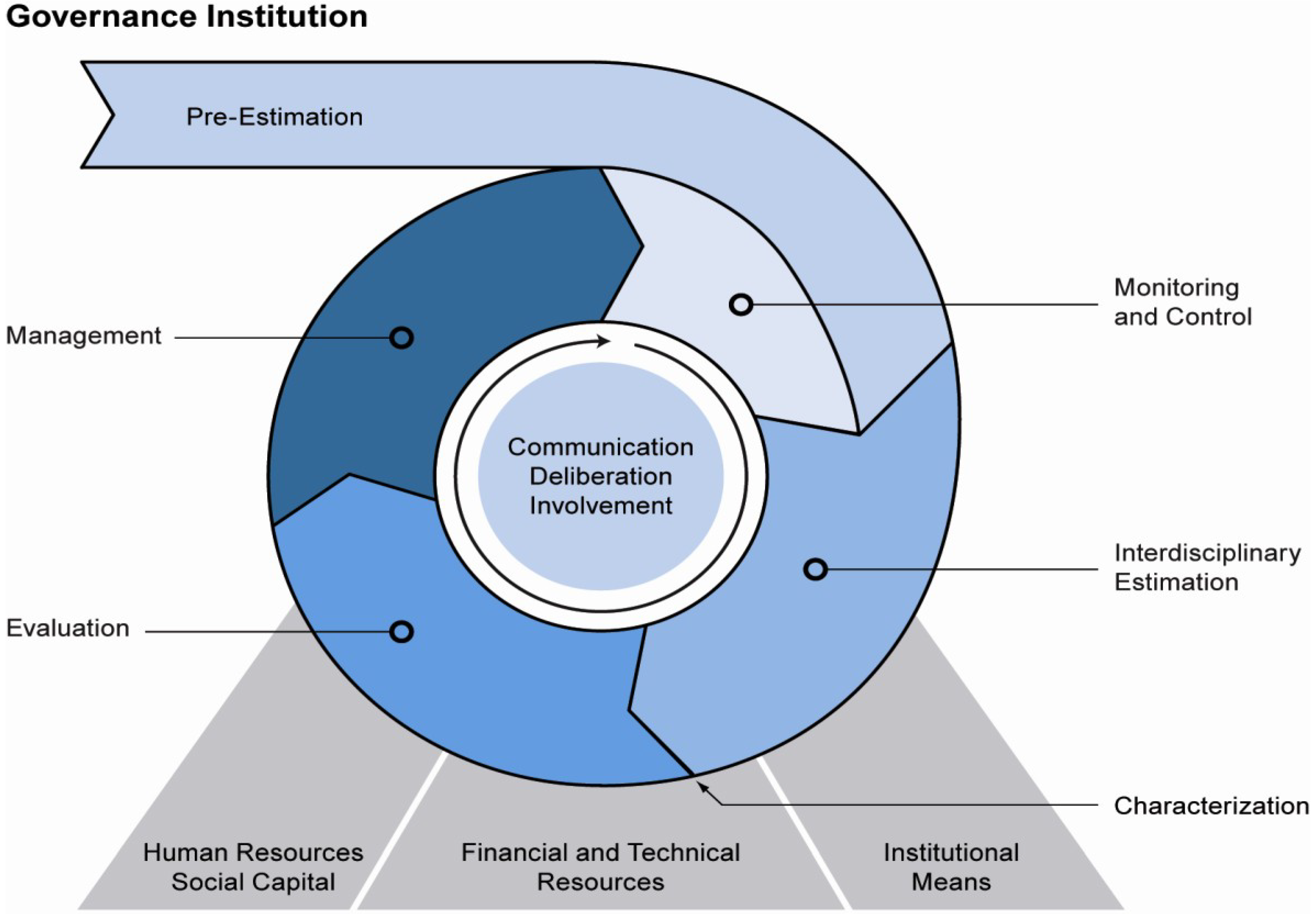

Adaptive and integrative governance on risk and uncertainty requires a set of resources available for accomplishing the tasks associated with the prudent handling of complexity, uncertainty and ambiguity. In 2005, the International Risk Governance Council suggested a process model of risk governance based on the work of the authors [

5,

8,

9,

10,

18]. This framework structures the risk governance process in four phases: pre-assessment, appraisal, characterization and evaluation, and risk management. Communication and stakeholder involvement were conceptualized as constant companions to all four phases of the risk governance cycle. Based on this framework and informed by many comments on the original framework [

40], we modified the original IRGC proposal. The new framework suggested here in this paper consists of the steps: pre-estimation, interdisciplinary risk estimation, risk characterization, risk evaluation and risk management. All four phases are related to the ability and capacity of risk governance institutions to assess, evaluate and manage risks in reflection to the physical threats and the social perceptions of the respective risks (see

Figure 1).

Appropriate resources include institutional and financial means as well as social capital (e.g., strong institutional mechanisms and configurations, transparent decision-making, allocation of decision making authority, formal and informal networks that promote collective risk handling, education), technical resources (e.g., databases, computer soft- and hardware,

etc.), and human resources (e.g., skills, knowledge, expertise, epistemic communities,

etc.). Hence the adequate involvement of experts, stakeholders and the public in the risk governance process is a crucial dimension to produce and convey adaptive and integrative capacity in risk governance institutions [

41]. Since the social acceptance of any response of risk governance to risk problems associated with complexity, uncertainty and/or ambiguity is critical, risk handling and response strategies need to be flexible and the risk management approaches need to be iterative and inclusionary.

Figure 1.

Adaptive and integrative risk governance model (adapted from [

9]). The adaptive and integrative risk governance model is based on a modification and refinement of the IRGC framework [

8].

Figure 1.

Adaptive and integrative risk governance model (adapted from [

9]). The adaptive and integrative risk governance model is based on a modification and refinement of the IRGC framework [

8].

4. Pre-Estimation

Risks are not real phenomena but mental constructions resulting from how people perceive uncertain phenomena and how their interpretations and responses are determined by social, political, economic and cultural contexts and judgments [

8,

42,

43].The introduction of risk as a mental construct is contingent on the presumption that human action can prevent harm in advance. Risk as a mental construct has major implications on how risk is considered. Risks are created and selected by human actors. What appears as a risk to someone may be a destiny explained by religion or even an opportunity for a third party. Although societies have over time gained experience and collective knowledge of the potential impacts of events and activities, one cannot anticipate all potential scenarios and be worried about all the many potential consequences of a proposed activity or an expected event. By the same token, it is impossible to include all possible options for intervention. Therefore societies have been

selective in what they have chosen to be worth considering and what to ignore.

The insight that risk are not objective entities that need to be discovered but mental constructs of how people select signals of the environment in order to be better prepared if a hazard strikes leads to the necessity to establish (culture-sensitive) institutions for early warning. Many such institutions exist—particularly on the national level. However, an adequate international mechanism for the

detection and early warning of some globally relevant potential future harm (for example regarding global environmental threats, global food security) is lacking in spite of the fact that some specialized organizations (e.g., International Atomic Energy Agency) have been established to monitor specific hazards and to detect hints of future problems on an international scale., The world community would certainly benefit from more international mechanism that would be responsible for the timely and integrated detection of novel risks of global importance that are only just beginning to become visible. It should underpin and stimulate existing relevant research, collect and synthesize valid scientific data and information, interpret findings and implications, deliberate and determine the appropriate scientific conventions for future action, and present these to policy-makers in a purposeful form. This would be a preliminary and superior process step where available knowledge provides an indication of the need to proceed then in more specialized risk governance processes [

44]. This process is not arbitrary. It is guided by cultural values, by institutional and financial resources, and by systematic reasoning. An international mechanism would function as network node in which various national risk identification and assessment processes are collected, collated and coordinated.

A systematic review of the stages in pre-estimation would start with

screening as an exploration of a large array of actions and problems looking for those with a specific risk-related feature. It is important to explore what major political and societal actors such as e.g., governments, companies, epistemic communities, nongovernmental organizations and the general public identify as risks and what types of problems they label as problems associated with risk and uncertainty. This is called

framing and it specifies how society and politics rely on schemes of selection and interpretation to understand and respond to those phenomena what is socially constructed as relevant risk topics [

45,

46,

47]. Interpretations of risk experience depend on the frames of reference [

48]. The process of framing corresponds with a multi-actor and multi-objective governance structure since governmental authorities (national, supranational and international agencies), risk and opportunity producers (e.g., industry), those affected by risks and opportunities (e.g., consumer organizations, environmental groups) and interested bystanders (e.g., the media or an intellectual elite) are all involved and often in conflict with each other about the appropriate frame to conceptualize the problem. What counts as risk may vary among these actors. Whether an overlapping consensus evolves about what requires consideration as a relevant risk depends on the legitimacy of the selection rule.

5. Interdisciplinary Risk Estimation

For politics and society to come to reasonable decisions about risks in public interest, it is not enough to consider only the results of (scientific) risk assessment. In order to understand the concerns of people affected and various stakeholders, information about both risk perceptions and the further implications of the direct consequences of a risk is needed and should be taken into account by risk management (This includes the social mobilization potential, i.e., how likely is it that the risk consequences generate social conflicts and psychological reactions by individuals or groups?).

Interdisciplinary risk estimation thus includes the scientific assessment of the risks to human health and the environment and an assessment of related concerns as well as social and economic implications [

8,

18]. The interdisciplinary estimation process should be clearly dominated by scientific analyses—but, in contrast to traditional risk regulation models, the scientific process includes both the natural/technical as well as the social sciences, including economics. The interdisciplinary risk estimation comprises two stages:

- (1)

Risk assessment: experts of natural and technical sciences produce the best estimate of the physical harm that a risk source may induce;

- (2)

Concern assessment: experts of social sciences including economics identify and analyze the issues that individuals or society as a whole link to a certain risk. For this purpose the repertoire of the social sciences such as survey methods, focus groups, econometric analysis, macro-economic modeling, or structured hearings with stakeholders may be used.

There are different approaches and proposals how to address the issue of interdisciplinary risk estimation. The German Advisory Council on Global Change (WBGU) has developed a set of eight criteria to characterize risks beyond the established assessment criteria [

9,

44]. Some of the criteria have been used by different risk agencies or risk estimation processes [

49].

Extent of damage: Adverse effects in natural units, e.g., death, injury, production loss, etc.

Probability of occurrence: Estimate of relative frequency, which can be discrete or continuous.

Incertitude: How do we take account of uncertainty in knowledge, in modeling of complex systems or in predictability in assessing a risk?

Ubiquity: Geographical dispersion of damage.

Persistence: How long will the damage last?

Reversibility: Can the damage be reversed?

Delay effects: Latency between initial event and actual damage.

Potential for mobilization: The broad social impact. Will the risk generate social conflict or outrage,

etc.?

- -

Inequity and injustice associated with the distribution of risks and benefits over time, space and social status;

- -

Psychological stress and discomfort associated with the risk or the risk source (as measured by psychometric scales);

- -

Potential for social conflict and mobilization (degree of political or public pressure on risk regulatory agencies);

- -

Spill-over effects that are likely to be expected when highly symbolic losses have repercussions on other fields such as financial markets or loss of credibility in management institutions.

These four sub-criteria of the last category reflect many factors that have been proven to influence risk perception. The “appraisal guidance” published by the UK Treasury Department in 2005 recommends a risk estimation procedure that is similar to our proposal and includes as well both the results of risk assessment and the direct input from data on public perception and the assessment of social concerns [

50].

6. Risk Evaluation

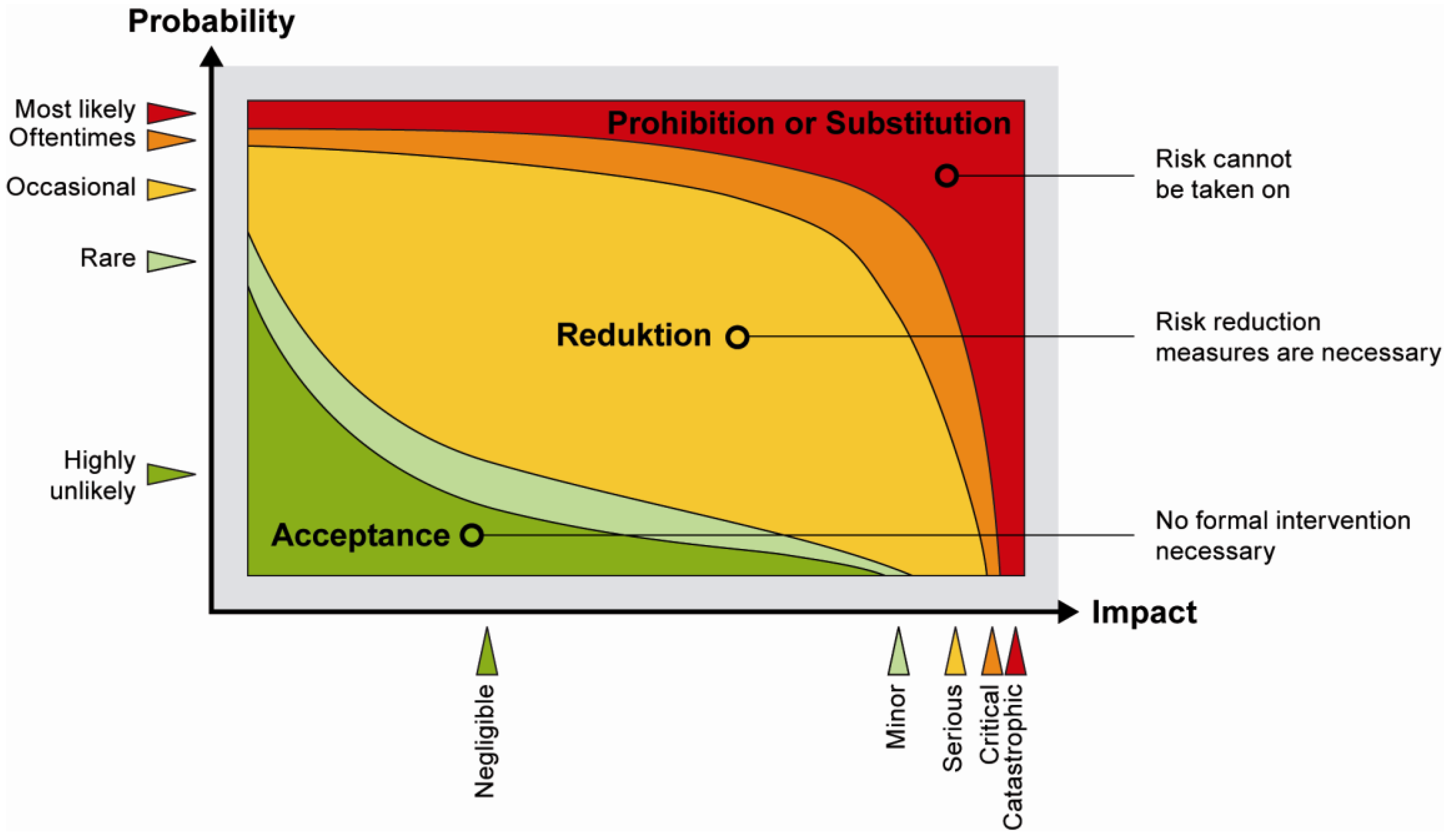

A heavily disputed task in the risk governance process relates to the procedure of how to classify a given risk and justify an evaluation about its societal acceptability or tolerability (see

Figure 2). In many approaches, risks are ranked and prioritized based on a combination of probability (how likely is it that the risk will occur) and impact (what are the consequences, if the risk does occur). In the so called traffic light model, risks are located in the diagram of probability

versus expected consequences and three areas are identified: green, yellow and red [

9,

51].

A risk falls into the green area if the occurrence is highly unlikely and the impact is negligible. No further formal intervention is necessary. A risk is seen as tolerable when serious impacts might occur occasionally (yellow area). The benefits are worth the risk, but risk reduction measures are necessary. Finally, a risk is viewed as intolerable when the occurrence of catastrophic impacts is most likely (red area). Possible negative consequences of the risk are so catastrophic that in spite of potential benefits it cannot be tolerated.

To draw the lines between “acceptable” (green area), “tolerable” (yellow area) and “intolerable” (red area) is one of the most controversial tasks in the risk governance process. The UK Health and Safety Executive developed a procedure for chemical risks based on risk-risk comparisons [

52]. Some Swiss cantons such as Basle County experimented with Round Tables as a means to reach consensus on drawing the two demarcation lines, whereby participants in the Round Table represented industry, administrators, county officials, environmentalists, and neighborhood groups. Irrespective of the selected means to support this task, the judgment on acceptability or tolerability is contingent on making use of a variety of different knowledge sources. One needs to include the data and insights resulting from the risk assessment activity, and additional data from the concern assessment.

The “traffic light model” has sometimes been criticized as being too simplistic. To meet this objection we have suggested including gradual transition zones to allow more differentiation in the evaluation of risks [

12]. If a given risk based on the risk assessment results cannot definitely be classified as “acceptable”, but it is plausible that the occurrence is rather rare and the impact is rather minor, the risk would be assigned to the light green transition zone. Furthermore, we would locate a given risk in the orange transition zone, if the risk cannot clearly be characterized as “intolerable” and, at the same time, the benefits are seen at least partially worthwhile to be taken by society.

Risk evaluations in general rely on causal and principal beliefs as well as worldviews [

53]. Causal beliefs refer to the scientific evidence from risk assessment, whether, how and to what extent the hazard potential causes harm to the environment or to human health. This dimension emphasizes cause-effect relations and provides factual guidance which strategy is appropriate to achieve the goal of risk avoidance or reduction.

However, the question of what is safe enough implies a moral judgment about acceptability of risk and the tolerable burden that risk producers can impose on others. The results of the concern assessment can provide hints of what kind of associations are present and which moral judgments people would prefer in a choice situation. Of major importance is the perception of just or unjust distribution of risks and benefits. How these moral judgments are made and justified depends to a large degree on cultural values and worldviews. They affect personal thinking and evaluation strategies and are shaped by collectively shared ontological and ethical convictions. The selection of strategies for risk handling is therefore understandable only within the context of broader worldviews. Hence society can never derive acceptability or tolerability from looking at the evidence alone. Likewise, evidence is essential if we are to know whether a value has been violated or not (or to what degree). With respect to values and evidence we can distinguish three cases:

Interpretative ambiguity means that evidence is seen as ambiguous but not on values. In those cases where there is unanimous agreement about the underlying values and even the threshold of what is regarded as acceptable or tolerable, evidence in the form of risk estimates may be sufficient to locate the risk within the risk area diagram. A judgment can then best be made by those who have most expertise in risk and concern assessments, in which case it makes sense to place this task within the domain of risk estimation by experts.

Normative ambiguity refers to the ambiguity on values but not on evidence. If the underlying values of what could be interpreted as acceptable or tolerable are disputed, while the evidence of what is at stake is clearly given and non-controversial, the judgment needs to be based on a discourse about values and their implications. Such a discourse should be part of risk management by the legitimate decision makers. In these cases, science is very familiar with the risks and there is little uncertainty and interpretative ambiguity about the risks and their effects. Yet there is considerable debate whether the risk is tolerable or not. One example may the level of protection against natural hazards. If a city is built in an earthquake zone a policy needs to be adopted that determines on the basis of probabilistic models the threshold between a tolerable and intolerable risk [

54]. Should the building code demand a protection level that exceeds the maximum strength of an earthquake of the last 300, 400 or even more years? Which residual risk is acceptable here? The same can be said to flood prone areas. Is it enough to protect a city against a 100-year-flood or should we design it to cope with a 200-year-flood?

Interpretative and normative ambiguity addresses a third case where both the evidence and the values are controversial. This would imply that assessment should engage in an activity to find some common ground for characterizing and qualifying the evidence and risk management needs to establish agreement about the appropriate values and their application. A good example for this third case may be the interpretative and normative implications of global climate change. The Intergovernmental Panel on Climate Change (IPCC) has gone through considerable efforts to articulate a common characterization of climatic risks and their uncertainties. Given the remaining uncertainties and the complexities of the causal relationships between greenhouse gases and climate change, it is both a question of contested evidence and of conflicting values whether governments place their priorities on prevention, mitigation or adaptation [

55,

56].

Since the last case includes both issues of the other two, the process of judging the tolerability and acceptability of a risk can be structured into two distinct components: risk characterization and risk evaluation [

8]. The first step,

risk characterization, determines the evidence-based component for making the necessary judgment on the tolerability and/or acceptability of a risk; the step

risk evaluation determines the value-based component for making this judgment.

The separation of evidence and values underlying the distinction between characterization and evaluation is, of course, functional and not necessarily organizational [

57]. Since risk characterization and evaluation are closely linked and each depends on the other, it may even be wise to perform these two steps simultaneously in a joint effort by both risk assessment experts and risk management decision makers. The US regulatory system tends to favor an organizational combination of characterization and evaluation, while European risk management tends to maintain the organizational separation [

58].

7. Risk Management

Risk management starts reviewing all relevant data and information generated in the previous steps of interdisciplinary risk estimation, characterization and risk evaluation. The systematic analysis of risk management options focuses on still tolerable risks (yellow area) and those where tolerability is disputed (light green and orange transition zones). The other cases (green and red area) are fairly easy to deal with. Intolerable risks demand prevention and prohibition strategies as a means of replacing the hazardous activity with another activity leading to identical or similar benefits. The management of acceptable risks is left to private actors (civil society and economy). They may initiate additional and voluntary risk reduction measures or to seek insurance for covering possible but rather minor or negligible losses. If risks are classified as tolerable, or if there is a dispute as to whether they are in the transition zones of tolerability, public risk management needs to design and implement actions that make these risks either acceptable or at least tolerable by introducing reduction strategies. This task can be described in terms of classic decision theory [

59,

60,

61]:

- -

Identification and generation of generic risk management options;

- -

Assessment of risk management options with respect to predefined criteria;

- -

Evaluation of risk management options;

- -

Selection of appropriate risk management options;

- -

Implementation of risk management options, and

- -

Monitoring and control of option performance.

Meeting the different challenges raised by complexity, scientific uncertainty and socio-political ambiguity, it is possible to design general strategies for risk management that can be applied to four distinct categories of risk problems, thus simplifying the process step of risk management mentioned above [

9]. The different categories are summarized in

Table 1.

Table 1.

Risk characteristics and their implications for risk management.

Table 1.

Risk characteristics and their implications for risk management.

| Knowledge characterization | Management strategy | Appropriate instruments | Stakeholder participation |

|---|

- 1

“Linear” risk problems

| Routine-based: (tolerability/acceptability judgement) | Applying “traditional” decision-makingRisk-benefit analysis Risk–risk trade-offs

| Instrumental discourse |

| (risk reduction) | | |

- 2

Complexity-induced risk problems

| Risk-informed: (risk agent and causal chain) | Characterizing the available evidence by expert consensus-seeking tools: | Epistemic discourse |

| Robustness-focused: (risk-absorbing system) | Improving buffer capacity of risk target through:Additional safety factors Redundancy and diversity in designing safety devices Improving coping capacity Establishing high-reliability organizations

| |

- 3

Uncertainty-induced risk problems

| Precaution-based: (risk agent) | Using hazard characteristics such as persistence and ubiquity as proxies for risk estimates. Tools include:Containment ALARA (as low as reasonably achievable) and ALARP (as low as reasonably practicable) BACT (best available control technology), etc.

| Reflective discourse |

| Resilience-focused: (risk-absorbing system) | Improving capability to cope with surprises. Diversity of means to accomplish desired benefits:Avoiding high vulnerability Allowing for flexible responses Preparedness for adaptation

| |

- 4

Ambiguity-induced risk problems

| Discourse-based | Application of conflict-resolution methods for reaching consensus or tolerance for risk evaluation results and management option selection. Integration of stakeholder involvement in reaching closure Emphasis on communication and social discourse

| Participatory discourse |

The first category refers to linear risk problems: they are characterized as having low scores on the dimensions of complexity, uncertainty and ambiguity. They can be addressed by linear risk management because they are normally easy to assess and quantify. Routine risk handling within risk assessment agencies and regulatory institutions is appropriate for this category, since the risk problems are well known, sufficient knowledge of key parameters is available and there are no major controversies about causes and effects or conflicting values. The management includes risk-benefit analysis, risk-risk comparisons or other instruments of balancing pros and cons.

If risks are ranked high on complexity but rather low on uncertainty and ambiguity, they require a systematic involvement and deliberation of experts representing the relevant epistemic communities for producing the most accurate estimate of the complex relationships. It does not make much sense to integrate public concerns, perceptions or any other social aspects for resolving complexity unless specific knowledge from the concern assessment helps to untangle complexity. Local, anecdotal or indigenous knowledge may also be of great value to gaining a better understanding of complex cause-effect relationships [

62]. Complex risk problems therefore demand

risk-informed management that can be offered by scientists and experts applying methods of expanded risk assessment, determining quantitative safety goals, consistently using cost-effectiveness methods, and monitoring and evaluating outcomes.

Risk problems that are characterized by high uncertainty but low ambiguity require precaution-based management. Since sufficient scientific certainty is currently either not available or unattainable, expanded knowledge acquisition may help to reduce uncertainty and, thus, move the risk problem back to first stage of handling complexity. If, however, uncertainty cannot be reduced by additional knowledge, risk management should foster and enhance precautionary and resilience-building strategies and decrease vulnerabilities in order to avoid irreversible effects. Appropriate instruments include containment, diversification, monitoring and substitution. Because the focal point here is to find the adequate and fair balance between being overcautious versus being not cautious enough, a reflective processing involving stakeholders is necessary to ponder concerns, economic budgeting and social evaluations.

Finally, if risk problems are ranked high on ambiguity (regardless of whether they are low or high on uncertainty), discourse-based management is required demanding participative processing. This includes the need to involve major stakeholders as well as the affected public. The goals of risk management is to produce a collective understanding among all stakeholders and concerned public on interpretative ambiguity or to find legitimate procedures of justifying collectively binding decisions on acceptability and tolerability. It is important that a consensus or a compromise is achieved between those who believe that the risk is worth taking (perhaps because of self-interest) and those who believe that the pending consequences do not justify the potential benefits of the risky activity or technology.

8. Adaptability through Communication, Deliberation and Involvement of Nongovernmental Actors

The effectiveness and legitimacy of the risk governance process depends on the capability of the management agencies to resolve complexity, characterize uncertainty and handle ambiguity by means of communication and deliberation. Adaptability can be accomplished by bringing governmental agencies and regulatory bodies together with stakeholder groups representing civil societal and economic interests, media and the public. In the following, we differentiate particular procedural mechanisms of communication and deliberation to address each of the specific challenges raised by complexity, scientific uncertainty and socio-political ambiguity.

8.1. Instrumental Processing Involving Governmental Actors

Dealing with linear risk issues, which are associated with low scores of complexity, scientific uncertainty and socio-political ambiguity, requires hardly any changes to conventional public policymaking. The data and information of such linear (routine) risk problems are provided by statistical analysis, law or statutory requirements determine the general and specific objectives, and the role of public policy is to ensure that all necessary measures of safety and control are implemented and enforced. Traditional cost-benefit analyses including effectiveness and efficiency criteria are the instruments of political choice for finding the right balance between under- and overregulation of risk-related activities and goods. In addition, monitoring the issue area is important as a reinsurance that no unexpected consequences may occur. For this reason, linear risk issues can well be handled by an instrumental involvement of departmental and agency staff and enforcement personnel of state-run governance institutions. The aim is to find the most cost-effective method for a desired regulation level [

63]. If necessary, stakeholders may be included in the deliberations as they have information and know-how that may provide useful hints for being more efficient.

8.2. Epistemic Processing Involving Experts

Resolving complex risk problems requires dialogue and deliberation among experts. Involving members of various epistemic communities, which demonstrate expertise and competence, is the most promising step for producing more reliable and valid judgments about the complex nature of a given risk [

64]. Epistemic discourse is the instrument for discussing the conclusiveness and validity of cause-effect chains relying on available probative facts, uncertain knowledge and experience that can be tested for empirical traceability and consistency. The objective of such a deliberation is to find the most cogent description and explanation of the phenomenological complexity in question as well as a clarification of dissenting views (for example, by addressing the question, which environmental and socio-economic impacts are to be expected by specific actions or events). The deliberation among experts might generate a profile of the complexity of the given risk issue on selected inter-subjectively chosen criteria. The deliberation may also reveal that there is more uncertainty and ambiguity hidden in the case than the initial appraisers had anticipated. It is advisable to include natural as well as social scientists in the epistemic discourse so that potential problems with risk perception can be anticipated. Controversies would occur less as a surprise than now.

8.3. Reflective Processing Involving Stakeholder

Characterizing and evaluating risks as well as developing and selecting appropriate management options for risk reduction and control in situations of high uncertainty pose particular challenges. How can risk managers characterize and evaluate the severity of a risk problem when the potential damage and its probability are unknown or highly uncertain? Scientific input is therefore only the first step in a series of steps during a more sophisticated evaluation process. It is crucial to compile the relevant data and information about the different types of uncertainties to inform the process of risk characterization [

6]. The outcome of the risk characterization provides the foundation for a broader deliberative arena, in which not only policy makers and scientists, but also directly affected stakeholders and public interest groups ought to be involved in order to discuss and ponder the “right” balances and trade-offs between over- and under-protection. This reflective involvement of stakeholders and interest groups pursues the purpose of finding a consensus on the extra margin of safety that potential victims would be willing to tolerate and potential beneficiaries of the risk would be willing to invest in order to avoid potentially critical and catastrophic consequences. If too much precaution is applied, innovations may be impeded or even eliminated; if too little precaution is applied, society may experience the occurrence of undesired consequences. The crucial question here is of how much uncertainty and ignorance are main stakeholders and public interest groups of society willing to accept or tolerate in exchange for some potential benefit. The nature and scope of uncertainty may have implications on the range of groups to be involved and procedures appropriate to address uncertainties and to debate how decisions should be made in the light of unresolved uncertainty. The reflective involvement of policy makers, scientists, stakeholders and public interest groups can be accomplished by a spectrum of different forms such as negotiated rule-making, mediation, round table or open forum, advisory committee [

65,

66,

67,

68].

8.4. Participative Processing Involving the Public

If risk problems are associated with high ambiguity, it is not enough to demonstrate that risk regulation addresses the issues of public concerns. In these cases, the process of evaluation needs to be open to public input and new forms of deliberation [

69,

70]. This starts with revisiting the question of proper framing. Is the issue really a risk problem or is it an issue of lifestyle or future vision? Often the benefits are contested as well as the risks. The debate about the number of residential units in a building may serve as an example here. Too many units in a building are likely to increase anonymity among neighbors and decreases a sense of accountability for commonly used facilities such as staircases [

71]. Thus the controversy is often much broader than dealing with risks only. The aim here is to find an overlapping consensus on the dimensions of ambiguity that need to be addressed in comparing risks and benefits, and balancing pros and cons. High ambiguity would require the most inclusive strategy for involvement because not only directly affected groups but also those indirectly affected should have an opportunity to contribute to this debate. Resolving ambiguities in risk debates necessitates a participatory involvement of the public to openly discuss competing arguments, beliefs and values. The chance for resolving these conflicting expectations lies in the process of identifying overarching common values, and in defining options that allow a desirable lifestyle without compromising the vision of others.

Other issues refer to finding equitable and just distribution rules when it comes to common resources and to activating institutional means for achieving common welfare so that all can benefit. The set of possible forms to involve the public includes citizen panels or juries, citizen forums, consensus conferences, public advisory committees and similar approaches [

65,

66,

67,

72,

73].

9. Application to Urban Planning

The risk governance model outlined above can be transferred to the issue of urban planning. The following section is devoted to a theoretical application of the risk framework to urban planning. According to our knowledge the framework has not been practically applied to this area.

The risks that we are facing in urban planning are financial risks, physical risks (natural hazards), technological risks (building structures, infrastructure, hazardous facilities) and social risks (violence, social dissatisfaction). These types of risks are all interconnected and need to be considered when urban areas are planned and renewed [

12,

18]. How can we handle these risks by using the risk governance model?

In the phase of pre-estimation it is essential to familiarize oneself with the various risk concepts and images that are part of the early planning process. Architects, builders, urban planners, industrial contractors, real estate agents and last not least the affected population all have different expectations and concerns that should be addressed before an actual plan is worked out. The idea is to collect these different concepts and make them an integral part of the urban renewal or development plan. The best instrument for implementing such an input is by interviewing key people in the process of developing the plan and to conduct a survey among residents about their preferences and concerns [

74]. In addition, it might be advisable to establish a Round Table in which different concepts are discussed and a consensus reached about the main goals and required steps to reach them.

In the phase of interdisciplinary estimation two major steps are to be taken: First it is mandatory to assess each risk that one faces in the development of new urban districts. These risks can refer to exposure to natural hazards, technical failures, infrastructure failure or inefficiency, planning mistakes, inadequate building codes and inadequate consideration of social needs and preferences. These risks are very different in nature and require specific techniques for addressing them. However, they all have in common that they include a hazard assessment (what is the potential harm?), an exposure assessment (who and what might be affected), a vulnerability analysis (what harm or damage can be expected for whom and to what degree?) and finally a quantitative or at least qualitative risk estimate which combines the hazards, exposure and vulnerability assessments to an overall risk profile. Once these profiles have been constructed it is very important to understand the connections between these risks. Some minor risk in one part can augment or amplify risks in another area [

75]. Formally such an integration can be performed by using influence diagrams or Petri nets.

The second step in risk estimation is the inclusion of the concerns and expectations by those involved in the urban planning process. The main idea is here to collect the necessary knowledge by stakeholders and affected citizens about their preferences in terms of risk reduction and risk handling. This step is often forgotten but is essential for matching the physical risk assessments with human perception [

76]. Among the instruments to perform such a concern assessment one would suggest Group Delphi processes (a variation of the normal Delphi process in which groups of experts are performing the judgments in small group settings) or hearings [

77].

In the phase of evaluation it is important to have different urban development plans or options and compare these options from both sides: the opportunities including potential revenues and the risks, including financial costs and liabilities. It is recommended to use either multi-criteria or multi-attribute decision analytic models to identify potential conflicts between objectives and criteria and to assign tradeoffs between these conflicting objectives [

55,

78]. It is recommended to have stakeholders and representatives of the public assist in determining relative weights and thus reflecting plural value input [

56,

73].

During the step of risk management it is required to design and assess different risk reduction measures. Once the most promising option for urban development or renewal is chosen the risk profile will show potential opportunities but also deficits in terms of risks or concerns. This is now the phase in which risk reduction options are generated, discussed and selected. Depending on the degree of complexity, uncertainty and ambiguity, one should choose risk reduction options that relate to best available technical knowledge (high complexity), emphasize reversibility and robustness (high uncertainty) and include participatory instruments in case of high ambiguity [

79]. If the risk reduction program is controversial or includes value conflicts instruments such as citizen panels or citizen advisory groups would be highly recommended [

67].

All four stages need to be accompanied by intensive risk communication efforts. These efforts should start during the pre-estimation phase. It should convey the basic concepts and what these concepts entail in terms of opportunities and risks [

80]. Feedback channels can be arranged on the Internet as a means to scan the responses by stakeholders and affected citizens. During the risk estimation phase the communication process should emphasize the process by which the research and planning team conducts the risk assessments. The main goal here is to promote trust in the risk handling authorities [

81]. It might be helpful to ask stakeholders and citizens for additional knowledge that the public officials may not have. More input from the public is encouraged during the evaluation phase. First of all, the process of how tradeoffs are assigned and justified needs to be made transparent to all stakeholders as well as the general public. Furthermore depending on the degree of ambiguity it might be useful to have procedures in place that systematically collect feedback and concerns with respect to the planned urban renewal or development options. During the management phase it is essential to familiarize all affected persons with the chosen or deliberated risk reduction measures, in particular those that rely on cooperation of the affected public (such as evacuation or sheltering plans). Instruments for making risk reduction plans known to the public are open meetings, brochures, websites, TV shows and other popular forms of information transfer [

82].

It is important to acknowledge that the risk governance cycle does not end with the implementation of the risk reduction measures. Governance is an iterative process. During the construction, the implementation and the practical realization of the envisioned plans new developments may occur that necessitate a re-assessment of the risks. Furthermore, the context conditions may change and thus a new tradeoff analysis is required. The risk governance cycle is a cycle without beginning and endings. It asks for permanent adjustment and improvement [

33].

Taking these steps in the risk governance cycle promises to improve the resilience of the system and thus contributes to the overall sustainability of the city development [

83]. The main purpose of adaptive governance is to provide the institutional structures and processes that help all actors involved to monitor changes and stressors from the inside and outside of the system and to design appropriate responses in form of assets, skills and procedures. Sustainability of cities has to be seen in the context of dynamic changes and transitions. A proactive, adaptive and flexible risk management structure is the most important condition for making a dynamic urban development capable of coping with the natural, social and cultural changes it will face in the future.

10. Conclusions

This paper attempted to expand the framework on risk governance in the direction of more adaptability and institutional capacity to include various actors and knowledge camps when addressing and regulating risks of urban planning. At the core of this paper was the idea of adaptive and integrative risk governance for urban planning and renewal. The goal has been to illustrate how the different components of pre-estimation, interdisciplinary risk estimation, risk characterization, risk evaluation, risk management as well as communication and involvement interact with each other and to demonstrate how the various combinations of complexity, uncertainty and ambiguity can be addressed by different risk management strategies.

The analytic distinction of risk characteristics—complexity, uncertainty and ambiguity—helps to facilitate an integrated approach to risk governance and urban planning. Whereas the analysis of simple and—to some degree—complex problems is better served by relying on the physical understanding of risks, uncertain and ambiguous problems demand the integration of social constructions and mental models for both understanding and managing these problems since urban planning affects the livelihood of people with all their beliefs, expectations and emotions. The distinction of risks according to risk characteristics not only highlights deficits in our knowledge concerning adequate risk handling in urban planning contexts, but also points the way forward for the selection of management options. Thus, the risk governance framework attributes an important function to public and stakeholder participation, as well as risk communication, in the risk governance process. The framework suggests efficient and adequate public or stakeholder participation procedures. The concerns of stakeholders and/or the public are integrated in the risk appraisal phase via concern assessment. Furthermore, stakeholder and public participation are an established part of risk management. The optimum participation method depends on the characteristics of the risk issue. In this respect, all aspects that matter to people in urban planning enter into the various discourses through the images that the participants bring into the discussions. The need for finding an agreement on the respective time and space boundaries, underlines the necessity to understand and comprehend the various concepts and images that people associate with quality of life in urban environments. This is also the best reassurance that the dynamic requirements of sustainable urban development can be met.