1. Introduction

Electric vehicles (EVs) are of great value in three aspects: environment protection, grid construction, and economical efficiency improvement. Electric vehicles include battery electric vehicles (BEVs), plug in hybrid electric vehicles (PHEVs), and fuel cell electric vehicles (FCEV). From the perspective of the environment, internal combustion engine vehicles (ICVs) driving by petrol or diesel will produce CO

2, SO

2, NO and other pollutants. However, promoting EVs can reduce these pollutants by decreasing the dependence on fossil fuels. The pollution produced by battery electric vehicles (BEVs) driving by electricity only is mainly from electricity generation progress [

1]. Some studies have investigated the potential of vehicle-to-grid (V2G) in providing services to the grid and integrating renewable energy sources (RES) generation [

2]. After RES is introduced into the generation progress, the pollution derived from EVs will somehow decrease.

Facilitated by smart grid technologies, EV could provide services to the grid, such as energy storage and ancillary services by injecting electricity back into the grid when they are integrated with V2G capability [

3]. EV storage acts as incentives for the development of the smart grid though new charging facilities will increase construction input. Many researchers have investigated the impact of EVs on grid investment. For instance, Pieltain Fernández evaluated the impact of plug-in electric vehicle (PEV) penetration on distribution network investment and incremental energy losses [

4]. Clement-Nyns pointed out that there could be a good combination with plug-in hybrid electric vehicles (PHEVs) and the grid as PHEVs can provide storage to make full use of the excess produced energy and apply it for driving or release it into the grid sometime later [

5].

As for increasing the operation efficiency, EV could smooth the load curve by increasing demand in valley hours, which will make a better utilization of system resources and a more efficient integration of intermittent RES generation [

2,

6]. In order to ensure the power balance in load valley, most of the large-scale thermal power units are reduced at minimum output, and small units need day and night two-shift rotation system running separately. This way of operation will lead to unfavorably economic and safe performance. EVs may act as power plant units when they are integrated with smart gird deployment.

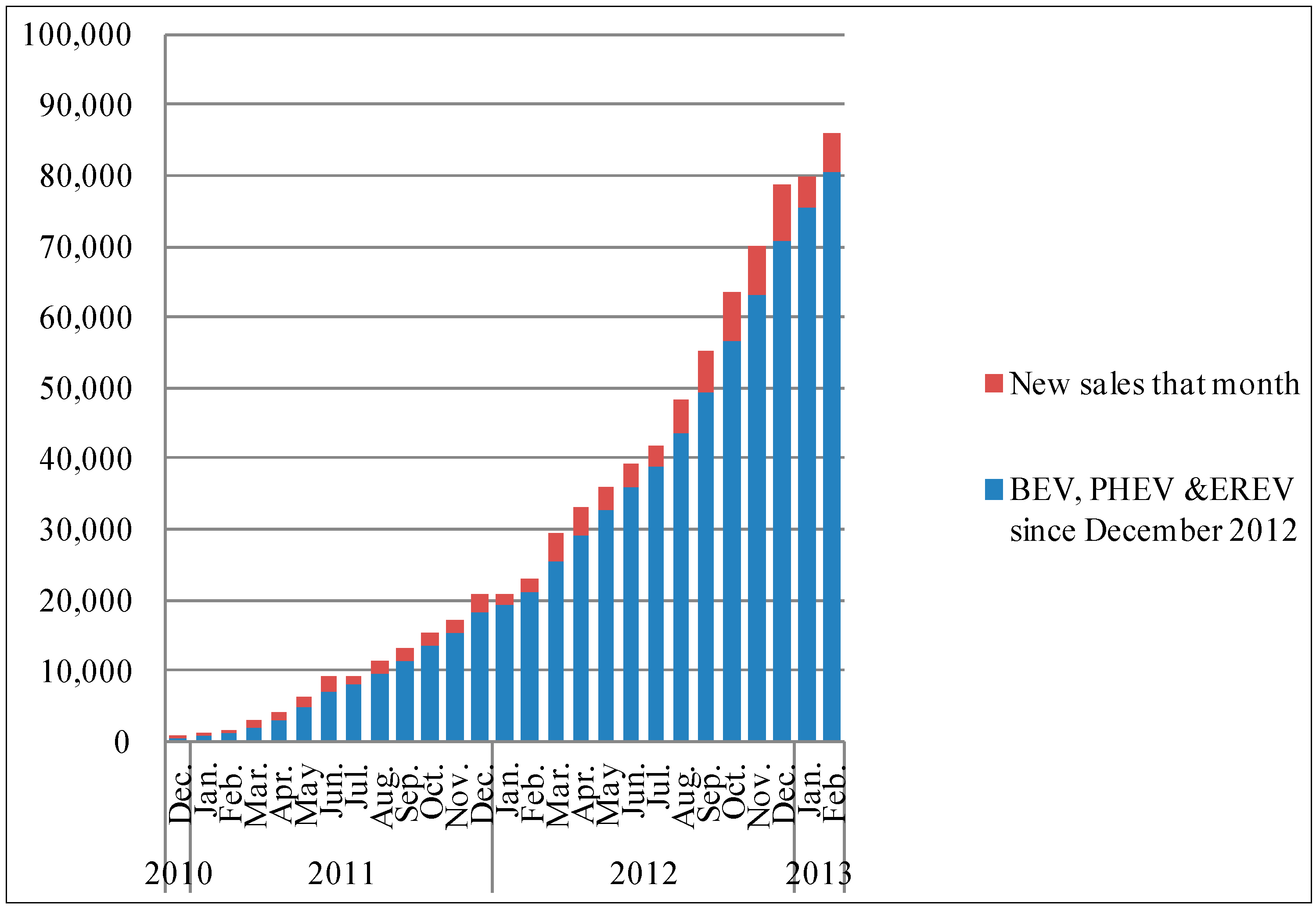

For these purposes, many countries start to promote energy storage technologies and carry out policies to introduce EV into daily life. EV industries are growing fast in many developed countries, such as the United States, the European Union, and Japan. Based on the 2012 fiscal budget, the United States provided 30 communities $10 million in total for EV deployment. Its EV market has made remarkable progress, as presented in

Figure 1. The United States is the largest share of the worldwide PHEV market, due to the predominance of the Chevrolet Volt. The country is targeting the deployment of over 22,000 chargers, including 350 fast chargers by 2014 [

7].

Since the first batch of electric vehicles was produced at the end of 1995, European countries have contributed to developing the EV industry. In recent years, the market share of EV in European Union has been increasing constantly. In addition, European countries have committed goals in EV market holdings. The target of France is to keep 2 million cumulative EVs/PHEVs by 2020. UK ranking ahead in charging infrastructure construction, aims at constructing 200 locations for EV charging by 2013. Each location has charging facilities for at least one vehicle and over 100 vehicles for most. Germany aims to maintain 1 million cumulative EVs including BEVs, PHEVs, fuel cell electric vehicles (FCEVs) by 2020, and 5 million by 2030.

Figure 1.

Cumulative electric vehicle sales in the United States [

8].

Figure 1.

Cumulative electric vehicle sales in the United States [

8].

Note: letters under columns mean months from December 2010 to February 2013.

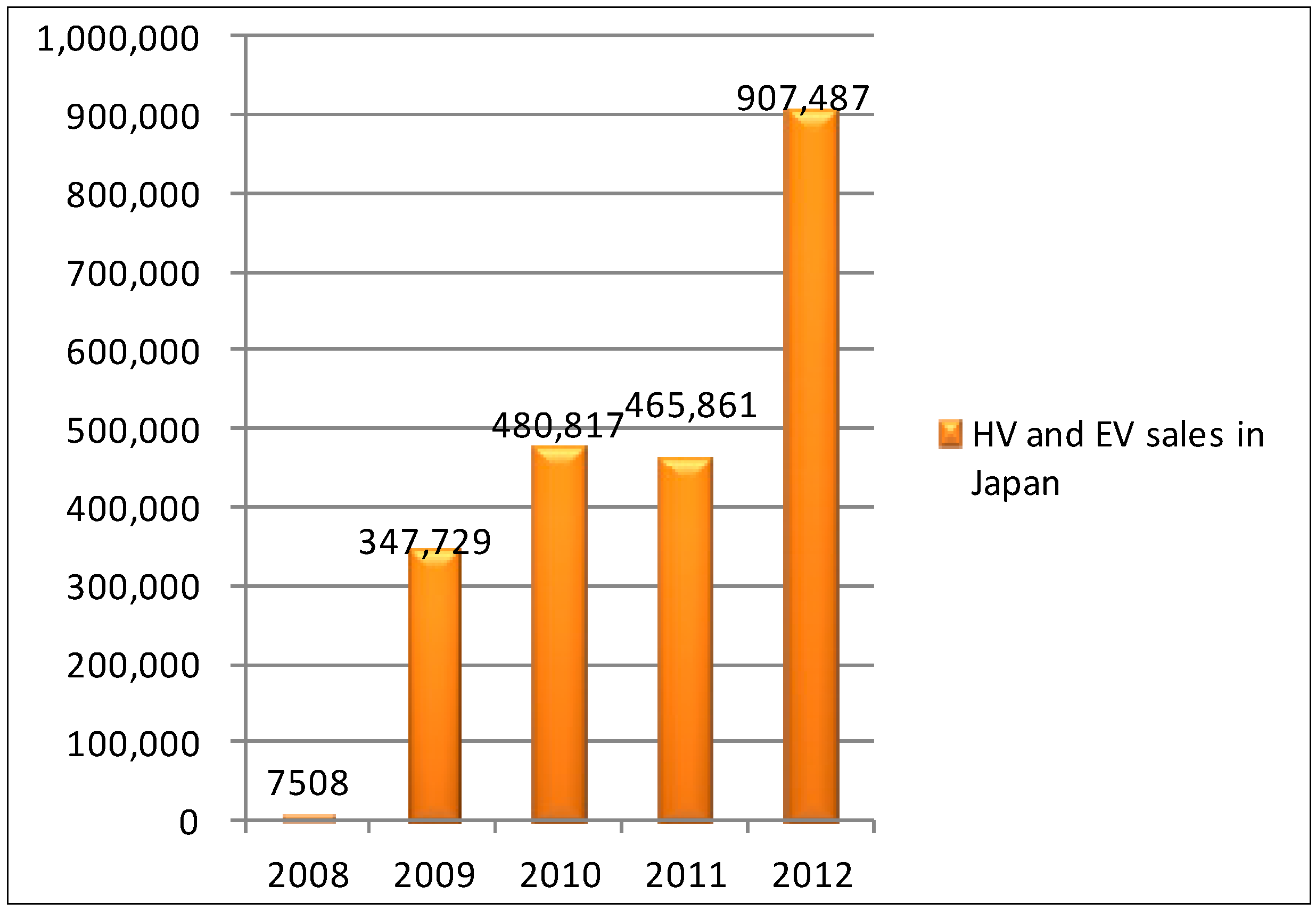

The developmental pace of EVs is very fast in Japan. Its cumulative EV stock in 2012 had mounted up to 44,727 which ranked second globally. EV sales were in a growing trend from 2008 to 2012 as shown in

Figure 2. Japan claimed to be the second largest share of the global PHEV market, largely due to the increasing sales of the Toyota plug-in Prius. In the worldwide BEV market, Japan held the largest share due to sales of the Nissan LEAF. Furthermore, Japan had already installed 1381 fast chargers which was the highest globally. For the sake of further promotion, Japan intends to realize its EV market sharing of 20% by 2020 [

9].

Figure 2.

Electronic Vehicle (EV) sales in Japan market [

10].

Figure 2.

Electronic Vehicle (EV) sales in Japan market [

10].

China promised to reduce its carbon intensity by 40%–45% by the year 2020, compared with 2005 levels. Taking the consideration of EVs great value in decreasing emissions, the Chinese government has put forward a series of policies and planning to initiate the EV industry. Through analyzing the current situation of electric vehicles industry and reviewing overall policies in China, this paper aims to find out the problems faced by EV market and put forward recommendations for further development.

2. Current Situation of Electric Vehicles Development in China

In order to mitigate climate changes and reduce emissions, the Ministry of Finance and Ministry of Science and Technology jointly issued the Notification of Energy-Saving and Electric vehicles Promotion in Pilot Demonstration Areas as the first specific policy to propose EV promotion in January 2009. From then on, Chinese government has committed to increasing the proportion of EV in vehicle market. The target of government is to hold 500,000 BEVs and HEVs by 2015, and 5 million by 2020.

2.1. Market Sales

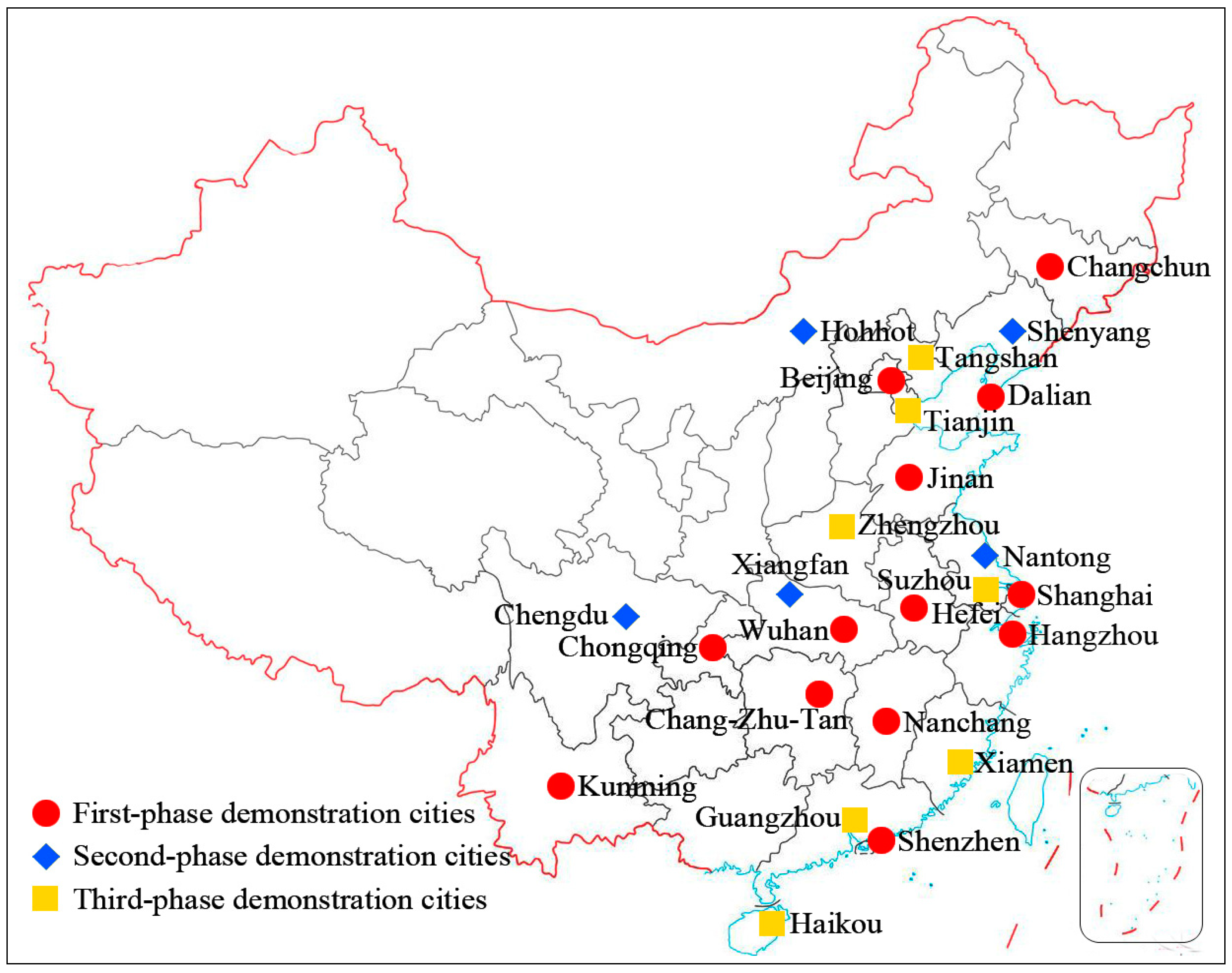

Since the

“Ten Cities with Thousands of EVs” program was launched (

Figure 3), there has been great progress in the popularization of electric vehicles including BEV, HEV and fuel cell electric vehicle (FCEV). The program proposed 13 pilot cities at first, most of which are representative in a province. These cities drove the program by influencing its surrounding areas. So far, 25 cities have entered the program to push forward the popularization of EV. In the light of statistics released by the government at the end of 2012, 24,800 motors listed in the

Directory of Energy Saving and Electric Automobile Types for Demonstration Application Engineering Recommendation had been produced, with an annual growth of 94%. Besides, the ownership of electric passenger vehicles had risen to 14,700, and commercial ones had reached to 10,000 above. According to different vehicle types, statistics of EV sales were listed: 13,300 BEVs, 10,400 HEVs, and more than 1000 PHEVs [

11].

Figure 3.

“Ten Cities-Thousand EVs” program demonstrate cities.

Figure 3.

“Ten Cities-Thousand EVs” program demonstrate cities.

Notes: Chang-Zhu-Tan is short for Changsha, Zhuzhou and Xiangtan economic zone.

Chinese automakers have made efforts to advance the production of EV. For instance, the First Automobile Workshop (FAW) Group Corporation announced that the development strategy of EVs would focus on strong hybrid electric busses, PHEV, and BEV. Furthermore, the enterprise established six technology platforms to bring about more than ten types of electric vehicles. Meanwhile, Dongfeng Motor (DFM) Corporation plans to raise the production scale to 100,000 HEVs and 50,000 BEVs in 2015, which would account for about 20% of its total production. Shanghai Automobile Corporation (SAIC) Motors signed the memorandum of strategic cooperation with General Electric Company (GE) in 2011 to further the investigation of basic technology and strengthen the research on new motorcycle types. Changan Motors also expressed that it would contribute to the industrialization of EVs and self-manufacture of core auto parts so as to get 20% of EV market share in 2015 [

12].

2.2. Charging Infrastructure

At the end of 2012, China possessed 15,907 articles of non-residential slow EV supply equipment, which ranked China No.1 in the world. Because of the motivation of the government, various parties in China (the power grid, automobile enterprise, and gas supply enterprise) are optimistic about electric vehicle charging services market currently.

2.2.1. China State Grid and China Southern Power Grid Company

In China, most EV chargers are governed by the China State Grid company. By 2012, the State Grid had accumulatively built 353 EV charging stations, and 14,703 sets of AC chargers. The company has signed the agreement named Charging Infrastructure Construction Strategic Cooperation Framework with all 273 municipal governments inside its business area. Similarly, China Southern Power Grid Company has stepped to big cities for breakthrough. It has confirmed the operation mode of giving priority to battery replacement, and slow charging as supplement. 11 charging stations and 354 chargers have been put into use in large and medium-sized cities, such as Guangzhou, Shenzhen, Zhuhai, Nanning, Guilin, Liuzhou, and Kunming city.

2.2.2. Petevio New Energy Company

With the support of Shenzhen Municipal Government, Potevio New Energy Company seized the opportunity of licensed electric vehicle infrastructure operator in Shenzhen. By 2011, this company had built 57 charging stations which spread over the six districts of Shenzhen with 850 charging spots, covered all the 77 electric bus lines in the 44 venues of Universiade Shenzhen and then provided charging and battery replacement services for 2011 electric buses and taxies (52.8% for public purpose). Furthermore, the company has already built a complete commercial operation service system based on the market-oriented operation mode, providing a variety of value-added services for users such as vehicle and station information, power system maintenance, and emergency rescue apart from ordinary charging and battery replacement services. Generally speaking, the proportion of electric buses is increasing while the operation network is expanding [

13].

2.2.3. Sinopec Group

Different from China National Offshore Oil Corporation, which declared to withdraw from the charging service, Sinopec Group (the largest petroleum supplier in China) wanted to take a share of EV industry profit. Though Sinopec step into EV industry relatively late, it is advanced in development planning, technical route, and pilot projects. The group established Beijing Sinopec Shouke New Energy Technology Co. Ltd. to carry out EV charging infrastructure construction and operation. Sinopec chose DC quick charge as main charging mode, with AC slow charge and battery replacement as alternatives. In addition, some of the gas stations will be transformed into gas and charging comprehensive sites. Sinopec began to construct gas and charging station in Beijing, Shenzhen, Shanghai, and Anhui in 2012. During

“the Twelfth Five-Year Plan” period (2011–2015), Sinopec will construct and transform 275 gas and charging comprehensive service stations, 100 from which are to be built in Beijing [

14].

2.3. Cells R&D

There are four types of batteries mainly used in EV industry, performances of which are described in

Table 1. Among these four types of batteries, the lithium iron phosphate power battery named ET-Power is of good dynamic performance and safety function. This battery is produced by the BYD Company which claims that a single charge could support a driving distance of 300 km and a capacity of 120 A·h. With the output power of 75 kW, the battery is installed on BYD E6 electric vehicle which weighed 2295 kg. Furthermore, this battery has the advantages of energy-saving and recycling. It is said that after circulated charging 4000 times, there are still 80% of capacity. A BYD EV consumes 19.5 kWh/km energy which equals a quarter of unit energy consumption for petrol vehicles [

15]. However, the sustainability of this type of cell remains to be proved for the technology has not been extensively applied by other manufacturers.

Table 1.

Performance indices of four types of EV batteries and applications to EVs [

15,

16].

Table 1.

Performance indices of four types of EV batteries and applications to EVs [15,16].

| Battery type | Lithium iron phosphate | Lead acid battery | NiMH battery | Lithium-ion battery |

|---|

| Specific type | BYD automobile lithium iron phosphate power battery ET-power | Chaowei Power automobile lead acid battery 6DM150 | Chunlan automobile NiMH battery QNFG90 | China Aviation Lithium battery SE400AHA |

| Energy per mass(W·h/kg) | 100–120 | 30–50 | 30–110 | 100–250 |

| Energy per volume(W·h/kg) | 310 | 60–75 | 140–490 | 250–360 |

| Power per mass (W/kg) | NA | 90–200 | 250–1200 | 250–340 |

| Circle index | 2000 | 500–800 | 500–1500 | 400–2000 |

| Voltage (V) | 3.3 | 2.105 | 1.2 | 3.7 |

| EV battery pack capacity (A·h) | 120 | 150 | 90 | 400 |

| EV battery pack mass (kg) | NA | 42 | 2.2 | 14.4 |

| EV battery pack voltage (V) | 3.3 | 12 | 1.2 | 3.2 |

| EV types applied | BEV (passenger cars and buses) | Short distance EV (sightseeing bus) | HEV | BEV (passenger cars and buses) |

Comparatively, the lead acid battery has been widely accepted in automobiles, mainly serving auxiliary power for the ICV (internal combustion vehicle) interior electronic equipment [

17]. In the past fifty years, the price of lead-acid battery is becoming low enough to be well accepted since the batteries are produced on a large scale with mature technology. There the lead-acid battery has constantly been used in rental cars, electric forklifts, and other short driving buses when other new battery technologies spring out.

Different from the other three batteries, NiMH car battery is often applied to HEV. As the representative of NiMH car battery manufacturers, Chunlan Power battery is the main power supplier of the “Ten Cities with Thousands of EVs” new energy promotion program. The NiMH battery and its management system are also used in the “Beijing Hybrid Electric Bus Demonstration Project” [

18]. Chunlan NiMH batteries are sold to the vehicle manufacturers listed in the promotion program, such as FAW, DFM, and Zhuzhou Bus.

The production of lithium-ion batteries increased very quickly in recent years. Its gross output in 2008 reached about 9000 t, valuing RMB 20 billion. The main lithium-ion power battery manufacturers include China Aviation Lithium Battery Co. Ltd., CITIC Guoan MGL Company, and Wanxiang Group [

19]. In addition, Lithium-ion batteries produced by Beijing New Energy Battery Technology Co. Ltd. are served in fifty automobile Futian “MIDI” battery electric taxies, with a capacity of 25 kWh, and a theoretic range of 150 km [

20].

3. Overall Policies for New Energy Vehicles

3.1. Industry Planning

The Chinese state council brought about the Automobile Industry Adjustment and Revitalization Planning in 2009 to activate the energy-saving electric automobile demonstration project. The planning put up three methods: firstly, the Chinese central government should give subsidies to support large and medium-sized cities to promote EV industry. Secondly, local governments at or above the county-level may draft planning to provide priority for promoting electric vehicles in city buses, taxies and sanitation vehicles etc. Thirdly, local governments should support the establishment of EV fast charging network and the construction of public charging facilities.

The planning emphasizes the importance to increase the production and sales of EV. The target is to build up 500,000 electric automobile capacities of BEV, HEV, etc., in 2015. The government stipulates the main automobile manufacturers should pass the authentication of producing EV auto parts, aiming at making the electric cars take up 5% of passenger vehicles market. Moreover, the industry is incited to form one billion (A·h) motor power battery monomer capacity to structure power module system. To realize the industrialization of EV, the plan encourages automobile producers to master design technology of special engine and power module (motors, batteries, and its management system etc.).

3.2. Tax Policies

In the light of the Energy Saving and New Energy Automobile Industry Development Planning, producers of energy saving vehicle and its key parts can enjoy preferential policies via High and New Technology Enterprise Income Tax Preferential Qualification. The enterprises, which engaged in technology development, services, and transfer consulting, can enjoy a business tax exemption policy.

3.3. Price Subsidy Policies

Four key ministries of central government (Ministry of Finance, Ministry of Science and Technology, Ministry of Industry and Information Technology, National Development and Reform Commission) jointly issued

Interim Measures for Financial Aid Fund Management of Electric Vehicles Private Purchase in Pilot Cities (2010–2012) [

21]. According to the regulation, the central government firstly announced to provide lump-sum subsidy to electric vehicles via private purchase or use in pilot city. Secondly, it’s settled to grant appropriate allowance for power battery production, battery charging station, and other infrastructure standardized construction. Thirdly, special funds will be arranged for directory review and inspection.

As for the first kind of subsidy, there are three ways with representative to private purchase and use:

- (1)

Direct purchase: the central government would provide subsidies to automobile manufactures based on the scale of private purchase in the city. The manufacturers sell electric automobiles to private users at the price after deducting allowances.

- (2)

The vehicle leasing: automobile producers sell EVs to rental enterprises at the price excluding the subsidies.

- (3)

Battery leasing: subsidies are given to battery lease firms which take charge of renting batteries, maintenance, replacement, and other services. The sum of subsidies is due to the amount of vehicles in service.

Subsidy standard is determined by the capacity of power battery molecule which means the electric vehicles meeting the qualifications would receive an allowance of 3000 Yuan/kWh (482.01USD or 354.449EUR). The highest subsidy for a plug-in hybrid passenger car is 50,000 Yuan (8033.613USD or 5907.477EUR) and 60,000 Yuan (9640.335USD or 7088.972EUR) for a battery electric passenger car. However, the financial aid will take decreasing mechanism that is to say after the sales of plug-in hybrid and battery electric passenger cars by each manufacturer separately targeting 50,000, the central government will lower the subsidy standard.

3.4. Investment Policies

During the period of 2009–2012, the central government of China arranged 10 billion Yuan (1.607 billion USD or 1.181billion EUR) in investments for technical progress and renovation, focusing on auto enterprise production upgrading, energy-saving, environmental protection as well. The investments are also spent on the research of key technical parts and the foundation of testing platforms. Two steps are taken to advance technical progress and technical renovation investment:

The first step is promoting and regulating automobile loan. The Automobile Industry Adjustment and Revitalization Planning are proposed to modify and perfect automobile consumer credit system. Car loans management regulations are formed, aiming at the standardization and legalization of automobile consumption credit (credit investigation, vehicle mortgage, loan guarantee and contract disposal). Furthermore, the planning encourages qualified domestic auto production backbones to establish automobile financial company to diversify the automobile consumption credit modes and normalize the securitization of credit assets. Financial bonds are propelled in the meantime.

The second step is providing support for financial services. Energy Conservation and Electric Automobile Industry Development Planning (2012–2020) is put forward to impel financial institutions to set up credit management and evaluation systems. The purpose of the planning is to innovate in intellectual property pledge financing and industrial chain financial products. The planning proposed to set up a multi-level guarantee system covering risk compensation policies, financial and social capital investment. Then it invites electric vehicles and key components producers to issue debt financing tools or to refinance by local venture investment funds. If the fund obeys the principles (government guidance, market operation, and innovation) and meets the conditions of application, the central financial may join into it to lead social capital to flow into electric automobile industry.

3.5. Research and Development Support

In the light of

the Twelfth Five-Year Electric Vehicle Technology Development Special Planning [

22], Ministry of Science and Technology intended to found the electric vehicle technology system and form a programming named three horizontals, three verticals, three platforms (three horizontals: HEV, BEV, FCEV; three verticals: battery, motor, electric control system; three platforms: standard detection, energy supply, integration). The planning pointed out that lithium ion power battery would be a core breakthrough in power module.

By March 2012, more than 3000 patents had been applied for. The Chinese government issued 56 national electric car industry standards and built more than 30 electric automotive technology innovation platforms. It is estimated that there will be 29 technological innovations in vehicle, key parts, public platforms, and above 3000 core technology patent items by 2015. To meet the large-scale energy supply demand of EVs, power supply network which is composed of 400,000 chargers, 2000 charging stations in more than twenty demonstration cities will come into service.

Details of the policies related to EV industry motivation are tabulated in

Table 2.

Table 2.

China energy saving and new energy vehicles development policy summary.

Table 2.

China energy saving and new energy vehicles development policy summary.

| Year | Law or regulation | Authority |

|---|

| 2009 | Notification of energy saving and new energy vehicles of the pilot demonstration promotion. | Ministry of Finance, Ministry of Science and Technology |

| New Energy Vehicle Production Enterprise Access Management Rules | Ministry of Industry and Information Technology |

| 2010 | Notification about extending public service areas energy saving and new energy vehicle demonstration to promote the work;

Notification about subsidy for new energy vehicles private purchase in pilot cities;

Interim Measures for Financial Aid Fund Management of New Energy Vehicles Private Purchase in Pilot Cities (2010–2012) | Four departments( Ministry of Finance, Ministry of Science and Technology, Ministry of Industry and Information Technology, The National Development and Reform Commission) |

| Notification about increasing pilot cities to promote energy saving and new energy vehicle demonstration in public service area | Four departments |

| 2011 | Notification about energy conservation and emissions reduction fiscal policy comprehensive demonstration work | Ministry of Finance, The National Development and Reform Commission |

| Letter about strengthening safety management of energy saving and new energy vehicle demonstration | Four departments |

| Notification about further work on the demonstration of energy saving and new energy vehicles in pilot cities | Four departments |

| 2012 | The Twelfth Five-Year Electric Vehicle Technology Development Special Planning;

Automobile Industry Adjustment and Revitalization Planning | Ministry of Science and Technology |

| Energy Conservation and New Energy Automobile Industry Development Planning (2012–2020) | The State Council |

4. Problems

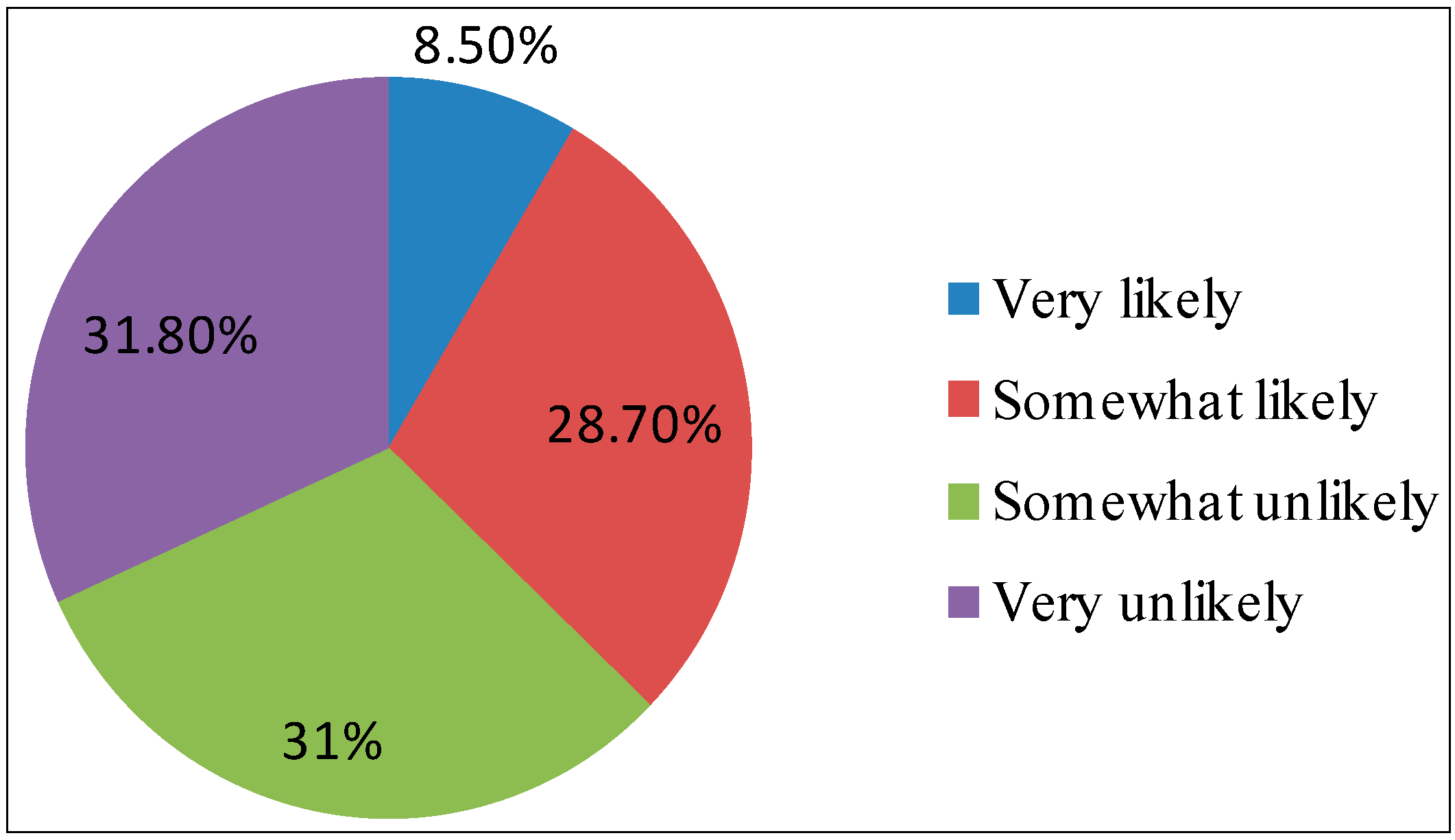

Although the Chinese government has spared effort on making planning and policies to cultivate EV industry, the problem of customer acceptance of EV still exists. This problem is also faced by other developed countries. A survey about EV industry development in the US was conducted by the Zpryme research and consulting company in December 2010 among 1046 U.S. drivers aging 18–65 to assess their overall interests in EV, key reasons to purchase EV, and charging preferences [

23].

Figure 4 indicates that most of the American latent customers do not plan to buy an electric vehicle in the near future. In addition, the survey of EV industry in China (based on Nielsen Company study) illustrates that about 11.02% of consumers intend to buy EV, and 18.33% are likely to buy HEV. The results from two countries are very similar.

Figure 4.

Possibilities for American customers to purchase an EV in the next two years.

Figure 4.

Possibilities for American customers to purchase an EV in the next two years.

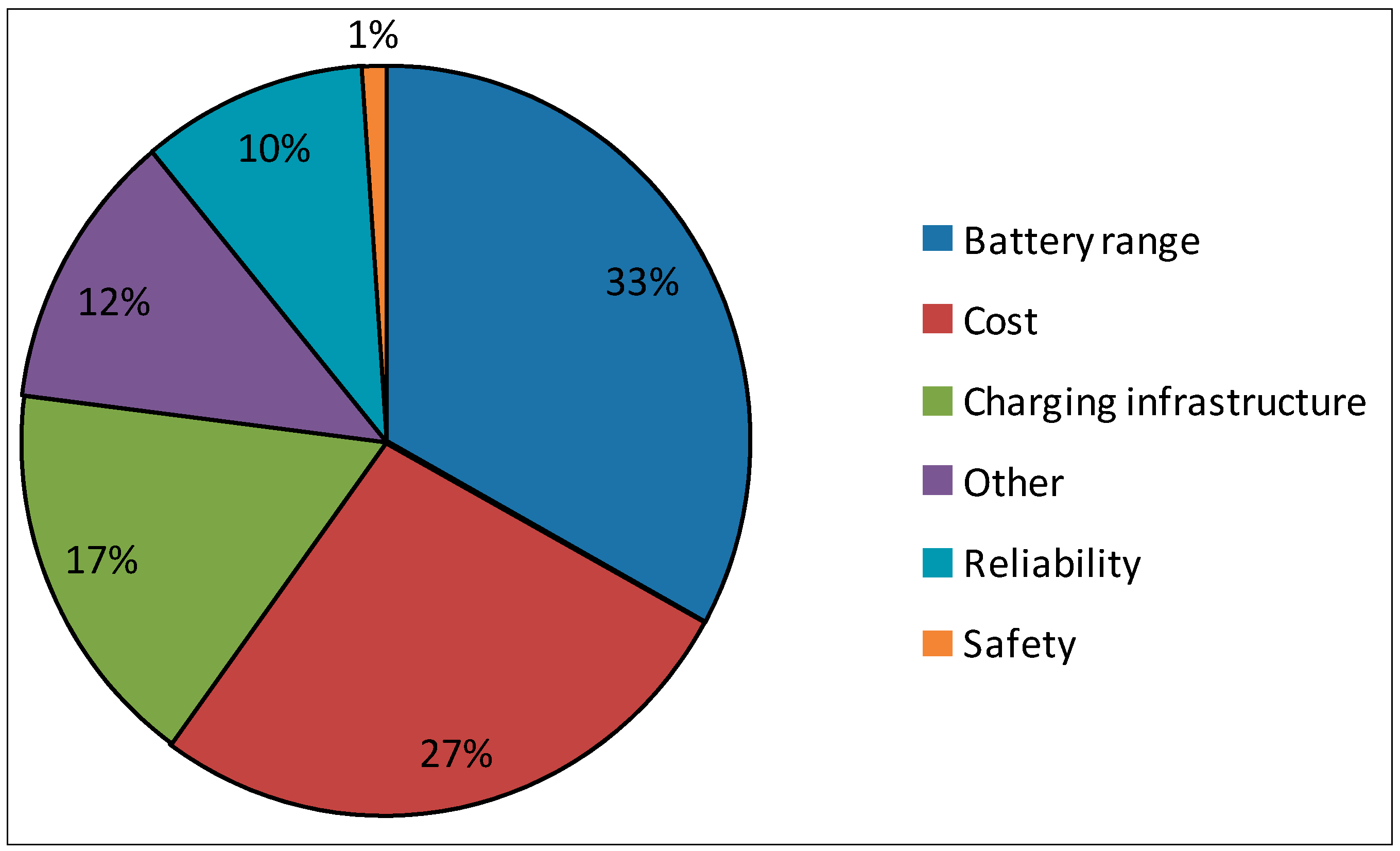

The customer attitude towards EV becomes a crucial barrier in the development of electric vehicle industry. The main concerns of American customers shown in

Figure 5 include battery range, cost, charging infrastructure, reliability and safety. One third of the customers think battery range is the crucial problem which will influence their purchasing behavior. Reliability and safety have less percentage compared to electric vehicle cost and battery range.

Figure 5.

American customer concerns about EVs [

24].

Figure 5.

American customer concerns about EVs [

24].

Chinese buyers’ concerns about EV, as demonstrated in

Figure 6, are almost the same as those from the United States. What troubles objective customers most is the inconvenience of charging, followed by battery range. Another worry is immature technology and malfunction which can be regarded as safety and reliability. In a word, the consumer concerns about EV are mainly about inconvenience of charging, short battery range, cost, safety, reliability, and psychological factors (added values like environmental friendly, symbol of status, taste,

etc.).

Figure 6.

Reasons not to buy an EV for Chinese customers [

25].

Figure 6.

Reasons not to buy an EV for Chinese customers [

25].

Note: The reasons not to buy an EV is conducted among all respondents who refuse to consider EV in China.

4.1. Charging Infrastructure

There are two problems in charging infrastructure: one is the insufficiency of charging infrastructure, and the other is long charging time. As for the first problem, a lack of systems’ integration between EVs and grids will surely deter or prevent the adoption of EV and RES power [

26]. Whether charging points are available at supermarket car parks and town center car parks will influence the conscientiousness and likelihood to buy a BEV [

27]. However, it can be concluded from the aforementioned that the construction of charging infrastructures is just at the starting period. Lacking of charging points is unavoidable in a short term.

For the second problem, 32.1% of likely EV drivers think that a 4-hour charging time is acceptable. 87.4% of likely EV drivers would like to pay a premium for fast charging. 93.2% of likely EV drivers hold that it is very important to be able to charge at home/residence [

23]. A vehicle has to be charged every 2 or 3 days on average because its autonomy is limited. In practice, drivers plug in their vehicles each night and drive in the day with full power [

28]. Seen from

Table 3, a charging time of 3–4 hours could be available if enough charging poles are built in parking lots. Actually, the power cannot reach 7 kW or more as the electricity carried by wire is limited. The voltage of residential electricity in China is 220VAC, so it takes 6-8 hours to charge which is far from 4 hours in expectation.

Table 3.

Charging time and required conditions [

28].

Table 3.

Charging time and required conditions [28].

| Charging time | Power supply | Voltage | Max current |

|---|

| 6–8 h | Single phase 3.3 kW | 230 VAC | 16 A |

| 3–4 h | Single phase 7 kW | 230 VAC | 32 A |

| 2–3 h | Three phase 10 kW | 400 VAC | 16 A |

| 1–2 h | Three phase 24 kW | 400 VAC | 32 A |

| 20–30 min | Three phase 43 kW | 400 VAC | 63 A |

| 20–30 min | Direct current 50 kW | 400–500 VDC | 100–125 A |

4.2. Battery Range

Whether EVs can meet battery range need is a problem worth investigating. For instance, Beijing is a metropolitan city and people’s range of activity is much larger compared to normal cities. Related to

China’s New Urbanization Report in 2012, people on average need 52 minutes to go to work from home, of which 38 minutes for driving and 14 minutes for waiting in the traffic jam. Another survey proves that the average distance to go to work in Beijing is 15.8 km [

29]. So the distance to go to work and come back home is about 31.6 km. Beijing residents daily activity range is 7.8 km [

29]. The distance is added up for 38.4 km. In addition, the battery capacity of a fully charged electric vehicle from traditional automakers (such as General Motors) is about 20 kWh, providing it with an electrical autonomy of about 100 kilometers. Battery capacities of Model S from Tesla Motors are 40 kWh, 60 kWh and 85 kWh. 85 kWh power may guarantee an estimated range of 480 km. A chargeable hybrid vehicle is with a capacity of roughly 3–5 kWh and an electrical autonomy of 20 to 40 kilometers (the gasoline engine ensures the autonomy of a conventional vehicle). If the capacity of battery is 20 kWh or above, a driving distance of 38.4 km can be easily satisfied. So it can be found that the barrier to accept EV in daily use is not the range, but customers’ high expectation of it.

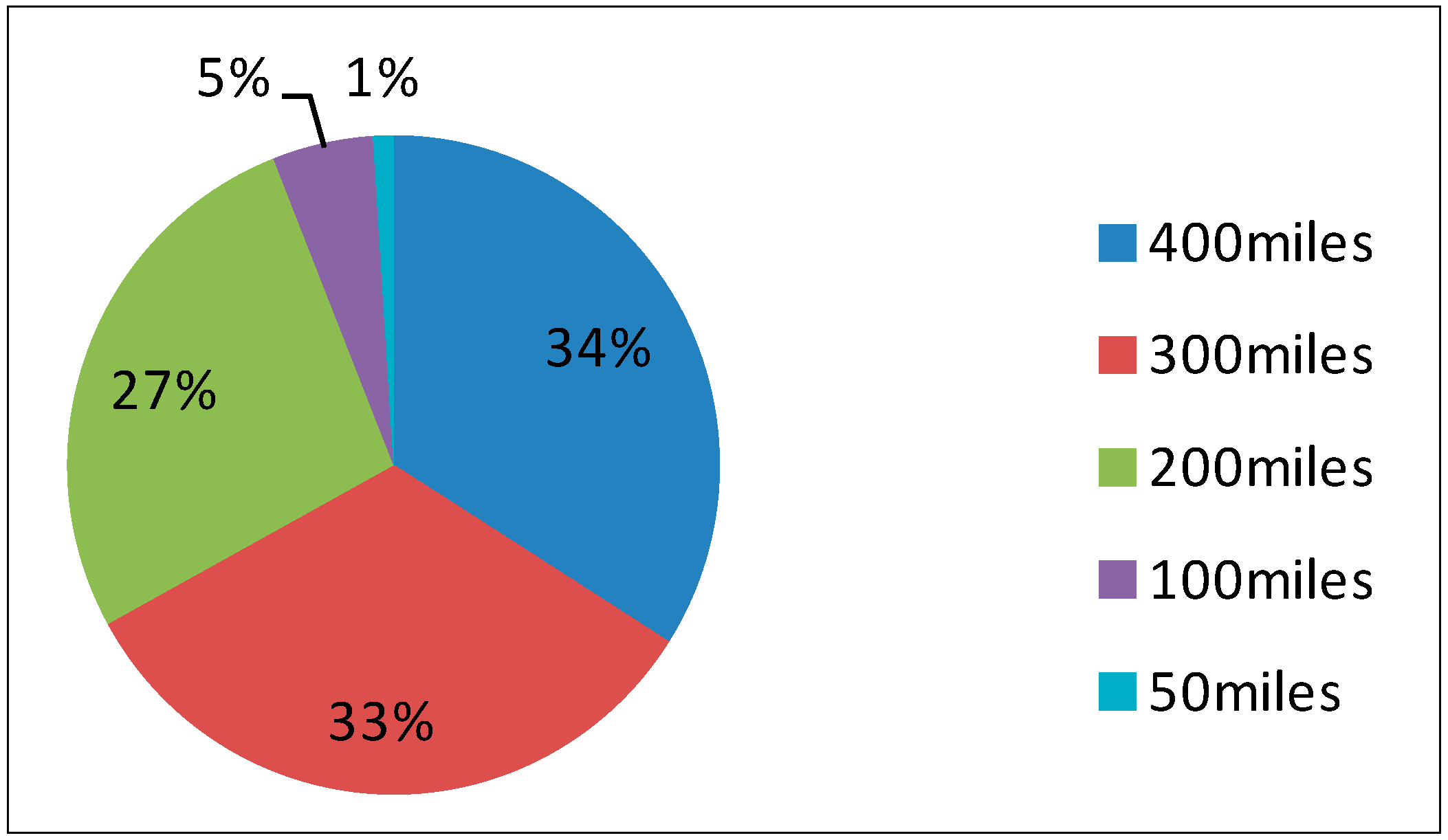

Figure 7 indicates that customers’ expectation range mostly concentrate between 300–400 km while petrol vehicles range on average is 500–600 km. Customers may pay more attention to what the longest distance they can enjoy than the real range they need. Many people hold that it is not the average length of their daily travel that determines a person’s range requirement, but the maximum distance that they would drive the vehicle in a single journey in their normal usage pattern. In reality, the longest travel distance of electric vehicle reached 480 km (Tesla model S electric vehicle). It means the travel distance of electric vehicle is very close to petrol cars.

Figure 7.

Acceptable EV driving range before needing to be recharged [

23].

Figure 7.

Acceptable EV driving range before needing to be recharged [

23].

4.4. Psychological Factors and Customer Preferences

Apart from these objective factors, subjective psychological factors are equally important, which include the following: private motorists’ attitudes, lifestyle, personality and self-image [

32]; and additionally for fleet purchasers’ risk-perception, corporate culture, and company image [

26]. In short, a car is not only a tool for transportation but a symbol of identity. EV has the advantages of environment friendly and energy saving which are consistent with environmentalists’ lifestyle. The new technology will also make customers feel that they are in trend. However, the outward appearance of EV is not that appealing to customers, especially young ones. Chinese car buyers born in the 1960s and 1970s may set emphasis on the car’s brand image, its function, and the purpose of using the car, while the new generation of customer views cars as expressions of their identity and personality [

27]. The top purchase criterion in choosing a car for the generation born in the 1990s is safety (54%), followed by exterior design (47%), price (39%) and quality (38%) [

33]. Improving the performance and appearance of EV can elevate its impression in the eyes of customers and grasp would-be buyers.

5. Conclusions and Recommendations

5.1. Diversifying Charging Ways

Offering fast charging service, specialized charging stations require high construction costs and land rent. If better use can be made of existing venues and charging facilities, charging price can be significantly reduced [

34]. Charging patterns should be clarified by different customers as utility vehicles, private cars, and commercial cars. Utility vehicles include bus, taxi and sanitation truck. These vehicles can be slow charged in terminal station at night and be recharged by battery switch in the day. Since private cars’ driving distance is relatively short, fully charging at night could guarantee daily power use. Obviously, commercial cars travel further than other categories. If there were not complete charging facilities, spare batteries should be essential. Some measures could be taken to fulfill the power supply need:

- (1)

Battery switch service should be brought into gas station. Since the distribution of gas stations is comparatively mature and suits the urban road system well, charging services can rely on this superiority. It will avoid repeated construction in architecture and save lots of expenses on land. Power Supply Company may get batteries charged in off-peak hours, and transport the fully charged batteries to gas station. In this way, the load difference between peak and valley could be decreased.

- (2)

Charging piles can be installed in vehicle populated area, such as parking lots in commercial district and residential area. It requires that the charging pile be maintained periodically which calls for joint effort of government and charging service provider. For example, Shanghai government has planned to set up accumulatively 5000 public charging piles in park and ride parking places or along the road by 2015 [

35].

- (3)

Introducing renewable energy such as wind, solar power into charging power can reduce carbon emissions. Many customers hold suspicious attitude to the environmental performance of EV because 79.3% of electricity is generated from coal in China. EV manufacturers should apply a green marketing strategy to convert the trendsetters into early adopters, who will in turn lead the market and contribute to the development of the industry’s latest selling point [

33].

5.2. Lowering the Cost of EV

5.2.1. Perfecting the Charging Pricing Mechanism

As for the three aspects mentioned at the beginning, only charging in order can achieve these targets. A dumb charging approach would result in even upper bound of incremental costs and higher risk in the operation of network. A flexible pricing mechanism will do well to attracting consumers to alter their charging behaviors. The supply contract between the supplier and the residential final customer would be a contract with TOU prices (

Table 7) [

30]. The price differentiation between peak and off-peak should be large enough to stimulate consumers. A charging station may profit from the grid by charging batteries in the valley and switching them to customers at the agreed price. It may also benefit from discharging at peak hours and reducing load reserve. The pricing system should not only meet the profit needs of operators, but also help lower EV users’ total expenditure compared to the use of ICV [

34].

Table 7.

TOU pricing of electricity in Beijing [

34].

Table 7.

TOU pricing of electricity in Beijing [34].

| Period | Time | Price/Yuan (kWh)−1 |

|---|

| Valley | 0:00–8:00 | 0.3539 |

| Flat | 12:00–18:00 | 0.7785 |

| 22:00–24:00 |

| High | 8:00–12:00 | 1.2283 |

| Peak | 18:00–22:00 | 1.3377 |

5.2.2. Extending the Scope of Subsidy

On the grounds of previous central government subsidy scheme, the highest subsidies of PHEV may reach 50,000 Yuan per car and BEV for 60,000 Yuan per car. Beijing municipal government also offered the same standard of subsidies. In other words, an individual who purchases an electric passenger car may obtain 120,000 Yuan subsidy in most cases. Shanghai EV buyers may get subsidy in accordance with 2000 Yuan per kWh and 40,000 most for an EV. Apart from subsidies, the EV drivers can enjoy a free license plate. Since this policy was introduced at the beginning of 2013, the sale of EV in Shanghai has mounted up. Plot cities as Beijing and Shanghai enjoy subsidization from both central and municipal government. As subsidy policy is proved effective, it is salutary to push forward this policy to other cities.

5.3. Lowering the Administrative Difficulty of Purchase

In order to limit the quantity of vehicles, top cities in China, such as Beijing, Shanghai and Guangzhou set obstacles in obtaining license plate, like winning license by lottery or auction. In Beijing, for instance, there are five kinds of residents qualified to participate in the lottery: Beijing household registered people, people with valid temporary residence permission in Beijing and having paid social security and personal income tax for five consecutive years, soldiers or police in active service stationed in Beijing, legal residents for more than one year with foreign nationality or Chinese citizens residing abroad. Moreover, these five kinds of inhabitants must first meet the three conditions: dwelling at Beijing with no registered car and owning a valid motor vehicle driving license. Let alone these strict rules, the lot winning rate is as low as 1/80 in March 2013.

It is wondered whether EV, as a new type of vehicle, should obey the same rules as ICV. In Beijing, EV owners can ask administration for driving permission without participating in the license-plate lottery. In return, they will sacrifice the right of owning another car no matter it is an EV or ICV, which scares many customers off. On the other hand, Shanghai government issued 20,000 licenses for EV in 2012. Although Guangzhou issues license plate by auction, EV owners can apply for plates without auction. However, other common cities cannot enjoy such preferential policies, and don’t even have the perk of obtaining EV licenses. If these cities intend to popularize EV, obstacles of administration must be cleared.