1. Introduction

The Korean War (1950–1953) not only devastated Korea’s territories, but also resulted in an extreme shortage of urban infrastructure and housing. The Korean government adopted diverse urban policies after the war to accommodate huge in-migration toward the capital regions, especially Seoul. Furthermore, unprecedented economic growth over the last four to five decades has caused rapid growth in Korea’s housing industry [

1]. The Korean housing business has grown to become a very significant part of the business portfolio of Korean construction companies because of this economic growth and the imbalance between housing supply and demand.

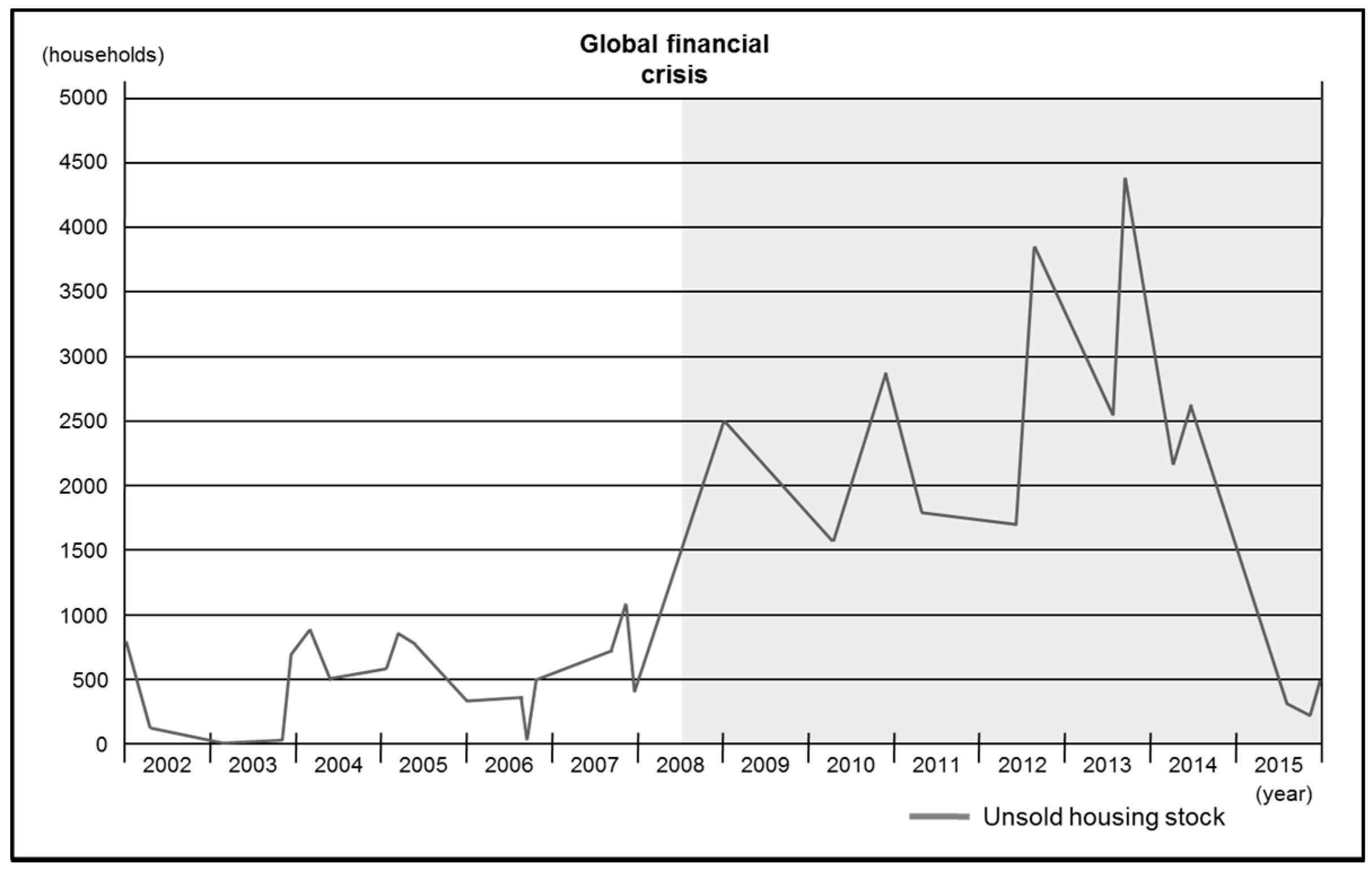

Accordingly, unsold new housing stocks aggravate the financial difficulties of construction companies at an alarming rate, thereby resulting in insolvency. Such insolvency affects not only construction companies, but also their various stakeholders [

2].

Unsold new housing stocks represent the imbalance between housing supply and demand. Unlike usual products, housing projects normally take long periods of time to be completed, which causes difficulties in maintaining the balance between demand and supply at the right time. Therefore, the probability of the occurrence of unsold new housing stocks is always present. The number of unsold new housing stocks is the main sign of the economic situation of the housing market. It is also used as a market indicator that reflects the preferences of homebuyers. In other words, the number of unsold new housing stocks is an important indicator for determining the time of supply and purchase [

3]. From this point of view, the number of unsold new housing stocks has an immense effect on the financial sustainability of construction companies and their various stakeholders. It is also a key indicator of the housing market conditions. Therefore, it is very important to analyze the characteristics of the occurrence of unsold new housing stocks.

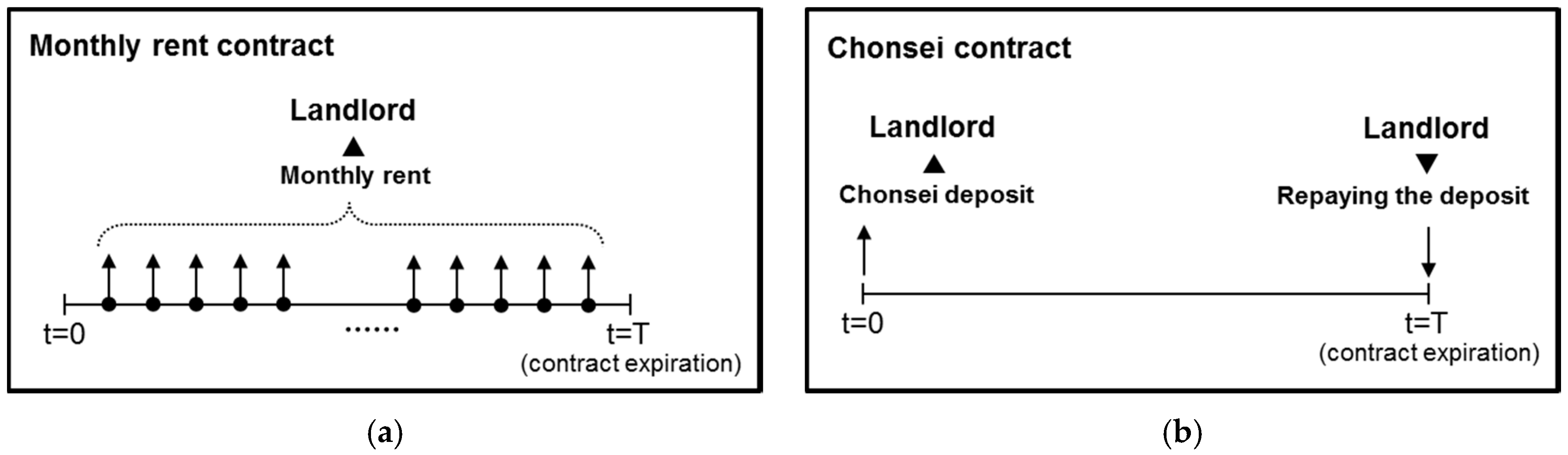

The Korean housing market has a structure that differs from the overseas housing market. Korea has a unique lease market, called the chonsei market. The tenant pays an upfront lump-sum deposit, which is typically from 40% to 90% of the property value, to the landlord for the use of the property. The landlord repays the nominal value of the deposit to the tenant upon contract termination. No additional requirements, such as periodic rental payments, are asked from the tenant. Hence, the chonsei deposit, which is held during the contract period and repaid by the landlord, becomes the substitute for such payments [

4].

The chonsei market is highly important in the Korean housing market because it has a different configuration from the overseas housing market, which consists of transaction and monthly rent. One of the main characteristics of the chonsei, which is another form of rent, is that the landlord can lower a significant portion of the equity capital investment ratio at the time of house purchase. Thus, the landlord can take out a loan from the market at the market interest rate and buy the house with the upfront deposit and seek profits through the rise in housing price, which, in the landlord’s perspective, functions as leverage. Meanwhile, in the tenant’s perspective, the upfront deposit functions as a reserve fund for future house purchasing. The deposit is given to the landlord for two years, and the tenant receives housing services in return [

4,

5].

Thus, the residential spaces in Korea can be effectively secured through the chonsei market without getting to the housing transaction market. In other words, the existence of the chonsei market in Korea has a very significant effect on the housing demand activities even in conditions where the housing market is unstable. From this perspective, it is very important to analyze the characteristics of unsold new housing stocks by considering the structural features of the Korean housing market for assessing sustainability of the housing market and developing appropriate business strategies.

Accordingly, in this paper, we intend to identify the characteristics of occurrence of unsold new housing stocks and draw the implications for the housing business strategy that can effectively cope with the risk of housing market fluctuation under the Korean housing market.

3. Theoretical Framework

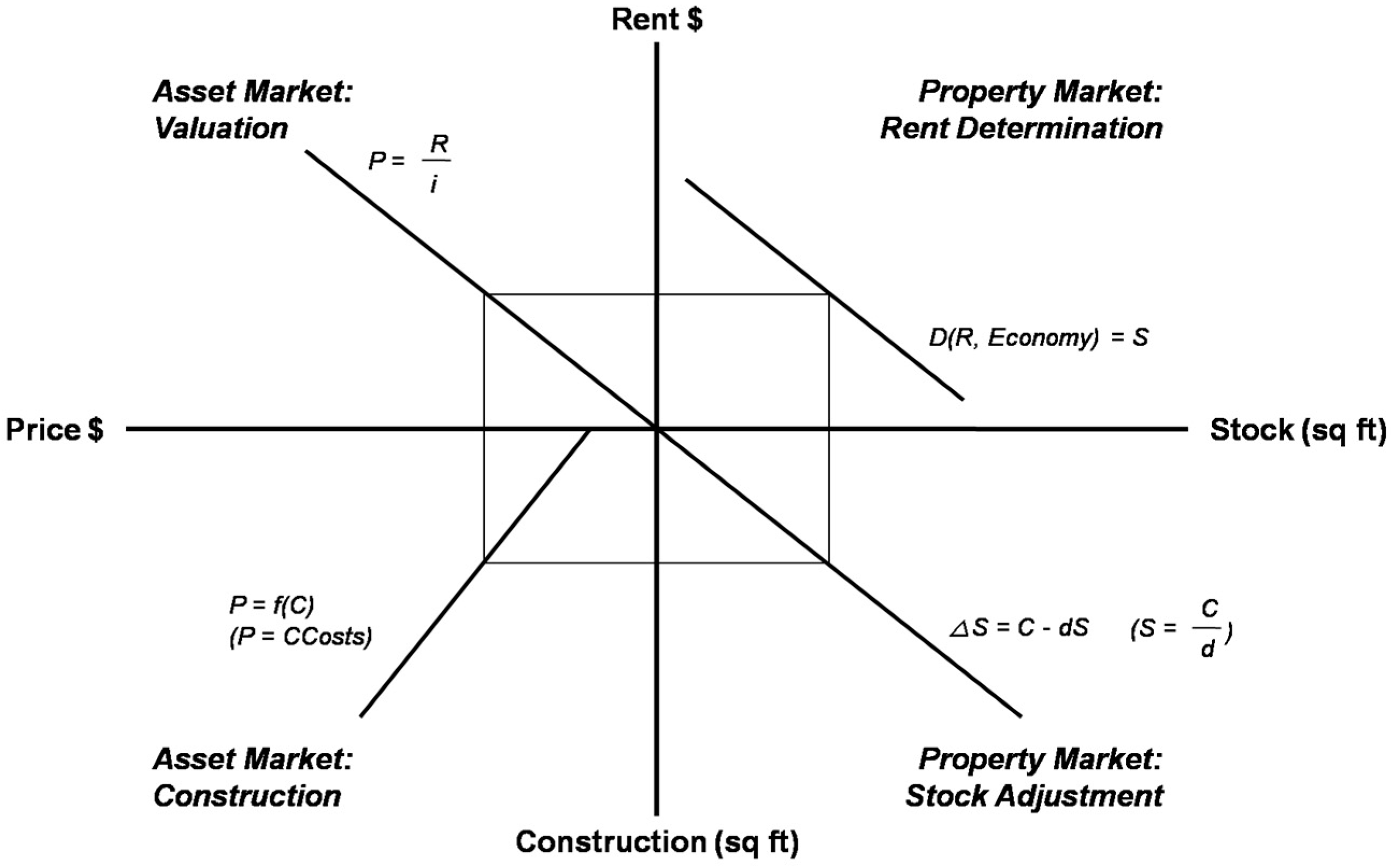

In this study, the relationship between occurrence of unsold new housing stocks and fluctuation of housing market was analyzed on the basis of the FDW model. Occurrence of unsold new housing stocks is after all a major phenomenon of the housing market which occurs due to the imbalance between the demand and supply in the housing market. Accordingly, dynamic relations are thought to exist between the diverse factors which affect the demand and supply in the housing market and occurrence of unsold new housing stocks. In such a point of view, the theoretical relation between the aspect of the fluctuation in the Korean housing market and occurrence of unsold new housing stocks was examined on the basis of the FDW model.

The Fisher–Dipasquale–Wheaton (FDW) model is a quadrant model that defines the equilibrium of demand and supply in a real estate market and traces the relation between spatial market and property market. The FDW model basically explains market equilibrium based on the demand-supply model. That is to say, the FDW model conceptually assumes that real estate development takes place when a profit can be created in the property market for the demand generated by an imbalance between the demand and supply in the spatial market. That is to say, if the spatial demand for real estate increases as a result of a macroeconomic change such as interest rate, economic growth or liquidity and the value of real estate as a property realizes a profit, development takes place and the equilibrium price is recovered in the long run [

24,

25].

There are largely two links between the property market and the spatial market. First, the level of rent determined in spatial market determines the demand for real properties. It is like investors purchasing properties predicting the current or future income in general. That is to say, the change in rent taking place in spatial market immediately affects the demand for properties in capital market; Second, the number of houses built plays the role of the link between the two markets. If the number of houses built increases, not only the price in the property market but also the rent in the spatial market comes to drop. Such a correlation between spatial market and property market is shown in the quadrant model in

Figure 5 below.

As can be seen in

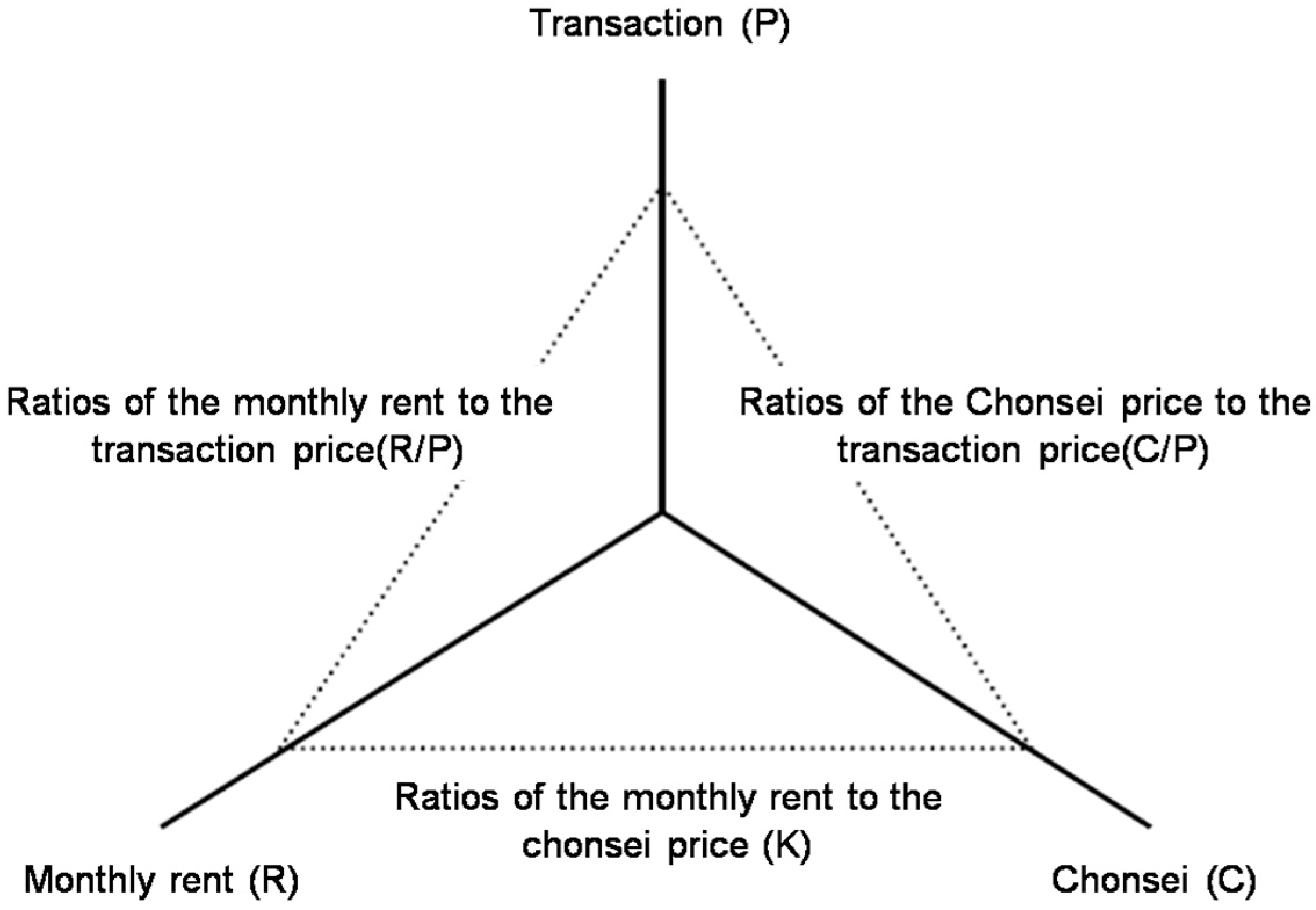

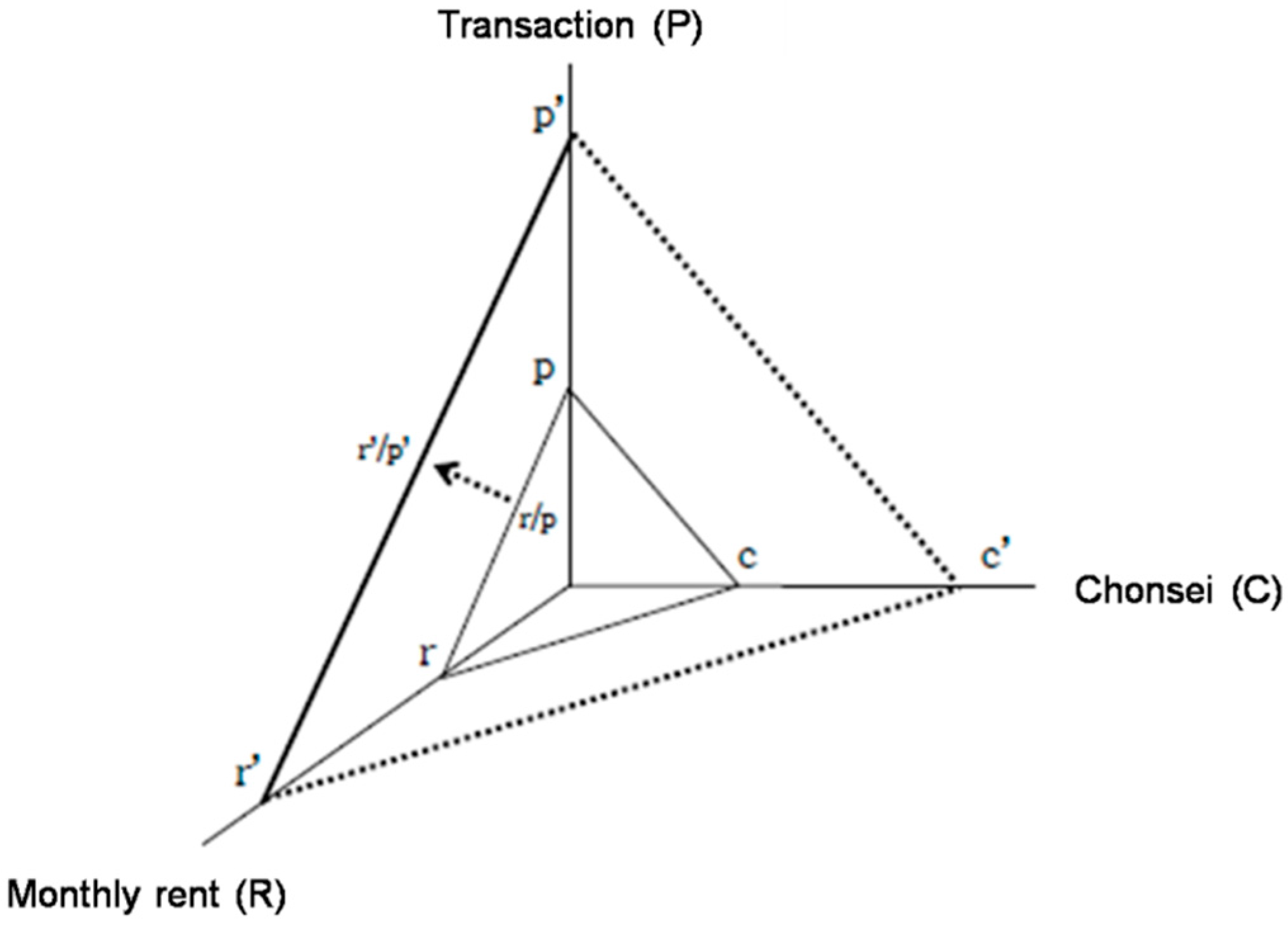

Figure 5, while the basic FDW model is made up of the relation between spatial market and property market, in the case of Korean housing market, the property market which is a rental market is classified into the chonsei market and rental market. In particular, chonsei market is a rental market unique to Korea, where the tenant secures the residential right for a space by putting down a security deposit. Accordingly, the structure of the Korean housing market comprised of transaction market, chonsei market and monthly rental market can be expressed as shown in

Figure 6 below [

26].

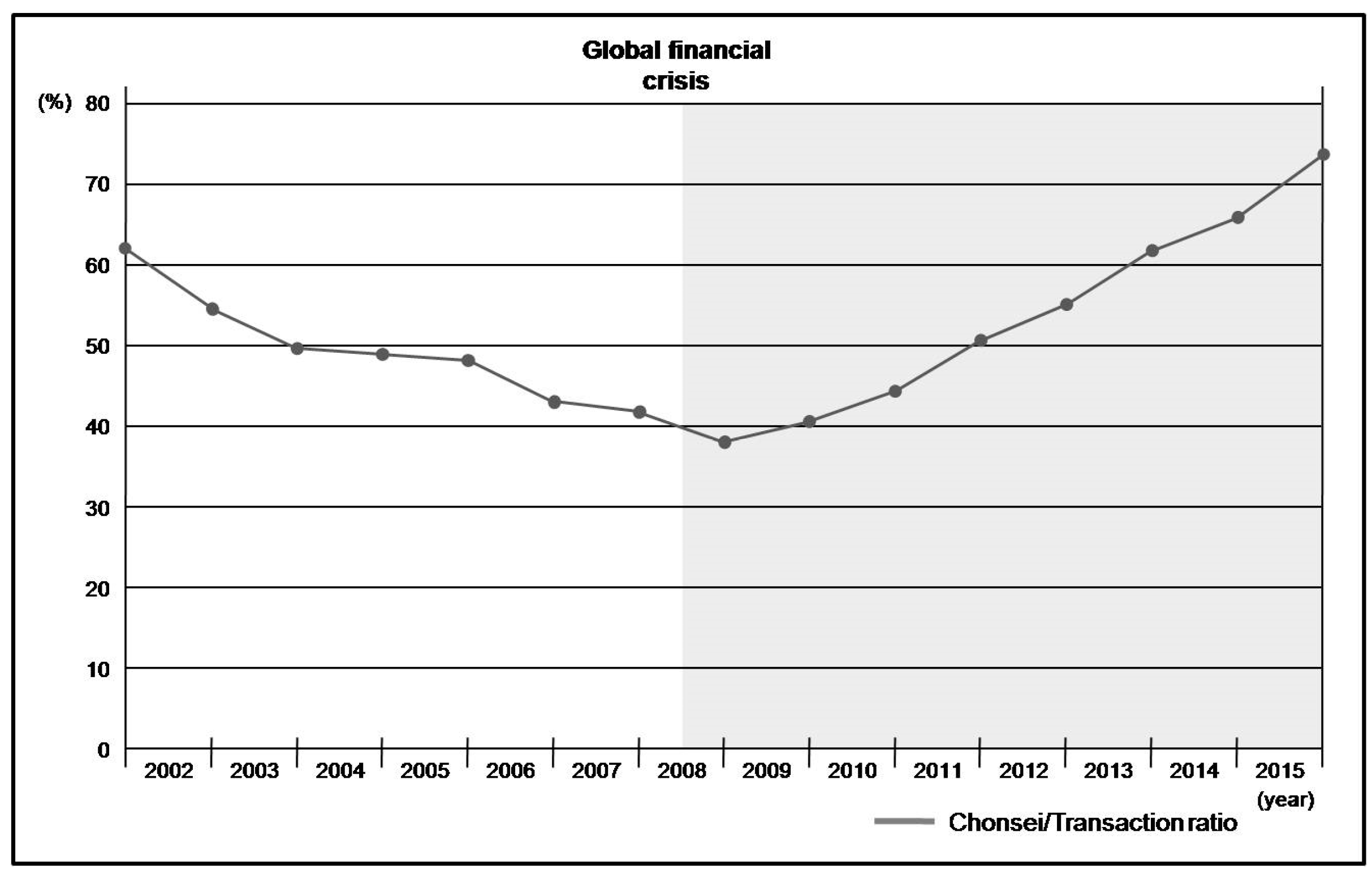

The three-dimensional structure model of the housing market is comprised of three axes called transaction, chonsei and monthly rent and the relations between the individual markets can be expressed in chonsei/transaction price ratio, monthly rent/transaction price ratio and chonsei/monthly rent conversion rate. The individual markets move independently and are changed by the factors inside the housing market such as the demand factor including the change in the number of households or the income, the supply factor including the increase in the housing stocks or the decrease in the number of houses built, the factors of property market such as the market interest rate, the expectations of the buyers-to-be for increase in the price, and the housing policy and taxes.

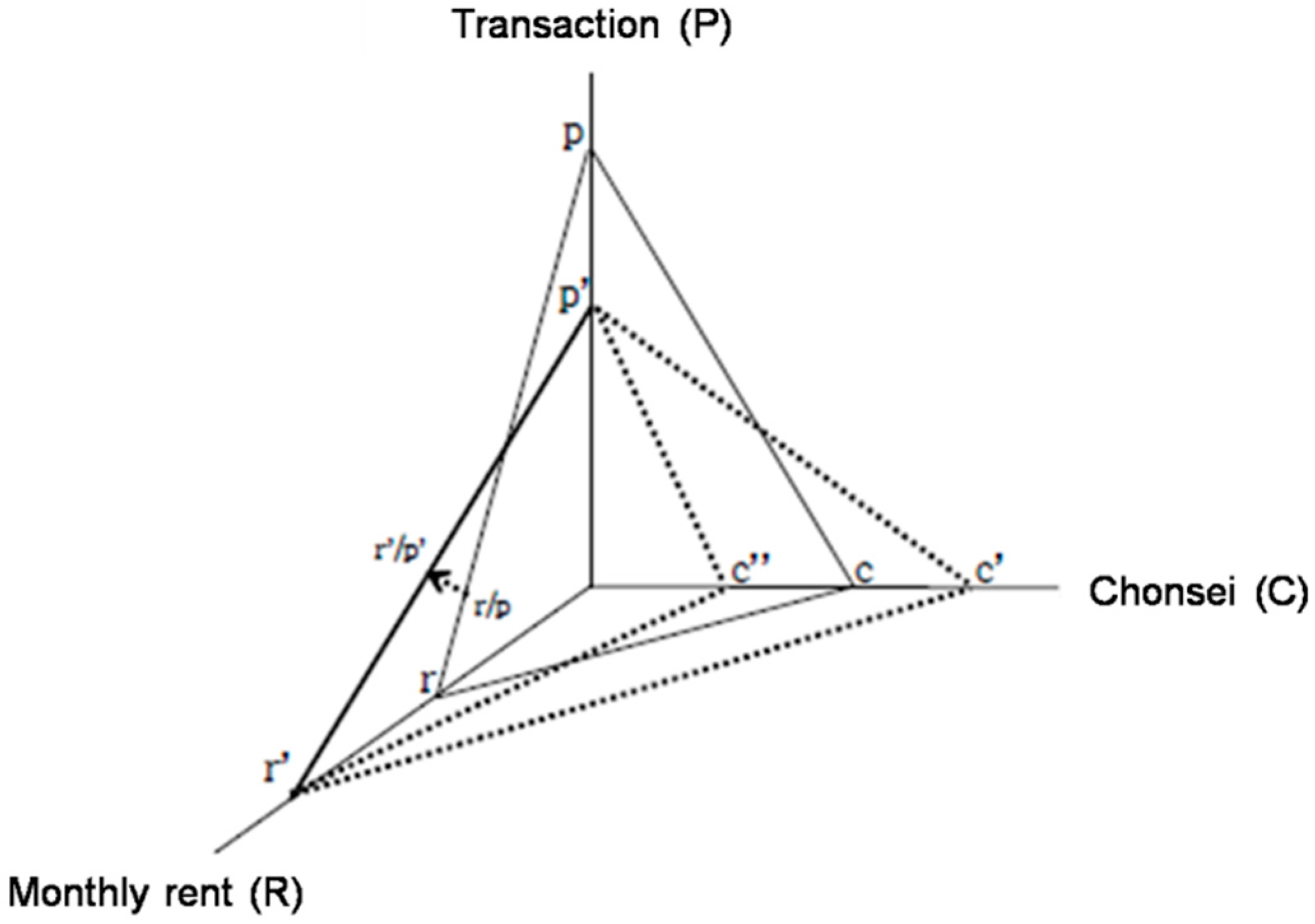

The change in the market caused by a change in the market interest rate is as shown in

Figure 7 below. According to the FDW model, housing price can be defined to be the value obtained by converting the rent (monthly rent) using the capitalization rate. If it is assumed that the capitalization rate moves in the same direction as the market interest rate moves, the transaction price drops and the rent (monthly rent) increases as the market interest rate increases. As can be seen in

Figure 7, if the market interest rate increases in the initial equilibrium state, the transaction price moves p → p′ and the monthly rent r → r′ and the monthly rent/transaction ratio grows. At this time, though the chonsei price changes being affected at the same time by the transaction price and the monthly rent, it is difficult to predict whether the change direction will be c → c′ or c → c″. It is because the market interest rate has an effect not only on the financing capability of the buyers-to-be but also on the suppliers as it acts as the reference for the profit rate in the housing rental market. First, if the market interest rate increases, the monthly rent also increases. Accordingly, demand can move between the monthly rental market and the chonsei market by comparing the interest rate, chonsei/monthly rent conversion rate and the capitalization rate. In addition, if the market interest rate increases, the transaction price drops. It is because the investment demand psychology for the transaction market has been shrunk and the financing capability of the end users in the chonsei market has been aggravated. Moreover, the aggravation of the financing capability of the end users resulting from the increase in the interest rate may cause movement of the demand up to the monthly rental market. Like this, it is difficult to predict how the price will actually change following a change in the interest rate because bi-directional changes in demand and supply occur in the chonsei market as a result of a change in the interest rate. However, as the change in the interest rate acts as an unfavorable factor on the housing transaction market, the unsold new housing stocks increase.

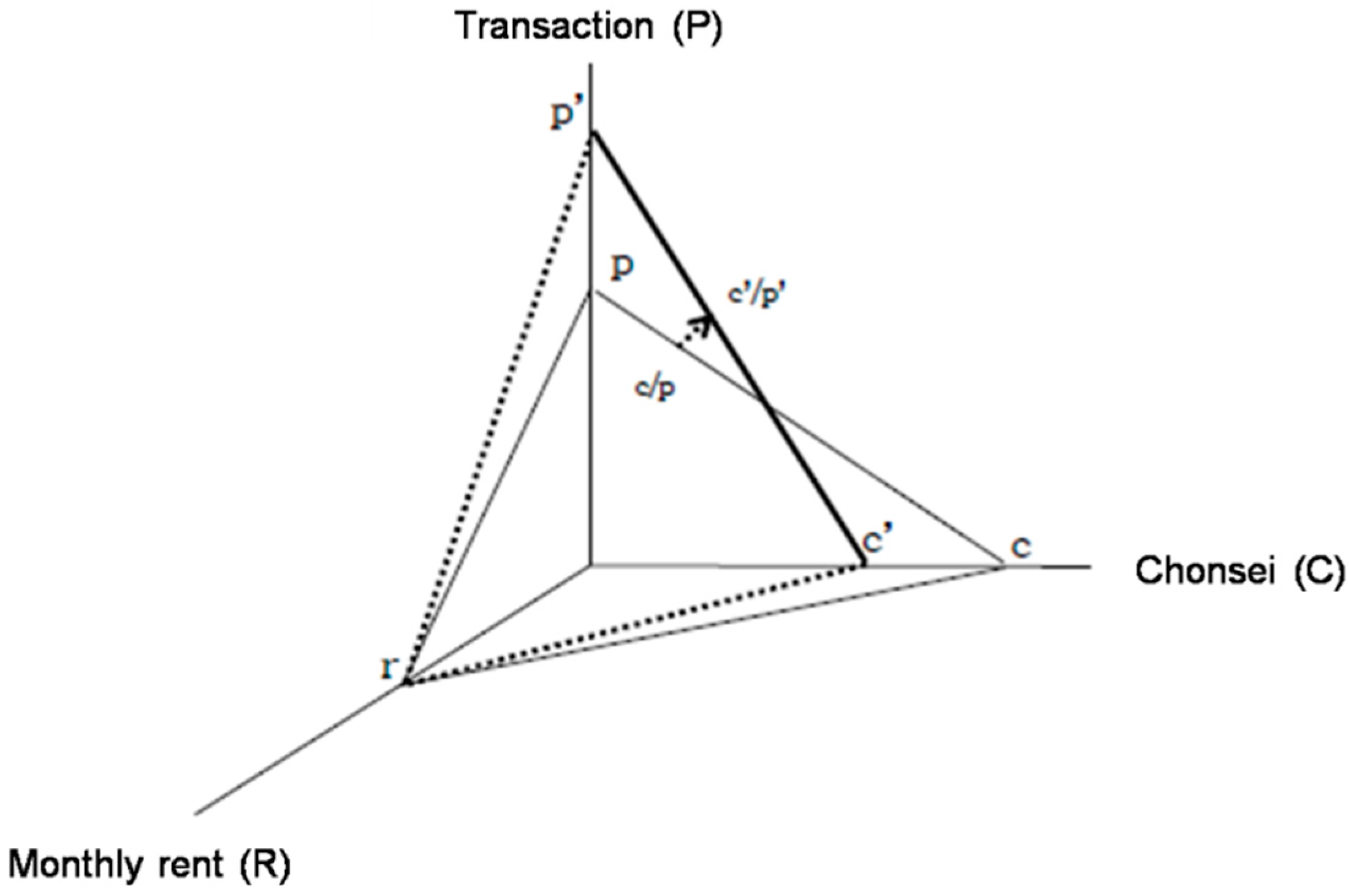

As the expected price increase rate is for the house investors to expect an increase or a decrease in the housing price in the future, it is conceptually independent from monthly rent. When we look it in the viewpoint of financial transaction, an increase in the expected price increases the housing price. However, chonsei price moves in the opposite direction to the expected price increase rate in the relations between the three markets. As the chonsei market has a nature of a rental market and reflects the current flow of the housing service, increase in the expected price increase rate has an effect of decreasing chonsei.

Figure 8 shows that, as the expected price increase rate increases in the initial equilibrium state, the transaction prices increases p → p′ and the chonsei price decreases c → c′. At this time, if the monthly rent is fixed, as the chonsei/monthly rent conversion rate increases, a bigger amount of monthly rent is required when converting the same chonsei amount to monthly rent. The chonsei/transaction ratio c′/p′ becomes bigger than c/p. Meanwhile, the rate of increase in c′/p′ varies depending on how sensitively the transaction and chonsei prices respond to the expected price increase rate. Accordingly, in the situation future price increase is expected, the chonsei price drops in comparison to the transaction price. In addition, as the increase in the transaction price following an increase in the expected price increase rate means inflow of the demand for houses into transaction market, the unsold new housing stocks come to decrease.

The content mentioned above expresses the result of the theoretical review carried out by analyzing the relations between the individual markets. However, the movement of the prices in an actual market is affected by demand and supply factors. In an equilibrium state, the rent (monthly rent) increases due to the decrease in supply (stock), etc. as shown in the FDW model and an increase in the rent brings about an increase in the transaction price if other factors such as the market interest rate are unchanged. In the same context, increase in demand brings about an increase in the rent and an increase in the transaction price. Accordingly, as it can be seen in

Figure 9, an increase in the demand and a decrease in the supply in an equilibrium state increase the transaction price and the monthly rent p → p′ and r → r′, respectively. As the chonsei price moves in the same direction as the monthly rent and the transaction price move, the chonsei price increases from c to c′. Of course, as the elasticity of the monthly rent and the transaction price relative to demand and supply and the elasticity of chonsei price relative to the change in the monthly rent and the transaction price are different from each other, the gradients of r′/p and r/p increase or decrease. In addition, in such a change in the housing market, the unsold new housing stocks decrease.

5. Discussion and Conclusions

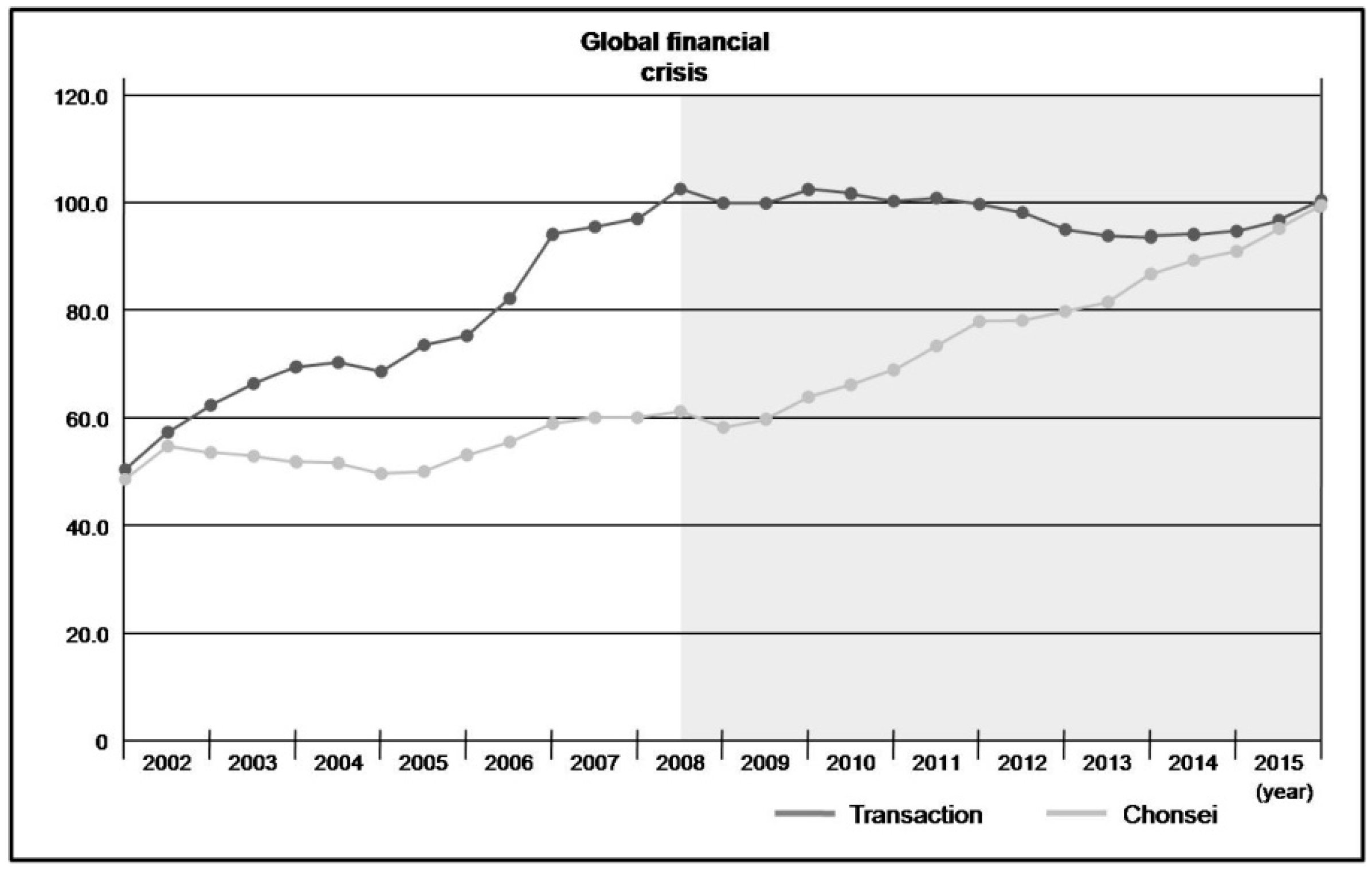

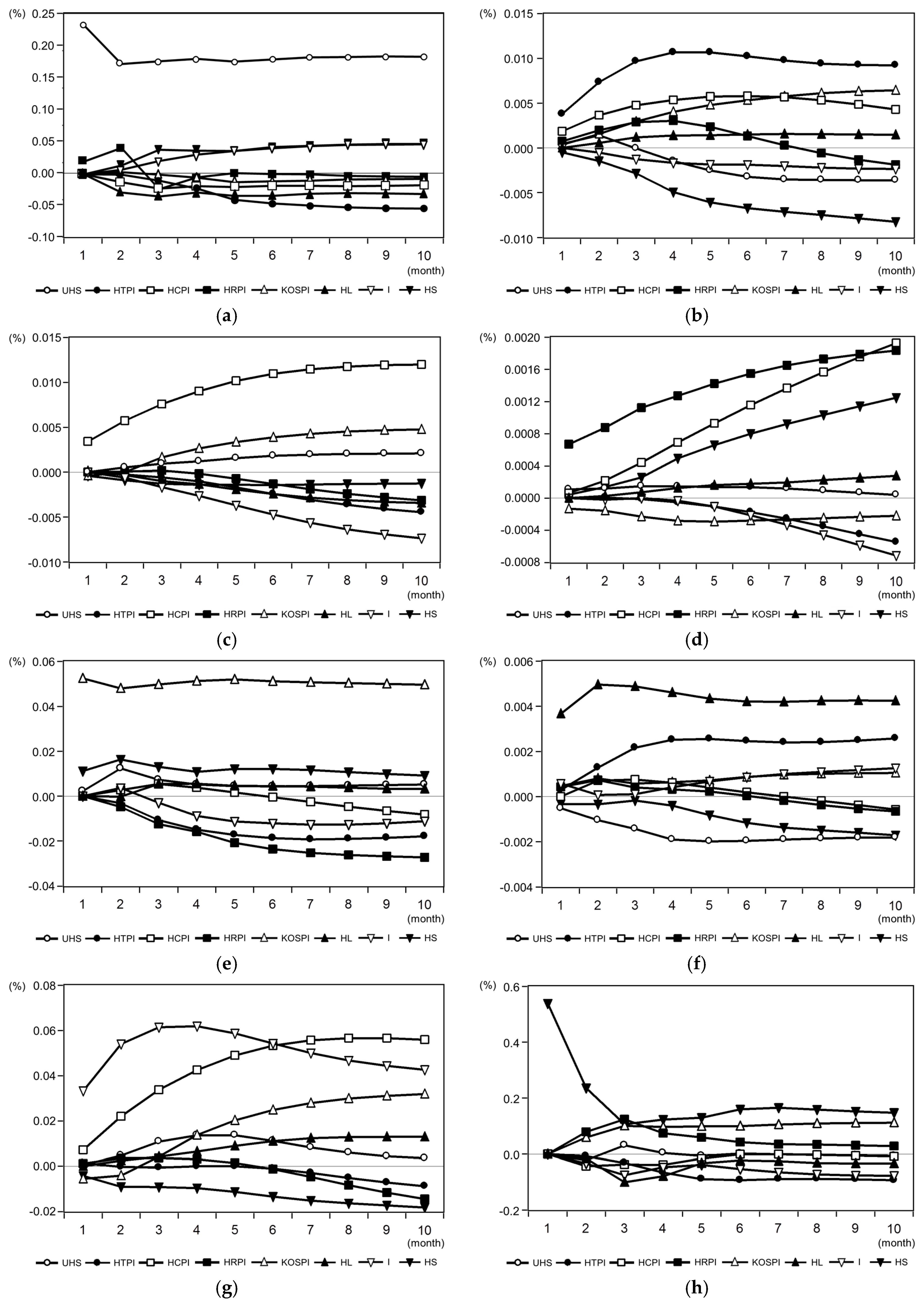

The objective of this paper is to examine the characteristics of occurrence of unsold new housing stocks by dividing the domestic housing market into the transaction market, chonsei market and the monthly rental market and analyzing their dynamic relations with occurrence of unsold new housing stocks through the vector error correction model and to elicit the implications for a housing business strategy that can effectively cope with the market risk in the Korean housing market. For this, in this paper, we defined the three-dimensional housing market structure of Korea based on the FDW model and examined the theory of imbalance between the housing demand and supply. Based on this, the number of the unsold new housing stocks, housing transaction price index, housing chonsei price index, housing monthly rent index, KOSPI, housing loan, interest rate, and the number of houses supplied were defined as the analysis variables. The temporal range of the time series data was January 2004 to December 2015, and the analysis data were secured through Statistics of Korea.

As a result of the analysis, it was basically confirmed that most of the theoretical relations between the number of the unsold new housing stocks and the housing market variables correspond to the result of the empirical analysis. In particular, the chonsei market that has a peculiar effect on the movement of the demand for houses in the middle of the transaction market and the monthly rental market is a housing market form unique to Korea and also has a significant relation with occurrence of unsold new housing stocks. Among such results of comprehensive analysis, the implications for a housing business strategy that can effectively cope with the market risk taking into account the characteristics of the Korean housing market can be put in order as shown in

Table 4 below.

Table 4 is summarized as follows. When the transaction price falls, the chonsei price rises. The housing chonsei price generally account for over 50% of the housing transaction price. However, as the number of the unsold new housing stocks increases, the housing chonsei demand increases sharply and the chonsei price show more than 90% of the transaction price. This means that if a certain ratio of the chonsei housing is supplied along with the transaction housing at the same time, developers can carry out the housing project stably against the market fluctuations. In other words, when only transaction housing are supplied, the loss may become very large when the number of the unsold new housing stocks increases sharply. However, if the transaction housing and chonsei housing are supplied simultaneously, the profit is relatively low, but catastrophic losses can be avoided rather than supplying only the transaction housing. In particular, if the number of the unsold housing stocks increases, the demand may rapidly move from the transaction market to the chonsei market and developers can secure funds equivalent to 80% to 90% of transaction price without interest cost. Moreover, it was confirmed that an increase in the housing chonsei price leads to an increase in the housing transaction price. It shows that developers become the lessor of the chonsei housing for a certain period, but it is able to profit from selling the chonsei housing to the market.

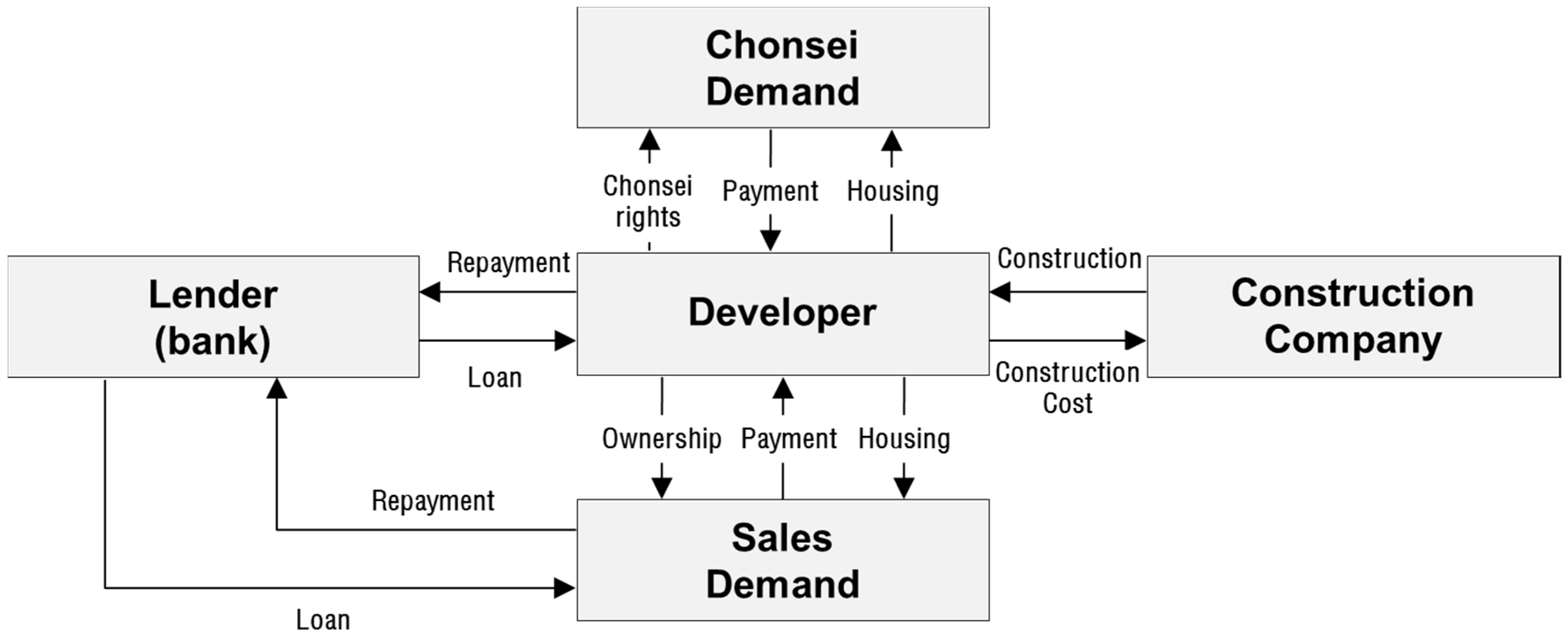

The basic concept of the housing business model proposed in this paper on the bases of the above analysis result is as follows: As it is very difficult to predict future housing demand and supply accurately due to the characteristics of the construction industry, it is impossible to prevent occurrence of unsold new housing stocks at source. Accordingly, it is important to secure strategic flexibility to cope with the uncertainty of the future such as occurrence of unsold new housing stocks. In such a viewpoint, this paper proposes to utilize the chonsei market which is a rental market unique to Korea. When we look into the fluctuations in the transaction price and chonsei price caused by the impulse of unsold new housing stocks, fluctuations in the number of unsold new housing stocks caused by the changes in the transaction price and the chonsei price, and the relation between the transaction price and the chonsei price put in order in

Table 4 above, it is thought that stable financing through the chonsei market can contribute to stable management of housing businesses against abrupt market fluctuation. As the tenant deposits a security amounting to 40% to 90% of the transaction price with the landlord under a chonsei contract, funds can be effectively raised with the security deposit during the business period. In addition, if the market situation improves after two years when the chonsei contract expires, the landlord may sell the relevant house and pay back the chonsei security deposit to the tenant, and, if the market stagnation continues, it is easy for the landlord to extend the chonsei contract period as the tenant may also stay in the chonsei market. That is to say, the chonsei market can be utilized as a way to effectively cope with the future changes in the market. In such a viewpoint, this paper proposes to construction companies a business model of supplying houses to both the chonsei market and the transaction market at a certain ratio as shown in

Figure 11 below instead of supplying the whole quantity to the transaction market when conducting a housing business. In this business model, supply of chonsei houses plays the role of lowering the sensitivity to the market fluctuation by effectively raising funds and enhancing the leverage effect and supply of transaction houses plays the role of securing a short-term profit.

However, a plan for determining the housing supply stocks that will be targeted at each market is necessary to materialize the sustainable housing project model proposed in this paper. Moreover, in terms of policies, a plan for supplementing the business model proposed herein will also be necessary. Thus, the cash flow of the sustainable housing projects model will be completed and its validity will be tested in future studies. In addition, policy support measures will be explored to harmonize the flow of funds between the tenants and the landlords.