Exploring a Novel Agricultural Subsidy Model with Sustainable Development: A Chinese Agribusiness in Liaoning Province

Abstract

:1. Introduction

2. Literature Review

2.1. Agricultural Subsidies

2.2. Sustainable Development

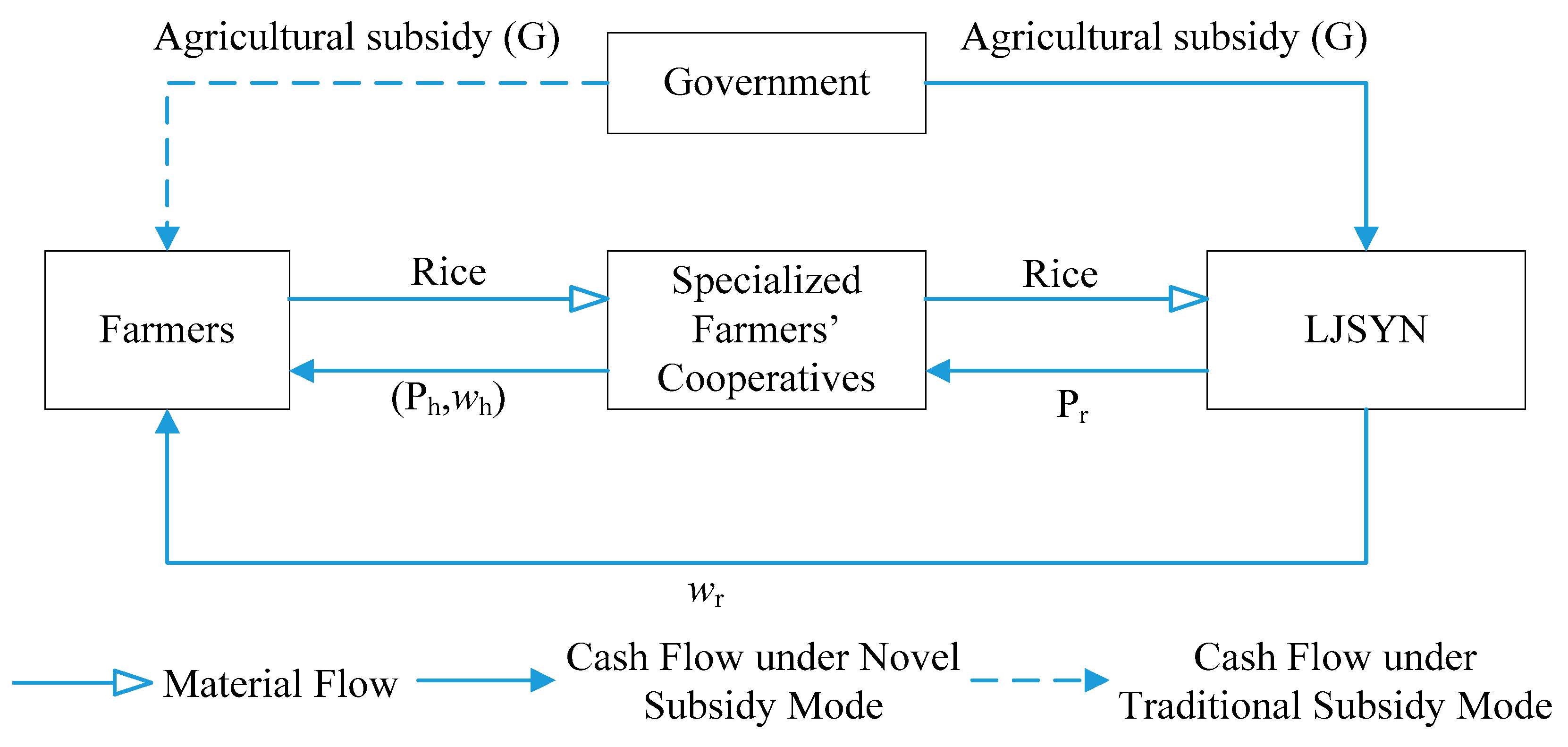

3. A Novel Agricultural Subsidy Model

3.1. Notations

| : | the market price when the farmer sells rice directly to the market |

| : | the unit cost of cultivation without any control by agribusiness |

| : | the government subsidy per unit of rice |

| : | the annual productivity of rice |

| : | the acquisition price when the farmer joins the specialized farmers’ cooperative; normally, > |

| : | the cultivation cost under the novel agricultural model |

| : | the acquisition price based on the price of rice purchased by the agribusiness from the specialized farmers’ cooperative (a specialized farmers’ cooperative is a cooperative economic organization developed to resolve conflicts between the farmers’ small production and the large market.) |

| : | the selling price of rice from the agribusinesses to customers |

| : | the percentage of the net profit that specialized farmers’ cooperatives return to farmers, |

| : | the percentage of net profit that the agribusinesses return to farmers, |

| : | the profit of farmers under the traditional subsidy model |

| : | the profit of specialized farmers’ cooperatives |

| : | the profit of the agribusiness |

| : | the profit of farmers under the novel agricultural model |

3.2. Farmers’ Income Function

3.3. The Proposed Analytical Procedure for Selecting the Optimal Subsidy Rate

- (1)

- Identify the major participants of the different models: the major participants in the traditional subsidy model are farmers and the government, and the distribution of subsidies depends on the area of land under contract with the government. Thus, farmers receive compensation directly from the government. In the novel agricultural subsidy model, in addition to the farmers and the government, the agribusiness and specialized farmers’ cooperatives are also participants. In this novel model, the farmers no longer sign a contract with the government; instead, the specialized farmers’ cooperatives sign the contract. The cooperatives must associate with the agribusiness to develop agriculture and promote sales. The government gives the subsidies to the agribusiness to maximize performance.

- (2)

- Confirm the agricultural product price in each node: agribusiness research facilitates the acquisition of the market price of a product. For example, the market price , direct purchase price , and indirect purchase price of rice can be obtained from the rice subsidy. A detailed discussion about the collection of data on the price of rice is provided in Section 4.2.

- (3)

- Gather annual productivity and government subsidy data: the annual productivity for rice is obtained from internal agribusiness information. The government subsidy is stated in the relevant policy document.

- (4)

- Identify the farmers’ income function: the farmers’ income function under different models is obtained through the different subsidy models and survey responses.

- (5)

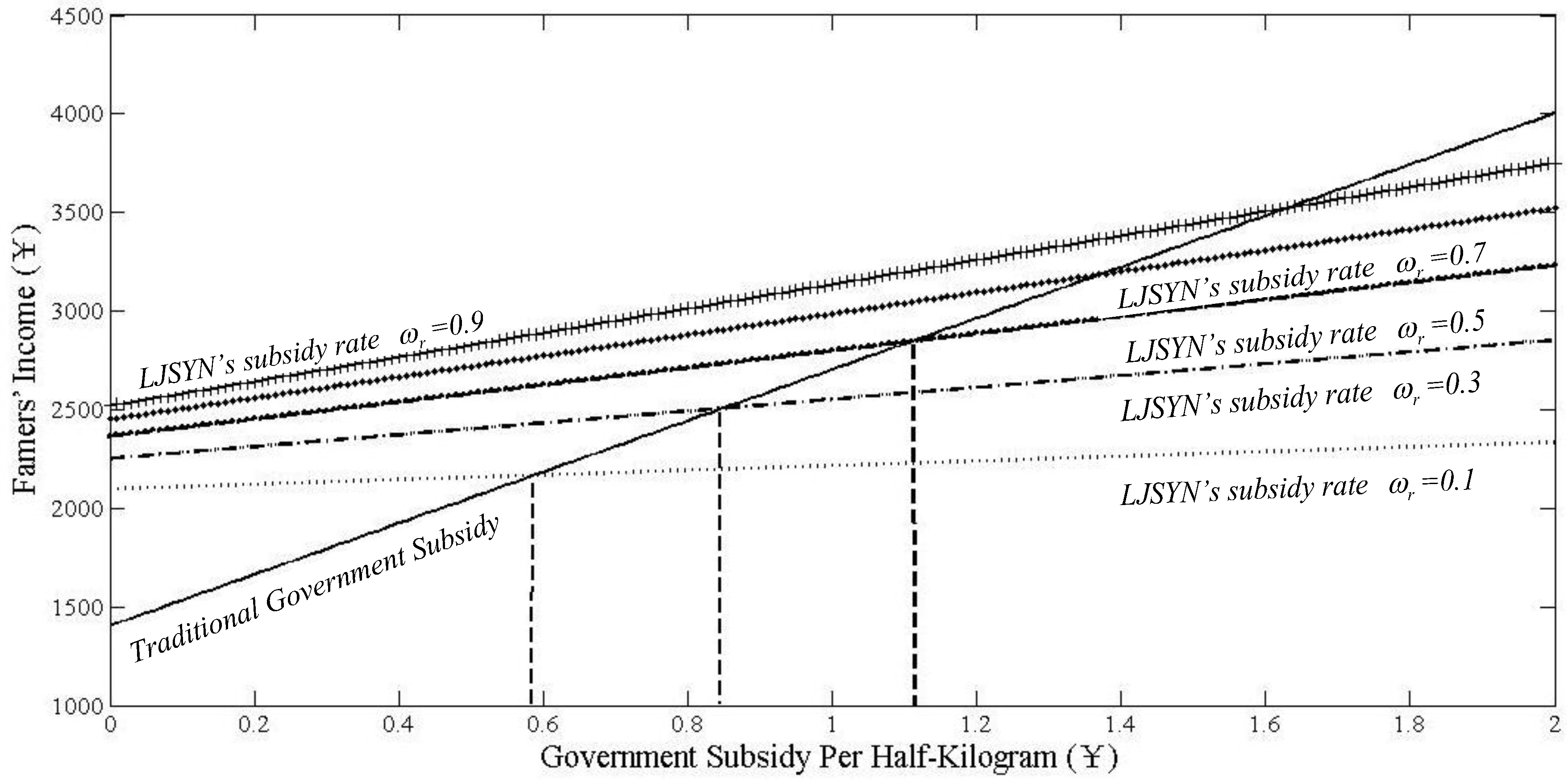

- Determine the optimal subsidy rate for the agribusiness: the appropriate subsidy for farmers is determined based on farmers’ income and requires a comparison between the traditional model and the novel model to explore the effects of the government subsidy, the agribusiness subsidy and the farmers’ income. The optimal subsidiary rate for the agribusiness is selected by examining these influences. This ensures that the rate offered provides the optimal income for farmers.

4. Empirical Study

4.1. Case Background

4.2. Data Collection

- (1)

- If farmers directly sell the rice in the market, the price is Ұ1.62 per half-kilogram.

- (2)

- Annual production is 1300 half-kilograms.

- (3)

- The cost to farmers to cultivate the rice without any control by the LJSYN is Ұ700 per acre; if each acre can generate 1300 half-kilograms, the cost of cultivation is Ұ0.54 per half-kilogram.

- (4)

- After farmers join the specialized farmers’ cooperatives, the cooperatives require Ұ0.05 to acquire the rice from the farmers, in addition to the purchase price of Ұ1.67 per half-kilogram.

- (5)

- The farmers’ cultivation cost is Ұ300 per acre and Ұ0.23 per half-kilogram under the novel model.

- (6)

- The LJSYN’s selling price for rice is Ұ3 per half-kilogram.

- (7)

- The LJSYN acquires the rice from the specialized farmers’ cooperatives. The acquisition price is higher than the market price of Ұ0.05. Thus, . Accordingly, the acquisition price is Ұ2.15 per half-kilogram.

- (8)

- The specialized farmers’ cooperatives offer a 25% net profit to farmers.

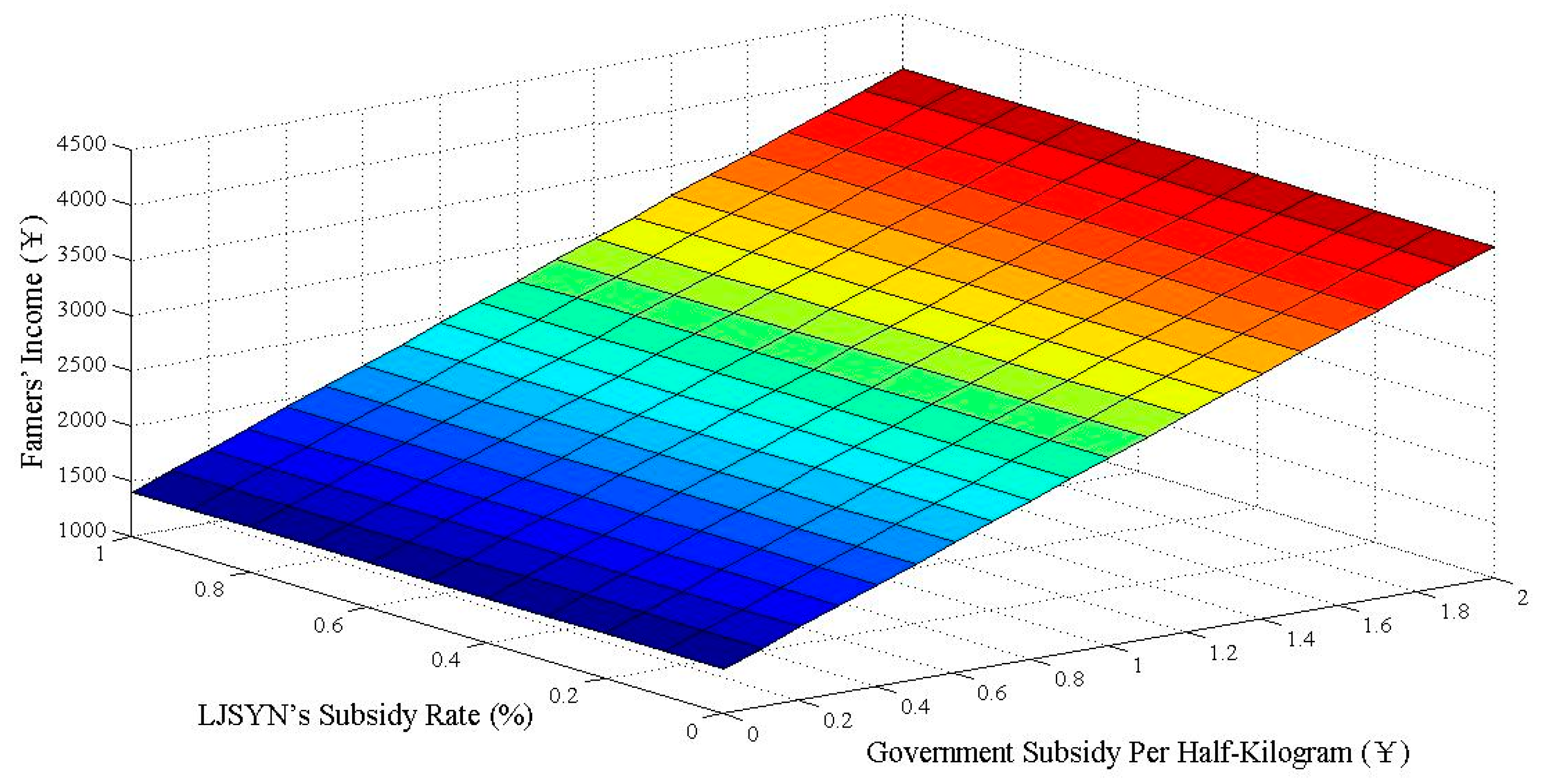

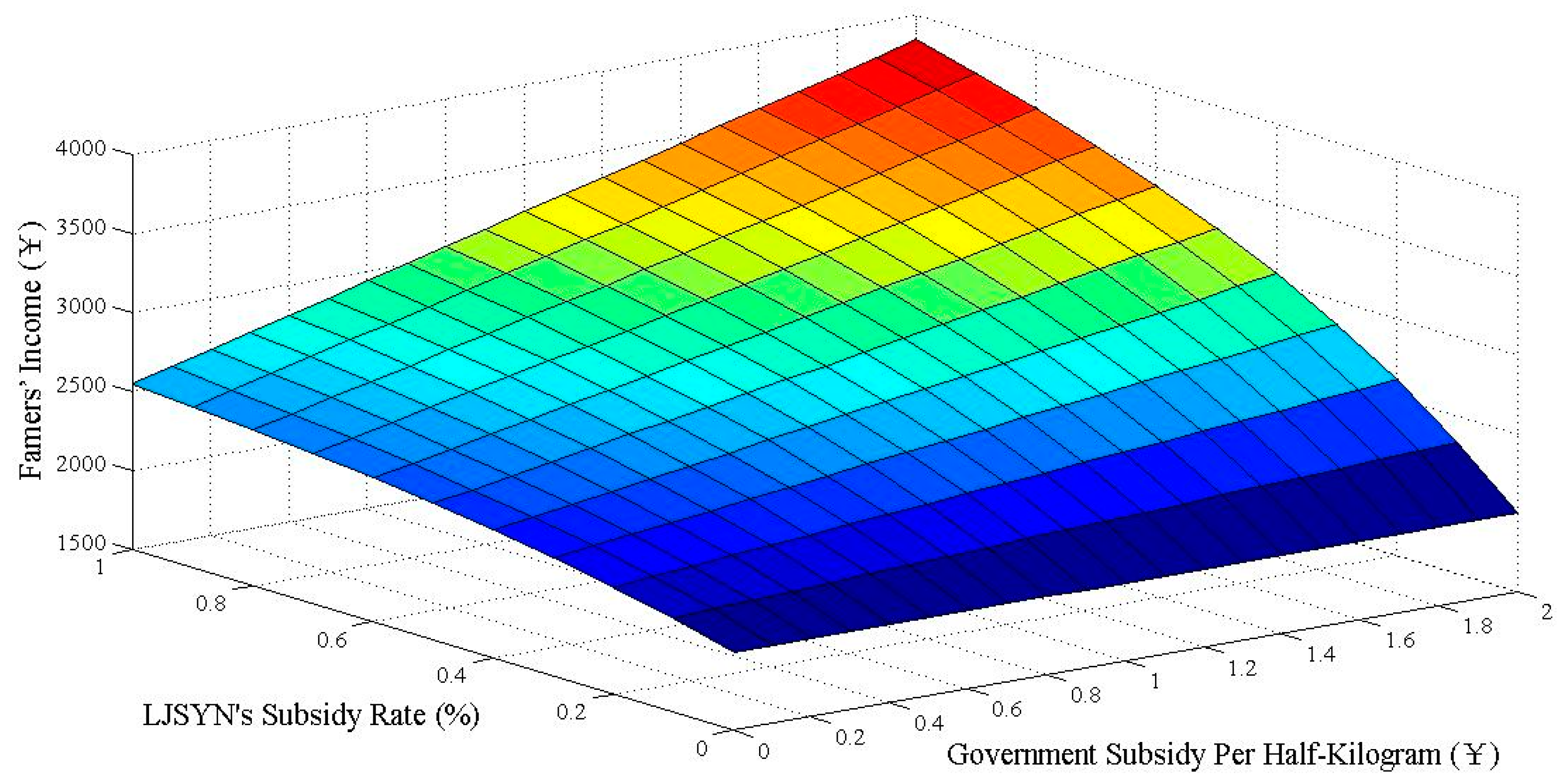

4.3. Empirical Results

5. Implications

6. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Li, J.Q. The present situation and prospect China’s agriculture. China Agric. Inform. 2013, 17, 142. [Google Scholar]

- Zhao, S.K. The farmers’ political: Confusion and thoughts. China Dev. Observ. 2009, 9, 7–13. [Google Scholar]

- Zhu, M.D.; Li, X.Y.; Cheng, G.Q. Comprehensive income support impact analysis of China’s corn total factor productivity: Based on the provincial panel data of DEA—Tobit two-stage method. Chin. Rural Econ. 2015, 11, 4–14. (In Chinese) [Google Scholar]

- Anderson, K.; Rausser, G.; Swinnen, J. Political economy of public policies: Insights from distortions to agricultural and food markets. J. Econ. Lit. 2013, 51, 423–477. [Google Scholar] [CrossRef]

- Kirwan, B. The incidence of U.S. agricultural subsidies on farmland rental rates. J. Political Econ. 2009, 117, 138–164. [Google Scholar] [CrossRef]

- Chen, C. The agricultural subsidy policy impact on the farmers’ land circulation behavior mechanism. Econ. Res. Guide 2014, 22, 36–37. [Google Scholar]

- Zhu, Q.; Geng, Y.; Sarkis, J. Shifting Chinese organizational responses to evolving greening pressures. Ecol. Econ. 2016, 121, 65–74. [Google Scholar] [CrossRef]

- Chen, Y.H.; Wan, J.Y.; Wang, C. Agricultural subsidy with capacity constraints and demand elasticity. Agric. Econ. (Czech Repub.) 2015, 61, 39–49. [Google Scholar] [CrossRef]

- Wang, Y.; Yang, J. Investigation and analysis of Land moderate scale operation under the perspective of agricultural subsidy—A Case of Manas in Xinjiang. J. Shanxi Agric. Sci. 2016, 44, 541–544. (In Chinese) [Google Scholar]

- Zhao, S.; Zhu, Q.; Cui, L. A decision-making model for remanufacturers: Considering both consumers’ environmental preference and the government subsidy policy. Resour. Conserv. Recycl. 2016, in press. [Google Scholar] [CrossRef]

- Kroupová, Z.; Malý, M. Analysis of agriculture subsidy policy tools-application of production function. Politická Ekon. 2010, 6, 774–794. [Google Scholar] [CrossRef]

- Mao, Z.Y.; Gao, P. National food security and grain subsidies. Jiangxi. Soc. Sci. 2004, 11, 240–246. (In Chinese) [Google Scholar]

- Banse, M.; Gorton, M.; Hartel, J.; Hughes, G.; Köckler, J.; Möllman, T.; Münch, W. The evolution of competitiveness in Hungarian agriculture: From transition to accession. MOCT-MOST 1999, 9, 307–318. [Google Scholar] [CrossRef]

- Franck, C.; Grandi, S.M.; Eisenberg, M.J. Agricultural subsidies and the American obesity epidemic. Am. J. Prev. Med. 2013, 45, 327–333. [Google Scholar] [CrossRef] [PubMed]

- Chen, L.J.; Hu, S.W.; Wang, V.; Wen, J.; Ye, C. The effects of purchasing and price subsidy policies for agricultural products under target zones. Econ. Model. 2014, 43, 439–447. [Google Scholar] [CrossRef]

- Demirdöğen, A.; Olhan, E.; Chavas, J.P. Food vs. fiber: An analysis of agricultural support policy in Turkey. Food Policy 2016, 61, 1–8. [Google Scholar] [CrossRef]

- Sicular, T. Agricultural planning and pricing in the post-Mao period. China Q. 1988, 116, 671–705. [Google Scholar] [CrossRef]

- Bernstein, T.P.; Lü, X. Taxation without Representation in Contemporary Rural China; Cambridge University Press: Cambridge, UK, 2003. [Google Scholar]

- Liu, Z.W.; OuYang, H.H.; Zhang, Z.X. Discussion on the grain subsidy way reforms. Prob. Agric. Econ. 2003, 5, 4–9. (In Chinese) [Google Scholar]

- Tao, R.; Lin, J.Y.; Liu, M.; Zhang, Q. Rural taxation and government regulation in China. Agric. Econ. 2004, 31, 161–168. [Google Scholar] [CrossRef]

- Gale, H.F.; Lohmar, B.; Tuan, F.C. China’s New Farm Subsidies; USDA-ERS WRS-05-01; U.S. Department of Agriculture (USDA): Washington, DC, USA, 2005.

- Chen, L. The effect of China’s RMB exchange rate movement on its agricultural export: A case study of export to Japan. China Agric. Econ. Rev. 2011, 3, 26–41. [Google Scholar] [CrossRef]

- Huang, J.; Wang, X.; Rozelle, S. The subsidization of farming households in China’s agriculture. Food Policy 2013, 41, 124–132. [Google Scholar] [CrossRef]

- Huang, J.; Wang, X.; Zhi, H.; Huang, Z.; Rozelle, S. Subsidies and distortions in China’s agriculture: Evidence from producer-level data. Aust. J. Agric. Res. Econ. 2011, 55, 53–71. [Google Scholar] [CrossRef]

- Liu, Y. Empirical analysis of China’s direct Food subsidy policy based on DEA model: A Case study of direct Food subsidy policy in Shandong Province. Asian Agric. Res. 2014, 6, 23–28. (In Chinese) [Google Scholar]

- Yi, F.; Sun, D.; Zhou, Y. Grain subsidy, liquidity constraints and food security—Impact of the grain subsidy program on the grain-sown areas in China. Food Policy 2015, 50, 114–124. [Google Scholar] [CrossRef]

- Ito, J. Diversification of agricultural production in China: Economic rationality of Crop choice under the producer subsidy program. Jpn. J. Rural Econ. 2015, 17, 1–17. [Google Scholar] [CrossRef]

- Chen, X. Review of China’s agricultural and Rural Development: Policy changes and current issues. China Agric. Econ. Rev. 2009, 1, 121–135. [Google Scholar] [CrossRef]

- Trade, O. Agricultural Policy Monitoring and Evaluation 2011: OECD Countries and Emerging Economies; Organisation for Economic Co-Operation and Development (OECD) Publishing: Paris, France, 2011. [Google Scholar]

- Trade, O. Agricultural Policy Monitoring and Evaluation 2013: OECD Countries and Emerging Economies; Organisation for Economic Co-Operation and Development (OECD): Paris, France, 2013. [Google Scholar]

- Pan, Y.; Yu, Z.; Holst, J.; Doluschitz, R. Integrated assessment of cropping patterns under different policy scenarios in Quzhou County, North China Plain. Land Use Policy 2014, 40, 131–139. [Google Scholar] [CrossRef]

- Giddings, B.; Hopwood, B.; O’brien, G. Environment, economy and society: Fitting them together into sustainable development. Sustain. Dev. 2002, 10, 187–196. [Google Scholar] [CrossRef]

- Lin, B.B. Resilience in agriculture through crop diversification: Adaptive management for environmental change. BioScience 2011, 61, 183–193. [Google Scholar] [CrossRef]

- Davis, A.S.; Hill, J.D.; Chase, C.A.; Johanns, A.M.; Liebman, M. Increasing cropping system diversity balances productivity, profitability and environmental health. PLoS ONE 2012, 7, 1–8. [Google Scholar] [CrossRef] [PubMed]

- Brown, L.R. Who will feed China. World Watch 1994, 7, 10–19. [Google Scholar]

- Xu, Z.; Zhang, W.; Li, M. China’s grain production: A decade of consecutive growth or stagnation? Mon. Rev. 2014, 66, 25–37. (In Chinese) [Google Scholar] [CrossRef]

- Singh, J.S.; Pandey, V.C.; Singh, D.P. Efficient soil microorganisms: A new dimension for sustainable agriculture and environmental development. Agric. Ecosyst. Environ. 2011, 140, 339–353. [Google Scholar] [CrossRef]

- Wezel, A.; Casagrande, M.; Celette, F.; Vian, J.; Ferrer, A.; Peigné, J. Agroecological practices for sustainable agriculture. A review. Agron. Sustain. Dev. 2014, 34, 1–20. [Google Scholar] [CrossRef]

- Qian, J.; Ito, S.; Zhao, Z.; Mu, Y.; Hou, L. Impact of agricultural subsidy policies on grain prices in China. J. Fac. Agric. Kyushu Univ. 2015, 60, 273–279. [Google Scholar]

- Zhu, Q.; Li, H.; Zhao, S.; Lun, V. Redesign of service modes for remanufactured products and its financial benefits. Int. J. Prod. Econ. 2016, 171, 231–240. [Google Scholar] [CrossRef]

- Bermouna, S.; Li, J. China’s agricultural project finance and support policies. Eur. Food Feed Law Rev. 2014, 9, 171–178. [Google Scholar]

- Qin, T.; Gu, X.; Tian, Z.; Deng, J. Comparison of agriculture and Forestry fiscal subsidy policies in China. J. Sustain. For. 2015, 34, 683–697. [Google Scholar] [CrossRef]

- Gold, C.S.; Kiggundu, A.; Abera, A.M.K.; Karamura, D. Diversity, distribution and farmer preference of Musa cultivars in Uganda. Exp. Agric. 2002, 38, 39–50. [Google Scholar] [CrossRef]

- Anglaaere, L.C.N.; Cobbina, J.; Sinclair, F.L.; McDonald, M.A. The effect of land use systems on tree diversity: Farmer preference and species composition of cocoa-based agroecosystems in Ghana. Agrofor. Syst. 2011, 81, 249–265. [Google Scholar] [CrossRef]

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cui, L.; Wu, K.-J.; Tseng, M.-L. Exploring a Novel Agricultural Subsidy Model with Sustainable Development: A Chinese Agribusiness in Liaoning Province. Sustainability 2017, 9, 19. https://doi.org/10.3390/su9010019

Cui L, Wu K-J, Tseng M-L. Exploring a Novel Agricultural Subsidy Model with Sustainable Development: A Chinese Agribusiness in Liaoning Province. Sustainability. 2017; 9(1):19. https://doi.org/10.3390/su9010019

Chicago/Turabian StyleCui, Li, Kuo-Jui Wu, and Ming-Lang Tseng. 2017. "Exploring a Novel Agricultural Subsidy Model with Sustainable Development: A Chinese Agribusiness in Liaoning Province" Sustainability 9, no. 1: 19. https://doi.org/10.3390/su9010019