Analysis of Environmental Accounting and Reporting Practices of Listed Banking Companies in Bangladesh †

Abstract

:1. Introduction

Some 3 million deaths a year are linked to exposure to outdoor air pollution. Indoor air pollution can be just as deadly. In 2012, an estimated 6.5 million deaths (11.6% of all global deaths) were associated with indoor and outdoor air pollution together. Nearly 90% of air-pollution-related deaths occur in low- and middle-income countries, with nearly 2 out of 3 occurring in WHO’s South-East Asia and Western Pacific regions. WHO’s air quality model confirms that 92% of the world’s population lives in places where air quality levels exceed WHO limits. Environmental risk factors, such as air, water and soil pollution, chemical exposures, climate change, and ultraviolet radiation, contribute to more than 100 diseases and injuries.[1]

2. Legal Status of Environmental Accounting and Reporting in Bangladesh

3. Theoretical Background and Literature Review

3.1. Theoretical Background

3.1.1. Stakeholder Theory and EAR Disclosure

3.1.2. Legitimacy Theory and EAR Disclosure

3.2. EAR in Developing Countries

4. Research Methodology

4.1. Sample and Data

4.2. Data Collection Period

4.3. Research Method

5. Findings and Results

5.1. EAR Disclosure Performance Measurement

5.1.1. Environmental Projects and Finance

5.1.2. Environmental Disclosures in Selected Categories

5.1.3. Ranking of Banks

5.2. Environmental Disclosure in the Annual Reports

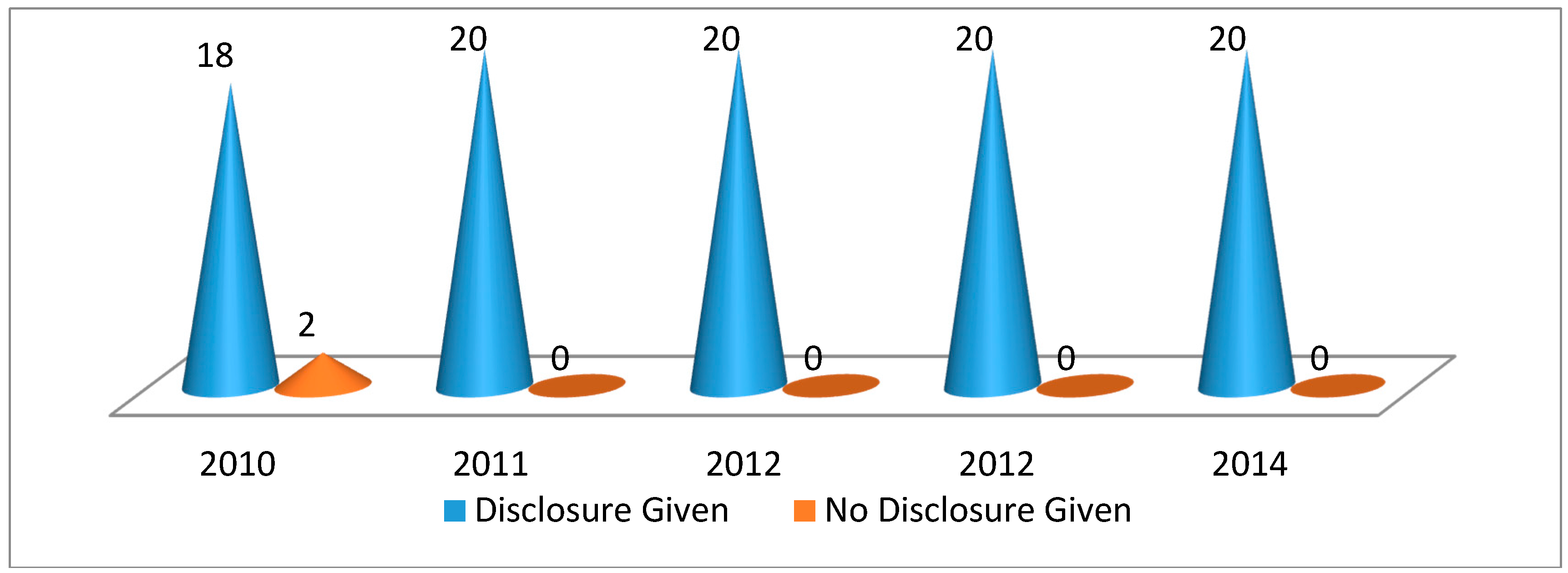

5.2.1. Disclosure and Nondisclosure of EAR Information

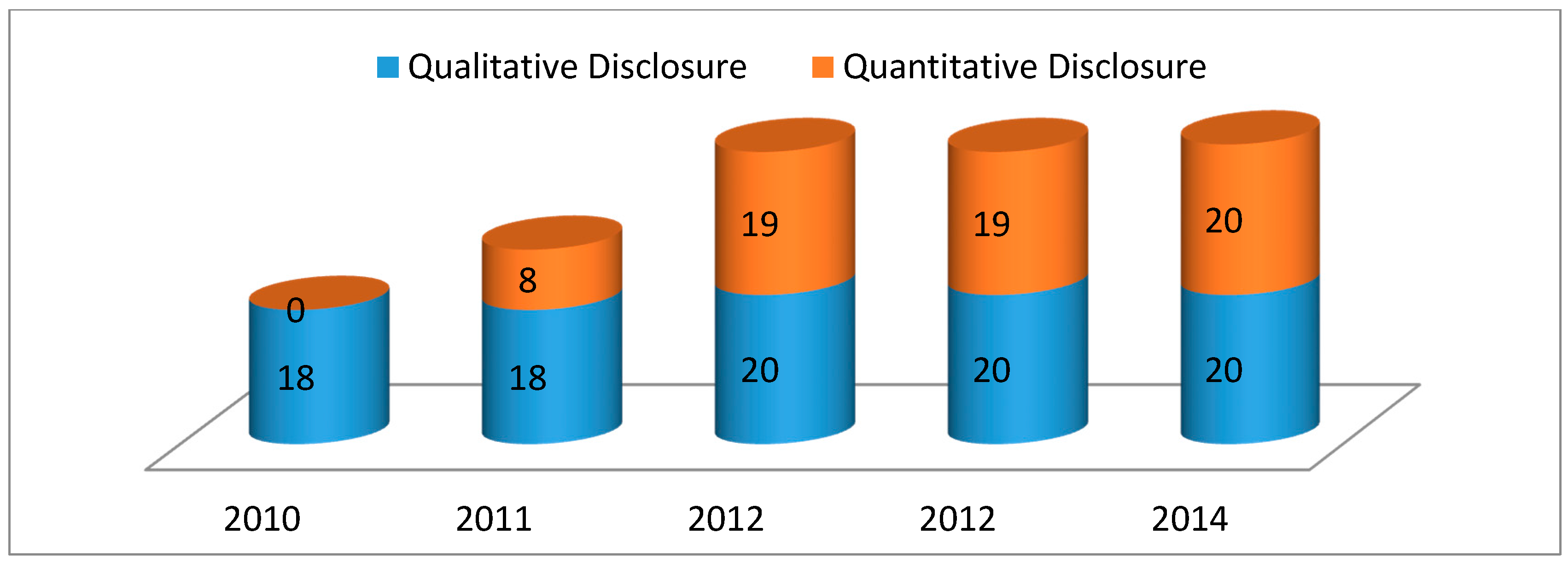

5.2.2. Qualitative and Quantitative EAR disclosure

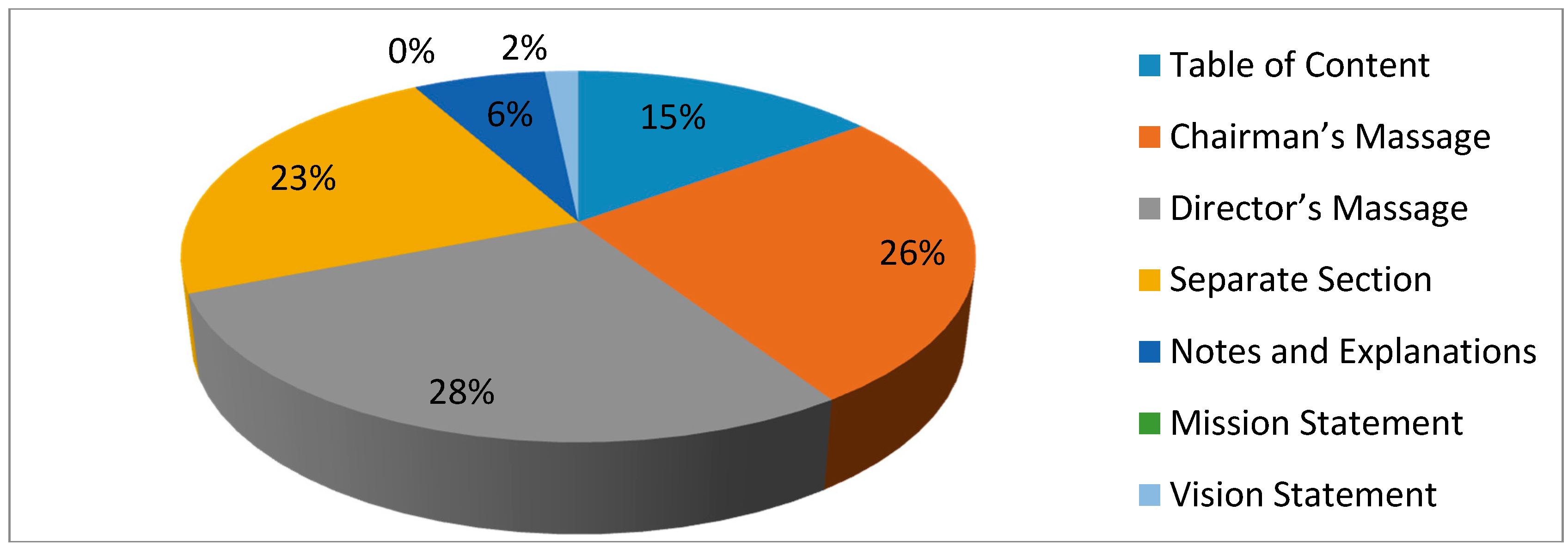

5.2.3. Environmental Information Disclosing Section

6. Conclusions and Managerial Implications

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A

| Al-Arafah Islami Bank Ltd. (AAIBL) BRAC Bank Ltd. (BRAC) Bank Asia Ltd. (BAL) City Bank Ltd. (CBL) Dutch Bangla Bank Ltd. (DBBL) EXIM Bank Ltd. (EXIM) Eastern Bank Ltd. (EBL) First Security Islami Bank Ltd. (FSIBL) ICB Islami Bank Ltd. (ICB) IFIC Bank Ltd. (IFIC) | Islami Bank Bangladesh Ltd. (IBBL) Jamuna Bank Ltd. (JBL) Mercantile Bank Ltd. (MBL) One Bank Ltd. (OBL) Prime Bank Ltd. (PBL) South East Bank Ltd. (SEBL) Social Islami Bank Ltd. (SoIBL) Shahjalal Islami Bank Ltd. (ShIBL) Standard Bank Ltd. (SBL) United Commercial Bank Ltd. (UCB) |

Appendix B

| EARS Code No. | EARS Code Items |

|---|---|

| C1 | Air pollution and control disclosure |

| C2 | Water pollution and control disclosure |

| C3 | Waste management and investment disclosure |

| C4 | Renewable energy and investment disclosure |

| C5 | Energy savings and improvements disclosure |

| C6 | Environmental, ecological and carbon management policy and strategy related disclosure |

| C7 | Award and appreciation for environmental initiatives and protections related disclosure |

| C8 | Separate department of environment, CSR and green banking disclosure |

| C9 | Green banking initiatives, policy, strategy and implementation disclosure |

| C10 | Tree plantation and forestry disclosure |

| C11 | Environmental awareness, training & education related disclosure |

| C12 | Climate change & global warming disclosure |

References

- World Health Organization. Available online: http://www.who.int/phe/publications/air-pollution-global-assessment/en/ (accessed on 1 October 2016).

- The Daily Star. Available online: http://www.thedailystar.net (accessed on 4 January 2016).

- Masud, M.A.K.; Hossain, M.S.; Khan, S. Environmental Accounting Concept and Reporting Practice: Evidence from Banking Sector of Bangladesh. Presented at the 1st Dhaka International Business and Social Science Research Conference, Dhaka, Bangladesh, 20–22 January 2016. [Google Scholar]

- Nurunnabi, M. Who cares about climate change reporting in developing countries? The market response to, and corporate accountability for, climate change in Bangladesh. Environ. Dev. Sustain. A Multidiscip. Approach Theory Pract. Sustain. Dev. 2015, 17. [Google Scholar] [CrossRef]

- Hubbard, G. Measuring organizational performance: Beyond the triple bottom line. Bus. Strateg. Environ. 2009, 18, 177–191. [Google Scholar] [CrossRef]

- Dilling, P.F. Sustainability reporting in a global context: What are the characteristics of corporations that provide high-quality sustainability reports-an empirical analysis? Int. Bus. Econ. Responsib. J. 2010, 9, 19–30. [Google Scholar] [CrossRef]

- Elijido-Ten, E. The impact of sustainability and balanced scorecard disclosures on market performance: Evidence from Australia’s top 100. J. Appl. Manag. Account. Res. 2011, 9, 59–73. [Google Scholar]

- Dissanayake, D.; Tilt, C.; Lobo, M.X. Sustainability reporting by listed companies in Sri Lanka. J. Clean. Prod. 2016, 30, 1–14. [Google Scholar] [CrossRef]

- Rahman, S.R.; Muttakin, M.B. Corporate Environmental Reporting Practices in Bangladesh—A Study of Some Selected Companies. Cost Manag. 2005, 33, 13–21. [Google Scholar]

- The SIGMA Guidelines-Toolkit: SIGMA Environmental Accounting Guide. SIGMA Project: London, UK, 2003. Available online: http://www.projectsigma.co.uk/Toolkit/SIGMAEnvironmentalAccounting.pdf (access on 20 September 2014).

- Bose, S. Environmental Accounting and Reporting in Fossil Fuel Sector: A Study on Bangladesh Oil, Gas and Mineral Corporation (Petrobangla). Cost Manag. 2006, 34, 53–67. [Google Scholar]

- Savage, A.A. Environmental Reporting: Stakeholders’ Perspective; Working Paper 94; University of Port Elizabeth: Port Elizabeth, South Africa, 1994. [Google Scholar]

- Belal, A.R.; Copper, S.M.; Khan, N.A. Corporate Environmental Responsibility and Accountability: What Chance in Vulnerable Bangladesh. Crit. Perspect. Account. 2015, 33, 44–58. [Google Scholar] [CrossRef]

- Gupta, V.K. Environmental Accounting and Reporting—An Analysis of Indian Corporate Sector. Available online: http://www.wbiconpro.com/110-Gupta.pdf or http://business.wesrch.com/mobile/paper-details/pdf-BU1H5H4B3ABQM-environmental-accounting-and-reporting (accessed on 10 December 2012).

- Confederation of Asia and Pacific Accountants. Annual Report 2009. Available online: http://www.capa.com.my/wp-content/uploads/2017/02/CAPA_AnnualReport_2009_FINAL.pdf (accessed on 22 September 2017).

- Government of Bangladesh. Annual Budget Published by the Ministry of Finance. 2015. Available online: http://www.mof.gov.bd (accessed on 10 July 2015).

- Khan, M.H.U.Z.; Islam, M.A.; Fatima, J.K.; Ahmed, K. Corporate sustainability reporting of major commercial banks in line with GRI: Bangladesh evidence. Soc. Responsib. J. 2011, 7, 347–363. [Google Scholar] [CrossRef]

- Khan, M.T.A. Sustainability Reporting under global reporting initiative. Cost Manag. 2016, 43, 4–17. [Google Scholar]

- Sayaduzzaman, M.; Masud, M.A.K. Corporate Social Responsibility Practices of Private Commercial Banks in Bangladesh: A Comparative Study. Cost Manag. 2012, 40, 34–39. [Google Scholar]

- Bangladesh Bank. Review of CSR Activities of Financial Sector. Published by Green Banking and CSR Department. 2013, 2014, 2015. Available online: https://www.bb.org.bd/pub/index.php (accessed on 2 November 2016).

- Ullah, M.H.; Rahman, M.A. Corporate social responsibility reporting practices in banking companies in Bangladesh: Impact of regulatory change. J. Financ. Report. Account. 2015, 13, 200–225. [Google Scholar] [CrossRef]

- Sobhani, F.A.; Arman, A.; Zianuddin, U. Revisiting the Practices of Corporate Social and Environmental Disclosure in Bangladesh. Corp. Soc. Responsib. Environ. Manag. 2009, 16, 167–183. [Google Scholar] [CrossRef]

- Sobhani, F.A.; Arman, A.; Zianuddin, U. Sustainability disclosure in annual reports and websites: A study of the banking industry in Bangladesh. J. Clean. Prod. 2011, 23, 75–85. [Google Scholar] [CrossRef]

- Belal, A.R. Environmental Reporting in Developing Countries: Empirical Evidence from Bangladesh. Eco-Manag. Audit. 2000, 7, 114–121. [Google Scholar] [CrossRef]

- Imam, S. Environmental Reporting in Bangladesh. Soc. Environ. Account. 1999, 19, 12–14. [Google Scholar] [CrossRef]

- Shil, N.; Iqubal, M. Environmental Disclosure-Bangladesh Perspective. Cost Manag. 2005, 33, 85–93. [Google Scholar]

- Hossain, M.; Islam, K.; Andrew, J. Corporate social and environmental disclosure in developing countries: Evidence from Bangladesh. In Proceedings of the Asian Pacific Conference on International Accounting Issues, Maui, HI, USA, 18 October 2006; Available online: http://ro.uow.edu.au/commpapers/179/ (accessed on 5 March 2014).

- Khan, M.H.U.Z. The Effect of Corporate Governance elements on Corporate Social Responsibility (CSR) Reporting: Empirical Evidence from Private Commercial Banks of Bangladesh. Int. J. Law Manag. 2010, 52, 82–109. [Google Scholar] [CrossRef]

- Bose, S.; Khan, B.Z.; Rashid, A.; Islam, S. What drives green banking disclosure? An institutional and corporate governance perspective. Asia Pac. J. Manag. 2017. [Google Scholar] [CrossRef]

- Khan, M.H.U.Z.; Halabi, A.; Samy, M. CSR Reporting Practice: A study of Selected Banking Companies in Bangladesh. Soc. Responsib. J. 2009, 5, 344–357. [Google Scholar] [CrossRef]

- Masud, M.A.K.; Kabir, H.M. Corporate social responsibility evaluation by different levels of management of Islamic banks and traditional banks: Evidence from banking sector of Bangladesh. Probl. Perspect. Manag. 2016, 14, 194–202. [Google Scholar] [CrossRef]

- Killic, M.; Kuzey, C.; Uyar, A. The impact of ownership and board structure on corporate social responsibility reporting in the Turkish banking industry. Corp. Gov. 2015, 15, 357–372. [Google Scholar] [CrossRef]

- Lu, Y.; Abeysekera, I.; Cortese, C. Corporate social responsibility reporting quality, board characteristics and corporate social reputation: Evidence from China. Pac. Account. Rev. 2015, 27, 95–118. [Google Scholar] [CrossRef]

- Comyns, B. Determinants of GHG reporting: An analysis of global oil and gas companies. J. Bus. Ethics 2014. [Google Scholar] [CrossRef]

- Villers, C.; Naiker, V.; Staden, C. The effects of board characteristics on firm environmental performance. J. Manag. 2011, 37, 1636–1663. [Google Scholar] [CrossRef]

- Freeman, R.; Harrison, J.; Wicks, A.; Parmar, B.; Colle, S. Stakeholder Theory: The State of the Art; Cambridge University Press: New York, NY, USA, 2010. [Google Scholar]

- KPMG. The KPMG Survey of Corporate Responsibility Reporting 2017. Available online: https://assets.kpmg.com/content/dam/kpmg/pdf/2015/08/kpmg-survey-of-corporate-responsibility-reporting-2013.pdf (accessed on 5 August 2015).

- Gray, R.H.; Owen, D.; Adams, C. Accounting & Accountability: Changes and Challenges in Corporate Social and Environmental Reporting; Prentice Hall: Upper Saddle River, NJ, USA, 1996. [Google Scholar]

- Suchman, M.C. Managing legitimacy: Strategic and institutional approaches. Acad. Manag. Rev. 1995, 20, 571–610. [Google Scholar]

- Masud, M.A.K.; Hossain, M.S. Corporate Social Responsibility Reporting Practices in Bangladesh: A Study of Selected Private Commercial Banks. IOSR J. Bus. Manag. 2012, 6, 42–47. [Google Scholar] [CrossRef]

- Sahay, A. Environmental reporting by Indian corporations. Corp. Soc. Responsib. Environ. Manag. 2004, 11, 12–22. [Google Scholar] [CrossRef]

- Azim, M.I.; Ahmed, S.; Islam, M.S. Corporate social reporting practice: Evidence from listed companies in Bangladesh. J. Asia Pac. Bus. 2009, 10, 130–145. [Google Scholar] [CrossRef]

- Belal, A.R.; Owen, D.L. The view of corporate managers on the current state of, and future prospects for, social reporting in Bangladesh: An engagement-based study. Account. Audit. Account. J. 2007, 20, 472–494. [Google Scholar] [CrossRef]

- Hoque, A.; Clarke, A.; Huang, L. Lack of Stakeholder Influence on Pollution Prevention: A Developing Country Perspective. Organ. Environ. 2016, 1–19. [Google Scholar] [CrossRef]

- Meena, R. Green banking as initiative for sustainable development. Glob. J. Manag. Bus. Stud. 2013, 3, 1181–1186. [Google Scholar]

- Teoh, H.Y.; Pin, F.W.; Joo, T.T.; Ling, Y.Y. Environmental Disclosures-Financial Performance Link: Further Evidence from Industrializing Economy Perspective. 2016. Available online: http://citeseerx.ist.psu.edu/viewdoc/summary?doi=10.1.1.202.164 (accessed on 30 September 2016).

- Fifka, M. The development and state of research on social and environmental reporting in global comparison. J. Betriebswirtsch. 2012, 62, 45–84. [Google Scholar] [CrossRef]

- Choi, J.S. An investigation of the initial voluntary environmental disclosures made in Korean semi-annual financial reports. Pac. Account. Rev. 1998, 11, 73–102. [Google Scholar]

- Baughn, C.C.; McIntosh, J.C. Corporate social and environmental responsibility in Asian countries and other geographical regions. Corp. Soc. Responsib. Environ. Manag. 2007, 14, 189–205. [Google Scholar] [CrossRef]

- Global Reporting Initiative. The 2016 Sustainability Leaders: A Globe Scan/Sustainability Survey. 2010–2016. Available online: https://www.globalreporting.org/Pages/default.aspx (accessed on 3 October 2016).

- Kabir, M.H.; Akinnusi, D.A. Corporate social and environmental accounting information reporting practices in Swaziland. Soc. Responsib. J. 2012, 8, 156–173. [Google Scholar] [CrossRef]

- Tsang, E.W.K. A longitudinal study of corporate social reporting in Singapore: The case of the banking, food and beverages and hotel industries. Account. Audit. Account. J. 1998, 11, 624–635. [Google Scholar] [CrossRef]

- Jamali, D.; Mishak, R. Corporate social responsibility (CSR): Theory and practice in a developing country context. J. Bus. Ethics 2007, 72, 243–262. [Google Scholar] [CrossRef]

- Rahman, S.R. Corporate social reporting in India-A view from the top. Glob. Bus. Rev. 2006, 7, 313–324. [Google Scholar] [CrossRef]

- Sawani, Y.; Mustaffa, M.Z.; Darus, F. Preliminary insights on sustainability reporting and assurance practices in Malaysia. Soc. Responsib. J. 2010, 6, 627–645. [Google Scholar] [CrossRef]

- Hossain, I.; Chowdhury, A. Environmental Reporting: A study of the listed companies in Bangladesh. Cost Manag. 2014, 42, 36–46. [Google Scholar]

- Dutta, P.; Bose, S. Corporate Environmental Reporting on the Internet in Bangladesh: An Exploratory Study. Int. Rev. Bus. Res. Pap. 2008, 4, 38–150. [Google Scholar]

- The Daily Prothom-Alo. Available online: http://www.prothom-alo.com (accessed on 5 January 2016).

- UNESCO. Available online: http://www.unescobkk.org/fileadmin/user_upload/library/OPI/Documents/UNESCO_in_the_news_2014/141130Sundarbans_may_lose_its_heritage_status__UNESCO.pdf (accessed on 10 October 2016).

- Guthrie, J.; Parker, L. Corporate Social Disclosure Practice: A Comparative International Analysis. Adv. Public Interest Account. 1990, 3, 159–175. [Google Scholar]

- Singh, D.R.; Ahuja, J.M. Corporate social reporting in India. Int. J. Account. Educ. Res. 1983, 18, 151–169. [Google Scholar]

- Adams, C.A. Internal organizational factors influencing corporate social and ethical reporting: Beyond current theorizing. Account. Audit. Account. J. 2002, 15, 223–250. [Google Scholar] [CrossRef]

- Adams, C.A.; Hill, W.Y.; Roberts, C.B. Corporate Social Reporting Practices in Western Europe: Legitimating Corporate Behavior? Br. Account. Rev. 1998, 30, 1–21. [Google Scholar] [CrossRef]

- Gray, R.; Kouhy, R.; Lavers, S. Corporate social and environmental reporting: A review of the literature and a longitudinal study of UK disclosure. Account. Audit. Account. J. 1995, 8, 47–77. [Google Scholar] [CrossRef]

- Islam, M.A.; Deegan, C. Motivations for an organization within a developing country to report social responsibility information: Evidence from Bangladesh. Account. Audit. Account. J. 2008, 21, 850–874. [Google Scholar] [CrossRef] [Green Version]

- Hossain, D.M.; Bir, A.T.; Tarique, K.M.; Momen, A. Disclosure of Green Banking Issues in the Annual Reports: A Study on Bangladeshi Banks. Middle East J. Bus. 2016, 7, 19–30. [Google Scholar] [CrossRef]

- Bangladesh Bank. Available online: https://www.bb.org.bd/fnansys/bankfi.php (accessed on 24 August 2017).

- Dhaka Stock Exchange. Available online: http://www.dsebd.org/companylistbyindustry.php?industryno=11 (accessed on 24 August 2017).

- Krippendorf, K. Content Analysis: An Introduction to Its Methodology; Sage: New York, NY, USA, 1980. [Google Scholar]

- Hossain, M.; Tan, L.; Adams, M. Voluntary disclosure in an emerging capital market: Some empirical evidence from companies listed on the Kuala Lumpur stock exchange. Int. J. Account. 1994, 29, 334–351. [Google Scholar]

- Ahmed, K.; Nicholls, D. The impact of non-financial company characteristics on mandatory compliance in developing countries: The case of Bangladesh. Int. J. Account. 1994, 29, 60–77. [Google Scholar]

- Beattie, V.; Jones, M.J. The use and abuse of graphs in annual reports: A theoretical framework and empirical study. Account. Bus. Res. 1992, 22, 291–303. [Google Scholar] [CrossRef]

- Beattie, V.; Jones, M.J. An empirical study of graphical format choices in charity annual reports. Financ. Account. Manag. 1994, 10, 215–236. [Google Scholar] [CrossRef]

- Zeghal, D.; Ahmed, S.A. Comparison of social responsibility information disclosure media used by Canadian firms. Account. Audit. Account. J. 1990, 3, 38–53. [Google Scholar] [CrossRef]

- Unerman, J. Methodology issues-reflections on quantification in corporate social reporting content analysis. Account. Audit. Account. J. 2000, 13, 667–681. [Google Scholar] [CrossRef]

- Milne, M.J.; Adler, R.W. Exploring the reliability of social and environmental disclosures content analysis. Account. Audit. Account. J. 1999, 12, 237–256. [Google Scholar] [CrossRef]

- Hackston, D.; Milne, M.J. Some determinants of social and environmental disclosures in New Zealand companies. Account. Audit. Account. J. 1996, 9, 77–108. [Google Scholar] [CrossRef]

- Wiseman, J. An evaluation of environmental disclosures made in corporate annual reports. Account. Organ. Soc. 1982, 7, 53–63. [Google Scholar] [CrossRef]

- Cooke, T.E. The impact of size, stock market listing and industry type on disclosure in the annual reports of Japanese listed corporations. Account. Bus. Res. 1992, 22, 229–237. [Google Scholar] [CrossRef]

- Clarkson, P.; Li, Y.; Richardson, G.; Vasvari, F. Revisiting the Relation between Environmental Performance and Environmental Disclosure: An Empirical Analysis. Account. Organ. Soc. 2008, 33, 303–327. [Google Scholar] [CrossRef]

- Bangladesh Bank. Annual Report on Green Banking. Green Banking Wing. 2012. Available online: https://www.bb.org.bd/pub/index.php (accessed on 2 November 2016).

- Islamic Bank Bangladesh Ltd. Annual Report, 2014. Available online: http://www.islamibankbd.com/abtIBBL/financial_report.php (accessed on 21 August 2017).

- Azim, M.I.; Ahmed, E.; D’Netto, B. Corporate social disclosure in Bangladesh: A study of the financial sector. Int. Rev. Bus. Res. Pap. 2011, 7, 37–55. [Google Scholar]

- Bank Asia Ltd. Annual Report, 2014. Available online: http://www.bankasia-bd.com/home/annual_reports (accessed on 21 August 2017).

- Gray, R. Social, environmental and sustainability reporting and organizational value creation? Whose value? Whose creation? Account. Audit. Account. J. 2006, 19, 793–819. [Google Scholar] [CrossRef]

| EAR Legal Status in Bangladesh | |

|---|---|

| 1. | Ministry of Environment and Forests |

| 2. | Forest Department |

| 3. | Department of Environment |

| 4. | Planning Commission |

| 5. | Bank Companies Act, 1991 |

| 6. | National Environment Policy, 1992 |

| 7. | Financial Institutions Act, 1993 |

| 8. | Securities and Exchange Commission Act 1993 |

| 9. | Financial Institutions Act, 1993 |

| 10. | Companies Act, 1994 |

| 11. | National Environmental Management Action Plan, 1995 |

| 12. | Environmental Conversion Act, 1995 |

| 13. | Environmental Conversion Rules, 1997 |

| 14. | Bankruptcy Act, 1997 |

| 15. | Ozone Depleting Substances Rules, 2004 |

| 16. | Environmental Court Act, 2010 |

| 17. | Climate Change Trust Act, 2010 |

| 18. | Credit Risk Management Industry Best Practices by Bangladesh Bank in 2010 |

| 19. | Environmental Risk Management Guidelines, 2011 |

| 20. | Policy Guidelines for Green Banking, 2011 |

| 21. | Finance Act (changes from time to time) |

| 22. | Bangladesh Biodiversity Act, 2012 |

| 23. | Securities and Exchange Rules |

| 24. | Bangladesh Bank Rules |

| 25. | Tax Ordinances |

| 26. | IFIC guidelines |

| 27. | IASC guidelines |

| 28. | FASB guidelines |

| 29. | BFRS guidelines |

| Sample Selection Criteria | Banks |

|---|---|

| Total banks [67] | 57 |

| Banks not listed on Dhaka Stock Exchange (DSE) | (27) |

| Banks listed on DSE [68] | 30 |

| Banks with missing annual reports | (10) |

| Final sample banks | 20 |

| EAR Categories | Sources |

|---|---|

| Air pollution, water pollution, waste management, environmental policy, award for environmental protection, separate department of environment | Wiseman [76] |

| Green banking, tree plantation, environmental awareness training & education, renewable energy, climate change risk | Ullah and Rahman [21] |

| Energy-saving | Kabir and Akinnusi [51] |

| Name of Bank | Major Environmental Financing Areas |

|---|---|

| Islami Bank | Effluent Treatment Plant (ETP), biogas plants, solar home systems, solar panel trades, bio-fertilizer plants, tunnel kilns, installation of zigzag kilns, waste and hazardous disposal plants, waste paper recycling plants, waste battery recycling plants, LED bulb production, safe/clean water supply projects, improved cooking stoves, green projects (at zero rate of return), electricity generation from rice husks, rice bran oil production, e-commerce and e-business promotions, investing via online banking |

| Brac Bank | Solar energy, green projects, ETP, double hull oil tankers, environment-friendly brickfields, e-commerce and e-business promotions, investing via online banking |

| EXIM Bank | ETP, renewable energy, clean water supply, wastewater treatment plants, recycling of harmful waste, solid and hazardous waste disposal plants, biogas plants, bio-fertilizer plants, environment-friendly brickfields, e-commerce and e-business promotions, investing via online banking |

| Bank Asia | Renewable energy and carbon offset projects, reducing energy and resource consumption, solar home systems, consumption of water, solar energy, biogas, ETP, HHK projects, greenhouse gas emission projects, waste management, e-commerce and e-business promotions, investing via online banking |

| Prime Bank | ETP, HHK projects, solid waste management, energy and water management, renewable energy projects, green travel, and e-commerce and e-business promotions, investing via online banking |

| ER Categories/Banks | Disclosing EAR Information | Percentage (%) |

|---|---|---|

| AAIBL | 10 | 83 |

| BRAC | 12 | 100 |

| BAL | 12 | 100 |

| CBL | 9 | 75 |

| DBBL | 12 | 100 |

| EXIM | 11 | 92 |

| EBL | 11 | 92 |

| FSIBL | 8 | 67 |

| ICB | 9 | 75 |

| IFIC | 11 | 92 |

| IBBL | 12 | 100 |

| JBL | 9 | 75 |

| MBL | 10 | 83 |

| OBL | 8 | 67 |

| PBL | 10 | 83 |

| SEBL | 12 | 100 |

| SoIBL | 11 | 92 |

| ShIBL | 8 | 67 |

| SBL | 9 | 75 |

| UCB | 12 | 100 |

| Average | 10 | 85 |

| EARS Code/Banks | C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | C10 | C11 | C12 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| AAIBL | 2 | 2 | 0 | 4 | 5 | 4 | 0 | 3 | 5 | 1 | 4 | 3 |

| BRAC | 1 | 2 | 4 | 5 | 3 | 2 | 1 | 3 | 3 | 2 | 1 | 1 |

| BAL | 4 | 4 | 4 | 4 | 4 | 3 | 3 | 4 | 4 | 1 | 4 | 4 |

| CBL | 0 | 0 | 1 | 3 | 3 | 4 | 0 | 2 | 4 | 1 | 4 | 1 |

| DBBL | 3 | 3 | 3 | 4 | 3 | 3 | 3 | 3 | 5 | 5 | 3 | 5 |

| EXIM | 0 | 2 | 2 | 2 | 2 | 4 | 2 | 2 | 4 | 3 | 2 | 4 |

| EBL | 1 | 4 | 3 | 5 | 5 | 4 | 2 | 2 | 4 | 0 | 5 | 2 |

| FSIBL | 1 | 1 | 0 | 2 | 2 | 1 | 0 | 0 | 3 | 3 | 0 | 1 |

| ICB | 5 | 5 | 0 | 4 | 4 | 4 | 0 | 0 | 4 | 2 | 4 | 5 |

| IFIC | 4 | 4 | 0 | 5 | 4 | 4 | 1 | 4 | 4 | 4 | 5 | 4 |

| IBBL | 5 | 5 | 4 | 5 | 5 | 5 | 3 | 3 | 5 | 5 | 5 | 5 |

| JBL | 0 | 2 | 2 | 2 | 2 | 2 | 0 | 0 | 2 | 2 | 2 | 2 |

| MBL | 0 | 4 | 2 | 2 | 4 | 1 | 0 | 4 | 4 | 2 | 3 | 2 |

| OBL | 0 | 0 | 1 | 4 | 4 | 4 | 0 | 3 | 4 | 0 | 4 | 1 |

| PBL | 4 | 4 | 4 | 5 | 4 | 4 | 0 | 4 | 5 | 0 | 4 | 4 |

| SEBL | 2 | 2 | 2 | 2 | 3 | 2 | 2 | 3 | 2 | 3 | 2 | 1 |

| SoIBL | 1 | 1 | 0 | 3 | 2 | 3 | 3 | 3 | 3 | 2 | 2 | 1 |

| ShIBL | 0 | 0 | 0 | 4 | 4 | 3 | 0 | 3 | 4 | 1 | 4 | 2 |

| SBL | 4 | 4 | 0 | 5 | 5 | 4 | 0 | 4 | 4 | 0 | 4 | 5 |

| UCB | 3 | 4 | 3 | 5 | 5 | 5 | 3 | 4 | 4 | 3 | 5 | 5 |

| Total | 40 | 53 | 35 | 75 | 73 | 66 | 23 | 54 | 77 | 40 | 67 | 58 |

| Average EARS on Bank | 2.00 | 2.65 | 2.06 | 3.75 | 3.65 | 3.30 | 1.28 | 2.84 | 3.85 | 2.22 | 3.35 | 2.90 |

| Rank | Bank Name | Total Disclosures | Rank | Bank Name | Total Disclosure |

|---|---|---|---|---|---|

| 1 | IBBL | 55 | 8 | EXIM | 29 |

| 2 | UCB | 49 | 9 | BRAC | 28 |

| 3 | BAL | 43 | 9 | MBL | 28 |

| 3 | DBBL | 43 | 10 | SEBL | 26 |

| 3 | IFIC | 43 | 11 | OBL | 25 |

| 4 | PBL | 42 | 11 | ShIBL | 25 |

| 5 | SBL | 39 | 12 | SoIBL | 24 |

| 6 | EBL | 37 | 13 | CBL | 23 |

| 6 | ICB | 37 | 14 | JBL | 18 |

| 7 | AAIBL | 33 | 15 | FSIBL | 14 |

| EARS Categories | 2010 | 2011 | 2012 | 2013 | 2014 |

|---|---|---|---|---|---|

| C1 | 2 | 7 | 8 | 11 | 12 |

| C2 | 3 | 9 | 10 | 15 | 16 |

| C3 | 2 | 2 | 7 | 11 | 13 |

| C4 | 7 | 13 | 15 | 20 | 20 |

| C5 | 5 | 13 | 15 | 20 | 20 |

| C6 | 2 | 11 | 15 | 18 | 20 |

| C7 | 0 | 1 | 5 | 7 | 10 |

| C8 | 0 | 5 | 14 | 17 | 18 |

| C9 | 4 | 15 | 18 | 20 | 20 |

| C10 | 4 | 5 | 9 | 9 | 13 |

| C11 | 4 | 12 | 13 | 19 | 19 |

| C12 | 5 | 10 | 11 | 15 | 17 |

| Total Disclosure | 38 | 103 | 140 | 182 | 198 |

| Percentage (%) of EAR disclosure | 16 | 43 | 58 | 76 | 83 |

| Year | Mean | Median | Std. Dev. | Minimum | Maximum | Mode |

|---|---|---|---|---|---|---|

| 2010 | 3.167 | 3.5 | 2.082 | 0 | 7 | 2 |

| 2011 | 8.583 | 9.5 | 4.562 | 1 | 15 | 13 |

| 2012 | 11.667 | 12 | 3.939 | 5 | 18 | 15 |

| 2013 | 15.167 | 16 | 4.629 | 7 | 20 | 20 |

| 2014 | 16.500 | 17.5 | 3.631 | 10 | 20 | 20 |

| 2011–2014 | 12.979 | 13 | 5.134 | 1 | 20 | 20 |

| Comparison between 2010 and 2011–2014 | t = 7.55 p = 0.001 | z = 5.55 p = 0.01 | ||||

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Masud, M.A.K.; Bae, S.M.; Kim, J.D. Analysis of Environmental Accounting and Reporting Practices of Listed Banking Companies in Bangladesh. Sustainability 2017, 9, 1717. https://doi.org/10.3390/su9101717

Masud MAK, Bae SM, Kim JD. Analysis of Environmental Accounting and Reporting Practices of Listed Banking Companies in Bangladesh. Sustainability. 2017; 9(10):1717. https://doi.org/10.3390/su9101717

Chicago/Turabian StyleMasud, Md. Abdul Kaium, Seong Mi Bae, and Jong Dae Kim. 2017. "Analysis of Environmental Accounting and Reporting Practices of Listed Banking Companies in Bangladesh" Sustainability 9, no. 10: 1717. https://doi.org/10.3390/su9101717