Spatial–Temporal Modeling for Regional Economic Development: A Quantitative Analysis with Panel Data from Western China

Abstract

:1. Introduction

2. Literature Review

2.1. Spatial Effects between Regions

2.2. Internal Region

3. The Proposed Regional Economic Difference Model

3.1. General Spatial–Temporal Model

3.2. Extended Application of General Model

4. Empirical Results

4.1. Data Collection

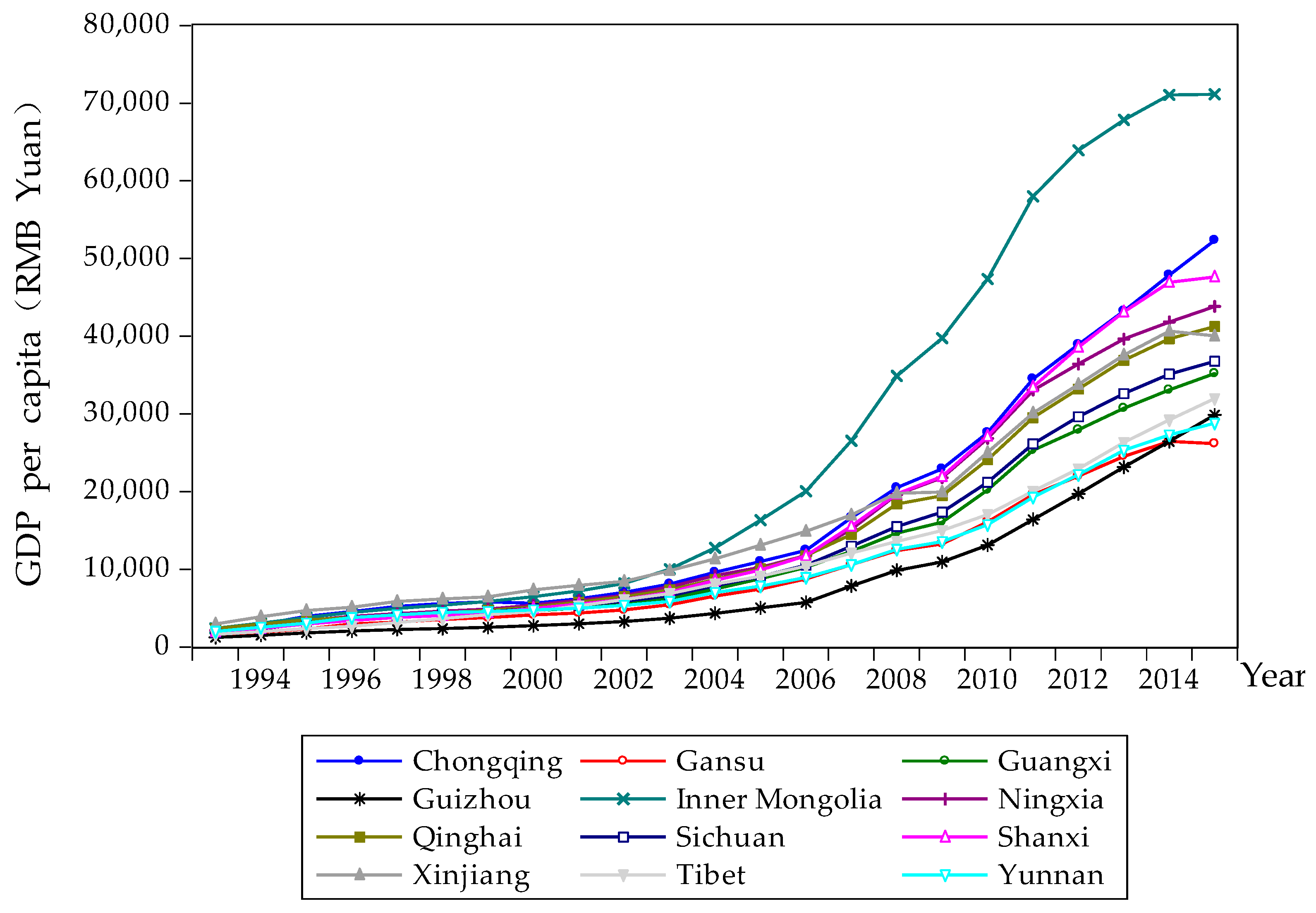

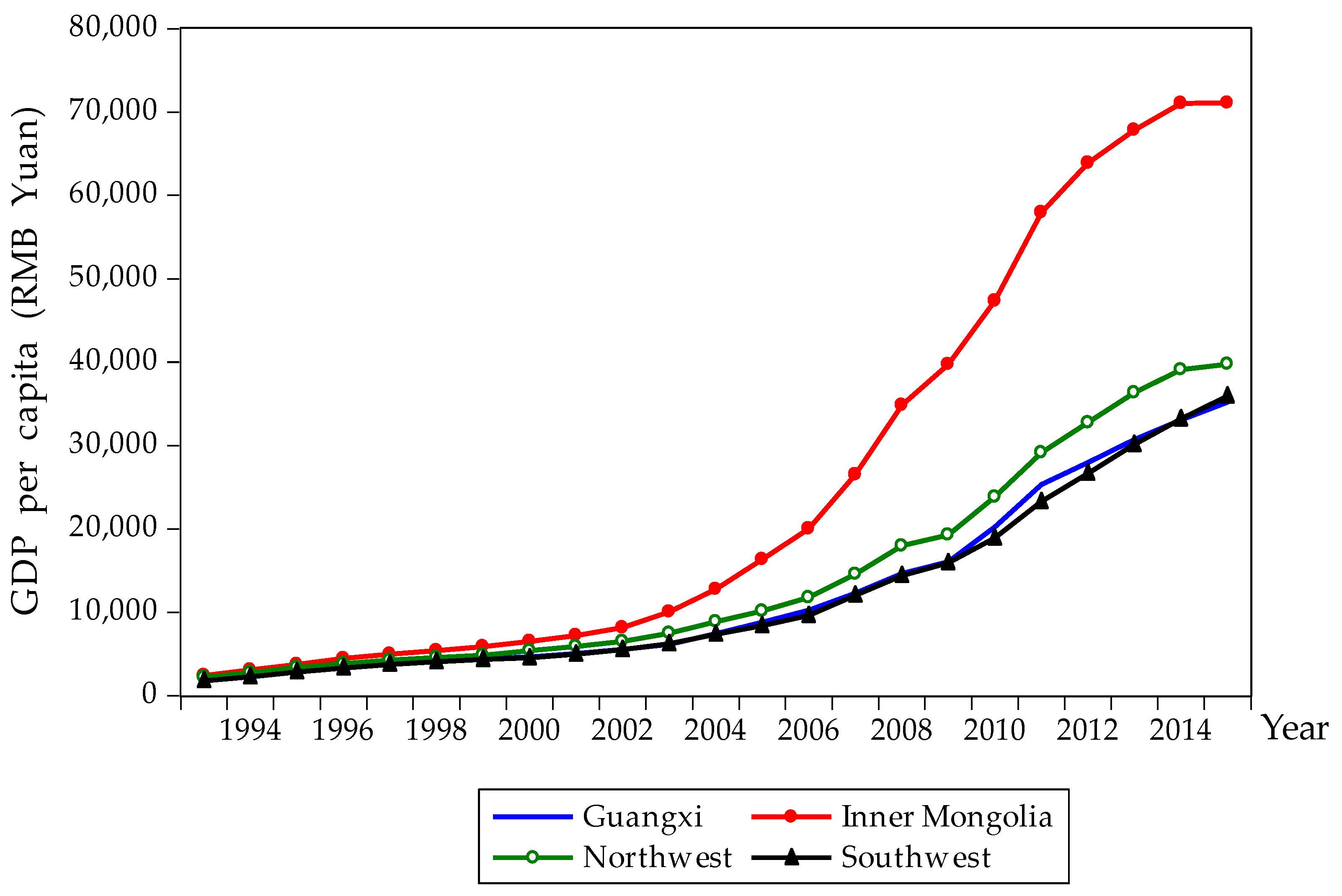

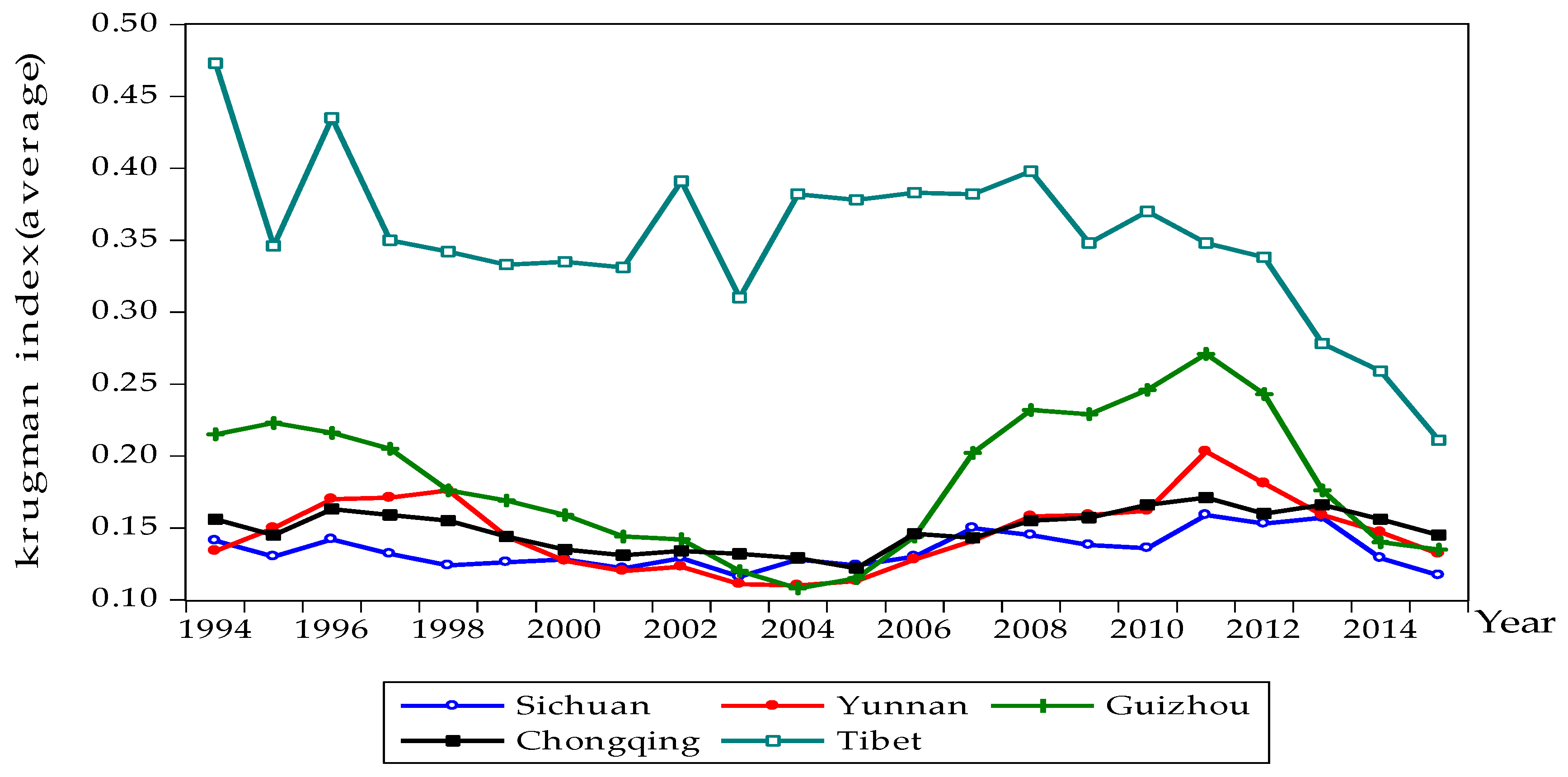

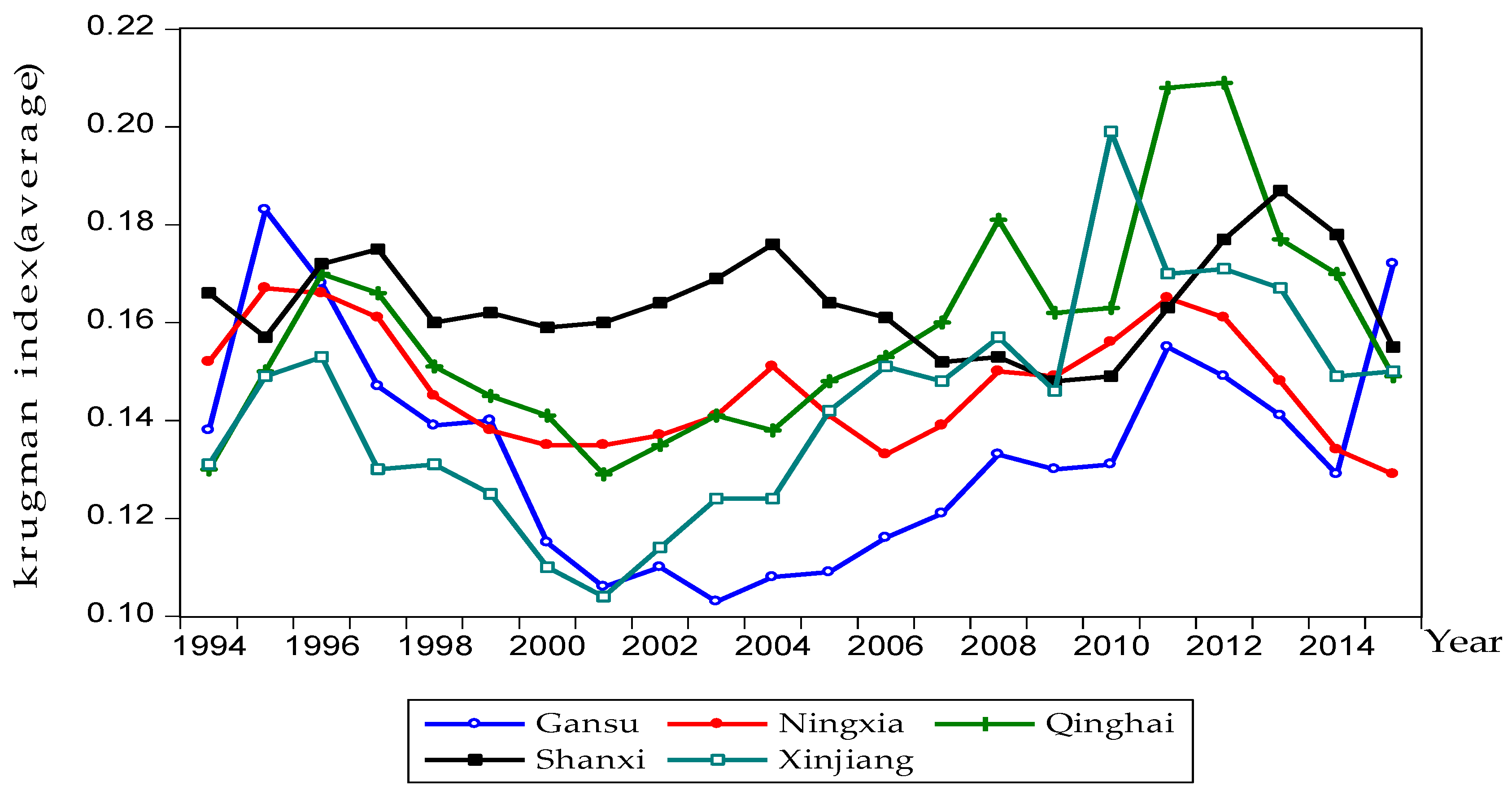

4.2. Regional Economic Difference Analysis

4.3. Influencing Factors Analysis of Regional Economic Difference

4.3.1 Moran’s I Index Calculation

4.3.2. Hausman Test

4.3.3. Extended Model Analysis

- (1)

- It was clear to see that two major capital factors played a leading role in western economic growth, which indicated that total capital formation is the main direct force of economic development since total capital formation is close with the economic activities [51,52]. At the same time, fixed asset investment (p < 0.1%) also showed positive promotion to the economic development difference [53,54].

- (2)

- Government investment expenditure (p < 0.1%) also played an important role to support the western economic growth. Government investment expenditure can promote the regional infrastructure construction, and reduce the gap of public service level between regions [40].

- (3)

- It was a disappointment to find that infrastructure construction, the length of the railway and the number of universities are not significant (p > 5%). The number of MI (p < 1%) showed a negative relationship with economic development difference, which seemed to be inconsistent with the reality, because it is common sense that the more developed a regional economy is, the more MI there would be. However, the argument that more medical institutions could promote regional economic development difference has not been tested. In China, the number of medical institutions is now growing significantly. Firstly, the “difficult to see a doctor, expensive to see a doctor” phenomenon is particularly prominent, the low living standard people do not have money to see a doctor, and many people choose not to treat the disease. Moreover, although there are many hospitals, there are only a few good hospitals. Most clinics’ sizes are small, and they lack formal medical equipment or medical resources, leading to overcrowding in large hospitals and sparsely population in small hospitals. Many hospitals lack income sources, thus the overall economic benefits are affected, resulting in the number of medical institutions negatively correlated with economic growth. The expansion of MI is not conducive to economic growth. Otherwise, the expansion of MI will promote the regional economic development difference statistically.

- (4)

- Human capital (p < 0.1%) showed a significant positive impact [55,56,57]. This result showed that higher education will promote economic development difference. Patent authorization (p < 0.1%), to a certain level, representing the regional innovation capability, was the key reason of the regional economic difference formation.

- (5)

- With the interaction of space variable W, human capital (p < 0.1%) had a significant positive influence on regional economic development difference. This showed that knowledge spatial spillover and talent flow were becoming the driving force of regional economic difference [56,58]. Especially, the better the geographical location is, the stronger the economic development force is. At the same time, the spatial function of FDI was also highly significant. The closer to the central zone a region is located, the more foreign direct investment it attracts, and the faster the economic development difference forms [59,60,61,62].

- (6)

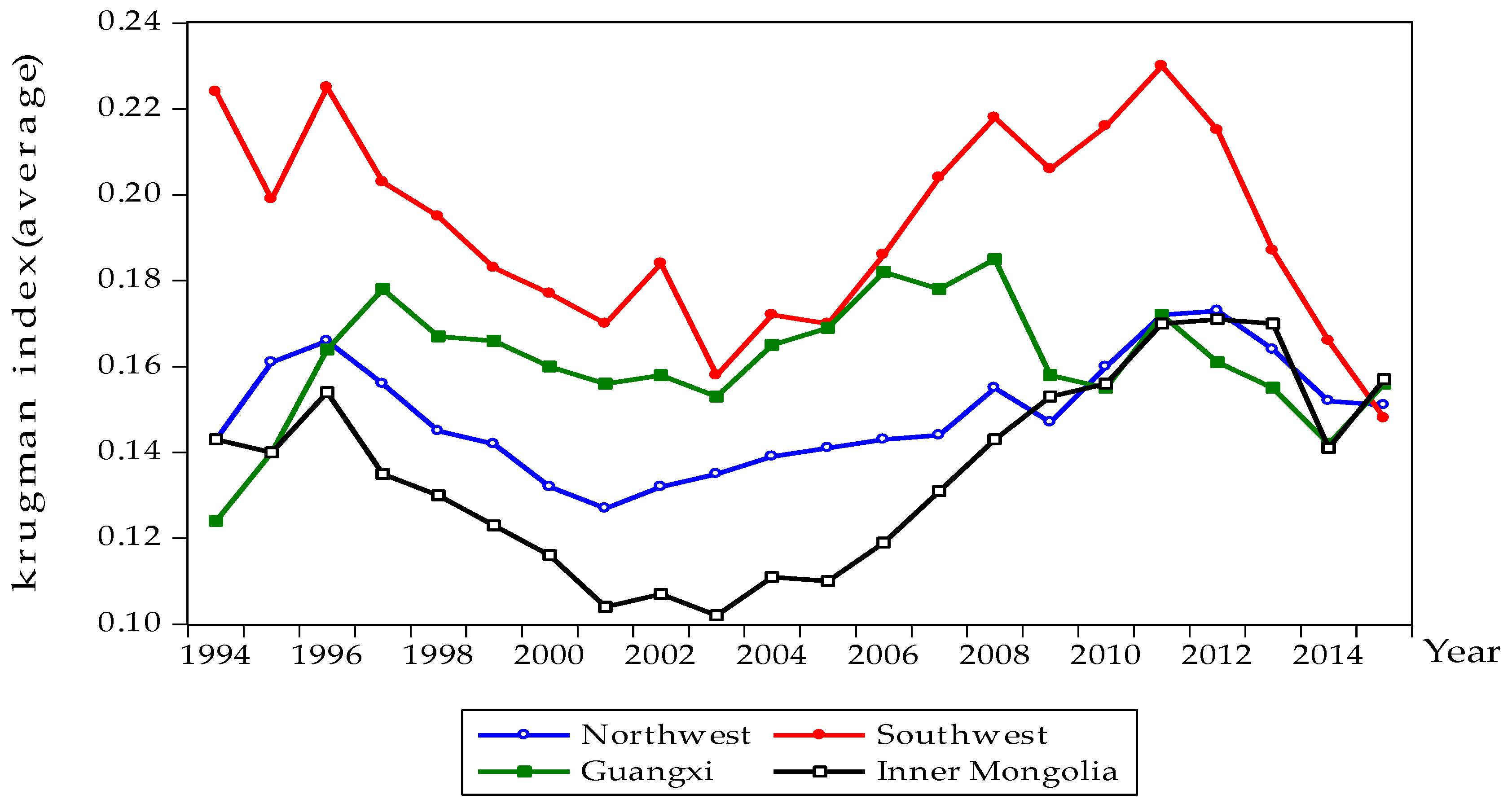

- As a control variable, Krugman index (p < 0.1%) was positive here, which indicated that the larger the Krugman index was, the lower the industrial isomorphism was, and, the more obvious the industry division of labor was, the greater the impact on economic development [42]. It should be noted that the dummy variables of DWEST did not show a significant positive effect on the development of western China.

5. Robustness Test

5.1. Filter Variable Method

- (1)

- There were five variables (p < 0.1%), which had significant positive relationship with GDP per capita to push the economic growth: the total capital formation, fixed asset investment, government expenditure, human capital, and patent authorization.

- (2)

- MI (p < 0.1%) was significant negative relate with GDP per capita.

- (3)

- The W spatial intersection with human capital (p < 5%) and foreign direct investment (p < 0.1%), respectively, can effectively promote economic growth.

- (4)

- The coefficient signal of Krugman index (p < 0.1%) was positive, which indicated that the similar industrial isomorphism resulted in western region’s industry convergence. This phenomenon was unfavorable to the western economic development in China. Thus, western regions should develop their local economic features to the industrial isomorphism. Population density (p < 0.1%) was also highly significant, indicating that the rapid economic development was closely related to regional population density.

5.2. Spatial Lag Model and Spatial Error Model

6. Discussions

- (1)

- (2)

- Increase the financial investment expenditure and make the short-term and long-term investment expenditure policies based on the contribution of the effect period to the economic growth [67,68,69]. The fiscal expenditure policy should promote the steady growth of the economy, and take full advantage of the positive expenditure effect on the economy.

- (3)

- (4)

- Take a series of measures to encourage high school students to pursue higher education, and eliminate the corresponding institutional obstacles. For example, local government should gradually eliminate the socio-economic role differences on the aspects of household registration, archives, personnel relations, etc. [72,73]. In addition, local government should use a fair entry system, and increase various types of scholarships and employment incentives to achieve a fair allocation of public resources. When we take these similar actions, local HR market will serve the flow of talent, and attract outland students learning locally and realize the human resources communication [74,75,76].

- (5)

- The quantity of patent authorization is an important performance of knowledge innovation level [9]. Knowledge innovation drives the development of local industry [73,77]. Thus, local government should pay more attention to technology development and patent protection to improve innovation level. In addition, incentive measures and action on technological transformation should be taken to promote the development of local economic development such as the tax reduction of patent application [62,78,79,80].

7. Conclusions

Supplementary Materials

Supplementary File 1Acknowledgments

Author Contributions

Conflicts of Interest

Abbreviations

| TCF | Total capital formation |

| FAI | Fixed asset investments |

| FE | Fiscal expenditure |

| FDI | Foreign direct investment |

| RLL | Railway line length |

| OHS | Ordinary higher school |

| MI | Medical institutions |

| HC | Human capital |

| PA | Patent authorization |

| Krugman | Krugman index |

| PD | Population density |

| W | Space weight matrix |

| WHC | W* Human capital |

| WFDI | W* Foreign direct investment |

| DWEST | West development dummy variables |

| FGLS | Feasible generalized least square |

| OLS | Ordinary least square |

| SLM | Spatial Lag Model |

| SEM | Spatial Error Model |

References

- Barnes, T.J. Reading Economic Geography; Blackwell Pub.: Malden, MA, USA, 2004. [Google Scholar]

- Smith, A. Reconstructing the Regional Economy: Industrial Transformation and Regional Development in Slovakia; Edward Elgar Publishing: Cheltenham, UK; Northampton, MA, USA, 1998. [Google Scholar]

- Bao, S.; Lin, S.; Zhao, C. The Chinese Economy after WTO Accession; Ashgate: Aldershot, UK; Burlington, VT, USA, 2006. [Google Scholar]

- Bowles, P.; Harriss, J.; Ebooks Corporation. Globalization and labour in china and India impacts and responses. In International Political Economy Series; Palgrave Macmillan: Basingstoke, UK; New York, NY, USA, 2010. [Google Scholar]

- Bregolat, E. The Second Chinese Revolution; Palgrave Macmillan: Basingstoke, UK, 2014. [Google Scholar]

- Teti, D.M. Handbook of Research Methods in Developmental Science; Blackwell Pub.: Malden, MA, USA, 2005. [Google Scholar]

- Khosla, P. Intra-regional trade in Africa and the impact of Chinese intervention: A gravity model approach. J. Econ. Dev. 2015, 40, 41–66. [Google Scholar]

- Sornarajah, M.; Wang, J. China, India, and the International Economic Order; Cambridge University Press: Cambridge, UK; New York, NY, USA, 2010. [Google Scholar]

- Bulman, D.J. Incentivized Development in China: Leaders, Governance, and Growth in China’s Counties; NY Cambridge University Press: New York, NY, USA, 2016. [Google Scholar]

- Peng, W.; Liu, Y. Temporal and spatial evolution characteristics of the three regional economic differences in east, west and east of China. Econ. Geogr. 2010, 30, 574–578. [Google Scholar]

- Cheng, W. Research on Regional Economic Difference and Coordinated Development in Xinjiang under the Background of “New Normal”. Master’s Thesis, Xinjiang Normal University, Urumqi, China, 2016. [Google Scholar]

- Yang, H. Analysis of regional Economic Growth Difference and Influence Factors in Henan Province. Master’s Thesis, Jilin University, Changchun, China, 2016. [Google Scholar]

- Liu, S.; Hu, A. Transportation infrastructure and economic growth: A perspective of regional difference in China. Chin. Ind. Econ. 2010, 28, 14–23. [Google Scholar]

- Capello, R.; Nijkamp, P. Handbook of Regional Growth and Development Theories; Edward Elgar Publishing Limited: Camnerley, UK, 2009. [Google Scholar]

- Crescenzi, R.; Percoco, M. Geography, institutions and regional economic performance. In Advances in Spatial Science; Springer: Heidelberg, Germany; New York, NY, USA, 2013. [Google Scholar]

- Boschma, R.A.; Kloosterman, R. Learning from Clusters: A Critical Assessment from an Economic-Geographical Perspective; Springer: Dordrecht, The Netherlands, 2005. [Google Scholar]

- Fuchs, G.; Shapira, P.; SpringerLink (Online service). Rethinking regional innovation and changepath dependency or regional breakthrough. In Economics of Science, Technology, and Innovation v 30; Springer: New York, NY, USA, 2005. [Google Scholar]

- Yu, L.; Yu, W.; Wen, W. The empirical research between the financial industry clusters and regional economic development. Lect. Notes Electr. Eng. 2013, 185, 329–341. [Google Scholar]

- Niu, L.D.; Lu, H.S.; Jiang, M.Y.; IEEE. Research on the relationship between construction land expansion and regional economic development in Yunnan urban agglomeration based on GIS. In Proceedings of the 2016 International Conference on Robots & Intelligent System (ICRIS), Zhangjiajie, China, 27–28 August 2016; pp. 387–393. [Google Scholar]

- Xu, C.; Li, J.; Ran, Y. Space-time difference research on county economy in hexi region based on different scales. Int. J. Earth Sci. Eng. 2014, 7, 771–779. [Google Scholar]

- Zhao, P.; Zhu, X. Regional economic difference in China based on different scales. J. Geogr. 2012, 67, 1085–1097. [Google Scholar]

- Galazova, S.S. Regional growth factors: Current trends. Terra Econ. 2012, 10, 141–143. [Google Scholar]

- Choi, Y.; Kim, H. Analysis of spatial association of regional economic growth and land use considering regional economic sphere. J. Korean Soc. Civil Eng. D 2008, 28, 713–721. [Google Scholar]

- Kim, E.-S.; Lee, J.H.; Hwang, J. Regional Governments consumption expenditure and regional economic growth in Korean. Gyeonggi Res. Inst. 2012, 14, 67–86. [Google Scholar]

- Kim, Y.; Han, H. The impact of service sector on regional economic growth. J. Reg. Stud. Dev. 2012, 21, 1–29. [Google Scholar]

- Berthlemy, J.-C.; Demurger, S. Foreign direct investment and economic growth: Theory and application to China. Rev. Dev. Econ. 2000, 4, 140–155. [Google Scholar] [CrossRef]

- Fleisher, B.; Li, H.; Zhao, M.Q. Human capital, economic growth, and regional inequality in China. J. Dev. Econ. 2010, 92, 215–231. [Google Scholar] [CrossRef]

- Shim, J. An analysis on correlation between infrastructure and regional economic growth. J. Ind. Econ. Bus. 2004, 17, 387–400. [Google Scholar]

- Dai, K. Analysis of Regional Economic Differences and influencing Factors in Three Provinces of Northeast China. Master’s Thesis, Shenyang University, Shenyang, China, 2016. [Google Scholar]

- Zhang, N. Spatial Statistical Analysis of Regional Economic Difference in Shaanxi Province. Master’s Thesis, Shaanxi Normal University, Xi’an, China, 2011. [Google Scholar]

- Wu, Y. Research on the Relationship between Innovation Capability and Regional Economic Development of National High Tech Parks in West China. Master’s Thesis, Southwestern University of Finance and Economics, Chengdu, China, 2012. [Google Scholar]

- Li, S. An empirical analysis of fiscal policy expenditure and economic growth—Taking Henan province as an example. Prod. Res. 2011, 26, 44–46. [Google Scholar]

- Kong, L. The Research of Impact of Fixed Asset Investment on Regional Economic Difference. Master’s Thesis, Shandong University, Jinan, China, 2013. [Google Scholar]

- Xi, J.; Liu, C.; Gao, X. Spatial statistical analysis of regional economic growth difference in Shaanxi province. Stat. Decis. 2009, 25, 92–95. [Google Scholar]

- Wang, K. Factor analysis of regional economic growth difference in western China—An empirical study of provincial panel data of manufacturing industry. Reg. Res. Dev. 2012, 31, 18–22. [Google Scholar]

- Xu, F.; Liao, G. Final consumption expenditure, total capital formation and economic growth in China—Analysis based on impulse response effect. J. Guangdong Univ. Foreign Stud. 2011, 22, 23–28. [Google Scholar]

- Wang, F. Study on the Impact of China’s High Speed Rail on Regional Economic Development. Ph.D. Dissertation, Jilin University, Changchun, China, 2012. [Google Scholar]

- McDonald, F.; Mayer, M.; Buck, T. The Process of Internationalization: Strategic, Cultural, and Policy Perspectives. In Proceedings of the 30th Conference Academy of International Business, UK Chapter, De Montfort University, Leicester, UK, 11–12 April 2003; Palgrave Macmillan: Basingstoke, UK; New York, NY, USA, 2004. [Google Scholar]

- Blenkhorn, D.L.; Fleisher, C.S. Competitive Intelligence and Global Business; Praeger Publishers: Westport, CT, USA, 2005. [Google Scholar]

- Crescenzi, R.; Giua, M. The EU cohesion policy in context: Regional growth and the influence of agricultural and rural development policies. In LEQS LSE ‘Europe in Question’ Discussion Paper Series; London School of Economics and Political Science: London, UK, 2014; Volume 85, pp. 1–56. [Google Scholar]

- Crescenzi, R.; Rodríguez-Pose, A. Innovation and regional growth in the European Union. In Advances in Spatial Science; Springer: Berlin/Heidelberg, Germany; New York, NY, USA, 2011. [Google Scholar]

- Zhao, Y.; Shi, M. Research on the isomorphism and countermeasures of manufacturing specialization and industry in southwest China. Ind. Technol. Econ. 2016, 36, 43–50. [Google Scholar]

- Zhong, Z. Proceedings of the international conference on information engineering and applications (IEA) 2012. Volume 2. In Lecture Notes in Electrical Engineering; Springer: London, UK; New York, NY, USA, 2013. [Google Scholar]

- Ruefli, T.W. Ordinal Time Series Analysis: Methodology and Applications in Management Strategy and Policy; Quorum Books: New York, NY, USA, 1990. [Google Scholar]

- Wang, X. Analysis of influencing factors of regional economic development based on spatial lag model. J. Shanxi Datong Univ. (Nat. Sci. Ed.) 2013, 29, 6–10. [Google Scholar]

- Simpson, R.; Zimmermann, M.; Ebooks Corporation. The economy of green cities a world compendium on the green urban economy. In Local Sustainability; Springer: Dordrecht, The Netherlands; New York, NY, USA, 2013. [Google Scholar]

- Morgan, G.A. Spss for Introductory Statistics: Use and Interpretation/George a. Morgan ... [et al.]; Lawrence Erlbaum: Mahwah, NJ, USA, 2007. [Google Scholar]

- Zhu, Z.; Zhang, W. Total factor productivity of industries in China under carbon emission constraints. Resour. Sci. 2015, 37, 2341–2349. [Google Scholar]

- Yao, X.; Guo, C.; Shao, S.; Jiang, Z. Total-factor co2 emission performance of China’s provincial industrial sector: A meta-frontier non-radial malmquist index approach. Appl. Energy 2016, 184, 1142–1153. [Google Scholar] [CrossRef]

- Waghmode, L.Y.; Patil, R.B. Reliability analysis and life cycle cost optimization: A case study from Indian industry. Int. J. Qual. Reliabil. Manag. 2016, 33, 414–429. [Google Scholar] [CrossRef]

- Zuo, X.; Hua, H.; Dong, Z.F.; Hao, C.X. Environmental performance index at the provincial level for China 2006–2011. Ecol. Indic. 2017, 75, 48–56. [Google Scholar] [CrossRef]

- Woronowicz, T.; Boronowsky, M.; Wewezer, D.; Mitasiunas, A.; Seidel, K.; Rada Cotera, I. Towards a regional innovation strategies modelling. Procedia Comput. Sci. 2017, 104, 227–234. [Google Scholar] [CrossRef]

- Zehender, W.; Deutsches Institut für Entwicklungspolitik. Evaluation of a Regional Development Strategy: A Case Study in the Kathmandu Growth Zone; Dt. Inst. f. Entwicklungspolitik: Berlin, Germany, 1975. [Google Scholar]

- Yusuf, S.; Evenett, S.J.; Wu, W. Facets of Globalization: International and Local Dimensions of Development; World Bank: Washington, DC, USA, 2001. [Google Scholar]

- Rao, T.V. HRD Audit: Evaluating the Human Resource Function for Business Improvement, 2nd ed.; Sage Publications India Pvt. Ltd.: New Delhi, India, 2014; p. 125. [Google Scholar]

- Vaiman, V. Talent Management of Knowledge Workersembracing the Non-Traditional Workforce; Palgrave Macmillan: New York, NY, USA, 2010. [Google Scholar]

- Toner, P. Workforce skills and innovationan overview of major themes in the literature. In OECD Science, Technology and Industry Working Papers; OECD Publishing: Paris, France, 2011. [Google Scholar]

- Youngberg, E.; Olsen, D.; Hauser, K. Determinants of professionally autonomous end user acceptance in an enterprise resource planning system environment. Int. J. Inf. Manag. 2009, 29, 138–144. [Google Scholar] [CrossRef]

- Zhang, J. Foreign Direct Investment, Governance, and the Environment in China: Regional Dimensions; Nottingham China Policy Institute: Nottingham, UK, 2013. [Google Scholar]

- Lu, X.; Yang, Z. FDI effect of regional economic integration: An estimation based on FGLS. World Econ. Papers 2009, 53, 77–90. [Google Scholar]

- Robles, J.D.; Geoffrey, J.D.H. The FDI and the Regional Development in Chile. Ph.D. Thesis, University of Illinois at Urbana-Champaign, Urbana-Champaign, IL, USA, 2010. [Google Scholar]

- Rahman, R.D.; Andreu, J.M. China and India: Towards Global Economic Supremacy? Academic Foundation: New Delhi, India, 2006; p. 249. [Google Scholar]

- Thrift, N.J.; Kitchin, R. International Encyclopedia of Human Geography; Elsevier: Amterdam, The Netherlands; London/Oxford, UK, 2009. [Google Scholar]

- Reinert, E.S.; Shafaeddin, M. Competitiveness and development myth and realities. In Anthem other Canon Series; Cambridge University Press: Cambridge, UK, 2013. [Google Scholar]

- Weaver, C. Regional Development and the Local Community, Planning, Politics, and Social Context; Wiley: Chichester Sussex, UK; New York, NY, USA, 1984. [Google Scholar]

- Teather, D.C.B.; Yee, H.S.; Campling, J. China in Transition: Issues and Policies; St. Martin’s Press: New York, NY, USA, 1999. [Google Scholar]

- Zhao, X.D.; Yeung, J.H.Y.; Zhou, Q. Competitive priorities of enterprises in Mainland China. Total Qual. Manag. 2002, 13, 285–300. [Google Scholar] [CrossRef]

- Zhang, G. Promoting IPR policy and enforcement in China summary of dialogues between OECD and China. In OECD Science, Technology and Industry Working Papers; OECD Publishing: Paris, France, 2005. [Google Scholar]

- Wong, J.; Lu, T. China’s Economy into the New Century: Structural Issues and Problems; Singapore University Press; World Scientific: Singapore, 2002. [Google Scholar]

- Yeung, Y.-M.; Shen, J. Developing China’s West: A Critical Path to Balanced National Development; Chinese University Press: Hong Kong, China, 2004. [Google Scholar]

- Wu, X.; Jiang, Y. Sectoral role change in transition china: A network analysis from 1990 to 2005. Appl. Econ. 2012, 44, 2699–2715. [Google Scholar] [CrossRef]

- Organisation for Economic Co-operation and Development. Higher education in regional and city development: The free state, South Africa 2012. In Higher Education in Regional and City Development; OECD Publishing: Paris, France, 2012. [Google Scholar]

- Yusuf, S.; Nabeshima, K. How Universities Promote Economic Growth; World Bank: Washington, DC, USA, 2007. [Google Scholar]

- Guo, R. China’s Regional Development and Tibet; Springer: Singapore, 2016. [Google Scholar]

- Flower, J. Healthcare beyond Reform: Doing It Right for Half the Cost; CRC/Taylor & Francis: Boca Raton, FL, USA, 2012. [Google Scholar]

- Dainian, F.; Cohen, R.S. Chinese studies in the history and philosophy of science and technology. In Boston Studies in the Philosophy of Science; Springer: Dordrecht, The Netherlands, 1996. [Google Scholar]

- Crescenzi, R.; Pietrobelli, C.; Rabellotti, R. Innovation drivers, value chains and the geography of multinational corporations in Europe. J. Econ. Geogr. 2014, 14, 1053–1086. [Google Scholar] [CrossRef]

- Zhu, Q.; Wu, J.; Li, X.; Xiong, B. China’s regional natural resource allocation and utilization: A dea-based approach in a big data environment. J. Clean. Prod. 2017, 142, 809–818. [Google Scholar] [CrossRef]

- Pike, A.; Rodríguez-Pose, A.; Tomaney, J. Handbook of Local and Regional Development; Routledge: London, UK; New York, NY, USA, 2011. [Google Scholar]

- Mitcham, C. Encyclopedia of Science, Technology, and Ethics; Macmillan Reference USA: Detroit, MI, USA, 2005. [Google Scholar]

| Natural logarithm of GDP per capita at the end of each year | Factor | Indicator | Symbol | Explanation | Data Source | Cite Source |

| Capital Matrix | Total capital formation | TCF | Net amount of fixed assets and inventories obtained within a certain period of time minus disposal | Download the annual data of the province from the National Bureau of Statistics (available at http: Jan Data stats. Gov. Cn Easyquery. htmCnco C01) | Xu, Fei et al. (2011) [36] | |

| Fixed assets investment | FAI | Non-monetary assets | Download the annual data of the province from the National Bureau of Statistics (available at http: Jan Data stats. Gov. Cn Easyquery. htmCnco C01) | Kong, Lingshuai (2013) [33] | ||

| Government Expenditure | Financial expenditure | FE | Investment expenditure of the Government | Download the annual data of the province from the National Bureau of Statistics (available at http: Jan Data stats. Gov. Cn Easyquery. htmCnco C01) | Li, Shuhong (2011) [32] | |

| External Environment | Foreign direct investment | FDI | Regional attraction of foreign investment | Download the annual data of the province from the National Bureau of Statistics (available at http: Jan Data stats. Gov. Cn Easyquery. htmCnco C01) | Jean-Claude Berthelemy, etc. (2000) [26] | |

| Infrastructure Matrix | Railway line length | RLL | Reflecting traffic conditions | Download the annual data of the province from the National Bureau of Statistics (available at http: Jan Data stats. Gov. Cn Easyquery. htmCnco C01) | Wang, Fengxue (2012) [37] | |

| Ordinary higher school | OHS | The construction of education | Download the annual data of the province from the National Bureau of Statistics (available at http: Jan Data stats. Gov. Cn Easyquery. htmCnco C01) | New factor | ||

| Medical institutions | MI | Health care | Download the annual data of the province from the National Bureau of Statistics (available at http: Jan Data stats. Gov. Cn Easyquery. htmCnco C01) | New factor | ||

| Knowledge Innovation Matrix | Human capital | HC | Reflecting education | Belton Fleisher et al. (2010) [27] | ||

| Patent authorization | PA | The representation of innovative ability | Download the annual data of the province from the National Bureau of Statistics (available at http: Jan Data stats. Gov. Cn Easyquery. htmCnco C01) | Wu, You (2012) [31] | ||

| Space Lag Variable | W* Human capital | WHC | Reflecting the spatial spillover effect | The weighted matrix calculated by the adjacency criterion * human capital: W*HC | Riccardo Crescenzi et al. (2014) [40,41] | |

| W* Foreign direct investment | WFDI | Reflecting the spatial spillover effect | Weight matrix calculated by Adjacency criterion * Patent Application authorization Amount: W*FDI | Riccardo Crescenzi et al.. (2014) [40,41] | ||

| Control Variables | Degree of industrial isomorphism | Krugman | Measuring the overall difference of industrial structure between regions | Zhao, Ye et al. (2016) [42] | ||

| Population density | PD | Indicators that indicate the intensity of the population everywhere | Total population of area at the end of the year/Total land area of area | Riccardo Crescenzi et al. (2014) [40,41] | ||

| West development dummy variables | DWEST | Major strategic policies in the western region | 0,1 dummy variables It is 0 before 2000, it is 1 after 2000 | Liu, Shenglong(2009) [43] |

| Variable | Mean | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|

| Y | 9.20928 | 0.9166225 | 7.33 | 11.17 |

| TCF | 2714.305 | 3556.76 | 23.07 | 15,728.14 |

| FAI | 3129.583 | 4598.551 | 21.17 | 25,525.9 |

| FE | 1071.08 | 1363.291 | 19.38 | 7497.51 |

| FDI | 11,003.27 | 15,249.63 | 93 | 88,409 |

| RLL | 0.2475379 | 0.1881398 | 0 | 1.21 |

| OHS | 35.30682 | 24.55228 | 3 | 109 |

| MI | 13,431.57 | 14,263.64 | 476 | 81,070 |

| HC | 0.0832909 | 0.062462 | 0.0094 | 0.2913 |

| PA | 3717.205 | 8120.965 | 2 | 64,953 |

| WHC | 0.3401163 | 0.2635785 | 0.0225 | 1.1797 |

| WFDI | 46,997.64 | 47,905.25 | 989 | 242,503 |

| Krugman | 0.1670833 | 0.0630569 | 0.102 | 0.473 |

| PD | 116.382 | 102.013 | 1.91 | 364.56 |

| DWEST | 0.7272727 | 0.4462077 | 0 | 1 |

| LNFE | 6.141705 | 1.39288 | 2.96 | 8.92 |

| LNTCF | 7.044091 | 1.434999 | 3.14 | 9.66 |

| LNFAI | 7.010985 | 1.547257 | 3.05 | 10.15 |

| Year | Variables | I | sd(I) | z | p-Value * |

|---|---|---|---|---|---|

| 1994 | HC | 0.187 | 0.156 | 1.783 | 0.075 |

| 1995 | HC | 0.160 | 0.156 | 1.605 | 0.108 |

| 1996 | HC | 0.152 | 0.152 | 1.603 | 0.109 |

| 1997 | HC | 0.145 | 0.150 | 1.567 | 0.117 |

| 1998 | HC | 0.119 | 0.145 | 1.453 | 0.146 |

| 1999 | HC | 0.112 | 0.140 | 1.453 | 0.146 |

| 2000 | HC | 0.110 | 0.142 | 1.418 | 0.156 |

| 2001 | HC | 0.156 | 0.147 | 1.679 | 0.093 |

| 2002 | HC | 0.168 | 0.142 | 1.816 | 0.069 |

| 2003 | HC | 0.208 | 0.138 | 2.157 | 0.031 |

| 2004 | HC | 0.223 | 0.136 | 2.308 | 0.021 |

| 2005 | HC | 0.214 | 0.135 | 2.252 | 0.024 |

| 2006 | HC | 0.219 | 0.139 | 2.229 | 0.026 |

| 2007 | HC | 0.234 | 0.143 | 2.270 | 0.023 |

| 2008 | HC | 0.257 | 0.144 | 2.424 | 0.015 |

| 2009 | HC | 0.276 | 0.145 | 2.540 | 0.011 |

| 2010 | HC | 0.267 | 0.147 | 2.425 | 0.015 |

| 2011 | HC | 0.284 | 0.150 | 2.489 | 0.013 |

| 2012 | HC | 0.301 | 0.152 | 2.584 | 0.010 |

| 2013 | HC | 0.316 | 0.151 | 2.692 | 0.007 |

| 2014 | HC | 0.330 | 0.153 | 2.750 | 0.006 |

| 2015 | HC | 0.341 | 0.155 | 2.791 | 0.005 |

| Variable | (1) | (2) |

|---|---|---|

| LNTCF | 0.318 *** | 0.368 *** |

| (12.03) | (13.80) | |

| LNFAI | 0.245 *** | 0.174 *** |

| (8.36) | (6.02) | |

| LNFE | 0.0848 *** | 0.0830 *** |

| (3.32) | (3.48) | |

| FDI | 0.000000750 | 0.000000640 |

| (1.07) | (0.88) | |

| RLL | 0.120 | 0.255 *** |

| (1.83) | (3.71) | |

| OHS | −0.000986 | −0.00177** |

| (−1.67) | (−3.12) | |

| MI | −0.00000129 ** | −0.00000107 ** |

| (−3.21) | (−2.85) | |

| HC | 1.583 *** | 1.301 *** |

| (4.97) | (4.10) | |

| PA | 0.00000341 *** | 0.00000137 |

| (3.89) | (1.52) | |

| WHC | 0.141 ** | |

| (3.03) | ||

| WFDI | 0.000000953 *** | |

| (4.42) | ||

| Krugman | 1.033 *** | 1.037 *** |

| (7.34) | (9.25) | |

| PD | −0.00391 *** | −0.00321 *** |

| (−6.45) | (−5.31) | |

| DWEST | 0.0201 | 0.0310 |

| (1.13) | (1.82) | |

| province2 | −1.265 *** | −1.175 *** |

| (−5.93) | (−5.52) | |

| province3 | −0.947 *** | −0.830 *** |

| (−6.51) | (−5.59) | |

| province4 | −0.997 *** | −0.993 *** |

| (−6.88) | (−6.76) | |

| province5 | −1.192 *** | −1.062 *** |

| (−5.06) | (−4.51) | |

| province6 | −0.247 | −0.139 |

| (−1.25) | (−0.70) | |

| province7 | −0.507 * | −0.367 |

| (−2.11) | (−1.53) | |

| province8 | −1.406 *** | −1.315 *** |

| (−8.87) | (−8.28) | |

| province9 | −1.040 *** | −0.966 *** |

| (−6.56) | (−6.04) | |

| Province 10 | −1.194 *** | −0.974 *** |

| (−5.06) | (−4.13) | |

| Province 11 | −0.408 | −0.262 |

| (−1.43) | (−0.92) | |

| Province 12 | −1.339 *** | −1.224 *** |

| (−7.25) | (−6.56) | |

| _cons | 5.745 *** | 5.638 *** |

| (22.37) | (22.01) | |

| N | 264 | 264 |

| Variable | (1) | (2) |

|---|---|---|

| LNTCF | 0.310 *** | 0.336 *** |

| (11.95) | (12.76) | |

| LNFAI | 0.257 *** | 0.216 *** |

| (9.20) | (7.94) | |

| LNFE | 0.0885 *** | 0.0930 *** |

| (3.57) | (3.81) | |

| FDI | 0.000000380 | 0.000000130 |

| (0.58) | (0.18) | |

| MI | −0.00000142 *** | −0.00000122 ** |

| (−3.59) | (−3.04) | |

| HC | 1.396 *** | 0.972 *** |

| (4.73) | (3.32) | |

| PA | 0.00000343 *** | 0.00000180 |

| (3.95) | (1.83) | |

| WHC | 0.0986 * | |

| (2.00) | ||

| WFDI | 0.000000762 *** | |

| (3.40) | ||

| Krugman | 1.003 *** | 1.028 *** |

| (7.10) | (8.58) | |

| PD | −0.00378 *** | −0.00300 *** |

| (−6.02) | (−4.72) | |

| DWEST | 0.00936 | 0.0105 |

| (0.57) | (0.64) | |

| Province 2 | −1.211 *** | −1.055 *** |

| (−5.50) | (−4.76) | |

| Province 3 | −0.924 *** | −0.793 *** |

| (−6.17) | (−5.15) | |

| Province 4 | −0.979 *** | −0.946 *** |

| (−6.55) | (−6.21) | |

| Province 5 | −1.077 *** | −0.834 *** |

| (−4.52) | (−3.46) | |

| Province 6 | −0.191 | −0.0274 |

| (−0.94) | (−0.13) | |

| Province 7 | −0.436 | −0.229 |

| (−1.76) | (−0.91) | |

| Province 8 | −1.399 *** | −1.292 *** |

| (−8.66) | (−7.87) | |

| Province 9 | −1.015 *** | −0.905 *** |

| (−6.25) | (−5.47) | |

| Province 10 | −1.130*** | −0.860 *** |

| (−4.65) | (−3.49) | |

| Province 11 | −0.338 | −0.140 |

| (−1.15) | (−0.47) | |

| Province 12 | −1.317 *** | −1.177 *** |

| (−6.89) | (−6.04) | |

| _cons | 5.656 *** | 5.459 *** |

| (21.41) | (20.65) | |

| N | 264 | 264 |

| Variable | SLM | SEM |

|---|---|---|

| Wy | 0.219 *** | |

| (3.98) | ||

| LNTCF | 0.218 *** | 0.238 *** |

| (3.41) | (3.73) | |

| LNFAI | 0.212 ** | 0.283 *** |

| (2.86) | (3.74) | |

| LNFE | 0.0605 | 0.148 ** |

| (1.20) | (2.68) | |

| FDI | 0.000000177 | 0.00000191 |

| (0.08) | (0.92) | |

| HC | 0.762 | 0.920 |

| (1.49) | (1.66) | |

| RLL | 0.0827 | 0.150 |

| (0.57) | (1.05) | |

| OHS | −0.000433 | −0.000533 |

| (−0.30) | (−0.33) | |

| MI | −0.00000114 | −0.000000211 |

| (−0.81) | (−0.13) | |

| PA | 0.00000162 | 0.00000550 |

| (0.46) | (1.52) | |

| PD | −0.00346 | −0.00507 ** |

| (−1.90) | (−2.64) | |

| DWEST | 0.0162 | 0.00852 |

| (0.55) | (0.21) | |

| Krugman | 0.855 ** | 0.837 ** |

| (2.79) | (2.64) | |

| Province 2 | −1.486 ** | −3.262 ** |

| (−2.62) | (−3.17) | |

| Province 3 | −0.705 * | −0.396 |

| (−2.49) | (−1.06) | |

| Province 4 | −1.003 *** | −1.645 *** |

| (−3.77) | (−4.86) | |

| Province 5 | −1.068 | −1.529 * |

| (−1.78) | (−2.53) | |

| Province 6 | −0.345 | −0.473 |

| (−0.73) | (−1.00) | |

| Province 7 | −0.708 | −1.538 |

| (−1.15) | (−1.94) | |

| Province 8 | −1.618 *** | −3.905 *** |

| (−3.88) | (−3.48) | |

| Province 9 | −1.101 ** | −2.307 *** |

| (−3.24) | (−3.52) | |

| Province 10 | −1.091 | −1.562 * |

| (−1.80) | (−2.53) | |

| Province 11 | −0.645 | −1.342 |

| (−1.04) | (−1.76) | |

| Province 12 | −1.281 ** | −2.119 *** |

| (−2.96) | (−3.96) | |

| _cons | 4.477 *** | 4.702 *** |

| (6.46) | (6.11) | |

| Rho | ||

| _cons | 0.0123 | |

| (1.66) | ||

| sigma | ||

| _cons | 0.116 *** | 0.119 *** |

| (22.98) | (22.98) | |

| lambda | ||

| _cons | 0.0854 ** | |

| (2.76) | ||

| N | 264 | 264 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, J.; Liu, Q.; Wang, C.; Li, H. Spatial–Temporal Modeling for Regional Economic Development: A Quantitative Analysis with Panel Data from Western China. Sustainability 2017, 9, 1955. https://doi.org/10.3390/su9111955

Zhang J, Liu Q, Wang C, Li H. Spatial–Temporal Modeling for Regional Economic Development: A Quantitative Analysis with Panel Data from Western China. Sustainability. 2017; 9(11):1955. https://doi.org/10.3390/su9111955

Chicago/Turabian StyleZhang, Jingxiao, Qiaoling Liu, Chao Wang, and Hui Li. 2017. "Spatial–Temporal Modeling for Regional Economic Development: A Quantitative Analysis with Panel Data from Western China" Sustainability 9, no. 11: 1955. https://doi.org/10.3390/su9111955