1. Introduction

Since its foundation in 1993, the European Union (EU) has been faced with periods of prosperity and recession. The most recent crisis befell Europe in the late 2000s, and was known as the European sovereign debt crisis. Several countries were driven to catastrophic situations that affected their local economies and the standard of living of their citizens [

1]. Four countries especially suffered from this crisis: Portugal, Ireland, Greece, and Spain (PIGS). These four countries overcame the situation in different ways. Economic troubles in Portugal forced it into a punishing bailout program, which cut public-sector wages and pensions and left it with an unemployment rate of 17.5% in early 2013. In 2010, Ireland faced the bankruptcies of the now defunct Anglo Irish Bank and Irish Nationwide, and was unable to rescue them on its own, thereby forcing a bailout from the EU and the International Monetary Fund (IMF). Greece is currently undergoing the third infusion of funds in its bailout program, which started in 2009. Finally, in 2012, Spain acceded to the European Stability Mechanism to recapitalise its banks.

Spain was the only country of the PIGS that, during the European debt crisis, was not formally involved in a bailout. In 2007, Spain was ranked fifth with respect to its contribution to the business economic volume in Europe and, similar to most of the economies in the EU, its figures were explained by the increasing activity of two main sectors: services and construction. Moreover, from 1994 to 2007, with a short period of stability between 1999 and 2001, manufacturers increased their levels of labour productivity [

2]. In 2010, the manufacturing industry was the only industry that presented growing rates in its contribution to the Gross National Product, while the two sectors that had traditionally contributed most to the GNP remained in recession. During 2010 and 2011, Spanish manufacturers’ contributions to the GNP were rising, and achieved rates of growth higher than 3% in 2011 [

3]. No other industry contribution to the GNP in the country was increasing with such intensity. The first quarter of 2012 started with a growth of 3% for Spanish manufacturers and fell to negative results in the second quarter of 2012 [

4]. When, in 2012, the Spanish Government launched the anti-crisis Law which curbed salaries in the public sector (

Real Decreto-ley 20/2012,

de 13 de julio,

de medidas para garantizar la estabilidad presupuestaria y de fomento de la competitividad;

Royal Decree-Law 20/2012, July, 13, Measures to guarantee budgetary stability and to promote competitiveness), manufacturers suffered a new recession due to the paralysis of business for retailers and wholesalers [

5] and, consequently, growth was not possible in the short/medium term. Together, these circumstances led manufacturing firms to play a key role in the recovery of the crisis in Spain thereby making them an interesting setting to study.

This leads us to set certain research questions: How can the phenomenon of the manufacturers’ growing contribution to GNP in periods of recession in Spain be explained? Do these firms have critical characteristics that make them the first to recover in periods of recession? This work presents a methodology that strives to answer these research questions. The application of the proposed procedure to other countries and other contexts is also proposed as a future line of research.

The majority of Spanish firms are SMEs, and represent more than 99% of the total number of firms [

2,

6]. In the case of industrial firms, in 2011, SMEs were responsible for 47.5% of the industry’s turnover, and for 48.6% of the total exports for manufacturers [

7]. However, the relevance of SMEs is not exclusive to the Spanish case nor to the manufacturing sector. In the EU, SMEs represent 99% of all enterprises and contribute to more than half of all value added created by business [

8]. The Organization for Economic Cooperation and Development (OECD) identifies SMEs as a driving force for societies that are more inclusive and prosperous, and calls for evidence in the analysis of the SME business environment [

9]. Specifically, SMEs that frequently appear as a result of an entrepreneurial activity contribute to economic growth, development, employment, and innovation. In this context, it is of the highest importance to study how SMEs manage to survive and compete in periods of crisis [

1].

The aim of the present study is to highlight what resources and capabilities allow SMEs to adapt to changing markets. Capabilities play a key role in dealing with environmental forces through resource integration [

10]. The literature summarises the key elements in the Resource-Based View (RBV) theory to explain resilience based on the idea that SMEs are able to manage resources properly in order to survive [

11].

This study proposes the use of longitudinal analysis to provide a perspective of the alignment of resources and capabilities to be successful and considers various changing market conditions for SMEs [

12,

13]. The data used in this research have been extensively detailed in the sample description section; it is important to mention, however, that the time frame (1994–2011) has been selected in such a way that it considers all years previous to the application of anti-crisis regulation, that is, before the end of 2011. In 2012, with the application of the European Stability Mechanism, market conditions radically changed for manufacturers. The anti-crisis measures entailed the interaction of two different environmental forces: the economic situation and political forces. This new situation made it necessary for manufacturers to yet again adapt to a disruption in the market that appeared when they were still adjusting to cope with the recession. The results of these anti-crisis measures are impossible to measure nowadays because data are not yet available and the Spanish Government is still maintaining certain anti-crisis interventions with respect to public salaries. Consequently, the last year considered in this research is 2011.

Regarding the literature analysed, the method proposed in this paper constitutes an extension of previous work [

14] by analysing how higher and lower levels of specific capabilities interact with the different levels of other capabilities. Not only do the results identify heterogeneity, but also how firms can be classified considering this heterogeneity, and how firms in a specific class of firms can achieve higher efficiency levels by managing their key capabilities. To achieve the goals of this work, an appropriate panel dataset has been used as well as methods that allow differences to be captured regarding how firms transform resources into results, thereby making it possible to explain heterogeneity. Data have been analysed using two different tools. Firstly, firms’ capabilities in transforming their resources into results have been captured using a methodology specifically designed to measure the efficiency of units in transforming input into outputs, known as Data Envelopment Analysis (DEA). This methodology provides an efficiency score for each company. Differences in efficiency levels have been used in previous studies to explain firms’ heterogeneity using the RBV [

15,

16]. As a second step, once an efficiency score has been obtained for each firm, the existence of a nominal variable that describes firms is proposed. This variable varies with the way that firms develop their efficiency. A simple example can be useful to illustrate this nominal variable: there is a difference in the way women and men use razors; it is clear and intrinsic to the nature of gender differences. Consequently, the razor market can be divided by gender, since there is an identified nominal variable, gender, which classifies consumers’ use. In the case of firms’ capabilities, it is observed that there are certain firms that behave differently from others, by transforming the same resources into different outputs; that is, there is durable firm’s heterogeneity that is latent. Is it possible to identify a nominal variable that explains this heterogeneity? In other words, what is the latent “gender” of the firm that aggregates firms depending on the way they adapt resources to market changes over time? The use of Latent Class Regression Analysis [

17] in this work allows the levels of this latent nominal variable to be identified. As a result, a firm’s heterogeneity is captured by studying how it transforms resources into outcomes under different market conditions over time [

13]. This approach presents a useful tool for decision makers interested in efficiency improvements and for the implementation of public policies in order to improve the growth rates of manufacturers and consequently, the GNP. In addition, a broad overview of company capabilities is shown in this work, whereby special attention is paid to the combination of Information and Technology (IT) capabilities that have yet to be studied jointly with marketing, innovation company capabilities, and market conditions in longitudinal analyses [

18]. These should be considered as complementary capabilities that contribute to performance along with other firm assets and capabilities [

19].

This work contributes to the existing literature by showing a framework that enables the identification of the resource integration needed in order to confront changes in market conditions due to environmental forces. To this end, a tool is provided that identifies firms with different needs for the development of capabilities in order to be more efficient in the market. This identification enables firms’ heterogeneity to be captured as a source of competitive advantage, and a variety of routines and investments that firms might execute over time to be identified, by making this knowledge available in the public domain. Consequently, the results provide useful implications to practitioners [

20] and give firms the opportunity to learn and apply tested successful strategies. Additionally, industry and corporate effects are combined in this paper [

21] with the analysis of resource integration proposed by the RBV of the firm [

22]. The two approaches are complementary when heterogeneity crosses the boundaries of the industry and this is captured as an explanation of how firms respond to market changes, thereby setting a better integration of their resources to increase efficiency.

In the achievement of a sustainable future for society and the economic system, the identification and understanding of those SMEs that better confront unstable markets could not only help other firms to implement better strategies based on the lessons learned, but also establish public policies aimed at improving the economic system instead of implementing policies that may negatively affect firms during times of recession [

23].

The paper is structured as follows: The Introduction covers the literature review and introduces the hypotheses. In the

Section 2, the material and methods are presented. The paper then lays out the procedures and results, and finally a discussion is provided and the main conclusions are drawn.

1.1. Literature Review

Classic theories in industrial organisation explain how the most important resources of economic income for a business unit represent specific endowments, positions and strategies followed by the firm [

21], and how industry and corporate effects should be complemented with the study of the resource environment of the firm in order to explain firm performance [

24]. On the other hand, the RBV (or capabilities theory) focuses on firms’ resources that are rare, sustainable, and difficult to imitate because they represent a source of competitive advantage and a source of within-industry heterogeneity [

25]. Specifically, in changing environments, these capabilities need to be adapted and, consequently, can be considered dynamic [

22]. The need to adapt to external forces recognises the existence of environmental forces as well as certain idiosyncratic firm attributes that explain how firms adapt to changes in the environment [

25]. Few studies consider both approaches, how firms resources into capabilities and how strategies, complemented with environmental factors, explain firms’ results [

26]. Moreover, in the presence of environmental changes, such as rapid technological changes, firms need to develop dynamic capabilities in order to address these new situations [

27]. In response to environmental and market changes, they should also develop identifiable organisational processes and reallocation of resources that, in moderately dynamic markets, could be understood as the traditional conception of routines [

28]. Exposed to market conditions, the competitive advantage potential of firm’s capabilities can then be developed by an efficient combination of business processes and resources [

29]. Consequently, to really capture the transformation of resources into competitive advantages over time, and to understand how the capability development and deployment affect firms’ performance under changing market conditions, it seems necessary to study both market conditions and firms’ resources and processes. Furthermore, the study of firms’ heterogeneity with respect to their adaptation to market conditions must include key aspects, such as the organisational capacity [

15], the environmental and market complexity [

30], and the competitive advantage developed for transforming firms’ resources into results [

16].

Inter-firm heterogeneity in terms of adaptation to market conditions is referred to in this work as the transformation of resources to create higher levels of efficiency in specific situations over time. The relationship between firms’ heterogeneity and the market has been extensively studied in the literature from various points of view, thereby providing useful insights for decision makers. One of the perspectives taken by previous analyses [

31] considers the productivity of heterogeneous firms in relation with different cap-and-trade program designs shows how these programs contribute to environmental quality while having no effect on the firms’ productivity. One interesting result [

31] is that, in monopolistic situations, the reallocation of resources intensifies with the heterogeneity of firms. However, nothing is explained regarding what happens in non-monopolistic markets. Moreover, firms’ heterogeneity has been proven to be a key determinant of the relevant decisions taken by the firm; in particular, a recent study shows how a firm’s heterogeneity explains decisions concerning internationalisation [

32]. Nevertheless, in [

32], the phenomenon is studied using cross-sectional data gathered over one single period of time. Previous studies have shown that internationalisation decisions are dynamic and can be explained by a mix of resources and capabilities managed by the firm that determine the evolution from one state of internationalisation to another [

33]. Heterogeneity in terms of individual characteristics of the firm also explains market selection [

32,

34] and how firms become more global through their access to extensive labour markets that increase firms’ productivity [

35].

Nevertheless, the effect of macro-environment forces on SME performance remains controversial. Several authors point to the idea that when firms become larger, they are less vulnerable to the macro-economic situation [

8], which is in contrast to the extended idea that SMEs adapt better to changes in the market because they present higher levels of strategic and operational flexibility due to their reduced size [

11,

26]. The adaptability of SMEs to changes in market conditions due to environment forces is based on flexibility and on the existence of a proactive attitude of the firm. Environmental forces can change the labour market, consumer demand, supply ability, and costs, thereby resulting in a volatile and uncertain market that requires a high level of adaptation of the firm’s resources [

10].

Nevertheless, most previous studies into firms’ capabilities are based on cross-sectional data that cannot capture this evolution over time and, consequently, cannot capture the firms’ adaptability to changes in the environment [

10,

36]. Repeated measures have rarely been used and only in specific contexts. For example, in [

37], only firms that are leaders in technology are considered. Other studies enfold the resource-based view theory by studying the capabilities that drive firms to adopt outsourcing in order to achieve strategic goals [

38]. Finally, there are other studies that measure a firm’s efficiency in transforming resources [

16], but the results of these studies fail to explain how market conditions and strategic decisions affect a firm’s efficiency.

1.2. Hypotheses—Marketing and IT Capabilities

Certain firms achieve superior business efficiency since they have a greater understanding of customers’ needs and wants, they provide superior services, set better strategies than their competitors, match channel requirements and developments, and are exposed to the market environment, which, in short, means that they manage tangible and intangible assets better than their competitors [

29]. Specifically, firm survival is based on being able to identify opportunities for the creation of value of a firm by the use of their capabilities as a means to improve their performance in the industry’s ever-changing landscape. Key pre-entry capabilities in diversification strategies that explain survival during an industry shakedown for manufacturers include technology, corporate-level integrative capabilities, marketing, and distribution [

39]. Specifically, distribution, advertising, R&D, and IT capabilities have been identified as the key variables for survival as well as antecedents of performance for manufacturing SMEs [

40]. The hypotheses presented in this study are based on the idea that these capabilities are a result of the correct combination of tangible and intangible assets, which explains how manufacturing SMEs respond to market changes with different levels of efficiency.

Firms’ tangible and intangible assets can be estimated by their R&D and Marketing intensity [

41] and by the complexity of the market [

30]. Specifically, in the Marketing literature, Marketing is referred to as the processes needed to meet customers’ needs, and marketing capability should be understood as the management of market sensing and customers-linking capabilities [

42]. The present work specifically focuses on the study of marketing capabilities in explaining firms’ efficiency under different market conditions rather than marketing expenditures as an input and sales as an output to measure efficiency in marketing [

43]. Efficiency refers to the outcomes a firm achieves relative to the resources it uses due to the implementation and adjustment of these business processes in response to market changes that allow firms to outperform their competitors [

16]. On assuming that marketing capabilities should include the capacity to adapt to market and environment changes, the gap should be filled between environmental needs and organisational capacity as a source to explain a firm’s heterogeneity within the industry [

30].

Given all previous reasoning, it is expected that:

Hypotheses 1 (H1). Marketing capabilities explain firms’ heterogeneity with respect to their efficiency in adapting to the market and environmental changes.

Within changing global environments, IT capabilities form part of this complex process; technological solutions are necessary to meet customers’ needs through the support of marketing activities with information technology [

44]. Firms are in need of developing new knowledge regarding markets, products, and technologies, and of combining all of this knowledge in order to develop capabilities to become more competitive [

45]. The joint analysis of marketing and IT has resulted in new approaches, such as e-marketing capabilities [

18]. However, little attention has been paid to how small- and medium-sized producers are able to adapt to market changes by combining marketing and IT capabilities as the basis for the development of any strategic advantage when firms experience environmental turbulence [

46]. In this work, the ways in which firms combine marketing and IT capabilities are suggested as predictors of firms’ efficiency. Firms can achieve a competitive advantage by using IT through the design of the appropriate IT structure and by building the capabilities needed for their management. On the one hand, IT resources include tangible, human-related, and relational resources, while, on the other hand, the concept of IT capability is defined as “a firm’s ability to mobilize and deploy IT resources effectively to perform strategic IT planning, develop Information Systems (IS) and leverage, use these systems, and manage IT functions and IT assets” [

47] (p. 329). In the study of IT capabilities, as part of the process of business value creation, two elements should be included: the resources used by the company, and the results achieved by their use, which are a reflection of the capabilities of the company. It can be assumed that the results explained by the use of IT resources show the existence of IT capabilities in the company because resources themselves cannot create any business value. In this sense, capabilities can be seen as a transformer of inputs into outputs, in other words, a latent concept that can be measured by observing how two firms using the same resources may achieve different outcome levels [

48]. For instance, the evaluation of IS has been implemented, and measures of its performance, as part of IT resource management, is integrated as a whole with all the company areas that interact to face changing environments in order to create learning and leverage, thereby contributing to the achievement of a firm’s goals [

49]. Furthermore, depending on the extent to which a firm’s goals are achieved, there exist certain IT capabilities that contribute to the development of a competitive advantage reflected on higher levels of a company’s efficiency [

50] that allow firms to create business value in changing environments [

51].

The study of the relationship between IT capabilities and firms’ outcomes has failed to show conclusive results regarding a sustainable and positive effect of this capability on performance [

52]. Not only do firms have to align IT capabilities with company strategies in order to achieve a better internal adjustment, but a firm’s environment also needs to be included in order to prevent firms from wasting their scarce resources [

53] and to develop an ability to adapt to the changing environment that refers to IT capabilities.

Previous studies have shown that IT creates business value in certain circumstances while it fails to do so in other circumstances, and it is revealed that IT does not always lead to positive outcomes, which is because IT has a different utility in stable versus dynamic environments [

47], and hence it is expected that IT capabilities capture firm heterogeneity over time [

37]:

Hypotheses 2 (H2). IT capabilities explain firms’ heterogeneity with respect to their efficiency in adapting to the market and environmental changes.

4. Discussion

In this work, a longitudinal data analysis is presented that studies the effect of key strategies that have been extensively related in the literature with firms’ success. The results from current theories from marketing and management are compared with the real results of the firms over time, in an effort to provide certain insights into how to manage resource allocation and the development of capabilities to efficiently compete in the marketplace.

Our contribution to the literature is that we offer a procedure for the analysis of firms’ heterogeneity in their capabilities and how to classify certain firms in accordance with their capabilities with the aim to identify which capabilities are best for each firm depending on the class of firms they belong to. Our procedure is based on two interesting techniques, Data Envelopment Analysis and Latent Class Regression. In our empirical analysis, a large dataset of manufacturing SMEs is analysed that supports our hypotheses and theoretical discussion. One way to identify firms that need to invest and develop certain capabilities instead of others is presented. This work provides a first step in the understanding of some previous results concerning the impact of resources and capabilities on firms’ performance since efficiency is considered an antecedent of performance.

While the literature has most often measured firm capabilities using subjective measures, or measures that are specific to the problem under analysis [

34], in this study, DEA is used to capture the ability of resources transforming into outcomes. Other methods for the estimation of firm-specific effects have been used in previous studies, such as panel data and stochastic frontier analysis [

32,

59,

75,

76], however, DEA presents a set of advantages over other methods used in previous studies, such as not imposing any functional form or distributional assumptions on the error term, and it fitted well for the available data in this work. Nevertheless, future studies testing the suitability of the combined stochastic frontier analysis to estimate firm capabilities, followed by an LCC analysis, would be desirable when appropriate data become available.

To avoid the effects of time and sector, we recommend the use of a different DEA model for each sector and for each time period to be carried out. Several previous studies use dummy variables for sector and time [

59], but such studies assume that the technology and the combination of inputs to produce outputs is the same for all sectors and only allows for constant deviations from the average frontier per sector, whereas, in this work, each sector in each time period is allowed to present a different technology. Furthermore, the practice of using dummy variables may lead to heterogeneity being masked as inefficiency [

77].

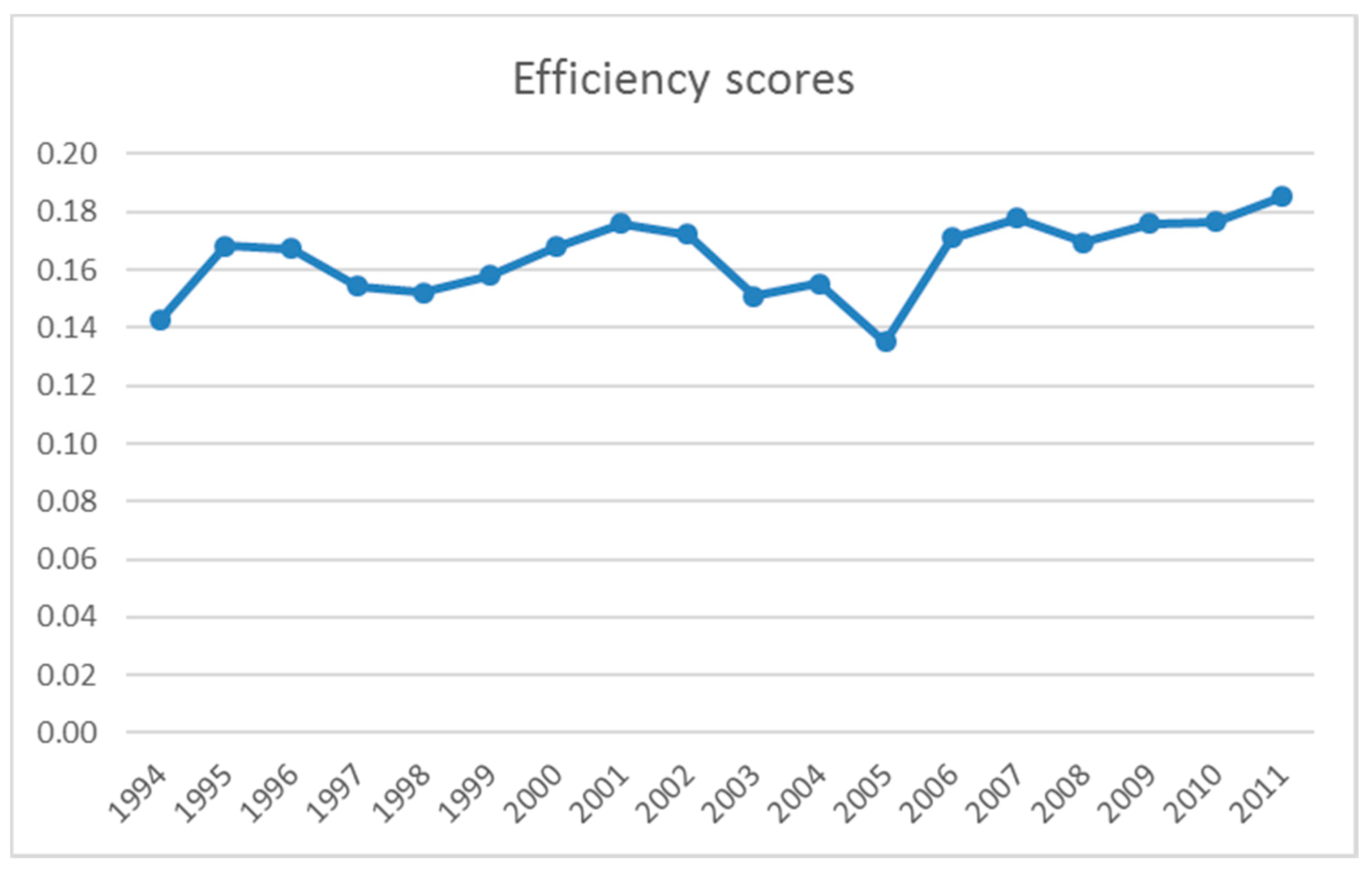

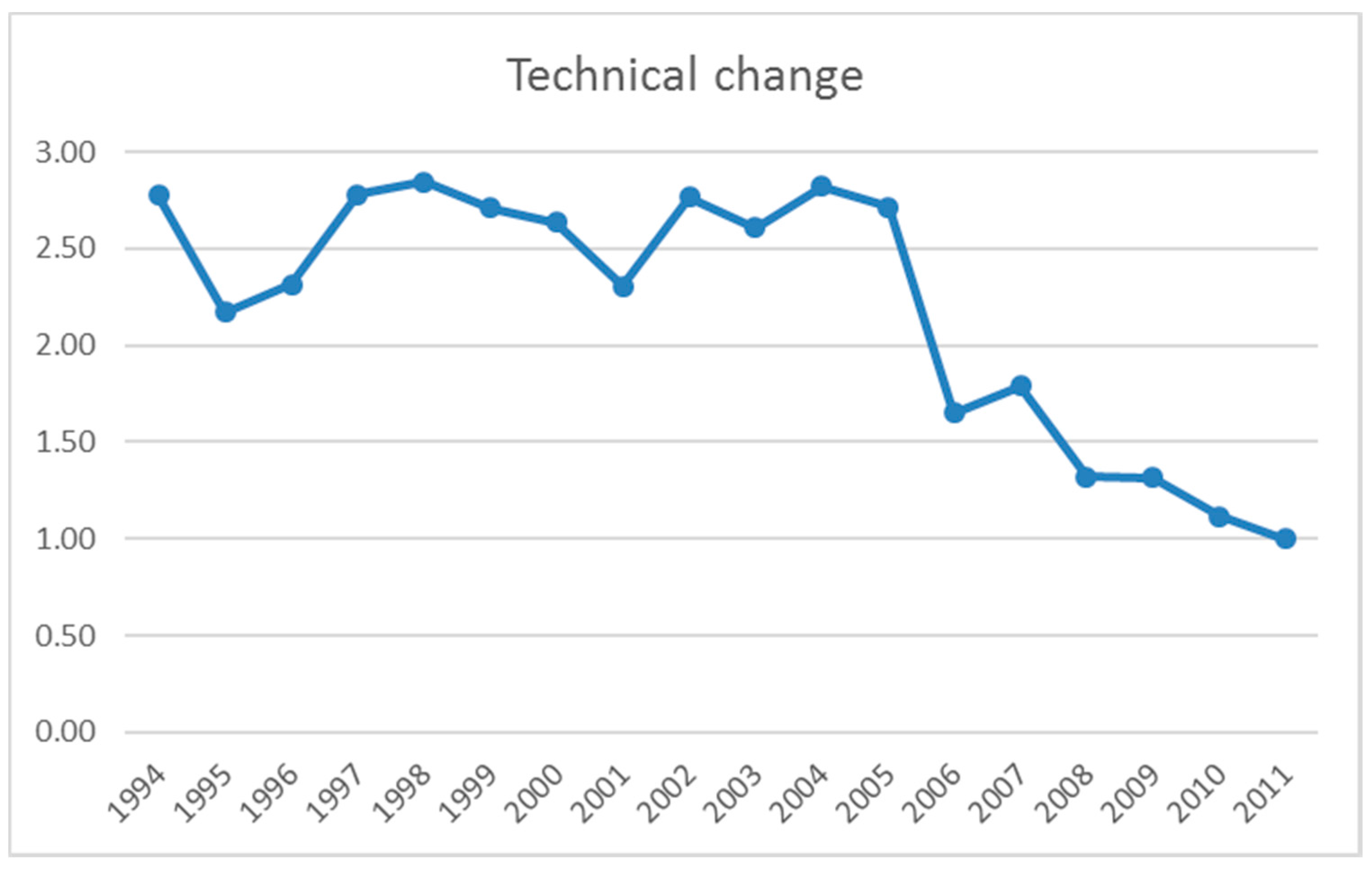

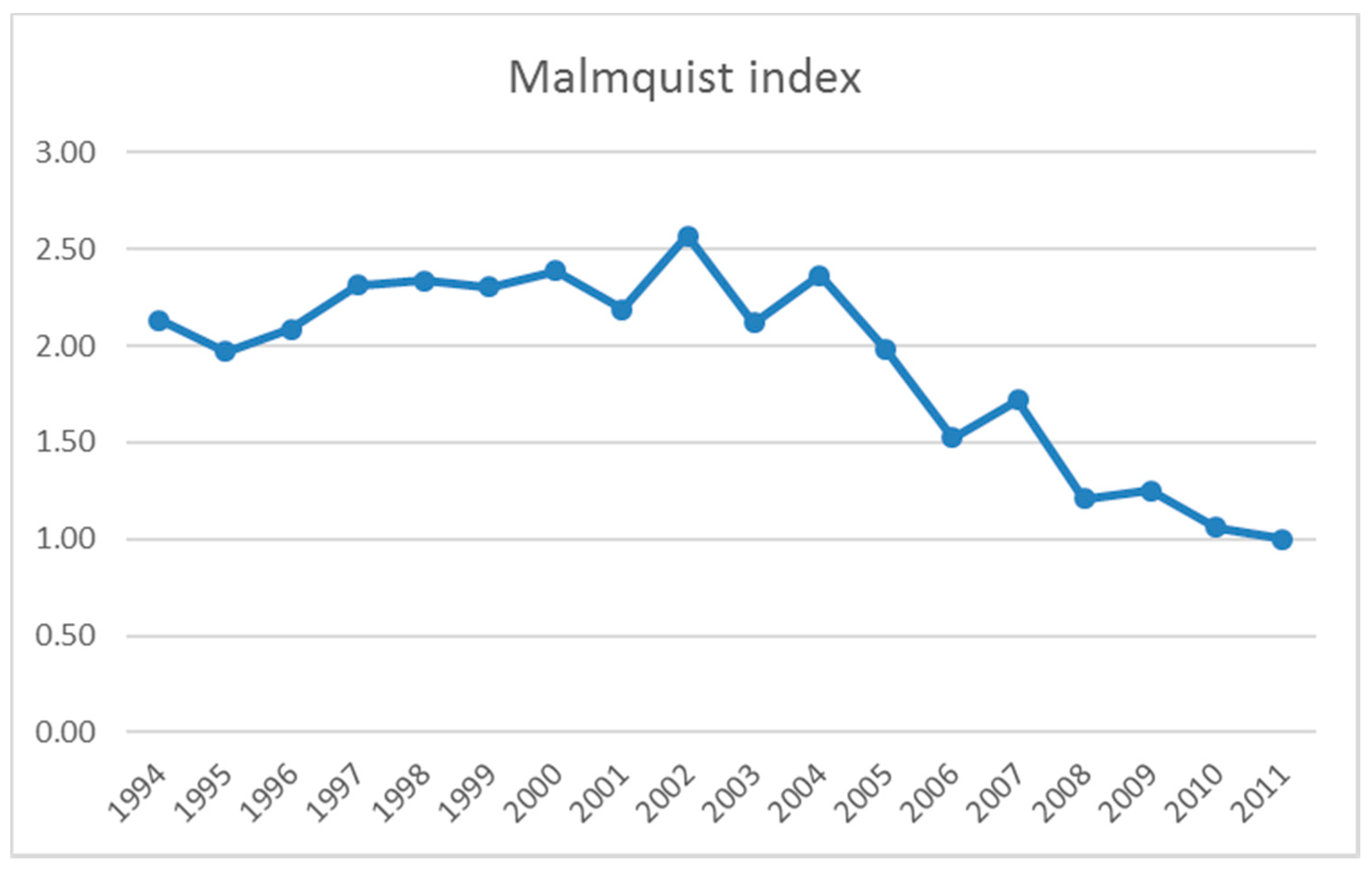

Interestingly, results show that average efficiency has steadily been increasing since the first signs of recession appeared (from 2006 onwards) while at the same time the economy shows decreasing levels of technical change over time. Several conclusions could be drawn from these results. On the one hand, it implies that only the best and most efficient firms survive adverse economic situations, thereby producing an apparent increase in average efficiency. On the other hand, it seems that firms that survive need to struggle to become more efficient, thereby moving closer to the best-practice frontier, in an effort to survive economic recessions.

Our results extend the analysis of [

78] by showing that even firms with low levels of TE can present a potential for survival if the firm develops certain capabilities. This work not only offers a new procedure to capture firm’s heterogeneity with regard to the capabilities they possess in operating efficiently in dynamic environments, but this approach also makes it possible to identify the classes of firms that develop capabilities with an exclusive combination of resources. That is, class members develop capabilities in a similar way, whereas members of other classes develop capabilities differently, and hence the resulting classification presents within-class homogeneity and interclass heterogeneity. From this analysis, it is possible to conclude that there is a nominal variable that classifies manufacturing SMEs that are analysed based on market conditions, firms’ marketing, and on IT capability effects on efficiency. This procedure extends previous work which, despite including non-linear relationships among the variables proposed, remained unable to classify firms in within-class homogeneous groups that could explain firm capabilities [

79]. Information Technology capabilities are more difficult to imitate than Marketing capabilities [

47] and therefore it is not surprising that IT capabilities present stronger effects in the explanation of firm heterogeneity than Marketing capabilities. The effect of advertising and distribution strategies should be analysed using new approaches such as serial analysis [

70]. Future analyses of the data from the firms’ Strategic Business Units may show how these firms perform and develop their competitive advantages based on Marketing capabilities [

80].

The nominal variable identified four different classes of firms. Firstly, there is a class of firms that need more flexibility in reducing its size (Class 1). There is a set of firms that take advantage of recessions through the identification and achievement of the opportunities of the crisis (Class 3). There is a third class of firms that can increase their levels of efficiency by developing IT capabilities. Finally, there is another class of firms, which are the most efficient: those that should better invest in IT capabilities while at the same time should not invest in in R&D (Class 4). The identification of these four groups allows firms to implement the theories discussed in the literature, although in the discussion of the previous literature certain approaches can appear contradictory since results show that all of the approaches are possible strategies in a recession, but are not valid for everyone. The contribution lies in the identification of those firms that should apply the most efficient strategies. For some firms, it is necessary to reduce their size, while, for others, to invest in IT capabilities [

80]. One limitation of the dataset used in this work is that it fails to allow the identification of firms; the firms in the dataset used are identified with an ID number, which prevents direct contact with the firms in the various classes requesting detailed information, such as whether they have a specific market orientation or any other characteristics that can be observed using surveys [

18,

45,

68]. This represents a limitation of the current study, but the method proposed to capture heterogeneity can be used along with other datasets such as COMPUSTAT where firms can be identified and contacted to better understand capabilities and where firms of a more diverse nature can be included in the sample.

Market conditions have been included as a result of environmental forces, that is, of a recession. Nevertheless, the concept of dynamic capabilities has not been specifically studied. The reason is that the speed of the changes produced in the market is not observed, thereby making it impossible to conclude whether markets are moderate or intensively dynamic [

28]. Future research in this vein could provide a better understanding of how firms adapt to these changes by developing dynamic capabilities. The present study presents data from times of prosperity, stability, and recession (as shown in

Figure 2) and it seems that firms have developed higher levels of efficiency due to the crisis, which implies that they are capable of adapting to changes in the environment [

22]. Further research should focus on the study of the level of dynamism of these capabilities, and on the identification of those firms that respond to changes faster than others, and on the effect of this dynamism on long-term efficiency. The present study also calls for an improvement in the method available for the analysis of mixture models (LC) and repeated measures. Although packages such as Mplus

® (Muthén & Muthén, Los Angeles, CA, USA) allow the inclusion of Structural Equation Models with non-linear effects and mediators with LC, there is no evidence in the literature that these models can be applied with repeated measures. Further research should explore methods to study how capabilities interact and mediate the apparition of efficiency.

5. Conclusions

In this work, a new procedure is offered for the analysis of firms’ heterogeneity with respect to the capabilities they possess; these capabilities are the key to achieving sustainable firms able to survive economic recessions. The most relevant conclusion from the results is that the investment in certain capabilities does not necessarily lead to better outcomes, but that it depends of each specific firm. Firms can be classified into different classes and, depending on the type of firms, some capabilities explain the results better than others, and firms can improve their levels of efficiency by investing in the specific resources that benefits them the most. Interestingly, most of the firms analysed would not achieve a competitive advantage by investing in R&D in recessive markets: less than 20% of the firms in the sample analysed (Class 3) could increase their efficiency by increasing their investment in R&D. The majority of firms, the remaining 80%, need to develop more flexibility or capabilities to improve their efficiency. Another intriguing conclusion is that, contrary to the common assumption that lower size provides more flexibility, only half of our sample should decrease its size to become more efficient during the recession analysed. The key implication for managers consists of being able to identify the class their firm belongs to and to design a proper integration of the resources. However, how to adapt to economic changes can be easily altered over time. For example, in 2011, before the intervention of the Spanish Government, manufacturing SMEs had the opportunity to develop efficiency by reducing their size and with the appropriate integration of resources. After the intervention, market conditions changed again and firms had to reorganise their strategies. Since at least 80% of the firms analysed were unprepared to make the most of the opportunities offered by a recession, they had to manage their firms without a clear understanding of their future policies.

It is challenging to solve the problem regarding the best way to manage public resources, and, unfortunately, the integration of public resources based on efficiency-enhancing key actors in the economy remains far from being put into practice.