The Role of Sustainable Investment in Climate Policy

Abstract

:1. Introduction

- Several studies argue that the transition to a low-carbon economy requires large additional investment, e.g., UNEP and IEA estimate the required additional investment at global scale to be $0.5 trillion annually by 2020 and $1 trillion annually by 2030, in order to reach the target of staying below 2 °C global warming [21]. This number would increase for a 1.5 °C target. However, academic literature on the effects of green investment programs is scarce. To address this research gap, we introduce an investment program and investigate its effects.

- Technical progress is often regarded as a key mechanism for reducing abatement costs. Wing [22] notes that computational models used to evaluate the costs and benefits of climate policy often treat technical progress as exogenous and invariant to climate policy, and therefore disregard the feedback effects involved. There is a variety of approaches for the endogenization of technical progress, from the original hypothesis on induced technical change (ITC) by Hicks [23] to directed technical change for climate change mitigation by Acemoglu [24]. Most commonly used approaches are the stock of knowledge approach (see e.g., [25]) and the learning-by-doing approach (see e.g., [26,27]). We introduce a simple learning-by-doing mechanism based on production levels.

- As pointed out by Wing [22], the endogenization of technical progress via learning-by-doing gives rise to multiple equilibria. With more than one possible equilibrium, the question of equilibrium selection arises, which causes problems in a general equilibrium framework. This problem can be described as a coordination problem (see e.g., [28,29]). To address this, we introduce a mechanism of adaptive expectations, in which investment decisions of firms are influenced by sales expectations in the specific sector.

2. Materials and Methods

2.1. Landscape

2.2. The GEM-E3 Model

2.2.1. Model Description

- Firms: Firms operate under perfect competition and use a nested production function, including capital, labour, energy and materials. Firms are characterized by myopic expectations.

- Households: Representative households (one for each country and region) maximize a utility function to determine their demand for goods and services. The household can buy durable (equipment) goods, non-durable (consumable) goods, and services. The use of durable goods requires some amounts of non-durable goods.

- Markets: Firms optimize their profits and households optimize their utility, determining supply and demand for goods and services. Equilibrium prices are derived in the market, by ensuring that supply equals demand. Consumption and investment are allocated using transition matrices.

- Technology: Technical progress is exogenously represented in the production function. In each time step, the producer can change its production inputs depending on changes in prices of labour, capital and all intermediate goods and services. The electricity sector is more detailed, differentiating between different technologies producing electricity.

- Externalities: Greenhouse gas emissions are included as an environmental externality by introducing an additional constraint on the system. The emission constraint produces a shadow price for the emissions. Firms can invest in pollution abatement capital, which reduces emissions per unit of output, and hence its costs. This version of the model does not include damages to the environment and the economy in the future.

- Output: Projections are made in 5-year intervals and include macroeconomic output (investment, capital, consumption, employment, balance of payments, input-output-tables, and others) as well as output related to energy and the environment (energy use and supply, greenhouse gas emissions, pollution permits, pollution abatement capital).

2.2.2. Investment and Related Mechanisms

- Inputs to investment: The investment demand is endogenously specified using Tobins’Q [35], by comparing the market price of capital with its replacement cost. In the current implementation, investment depends on: the optimal demand for capital (given by the production function and elasticities), the depreciation rate (technologically determined), the interest rate (arising from financial market dynamics which are outside the scope of the model), the unit cost of investment, expectations on sectoral growth (exogenously defined), as well as a calibrated scale parameter. We derived two main possibilities of influencing the investment decision:

- To change the unit cost of investment via an investment subsidy

- To endogenize expectation dynamics, such that investors learn from their past experience.

- Outputs of investment:

- Technical progress is exogenous in the model at hand. In the real-world, however, investment has an influence on technical progress - therefore this mechanism will be addressed.

- Investment influences the size of the capital stock and through that production and employment. Its effect is the substitution of labour with capital and between different types of capital - leading to higher unemployment and crowding-out of investment as a first-round effect (which is then offset through higher production levels as a second-round effect). This is an issue we will investigate in the simulation results.

2.2.3. GHG Emissions Constraint

2.3. Relevant Mechanisms and Related Model Extensions

2.3.1. Investment Program

2.3.2. Learning by Doing

2.3.3. Expectations

2.4. Scenario Description

2.4.1. Reference Scenario (Ref)

2.4.2. Climate Policy Scenario (M50 Only)

2.4.3. Variants with Model Changes

3. Results

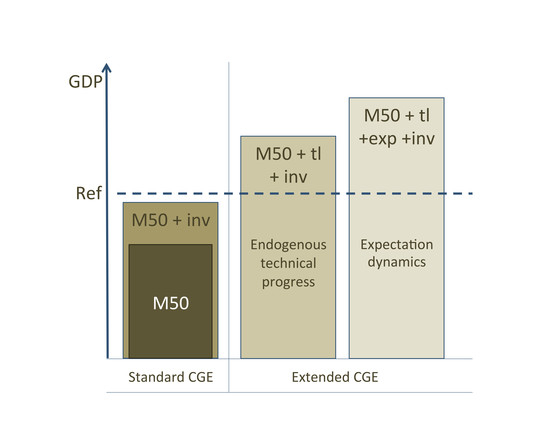

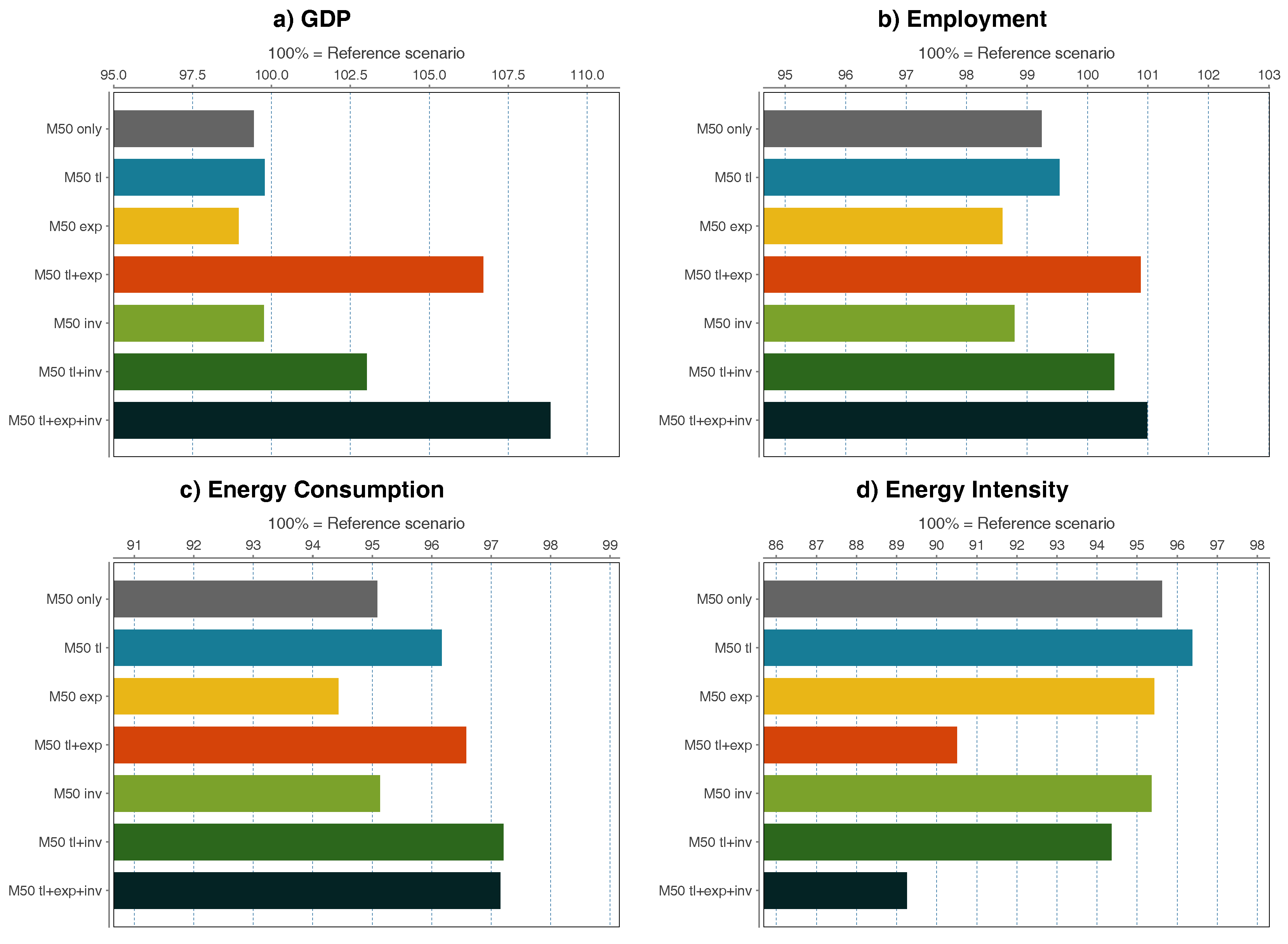

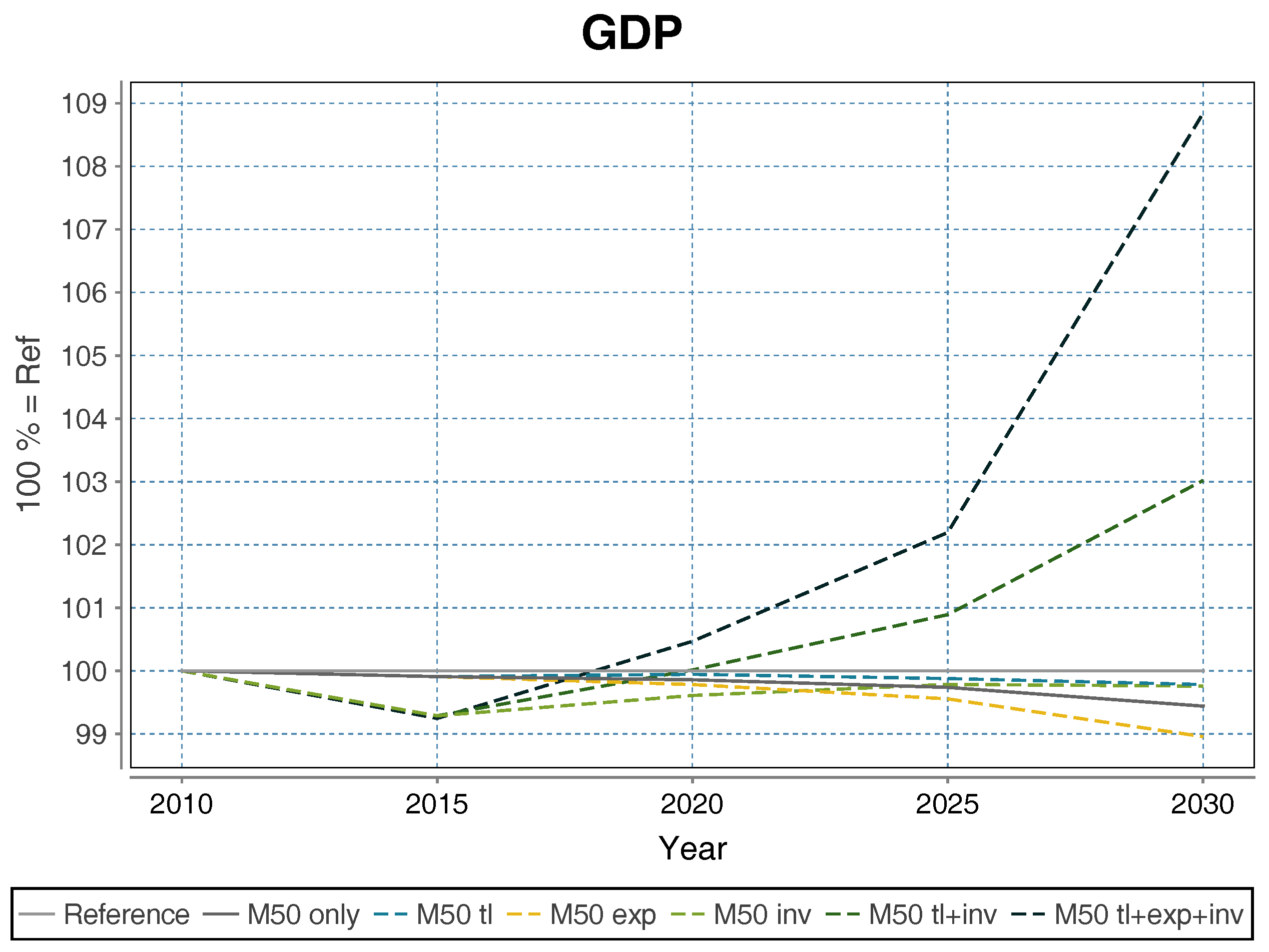

3.1. Macroeconomic Aggregates

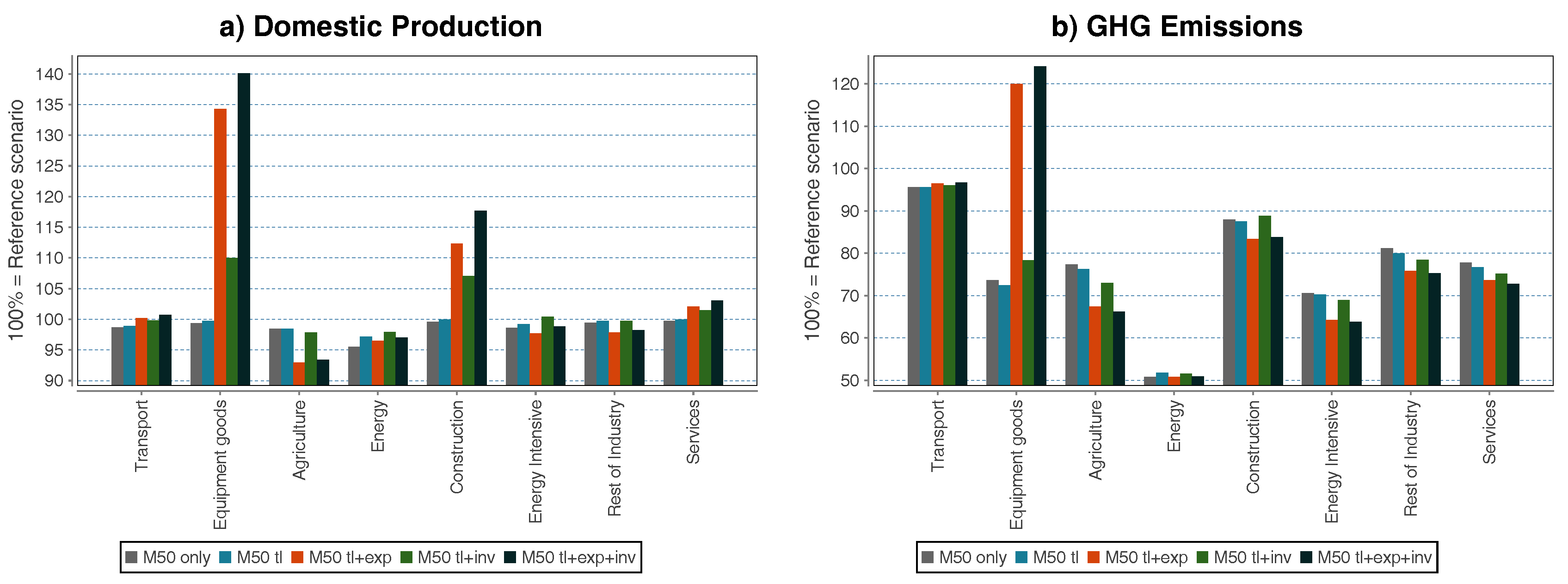

3.2. Sectoral Impacts

4. Discussion

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A. Short Technical Description of the GEM-E3-M50 Model

Appendix A.1. Firms

Appendix A.2. Households

Appendix A.3. Government Consumption

Appendix A.4. Investment

Appendix A.5. Labour Supply

Appendix A.6. GHG Emissions

Appendix B. Reference Scenario

| EU-28 | 2015–2020 | 2020–2025 | 2025–2030 |

|---|---|---|---|

| Gross Domestic Product | 1.5% | 1.6% | 1.5% |

| Investment | 1.4% | 1.6% | 1.5% |

| Public Consumption | 1.6% | 1.6% | 1.5% |

| Private Consumption | 1.6% | 1.7% | 1.6% |

| Exports | 2.0% | 2.0% | 2.1% |

| Imports | 2.3% | 2.3% | 2.3% |

| Labour productivity | 1.2% | 1.6% | 1.7% |

| EU-28 | 2015 | 2020 | 2025 | 2030 |

|---|---|---|---|---|

| Employment (in m. persons) | 224 | 227 | 227 | 225 |

| Population (in m. persons) | 434 | 436 | 432 | 425 |

| Labour Force (in m. persons) | 101 | 102 | 101 | 99 |

| Unemployment rate | 11% | 10% | 9% | 9% |

References

- Wolf, S.; Schütze, F.; Jaeger, C.C. Balance or Synergies between Environment and Economy—A Note on Model Structures. Sustainability 2016, 8, 761. [Google Scholar] [CrossRef]

- Antal, M.; van den Bergh, J.C.J.M. Green growth and climate change: Conceptual and empirical considerations. Clim. Policy 2016, 16, 165–177. [Google Scholar] [CrossRef]

- Jaenicke, M. “Green Growth”: From a growing eco-industry to economic sustainability. Energy Policy 2012, 48, 13–21. [Google Scholar] [CrossRef]

- Pollin, R. Greening the Global Economy; MIT Press: Cambridge, MA, USA, 2015. [Google Scholar]

- Jaeger, C.C.; Paroussos, L.; Mangalagiu, D.; Kupers, R.; Mandel, A.; Tábara, J.D. A New Growth Path for Europe: Generating Prosperity and Jobs in the Low-Carbon Economy; Synthesis Report; A Study Commissioned by the German Federal Ministry for the Environment; Nature Conservation and Nuclear Safety: Berlin, Germany, 2011. [Google Scholar]

- Jaeger, C.C.; Schütze, F.; Fürst, S.; Mangalagiu, D.; Meißner, F.; Mielke, J.; Steudle, G.A.; Wolf, S. Investment-Oriented Climate Policy: An opportunity for Europe; A Study Commissioned by the German Federal Ministry for the Environment; Nature Conservation, Building and Nuclear Safety: Berlin, Germany, 2015. [Google Scholar]

- Guo, L.L.; Qu, Z.; Tseng, M.L. The interaction effects of environmental regulation and technological innovation on regional green growth performance. J. Clean. Prod. 2017, 162, 864–902. [Google Scholar] [CrossRef]

- UNEP. Towards a Green Economy: Pathways to Sustainable Development and Poverty Eradication; United Nations Environment Programme: Nairobi, Kenya, 2011. [Google Scholar]

- World Economic Forum. The Green Investment Report. The Ways and Means to Unlock Private Finance for Green Growth. A Report of the Green Growth Action Alliance; World Economic Forum: Colony, Switzerland, 2013. [Google Scholar]

- Global Commission on the Economy and Climate. Better Growth, Better Climate. The New Climate Economy Report. In The Global Report; The New Climate Economy/World Resources Institute: Washington, DC, USA, 2014. [Google Scholar]

- OECD. Investing in Climate, Investing in Growth; OECD Publishing: Paris, France, 2017. [Google Scholar]

- Capros, P.; Georgakopoulos, T.; Filippoupolitis, A.; Kotsomiti, S.; Atsavesand, G.; Proost, S.; van Regemorter, D.; Conrad, K.; Schmidt, T. The GEM-E3 Model: Reference Manual; National University of Athens: Athens, Greece, 1999. [Google Scholar]

- Van der Ploeg, R.; Withagen, C. Green Growth, Green Paradox and the global economic crisis. Environ. Innov. Soc. Trans. 2013, 6, 116–119. [Google Scholar] [CrossRef]

- Intergovernmental Panel on Climate Change. Climate Change 2014: Mitigation of Climate Change; Contribution of Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change; IPCC Working Group III Contribution to AR5; Cambridge University Press: Cambridge, UK, 2014; Volume 1, pp. 1–1455. [Google Scholar]

- OECD. Climate Change: Meeting the Challenge to 2050; Policy Brief; OECD: Paris, France, 2008; pp. 1–8. [Google Scholar]

- Kriegler, E.; Tavoni, M.; Aboumahboub, T.; Luderer, G.; Calvin, K.; Demaere, G.; Krey, V.; Riahi, K.; Rösler, H.; Schaeffer, M.; et al. What Does The 2 °C Target Imply For A Global Climate Agreement In 2020? The Limits Study On Durban Platform Scenarios. Clim. Chang. Econ. (CCE) 2013, 4, 1340008. [Google Scholar] [CrossRef]

- European Commission Staff. Accompanying the Communication: A Policy Framework for Climate and Energy in the Period from 2020 up to 2030; Commission Staff Working Paper; European Commission Staff: Brussels, Belgium, 2014. [Google Scholar]

- Rosen, R.A. Is the IPCC’s 5th Assessment a denier of possible macroeconomic benefits from mitigating climate change? Clim. Chang. Econ. 2016, 7, 1640003. [Google Scholar] [CrossRef]

- Rosen, R.A.; Guenther, E. The Energy Policy Relevance of the 2014 IPCC Working Group III Report on the Macro-Economics of Mitigating Climate Change. Energy Policy 2016, 93, 330–334. [Google Scholar] [CrossRef]

- Stern, N. The Economics of Climate Change. The Stern Review; Cambridge University Press: Cambridge, UK, 2007. [Google Scholar]

- IEA. World Energy Investment Outlook; International Energy Agency: Paris, France, 2014. [Google Scholar]

- Wing, I.S. Representing induced technological change in models for climate policy analysis. Energy Econ. 2006, 28, 539–562. [Google Scholar] [CrossRef]

- Hicks, J. The Theory of Wages; Macmillan: London, UK, 1932. [Google Scholar]

- Acemoğlu, D.; Aghion, P.; Bursztyn, L.; Hemous, D. The Environment and Directed Technical Change. Am. Econ. Rev. 2012, 102, 131–166. [Google Scholar] [CrossRef] [PubMed]

- Popp, D. ENTICE: Endogenous technological change in the DICE model of global warming. J. Environ. Econ. Manag. 2004, 48, 742–768. [Google Scholar] [CrossRef]

- Grübler, A.; Messner, S. Technological change and the timing of mitigation measures. Energy Econ. 1998, 20, 495–512. [Google Scholar] [CrossRef]

- Grubb, M.; Chapuis, T.; Duong, M.H. The economics of changing course: Implications of adaptability and inertia for optimal climate policy. Energy Policy 1995, 23, 417–431. [Google Scholar] [CrossRef] [Green Version]

- Bryant, J. A Simple Rational Expectations Keynes-Type Model. Q. J. Econ. 1983, 98, 525–528. [Google Scholar] [CrossRef]

- Cooper, R.; John, A. Coordinating Coordination Failures in Keynesian Models. Q. J. Econ. 1988, 103, 441–463. [Google Scholar] [CrossRef]

- Arrow, K.J.; Debreu, G. Existence of an Equilibrium for a Competitive Economy. Econ. Soc. 1954, 22, 265–290. [Google Scholar] [CrossRef]

- Boeters, S.; Savard, L. The Labour Market in CGE Models; ZEW—Centre for European Economic Research: Mannheim Germany, 2011; pp. 1–95. [Google Scholar]

- Balistreri, E.J.; Rutherford, T.F. Chapter 23—Computing General Equilibrium Theories of Monopolistic Competition and Heterogeneous Firms. In Handbook of Computable General Equilibrium Modeling; Dixon, P.B., Jorgenson, D.W., Eds.; Elsevier: Amsterdam, The Netherlands, 2013; Volume 1, pp. 1513–1570. [Google Scholar]

- Tarr, D.G. Chapter 6—Putting Services and Foreign Direct Investment with Endogenous Productivity Effects in Computable General Equilibrium Models. In Handbook of Computable General Equilibrium Modeling; Dixon, P.B., Jorgenson, D.W., Eds.; Elsevier: Amsterdam, The Netherlands, 2013; Volume 1, pp. 303–377. [Google Scholar]

- Capros, P.; van Regemorter, D.; Paroussos, L.; Karkatsoulis, P.; Fragkiadakis, C.; Tsani, S.; Charalampidis, I.; Revesz, T. GEM-E3 model documentation. JRC Sci. Policy Rep. 2013, 26034. [Google Scholar] [CrossRef]

- Tobin, J. A general equilibrium approach to monetary theory. J. Money Credit Bank. 1969, 1, 15–29. [Google Scholar] [CrossRef]

- Bowen, A.; Fankhauser, S.; Stern, N.; Zenghelis, D. An Outline of the Case for a ’Green’ Stimulus; Policy Brief; Grantham Research Institute on Climate Change and the Environment: London, UK; Centre for Climate Change Economics and Policy: Leeds, UK, 2009. [Google Scholar]

- Edenhofer, O.; Stern, N. Towards a global green recovery. Recommendations for immediate G20 action. In Report Submitted to the G20 London Summit; Potsdam Institute for Climate Impact Research: Potsdam, Germany; Grantham Research Institute on Climate Change and the Environment: London, UK, 2009. [Google Scholar]

- Zenghelis, D. A Macroeconomic Plan for a Green Recovery; Grantham Research Institute on Climate Change and the Environment: London, UK; Centre for Climate Change Economics Policy Paper: Leeds, UK, 2011. [Google Scholar]

- Beyerle, H.; Fricke, T. A Climate Deal to Rescue Europe. In Proceedings of the Workshop Report: A European Climate Foundation Workshop, Berlin, Germany, 7–8 May 2014. [Google Scholar]

- Schepelmann, P.; Stock, M.; Koska, T.; Schüle, R.; Reutter, O. A Green New Deal for Europe: Towards Green Modernisation in the Face of Crisis; Green New Deal Series; Green European Foundation: Luxembourg, 2009; Volume 1. [Google Scholar]

- Zenghelis, D. A Strategy for Restoring Confidence and Economic Growth through Green Investment and Innovation; Grantham Research Institute on Climate Change and the Environment: London, UK; Centre for Climate Change Economics and Policy: Leeds, UK, 2012. [Google Scholar]

- Romani, M.; Stern, N.; Zenghelis, D. The basic economics of low-carbon growth in the UK. In Policy Brief; Grantham Research Institute on Climate Change and the Environment: London, UK; Centre for Climate Change Economics and Policy: Leeds, UK, 2011. [Google Scholar]

- Arrow, K.J. The Economic Implications of Learning by Doing. Rev. Econ. Stud. 1962, 29, 155–173. [Google Scholar] [CrossRef]

- Wright, T. Factors affecting the cost of airframes. J. Aeronaut. Sci. 1936, 3, 112–118. [Google Scholar] [CrossRef]

- Nagy, B.; Farmer, J.D.; Trancik, J.E.; Bui, Q.M. Testing Laws of Technological Progress; SFI Working Paper; Santa Fe Institute: Santa Fe, NM, USA, 2010. [Google Scholar]

- European Commission. The 2012 Ageing Report. Economic and Budgetary Projections for the 27 EU Member States (2010–2060); European Commission: Brussels, Belgium, 2012. [Google Scholar]

| Abbreviation | Scenario | Description |

|---|---|---|

| Ref | Reference | Optimal path, assuming a business-as-usual policy framework |

| M50 only | M50 | 50% reduction of GHG emissions compared to 1990 |

| M50 inv | M50 with investment program | Part of the investment required to decarbonize the EU economy is financed by increasing consumption taxes |

| M50 tl | M50 with technical progress | Learning by doing effects are introduced in the sectors producing both clean energy technologies and other equipment goods |

| M50 exp | M50 with adaptive expectations | The investment decision of firms is adjusted so as incorporate expectation dynamics, next to myopic expectations |

| M50 tl + inv | M50 with technical progress and investment program | |

| M50 tl + exp | M50 with technical progress and adaptive expectations | |

| M50 tl + exp + inv | M50 with technical progress, adaptive expectations and investment program |

| M50 only | M50 tl | M50 exp | M50 inv | tl + exp + inv | |

|---|---|---|---|---|---|

| GDP | −0.56% | −0.22% | −1.04% | −0.24% | +9.73% |

| Employment | −0.76% | −0.46% | −1.41% | −1.21% | +1.18% |

| Energy Use | −4.91% | −3.83% | −5.57% | −4.87% | −2.73% |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Schütze, F.; Fürst, S.; Mielke, J.; Steudle, G.A.; Wolf, S.; Jaeger, C.C. The Role of Sustainable Investment in Climate Policy. Sustainability 2017, 9, 2221. https://doi.org/10.3390/su9122221

Schütze F, Fürst S, Mielke J, Steudle GA, Wolf S, Jaeger CC. The Role of Sustainable Investment in Climate Policy. Sustainability. 2017; 9(12):2221. https://doi.org/10.3390/su9122221

Chicago/Turabian StyleSchütze, Franziska, Steffen Fürst, Jahel Mielke, Gesine A. Steudle, Sarah Wolf, and Carlo C. Jaeger. 2017. "The Role of Sustainable Investment in Climate Policy" Sustainability 9, no. 12: 2221. https://doi.org/10.3390/su9122221