Analyzing the Learning Path of US Shale Players by Using the Learning Curve Method

Abstract

:1. Introduction

2. Literature Review

2.1. Learning Rate of Energy Industry

2.2. Learning Rate of Shale Industry

2.3. Opportunity for Technological Development of the Shale Industry

3. Methodology

3.1. Learning Rate Method

3.2. Data Collection

4. Results and Discussion

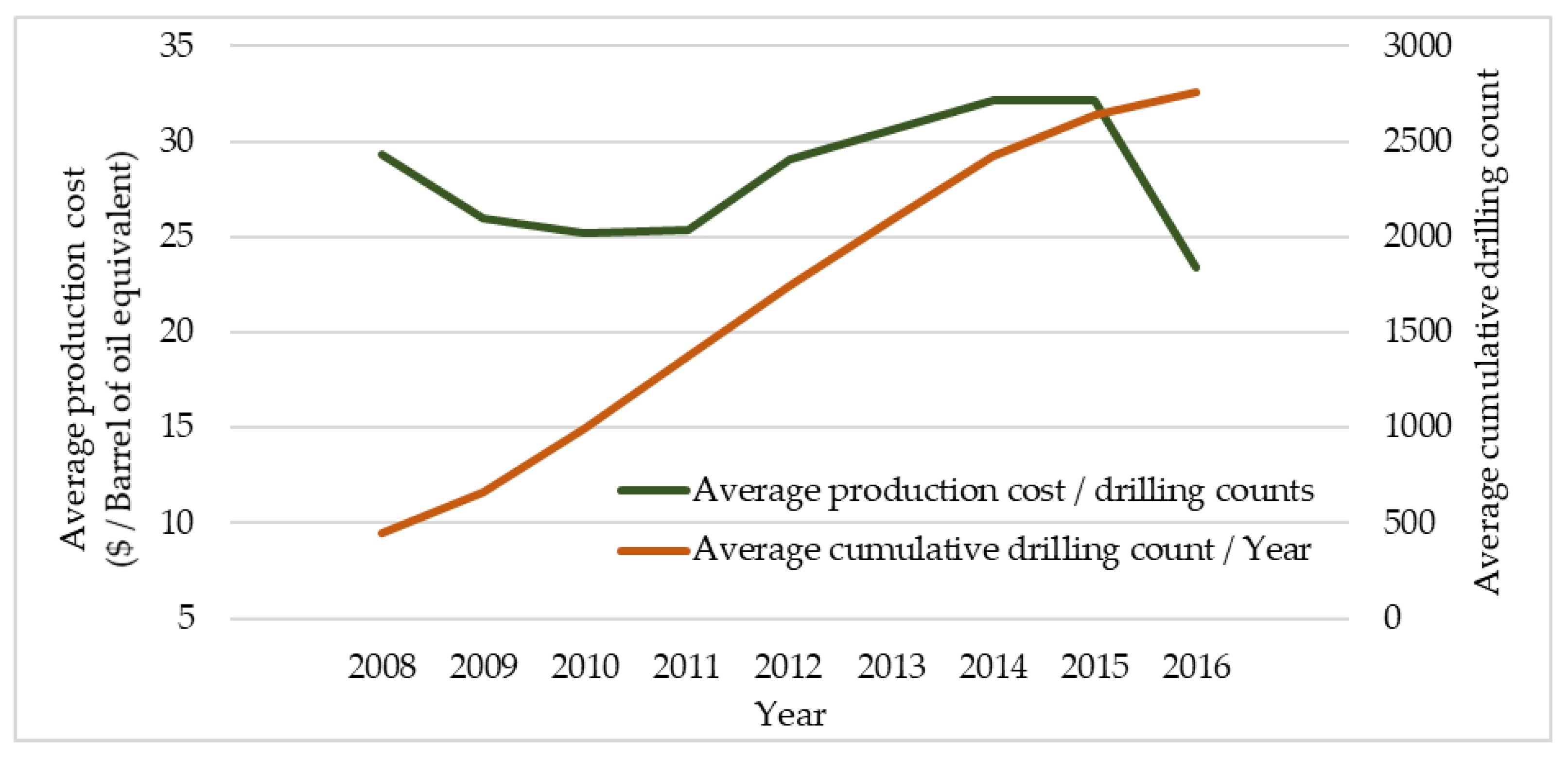

4.1. Basic Review of Drilling and Production Cost

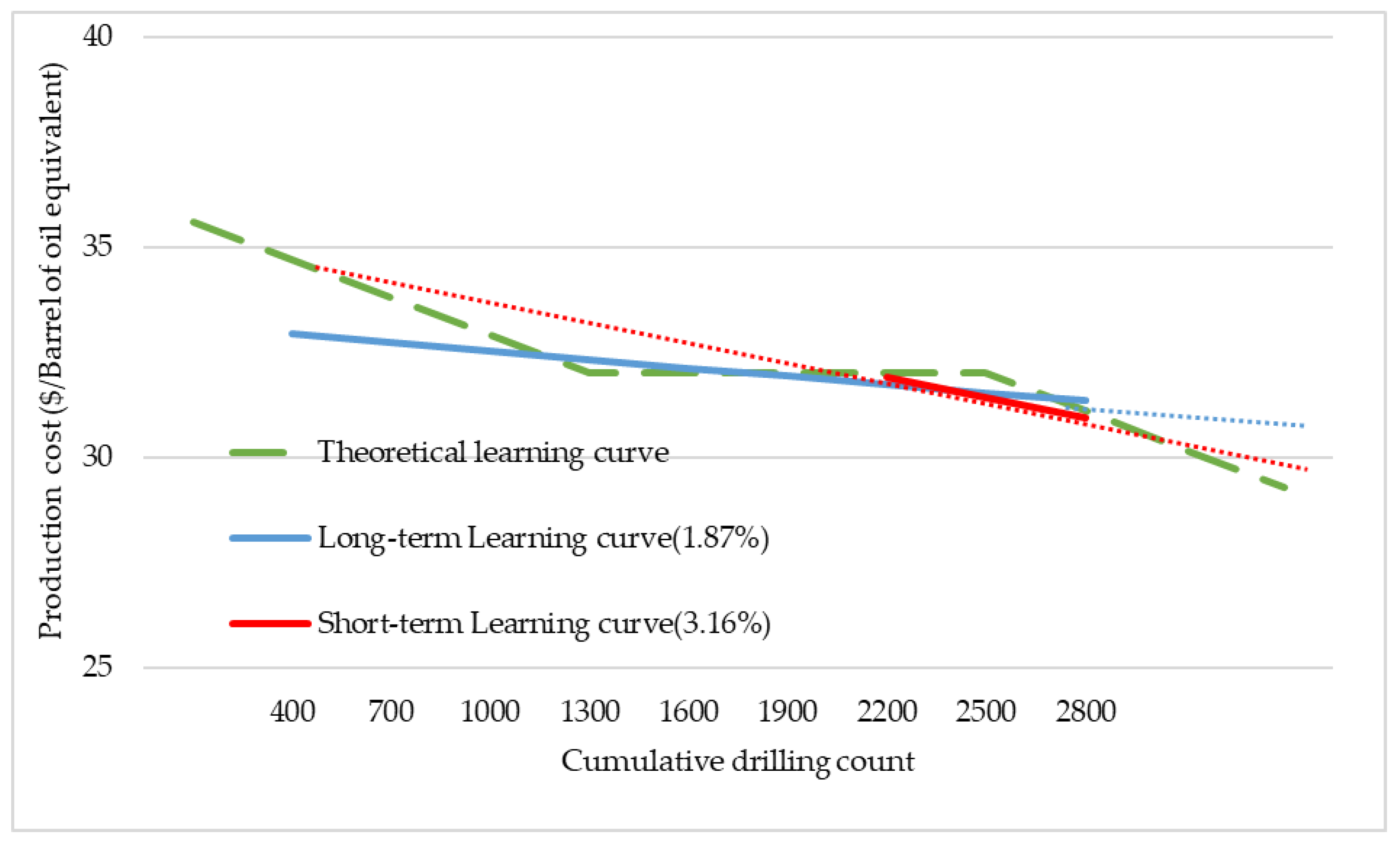

4.2. Results from the Measurement of Learning Curves

4.3. Discussion

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Hartmann, B.; Sam, S. What Low Oil Prices Really Mean. Harv. Bus. Rev. Digit. Artic. 2016, 2–6, March 28. [Google Scholar]

- Behar, A.; Ritz, R.A. An Analysis of OPEC’s Strategic Actions, US Shale Growth and the 2014 Oil Price Crash; IMF Working Paper 16/131; International Monetary Fund: Washington, DC, USA, 2016.

- US Energy Information Administration (EIA). Annual Energy Outlook 2016 with Projection to 2040; US Energy Information Administration: Washington, DC, USA, 2016.

- Wright, T.P. Factors affecting the costs of airplanes. J. Aeronaut. Sci. 1936, 3, 122–128. [Google Scholar] [CrossRef]

- Buzzell, R.D.; Gale, B.T.; Sultan, R.M. Market share—A key to profitability. Harv. Bus. Rev. 1975, 53, 97–106. [Google Scholar]

- Day, G.S.; Montgomery, D.B. Diagnosing the experience curve. J. Mark. 1983, 47, 44–58. [Google Scholar] [CrossRef]

- Wene, C.O. Experience Curves for Energy Technology Policy; International Energy Agency (IEA): Paris, France, 2000. [Google Scholar]

- Oh, D.-H.; Lee, Y.-G. Productivity decomposition and economies of scale of Korean fossil-fuel power generation companies: 2001–2012. Energy 2016, 100, 1–9. [Google Scholar] [CrossRef]

- Hong, S.; Chung, Y.; Woo, C. Scenario analysis for estimating the learning rate of photovoltaic power generation based on learning curve theory in South Korea. Energy 2015, 79, 80–89. [Google Scholar] [CrossRef]

- Kahouli-Brahmi, S. Technological learning in energy-environment-economy modelling: A survey. Energy Policy 2008, 36, 138–162. [Google Scholar] [CrossRef]

- Lundvall, B.A.; Dosi, G.; Freeman, C.; Nelson, R.; Silverberg, G.; Soete, L. Innovation as an Interactive Process: From User-Producer Interaction to the National System Of Innovation, Technical Change and Economic Theory; Pinter: London, UK, 1988; pp. 349–369. [Google Scholar]

- Fukui, R.; Greenfield, C.; Pogue, K.; der Zwaan, B. Experience curve for natural gas production by hydraulic fracturing. Energy Policy 2017, 105, 263–268. [Google Scholar] [CrossRef]

- Covert, T.R. Experiential and Social Learning in Firms: The Case of Hydraulic Fracturing in the Bakken Shale; Harvard Environmental Economics Program: Cambridge, MA, USA, 2014. [Google Scholar]

- Middleton, R.S.; Gupta, R.; Hyman, J.D.; Viswanathan, H.S. The shale gas revolution: Barriers, sustainability, and emerging opportunities. Appl. Energy 2017, 199, 88–95. [Google Scholar] [CrossRef]

- Striolo, A.; Cole, D.R. Understanding Shale Gas: Recent Progress and Remaining Challenges. Energy Fuels 2017, 31, 10300–10310. [Google Scholar] [CrossRef]

- Chang, H.; You, F. Deciphering the true life cycle environmental impacts and costs of the mega-scale shale gas-to-olefins projects in the United States. Energy Environ. Sci. 2016, 9, 820–840. [Google Scholar]

- Weijermars, R. Shale gas technology innovation rate impact on economic Base Case—Scenario model benchmarks. Appl. Energy 2015, 139, 398–407. [Google Scholar] [CrossRef]

- Curtis, T. Unravellling the US Shale Productivity Gains; Oxford Institute for Energy Studies: Oxford, UK, 2016. [Google Scholar]

- Energy Information Administration (EIA). Trends in U.S. Oil and Natural Gas Upstream Costs; Energy Information Administration: Washington, DC, USA, 2016.

- Arrow, K.J. The Economic Implications of Learning by Doing. Rev. Econ. Stud. 1962, 29, 155–173. [Google Scholar] [CrossRef]

- Schaeffer, G.J.; Seebregts, A.J.; Beurskens, L.W.M.; Moor, H.H.C.; Alsema, E.A.; Sark, W.; Durstewicz, M.; Perrin, M.; Boulanger, P.; Laukamp, H.; et al. Learning from the Sun; Analysis of the Use of Experience Curves for Energy Policy Purposes-The Case of Photovoltaic Power; Final Report of the Photex Project, DEGO: ECN-C–04-035; Energy Research Centre of the Netherlands: Petten, The Netherlands, 2004. [Google Scholar]

| Wright’s Formula [4] | ||||||

| Variables | Y | X | n | |||

| mean | Production cost | Production quantity | Decline rate | |||

| Fukui’s Formula [12] | ||||||

| Variables | . | LR | ||||

| mean | Unit production cost | Unit production cost of first year | Cumulative drilling count | Cumulative drilling count of first year | Learning parameter | Learning rate |

| Year | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

|---|---|---|---|---|---|---|---|---|---|

| $/BOE | 29.35 | 25.94 | 25.20 | 25.35 | 29.10 | 30.66 | 32.19 | 32.18 | 23.42 |

| Long-Term Regression Model (2008–2016) | Short-Term Regression Model (2014–2016) | |

|---|---|---|

| R2 | 0.096 | 0.098 |

| F | Less than 0.000 | 0.015 |

| Long-Term Learning Curve (2008–2016) | Short-Term Learning Curve (2014–2016) | |

|---|---|---|

| LR (Learning rate) | 1.87% | 3.16% |

| L (Learning parameter) | 0.0272 | 0.0464 |

| P(X0) (First year production cost) ($/BOE) | 32.93 | 31.92 |

| Required time approaching to double experience (year) | 3.05 | 2.02 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, J.-H.; Lee, Y.-G. Analyzing the Learning Path of US Shale Players by Using the Learning Curve Method. Sustainability 2017, 9, 2232. https://doi.org/10.3390/su9122232

Kim J-H, Lee Y-G. Analyzing the Learning Path of US Shale Players by Using the Learning Curve Method. Sustainability. 2017; 9(12):2232. https://doi.org/10.3390/su9122232

Chicago/Turabian StyleKim, Jong-Hyun, and Yong-Gil Lee. 2017. "Analyzing the Learning Path of US Shale Players by Using the Learning Curve Method" Sustainability 9, no. 12: 2232. https://doi.org/10.3390/su9122232