Identifying Critical Factors Influencing the Rents of Public Rental Housing Delivery by PPPs: The Case of Nanjing

Abstract

:1. Introduction

2. Literature Review

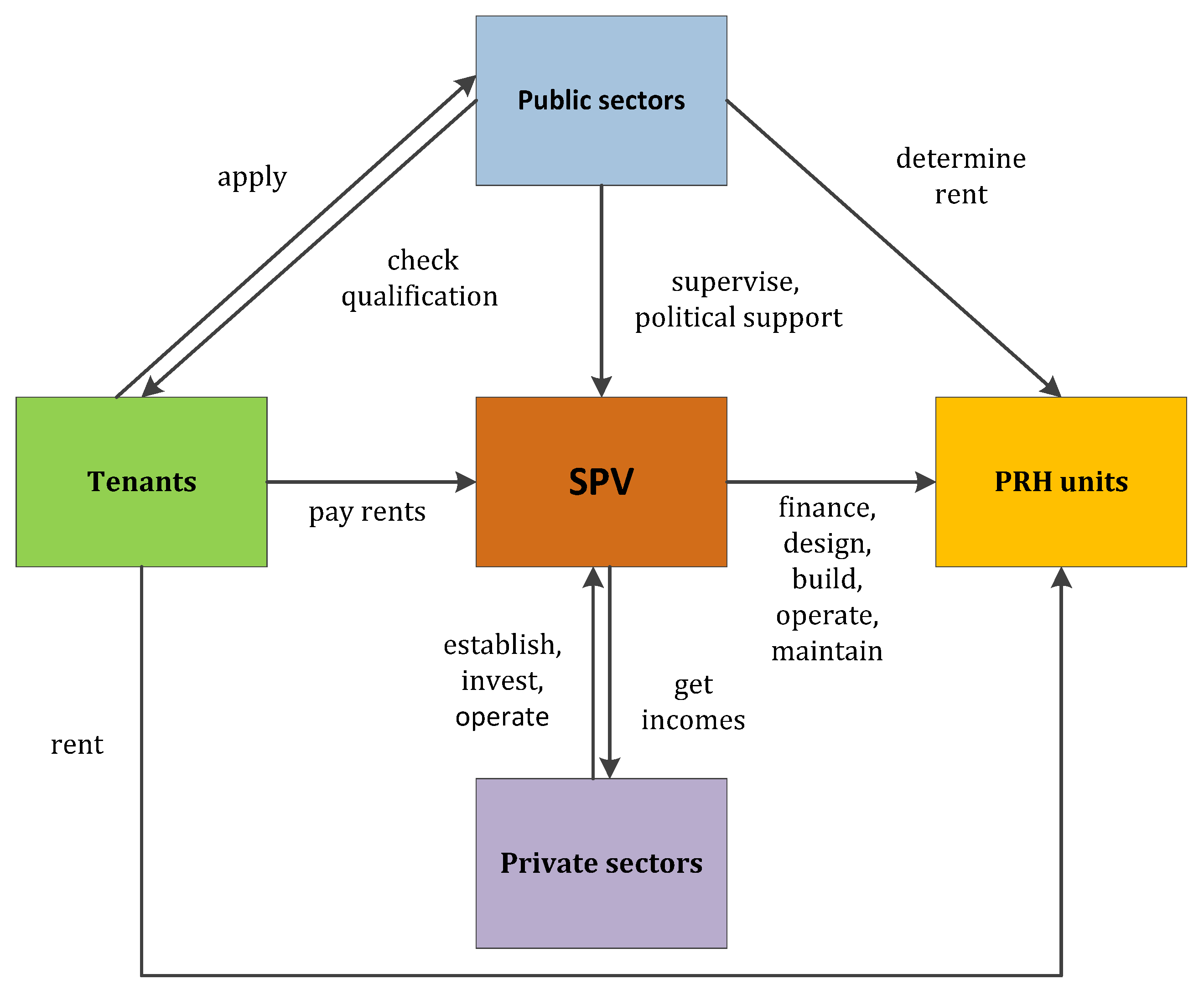

2.1. PPPs in Public Rental Housing

2.2. Factors Influencing the Housing Rental Price

2.3. Knowledge Gap

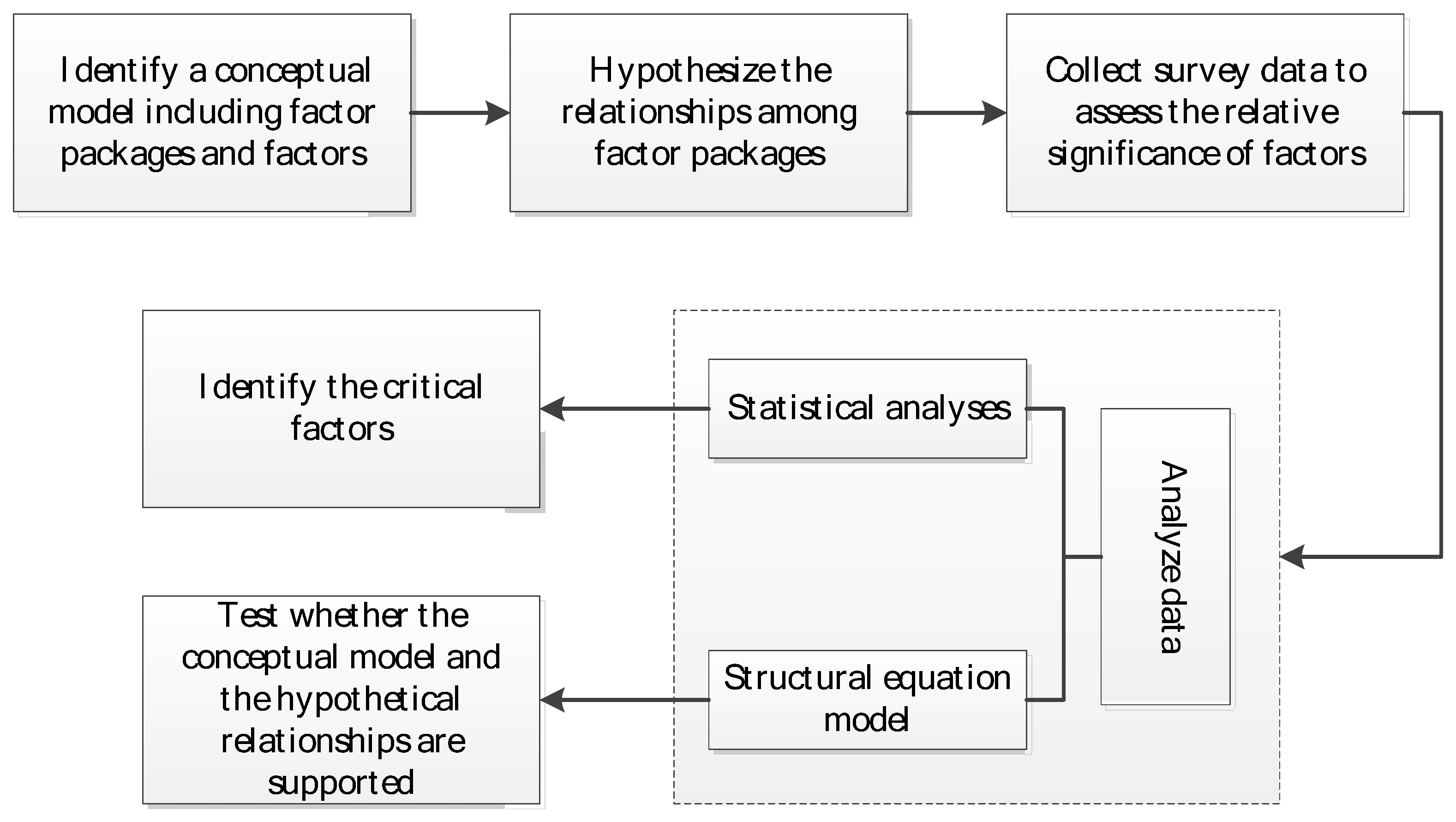

3. Research methodology

3.1. Research Design

3.2. Data Collection

3.3. Data Analysis

3.3.1. Statistical Analysis

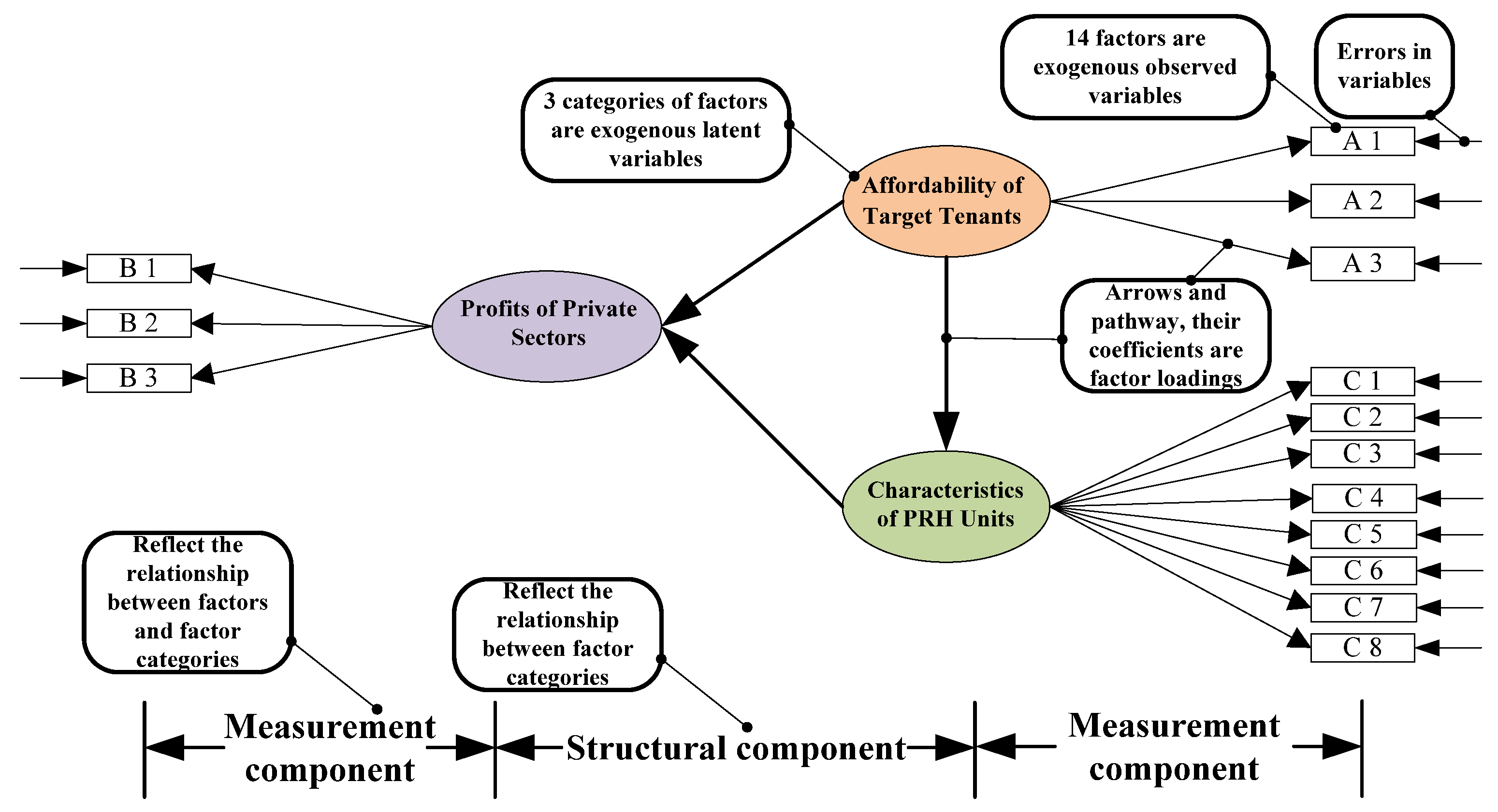

3.3.2. Structural Equation Model

4. Identification of Factors Influencing the Rents for PRH Delivered by PPP in China

4.1. The Conceptual Model for the Factors Influencing the Rents of PRH Delivery by PPP in China

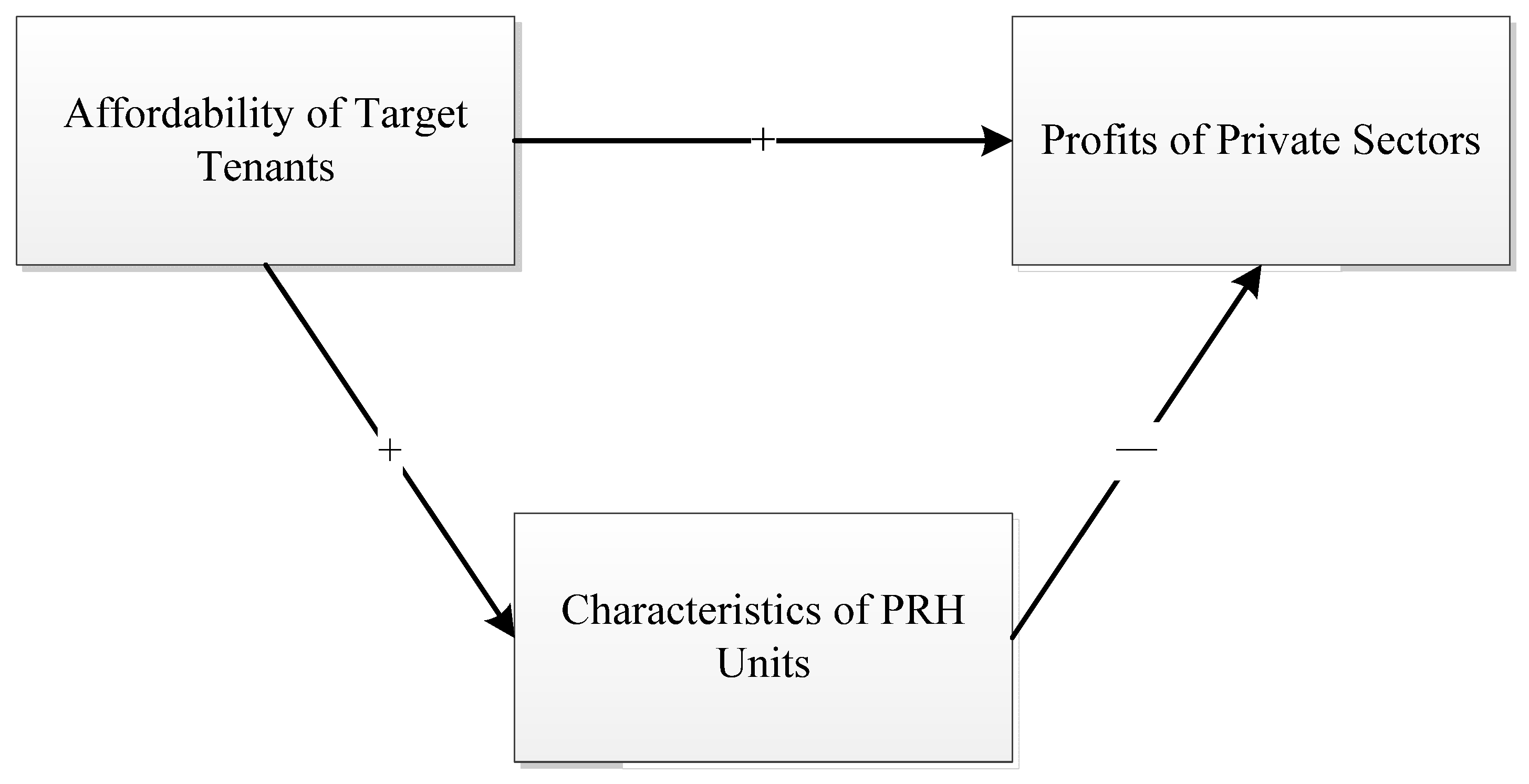

4.2. The Hypothetical Relationships among Factor Packages

4.2.1. The Relationship Between Affordability of Target Tenants and Profits of Private Sectors

4.2.2. The Relationship Between Affordability of Target Tenants and Characteristics of PRH Units

4.2.3. The Relationship Between Characteristics of PRH Units and Profits of Private Sectors

5. Critical Factors Influencing the Rents of PRH Delivery by PPP in China

5.1. Survey Results

5.2. Discussion on the Critical Factors

5.2.1. Construction Costs

5.2.2. Household Income

5.2.3. Floor Area and Structure

5.2.4. Transportation

5.2.5. Market Rents in the Same District

5.2.6. Public Facilities

6. The Relationship Analysis of Different Factor Packages

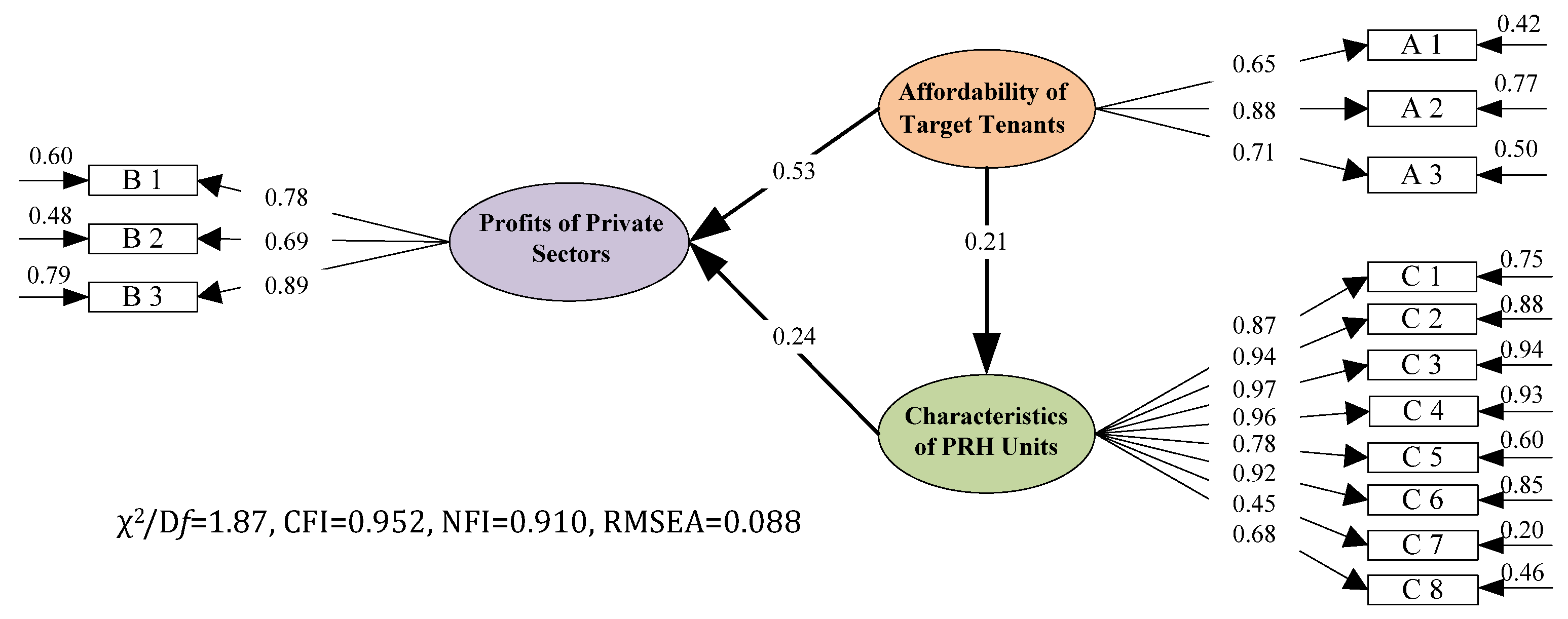

6.1. SEM analysis of Survey Data

6.2. Performing SEM to Analyze Results

6.3. Discussion

6.3.1. Measurement Component of SEM Framework

6.3.2. Structural Component of SEM Framework

7. Research Findings and Potential Uses

- Which influences more: The construction costs are a most crucial factor to influence rents of PRH in China. Thus, optimizing construction costs, which can further reduce the lifecycle costs, may: (1) increase profits of participant enterprises; (2) decrease the PRH rent to improve the social welfare of PRH projects; (3) reduce tenants’ rent burdens; and (4) improve the application rate of PRH in China. To achieve this goal, there are mainly three approaches. The first way is that the government can reduce the land-transferring fees or provide the land for free because the cost of land occupies a great percentage of the construction costs [65]. The second one is that the government can reduce or remit taxes, which accounts for a significant percentage of the construction costs. Lastly, private sectors can optimize design to save life-cycle costs [80]. Household income and market rents in neighborhood area are another two critical ones. However, they both are not stable. Thus, a dynamic rent adjustment system is necessary according to household income and market rents in the same district. The local governments need to assess the tenants’ household income and market rents in the same district at regular intervals for adjusting rents of PRH accordingly.On the other hand, useful suggestions to influence the reasonable rents in PRH PPP projects can be drawn from the perspective of improving the social sustainability of PRH PPP projects. Firstly, the reachability of PRH projects should be improved by better conditions of transportation to bring additional value to the location and reduce the transportation costs of tenants. Secondly, more public facilities should be planned and provided by government and private sectors including schools, supermarkets, healthcare center, and athletic facilities etc. to help tenants improve the quality of life.

- How to balance: According to the questionnaire survey results, three factor packages (affordability of target tenants, profits of private sectors, and characteristics of PRH units) shared same significance level but interrelated with each other. Therefore, the social welfare should be firstly put into consideration for the PRH rents. Moreover, the profits of private sectors in the PPP investments have direct impacts on the rents through governmental policy support when considering the change of interest rate and inflation rate. The important issue to balance the benefits of private sectors and target tenants is to control the quality of PRH units including location features, architectural features, neighborhood features, and indoor facilities, which can also influence the rents of PRH. The quality of PRH units should be kept in a relatively high level to attract target tenants to live [72]. At the same time, too high quality of PRH units may increase the rents of PRH, which would exceed the affordability of target tenants [33,34,50]. Thus, the characteristics of PRH units can be viewed as a primary variable to influence the rents of PRH.However, the mentioned-above “balance” is a difficult status to be achieved indeed. Hence, PPPs should be more adopted by government to provide more and more PRHs and reach the balance between social welfare and market benefits. In the future, PPPs can help governments fill the capital gaps to smooth and optimize fiscal expenditures as well as resolve the management problems in project operation, resources utilization, and service delivery. Thus, the suggestions for facilitating the PRH PPP project is that the public sectors should generate more methods to entice the private sector to participate, including reducing the financing costs, approving earlier participation in the project since the stage of planning, and providing more commercial facilities to compensate the costs in public service delivery.

8. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Huang, Y. Low-Income Housing in Chinese Cities: Policies and Practices. China Q. 2012, 212, 941–964. [Google Scholar] [CrossRef]

- Zou, Y. Contradictions in China’s Affordable Housing Policy: Goals vs. Structure. Habitat Int. 2014, 41, 8–16. [Google Scholar] [CrossRef]

- Ministry of Housing and Urban-Rural Development of the People’s Republic of China. The Opinions on Accelerating the Development of Public Rental Housing. 2010. Available online: http://www.gov.cn/gzdt/2010-06/13/content_1627138.htm (accessed on 1 August 2016). [Google Scholar]

- Hui, E.C.M.; Yu, K.H.; Ye, Y. Housing Preferences of Temporary Migrants in Urban China in the wake of Gradual Hukou Reform: A Case Study of Shenzhen. Int. J. Urban Reg. Res. 2014, 38, 1384–1398. [Google Scholar] [CrossRef]

- Chinese Education Online. Numbers of University Graduates in China from 2001 to 2015. Beijing China, 2015. Available online: http://www.eol.cn/html/c/2015gxbys/index.shtml (accessed on 1 August 2016).

- Lin, S. The Study of the Low Occupy Rate of Public Rental Housing: Based on Shanghai, Nanjing, Wuhan, Zhengzhou. Price Theor. Pract. 2012, 7, 21–22. (In Chinese) [Google Scholar]

- Wu, S.; Liu, Y. Determining Public Housing Rent: Based on Hedonic Model. Constr. Econ. 2013, 11, 67–69. (In Chinese) [Google Scholar]

- Zhou, X. Determining Public Housing Rent in China: Based on AHP. Price Theor. Pract. 2013, 6, 58–59. (In Chinese) [Google Scholar]

- Williamson, A.R. Can They Afford the Rent? Resident Cost Burden in Low Income Housing Tax Credit Developments. Urban Aff. Rev. 2011, 47, 775–799. [Google Scholar] [CrossRef]

- Zhang, J.; Yuan, J.; Skibniewski, M.J. The Analysis on the Policy of Access to Economically Affordable Housing in China: An Area Calculation Model Based on the Incentive Mechanism Design. Int. J. Strateg. Prop. Manag. 2011, 15, 231–256. [Google Scholar] [CrossRef]

- The State Council of the People’s Republic of China. The Advices the Strengthen the Management of Debts for Local Governments. 2014; The State Council of the People’s Republic of China: Beijing, China. Available online: http://www.gov.cn/zhengce/content/2014-10/02/content_9111.htm (accessed on 1 August 2016). [Google Scholar]

- Tang, L.Y.; Shen, Q.; Cheng, E.W.L. A Review of Studies on Public–Private Partnership Projects in the Construction Industry. Int. J. Proj. Manag. 2010, 28, 683–694. [Google Scholar] [CrossRef]

- Ministry of Finance of the People’s Republic of China. The Notice to Facilitate the Investments, Construction, and Operation of Public Rental Housing by Using PPP. 2015. Available online: http://www.gov.cn/xinwen/2015-5/22/content_2866839.htm (accessed on 1 August 2016). [Google Scholar]

- Xu, Y.; Peng, Y.; Qian, Q.; Chan, A. An Alternative Model to Determine the Financing Structure of PPP-Based Young Graduate Apartments in China: A Case Study of Hangzhou. Sustainability 2015, 7, 5720–5734. [Google Scholar] [CrossRef]

- Dixon, T.; Pottinger, G.; Jordan, A. Lessons from the Private Finance Initiative in the UK: Benefits, Problems and Critical Success Factors. J. Prop. Invest. Financ. 2005, 23, 412–423. [Google Scholar] [CrossRef]

- Abdul-Aziz, A.R.; Kassim, P.S.J. Objectives, Success and Failure Factors of Housing Public–Private Partnerships in Malaysia. Habitat Int. 2011, 35, 150–157. [Google Scholar] [CrossRef]

- Ong, H.C.; Lenard, D. Can Private Finance be Applied in the Provision of Housing? In Proceedings of the FIG XXII International Congress 2002, Washington, DC, USA, 19–26 April 2002.

- Sengupta, U. Liberalization and the Privatization of Public Rental Housing in Kolkata. Cities 2006, 23, 269–278. [Google Scholar] [CrossRef]

- Sengupta, U. Government Intervention and Public–Private Partnerships in Housing Delivery in Kolkata. Habitat Int. 2006, 30, 448–461. [Google Scholar] [CrossRef]

- Parashar, D. The Government’s Role in Private Partnerships for Urban Poor Housing in India. Int. J. Hous. Markets Anal. 2014, 7, 524–538. [Google Scholar] [CrossRef]

- Taiwo, A. The Need for Government to Embrace Public–Private Partnership Initiative in Housing Delivery to Low-Income Public Servants in Nigeria. Urban Des. Int. 2015, 20, 56–65. [Google Scholar] [CrossRef]

- Shan, X.Q.; Ye, X.S. Research on Public-Private Financing Mode of Public Rental Housing and its Selection. In Proceedings of the International Conference on Management Science and Engineering, Richardson, TX, USA, 20–22 September 2012.

- Li, D.; Chen, Y.; Chen, H.; Hui, E.; Guo, K. Evaluation and Optimization of the Financial Sustainability of Public Rental Housing Projects: A Case Study in Nanjing, China. Sustainability 2016, 8, 330. [Google Scholar] [CrossRef]

- Davidoff, T. Labor Income, Housing Prices, and Homeownership. J. Urban Econ. 2003, 59, 209–235. [Google Scholar] [CrossRef]

- Wu, J.J.; Adams, R.M.; Plantinga, A.J. Amenities in an Urban Equilibrium Model: Residential Development in Portland, Oregon. Land Econ. 2004, 80, 19–32. [Google Scholar] [CrossRef]

- Miller, N.; Peng, L. Exploring Metropolitan Housing Price Volatility. J. Real Estate Financ. Econ. 2006, 33, 5–18. [Google Scholar] [CrossRef]

- Marks, D. The Effect of Rent Control on the Price of Rental Housing: An Hedonic Approach. Land Econ. 1984, 59, 81–94. [Google Scholar] [CrossRef]

- Bible, D.S.; Hsieh, C.H. Applications of Geographic Information Systems for the Analysis of Apartment Rents. J. Real Estate Res. 1996, 12, 79–88. [Google Scholar]

- Atterhög, M.; Lind, H. How Does Increased Competition on the Housing Market Affect Rents? An Empirical Study Concerning Sweden. Hous. Stud. 2004, 19, 107–123. [Google Scholar] [CrossRef]

- Smith, C.A.; Kroll, M.J. An Analysis of Tenant Demand for Amenities. J. Prop. Manag. 1987, 14, 17. [Google Scholar]

- Benjamin, J.D.; Sirmans, G.S. Apartment Rent: Rent Control and Other Determinants. J. Prop. Res. 1994, 11, 27–50. [Google Scholar] [CrossRef]

- Sirmans, G.S.; Sirmans, C.F.; Benjamin, J.D. Determining Apartment Rent: The Value of Amenities, Services, and External Factors. J. Real Estate Res. 1989, 4, 33–44. [Google Scholar]

- Benjamin, J.D.; Sirmans, G.S. Mass Transportation, Apartment Rent and Property Values. J. Real Estate Res. 1996, 12, 1–8. [Google Scholar]

- Hui, E.C.M. Public Housing Rents in Hong Kong: Policy and Structure. J. Urban Plan. Dev. 1999, 125, 36–53. [Google Scholar] [CrossRef]

- Likert, R. A technique for the measurement of attitudes. Arch. Psychol. 1932, 140, 1–55. [Google Scholar]

- Carifio, J.; Perla, R.J. Ten common misunderstandings, misconceptions, persistent myths and urban legends about Likert scales and Likert response formats and their antidotes. J. Soc. Sci. 2007, 3, 106–116. [Google Scholar] [CrossRef]

- Doloi, H.; Iyer, K.C.; Sawhney, A. Structural Equation Model for Assessing Impacts of Contractor’s Performance on Project Success. Int. J. Proj. Manag. 2011, 29, 687–695. [Google Scholar] [CrossRef]

- Yuan, J.; Wang, C.; Skibniewski, M.; Li, Q. Developing Key Performance Indicators for Public-Private Partnership Projects: Questionnaire Survey and Analysis. J. Manag. Eng. 2012, 28, 252–264. [Google Scholar] [CrossRef]

- Burns, A.; Burns, R. Basic Marketing Research, 2nd ed.; Pearson Education: Bergen County, NJ, USA, 2008; p. 245. [Google Scholar]

- Ng, S.T.; Wong, Y.M.W.; Wong, J.M.W. A Structural Equation Model of Feasibility Evaluation and Project Success for Public–Private Partnerships in Hong Kong. IEEE Trans. Eng. Manag. 2010, 57, 310–322. [Google Scholar] [CrossRef] [Green Version]

- Nunnally, J.C. Psychometric Theory, 2nd ed.; McGraw-Hill: City of New York, NY, USA, 1978; pp. 37–42. [Google Scholar]

- Lewicki, P.; Hill, T. Statistics: Methods and Application; StatSoft: Tulsa, OK, USA, 2006; pp. 465–470. [Google Scholar]

- Isah, A.D.; Khan, T.H.; Ahmad, A.S.B. Exploring Socio-Economic Design Implications of Public Housing Transformation; The Nigerian Experience. Appl. Mech. Mater. 2014, 584–586, 211–216. [Google Scholar] [CrossRef]

- Boomsma, A. Structural Equation Modeling Introduction; Department of Statistics and Measurement Theory, University of Groningen: Groningen, The Netherlands, 2005. [Google Scholar]

- Holbert, R.L.; Stephenson, M.T. Structural Equation Modeling in the Communication Sciences, 1995–2000. Hum. Commun. Res. 2002, 28, 531–551. [Google Scholar]

- Jashapara, A. Cognition, Culture and Competition: An Empirical Test of the Learning Organization. Learn. Organ. 2003, 10, 31–50. [Google Scholar] [CrossRef]

- Wolf, E.; Harrington, K.; Clark, S.; Miller, M. Sample Size Requirements for Structural Equation Models: An Evaluation of Power, Bias, and Solution Propriety. Educ. Psychol. Meas. 2013, 73, 913–934. [Google Scholar] [CrossRef] [PubMed]

- Sideridis, G.; Simos, P.; Papanicolaou, A.; Fletcher, J. Using Structural Equation Modeling to Assess Functional Connectivity in the Brain: Power and Sample Size Considerations. Educ. Psychol. Meas. 2014, 74, 733–758. [Google Scholar] [CrossRef] [PubMed]

- Cai, J.; Jia, S. Factors on Housing Rent: Based on Hedonic Model. Econ. Res. Guide 2010, 30, 150–152. (In Chinese) [Google Scholar]

- Hui, E.C.M. Measuring Affordability in Public Housing from Economic Principles: Case Study of Hong Kong. J. Urban Plan. Dev. 2001, 127, 34–49. [Google Scholar] [CrossRef]

- Prasad, A. Demand Elasticity; John Wiley & Sons, Ltd.: New York, NY, USA, 2010; pp. 46–49. [Google Scholar]

- Zhang, X.; Bao, H.; Wang, H.; Skitmore, M. A Model for Determining the Optimal Project Life Span and Concession Period of BOT Projects. Int. J. Proj. Manag. 2016, 34, 523–532. [Google Scholar] [CrossRef]

- Park, C.S. Contemporary Engineering Economics; Prentice Hall: Upper Saddle River, NJ, USA, 2002; pp. 61–72. [Google Scholar]

- Nakagawa, M.; Saito, M.; Yamaga, H. Earthquake Risk and Housing Rents: Evidence from the Tokyo Metropolitan Area. Reg. Sci. Urban Econ. 2007, 37, 87–99. [Google Scholar] [CrossRef]

- Malpezzi, S.; Ozanne, L.; Thibodeau, T.G. Microeconomic Estimates of Housing Depreciation. Land Econ. 1987, 63, 372–385. [Google Scholar] [CrossRef]

- Luttik, J. The Value of Trees, Water and Open Space as Reflected by House Prices in The Netherlands. Landsc. Urban Plan. 2000, 48, 161–167. [Google Scholar] [CrossRef]

- Haurin, D.R.; Brasington, D. School Quality and Real House Prices: Inter- and Intrametropolitan Effects. J. Hous. Econ. 1996, 5, 351–368. [Google Scholar] [CrossRef]

- Jud, G.D.; Frew, J. Atypicality and the Natural Vacancy Rate Hypothesis. Real Estate Econ. 1990, 18, 294–301. [Google Scholar] [CrossRef]

- He, Y.; Li, B. Government Financial Subsidies in the Influence of Public Housing Under the PPP Financing Model. In Proceedings of the 17th International Symposium on Advancement of Construction Management and Real Estate; Springer: Berlin/Heidelberg, Germany, 2014; pp. 1123–1132. [Google Scholar]

- Ommeren, J.V.; Koopman, M. Public Housing and the Value of Apartment Quality to Households. Reg. Sci. Urban Econ. 2011, 41, 207–213. [Google Scholar] [CrossRef]

- Chan, A.P.; Lam, P.; Chan, D.; Cheung, E.; Ke, Y. Critical success factors for PPPs in infrastructure developments: Chinese perspective. J. Constr. Eng. Manag. 2010, 136, 484–494. [Google Scholar] [CrossRef]

- Wong, P.S.-P.; Cheung, S.-O. Trust in construction partnering: Views from parties of the partnering dance. Int. J. Proj. Manag. 2004, 22, 437–446. [Google Scholar] [CrossRef]

- Tiwari, P.; Parikh, J. Affordability, Housing Demand and Housing Policy in Urban India. Urban Stud. 1998, 35, 2111–2129. [Google Scholar] [CrossRef]

- Chen, Y.; Clapp, J.M.; Tirtiroglu, D. Hedonic Estimation of Housing Demand Elasticity with a Markup over Marginal Costs. J. Hous. Econ. 2011, 20, 233–248. [Google Scholar] [CrossRef]

- Chiu, R.L.H. Planning, Land and Affordable Housing in Hong Kong. Housing Stud. 2007, 22, 63–81. [Google Scholar] [CrossRef]

- Xu, Y.; Yeung, J.F.Y.; Jiang, S. Determining Appropriate Government Guarantees for Concession Contract: Lessons Learned from 10 PPP Projects in China. Int. J. Strateg. Prop. Manag. 2014, 18, 356–367. [Google Scholar] [CrossRef]

- Chileshe, N.; Yirenkyi-Fianko, A.B. Perceptions of Threat Risk Frequency and Impact on Construction Projects in Ghana: Opinion Survey Findings. J. Constr. Dev. Ctries. 2011, 16, 115–149. [Google Scholar]

- Ke, Y.; Wang, S.; Chan, A.; Cheung, E. Understanding the Risks in China’s PPP Projects: Ranking of Their Probability and Consequence. Eng. Constr. Archit. Manag. 2011, 18, 481–496. [Google Scholar] [CrossRef]

- Bourguignon, F. Family Size and Social Utility: Income Distribution Dominance Criteria. J. Econom. 1989, 42, 67–80. [Google Scholar] [CrossRef]

- Revington, N.; Townsend, C. Market Rental Housing Affordability and Rapid Transit Catchments: Application of a New Measure in Canada. Hous. Policy Debate 2016, 26, 864–886. [Google Scholar] [CrossRef]

- Walker, B.; Marsh, A. Setting the Rents of Social Housing: The Impact and Implications of Rent Restructuring in England. Urban Stud. 2003, 40, 2023–2047. [Google Scholar] [CrossRef]

- Walker, B.; Marsh, A.; Wardman, M.; Niner, P. Modelling Tenants’ Choices in the Public Rented Sector: A Stated Preference Approach. Urban Stud. 2002, 39, 665–688. [Google Scholar] [CrossRef]

- Ibem, E.O.; Aduwo, E.B. Assessment of Residential Satisfaction in Public Housing in Ogun State, Nigeria. Habitat Int. 2013, 40, 163–175. [Google Scholar] [CrossRef]

- Efthymiou, D.; Antoniou, C. How do Transport Infrastructure and Policies Affect House Prices and Rents? Evidence from Athens, Greece. Transp. Res. Part A Policy Pract. 2013, 52, 1–22. [Google Scholar] [CrossRef]

- Hanink, D.M.; Cromley, R.G.; Ebenstein, A.Y. Spatial Variation in the Determinants of House Prices and Apartment Rents in China. J. Real Estate Financ. Econ. 2012, 45, 1–17. [Google Scholar] [CrossRef]

- Government of Guangzhou China. Implementation Guidelines of Public Rental Housing Security System in Guangzhou. 2013. Available online: http://www.laho.gov.cn/xwzx/tzgg/201302/t20130221_375170.htm (accessed on 1 August 2016). [Google Scholar]

- Huang, Z.; Du, X. Assessment and Determinants of Residential Satisfaction with Public Housing in Hangzhou, China. Habitat Int. 2015, 47, 218–230. [Google Scholar] [CrossRef]

- Shehayeb, D.; Kellett, P. Towards Affordability: Maximising Use Value in Low-Income Housing. Open House Int. 2011, 36, 85–96. [Google Scholar]

- Bentler, P.M.; Bonett, D.G. Significance tests and goodness of fit in the analysis of covariance structures. Psychol. Bull. 1980, 88, 588–606. [Google Scholar] [CrossRef]

- Mcdonald, M.; Madanat, S. Life-Cycle Cost Minimization and Sensitivity Analysis for Mechanistic-Empirical Pavement Design. J. Transp. Eng. 2012, 138, 706–713. [Google Scholar] [CrossRef]

| Status of Respondents | Percentage |

|---|---|

| Target tenants of PRH | 30.75% |

| Officials from public sectors | 35.29% |

| Managers from private sectors | 33.96% |

| Goodness of Fit Measure | Recommended Level of GOF Measure |

|---|---|

| χ2/degree of freedom (Df) | From 1 to 2 |

| Comparative fit index (CFI) | 0 (no fit) to 1 (perfect fit) |

| Normal fit index (NFI) | 0 (no fit) to 1 (perfect fit) |

| Root mean square error of approximation (RMSEA) | <0.05 indicate very good fit (Threshold level = 0.1) |

| Factor Packages | No. | Factors | Description | References |

|---|---|---|---|---|

| A. Affordability of Target Tenants | A1 | Household income | A direct influence on tenants’ affordability | [34,50] |

| A2 | Demand elasticity | Price elasticity of demand that reflects tenants’ dependency on PRH | [51] | |

| A3 | Renting duration | The period that the tenants rent PRH units | [23] | |

| B. Profits of Private Sectors | B1 | Governmental policy support | Another important source to gain investment profits | [13,59] |

| B2 | Interest rate | Reflect time value of money that can influence significantly profits of private sectors | [53] | |

| B3 | Inflation rate | Reflect inflation that can influence significantly profits of private sectors | [34] | |

| C. Characteristics of PRH Units | C1 | Market rents in the same district | Directly reflect the basic value of location and is one important location feature that has strong impacts on the housing rents | [28] |

| C2 | Transportation | Bring additional value to the location and is another important location feature that has strong impacts on the housing rents | [32,33] | |

| C3 | Construction costs | Directly reflect the quality of housing (an important architectural feature that has strong impacts on the housing rents) | [54] | |

| C4 | Floor area and structure | An important architectural feature that has strong impacts on the housing rentsStructure means the space distribution in different rooms | [29,55] | |

| C5 | Floor and orientation | An important architectural feature that has strong impacts on the housing rents | [27,55] | |

| C6 | Public facilities | Such as schools, supermarkets and athletic facilities | [30,57] | |

| C7 | Surrounding environment | Such as crime rate, noise, and pollution | [56] | |

| C8 | Indoor facilities | Such as televisions, air-conditions, washing machines, and micro-wave oven | [27,30] |

| Factor Packages | No. | Factors | Mean Value | SD | Ranking in All Packages | Ranking within Different Packages | Mean Value for Packages |

|---|---|---|---|---|---|---|---|

| A. Affordability of Target Tenants | A1 | Household income | 4.235 | 0.898 | 2 | 1 | 3.586 |

| A2 | Demand elasticity | 3.492 | 1.037 | 11 | 2 | ||

| A3 | Renting duration | 3.030 | 0.899 | 13 | 3 | ||

| B. Profits of Private Sectors | B1 | Governmental policy support | 3.909 | 0.984 | 7 | 1 | 3.475 |

| B2 | Interest rate | 2.924 | 1.189 | 14 | 3 | ||

| B3 | Inflation rate | 3.591 | 1.191 | 9 | 2 | ||

| C. Characteristics of PRH Units | C1 | Market rents in the same district | 4.129 | 1.003 | 5 | 4 | 3.905 |

| C2 | Transportation | 4.136 | 1.017 | 4 | 3 | ||

| C3 | Construction costs | 4.250 | 1.007 | 1 | 1 | ||

| C4 | Floor area and structure | 4.205 | 0.871 | 3 | 2 | ||

| C5 | Floor and orientation | 3.780 | 0.570 | 8 | 6 | ||

| C6 | Public facilities | 4.091 | 1.022 | 6 | 5 | ||

| C7 | Surrounding environment | 3.083 | 0.989 | 12 | 8 | ||

| C8 | Indoor facilities | 3.568 | 0.783 | 10 | 7 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license ( http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yuan, J.; Zheng, X.; You, J.; Skibniewski, M.J. Identifying Critical Factors Influencing the Rents of Public Rental Housing Delivery by PPPs: The Case of Nanjing. Sustainability 2017, 9, 345. https://doi.org/10.3390/su9030345

Yuan J, Zheng X, You J, Skibniewski MJ. Identifying Critical Factors Influencing the Rents of Public Rental Housing Delivery by PPPs: The Case of Nanjing. Sustainability. 2017; 9(3):345. https://doi.org/10.3390/su9030345

Chicago/Turabian StyleYuan, Jingfeng, Xiaodan Zheng, Jia You, and Mirosław J. Skibniewski. 2017. "Identifying Critical Factors Influencing the Rents of Public Rental Housing Delivery by PPPs: The Case of Nanjing" Sustainability 9, no. 3: 345. https://doi.org/10.3390/su9030345