Environmentally Friendly Supplier Selection Using Prospect Theory

Abstract

:1. Introduction

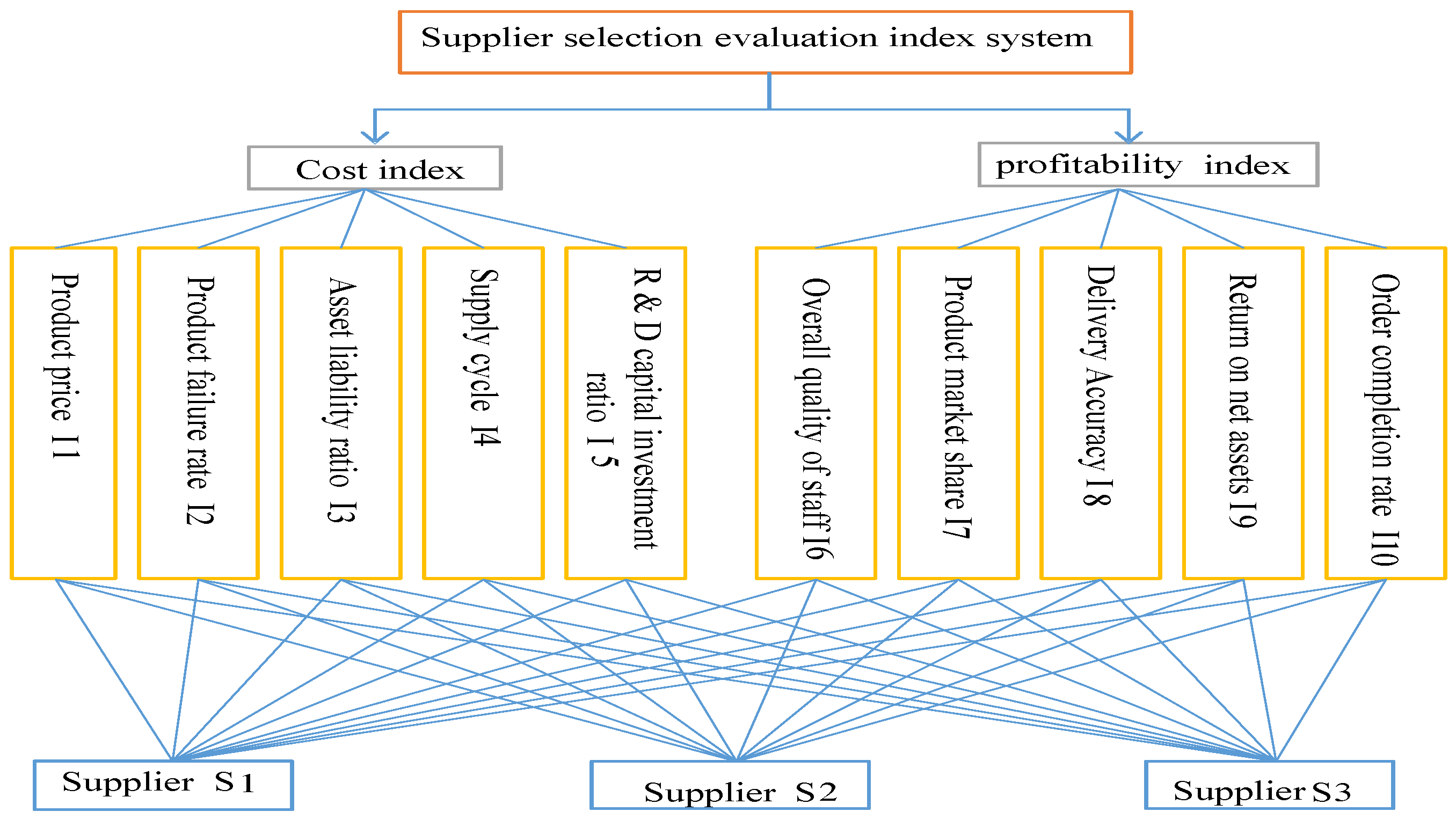

2. Supplier Selection Decision Model

- Cost index:

- 1.1.

- Product price (I1): the cost directly related to obtaining the corresponding supplier’s product.

- 1.2.

- Product failure ratio (I2): the product’s failure rate when environmentally friendly factors are considered. For the environmentally friendly supplier selection problem, the environmental performance index (EPI) is one method to quantify and numerically mark a supplier’s environmental performance. If a product has environmentally friendly attributes, it can be accepted as a satisfactory product; this directly connects the product failure ratio to an index related to the environment.

- 1.3.

- Asset liability ratio (I3): the proportion of a company’s assets that are being financed with debt, rather than equity. This ratio is used to determine the financial risk of a business.

- 1.4.

- Supply cycle (I4): the speed at which the supplier provides the ordered products.

- 1.5.

- Research and development (R & D) capital investment ratio (I5): the ratio of R & D investment divided by the revenues.

- Profitability index:

- 2.1.

- The Quality of the Staff (I6): staff quality indicates employee quality.

- 2.2.

- Product market share (I7): percentage of a market (defined in terms of either units or revenue) accounted for by a specific entity.

- 2.3.

- Delivery accuracy (I8): an important operational performance measure that combines non-financial elements, namely time and quality.

- 2.4.

- Return on net assets (I9): a measure of financial performance, calculated as net income divided by fixed assets and net working capital.

- 2.5.

- Order Completion Rate (I10): percent of orders shipped containing all items of a sales order. It is calculated as the number of annual sales orders delivered as a complete shipment according to the sales order (with no items on back order), divided by the total number of annual sales orders.

2.1. Calculation of Gain and Loss

2.2. The Calculation of the Foreground Value and the Ranking of the Schemes

- (1)

- Based on (4)–(19): Establish risk return matrix and risk loss matrix

- (2)

- Based on (20)–(24): Establish decision matrix

- (3)

- Based on (25) and (26): Establish a standardized decision-making matrix

- (4)

- Based on (27): Calculate the overall outlook for each vendor , and based on the value, determine the size of all suppliers using a row sort.

3. Example Analysis

4. Concluding Remarks

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Degraeve, Z.; Labro, E.; Roodhooft, F. Total cost of ownership purchasing of a service: The case of airline selection at Alcatel Bell. Eur. J. Oper. Res. 2004, 156, 23–40. [Google Scholar] [CrossRef]

- Arikan, F. A fuzzy solution approach for multi objective supplier selection. Expert Syst. Appl. 2013, 40, 947–952. [Google Scholar] [CrossRef]

- Ghodsypour, S.H.; O’Brien, C. The total cost of logistics in supplier selection, under conditions of multiple sourcing, multiple criteria and capacity constraint. Int. J. Prod. Econ. 2001, 73, 15–27. [Google Scholar] [CrossRef]

- Shiromaru, I.; Inuiguchi, M.; Sakawac, M. A fuzzy satisfying method for electric power plant coal purchase using genetic algorithms. Eur. J. Oper. Res. 2000, 126, 218–230. [Google Scholar] [CrossRef]

- Huang, S.F.; Zhao, H. AHW stochastic DEA method for supplier selection. J. Chongqing Univ. 2004, 27, 28–31. [Google Scholar]

- Xu, P.; Zhang, Q.S. Decision-making model of grey clustering for supplier selection. Harbin Gongye Daxue Xuebao/J. Harbin Inst. Technol. 2007, 39, 2006–2008. [Google Scholar]

- Zhang, Z.; Yang, Z. Supplier selection problem based on AHP and Neulonet. Syst. Eng. Electron. Technol. 2007, 29, 570–573. [Google Scholar]

- Wang, J.J.; Li, L.; Ding, L. Application of SVR with backtracking search algorithm for long-term load forecasting. J. Intell. Fuzzy Syst. 2016, 31, 2341–2347. [Google Scholar]

- Ruan, J.H.; Yan, S. Monitoring and assessing fruit freshness in IOT-based e-commerce delivery using scenario analysis and interval number approaches. Inf. Sci. 2016, 12, 557–570. [Google Scholar] [CrossRef]

- Ruan, J.H.; Wang, X.P.; Chan, F.T.S.; Shi, Y. Optimizing the intermodal transportation of emergency medical supplies using balanced fuzzy clustering. Int. J. Prod. Res. 2016, 54, 4368–4386. [Google Scholar] [CrossRef]

- Ruan, J.H.; Shi, P.; Lim, C.C.; Wang, X.P. Relief supplies allocation and optimization by interval and fuzzy number approaches. Inf. Sci. 2015, 303, 15–32. [Google Scholar] [CrossRef]

- Ruan, J.H.; Chan, F.T.S.; Zhu, F.W.; Wang, X.P.; Yang, J. A visualization review of cloud computing algorithms in the Last Decade. Sustainability 2016, 8, 1008. [Google Scholar] [CrossRef]

- Zeydan, M.; Coplan, C.; Cobanoglu, C. A combined methodology for supplier selection and performance evaluation. Expert Syst. Appl. 2011, 38, 2741–2751. [Google Scholar] [CrossRef]

- Kannan, D.; Jabbour, A.B.L.S.; Jabbour, C.J.C. Selecting green suppliers based on GSCM practices: Using fuzzy TOPSIS applied to a Brazilian electronics company. Eur. J. Oper. Res. 2012, 233, 432–447. [Google Scholar] [CrossRef]

- Sanayei, A.; Farid, M.S.; Yazdankha, A. Group decision making process for supplier selection with VIKOR under fuzzy environment. Expert Syst. Appl. 2010, 37, 24–30. [Google Scholar] [CrossRef]

- Shemshadi, A.; Shirazi, H.; Toreihi, M. A fuzzy VIKOR method for supplier selection based on entropy measure for objective weighting. Expert Syst. Appl. 2011, 38, 12160–12167. [Google Scholar] [CrossRef]

- Sahu, N.K.; Datta, S.; Mahapatra, S.S. Performance evaluation of green supplier using generalized trapezoidal fuzzy numbers set. In Proceedings of the National Conference on Emerging Challenges for Sustainable Business, Haridwar, India, 1–2 June 2012.

- Chung, C.C.; Chao, L.C.; Lou, S.J. The establishment of a green supplier selection and guidance mechanism with the ANP and IPA. Sustainability 2016, 8, 259. [Google Scholar] [CrossRef]

- Boran, F.E.; Genç, S.; Kurt, M.; Akay, D. A multi-criteria intuitionistic fuzzy group decision making for supplier selection with TOPSIS method. Expert Syst. Appl. 2009, 36, 11363–11368. [Google Scholar] [CrossRef]

- Junior, F.R.L.; Osiro, L.; Carpinetti, L.C.R. A comparison between Fuzzy AHP and Fuzzy TOPSIS methods to supplier selection. Appl. Soft Comput. 2014, 21, 194–209. [Google Scholar] [CrossRef]

- Wu, J.; Cao, Q.; Li, H. Green supplier selection method based on Cooperator in fuzzy environment decision. J. Manag. Eng. 2010, 24, 61–65. [Google Scholar]

- Liu, Z.Y.; Zha, Y. Behavior operation management: An emerging research area. J. Manag. Sci. 2009, 12, 64–74. [Google Scholar]

- Kuo, T.C.; Hsu, C.W.; Li, J.Y. Developing a green supplier selection model by using the DANP with VIKOR. Sustainability 2015, 7, 1661–1689. [Google Scholar] [CrossRef]

- Liu, A.; Fowler, J.; Pfund, M. Dynamic co-ordinated scheduling in the supply chain considering flexible routes. Int. J. Prod. Res. 2016, 54, 322–335. [Google Scholar] [CrossRef]

- Minehari, D.; Neeman, Z. Termination and coordination in partnerships. J. Econ. Manag. Strat. 1999, 8, 191–221. [Google Scholar] [CrossRef]

- Zitzler, E.; Laumanns, M.; Thiele, L. SPEA2: Improving the strength Pareto evolutionary algorithm for multi-objective optimization. In Proceedings of the Evolutionary Methods for Design, Optimization and Control, Athens, Greece, 19–21 September 2002; pp. 95–100.

- Karpak, B.; Kumcu, E.; Kasuganti, R. Purchasing materials in the supply chain: Managing a multi-objective task. Eur. J. Puchasing Supply Manag. 2001, 7, 209–216. [Google Scholar] [CrossRef]

- Li, D.; Nagurney, A. A general multitiered supply chain network model of quality competition with suppliers. Int. J. Prod. Econ. 2015, 17, 336–356. [Google Scholar] [CrossRef]

- Zhang, X.; Fan, Z.P. A method of multi attribute decision making based on prospect theory for risk type. J. Oper. Manag. 2012, 6, 45–50. [Google Scholar]

- Punniyamoorthy, P.; Mathiyalagan, P.; Parthiban, P. A strategic model using structural equation modeling and fuzzy logic in supplier selection. Expert Syst. Appl. 2011, 38, 458–474. [Google Scholar] [CrossRef]

- Khaleie, S.; Fasanghari, M.; Tavassoli, E. Supplier selection using a novel intuitionist fuzzy clustering approach. Appl. Soft Comput. 2012, 12, 1741–1754. [Google Scholar] [CrossRef]

- Zhang, X.; Fan, Z.P. Method for risky hybrid multiple attribute decision making based on prospect theory. J. Syst. Eng. 2012, 12, 772–781. [Google Scholar]

- Chu, T.C.; Varma, R. Evaluating suppliers via a multiple levels multiple criteria decision making method under fuzzy environment. Comput. Ind. Eng. 2012, 62, 653–660. [Google Scholar] [CrossRef]

- Deng, H.; Ye, C.H.; Willis, R.J. Inter-comparison using modified TOPSIS with objective weighs. Comput. Oper. Res. 2000, 27, 963–973. [Google Scholar] [CrossRef]

- Tversky, A.; Kahneman, D. Advances in prospect theory: Cumulative representation of uncertainty. J. Disk Uncedtainty 1992, 5, 297–323. [Google Scholar] [CrossRef]

- Abdellaoui, M. Parameter-free elicitation of utility and probability weighting functions. Manag. Sci. 2000, 46, 1497–1512. [Google Scholar] [CrossRef]

- Xu, Y.; Zhou, J.; Xu, W. A decision-making rule for modeling travelers’ route choice behavior based on cumulative prospect theory. Transp. Res. Part C 2011, 19, 218–228. [Google Scholar] [CrossRef]

- Yao, J.M.; Pu, Y.; Zhou, G.; Zhao, Z. Multivendor selection model and decomposition algorithm for multi variety supply. J. Southwest Jiao Tong Univ. 2005, 4, 519–524. [Google Scholar]

- Krohling, R.A.; Souza, T.T.M.D. Combining prospect theory and fuzzy numbers to multi-criteria decision making. Expert Syst. Appl. 2012, 39, 11487–11493. [Google Scholar] [CrossRef]

- Mahdavi, I.; Mahdavi-Amiri, N.; Heidarzade, A.; Nourifar, R. Designing a model of fuzzy TOPSIS in multiple criteria decision making. Appl. Math. Comput. 2008, 206, 607–617. [Google Scholar] [CrossRef]

- Nezami, F.G.; Yildirim, M.B. A sustainability approach for selecting maintenance strategy. Int. J. Sustain. Eng. 2013, 6, 332–343. [Google Scholar] [CrossRef]

| Variable | Meaning |

|---|---|

| A collection of m supplier alternatives | |

| Number of suppliers | |

| A set of n indicators | |

| Subscripted collections of index | |

| Subscripted collections of profit index and cost index | |

| Weight vector of index | |

| Y | The index of natural state |

| Natural state set | |

| A collection of natural states of y | |

| Probability of occurrence of state | |

| The desired vector of the index | |

| The expectation of decision makers for attribute | |

| The status of decision makers to target the expectations of | |

| Risk decision matrix | |

| The status of , supplier aims at decision results of | |

| , | Lower and upper bounds of interval numbers |

| Value of fuzzy number | |

| Index value is the index set of clear number | |

| Index value is the index set of interval number | |

| Index value is the index set of intuitionistic trapezoidal fuzzy number | |

| Subscripted collections of index subset | |

| Subscripted collections of index subset | |

| Subscripted collections of index subset |

| Index | State | State | Supplier | Mean Vector | ||||

|---|---|---|---|---|---|---|---|---|

| Probability | S1 | S2 | S3 | S4 | S5 | |||

| I1 | A1 | 0.2 | 15 | 16 | 16 | 17 | 14 | 15 |

| A2 | 0.2 | 13 | 15 | 14 | 16 | 13 | ||

| A3 | 0.2 | 12 | 14 | 11 | 15 | 12 | ||

| A4 | 0.2 | 11 | 13 | 10 | 13 | 11 | ||

| A5 | 0.2 | 10 | 12 | 9 | 9 | 10 | ||

| I2 | A1 | 0.2 | 0.95 | 0.93 | 0.95 | 0.93 | 0.90 | 0.90 |

| A2 | 0.2 | 0.93 | 0.90 | 0.80 | 0.91 | 0.88 | ||

| A3 | 0.2 | 0.90 | 0.85 | 0.75 | 0.90 | 0.85 | ||

| A4 | 0.2 | 0.88 | 0.82 | 0.72 | 0.85 | 0.83 | ||

| A5 | 0.2 | 0.85 | 0.80 | 0.70 | 0.80 | 0.80 | ||

| I3 | A1 | 0.2 | 0.55 | 0.60 | 0.50 | 0.55 | 0.50 | 0.60 |

| A2 | 0.2 | 0.58 | 0.62 | 0.60 | 0.58 | 0.57 | ||

| A3 | 0.2 | 0.60 | 0.65 | 0.65 | 0.60 | 0.60 | ||

| A4 | 0.2 | 0.62 | 0.67 | 0.66 | 0.65 | 0.62 | ||

| A5 | 0.2 | 0.65 | 0.70 | 0.68 | 0.70 | 0.65 | ||

| I4 | A1 | 0.2 | 15 | 16 | 14 | 15 | 16 | 15 |

| A2 | 0.2 | 18 | 18 | 20 | 16 | 18 | ||

| A3 | 0.2 | 20 | 22 | 21 | 18 | 20 | ||

| A4 | 0.2 | 21 | 24 | 22 | 19 | 21 | ||

| A5 | 0.2 | 22 | 25 | 23 | 20 | 22 | ||

| I5 | A1 | 0.2 | 0.25 | 0.25 | 0.20 | 0.30 | 0.25 | 0.20 |

| A2 | 0.2 | 0.23 | 0.22 | 0.18 | 0.22 | 0.22 | ||

| A3 | 0.2 | 0.20 | 0.15 | 0.15 | 0.20 | 0.20 | ||

| A4 | 0.2 | 0.15 | 0.12 | 0.14 | 0.15 | 0.18 | ||

| A5 | 0.2 | 0.10 | 0.10 | 0.12 | 0.10 | 0.15 | ||

| I6 | A1 | 0.2 | ([5,6,7,8]; 0.7,0.3) | ([6,7,8,9]; 0.8,0.1) | ([4,6,7,8]; 0.6,0.3) | ([6,7,8,9]; 0.8,0.2) | ([6,7,8,9]; 0.8,0.1) | 6 |

| A2 | 0.2 | ([4,5,6,7]; 0.7,0.2) | ([5,7,8,9]; 0.8,0.2) | ([3,4,7,8]; 0.6,0.4) | ([5,6,8,9]; 0.8,0.2) | ([5,6,7,8]; 0.8,0.2) | ||

| A3 | 0.2 | ([3,4,5,6]; 0.6,0.2) | ([4,5,6,7]; 0.8,0.2) | ([3,4,5,6]; 0.6, 0.4) | ([5,6,7,8]; 0.8,0.2) | ([4,5,7,8]; 0.8,0.2) | ||

| A4 | 0.2 | ([2,4,5,6]; 0.6,0.3) | ([3,4,5,6]; 0.8,0.2) | ([2,3,4,5]; 0.6,0.3) | ([4,5,6,7]; 0.8,0.2) | ([4,5,6,7]; 0.8,0.2) | ||

| A5 | 0.2 | ([2,3,5,6]; 0.6,0.3) | ([2,4,6,7]; 0.8,0.2) | ([1,3,4,5]; 0.6,0.3) | ([3,4,6,7]; 0.8,0.2) | ([3,5,6,7]; 0.8,0.2) | ||

| I7 | A1 | 0.2 | 0.25 | 0.25 | 0.26 | 0.26 | 0.25 | 0.22 |

| A2 | 0.2 | 0.22 | 0.23 | 0.25 | 0.25 | 0.23 | ||

| A3 | 0.2 | 0.20 | 0.22 | 0.20 | 0.23 | 0.22 | ||

| A4 | 0.2 | 0.19 | 0.21 | 0.19 | 0.20 | 0.19 | ||

| A5 | 0.2 | 0.18 | 0.20 | 0.18 | 0.18 | 0.18 | ||

| I8 | A1 | 0.2 | 0.90 | 0.95 | 0.95 | 0.95 | 0.90 | 0.90 |

| A2 | 0.2 | 0.88 | 0.90 | 0.92 | 0.92 | 0.88 | ||

| A3 | 0.2 | 0.85 | 0.85 | 0.90 | 0.90 | 0.85 | ||

| A4 | 0.2 | 0.82 | 0.83 | 0.85 | 0.88 | 0.83 | ||

| A5 | 0.2 | 0.80 | 0.80 | 0.80 | 0.85 | 0.80 | ||

| I9 | A1 | 0.2 | 0.15 | 0.16 | 0.15 | 0.14 | 0.15 | 0.13 |

| A2 | 0.2 | 0.13 | 0.15 | 0.14 | 0.13 | 0.14 | ||

| A3 | 0.2 | 0.12 | 0.14 | 0.13 | 0.12 | 0.12 | ||

| A4 | 0.2 | 0.11 | 0.13 | 0.12 | 0.11 | 0.11 | ||

| A5 | 0.2 | 0.10 | 0.12 | 0.11 | 0.10 | 0.10 | ||

| I10 | A1 | 0.2 | 0.95 | 0.96 | 0.95 | 0.96 | 0.95 | 0.93 |

| A2 | 0.2 | 0.93 | 0.95 | 0.90 | 0.95 | 0.92 | ||

| A3 | 0.2 | 0.90 | 0.90 | 0.88 | 0.90 | 0.90 | ||

| A4 | 0.2 | 0.88 | 0.85 | 0.86 | 0.89 | 0.89 | ||

| A5 | 0.2 | 0.85 | 0.80 | 0.85 | 0.88 | 0.88 | ||

| Index | State | Supplier | ||||

|---|---|---|---|---|---|---|

| S1 | S2 | S3 | S4 | S5 | ||

| I1 | A1 | 0.00 | 0.00 | 0.00 | 0.00 | 1.00 |

| A2 | 2.00 | 0.00 | 1.00 | 0.00 | 2.00 | |

| A3 | 3.00 | 1.00 | 4.00 | 0.00 | 3.00 | |

| A4 | 4.00 | 2.00 | 5.00 | 2.00 | 4.00 | |

| A5 | 5.00 | 3.00 | 6.00 | 6.00 | 5.00 | |

| I2 | A1 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| A2 | 0.00 | 0.00 | 0.10 | 0.00 | 0.02 | |

| A3 | 0.00 | 0.05 | 0.15 | 0.00 | 0.05 | |

| A4 | 0.02 | 0.08 | 0.18 | 0.05 | 0.07 | |

| A5 | 0.05 | 0.10 | 0.20 | 0.10 | 0.10 | |

| I3 | A1 | 0.05 | 0.00 | 0.10 | 0.05 | 0.10 |

| A2 | 0.02 | 0.00 | 0.00 | 0.02 | 0.03 | |

| A3 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| A4 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| A5 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| I4 | A1 | 0.00 | 0.00 | 1.00 | 0.00 | 0.00 |

| A2 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| A3 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| A4 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| A5 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| I5 | A1 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| A2 | 0.00 | 0.00 | 0.02 | 0.00 | 0.00 | |

| A3 | 0.00 | 0.05 | 0.05 | 0.00 | 0.00 | |

| A4 | 0.05 | 0.08 | 0.06 | 0.05 | 0.02 | |

| A5 | 0.10 | 0.10 | 0.08 | 0.10 | 0.05 | |

| I6 | A1 | 4.00 | 12.83 | 4.00 | 12.83 | 12.83 |

| A2 | 0.17 | 12.83 | 4.00 | 15.83 | 4.00 | |

| A3 | 0.00 | 0.17 | 0.00 | 4.00 | 4.00 | |

| A4 | 0.00 | 0.00 | 0.00 | 0.17 | 0.17 | |

| A5 | 0.00 | 0.00 | 0.00 | 0.17 | 0.17 | |

| I7 | A1 | 0.03 | 0.03 | 0.04 | 0.04 | 0.03 |

| A2 | 0.00 | 0.01 | 0.03 | 0.03 | 0.01 | |

| A3 | 0.00 | 0.00 | 0.00 | 0.01 | 0.00 | |

| A4 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| A5 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| I8 | A1 | 0.00 | 0.05 | 0.05 | 0.05 | 0.00 |

| A2 | 0.00 | 0.00 | 0.02 | 0.02 | 0.00 | |

| A3 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| A4 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| A5 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| I9 | A1 | 0.02 | 0.03 | 0.02 | 0.01 | 0.02 |

| A2 | 0.00 | 0.02 | 0.01 | 0.00 | 0.01 | |

| A3 | 0.00 | 0.01 | 0.00 | 0.00 | 0.00 | |

| A4 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| A5 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| I10 | A1 | 0.02 | 0.03 | 0.02 | 0.03 | 0.02 |

| A2 | 0.00 | 0.02 | 0.00 | 0.02 | 0.00 | |

| A3 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| A4 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| A5 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Index | State | Supplier | ||||

|---|---|---|---|---|---|---|

| S1 | S2 | S3 | S4 | S5 | ||

| I1 | A1 | 0.00 | −1.00 | −1.00 | −2.00 | 0.00 |

| A2 | 0.00 | 0.00 | 0.00 | −1.00 | 0.00 | |

| A3 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| A4 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| A5 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| I2 | A1 | −0.05 | −0.03 | −0.05 | −0.03 | 0.00 |

| A2 | −0.03 | 0.00 | 0.00 | −0.01 | 0.00 | |

| A3 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| A4 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| A5 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| I3 | A1 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| A2 | 0.00 | −0.02 | 0.00 | 0.00 | 0.00 | |

| A3 | 0.00 | −0.05 | −0.05 | 0.00 | 0.00 | |

| A4 | −0.02 | −0.07 | −0.06 | −0.05 | −0.02 | |

| A5 | −0.05 | −0.10 | −0.08 | −0.10 | −0.05 | |

| I4 | A1 | 0.00 | −1.00 | 0.00 | 0.00 | −1.00 |

| A2 | −3.00 | −3.00 | −5.00 | −1.00 | −3.00 | |

| A3 | −5.00 | −7.00 | −6.00 | −3.00 | −5.00 | |

| A4 | −6.00 | −9.00 | −7.00 | −4.00 | −6.00 | |

| A5 | −7.00 | −10.00 | −8.00 | −5.00 | −7.00 | |

| I5 | A1 | −0.05 | −0.05 | 0.00 | −0.10 | −0.05 |

| A2 | −0.03 | −0.02 | 0.00 | −0.02 | −0.02 | |

| A3 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| A4 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| A5 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| I6 | A1 | −0.17 | 0.00 | −1.33 | 0.00 | 0.00 |

| A2 | −3.33 | −0.17 | −10.50 | −0.17 | −0.17 | |

| A3 | −8.17 | −3.33 | −8.17 | −0.17 | −3.33 | |

| A4 | −24.33 | −8.17 | −11.17 | −3.33 | −3.33 | |

| A5 | −34.67 | −24.33 | −16.83 | −10.50 | −6.00 | |

| I7 | A1 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| A2 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| A3 | −0.02 | 0.00 | −0.02 | 0.00 | 0.00 | |

| A4 | −0.03 | −0.01 | −0.03 | −0.02 | −0.03 | |

| A5 | −0.04 | −0.02 | −0.04 | −0.04 | −0.04 | |

| I8 | A1 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| A2 | −0.02 | 0.00 | 0.00 | 0.00 | −0.02 | |

| A3 | −0.05 | −0.05 | 0.00 | 0.00 | −0.05 | |

| A4 | −0.08 | −0.07 | −0.05 | −0.02 | −0.07 | |

| A5 | −0.10 | −0.10 | −0.10 | −0.05 | −0.10 | |

| I9 | A1 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| A2 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| A3 | −0.01 | 0.00 | 0.00 | −0.01 | −0.01 | |

| A4 | −0.02 | 0.00 | −0.01 | −0.02 | −0.02 | |

| A5 | −0.03 | −0.01 | −0.02 | −0.03 | −0.03 | |

| I10 | A1 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| A2 | 0.00 | 0.00 | −0.03 | 0.00 | −0.01 | |

| A3 | −0.03 | −0.03 | −0.05 | −0.03 | −0.03 | |

| A4 | −0.05 | −0.08 | −0.07 | −0.04 | −0.04 | |

| A5 | −0.08 | −0.13 | −0.08 | −0.05 | −0.05 | |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license ( http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Song, W.; Chen, Z.; Wang, X.; Wang, Q.; Shi, C.; Zhao, W. Environmentally Friendly Supplier Selection Using Prospect Theory. Sustainability 2017, 9, 377. https://doi.org/10.3390/su9030377

Song W, Chen Z, Wang X, Wang Q, Shi C, Zhao W. Environmentally Friendly Supplier Selection Using Prospect Theory. Sustainability. 2017; 9(3):377. https://doi.org/10.3390/su9030377

Chicago/Turabian StyleSong, Wei, Zhiya Chen, Xuping Wang, Qian Wang, Chenghua Shi, and Wei Zhao. 2017. "Environmentally Friendly Supplier Selection Using Prospect Theory" Sustainability 9, no. 3: 377. https://doi.org/10.3390/su9030377