The Diversification Benefits of Including Carbon Assets in Financial Portfolios

Abstract

:1. Introduction

2. Literature Review

3. Methodology

3.1. Global Minimum Variance Model

3.2. Mean-Variance-OGARCH Model

σi,k2 = α0 + α1εi,k−12 + α2σi,k−12

3.3. MV-DCC Model

Ht = DtRtDt

4. Empirical Results

4.1. Data

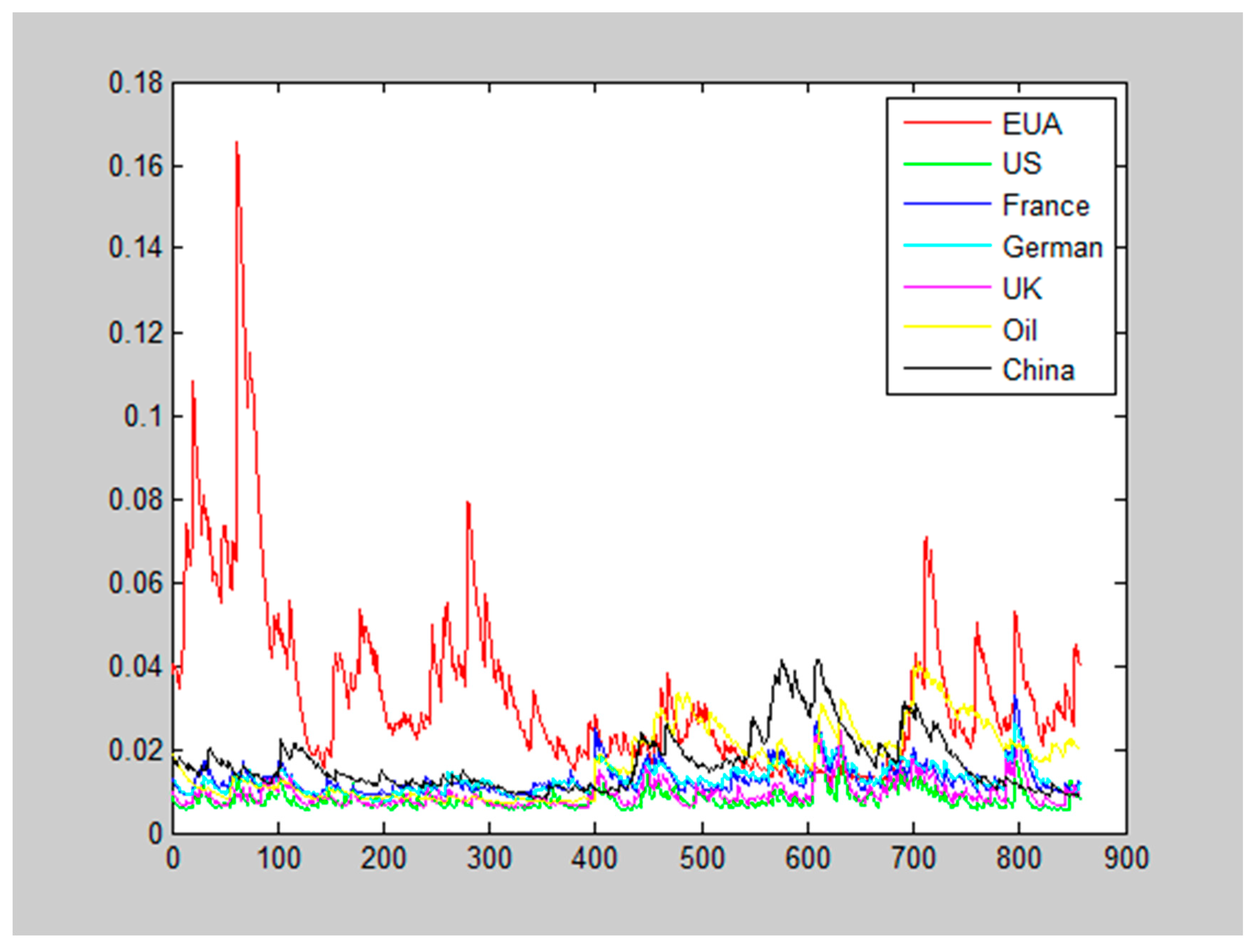

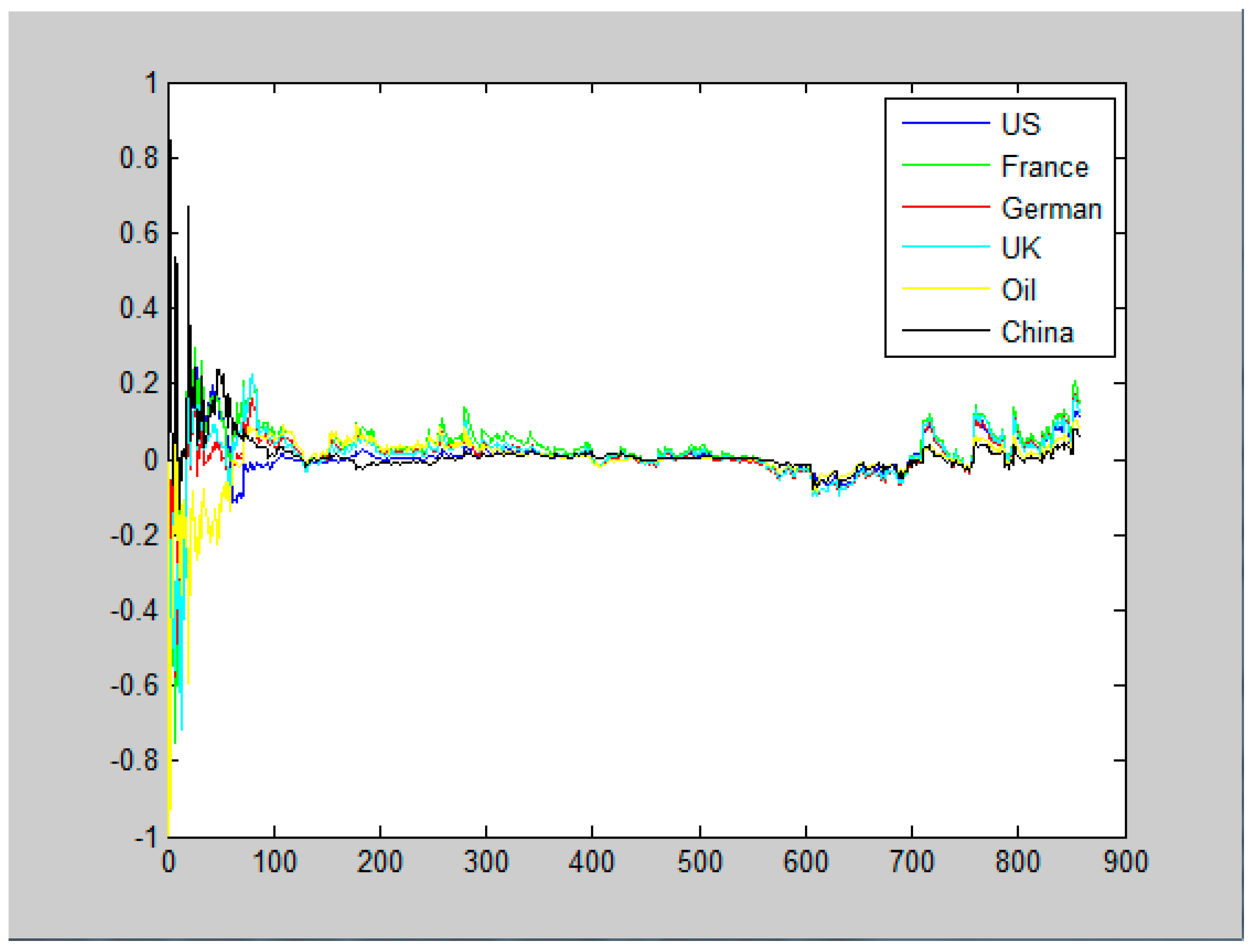

4.2. Dynamic Volatility under MV-OGARCH and MV-DCC Assumptions

4.3. Portfolio Optimization Results

4.4. Diversification Benefits

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Hughes, T.P.; Baird, A.H.; Bellwood, D.R.; Card, M.; Connolly, S.R.; Folke, C.; Grosberg, R.; Hoegh-Guldberg, O.; Jackson, J.B.C.; Kleypas, J. Climate change, human impacts, and the resilience of coral reefs. Science 2003, 301, 929–933. [Google Scholar] [CrossRef] [PubMed]

- United Nations Development Programme. Human Development Report 2007/2008: Fighting Climate Change: Human Solidarity in a Divided World; Palgrave Macmillan: London, UK, 2007; pp. 1–18. Available online: http://link.springer.com/chapter/10.1057/9780230598508_1 (accessed on 14 March 2017).

- Barnett, J.; Adger, W.N. Climate change, human security and violent conflict. Political Geogr. 2007, 26, 639–655. [Google Scholar] [CrossRef]

- Ellerman, A.D.; Buchner, B.K. The European Union emissions trading scheme: Origins, allocation, and early results. Rev. Environ. Econ. Policy 2007, 1, 66–87. [Google Scholar] [CrossRef]

- Yang, L.; Li, F.; Zhang, X. Chinese companies’ awareness and perceptions of the Emissions Trading Scheme (ETS): Evidence from a national survey in China. Energy Policy 2016, 98, 254–265. [Google Scholar] [CrossRef]

- What Are CO2 Emission Allowances. Available online: http://carbonexpert.ro/en/CO2-emissions/what-are-CO2-emissions-allowances/ (accessed on 14 March 2017).

- Lin, J. Development of the Carbon Market; Shanghai Jiao Tong University Press: Shanghai, China, 2013. (In Chinese) [Google Scholar]

- BlueNext—Wikipedia. Available online: https://en.wikipedia.org/wiki/BlueNext (accessed on 14 March 2017).

- Kanen, J.L.M. Carbon Trading and Pricing; Environmental Finance Publications: London, UK, 2006. [Google Scholar]

- Arouri, M.E.H.; Nguyen, D.K. Oil prices, stock markets and portfolio investment: Evidence from sector analysis in Europe over the last decade. Energy Policy 2010, 38, 4528–4539. [Google Scholar] [CrossRef]

- Ciner, C. Energy shocks and financial markets: Nonlinear linkages. Stud. Nonlinear Dyn. Econom. 2001, 5, 203–212. [Google Scholar] [CrossRef]

- Zhang, Y.J.; Sun, Y.F. The dynamic volatility spillover between European carbon trading market and fossil energy market. J. Clean. Prod. 2016, 112, 2654–2663. [Google Scholar] [CrossRef]

- Zhuang, X.; Wei, Y.; Zhang, B. Multifractaldetrended cross-correlation analysis of carbon and crude oil markets. Physica A 2014, 399, 113–125. [Google Scholar] [CrossRef]

- Hammoudeh, S.; Nguyen, D.K.; Sousa, R.M. Energy prices and CO2 emission allowance prices: A quantile regression approach. Energy Policy 2014, 70, 201–206. [Google Scholar] [CrossRef]

- Peri, M.; Baldi, L. Nonlinear price dynamics between CO2 futures and Brent. Appl. Econ. Lett. 2011, 18, 1207–1211. [Google Scholar] [CrossRef]

- Daskalakis, G.; Psychoyios, D.; Markellos, R.N. Modeling CO2 emission allowance prices and derivatives: Evidence from the European trading scheme. J. Bank. Financ. 2009, 33, 1230–1241. [Google Scholar] [CrossRef]

- Yu, L.; Li, J.; Tang, L.; Wang, S. Linear and nonlinear Granger causality investigation between carbon market and crude oil market: A multi-scale approach. Energy Econ. 2015, 51, 300–311. [Google Scholar] [CrossRef]

- Reboredo, J.C. Modeling EU allowances and oil market interdependence. Implications for portfolio management. Energy Econ. 2013, 36, 471–480. [Google Scholar] [CrossRef]

- Reboredo, J.C. Volatility spillovers between the oil market and the European Union carbon emission market. Econ. Model. 2014, 36, 229–234. [Google Scholar] [CrossRef]

- Basher, S.A.; Sadorsky, P. Oil price risk and emerging stock markets. Glob. Financ. J. 2006, 17, 224–251. [Google Scholar] [CrossRef]

- Park, J.; Ratti, R.A. Oil price shocks and stock markets in the US and 13 European countries. Energy Econ. 2008, 30, 2587–2608. [Google Scholar] [CrossRef]

- Arouri, M.E.H.; Jouini, J.; Nguyen, D.K. Volatility spillovers between oil prices and stock sector returns: Implications for portfolio management. J. Int. Money Financ. 2011, 30, 1387–1405. [Google Scholar] [CrossRef]

- Reboredo, J.C. Nonlinear effects of oil shocks on stock returns: A Markov-switching approach. Appl. Econ. 2010, 42, 3735–3744. [Google Scholar] [CrossRef]

- Wang, Y.; Wu, C.; Yang, L. Oil price shocks and stock market activities: Evidence from oil-importing and oil-exporting countries. J. Comp. Econ. 2013, 41, 1220–1239. [Google Scholar] [CrossRef]

- Zhu, H.; Su, X.; Guo, Y.; Ren, Y. The Asymmetric Effects of Oil Price Shocks on the Chinese Stock Market: Evidence from a Quantile Impulse Response Perspective. Sustainability 2016, 8, 766. [Google Scholar] [CrossRef]

- Lee, C.C.; Zeng, J.H. The impact of oil price shocks on stock market activities: Asymmetric effect with quantile regression. Math. Comput. Simul. 2011, 81, 1910–1920. [Google Scholar] [CrossRef]

- Reboredo, J.C.; Rivera-Castro, M.A. A wavelet decomposition approach to crude oil price and exchange rate dependence. Econ. Model. 2013, 32, 42–57. [Google Scholar] [CrossRef]

- Luo, C.; Wu, D. Environment and economic risk: An analysis of carbon emission market and portfolio management. Environ. Res. 2016, 149, 297–301. [Google Scholar] [CrossRef] [PubMed]

- Lu, W.; Wang, W. Dynamic correlation between carbon market and Chinese stock market based on AGDCC-GARCH. In Proceedings of the International Conference on Management Science and Engineering, Moscow, Russia, 14–16 September 2009.

- Koleini, A. Portfolio Diversification; Benefits of Investing in Carbon Markets from a New Zealand Investor Perspective. Master’s Thesis, Auckland University of Technology, Auckland, New Zealand, 2011. [Google Scholar]

- Mansanet-Bataller, M.; Pardo, A. CO2 prices and portfolio management. Int. J. Glob. Energy Issues 2011, 35, 158–177. [Google Scholar] [CrossRef]

- Afonin, A.; Bredin, D.; Muckley, C.B.; Nitzsche, D. Carbon Portfolio Management. 2014. Available online: http://dx.doi.org/10.2139/ssrn.2507725 (accessed on 14 March 2017).

- Oestreich, A.M.; Tsiakas, I. Carbon emissions and stock returns: Evidence from the EU Emissions Trading Scheme. J. Bank. Financ. 2015, 58, 294–308. [Google Scholar] [CrossRef]

- Markowitz, H. Portfolio selection. J. Financ. 1952, 7, 77–91. [Google Scholar] [CrossRef]

- Dobrovolskienė, N.; Tamošiūnienė, R. Sustainability-Oriented Financial Resource Allocation in a Project Portfolio through Multi-Criteria Decision-Making. Sustainability 2016, 8, 485. [Google Scholar] [CrossRef]

- Michaud, R.O. The Markowitz optimization enigma: Is optimized optimal? Financ. Anal. 1989, 45, 31–42. [Google Scholar] [CrossRef]

- Chopra, V.K.; Ziemba, W.T. The effects of errors in means, variances, and covariances on optimal portfolio choice. J. Portf. Manag. 1993, 20, 6–11. [Google Scholar] [CrossRef]

- Broadie, M. Computing efficient frontiers using estimated parameters. Ann. Oper. Res. 1993, 45, 21–58. [Google Scholar] [CrossRef]

- Haugen, R.A.; Baker, N.L. The efficient market inefficiency of capitalization–weighted stock portfolios. J. Portf. Manag. 1991, 17, 35–40. [Google Scholar] [CrossRef]

- Clarke, R.G.; de Silva, H.; Thorley, S. Minimum-Variance Portfolios in the U.S. Equity Market. J. Portf. Manag. 2006, 33, 10–24. [Google Scholar] [CrossRef]

- Frahm, G. Linear statistical inference for global and local minimum variance portfolios. Stat. Pap. 2010, 51, 789–821. [Google Scholar] [CrossRef]

- Chan, L.K.C.; Karceski, J.; Lakonishok, J. On portfolio optimization: Forecasting covariances and choosing the risk model. Rev. Financ. Stud. 1999, 5, 937–974. [Google Scholar] [CrossRef]

- Jagannathan, R.; Ma, T. Risk reduction in large portfolios: Why imposing the wrong constraints helps. J. Financ. 2003, 58, 1651–1684. [Google Scholar] [CrossRef]

- Papantonis, I. Volatility risk premium implications of GARCH option pricing models. Econ. Model. 2016, 58, 104–115. [Google Scholar] [CrossRef]

- Ranković, V.; Drenovak, M.; Urosevic, B.; Jelic, R. Mean-univariate GARCH VaR portfolio optimization: Actual portfolio approach. Comput. Oper. Res. 2016, 72, 83–92. [Google Scholar] [CrossRef]

- Ding, Z. Time Series Analysis of Speculative Returns. Ph.D. Thesis, University of California, San Diego, CA, USA, 1994. [Google Scholar]

- Alexander, C.; Chibumba, A. Multivariate Orthogonal Factor GARCH; University of Sussex: Mimeo, UK, 1997. [Google Scholar]

- Lam, L.; Fung, L.; Yu, I. Forecasting a Large Dimensional Covariance Matrix of a Portfolio of Different Asset Classes. Discussion Paper 1. Hong Kong Monetary Authority Working Paper. 2009. Available online: http://dx.doi.org/10.2139/ssrn.1337921 (accessed on 14 March 2017).

- Engle, R. Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models. J. Bus. Econ. Stat. 2002, 20, 339–350. [Google Scholar] [CrossRef]

- Bollerslev, T. Modeling the Coherence in Short-run Nominal Exchange Rates: A Multivariate Generalized ARCH Approach. Rev. Econ. Stat. 1990, 72, 498–505. [Google Scholar] [CrossRef]

- Rittler, D. Price discovery and volatility spillovers in the European Union emissions trading scheme: A high-frequency analysis. J. Bank. Financ. 2012, 36, 774–785. [Google Scholar] [CrossRef]

- Kaufmann, R.K.; Dees, S.; Karadeloglou, P.; Sanchez, M. Does OPEC matter? An econometric analysis of oil prices. Energy J. 2004, 25, 67–90. [Google Scholar] [CrossRef]

- Blum, A.; Kalai, A. Universal portfolios with and without transaction costs. Mach. Learn. 1999, 35, 193–205. [Google Scholar] [CrossRef]

- Della Corte, P.; Sarno, L.; Tsiakas, I. An economic evaluation of empirical exchange rate models. Rev. Financ. Stud. 2009, 22, 3491–3530. [Google Scholar] [CrossRef]

| Statistical (%) | EUA | US | France | Germany | England | Oil | China |

|---|---|---|---|---|---|---|---|

| Mean | −0.04 | 0.05 | 0.02 | 0.03 | 0.01 | −0.11 | 0.03 |

| Std. dev. | 3.82 | 0.85 | 1.3 | 1.29 | 0.98 | 1.85 | 1.79 |

| Skewness | −171.73 | −36.21 | −56.23 | −45.38 | −17.16 | 57.08 | −85.97 |

| Kurtosis | 2614.72 | 626.42 | 668.50 | 519.10 | 574.26 | 747.82 | 753.42 |

| Min | −43.46 | −4.02 | −8.38 | −7.07 | −4.78 | −6.75 | −9.15 |

| Max | 24.05 | 4.75 | 4.91 | 4.85 | 5.04 | 10.8 | 6.5 |

| Medium | 0 | 0.07 | 0.07 | 0.10 | 0.06 | −0.14 | 0.03 |

| EUA | US | France | Germany | England | Oil | China | |

|---|---|---|---|---|---|---|---|

| EUA | |||||||

| US | 0.0867 | ||||||

| France | 0.1241 | 0.5961 | |||||

| Germany | 0.1042 | 0.5646 | 0.9347 | ||||

| England | 0.1064 | 0.6053 | 0.8533 | 0.8146 | |||

| Oil | 0.0672 | 0.2335 | 0.2763 | 0.2247 | 0.3324 | ||

| China | 0.0331 | 0.1531 | 0.1407 | 0.1339 | 0.1815 | 0.1319 |

| Statistic (%) | EUA | US | France | Germany | England | Oil | China |

|---|---|---|---|---|---|---|---|

| GMV | 0.0260 | 0.6422 | −0.2386 | 0.0210 | 0.4358 | 0.0448 | 0.0679 |

| MV-OGARCH | 0.1623 | 0.1436 | 0.1296 | 0.1326 | 0.1397 | 0.1579 | 0.1333 |

| MV-DCC | 0.1133 | 0.55372 | −0.1543 | 0.0600 | 0.1809 | 0.1289 | 0.1164 |

| EUA | US | France | Germany | England | Oil | China | |

|---|---|---|---|---|---|---|---|

| GMV | 0.0260 | 0.6422 | −0.2386 | 0.0210 | 0.4358 | 0.0448 | 0.0679 |

| MV-OGARCH | 0.1341 | 0.1725 | 0.2009 | 0.1071 | 0.1748 | 0.1333 | 0.0766 |

| MV-DCC | 0.1271 | 0.6273 | −0.1681 | −0.0140 | 0.1648 | 0.1238 | 0.1381 |

| Statistic (%) | Mean | Min | Max | Medium | Std. Dev. |

|---|---|---|---|---|---|

| GMV | 0.0227 | −4.34 | 4.80 | 0.0663 | 0.75 |

| MV-OGARCH | 0.0288 | −4.59 | 4.10 | 0.0713 | 0.92 |

| MV-DCC | 0.0167 | −6.67 | 4.36 | 0.0510 | 0.82 |

| Statistic (%) | Mean | Min | Max | Medium | Std. Dev. |

|---|---|---|---|---|---|

| GMV | 0.0553 | −2.44 | 2.11 | 0.0256 | 0.69 |

| MV-OGARCH | 0.0766 | −3.58 | 1.82 | 0.0585 | 0.74 |

| MV-DCC | 0.0332 | −2.62 | 1.67 | −0.0234 | 0.72 |

| GMV | MV-OGARCH | MV-DCC | ||

|---|---|---|---|---|

| With Carbon Market | Mean | 0.0553% | 0.0766% | 0.0332% |

| Min | −2.44% | −3.58% | −2.62% | |

| Max | 2.11% | 1.82% | 1.67% | |

| Medium | 0.0256% | 0.0585% | −0.0234% | |

| Std. dev. | 0.69% | 0.74% | 0.72% | |

| Without Carbon Market | Mean | 0.0631% | 0.0830% | 0.0430% |

| Min | −2.67% | −3.19% | −4.20% | |

| Max | 3.24% | 4.20% | 4.81% | |

| Medium | 0.0453% | 0.0047% | 0.0130% | |

| Std. dev. | 0.74% | 0.75% | 0.74% |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license ( http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, Y.; Liu, Z.; Yu, X. The Diversification Benefits of Including Carbon Assets in Financial Portfolios. Sustainability 2017, 9, 437. https://doi.org/10.3390/su9030437

Zhang Y, Liu Z, Yu X. The Diversification Benefits of Including Carbon Assets in Financial Portfolios. Sustainability. 2017; 9(3):437. https://doi.org/10.3390/su9030437

Chicago/Turabian StyleZhang, Yinpeng, Zhixin Liu, and Xueying Yu. 2017. "The Diversification Benefits of Including Carbon Assets in Financial Portfolios" Sustainability 9, no. 3: 437. https://doi.org/10.3390/su9030437