Competitive Success in Responsible Regional Ecosystems: An Empirical Approach in Spain Focused on the Firms’ Relationship with Stakeholders

Abstract

:1. Introduction

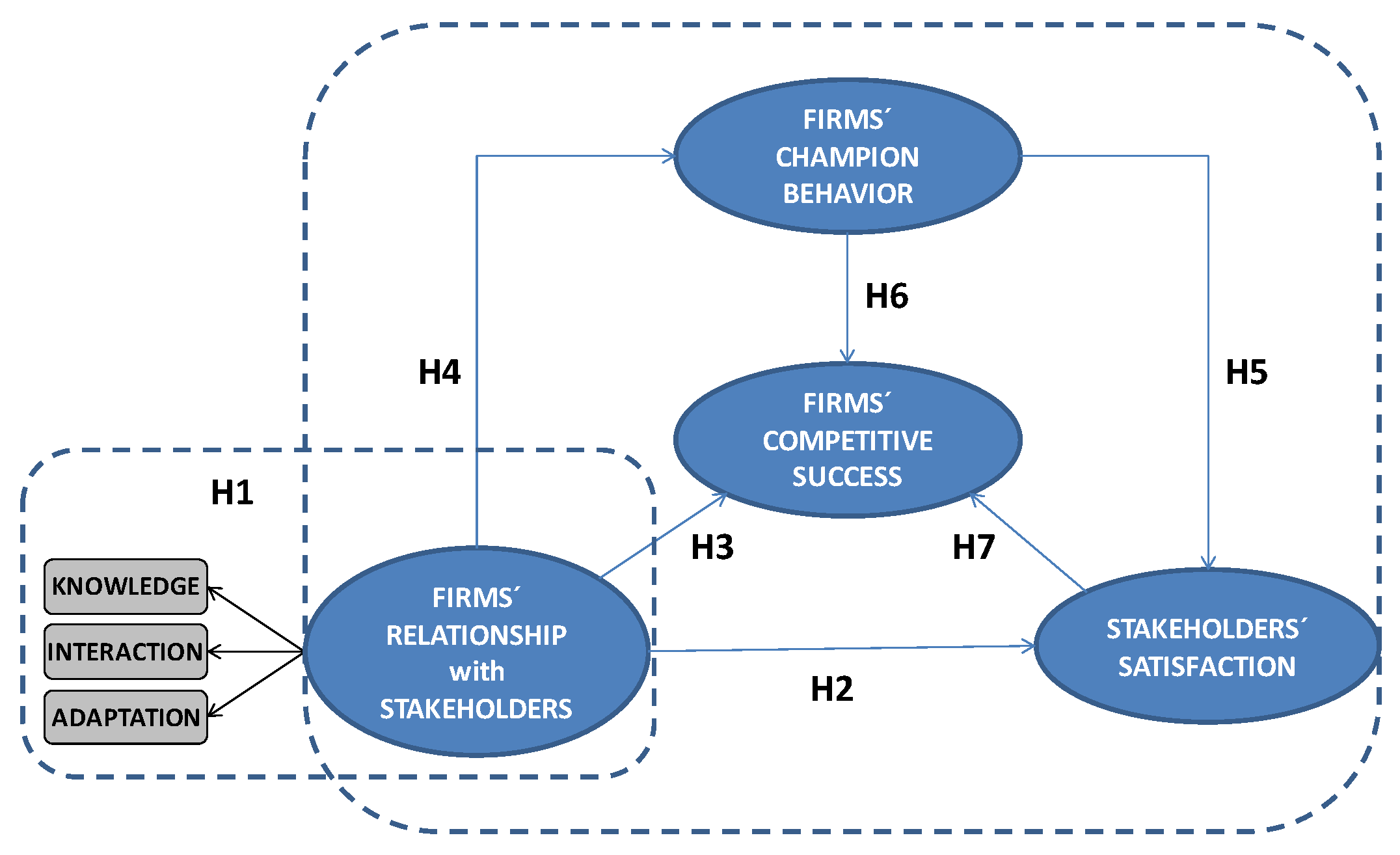

2. Theoretical Foundations and Model Development

2.1. Creating Shared Value

2.2. Responsible Regional Context and Local Cluster Development

2.3. Theoretical Model Development

3. Empirical Analysis

3.1. Method

3.2. Sample and Procedure

3.3. Measures

4. Results and Discussion

4.1. Evaluation of the Measurement Model

4.2. Evaluation of the Structural Model

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A

| Firms’ Knowledge of Stakeholders |

| The company dedicates time and resources to knowing the characteristics of its stakeholders (relationships between different stakeholders, potential threats, cooperation, etc.) (KNOW 1) * |

| The company obtains feed-back on its repercussions on stakeholders (KNOW 2) |

| The company keeps documented information on the previous relationships with stakeholders related to important meetings (KNOW 3) |

| The company keeps documented information on the previous relationships with employees, partners, suppliers or clients, related to conflicts, judicial or extrajudicial demands (KNOW 4) |

| The company keeps documentation related to collective bargaining agreements and relationships with trade unions (KNOW 5) |

| The company keeps documentation related to agreements with suppliers and partners (KNOW 6) * |

| The company obtains feed-back on its repercussions on clients (suggestions, complains, budgets requests, etc.) (KNOW 7) * |

| The company obtains feed-back on its repercussions on employees (opinions, level of satisfaction, engagement, etc.) (KNOW 8) * |

| Knowledge of all stakeholders and their demands is very important for the managers (performance, relationships among them, positioning of power, importance and satisfaction, etc.) (KNOW 9) * |

| Firms’ adaptation to stakeholders’ demands |

| The company makes a special effort to prepare the information for the different stakeholders (ADAPT 1) * |

| There is frequent managerial debate about the demands of the stakeholders (ADAPT 2) * |

| The company is willing to change its objectives in line with stakeholders’ demands (ADAPT 3) * |

| The company is willing to change its norms or process in line with employees’ suggestions (ADAPT 4) |

| The company is willing to change some aspects related to management following trade unions’ recommendations (ADAPT 5) |

| The company is willing to change its process in line with suppliers’ indications (ADAPT 6) |

| Sometimes the company changes its practices to encounter the local community’s expectations (ADAPT7) * |

| The company’s policies and priorities are adapted to clients’ demands (ADAPT8) |

| The company is willing to change its objectives in line with stakeholders’ demands (ADAPT9) * |

| Firms’ interaction with stakeholders |

| The company frequently has meetings with the stakeholders (clients, partners, suppliers, etc.) (INTER 1) * |

| The company consults the stakeholders and asks them for information before taking decisions (INTER 2) * |

| The company’s formal or informal cooperation with the stakeholders is intense (commitments, collaboration agreements, etc.) (INTER 3) * |

| The company consults the employees any action affecting them before taking decisions (INTER 4) * |

| The company consults the clients’ opinion about any action affecting them before taking decisions (INTER 5) * |

| The company considers any opinion from the local community (INTER6) * |

| The company considers any opinion from its main suppliers (INTER7) |

| The company collaborates with the main trade unions (INTER8) |

| The company collaborates with the Public Administration (INTER9) * |

| The company strives to develop new contacts with all the stakeholders and to enlarge its networks (INTER10) * |

| The company strives to develop the existing relations with the stakeholders (INTER11) |

| Stakeholder satisfaction |

| In general, the company perceives a high-level of trust toward the company in the different stakeholders (SSAT 1) * |

| The company perceives that the key stakeholders are satisfied with the economic benefits of their relationships with the company (SSAT 2) * |

| The company perceives that the stakeholders are satisfied with the response to their demands (SSAT 3) * |

| The company perceives that it has a good image and a high credibility among all its stakeholders (SSAT 4) * |

| The company perceives that the different stakeholders are satisfied with how the company acts to make compatible their demands (SSAT 5) * |

| Firms’ champion behavior |

| Expresses confidence in what the innovation can do (CHAM 1) * |

| Points out reasons why the innovation will succeed (CHAM 2) * |

| Enthusiastically promotes the innovation’s advantages (CHAM 3) * |

| Gets the key decision makers involved (CHAM 4) * |

| Secures the top level support required (CHAM 5) * |

| Gets problems into the hands of those who can solve them (CHAM 6) * |

| Gets the right people involved in our projects (CHAM 7) * |

| Persists in the face of adversity (CHAM 8) * |

| Does not give up when others say it cannot be done (CHAM 9) * |

| Knocks down barriers to the innovation (CHAM 10) * |

| Shows tenacity in overcoming obstacles (CHAM 11) * |

| Firms’ competitive success |

| Quality in our human resource management (COM1) * |

| Levels of training and empowerment of our personnel (COM2) * |

| Leadership capabilities of our managers (COM3) * |

| Our capabilities in the field of marketing (COM4) * |

| Quality of our products and services (COM5) * |

| Levels of organizational and technological innovation (COM6) * |

| Technological resources and information systems (COM7) * |

| Quality and transparency of our financial management (COM8) * |

| Cohesion of our corporate values and culture (COM9) * |

| Efficacy of our organizational structure (COM10) * |

| Market knowledge, know-how, and accumulated experience (COM11) * |

References

- Aminia, M.; Bienstock, C.C. Corporate sustainability: An integrative definition and framework to evaluate corporate practice and guide academic research. J. Clean. Prod. 2014, 76, 12–19. [Google Scholar] [CrossRef]

- McWilliams, A.; Siegel, D.S. Creating and capturing value: Strategic corporate social responsibility, resource-based theory, and sustainable competitive advantage. J. Manag. 2011, 37, 1480–1495. [Google Scholar] [CrossRef]

- Gallardo-Vázquez, D.; Sánchez-Hernández, M.I. Measuring Corporate Social Responsibility for competitive success at a regional level. J. Clean. Prod. 2014, 72, 14–22. [Google Scholar] [CrossRef]

- Martínez-Martínez, D.; Herrera Madueño, J.; Larrán Jorge, M.; Lechuga Sancho, M.P. The strategic nature of corporate social responsibility in SMEs: A multiple mediator analysis. Ind. Manag. Data Syst. 2017, 117, 2–31. [Google Scholar] [CrossRef]

- Vogel, D.J. Is there a market for virtue? The business case for corporate social responsibility. Calif. Manag. Rev. 2005, 47, 19–45. [Google Scholar] [CrossRef]

- Weber, M. The business case for corporate social responsibility: A company-level measurement approach for CSR. Eur. Manag. J. 2008, 26, 247–261. [Google Scholar] [CrossRef]

- Carroll, A.B.; Shabana, K.M. The business case for corporate social responsibility: A review of concepts, research and practice. Int. J. Manag. Rev. 2010, 12, 85–105. [Google Scholar] [CrossRef]

- Schreck, P. Reviewing the business case for corporate social responsibility: New evidence and analysis. J. Bus. Ethics 2011, 103, 167. [Google Scholar] [CrossRef]

- Greening, D.W.; Turban, D.B. Corporate social performance as a competitive advantage in attracting a quality workforce. Bus. Soc. 2000, 39, 254–280. [Google Scholar] [CrossRef]

- Saeidi, S.P.; Sofian, S.; Saeidi, P.; Saeidi, S.P.; Saaeidi, S.A. How does corporate social responsibility contribute to firm financial performance? The mediating role of competitive advantage, reputation, and customer satisfaction. J. Bus. Res. 2015, 68, 341–350. [Google Scholar] [CrossRef]

- Smith, A.D. Making the case for the competitive advantage of Corporate Social Responsibility. Bus. Strategy Ser. 2007, 8, 186–195. [Google Scholar] [CrossRef]

- Bernard, A.B.; Redding, S.J.; Schott, P.K. Comparative advantage and heterogeneous firms. Rev. Econ. Stud. 2007, 74, 31–66. [Google Scholar] [CrossRef]

- Flint, D.J.; Golicic, S.L. Searching for competitive advantage through sustainability: A qualitative study in the New Zealand wine industry. Int. J. Phys. Distrib. Logist. Manag. 2009, 39, 841–860. [Google Scholar] [CrossRef]

- Freeman, R.E. Strategic Management: A Stakeholder Approach; Cambridge University Press: Cambridge, UK, 2010. [Google Scholar]

- Freeman, R.E.; McVea, J. A stakeholder approach to strategic management. In Handbook of Strategic Management; Hitt, M., Harrison, J., Freeman, R.E., Eds.; Blackwell Publishing: Oxford, UK, 2001. [Google Scholar]

- Karaibrahimoglu, Y.Z. Corporate Social Responsibility in times of financial crisis. Afr. J. Bus. Manag. 2010, 4, 382–389. [Google Scholar]

- Hart, S.L.; Milstein, M.B. Creating sustainable value. Acad. Manag. Executive 2003, 17, 56–67. [Google Scholar] [CrossRef]

- Park, J.; Lee, H.; Kim, C. Corporate social responsibilities, consumer trust and corporate reputation: South Korean consumers’ perspectives. J. Bus. Res. 2014, 67, 295–302. [Google Scholar] [CrossRef]

- Servaes, H.; Tamayo, A. The Impact of Corporate Social Responsibility on Firm Value: The Role of Customer Awareness. Manag. Sci. 2013, 59, 1045–1061. [Google Scholar] [CrossRef]

- Dogl, C.; Holtbrugge, D. Corporate environmental responsibility, employer reputation and employee commitment: An empirical study in developed and emerging economies. Int. J. Hum. Resour. Manag. 2014, 25, 1739–1762. [Google Scholar] [CrossRef]

- Girerd, I.; Jimenez, S.; Louvet, P. Which Dimensions of Social Responsibility Concern Financial Investors? J. Bus. Ethics 2014, 121, 559–576. [Google Scholar] [CrossRef]

- Surroca, J.; Tribó, J.A.; Waddock, S. Corporate responsibility and financial performance: The role of intangible resources. Strategic Manag. J. 2010, 31, 463–490. [Google Scholar] [CrossRef] [Green Version]

- Russo, A.; Tencati, A. Formal vs. informal CSR strategies: Evidence from Italian micro, small, medium-sized, and large firms. J. Bus. Ethics 2009, 85, 339–353. [Google Scholar] [CrossRef]

- Lukács, E. The economic role of SMEs in world economy, especially in Europe. Eur. Integr. Stud. 2005, 1, 3–12. [Google Scholar]

- Carroll, A.B. A three-dimensional conceptual model of corporate performance. Acad. Manag. Rev. 1979, 4, 497–505. [Google Scholar]

- Wartick, S.L.; Cochran, P.L. The evolution of the corporate social performance model. Acad. Manag. Rev. 1985, 10, 758–769. [Google Scholar]

- Carroll, A.B. The pyramid of corporate social responsibility: Toward the moral management of organizational stakeholders. Bus. Horiz. 1991, 34, 39–48. [Google Scholar] [CrossRef]

- Wood, D.J. Corporate social performance revisited. Acad. Manag. Rev. 1991, 16, 691–718. [Google Scholar]

- Elkington, J. Towards the Suitable Corporation: Win-win-win Business Strategies for Sustainable Development. Calif. Manag. Rev. 1994, 36, 90–100. [Google Scholar] [CrossRef]

- Shiller, R.J. The Subprime Solution: How Today's Global Financial Crisis Happened, and What to Do about It; Princeton University Press: Princeton, NJ, USA, 2012. [Google Scholar]

- Carroll, A.B.; Buchholtz, A.K. Business and Society: Ethics, Sustainability, and Stakeholder Management; Cengage Learning: Stamford, CT, USA, 2012. [Google Scholar]

- Epstein, M.J.; Buhovac, A.R. Making Sustainability Work: Best Practices in Managing and Measuring Corporate Social, Environmental, and Economic Impacts; Berrett-Koehler Publishers: Oakland, CA, USA, 2014. [Google Scholar]

- Parket, I.R.; Eilbirt, H. The practice of business social responsibility: The underlying factors. Bus. Horiz. 1975, 18, 5–10. [Google Scholar] [CrossRef]

- Sahlin-Andersson, K. Corporate Social Responsibility: A Trend and a Movement, But of What and for What? Corp. Gov. Int. J. Bus. Soc. 2006, 6, 595–608. [Google Scholar] [CrossRef]

- Lougee, B.; Wallace, J. The corporate social responsibility (CSR) trend. J. Appl. Corp. Financ. 2008, 20, 96–108. [Google Scholar] [CrossRef]

- Friedman, M. The Social Responsibility of Business is to Increase its Profits. N. Y. Times 1970, 13, 32–33. [Google Scholar]

- Handy, C. What’s a Business For? Harv. Bus. Rev. 2002, 80, 49–55. [Google Scholar] [PubMed]

- Bowen, H.R. Social Responsibilities of the Businessman; The University of Iowa Press: Iowa City, IA, USA, 1953. [Google Scholar]

- Carroll, A.B. Corporate Social Responsibility Evolution of a Definitional Construct. Bus. Soc. 1999, 38, 268–295. [Google Scholar] [CrossRef]

- Porter, M.E.; Kramer, M.R. The Link between Competitive Advantage and Corporate Social Responsibility. Harv. Bus. Rev. 2006, 84, 78–92. [Google Scholar] [PubMed]

- Porter, M.E.; Kramer, M.R. Creating Shared Value. Harv. Bus. Rev. 2011, 89, 62–77. [Google Scholar]

- Giannarakis, G.; Theotokas, I. The effect of financial crisis in corporate social responsibility performance. Int. J. Mark. Stud. 2011, 3, 2–10. [Google Scholar] [CrossRef]

- Porter, M. The Competitive Advantage of Nations; The Free Press: New York, NY, USA, 1990. [Google Scholar]

- Kitson, M.; Martin, R.; Tyler, P. Regional competitiveness: An elusive yet key concept? Reg. Stud. 2004, 38, 991–999. [Google Scholar] [CrossRef]

- Dudensing, R.M. Benchmarking Regional Competitiveness: The Role of a Region’s Economic Legacy in Determining Competitiveness; Clemson University: Clemson, SC, USA, 2008. [Google Scholar]

- Benzaquen, J.; Carpio, L.A.; Zegarra, L.A.; Valdivia, C.A. A competitiveness index for the regions of a country. CEPAL Rev. 2010, 102, 67–84. [Google Scholar] [CrossRef]

- McCann, P.; Ortega-Argilés, R. Smart Specialisation, Regional Growth and Applications to EU Cohesion Policy; University of Groningen: Groningen, The Netherlands, 2011. [Google Scholar]

- Scott, A.J.; Storper, M. Regions, globalization, development. Reg. Stud. 2003, 37, 579–593. [Google Scholar] [CrossRef]

- Johnson, G.; Scholes, K. Exploring Corporate Strategy; Pearson Education: Harlow, UK, 2002. [Google Scholar]

- Ruf, B.M.; Muralidhar, K.; Brown, R.M.; Janney, J.J.; Paul, K. An empirical investigation of the relationship between change in corporate social performance and financial performance: A stakeholder theory perspective. J. Bus. Ethics 2001, 32, 143–156. [Google Scholar] [CrossRef]

- Penrose, E. The Theory of the Growth of the Firm; Wiley: New York, NY, USA, 1959. [Google Scholar]

- Wernerfelt, B. A resource-based view of the firm. Strategic Manag. J. 1984, 5, 171–180. [Google Scholar] [CrossRef]

- Barney, J.B. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Barney, J.B. How marketing scholars might help address issues in resource-based theory. J. Acad. Mark. Sci. 2014, 42, 24–26. [Google Scholar] [CrossRef]

- Ackermann, F.; Eden, C. Strategic management of stakeholders: Theory and practice. Long Range Plan. 2011, 44, 179–196. [Google Scholar] [CrossRef]

- Castelo-Branco, M.; Lima-Rodrigues, L. Corporate Social Responsibility and resource-based perspectives. J. Bus. Ethics 2006, 69, 111–132. [Google Scholar] [CrossRef]

- Plaza-Úbeda, J.A.; de Burgos-Jiménez, J.; Carmona-Moreno, E. Measuring stakeholder integration: Knowledge, interaction and adaptational behavior dimensions. J. Bus. Ethics 2010, 93, 419–442. [Google Scholar] [CrossRef]

- Rueda-Manzanares, A.; Aragón-Correa, A.; Sharma, S. The Influence of Stakeholders on the Environmental Strategy of Service Firms: The Moderating Effects of Complexity, Uncertainly and Munificence. Br. J. Manag. 2008, 19, 185–203. [Google Scholar] [CrossRef]

- Maignan, I.; Ferrell, O. Corporate Social Responsibility and Marketing: An Integrative Framework. Acad. Mark. Sci. 2004, 32, 3–19. [Google Scholar] [CrossRef]

- Jones, T.M.; Wicks, C. Convergent stakeholder theory. Acad. Manag. Rev. 1999, 24, 206–222. [Google Scholar]

- Van der Raadt, B.; Bonnet, M.; Schouten, S.; van Vliet, H. The relation between EA effectiveness and stakeholder satisfaction. J. Syst. Softw. 2010, 83, 1954–1969. [Google Scholar] [CrossRef]

- Strong, K.C.; Ringer, R.C.; Taylor, S.A. The ruled of stakeholder’s satisfaction (Timeliness, Honesty, Empathy). J. Bus. Ethics 2001, 32, 219–231. [Google Scholar] [CrossRef]

- Manetti, G. The quality of stakeholder engagement in sustainability reporting: Empirical Evidence and critical points. Corp. Soc. Responsib. Environ. Manag. 2011, 18, 110–122. [Google Scholar] [CrossRef]

- Hosmer, L.T. Strategic planning as if ethics mattered. Strategic Manag. J. 1994, 15 (Suppl. 2), 17–34. [Google Scholar] [CrossRef]

- Fritz, J.M.H.; Arnett, R.C.; Conkel, M. Organizational Ethical Standards and Organizational Commitment. J. Bus. Ethics 1999, 20, 289–299. [Google Scholar] [CrossRef]

- Costa, R.; Menichini, T. A multidimensional approach for CSR assessment: The importance of the stakeholder perception. Expert Syst. Appl. 2013, 40, 150–161. [Google Scholar] [CrossRef]

- Black, L.D.; Härtel, C.E. The five capabilities of socially responsible companies. J. Public Aff. 2004, 4, 125–144. [Google Scholar] [CrossRef]

- Rasche, A.; Esser, D.E. From stakeholder management to stakeholder accountability. J. Bus. Ethics 2006, 65, 251–267. [Google Scholar] [CrossRef]

- Berrone, P.; Surroca, J.; Tribó, J.A. Corporate ethical identity as a determinant of firm performance: A test of the mediating role of stakeholder satisfaction. J. Bus. Ethics 2007, 76, 35–53. [Google Scholar] [CrossRef] [Green Version]

- Cruz-Ros, S.; González-Cruz, T.F.; Pérez-Cabañero, C. Marketing capabilities, stakeholders’ satisfaction, and performance. Serv. Bus. 2010, 4, 209–223. [Google Scholar] [CrossRef]

- Galbreath, J. Corporate social responsibility strategy: Strategic options, global considerations. Corp. Gov. 2006, 6, 175–187. [Google Scholar] [CrossRef]

- Mantere, S. Strategic practices as enablers and disablers of championing activity. Strategic Organ. 2005, 3, 157–183. [Google Scholar] [CrossRef]

- Howell, J.M.; Shea, C.M.; Higgins, C.A. Champions of product innovations: Defining, developing, and validating a measure of champion behavior. J. Bus. Ventur. 2005, 20, 641–661. [Google Scholar] [CrossRef]

- Hendy, J.; Barlow, J. The role of the organizational champion in achieving health system change. Soc. Sci. Med. 2012, 74, 348–355. [Google Scholar] [CrossRef] [PubMed]

- Howell, J.M.; Shea, C.M. Individual differences, environmental scanning, innovation framing, and champion behavior: Key predictors of project performance. J. Prod. Innov. Manag. 2001, 18, 15–27. [Google Scholar] [CrossRef]

- Walter, A.; Parboteeah, K.P.; Riesenhuber, F.; Hoegl, M. Championship behaviors and innovations success: An empirical investigation of University Spin-Offs. J. Prod. Innov. Manag. 2011, 28, 586–598. [Google Scholar] [CrossRef]

- Luo, X.; Bhattacharya, C.B. Corporate social responsibility, customer satisfaction, and market value. J. Mark. 2006, 70, 1–18. [Google Scholar] [CrossRef]

- Ringle, C.M.; Wende, S.; Will, A. Smart PLS 2.0 (Beta). 2005. Available online: http://www.smartpls.de (accessed on 4 September 2016).

- Wold, H. Soft modeling: The basic design and some extensions. In Systems under Indirect Observation, Part 2; Joreskog, K.G., Wold, H., Eds.; North-Holland: Amsterdam, The Netherlands, 1982; pp. 1–54. [Google Scholar]

- Reinartz, W.; Haenlein, M.; Henseler, J. An Empirical Comparison of the Efficacy of Covariance-Based and Variance- Based SEM. Int. J. Res. Mark. 2009, 26, 332–344. [Google Scholar] [CrossRef]

- Lu, I.R.R.; Kwan, E.; Thomas, D.R.; Cedzynski, M. Two New Methods for Estimating Structural Equation Models: An Illustration and a Comparison with Two Established Methods. Int. J. Res. Mark. 2011, 28, 258–268. [Google Scholar] [CrossRef]

- Coller, X.; Cambra-Fierro, J.; Gualtieri, T.; Melero-Polo, I. Spain: An opportunity to improve working conditions trough CSR. In Corporate Social Responsibility and Trade Unions: Perspectives across Europe; Preuss, L., Gold, M., Rees, C., Eds.; Routledge: Abingdon-on-Thames, UK, 2014; pp. 151–168. [Google Scholar]

- Parrilli, M.D. Collective efficiency, policy inducement and social embeddedness: Drivers for the development of industrial districts. Entrep. Reg. Dev. 2009, 21, 1–24. [Google Scholar] [CrossRef]

- Sánchez-Hernández, M.I. Clusters as entrepreneurial ecosystems for Corporate Social Responsibility in SMEs. In Handbook of Research on Entrepreneurial Success and Its Impact on Regional Development; Carvalho, L., Ed.; IGI Global: Hershey, PA, USA, 2015; pp. 72–87. [Google Scholar]

- Baruch, Y.; Holtom, B.C. Survey response rate levels and trends in organizational research. Hum. Relat. 2008, 61, 1139–1160. [Google Scholar] [CrossRef]

- Amstrong, J.S.; Overton, T.S. Estimating nonresponse bias in mail surveys. J. Mark. Res. 1977, 14, 396–402. [Google Scholar] [CrossRef]

- Marcoulides, G.A.; Saunders, C. Editor’s Comments—PLS: A Silver Bullet? MIS Q. 2006. [Google Scholar] [CrossRef]

- Jarvis, C.B.; MacKenzie, S.B.; Podsakoff, P.M. A Critical Review of Construct Indicators and Measurement Model Misspecification in Marketing and Consumer Research. J. Consum. Res. 2003, 30, 199–218. [Google Scholar] [CrossRef]

- Petter, S.; Straub, D.; Rai, A. Specifying formative constructs in information systems research. MIS Q. 2007, 31, 623–656. [Google Scholar]

- De Bussy, N. Dialogue as a basis for stakeholder engagement: Defining and measuring the core competencies. In The SAGE Handbook of Public Relations; Robert Heath; Sage Publications: Thousand Oaks, CA, USA, 2010; pp. 127–144. [Google Scholar]

- Warren, L.; Hutchinson, W. Success factors for high-technology SMEs: A case study from Australia. J. Small Bus. Manag. 2000, 38, 86–91. [Google Scholar]

- Weerawardena, J.; Sullivan Mort, G.; Liesh, P.W.; Knight, G. Conceptualizing accelerated internationalization in the born global firm: A dynamic capabilities perspective. J. World Bus. 2007, 42, 294–306. [Google Scholar] [CrossRef] [Green Version]

- Das, A.; Handfield, R.B.; Calantone, R.J.; Ghosh, S. A contingent view of quality management—The impact of international competition on quality. Decis. Sci. 2000, 31, 649–690. [Google Scholar] [CrossRef]

- Wade, M.; Hulland, J. The resource-based view and information systems research: Review, extension and suggestions for future research. MIS Q. 2004, 28, 107–142. [Google Scholar]

- Hung, R.Y.Y. Business process management as competitive advantage: A review and empirical study. Total Qual. Manag. Bus. Excell. 2006, 17, 21–40. [Google Scholar] [CrossRef]

- Bollen, K.A. Structural Equations with Latent Variables; John Wiley & Sons: New York, NY, USA, 1989. [Google Scholar]

- Falk, R.; Miller, N. A Primer for Soft Modelling; The University of Arkon: Akron, OH, USA, 1992. [Google Scholar]

- Carmines, E.G.; Zeller, R.A. Reliability and validity assessment. In Sage University Paper Series on Quantitative Applications in the Social Sciences; N-07-017; Sage: Beverly Hills, CA, USA, 1979. [Google Scholar]

- Nunnally, J.C. Phychometric Theory; McGraw-Hill: New York, NY, USA, 1978. [Google Scholar]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Chin, W. The partial least squares approach to structural equation modeling. Mod. Methods Bus. Res. 1998, 295, 295–336. [Google Scholar]

- Hair, J.F.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM); Sage: Thousand Oaks, CA, USA, 2014. [Google Scholar]

| Item | Data |

|---|---|

| Geographical scope | Region of Extremadura (Spain) |

| Population census | 196 firms in clusters |

| Period under study | January, February and March 2016 |

| Method of gathering information | Electronic questionnaire reinforced by previous phone call |

| Sampling unit | Managers |

| Sample | 130 |

| Participation index | 66.32% |

| Maximum error sample | 5% |

| Confidence level | 95% |

| By Sector | Cases | Total % |

| Agri-Food | 24 | 18% |

| Industry | 21 | 16% |

| Knowledge Services | 25 | 19% |

| Health Services | 11 | 8% |

| Audiovisual Services | 17 | 13% |

| Tourism and Recreation | 32 | 25% |

| By Size | Cases | Total % |

| Up to 49 Employees | 115 | 88.5% |

| Up to 250 Employees | 15 | 11.5% |

| Construct | Indicators | Factor Loadings (λ) | Composite Reliability | AVE |

|---|---|---|---|---|

| Firms’ relationship with stakeholders (SREL) | 0.942 | 0.843 | ||

| KNOW | 0.890 | |||

| INTER | 0.907 | |||

| ADAPT | 0.956 | |||

| Champion behavior (CHAM) | 0.962 | 0.686 | ||

| CHAM1 | 0.874 | |||

| CHAM2 | 0.807 | |||

| CHAM3 | 0.858 | |||

| CHAM4 | 0.829 | |||

| CHAM5 | 0.874 | |||

| CHAM6 | 0.821 | |||

| CHAM7 | 0.843 | |||

| CHAM8 | 0.853 | |||

| CHAM9 | 0.763 | |||

| CHAM10 | 0.827 | |||

| CHAM11 | 0.828 | |||

| Stakeholders’ satisfaction (SSAT) | 0.942 | 0.766 | ||

| SSAT1 | 0.885 | |||

| SSAT2 | 0.910 | |||

| SSAT3 | 0.926 | |||

| SSAT4 | 0.808 | |||

| SSAT5 | 0.843 | |||

| Competitive success (COM) | 0.959 | 0.686 | ||

| COM1 | 0.846 | |||

| COM2 | 0.880 | |||

| COM3 | 0.888 | |||

| COM4 | 0.703 | |||

| COM5 | 0.800 | |||

| COM6 | 0.862 | |||

| COM7 | 0.810 | |||

| COM8 | 0.815 | |||

| COM9 | 0.901 | |||

| COM10 | 0.743 | |||

| COM11 | 0.841 |

| HYPOTHESES | |||||

| H1: SREL second order construct | ✓ | ||||

| [KNOW(β = 0.890); INTER (β = 0.907); ADAPT (β = 0.956)] | |||||

| HYPOTHESES/Structural Path A ➔ B | Original Sample (β) | Expected Sign | Sample Mean | t-Student (Standard Error) | |

| H2: SREL ➔ SSAT | 0.762 | + | 0.765 | 18.619 | ✓ |

| (0.04) | |||||

| H3: SREL ➔ COM | 0.663 | + | 0.664 | 10.103 | ✓ |

| (0.06) | |||||

| H4: SREL ➔ CHAM | 0.772 | + | 0.774 | 18.259 | ✓ |

| (0.04) | |||||

| H5: CHAM ➔ SSAT | 0.312 | + | 0.320 | 5.496 | ✓ |

| (0.07) | |||||

| H6: CHAM ➔ COM | 0.507 | + | 0.505 | 5.496 | ✓ |

| (0.09) | |||||

| H7: SSAT ➔ COM | 0.324 | + | 0.331 | 4.302 | ✓ |

| (0.07) | |||||

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license ( http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sánchez-Hernández, M.I.; Bañegil-Palacios, T.M.; Sanguino-Galván, R. Competitive Success in Responsible Regional Ecosystems: An Empirical Approach in Spain Focused on the Firms’ Relationship with Stakeholders. Sustainability 2017, 9, 449. https://doi.org/10.3390/su9030449

Sánchez-Hernández MI, Bañegil-Palacios TM, Sanguino-Galván R. Competitive Success in Responsible Regional Ecosystems: An Empirical Approach in Spain Focused on the Firms’ Relationship with Stakeholders. Sustainability. 2017; 9(3):449. https://doi.org/10.3390/su9030449

Chicago/Turabian StyleSánchez-Hernández, M. Isabel, Tomás M. Bañegil-Palacios, and Ramón Sanguino-Galván. 2017. "Competitive Success in Responsible Regional Ecosystems: An Empirical Approach in Spain Focused on the Firms’ Relationship with Stakeholders" Sustainability 9, no. 3: 449. https://doi.org/10.3390/su9030449