Integrating Analytic Hierarchy Process (AHP) and Balanced Scorecard (BSC) Framework for Sustainable Business in a Software Factory in the Financial Sector

Abstract

:1. Introduction

- Not making enough money. Despite all of the headlines about banking profitability, banks and financial institutions are still not making enough return on investment, or return on equity, that shareholders require.

- Consumer expectations. These days, it’s all about the customer experience, and many banks are feeling pressure because they are not delivering the level of service that consumers are demanding, especially in regards to technology.

- Increasing competition from financial technology companies. Financial technology (FinTech) companies are usually start-up companies based on using software to provide financial services. The increasing popularity of FinTech companies is disrupting the way in which traditional banking is being run. This creates a big challenge for traditional banks because they are not able to adjust quickly to the changes—not just in technology, but also in operations, culture, and other facets of the industry.

- Regulatory pressure. Regulatory and legal requirements continue to increase, and banks need to spend a large part of their discretionary budget on being compliant, and on building systems and processes, in order to keep up with the escalating requirements.

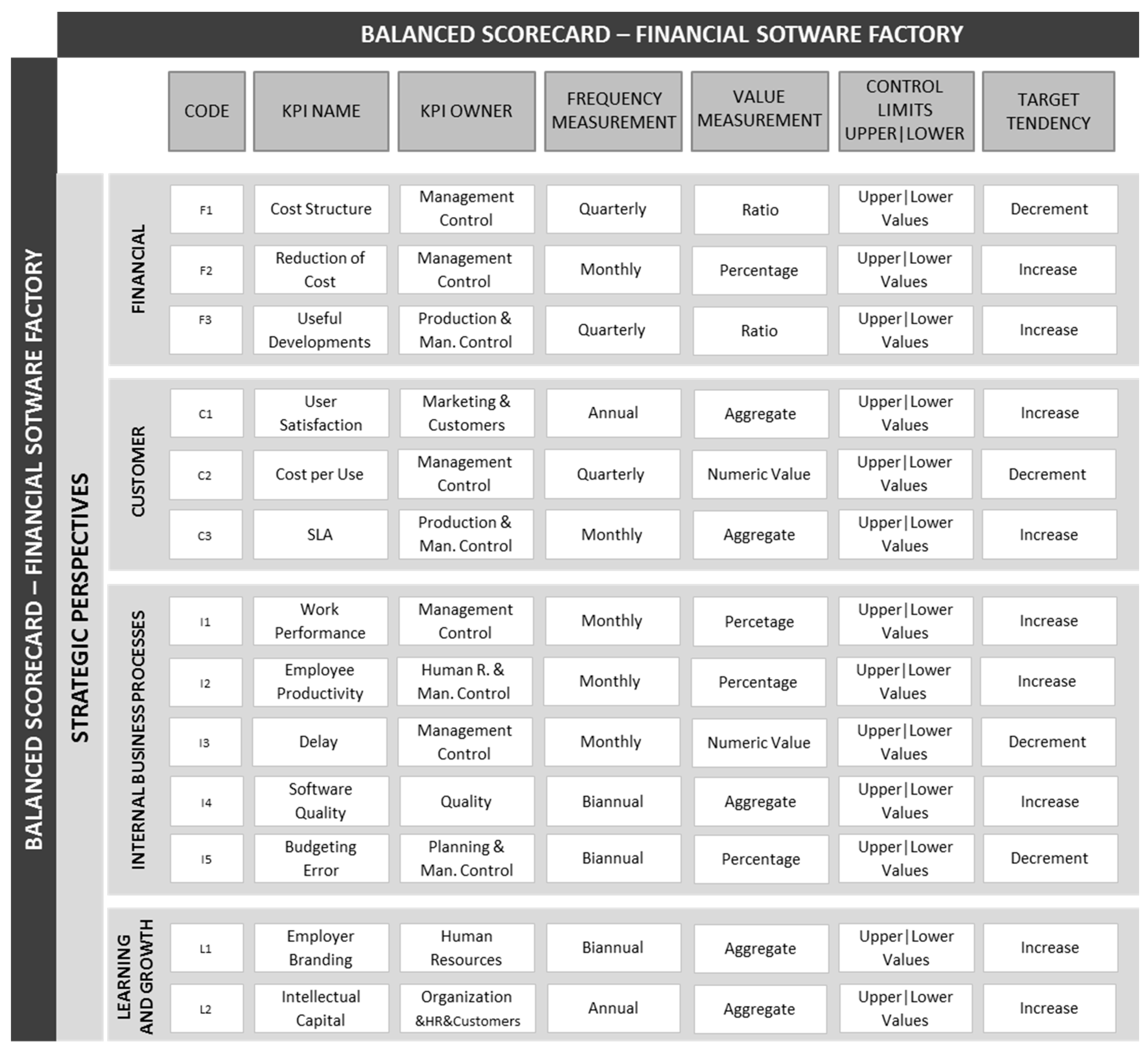

2. Performance Evaluation Framework for an FSF Based on BSC and AHP

2.1. The BSC Framework

- Improve the performance and productivity of the FSF.

- Delivery of software development must be of a good quality and the level of use of the delivered software by the customers should be increased.

- Optimize and decrease the cost and expense of the software factory.

- Sell the developments and services to companies outside of the owning financial group, to recover the development cost with external revenue.

2.2. AHP

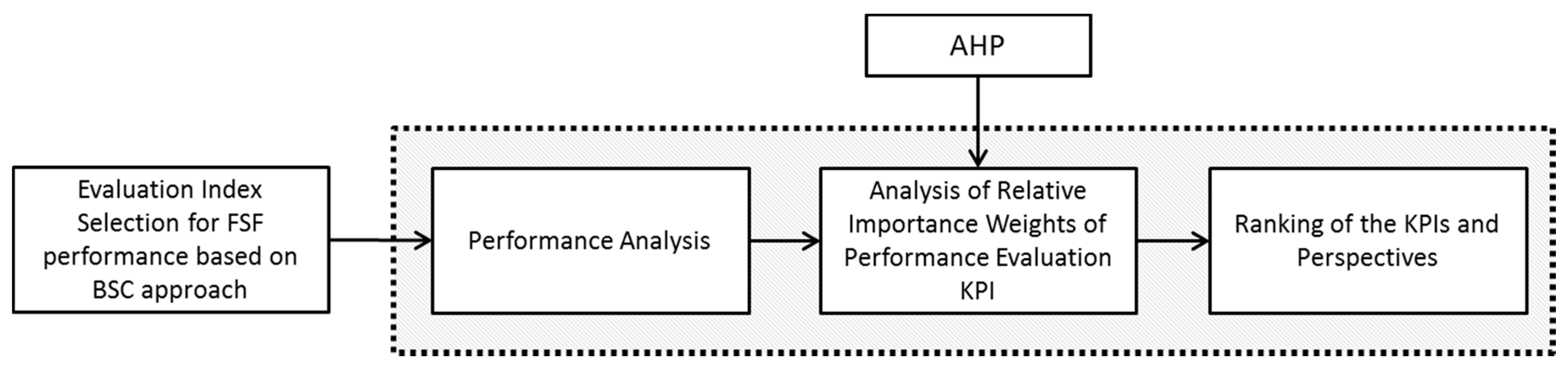

2.3. Integration of BSC Framework and AHP to Evaluate Performance

3. Methodology

- Analyse the BSC of the FSF (the studied organization).

- Define the hierarchical framework related to this BSC.

- Prepare a questionnaire in AHP format based on this hierarchy to obtain the opinion of experts regarding the indicators and perspectives of the BSC, with the aim of business sustainability.

- Prepare the answers obtained from the experts and give them the necessary format for computer treatment with AHP software.

- Calculate the weights of the global and different stakeholder roles of all the indicators and perspectives included in the BSC, according to the performance aim of the FSF.

- Show the results and analyse them to discuss the result and obtain conclusions.

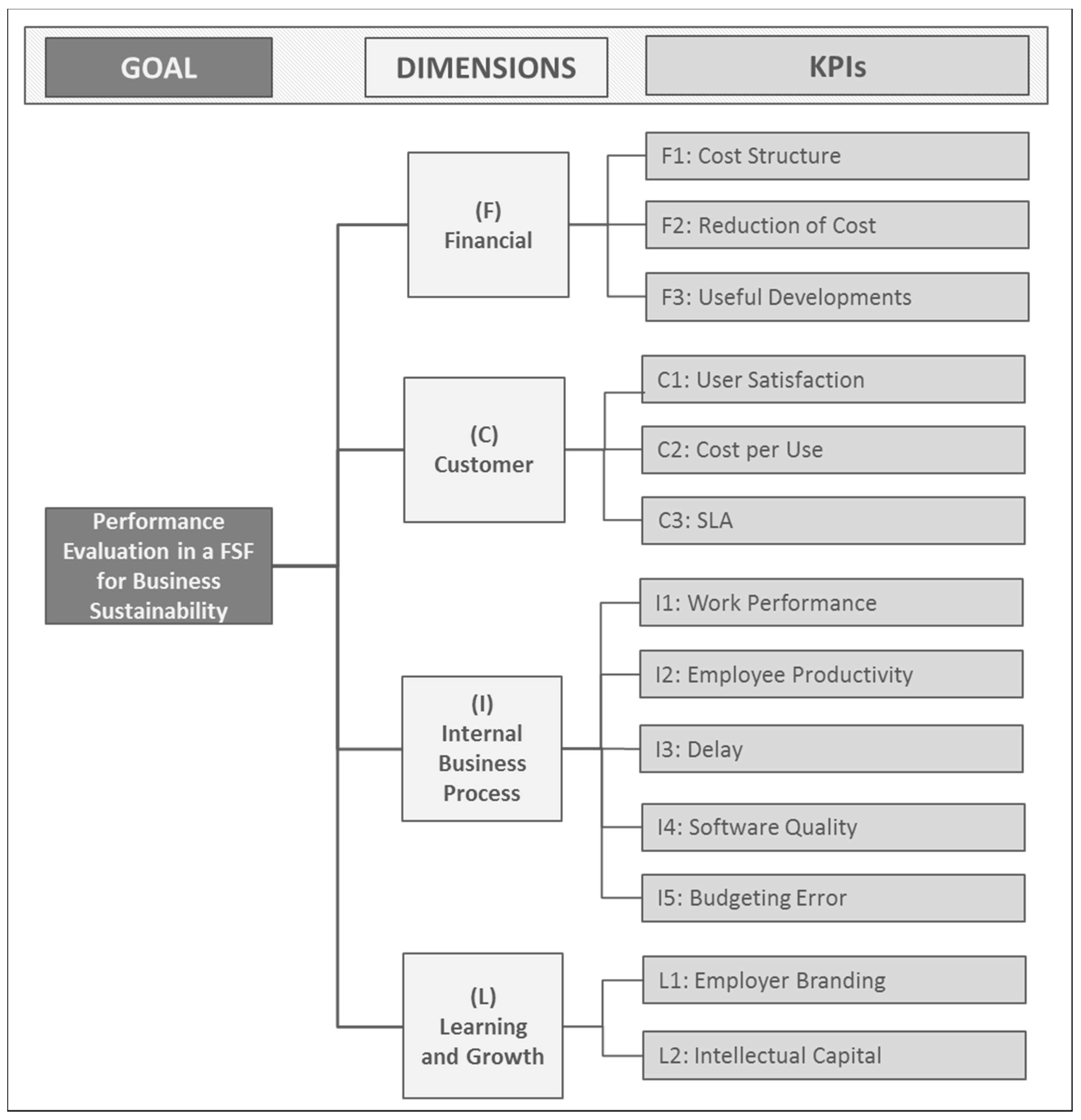

3.1. Hierarchical Framework of the BSC Performance Evaluation Criteria in an FSF

3.2. Data Collection

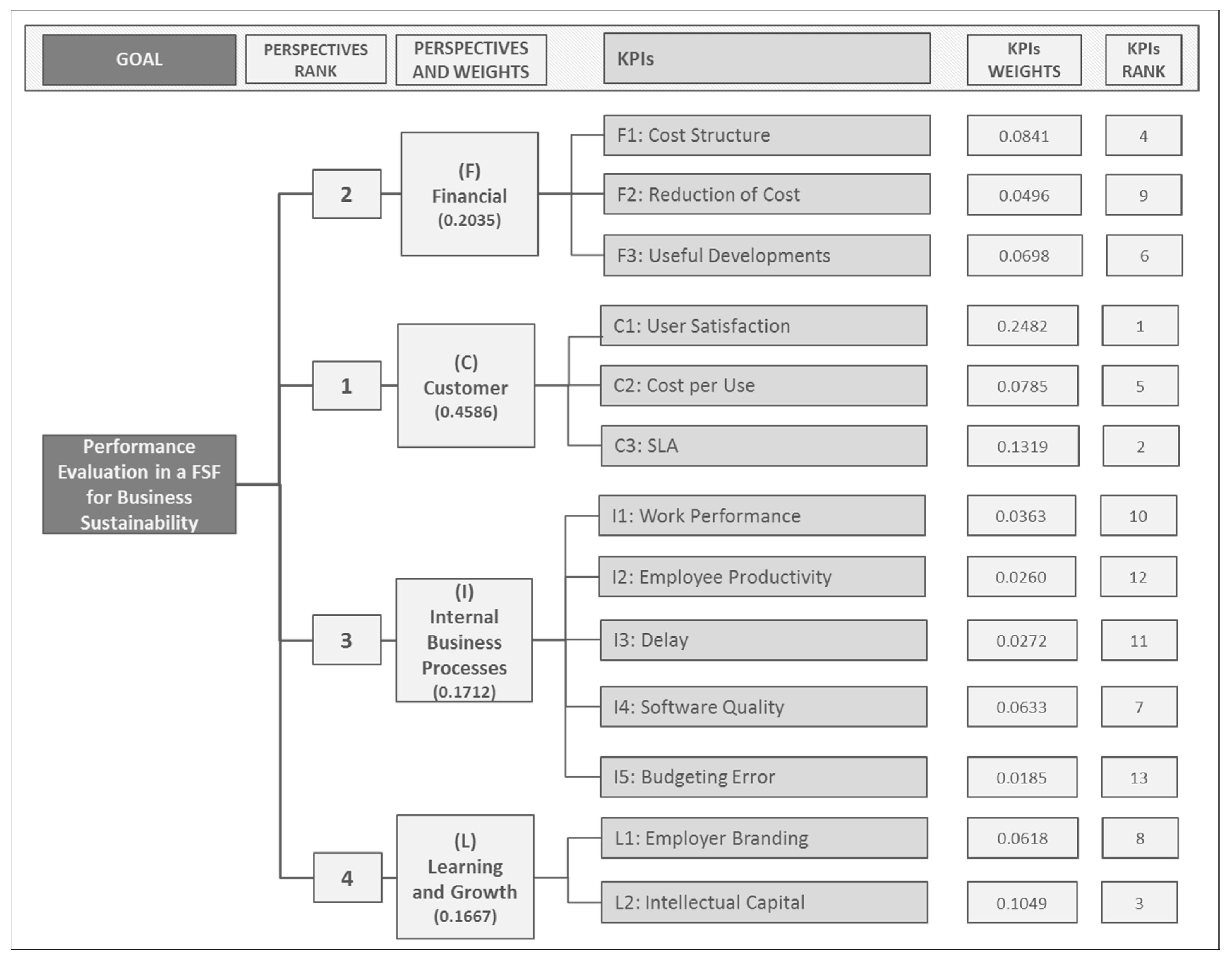

4. Results: A Case Study for FSF

5. Discussion

6. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Schubert, J. Top Challenges Facing the Banking Industry Right Now. Available online: https://goo.gl/b5NMD0 (accessed on 27 November 2016).

- De la Fuente Asprón, R. Medir la Productividad del Desarrollo de Software en Banca. Available online: http://www.financialtech-mag.com (accessed on 22 June 2013). (In Spanish).

- Emaldi Abasolo, M. The Software Factories. Dyna Bilbao 2007, 82, 330–333. (In Spanish) [Google Scholar]

- Murphy, G.C. What is software development productivity, anyway? (Keynote). In Proceedings of the 2013 10th IEEE Working Conference on Mining Software Repositories (MSR), San Francisco, CA, USA, 18–26 May 2013. [Google Scholar]

- Álvarez, C.; Rodríguez, V.; Ortega, F.; Villanueva, J. A Scorecard Framework Proposal for Improving Software Factories’ Sustainability: A Case Study of a Spanish Firm in the Financial Sector. Sustainability 2015, 7, 15999–16021. [Google Scholar] [CrossRef]

- Brown, A.; Lopez, A.; Reyes, L. Practical Experiences with Software Factory Approaches in Enterprise Software Delivery. In Proceedings of the 6th International Conference on Software Engineering Advances (ICSEA), Barcelona, Spain, 23–29 October 2011; IARIA: Barcelona, Spain, 2011; Volume 2011, pp. 465–470. [Google Scholar]

- Kaplan, R.S.; Norton, D.P. The balanced scorecard—Measures that drive performance. Harv. Bus. Rev. 1992, 70, 71–79. [Google Scholar] [PubMed]

- Kaplan, R.S.; Norton, D.P. The Balanced Scorecard: Translating Strategy into Action; Harvard Business Press: Boston, MA, USA, 1996. [Google Scholar]

- Bentes, A.V.; Carneiro, J.; da Silva, J.F.; Kimura, H. Multidimensional assessment of organizational performance: Integrating BSC and AHP. J. Bus. Res. 2012, 65, 1790–1799. [Google Scholar] [CrossRef]

- Netherlands Software Metrics Users Association Challenges in Productivity Measurement. Why Is It Hard to Measure Productivity in the Software Industry? Available online: https://goo.gl/GfkkAr (accessed on 4 February 2017).

- De Felice, F.; Petrillo, A.; Autorino, C. Development of a framework for sustainable outsourcing: Analytic Balanced Scorecard Method (A-BSC). Sustainability 2015, 7, 8399–8419. [Google Scholar] [CrossRef]

- Bulut, C.; Can, O. Business Performance. In Encyclopedia of Corporate Social Responsibility; Idowu, S.O., Capaldi, N., Zu, L., Gupta, A.D., Eds.; Springer: Berlin/Heidelberg, Germany, 2013; pp. 273–279. [Google Scholar]

- Wu, H.-Y.; Tzeng, G.-H.; Chen, Y.-H. A fuzzy MCDM approach for evaluating banking performance based on Balanced Scorecard. Expert Syst. Appl. 2009, 36, 10135–10147. [Google Scholar] [CrossRef]

- Kaplan, R.S.; Norton, D.P. Using the balanced scorecard as a strategic management system. Harv. Bus. Rev. 2007, 85, 150–161. [Google Scholar]

- Bourguignon, A.; Malleret, V.; Nørreklit, H. Balanced Scorecard versus French Tableau de Bord: Beyond Dispute, a Cultural and Ideological Perspective; Groupe HEC: Cergy-Pontoise, France, 2001. [Google Scholar]

- Van Grembergen, W. The Balanced Scorecard and IT Governance. Inf. Syst. Control J. 2000, 2, 40–43. [Google Scholar]

- Keyes, J. Implementing the IT Balanced Scorecard: Aligning IT with Corporate Strategy; CRC Press: Boca Raton, FL, USA, 2016. [Google Scholar]

- Figge, F.; Hahn, T.; Schaltegger, S.; Wagner, M. The Sustainability BSC—Theory and Applicantion of a Tool for Value-Based Sustainability Management. In Corporate Social Responsability—Governance for Sustainability, Proceedings of the Greening of Industry Network Conference, Gothenburg, Sweden, June 23–26 2002; Emerald Publishing Limited: Bingley, UK, 2002. [Google Scholar]

- Rohm, H.; Montgomery, D. Link Sustainability to Corporate Strategy Using the Balanced Scorecard; The Balanced Scorecard Institute: Cary, NC, USA, 2011. [Google Scholar]

- Lu, I.-Y.; Kuo, T.; Lin, T.-S.; Tzeng, G.-H.; Huang, S.-L. Multicriteria decision analysis to develop effective sustainable development strategies for enhancing competitive advantages: Case of the TFT-LCD industry in Taiwan. Sustainability 2016, 8, 646. [Google Scholar] [CrossRef]

- Davis, S.; Albright, T. An investigation of the effect of balanced scorecard implementation on financial performance. Manag. Account. Res. 2004, 15, 135–153. [Google Scholar] [CrossRef]

- Al-Najjar, S.M.; Kalaf, K.H. Designing a balanced scorecard to measure a bank’s performance: A case study. Int. J. Bus. Adm. 2012, 3, 44. [Google Scholar] [CrossRef]

- Montequín, V.R.; Fernández, F.O.; Pérez, C.Á.; Balsera, J.V. Scorecard and KPIs for monitoring software factories effectiveness in the financial sector. Int. J. Inf. Syst. Proj. Manag. 2013, 1, 29–43. [Google Scholar]

- Saaty, T.L. A scaling method for priorities in hierarchical structures. J. Math. Psychol. 1977, 15, 234–281. [Google Scholar] [CrossRef]

- Saaty, T.L. The Analytic Hierarchy Process: Planning, Priority Setting, Resource Allocation; McGraw-Hill International Book Company: New York, NY, USA, 1980. [Google Scholar]

- Wang, Y.; Xia, Q. A fuzzy AHP and BSC approach for evaluating performance of a software company based on knowledge management. In Proceedings of the IEEE 2009 First International Conference on Information Science and Engineering, Nanjing, China, 26–28 December 2009; pp. 2242–2245. [Google Scholar]

- Dyer, J.S. Remarks on the analytic hierarchy process. Manag. Sci. 1990, 36, 249–258. [Google Scholar] [CrossRef]

- Liu, D.; Bishu, R.R.; Najjar, L. Using the analytical hierarchy process as a tool for assessing service quality. Ind. Eng. Manag. Syst. 2005, 4, 129–135. [Google Scholar]

- Hua Lu, M.; Madu, C.N.; Kuei, C.; Winokur, D. Integrating QFD, AHP and benchmarking in strategic marketing. J. Bus. Ind. Mark. 1994, 9, 41–50. [Google Scholar] [CrossRef]

- Liberatore, M.J.; Monahan, T.F.; Stout, D.E. A framework for integrating capital budgeting analysis with strategy. Eng. Econ. 1992, 38, 31–43. [Google Scholar] [CrossRef]

- Chan, Y.L.; Lynn, B.E. Performance evaluation and the analytic hierarchy process. J. Manag. Account. Res. 1991, 3, 57–87. [Google Scholar]

- Thomas, S. The Analytic Hierarchy Process: Planning, Priority Setting, Resource Allocation; Pittsburgh PA Univ.: Pittsburgh, PA, USA, 1980. [Google Scholar]

- Saaty, T.L. How to make a decision: The analytic hierarchy process. Eur. J. Oper. Res. 1990, 48, 9–26. [Google Scholar] [CrossRef]

- Voronin, A.N. A method of multicriteria evaluation and optimization of hierarchical systems. Cybern. Syst. Anal. 2007, 43, 384–390. [Google Scholar] [CrossRef]

- Sharma, M.K.; Bhagwat, R. An integrated BSC-AHP approach for supply chain management evaluation. Meas. Bus. Excell. 2007, 11, 57–68. [Google Scholar] [CrossRef]

- Saaty, T.L. An exposition of the AHP in reply to the paper “remarks on the analytic hierarchy process”. Manag. Sci. 1990, 36, 259–268. [Google Scholar] [CrossRef]

- Hosein, Z.Z.; Yousefie, A.; Mehrizi, S.M.T. Evaluating and Ranking Performance by Combination Model of Balanced Scorecard and Ariadne Uncertain Estimate. Asian Soc. Sci. 2014, 10, 70. [Google Scholar]

- Noori, B. Prioritizing strategic business units in the face of innovation performance: Combining fuzzy AHP and BSC. Int. J. Bus. Manag. 2015, 3, 36–56. [Google Scholar] [CrossRef]

- Yaghoobi, T.; Haddadi, F. Organizational performance measurement by a framework integrating BSC and AHP. Int. J. Product. Perform. Manag. 2016, 65, 959–976. [Google Scholar] [CrossRef]

- Castrogiovanni, G.; Ribeiro-Soriano, D.; Mas-Tur, A.; Roig-Tierno, N. Where to acquire knowledge: Adapting knowledge management to financial institutions. J. Bus. Res. 2016, 69, 1812–1816. [Google Scholar] [CrossRef]

- Chang, S.-C.; Tsai, P.-H. A hybrid financial performance evaluation model for wealth management banks following the global financial crisis. Technol. Econ. Dev. Econ. 2016, 22, 21–46. [Google Scholar] [CrossRef]

- Rabbani, A.; Zamani, M.; Yazdani-Chamzini, A.; Zavadskas, E.K. Proposing a new integrated model based on sustainability balanced scorecard (SBSC) and MCDM approaches by using linguistic variables for the performance evaluation of oil producing companies. Expert Syst. Appl. 2014, 41, 7316–7327. [Google Scholar] [CrossRef]

- Sundharam, V.N.; Sharma, V.; Stephan Thangaiah, I.S. An integration of BSC and AHP for sustainable growth of manufacturing industries. Int. J. Bus. Excell. 2013, 6, 77–92. [Google Scholar] [CrossRef]

- Chung, C.-C.; Chao, L.-C.; Chen, C.-H.; Lou, S.-J. A Balanced Scorecard of Sustainable Management in the Taiwanese Bicycle Industry: Development of Performance Indicators and Importance Analysis. Sustainability 2016, 8, 518. [Google Scholar] [CrossRef]

- Kaplan, R.S. Conceptual foundations of the balanced scorecard. Handb. Manag. Account. Res. 2008, 3, 1253–1269. [Google Scholar]

- Caha, J.; Drážná, A. Information about Fuzzy AHP Package for R (Version 0.8.0). Available online: https://goo.gl/DXlLm8 (accessed on 20 March 2017).

- Saaty, R.W. The analytic hierarchy process—What it is and how it is used. Math. Model. 1987, 9, 161–176. [Google Scholar] [CrossRef]

- Malczewski, J. GIS and Multicriteria Decision Analysis; John Wiley & Sons: New York, NY, USA, 1999. [Google Scholar]

- Amrit, C.; Daneva, M.; Damian, D. Human factors in software development: On its underlying theories and the value of learning from related disciplines. A guest editorial introduction to the special issue. Spec. Issue Hum. Factors Softw. Dev. 2014, 56, 1537–1542. [Google Scholar] [CrossRef]

- Curtis, B.; Krasner, H.; Iscoe, N. A field study of the software design process for large systems. Commun. ACM 1988, 31, 1268–1287. [Google Scholar] [CrossRef]

- Joint Technical Committee ISO/IEC JTC 1/SC7 ISO/IEC 25010:2011 Systems and Software Engineering—Systems and software Quality Requirements and Evaluation (SQuaRE)—System and Software Quality Models. Available online: https://www.iso.org/standard/35733.html (accessed on 20 March 2017).

| No. | KPIs | Description and Explanation |

|---|---|---|

| 1 | (F1) Cost Structure | Cost evolution according to financial entity size. The costs of the software factory and the size of the financial entity are compared in such way that when the size of the matrix financial group decreases, the costs of the software factory should also decrease in a similar proportion. This indicator is in connexion with the third strategic line (optimization of cost). |

| 2 | (F2) Reduction of Cost | The ratio of cost that is covered by sales to companies outside the group. The purpose of this indicator is to assess the percentage of the structural cost of the software factory that is covered by income over the last year, whose source is the sale of software developments and services to companies outside the corporate group. Because of the huge cost of software development, sales revenue outside the financial group owner is generally seen as a reduction of costs. The indicator is derived from the fourth strategic line (sell the developments and services to other companies different from the owning financial group). |

| 3 | (F3) Useful Developments | Degree of use of the delivered software by the customers. In this particular case, the degree of use of the developments is indicated by the number of software executions and the indicator is calculated as the cumulative number of these executions in relation to the size of the financial institution over the last year. In this framework is understood that the greater use of the developments, the higher income should be achieved. The indicator is derived from the second strategic line (the level of use of the delivered software by the customers should be increased). |

| 4 | (C1) User Satisfaction | Degree of customer satisfaction concerning software developments and services given by the software factory. Customers are the users of these software developments and services. The indicator is connected to the second strategic line. |

| 5 | (C2) Cost per Use | The proportion between the cost paid by the customer and the degree of use of the delivered software, measured by means of the cumulative number of executions as in (F3). The indicator is connected to the third strategic line. |

| 6 | (C3) SLA | Level of service expected from the software factory as a service provider. The proposed SLA indicator to use in the BSC is a multi-indicator that joins and unifies all the agreements reached with the financial group, and more specifically between the financial institution and the FSF. The indicator is connected to the first and second strategic lines. |

| 7 | (I1) Work Performance | Efficiency level in terms of improving rates of software built. The indicator is calculated as ratio between budgeted hours and the performed hours and it is derived from the strategic line of improve the performance and productivity of the FSF. |

| 8 | (I2) Employee Productivity | Amount of software that an employee produces for each hour on the job. The ratio is connected with the improvement of performance and productivity of the FSF. |

| 9 | (I3) Delay | Average waiting time for delivery of software. This indicator shows the delay in hours when the software factory is delivering software developments. The indicator is connected with the improvement of performance and productivity of the FSF. |

| 10 | (I4) Software Quality | Aggregated indicator that assess the software quality, in connection with the second strategic line (delivery of software development must be good quality). |

| 11 | (I5) Budgeting Error | Accuracy of the estimates linked to software development. The indicator shows how good the estimations are over the last year and it is related with the third strategic line. |

| 12 | (L1) Employer Branding | Reputation of the software factory as an employer. Employees, and especially high-quality employees as a very important part of intellectual capital, must be attracted and retained by firms, and employer branding can help them to address the different needs and expectations of potential and existing employees. This indicator contributes to support all the strategic lines. |

| 13 | (L2) Intellectual Capital | Aggregated indicator that assess the intellectual capital as a compendium of human, structural and relational capital. This indicator contributes to support all the strategic lines. |

| Intensity of Importance on an Absolute Scale | Definition | Explanation |

|---|---|---|

| 1 | Equally important | Two activities contribute equally to the objective |

| 3 | Weakly important | Experience and judgment strongly favour one activity over another |

| 5 | Essentially important | Experience and judgment strongly favour one activity over another |

| 7 | Very strongly important | An activity is strongly favoured and its dominance demonstrated in practice |

| 9 | Absolutely important | The evidence favouring one activity over another is of the highest possible order of affirmation |

| 2, 4, 6, 8 | Intermediate value between two adjacent judgments | When compromise is needed |

| Reciprocals | If activity i has one of the above numbers assigned to it when compared with activity j, then j has the reciprocal value when compared with i | |

| Stakeholder Roles | Relation with the FSF |

|---|---|

| Shareholders | The shareholders are the owners of the company. They are usually top management of the financial entities involved in the same financial group. |

| Top Management | Top management are the highest ranking executives responsible for the entire FSF. They translate policy into goals and strategies for the future. Top management make decisions affecting everyone in the software factory. |

| Middle Managers | The middle managers are the employees of the FSF who manage at least one subordinate level of managers, and report to the top management in the organisation to ensure smooth functioning of the software factory. |

| Other Employees | Other employees are the lowest level of managers and the rest of the employees of the software factory, including analysts and developers. |

| Customers | Customers are the financial entities for which the software factory develops software and offers services to them. |

| Experts in Software Factories | Experts are a group of managers of other software factories from different sectors, professors and researchers in relation to software factories. |

| Stakeholder Roles | Number of Sent Questionnaires | Number of Received Questionnaires | Number of Valid Received Questionnaires (Received/Sent) | ||

|---|---|---|---|---|---|

| Shareholders | 13 | 9 | 69.2% | 6 | 66.7%/46.2% |

| Top Management | 12 | 8 | 66.7% | 6 | 75.0%/50.0% |

| Middle Managers | 15 | 13 | 86.7% | 8 | 61.5%/53.3% |

| Other Employees | 13 | 6 | 46.1% | 5 | 83.3%/38.5% |

| Customers | 15 | 14 | 93.3% | 10 | 71.4%/66.7% |

| Experts in Software Factories | 15 | 11 | 73.3% | 9 | 81.8%/60.0% |

| Total | 83 | 61 | 73.5% | 44 | 72.1%/53.0% |

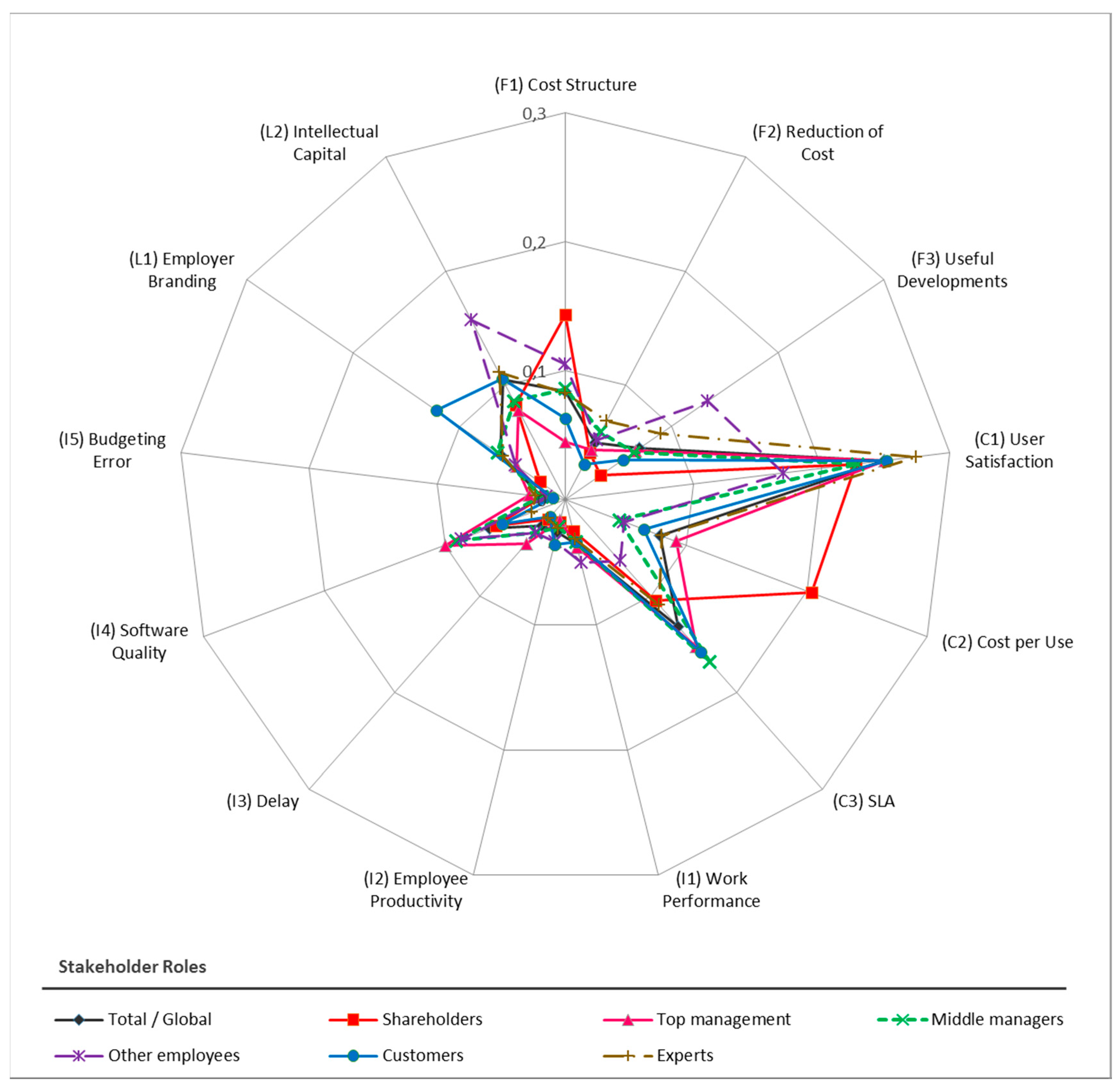

| Criteria and Sub-Criteria/Roles of Stakeholders | Total/Global | Share-Holders | Top Management | Middle Managers | Other Employees | Customers | Experts |

|---|---|---|---|---|---|---|---|

| (F) Finance | 0.2035 | 0.2172 | 0.1536 | 0.2090 | 0.2914 | 0.1482 | 0.2407 |

| (F1) Cost Structure | 0.0841 | 0.1430 | 0.0446 | 0.0859 | 0.1051 | 0.0632 | 0.0825 |

| (F2) Reduction of Cost | 0.0496 | 0.0409 | 0.0430 | 0.0588 | 0.0522 | 0.0305 | 0.0684 |

| (F3) Useful Developments | 0.0698 | 0.0333 | 0.0659 | 0.0643 | 0.1340 | 0.0545 | 0.0898 |

| (C) Customer | 0.4586 | 0.5352 | 0.4933 | 0.4417 | 0.2829 | 0.4735 | 0.4628 |

| (C1) User Satisfaction | 0.2482 | 0.2263 | 0.2495 | 0.2284 | 0.1704 | 0.2508 | 0.2739 |

| (C2) Cost per Use | 0.0785 | 0.2041 | 0.0917 | 0.0446 | 0.0487 | 0.0646 | 0.0797 |

| (C3) SLA | 0.1319 | 0.1048 | 0.1522 | 0.1686 | 0.0638 | 0.1581 | 0.1093 |

| (I) Internal Business Processes | 0.1712 | 0.1403 | 0.2287 | 0.1992 | 0.2214 | 0.1510 | 0.1264 |

| (I1) Work Performance | 0.0363 | 0.0252 | 0.0381 | 0.0341 | 0.0508 | 0.0339 | 0.0320 |

| (I2) Employee Productivity | 0.0260 | 0.0178 | 0.0169 | 0.0219 | 0.0342 | 0.0364 | 0.0230 |

| (I3) Delay | 0.0272 | 0.0205 | 0.0455 | 0.0340 | 0.0348 | 0.0181 | 0.0198 |

| (I4) Software Quality | 0.0633 | 0.0580 | 0.0998 | 0.0906 | 0.0865 | 0.0527 | 0.0282 |

| (I5) Budgeting Error | 0.0185 | 0.0187 | 0.0285 | 0.0185 | 0.0151 | 0.0099 | 0.0234 |

| (L) Learning and Growth | 0.1667 | 0.1073 | 0.1244 | 0.1502 | 0.2043 | 0.2272 | 0.1700 |

| (L1) Employer Branding | 0.0618 | 0.0241 | 0.0459 | 0.0640 | 0.0473 | 0.1218 | 0.0591 |

| (L2) Intellectual Capital | 0.1049 | 0.0832 | 0.0785 | 0.0861 | 0.1570 | 0.1054 | 0.1110 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Álvarez Pérez, C.; Rodríguez Montequín, V.; Ortega Fernández, F.; Villanueva Balsera, J. Integrating Analytic Hierarchy Process (AHP) and Balanced Scorecard (BSC) Framework for Sustainable Business in a Software Factory in the Financial Sector. Sustainability 2017, 9, 486. https://doi.org/10.3390/su9040486

Álvarez Pérez C, Rodríguez Montequín V, Ortega Fernández F, Villanueva Balsera J. Integrating Analytic Hierarchy Process (AHP) and Balanced Scorecard (BSC) Framework for Sustainable Business in a Software Factory in the Financial Sector. Sustainability. 2017; 9(4):486. https://doi.org/10.3390/su9040486

Chicago/Turabian StyleÁlvarez Pérez, César, Vicente Rodríguez Montequín, Francisco Ortega Fernández, and Joaquín Villanueva Balsera. 2017. "Integrating Analytic Hierarchy Process (AHP) and Balanced Scorecard (BSC) Framework for Sustainable Business in a Software Factory in the Financial Sector" Sustainability 9, no. 4: 486. https://doi.org/10.3390/su9040486