3.1. Model Setting

We consider a model where two symmetric firms which may be farmers/farming firms, denoted as Firm 1 and Firm 2 respectively, are competing in a market with M customers. Each firm can offer organic or non-organic food products. The customers are distributed uniformly on a product line of length 1 between the two firms, with Firm 1’s food products located at the left end, denoted by , and Firm 2’s food products at the right end, denoted by . A customer’s location at the product line is denoted as representing their relative preference for two firms’ food products. A customer located at the left end of the product line () treats Firm 1’s product as an ideal product, and a customer located at the right end () treats Firm 2’s as their favorite. The distance from a customer’s location to the left (or right) end of this line, which is x (or ), denotes the difference between the customer’s ideal food products from Firm 1 (or Firm 2)’s food products. We assume that each customer has a unitary demand.

As mentioned in

Section 1, organic food products fit the customers’ organic preferences and bring extra utility, but incur lower yields and higher production cost than non-organic food products. Thus, it is reasonable to assume that

and define

, where

and

denote the unit production cost of organic food products and non-organic food products, respectively. Note in some special cases, organic production cost may not be higher than non-organic production cost [

37]. In our paper, we consider the general cases where organic production incurs higher cost.

As organic food is difficult to distinguish from non-organic food, firms offering organic products also need to invest in credence to respond to consumers’ potential mistrust in organic products. In this paper, a firm’s credence investment is spent on building their own credence system, thus we assume that the belief of consumers in two firms’ credence is independent. This setting is different from the authority-certified labeling investment where trusts are towards all labeled firms. Thus, the credence investment cost function is assumed as , where is the ratio of customers in the whole market who trust the credence of organic products, and is a parameter which captures the cost of organic credence investment. This function is concave and increasing, which reflects that the cost and the marginal cost are both increasing in a. Besides, when a tends to 1, the investment cost tends to infinity. This property is in accordance with reality, where it is difficult to make all customers trust a firm’s organic products. For analysis convenience, we also assume that when the credence investment of a firm is less than a threshold value, i.e., , there will be no customers who trust their organic products. This assumption can be relaxed in future study. As in the more general case, there already exists some customer trust in a firm’s organic products even when the firm does not invest in any credence system. The monotonicity of cost function indicates that the credence cost and the trust ratio a form a one-to-one mapping, e.g., for any fixed , there always exists a such that . Thus, although the firms’ real decision is the investment, i.e., the value of , we can use as a decision variable of firm i in the later sections for the sake of analysis convenience.

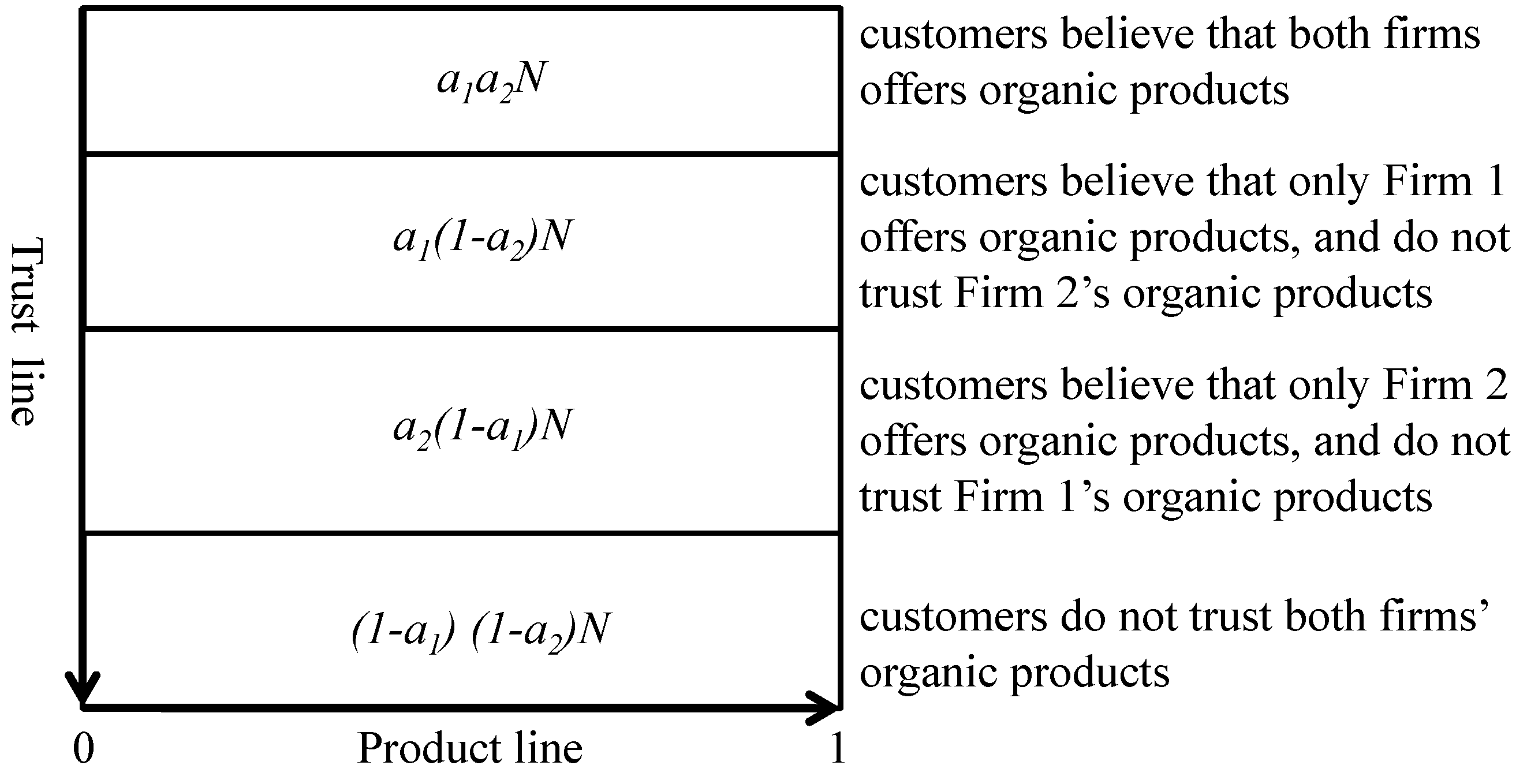

In addition to the product line, customers are also uniformly distributed along an organic trust line, where customers have different beliefs regarding the firms’ organic credence system. The product line and the trust line constitute a rectangular space, which represents the whole market where the customers are uniformly distributed. When both firms offer organic food products, given two firms’ organic credence system investment, the trust ratio

and

are determined. Along the trust line, the probability that a customer trusts both firms’ organic food products is

, the probability that a customer trusts Firm1’s organic food products but does not trust Firm 2’s organic food products is

, the probability that a customer trusts in Firm2’s organic food products but does not trust Firm 1’s organic food products is

, and the probability that a customer does not trust both firms’ organic food products is

. Thus, we can see that the whole market can be divided into four parts:

customers trusting both Firms’ organic food products,

customers only believing that firm 1’s food products are organic,

customers only believing that Firm 2’s food products are organic, and the rest

of the customers trust neither of the two firms. The market structure is illustrated in

Figure 1.

Customers choose organic or non-organic food products of the two firms based on their own food product preference, the price, and their trust as to whether the food products are organic. Suppose that Firm 1 offers organic food products to customers at a price

. For the customer at location

x of product line believing that the product is organic, the net utility of buying an organic product from Firm 1 is

, where

U is the utility for a customer getting their ideal non-organic product for free,

is the additional utility from an organic product compared to a non-organic product, and

U and

are the same for all customers. In general, customers may have different utility in organic products, for example sometimes the willingness to pay for organic food is even negative [

28]. However, for the sake of analysis convenience, we assume homogeneity in organic utility. Similar homogeneity in utility assumption can be seen in [

32]. This utility function is quite intuitive. A customer’s utility is linearly decreasing in the charged price

and the degree of difference to customer’s ideal product,

x. The term

represents the loss of utility due to the difference between Firm 1’s food products and the ideal food products of a customer at

x, where

t is the intensity of relative preference of firms. When

t is very small, e.g.,

, customers have almost no preference differences between two firms. A higher

t implies a bigger difference between two firms. If the customer does not trust the organic food products, they treats them as non-organic food products. Thus, the net utility of buying an organic product from Firm 1 is

. Suppose that Firm 1 offers non-organic food products to customers at a price

. For the customer located at

x of product line, the net utility of buying a non-organic product from Firm 1 is

. Similarly, when Firm 2 offers organic food products, the customer trusts that the organic food products gets utility

, while the customer that does not trust organic food products gets utility

. A customer buys organic or non-organic food products from the firm that offers them a higher utility. In this study, we consider the case that the whole market is covered by the two firms, and thus assume

U is large enough so that all customers’ net utility are nonnegative. Here, we also assume

, i.e., the additional utility of a organic product is higher than the required additional production cost.

We consider an three-stage game. At the first stage, both firms decide whether to offer organic or non-organic food products. We denote the first stage decision of Firm

i,

, as

, where

O represents the decision to offer organic food products, and

N represents the decision to offer non-organic food products, respectively. We use

to denote the outcome of the first stage decisions. At the second stage, given the strategy decisions

, firms choosing to offer organic food products determine the investment on the organic credence while the ones choosing to offer non-organic food products do not make a decision. At the final stage, two firms determine the prices for organic or non-organic food products. After the price decision, the demand is realized. For such a multi-stage game, it is more analytically convenient to consider a simultaneous decision game than sequential game, e.g., [

30,

36]. Besides, in a sequential decision game, the sequence of decision will have an impact on the final equilibrium, where the first mover may have more advantages. To avoid such additional first mover advantage and focus on the impacts of market conditions, we consider a simultaneous decision game.

3.2. Equilibrium Analysis

At stage 1, since each firm can decide to offer organic or non-organic food products, we analyze the following subgames induced by the outcomes of the first stage before analyzing the overall game: (1) Both firms offer non-organic food products, denoted as ; (2) Both firms offer organic food products, denoted as ; (3) Firm 1 offers organic food products while Firm 2 offers non-organic food products, denoted as . In this model, as we assume that two firms are symmetric, the analysis of is same to that of .

3.2.1. Both Firms Offer Non-Organic Food Products

When both firms decide to offer non-organic food products, they just need to determine the price at the final stage. Using standard backward induction, we first consider the firms’ pricing decisions at the final stage.

From the utility function, we can see that a customer located at

is indifferent between the two firm’s food products iff:

It can be derived from the Equation (

1) that the customer’s location is

. Those customers whose locations are at the left to

, i.e.,

, will buy one unit of non-organic food products from Firm 1, and the rest customers, i.e.,

will purchase one unit of Firm 2’s non-organic food products. Thus the demands of Firm 1 and Firm 2 are

and

, respectively.

Back to the pricing decision stage, two firms determine the prices to maximize their own profits, which are and . Using first order conditions, we can obtain the equilibrium solutions in the subgame , which are stated in Proposition 1.

Proposition 1. If both firms choose to offer non-organic food products to customers at the first stage, the equilibrium prices are: , and the equilibrium profits are: .

In the subgame

, both firms charge the same price that exceeds unit production cost

by

t. While

t represents the difference between two firms’ food products, firms can charge a higher price when

t is larger. This is in accordance with the conclusion of prior literature, i.e., [

38], that increasing firm differentiation will lower the intensity of price competition. The expected profits of two firms are the same and increasing with the market size

M and

t. Thus, a larger market size or a bigger firm differentiation will lead to higher expected profits of the two firms.

3.2.2. Both Firms Offer Organic Food Products

When both firms decide to offer organic food products to customers at the first stage, they need to determine the investment on the credence of organic food products at the second stage and the prices at the final stage.

We first analyze the market structure for given credence investment decisions. Given Firm 1’s decision

and Firm 2’s decision

, the whole market can be divided into four parts as discussed in

Section 3. Now we analyze the two firms’ market share for given price and credence investment decisions. We analyze the two firms’ demand in four parts of the market respectively, and then we sum up these demands to get the total demands.

For the

customers who believe that both firms offer organic food products, a customer located at

is indifferent between two firm’s food products iff:

It can be derived from the above equation that the customer’s location is . Those customers whose locations are at the left to , i.e., , will buy a unit of organic food products from Firm 1, while the rest customers will purchase a unit of organic food products from Firm 2. Thus, the demands of Firm 1 and Firm 2 in this part of market are and , respectively.

For

customers who trust Firm 1’s organic food products and do not trust Firm 2’s organic food products, a customer located at

is indifferent between the two firm’s food products iff:

It can be derived from the above equation that the customer’s location is . Since we are interested in a more general case when both firms are in the market, we impose a condition , which requires an assumption , i.e., firm differentiation is sufficiently large. Those customers located at the left to , i.e., , will buy one unit of organic food products from Firm 1, and the other customers will purchase a unit of organic food products from Firm 2. Thus, the demands of Firm 1 and Firm 2 in this part of market are and , respectively.

For

customers who trust Firm 2’s organic food products and do not trust Firm 1’s organic food products, a customer located at

is indifferent between the two firm’s food products iff:

It can be derived from the above equation that the customer’s location is

. Those customers located at the left to

, i.e.,

, will buy one unit of organic food products from Firm 1, and the other customers will purchase a unit of organic food products from Firm 2. Thus, the demands of Firm 1 and Firm 2 in this part of market are

and

, respectively. For the rest

customers who do not trust both firms’ organic food products, a customer located at

is indifferent between the two firm’s food products iff:

It can be derived from the above equation that the customer’s location is

. Those customers whose locations are at the left to

, i.e.,

, will buy a unit of organic food products from Firm 1, and the rest customers will purchase a unit of organic food products from Firm 2. Thus, the demands of Firm 1 and Firm 2 in this part of market are

and

, respectively. Thus the total demands of two Firms are:

Now we analyze the equilibrium price and organic credence investment decisions. Using standard backward induction, we first consider two firms’ pricing decisions at the final stage. Two firms determine their prices to maximize their own profits:

Optimizing these profits with respect to and , respectively, we obtain two firms’ optimal prices: and . By substituting the optimal prices into two firms profit functions, we can then solve the equilibrium credence investment decision in the subgame , which are summarized in Proposition 2.

Proposition 2. If both firms choose to offer organic food products to customers, the equilibrium organic credence investment decisions are: , the cost of organic credence investment are , the equilibrium prices are , and the equilibrium profits are .

We can see that the equilibrium profits when both firms offering organic food products, are less than when both firms offering non-organic food products, and the gap is just the cost of organic credence investment. Due to the fixed market size assumption, this observation is reasonable. As compared to non-organic food products, offering organic food products leads to additional competition in credence investment, but does not increase the total demand. It can also be observed that the additional cost of credence investment is increasing in and . The former is intuitive as the more customers value organic food products, the more firms would invest in organic credence. The explanation of the latter maybe that firms need to invest more in credence when it costs more.

3.2.3. Firm 1 Offers Organic Food Products and Firm 2 Offers Non-Organic Food Products

In the subgame , where Firm 1 offers organic food products and Firm 2 offers non-organic food products, Firm 1 needs to determine the organic credence investment at the second stage and both firms need to determine the price at the final stage.

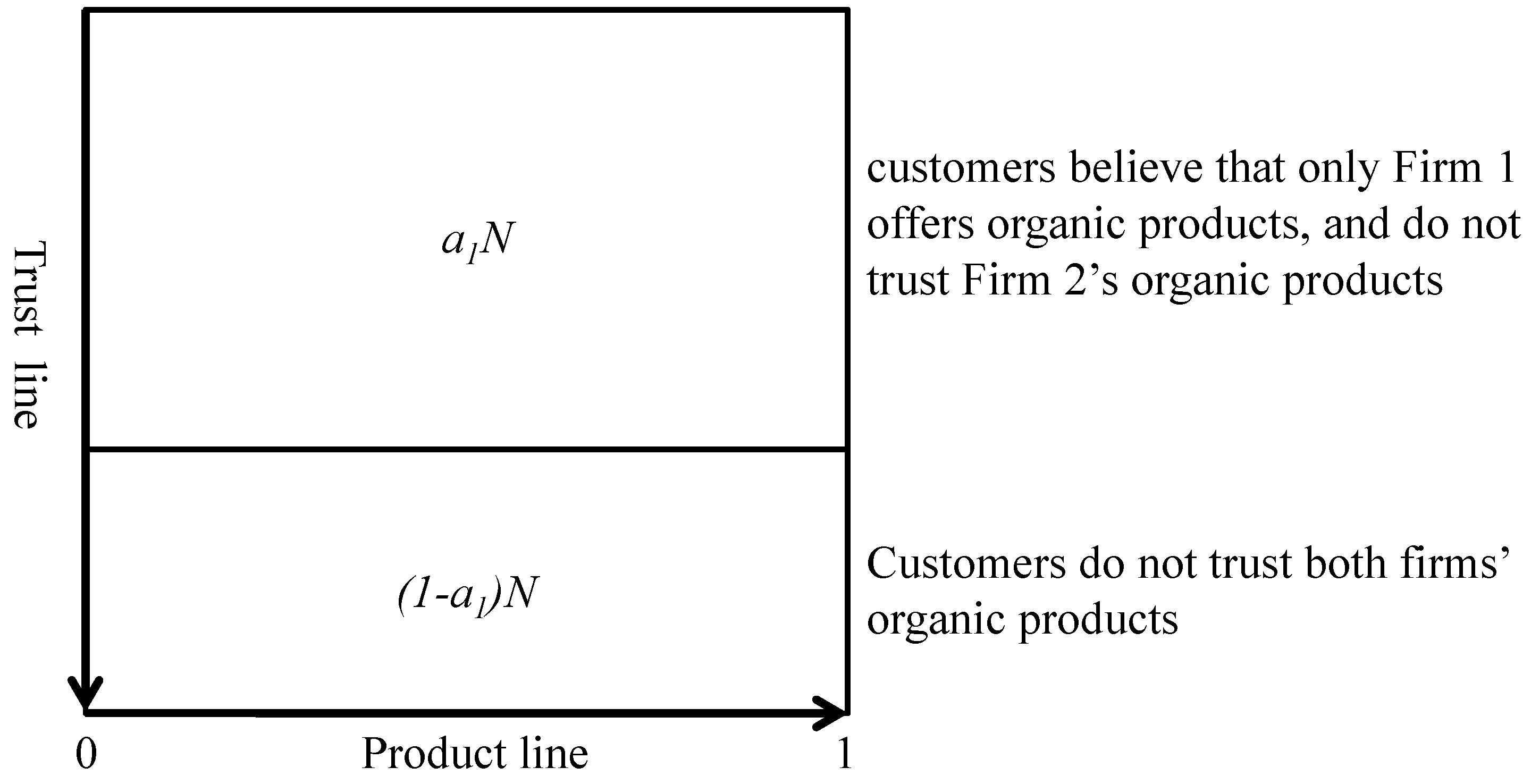

We first analyze the market structure given Firm 1’s credence investment decisions. For given

, the whole market can be divided into two parts.

customers trust the organic food products offered by Firm 1, while

customers do not trust Firm 1’s organic food products, and thus treat both two firms’ food products as normal non-organic food products. The market structure is illustrated in

Figure 2.

Following similar analysis in last subsection, we can obtain that the market share of two firms in the first part of market are and , respectively. The market share of two firms in the second part of market are and , respectively.

The total demands of two firms are:

Now we study two firms’ optimal decisions and equilibrium outcomes. At the third stage, two firms determine price to maximize their own profits:

The first order conditions lead to the equilibrium price decisions:

Now back to the second stage, Firm 1 makes the organic credence investment decision

to maximize their profit:

From the first order condition, we can see that the optimal

satisfies:

Lemma 1 guarantees that there exists a unique solution for Equation (

17).

Lemma 1. Equation has a unique solution for .

By substituting into the expressions of equilibrium prices and profits, we can further derive all equilibrium solutions in the subgame , which are summarized in the following proposition.

Proposition 3. Let be the solution in of following Equation (17). If Firm 1 offers organic food products and Firm 2 offers non-organic food products , the equilibrium prices are and . Firm 1’s organic credence investment decision is . The equilibrium profits are: and .

Note that we do not have a closed form of in Proposition 3, and all the equilibrium solutions are dependent on the value of . Thus the impacts of market parameters over the equilibrium outcomes are still not clear. In the following we further uncover the impacts of market parameters over the equilibrium credence investment decision, the equilibrium prices and the equilibrium profits, which are stated in Corollary 1.

Corollary 1. In the subgame :

- 1.

Firm 1’s organic credence investment decision is increasing in and decreasing in and .

- 2.

Firm 1’s equilibrium price is increasing in and decreasing in ; Firm 2’s equilibrium price is decreasing in and increasing in .

- 3.

Firm 1’s equilibrium profit is increasing in and decreasing in , ; Firm 2’s equilibrium profit is decreasing in and increasing in , and .

The majority of Corollary 1 is intuitive, except one counter-intuitive result in Corollary 1-(2). It is interesting to see that is decreasing in while is increasing in . Usually, a higher cost will lead to a higher price. An explanation is that captures the cost to make customers trust the organic food products. A lower means that the firm offering organic food products is more competitive and thus can offer a higher price.

In Corollary 2, we compare the equilibrium solutions and market shares in different subgames under a general condition.

Corollary 2. If , then:

- 1.

.

- 2.

the equilibrium prices in different subgames satisfy the following relationships: .

- 3.

the market shares in different subgames satisfy the following relationships: .

The condition is quite general condition, which will be discussed in next section. As is increasing in a, Corollary 2-(1) also indicates that Firm 1 would invest more on organic credence when only Firm 1 offers organic food products than when both firms offer organic food products. This is an interesting result as one might expect the opposite that competitive pressures would force firms to invest more in organic credence. The reason is that in our model, when firms make credence investment decisions, they can recognize its strategic effect on the price competition of next stage. When both firms offer organic food products, investing too much in organic credence intensifies price competition. Internalizing this effect, firms keep the equilibrium credence investment cost low. When only one firm offers organic food products, their organic food products competes with the rival’s non-organic food products. Although increasing the degree of competition does intensify prices competition, but the magnitude of this effect is not the same as in the case when both firms offer organic food products. The remaining part of Corollary 2 is quite intuitive.

3.3. Strategy Equilibrium

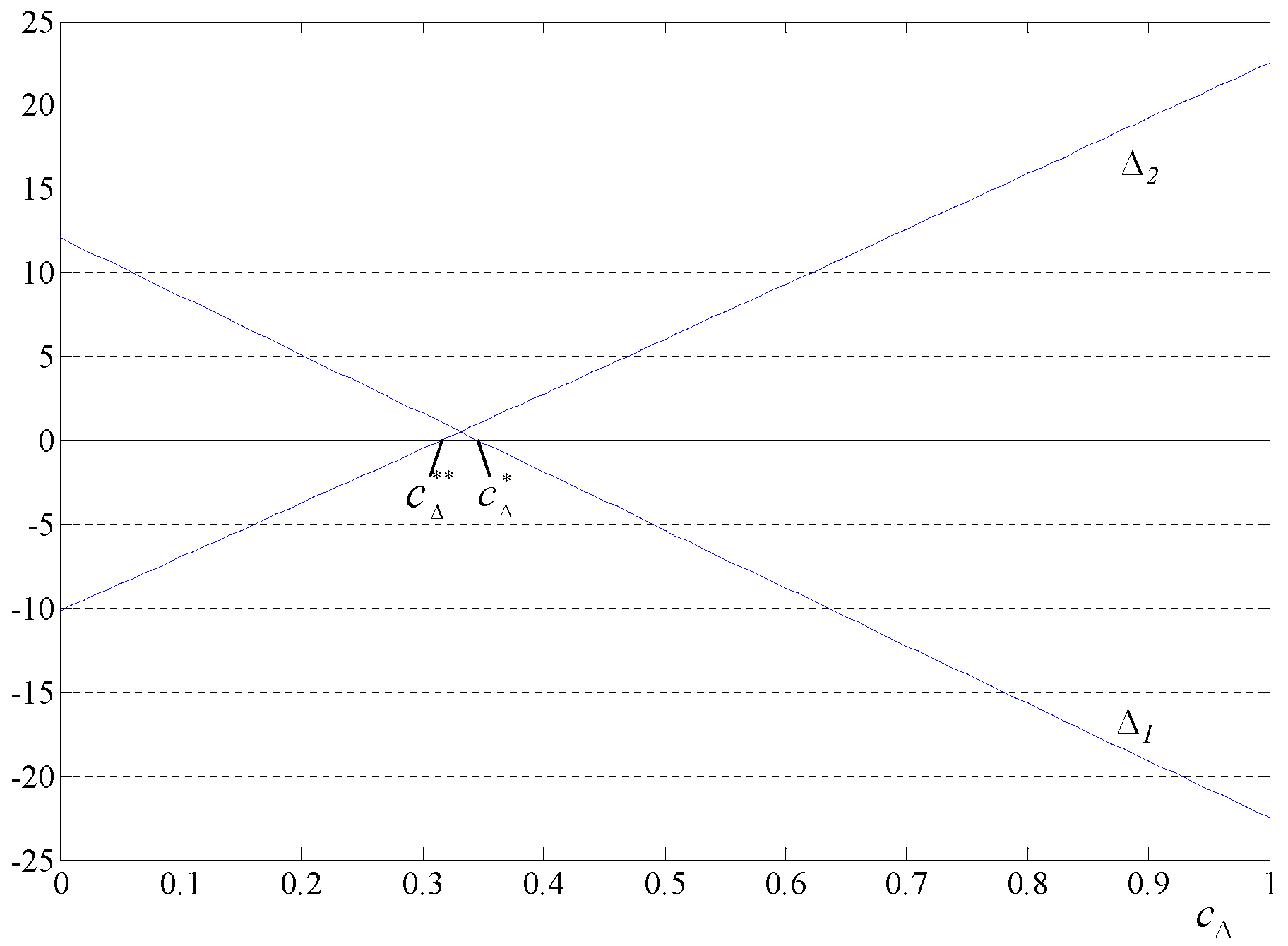

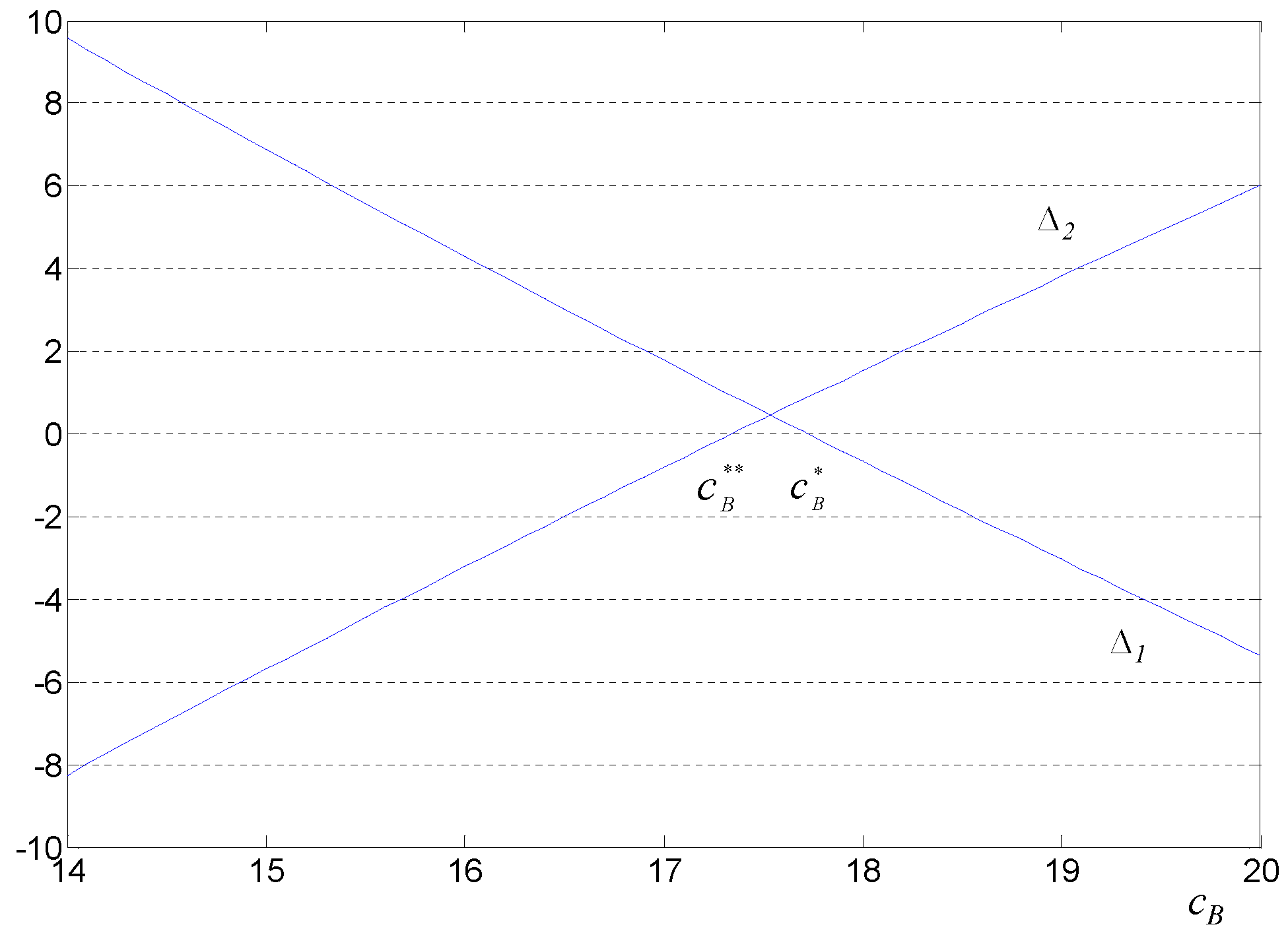

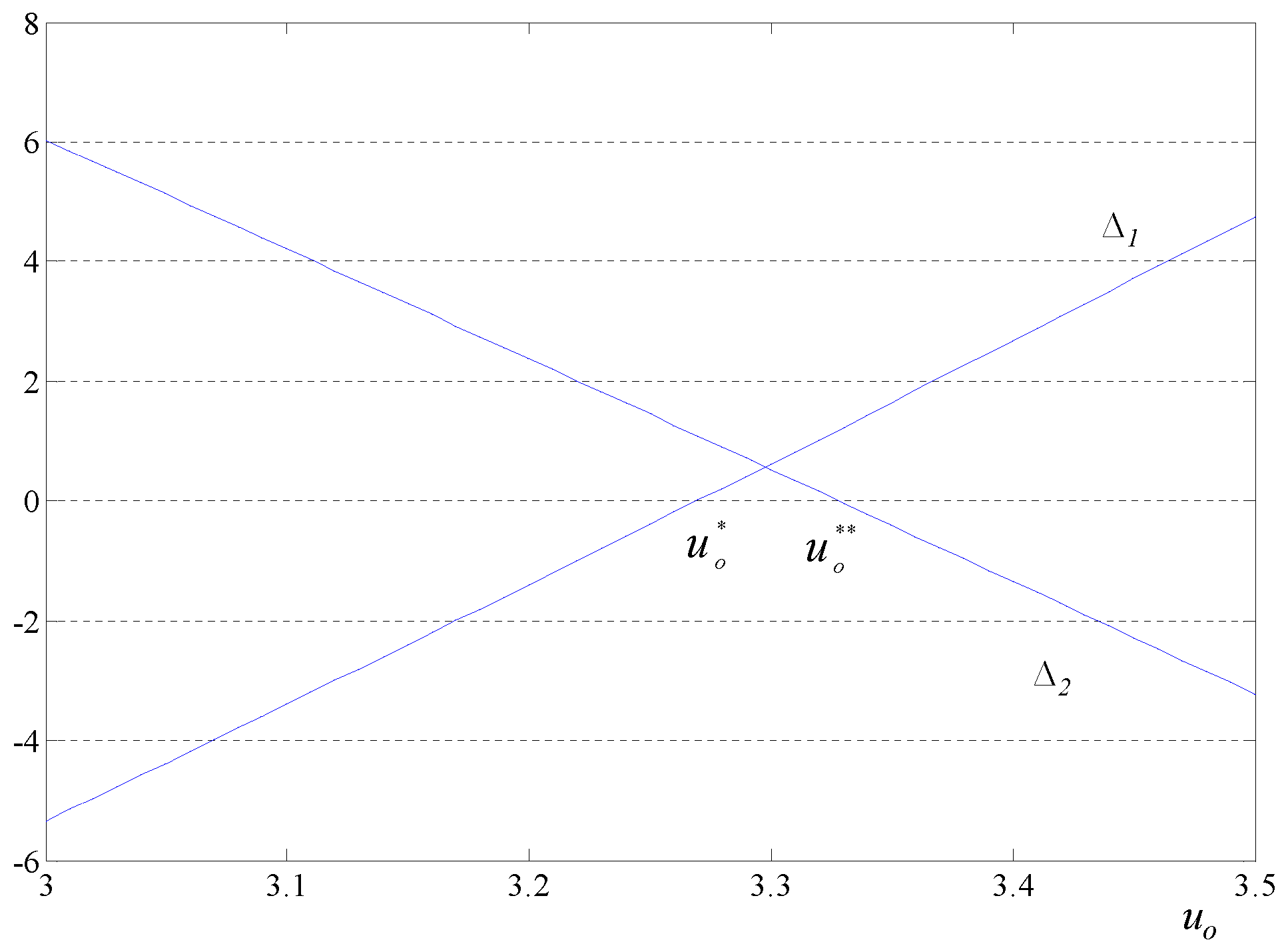

Now we consider two firms’ strategy choices at the first stage. We compare the outputs of all subgames first. Define

and

. Notice that the sign of

(

) determines if Firm 1 (Firm 2) would offer organic or non-organic food products when Firm 2 (Firm 1) offers non-organic (organic) food products. Thus the final equilibrium depends the signs of

and

. We further rewrite

and

as follows:

When , it can be seen that and always hold, which indicates that both firms have no motivations to offer organic food products. To avoid such an extreme case, we need to identify conditions ensuring . This condition is stated in Lemma 2.

Lemma 2. Let be the solution of . If , then , and .

From Lemma 2 we have Proposition 4, which identifies a condition on organic product credence investment cost under which the final equilibrium is .

Proposition 4. If , and , the equilibrium is , both firms offer non-organic food products.

Proposition 4 shows that if the credence investment cost is sufficiently large, firms will have no motivations offering organic food products. Note that when , which is mostly favourable for offering organic food products, firms may still have no motivations if the credence investment is too expensive, e.g., . Generally, production costs for organic food products are typically higher due to restricting the use of certain pesticides and fertilizers in farming which brings the greater labor inputs, the high expense on fertility, weed control, as well as pest and disease control, etc. However, there are still several arguments that the production costs for for organic food products may be similar to those of non-organic food products. Our above result indicates that even if under the case that production costs for both organic and non-organic food products are identical, firms still may not offer organic food products. The reason is that if it is expensive to make customers trust organic food products, offering organic food products still can not be competitive even if organic production cost appears to have no disadvantage compared to non-organic.

Lemma 3 characterizes a condition on such that when , , i.e., at most one firm will offer organic food products.

Lemma 3. There exists a , such that when and :

where is the solution of .

We can also see that

is the solution of the following equations:

From Lemma 3, we have Proposition 5 which further identifies a sufficient condition of organic product credence investment cost under which the final equilibrium will not be .

Proposition 5. If , , the equilibrium may be , or , firms may offer organic food products or non-organic food products, except the case that both firms offer organic food products.

Note that the conditions in Proposition 5 are independent of the value of . Proposition 5 further provides important managerial insights on firms strategy choices between offering organic and non-organic food products: when is sufficiently large, at most one firm will offer organic food products, regardless of the cost of organic production. The insights from Proposition 4 and 5 are intuitive. When it is expensive to invest in organic credence, firms are less likely to offer organic food products.

We are also interested in the impacts of organic production cost over the final equilibrium. Before introducing the main results, we have Lemma 4, which characterizes the value of and over different spaces of .

Lemma 4. If and , for :

- (1)

There exists a critical value such that: when , ; when , ,

- (2)

There exists a critical value such that: when , ; when , ,

- (3)

.

From Lemma 4 we directly have Proposition 6, which describes how the cost difference between organic and non-organic food products impacts the final equilibrium.

Proposition 6. If and , then:

- (1)

If , , , the final equilibrium is , both firms offer organic food products.

- (2)

If , , , the final equilibrium is or , only one firm offers organic food products and the other firm offers non-organic food products.

- (3)

If , , , the final equilibrium is , both firms offer non-organic food products.

Proposition 6 has important managerial implications for firms making strategy choices between offering organic and non-organic food products. For fixed organic credence investment cost, the production cost difference between organic and non-organic food products determines the final equilibrium. As one may expect, firms’ choices are dependent on the production cost difference: (i) if it is large enough, both firms will offer non-organic food products to customers; (ii) if it is moderately large, only one firm offers organic food products to customers; (iii) if it is relatively low, both firms offer organic food products to customers. These observations are consistent with the practice in industry. In 2014, a lot of organic food producers in Wuhan China abandoned organic production due to the high organic production costs [

39].