A Decision Model to Predict the Optimal Size of the Diversified Management Industry from the View of Profit Maximization and Coordination of Industrial Scale

Abstract

:1. Introduction

2. Literature Review

3. Method: Optimal Decision Model

3.1. Model Hypothesis

- That production technology level remained unchanged during the planned period.

- That raw materials arrived at the beginning of each period without delays or shortages.

- That a total of industries was covered by the enterprise, with the unit product price, sales volume, as well as the capital investment and labor input for each industry expressed as . The planned period lasted one year, and decisions were to be made at each quarter. is the time serial number during the planned period, . represents the capital input for each unit of production during the time period . represents the labor input for each unit of production during time period .

- In the statistics of product sales, the sales volume was divided into internal trading volume and market trading volume (as regards the synergy among various coal-related industries, the internal trading volume refers to the condition when certain a product is used as a raw material for other products made by the enterprise; otherwise, the trading volume is classified as market trading volume). The trading volume is expressed as , and refer to internal and market trading volume, respectively. Accordingly, the prices for internal and market transactions are expressed as and . represents the internal transaction price of a unit product during time period , and represents the market transaction price of a unit product during time period . represents the internal trading volume of a unit product during time period , and represents the market trading volume of the unit product during time period . represents the total industrial production generated during .

- That production costs included capital investments, labor input, and other fixed investments. Capital investments, labor input, and fixed investments are represented by , , and , respectively. Accordingly, the unit price of capital and labor are represented by and . represents the unit price of capital input during time period , and represents the unit price of labor input during the time period. The capital and labor input during the time period are expressed with and . Therefore, the total variable cost during the time period is expressed with . The fixed input during the time period is . Therefore, the total input for production can be expressed using .

3.2. Model Construction

3.2.1. Selection of Decision Variable

3.2.2. Determination of Objective Function

3.2.3. Statement of Constraint

3.2.4. Theoretical Model of Profit Decision

3.3. Solution for the Model: Case of China Coal Energy

3.3.1. Data Collection and Determination of Parameter Values

3.3.2. Solution of Optimal Value

3.4. Sensitivity and Reliability Analysis

4. Results

- Based on the program results, one recommendation is to develop the chemical industry and expand the scale of production after comprehensively considering the profit ratio, industrial cooperation, and the political environment.

- (1)

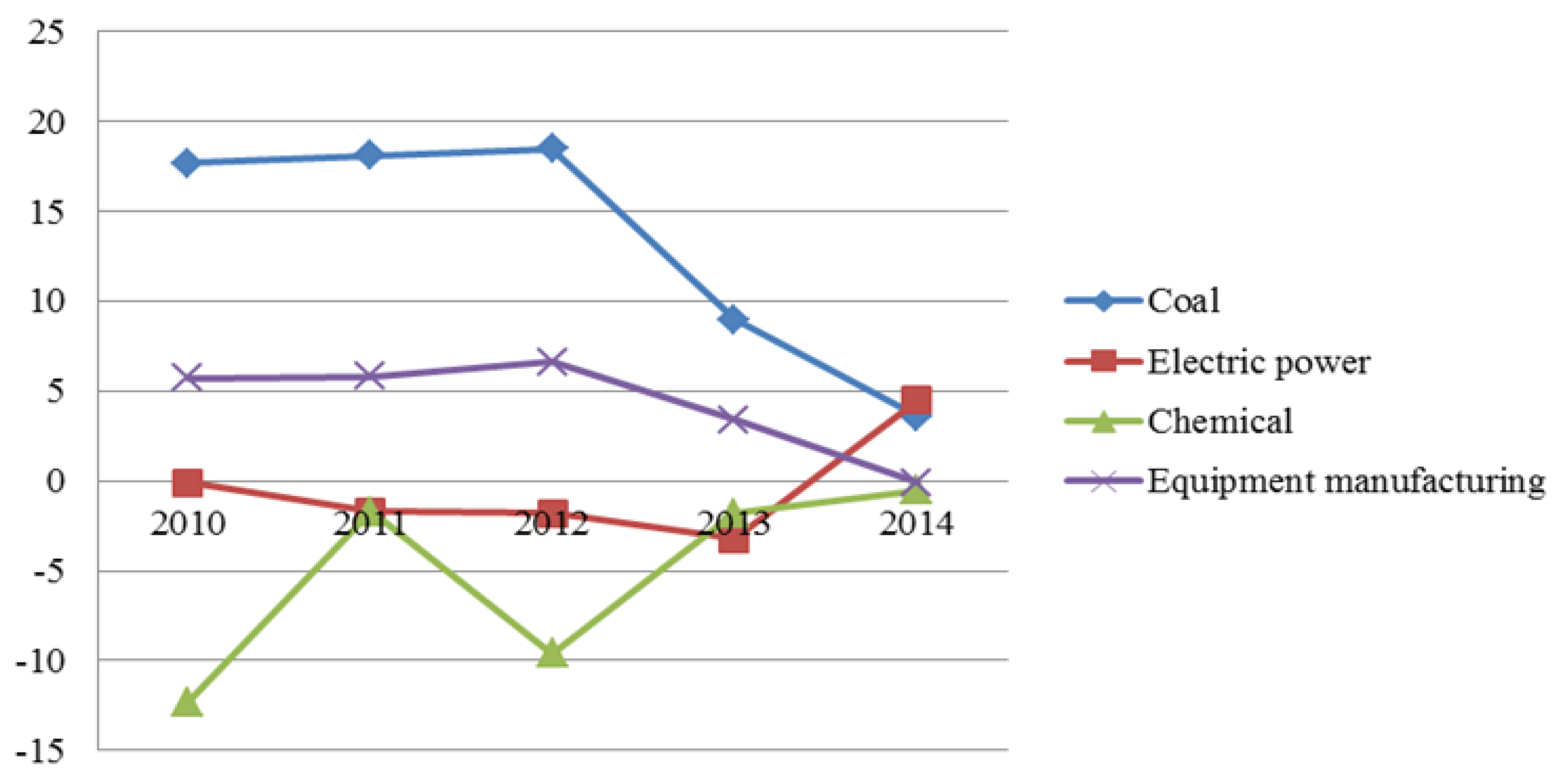

- The profit rate of the chemical industry is on the rise, especially since 2012 when the profit rate increased with a scale expansion of a larger rising degree.

- (2)

- The coal industry and coal chemical industry are closely linked. The raw materials of chemical products such as synthetic gas, liquefied petroleum, coke, and other such products are dependent on the supply of the coal industry, which greatly affects the chemical industry. As coal prices continue to decline, the cost of the coal chemical industry will decrease, raising the profit ratios.

- (3)

- Implementation of the clean coal utilization strategy in China supports the development of the coal chemical industry, which is then supported by a favorable policy environment.

- As the profit ratio of the coal industry keeps decreasing due to the macro economy and overcapacity problems, we propose compressing the production scale of coal block.

- (1)

- Since 2012, the coal industry has been affected by the macro economy, overcapacity, and oversupply, causing a significant decrease in the coal industry’s profit ratio.

- (2)

- In the profit decision model, the scale of each industry is limited by the enterprise’s total capital investment, which explains the relationship in which the scale of chemical industry production has greatly improved while other industries are downregulated.

- (3)

- Considering the political factors, China promotes the development of new energy and limits coal consumption, which leads coal enterprises to actively adjust their industrial layout, reducing coal production.

- The production scale of the equipment manufacturing industry is influenced by the coal industry. With the decline in production scale and the decreasing profit ratio of the coal industry, we recommend compressing the production scale of the equipment manufacturing industry.

- (1)

- The equipment manufacturing industry’s profit ratio continued to decline, and the decline range was fairly large, whereas the equipment manufacturing industry fell below the break-even point in 2014 with negative annual growth.

- (2)

- The equipment manufacturing industry is closely linked to the development of the coal industry. The primary product of the coal equipment manufacturing industry developed by China Coal Energy is coal machine equipment, where the customers are the coal production enterprises, or for the manufacturing industry’s own use. The coal industry influences the equipment manufacturing industry’s production scale, and the changing profit trends of these two are consistent. As the coal industry shrinks, the equipment-manufacturing industry should correspondingly reduce its expected output.

- (3)

- As the products of the equipment manufacturing industry—conducted by coal enterprises—are supplied to coal production enterprises or to the coal sector of the enterprise, political factors also affect the equipment manufacturing industry.

- Since the total investment of these enterprises is fixed and we have already proposed to greatly expand the production scale of the chemical industry, with the addition of considerations regarding profit rate and political factors, we suggest maintaining or appropriately expanding the scale of the power industry.

- (1)

- The electric power industry’s profit ratio continued to decline from 2010 to 2013, but increased substantially from 2013–2014, changing from a negative to a positive number. By analyzing China Coal Energy’s annual data, we see that the operating revenue of the power industry was relatively stable during 2013 and 2014, while business costs decreased significantly. Therefore, we see a remarkable increase in the operating margin. Based on changes to the profit rate, should the profit ratio keep increasing for an extended period, the enterprise’s decision makers could consider expanding the scale of the power industry.

- (2)

- With consideration to the financing ability of coal enterprises due to the limited total capital invested by the enterprise, and because the industrial scale is limited by the total capital of the enterprise, blind expansion of the electric power industry should be avoided while greatly improving the scale of the chemical industry.

- (3)

- Under the background of a national call for the development of clean electricity, coal enterprises should make appropriate decisions to increase or cut back production during the diversification process by integrating multiple factors, including policy, industry profit ratios, and business risks.

5. Conclusions and Prospects

- (1)

- We have calculated and predicted the development tendency of each industry in the case study. However, the results are based only on the decision model and the limited data. Decision makers in both coal enterprises and government should consider other factors, such as the human cost change, inflation or deflation, and technical progress. Additionally, given that the industries that the coal enterprises develop are more or less connected with core mining business, there still exists some future risk;

- (2)

- The optimal scale model of industries should concern different policy scenarios, such as the policies of the different industries made by the government—especially energy and coal industry plans issued by the government—which could affect the product output;

- (3)

- Although we have mentioned several policy factors, including the social and environmental benefits, when we offer proposals in the case study, the decision target is still the profit maximization in the decision model. The next step will be quantifying the social and environmental impacts with objective functions.

- (4)

- It is recommended that more data are collected and calculated in the model to improve the reliability of the results.

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Project Group of China’s Medium-to-Long-Term Energy Development Strategy Research. Research on China’s Medium-to-Long-Term Energy Development Strategy (2030, 2050), Energy Saving and Coal Volume; Science Press: Beijing, China, 2011. (In Chinese) [Google Scholar]

- General Office of the State Council of China Action Plans for Energy Development Strategy (2014–2020). Available online: http://www.gov.cn/zhengce/content/2014-11/19/content_9222.htm (accessed on 20 December 2016). (In Chinese)

- Tang, X.; Jin, Y.; McLellan, B.C.; Wang, J.; Li, S. China’s coal consumption declining—Impermanent or permanent? Resour. Conserv. Recycl. 2016. [Google Scholar] [CrossRef]

- Li, C.; Nie, R.; Wang, D. Scientific mining in China—Problems, progress, and prospects. Electron. J. Geotech. Eng. 2015, 20, 6491–6506. [Google Scholar]

- National Bureau of Statistic of China from January through June of 2016, Enterprises at National Scale Increased by 27.9% over the Same Period of Last Year. Available online: http://www.stats.gov.cn/tjsj/zxfb/201607/t20160727_1381841.html (accessed on 20 December 2016). (In Chinese)

- Li, C.; Cui, T.; Nie, R.; Yan, X. Measurement of the Industrial Collaboration of the Diversified Coal Industry: China Coal Energy Company as an Example. Math. Probl. Eng. 2017, 2017, 9416279. [Google Scholar] [CrossRef]

- Li, Q.; Wang, W.; Lou, Y.; Cheng, K.; Yang, X. Diversification and Corporate Performance: Evidence from China’s Listed Energy Companies. Sustainability 2016, 8, 983. [Google Scholar] [CrossRef]

- China Coal Information Institute. China Cola Industry Yearbook 2013; China Coal Industry Publishing Home: Beijing, China, 2015. (In Chinese) [Google Scholar]

- Cui, T.; Li, C.-M.; Nie, R.; Yan, X.-Y.; Qian, X.-Y. Measurement of diversification degree in large listed coal enterprises in china—A case study of shenhua group. Electron. J. Geotech. Eng. 2016, 21, 4013–4024. [Google Scholar]

- Ansoff, H.I. Strategies for diversification. Harv. Bus. Rev. 1957, 35, 113–124. [Google Scholar]

- Hoskisson, R.E.; Hitt, M.A. Antecedents and performance outcomes of diversification: A review and critique of theoretical perspectives. J. Manag. 1990, 16, 461–509. [Google Scholar] [CrossRef]

- Markides, C.C.; Williamson, P.J. Corporate diversification and organizational structure: A resource-based view. Acad. Manag. J. 1996, 39, 340–367. [Google Scholar] [CrossRef]

- Hyland, D.C.; Diltz, J.D. Why firms diversify: An empirical examination. Financ. Manag. 2002, 31, 51–81. [Google Scholar] [CrossRef]

- Ueng, C.J.; Wells, D.W. Corporate diversification, manager’s incentive, and shareholder wealth. J. Appl. Bus. Res. 2011, 17. [Google Scholar] [CrossRef]

- Penrose, E.T. The Theory of the Growth of the Firm; Oxford University Press: New York, NY, USA, 1995. [Google Scholar]

- Wernerfelt, B. Umbrella branding as a signal of new product quality: An example of signalling by posting a bond. RAND J. Econ. 1988, 19, 458–466. [Google Scholar] [CrossRef]

- Ramanujam, V.; Varadarajan, P. Research on corporate diversification: A synthesis. Strateg. Manag. J. 1989, 10, 523–551. [Google Scholar] [CrossRef]

- George, R.; Kabir, R. Heterogeneity in business groups and the corporate diversification–firm performance relationship. J. Bus. Res. 2012, 65, 412–420. [Google Scholar] [CrossRef]

- Nath, P.; Nachiappan, S.; Ramanathan, R. The impact of marketing capability, operations capability and diversification strategy on performance: A resource-based view. Ind. Mark. Manag. 2010, 39, 317–329. [Google Scholar] [CrossRef]

- Dervaric, E.; Medved, M.; Malenkovic, V. Strategic factors and a model of enterprise restructuring in the coal industry in Europe with emphasis on experiences in a Slovenia-Valenje coal mine case. J. South. Afr. Inst. Min. Metall. 2008, 108, 627–640. [Google Scholar]

- Nawrocki, T.L.; Jonek-Kowalska, I. Assessing operational risk in coal mining enterprises—Internal, industrial and international perspectives. Resour. Policy 2016, 48, 50–67. [Google Scholar] [CrossRef]

- Hu, X. From Coal Mining to Coal Chemicals? Unpacking New Path Creation in an Old Industrial Region of Transitional China. Growth Chang. 2017. [Google Scholar] [CrossRef]

- Song, M.; Wang, J. Coal price fluctuations in China: Economic effects and policy implications. J. Renew. Sustain. Energy 2016, 8, 065901. [Google Scholar] [CrossRef]

- Zhou, Y.M. Synergy, coordination costs, and diversification choices. Strateg. Manag. J. 2011, 32, 624–639. [Google Scholar] [CrossRef]

- Christensen, H.K.; Montgomery, C.A. Corporate economic performance: Diversification strategy versus market structure. Strateg. Manag. J. 1981, 2, 327–343. [Google Scholar] [CrossRef]

- Nayyar, P.R. On the measurement of corporate diversification strategy: Evidence from large US service firms. Strateg. Manag. J. 1992, 13, 219–235. [Google Scholar] [CrossRef]

- Boehe, D.M.; Jimenez, A. How does the geographic export diversification-performance relationship vary at different levels of export intensity? Int. Bus. Rev. 2016, 25, 1262–1272. [Google Scholar] [CrossRef]

| Industry Name | (yuan/ton or kWh) | (yuan/ton or kWh) | (Labor/ton or kWh) | (yuan/ton or kWh) | (ton or kWh) |

|---|---|---|---|---|---|

| Coal industry | 88.487 | 315.991 | 0.000258 | 50.8632 | 168,383,373.3 |

| Electric power industry | 0.343 | 0.343 | 2.558 × 10−7 | 0.07215 | 5,130,480,998 |

| Chemical industry | 2076.117 | 2076.117 | 0.001878 | 2017.471 | 16,156,261.36 |

| Equipment manufacturing industry | 20,401.54 | 20,401.54 | 0.04678 | 1211.775 | 181,375.5781 |

| Lt | 73,748.993 | ||||

| Kt | 25,272,465,088 | ||||

| TFCt | 78,22,610,567 | ||||

| Variable | Current Coefficient | Allowable Increase | Allowable Decrease |

|---|---|---|---|

| A | 88.48699951 | 227.5039978 | infinity |

| B | 315.9909973 | infinity | 227.5039978 |

| C | 3430 | infinity | 2687.526298 |

| D | 2076.117004 | 7514.904617 | 2076.117004 |

| E | 20,401.54 | infinity | 19,154.51348 |

| Row | Current RHS | Allowable Increase | Allowable Decrease |

|---|---|---|---|

| 2 | 73,748.993 | infinity | 5504.716969 |

| 3 | 2,527,246.509 | 591,352.5742 | 1,611,853.159 |

| 4 | 168,383,373.3 | 26,131,307.51 | 168,383,373.3 |

| 5 | 513,048.0998 | 2,918,140.811 | 513,048.0998 |

| 6 | 16,156,261.36 | infinity | 8,166,783.652 |

| 7 | 181,375.5781 | 120,580.0449 | 181,375.5781 |

| Industry Name | Parameters | 2013 | 2014 | 2016 |

|---|---|---|---|---|

| Coal | Total output (10 thousand tons) | 19,084 | 18,304 | 16,838.34 |

| Electric power | Total output (10 thousand kWh) | 471,708 | 485,104 | 513,048.1 |

| Chemical | Total output (10 thousand tons) | 172.163 | 644.371 | 798.9478 |

| Equipment manufacturing | Total output (10 thousand tons) | 33.5212 | 27.3153 | 18.1376 |

| Operating Profit Ratio | 2010 | 2011 | 2012 | 2013 | 2014 |

|---|---|---|---|---|---|

| Coal | 17.7 | 18.1 | 18.5 | 9.0 | 3.6 |

| Electric power | −0.09 | −1.7 | −1.8 | −3.2 | 4.5 |

| Chemical | −12.3 | −1.7 | −9.6 | −1.8 | −0.5 |

| Equipment manufacturing | 5.7 | 5.8 | 6.6 | 3.4 | −0.1 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, C.-M.; Cui, T.; Nie, R.; Shan, Y.; Wang, J.; Qian, X. A Decision Model to Predict the Optimal Size of the Diversified Management Industry from the View of Profit Maximization and Coordination of Industrial Scale. Sustainability 2017, 9, 642. https://doi.org/10.3390/su9040642

Li C-M, Cui T, Nie R, Shan Y, Wang J, Qian X. A Decision Model to Predict the Optimal Size of the Diversified Management Industry from the View of Profit Maximization and Coordination of Industrial Scale. Sustainability. 2017; 9(4):642. https://doi.org/10.3390/su9040642

Chicago/Turabian StyleLi, Chong-Mao, Tao Cui, Rui Nie, Yuli Shan, Juan Wang, and Xiangyan Qian. 2017. "A Decision Model to Predict the Optimal Size of the Diversified Management Industry from the View of Profit Maximization and Coordination of Industrial Scale" Sustainability 9, no. 4: 642. https://doi.org/10.3390/su9040642