Risk Assessment of China’s Overseas Oil Refining Investment Using a Fuzzy-Grey Comprehensive Evaluation Method

Abstract

:1. Introduction

2. Risk Factor Analysis on Overseas Refining Investment

2.1. Local Investment Environment Risks

- Local political stability. This refers to the governing on the domestic political situation of the local government, which can be reflected in the regime change, war and civil strife. Local political instability imposes severe threats on overseas refining projects, which will lead to the high-risk level of the project from the initial stage of the investment [30].

- Policy continuity in the petrochemical industry. The invested overseas project has to strictly follow the local laws and regulations for the petroleum and petrochemical industries. The discontinuity in the petrochemical industry policy may cause damages to oil refining projects [31].

- Market access risk. This is defined as the permission of the host country for Chinese oil companies to participate in the local oil refining projects with few or no tariff barriers [32].

- Market competition risk. The market competition risk refers to the influence aroused by the competition from petroleum and petrochemical companies of other countries on the uncertainty of the project implementation. Fierce market competition indicates high risks [33].

2.2. Technical Risks

- Refinery design risk. The successful commissioning of the overseas oil refining project greatly depends on the initial design of the refinery plant, which mainly consists of the selection of the refining process, determination of the production capacity, and arrangement of the main process unit and flare system [35].

- Engineering construction risk. This refers to the odds of engineering quality deviation from the expectation due to the limitation in the ground condition and subjective causes of the construction team during the building process of the refinery [36].

- Project completion risk. This risk refers to the uncertainty in the engineering construction stage and pilot production stage of the oil refinery project, and mainly occurs in the forms of engineering construction delay, cost overrun, and below-standard engineering quality [37].

- Equipment maintenance risk. The equipment may malfunction in its operation process, so that the equipment maintenance is needed to ensure the safe operation of the refinery after it runs for a period of time. The maintenance cost and shutdown loss constitute the equipment maintenance risk [38].

- Material and equipment procurement risk. This risk can be defined as the uncertainty deriving from inappropriate procurement budget that can cause the failure of engineering materials to meet the production requirement or exceed the budget. The procurement risk can increase the required investment of the project and prolong the duration of construction [39].

2.3. Organization Management Risks

- Human resource management risk. The human resource is an important factor for the success of overseas projects. The comprehensive quality, professional proficiency, and education level of the project team member to a certain extent affects the overseas oil refining project [41].

- Intercultural management risk. When an oil company invests on an oil refining project in a foreign country, the project inevitably exists in a different cultural environment. The intercultural management risk means the probability of the project loss because of cultural misunderstandings and cultural conflicts [42].

- Contract management risk. The contract management risk refers to the probability of situations where the project suffers losses due to the omission of contract terms, ambiguous expression, inappropriate selection of contract types, or wrong choice of contracting forms during the entire process from the contract bidding of the oil refining project, through the contract conclusion, to the execution and termination [43].

- Refinery operation management risk. The refinery operation management risk describes the odds of the failure of the refinery operation to meet the expectation or the project loss due to the complexity and variability of the external environment and the limited cognitive and adaptive abilities of the administrator to the environment [44].

2.4. HSE and Social Responsibility Risks

- Environmental risk. The environmental risk mainly refers to the potential damage to surroundings. The oil refining company produces a mass of waste oil, industrial residues and waste water (known as the three wastes) and they tend to negatively impact the environment—causing vegetation deterioration, air pollution and geological alteration [46].

- The safety and health risk. The safety and health risk describes the probability of accidents such as loss of life and personal injuries, occupational diseases, property damage, workplace destruction during the construction and production of the refinery plant [47].

- The social responsibility risk. The social responsibility risk points to the odds of the refinery project damage due to the company’s lack of or inappropriate undertaking of social responsibilities and impacts on the sustainable development of the local society. The social responsibility risk often affects the reputation of the refinery and hence influences its sustainable development [48].

2.5. Economic Risks

- Local fiscal and taxation policy risk. The potential change in the revenue of the refinery due to the variation in the local fiscal and taxation policy is defined as the local fiscal and taxation policy risk. This so-called change in the local fiscal and taxation policy includes the alteration of the interest rate, exchange rate and tax rate, which has effects on the income of the refinery [50].

- Crude oil supply risk. The crude oil access risk refers to the uncertainty originating from the impacted raw material supply for the refinery. Therefore, problems in the access to crude oil mean no raw materials for processing and failure to maintain production. The revenue of the refinery vanishes, which causes tremendous economic loss of the refinery [51].

- Refined oil market demand risk. This relates to the uncertainty in the local refined oil demand. The refined oil is associated with profits of the refinery. High local demand for the refined oil indicates good sales of the refined oil. On the contrary, weak market demand for the refined oil leads to slow distribution of the refined oil and dead product stock of the refinery [52].

- Marketization level risk of the local refined oil pricing system. The revenue of the overseas refinery is attributed to the sale of the refined oil, which greatly relies on the price of the refined oil. In terms of the overseas refining project, the host country often imposes limits on the refined oil price to protect the local stakeholder, which lowers the marketization level of the refined oil pricing system and leads to insecurity of the refinery revenue [53].

3. Methodology

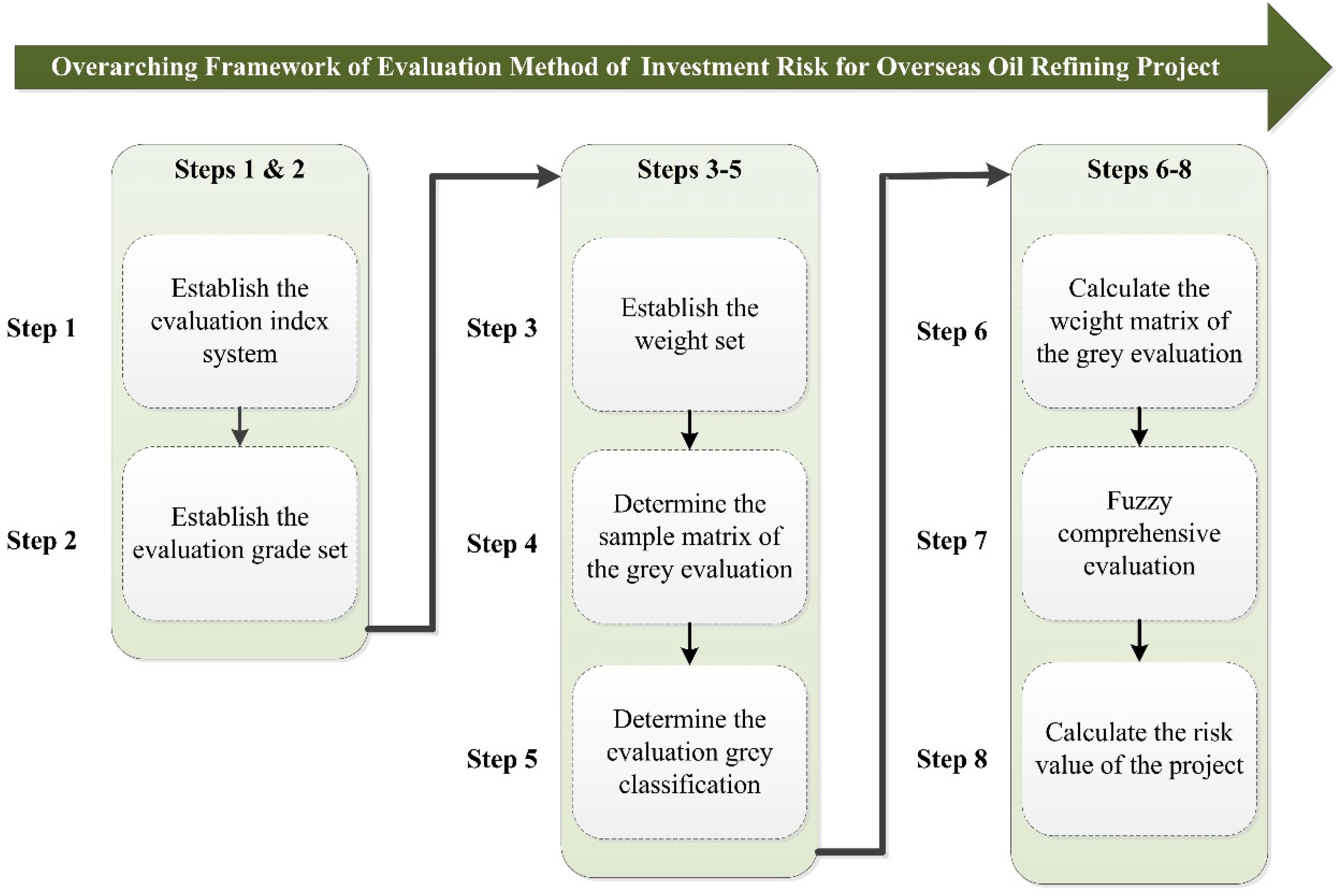

3.1. Overarching Framework

3.2. Solution Method

4. Case Study

4.1. Background

4.2. Risk Assessment Results

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Moro, L.F.L. Process technology in the petroleum refining industry—Current situation and future trends. Comput. Chem. Eng. 2003, 27, 1303–1305. [Google Scholar] [CrossRef]

- Su, M.; Zhang, M.; Lu, W.; Chang, X.; Chen, B.; Liu, G.; Hao, Y.; Zhang, Y. Ena-based evaluation of energy supply security: Comparison between the chinese crude oil and natural gas supply systems. Renew. Sustain. Energy Rev. 2017, 72, 888–899. [Google Scholar] [CrossRef]

- Dong, K.; Sun, R.; Li, H.; Zheng, S.; Yuan, B.; Chung, K.H. Weaker demand outlook, heightened regulations create uncertainty for chinese refiners. Oil Gas J. 2016, 114, 63–67. [Google Scholar]

- Dong, K.-Y.; Sun, R.-J.; Li, H.; Jiang, H.-D. A review of china’s energy consumption structure and outlook based on a long-range energy alternatives modeling tool. Petroleum Sci. 2016, 14, 1–14. [Google Scholar] [CrossRef]

- Fang, W.L.; Y.L.; An, H.Z. Views on global cooperation in oil-gas resource. Resour. Ind. 2011, 13, 43–46. (In Chinese) [Google Scholar]

- Len, C. China’s 21st century maritime silk road initiative, energy security and sloc access. Marit. Aff. 2015, 11, 1–18. [Google Scholar] [CrossRef]

- Mckinsey’s Energy Insights. Impact of Low Crude Prices on Refining. 2015. Available online: https://www.mckinseyenergyinsights.com/insights/impact-of-low-crude-prices-on-refining.aspx (accessed on 25 April 2017).

- Hong, E.; Sun, L. Dynamics of internationalization and outward investment: Chinese corporations’ strategies. China Q. 2006, 187, 610–634. [Google Scholar] [CrossRef]

- Houser, T. The roots of chinese oil investment abroad. Asia Policy 2008, 5, 141–166. [Google Scholar] [CrossRef]

- Li, H.; Dong, K.; Sun, R.; Yu, J.; Xu, J. Sustainability Assessment of Refining Enterprises Using a DEA-Based Model. Sustainability 2017, 9, 620. [Google Scholar] [CrossRef]

- Iea. Overseas Investments by Chinese National Oil Companies: Assessing the Drivers and Impacts. 2011. Available online: https://www.iea.org/publications/freepublications/publication/overseas_china.pdf (accessed on 25 April 2017).

- Huang, Y.Z. How to avoid the technical risk of overseas refining projects. Int. Petroleum Econ. 1999, 7, 37–41. (In Chinese) [Google Scholar]

- Milani, R.V.; Lavie, C.J. Another step forward in refining risk stratification. J. Am. Coll. Cardiol. 2011, 58, 464–466. [Google Scholar] [CrossRef] [PubMed]

- Guo, P.G.H.; Feng, W.K. Reflections on participation in international refining project cooperation. Econ. Anal. China’s Petroleum Chem. Ind. 2008, 10, 52–54. [Google Scholar]

- Felder, F.A. Risk modeling, assessment, and management. IIE Trans. 2005, 37, 586–587. [Google Scholar]

- Hughes, R.T. Expert judgement as an estimating method. Inf. Softw. Technol. 1996, 38, 67–75. [Google Scholar] [CrossRef]

- Li, P.; Chen, B.; Li, Z.; Zheng, X.; Wu, H.; Jing, L.; Lee, K. A monte carlo simulation based two-stage adaptive resonance theory mapping approach for offshore oil spill vulnerability index classification. Mar. Pollut. Bull. 2014, 86, 434–442. [Google Scholar] [CrossRef] [PubMed]

- Abbasitabar, F.; Zare-Shahabadi, V. In silico prediction of toxicity of phenols to tetrahymena pyriformis by using genetic algorithm and decision tree-based modeling approach. Chemosphere 2017, 172, 249–259. [Google Scholar] [CrossRef] [PubMed]

- Kokangül, A.; Polat, U.; Dağsuyu, C. A new approximation for risk assessment using the ahp and fine kinney methodologies. Saf. Sci. 2017, 91, 24–32. [Google Scholar] [CrossRef]

- Yu, C. Quantitative risk analysis method of information security-combining fuzzy comprehensive analysis with information entropy. BioTechnology 2014, 10, 12753–12761. [Google Scholar]

- Liu, H.-C.; Liu, L.; Liu, N. Risk evaluation approaches in failure mode and effects analysis: A literature review. Expert Syst. Appl. 2013, 40, 828–838. [Google Scholar] [CrossRef]

- Li, H.; Sun, R.; Lee, W.-J.; Dong, K.; Guo, R. Assessing risk in chinese shale gas investments abroad: Modelling and policy recommendations. Sustainability 2016, 8, 708. [Google Scholar] [CrossRef]

- Hsu, H.-M.; Chen, C.-T. Fuzzy credibility relation method for multiple criteria decision-making problems. Inf. Sci. 1997, 96, 79–91. [Google Scholar]

- Billaudel, P.; Devillez, A.; Lecolier, G.V. Performance evaluation of fuzzy classification methods designed for real time application. Int. J. Approx. Reason. 1999, 20, 1–20. [Google Scholar] [CrossRef]

- Julong, D. Introduction to grey system theory. J. Grey Syst. 1989, 1, 1–24. [Google Scholar]

- Guo, P.; Shi, P.-G. Research on fuzzy-grey comprehensive evaluation method of project risk. J. Xi’an Univ. Technol. 2005, 21, 106–109. [Google Scholar]

- Chen, Q. The principle and strategy for overseas refining and petrochemical projects development at the time of global recession. Petroleum Petrochem. Today 2011, 3, 2–6. [Google Scholar]

- Ramos, S.B.; Veiga, H. Risk factors in oil and gas industry returns: International evidence. Energy Econ. 2011, 33, 525–542. [Google Scholar] [CrossRef]

- Apex Oil Company. Available online: http://apexoil.com/ (accessed on 25 April 2017).

- Osabutey, D.; Obro-Adibo, G.; Agbodohu, W.; Kumi, P. Analysis of risk management practices in the oil and gas industry in ghana. Case study of tema oil refinery (tor). Eur. J. Bus. Manag. 2013, 5, 139–150. [Google Scholar]

- Busse, M.; Hefeker, C. Political risk, institutions and foreign direct investment. Eur. J. Political Econ. 2007, 23, 397–415. [Google Scholar] [CrossRef]

- Fia Maket Access Working Group, Market Access Risk Management Recommendations. 2010. Available online: https://secure.fia.org/downloads/market_access-6.pdf (accessed on 25 April 2017).

- Laksmana, I.; Yang, Y.-W. Product market competition and corporate investment decisions. Rev. Acc. Financ. 2015, 14, 128–148. [Google Scholar] [CrossRef]

- Zhang, B.S.; Wang, Q.; Wang, Y.J. Model of risk-benefit co-analysis on oversea oil and gas projects and its application. Syst. Eng. Theory Pract. 2012, 32, 246–256. (In Chinese) [Google Scholar]

- Markowski, A.S. Quantitative risk assessment improves refinery safety. Oil Gas J. 2002, 100, 56–63. [Google Scholar]

- Iqbal, S.; Choudhry, R.M.; Holschemacher, K.; Ali, A.; Tamošaitienė, J. Risk management in construction projects. Technol. Econ. Dev. Econ. 2015, 21, 65–78. [Google Scholar] [CrossRef]

- Kokkaew, N.; Wipulanusat, W. Completion delay risk management: A dynamic risk insurance approach. KSCE J. Civ. Eng. 2014, 18, 1599–1608. [Google Scholar] [CrossRef]

- Bigliani, R. Reducing Risk in Oil and Gas Operations; IDC Energy Insights: Framingham, MA, USA, 2013. [Google Scholar]

- Anvaripour, B.; Sa’idi, E.; Nabhani, N.; Jaderi, F. Risk analysis of crude distillation unit’s assets in abadan oil refinery using risk based maintenance. TJEAS J. 2013, 3, 1888–1892. [Google Scholar]

- Muralidhar, K. Enterprise risk management in the middle east oil industry: An empirical investigation across gcc countries. Int. J. Energy Sect. Manag. 2010, 4, 59–86. [Google Scholar] [CrossRef]

- Stephens, J.C.; Wilson, E.J.; Peterson, T.R. Socio-political evaluation of energy deployment (speed): An integrated research framework analyzing energy technology deployment. Technol. Forecast. Soc. Chang. 2008, 75, 1224–1246. [Google Scholar] [CrossRef]

- Li, S. Risk management for overseas development projects. Int. Bus. Res. 2009, 2, 193. [Google Scholar] [CrossRef]

- Pongsakdi, A.; Rangsunvigit, P.; Siemanond, K.; Bagajewicz, M.J. Financial risk management in the planning of refinery operations. Int. J. Prod. Econ. 2006, 103, 64–86. [Google Scholar] [CrossRef]

- Ribas, G.P.; Leiras, A.; Hamacher, S. Operational planning of oil refineries under uncertainty special issue: Applied stochastic optimization. IMA J. Manag. Math. 2012, 23, 397–412. [Google Scholar] [CrossRef]

- Spence, D.B. Corporate social responsibility in the oil and gas industry: The importance of reputational risk. Chic.-Kent Law Rev. 2011, 86, 59. [Google Scholar]

- Rezaian, S.; Jozi, S.A. Health-safety and environmental risk assessment of refineries using of multi criteria decision making method. APCBEE Procedia 2012, 3, 235–238. [Google Scholar] [CrossRef]

- Chauhan, N. Safety and Health Management System in Oil and Gas Industry; Wipro Technologies: Bangalore, India, 2013. [Google Scholar]

- Ledwidge, J. Corporate social responsibility: The risks and opportunities for hr: Integrating human and social values into the strategic and operational fabric. Hum. Resour. Manag. Int. Dig. 2007, 15, 27–30. [Google Scholar] [CrossRef]

- Paté-Cornell, M.E. Fire risks in oil refineries: Economic analysis of camera monitoring. Risk Anal. 1985, 5, 277–288. [Google Scholar] [CrossRef]

- Nakhle, C. Petroleum Taxation: Sharing the Oil Wealth: A Study of Petroleum Taxation Yesterday, Today and Tomorrow; Routledge: Oxford, UK, 2008. [Google Scholar]

- Nnadili, B.N. Supply and Demand Planning for Crude Oil Procurement in Refineries. Master’s Thesis, Massachusetts Institute of Technology, Cambridge, MA, USA, 2006. [Google Scholar]

- Zhang, G.; Zou, P.X. Fuzzy analytical hierarchy process risk assessment approach for joint venture construction projects in china. J. Constr. Eng. Manag. 2007, 133, 771–779. [Google Scholar] [CrossRef]

- Song, C.; Li, C. Relationship between chinese and international crude oil prices: A vec-tarch approach. Math. Probl. Eng. 2015, 2015, 842406. [Google Scholar] [CrossRef]

- Baker, E.; Keisler, J.M. Cellulosic biofuels: Expert views on prospects for advancement. Energy 2011, 36, 595–605. [Google Scholar] [CrossRef]

- Liu, H.-C.; Liu, L.; Bian, Q.-H.; Lin, Q.-L.; Dong, N.; Xu, P.-C. Failure mode and effects analysis using fuzzy evidential reasoning approach and grey theory. Expert Syst. Appl. 2011, 38, 4403–4415. [Google Scholar] [CrossRef]

- Bu, G.; Zhang, Y. Grey fuzzy comprehensive evaluation based on the theory of grey fuzzy relation. Syst. Eng. Theory Pract. 2002, 4, 141–144. [Google Scholar]

- Lee, M.-C. Information security risk analysis methods and research trends: Ahp and fuzzy comprehensive method. Int. J. Comput. Sci. Inf. Technol. 2014, 6, 29. [Google Scholar]

- Vargas, L.G. An overview of the analytic hierarchy process and its applications. Eur J. Oper. Res. 1990, 48, 2–8. [Google Scholar] [CrossRef]

- Cnpc Annual Report. Available online: http://www.cnpc.com.cn/en/ar2015/annualreport_list.shtml (accessed on 25 April 2017).

- Mas-Verdu, F.; Ribeiro Soriano, D.; Roig Dobon, S. Regional development and innovation: The role of services. Serv. Ind. J. 2010, 30, 633–641. [Google Scholar] [CrossRef]

- Dobón, S.R.; Soriano, D.R. Exploring alternative approaches in service industries: The role of entrepreneurship. Serv. Ind. J. 2008, 28, 877–882. [Google Scholar] [CrossRef]

- Soriano, D.R.; Peris-Ortiz, M. Subsidizing technology: How to succeed. J. Bus. Res. 2011, 64, 1224–1228. [Google Scholar] [CrossRef]

| Methods | Examples | Advantages | Disadvantages |

|---|---|---|---|

| Qualitative method |

|

|

|

| Quantitative method |

|

|

|

| Comprehensive method |

|

|

|

| Goals | Criteria | Factors |

|---|---|---|

| Investment risks of overseas oil refining projects, G | Local investment environment risks, A | Local political stability risks, A1 |

| Local petrochemical policy continuity risks, A2 | ||

| Market access risks, A3 | ||

| Market competition risk, A4 | ||

| Technical risks, B | Refinery design risks, B1 | |

| Engineering construction risks, B2 | ||

| Equipment maintenance risks, B3 | ||

| Project completion risks, B4 | ||

| Material and equipment procurement risks, B5 | ||

| Organization management risks, C | Human resource risks, C1 | |

| Intercultural management risks, C2 | ||

| Contract management risks, C3 | ||

| Refinery operation management, C4 | ||

| HSE and social responsibility risks, D | Environmental risks, D1 | |

| Safety and health risks, D2 | ||

| Social responsibility risks, D3 | ||

| Economic risks, E | Local fiscal and taxation policy risks, E1 | |

| Crude oil access risks, E2 | ||

| Marketization level risks of the local refined oil pricing system, E3 | ||

| Refined oil market demand risks, E4 |

| Participant Characteristics | Frequency | % |

|---|---|---|

| Gender | ||

| Males | 62 | 68 |

| Females | 29 | 32 |

| Age | ||

| <30 | 17 | 19 |

| 30–40 | 23 | 25 |

| >40 | 51 | 56 |

| Education | ||

| Bachelor’s degree | 12 | 13 |

| Graduate degree | 48 | 53 |

| Doctorate degree | 31 | 34 |

| Working years | ||

| <5 | 22 | 24 |

| 5–10 | 29 | 32 |

| >10 | 40 | 44 |

| Index No. | Risk Index | Total Points | Average Points |

|---|---|---|---|

| A | Local investment environment risks | 387 | 4.2527 |

| B | Technical risks | 283 | 3.1099 |

| C | Organization management risks | 268 | 2.9451 |

| D | HSE and social responsibility risks | 341 | 3.7473 |

| E | Economic risks | 378 | 4.1538 |

| A1 | Local political stability risks | 391 | 4.2967 |

| A2 | Local petrochemical policy continuity risks | 336 | 3.6923 |

| A3 | Market access risks | 245 | 2.6923 |

| A4 | Market competition risk | 267 | 2.9341 |

| B1 | Refinery design risks | 210 | 2.3077 |

| B2 | Engineering construction risks | 210 | 2.3077 |

| B3 | Equipment maintenance risks | 243 | 2.6703 |

| B4 | Project completion risks | 191 | 2.0989 |

| B5 | Material and equipment procurement risks | 306 | 3.3626 |

| C1 | Human resource risks | 275 | 3.0220 |

| C2 | Intercultural management risks | 283 | 3.1099 |

| C3 | Contract management risks | 275 | 3.0220 |

| C4 | Refinery operation management | 257 | 2.8242 |

| D1 | Environmental risks | 312 | 3.4286 |

| D2 | Safety and health risks | 296 | 3.2527 |

| D3 | Social responsibility risks | 276 | 3.0330 |

| E1 | Local fiscal and taxation policy risks | 330 | 3.6264 |

| E2 | Crude oil access risks | 290 | 3.1868 |

| E3 | Marketization level risks of the local refined oil pricing system | 334 | 3.6703 |

| E4 | Refined oil market demand risks | 284 | 3.1209 |

| Criteria | Weights | Factors | Weights |

|---|---|---|---|

| Local investment environment risks, A | 0.2843 | Local political stability risks, A1 | 0.3967 |

| Local petrochemical policy continuity risks, A2 | 0.2721 | ||

| Market access risks, A3 | 0.1602 | ||

| Market competition risk, A4 | 0.1710 | ||

| Technical risks, B | 0.1391 | Refinery design risks, B1 | 0.1735 |

| Engineering construction risks, B2 | 0.1678 | ||

| Equipment maintenance risks, B3 | 0.1613 | ||

| Project completion risks, B4 | 0.1979 | ||

| Material and equipment procurement risks, B5 | 0.2995 | ||

| Organization management risks, C | 0.1287 | Human resource risks, C1 | 0.2507 |

| Intercultural management risks, C2 | 0.2646 | ||

| Contract management risks, C3 | 0.2432 | ||

| Refinery operation management, C4 | 0.2415 | ||

| HSE and social responsibility risks, D | 0.2012 | Environmental risks, D1 | 0.3622 |

| Safety and health risks, D2 | 0.3519 | ||

| Social responsibility risks, D3 | 0.2859 | ||

| Economic risks, E | 0.2467 | Local fiscal and taxation policy risks, E1 | 0.2683 |

| Crude oil access risks, E2 | 0.2342 | ||

| Marketization level risks of the local refined oil pricing system, E3 | 0.2656 | ||

| Refined oil market demand risks, E4 | 0.2319 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, H.; Dong, K.; Jiang, H.; Sun, R.; Guo, X.; Fan, Y. Risk Assessment of China’s Overseas Oil Refining Investment Using a Fuzzy-Grey Comprehensive Evaluation Method. Sustainability 2017, 9, 696. https://doi.org/10.3390/su9050696

Li H, Dong K, Jiang H, Sun R, Guo X, Fan Y. Risk Assessment of China’s Overseas Oil Refining Investment Using a Fuzzy-Grey Comprehensive Evaluation Method. Sustainability. 2017; 9(5):696. https://doi.org/10.3390/su9050696

Chicago/Turabian StyleLi, Hui, Kangyin Dong, Hongdian Jiang, Renjin Sun, Xiaoyue Guo, and Yiqiao Fan. 2017. "Risk Assessment of China’s Overseas Oil Refining Investment Using a Fuzzy-Grey Comprehensive Evaluation Method" Sustainability 9, no. 5: 696. https://doi.org/10.3390/su9050696