Extractive Economies in Material and Political Terms: Broadening the Analytical Scope

Abstract

:1. Introduction

2. Extractive Economies in the Global Economy

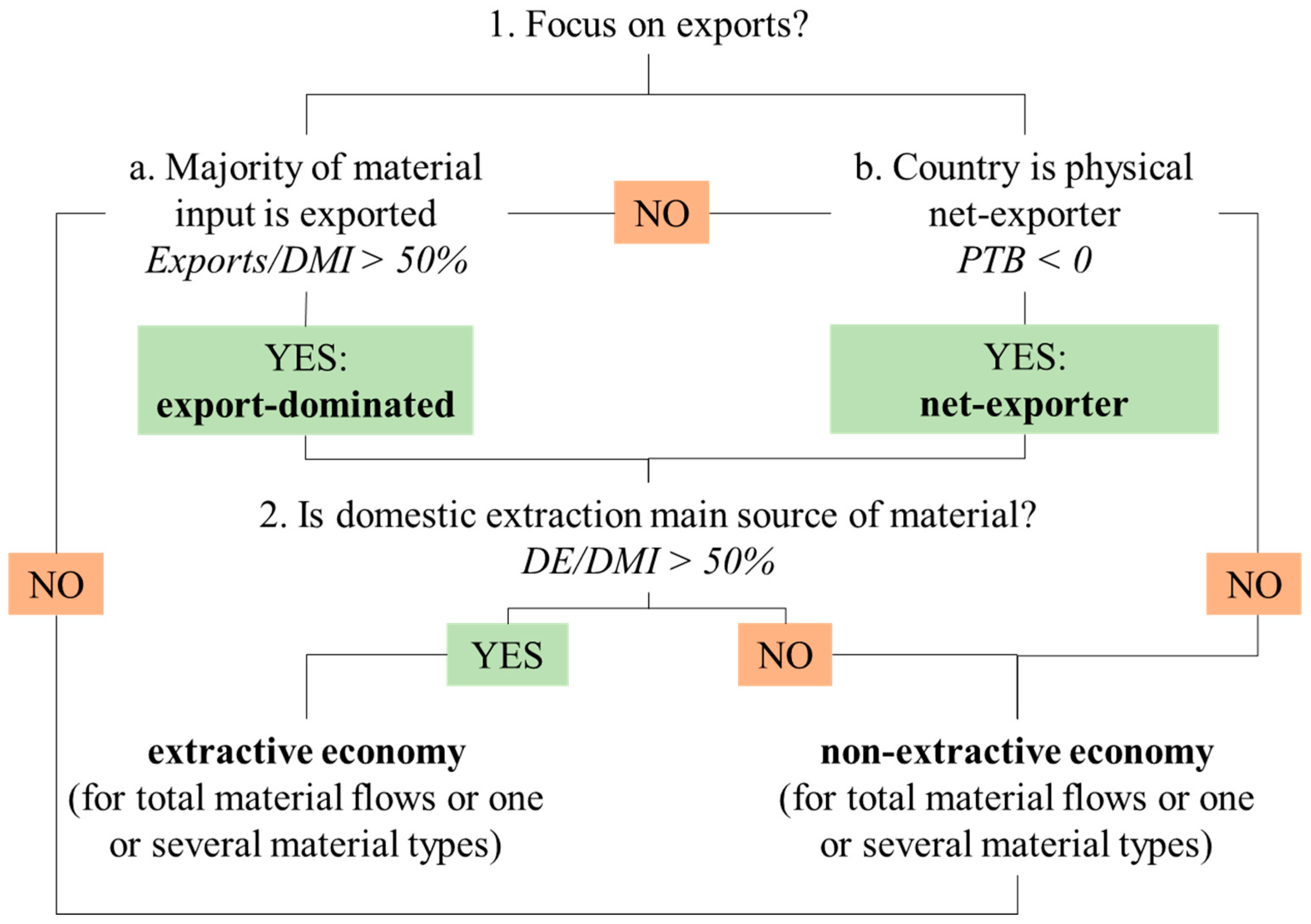

3. Defining Extractive Economies in Quantitative Terms

4. Comparing Extractive Economies

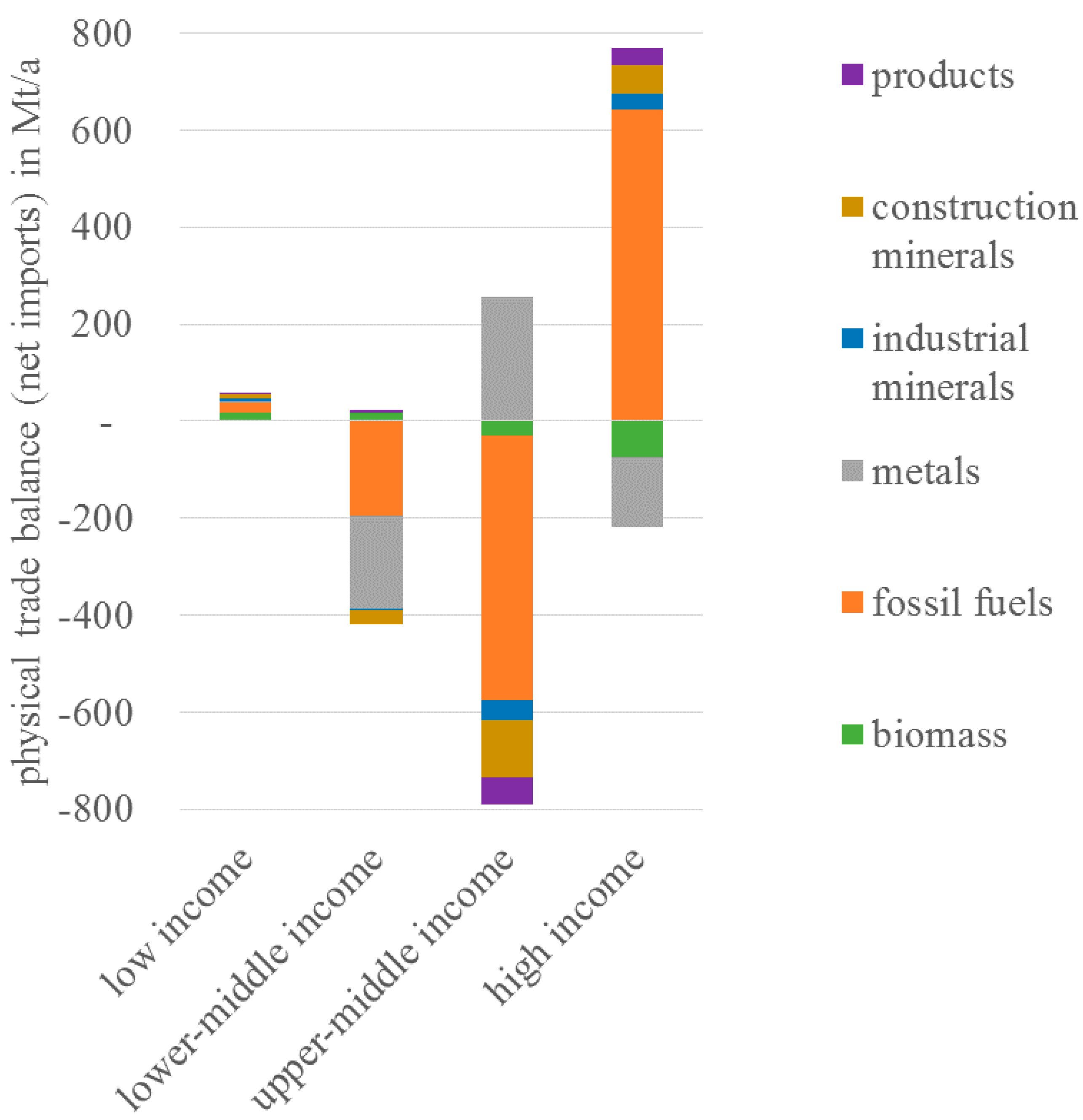

4.1. Extractive Economies in Global Trade by Income Groups

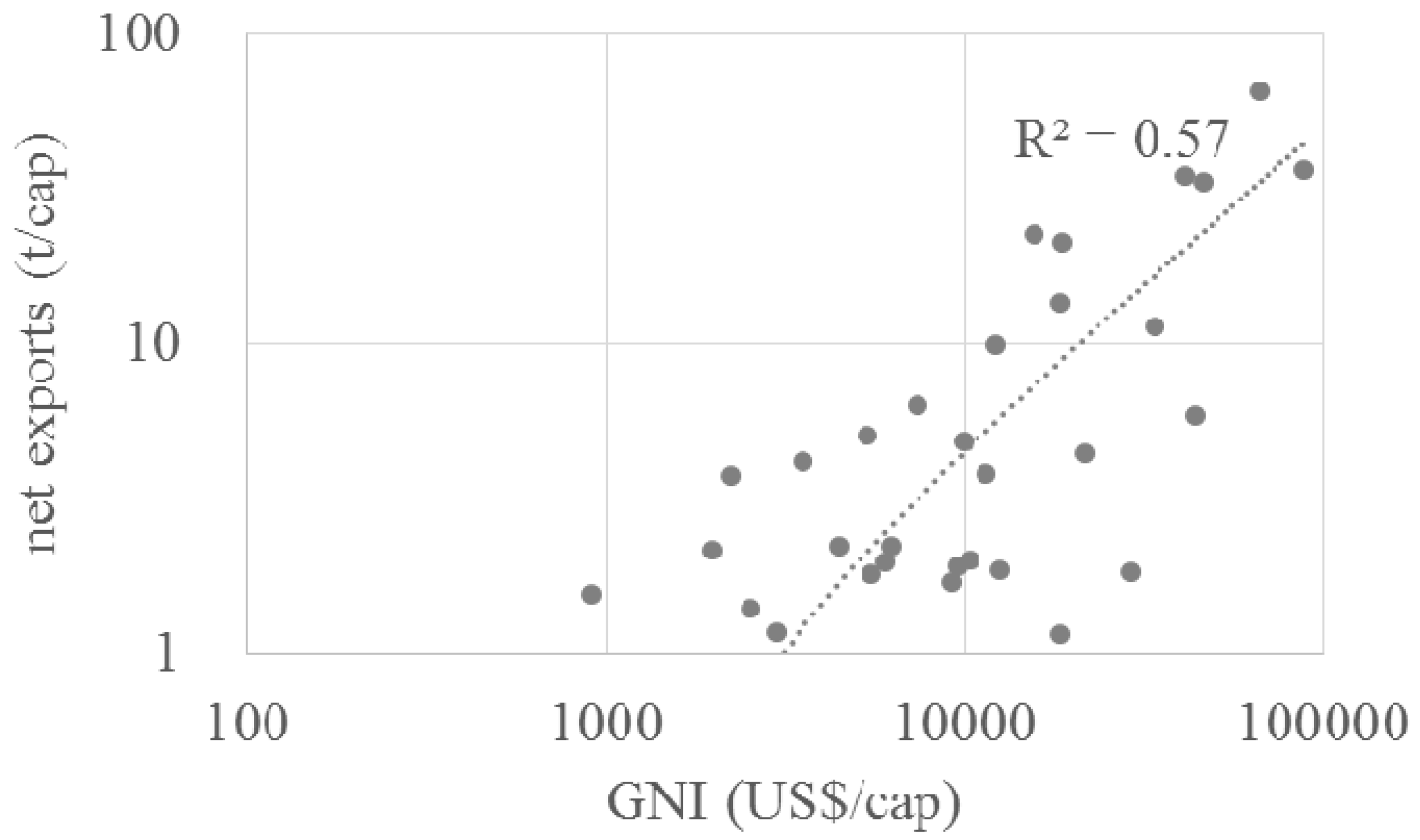

4.2. Extractive Economies’ Material Flows and Income

4.3. Extractive Economies by Material Types

5. Insights from Political Ecology and Political Economy

5.1. Contested Access to and Control Over Land and Resources

5.2. Transnational Production and Consumption Networks

5.3. Inequality and Justice

6. Conclusions: Socio-Ecological Research on Extractive Economies

Author Contributions

Conflicts of Interest

References

- Akenji, L.; Bengtsson, M.; Bleischwitz, R.; Tukker, A.; Schandl, H. Ossified materialism: Introduction to the special volume on absolute reductions in materials throughput and emissions. J. Clean. Prod. 2016, 132, 1–16. [Google Scholar] [CrossRef]

- Wiedenhofer, D.; Rovenskaya, E.; Haas, W.; Krausmann, F.; Pallua, I.; Fischer-Kowalski, M. Is there a 1970s Syndrome? Analyzing Structural Breaks in the Metabolism of Industrial Economies. Energy Procedia 2013, 40, 182–191. [Google Scholar]

- Schaffartzik, A.; Mayer, A.; Gingrich, S.; Eisenmenger, N.; Loy, C.; Krausmann, F. The global metabolic transition: Regional patterns and trends of global material flows, 1950–2010. Glob. Environ. Chang. 2014, 26, 87–97. [Google Scholar] [CrossRef] [PubMed]

- Fischer-Kowalski, M.; Krausmann, F.; Giljum, S.; Lutter, S.; Mayer, A.; Bringezu, S.; Moriguchi, Y.; Schütz, H.; Schandl, H.; Weisz, H. Methodology and Indicators of Economy-wide Material Flow Accounting. J. Ind. Ecol. 2011, 15, 855–876. [Google Scholar] [CrossRef]

- Bebbington, A. Social Conflict, Economic Development and the Extractive Industry: Evidence from South America; Routledge: London, UK, 2011. [Google Scholar]

- Bunker, S.G. Underdeveloping the Amazon: Extraction, Unequal Exchange, and the Failure of the Modern State; University of Chicago Press: Chicago, IL, USA, 1985. [Google Scholar]

- Eisenmenger, N.; Giljum, S. Evidence from societal metabolism studies for ecological unequal trade. In The World System and the Earth System: Global Socioenvironmental Change and Sustainability since the Neolithic; Hornborg, A., Crumley, C.L., Eds.; Left Coast Press: Walnut Creek, CA, USA, 2007; pp. 288–302. [Google Scholar]

- Schaffartzik, A.; Mayer, A.; Eisenmenger, N.; Krausmann, F. Global patterns of metal extractivism, 1950–2010: Providing the bones for the industrial society’s skeleton. Ecol. Econ. 2016, 122, 101–110. [Google Scholar] [CrossRef]

- European Commission. The Raw Materials Initiative. Meeting Our Critical Needs for Growth and Jobs in Europe; European Commission: Brussels, Belgium, 2008. [Google Scholar]

- European Commission. Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions for a European Ind. Renaissance; European Commission: Brussels, Belgium, 2014. [Google Scholar]

- European Commission. Innovating for Sustainable Growth. A Bioeconomy for Europe; Publications Office of the European Union: Luxembourg, 2012. [Google Scholar]

- United Nations. Transforming Our World: The 2030 Agenda for Sustainable Development; United Nations: New York, NY, USA, 2015; Volume A/RES/70/1. [Google Scholar]

- UNDP Helen Clark: Speech at the Event “Extractive Industries and the Sustainable Development Goals—Enhancing Collaboration for Sustainability”. Available online: http://www.undp.org/content/undp/en/home/presscenter/speeches/2015/09/27/helen-clark-speech-at-the-event-extractive-industries-and-the-sustainable-development-goals-enhancing-collaboration-for-sustainability-.html (accessed on 10 January 2017).

- Watkins, M.H. A Staple Theory of Economic Growth. Can. J. Econ. Political Sci. 1963, 29, 141–158. [Google Scholar] [CrossRef]

- Russi, D.; Gonzalez-Martinez, A.C.; Silva-Macher, J.C.; Giljum, S.; Martinez-Alier, J.; Vallejo, M.C. Material Flows in Latin America. J. Ind. Ecol. 2008, 12, 704–720. [Google Scholar] [CrossRef]

- Gonzalez-Martinez, A.C.; Schandl, H. The biophysical perspective of a middle income economy: Material flows in Mexico. Ecol. Econ. 2008, 68, 317–327. [Google Scholar] [CrossRef]

- Vallejo, M.C. Biophysical structure of the Ecuadorian economy, foreign trade, and policy implications. Ecol. Econ. 2010, 70, 159–169. [Google Scholar] [CrossRef]

- Vallejo, M.C.; Pérez Rincón, M.A.; Martinez-Alier, J. Metabolic Profile of the Colombian Economy from 1970 to 2007. J. Ind. Ecol. 2011, 15, 245–267. [Google Scholar] [CrossRef]

- Fischer-Kowalski, M.; Weisz, H. The Archipelago of Social Ecology and the Island of the Vienna School. In Social Ecology. Society-Nature Relations across Time and Space; Haberl, H., Fischer-Kowalski, M., Krausmann, F., Winiwarter, V., Eds.; Springer International Publishing: Cham, Switzerland, 2016; Volume 5, pp. 3–28. [Google Scholar]

- Prebisch, R. The Economic Development of Latin America and Its Principal Problems; United Nations Economic Commission for Latin America: New York, NY, USA, 1949. [Google Scholar]

- Singer, H.W. The Distribution of Gains between Investing and Borrowing Countries. Am. Econ. Rev. 1950, 40, 473–485. [Google Scholar]

- Harvey, D.I.; Kellard, N.M.; Madsen, J.B.; Wohar, M.E. The Prebisch-Singer Hypothesis: Four Centuries of Evidence. Rev. Econ. Stat. 2010, 92, 367–377. [Google Scholar] [CrossRef]

- Frank, A.G. Latin America: Underdevelopment or Revolution: Essays on the Development of Underdevelopment and the Immediate Enemy; Monthly Review Press: New York, NY, USA, 1969. [Google Scholar]

- Wallerstein, I.M. World-Systems Analysis: An Introduction; Duke University Press: Durham, NC, USA, 2004. [Google Scholar]

- Hornborg, A. Towards an ecological theory of unequal exchange: Articulating world system theory and ecological economics. Ecol. Econ. 1998, 25, 127–136. [Google Scholar] [CrossRef]

- Muradian, R.; O’Connor, M.; Martinez-Alier, J. Embodied pollution in trade: Estimating the “environmental load displacement” of industrialised countries. Ecol. Econ. 2002, 41, 51–67. [Google Scholar] [CrossRef]

- Sachs, J.D.; Warner, A.M. Natural Resource Abundance and Economic Growth; National Bureau of Economic Research: Cambridge, MA, USA, 1995. [Google Scholar]

- Ross, M.L. The Political Economy of the Resource Curse. World Politics 1999, 51, 297–322. [Google Scholar] [CrossRef]

- Karl, T.L. The Paradox of Plenty: Oil Booms and Petro-States; University of California Press: Oakland, CA, USA, 1997. [Google Scholar]

- Collier, P.; Hoeffler, A. Greed and grievance in civil war. Oxf. Econ. Pap. 2004, 56, 563–595. [Google Scholar] [CrossRef]

- Brunnschweiler, C.N.; Bulte, E.H. Linking Natural Resources to Slow Growth and More Conflict. Science 2008, 320, 616–617. [Google Scholar] [CrossRef] [PubMed]

- Brunnschweiler, C.N.; Bulte, E.H. The resource curse revisited and revised: A tale of paradoxes and red herrings. J. Environ. Econ. Manag. 2008, 55, 248–264. [Google Scholar] [CrossRef]

- World Bank. Expanding the Measure of Wealth: Indicators of Environmentally Sustainable Development; The World Bank: Washington, DC, USA, 1997; p. 1. [Google Scholar]

- Giljum, S.; Eisenmenger, N. North-South Trade and the Distribution of Environmental Goods and Burdens: A Biophysical Perspective. J. Environ. Dev. 2004, 13, 73–100. [Google Scholar] [CrossRef]

- Pérez-Rincón, M.A. Colombian international trade from a physical perspective: Towards an ecological “Prebisch thesis”. Ecol. Econ. 2006, 59, 519–529. [Google Scholar] [CrossRef]

- Moran, D.D.; Lenzen, M.; Kanemoto, K.; Geschke, A. Does ecologically unequal exchange occur? Ecol. Econ. 2013, 89, 177–186. [Google Scholar] [CrossRef]

- Prell, C.; Feng, K.; Sun, L.; Geores, M.; Hubacek, K. The Economic Gains and Environmental Losses of US Consumption: A World-Systems and Input-Output Approach. Soc. Forces 2014, 93, 405–428. [Google Scholar] [CrossRef]

- Weisz, H. Combining Social Metabolism and Input-Output Analyses to Account for Ecologically Unequal Trade. In Rethinking Environmental History: World-System History and Global Environmental Change; Hornborg, A., McNeill, J.R., Martinez-Alier, J., Eds.; Rowman Altamira: Lanham, MD, USA, 2007; pp. 289–306. [Google Scholar]

- Dorninger, C.; Hornborg, A. Can EEMRIO analyses establish the occurrence of ecologically unequal exchange? Ecol. Econ. 2015, 119, 414–418. [Google Scholar] [CrossRef]

- Hornborg, A.; Martinez-Alier, J. Ecologically unequal exchange and ecological debt. J. Political Ecol. 2016, 23, 328–333. [Google Scholar]

- Dorninger, C.; Eisenmenger, N. South America’s biophysical involvement in international trade: The physical trade balances of Argentina, Bolivia, and Brazil in the light of ecologically unequal exchange. J. Political Ecol. 2016, 23, 394–409. [Google Scholar]

- Martinez-Alier, J.; Demaria, F.; Temper, L.; Walter, M. Changing social metabolism and environmental conflicts in India and South America. J. Political Ecol. 2016, 23, 467–491. [Google Scholar]

- Schandl, H.; West, J. Material Flows and Material Productivity in China, Australia, and Japan. J. Ind. Ecol. 2012, 16, 352–364. [Google Scholar] [CrossRef]

- Ekins, P.; Folke, C.; Costanza, R. Trade, environment and development: The issues in perspective. Ecol. Econ. 1994, 9, 1–12. [Google Scholar] [CrossRef]

- Muradian, R.; Martinez-Alier, J. Trade and the environment: From a “Southern”perspective. Ecol. Econ. 2001, 36, 281–297. [Google Scholar] [CrossRef]

- World Bank. World DataBank. World Development Indicators; World Bank: Washington, DC, USA, 2016. [Google Scholar]

- World Bank. World Bank GNI per Capita Operational Guidelines & Analytical Classifications; World Bank: Washington, DC, USA, 2016. [Google Scholar]

- Dittrich, M.; Bringezu, S. The physical dimension of international trade: Part 1: Direct global flows between 1962 and 2005. Ecol. Econ. 2010, 69, 1838–1847. [Google Scholar] [CrossRef]

- Giljum, S. Trade, Materials Flows, and Economic Development in the South: The Example of Chile. J. Ind. Ecol. 2004, 8, 241–261. [Google Scholar] [CrossRef]

- Muñoz, P.; Giljum, S.; Roca, J. The raw material equivalents of international trade. J. Ind. Ecol. 2009, 13, 881–897. [Google Scholar] [CrossRef]

- Eurostat. Economy-Wide Material Flow Accounts (EW-MFA); Eurostat: Luxembourg, 2012. [Google Scholar]

- Wiedmann, T.; Wilting, H.C.; Lenzen, M.; Lutter, S.; Palm, V. Quo Vadis MRIO? Methodological, data and institutional requirements for multi-region input–output analysis. Ecol. Econ. 2011, 70, 1937–1945. [Google Scholar] [CrossRef]

- Weisz, H.; Duchin, F. Physical and monetary input–output analysis: What makes the difference? Ecol. Econ. 2006, 57, 534–541. [Google Scholar] [CrossRef]

- Hubacek, K.; Giljum, S. Applying physical input–output analysis to estimate land appropriation (ecological footprints) of international trade activities. Ecol. Econ. 2003, 44, 137–151. [Google Scholar] [CrossRef]

- Simoes, A.; Hidalgo, C. The Economic Complexity Observatory: An Analytical Tool for Understanding the Dynamics of Economic Development; Massachusetts Institute of Technology: Boston, MA, USA, 2016. [Google Scholar]

- Kavoussi, R.M. Export expansion and economic growth. J. Dev. Econ. 1984, 14, 241–250. [Google Scholar] [CrossRef]

- Sheehey, E.J. Exports and growth: A flawed framework. J. Dev. Stud. 1990, 27, 111–116. [Google Scholar] [CrossRef]

- Hall, D. Land grabs, land control, and Southeast Asian crop booms. J. Peasant Stud. 2011, 38, 837–857. [Google Scholar] [CrossRef]

- Brad, A.; Schaffartzik, A.; Pichler, M.; Plank, C. Contested territorialization and biophysical expansion of oil palm plantations in Indonesia. Geoforum 2015, 64, 100–111. [Google Scholar] [CrossRef]

- Ribot, J.C.; Peluso, N.L. A theory of access. Rural Sociol. 2003, 68, 153–181. [Google Scholar] [CrossRef]

- Backhouse, M. Green grabbing—The case of palm oil expansion in so-called degraded areas in the eastern Brazilian Amazon. In Political Ecology Agrofuels; Routledge: London, UK, 2014; pp. 167–184. [Google Scholar]

- Pichler, M. Legal Dispossession: State Strategies and Selectivities in the Expansion of Indonesian Palm Oil and Agrofuel Production. Dev. Chang. 2015, 64, 508–533. [Google Scholar] [CrossRef]

- Niewöhner, J.; Nielsen, J.Ø.; Gasparri, I.; Gou, Y.; Hauge, M.; Joshi, N.; Schaffartzik, A.; Sejersen, F.; Seto, K.C.; Shughrue, C. Conceptualizing Distal Drivers in Land Use Competition. In Land Use Competition; Niewöhner, J., Bruns, A., Hostert, P., Krueger, T., Nielsen, J.Ø., Haberl, H., Lauk, C., Lutz, J., Müller, D., Eds.; Springer International Publishing: Cham, Switzerland, 2016; Volume 6, pp. 21–40. [Google Scholar]

- Einzenberger, R. Contested Frontiers: Indigenous Mobilization and Control over Land and Natural Resources in Myanmar’s Upland Areas. Austrian J. South-East Asian Stud. 2016, 9, 163. [Google Scholar]

- Kelly, A.B.; Peluso, N.L. Frontiers of Commodification: State Lands and Their Formalization. Soc. Nat. Res. 2015, 28, 473–495. [Google Scholar] [CrossRef]

- Martinez-Alier, J. Social metabolism, ecological distribution conflicts, and languages of valuation. Capital. Nat. Soc. 2009, 20, 58–87. [Google Scholar] [CrossRef]

- Brand, U.; Dietz, K. (Neo-)Extraktivismus als Entwicklungsoption? Zu den aktuellen Dynamiken und Widersprüchen rohstoffbasierter Entwicklung in Lateinamerika. Polit. Vierteljahresschr. 2014, 48, 133–170. [Google Scholar]

- Gellert, P.K. Extractive Regimes: Toward a Better Understanding of Indonesian Development: Extractive Regimes. Rural Sociol. 2010, 75, 28–57. [Google Scholar] [CrossRef]

- NFF to Hold Urgent Talks on Water Crisis. Syd. Morning Her. 2007. Available online: http://www.smh.com.au/national/nff-to-hold-urgent-talks-on-water-crisis-20070419-8kj.html (accessed on 24 May 2017).

- Gale, M.; Edwards, M.; Wilson, L.; Greig, A. The Boomerang Effect: A Case Study of the Murray-Darling Basin Plan. Aust. J. Public Adm. 2014, 73, 153–163. [Google Scholar] [CrossRef]

- Auty, R.M. Natural resources, capital accumulation and the resource curse. Ecol. Econ. 2007, 61, 627–634. [Google Scholar] [CrossRef]

- Burchardt, H.-J.; Dietz, K. (Neo-)extractivism—A new challenge for development theory from Latin America. Third World Q. 2014, 35, 468–486. [Google Scholar] [CrossRef]

- Staritz, C.; Gereffi, G.; Cattaneo, O. Shifting end markets and upgrading prospects in global value chains. Int. J. Technol. Learn. Innov. Dev. 2011, 44, 2. [Google Scholar]

- Bridge, G. Global production networks and the extractive sector: Governing resource-based development. J. Econ. Geogr. 2008, 8, 389–419. [Google Scholar] [CrossRef]

- Veltmeyer, H. The political economy of natural resource extraction: A new model or extractive imperialism? Can. J. Dev. Stud. Rev. Can. D’études Dév. 2013, 34, 79–95. [Google Scholar] [CrossRef]

- Buur, L.; Monjane, C.M. Elite capture and the development of natural resource linkages in Mozambique. In Fairness and Justice in Natural Resource Politics; Pichler, M., Staritz, C., Küblböck, K., Plank, C., Raza, W., Peyré, F.R., Eds.; Routledge: London, UK, 2017; pp. 200–217. [Google Scholar]

- Pichler, M.; Staritz, C.; Küblböck, K.; Plank, C.; Raza, W.; Peyré, F.R. Fairness and Justice in Natural Resource Politics; Routledge/Taylor & Francis Group: London, UK, 2016. [Google Scholar]

- Martinez-Alier, J. The Environmentalism of the Poor: A Study of Ecological Conflicts and Valuation; Edward Elgar Publishing: Cheltenham, UK, 2003. [Google Scholar]

- Kohl, B.; Farthing, L. Material constraints to popular imaginaries: The extractive economy and resource nationalism in Bolivia. Political Geogr. 2012, 31, 225–235. [Google Scholar] [CrossRef]

- Andreucci, D.; Radhuber, I.M. Limits to “counter-neoliberal” reform: Mining expansion and the marginalisation of post-extractivist forces in Evo Morales’s Bolivia. Geoforum 2015, in press. [Google Scholar] [CrossRef]

- Pichler, M. What´s democracy got to do with it? A political ecology perspective on socio-ecological justice. In Fairness and Justice in Natural Resource Politics; Pichler, M., Staritz, C., Küblböck, K., Plank, C., Raza, W., Peyré, F.R., Eds.; Routledge/Taylor & Francis Group: London, UK, 2016; pp. 33–51. [Google Scholar]

- Brand, U.; Dietz, K.; Lang, M. Neo-Extractivism in Latin America-one side of a new phase of global capitalist dynamics. Cienc. Política 2016, 11, 125–159. [Google Scholar] [CrossRef]

- Economist Tata Steel: Cast-Iron Arguments. Economist 2016. Available online: http://www.economist.com/news/leaders/21696527-how-should-governments-cope-global-glut-steel-britain-depressing-case (accessed on 24 May 2017).

- Economist Global Steel: Through the Mill. Economist 2016. Available online: http://www.economist.com/news/business/21696556-it-hard-see-future-many-worlds-high-cost-steel-producers-britains-are-no (accessed on 24 May 2017).

| Export-Dominated | Net-Exporters | |||||||

|---|---|---|---|---|---|---|---|---|

| n(1) | Share in Global Exports | Average Income (GNI/cap) | Average Income Level | n(2) | Share in Global Exports | Average Income (GNI/cap) | Average Income Level | |

| Total | 7 | 13.5% | 43,228 | H | 49 | 59.0% | 6813 | UM |

| Biomass | 1 | 0.1% | 36,670 | H | 57 | 68.3% | 10,136 | UM |

| Fossil Fuels | 25 | 52.0% | 6787 | UM | 38 | 76.0% | 6110 | UM |

| Metals | 11 | 47.1% | 3359 | LM | 28 | 62.6% | 4176 | UM |

| Industrial Minerals | 14 | 32.3% | 10,673 | UM | 26 | 61.0% | 7484 | UM |

| Construction Minerals | 3 | 3.8% | 8301 | UM | 45 | 78.3% | 7150 | UM |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Schaffartzik, A.; Pichler, M. Extractive Economies in Material and Political Terms: Broadening the Analytical Scope. Sustainability 2017, 9, 1047. https://doi.org/10.3390/su9071047

Schaffartzik A, Pichler M. Extractive Economies in Material and Political Terms: Broadening the Analytical Scope. Sustainability. 2017; 9(7):1047. https://doi.org/10.3390/su9071047

Chicago/Turabian StyleSchaffartzik, Anke, and Melanie Pichler. 2017. "Extractive Economies in Material and Political Terms: Broadening the Analytical Scope" Sustainability 9, no. 7: 1047. https://doi.org/10.3390/su9071047