1. Introduction

To deal with environmental challenges and respond to customer demands in a timely manner, there has been a need for firms to create value jointly with their supply chain partners [

1,

2]. Previous literature has emphasized the important roles of green customer and supplier integration in providing resources and knowledge [

3,

4]. Thus, green external customer and supplier integration provides opportunities for firms to accelerate the pace of the introduction of environmentally friendly products [

5,

6], secure complementary resources and information [

7], and improve performance and competitive advantages [

8,

9].

Despite the fact that its importance has been widely recognized, green external integration has only a recently become an entry on the agenda of researchers. In addition, findings about the relationship between green external integration and firm performance from previous studies are inconsistent. While some studies provided empirical evidence for the positive impact of green external integration on performance [

10,

11,

12], others reported an insignificant or negative link between green external integration and performance [

13]. We attribute the inconsistency in the findings concerning the relationship between green external integration and firm performance to the ignoring of context factors such as firm characteristics. To better understand the relationship between green external integration and firm performance, it is necessary to investigate whether green external integration is always effective under different conditions.

We conducted this study from the perspective of the organizational capability (OC). The OC perspective is similar to the resource-based view of the firm, which demonstrates how capabilities and resources enhance competitive advantages [

1]. Firms with different sizes may differ in their levels of capability for the internalization and transfer of the knowledge gained from customers and suppliers due to their varying absorptive capacity, which measures the ability to identify, evaluate, assimilate and exploit external information and knowledge [

1]. It has also been argued that larger firms have more flexibility to devote resources to green external integration activities than small firms [

14]. Thus, firms with different sizes may have different green external integration efforts and capabilities and achieve different levels of performance. Moreover, many of the widely advocated green external integration practices are based on their successful adoption by relatively large firms [

9]. The applicability and feasibility of such practices for small firms is still unknown; for example, small firms may lack the resources and capabilities to implement and profit from green supplier and customer integration [

15]. This study explores how firm size, which is a proxy for absorptive capability and resources, influences the relationships between two dimensions of green external integration and two types of firm performance. Thus, our research question is: How does firm size influence the link between green external integration and firm performance?

Considering high-velocity environments, the time-to-market of products has emerged in recent years as an important competitive capability for achieving superior performance [

16,

17]. By integrating resources and information possessed by customers and suppliers, manufacturers can enhance the external innovation search capability and gain complementary resources and information, thereby reducing the time-to-market of environmentally friendly products [

18]. Therefore, the time-to-market of environmentally friendly products may be an intermediate outcome of effective green external integration, which ultimately leads to improved performance. In this study, we investigate the moderating roles of firm size on the relationships between green external integration, the time-to-market of environmentally friendly products and firm performance.

The rest of this study is structured as follows. We first develop research hypotheses in

Section 2. Subsequently, we discuss how survey data were collected and analyzed in

Section 3.

Section 4 demonstrates the analysis results, and discussion and managerial implications are shown in

Section 5. Finally, we highlight the research contributions and offer opportunities for future research directions in

Section 6.

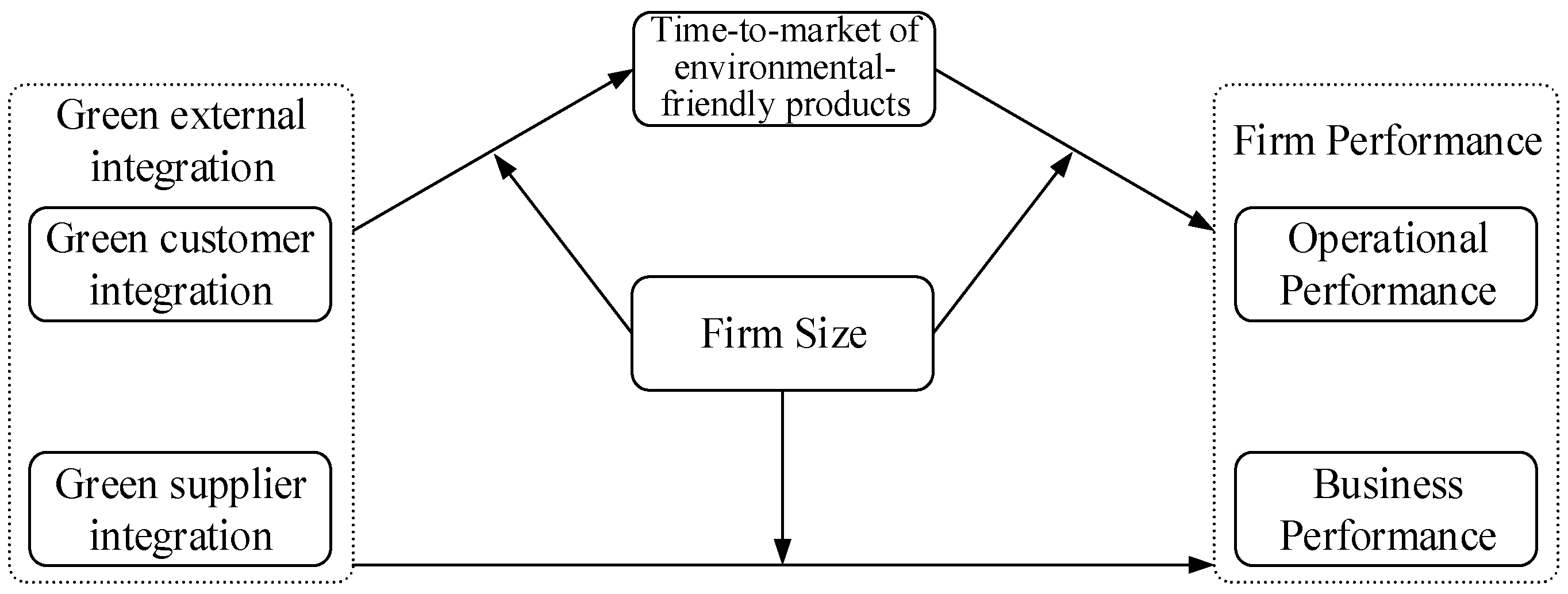

2. Theory Framework and Hypotheses Development

By implementing green customer and supplier integration, supply chain partners can work to solve environmental problems jointly [

19,

20,

21]. They can combine external resources and internal resource endowments to generate benefits [

1,

9,

22]. Thus, green external integration is likely to decrease the time-to-market of environmentally friendly products and enhance firm performance. From the perspective of OC, the relationships among green external integration, the time-to-market of environmentally friendly products and firm performance might also be moderated by firm size. As presented in

Figure 1, we have captured these relationships in an integrated framework.

Green external integration refers to the degree of environmental collaboration, information sharing and communal environmental problem-solving between manufacturers and their external partners [

21,

23]. There are mainly two types of green external integration: green customer integration and green supplier integration.

Although green external integration is considered to be performance-enhancing, it is questionable whether firms with different sizes can share equal benefits from green integration [

1,

9,

20]. As indicated by OC, large and medium firms will be more capable of integrating leading customers into their environmental activities, because customers are more willing to do business with large firms [

24,

25]. On the other hand, small firms may be unable to convince leading customers to involve themselves in their environmental activities due to their low brand awareness [

26,

27]. Therefore, the options for small firms are admittedly limited when making green customer integration decisions. Furthermore, large firms are generally in better positions to monitor their dynamic environment and determine which customers are more or less suitable to be integrated [

26,

28].

Small and large firms also differ in their capabilities for the management green customer integration [

1]. These capabilities include general routines that enhance inter-functional coordination, as well as firm-specific processes that aid in facilitating communication [

4,

17]. It is easier for large firms to internalize and transfer what they have learnt from customers [

24,

25], while small firms may lack the resources, skills and capabilities that facilitate the effective transmission of green information and knowledge gained from green customer integration [

29,

30]. Moreover, small firms are less likely to hire experienced specialists who directly manage environmental issues and green customer integration activities, and are less likely to invest in and develop skills in managing inter-organizational partnerships [

27]. Given the associated challenges of managing green customer integration listed above, the lack of managerial and administrative skills and supporting resources of small firms suggests that they benefit less from green customer integration than large firms [

1,

26].

The risks, costs and opportunistic behaviors associated with green customer integration cannot be ignored [

31]. The techniques which reduce the likelihood of collaboration risks and the opportunistic behaviors from their occurrence often require significant human and financial resources [

32]. Small firms have a comparatively greater difficulty bearing these risks and costs in comparison to large firms. In addition, the history of green customer integration may be longer-lasting for large firms. Supply chain partners with a prior history of business relationships tend to develop a mutual trust and understanding, which can avoid opportunistic behaviors [

33]. Thus, we propose:

Hypothesis 1. The effects of green customer integration on (a) the time-to-market of environmentally friendly products, (b) operational performance and (c) business performance are moderated by firm size.

From an organizational perspective, the abilities for the identification and selection of suitable suppliers may also be affected by firm size. Large firms may hold more power over suppliers, and thus they can attract first class suppliers. Small firms may only account for a slight portion of a supplier’s volume, and hence their ability to integrate suppliers into environmental activities could be curtailed [

14]. As a result, given that small firms have no, or at least more limited, options, they are more likely to integrate less capable suppliers in comparison to large firms. If small firms integrate less capable suppliers, they will be disadvantaged in their ability to achieve superior performance.

It is green information, knowledge and resources from suppliers which can contribute to performance improvement [

34]. However, green supplier integration only provides the potential to access green information, knowledge and resources; it does not necessarily ensure the realization of performance improvement. To achieve the potential profits, firms should have the ability to evaluate, assimilate and exploit information and knowledge. Large firms can devote more resources to green supplier integration activities and make the best use of the information and knowledge available from suppliers [

1].

The prior green supplier integration history of large firms signals trust and commitment to the relationship. Mutual trust and commitment are important in reducing risks and the opportunistic behaviors related to green supplier integration [

19]. For small firms, conflicts between manufacturers and suppliers may exist in the early stage of green supplier integration, influencing the performance outcomes of green supplier integration. Thus, we propose:

Hypothesis 2. The effects of green supplier integration on (a) the time-to-market of environmentally friendly products, (b) operational performance and (c) business performance are moderated by firm size.

Some supply chain management studies have suggested the use of both operational and business performance as indicators of firm performance [

1,

19,

35]. This study uses two types of firm performance: operational performance and business performance. Operation performance refers to a firm’s performance in meeting its customer demands; business performance is defined as a firm’s profitability and market growth. While operational performance focuses on the operational aspects of firms, business performance evaluates the overall firm performance [

35]. Suggested by the OC perspective, small firms often lack the experience and skill to manage the development of environmentally friendly products. For some small firms, shortening the time-to-market of environmentally friendly products often means blindly pursuing drastic cuts in development activities, which typically undermine performance [

36,

37]. Large firms usually decrease the time-to-market of environmentally friendly products by simplifying or speeding up operations, eliminating delays, or facilitating parallel processing of steps rather than skipping critical steps entirely [

36,

38].

The profits of the time-to-market of environmentally friendly products may be contingent on the capabilities of suppliers [

37]. Only suppliers can delivery parts or components with a good quality at the right time and in the right place, meaning that manufacturers can translate this time advantage into operational and business performance improvement. As mentioned above, small firms are more likely to select less capable suppliers in comparison to large firms. Therefore, it is difficult for small firms to improve performance through shortening the time-to-market of environmentally friendly products, since small firms often cut important development activities to speed environmentally friendly products to market [

36,

37]. Therefore, we hypothesize:

Hypothesis 3. The effects of the time-to-market of environmentally friendly products on (a) operational performance and (b) business performance are moderated by firm size.

4. Results

Before testing the hypotheses, sample firms were classified into different groups according to their sizes. We formed small, medium and large groups based on the number of employees. Firms with less than 300, between 300 and 2000, and greater than 2000 employees are respectively classified as small (

n = 57), medium (

n = 58), and large (

n = 61) firms. The standard of classification is consistent with the National Bureau of Statistics of China and the SME (small and medium enterprises) promotion law of China [

53]. To test the moderating effect of firm size, a multi-group analysis of structural invariance across firm sizes was employed [

1,

14,

54].

A baseline model for the three groups was first developed (Model 1). No equality constraints are specified across the three groups. This is followed by the imposition of equality constraints on both the factor loadings of the dependent and independent variables (Model 2). This test determines whether factor loadings are the same across groups. A χ2 difference between Models 2 and 1 can indicate whether the factor loadings are invariant across the three groups. To further test for the invariance of the model, additional constraints of equality are also placed on the error terms of the measurement (Model 3). A non-significant χ2 difference between Models 3 and 2 would indicate an invariance in the error terms between the three groups examined. Structural coefficient equality constraints can be imposed to establish Model 4. If no significant χ2 difference is found between Models 4 and 3, then there is evidence that the structural coefficients do not differ across the groups examined. If, however, there is a significant χ2 difference, then a search to identify which particular coefficients differ should logically take place (Model 5a, 5b, 5c, 5d, 5e, 5f, 5g and 5h).

The χ2 of the base line model with 460 degrees of freedom was compared against the χ2 of a model that specified equal factor loadings (Model 2) with 488 degrees of freedom. The difference of 28.18 in χ2 for 28 degrees of freedom is not statically significant (p = 0.455). The factor loadings appear to be invariant across the small, medium and large groups. Next, we compared the χ2 between Model 3 and Model 2. The χ2 difference between Model 3 and Model 2 is 40.41 with 19 degrees of freedom. The significant result (p = 0.003) indicates that the measurement errors are not equivalent across the three groups. Similarly, the difference in χ2 is 27.25 with 16 degrees of freedom. The difference is statistically significant (p = 0.039) and thus differences in structural coefficients are detected. Subsequently, a search procedure was performed to identify the different structural coefficients for the three groups.

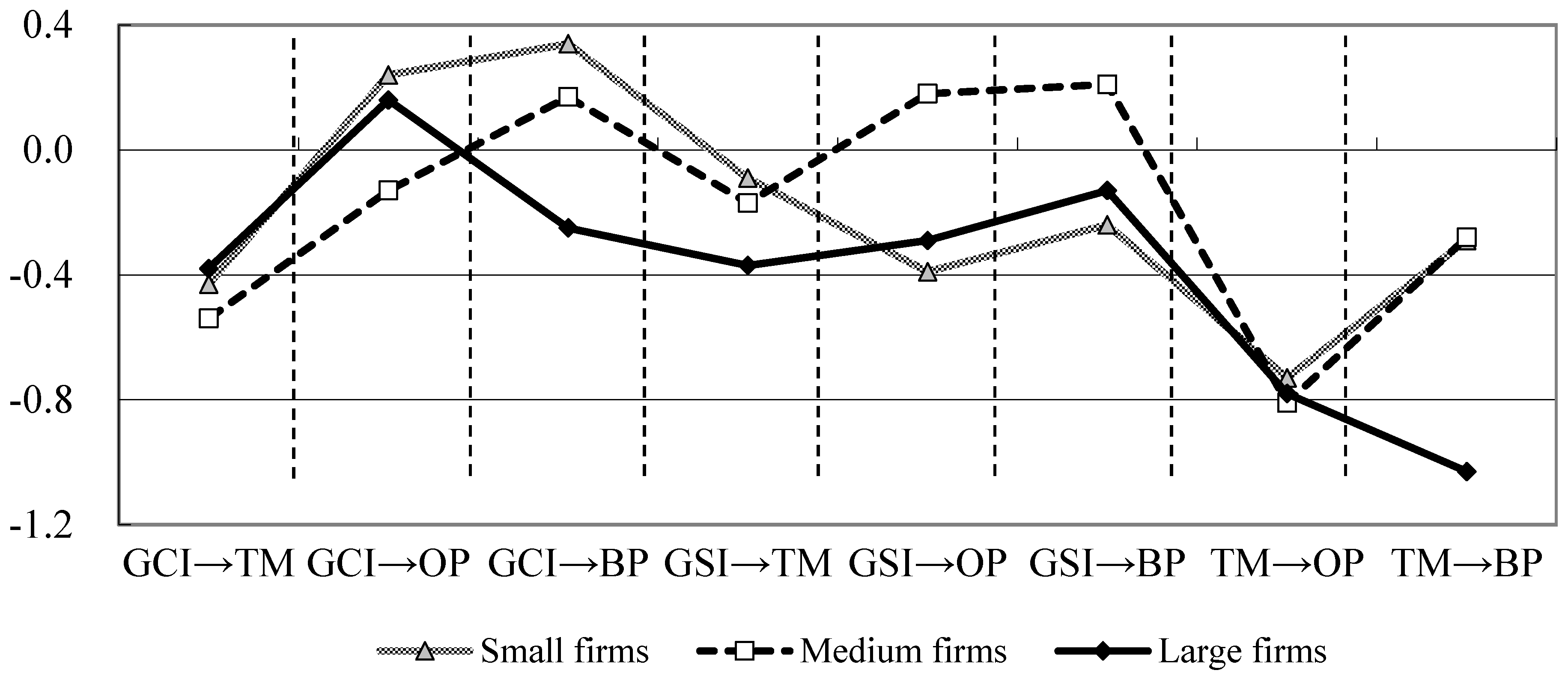

This involves the comparison of two models at a time; Model 3, and a model in which a given structural coefficient is specified as the invariant (

Table 5). Thus, the difference in degrees of freedom is two. Chi-square differences greater than 5.99 are statistically significant at the level of 0.05. This is the case for three structural coefficients. The impact of green customer integration on business performance is contingent on firm size (

χ2 difference = 6.48). Thus, H1c is supported. For small firms, green customer integration improves business performance significantly; however, for medium and large firms, green customer integration does not directly impact on business performance. The significant result reveals that the association between green supplier integration and operational performance is also different across small, medium and large firms (

χ2 difference = 7.17), providing support for H2b. Surprisingly, the direct impact of green supplier integration on operational performance is significantly negative for small firms, while it is not significant for medium and large firms. Finally, the structural coefficient indicates that the relationship between the time-to-market of environmentally friendly products and business performance is not similar (

χ2 difference = 13.76) across firm sizes, which offers empirical support for H3b. In fact, it appears that the time-to-market of environmentally friendly products has a significantly negative effect on business performance for large firms, while the effect is not significant for small and medium firms. To further analyze the moderating effect of firm size, the standardized structural coefficients across small, medium and large firms are plotted in

Figure 2. To further validate the hypotheses, we conducted several regression analyses. The results are shown in

Appendix B.