Impact of Firms’ Cooperative Innovation Strategy on Technological Convergence Performance: The Case of Korea’s ICT Industry

Abstract

:1. Introduction

2. Research Framework Based on Previous Studies

2.1. Identification of Technological Convergence Trend

2.2. Impact Analysis of Cooperative Innovation Strategies on Technological Convergence

3. Methodology

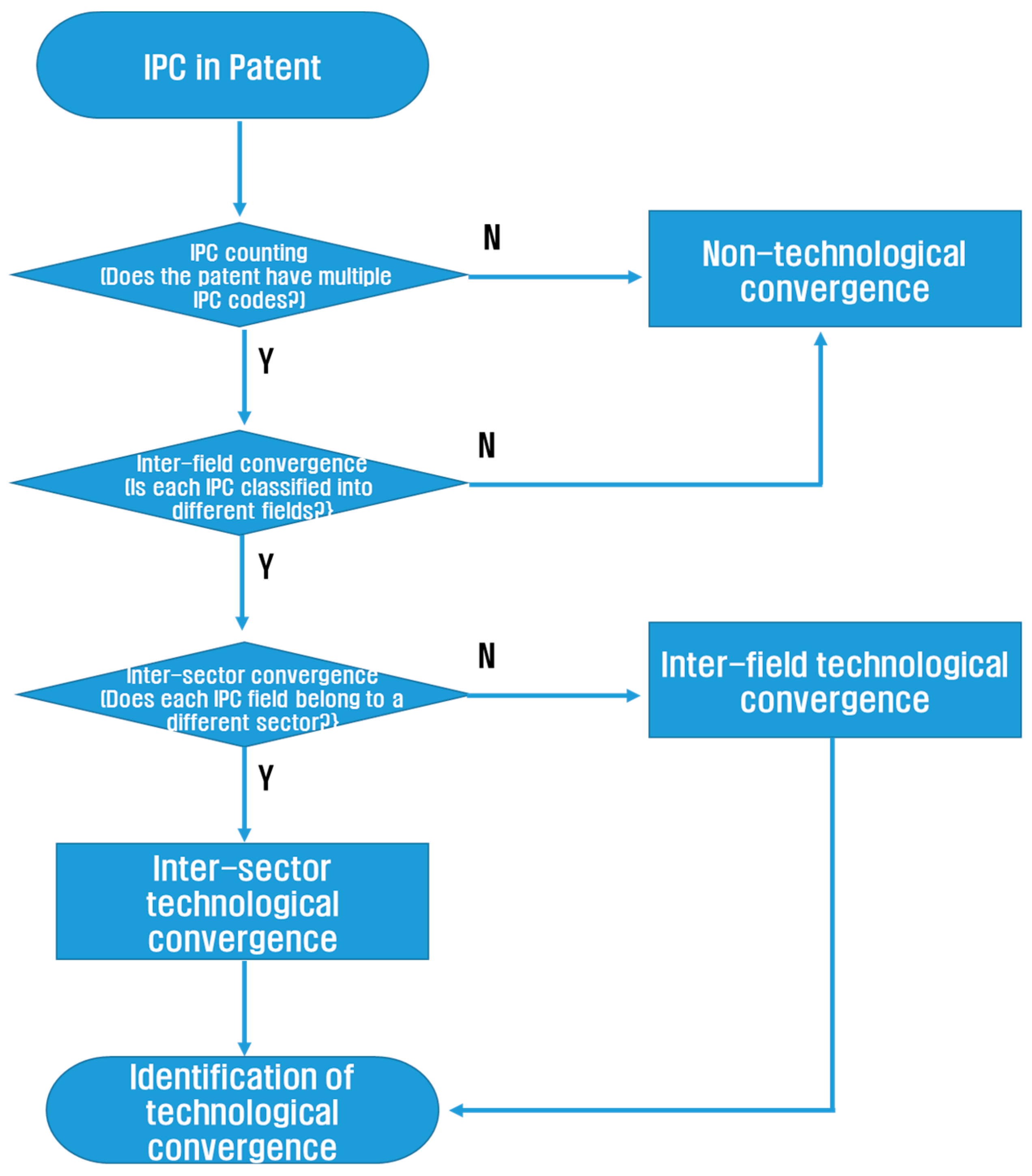

3.1. Measurement of Technological Convergence

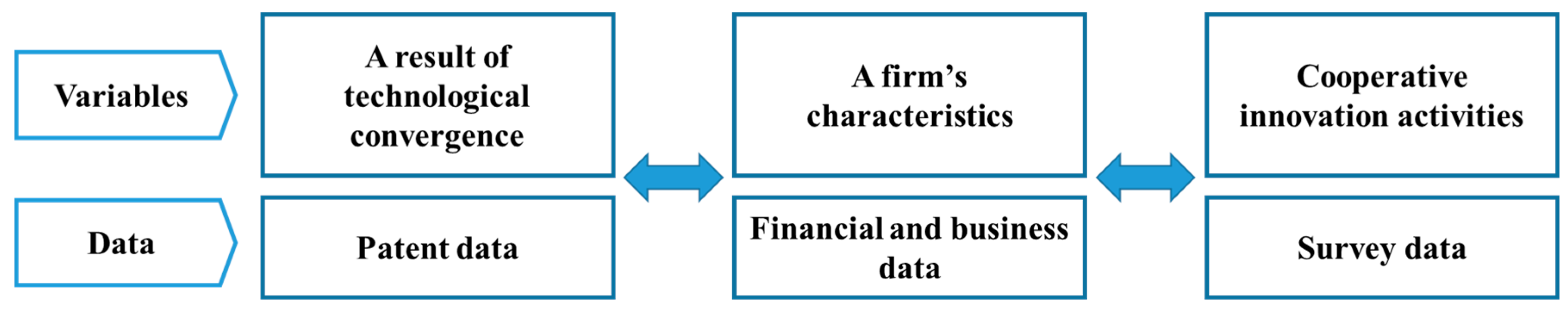

3.2. Establishing an Integrated Database and Variables

3.3. Estimation Methods

4. Empirical Results

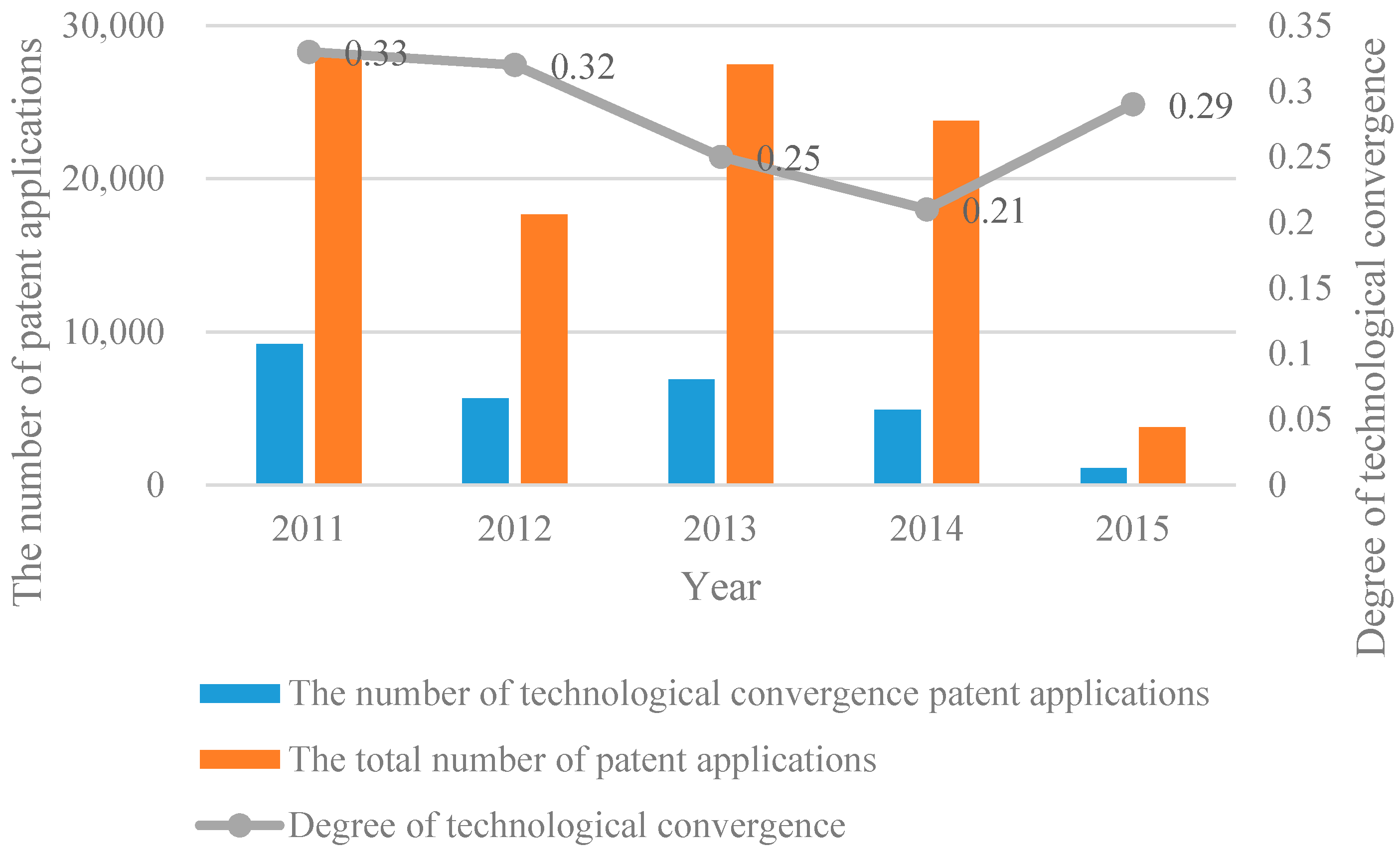

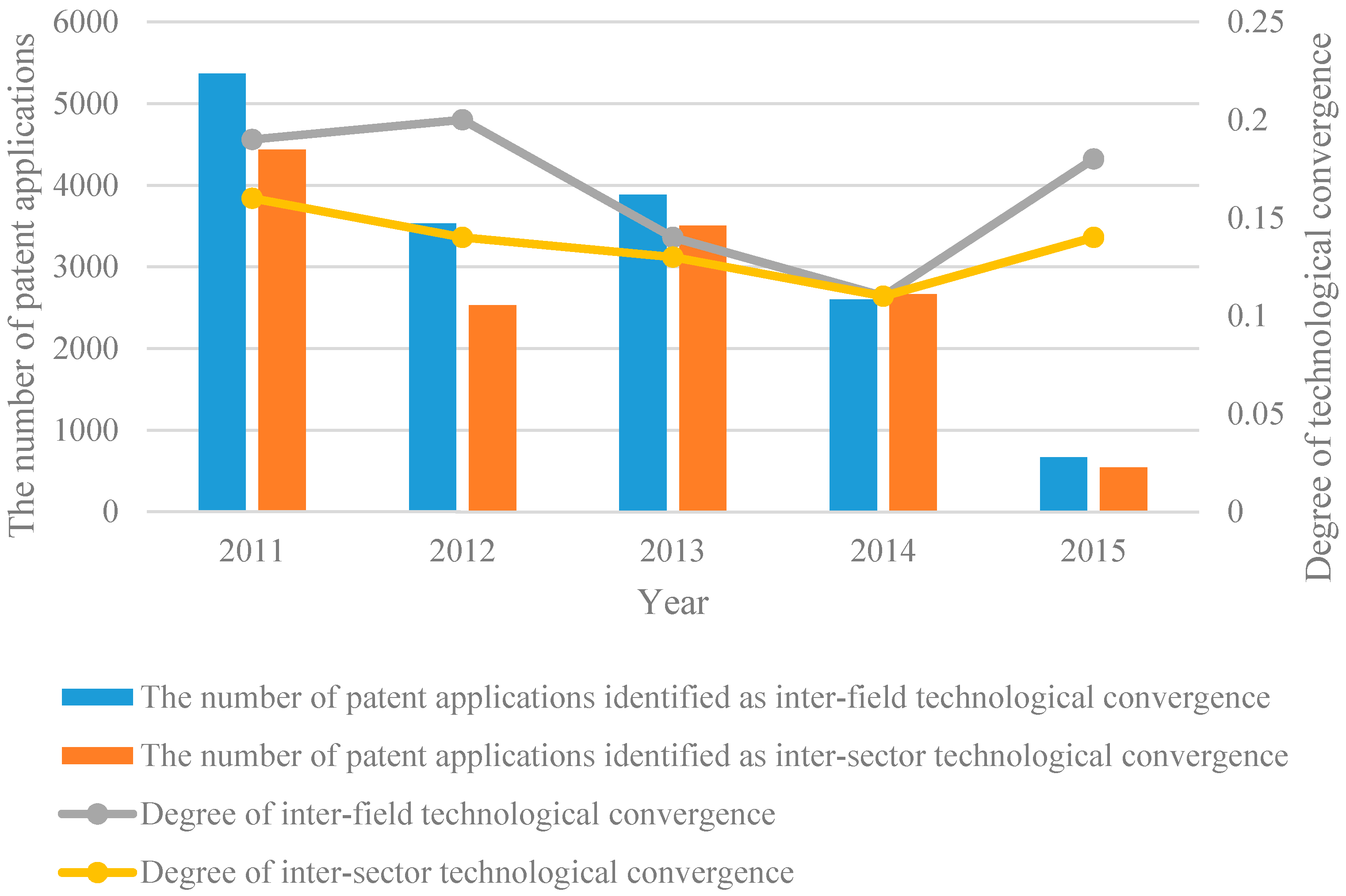

4.1. Result of Technological Convergence

4.2. Impact Assessment of Firms’ Cooperative Innovation Strategies

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A

| Sector | Field | IPC | |

|---|---|---|---|

| 1 | Electrical engineering | Electrical machinery, apparatus, energy | F21H, F21K, F21L, F21S, F21V, F21W, F21Y, H01B, H01C, H01F, H01G, H01H, H01J, H01K, H01M, H01R, H01T, H02B, H02G, H02H, H02J, H02K, H02M, H02N, H02P, H05B, H05C, H05F, H99Z |

| 2 | Audio-visual technology | G09F, G09G, G11B, H04N 3, H04N 5, H04N 7, H04N 9, H04N 11, H04N 13, H04N 15, H04N 17, H04N 101, H04R, H04S, H05K | |

| 3 | Telecommunications | G08C, H01P, H01Q, H04B, H04H, H04J, H04K, H04M, H04N 1, H04Q | |

| 4 | Digital communication | H04L, H04N 21, H04W | |

| 5 | Basic communication processes | H03B, H03C, H03D, H03F, H03G, H03H, H03J, H03K, H03L, H03M | |

| 6 | Computer technology | G06C, G06D, G06E, G06F, G06G, G06J, G06K, G06M, G06N, G06T, G10L, G11C | |

| 7 | IT methods for management | G06Q | |

| 8 | Semiconductors | H01L | |

| 9 | Instruments | Optics | G02B, G02C, G02F, G03B, G03C, G03D, G03F, G03G, G03H, H01S |

| 10 | Measurement | G01B, G01C, G01D, G01F, G01G, G01H, G01J, G01K, G01L, G01M, G01N 1, G01N 3, G01N 5, G01N 7, G01N 9, G01N 11, G01N 13, G01N 15, G01N 17, G01N 19, G01N 21, G01N 22, G01N 23, G01N 24, G01N 25, G01N 27, G01N 29, G01N 30, G01N 31, G01N 35, G01N 37, G01P, G01Q, G01R, G01S, G01V, G01W, G04B, G04C, G04D, G04F, G04G, G12B, G99Z | |

| 11 | Analysis of biological materials | G01N 33 | |

| 12 | Control | G05B, G05D, G05F, G07B, G07C, G07D, G07F, G07G, G08B, G08G, G09B, G09C, G09D | |

| 13 | Medical technology | A61B, A61C, A61D, A61F, A61G, A61H, A61J, A61L, A61M, A61N, H05G | |

| 14 | Chemistry | Organic fine chemistry | A61K 8, A61Q, C07B, C07C, C07D, C07F, C07H, C07J, C40B |

| 15 | Biotechnology | C07G, C07K, C12M, C12N, C12P, C12Q, C12R, C12S | |

| 16 | Pharmaceuticals | A61K 6, A61K 9, A61K 31, A61K 33, A61K 35, A61K 36, A61K 38, A61K 39, A61K 41, A61K 45, A61K 47, A61K 48, A61K 49, A61K 50, A61K 51, A61K 101, A61K 103, A61K 125, A61K 127, A61K 129, A61K 131, A61K 133, A61K 135, A61P | |

| 17 | Macromolecular chemistry, polymers | C08B, C08C, C08F, C08G, C08H, C08K, C08L | |

| 18 | Food chemistry | A01H, A21D, A23B, A23C, A23D, A23F, A23G, A23J, A23K, A23L, C12C, C12F, C12G, C12H, C12J, C13B 10, C13B 20, C13B 30, C13B 35, C13B 40, C13B 50, C13B 99, C13D, C13F, C13J, C13K | |

| 19 | Basic materials chemistry | A01N, A01P, C05B, C05C, C05D, C05F, C05G, C06B, C06C, C06D, C06F, C09B, C09C, C09D, C09F, C09G, C09H, C09J, C09K, C10B, C10C, C10F, C10G, C10H, C10J, C10K, C10L, C10M, C10N, C11B, C11C, C11D, C99Z | |

| 20 | Materials, metallurgy | B22C, B22D, B22F, C01B, C01C, C01D, C01F, C01G, C03C, C04B, C21B, C21C, C21D, C22B, C22C, C22F | |

| 21 | Surface technology, coating | B05C, B05D, B32B, C23C, C23D, C23F, C23G, C25B, C25C, C25D, C25F, C30B | |

| 22 | Micro-structural and nano-technology | B81B, B81C, B82B, B82Y | |

| 23 | Chemical engineering | B01B, B01D 1, B01D 3, B01D 5, B01D 7, B01D 8, B01D 9, B01D 11, B01D 12, B01D 15, B01D 17, B01D 19, B01D 21, B01D 24, B01D 25, B01D 27, B01D 29, B01D 33, B01D 35, B01D 36, B01D 37, B01D 39, B01D 41, B01D 43, B01D 57, B01D 59, B01D 61, B01D 63, B01D 65, B01D 67, B01D 69, B01D 71, B01F, B01J, B01L, B02C, B03B, B03C, B03D, B04B, B04C, B05B, B06B, B07B, B07C, B08B, C14C, D06B, D06C, D06L, F25J, F26B, H05H | |

| 24 | Environmental technology | A62C, B01D 45, B01D 46, B01D 47, B01D 49, B01D 50, B01D 51, B01D 52, B01D 53, B09B, B09C, B65F, C02F, E01F 8, F01N, F23G, F23J, G01T | |

| 25 | Mechanical engineering | Handling | B25J, B65B, B65C, B65D, B65G, B65H, B66B, B66C, B66D, B66F, B67B, B67C, B67D |

| 26 | Machine tools | A62D, B21B, B21C, B21D, B21F, B21G, B21H, B21J, B21K, B21L, B23B, B23C, B23D, B23F, B23G, B23H, B23K, B23P, B23Q, B24B, B24C, B24D, B25B, B25C, B25D, B25F, B25G, B25H, B26B, B26D, B26F, B27B, B27C, B27D, B27F, B27G, B27H, B27J, B27K, B27L, B27M, B27N, B30B | |

| 27 | Engines, pumps, turbines | F01B, F01C, F01D, F01K, F01L, F01M, F01P, F02B, F02C, F02D, F02F, F02G, F02K, F02M, F02N, F02P, F03B, F03C, F03D, F03G, F03H, F04B, F04C, F04D, F04F, F23R, F99Z, G21B, G21C, G21D, G21F, G21G, G21H, G21J, G21K | |

| 28 | Textile and paper machines | A41H, A43D, A46D, B31B, B31C, B31D, B31F, B41B, B41C, B41D, B41F, B41G, B41J, B41K, B41L, B41M, B41N, C14B, D01B, D01C, D01D, D01F, D01G, D01H, D02G, D02H, D02J, D03C, D03D, D03J, D04B, D04C, D04G, D04H, D05B, D05C, D06G, D06H, D06J, D06M, D06P, D06Q, D21B, D21C, D21D, D21F, D21G, D21H, D21J, D99Z | |

| 29 | Other special machines | A01B, A01C, A01D, A01F, A01G, A01J, A01K, A01L, A01M, A21B, A21C, A22B, A22C, A23N, A23P, B02B, B28B, B28C, B28D, B29B, B29C, B29D, B29K, B29L, B99Z, C03B, C08J, C12L, C13B 5, C13B 15, C13B 25, C13B 45, C13C, C13G, C13H, F41A, F41B, F41C, F41F, F41G, F41H, F41J, F42B, F42C, F42D | |

| 30 | Thermal processes and apparatus | F22B, F22D, F22G, F23B, F23C, F23D, F23H, F23K, F23L, F23M, F23N, F23Q, F24B, F24C, F24D, F24F, F24H, F24J, F25B, F25C, F27B, F27D, F28B, F28C, F28D, F28F, F28G | |

| 31 | Mechanical elements | F15B, F15C, F15D, F16B, F16C, F16D, F16F, F16G, F16H, F16J, F16K, F16L, F16M, F16N, F16P, F16S, F16T, F17B, F17C, F17D, G05G | |

| 32 | Transport | B60B, B60C, B60D, B60F, B60G, B60H, B60J, B60K, B60L, B60M, B60N, B60P, B60Q, B60R, B60S, B60T, B60V, B60W, B61B, B61C, B61D, B61F, B61G, B61H, B61J, B61K, B61L, B62B, B62C, B62D, B62H, B62J, B62K, B62L, B62M, B63B, B63C, B63G, B63H, B63J, B64B, B64C, B64D, B64F, B64G | |

| 33 | Other fields | Furniture, games | A47B, A47C, A47D, A47F, A47G, A47H, A47J, A47K, A47L, A63B, A63C, A63D, A63F, A63G, A63H, A63J, A63K |

| 34 | Other consumer goods | A24B, A24C, A24D, A24F, A41B, A41C, A41D, A41F, A41G, A42B, A42C, A43B, A43C, A44B, A44C, A45B, A45C, A45D, A45F, A46B, A62B, A99Z, B42B, B42C, B42D, B42F, B43K, B43L, B43M, B44B, B44C, B44D, B44F, B68B, B68C, B68F, B68G, D04D, D06F, D06N, D07B, F25D, G10B, G10C, G10D, G10F, G10G, G10H, G10K | |

| 35 | Civil engineering | E01B, E01C, E01D, E01F 1, E01F 3, E01F 5, E01F 7, E01F 9, E01F 11, E01F 13, E01F 15, E01H, E02B, E02C, E02D, E02F, E03B, E03C, E03D, E03F, E04B, E04C, E04D, E04F, E04G, E04H, E05B, E05C, E05D, E05F, E05G, E06B, E06C, E21B, E21C, E21D, E21F, E99Z |

Appendix B

| Model | Poisson Model | N.B Model | |||||

|---|---|---|---|---|---|---|---|

| Dependent Variable | Technological Convergence | Inter-Sector Technological Convergence | Inter-Field Technological Convergence | Technological Convergence | Inter-Sector Technological Convergence | Inter-Field Technological Convergence | |

| Explanatory Variables | Licensing | 0.166 *** | 0.162 *** | 0.167 *** | 0.203 *** | 0.183 ** | 0.211 ** |

| (0.000) | (0.000) | (0.001) | (0.003) | (0.025) | (0.034) | ||

| External research contracts | 0.020 | 0.036 | 0.006 | 0.010 | 0.046 | −0.031 | |

| (0.424) | (0.248) | (0.865) | (0.853) | (0.471) | (0.638) | ||

| Joint research | 0.108 | 0.220* | 0.048 | 0.125 | 0.235 | 0.032 | |

| (0.306) | (0.066) | (0.767) | (0.466) | (0.233) | (0.900) | ||

| Joint ventures | −13.900 | −13.711 | −10.630 | −19.684 | −18.499 | −13.548 | |

| (0.991) | (0.992) | (0.977) | (0.999) | (0.999) | (0.993) | ||

| Mergers and acquisitions | 0.062 | −0.048 | 0.097 | 0.276 | 0.196 | 0.239 | |

| (0.763) | (0.871) | (0.729) | (0.390) | (0.639) | (0.587) | ||

| Others | 0.018 | −0.033 | −0.004 | 0.009 | −0.063 | 0.019 | |

| (0.936) | (0.919) | (0.989) | (0.980) | (0.885) | (0.969) | ||

| Control Variables | Total capital | 3.85 × 10−8 *** | 4.29 × 10−8 *** | 3.14 × 10−8 *** | 3.79 × 10−8 *** | 3.93 × 10−8 *** | 3.71 × 10−8 *** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | ||

| Total laborers | −0.002 *** | −0.003 *** | −0.001 | −0.001 | −0.003 | −0.000 | |

| (0.009) | (0.003) | (0.450) | (0.344) | (0.110) | (0.806) | ||

| Year Dummy | 2012 | −0.240 ** | −0.293 * | −0.177 | −0.147 | −0.174 | −0.128 |

| (0.030) | (0.053) | (0.238) | (0.393) | (0.421) | (0.587) | ||

| 2013 | −0.398 *** | −0.381 ** | −0.471 *** | −0.306 * | −0.237 | −0.463 * | |

| (0.001) | (0.014) | (0.004) | (0.082) | (0.278) | (0.062) | ||

| 2014 | −0.390 *** | −0.166 | −0.626 *** | −0.297 * | −0.021 | −0.580 ** | |

| (0.001) | (0.257) | (0.000) | (0.093) | (0.921) | (0.022) | ||

| Constant | −0.296 *** | −0.883 *** | −0.927 *** | −0.417 *** | −0.997 *** | −1.027 *** | |

| (0.000) | (0.000) | (0.000) | (0.002) | (0.000) | (0.000) | ||

| Observation | 754 | 754 | 754 | 754 | 754 | 754 | |

| LR ratio | 215.09 | 140.73 | 88.93 | 74.73 | 53.02 | 38.14 | |

Appendix C. Questionnaire for Survey

Part A. Innovation Activity and Strategy

| ① Based technology research | ② Applied technology research | ③ Development of new technology | ④ Improvement of existing technology | |

|---|---|---|---|---|

| R&D stage |

| Year | 2011 | 2012 | 2013 | 2014 | 2015 | |

|---|---|---|---|---|---|---|

| Domestic patent applications | ||||||

| Overseas patent applications | ||||||

| Patents owned | Number of cumulative patents | |||||

| Adjacency between fields of patent | ① Very high ② High ③ Modest ④ Low ⑤ Very low | |||||

| Sales | ||||||

| Exports | ||||||

| ① Research | ② Pilot test | ③ Development products (Certification/Standardization) | ④ Production and commercialization | ⑤ Distribution and marketing | |

|---|---|---|---|---|---|

| Firm experience |

| Main purpose of innovation | Whether to perform (Y/N) | Low<-----------Importance----------->High | |||||

|---|---|---|---|---|---|---|---|

| (1) Substitute existing products/diversify products | Y | N | ① | ② | ③ | ④ | ⑤ |

| (2) Expansion and maintenance of market share | Y | N | ① | ② | ③ | ④ | ⑤ |

| (3) Pioneering new markets | Y | N | ① | ② | ③ | ④ | ⑤ |

| (4) Quick response to consumer needs | Y | N | ① | ② | ③ | ④ | ⑤ |

| (5) Improving production efficiency | Y | N | ① | ② | ③ | ④ | ⑤ |

| (6) Expanding production capacity | Y | N | ① | ② | ③ | ④ | ⑤ |

| (7) Improving work environment/safety | Y | N | ① | ② | ③ | ④ | ⑤ |

| (8) Response domestic and overseas regulations | Y | N | ① | ② | ③ | ④ | ⑤ |

| Cooperative innovation strategy | 2011 | 2012 | 2013 | 2014 | 2015 |

|---|---|---|---|---|---|

| (1) Licensing | |||||

| (2) External research contracts | |||||

| (3) Joint research | |||||

| (4) Joint venture | |||||

| (5) Mergers and acquisitions | |||||

| (6) others |

References

- Chesbrough, H.W. The Era of Open Innovation. MIT Sloan Manag. Rev. 2003, 44, 35–41. [Google Scholar]

- Chesbrough, H.W. Open Innovation; Harvard University Press: Boston, MA, USA, 2003. [Google Scholar]

- Von Hippel, E.; von Krogh, G. Free revealing and the private-collective model for innovation incentives. R&D Manag. 2006, 36, 295–306. [Google Scholar]

- Sánchez, A.M.; Pérez, M.P. Cooperation and the ability to minimize the time and cost of new product development within the Spanish automotive supplier industry. J. Prod. Innov. Manag. 2003, 20, 57–69. [Google Scholar] [CrossRef]

- Belderbos, R.M.; Carree, B.; Lokshin, H. Cooperative R&D and firm performance. Res. Policy 2004, 33, 1477–1492. [Google Scholar]

- Faems, D.; Van Looy, B.; Debackere, K. Inter-organizational collaboration and innovation: Toward a portfolio approach. J. Prod. Innov. Manag. 2005, 22, 238–250. [Google Scholar] [CrossRef]

- Chesbrough, H.W.; Crowther, A.K. Beyond high-tech: Early adopters of Open Innovation in other industries. R&D Manag. 2006, 36, 229–236. [Google Scholar]

- Laursen, K.; Salter, A. Open for innovation: The role of open innovativeness in explaining innovation performance among U.K. manufacturing firms. Strateg. Manag. J. 2006, 27, 131–150. [Google Scholar] [CrossRef]

- Nieto, M.J.; Santamaría, L. The importance of diverse collaborative networks for the novelty of product innovation. Technovation 2007, 27, 367–377. [Google Scholar] [CrossRef]

- Arranz, N.; Arroyabe, J.C.F. The choice of partners in R&D cooperation: An empirical analysis of Spanish firms. Technovation 2008, 28, 88–110. [Google Scholar]

- Lichtenthaler, U. Integrated roadmaps for open innovation. Res. Technol. Manag. 2008, 51, 45–49. [Google Scholar]

- Stanko, M.; Calantone, R. Controversy in Innovation Outsourcing Research: Review, Synthesis and Future Direction. R&D Manag. 2011, 41, 8–20. [Google Scholar]

- Kim, S.H.; Kim, J.H. An Exploratory Study on the Performance of Open Product Innovation: Product Innovation Strategy, Source and Partner Contribution Perspectives. Korean J. Bus. Adm. 2011, 24, 685–703. [Google Scholar]

- Back, C.W.; Noh, M.S. The effect of firm’s R&D investment strategies on managerial performance. Innov. Stud. 2014, 9, 29–48. [Google Scholar]

- Curran, C.S.; Leker, J. Patent indicators for monitoring convergence—Examples from NFF and ICT. Technol. Forecast. Soc. Chang. 2011, 78, 256–273. [Google Scholar] [CrossRef]

- Geum, Y.; Kim, C.; Lee, S.; Kim, M. Technological Convergence of IT and BT: Evidence from Patent Analysis. ETRI J. 2012, 34, 439–449. [Google Scholar] [CrossRef]

- Choi, J.Y.; Jeong, S.K.; Kim, K.N. A study on Diffusion Pattern of Technology Convergence: Patent Analysis for Korea. Sustainability 2015, 7, 11546–11569. [Google Scholar] [CrossRef]

- Venkatraman, N.; Ramanujam, V. Measurement of Business Performance in Strategy Research: A Comparison of Approaches. Acad. Manag. Rev. 1986, 11, 801–814. [Google Scholar]

- Lussier, R.N. Non-financial Business Success versus Failure Prediction Model. J. Small Bus. Manag. 1995, 33, 8–20. [Google Scholar]

- Wright, M.; Robbie, K. Venture capital and private equity: A review and synthesis. J. Bus. Financ. Account. 1998, 25, 521–570. [Google Scholar] [CrossRef]

- Alemany, L.; Martí, J. Productivity growth in Spanish venture-backed firms. In Venture Capital in Europe; Gregoriou, G.N., Kooli, M., Kraeussl, R., Eds.; Elsevier: Amsterdam, The Netherlands, 2006; pp. 100–114. [Google Scholar]

- Chemmanur, T.J.; Krishnan, K.; Nandy, D. How does venture capital financing improve efficiency in private firms? A look beneath the surface. Rev. Financ. Stud. 2011, 24, 4037–4090. [Google Scholar] [CrossRef]

- Croce, A.; Martí, J.; Murtinu, S. The impact of venture capital on the productivity growth of European entrepreneurial firms: ‘Screening’ or ‘value added’ effect? J. Bus. Ventur. 2013, 28, 489–510. [Google Scholar] [CrossRef]

- Heil, M. Finance and Productivity: A Literature Review; OECD Economics Department Working Papers No. 1374; OECD Publishing: Paris, France, 2017. [Google Scholar] [CrossRef]

- Yoffie, D.B. Competing in the age of digital convergence. Calif. Manag. Rev. 1996, 4, 31–53. [Google Scholar] [CrossRef]

- Wolbring, G. Why NBIC? Why human performance enhancement? Eur. J. Soc. Sci. Res. 2008, 21, 25–40. [Google Scholar] [CrossRef]

- Jeong, S.; Kim, J.C.; Choi, J.Y. Technology convergence: What developmental stage are we in? Scientometrics 2015, 104, 841–871. [Google Scholar] [CrossRef]

- Keupp, M.M.; Gassmann, O. Determinants and archetype users of open innovation. R&D Manag. 2009, 39, 331–341. [Google Scholar]

- Hacklin, F. Management of Convergence in Innovation: Strategies and Capabilities for Value Creation beyond Blurring Industry Boundaries: Contributions to Management Science; Springer: Berlin, Germany, 2008. [Google Scholar]

- Athreye, S.; Keeble, D. Technology convergence, globalisation and ownership in the UK computer industry. Technovation 2000, 20, 227–245. [Google Scholar] [CrossRef]

- Roco, M.C.; Bainbridge, W.S. Converging Technologies for Improving Human Performance; National Science Foundation: Arlington, VA, USA. Available online: http://www.nsf.gov/crssprgm/nano/activities/ct05_flyer_rev54.pdf (accessed on 26 July 2017).

- Lee, H.; Kim, P.R.; Zo, H. Impact of cooperative R&D projects on ICT-based technology convergence. ETRI J. 2017. [Google Scholar] [CrossRef]

- Basole, R.C.; Rouse, W.B. Complexity of service value networks: Conceptualization and empirical investigation. IBM Syst. J. 2008, 47, 53–70. [Google Scholar] [CrossRef]

- Basole, R.C.; Park, H.; Barnett, B.C. Coopetition and convergence in the ICT ecosystem. Telecommun. Policy 2015, 39, 537–552. [Google Scholar] [CrossRef]

- OECD StatExtracts. Patent by Technology. 2014. Available online: http://stats.oecd.org/index.aspx (accessed on 26 July 2017).

- Choi, J.Y.; Moon, H.S.; Jo, Y.A.; Jeong, S.K. An Analysis on the Trends and Determinants of Technology Convergence of Korea; Research paper 2014-709; Korea Institute for Industrial Economics & Trade: Seoul, Korea, 2014. [Google Scholar]

- Gambardella, A.; Giuri, P.; Luzzi, A. The market for patents in Europe. Res. Policy 2007, 36, 1163–1183. [Google Scholar] [CrossRef]

- Karvonen, M.; Kassi, T. Patent citations as a tool for analysing the early stages of convergence. Technol. Forecast. Soc. Chang. 2013, 80, 1094–1107. [Google Scholar] [CrossRef]

- Rosenfeld, S.A. Does cooperation enhance competitiveness? Assessing the impacts of inter-firm collaboration. Res. Policy 1996, 25, 247–263. [Google Scholar] [CrossRef]

- Okamuro, H. The Effects of Inter-Firm Cooperation: A Comparative Analysis of Small and Large Firms Using Micro Data; COE/RES Discussion Paper No. 66; Hitotsubashi University: Tokyo, Japan, 2004. [Google Scholar]

- Okamuro, H. Cooperative R&D by SMEs and Intellectual Property. Proc. Jpn. Acad. Small Bus. Stud. 2005, 24, 3–16. [Google Scholar]

- Schartinger, D.; Rammer, C.; Fischer, M.M.; Fröhlich, J. Knowledge interactions between universities and industry in Austria: Sectoral patterns and determinants. Res. Policy 2002, 31, 303–328. [Google Scholar] [CrossRef]

- Tether, B. Who co-operates for innovation, and why: An empirical analysis. Res. Policy 2002, 31, 947–967. [Google Scholar] [CrossRef]

- Santoro, M.D.; Chakrabarti, A.K. Firm Size and Technology Centrality in Industry-University Interactions. Res. Policy 2002, 31, 1163–1180. [Google Scholar] [CrossRef]

- Rosenberg, N. Learning by using. In Inside the Black Box: Technology and Economics; Cambridge University Press: Cambridge, UK, 1982; pp. 120–140. [Google Scholar]

- Lilien, G.L.; Morrison, P.D.; Searls, K.; Sonnack, M.; von Hippel, E. Performance assessment of the lead user idea-generation process for new product development. Manag. Sci. 2002, 48, 1042–1059. [Google Scholar] [CrossRef]

- Robertson, P.L.; Patel, P.R. New wine in old bottles: Technological diffusion in developed economies. Res. Policy 2007, 36, 708–721. [Google Scholar] [CrossRef]

- Gassmann, O.; Enkel, E. Towards a theory of open innovation: Three core process archetypes. In Proceedings of the R&D Management Conference, Lisbon, Portugal, 6–9 July 2004. [Google Scholar]

- Lichtenthaler, U.; Ernst, H. External technology commercialization in large firms: Results of a quantitative benchmarking study. R&D Manag. 2007, 37, 383–397. [Google Scholar]

- Vanhaverbecke, W.; Van de Vrade, V.; Chesbrough, H.W. Understanding the advantages of open innovation practices in corporate venturing in terms of real options. Creat. Innov. Manag. 2008, 17, 251–258. [Google Scholar] [CrossRef]

- Chesbrough, H.W. Why companies should have open business models. MIT Sloan Manag. Rev. 2007, 48, 22–28. [Google Scholar]

- Enkel, E.; Gassmann, O.; Chesbrough, H.W. Open R&D and open innovation: Exploring the phenomenon. R&D Manag. 2009, 39, 311–316. [Google Scholar]

- Tsai, K.H.; Wang, J.C. External technology sourcing and innovation performance in LMT sectors: An analysis based on the Taiwanese Technological Innovation Survey. Res. Policy 2009, 38, 518–526. [Google Scholar] [CrossRef]

- Becker, W.; Dietz, J. R&D cooperation and innovation activities of firms-evidence for the German manufacturing industry. Res. Policy 2004, 33, 209–223. [Google Scholar]

- Eisenhardt, K.M.; Tabrizi, B.N. Accelerating adaptive process: Product innovation in the global computer industry. Adm. Sci. Q. 1995, 40, 84–110. [Google Scholar] [CrossRef]

- Witzeman, S.; Slowinski, G.; Dirkx, R.; Gollob, L.; Tao, J.; Ward, S.; Miraglia, S. Harnessing external technology for innovation. Res. Technol. Manag. 2006, 49, 19–27. [Google Scholar]

- Caloghirou, Y.; Kastelli, I.; Tsakanikas, A. Internal capability and external knowledge sources: Compliments or substitutes for innovative performance? Technovation 2004, 24, 29–39. [Google Scholar] [CrossRef]

- Megantz, R.C. How to License Technology; John Wiley & Sons: New York, NY, USA, 1996. [Google Scholar]

- Megantz, R.C. Technology Management, Developing and Implementing Effective Licensing Programs; John Wiley & Sons: New York, NY, USA, 2002. [Google Scholar]

- World Intellectual Property Organisation (WIPO). Concept of a Technology Classification for Country Comparisons; WIPO: Karlsruhe, Germany, 2008. [Google Scholar]

- Pakes, A.; Griliches, Z. Patents and R&D at the firm level: A first report. Econ. Lett. 1980, 5, 377–381. [Google Scholar]

- Hall, B.H.; Griliches, Z.; Hausman, J.A. Patents and R&D: Is there a lag? Int. Econ. Rev. 1986, 27, 265–284. [Google Scholar]

- World Intellectual Property Organization (WIPO). World Intellectual Property Indicators; WIPO Economics & Statistics Series (WIPO Publication No. 941E); World Intellectual Property Organization (WIPO): Geneva, Switzerland, 2011. [Google Scholar]

- Cameron, A.C.; Trivedi, P.K. Microeconometrics Using Stata, Revised Edition; Stata Press: College Station, TX, USA, 2010. [Google Scholar]

- Osgood, D.W. Poisson-based regression analysis of aggregate crime rates. J. Quant. Criminol. 2000, 16, 21–43. [Google Scholar] [CrossRef]

- Tuttlebee, W.H.W. Cordless Telecommunications Worldwide; Springer: Berlin, Germany, 1996; ISBN 978-3-540-19970-0. [Google Scholar]

- OECD StatExtracts. Gross Domestic Expenditure on R-D by Sector of Performance and Source of Funds. 2017. Available online: http://stats.oecd.org/ (accessed on 26 July 2017).

| Variables | Description | |

|---|---|---|

| Dependent Variables | Technological convergence | The number of patent applications identified as exhibiting technological convergence |

| Inter-sector technological convergence | The number of patent applications identified as exhibiting inter-sector technological convergence | |

| Inter-field technological convergence | The number of patent applications identified as exhibiting inter-field technological convergence | |

| Explanatory Variables | Licensing | The number of technology transfers by licensing |

| External research contracts | The number of outsourced external research contracts | |

| Joint research | The number of joint research projects conducted with external research institutes | |

| Joint ventures | The amount of technical commercialization after joint venture enterprise establishment | |

| Mergers and acquisitions | The number of innovative firm acquisitions to introduce promising technologies | |

| Others | The quantity of other external cooperation | |

| Control Variables | Total capital | Total firm capital noted in financial statements |

| Total laborers | The number of employees noted in financial statements | |

| Time effect | Year dummy during 2011–2015 |

| Variables | Observations | Mean | Standard Deviation | Min. | Max. |

|---|---|---|---|---|---|

| Technological convergence | 1000 | 0.67 | 1.44 | 0 | 12 |

| Inter-sector technological convergence | 1000 | 0.39 | 1.03 | 0 | 11 |

| Inter-field technological convergence | 1000 | 0.33 | 0.98 | 0 | 12 |

| Licensing | 1000 | 0.19 | 0.87 | 0 | 10 |

| External research contracts | 1000 | 0.19 | 0.87 | 0 | 15 |

| Joint research | 1000 | 0.1 | 0.41 | 0 | 5 |

| Joint ventures | 1000 | 0.003 | 0.05 | 0 | 1 |

| Mergers and acquisitions | 1000 | 0.01 | 0.14 | 0 | 2 |

| Others | 1000 | 0.02 | 0.21 | 0 | 3 |

| Total capital | 954 | 1.4 × 107 | 2.41 × 107 | 8973 | 3.31 × 108 |

| Total laborers | 970 | 50.76 | 65.48 | 0 | 375 |

| Year | 2011 | 2012 | 2013 | 2014 | 2015 |

|---|---|---|---|---|---|

| Number of patent applications identified as technologically convergent | 9211 | 5645 | 6885 | 4897 | 1084 |

| Total patent applications | 27,958 | 17,651 | 27,477 | 23,801 | 3782 |

| Degree of technological convergence | 0.33 | 0.32 | 0.25 | 0.21 | 0.29 |

| Year | 2011 | 2012 | 2013 | 2014 | 2015 | |

|---|---|---|---|---|---|---|

| Inter-sector technological convergence | Number of patent applications | 4435 | 2530 | 3505 | 2669 | 543 |

| Degree of technological convergence | 0.16 | 0.14 | 0.13 | 0.11 | 0.14 | |

| Inter-field technological convergence | Number of patent applications | 5367 | 3531 | 3886 | 2603 | 668 |

| Degree of technological convergence | 0.19 | 0.20 | 0.14 | 0.11 | 0.17 | |

| Model | Poisson Model | N.B. Model | |||

|---|---|---|---|---|---|

| Dependent Variable | Technological Convergence | Technological Convergence | |||

| Time Lags of Explanatory Variables | T | T-1 | T | T-1 | |

| Explanatory Variables | Licensing | 0.158 *** | 0.145 *** | 0.173 *** | 0.162 ** |

| (0.000) | (0.000) | (0.005) | (0.038) | ||

| External research contracts | 0.037 | −0.027 | 0.006 | −0.063 | |

| (0.119) | (0.485) | (0.913) | (0.317) | ||

| Joint research | 0.145 | 0.210 * | 0.205 | 0.298 | |

| (0.129) | (0.095) | (0.178) | (0.123) | ||

| Joint ventures | −11.855 | −11.779 | −15.857 | −15.922 | |

| (0.978) | (0.989) | (0.996) | (0.998) | ||

| Mergers and acquisitions | 0.067 | −0.086 | 0.280 | 0.129 | |

| (0.739) | (0.730) | (0.398) | (0.718) | ||

| Others | −0.096 | −0.264 | −0.092 | −0.199 | |

| (0.672) | (0.442) | (0.779) | (0.647) | ||

| Control Variables | Total capital | 1.43 × 10−8 *** | 1.28 × 10−8 *** | 3.31 × 10−8 *** | 3.34 × 10−8 *** |

| (0.000) | (0.000) | (0.000) | (0.000) | ||

| Total laborers | 0.002 *** | 0.001 ** | −0.001 | −0.001 | |

| (0.001) | (0.025) | (0.664) | (0.471) | ||

| Year Dummy | 2012 | −0.224 ** | −0.147 | ||

| (0.044) | (0.406) | ||||

| 2013 | −0.363 *** | −0.089 | −0.303 * | −0.139 | |

| (0.002) | (0.460) | (0.093) | (0.447) | ||

| 2014 | −0.365 *** | −0.148 | −0.296 | −0.156 | |

| (0.002) | (0.225) | (0.102) | (0.393) | ||

| 2015 | −1.897 *** | −1.540 *** | −1.702 *** | −1.540 *** | |

| (0.000) | (0.000) | (0.000) | (0.000) | ||

| Constant | −0.300 *** | −0.466 *** | −0.418 *** | −0.521 *** | |

| (0.000) | (0.000) | (0.002) | (0.000) | ||

| Observation | 924 | 731 | 924 | 731 | |

| LR ratio | 249.59 | 149.78 | 117.35 | 85.99 | |

| Model | Poisson Model | N.B. Model | |||

|---|---|---|---|---|---|

| Dependent Variable | Inter-Sector Technological Convergence | Inter-Sector Technological Convergence | |||

| Time Lags of Explanatory Variables | T | T-1 | T | T-1 | |

| Explanatory Variables | Licensing | 0.163 *** | 0.162 *** | 0.175 ** | 0.183 * |

| (0.000) | (0.001) | (0.020) | (0.056) | ||

| External research contracts | 0.052 * | 0.006 | 0.033 | −0.028 | |

| (0.090) | (0.891) | (0.596) | (0.721) | ||

| Joint research | 0.274 * | 0.364 *** | 0.342 * | 0.450 * | |

| (0.010) | (0.009) | (0.053) | (0.056) | ||

| Joint ventures | −15.598 | −13.587 | −19.390 | −17.096 | |

| (0.996) | (0.996) | (0.999) | (0.999) | ||

| Mergers and acquisitions | −0.075 | −0.186 | 0.209 | 0.218 | |

| (0.799) | (0.558) | (0.630) | (0.630) | ||

| Others | −0.164 | −12.726 | −0.145 | −16.255 | |

| (0.610) | (0.980) | (0.733) | (0.996) | ||

| Control Variables | Total capital | 1.44 × 10−8 *** | 1.21 × 10−8 *** | 3.74 × 10−8 *** | 3.45 × 10−8 *** |

| (0.000) | (0.000) | (0.000) | (0.000) | ||

| Total laborers | 0.001 ** | 0.001 | −0.002 | −0.002 | |

| (0.045) | (0.181) | (0.143) | (0.213) | ||

| Year Dummy | 2012 | −0.272 * | −0.180 | ||

| (0.073) | (0.424) | ||||

| 2013 | −0.345 ** | −0.025 | −0.241 | −0.035 | |

| (0.026) | (0.878) | (0.287) | (0.883) | ||

| 2014 | −0.144 | 0.123 | −0.030 | 0.162 | |

| (0.326) | (0.433) | (0.892) | (0.481) | ||

| 2015 | −1.758 *** | −1.312 *** | −1.605 *** | −1.381 *** | |

| (0.000) | (0.000) | (0.000) | (0.000) | ||

| Constant | −0.892 *** | −1.103 *** | −0.998 *** | −1.139 *** | |

| (0.000) | (0.000) | (0.000) | (0.000) | ||

| Observation | 924 | 731 | 924 | 731 | |

| LR ratio | 146.12 | 93.66 | 81.70 | 58.45 | |

| Model | Poisson Model | N.B. Model | |||

|---|---|---|---|---|---|

| Dependent Variable | Inter-Field Technological Convergence | Inter-Field Technological Convergence | |||

| Time Lags of Explanatory Variables | T | T-1 | T | T-1 | |

| Explanatory Variables | Licensing | 0.155 *** | 0.141 ** | 0.169 * | 0.163 |

| (0.001) | (0.021) | (0.051) | (0.137) | ||

| External research contracts | 0.022 | −0.113 | −0.024 | −0.130 | |

| (0.540) | (0.187) | (0.717) | (0.185) | ||

| Joint research | 0.106 | 0.108 | 0.162 | 0.227 | |

| (0.460) | (0.595) | (0.463) | (0.420) | ||

| Joint ventures | −10.698 | −10.549 | −14.579 | −16.249 | |

| (0.978) | (0.987) | (0.996) | (0.999) | ||

| Mergers and acquisitions | 0.112 | −0.039 | 0.244 | 0.048 | |

| (0.685) | (0.915) | (0.583) | (0.925) | ||

| Others | −0.095 | 0.141 | −0.103 | 0.122 | |

| (0.769) | (0.672) | (0.820) | (0.803) | ||

| Control Variables | Total capital | 1.32 × 10−8 *** | 1.28 × 10−8 *** | 2.58 × 10−8 *** | 2.97 × 10−8 *** |

| (0.000) | (0.000) | (0.002) | (0.001) | ||

| Total laborers | 0.002 ** | 0.001 | 0.001 | -0.000 | |

| (0.012) | (0.183) | (0.578) | (0.887) | ||

| Year Dummy | 2012 | −0.167 | −0.115 | ||

| (0.267) | (0.630) | ||||

| 2013 | −0.445 *** | −0.222 | −0.423 * | −0.289 | |

| (0.006) | (0.183) | (0.089) | (0.240) | ||

| 2014 | −0.609 *** | −0.442 ** | −0.551 ** | −0.457 * | |

| (0.000) | (0.013) | (0.031) | (0.070) | ||

| 2015 | −1.961 *** | −1.718 *** | −1.774 *** | −1.653 *** | |

| (0.000) | (0.000) | (0.000) | (0.000) | ||

| Constant | −0.931 *** | −1.024 *** | −1.037 *** | −1.095 *** | |

| (0.000) | (0.000) | (0.000) | (0.000) | ||

| Observation | 924 | 731 | 924 | 731 | |

| LR ratio | 121.83 | 76.16 | 58.47 | 45.14 | |

© 2017 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, K. Impact of Firms’ Cooperative Innovation Strategy on Technological Convergence Performance: The Case of Korea’s ICT Industry. Sustainability 2017, 9, 1601. https://doi.org/10.3390/su9091601

Kim K. Impact of Firms’ Cooperative Innovation Strategy on Technological Convergence Performance: The Case of Korea’s ICT Industry. Sustainability. 2017; 9(9):1601. https://doi.org/10.3390/su9091601

Chicago/Turabian StyleKim, Kyunam. 2017. "Impact of Firms’ Cooperative Innovation Strategy on Technological Convergence Performance: The Case of Korea’s ICT Industry" Sustainability 9, no. 9: 1601. https://doi.org/10.3390/su9091601