The Influence of Priming on Reference States

Abstract

:1. Introduction

2. Experiment

2.1. Classroom experiment

2.2. Laboratory experiment

3. Background and Methodology

4. Results

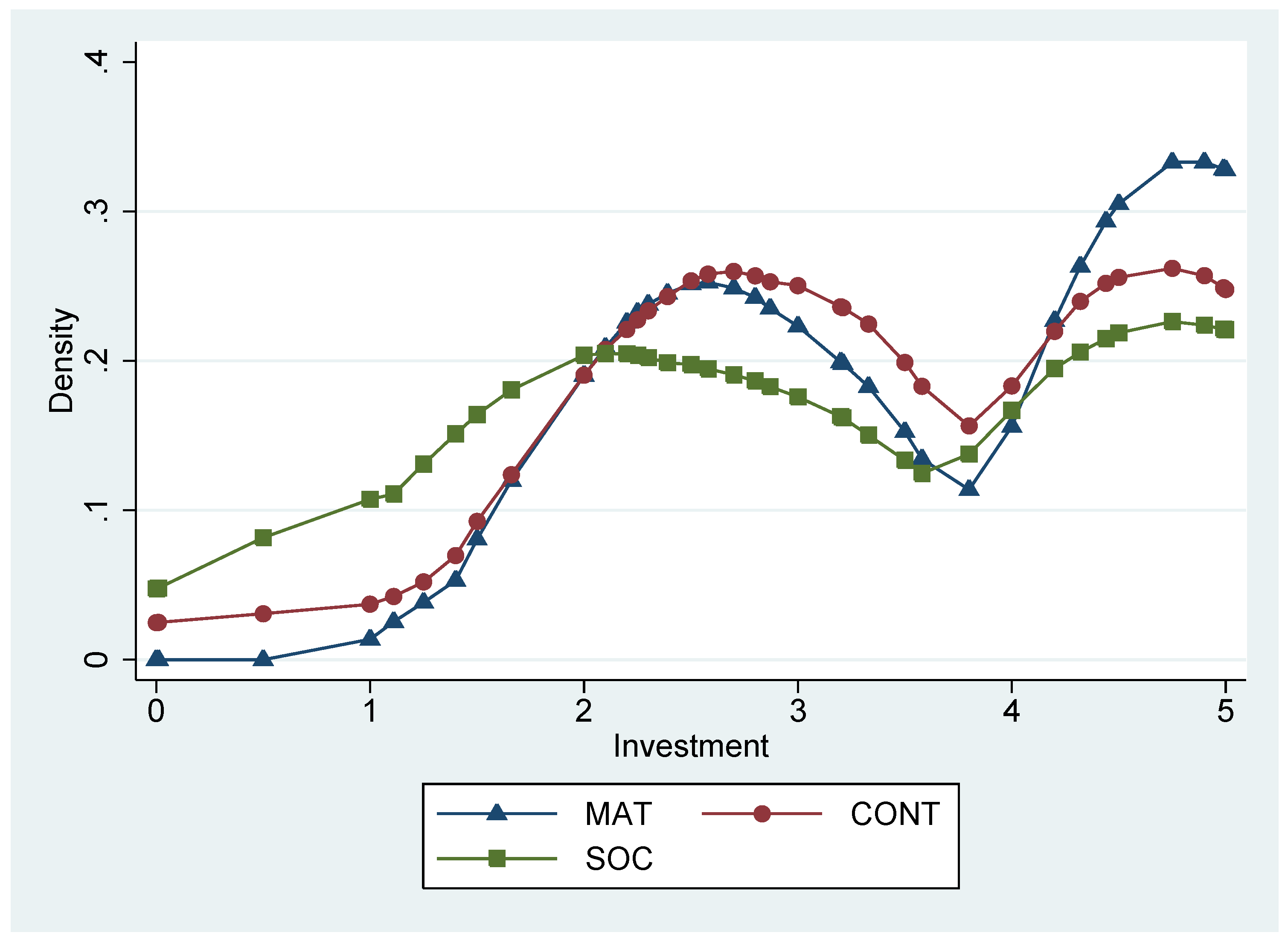

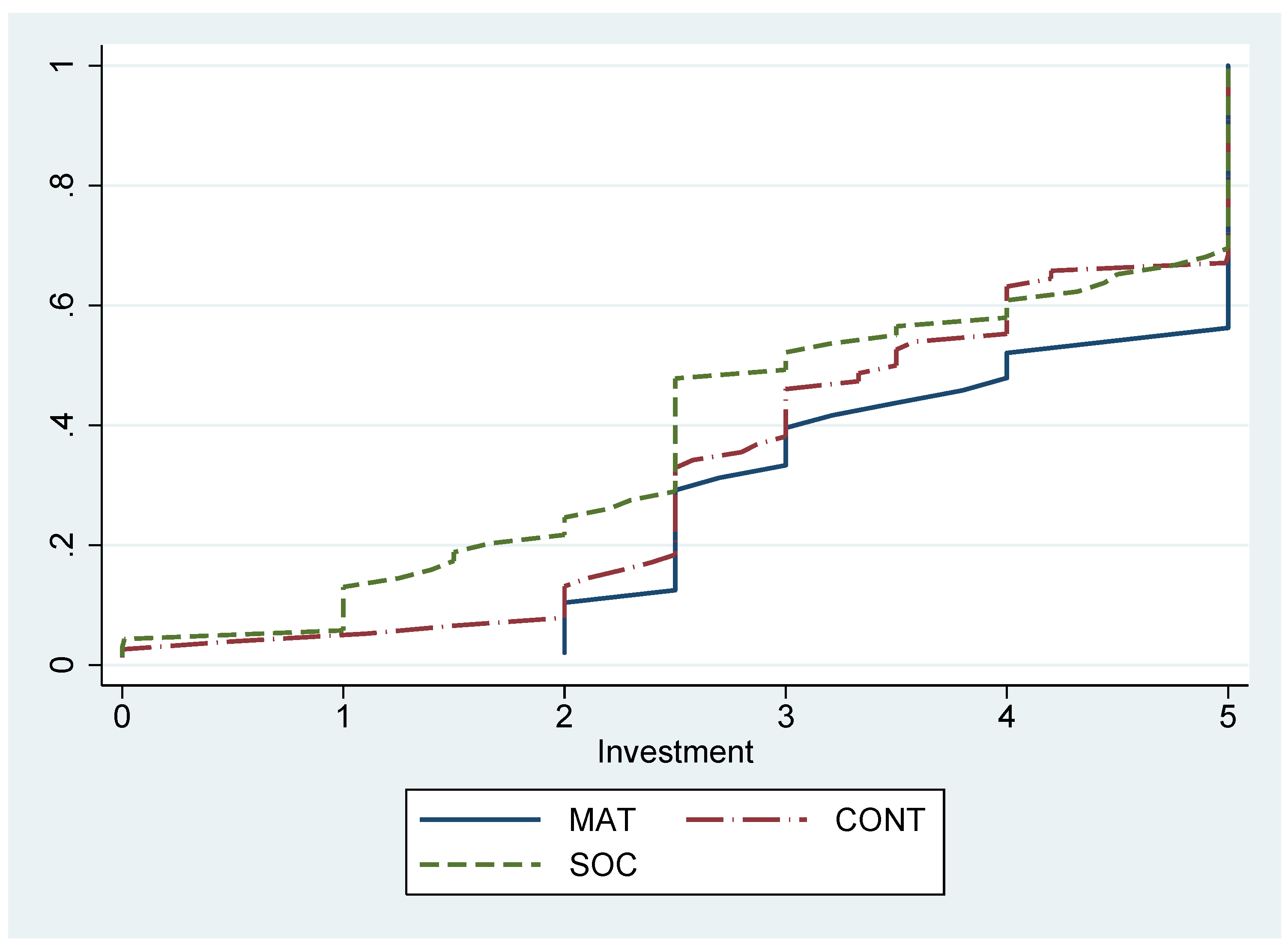

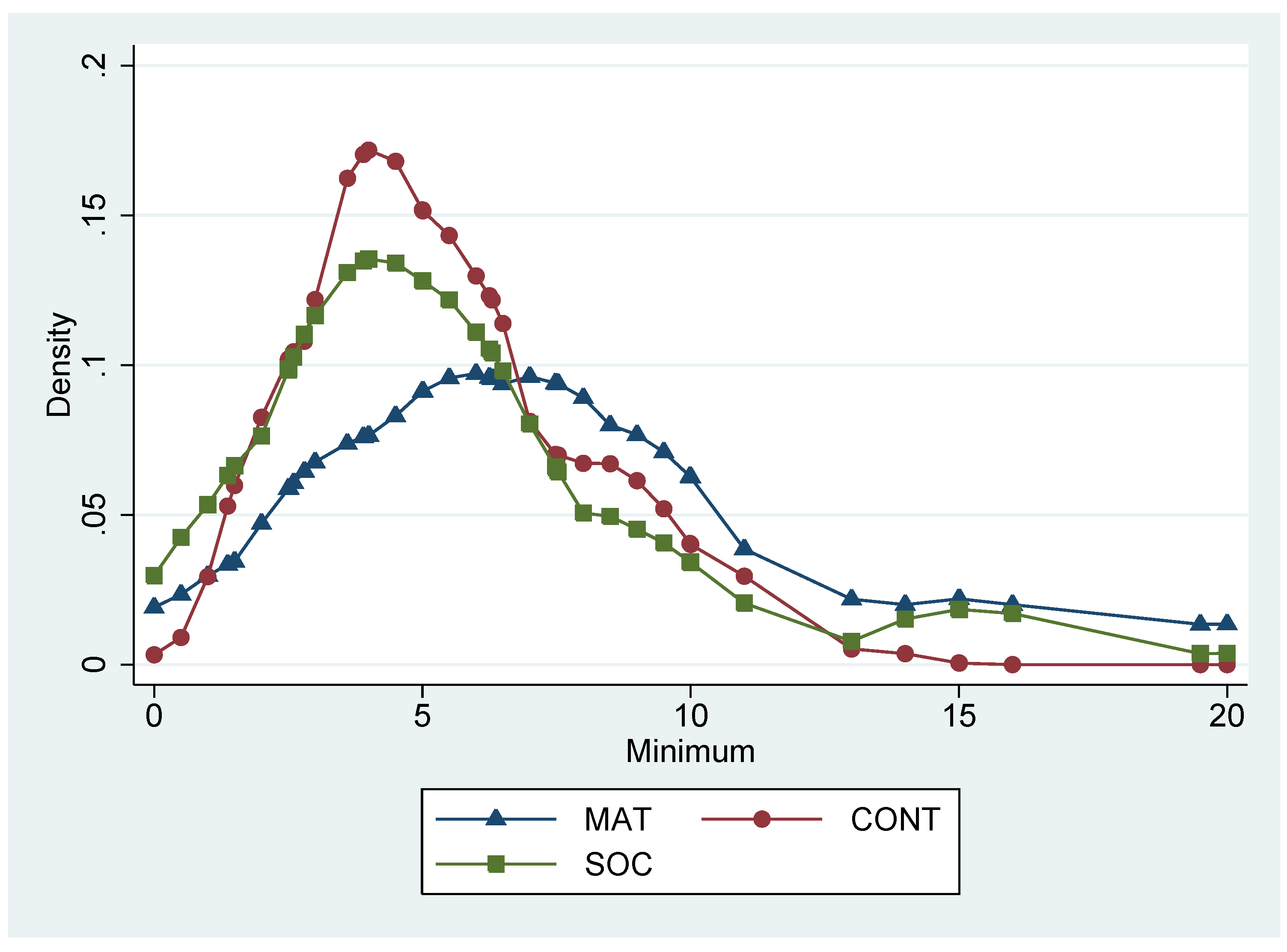

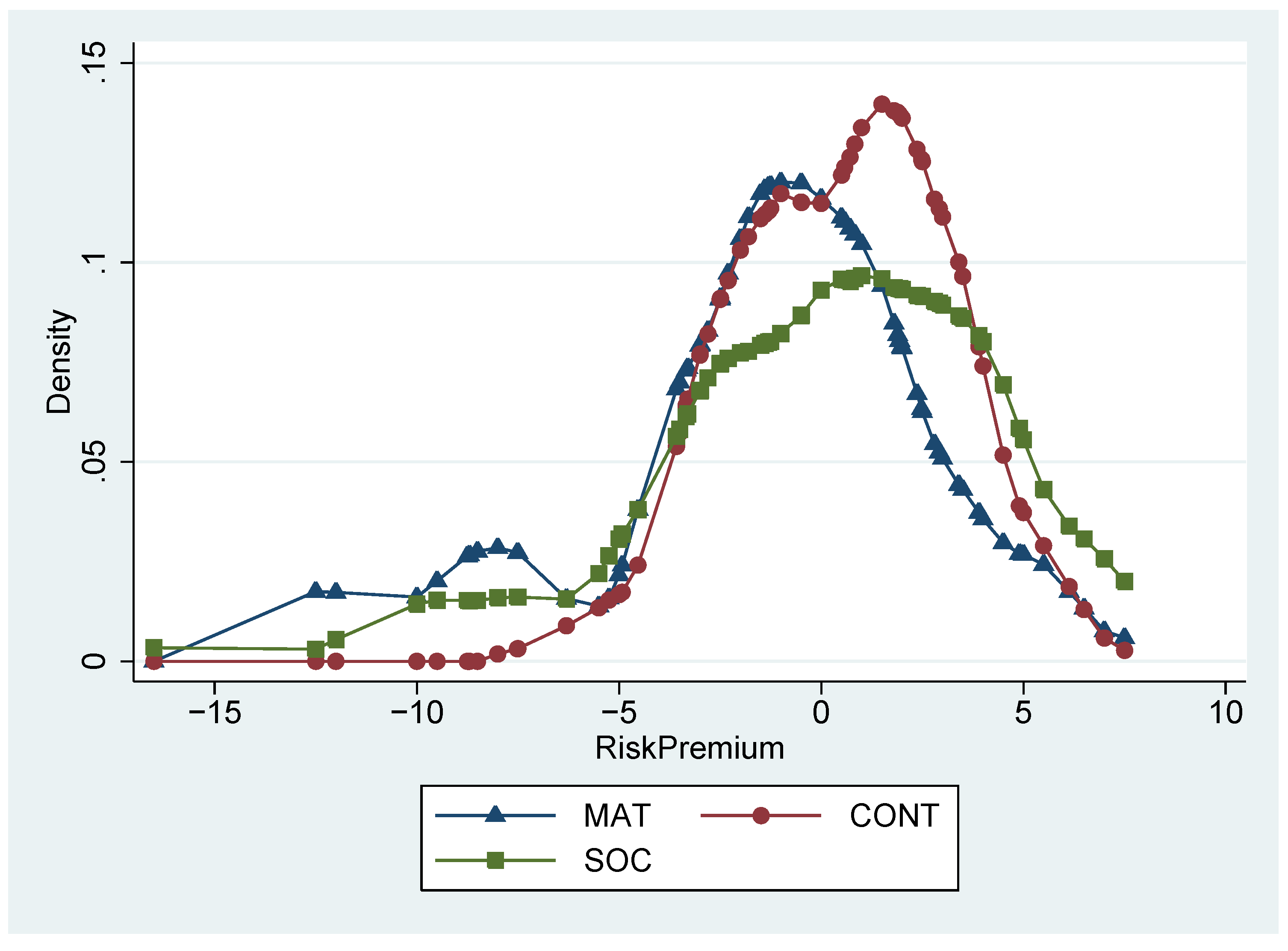

4.1. Classroom experiment

4.2. Laboratory experiment

5. Discussion

Supplementary materials

Supplementary File 1Supplementary File 2Supplementary File 3Acknowledgements

Appendix A - Data

| MAT | CONT | SOC | ||

|---|---|---|---|---|

| investment | mean | 3.84 | 3.48 | 3.23 |

| median | 4 | 3.5 | 3 | |

| minimum | mean | 7.9 | 5.48 | 5.86 |

| median | 7.5 | 5 | 5 | |

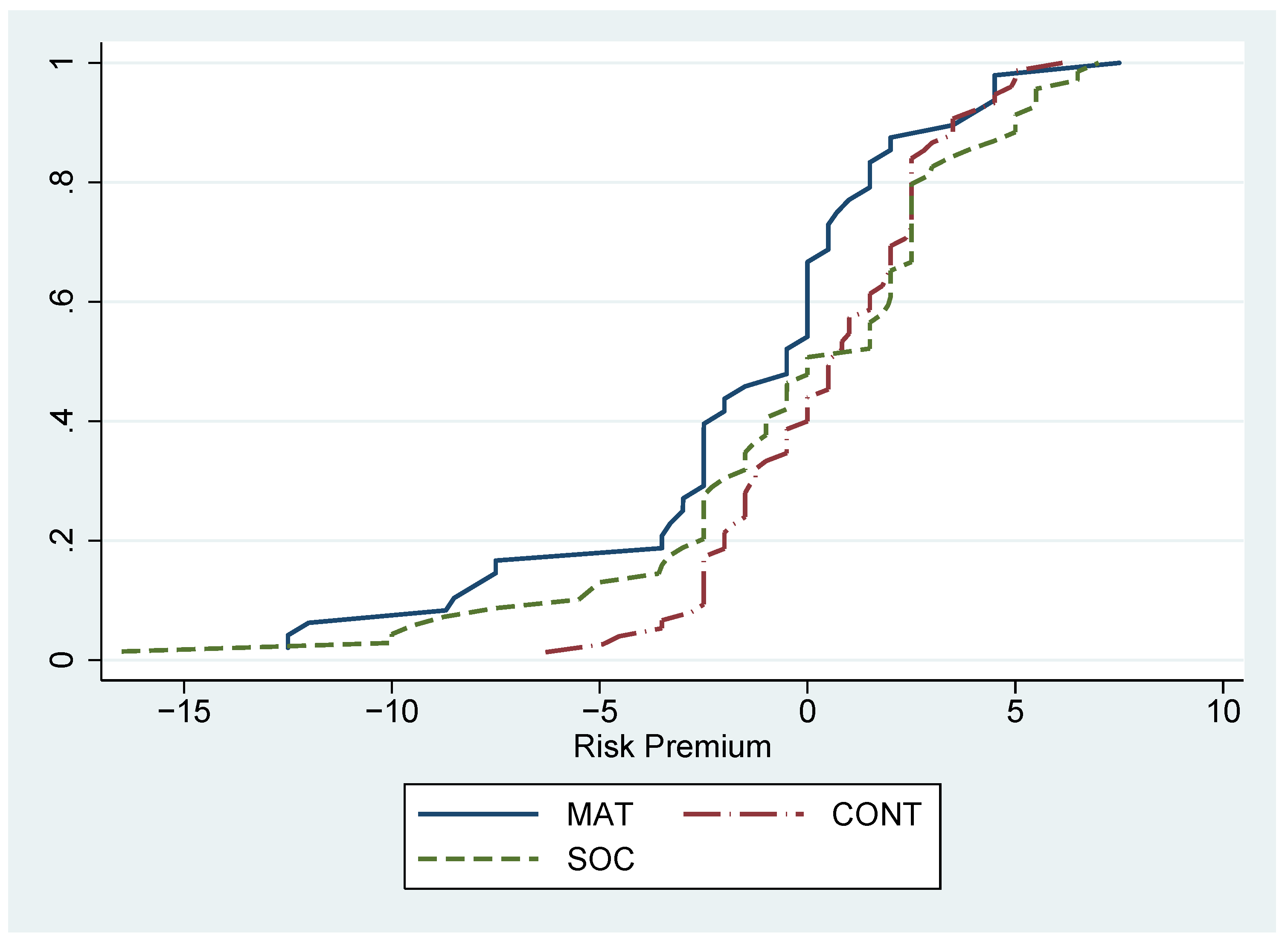

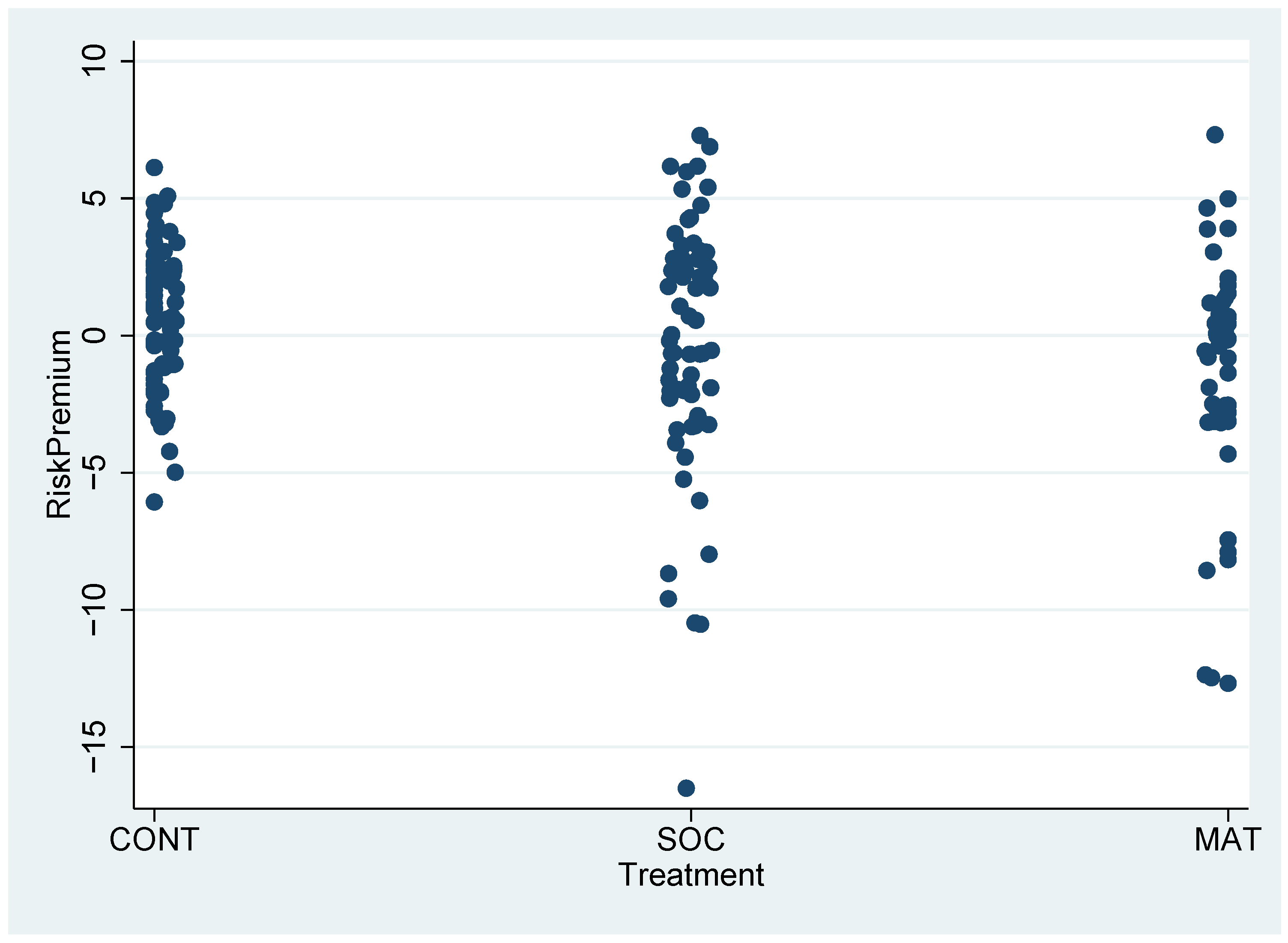

| risk premium | mean | -1.57 | 0.55 | 0.14 |

| median | -0.5 | 0.58 | 0 | |

| observations | 48 | 75 | 69 |

| investment | minimum | |||

|---|---|---|---|---|

| coeff. | st.error | coeff. | st.error | |

| CONT | -1.5392 | .5853*** | -3.2880 | 1.2146*** |

| SOC | -1.6858 | .6071*** | -2.5295 | 1.2820** |

| Age | .1038 | .0541* | .0550808 | .1241 |

| MAT*Female | -1.5207 | .6426** | -1.0795 | 1.4847 |

| constant | 3.0392 | 1.3440** | 7.4171 | 2.9891** |

Appendix B - Instructions classroom experiment

1. Sorting of groups of words

| investment | minimum | |||

|---|---|---|---|---|

| coeff. | st.error | coeff. | st.error | |

| CONT | -.1782 | .3130 | -1.2627 | .8109 |

| SOC | -.0594 | .2812 | -1.0286 | .5902* |

| Decision time | .0444 | .0224* | .0417 | .0313 |

| Female | -.5970 | .2650** | -.0413 | .5742 |

| Difficulty | -.2768 | .1625* | -.4943 | .4036 |

| constant | 3.1203 | .3434*** | 9.7308 | .9372*** |

| Positive Affect | Negative Affect | |||

|---|---|---|---|---|

| coeff. | st.error | coeff. | st.error | |

| CONT | -.5357 | 1.9678 | 1.5477 | 1.1102 |

| SOC | -2.3266 | 1.9226 | 1.4733 | 1.1233 |

| Profit | .4462 | .4939 | .8346 | .3114*** |

| Coin | 1.9727 | 4.2697 | -8.3927 | 2.6503*** |

| Female | -1.7753 | 1.6780 | -1.6157 | .9399* |

| Difficulty | .2478 | .9214 | -.8164 | .6304 |

| constant | 25.6926 | 2.6388*** | 11.308 | 1.5439*** |

| Statistics: | ||||||||

| Major: | ||||||||

| Semester: | ||||||||

| Age: | ||||||||

| Sex: | o | female | o | male | ||||

2. Game

| After you state the amount you want to invest below, we collect the sheets. Then we randomly draw 25 numbers. For the sheets with these numbers we pay you according to your investment and the flip of the coin. We flip a coin separately for each of the 25 numbers. You can pick up your payoff immediately after the lecture, or at the secretaries office. |

| [Here followed some technical remarks regarding the identification of sheets with subjects.] |

Appendix C - Instructions laboratory experiment

Instructions

Procedure

Part 1

Part 2

Example 1

Example 2

Payoff

References

- von Neumann, J.; Morgenstern, O. Theory of Games and Economic Behavior; Princeton University Press, 1944. [Google Scholar]

- Caplin, A.; Leahy, J. Psychological Expected Utility and Anticipatory Feelings. Quarterly Journal of Economics 2001, 116(1), 55–80. [Google Scholar]

- Kahneman, D.; Tversky, A. Prospect Theory: An Analysis of Decision under risk. Econometrica 1979, 47(2), 263–292. [Google Scholar]

- Matthey, A. Yesterdays expectation of tomorrow determines what you do today: The role of reference-dependent utility from expectations. Jena Economic Research Paper 2008-003, 2008. [Google Scholar]

- Kőszegi, B.; Rabin, M. Reference-dependent consumption plans. American Economic Review 2009, 99(3), 909–936. [Google Scholar]

- Campbell, J.; Cochrane, J. By Force of Habit: A Consumption-Based Explanation of Aggregate Stock Market Behavior. Journal of Political Economy 1999, 107(2), 205–251. [Google Scholar]

- Abel, A. Asset Prices under Habit Formation and Catching up with the Joneses. American Economic Review 1990, 80, 38–42. [Google Scholar]

- Kőszegi, B.; Rabin, M. A Model of Reference-dependent Preferences. Quarterly Journal of Economics 2006, 121(4), 1133–1165. [Google Scholar]

- Bargh, J.A. What have we been priming all these years? On the development, mechanisms, and ecology of nonconscious social behavior. European Journal of Social Psychology 2006, 36, 147–168. [Google Scholar] [CrossRef] [PubMed]

- Dijksterhuis, A.; Aarts, H.; Smith, P.K. The power of the subliminal: On subliminal persuasion and other potential applications. In The new unconscious; Hassin, R., Uleman, J.S., Bargh, J.A., Eds.; Oxford University Press: New York, NY, USA, 2005; pp. 77–106. [Google Scholar]

- Vohs, K.D.; Mead, N.L.; Goode, M.R. The psychological consequences of money. Science 2006, 314, 1154–1156. [Google Scholar]

- Matthey, A.; Dwenger, N. Don’t aim too high: the potential costs of high aspirations. Jena Economic Research Paper 2007-097, 2007. [Google Scholar]

- Tversky, A.; Kahneman, D. Rational Choice and the Framing of Decisions. The Journal of Business 1986, 59(4), S251–S278. [Google Scholar]

- Ariely, D.; Loewenstein, G.; Prelec, D. Tom Sawyer and the construction of value. Journal of Economic Behavior and Organisation 2006, 60, 1–10. [Google Scholar] [CrossRef]

- Stutzer, A. The role of income aspirations in individual happiness. Journal of Economic Behavior and Organization 2004, 54(1), 89–109. [Google Scholar]

- Rizzo, J.A.; Zeckhauser, R.J. Pushing incomes to reference points: Why do male doctors earn more. Journal of Economic Behavior and Organization 2007, 63(3), 514–536. [Google Scholar]

- Hebb, D. O. Organization of behavior; Wiley: New York, 1949. [Google Scholar]

- Bargh, J. A.; Chartrand, T. L. The mind in the middle: A practical guide to priming and automaticity research. In Handbook of research methods in social and personality psychology; Judd, H. T., Reis, M. C., Eds.; Cambridge University Press: New York, NY, USA, 2000; pp. 253–285. [Google Scholar]

- Watson, D.; Clark, L.A.; Tellegen, A. Development and Validation of Brief Measures of Positive and Negative Affect: The PANAS Scales. Journal of Personality and Social Psychology 1988, 54(6), 1063–1070. [Google Scholar]

- Krohne, H.W.; Egloff, B.; Kohlmann, C.-W.; Tausch, A. Untersuchung mit einer deutschen Form der Positive and Negative Affect Schedule (PANAS). Diagnostica 1996, 42, 139–156. [Google Scholar]

- Gomes, F.; Michaelides, A. Portfolio Choice with Internal Habit Formation: A Life-Cycle Model with Uninsurable Labour Income Risk. CEPR Discussion Paper No. 3868, 2003. [Google Scholar]

- Shalev, J. Loss Aversion Equilibrium. International Journal of Game Theory 2000, 29(2), 269–287. [Google Scholar]

- Simon, H. Theories of decision making in economics and behavioral science. American Economic Review 1959, 49, 253–283. [Google Scholar]

- Lopes, L.; Oden, G.C. The Role of Aspiration Level in Risky Choice: A Comparison of Cumulative Prospect Theory and SP/A Theory. Journal of Mathematical Psychology 1999, 43, 286–313. [Google Scholar]

- McBride, M. Money, Happiness, and Aspirations: An Experimental Study. University of California-Irvine, Department of Economics Working Paper 060721, 2007. [Google Scholar]

- Cox, J.C.; Sadiraj, V. Small- and large-stakes risk aversion: Implications of concavity calibration for decision theory. Games and Economic Behavior 2006, 56, 45–60. [Google Scholar] [CrossRef]

- Schoemaker, P.J.H. Are risk-attitudes related across domains and response modes? Management Science 1990, 36, 1451–1463. [Google Scholar]

- Weber, E.U.; Blais, A.E.; Betz, N.E. A domain-specific risk-attitude scale: measuring risk perceptions and risk behavior. Journal of Behavioral Decision Making 2002, 15, 263–290. [Google Scholar] [CrossRef]

- Wittenberg, E. Do risk attitudes differ across domains and respondent types? Medical Decision Making 2007, 27, 281–287. [Google Scholar]

- Thaler, R.H.; Johnson, E.J. Gambling with the house money and trying to break even: The effects of prior outcomes on risky choice. Management Science 1990, 36(6), 643–660. [Google Scholar]

- Weber, M.; Zuchel, H. How Do Prior Outcomes Affect Risk Attitude? Comparing Escalation of Commitment and the House-Money-Effect. Decision Analysis 2005, 2(1), 30–43. [Google Scholar]

- 1.The author is grateful to an anonymous referee for pointing out these issues.

- 2.We used the German version developed by [20].

© 2010 by the author; licensee Molecular Diversity Preservation International, Basel, Switzerland. This article is an open-access article distributed under the terms and conditions of the Creative Commons Attribution license http://creativecommons.org/licenses/by/3.0/.

Share and Cite

Matthey, A. The Influence of Priming on Reference States. Games 2010, 1, 34-52. https://doi.org/10.3390/g1010034

Matthey A. The Influence of Priming on Reference States. Games. 2010; 1(1):34-52. https://doi.org/10.3390/g1010034

Chicago/Turabian StyleMatthey, Astrid. 2010. "The Influence of Priming on Reference States" Games 1, no. 1: 34-52. https://doi.org/10.3390/g1010034