Economic Harmony: An Epistemic Theory of Economic Interactions

Abstract

:1. Introduction

2. Economic Harmony Theory

Theory Predictions

3. Predicting Behavior in Experimental Games

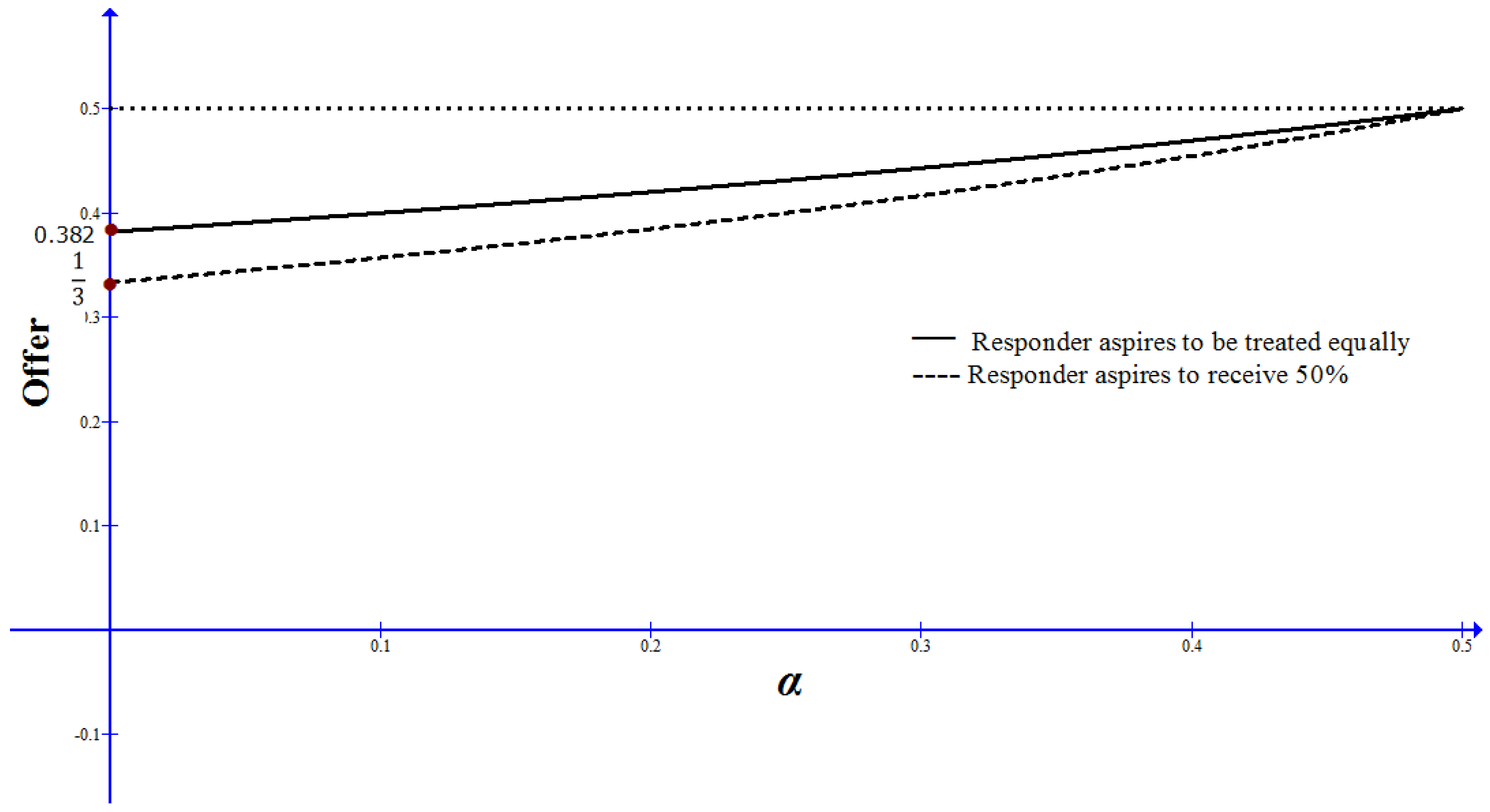

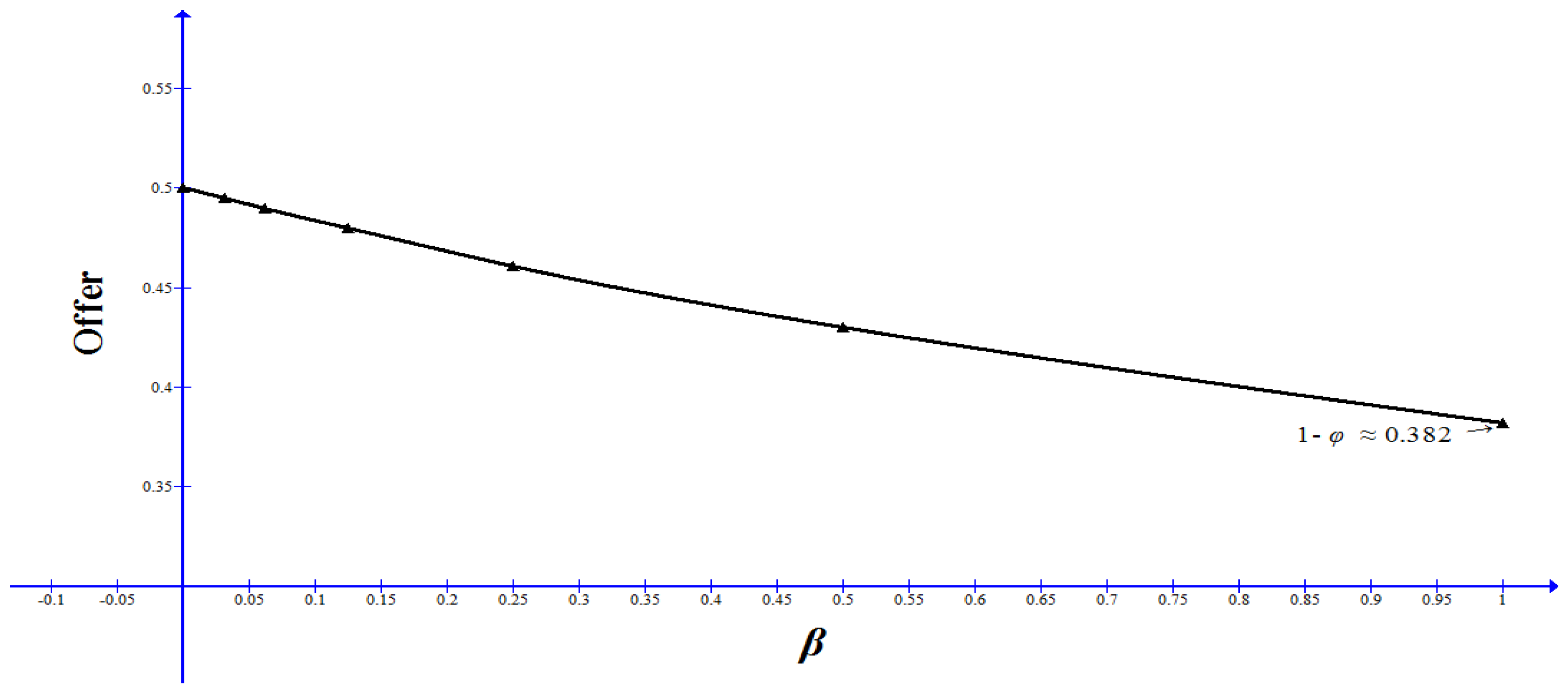

3.1. Predicting Offers in the Ultimatum Game

3.1.1. Economic Harmony Prediction

3.1.2. Empirical Validation

3.1.3. Relaxing the Rationality Assumption

3.1.4. Relaxing the Linearity Assumption

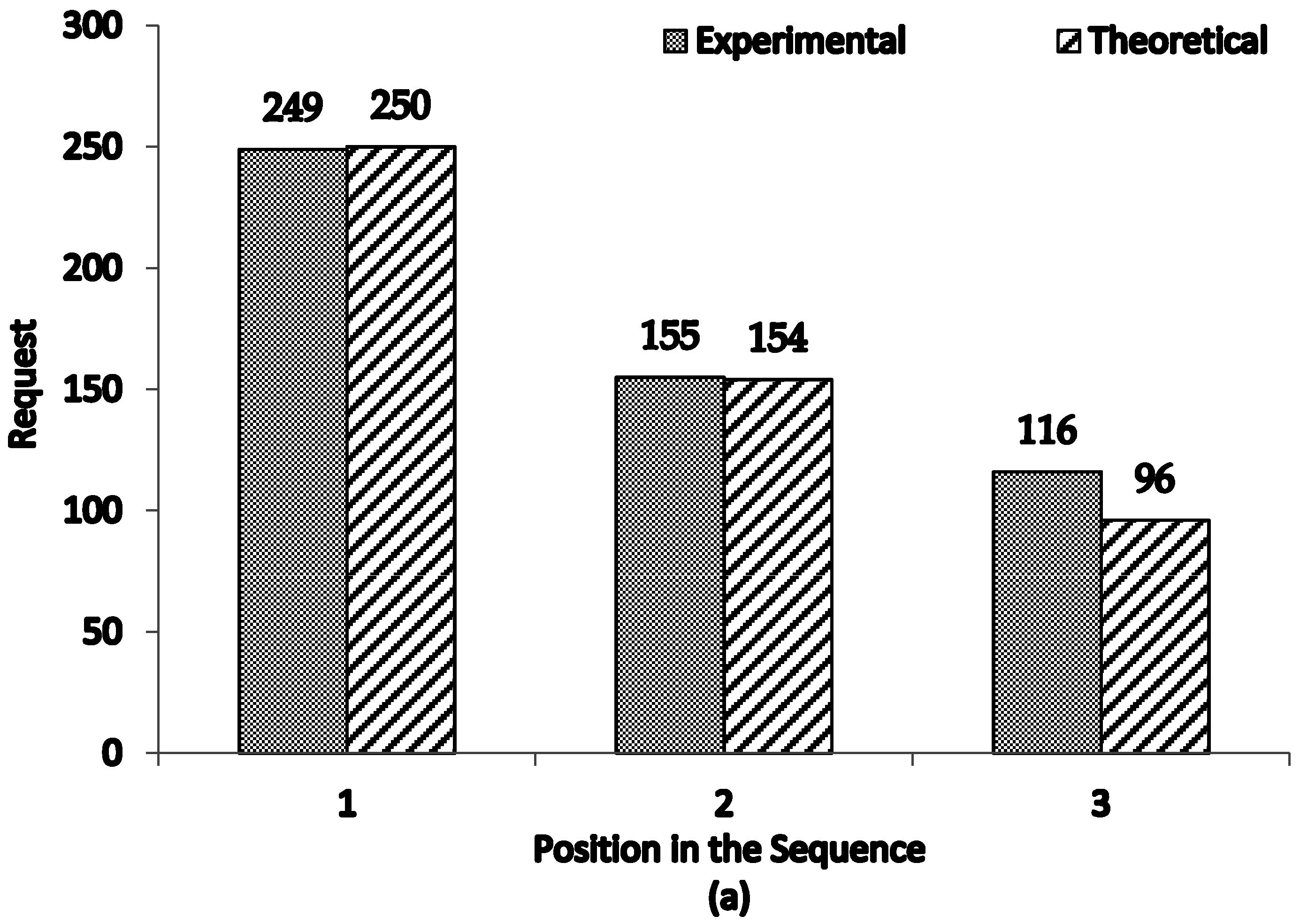

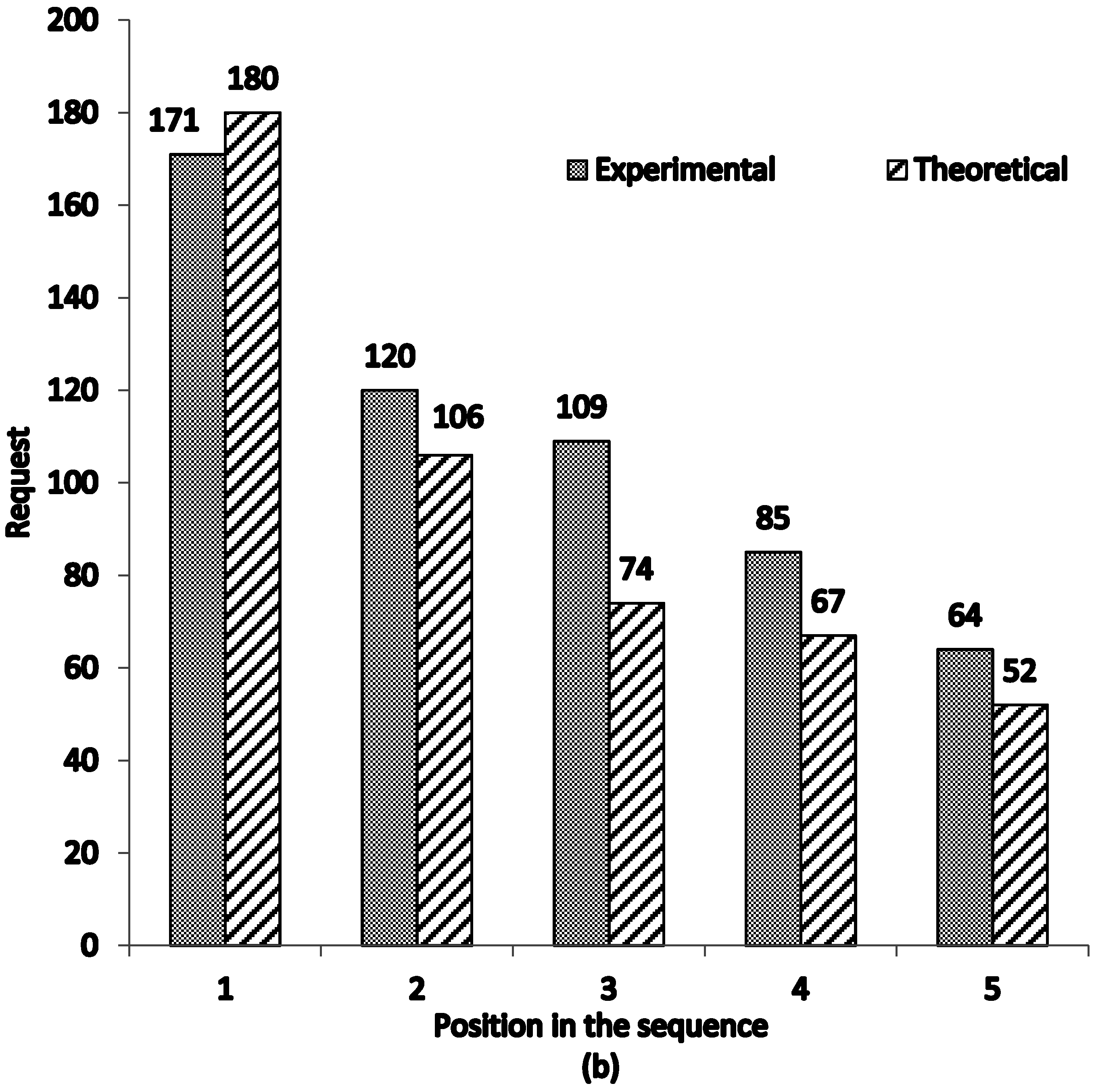

3.2. Predicting Requests in a Sequential CPR Game

3.2.1. Economic Harmony Prediction

3.2.2. Empirical Validation

4. Summary and Concluding Remarks

Acknowledgments

Conflicts of Interest

References

- Hertwig, R.; Andreas, O. Experimental practices in economics: A methodological challenge for psychologists. Behav. Brain Sci. 2001, 24, 433–452. [Google Scholar]

- Suleiman, R. Different perspectives of human behavior entail different experimental practices. Behav. Brain Sci. 2001, 24, 429. [Google Scholar]

- Bardsley, N. Dictator game giving: Altruism or artefact? Exp. Econ. 2008, 11, 122–133. [Google Scholar] [CrossRef]

- Camerer, C.; Thaler, R.H. Ultimatums, dictators and manners. J. Econ. Perspect. 1995, 9, 209–219. [Google Scholar] [CrossRef]

- Güth, W.; Schmittberger, R.; Schwartze, B. An experimental analysis of ultimatum games. J. Econ. Behav. Org. 1982, 3, 367–388. [Google Scholar] [CrossRef]

- Kahneman, D.; Knetsch, J.L.; Thaler, R.H. Fairness and the assumptions of economics. J. Bus. 1986, 59, 285–300. [Google Scholar] [CrossRef]

- Suleiman, R. Expectations and fairness in a modified ultimatum game. J. Econ. Psychol. 1996, 17, 531–554. [Google Scholar] [CrossRef]

- Dawes, R.M. Social Dilemmas. Annu. Rev. Psychol. 1980, 31, 69–193. [Google Scholar] [CrossRef]

- Kollock, P. Social Dilemmas: The Anatomy of Cooperation. Annu. Rev. Sociol. 1998, 1, 83–214. [Google Scholar] [CrossRef]

- Van Lange, P.A.M.; Joireman, J.; Parks, C.D.; van Dijk, E. The psychology of social dilemmas: A review. Organ. Behav. Hum. Dec. 2013, 120, 125–141. [Google Scholar] [CrossRef]

- Bolton, G.E.; Ockenfels, A. ERC: A theory of equity, reciprocity, and competition. Am. Econ. Rev. 2000, 90, 166–193. [Google Scholar] [CrossRef]

- Fehr, E.; Schmidt, K.M. A theory of fairness, competition, and cooperation. Q. J. Econ. 1999, 114, 817–868. [Google Scholar] [CrossRef]

- Rabin, M. Incorporating fairness into game theory and economics. Am. Econ. Rev. 1993, 83, 1281–1302. [Google Scholar]

- Kagel, J.H.; Wolfe, K.W. Test of fairness models based on equity consideration in a three-person ultimatum game. Exp. Econ. 2001, 4, 203–219. [Google Scholar] [CrossRef]

- Aumann, R.J. Interactive epistemology I: Knowledge. Int. J. Game Theory 1999, 28, 263–300. [Google Scholar] [CrossRef]

- Aumann, R.J.; Brandenburger, A. Epistemic conditions for Nash equilibrium. Econometrica 1995, 63, 1161–1180. [Google Scholar] [CrossRef]

- Stalnaker, R. Knowledge, belief and counterfactual reasoning in games. Econ. Philos. 1996, 12, 133–163. [Google Scholar] [CrossRef]

- Battigalli, P.; Siniscalchi, M. Hierarchies of conditional beliefs and interactive epistemology in dynamic games. J. Econ. Theory 1999, 88, 188–230. [Google Scholar] [CrossRef]

- Hilgard, E.R.; Sait, E.M.; Margaret, G.A. Level of aspiration as affected by relative standing in an experimental social group. J. Exp. Psychol. 1940, 27, 411–421. [Google Scholar] [CrossRef]

- Lewin, K.; Dembo, T.; Festinger, L.; Sears, P.S. Level of aspiration. In Personality and the Behavior Disorders; Hunt, J., Ed.; Ronald Press: Oxford, UK, 1944; pp. 333–378. [Google Scholar]

- Simon, H.A. Theories of decision-making in economics and behavioral science. Am. Econ. Rev. 1959, 49, 253–283. [Google Scholar]

- Lopes, L.L. Between hope and fear: The psychology of risk. Adv. Exp. Soc. Psychol. 1987, 20, 255–295. [Google Scholar]

- Lopes, L.L. Algebra and process in the modeling of risky choice. In Decision Making from a Cognitive Perspective; Busemeyer, J., Hastie, R., Medin, D.L., Eds.; Academic Press: San Diego, CA, USA, 1995; Volume 32, pp. 177–220. [Google Scholar]

- Lopes, L.L.; Oden, G.C. The role of aspiration level in risky choice: A comparison of cumulative prospect theory and SP/A theory. J. Math. Psychol. 1999, 43, 86–313. [Google Scholar] [CrossRef] [PubMed]

- Rieger, M.O. SP/A and CPT: A reconciliation of two behavioral decision theories. Econ. Lett. 2010, 108, 327–329. [Google Scholar] [CrossRef]

- Siegel, S. Level of aspiration in decision making. Psychol. Rev. 1957, 64, 253–262. [Google Scholar] [CrossRef] [PubMed]

- Crowne, D.P. Family orientation, level of aspiration, and interpersonal bargaining. J. Personal. Soc. Psychol. 1966, 3, 641–664. [Google Scholar] [CrossRef]

- Hamner, W.C.; Donald, L.H. The effects of information and aspiration level on bargaining behavior. J. Exp. Soc. Psychol. 1975, 11, 329–342. [Google Scholar] [CrossRef]

- Rapoport, A.; Kahan, J.P. Standards of fairness in 3-quota 4-person games. In Aspiration Levels in Bargaining and Economic Decision-Making; Tietz, R., Ed.; Springer: New York, NY, USA, 1983; pp. 337–351. [Google Scholar]

- Komorita, S.S.; Ellis, A.L. Level of aspiration in coalition bargaining. J. Personal. Soc. Psychol. 1988, 54, 421–431. [Google Scholar] [CrossRef]

- Thompson, L.L.; Mannix, E.A.; Bazerman, M.H. Group negotiation: Effects of decision rule, agenda, and aspiration. J. Personal. Soc. Psychol. 1988, 54, 86–95. [Google Scholar] [CrossRef]

- Tietz, R. Adaptation of aspiration levels—Theory and experiment. In Understanding Strategic Interactions; Albers, W., Güth, W., Hammerstein, P., Moldovanu, B., van Damme, E., Eds.; Essays in Honor of Reinhard Selten; Springer: Berlin/Heidelberg, Germany, 1997; pp. 345–364. [Google Scholar]

- Fechner, G.T. Elemente der Psychophysik (Elements of Psychophysics); Holt, Rinehard and Winston: New York, NY, USA, 1860. [Google Scholar]

- Stevens, S.S. On the theory of scales of measurement. Science 1946, 103, 677–680. [Google Scholar] [CrossRef] [PubMed]

- Stevens, S.S. The psychophysics of sensory function. Am. Sci. 1960, 48, 226–253. [Google Scholar]

- Luce, R.D.; Steingrimsson, R.; Narens, L. Are psychophysical scales of intensities the same or different when stimuli vary on other dimensions? Theory with experiments varying loudness and pitch. Psychol. Rev. 2010, 117, 1247–1258. [Google Scholar] [CrossRef] [PubMed]

- Posch, M. Win-stay, lose-shift strategies for repeated games – memory length, aspiration levels and noise. J. Theor. Biol. 1999, 198, 183–195. [Google Scholar] [CrossRef] [PubMed]

- Henrich, J.; McElreath, R.B.; Ensminger, A.; Barrett, J.; Bolyanatz, C.; Cardenas, A.; Gurven, J.C.; Gwako, M.; Henrich, E.; Lesorogol, N.; et al. Costly punishment across human societies. Science 2006, 312, 1767–1770. [Google Scholar] [CrossRef] [PubMed]

- Fehr, E.; Gächter, S. Altruistic punishment in humans. Nature 2002, 415, 137–140. [Google Scholar] [CrossRef] [PubMed]

- Samid, Y.; Suleiman, R. Effectiveness of coercive and voluntary institutional solutions to social dilemmas. In New Issues and Paradigms in Research on Social Dilemmas; Biel, A., Eek, D., Garling, T., Gustafsson, M., Eds.; Springer: Berlin, Germany, 2008; pp. 124–141. [Google Scholar]

- Trivers, R. The Evolution of Reciprocal Altruism. Q. Rev. Biol. 1971, 46, 35–57. [Google Scholar] [CrossRef]

- Haley, K.J.; Fessler, D.M.T. Nobody’s watching? Evol. Hum. Behav. 2005, 26, 245–256. [Google Scholar] [CrossRef]

- Shariff, A.F.; Norenzayan, S.A. God is watching you: Priming God concepts increases prosocial behavior in an anonymous economic game. Psychol. Sci. 2007, 18, 803–809. [Google Scholar] [CrossRef] [PubMed]

- Lant, T.K.; Mezias, S.J. Managing discontinuous change: A simulation study of organizational learning and entrepreneurship. Strateg. Manag. J. 1990, 11, 147–179. [Google Scholar]

- Lant, T.K. Aspiration Level Adaptation: An Empirical Exploration. Manag. Sci. 1992, 38, 623–644. [Google Scholar] [CrossRef]

- Oosterbeek, H.; Sloof, R.; van de Kuilen, G. Cultural differences in ultimatum game experiments: Evidence from a meta-analysis. J. Exp. Econ. 2004, 7, 171–188. [Google Scholar] [CrossRef]

- Henrich, J.; Boyd, R.; Bowles, S.; Camerer, C.; Fehr, E.; Gintis, H.; McElreath, R.; Alvard, M.; Barr, A.; Ensminger, J.; et al. Behavioral and brain sciences “Economic man” in cross-cultural perspective: Behavioral experiments in 15 small-scale societies. Behav. Brain Sci. 2005, 28, 795–855. [Google Scholar] [CrossRef] [PubMed]

- Forsythe, R.; Horowitz, J.L.; Savin, N.E.; Sefton, M. Fairness in Simple Bargaining Experiments. Game Econ. Behav. 1994, 6, 347–369. [Google Scholar] [CrossRef]

- Hoffman, E.; McCabe, K.; Shachat, K.; Smith, V. Preferences, property rights, and anonymity in bargaining games. Game Econ. Behav. 1994, 7, 346–380. [Google Scholar] [CrossRef]

- Weg, E.; Smith, V. On the failure to induce meager offers in ultimatum game. J. Econ. Psychol. 1993, 14, 17–32. [Google Scholar] [CrossRef]

- Livio, M. The Golden Ratio: The Story of Phi, the World’s Most Astonishing Number; Broadway Books: New York, NY, USA, 2000. [Google Scholar]

- Posamentier, A.S.; Lehmann, I. The Fabulous Fibonacci Numbers; Prometheus Books: Amherst, NY, USA, 2007. [Google Scholar]

- Liua, J.P.; Chow, S.C. A two one-sided tests procedure for assessment of individual bioequivalence. J. Biopharm. Stat. 1997, 7, 49–61. [Google Scholar] [CrossRef] [PubMed]

- Kahneman, D.; Lovallo, D. Timid choices and bold forecasts: A cognitive perspective on risk taking. Manag. Sci. 1993, 39, 17–31. [Google Scholar] [CrossRef]

- Harrison, G.; Hirshleifer, J. An experimental evaluation of weakest-link/best-shot models of public goods. J. Public Econ. 1989, 97, 201–225. [Google Scholar] [CrossRef]

- Rapoport, A.; Budescu, D.V.; Suleiman, R. Sequential requests from randomly distributed Shared resources. J. Math. Psychol. 1993, 37, 241–265. [Google Scholar] [CrossRef]

- Budescu, D.V.; Au, W.; Chen, X. Effects of protocol of play and social orientation in resource dilemmas. J. Organ. Behav. Hum. Decis. 1997, 69, 179–193. [Google Scholar] [CrossRef]

- Budescu, D.V.; Au, W. A model of sequential effects in common pool resource dilemmas. J. Behav. Decis. Mak. 2002, 15, 37–63. [Google Scholar] [CrossRef]

- Suleiman, R.; Budescu, D.V. Common Pool Resource (CPR) dilemmas with incomplete information. In Game and Human Behavior; Budescu, D.V., Erev, I., Zwig, R., Eds.; Lawrence Erlbaum Associates, Inc. Publishers: Mahwah, NJ, USA, 1999; pp. 387–410. [Google Scholar]

- Budescu, D.V.; Rapoport, A.; Suleiman, R. Common pool resource dilemmas under uncertainty: Qualitative tests of equilibrium solutions. Game Econ. Behav. 1995, 10, 171–201. [Google Scholar] [CrossRef]

- Budescu, D.V.; Suleiman, R.; Rapoport, A. Positional order and group size effects in resource dilemmas with uncertain resources. J. Organ. Behav. Hum. Dec. 1995, 61, 225–238. [Google Scholar] [CrossRef]

- Schuster, S. The Golden Ratio as a Proposed Solution of the Ultimatum Game: An Epistemic Explanation by Continued Fractions. Available online: https://arxiv.org/abs/1502.02552v1 (accessed on 21 December 2016).

- Klar, A.J.S. Fibonacci’s flowers. Nature 2000, 417, 595. [Google Scholar] [CrossRef] [PubMed]

- Shechtman, D.; Blech, I.; Gratias, D.; Cahn, J.W. Metallic phase with long-range orientational order and no translational symmetry. Phys. Rev. Lett. 1984, 53, 1951–1954. [Google Scholar] [CrossRef]

- Coldea, R.; Tennant, D.A.; Wheeler, E.M.; Wawrzynska, E.; Prabhakaran, D.; Telling, M.; Habicht, K.; Smeibidl, P.; Kiefer, K. Quantum criticality in an Ising chain: Experimental evidence for emergent E8 symmetry. Science 2010, 327, 177–180. [Google Scholar] [CrossRef] [PubMed]

- Weiss, H.; Weiss, V. The golden mean as clock cycle of brain waves. Chaos Solitons Fract. 2003, 18, 643–652. [Google Scholar] [CrossRef]

- Roopun, A.K.; Kramer, M.A.; Carracedo, L.M.; Kaiser, M.; Davies, C.H.; Traub, R.D.; Kopell, N.J.; Whittington, M.A. Temporal interactions between cortical rhythms. Front. Neurosci. 2008, 2, 145–154. [Google Scholar] [CrossRef] [PubMed]

- Pittard, N.; Ewing, M.; Jevons, C. Aesthetic theory and logo design: Examining consumer response to proportion across cultures. Int. Mark. Rev. 2007, 24, 457–473. [Google Scholar] [CrossRef]

- Wang, T.; Mo, L.; Mo, C.; Tan, L.H.; Cant, J.S.; Zhong, L.; Cupchik, G. Is moral beauty different from facial beauty? Evidence from an fMRI study. Soc. Cogn. Affect. Neurosci. 2015, 10, 814–823. [Google Scholar] [CrossRef] [PubMed]

- Suleiman, R. An Aspirations Model of Decisions in a Class of Ultimatum Games. Unpublished Manuscript. 2014. Available online: http://vixra.org/pdf/1412.0147v1.pdf (accessed on 21 December 2016).

- Rapoport, A.; Sundali, J.A.; Seale, D.A. Ultimatums in two-person bargaining with one-sided uncertainty: Demand games. J. Econ. Behav. Organ. 1996, 30, 173–196. [Google Scholar] [CrossRef]

- Suleiman, R. Economic Harmony: An Epistemic Theory of Economic Interactions. In Proceedings of the International Conference on Social Interaction and Society, ETH Zurich, Switzerland, 26–28 May 2016.

- Nowak, M.A.; Page, K.M.; Sigmund, K. Fairness versus reason in the ultimatum game. Science 2000, 289, 1773–1775. [Google Scholar] [CrossRef] [PubMed]

- Miyaji, K.; Wang, Z.; Tanimoto, J.; Hagishima, A.; Kokubo, S. The evolution of fairness in the coevolutionary ultimatum games. Chaos Soliton Fract. 2013, 56, 13–18. [Google Scholar] [CrossRef]

- Zhang, B. Social Learning in the Ultimatum Game. PLoS ONE 2013, 8, e74540. [Google Scholar] [CrossRef] [PubMed]

- Erev, I.; Roth, A.E. Learning in extensive-form games: Experimental data and simple dynamic models in the intermediate term. Am. Econ. Rev. 1998, 88, 848–881. [Google Scholar]

- Roth, A.E.; Erev, I. Learning in extensive-form games: Experimental data and simple dynamic models in the intermediate term. Game Econ. Behav. 1995, 8, 164–212. [Google Scholar] [CrossRef]

- Cooper, D.J.; Feltovich, N.; Roth, A.E.; Zwick, R. Relative versus absolute speed of adjustment in strategic environments: Responder behavior in ultimatum games. Exp. Econ. 2003, 6, 181–207. [Google Scholar] [CrossRef]

© 2017 by the author; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Suleiman, R. Economic Harmony: An Epistemic Theory of Economic Interactions. Games 2017, 8, 2. https://doi.org/10.3390/g8010002

Suleiman R. Economic Harmony: An Epistemic Theory of Economic Interactions. Games. 2017; 8(1):2. https://doi.org/10.3390/g8010002

Chicago/Turabian StyleSuleiman, Ramzi. 2017. "Economic Harmony: An Epistemic Theory of Economic Interactions" Games 8, no. 1: 2. https://doi.org/10.3390/g8010002